Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

January 29, 2015

VIA EDGAR

United States Securities and Exchange Commission

100 F. Street, N.E.

Division of Corporation Finance

WASHINGTON, D.C. 20549

Attention: Tom Kluck

| | RE: | Caesars Entertainment Resort Properties, LLC |

| | | Amendment No. 2 to Registration Statement on Form S-4 |

Dear Mr. Kluck:

On behalf of Caesars Entertainment Resort Properties, LLC, a Delaware limited liability company (the “Company”), we submit in electronic form excerpted changed pages, marked to indicate changes from Amendment No. 2 (“Amendment No. 2”) to the Registration Statement (the “Registration Statement”) on Form S-4 of the Company as originally filed with the Securities and Exchange Commission (the “Commission”) on December 24, 2014.

The attached changed pages reflect the Company’s revised disclosure in response to the comment received from the Staff of the Commission (the “Staff”) in a letter from Tom Kluck, dated January 16, 2015.

As discussed with the Staff on January 28, 2015, we would appreciate the opportunity to discuss the attached changed pages prior to the Company filing a third amendment to the Registration Statement.

|

| Respectfully submitted, |

|

| /s/ Robert C. Goldstein |

| Robert C. Goldstein |

Enclosure

Securities and Exchange Commission

Page 2

| cc: | Scott E. Wiegand, Esq. |

| | Caesars Entertainment Resort Properties, LLC |

| | Caesars Entertainment Resort Properties, LLC |

| | Paul, Weiss, Rifkind, Wharton & Garrison LLP |

As filed with the Securities and Exchange Commission on January , 2015

Registration No. 333-199393

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CAESARS ENTERTAINMENT RESORT PROPERTIES, LLC

(Exact name of registrant as specified in its charter)

| | | | |

| DELAWARE | | 7993 | | 46-3675913 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

One Caesars Palace Drive

Las Vegas, NV89109

(702) 407-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

*ADDITIONAL REGISTRANTS LISTED ON SCHEDULE A HERETO

Scott E. Wiegand, Esq.

Senior Vice President, Deputy General Counsel and Corporate Secretary

One Caesars Palace Drive, Las Vegas, Nevada 89109

(702) 407-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Monica K. Thurmond, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit | | Proposed maximum aggregate offering price(1) | | Amount of

registration fee(2)(4) |

8% First-Priority Senior Secured Notes due 2020 | | $1,000,000,000 | | 100% | | $1,000,000,000 | | $116,200 |

Guarantees of 8% First-Priority Senior Secured Notes due 2020 | | N/A | | N/A | | N/A | | N/A(3) |

11% Second-Priority Senior Secured Notes due 2021 | | $1,150,000,000 | | 100% | | $1,150,000,000 | | $133,630 |

Guarantees of 11% Senior Notes due 2021 | | N/A | | N/A | | N/A | | N/A(3) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Calculated pursuant to Rule 457(f) of the rules and regulations of the Securities Act. |

| (3) | Pursuant to Rule 457(n) of the rules and regulations under the Securities Act, no separate fee for the guarantee is payable. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not complete the exchange offers and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

Subject to Completion, dated January , 2015

PRELIMINARY PROSPECTUS

| | | | |

| Caesars Entertainment Resort Properties, LLC | | Harrah’s Las Vegas, LLC | | Caesars Entertainment Resort Properties Finance, Inc. |

| Harrah’s Laughlin, LLC | | Rio Properties, LLC | | AC Conference Holdco., LLC |

| AC Conference Newco., LLC | | Caesars Linq, LLC | | Caesars Florida Acquisition Company, LLC |

| Caesars Octavius, LLC | | Flamingo Las Vegas Operating Company, LLC | | Harrah’s Atlantic City Mezz 1, LLC |

| Harrah’s Atlantic City Mezz 2, LLC | | Harrah’s Atlantic City Mezz 3, LLC | | Harrah’s Atlantic City Mezz 4, LLC |

| Harrah’s Atlantic City Mezz 5, LLC | | Harrah’s Atlantic City Mezz 6 LLC | | Harrah’s Atlantic City Mezz 7, LLC |

| Harrah’s Atlantic City Mezz 8, LLC | | Harrah’s Atlantic City Mezz 9, LLC | | Harrah’s Atlantic City Operating Company, LLC |

| Harrah’s Atlantic City Propco, LLC | | Octavius/Linq Intermediate Holding, LLC | | Paris Las Vegas Operating Company, LLC |

OFFERS TO EXCHANGE

$1,000,000,000 8% First-Priority Senior Secured Notes due 2020 and Related Guarantees and

$1,150,000,000 11% Second-Priority Senior Secured Notes due 2021 and Related Guarantees

The Notes and the Guarantees

| | • | | Caesars Entertainment Resort Properties, LLC, Caesars Entertainment Resort Properties Finance, Inc., Harrah’s Las Vegas, LLC, Harrah’s Laughlin, LLC, Rio Properties, LLC, AC Conference Holdco., LLC, AC Conference Newco., LLC, Caesars Florida Acquisition Company, LLC, Caesars Linq, LLC, Caesars Octavius, LLC, Flamingo Las Vegas Operating Company, LLC, Harrah’s Atlantic City Mezz 1, LLC, Harrah’s Atlantic City Mezz 2, LLC, Harrah’s Atlantic City Mezz 3, LLC, Harrah’s Atlantic City Mezz 4, LLC, Harrah’s Atlantic City Mezz 5, LLC, Harrah’s Atlantic City Mezz 6, LLC, Harrah’s Atlantic City Mezz 7, LLC, Harrah’s Atlantic City Mezz 8, LLC, Harrah’s Atlantic City Mezz 9, LLC, Harrah’s Atlantic City Operating Company, LLC, Harrah’s Atlantic City Propco, LLC, Octavius/Linq Intermediate Holding, LLC, Paris Las Vegas Operating Company, LLC (each an “Issuer” and collectively the “Issuers”), each an indirect wholly owned subsidiary of Caesars Entertainment Corporation (“Caesars Entertainment”), are offering to exchange for $1,000,000,000 of their outstanding 8% First-Priority Senior Secured Notes due 2020 and certain related guarantees, which were issued on October 11, 2013 in a private offering and which we collectively refer to as the “initial first lien notes,” a like aggregate amount of our registered 8% First-Priority Senior Secured Notes due 2020 and certain related guarantees, which we collectively refer to as the “exchange first lien notes.” The exchange first lien notes will be issued under the indenture dated as of October 11, 2013 governing the initial first lien notes, which we refer to as the “first lien indenture.” We refer to the initial first lien notes and the exchange first lien notes collectively as the “first lien notes.” |

| | • | | The Issuers are offering to exchange for $1,150,000,000 of their outstanding 11% Second-Priority Senior Secured Notes due 2021 and certain related guarantees, which were issued on October 11, 2013 in a private offering and which we collectively refer to as the “initial second lien notes,” a like aggregate amount of our registered 11% Second-Priority Senior Secured Notes due 2021 and certain related guarantees, which we collectively refer to as the “exchange second lien notes.” The exchange second lien notes will be issued under the indenture dated as of October 11, 2013 governing the initial second lien notes, which we refer to as the “second lien indenture.” We refer to the initial second lien notes and the exchange second lien notes collectively as the “second lien notes.” |

| | • | | We refer to the initial first lien notes and the initial second lien notes collectively or individually, as the context requires, as the “initial notes.” We refer to the exchange first lien notes and the exchange second lien notes collectively or individually, as the context requires, as the “exchange notes.” We refer to the initial notes and the exchange notes collectively as the “notes.” We refer to the first lien indenture and the second lien indenture as the “indentures.” |

| | • | | The exchange first lien notes will mature on October 1, 2020. We will pay interest on the exchange first lien notes semi-annually on April 1 and October 1 of each year, commencing on , at a rate of 8% per annum, to holders of record on the March 15 or September 15 immediately preceding the interest payment date. |

| | • | | The exchange second lien notes will mature on October 1, 2021. We will pay interest on the exchange second lien notes semi-annually on April 1 and October 1 of each year, commencing on , at a rate of 11% per annum, to holders of record on the March 15 or September 15 immediately preceding the interest payment date. |

| | • | | The exchange first lien notes will be senior secured obligations of the Issuers and rank equally and ratably in right of payment with all existing and future senior obligations and senior to all future subordinated indebtedness. The exchange |

| | first lien notes will be guaranteed on a senior secured basis by each wholly owned, domestic subsidiary of the Issuers (other than another Issuer, except to the extent such Issuer elects to be a guarantor of the applicable exchange notes in addition to being an Issuer) that is a subsidiary guarantor with respect to the Senior Secured Credit Facilities (as defined herein) (the “Subsidiary Guarantors”) and will be secured by a first-priority security interest, subject to permitted liens, in certain assets of the Issuers and the Subsidiary Guarantors. Subject to the limitations described herein, the exchange first lien notes will be secured by a first-priority pledge of the capital stock of the Issuers’ subsidiaries. Such first-priority security interests will be pari passu with the liens on substantially the same collateral securing the Senior Secured Credit Facilities and any future first lien indebtedness. The exchange first lien notes and the related guarantees will be structurally subordinated to any obligations of any subsidiary of the Issuers that is not a Subsidiary Guarantor. See “Description of First Lien Notes.” |

| | • | | The exchange second lien notes will be senior secured obligations of the Issuers and rank equally and ratably in right of payment with all existing and future senior obligations and senior to all future subordinated indebtedness. The exchange second lien notes will be guaranteed on a senior secured basis by the Subsidiary Guarantors and will be secured by a second-priority security interest, subject to permitted liens, in certain assets of the Issuers and the Subsidiary Guarantors. Subject to the limitations described herein, the exchange second lien notes will be secured by a second-priority pledge of the capital stock of the Issuers’ subsidiaries. Such second-priority security interests will be junior to the liens on substantially the same collateral securing the Senior Secured Credit Facilities, the first lien notes, any future first lien indebtedness and to all other permitted prior liens. The exchange second lien notes and the related guarantees will be structurally subordinated to any obligations of any subsidiary of the Issuers that is not a Subsidiary Guarantor. See “Description of Second Lien Notes.” |

Terms of the Exchange Offer

| | • | | The exchange offer will expire at 5:00 p.m., New York City time, on , 2015, unless we extend it. |

| | • | | If all the conditions to this exchange offer are satisfied, we will exchange all of our initial notes that are validly tendered and not withdrawn for the applicable exchange notes. |

| | • | | You may withdraw your tender of initial notes at any time before the expiration of this exchange offer. |

| | • | | The exchange notes that we will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights. |

| | • | | The exchange notes that we will issue you in exchange for your initial notes are new securities with no established market for trading. |

Before participating in this exchange offer, please refer to the section in this prospectus entitled “Risk Factors” commencing on page 23.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have not applied, and do not intend to apply, for listing or quotation of the notes on any national securities exchange or automated quotation system.

Each broker-dealer that receives new securities for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new securities. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new securities received in exchange for securities where such securities were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date and ending on the close of business one year after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution”.

The date of this prospectus is , 2015.

Caesars Entertainment revolutionized the approach the gaming industry takes with respect to marketing by introducing the Total Rewards loyalty program in 1997. Continual improvements have been made throughout the years enabling the system to remain the most effective in the industry and enabling Caesars Entertainment to grow and sustain revenues more efficiently than its largest competitors and generate cross-market play, which is defined as play by a guest in one of Caesars Entertainment’s properties outside its home market, which is where the guest signed up for Total Rewards. To support the Total Rewards loyalty program, Caesars Entertainment created the Winner’s Information Network, or WINet, the industry’s first sophisticated nationwide customer database. In combination, these systems supported the first technology-based customer relationship management strategy implemented in the gaming industry and have enabled Caesars Entertainment’s management teams to enhance overall operating results at its properties.

For the twelve months ended September 30, 2014, we derived approximately 47% of our gross revenues from gaming sources and approximately 53% from other sources, such as sales of lodging, food, beverages and entertainment. In future periods, we expect to derive additional revenue from non-gaming sources such as The LINQ and the High Roller observation wheel. For the twelve months ended September 30, 2014, we generated net revenues of $2,028.6 million, net loss of $884.2 million and Property EBITDA of $507.5 million. See “—Summary Historical Combined and Consolidated Financial Information and Other Data of Caesars Entertainment Resort Properties” for definitions of Property EBITDA and reconciliations of this non-GAAP measure to net income.

Recent Developments

Merger of Caesars Entertainment and CAC

On December 21, 2014, Caesars Entertainment entered into a merger agreement with Caesars Acquisition Company (“CAC”), under which CAC will merge with and into Caesars Entertainment, with Caesars Entertainment continuing as the surviving corporation. The consummation of the merger is subject to a number of closing conditions, many of which are not within Caesars Entertainment’s control, and failure to satisfy such conditions may prevent, delay or otherwise materially adversely affect the completion of the transaction.

CEOC Bankruptcy Petitions

On January 15, 2015 CEOC and certain of CEOC’s wholly-owned subsidiaries, in accordance with the Third Amended and Restated Restructuring Support and Forbearance Agreement, dated as of January 14, 2015, among Caesars Entertainment, CEOC and holders of claims in respect of CEOC’s first lien notes, filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Northern District of Illinois (the “Bankruptcy Court”). Effective October 1, 2014, all our properties are managed by CES. Under the terms of the CES joint venture and the related Omnibus Agreement, we believe that CERP LLC and its subsidiaries will continue to have access to the services historically provided to us by CEOC and its employees, its trademarks and its programs. See “Certain Relationships and Related Party Transactions—Omnibus License and Enterprise Services Agreement.”

The Sponsors

Apollo

Founded in 1990, Apollo is a leading global alternative asset manager with offices in New York, Los Angeles, London, Houston, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of September 30, 2014, Apollo had assets under management of approximately $164 billion in its private equity, capital markets and real estate businesses.

3

TPG

TPG is a leading global private investment firm founded in 1992 with over $59 billion of assets under management as of December 31, 2013, as adjusted for commitments accepted on January 2, 2014, and offices in San Francisco, Fort Worth, Austin, Beijing, Chongqing, Hong Kong, London, Luxembourg, Melbourne, Moscow, Mumbai, New York, Paris, São Paulo, Shanghai, Singapore and Tokyo. TPG has extensive experience with global public and private investments executed through leveraged buyouts, recapitalizations, spinouts, growth investments, joint ventures and restructurings.

3.1

Organizational Structure

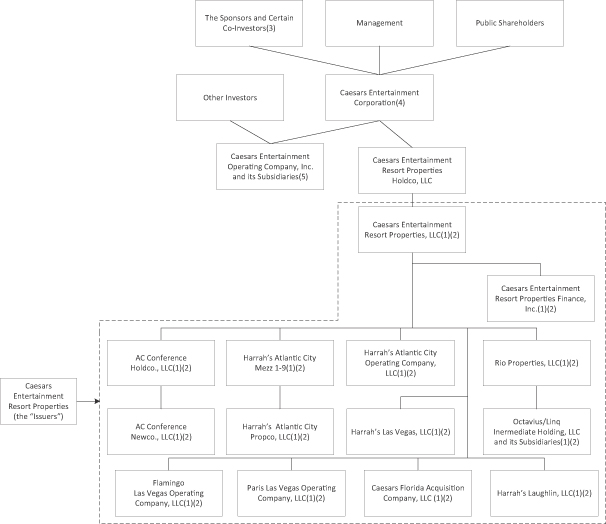

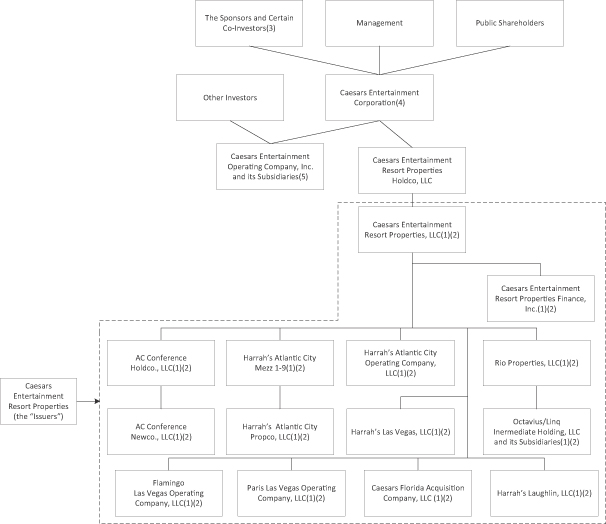

The diagram below is a summary of our organizational structure.

| (1) | Each Issuer’s indebtedness includes $1,000.0 million of first lien notes, $1,150.0 million of second lien notes and $2,481.3 million of indebtedness outstanding under Senior Secured Credit Facilities (with $75.0 million of utilization and $194.5 million of unutilized capacity available under the revolving credit facility portion of the Senior Secured Credit Facilities). |

| (2) | Each of the wholly owned domestic subsidiaries of Caesars Entertainment Resort Properties, LLC, a Delaware limited liability company (“CERP LLC”) (other than another Issuer, except to the extent such Issuer elects to be a guarantor of the applicable exchange notes in addition to being an Issuer) that guarantees the loans under the Senior Secured Credit guarantees the Issuers’ obligations under the first lien notes, the second lien notes and the Senior Secured Credit Facilities and pledges its assets to secure the |

4

| | first lien notes, the second lien notes and the Senior Secured Credit Facilities; provided, however, that the equity interests of the Issuers’ subsidiaries that have been pledged to secure the Issuers’ and the Subsidiary Guarantors’ obligations under the Senior Secured Credit Facilities have been or will be released from the collateral securing the first lien notes and the second lien notes to the extent separate financial statements would be required under Regulation S-X of the Securities Act. See “Description of First Lien Notes—Security for the Notes,” and “Description of Second Lien Notes—Security for the Notes.” As of the issue date of the exchange notes, each subsidiary of CERP LLC that is an Issuer, along with CERP LLC itself, will be a guarantor of the exchange notes. |

| (3) | Shares held by funds affiliated with and controlled by the Sponsors and their co-investors, representing approximately 60.7% of Caesars Entertainment’s outstanding common stock as of September 30, 2014, are subject to the irrevocable proxy that gives Hamlet Holdings the members of which are comprised of individuals affiliated with the Sponsors, sole voting and sole dispositive power with respect to such shares. |

| (4) | Caesars Entertainment will not guarantee, or pledge its assets as security for, the first lien notes, the second lien notes or the Senior Secured Credit Facilities. Not all subsidiaries of Caesars Entertainment are depicted. |

| (5) | CEOC and its subsidiaries will not guarantee, or pledge their assets as security for, the first lien notes, the second lien notes, the Senior Secured Credit Facilities or any other indebtedness of the Issuers and are not liable for any obligations thereunder. |

Additional Information

Our principal executive offices are located at One Caesars Palace Drive, Las Vegas, NV 89109 and our telephone number is (702) 407-6000. The address of Caesars Entertainment’s internet site is http://www.caesars.com. This internet address is provided for informational purposes only and is not intended to be a hyperlink. Accordingly, no information at this internet address is included or incorporated by reference herein.

5

Summary of the Terms of the Exchange Offers

Exchange Offer | We are offering to exchange $1,000 million aggregate principal amount of our exchange first lien notes and certain related guarantees and $1,150 million aggregate principal amount of our exchange second lien notes and certain related guarantees for a like aggregate principal amount of our initial first lien notes and initial second lien notes, respectively, and certain related guarantees. |

| | In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are validly tendered and not validly withdrawn. Initial notes may be exchanged only for a minimum principal denomination of $2,000 and in integral multiples of $1,000 in excess thereof. |

Expiration Date | This exchange offer will expire at 5:00 p.m., New York City time, on , 2015 (the “expiration date”), unless we decide to extend it. |

Exchange Notes | The exchange notes will be identical in all material respects to the initial notes except that: |

| | • | | the exchange notes have been registered under the Securities Act and will be freely tradable by persons who are not affiliates of ours or subject to restrictions due to being broker-dealers; |

| | • | | the exchange notes are not entitled to the registration rights applicable to the initial notes under the registration rights agreement dated October 11, 2013 (the “Registration Rights Agreement”); and |

| | • | | our obligation to pay additional interest on the initial notes due to the failure to consummate the exchange offer by a prior date does not apply to the exchange notes. |

Conditions to the Exchange Offer | We will complete this exchange offer only if: |

| | • | | there is no change in the laws and regulations which would impair our ability to proceed with this exchange offer; |

| | • | | there is no change in the current interpretation of the staff of the SEC which permits resales of the exchange notes; |

| | • | | there is no stop order issued by the SEC which would suspend the effectiveness of the registration statement which includes this prospectus or the qualification of the indentures under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”); |

| | • | | there is no litigation or threatened litigation which would impair our ability to proceed with this exchange offer; and |

| | • | | we obtain all the governmental approvals we deem necessary to complete this exchange offer. |

| | Please refer to the section in this prospectus entitled “The Exchange Offer—Conditions to the Exchange Offer.” |

6

The holders of the notes and the trustee also may be limited in their ability to enforce a breach of the “no liens” covenant. Some decisions of state courts have placed limits on a lender’s ability to accelerate debt secured by real property upon breach of covenants prohibiting the creation of certain junior liens or leasehold estates, and a lender may need to demonstrate that enforcement is reasonably necessary to protect against impairment of the lender’s security or to protect against an increased risk of default. Although the foregoing court decisions may have been preempted, at least in part, by certain federal laws, the scope of such preemption, if any, is uncertain. Accordingly, a court could prevent the trustee and the holders of the notes from declaring a default and accelerating the notes by reason of a breach of this covenant, which could have a material adverse effect on the ability of holders to enforce the covenant.

The collateral securing the notes may be diluted under certain circumstances.

The collateral that secures the notes also secures our obligations under the Senior Secured Credit Facilities. This collateral may secure additional senior indebtedness that the Issuers or certain of their subsidiaries incur in the future, subject to restrictions on their ability to incur debt and liens under the Senior Secured Credit Facilities and the indentures. Your rights to the collateral would be diluted by any increase in the indebtedness secured by this collateral.

Federal and state statutes allow courts, under specific circumstances, to void the issuance of debt securities. In such circumstances, the notes, the subsidiary guarantees and the pledges securing the notes could be voided and holders could be required to return payments received.

If any Issuers or any Subsidiary Guarantor becomes a debtor in a case under the United States Bankruptcy Code (the “Bankruptcy Code”) or encounters other financial difficulty, under federal or state fraudulent transfer law, a court may void, subordinate or otherwise decline to enforce the notes, such Subsidiary Guarantor’s pledge of assets securing the notes or such Subsidiary Guarantor’s guarantee of the notes. A court might do so if it found that when the notes were issued or the Subsidiary Guarantor made its pledge or guarantee, as applicable, or in some states when payments became due under the notes, the Subsidiary Guarantor or the Issuers received less than reasonably equivalent value or fair consideration and either:

| | • | | was insolvent or rendered insolvent by reason of such incurrence; or |

| | • | | was left with inadequate capital to conduct its business; or |

| | • | | believed or reasonably should have believed that it would incur debts beyond its ability to pay. |

The court might also void the issuance of the notes, related pledge or guarantee by a Subsidiary Guarantor, without regard to the above factors, if the court found that the Issuers issued the notes or the applicable Subsidiary Guarantor made its pledge or guarantee with actual intent to hinder, delay or defraud its creditors.

A court would likely find that the Issuers or a Subsidiary Guarantor did not receive reasonably equivalent value or fair consideration for the notes, its pledge securing the notes or guarantee, if the Issuers or a Subsidiary Guarantor did not substantially benefit directly or indirectly from the issuance of the notes. If a court were to void the issuance of the notes, any pledge or guarantee you would no longer have any claim against the Issuers or the applicable Subsidiary Guarantor. Sufficient funds to repay the notes may not be available from other sources, including the remaining obligors, if any. In addition, the court might direct you to repay any amounts that you already received from the Issuers or a Subsidiary Guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a Subsidiary Guarantor would be considered insolvent if:

| | • | | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; or |

27

Risks Related to Our Indebtedness

Our substantial indebtedness, and the substantial indebtedness guaranteed by Caesars Entertainment, CEOC and CAC and their respective subsidiaries, could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from making debt service payments.

We and Caesars Entertainment and its other subsidiaries are highly leveraged businesses. As of September 30, 2014, we had $4,737.2 million face value of outstanding indebtedness including capital lease indebtedness. Cash paid for interest for the nine months ended September 30, 2014 was $243.7 million. Payments of short-term debt obligations and other commitments are expected to be made from operating cash flows.

Our estimated interest payments for the remainder of 2014 are $162.8 million, and for the years ended December 31, 2015 through 2018 are $390.0 million, $395.3 million, $413.6 million, and $422.7 million, respectively, and our estimated annual interest payments thereafter are $933.8 million.

Our substantial indebtedness, and indebtedness of, or guaranteed by, Caesars Entertainment, CEOC and CAC and their respective affiliates, could:

| | • | | limit our ability to borrow money for our working capital, capital expenditures, development projects, debt service requirements, strategic initiatives or other purposes; |

| | • | | make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing our indebtedness; |

| | • | | require us to dedicate a substantial portion of our cash flow from operations to the payment of interest and the repayment of our indebtedness thereby reducing funds available to us for other purposes; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our operations or business; |

| | • | | make us more highly leveraged than some of our competitors, which may place us at a competitive disadvantage; |

| | • | | make us more vulnerable to downturns in our business or the economy; |

| | • | | restrict us from making strategic acquisitions, developing new gaming facilities, introducing new technologies or exploiting business opportunities; |

| | • | | affect our ability to renew gaming and other licenses; |

| | • | | limit, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds or dispose of assets; and |

| | • | | expose us to the risk of increased interest rates as certain of our borrowings are at variable rates of interest. |

Any of the foregoing could have a material adverse effect on our business, financial condition, results of operations, prospects and ability to satisfy our obligations under the notes.

Our ability to satisfy our debt obligations will depend upon, among other things:

| | • | | our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, many of which are beyond our control; and |

| | • | | our future ability to borrow under the Senior Secured Credit Facilities, the availability of which depends on, among other things, our complying with the covenants thereunder. |

33

We are dependent on the expertise of Caesars Entertainment’s and CES’s management and employees. Loss of the services of any key personnel from Caesars Entertainment or CES could have a material adverse effect on our business.

The leadership of Caesars Entertainment’s chief executive officer, Mr. Gary Loveman, and other members of Caesars Entertainment’s and CES’s management and employees has been a critical element of our success. The advisory and management services provided to our properties depend on Mr. Loveman and other members of Caesars Entertainment’s and CES’s management, who also work with CEOC and CGP LLC. The death or disability of Mr. Loveman or other extended or permanent loss of his services, or any negative market or industry perception with respect to him or arising from his loss, could have a material adverse effect on our business. Caesars Entertainment’s and CES’s other executive officers and other members of management have substantial experience and expertise in the casino business. Additionally, we rely on other Caesars Entertainment’s and CES’s employees and teams to operate our business. For example, CES’s marketing team, which works with all of Caesars Entertainment’s properties, has the responsibility for marketing for our properties. The unexpected loss of services of one or more members of Caesars Entertainment’s or CES’s management and key employees could also adversely affect us. We are not protected by key man insurance or similar life insurance covering members of Caesars Entertainment’s or CES’s management, nor do we have employment agreements with any of Caesars Entertainment’s or CES’s members of management or any other employees.

The interests of Caesars Entertainment’s or CES’s management and the managers of our properties who also work with CEOC or CGP LLC may not be directly aligned with ours.

Key managers of our properties work with CEOC, CGP LLC or other subsidiaries of Caesars Entertainment as well as us and therefore their interests may not be directly aligned with ours. Additionally, managing CEOC’s and CGP LLC’s business separately from our business requires a significant amount of resources and devotion of management’s and our property managers’ time. The additional demands associated with providing services to CEOC, CGP LLC or other subsidiaries of Caesars Entertainment may impact regular operations of our business by diverting the attention of some of our management team and our property managers away from revenue producing activities and operating our properties, adversely affecting our ability to attract and complete business opportunities and increasing the difficulty in both retaining professionals and managing and growing our businesses. Additionally, Caesars Entertainment, CES and their management have limited experience running an amusement ride like the High Roller observation wheel or shopping mall retail space similar to The LINQ. The LINQ and the High Roller observation wheel requires additional time and resources from Caesars Entertainment’s and CES’s management and they may not be able to divert such time and resources or may be unsuccessful in managing this new endeavor. The individuals who manage our casino properties are compensated based on the performance of the Caesars properties in the city in which they operate, not on the performance of our properties alone, and some of our key managers also manage other Caesars properties. For example, the management team of Paris Las Vegas also has responsibility for Planet Hollywood Resort and Casino and Bally’s Las Vegas, which are not our properties. As a result, the interests of our property managers may not be directly aligned with ours. Any of these effects could harm our business, financial condition and results of operations.

CEOC and a substantial majority of its wholly owned subsidiaries, which does not include the Issuers, filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code, and are subject to the risks and uncertainties associated with bankruptcy proceedings.

On January 15, 2015, CEOC and a substantial majority of its wholly owned subsidiaries, which does not include the Issuers (collectively, the “CEOC Debtors”), filed voluntary petitions for reorganization under Chapter 11 of the Bankruptcy Code in the Bankruptcy Court. The Chapter 11 proceedings are being jointly administered under the caption In re Caesars Entertainment Operating Company, Inc., et al., Case No. 15-01145.

38

Caesars Entertainment is subject to a number of risks and uncertainties associated with the Chapter 11 proceedings, which may lead to potential adverse effects on its liquidity, results of operations or business prospects. We cannot assure you of the outcome of the Chapter 11 proceedings. Risks associated with the Chapter 11 proceedings include the following:

| | • | | the ability of the CEOC Debtors to continue as a going concern; |

| | • | | the ability of the CEOC Debtors to obtain bankruptcy court approval with respect to motions in the Chapter 11 proceedings and the outcomes of bankruptcy court rulings of the proceedings in general; |

| | • | | risks associated with involuntary bankruptcy proceedings in the United States Bankruptcy Court for the District of Delaware; |

| | • | | the length of time the CEOC Debtors will operate under the Chapter 11 proceedings and their ability to successfully emerge, including with respect to obtaining any necessary regulatory approvals; |

| | • | | the ability of the CEOC Debtors to negotiate, confirm and consummate a plan of reorganization with respect to the Chapter 11 proceedings; |

| | • | | whether Caesars Entertainment loses control over the operation of the CEOC Debtors as a result of the restructuring process; |

| | • | | risks associated with third party motions in Chapter 11 proceedings, which may interfere with Caesars Entertainment’s restructuring plan; |

| | • | | the ability of the CEOC Debtors to maintain sufficient liquidity throughout the Chapter 11 proceedings; |

| | • | | increased costs related to the bankruptcy filing and other litigation; |

| | • | | if the Bankruptcy Court approves Caesars Entertainment’s restructuring plan, in connection with the CEOC Debtors’ emergence from Chapter 11, Caesars Entertainment will be required to (i) contribute over $400 million to pay a forbearance fee, for general corporate purposes and to fund sources and uses and (ii) purchase up to approximately $1.0 billion of new equity in the restructured CEOC Debtors; |

| | • | | if the Bankruptcy Court approves Caesars Entertainment’s restructuring plan, Caesars Entertainment will be required to guarantee the lease payments owed by the restructured operating company to the restructured property companies and, if the restructured operating company is unable to or does not pay amounts due under the leases, Caesars Entertainment will be obligated to pay the full amount; |

| | • | | Caesars Entertainment’s ability to manage contracts that are critical to its operation, and to obtain and maintain appropriate credit and other terms with customers, suppliers and service providers; |

| | • | | Caesars Entertainment’s ability to attract, retain and motivate key employees; |

| | • | | Caesars Entertainment’s ability to fund and execute its business plan; |

| | • | | whether Caesars Entertainment’s non-Debtor subsidiaries continue to operate their business in the normal course; |

| | • | | the outcome of all pre-petition claims against Caesars Entertainment and the CEOC Debtors; and |

| | • | | Caesars Entertainment’s ability to maintain existing customers and vendor relationships and expand sales to new customers. |

Although Caesars Entertainment does not guarantee the Notes, any negative impact of the Chapter 11 proceedings on Caesars Entertainment could potentially hinder our operations, as we are dependent on Caesars Entertainment and CES for many of our operations, including the management of our properties. See “Risks Related to Our Dependence on CES and Caesars Entertainment” and “Certain Relationships and Related Party Transactions.”

39

The Chapter 11 proceedings may disrupt our business and may materially and adversely affect our operations.

We and Caesars Entertainment have attempted to minimize the adverse effect of the CEOC Debtors’ Chapter 11 reorganization on our relationships with our employees, suppliers, customers and other parties. Nonetheless, our relationships with our customers, suppliers and employees may be adversely impacted by negative publicity or otherwise and our operations could be materially and adversely affected. In addition, the continuation of the reorganization of the CEOC Debtors could negatively affect our ability to attract new employees and retain existing high performing employees, which could materially and adversely affect our operations.

Our operations depend on material contracts with third parties, including CEOC, the continued enforcement of which may be adversely impacted by a bankruptcy of such third parties.

The CEOC Debtors may, and other third parties with whom we have entered into material contracts that become debtors operating under the protection of the Bankruptcy Code could, exercise certain rights that would adversely affect our contractual rights and obligations. Additionally, as a result of CEOC’s Chapter 11 proceedings our ability to participate in the Caesars Entertainment system may be materially and adversely affected. The Bankruptcy Code invalidates clauses that permit the termination of contracts automatically upon the filing by or against one of the parties of a bankruptcy petition or which are conditioned on a party’s insolvency. Moreover, in this circumstance, we would ordinarily be required to continue performing our obligations under such agreement. Legal proceedings to obtain relief from the automatic stay and to enforce rights to payments or terminate agreements can be time consuming and uncertain as to outcome.

Under the Bankruptcy Code, a debtor may decide whether to assume or reject an executory contract. Bankruptcy court approval of assumption of a contract would permit the debtor to continue operating under the assumed contract subject to certain conditions the debtor would need to satisfy. As a general matter, a bankruptcy court approves a debtor’s assumption of a contract if the assumption appears to be in the best interest of the debtor’s estate, the debtor is able to perform and it is a good business decision to assume the contract. Subject to bankruptcy court approval and satisfaction of the “business judgment” rule, a debtor in chapter 11 may reject an executory contract, and rejection of an executory contract in a chapter 7 case may occur automatically by operation of law. If a debtor rejects an executory contract, the non-debtor party to the contract generally has an unsecured claim against the debtor’s bankruptcy estate for breach of contract damages arising from the rejection. A bankruptcy court may order the debtor to determine within a specific period of time whether to assume or reject an executory contract.

Federal and state statutes allow courts, under specific circumstances, to void certain transactions and could require us to return the Octavius Tower and The LINQ assets or their value to CEOC and its subsidiaries.

As CEOC has become a debtor in a case under the Bankruptcy Code, creditors of CEOC and its subsidiaries may sue us under federal or state fraudulent transfer law and a court may void the Octavius/Linq Transfer (as defined below). A court might do so if it found that when the Octavius/Linq Transfer occurred, CEOC or its subsidiaries received less than reasonably equivalent value or fair consideration and either:

| | • | | was insolvent or rendered insolvent by reason of such incurrence; or |

| | • | | was left with inadequate capital to conduct its business; or |

| | • | | believed or reasonably should have believed that it would incur debts beyond its ability to pay. |

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, CEOC or one of its subsidiaries would be considered insolvent if:

| | • | | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; or |

40

| | • | | if the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| | • | | it could not pay its debts as they become due. |

The court might also void the Octavius/Linq Transfer, without regard to the above factors, if the court found that CEOC or its subsidiaries made the transfer with actual intent to hinder, delay or defraud its creditors.

A court could find that CEOC or its subsidiaries did not receive reasonably equivalent value or fair consideration in the Octavius/Linq Transfer if CEOC or its subsidiaries did not substantially benefit directly or indirectly from the transfer. If a court were to void the Octavius/Linq Transfer, we may have to return the assets or their value to CEOC and such assets, including the Octavius Tower and The LINQ, would no longer constitute part of the collateral securing the notes. In addition, the court might direct us to repay any amounts that we received on account of the Octavius/Linq Transfer.

As part of the CERP Financing, Octavius/Linq Holding Co., LLC, which is an indirect subsidiary of CEOC that is not subject to restrictions imposed by covenants governing CEOC’s debt facilities, transferred Octavius/Linq Intermediate Holding, LLC to Caesars Entertainment, which then contributed Octavius/Linq Intermediate Holding, LLC to Rio Properties, LLC (the “Octavius/Linq Transfer”). The CERP Financing provided direct and indirect value and benefits to CEOC and its subsidiaries, including the transfer to CEOC of $69.5 million in aggregate principal amount (approximately $52.9 million aggregate market value at the time of transfer) of one or more series of outstanding notes of CEOC (and that was retired by CEOC), $80.7 million in cash and the repayment of $450.0 million in debt associated with these assets. In addition, by facilitating the refinancing of the CMBS Financing (as defined below), the CERP Financing (a) preserves for CEOC and its subsidiaries the substantial payments made under our shared services arrangements; and (b) allows the Casino Resort Properties to continue in the Caesars Entertainment corporate family, which has significant value to CEOC and its owned properties, given, among other things, the prominent positions of the Casino Resort Properties on the Las Vegas Strip, the integrated operations of our casinos and the Casino Resort Properties’ participation in the Total Rewards program. We were advised that CEOC obtained an opinion of an independent financial advisor that, based upon and subject to the assumptions and other matters set forth in such opinion, it received reasonably equivalent value in the transfer.

As part of CEOC’s Chapter 11 proceedings, CEOC could attempt to transfer licensed trademarks and copyrighted materials licensed to the Issuers to a purchaser and/or seek to reject any related license agreement.

We rely on trademark license agreements with CEOC and its subsidiaries and CES in order to use Caesars Entertainment’s brand names, such as “Harrah’s,” pursuant to the Omnibus Agreement and other intellectual property license agreements. See “Certain Relationships and Related Party Transactions—Omnibus License and Enterprise Services Agreement” and “Certain Relationships and Related Party Transactions—Intellectual Property License Agreements.” These brand names have global recognition and attract customers to our properties. We would be adversely affected if the trademark license agreements were terminated.

As CEOC has become a debtor in a case under the Bankruptcy Code, it (or a bankruptcy trustee if one is appointed) may seek to sell its trademarks and copyright assets in a bankruptcy case, free and clear of all interests of third parties such as the Issuers, pursuant to the Bankruptcy Code. The Bankruptcy Code gives a licensee of intellectual property, such as the copyrighted materials (but not licensed trademarks), the ability to retain its rights under such license notwithstanding the bankrupt debtor’s rejection of such license. Though the Issuers are unaware of any case holding that a licensor of intellectual property can sell the underlying intellectual property free and clear of a licensee’s rights under the Bankruptcy Code, one case held that a sale of real property was free and clear of a lessee’s similar right under section 365(h) of the Bankruptcy Code to elect to retain its rights under

41

such lease for the balance of the term of such lease and any renewal period. The Issuers believe that the precedential effect of this case is unclear for several technical reasons. In any case, the holders of the notes would have the right to seek adequate protection under the Bankruptcy Code due to their lien on the proceeds derived from the rights CEOC licensed to the Issuers. However, there can be no assurance that CEOC (or a bankruptcy trustee if one is appointed) would not attempt to sell the licensed trademarks and copyrighted materials licensed to the Issuers in this manner or that a court would not agree with the case described above, which may adversely affect the realization of proceeds generated by the intellectual property assets. Such a course of action could cause actual results to differ materially and adversely from our projections and have a material, adverse effect on the Issuers’ business, financial condition, results of operations and prospects and on the Issuers’ ability to pay outstanding principal of and interest on the notes.

Bankruptcy of the Issuers’ lessees or their parents could result in an automatic stay and adversely affect the Issuer’s ability to repay the notes.

The Issuers’ ability to make payments could be impaired by the commencement of a bankruptcy case by or against the Issuers’ lessees or a parent entity if the related Lessee were substantively combined and consolidated with such parent entity. Our business relies on income from certain leases, including an expected $50 million of annual rental income from the Octavius Tower lease and The LINQ Hotel Lease. Under the Bankruptcy Code, the filing of a petition in bankruptcy by or on behalf of a debtor results in an automatic stay against, among other things, the commencement or continuation of any action or proceeding on account of defaults under leases and executory contracts, including for past due rent, accelerated rent, damages or for any other relief with respect to a default under such lease or executory contract that occurred prior to the filing of such debtor’s bankruptcy petition.

In addition, the Bankruptcy Code generally provides that a trustee or debtor in possession may, with respect to an unexpired lease of non-residential real property, before the earlier of (i) 120 days after the filing of a bankruptcy case or (ii) the entry of an order confirming a plan, subject to approval of the court, (a) assume the lease and retain it or assign it to a third party or (b) reject the lease. If the trustee or debtor-in-possession fails to assume or reject the lease within the time specified in the preceding sentence, subject to any extensions by the bankruptcy court, the lease will be deemed rejected and the property will be surrendered to the lessor. The bankruptcy court may for cause shown extend the 120-day period up to 90 days for a total of 210 days. If the lease is assumed, the trustee in bankruptcy on behalf of the lessee, or the lessee as debtor in possession, or the assignee, if applicable, must cure any defaults under the lease, compensate the lessor for its losses and provide the lessor with “adequate assurance” of future performance. However, these remedies may, in fact, be insufficient and the lessor may be forced to continue under the lease with a lessee that is a poor credit risk or an unfamiliar tenant if the lease were assigned. If the lease is rejected, the rejection generally constitutes a breach of the unexpired lease immediately before the date of filing the petition. As a consequence, a lessor under a lease generally would have only an unsecured claim against the debtor for damages resulting from the breach, which could adversely affect the security for the related mortgage loan. In addition, pursuant to the Bankruptcy Code, a lessor’s damages for lease rejection in respect of future rent installments are limited to (a) the rent reserved by the lease, without acceleration, for the greater of one year or 15 percent, not to exceed three years, of the remaining term of the lease following the earlier of the date of the bankruptcy petition and the date on which the lessor regained possession of the property, plus (b) any unpaid rent due under such lease, without acceleration, on the earlier of such dates.

Lease payments could be considered preferential payments in a bankruptcy of the Issuers’ lessees.

In a bankruptcy or similar proceeding, action may be taken seeking the recovery as a preferential transfer of any payments made by the debtor in the 90-day period prior to the bankruptcy filing. Payments made in such 90-day period may be protected from recovery as preferences if, among other available defenses, they are payments in the ordinary course of business and made on debts incurred in the ordinary course of business. Whether any particular payment would be protected depends upon the facts specific to each particular transaction and payment.

42

We are or may become involved in legal proceedings that, if adversely adjudicated or settled, could impact our financial condition.

From time to time, we are defendants in various lawsuits or other legal proceedings relating to matters incidental to our business. The nature of our business subjects us to the risk of lawsuits filed by customers, past and present employees, competitors, business partners, Indian tribes, and others in the ordinary course of business. As with all legal proceedings, no assurance can be provided as to the outcome of these matters and, in general, legal proceedings can be expensive and time consuming. We may not be successful in the defense or prosecution of these lawsuits, which could result in settlements or damages that could significantly impact our business, financial condition, and results of operations.

Recently, CAC, CGP LLC, CEC, CEOC, and CERP received the March 21 Letter (as defined below in “Business—Legal Proceedings—Bondholder Disputes”) and CEC and CEOC received the April 3 Letter (as defined below in “Business—Legal Proceedings—Bondholder Disputes”) and was served with the Second Lien Lawsuit (as defined below in “Business—Legal Proceedings—Bondholder Disputes”). See “Business—Litigation—Bondholder Disputes.” [Although these lawsuits have been automatically stayed during the Chapter 11 process with respect to CEOC], if a court were to find in favor of the claimants in any of these disputes, such determination could have a material adverse effect on our business, financial condition, results of operations, and prospects and on the ability of lenders and noteholders to recover on claims under our indebtedness. If a court were to find in favor of the claimants in the Second Lien Lawsuit, such determination could have a material adverse effect on our business, financial condition, results of operations, and prospects and on the ability of lenders and noteholders to recover on claims under our indebtedness.

We may require additional capital to support business growth, and this capital might not be available on acceptable terms or at all.

We may require additional funds to respond to business challenges, including the need to improve our operating infrastructure or acquire complementary businesses, personnel and technologies. Accordingly, we may need to engage in debt financings to secure additional funds. Any debt financing that we secure in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult to obtain additional capital and to pursue business opportunities. If we are unable to obtain adequate financing or financing on satisfactory terms when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired, which could have a material adverse effect on our business, financial condition and operating results.

We may be subject to material environmental liability, including as a result of unknown environmental contamination.

The casino properties business is subject to certain federal, state and local environmental laws, regulations and ordinances which govern activities or operations that may have adverse environmental effects, such as emissions to air, discharges to streams and rivers and releases of hazardous substances and pollutants into the environment, as well as handling and disposal from municipal/non-hazardous waste, and which also apply to current and previous owners or operators of real estate generally. Federal examples of these laws include the Clean Air Act, the Clean Water Act, the Resource Conservation Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act and the Oil Pollution Act of 1990. Certain of these environmental laws may impose cleanup responsibility and liability without regard to whether the owner or operator knew of or caused particular contamination or release of hazardous substances. Should unknown contamination be discovered on our property, or should a release of hazardous substances occur on our property, we could be required to investigate and clean up the contamination and could also be held responsible to a governmental entity or third parties for property damage, personal injury or investigation and cleanup costs incurred in connection with the contamination or release, which may be substantial. Moreover, such contamination may also impair our ability to use the affected property. Such liability could be joint and several in nature, regardless of fault, and could affect us even if such property is vacated. The potential for substantial costs and an inability to use the property could adversely affect our business.

50

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements.” These statements can be identified by the fact that they do not relate strictly to historical or current facts. We have based these forward-looking statements on our current expectations about future events. Further, statements that include words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “continue,” or “pursue,” or the negative of these words or other words or expressions of similar meaning may identify forward-looking statements. These forward-looking statements are found at various places throughout this prospectus. These forward-looking statements, including, without limitation, those relating to future actions, new projects, strategies, future performance, the outcome of contingencies such as legal proceedings, and future financial results, wherever they occur in this prospectus, are necessarily estimates reflecting the best judgment of our management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward-looking statements should, therefore, be considered in light of various important factors set forth above and in this prospectus.

In addition to the risk factors set forth above, important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include without limitation:

| | • | | the impact of our substantial indebtedness and the restrictions in our debt agreements; |

| | • | | our dependence on CES and its management for services pursuant to the Omnibus Agreement, access to intellectual property rights, the Total Rewards loyalty program, its customer database and other services, rights and information, and our dependence on Caesars Entertainment’s management; |

| | • | | our ability to use Caesars Entertainment’s customer-tracking, customer loyalty and yield-management programs to continue to increase customer loyalty and same-store or hotel sales; |

| | • | | the effects of CEOC’s bankruptcy filing on us and Caesars Entertainment, and the interest of various creditors and other constituents; |

| | • | | the impact of a bankruptcy by other third parties that we depend on; |

| | • | | the effects of competition, including locations of competitors, growth of online gaming, competition for new licenses and operating and market competition; |

| | • | | reductions in consumer discretionary spending due to economic downturns or other factors; |

| | • | | continued growth in consumer demand for non-gaming replacing demand for gambling; |

| | • | | our ability to renew our agreement to host the World Series of Poker’s Main Event; |

| | • | | our ability to retain our resident performers on acceptable terms; |

| | • | | uncertainty in the completion of projects neighboring our properties that are expected to be beneficial to our properties; |

| | • | | our ability to realize any or all of our projected cost savings; |

| | • | | changes in the extensive governmental regulations to which we are subject, and changes in laws, including increased tax rates, smoking bans, gaming regulations or accounting standards, third-party relations and approvals, and decisions, disciplines and fines of courts, regulators and governmental bodies; |

| | • | | any impairments to goodwill, indefinite-lived intangible assets, or long-lived assets that we may incur; |

| | • | | acts of war or terrorist incidents, severe weather conditions, uprisings or natural disasters, including losses therefrom, including losses in revenues and damage to property, and the impact of severe weather conditions on our ability to attract customers to certain of our facilities, such as the amount of losses and disruption to our business as a result of Hurricane Sandy in late October 2012; |

52

| | • | | fluctuations in energy prices; |

| | • | | work stoppages and other labor problems; |

| | • | | the impact, if any, of unfunded pension benefits under multi-employer pension plans; |

| | • | | our ability to recover on credit extended to our customers; |

| | • | | the potential difficulties in employee retention and recruitment as a result of our substantial indebtedness, the ongoing downturn in the gaming industry, the restructuring of CEOC or any other factor; |

| | • | | differences in our interests and those of our Sponsors; |

| | • | | damage caused to our brands due to the unauthorized use of our brand names by third parties; |

| | • | | the failure of Caesars Entertainment to protect the trademarks that are licensed to us; |

| | • | | litigation outcomes, including, but not limited to, the proceedings described under “Business—Legal Proceedings—Bondholder Disputes,” and judicial and governmental body actions, including gaming legislative action, referenda, regulatory disciplinary actions, and fines and taxation; |

| | • | | our ability to access additional capital on acceptable terms or at all; |

| | • | | abnormal gaming holds (“gaming hold” is the amount of money that is retained by the casino from wagers by customers); |

| | • | | our exposure to environmental liability, including as a result of unknown environmental contamination; |

| | • | | our ability to recoup costs of capital investments through higher revenues; |

| | • | | access to insurance on reasonable terms for our assets; |

| | • | | the effects of compromises to our information systems or unauthorized access to confidential information or our customers’ personal information; |

| | • | | the effects of deterioration in the success of third parties adjacent to our business; and |

| | • | | the other factors set forth under “Risk Factors.” |

You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. We undertake no obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events, except as required by law.

53

On July 18, 2014, a letter was sent to outside counsel of CEOC (the “July 18 Letter”) by the law firm acting on behalf of the First Lien Group alleging, among other things, that CEOC and the pledgors of assets under the collateral agreement entered into in connection with the senior notes held by the First Lien Group were not in compliance with the terms of the collateral agreement.

On August 4, 2014, Wilmington Savings Fund Society, FSB, solely in its capacity as successor indenture trustee for the 2018 Notes, on behalf of itself and, it alleges, derivatively on behalf of CEOC, filed a lawsuit (the “Second Lien Lawsuit”) in the Court of Chancery in the State of Delaware against CEC and CEOC, CGP LLC, CAC, CERP, CES, Eric Hession, Gary Loveman, Jeffrey D. Benjamin, David Bonderman, Kelvin L. Davis, Marc C. Rowan, David B. Sambur, and Eric Press. The lawsuit alleges claims for breach of contract, intentional and constructive fraudulent transfer, breach of fiduciary duty, aiding and abetting breach of fiduciary duty, and corporate waste. The lawsuit seeks (1) an award of money damages; (2) to void certain transfers, the earliest of which dates back to 2010; (3) an injunction directing the recipients of the assets in these transactions to return them to CEOC; (4) a declaration that CEC remains liable under the parent guarantee formerly applicable to the 2018 Notes; (5) to impose a constructive trust or equitable lien on the transferred assets; and (6) an award to plaintiffs for their attorneys’ fees and costs. CEC and CERP strongly believe this lawsuit is without merit and will defend themselves vigorously. On September 23, 2014, defendants moved to dismiss the complaint, or alternatively, to stay the action on the ground that the asserted claims should have been brought in New York pursuant to the governing indenture and in view of a pending litigation filed in the Supreme Court of New York, New York County, by CEC and CEOC against certain institutional holders of first-lien and second-lien notes issued by CEOC. A motion to dismiss this action was filed by CEC and other defendants on September 23, 2014, and the motion has been fully briefed as of October 31, 2014. The parties agreed to stay discovery until a decision on the motion to dismiss is issued on this action.

On August 5, 2014, CEC, along with CEOC, filed a lawsuit in the Supreme Court of the State of New York, County of New York, against certain institutional holders of CEOC’s first and second lien notes. The complaint states that such institutional first and second lien note holders have acted against the best interests of CEOC and other creditors, including for the purpose of inflating the value of their credit default swap positions or improving other unique securities positions. The complaint asserts claims for tortious interference with prospective economic advantage, declaratory judgment and breach of contract and seeks, among other things, (1) money damages; (2) a declaration that no default or event of default has occurred or is occurring and CEC and CEOC have not breached their fiduciary duties or engaged in fraudulent transfers or other violation of law; and (3) a preliminary and permanent injunction prohibiting the defendants from taking further actions to damage CEC or CEOC. Defendants filed motions to dismiss this action on October 15, 2014. The parties have agreed to stay discovery until a decision on the motion to dismiss is issued in this action.

[Although these lawsuits have been automatically stayed during the Chapter 11 process with respect to CEOC], if the above matters were resolved in favor of CEOC note holders such determination could have a material adverse effect on our business, financial condition and results of operations. For example if CEOC were to default on its debt obligations as a result of such determination, its lenders could exercise significant influence over Caesars Entertainment’s business. Additionally, CEOC’s filing for bankruptcy protection under the Bankruptcy Code may materially and adversely affect our assets and result of operations. While the result of this influence and any related disruption in our business could have a material adverse effect on our business, financial condition and operating results, with the transition of CES, the services previously provided by CEOC and its subsidiaries are expected to be provided by CES, and any such effect may not be as significant as if such services were still provided by CEOC and its subsidiaries. The possible loss or range of loss resulting from these matters, if any, is inherently unpredictable and involves significant uncertainty. Consequently, no estimate can be made of any possible loss or range of loss.

Other Litigation

Over the course of several years, a former customer of the Rio All-Suites Hotel and Casino gambled with approximately $10 million in cashier’s checks. The customer later pleaded guilty to fraud in connection with a mortgage brokerage business. The mortgage brokerage business was placed in bankruptcy in California, where a

86

DESCRIPTION OF FIRST LIEN NOTES

General

CERP LLC, Caesars Entertainment Resort Properties Finance, Inc., a Delaware corporation, Harrah’s Las Vegas, LLC, a Nevada limited liability company, Harrah’s Laughlin, LLC, a Nevada limited liability company, Rio Properties, LLC, a Nevada limited liability company, AC Conference Holdco., LLC, a Delaware limited liability company, AC Conference Newco., LLC, a Delaware limited liability company, Caesars Florida Acquisition Company, LLC, a Delaware limited liability company, Caesars Linq, LLC, a Delaware limited liability company, Caesars Octavius, LLC, a Delaware limited liability company, Flamingo Las Vegas Operating Company, LLC, a Nevada limited liability company, Harrah’s Atlantic City Mezz 1, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 2, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 3, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 4, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 5, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 6, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 7, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 8, LLC, a Delaware limited liability company, Harrah’s Atlantic City Mezz 9, LLC, a Delaware limited liability company, Harrah’s Atlantic City Operating Company, LLC, a New Jersey limited liability company, Harrah’s Atlantic City Propco, LLC, a Delaware limited liability company, Octavius/Linq Intermediate Holding, LLC, a Delaware limited liability company, and Paris Las Vegas Operating Company, LLC, a Nevada limited liability company (each an “Issuer” and, collectively, the “Issuers”), collectively, are issuers of $1,000.0 million aggregate principal amount of 8% First-Priority Senior Secured Notes due 2020 (the “initial first lien notes”), issued on October 13, 2013, in a private offering (the “initial first lien notes”). The initial first lien notes were issued under an indenture (the “Indenture”), dated as of October 13, 2013, among the Issuers and U.S. Bank National Association, as trustee (in such capacity, the “Trustee”).

The terms of the exchange first lien notes are identical in all material respects to the initial first lien notes, except that upon completion of the exchange offer, the exchange first lien notes will be registered under the Securities Act and free of any covenants regarding exchange registration rights. For the purposes of this section, we refer to the initial first lien notes as “initial notes” and the exchange first lien notes as “exchange notes”. Unless otherwise indicated by the context, references in this “Description of First Lien Notes” to the “Notes” include both the exchange notes and initial notes.

The following summary of certain provisions of the Indenture, the Notes, the Security Documents, the First Lien Intercreditor Agreement and the Junior Lien Intercreditor Agreement does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all the provisions of those agreements, including the definitions of certain terms therein and those terms made a part thereof by the TIA. Capitalized terms used in this “Description of First Lien Notes” section and not otherwise defined have the meanings set forth in the section “—Certain Definitions.”

The Issuers will issue exchange notes in exchange for initial notes, in an initial aggregate principal amount of up to $1,000.0 million. The Issuers may issue additional Notes from time to time. Any offering of additional Notes is subject to the covenants described below under the caption “—Certain Covenants—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock and Preferred Stock” and “—Liens.” The Notes and any additional Notes subsequently issued under the Indenture may, at our election, be treated as a single class for all purposes under the Indenture, including, without limitation, waivers, amendments, redemptions and offers to purchase;provided that if the additional Notes are not fungible with the Notes for U.S. federal income tax purposes, the additional Notes will have a separate CUSIP number, if applicable. Unless the context otherwise requires, for all purposes of the Indenture and this “Description of First Lien Notes,” references to the Notes include any additional Notes actually issued.

Principal of, premium, if any, and interest on the Notes will be payable, and the Notes may be exchanged or transferred, at the office or agency designated by the Issuers (which initially shall be the principal corporate trust office of the Trustee).

153

CAESARS ENTERTAINMENT RESORT PROPERTIES, LLC

NOTES TO COMBINED AND CONSOLIDATED FINANCIAL STATEMENTS (Continued)

pursuant to the agreement’s terms. For each of the years ended December 31, 2013, 2012 and 2011, fees incurred under these agreements were $0.1 million, which are recorded in casino expense in the combined and consolidated statements of comprehensive income/(loss).

Note 19 — Subsequent Events

Management has evaluated subsequent events for potential disclosure through January [ ], 2015, which is the date on which the financial statements were available to be issued.

Bondholder Disputes