Exhibit 3.6

CERTIFICATE OF AMENDMENT TO THE

ARTICLES OF INCORPORATION

L. Perrigo Company, a Michigan corporation, whose registered office is located at 100 Brady Street, City of Allegan, Allegan County, Michigan, certifies pursuant to the provisions of Section 43 of Act No. 327 of the Public Acts of 1931, as amended, that at a meeting of the Shareholders of said corporation called for the purpose of amending the articles of incorporation, and held on the 1st day of April, 1957, it was resolved by the vote of the holders of two-thirds of the shares of each class entitled to vote and by a majority of the shares of each class whose rights, privileges or preferences are changed, that Article No. IV. of the Articles of Incorporation is amended to read as follows, viz:

ARTICLE IV.

The total number of authorized shares of the capital stock of the Corporation is One Hundred Four Thousand (104,000) shares, divided into two classes, namely:

Sixty Thousand (60,000) shares of 8% Cumulative Preferred Stock of the par value of Ten Dollars ($10.00) per share, and

Forty-Four Thousand (44,000) shares of Common Stock of the par value of Ten Dollars ($10.00) per share.

The following is a description of each class of stock of the Corporation, with the voting powers, preferences and rights; and the qualifications, limitations or restrictions thereof:

(1)Dividends on Preferred Stock.

That the holders of the 8% Cumulative Preferred Stock (hereinafter called “Preferred Stock”) shall be entitled to receive, when and as declared by the Board of Directors, out of any assets or funds of the Corporation at the time legally available for the payment of dividends under the laws of the State of Michigan, dividends at the rate of 8% per annum, payable annually on dates to be fixed by the Board of Directors of the Corporation. No dividends shall be paid upon the Common Stock of the Corporation in any fiscal year unless and until in the same fiscal year of payment the Board of Directors shall have declared and paid or set aside for payment upon the Preferred Stock, a dividend amounting to 8% per annum.

Dividends on the Preferred Stock shall be cumulative from and after December 1, 1956, so that, if in any dividend period or periods, dividends on the outstanding Preferred Stock at the rate of Eight Per Cent (8%) of the par value thereof per annum shall not have been paid or set apart for payment, the deficiency shall be paid or set apart for payment, but without interest, before any distribution, whether by way of dividends or otherwise, shall be declared or paid upon or set apart for the Common Stock, or any other stock of the corporation, except stock having a preference over or being on a parity with the Preferred Stock. The term “accrued” as hereinafter applied to dividends on the Preferred Stock shall mean the amount which shall be equal to the sum of all accumulated dividends as set forth in this Paragraph from the date from which such dividends shall have become cumulative, but without interest thereon, less the aggregate amount of all cumulative dividends theretofore paid or declared or set apart for the payment on the Preferred Stock.

(2)Dividends on Common Stock.

Subject always to the provisions of Paragraph (1) of this Article IV. after full cumulative dividends on all Preferred Stock then outstanding shall have been paid for all past annual periods, and after or cor currently with making payment of or provision for all dividends on all Preferred Stock then outstanding to the end of the current annual dividend period, then, and not otherwise, dividends may be declared upon and paid to the holders of the Common Stock to the exclusion of the holders of the Preferred Stock.

(3)Preferences on Liquidation.

In the event of any liquidation, dissolution or winding up of the corporation, the holders of the Preferred Stock shall be entitled before any of the assets of the Corporation shall be distributed among or paid over to the holders of the Common Stock, to be paid in full an amount equal to all cumulative unpaid dividends thereon. The holders of the Common Stock shall be entitled to the exclusion of the holders of the Preferred Stock, to share ratably in all assets of the corporation remaining after such payment to the holders of the Preferred Stock. Neither the consolidation nor merger of the corporation with or into any other corporation or corporations, or a sale or transfer of all, or substantially all, of its assets as an entirety, nor the authorization of a reduction in capital without distribution of its assets, shall be regarded as a voluntary liquidation for winding up of the corporation or as a proceeding resulting in any distribution of its assets to its shareholders within the meaning of any provision hereof.

(4)Redemption of Preferred Stock.

The Preferred Stock shall be redeemable at any time after April 1, 1967, and upon not less than thirty (30) days prior notice to the holders of record of the Preferred Stock given

-2-

in such manner and form and on such other terms and conditions as may be prescribed by resolution of the Board of Directors, by payment in cash for each share of Preferred Stock the sum of Ten Dollars ($10.00) per share, plus an amount equal to dividends accrued thereon up to the date of redemption. If less than all the outstanding shares are to be redeemed, the shares to be redeemed may be either (a) shares selected pro rata or by lot. or (b) share or shares of any particular shareholder or shareholders designated by the Board of Directors. From and after the date fixed in any such notice as the date of redemption, (unless default shall be made by the Corporation in the payment of the redemption price) all dividends on the Preferred Stock thereby called for redemption shall cease to accrue and all rights of the holders thereof as shareholders of the corporation, except the right to receive the redemption price, shall cease and determine.

Except as otherwise provided by the laws of the State of Michigan, the holders of the Common Stock shall exclusively possess voting power for the election of directors and for all other purposes, and the holders of the Preferred Stock shall have no voting power.

Signed on April 1, 1957.

| L. PERRIGO COMPANY | ||

| By | /s/ Ray B. Perrigo | |

| President | ||

| ||

Secretary | ||

| STATE OF MICHIGAN | ) | |

ALLEGAN | ) SS | |

| COUNTY OF | ) |

On this 1st day of April, 1957 before me appeared Ray B. Perrigo to me personally known, who, being by me duly sworn, did say that he is the president of L. Perrigo Company, which executed the foregoing instrument, and that the seal affixed to said instrument is the corporate seal of said corporation, and that said instrument was signed and sealed in behalf of said corporation by authority of its board of directors, and said officer acknowledged said instrument to be the free act and deed of said corporation.

| /s/ Philips McLaughlin

Notary Public for Allegan County, State of Michigan My commission expires July 5-1958 |

-3-

(For Use by Domestic Corporations)

RESTATED ARTICLES OF INCORPORATION

1. These Restated Articles of Incorporation are executed pursuant to the provisions of Sections 641-651, Act 284, Public Acts of 1972.

2. The present name of the corporation is L. Perrigo Company

3. All of the former names of the corporation are as follows: Not Applicable

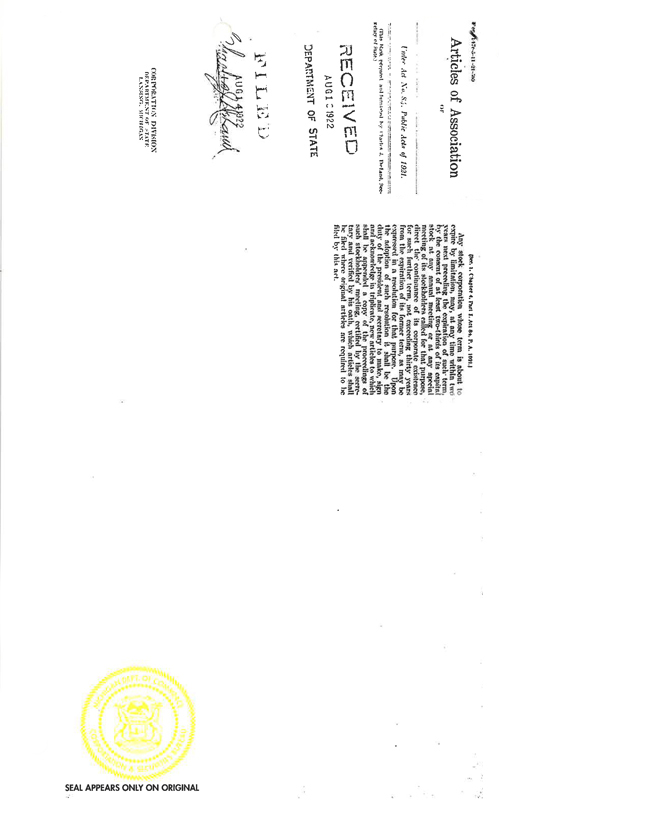

4. The date of filing the original articles of incorporation was June 6, 1892

5. The following Restated Articles of Incorporation supersede the original Articles of Incorporation as amended and shall be the Articles of Incorporation of the corporation:

ARTICLE I.

The name of the corporation is L. Perrigo Company

ARTICLE II.

The purpose or purposes for which the corporation is organized are:

To engage in any activity within the purposes for which corporations may be organized under the business corporation act of the State of Michigan.

ARTICLE III.

(Use the following if the shares are to consist of one class only.)

The total authorized capital stock is:

(1) Common shares Par Value per share

(No. of Shares)

OR (2) Common shares without par value.

(No. of Shares)

| C&5 – 104 |

ARTICLE IV.

(Use the following if the shares are to be divided into classes.)

The total authorized capital stock is:

8% Cumulative

(1) Preferred shs. | 60,000 | Par Value | $ | 10.00 | ||||||||||

Common shs. | 44,000 | Par Value | $ | 10.00 | per share | |||||||||

Non-Voting Convertible Common Shs. | 6,000 | Par Value | $ | 10.00 | per share |

| Preferred | ||||

and or shs. of (2) | no par value | |||

| Common |

(3) A statement of all or any of the relative rights, preferences and limitations of the shares of each class is as follows:

See Exhibit A attached hereto and made a part hereof.

ARTICLE V.

The address of the current registered office is:

117 Water Street, | Allegan | , | Michigan | 49010 | ||||

| (No. and Street) | (Town or City) | (Zip Code) |

The mailing address of the current registered office is (need not be completed unless different from above address):

|

| , | Michigan |

| ||||

| (No. and Street) | (Town or City) | (Zip Code) |

The name of the current resident agent is William S. Tripp

ARTICLE VI.

The duration of the corporation, if other than perpetual, is

ARTICLE VII.

(Optional: Delete Article VII if not applicable.)

ARTICLE VIII.

(Additional provisions, if any, may be inserted here.)

See Exhibit B attached hereto and made a part hereof.

(Use the following clause if the Restated Articles of Incorporation further amends the Articles of Incorporation.)

1. These Restated Articles of Incorporation were duly adopted by the shareholders on the 26th day of September, 1973, in accordance with the provisions of Section 642, Act 284, Public Acts of 1972. The necessary number of shares as required by statute were voted in favor of the Restated Articles of Incorporation.

Signed this 26th day of September, 1973

L. PERRIGO COMPANY | ||

| (Corporate Name) | ||

| BY | /s/ William S. Tripp | |

| (Signature of President, Vice-President, Chairman or Vice-Chairman) | ||

William S. Tripp, President | ||

| (Type or Print Name and Title) | ||

(See Instructions on Reverse Side)

(Please do not write in spaces below — for Department use)

| MICHIGAN DEPARTMENT OF COMMERCE — CORPORATION AND SECURITIES BUREAU | ||

| Date Received | ||

| SEP 26 1973 | ||

| ||

C & S–104

INFORMATION AND INSTRUCTIONS

Restated Articles of Incorporation—Profit Domestic Corporations

| 1. | Section 641 of the low provides that a corporation may integrate into a single instrument the provisions of its Articles of Incorporation which are currently in effect and operative and, at the same time, may also further amend the Articles by adopting Restated Articles of Incorporation. |

| 2. | Restated Articles of Incorporation which do not amend the Articles may be adopted by the Board of Directors without a vote of the shareholders. |

| 3. | Restated Articles of Incorporation which amend the Articles of Incorporation are required to be adopted by the shareholders. |

| 4. | The Restated Articles of Incorporation are required to be signed in ink by the chairman or vice-chairman of the board of directors or the president or a vice-president of the corporation. |

| 5. | An effective date, not later than 90 days subsequent to the date of filing, may be stated in the Restated Articles of Incorporation. |

| 6. | One original copy is required. A true copy will be prepared by the Corporation and Securities Bureau and returned to the person submitting the Restated Articles for filing. |

7. FEES: Filing Fee | $10.00 |

Franchise Fee (payable only in case of increase in authorized capital stock)-1/2mill

on each dollar of increase over highest previous authorized capital stock.

(Make fee payable to State of Michigan)

| 8. | Mail form and fees to: |

Michigan Department of Commerce

Corporation and Securities Bureau

Corporation Division

P. O. Drawer C

Lansing, Michigan 48904

EXHIBIT A

(3) A statement of all or any of the relative rights, preferences and limitations of the shares of each class is as follows :

A.8% Cumulative Preferred Shares

1. Holders of 8% Cumulative Preferred Shares (hereinafter called “Preferred Shares”) shall be entitled to receive when and as declared by the Board of Directors, out of any assets or funds of the corporation at the time legally available for the payment of dividends under the laws of the State of Michigan, dividends at the rate of 8% per annum, payable annually on dates to be fixed by the Board of Directors of the corporation. No dividends shall be paid upon the Common Shares or Non-Voting Convertible Common Shares of the corporation in any fiscal year unless and until in the same fiscal year of payment the Board of Directors shall have declared and paid or set aside for payment upon the Preferred Shares, a dividend amounting to 8% per annum.

2. Dividends on the Preferred Shares shall be cumulative from and after December 1, 1956, so that, if in any dividend period or periods, dividends on the outstanding Preferred Shares at the rate of Eight Per Cent (8%) of the par value thereof per annum shall not have been paid or set apart for payment, the deficiency shall be paid or set apart for payment, but without interest, before any distribution, whether by way of dividends or otherwise, shall be declared or paid upon or set apart for the Common Shares, or for the Non-Voting Convertible Common Shares, or any other shares of the corporation, except shares having a preference over or being on a parity with the Preferred Shares. The term “accrued” as hereinafter applied to dividends on the Preferred Shares shall mean the amount which shall be equal to the sum of all accumulated dividends as set forth in this Paragraph from the date from which such dividends shall have become cumulative, but without interest thereon, less the aggregate amount of all cumulative dividends theretofore paid or declared or set apart for the payment on the Preferred Shares.

3. The Preferred Shares shall be redeemable at any time after April 1, 1967, and upon not less than thirty (30) days prior notice to the holders of record of the Preferred Shares given in such manner and form and on such other terms and conditions as may be prescribed by resolution of the Board of Directors, by payment in cash for each Preferred Share the sum of Ten Dollars ($10.00) per share, plus an amount equal to dividends accrued thereon up to the date of redemption. If less than all the outstanding shares are to be redeemed, the shares to be redeemed may be either (a) shares selected pro rata or by lot, or (b) share or shares of any particular shareholder or shareholders designated by the Board of Directors. From and after the date fixed in any such notice as the date of redemption, (unless default shall be made by the corporation in the payment of the redemption price) all dividends on the Preferred Shares thereby called for redemption shall cease to accrue and all rights of the holders thereof as shareholders of the corporation, except the right to receive the redemption price, shall cease and determine.

B.Common Shares and Non-Voting Convertible Common Shares

1. The Common Shares and the Non-Voting Convertible Common Shares (hereinafter called “Non-Voting Shares”) shall be of equal rank and shall in all respects have the same rights, preferences and limitations except as otherwise provided herein.

2. Prior to their conversion into Common Shares in accordance with this Section B, the Non-Voting Shares shall not have any voting rights except that the corporation shall not, without the approval of the holders of 66-2/3% of the Non-Voting Shares outstanding, modify or amend the rights, preferences or limitations of holders of Non-Voting Shares set forth in this Section B.

3. Whenever dividends are declared or other distributions (including distributions on liquidation) are made, whether in cash, property or shares of stock or other securities of the corporation, the holders of Common Shares and the Non-Voting Shares shall be entitled to share equally, share for share, in such dividends or other distributions; except that in the case of dividends payable in Common Shares, the holders of Common Shares shall receive their dividends in Common Shares and the holders of Non-Voting Shares shall receive their dividends in Non-Voting Shares. Whenever the shares of either class are split up or combined, the shares of the other class shall be proportionately split up or combined. The provisions of this Paragraph shall not apply to any dividends declared or other distributions made to the holders of Preferred Shares or to any split up or combination of the Preferred Shares.

4. If at any time:

(a) the corporation shall file a registration statement with the Securities and Exchange Commission under the Securities Act of 1933; or

(b) the holder of Non-Voting Shares shall transfer any of such Shares to another person in accordance with Section 7 of that certain Purchase Agreement dated September 27, 1973 among the corporation, Paul B. Perrigo, Dr. Lemuel C. Curlin and First Century Partnership; or

(c) there shall be 40,000 Common Shares issued and outstanding (exclusive of any treasury shares and as adjusted to reflect any dividends in Common Shares or subdivisions or combinations of Common Shares subsequent to September 30, 1973); or

(d) the Company shall consolidate with or merge into another corporation; or

(e) after September 1, 1978, then, and in any such case, any holder of Non-Voting Shares shall have the right to convert each outstanding Non-Voting Share so held into one duly authorized, validly issued, fully-paid and nonassessable Common Share (except that in the case of a transfer referred to in Paragraph 4(b) above, only those Non-Voting Shares so transferred may be converted), subject to the following terms and conditions:

(i) the Non-Voting Shares shall be convertible at the principal office of the corporation, presently located at 117 Water Street, Allegan, Michigan. All declared dividends accrued and unpaid on the Non-Voting Shares converted shall, notwithstanding such conversion, constitute and remain a debt of the corporation payable to the converting shareholder.

(ii) in order to convert Non-Voting Shares into Common Shares the holder thereof shall surrender at the office of the corporation specified in (i) above, the certificate or certificates representing the Non-Voting Shares, duly endorsed to the corporation or in blank with signatures guaranteed by a national bank or a member of the New York Stock Exchange, and shall give written notice to the corporation at said office that such holder elects to convert the same. The corporation shall, as soon as practicable after such surrender, deliver at said office to such holder of Non-Voting Shares a certificate or certificates for the number of Common Shares to which such

holder shall be entitled as aforesaid. Non-Voting Shares converted at the option of the holder shall be deemed to be converted as of the date of actual receipt by, and surrender to, the corporation of the certificates representing such shares for conversion as hereinbefore provided, and the person entitled to receive the Common Shares issuable upon such conversion shall be treated for all purposes as the recordholder of such Common shares as of the close of business on such date; provided, however, that if such receipt and surrender does not occur on a business day, such receipt, surrender and conversion shall not be deemed to have taken place until the close of business on the next succeeding business day. For purposes of this Section, business days shall be deemed to be Mondays, Tuesdays, Wednesdays, Thursdays and Fridays which are not, in the place where the office referred to in (i) above is then located, a day on which banking institutions in such place are authorised by law to close.

(iii) the issuance of any certificate representing Common Shares upon the conversion of Non-Voting Shares to the holder of such Non-Voting Shares shall be made without charge to the converting shareholder for any transfer, issue, capital or similar tax imposed in respect of the issuance of such certificates.

(iv) the certificate(s) representing Common Shares issued upon the conversion of Non-Voting Shares may bear the following legend:

“The shares or other securities represented by this certificate or document have not been registered under the Securities Act of 1933 in reliance upon Section 4(2) thereof, and may not be sold, transferred, pledged, hypothecated or otherwise disposed of except pursuant to the requirements of the Securities Act of 1933 and the rules and regulations promulgated thereunder, and except upon compliance with the terms and conditions of a Purchase Agreement dated September 27, 1973 among the Company, Paul B. Perrigo, Dr. Lemuel C. Curlin and First Century Partnership, a copy of which may be inspected at the principal office of the Company, 117 water Street, Allegan, Michigan 49010.”

5. Promptly upon the occurrence of any of the events specified in Paragraphs 4(a), 4(c) or 4(d) of this Section B, the corporation shall give written notice of such occurrence to the holders of all outstanding Non-Voting Shares in the manner set forth in Paragraph 7 of this Section B.

6. The corporation will use its best efforts to list the Common Shares required to be delivered upon the exercise of the conversion rights set forth in this Section B prior to such delivery upon each national securities exchange upon which the outstanding Common Shares are listed at the time of such delivery.

7. Notices provided for in this Section B shall be given to holders of Non-Voting Shares by, and shall be deemed received by them upon mailing the same by registered mail, postage prepaid, return receipt requested, to their addresses as shown on the books of the corporation or at such other addresses as they have given in writing to the Secretary of the corporation.

C.Dividends

Subject always to the provisions of Paragraphs 1 and 2 of Section A above, after full cumulative dividends on all Preferred Shares then outstanding shall have been paid for all past annual periods, and after or concurrently with making payment of or provision for all dividends on all Preferred Shares then outstanding to the end of the current annual dividend period, then, and not otherwise, dividends may be declared upon and paid to the holders of the Common Shares and Non-Voting Shares to the exclusion of the holders of the Preferred Shares.

D.Liquidation

In the event of any liquidation, dissolution or winding up of the corporation, the holders of the Preferred Shares shall be entitled before any of the assets of the corporation shall be distributed among or paid over to the holders of the Common Shares or the Non-Voting Shares, to be paid in full an amount equal to all cumulative unpaid dividends thereon. The holders of the Common Shares and the Non-Voting Shares shall be entitled to the exclusion of the holders of the Preferred Shares, to share ratably in all assets of the corporation remaining after such payment to the holders of the Preferred Shares. Neither the consolidation nor merger of the corporation with or into any other corporation or corporations, or a sale or transfer of all, or substantially all, of its assets as an entirety, nor the authorization of a reduction in capital without distribution of its assets, shall be regarded as a voluntary liquidation or winding up of the corporation or as a proceeding resulting in any distribution of its assets to its shareholders within the meaning of any provision hereof.

E.Voting Power

Except as otherwise provided by the laws of the State of Michigan or as otherwise provided in Paragraph 2 of Section B, the holders of Common Shares shall exclusively possess voting power for the election of directors and for all other purposes,

and the holders of the Preferred Shares and the Non-Voting Shares shall have no voting power.

F.Preemptive Rights

The corporation may issue or deliver unissued or treasury shares, option rights, or securities having conversion or option rights, whether now or hereafter authorized, without first offering them to then existing shareholders.

EXHIBIT B

ARTICLE VIII

INDEMNIFICATION

1. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director or officer of the corporation, or is or was serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation or its shareholders, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interest of the corporation or its shareholders, and, with respect to any criminal action or proceeding, had reasonable cause to believe that his conduct was unlawful.

2. The corporation shall indemnify any person who was or is a party to or is threatened to be made a party to any threatened, pending or completed action or suit by or in the

right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director or officer of the corporation, or is or was serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation or its shareholders and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been finally adjudged to be liable for negligence or misconduct in the performance of his duty to the corporation unless and only to the extent that the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

3. To the extent that a present or former director or officer of the corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Paragraphs 1 or 2 of this Article VIII, or in defense of any claim, issue or matter therein, he shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him in connection therewith.

4. Any indemnification under Paragraphs 1 or 2 of this Article VIII (unless ordered by a court) shall be made by the corporation only as authorized in the specific case upon a determination that indemnification of the director or officer is proper in the circumstances because he has met the applicable

standard of conduct set forth in Paragraphs 1 or 2 of this Article VIII. Such determination shall be made (a) by the board of directors by a majority vote of a quorum consisting of directors who were not parties to such action, suit or proceeding, or (b) if such quorum is not obtainable, or, even if obtainable, a quorum of disinterested directors so directs, by independent legal counsel in a written opinion, or (c) by the shareholders.

5. Expenses incurred in defending a civil or criminal action, suit or proceeding described in Paragraphs 1 or 2 of this Article VIII may be paid by the corporation in advance of the final disposition of such action, suit or proceeding, as authorized in the manner provided in Paragraph 4 of this Article VIII, upon receipt of an undertaking by or on behalf of the director or officer to repay such amount unless it shall ultimately be determined that he is entitled to be indemnified by the corporation.

6. Nothing contained in this Article VIII shall affect the rights to indemnification to which persons other than directors and officers may be entitled by contract or otherwise by law. The indemnification provided in this Article VIII shall continue as to a person who has ceased to be a director or officer and shall inure to the benefit of the heirs, executors and administrators of such person.

7. The corporation may indemnify any person for liability incurred by reason of the fact he is or was an employee or agent (but not a director or officer) of the corporation or is or was serving at the request of the corporation as an employee or agent (but not a director or officer) of another corporation, partnership, joint venture, trust or other enterprise whenever the board of directors deems it equitable or desirable that such indemnification be made.

8. The corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him and incurred by him in any such capacity or arising out of his status as such, whether or not the corporation would have power to indemnify him against such liability under the foregoing provisions of this Article VIII.

9. For the purposes of this Article VIII, references to “the corporation” include all constituent corporations absorbed in a consolidation or merger and the resulting or surviving corporation, so that a person who is or was a director, officer, employee or agent of such constituent corporation or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, or other enterprise shall stand in the same position under the provisions of this Article VIII with respect to the resulting or surviving corporation as he would if he had served the resulting or surviving corporation in the same capacity.