- AXTA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Axalta Coating Systems (AXTA) DEF 14ADefinitive proxy

Filed: 23 Mar 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |

| x | Definitive Proxy Statement. | |

| ¨ | Definitive Additional Materials. | |

| ¨ | Soliciting Material Pursuant to §240.14a-12. | |

AXALTA COATING SYSTEMS LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (6) | Amount Previously Paid:

| |||

| (7) | Form, Schedule or Registration Statement No.:

| |||

| (8) | Filing Party:

| |||

| (9) | Date Filed:

| |||

March 23, 2015

Dear Member:

You are cordially invited to the 2015 Annual General Meeting of Members (the “Annual Meeting”) of Axalta Coating Systems Ltd., a Bermuda exempted company (the “Company”), to be held on Wednesday, May 13, 2015 at 2:00 p.m., local time, at Axalta Coating Systems’ offices located at 4500 River Ridge Drive, Clinton Township, MI 48038.

You will find information regarding the matters to be voted upon in the attached Notice of Annual Meeting and Proxy Statement. We are sending our shareholders, referred to as “members” under Bermuda law, a notice regarding the availability of this Proxy Statement, our 2014 Annual Report to Members and other proxy materials via the Internet. This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. You may request a paper copy of these materials using one of the methods described in the materials.

Whether or not you attend in person, it is importantthat your common shares be represented and voted at the Annual Meeting. I encourage you to sign, date and return the enclosed proxy card, or vote via telephone or the Internet as directed on the proxy card, at your earliest convenience. You are, of course, welcome to attend the Annual Meeting and vote in person, even if you have previously returned your proxy card or voted over the Internet or by telephone.

Sincerely,

Charles W. Shaver

Chairman and Chief Executive Officer

AXALTA COATING SYSTEMS LTD.

Two Commerce Square

2001 Market Street, Suite 3600

Philadelphia, PA 19103

NOTICE OF 2015 ANNUAL GENERAL MEETING

| Time and Date: | 2:00 p.m. local time on Wednesday, May 13, 2015 | |

| Place: | Axalta Coating Systems’ offices located at 4500 River Ridge Drive, Clinton Township, MI 48038 | |

| Who Can Vote: | Only holders of our common shares at the close of business on March 18, 2015, the record date, will be entitled to receive notice of, and to vote at, the Annual Meeting. | |

| Annual Report: | Our 2014 Annual Report to Members accompanies but is not part of these proxy materials. | |

| Proxy Voting: | Your Vote is Important. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card or voting instruction form will save the Company the expenses and extra work of additional solicitation. If you wish to vote by mail, we have enclosed an envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option. You may revoke your proxy at any time before it is voted by delivering to the Company a subsequently executed proxy or a written notice of revocation or by voting in person at the Annual Meeting. | |

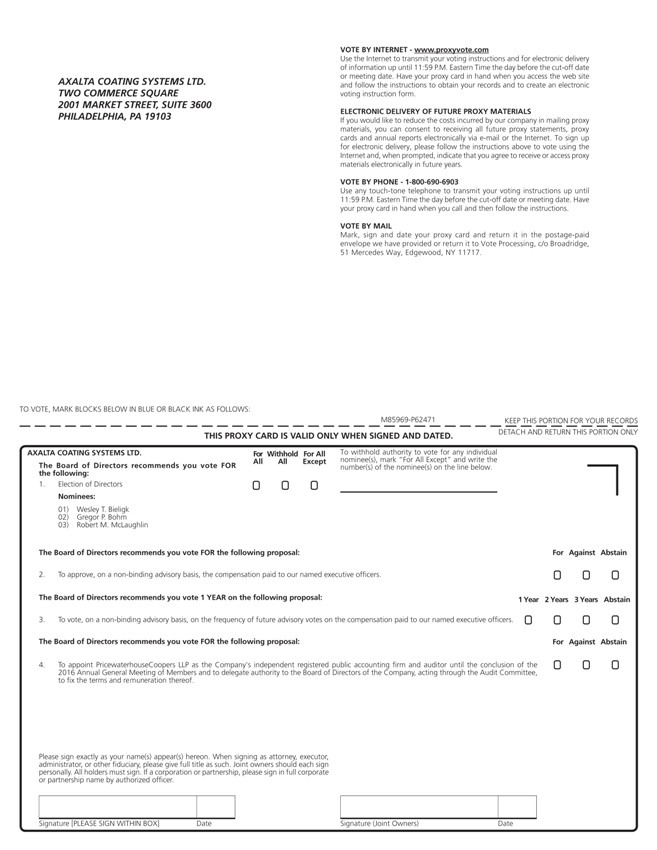

| Items of Business: | • To elect three Class I directors for terms ending at the 2018 Annual General Meeting of Members;

• To approve, on a non-binding advisory basis, the compensation paid to our named executive officers;

• To vote, on a non-binding advisory basis, on the frequency of future advisory votes on the compensation paid to our named executive officers;

• To appoint PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2016 Annual General Meeting of Members and to delegate authority to the board of directors of the Company, acting through the Audit Committee, to fix the terms and remuneration thereof; and

• To transact any other business that may properly come before the Annual Meeting. | |

| Date of Mailing: | A Notice of Internet Availability of Proxy Materials or this Proxy Statement is first being mailed to members on or about March 23, 2015. | |

BY ORDER OF THE BOARD OF DIRECTORS,

Sincerely,

Michael Finn

Senior Vice President, General Counsel and Corporate Secretary

March 23, 2015

i

| Page | ||||

| 24 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

MEMBER PROPOSALS FOR THE COMPANY’S 2016 ANNUAL GENERAL MEETING OF MEMBERS | 45 | |||

| 45 | ||||

| 45 | ||||

| 46 | ||||

ii

PROXY STATEMENT

Annual General Meeting

May 13, 2015

This proxy statement and accompanying proxy (the “Proxy Statement”) are being furnished to the members of Axalta Coating Systems Ltd., a Bermuda exempted company (the “Company” or “Axalta”), in connection with the solicitation of proxies by the board of directors of the Company (the “Board” or the “board of directors”) for use at the 2015 Annual General Meeting of Members, and at any adjournment or postponement thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of 2015 Annual General Meeting. The Annual Meeting will be held on May 13, 2015 at 2:00 p.m., local time, at Axalta’s offices located at 4500 River Ridge Drive, Clinton Township, MI 48038.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive a Notice of Internet Availability of Proxy Materials?

You are receiving this Proxy Statement because you owned Axalta common shares at the close of business on March 18, 2015 (the “Record Date”), and that entitles you to vote at the Annual Meeting. By use of a proxy, you can vote regardless of whether you attend the Annual Meeting.

We are furnishing proxy materials to our shareholders, referred to as “members” under Bermuda law, primarily via the Internet, instead of mailing printed copies of those materials to each member. On or about March 23, 2015, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our members. The Notice contains instructions about how to access our proxy materials and vote via the Internet. If you would like to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you previously chose to receive our proxy materials electronically, you will continue to receive access to these materials via e-mail unless you elect otherwise.

Who is entitled to vote at the Annual Meeting?

Holders of our outstanding common shares at the close of business on the Record Date are entitled to vote their shares at the Annual Meeting. As of the Record Date, 229,819,296 common shares were issued and outstanding. Each common share is entitled to one vote on each matter properly brought before the Annual Meeting.

The presence at the Annual Meeting in person or by proxy of the holders of record of a majority in voting power of the shares entitled to vote at the Annual Meeting, or 114,909,648 shares, will constitute a quorum for the transaction of business at the Annual Meeting.

What will I be voting on at the Annual Meeting and how does the Board recommend that I vote?

There are four proposals that members will vote on at the Annual Meeting:

| • | Proposal No. 1 — Election of three Class I directors to serve until the 2018 Annual General Meeting; |

| • | Proposal No. 2 — Non-binding advisory vote to approve the compensation paid to our named executive officers; |

1

| • | Proposal No. 3 — Non-binding advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers; and |

| • | Proposal No. 4 — Appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2016 Annual General Meeting of Members and the delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof. |

The Board recommends that you vote:

| • | Proposal No. 1 —FOR the election of the three nominees to the Board; |

| • | Proposal No. 2 —FOR the advisory vote to approve the compensation paid to our named executive officers; |

| • | Proposal No. 3 —FOR EVERY YEAR as the frequency of future advisory votes on the compensation paid to our named executive officers; and |

| • | Proposal No. 4 —FOR the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and auditor until the conclusion of the 2016 Annual General Meeting of Members and the delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof. |

Charles W. Shaver, Robert W. Bryant and Michael F. Finn, three of our executive officers, have been selected by our Board to serve as proxy holders for the Annual Meeting. All of our common shares represented by properly delivered proxies received in time for the Annual Meeting will be voted at the Annual Meeting by the proxy holders in the manner specified in the proxy by the member. If you sign and return a proxy card without indicating how you want your shares to be voted, the persons named as proxies will vote your shares in accordance with the recommendations of the Board.

What is the difference between holding common shares as a member of record and as a beneficial owner?

If your common shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, the “member of record.” The Notice has been or will be sent directly to you.

If your common shares are held in a stock brokerage account, by a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” The Notice has been or will be sent to you by your broker, bank or other holder of record who is considered, with respect to those shares, to be the member of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote the shares in your account.

Member of Record. If you are a member of record, you may vote by using any of the following methods:

| • | Through the Internet. You may vote by proxy through the Internet by following the instructions on the Notice or the instructions on the proxy card if you request printed copies of the proxy materials by mail. |

| • | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free telephone number shown on the proxy card and following the recorded instructions. |

| • | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by completing, signing and dating the proxy card and sending it back to the Company in the envelope provided. |

2

| • | In Person at the Annual Meeting. If you attend the Annual Meeting, you may vote your shares in person. We encourage you, however, to vote through the Internet, by telephone or by mailing us your proxy card even if you plan to attend the Annual Meeting so that your shares will be voted in the event you later decide not to attend the Annual Meeting. |

Beneficial Owners. If you are a beneficial owner of shares, you may vote by using any of the following methods:

| • | Through the Internet. You may vote by proxy through the Internet by following the instructions provided in the Notice and the voting instruction form provided by your broker, bank or other holder of record. |

| • | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the voting instruction form and following the recorded instructions. |

| • | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by completing, signing and dating the voting instruction form and sending it back to the record holder in the envelope provided. |

| • | In Person at the Annual Meeting. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker, bank or other holder of record and present it at the Annual Meeting. Please contact that organization for instructions regarding obtaining a legal proxy. |

What does it mean if I receive more than one Notice, proxy card or voting instruction form?

If you received more than one Notice, proxy card or voting instruction form, it means you hold your common shares in more than one name or are registered as the holder of common shares in different accounts. Please follow the voting instructions included in each Notice, proxy card and voting instruction form to ensure that all of your shares are voted.

May I change my vote after I have submitted a proxy?

If you are a member of record, you have the power to revoke your proxy at any time prior to the Annual Meeting by:

| • | delivering to our Secretary an instrument revoking the proxy; |

| • | delivering a new proxy in writing, through the Internet or by telephone, dated after the date of the proxy being revoked; or |

| • | attending the Annual Meeting and voting in person (attendance without casting a ballot will not, by itself, constitute revocation of a proxy). |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other holder of record. You may also revoke your previous voting instructions by voting in person at the Annual Meeting if you obtain a legal proxy from your broker, bank or other holder of record and present it at the Annual Meeting.

Who will serve as the proxy tabulator and inspector of election?

A representative from Broadridge will serve as the independent inspector of election and will tabulate votes cast by proxy or in person at the Annual Meeting. We will report the results in a Form 8-K filed with the Securities and Exchange Commission (the “Commission”) within four business days after the Annual Meeting.

3

What vote is required to approve each proposal?

The common shares of a member whose ballot on any or all proposals is marked as “abstain” will be included in the number of shares present at the Annual Meeting to determine whether a quorum is present.

If you are a beneficial owner of shares and do not provide the record holder of your shares with specific voting instructions, your record holder may vote your shares on the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm and auditor until the conclusion of the 2016 Annual General Meeting of Members and delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof (Proposal No. 4). However, your record holder cannot vote your shares without specific instructions on the election of directors (Proposal No. 1), the non-binding, advisory vote on the compensation paid to our named executive officers (Proposal No. 2) or the non-binding, advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers (Proposal No. 3). If your record holder does not receive instructions from you on how to vote your shares on Proposals 1, 2 or 3, your record holder will inform the inspector of election that it does not have the authority to vote on that proposal with respect to your common shares. This is generally referred to as a “broker non-vote.” Broker non-votes will be counted as present for purposes of determining whether enough votes are present to hold the Annual Meeting, but they will not be counted in determining the outcome of the vote on the applicable proposal.

The following table summarizes the votes required for passage of each proposal and the effect of abstentions and broker non-votes.

| Proposal | Vote Required | Impact of Abstentions and Broker Non-Votes, if any | ||||||

No. 1 — Election of directors. | Directors will be elected by a plurality of the votes cast, meaning the directors receiving the largest number of “for” votes will be elected. | Abstentions and broker non-votes will not affect the outcome of the vote. | ||||||

No. 2 — Non-binding, advisory vote to approve compensation paid to our named executive officers. | Approval by a majority of the votes cast. | Abstentions and broker non-votes will not affect the outcome of the vote. | ||||||

No. 3 — Non-binding, advisory vote on the frequency of future advisory votes on the compensation paid to our named executive officers. | Approval by a majority of the votes cast.* | Abstentions and broker non-votes will not affect the outcome of the vote. | ||||||

No. 4 — Appointment of independent registered public accounting firm and auditor until the conclusion of the 2016 Annual General Meeting of Members and the delegation of authority to the board of directors, acting through the Audit Committee, to fix the terms and remuneration thereof. | Approval by a majority of the votes cast. | Abstentions and broker non-votes will not affect the outcome of the vote. |

| * | In determining the frequency with which we hold future advisory votes on the compensation paid to our named executive officers, the Board will consider the frequency (every 3, 2 or 1 years) receiving the most votes as representing the members’ views on how frequently such votes should occur. |

4

Who is paying for the cost of this proxy solicitation?

Our Board is soliciting the proxy accompanying this Proxy Statement. The Company will pay all proxy solicitation costs. Proxies may be solicited by our officers, directors, and employees, none of whom will receive any additional compensation for their services. These solicitations may be made personally or by mail, facsimile, telephone, messenger, email, or the Internet. We will pay brokers, banks and certain other holders of record holding common shares in their names or in the names of nominees, but not owning such shares beneficially, for the expense of forwarding solicitation materials to the beneficial owners.

What do I need to do to attend the meeting in person?

In order to be admitted to the Annual Meeting, you must present proof of ownership of Axalta common shares as of the close of business on the Record Date in any of the following ways:

| • | a brokerage statement or letter from a bank or broker that is a record holder indicating your ownership of Axalta common shares as of the close of business on March 18, 2015; |

| • | the Notice of Internet Availability of Proxy Materials; |

| • | a printout of the proxy distribution email (if you received your materials electronically); |

| • | a proxy card; |

| • | a voting instruction form; or |

| • | a legal proxy provided by your broker, bank or nominee. |

Any holder of a proxy from a member must present the proxy card, properly executed, and a copy of one of the proofs of ownership listed above. Members and proxy holders must also present a form of photo identification such as a driver’s license. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures.

Is there a list of members entitled to vote at the Annual Meeting?

A list of members entitled to vote at the Annual Meeting will be available at the meeting and for ten days prior to the meeting, between the hours of 8:00 a.m. and 4:00 p.m. Atlantic Time, at our registered offices at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. If you would like to view the member list, please contact our Secretary to schedule an appointment.

I share an address with another member, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

To reduce costs and reduce the environmental impact of our Annual Meeting, we have adopted a procedure approved by the Commission called “householding.” Under this procedure, members of record who have the same address and last name and who do not participate in electronic delivery of proxy materials will receive only a single copy of our Proxy Statement and 2014 Annual Report, unless we have received contrary instructions from such member. Members who participate in householding will continue to receive separate proxy cards and Notices.

We will promptly deliver, upon written or oral request, individual copies of this Proxy Statement or the 2014 Annual Report to any member that received a householded mailing. If you would like an additional copy of the Proxy Statement or 2014 Annual Report, or you would like to request separate copies of future proxy materials, please contact our Secretary, by mail at Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia,

5

PA 19103 or by telephone at (855) 547-1461. If you are a beneficial owner, you may contact the broker or bank where you hold the account.

If you are eligible for householding, but you and other members of record with whom you share an address currently receive multiple copies of our Proxy Statement and 2014 Annual Report, or if you hold common shares in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact Broadridge Financial Solutions, Inc. at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717 or by telephone at(800) 542-1061.

Could other matters be decided at the Annual Meeting?

As of the date of this Proxy Statement, our Board is not aware of any matters, other than those described in this Proxy Statement, which are to be voted on at the Annual Meeting. If any other matters are properly raised at the Annual Meeting, however, the persons named as proxy holders intend to vote the shares represented by your proxy in accordance with their judgment on such matters.

CORPORATE GOVERNANCE MATTERS AND COMMITTEES OF THE BOARD OF DIRECTORS

For purposes of the New York Stock Exchange (“NYSE”) listing standards, we are and expect to continue to be a “controlled company.” Controlled companies under those rules are companies of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. Since our formation, funds affiliated with The Carlyle Group (collectively “Carlyle”) have controlled more than 50% of the combined voting power of our common shares and have the right to designate a majority of the members of our board of directors for nomination for election and the voting power to elect those directors nominees. Accordingly, we take advantage of certain exemptions from corporate governance requirements provided in the NYSE listing standards, and we may continue to take advantage of these exemptions for so long as we continue to be a controlled company. Specifically, as a controlled company, we are not required to have (i) a majority of independent directors, (ii) a nominating and corporate governance committee composed entirely of independent directors or (iii) a compensation committee composed entirely of independent directors. Accordingly, our members do not have the same protections afforded to shareholders of companies that are subject to all of the NYSE corporate governance listing standards. The controlled company exemption does not modify the independence requirements for the audit committee, and we are in compliance with the requirements of the Sarbanes-Oxley Act and the NYSE listing standard stock exchange rules, which require that our audit committee be composed of at least three members, one of whom had to be independent upon the listing of our common shares on the NYSE, a majority of whom had to be independent within 90 days of the effective date of the registration statement (the “Registration Statement”) that was filed in connection with our initial public offering (the “IPO”), which was November 10, 2014, and each of whom will be independent within one year of the effective date of the Registration Statement.

Policies on Corporate Governance

Our Board believes that good corporate governance is important to ensure that our business is managed for the long-term benefit of our members. We have adopted a Code of Business Conduct and Ethics that applies to all of our employees and directors, including our executive officers and senior financial and accounting officers. We have also adopted Corporate Governance Guidelines. Copies of the current versions of the Code of Business Conduct and Ethics and the Corporate Governance Guidelines are available on our website and will also be provided upon request to any person without charge. Requests should be made in writing to our Secretary at Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103, or by telephone at (855) 547-1461.

6

The board of directors does not have a set policy with respect to the separation of the offices of Chairman of the Board and Chief Executive Officer, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board regularly evaluates whether the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee of the Company. The Board believes these issues should be considered as part of the Board’s broader oversight and succession planning process. Currently, Mr. Shaver serves as our Chairman and Chief Executive Officer.

While risk management is primarily the responsibility of our management, the Board provides overall risk oversight focusing on the most significant risks facing us. The Board oversees the risk management processes that have been designed and are implemented by our executives to determine whether these processes are functioning as intended and are consistent with our business and strategy. The Board executes its oversight responsibility for risk management directly and through its committees. The Board’s role in risk oversight has not affected its leadership structure.

The Audit Committee is specifically tasked with reviewing with management, the independent auditors and our legal counsel, as appropriate, our compliance with legal and regulatory requirements and any related compliance policies and programs. The Audit Committee is also tasked with reviewing our financial and risk management policies. Members of our management who have responsibility for designing and implementing our risk management processes regularly meet with the Audit Committee. The Board’s other committees oversee risks associated with their respective areas of responsibility.

The full Board considers specific risk topics, including risk-related issues pertaining to laws and regulations enforced by the United States and foreign government regulators and risks associated with our business plan, strategies and capital structure. In addition, the Board receives reports from members of our management that include discussions of the risks and exposures involved with their respective areas of responsibility, and the Board is routinely informed of developments that could affect our risk profile or other aspects of our business.

Our Corporate Governance Guidelines generally require that the Board be comprised of a majority of directors who are “independent” under applicable NYSE rules. However, there is an exception to this requirement for so long as we qualify as a controlled company. Nonetheless, our Board has determined that a majority of our directors are independent under the NYSE listing standards, including each of Messrs. Bieligk, Böhm, Holt, Kramvis, Ledford, McLaughlin and Sumner.

Subject to our principal stockholders agreement (as defined below), the Nominating and Corporate Governance Committee (the “Nominating Committee”) will consider director nominees recommended by our members. For more information regarding our principal stockholders agreement, see “Certain Relationships and Related Party Transactions—Principal Stockholders Agreement.” A member who wishes to recommend a director candidate for consideration by the Nominating Committee should send the recommendation to our Secretary at Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103, who will then forward it to the Nominating Committee. The recommendation must include a description of the candidate’s qualifications for board service, including all of information that would be required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the Commission (as amended from time to time), the

7

candidate’s written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the member and the candidate for more information. A member who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the Nominating Committee as a nominee, must comply with the notice procedures set for in our Amended and Restated Bye-Laws (“Bye-Laws”). See “MEMBER PROPOSALS FOR THE COMPANY’S 2016 ANNUAL GENERAL MEETING OF MEMBERS” for more information on these procedures.

The Nominating Committee will consider and evaluate persons recommended by the members in the same manner as it considers and evaluates other potential directors. However, as described in more detail below, pursuant to our principal stockholders agreement, Carlyle currently has the right to designate all of our Board members, except that one member shall be the senior ranking executive officer of the Company, who is currently, and for so long as he is our Chief Executive Officer, will be Mr. Shaver. See “Certain Relationships and Related Party Transactions—Principal Stockholders Agreement.”

Subject to our principal stockholders agreement, the Nominating Committee is responsible for reviewing the qualifications of potential director candidates and recommending to the board of directors those candidates to be nominated for election to the board of directors. For more information regarding our principal stockholders agreement, see “Certain Relationships and Related Party Transactions—Principal Stockholders Agreement.” Our Corporate Governance Guidelines, which are available on our website as described above, set forth criteria that the Nominating Committee will consider when evaluating a director candidate for membership on the board of directors. These criteria are as follows: professional experience; education; skill; diversity; differences of viewpoint; and other individual qualities and attributes that will positively contribute to the Board. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee. Our Nominating Committee also considers the mix of backgrounds and qualifications of the directors in order to assure that the board of directors has the necessary experience, knowledge and abilities to perform its responsibilities effectively and to consider the value of diversity on the board of directors. While diversity and variety of experiences and viewpoints represented on the Board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, religion, national origin, sex, sexual orientation or disability.

Our board of directors currently consists of nine members, with Mr. Shaver serving as Chairman of the board of directors.

The number of members on our board of directors may be modified from time to time by our board of directors, subject to the terms of our principal stockholders agreement. Our Board is divided into three classes whose members serve three-year terms expiring in successive years. Directors hold office until their successors have been duly elected and qualified or until the earlier of their respective death, resignation or removal.

At each annual general meeting, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual general meeting following such election. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

In connection with our Acquisition of the performance coatings business from E.I. du Pont de Nemours and Company (“DuPont”) on February 1, 2013 (the “Acquisition”), we entered into a stockholders agreement, which we amended and restated on July 31, 2013 and to which Carlyle, members of management, directors and certain employees who hold our common shares are party. In connection with our IPO, certain provisions of the amended and restated stockholders agreement terminated automatically and we entered into the principal

8

stockholders agreement. See “Certain Relationships and Related Party Transactions—Principal Stockholders Agreement.” Pursuant to the principal stockholders agreement, but subject to the annual election process, Carlyle has the right to designate all of our directors, except that Mr. Shaver will also be a director, and shall serve as the Chairman of the Board, for so long as he is employed by us pursuant to his employment agreement. See “Compensation Discussion and Analysis—Employment and Severance Control Arrangements” for more information regarding the employment agreement we have entered into with Mr. Shaver. All parties to the principal stockholders agreement have agreed to vote their shares in favor of such designees. Carlyle is not obligated to designate the entire number of directors to which it is entitled and the positions for the additional Carlyle designees shall remain vacant until such time as Carlyle desires to exercise its right to designate a director to fill these vacancies, or, if it loses its right to designate any directors pursuant to the terms of the principal stockholders agreement, these positions will be filled by our members in accordance with our memorandum of association and Bye-Laws. Messrs. Bieligk, Böhm, Bustos, Holt, Kramvis, Ledford, McLaughlin and Sumner have been designated by Carlyle.

When considering whether directors and nominees have the experience, qualifications, attributes or skills, taken as a whole, to enable the board of directors to satisfy their oversight responsibilities effectively in light of our business and structure, the board of directors focused primarily on each person’s background and experience as reflected in the information discussed in each of the directors’ individual biographies set forth below. See “Proposal No. 1: Election of Directors.” We believe that our directors provide an appropriate diversity of experience and skills relevant to the size and nature of our business.

Member Communications with Board of Directors

The board of directors provides a process for members to send communications to the board of directors or any of the directors. Members may send written communications to the board of directors, or any of the individual directors, c/o the Secretary of the Company at Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103. All communications will be compiled by the Secretary of the Company and submitted to the board of directors or the individual directors, as applicable, on a periodic basis. In addition, all directors are invited, but not required, to attend our annual general meetings of members.

Board Meetings, Attendance and Executive Sessions

Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. The Board meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings and meetings of committees on which they serve. In addition, all directors are invited, but not required, to attend our annual general meeting of members. Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities.

In general, the Board reserves time during each regularly scheduled meeting to allow the non-management Board members and the independent directors to each meet in executive sessions.

In 2014, the Board met five times. All directors attended 75% or more of the meetings of the Board and committees on which they served.

Our board of directors directs the management of our business and affairs as provided by Bermuda law and conducts its business through meetings of the board of directors and four standing committees: the Audit, the Compensation, the Executive and the Nominating Committees. In addition, from time to time, other committees may be established under the direction of the board of directors when necessary or advisable to address specific issues.

9

Each of the Audit Committee, Compensation Committee and Nominating Committee operate under a charter that was approved by our board of directors. A copy of each of these charters is available on our website atwww.axaltacoatingsystems.com.

Audit Committee

The Audit Committee, which currently consists of Messrs. McLaughlin (Chairman), Kramvis and Sumner, is responsible for, among its other duties and responsibilities, assisting the board of directors in overseeing: our accounting and financial reporting processes and other internal control processes, the audits and integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm, our Code of Business Conduct and Ethics, and the performance of our internal audit function and independent registered public accounting firm. Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. Mr. McLaughlin was appointed as the Chairman of the Audit Committee in April 2014. Mr. Sumner served as the Chairman of the Audit Committee prior to the appointment of Mr. McLaughlin to this position. The board of directors has determined that each of Messrs. McLaughlin, Kramvis and Sumner is an “audit committee financial expert” as such term is defined under the applicable regulations of the Commission and has the requisite accounting or related financial management expertise and financial sophistication under the applicable rules and regulations of the NYSE. The board of directors has also determined that Messrs. McLaughlin and Kramvis are independent under Rule 10A-3 under the Exchange Act and the NYSE standard, for purposes of the Audit Committee. Rule 10A-3 under the Exchange Act requires that all members of the Audit Committee be independent (within the meaning of Rule 10A-3 under the Exchange Act and the NYSE standard) within one year from the effective date of the registration statement in our IPO. We intend to comply with this independence requirement. All members of the Audit Committee are able to read and understand fundamental financial statements, are familiar with finance and accounting practices and principles and are financially literate.

In 2014, the Audit Committee met ten times.

Compensation Committee

The Compensation Committee, which consists of Messrs. Sumner (Chairman), Bustos and Ledford, is responsible for, among its other duties and responsibilities, reviewing and approving the compensation philosophy for our chief executive officer, reviewing and approving all forms of compensation and benefits to be provided to our other executive officers and reviewing and overseeing the administration of our equity incentive plans. The Compensation Committee’s processes for fulfilling its responsibilities and duties with respect to executive compensation and the role of executive officers and management in the compensation process are each described under the heading “Determination of Compensation Awards” in this Proxy Statement.

In 2014, the Compensation Committee met four times.

Nominating Committee

The Nominating Committee, which consists of Messrs. Sumner (Chairman) and Ledford, is, subject to our principal stockholders agreement, responsible for, among its other duties and responsibilities, identifying and recommending director candidates for election to our board of directors and reviewing the composition of the board of directors and its committees. For more information regarding the principal stockholders agreement, see “Certain Relationships and Related Party Transactions—Principal Stockholders Agreement.”

The Nominating Committee was formed effective as of November 12, 2014 in connection with the IPO and did not meet in 2014.

10

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2014, our Compensation Committee consisted of Messrs. Sumner (Chairman), Ledford and Bustos. None of the members of our Compensation Committee is currently one of our officers or employees. Messrs. Bieligk, Böhm, Holt, Ledford and Sumner are employed by Carlyle. Carlyle is a party to both our stockholders agreement and our principal stockholders agreement. See “Certain Relationships and Related Party Transactions.” In addition, during the year ended December 31, 2014, we paid Carlyle fees of $16.6 million under a consulting agreement between us and Carlyle (approximately $13.4 million of which was to terminate the consulting agreement). See “Certain Relationships and Related Party Transactions—Consulting Agreement.” During the year ended December 31, 2014, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our Board has adopted a written statement of policy for the evaluation of and the approval, disapproval and monitoring of transactions involving us and “related persons.” For the purposes of the policy, “related persons” will include our executive officers, directors and director nominees or their immediate family members, or members owning five percent or more of our outstanding common shares and their immediate family members.

The policy covers any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we were or are to be a participant, the amount involved exceeds $100,000 and a related person had or will have a direct or indirect material interest. Pursuant to this policy, our management will present to our Audit Committee each proposed related person transaction, including all relevant facts and circumstances relating thereto. Our Audit Committee will then:

| • | review the relevant facts and circumstances of each related person transaction, including the financial terms of such transaction, the benefits to us, the availability of other sources for comparable products or services, if the transaction is on terms no less favorable to us than those that could be obtained in arm’s-length dealings with an unrelated third party or employees generally and the extent of the related person’s interest in the transaction; and |

| • | take into account the impact on the independence of any independent director and the actual or apparent conflicts of interest. |

All related person transactions may only be consummated if our Audit Committee has approved or ratified such transaction in accordance with the guidelines set forth in the policy. Certain types of transactions have been pre-approved by our Audit Committee under the policy. These pre-approved transactions include:

| • | The purchase of the Company’s products on an arm’s length basis in the ordinary course of business and on terms and conditions generally available to other similarly situated customers; |

| • | Resolution of warranty claims and associated activities relating to the Company’s products, provided such claims and activities are administered on an arm’s length basis in the ordinary course of business and consistent with the administration of the claims of other similar situated customers; |

| • | Any related person transaction within the scope of a related person’s ordinary business duties to the Company or the Company’s ordinary course of business when the interest of the related person arises solely from the ownership of a class of equity securities of the Company and all holders of such class of equity securities of the Company will receive the same benefit on a pro rata basis; |

| • | Receipt of compensation and benefits (subject to necessary Compensation Committee approvals) by an executive officer or director of the Company if the compensation is required to be reported in the |

11

Company’s proxy statement pursuant to Item 402 of Regulation S-K or to an executive officer of the Company, if such compensation would have been required to be reported under Item 402 of Regulation S-K as compensation earned for services to the Company if the executive was a “named executive officer” in the proxy statement and such compensation has been approved, or recommended to the Company’s Board for approval, by the Compensation Committee of the Board of the Company; |

| • | The Company’s payment or reimbursement of a related person’s expenses incurred in performing his or her Company-related responsibilities in accordance with the Company’s policies and procedures; |

| • | Any related person transaction in which the related person’s interest arises only: (i) from the related person’s position as a director of another corporation or organization that is a party to the related person transaction; (ii) from the direct or indirect ownership by the related person and all other related persons, in the aggregate, of less than a ten percent equity interest in another person (other than a partnership) which is a party to the related person transaction; or (iii) from both such position and ownership; |

| • | Any related person transaction in which the related person’s interest arises only from the related person’s position as a limited partner in a partnership in which the related person and all other related persons have an interest of less than ten percent and the person is not a general partner of and does not have another position in the partnership; and |

| • | Any related person transaction in which the related person is providing investment advisory, investment management, participant record-keeping, securities brokerage, clearing services or any similar services as part of an employee benefit plan or similar plan offered by the Company to its executive officers, directors or employees where (i) the related person was not a related person at the time the Company first engaged the related person for such services; (ii) the related person became a related person solely through the acquisition of five percent or more of the Company’s common shares; and (iii) the related person is eligible to, and does, report share holdings on Schedule 13G. |

No director may participate in the approval of a related person transaction for which he or she, or his or her immediate family member, is a party to the transaction.

On February 1, 2013, in connection with the Acquisition, we entered into a consulting agreement with Carlyle, pursuant to which we paid Carlyle a fee for consulting and oversight services provided to us and our subsidiaries. Pursuant to this agreement, subject to certain conditions, we paid an annual management fee to Carlyle of $3 million plus expenses. Further, under this agreement, Carlyle was entitled to additional reasonable fees and compensation agreed upon by the parties for advisory and other services provided by Carlyle to us from time to time, including additional advisory and other services associated with acquisitions and divestitures or sales of equity or debt instruments. We paid Carlyle a fee of approximately $13.4 million to terminate the consulting agreement in connection with the consummation of the IPO.

Principal Stockholders Agreement

In connection with the Acquisition, we entered into a stockholders agreement, which we amended and restated on July 31, 2013, and to which Carlyle, members of management who hold our common shares and certain other of our members were party. Certain provisions of this agreement terminated automatically upon the consummation of our IPO and were replaced by a new stockholders agreement with Carlyle (the “principal stockholders agreement”). Our board of directors currently consists of nine members. Pursuant to the principal stockholders agreement, Carlyle has designated all of our board members, except one member shall be the senior ranking executive officer of the Company, who currently, and for so long as he is the Company’s Chief Executive Officer, is Mr. Shaver. The number of board members that Carlyle (or such permitted transferee or affiliate) is entitled to designate is subject to maintaining certain ownership thresholds. If Carlyle (or such permitted transferee or affiliate) loses its right to designate any directors pursuant to the terms of the principal stockholders agreement, these positions will be filled by our members in accordance with our memorandum of association and

12

our Bye-Laws. In addition, the principal stockholders agreement provides that each committee of the board of directors will include a proportional number of directors designated by Carlyle (or such permitted transferee or affiliate) that is no less than the proportion of directors designated by Carlyle then serving on our board of directors), subject to Company’s obligation to comply with any applicable independence requirements.

The principal stockholders agreement also includes provisions pursuant to which we granted Carlyle (or such permitted transferee or affiliate) the right to cause us, in certain instances, at our expense, to file registration statements under the Securities Act covering resales of our common shares held by Carlyle (or such permitted transferee or affiliate) or to piggyback on such registration statements in certain circumstances. These shares represent approximately 74% of our outstanding common shares as of the Record Date. The principal stockholders agreement also requires us to indemnify Carlyle (or such permitted transferee or affiliate) and its affiliates in connection with any registrations of our securities.

In connection with our IPO, we entered into indemnification agreements with each of our directors and certain of our officers. These indemnification agreements provide the directors and officers with contractual rights to indemnification and expense advancement that are, in some cases, broader than the specific indemnification provisions contained under Bermuda law. We believe that these indemnification agreements are, in form and substance, substantially similar to those commonly entered into in transactions of like size and complexity sponsored by private equity firms.

See “Compensation Discussion and Analysis—Employment and Severance Arrangements” for information regarding the employment agreements that we have entered into with our executive officers.

OHorizons Global Consulting Agreement

In connection with the Acquisition, we paid consulting fees and expenses to OHorizons Global, an international management consulting network, of approximately $2.1 million, of which $2 million was incurred in 2012 and $0.1 million was incurred in 2013. One of our directors, Orlando Bustos, is the Chairman and Chief Executive Officer of OHorizons Global. As part of the compensation for the consulting services, we granted OHorizons Global an option award to purchase up to 352,143 of our common shares that had a fair value of approximately $0.5 million.

Service King Collision Repair, a former affiliate of Carlyle, has purchased products from our distributors in the past and may continue to do so in the future. In August 2013, we entered into a new long-term sales agreement with Service King to be their exclusive provider of coatings. In July 2014, Carlyle sold a majority stake in Service King to an unaffiliated third party. Related person sales prior to this transaction were approximately $4.0 million in 2014.

Common Share Purchases by Officers and Directors

During calendar year 2014, certain of our employees, former employees and directors have purchased an aggregate of 1,629,630 of our common shares at fair market value with an aggregate purchase price of approximately $10.9 million.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of March 18, 2015 by:

| • | each person known to us to own beneficially more than 5% of the capital stock; |

| • | each of our directors; |

| • | each of our named executive officers; and |

| • | all of our directors and executive officers as a group. |

We had 229,819,296 million common shares outstanding as of March 18, 2015. The amounts and percentages of shares beneficially owned are reported on the basis of Commission regulations governing the determination of beneficial ownership of securities. Under the Commission rules, a person is deemed to be a “beneficial” owner of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are not deemed to be outstanding for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

Except as otherwise indicated in these footnotes, each of the beneficial owners listed has, to our knowledge, sole voting and investment power with respect to the shares of capital stock and the business address of each such beneficial owner other than Carlyle is c/o Axalta Coating Systems Ltd., Two Commerce Square, 2001 Market Street, Suite 3600, Philadelphia, PA 19103.

| Number of Common Shares Beneficially Owned | ||||||||||

Name of Beneficial Owner | Number | Percent of Class | ||||||||

Principal Members | ||||||||||

Investments funds affiliated with The Carlyle Group(1) | 170,311,996 | 74.1 | % | |||||||

Executive Officers and Directors | ||||||||||

Charles W. Shaver(2) | 2,123,525 | * | ||||||||

Robert W. Bryant(3) | 691,579 | * | ||||||||

Stephen K. Markevich(4) | 505,605 | * | ||||||||

Joseph F. McDougall(5) | 256,256 | * | ||||||||

Michael F. Finn(6) | 265,992 | * | ||||||||

Orlando A. Bustos(7) | 162,879 | * | ||||||||

Robert M. McLaughlin(8) | 80,301 | * | ||||||||

Andreas C. Kramvis | 277,732 | * | ||||||||

Martin W. Sumner | — | — | ||||||||

Wesley T. Bieligk | — | — | ||||||||

Gregor P. Böhm | — | — | ||||||||

Allan M. Holt | — | — | ||||||||

Gregory S. Ledford | — | — | ||||||||

All executive officers and directors as a group (14 persons) | 4,541,026 | 2.00 | % | |||||||

| * | Denotes less than 1.0% of beneficial ownership. |

14

| (1) | Includes 36,241,700 shares held by Carlyle Partners V SA1 Cayman, L.P. (“CPV SA1”), 32,674,647 shares held by Carlyle Partners V SA2 Cayman, L.P. (“CPV SA2”), 33,533,083 shares held by Carlyle Partners V SA3 Cayman, L.P. (“CPV SA3”), 2,100,891 shares held by Carlyle Partners V-A Cayman, L.P. (“CPV-A”), 3,980,455 shares held by CP V Coinvestment A Cayman, L.P. (“CPV Coinvest A”), 477,868 shares held by CP V Coinvestment B Cayman, L.P. (“CPV Coinvest B”), 21,657,681 shares held by Carlyle Coatings Partners, L.P. (“CCP” and, together with CPV SA1, CPV SA2, CPV SA3, CPV-A, CPV Coinvest A and CPV Coinvest B, the “Carlyle Cayman Shareholders”) and 39,645,671 shares held by CEP III Participations, S.à r.l. SICAR (“CEP III” and, together with the Carlyle Cayman Shareholders, the “Carlyle Shareholders”). |

Carlyle Group Management L.L.C. is the general partner of The Carlyle Group L.P., which is a publicly traded entity listed on NASDAQ. The Carlyle Group L.P. is the managing member of Carlyle Holdings II GP L.L.C., which is the general partner of Carlyle Holdings II L.P., which is the general partner of TC Group Cayman Investment Holdings, L.P., which is the general partner of TC Group Cayman Investment Holdings Sub L.P., which is the sole member of CP V General Partner, L.L.C. and the sole shareholder of CEP III Managing GP Holdings, Ltd. CP V General Partner, L.L.C. is the general partner of TC Group V Cayman, L.P., which is the general partner of each of the Carlyle Cayman Shareholders. CEP III Managing GP Holdings, Ltd. is the general partner of CEP III Managing GP, L.P., which is the general partner of Carlyle Europe Partners III, L.P., which is the sole shareholder of CEP III.

Voting and investment determinations with respect to the shares held by the Carlyle Cayman Shareholders are made by an investment committee of TC Group V, L.P. comprised of Daniel D’Aniello, William Conway, David Rubenstein, Louis Gerstner, Allan Holt, Peter Clare, Gregor Böhm, Kewsong Lee and Thomas Mayrhofer. Voting and investment determinations with respect to the shares held by the CEP III are made by an investment committee of CEP III Managing GP, L.P. comprised of Daniel D’Aniello, William Conway, David Rubenstein, Louis Gerstner, Allan Holt, Kewsong Lee and Thomas Mayrhofer. Each member of the investment committees disclaims beneficial ownership of such shares.

The address for each of TC Group Cayman Investment Holdings, L.P., TC Group Cayman Investment Holdings Sub L.P., TC Group V Cayman, L.P. and the Carlyle Cayman Shareholders is c/o Intertrust Corporate Services, 190 Elgin Avenue, George Town, Grand Cayman, E9 KY1-9005, Cayman Islands. The address for CEP III is c/o The Carlyle Group, 2, avenue Charles de Gaulle, L -1653 Luxembourg, Luxembourg. The address of each of the other persons or entities named in this footnote is c/o The Carlyle Group, 1001 Pennsylvania Ave. NW, Suite 220 South, Washington, D.C. 20004-2505.

| (2) | Includes 338,000 common shares and 1,785,525 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

| (3) | Includes 84,500 common shares and 607,079 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

| (4) | Includes 144,532 common shares and 361,073 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

| (5) | Includes 38,025 common shares and 218,231 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

| (6) | Includes 109,758 common shares and 156,234 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

| (7) | Includes 162,879 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date held through OHorizons Global, a firm of which Mr. Bustos is the Chairman and Chief Executive Officer. |

| (8) | Includes 69,290 common shares and 11,011 common shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of the Record Date. |

15

The following table provides information regarding our executive officers:

Name | Age* | Position | ||

Charles W. Shaver | 56 | Chairman and Chief Executive Officer | ||

Robert W. Bryant | 46 | Executive Vice President and Chief Financial Officer | ||

Steven R. Markevich | 55 | Senior Vice President and President, OEM | ||

Joseph F. McDougall | 44 | Senior Vice President and Chief Human Resources Officer | ||

Michael F. Finn | 48 | Senior Vice President, General Counsel and Corporate Secretary | ||

Michael A. Cash | 53 | Senior Vice President and President, Industrial Coatings | ||

| * | As of March 18, 2015. |

Charles W. Shaver

Mr. Shaver has been our Chairman of the Board and Chief Executive Officer since February 2013. With over 34 years of leadership roles in the global petrochemical, oil and gas industry, he was most recently the Chief Executive Officer and President of the TPC Group from 2004 to April 2011. Mr. Shaver also served as Vice President and General Manager for General Chemical, a division of Gentek, from 2001 through 2004 and as a Vice President and General Manager for Arch Chemicals from 1999 through 2001. Mr. Shaver began his career with The Dow Chemical Company serving in a series of operational, engineering and business positions from 1980 through 1996. He has an extensive background of leadership roles in a variety of industry organizations, including serving on the American Chemistry Council board of directors, the American Chemistry Council Finance Committee and the National Petrochemical and Refiners Association Board and Executive Committee. Mr. Shaver currently serves as Chairman of the board of directors for U.S. Silica and formerly served on the board of directors of Taminco, Inc. from 2012 through 2014. Mr. Shaver earned his B.S. in Chemical Engineering from Texas A&M University. The board of directors has concluded that Mr. Shaver should serve as a director because of his leadership role with our Company, his experience in the chemical industry and his significant directorship experience.

Robert W. Bryant

Mr. Bryant became our Executive Vice President and Chief Financial Officer in February 2013. Previously, Mr. Bryant served as the Senior Vice President and Chief Financial Officer of Roll Global LLC. Before joining Roll Global in 2007, he was the Executive Vice President of Strategy, New Business Development, and Information Technology at Grupo Industrial Saltillo, S.A.B. de C.V. Prior to joining Grupo Industrial Saltillo in 2004, Mr. Bryant was President of Bryant & Company, which he founded in 2001. Prior positions included serving as Managing Principal with Texas Pacific Group’s Newbridge Latin America, L.P., a Senior Associate with Booz Allen & Hamilton Inc. and an Assistant Investment Officer with the International Finance Corporation (IFC). Mr. Bryant began his career at Credit Suisse First Boston. Mr. Bryant graduated summa cum laude and Phi Beta Kappa with a B.A. in Economics from the University of Florida and received his M.B.A. from the Harvard Business School.

Steven R. Markevich

Mr. Markevich became our Senior Vice President and President, OEM in June 2013. Previously, Mr. Markevich was Chief Executive Officer of GKN Driveline. Prior to that role, from July 2010 to August 2012, he was President, GKN Sinter Metals, responsible for global operations. From October 2007 to July 2010, Mr. Markevich was President, North American Operations for GKN Sinter Metals, and began his tenure with

16

GKN in 2007 as Vice President, Sales & Marketing. At Siegel-Robert Automotive, he led the company’s commercial strategy, sales, account and program management initiatives. While at Guardian Automotive, Mr. Markevich served in numerous leadership roles and was responsible for all senior level customer relationships. His career began at Deloitte & Touche consulting and the National Steel Corporation. Mr. Markevich holds a finance degree from University of Michigan’s Ross School of Business and is a Certified Public Accountant as well as being certified in Production & Inventory Management (CPIM). He has completed the Global Senior Leadership Program at UCLA and holds memberships in the Society of Automotive Engineers (SAE), Original Equipment Suppliers Association (OESA) and American Powder Metallurgy Institute International (APMI).

Joseph F. McDougall

Mr. McDougall became our Senior Vice President and Chief Human Resources Officer in May 2013. Previously, Mr. McDougall was Vice President, Human Resources, Communications and Six Sigma for Honeywell Performance Materials and Technologies. He served in a number of positions in Honeywell prior to this most recent position including Vice President, Human Resources for their Air Transport Division, Director of Human Resources for Honeywell Corporate from 2004-2007, Director of Compensation, Benefits and HRIS for Honeywell’s Specialty Materials Group from 2003-2004. Prior to joining Honeywell, Mr. McDougall served in human resources leadership roles at the Goodson Newspaper Group and Robert Wood Johnson University Hospital at Hamilton. He started his career as a human resources and benefits consultant. Mr. McDougall holds a B.A. from Rider University and graduated Beta Gamma Sigma with an M.B.A. from The Pennsylvania State University.

Michael F. Finn

Mr. Finn became our Senior Vice President and General Counsel as well as Chief Compliance Officer in April 2013. Mr. Finn also is Axalta’s Corporate Secretary. Previously, Mr. Finn was Vice President and General Counsel of General Dynamics’ Advanced Information Systems subsidiary. Before that, he was Vice President, General Counsel and Director of Ethics and Export Compliance at General Dynamics United Kingdom. From 2002 to 2005, Mr. Finn served as Senior Counsel for General Dynamics Corporation. Between 1999 and 2002 he was General Counsel and Vice President at Sideware Inc. and Associate General Counsel and Senior Director of Business Affairs at Teligent Inc. Prior to those roles, Mr. Finn worked in several positions, most notably as an Associate at Willkie, Farr & Gallagher and as an Attorney at the Office of the General Counsel at the FCC. Mr. Finn graduated from Indiana University with a degree in Finance and graduated cum laude from New York University’s School of Law.

Michael A. Cash

Mr. Cash became our Senior Vice President and President, Industrial Coatings in August 2013. Prior to joining Axalta, Mr. Cash was Managing Director, Powder Coatings—Asia Pacific Region at AkzoNobel Coatings from 2011 to 2013 and previously in charge of AkzoNobel’s powder business throughout the Americas from 2005 to 2011. Mr. Cash also held a number of positions at The Sherwin-Williams Company including Vice President, Automotive International, Vice President of Automotive Marketing and Vice President and Chief Financial Officer of its joint venture with Herberts GmbH, which was then a Hoechst company. Earlier in his career, Mr. Cash was Vice President and Chief Financial Officer of Carstar Automotive, a U.S. autobody repair franchise. Mr. Cash received his B.A. in Business Administration from Miami University (Ohio).

17

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Our board of directors currently consists of nine directors. Our directors are divided into three classes with staggered three-year terms so that the term of one class expires at each annual general meeting of members. Three nominees will be proposed for election as Class I directors at the Annual Meeting. Information regarding our directors’ professional experience and ages (as of March 18, 2015) is set forth below.

It is intended that the persons named in the accompanying proxy will vote to elect the nominees listed below unless authority to vote is withheld. The elected directors will serve until the annual general meeting of members in 2018 or until an earlier resignation or retirement or until their successors are elected and qualify to serve.

All of the nominees are presently serving as directors of the Company. The nominees have agreed to stand for reelection. However, if for any reason any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that shares represented by the accompanying proxy will be voted for the election of a substitute nominee designated by our board of directors, or the board of directors may determine to leave the vacancy temporarily unfilled.

Nominees for Election as Class I Directors

Wesley T. Bieligk

Mr. Bieligk, age 35, became a member of our board of directors following the Acquisition. Mr. Bieligk is a Principal at Carlyle focused on buyout opportunities in the industrial and transportation sectors. Mr. Bieligk is a member of the board of directors of Signode Industrial Group and Greater China Intermodal. In addition, he has been actively involved in Carlyle’s investments in Allison Transmission and the Hertz Corporation. Mr. Bieligk received an M.B.A. with honors from The Wharton School at the University of Pennsylvania and a B.S. in commerce with distinction from The McIntire School of Commerce at the University of Virginia. The board of directors has concluded that Mr. Bieligk should serve as a director because he has significant directorship experience and has significant core business skills, including financial and strategic planning.

Gregor P. Böhm

Mr. Böhm, age 50, became a member of our board of directors following the Acquisition. Mr. Böhm is a Managing Director at Carlyle and Co-head of the firm’s Europe Buyout group. He is based in London. Mr. Böhm is a member of the Board of HC Starck, Puccini, Ameos and Alloheim. He has previously served on the Boards of Andritz, Messer Cutting and Welding, Beru, Honsel Edscha, and HT Troplast. Prior to joining Carlyle, Mr. Böhm was a Manager at I.M.M., one of Germany’s leading buyout groups. Prior to that he was an Analyst with Morgan Stanley’s Mergers and Acquisitions department in London. Mr. Böhm is a graduate of Cologne University and earned his M.B.A. from Harvard Business School. The board of directors has concluded that Mr. Böhm should serve as a director because he has significant directorship experience and has significant core business skills, including financial and strategic planning.

Robert M. McLaughlin

Mr. McLaughlin, age 57, became a member of our board of directors in April 2014. Mr. McLaughlin is Senior Vice President and Chief Financial Officer of Airgas, Inc. and a member of the company’s Management Committee. Airgas is a leading U.S. supplier of industrial, medical and specialty gases, and hardgoods, such as personal protective equipment, welding equipment and other related products. Prior to assuming his current position on October 3, 2006, Mr. McLaughlin served as Vice President and Controller since joining Airgas in 2001. From 1999 to 2001, he served as Vice President of Finance for Asbury Automotive Group. From 1992 to 1999, Mr. McLaughlin was Vice President of Finance and held other senior financial positions at Unisource Worldwide, Inc. He began his career at Ernst & Young in 1979. He was a Certified Public Accountant and earned

18

his Bachelor’s degree in accounting from the University of Dayton. The board of directors has concluded that Mr. McLaughlin should serve as a director because he has significant and diverse business experience and has significant experience on all aspects of financial management and strategic planning in a public company environment.

The board of directors of the Company recommends a vote “FOR” each of the foregoing nominees for election as Class I directors.

Directors Continuing in Office

Continuing Class II Directors with Terms Expiring at the 2016 Annual General Meeting of Members

Andreas C. Kramvis

Mr. Kramvis, age 62, became a member of our board of directors in July 2014. Mr. Kramvis is Vice Chairman of Honeywell International focused on critical aspects for the achievement of the company’s Five Year Plan. Prior to this role, Mr. Kramvis served as the President and Chief Executive Officer of Honeywell Performance Materials and Technologies, a global leader in process technology for the oil and gas industries as well as the development and production of high-purity, high-quality performance chemicals and materials. Mr. Kramvis has also served as the President and CEO of Honeywell’s Environmental and Combustion Controls business. Intimately familiar with key markets and economies around the world, Mr. Kramvis has managed companies with global scope across five different industries. Mr. Kramvis is a Director of AptarGroup, a past Chairman of the Society of Chemical Industry and a Board Member and Executive Committee Member of the American Chemistry Council. He is the author of a book titled “Transforming the Corporation: Running a Business in the 21st Century,” which demonstrates how to systematically transform a business for high performance. Mr. Kramvis is a graduate of Cambridge University, where he studied engineering specializing in electronics and he holds an M.B.A. from Manchester Business School. The board of directors has concluded that Mr. Kramvis should serve as a director because he brings extensive experience regarding the management of public and private companies.

Gregory S. Ledford

Mr. Ledford, age 57, became a member of our board of directors following the Acquisition. Mr. Ledford is a Managing Director at Carlyle focused on the industrial and transportation sectors. He joined Carlyle in 1988 and, prior to his appointment as Managing Director, held the positions of Vice President and Principal, responsible for leading Carlyle’s Investments in numerous companies. From 1991 to 1997, he was Chairman and CEO of the Reilly Corp., a former Carlyle portfolio company. In addition, he was Director of Capital Leasing for MCI Telecommunications. Mr. Ledford is a member of the board of directors of Allison Transmission, Greater China Intermodal and HD Supply. Mr. Ledford is a graduate of the University of Virginia’s McIntire School of Commerce. He received an M.B.A. from Loyola College. The board of directors has concluded that Mr. Ledford should serve as a director because he brings extensive experience regarding the management of public and private companies, and the financial services industry.

Martin W. Sumner

Mr. Sumner, age 41, became a member of our board of directors in August 2012. Mr. Sumner is a Managing Director at Carlyle focused on U.S. buyout opportunities in the industrial and transportation sectors. Mr. Sumner has led, or been a key contributor in, Carlyle’s investments in Allison Transmission and Veyance Technologies where he served on the Board and was chairman of the audit committee. Additionally, he previously served on the Board of AxleTech International Holdings prior to its sale to General Dynamics and the Board of United Components prior to its sale to the Rank Group. Mr. Sumner received his M.B.A. from Stanford University, where he was an Arjay Miller Scholar. He received a B.S. in economics, magna cum laude, from the Wharton

19

School of the University of Pennsylvania. The board of directors has concluded that Mr. Sumner should serve as a director because he has significant directorship experience and has significant core business skills, including financial and strategic planning.

Continuing Class III Directors with Terms Expiring at the 2017 Annual General Meeting of Members

Orlando A. Bustos