Investor Presentation Second Quarter Fiscal 2021 Company LOGO Exhibit 99.1

Eric B. Heyer Senior Executive Vice President and Chief Operating Officer Keith Suchodolski Executive Vice President and Chief Financial Officer Craig L. Montanaro Director, President and Chief Executive Officer 2 Presenters Company LOGO

3 This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, The effects of COVID-19 on our business, financial condition or results of operations, the effects of and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, the impact of changes in laws, regulations and government policies regarding financial institutions (including laws concerning taxation, banking, securities and insurance), changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, technological changes, competition among financial services providers and, the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exhaustive. Readers should not place any undue reliance on any forward looking statements, which speak only as of the date made. The Company does not undertake any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. Forward Looking Statements Company LOGO

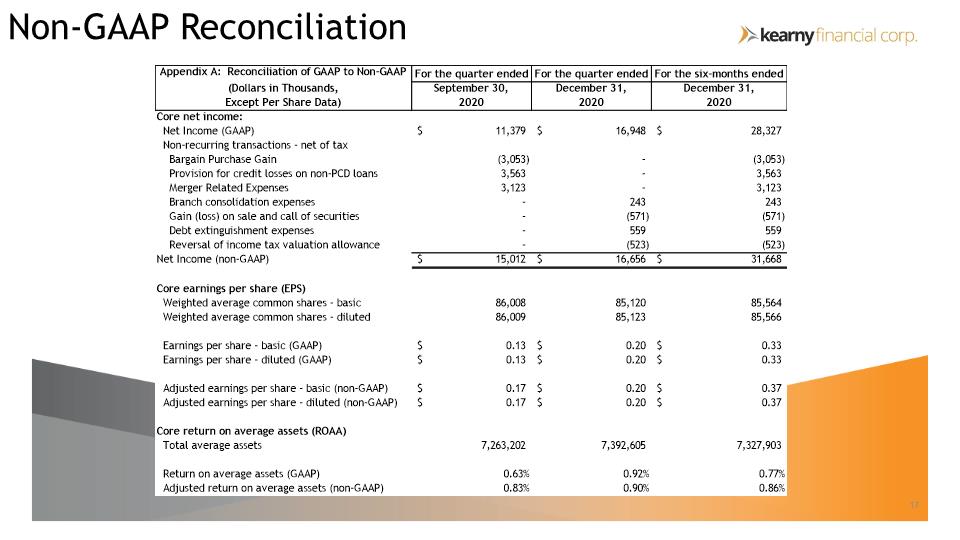

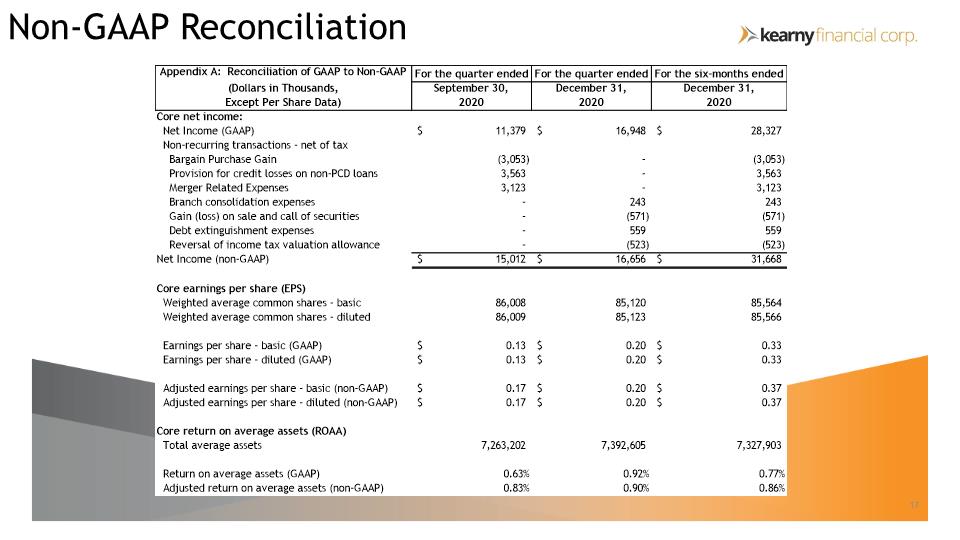

4 This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. Non-GAAP Financial Measures Company LOGO

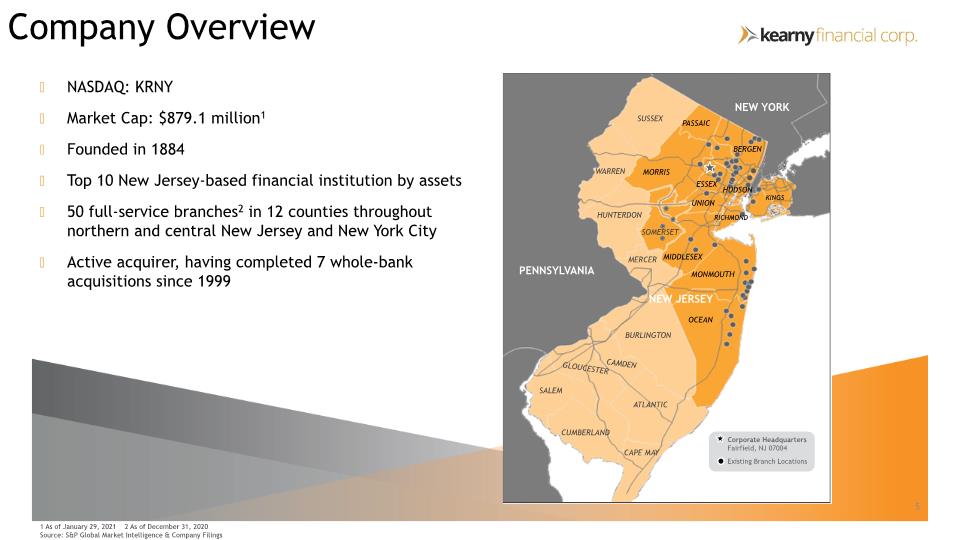

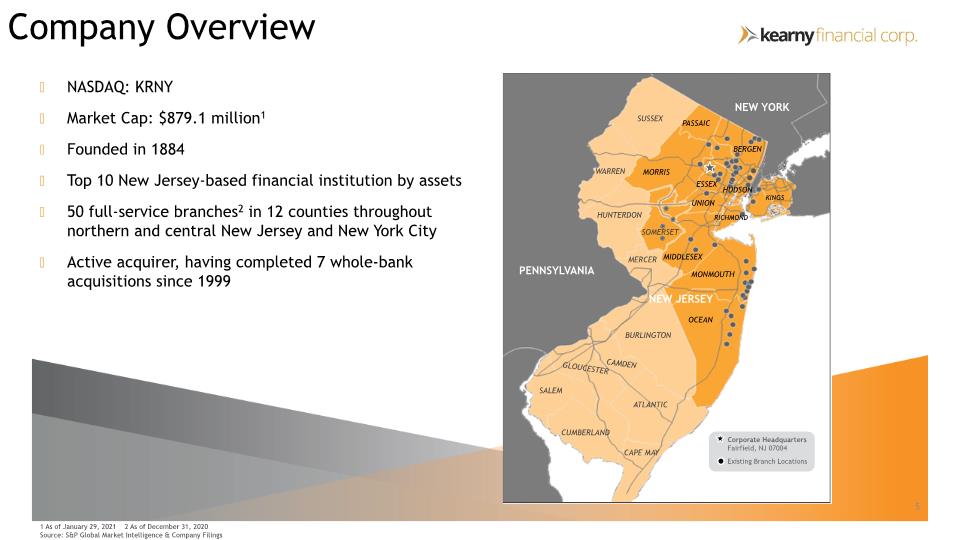

5 NASDAQ: KRNY Market Cap: $879.1 million1 Founded in 1884 Top 10 New Jersey-based financial institution by assets 50 full-service branches2 in 12 counties throughout northern and central New Jersey and New York City Active acquirer, having completed 7 whole-bank acquisitions since 1999 1 As of January 29, 2021 2 As of December 31, 2020 Source: S&P Global Market Intelligence & Company Filings PENNSYLVANIA NEW YORK CUMBERLAND CAPE MAY ATLANTIC BURLINGTON GLOUCESTER SALEM CAMDEN MERCER HUNTERDON SOMERSET WARREN SUSSEX PASSAIC MORRIS ESSEX UNION MONMOUTH OCEAN RICHMOND KINGS HUDSON BERGEN MIDDLESEX NEW JERSEY Company Overview Company LOGO

6 Second Quarter Highlights $7.3 billion in total assets $4.8 billion in total loans $5.3 billion in total deposits $1.1 billion in total equity Net income of $16.9 million, or $0.20 per share Core non-maturity deposit growth of $272.6 million, or 8.9% ROAA of 0.92%, ROTCE of 7.52% Efficiency ratio of 59.0% As of December 31, 2020 For the Quarter Ended December 31, 2020 Company LOGO

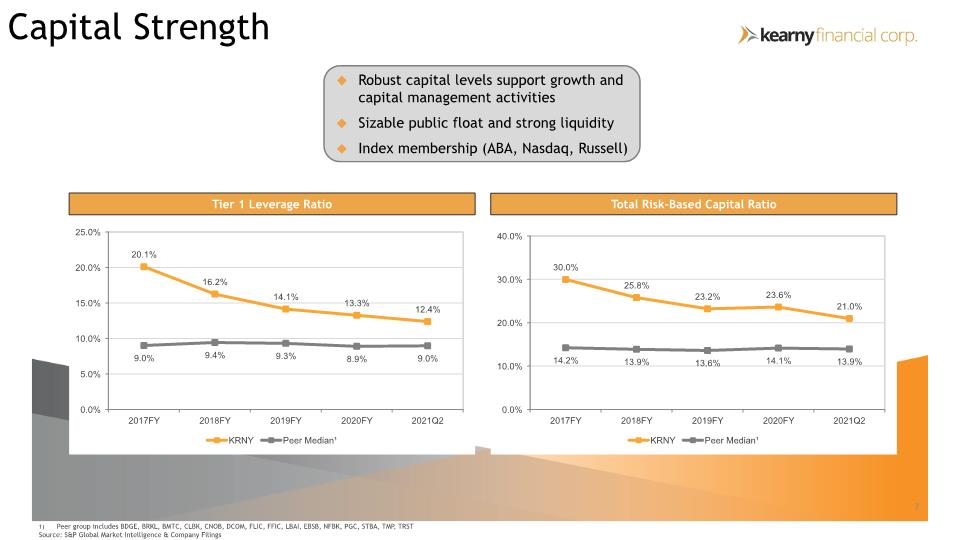

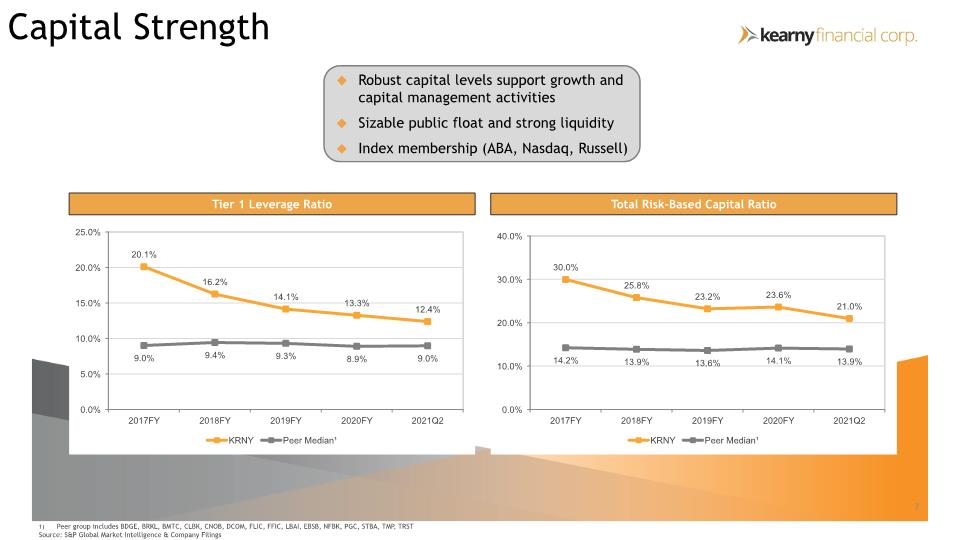

7 Capital Strength Tier 1 Leverage Ratio Total Risk-Based Capital Ratio Peer group includes BDGE, BRKL, BMTC, CLBK, CNOB, DCOM, FLIC, FFIC, LBAI, EBSB, NFBK, PGC, STBA, TMP, TRST Source: S&P Global Market Intelligence & Company Filings Robust capital levels support growth and capital management activities Sizable public float and strong liquidity Index membership (ABA, Nasdaq, Russell) Company LOGO Chart

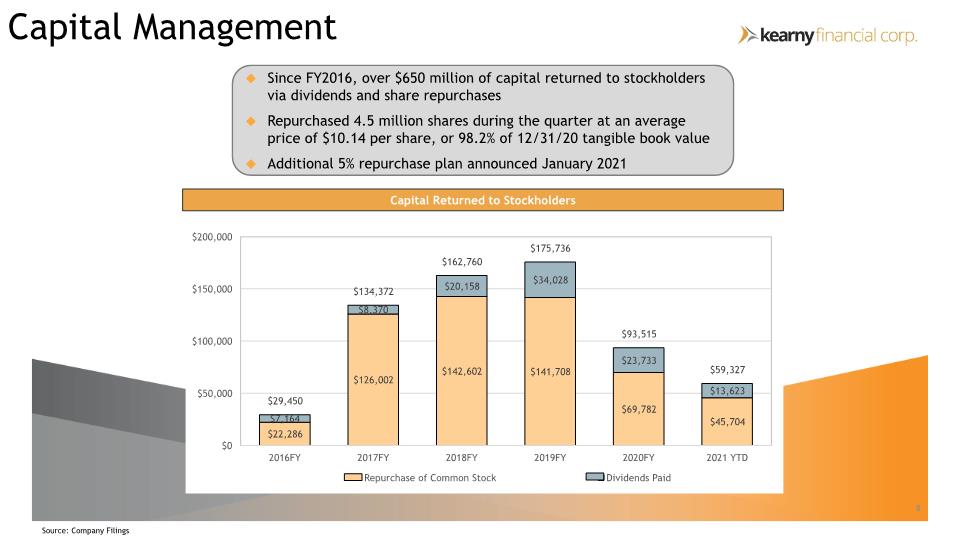

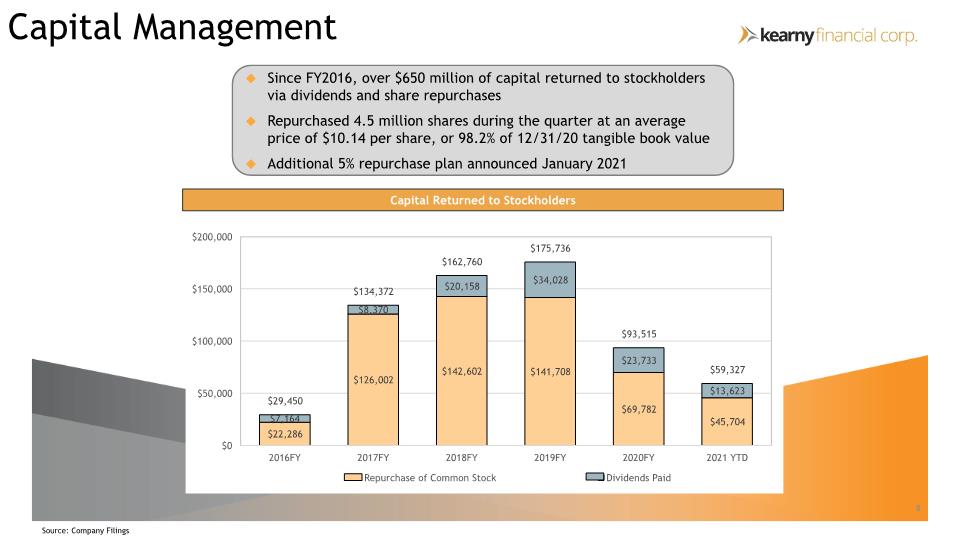

8 Capital Management Capital Returned to Stockholders Since FY2016, over $650 million of capital returned to stockholders via dividends and share repurchases Repurchased 4.5 million shares during the quarter at an average price of $10.14 per share, or 98.2% of 12/31/20 tangible book value Additional 5% repurchase plan announced January 2021 Source: Company Filings Company LOGO Chart Company LOGO Chart

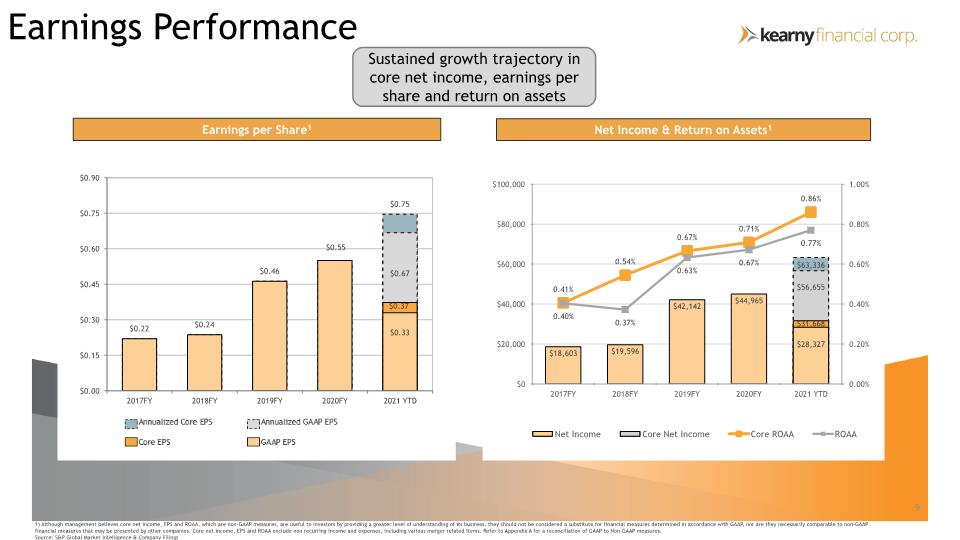

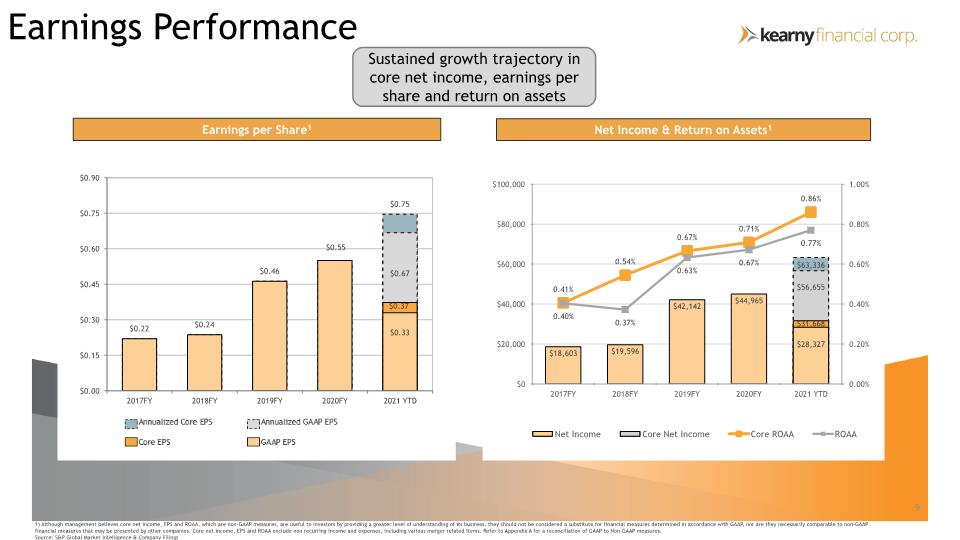

9 Earnings Performance Net Income & Return on Assets1 Earnings per Share1 1) Although management believes core net income, EPS and ROAA, which are non-GAAP measures, are useful to investors by providing a greater level of understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial measures that may be presented by other companies. Core net income, EPS and ROAA exclude non recurring income and expenses, including various merger related items. Refer to Appendix A for a reconciliation of GAAP to Non-GAAP measures. Source: S&P Global Market Intelligence & Company Filings Sustained growth trajectory in core net income, earnings per share and return on assets Annualized Core EPS Annualized GAP EPS Core EPS GAP EPS Company LOGO Chart

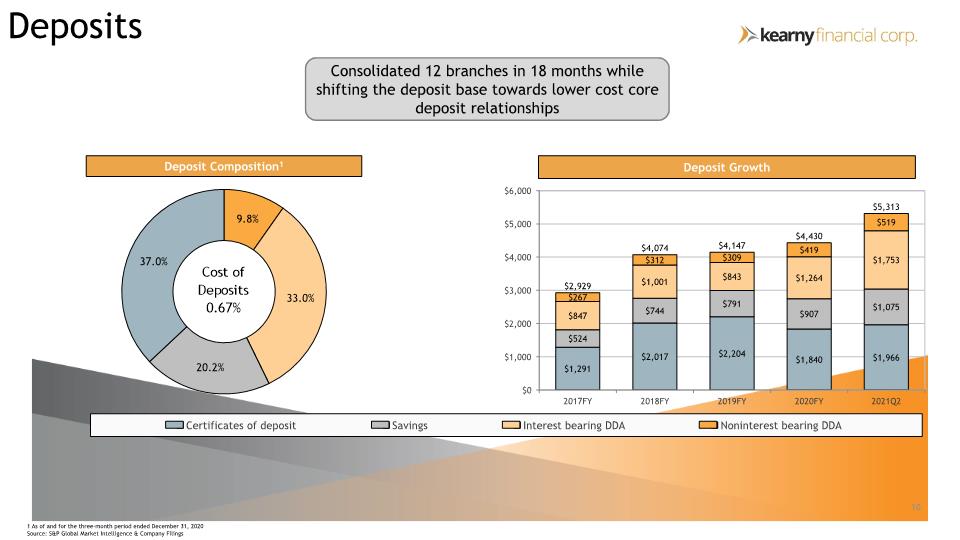

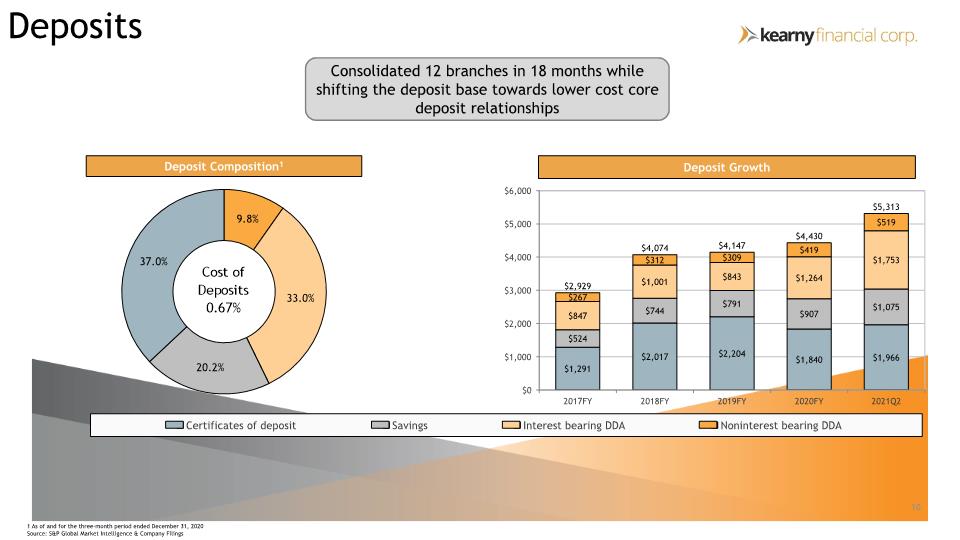

10 Deposits Consolidated 12 branches in 18 months while shifting the deposit base towards lower cost core deposit relationships Deposit Composition1 Deposit Growth 1 As of and for the three-month period ended December 31, 2020 Source: S&P Global Market Intelligence & Company Filings Company LOGO Chart

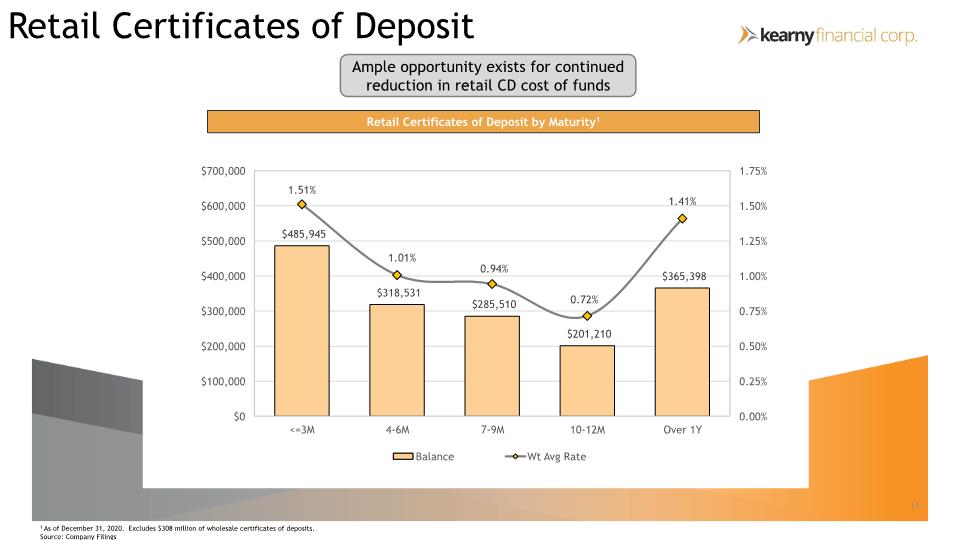

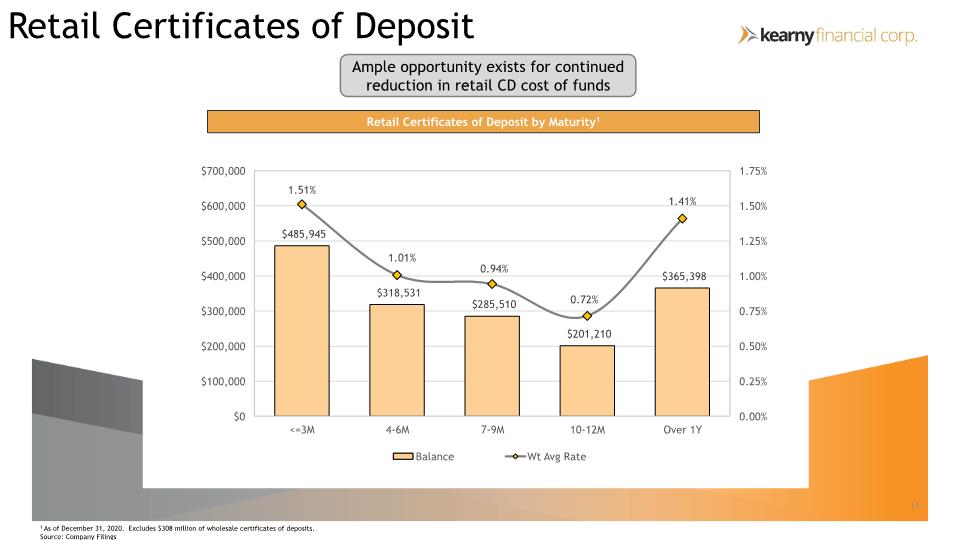

11 Retail Certificates of Deposit Retail Certificates of Deposit by Maturity1 1 As of December 31, 2020. Excludes $308 million of wholesale certificates of deposits. Source: Company Filings Ample opportunity exists for continued reduction in retail CD cost of funds Company LOGO Chart

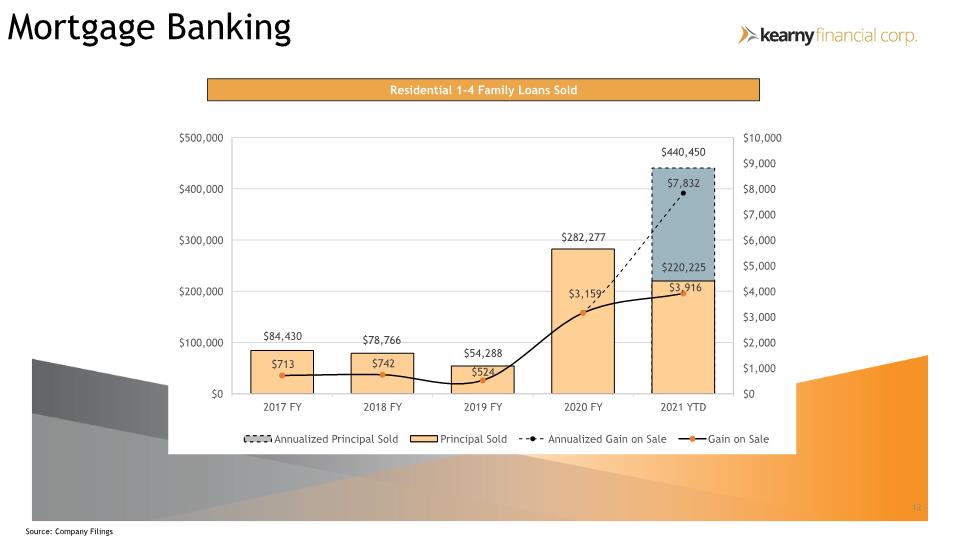

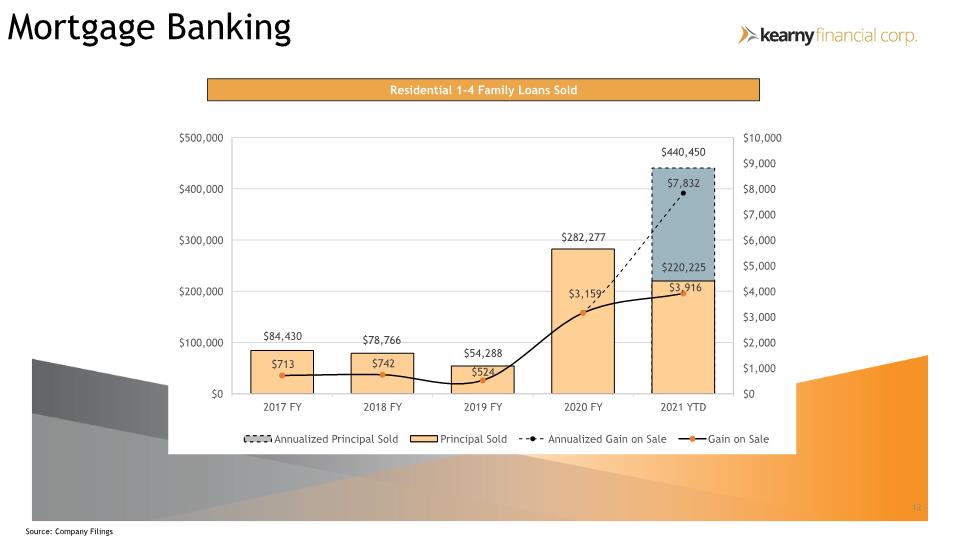

12 Mortgage Banking Residential 1-4 Family Loans Sold Source: Company Filings Company LOGO Chart

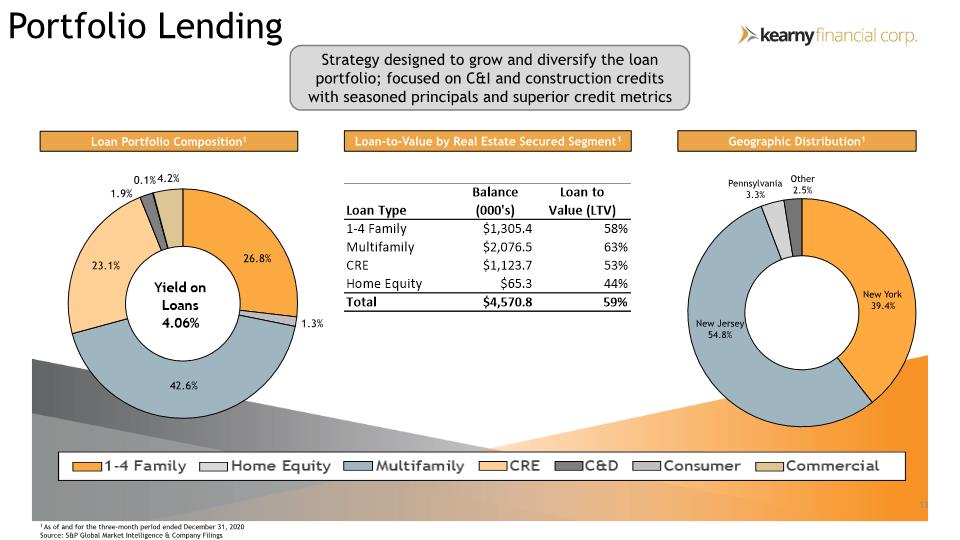

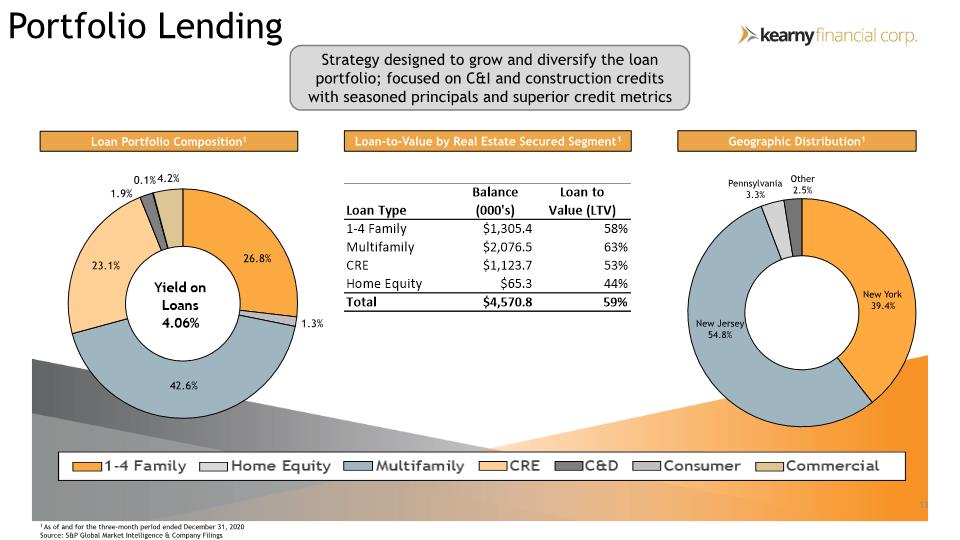

13 Portfolio Lending Loan Portfolio Composition1 Geographic Distribution1 1 As of and for the three-month period ended December 31, 2020 Source: S&P Global Market Intelligence & Company Filings Loan-to-Value by Real Estate Secured Segment1 Strategy designed to grow and diversify the loan portfolio; focused on C&I and construction credits with seasoned principals and superior credit metrics 1-4 Family Home Equity Multifamily CRE C&D Consumer Commercial Company LOGO Chart Loan Type Balance (000's) Loan to Value (LTV) 1-4 Family $1,305.4 58% Multifamily $2,076.5 63% CRE $1,123.7 53% Home Equity $65.3 44% Total $4,570.8 59%

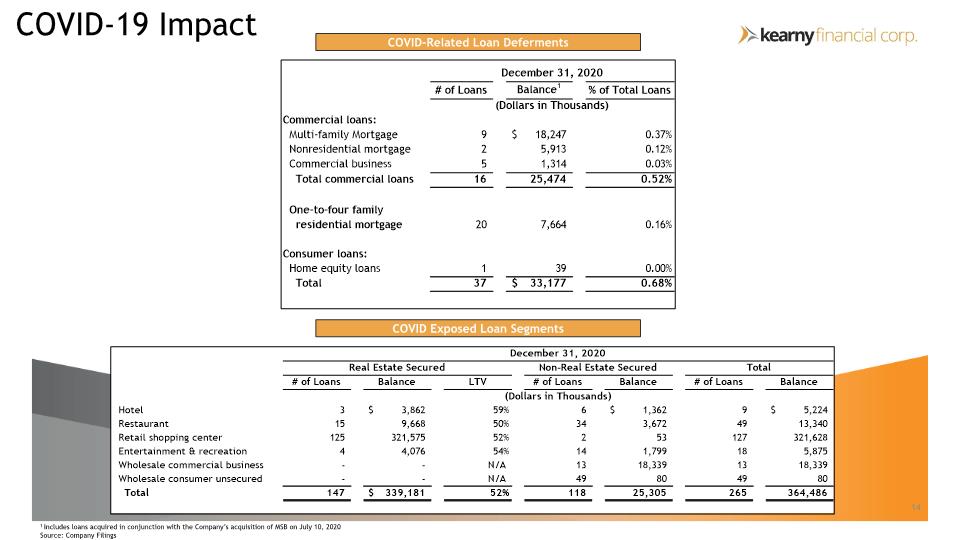

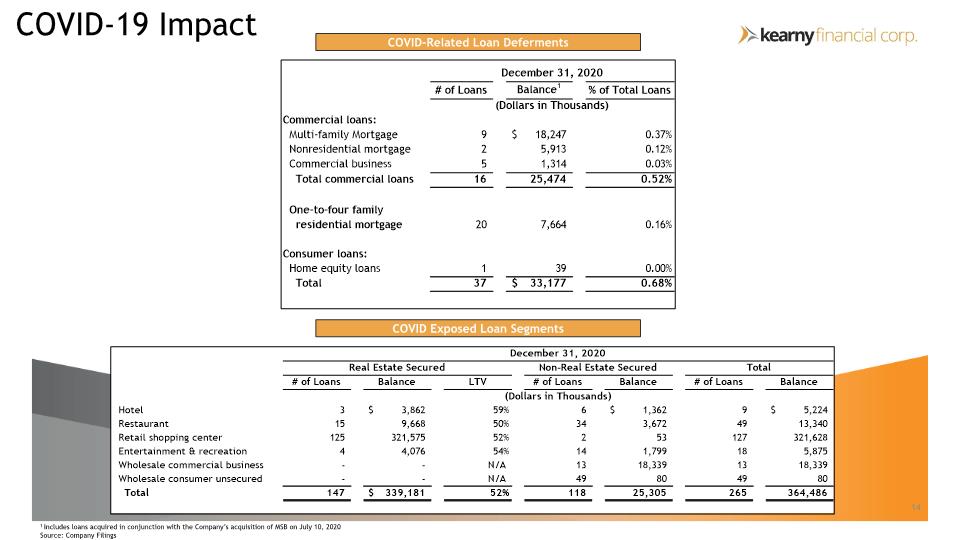

14 COVID-19 Impact 1 Includes loans acquired in conjunction with the Company’s acquisition of MSB on July 10, 2020 Source: Company Filings COVID Exposed Loan Segments COVID-Related Loan Deferments Commercial loans: Multi-family Mortgage Nonresidential mortgage Commercial business Total commercial loans One-to-four family residential mortgage Consumer loans: Home equity loans Total # of Loans December 31, 2020 1 Balance % of Total Loans (Dollars in Thousands) : 9 $ 18,247 0.37% 2 5,913 0.12% 5 1,314 0.03% 16 25,474 0.52% 20 7,664 0.16% 1 39 0.00% 37 $ 33,177 0.68% Hotel Restaurant Retail shopping center Entertainment & recreation Wholesale commercial business Wholesale consumer unsecured Total December 31, 2020 Real Estate Secured Non-Real Estate Secured Total # of Loans Balance LIV # of Loans Balance # of Loans Balance (Dollars in Thousands) 3. $ 3,862 59% 6 $ 1,362 9 $ 5,224 15 9,668 50% 34 3,672 49 13,340 125 321,575 52% 2 53 127 321,628 4 4,076 54% 14 1,799 18 5,875 - - N/A 13 18,339 13 18,339 : : N/A 49 80 49 80 147 $ 339,181 52% 118 25,305 265 364,486

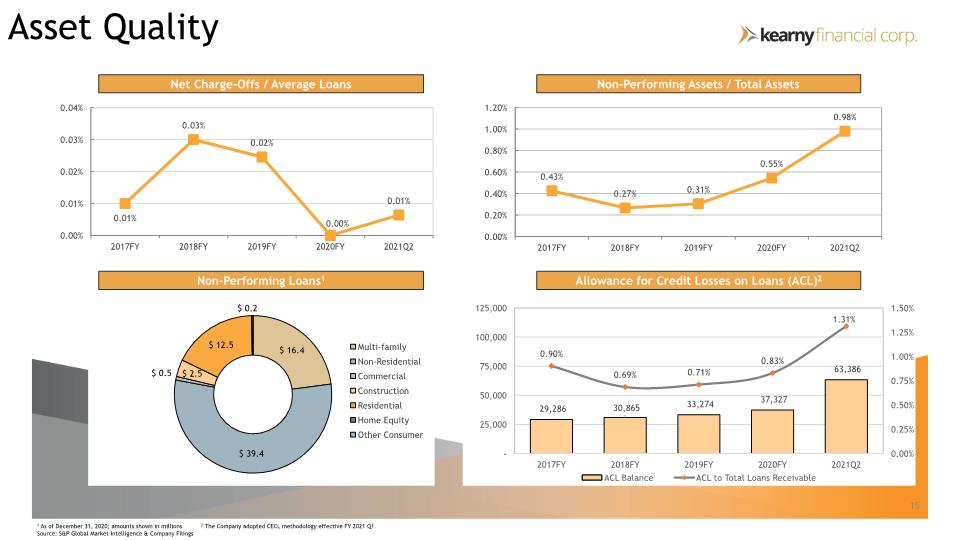

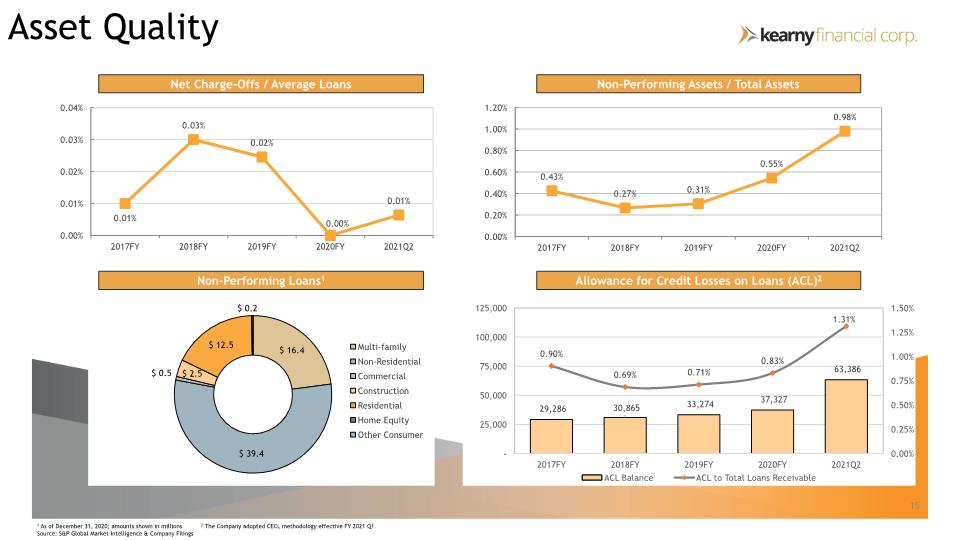

15 Asset Quality Net Charge-Offs / Average Loans Non-Performing Assets / Total Assets 1 As of December 31, 2020; amounts shown in millions 2 The Company adopted CECL methodology effective FY 2021 Q1 Source: S&P Global Market Intelligence & Company Filings Non-Performing Loans1 Allowance for Credit Losses on Loans (ACL)2 Company LOGO Chart

16 M&A History and Strategy Experienced acquirer and integrator, having successfully completed 7 whole-bank acquisitions over the past 20 years Opportunistic acquisition strategy with an emphasis on: Low premium deals Similar or complementary business models Expansion in existing or contiguous markets Cultural compatibility Focused on limiting tangible book value dilution and earn-back periods Company logo

17 Non-GAAP Reconciliation Company logo Appendix A: Reconciliation of GAAP to Non-GAAP (Dollars in Thousands, For the quarter ended| For the quarter ended | For the six-months ended Except Per Share Data) Core net income: Net Income (GAAP) Non-recurring transactions - net of tax Bargain Purchase Gain Provision for credit losses on non-PCD loans Merger Related Expenses Branch consolidation expenses Gain (loss) on sale and call of securities Debt extinguishment expenses Reversal of income tax valuation allowance Net Income (non-GAAP) Core earnings per share (EPS) Weighted average common shares - basic Weighted average common shares - diluted Earnings per share - basic (GAAP) Earnings per share - diluted (GAAP) Adjusted earnings per share - basic (non-GAAP) Adjusted earnings per share - diluted (non-GAAP) Core return on average assets (ROAA) Total average assets Return on average assets (GAAP) Adjusted return on average assets (non-GAAP) September 30, December 31, December 31, 2020 2020 2020 $ 11,379 $ 16,948 $ 28,327 (3,053) – (3,053) 3,563 – 3,563 3,123 – 3,123 – 243 243 – (571) (571) – 559 559 – (523) (523) $ 15,012 $ 16,656 $ 31,668 86,008 85,120 85,564 $ 0.13 $ 0.20 $ 0.33 $ 0.13 $ 0.20 $ 0.33 $ 0.17 $ 0.20 $ 0.37 $ 0.17 $ 0.20 $ 0.37 7,263,202 7,392,605 7,327,903 0.63% 0.92% 0.77% 0.83% 0.90% 0.86%

Investor Presentation Second Quarter Fiscal 2021 Company LOGO Chart Company logo