UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

J. Alexander’s Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Presentation to Investors June 4, 2019

About J. Alexander’s Holdings, Inc. J. Alexander’s Holdings, Inc. (“we,” “us,” “the Company,” or “J. Alexander’s”) is a collection of restaurants that focus on providing high quality food, outstanding professional service and an attractive ambiance. Our Company presently operates 46 restaurants in 16 states. Our Company has its headquarters in Nashville, Tennessee. For additional information, visit www.jalexandersholdings.com Forward-Looking Statements This communication contains forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding our expectations, intentions or strategies regarding the future. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including our Company’s ability to maintain satisfactory guest count levels and maintain or increase sales and operating margins in its restaurants under varying economic conditions; the number and timing of new restaurant openings and our Company’s ability to operate them profitably; the effect of higher commodity prices, unemployment and other economic factors on consumer demand; increases in food input costs or product shortages and our Company’s response to them; competition within the casual dining industry and within the markets in which our restaurants are located; adverse weather conditions in regions in which our Company’s restaurants are located; factors that are under the control of third parties, including government agencies; as well as other risks and uncertainties described under the headings “Forward-Looking Statements,” “Risk Factors” and other sections of our Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2019, as amended on April 29, 2019, and subsequent filings. Our Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It In connection with the solicitation of proxies for our Company’s 2019 annual meeting of shareholders, our Company has filed with the SEC a definitive proxy statement and an accompanying proxy card on Schedule 14A on May 10, 2019, which were made available to our Company’s shareholders on or about May 10, 2019. SHAREHOLDERS OF OUR COMPANY ARE STRONGLY URGED TO READ THE DEFINITIVE PROXY STATEMENT (AS SUPPLEMENTED AND REVISED ON MAY 10, 2019 AND MAY 23, 2019) AND ACCOMPANYING WHITE PROXY CARD AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the definitive proxy statement (including all supplements and amendments thereto) and other filings containing information about our Company at the SEC’s website at www.sec.gov. The definitive proxy statement (including all supplements and amendments thereto) and the other filings may also be obtained free of charge at our Company’s “Investor Relations” website at investor.jalexandersholdings.com under the tab “More” and then under the tab “SEC Filings.” Participants in the Solicitation Our Company, its directors, and its executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of our Company’s shareholders in connection with the matters to be considered at our Company’s 2019 annual meeting. Information regarding the persons who may, under the SEC’s rules, be considered participants in the solicitation of Company shareholders in connection with our Company’s 2019 annual meeting, and their direct and indirect interests, by security holdings or otherwise, which may be different from those of our Company’s shareholders generally, are set forth in the definitive proxy statement (as supplemented and amended) and accompanying proxy card for our Company’s 2019 annual meeting of shareholders, as filed with the SEC on Schedule 14A on May 10, 2019, as supplemented and revised on May 10, 2019 and May 23, 2019, and any other relevant solicitation materials filed by our Company with the SEC in connection with the 2019 annual meeting. Free copies of these documents may be obtained as described in the preceding paragraph. i

Overview We are making significant progress on our strategic and operational plan to deliver significant value to our shareholders. Our operations, financial results and outlook continue to be positive, which is not fully reflected in the current stock price. Our Company has a highly qualified and engaged Board that is singularly focused on maximizing shareholder value. Ancora’s April 10, 2019 purported proposal to acquire our Company for $11.75 per share is nowhere near a full and fair value for the sale of our Company and seeks to deprive our other shareholders of future stock price appreciation. The amendments proposed in our Amended and Restated Equity Plan are consistent with sound corporate governance practices and necessary to allow us to attract and retain key officers, employees and directors. 1

We are focused on our strategic and operational plan We believe that there are significant opportunities to grow our restaurant concepts on a nationwide basis in both existing and new markets where we believe we can generate attractive unit economics. We recently announced the opening of two new locations: Houston, Texas in 2019 (a J. Alexander’s/Grill restaurant) San Antonio, Texas in 2020 (first Redlands Grill restaurant not part of the conversion process) We believe that our future earnings and cash flows will substantially benefit from two recent events: the completion of substantial investments in new restaurants, and the termination of the Management Consulting Agreement with Black Knight Advisory Services 2

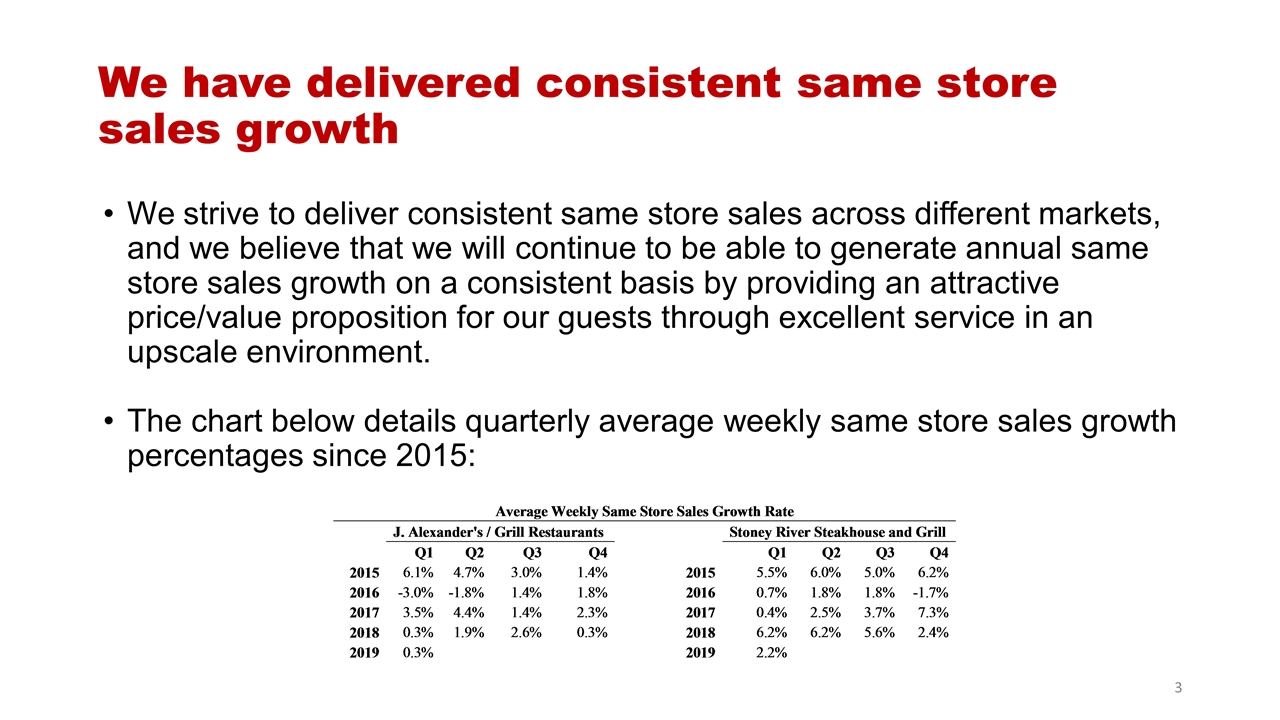

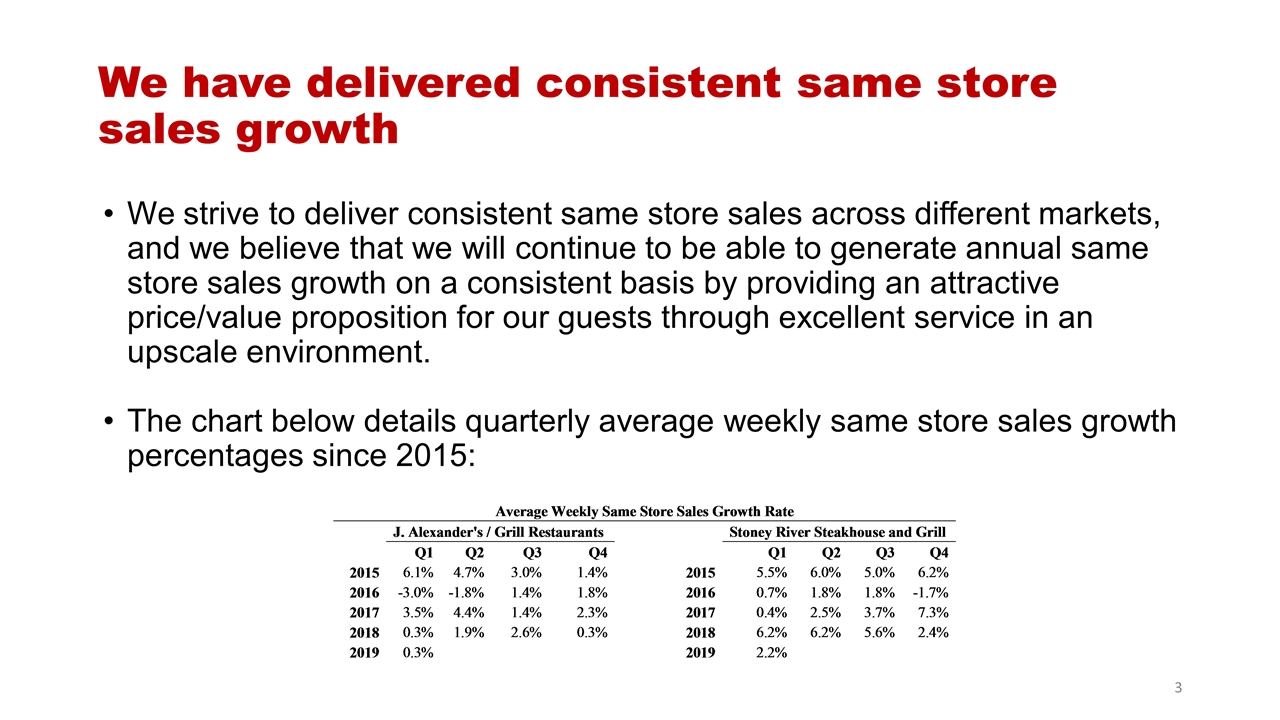

We have delivered consistent same store sales growth We strive to deliver consistent same store sales across different markets, and we believe that we will continue to be able to generate annual same store sales growth on a consistent basis by providing an attractive price/value proposition for our guests through excellent service in an upscale environment. The chart below details quarterly average weekly same store sales growth percentages since 2015: 3

Ancora’s attacks on our performance and operating results are misleading We have been unable to independently verify the performance and operating results figures that Ancora presents in its soliciting materials. For example: We are unable to verify Ancora’s TSR calculations, which are inconsistent with even their own figures set forth in previous filings. Similarly, we are unable to verify Ancora’s return on invested capital calculations, which are based on adjusted operating income and are presented without explanation as to what adjustments are made and why certain assumptions are appropriate. Without understanding Ancora’s adjustments, we are not able to evaluate the accuracy of the figures Ancora has reported, and we have been unable to arrive at the same figures for certain data presented based on our own calculations. We caution shareholders against relying upon any of Ancora’s calculations without independent investigation. Even if Ancora’s calculations are supportable, we do not believe these metrics are accurate measures of our success since the spin-off. While we do not ascribe particular importance to our stock price on any given day, we understand that some of our shareholders may. We note to such shareholders that within the last year, our stock has traded as high as $13.40 per share (and closed at $13.20 per share) on September 21, 2018. We believe our operational excellence, financial stability and successful history of growing sales, coupled with the termination of the Management Consulting Agreement, will reward our shareholders in the long term. 4

Our Board is highly qualified and engaged We have a strong, engaged Board with active participation of our independent directors. Our two director nominees for this year, Mr. Janszen and Mr. Maggard, are both independent directors. Together, Mr. Janszen and Mr. Maggard bring to our Board over 60 years of experience as restaurant investors and Mr. Janszen is a representative of our largest shareholder. Our other Board members have leadership experience in executive management, accounting, finance, technology and other disciplines, which provides critical support to our Board and Board committee functions. A total of four of our six directors are independent, including our Lead Independent Director, Mr. Martire, who facilitates our Board’s independent oversight of management and leads our Board’s consideration of key corporate governance matters. Our seasoned Board is well qualified to oversee our Company’s operations and to grow shareholder value. 5

Ancora’s attacks on our Board’s independence are misguided We believe Ancora’s persistent focus on our Board’s independence with respect to the terminated transaction with 99 Restaurants in 2017/2018 to be inappropriate. As we have previously disclosed, our Board recognized the inherent risk of potential conflicts of interest with respect to the transaction with 99 Restaurants and our Board specifically negotiated to ensure the completion of the transaction was contingent on the approval of our disinterested shareholders. When our disinterested shareholders chose not to approve the transaction, our Board immediately terminated the transaction. Ancora’s misguided attacks are inconsistent with our Board’s commitment to the best interests of our shareholders. 6

Ancora’s purported proposal Our Board and senior management regularly evaluate potential transactions relating to our Company’s business, including prospects for alternative financing structures, potential additional restaurant concepts and other uses of capital, all with a view toward maximizing shareholder value. To that end, over the past several years, our Board and management have engaged financial and legal advisors to evaluate bona fide transaction opportunities. After reviewing Ancora’s purported proposal, our Board determined that the proposal was neither value-maximizing to shareholders other than Ancora nor bona fide. 7

Ancora’s purported proposal is not value-maximizing Ancora’s proposed purchase price is more than 12% lower than the 52-week trading high for J. Alexander’s stock, and nearly 22% lower than the prevailing equity analyst price target for J. Alexander’s. Allowing Ancora to buy our Company at a bargain price in order to reap the benefits of recent substantial investments in new restaurants and the termination of the Black Knight Management Consulting Agreement—each of which our Board believes will substantially benefit our earnings, our Company and our shareholders in the future—would deprive long-term investors of a significant value realization opportunity. 8

We doubt whether Ancora’s purported proposal is bona fide We strongly doubt whether Ancora’s proposal is a bona fide offer. Ancora’s proposal lacks specific or verifiable details regarding Ancora’s planned financing of the proposed transaction. At no time, including during subsequent engagements with our management, has Ancora attempted to construct a more credible proposal, nor has Ancora taken its proposal directly to our shareholders by pursuing a tender offer. Ancora has not provided any credible explanation as to why it chose not to nominate its own slate of directors to our Board through the process afforded by our bylaws and instead has engaged in its current disruptive campaign without offering any proposed solutions to what it perceives as problems with our Company’s performance and management. 9

We doubt whether Ancora’s purported proposal is bona fide, cont. We view Ancora’s spurious proposal and open attack as a publicity attempt intended to bolster Ancora’s future fundraising and line their pockets with fees—actions we view as hardly defensible, especially in light of the SEC’s recent censuring of Ancora in connection with willful violations by Ancora of the SEC’s “pay-to-play” rule in connection with four separate campaign contributions by covered associates of Ancora totaling $46,908 in the aggregate. A copy of the SEC’s order relating to Ancora’s actions can be found at: https://www.sec.gov/litigation/admin/2018/ia-5077.pdf Our Board takes its fiduciary duties to all of our shareholders seriously and will always consider bona fide offers that are in the best interests of all of our shareholders. However, our Board and management do not believe that $11.75 per share is anywhere near a full and fair price for the sale of our Company and we also do not believe that Ancora should have the opportunity to rob our shareholders of realizing the long-term value of their investment in our Company. 10

The Amendments to our Equity Plan are necessary to allow us to attract and retain key officers, employees and directors We view the request in shares authorized for issuance under our Equity Plan as representing a modest increase necessary to attain our objectives of attraction and retention of key officers, employees and directors (assuming we continue to grant awards consistent with historical usage and expected practices, such increase would be sufficient to allow us to make equity grants through the 2021 fiscal year). If our Amended and Restated Equity Plan is not approved by our shareholders, we will only have 4,250 shares remaining available for grant under the plan—an amount that is wholly inadequate to allow us to grant equity incentive awards consistent with historical practice for even the current fiscal year. The increase of authorized shares is needed so that we may continue to grant equity incentive awards under the plan, thereby further aligning the interests of our key officers, employees and directors with those of our shareholders. We believe that the other revisions contained in the Amended and Restated 2015 Equity Incentive Plan are consistent with sound corporate governance practices and will strengthen the alignment of the plan with the interests of our shareholders. 11