JANUARY 26, 2023 I N V E S T O R P R E S E N T A T I O N S E C O N D Q U A R T E R F I S C A L 2 0 2 3 Exhibit 99.2

Forward Looking Statements 2

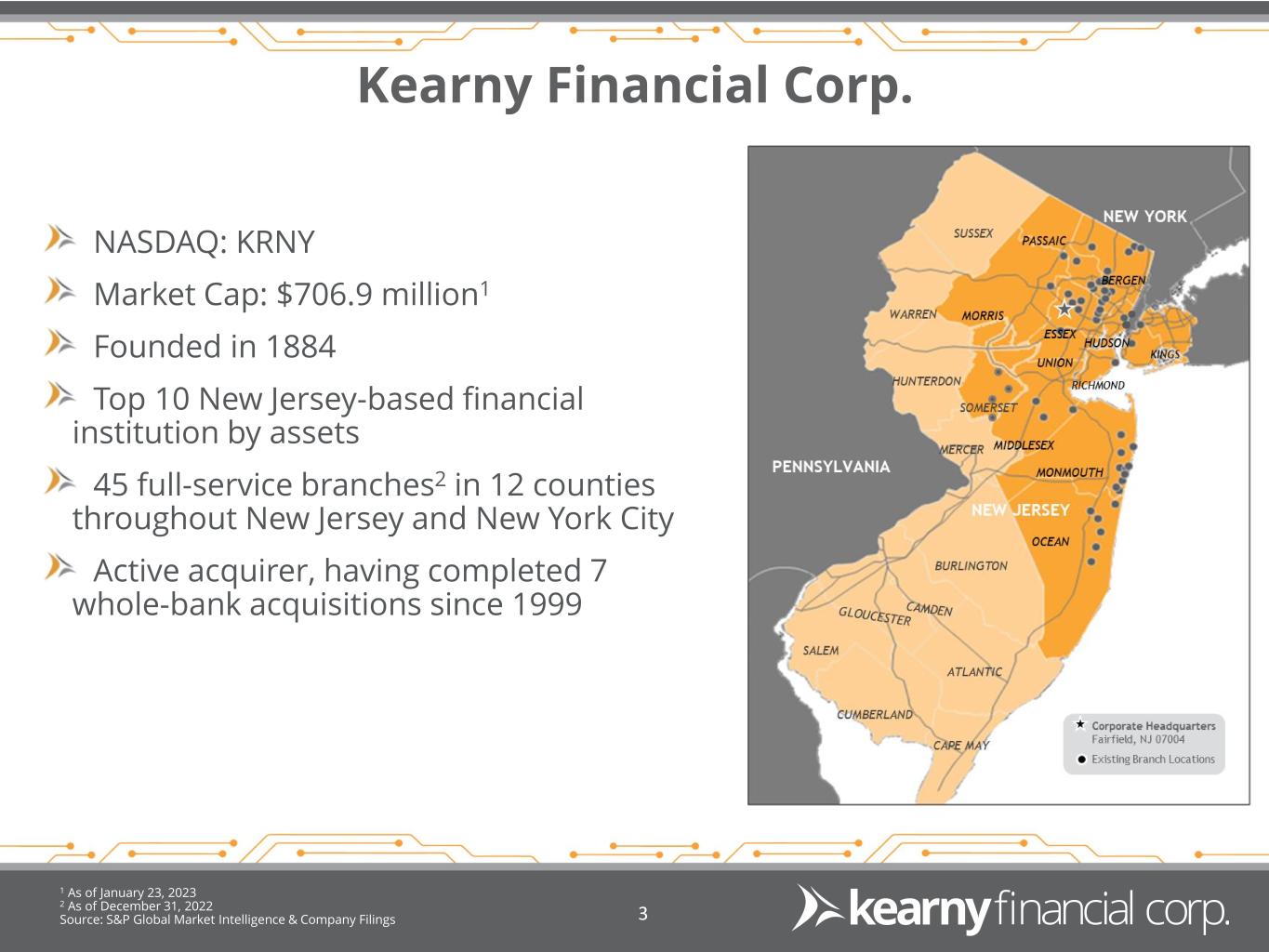

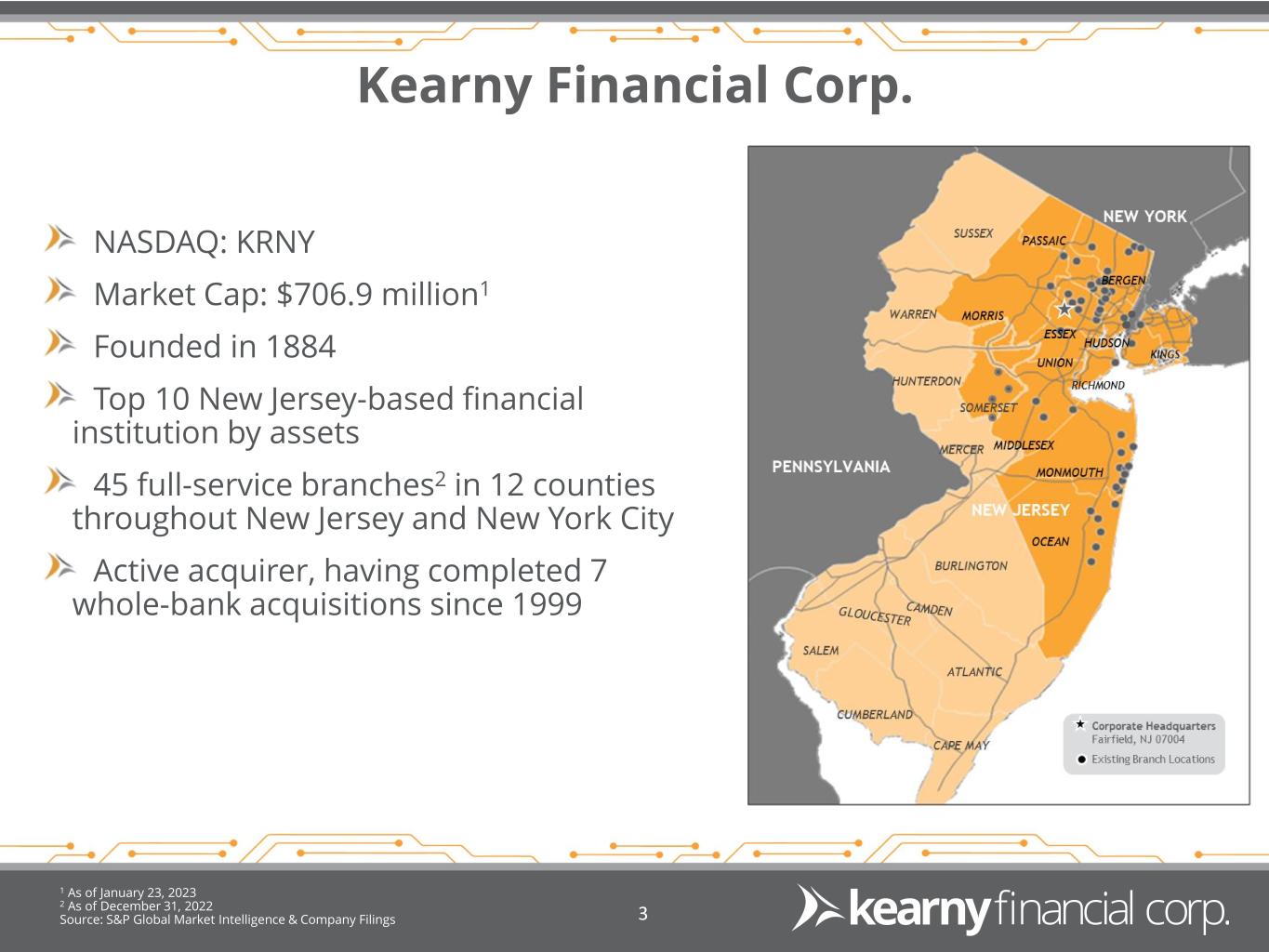

Kearny Financial Corp. NASDAQ: KRNY Market Cap: $706.9 million1 Founded in 1884 Top 10 New Jersey-based financial institution by assets 45 full-service branches2 in 12 counties throughout New Jersey and New York City Active acquirer, having completed 7 whole-bank acquisitions since 1999 1 As of January 23, 2023 2 As of December 31, 2022 Source: S&P Global Market Intelligence & Company Filings 3

138 Years of Serving our Communities and Clients 44

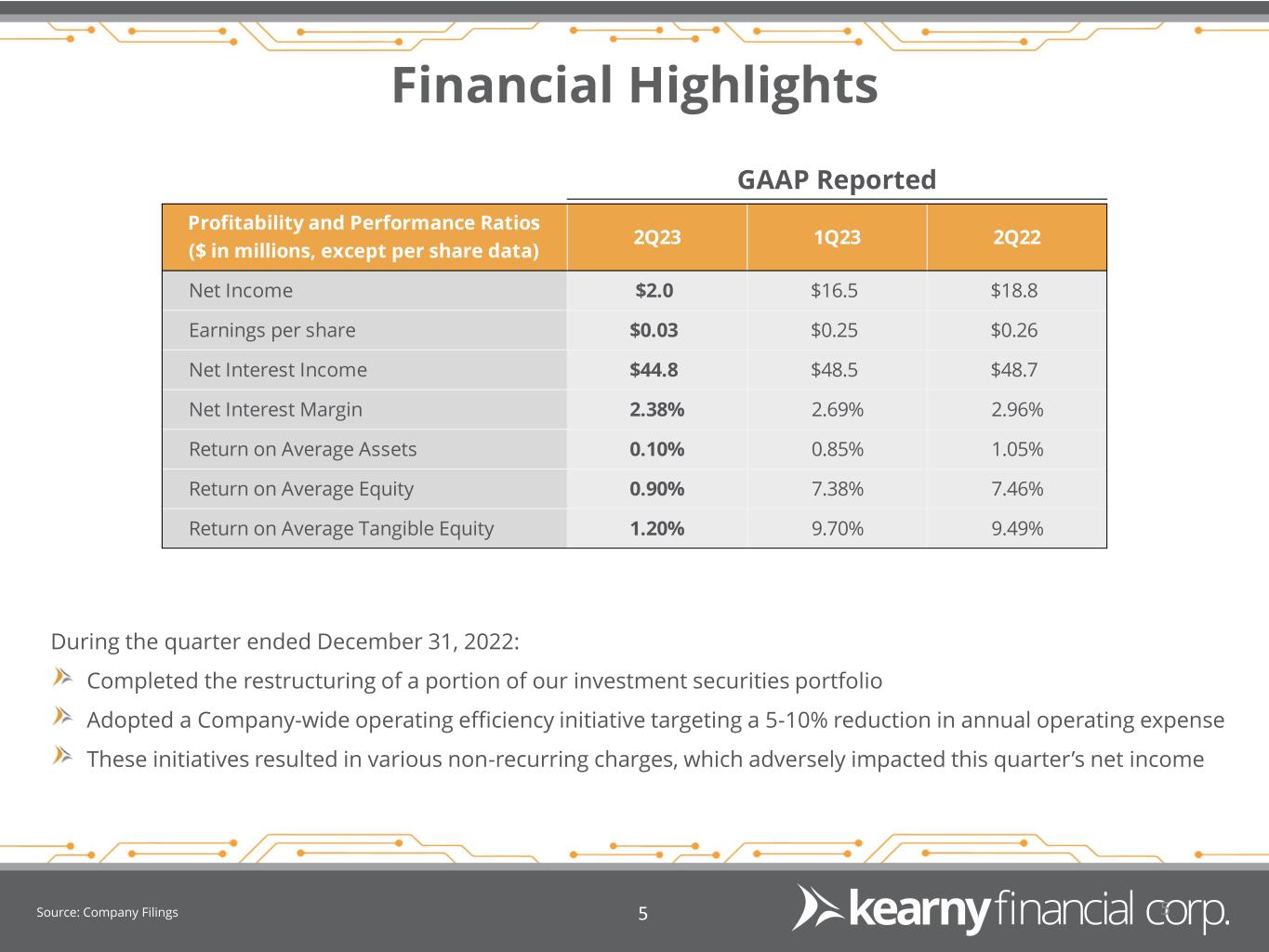

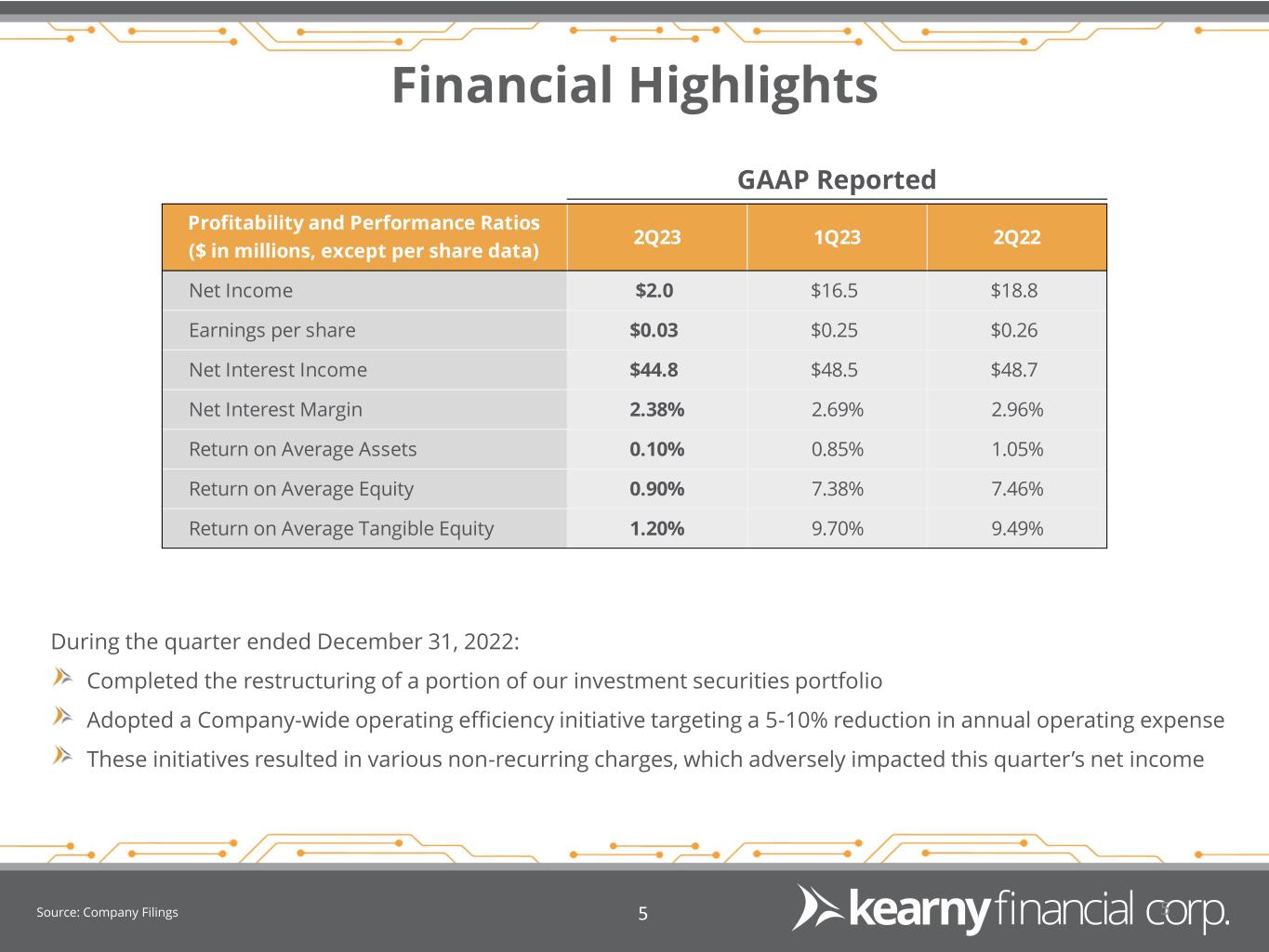

Financial Highlights Source: Company Filings 55 Profitability and Performance Ratios ($ in millions, except per share data) 2Q23 1Q23 2Q22 Net Income $2.0 $16.5 $18.8 Earnings per share $0.03 $0.25 $0.26 Net Interest Income $44.8 $48.5 $48.7 Net Interest Margin 2.38% 2.69% 2.96% Return on Average Assets 0.10% 0.85% 1.05% Return on Average Equity 0.90% 7.38% 7.46% Return on Average Tangible Equity 1.20% 9.70% 9.49% GAAP Reported During the quarter ended December 31, 2022: Completed the restructuring of a portion of our investment securities portfolio Adopted a Company-wide operating efficiency initiative targeting a 5-10% reduction in annual operating expense These initiatives resulted in various non-recurring charges, which adversely impacted this quarter’s net income

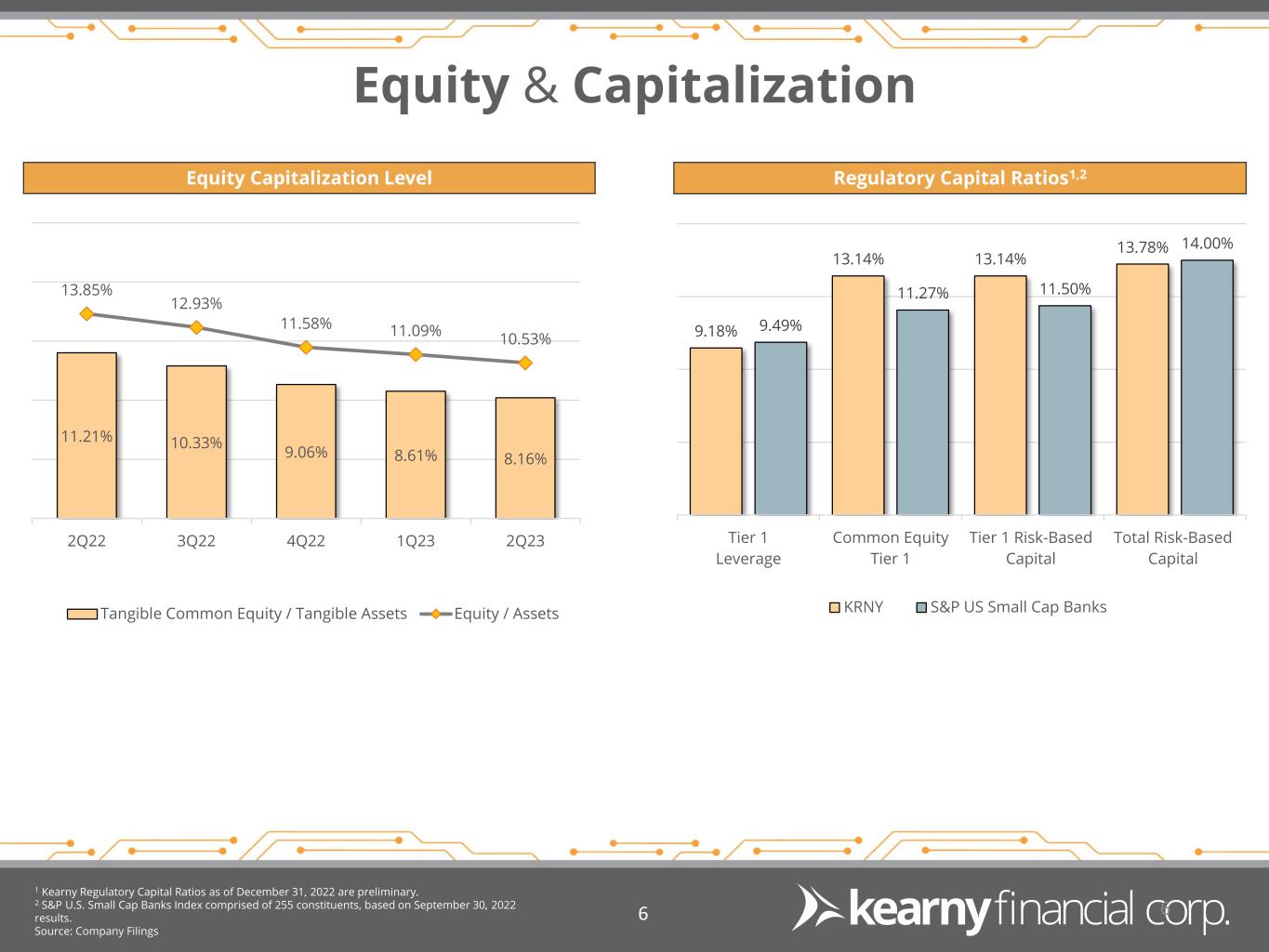

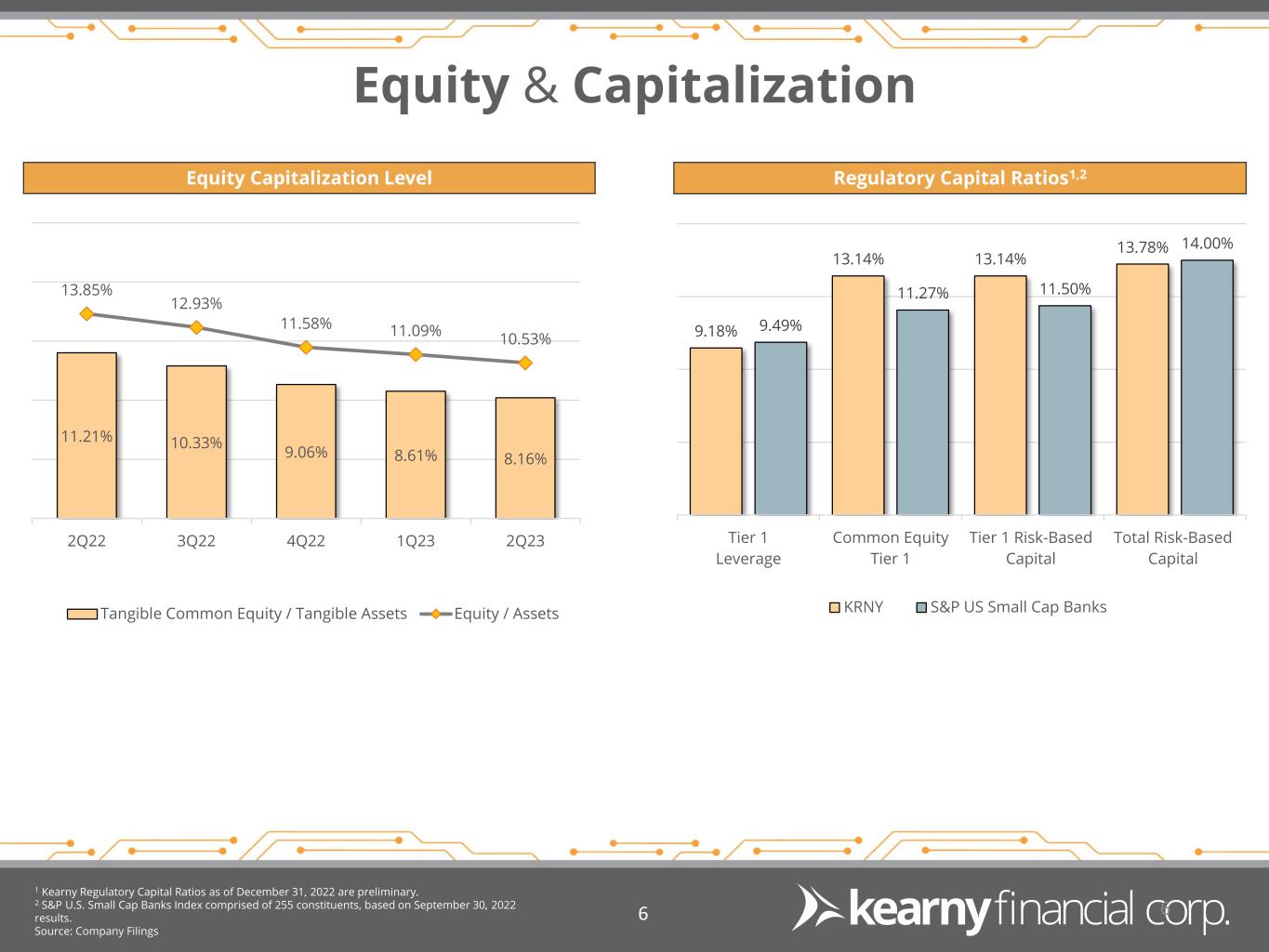

Equity & Capitalization Equity Capitalization Level 11.21% 10.33% 9.06% 8.61% 8.16% 13.85% 12.93% 11.58% 11.09% 10.53% 2Q22 3Q22 4Q22 1Q23 2Q23 Tangible Common Equity / Tangible Assets Equity / Assets 1 Kearny Regulatory Capital Ratios as of December 31, 2022 are preliminary. 2 S&P U.S. Small Cap Banks Index comprised of 255 constituents, based on September 30, 2022 results. Source: Company Filings 66 9.18% 13.14% 13.14% 13.78% 9.49% 11.27% 11.50% 14.00% Tier 1 Leverage Common Equity Tier 1 Tier 1 Risk-Based Capital Total Risk-Based Capital KRNY S&P US Small Cap Banks Regulatory Capital Ratios1,2

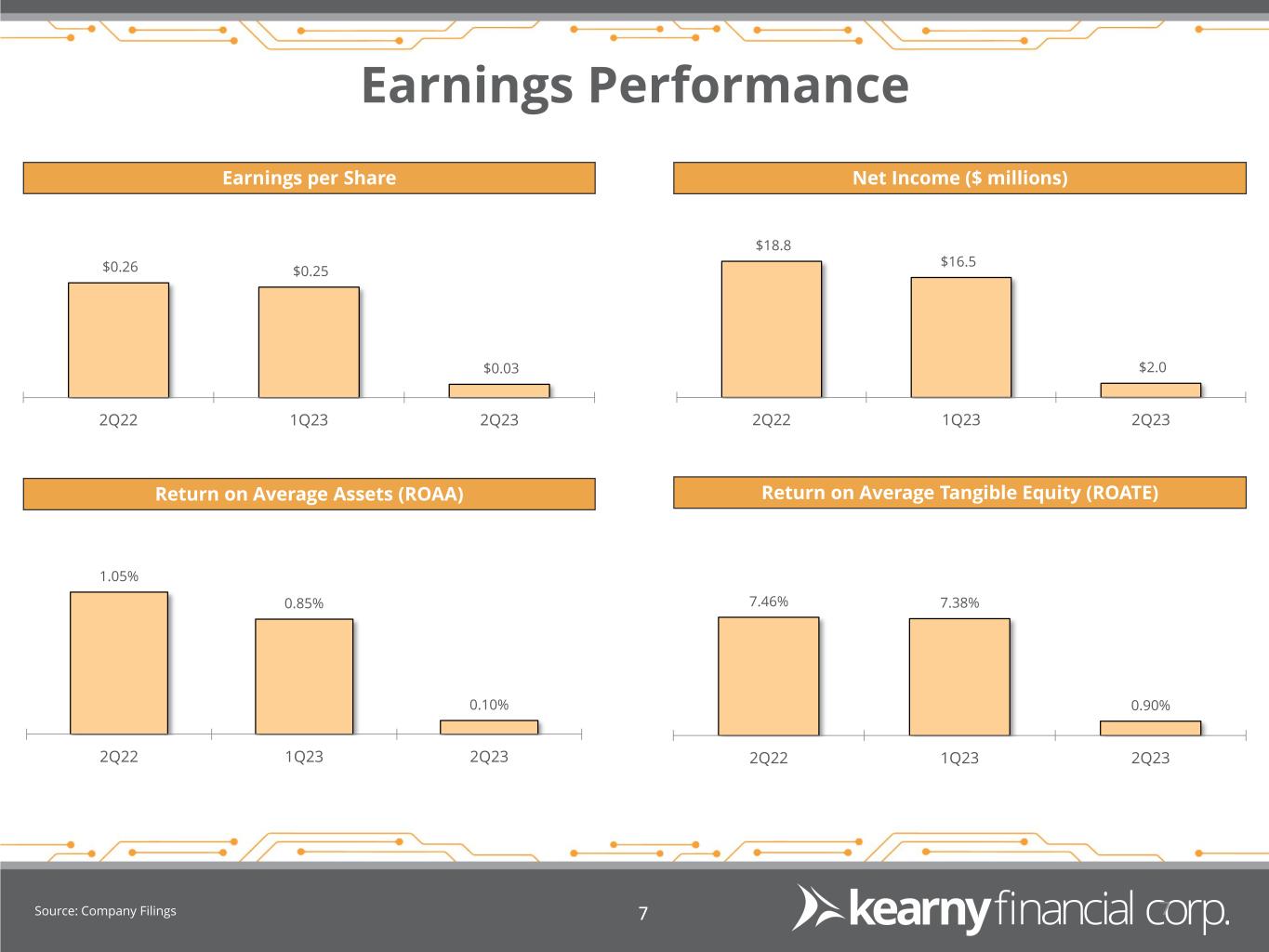

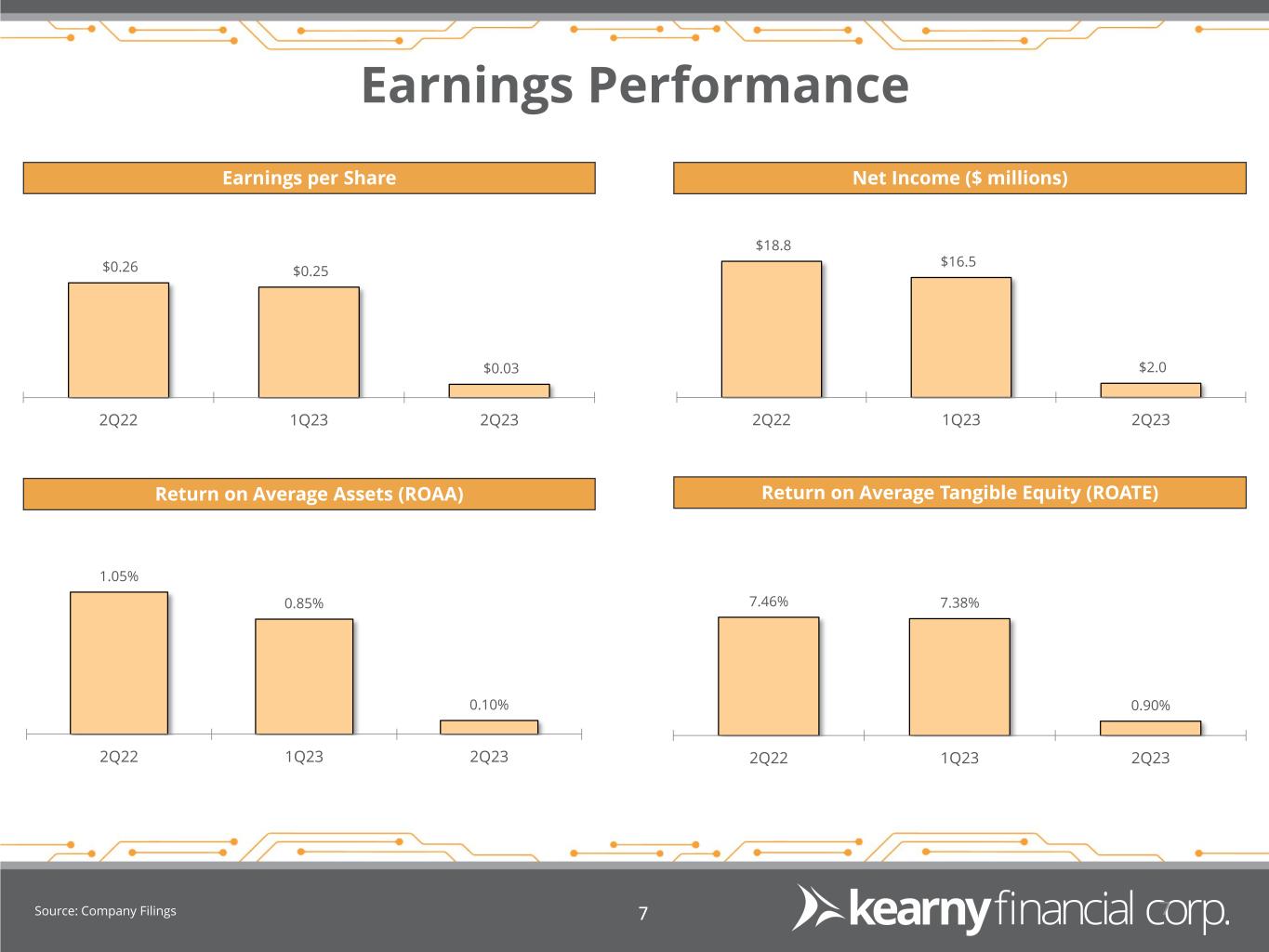

Earnings Performance Earnings per Share Net Income ($ millions) Source: Company Filings Return on Average Assets (ROAA) Return on Average Tangible Equity (ROATE) 77 $0.26 $0.25 $0.03 2Q22 1Q23 2Q23 $18.8 $16.5 $2.0 2Q22 1Q23 2Q23 1.05% 0.85% 0.10% 2Q22 1Q23 2Q23 7.46% 7.38% 0.90% 2Q22 1Q23 2Q23

Deposits Deposit Composition1 Deposit Growth $1,185 $1,122 $1,116 $1,263 $1,355 $469 $541 $773 $797 $747 $1,088 $1,089 $1,053 $983 $902 $2,107 $2,155 $2,266 $2,382 $2,316 $605 $622 $654 $683 $651 $5,454 $5,529 $5,862 $6,108 $5,971 2Q22 3Q22 4Q22 1Q23 2Q23 ($ millions) As of December 31, 2022, the Bank operates 45 full-service branches Consolidated 16 branches over a four-year period QTD Cost of Deposits 1.37% 22.7% 12.5% 15.1% 38.8% 10.9% Retail CDs Wholesale CDs Savings Interest bearing DDA Noninterest bearing DDA 1 For the quarter ended December 31, 2022. Source: S&P Global Market Intelligence & Company Filings 88

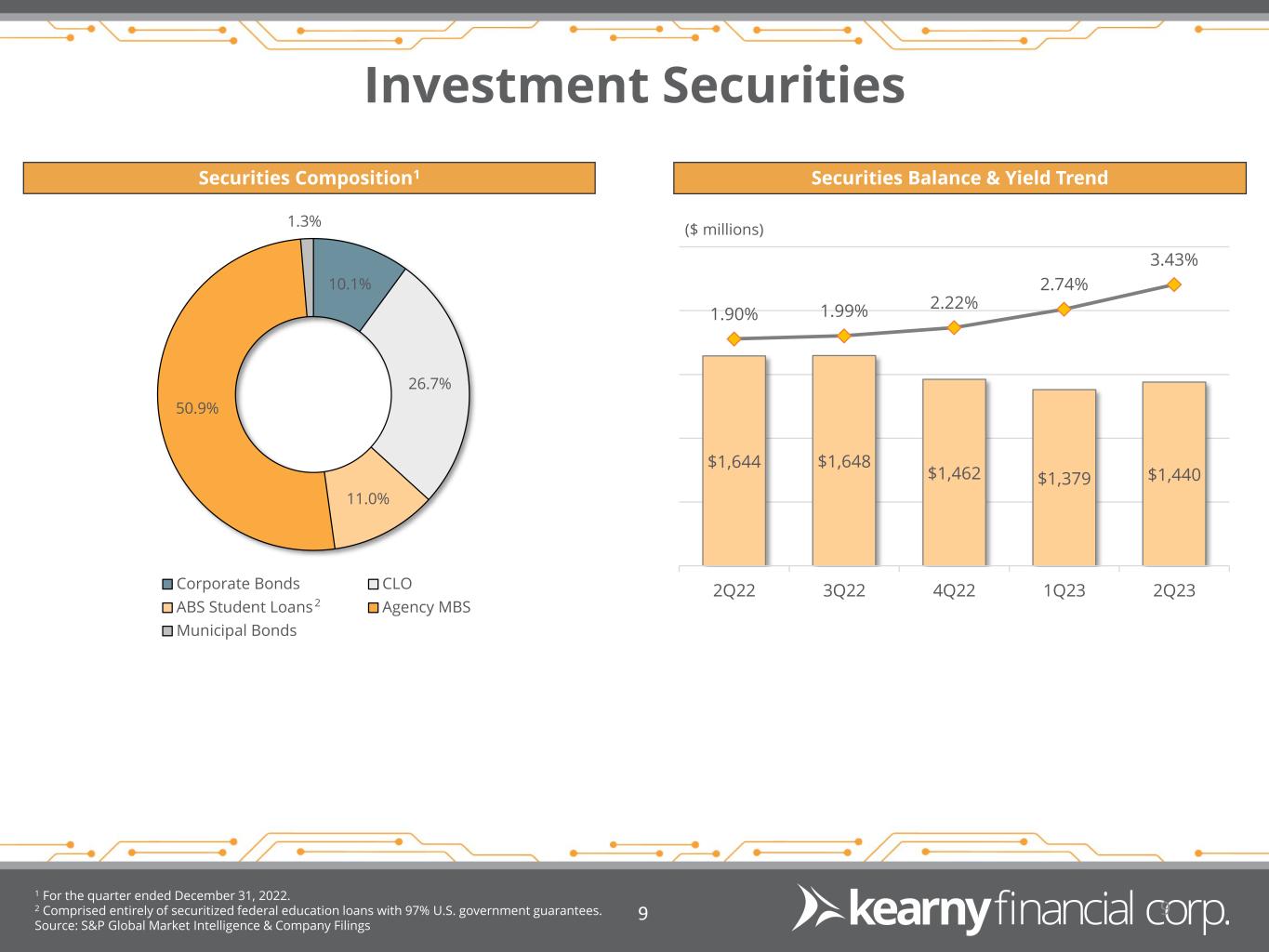

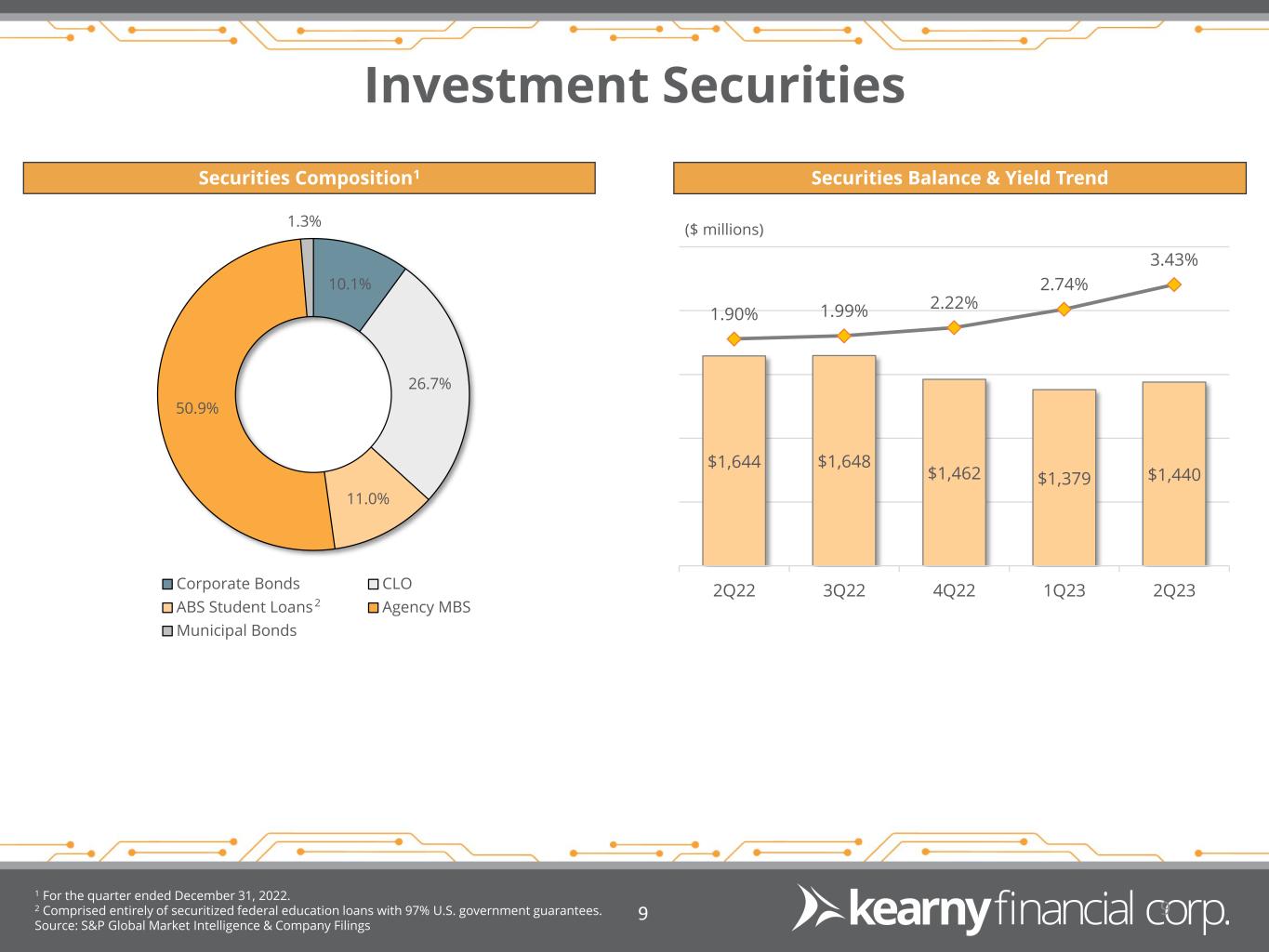

Investment Securities Securities Composition1 1 For the quarter ended December 31, 2022. 2 Comprised entirely of securitized federal education loans with 97% U.S. government guarantees. Source: S&P Global Market Intelligence & Company Filings 99 $1,644 $1,648 $1,462 $1,379 $1,440 1.90% 1.99% 2.22% 2.74% 3.43% 2Q22 3Q22 4Q22 1Q23 2Q23 ($ millions) Securities Balance & Yield Trend 10.1% 26.7% 11.0% 50.9% 1.3% Corporate Bonds CLO ABS Student Loans Agency MBS Municipal Bonds 2

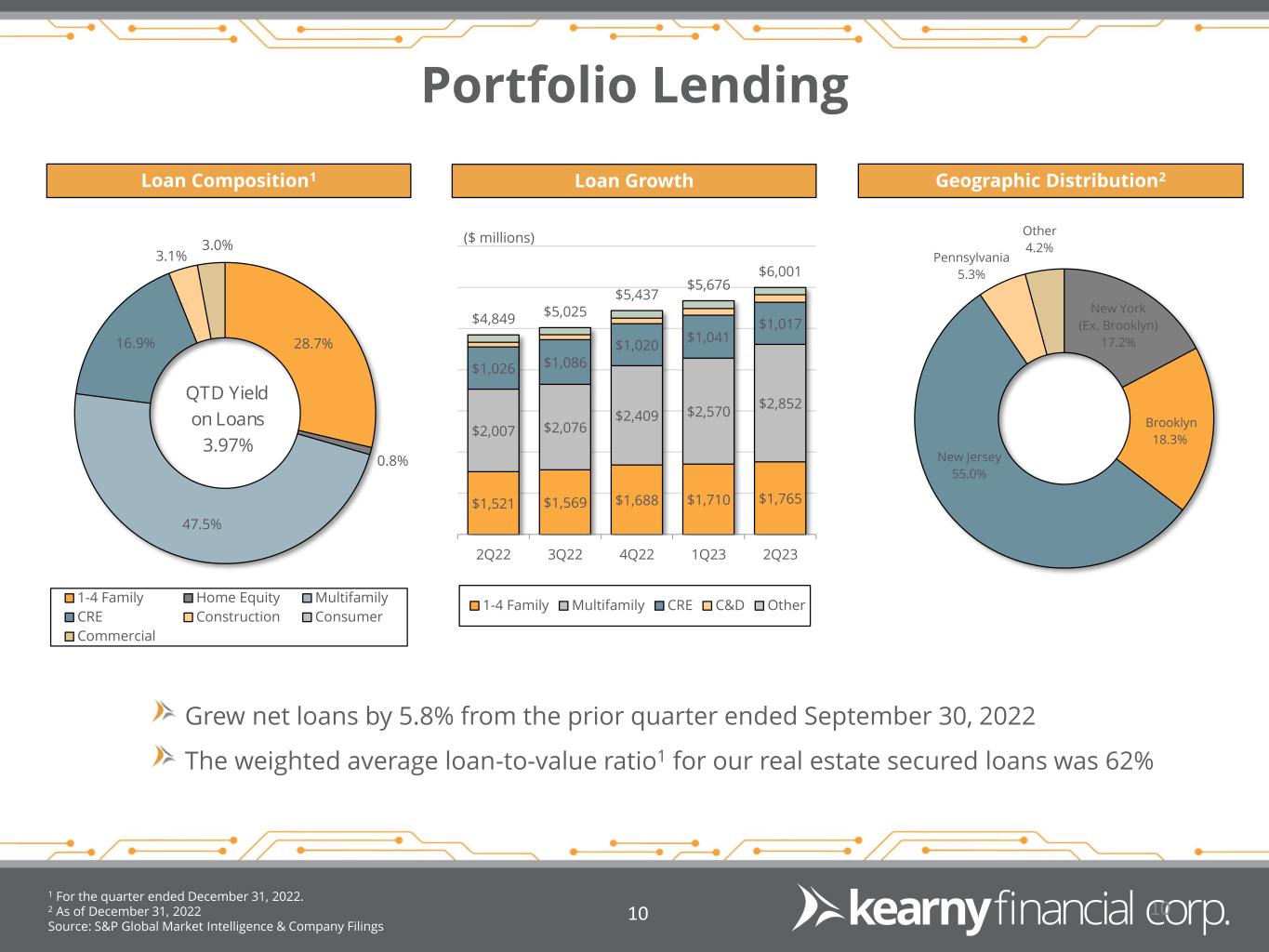

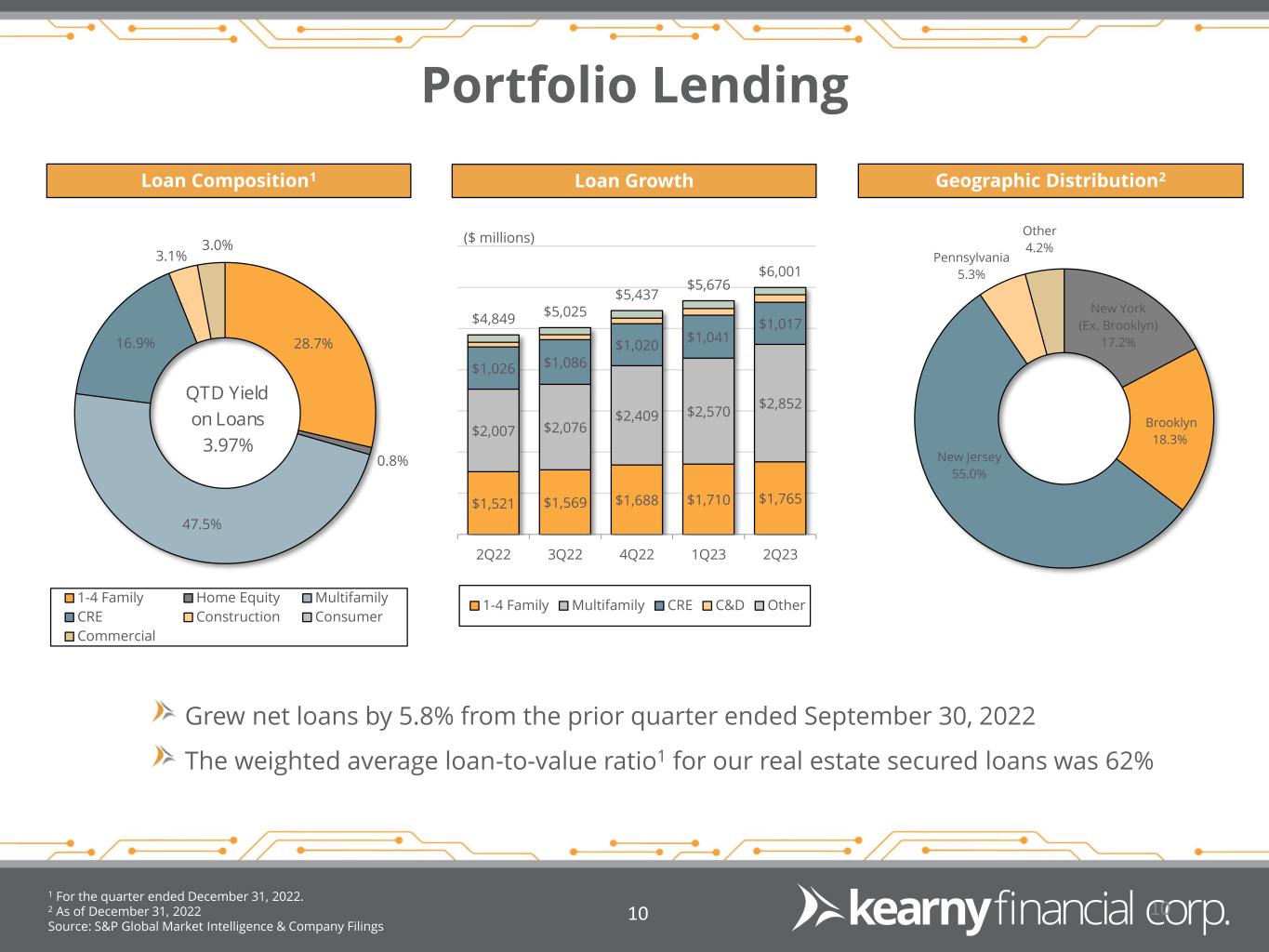

Portfolio Lending Loan Composition1 Geographic Distribution2Loan Growth $1,521 $1,569 $1,688 $1,710 $1,765 $2,007 $2,076 $2,409 $2,570 $2,852 $1,026 $1,086 $1,020 $1,041 $1,017$4,849 $5,025 $5,437 $5,676 $6,001 2Q22 3Q22 4Q22 1Q23 2Q23 1-4 Family Multifamily CRE C&D Other ($ millions) Grew net loans by 5.8% from the prior quarter ended September 30, 2022 The weighted average loan-to-value ratio1 for our real estate secured loans was 62% 1 For the quarter ended December 31, 2022. 2 As of December 31, 2022 Source: S&P Global Market Intelligence & Company Filings QTD Yield on Loans 3.97% 28.7% 0.8% 47.5% 16.9% 3.1% 3.0% 1-4 Family Home Equity Multifamily CRE Construction Consumer Commercial 1010 New York (Ex. Brooklyn) 17.2% Brooklyn 18.3% New Jersey 55.0% Pennsylvania 5.3% Other 4.2%

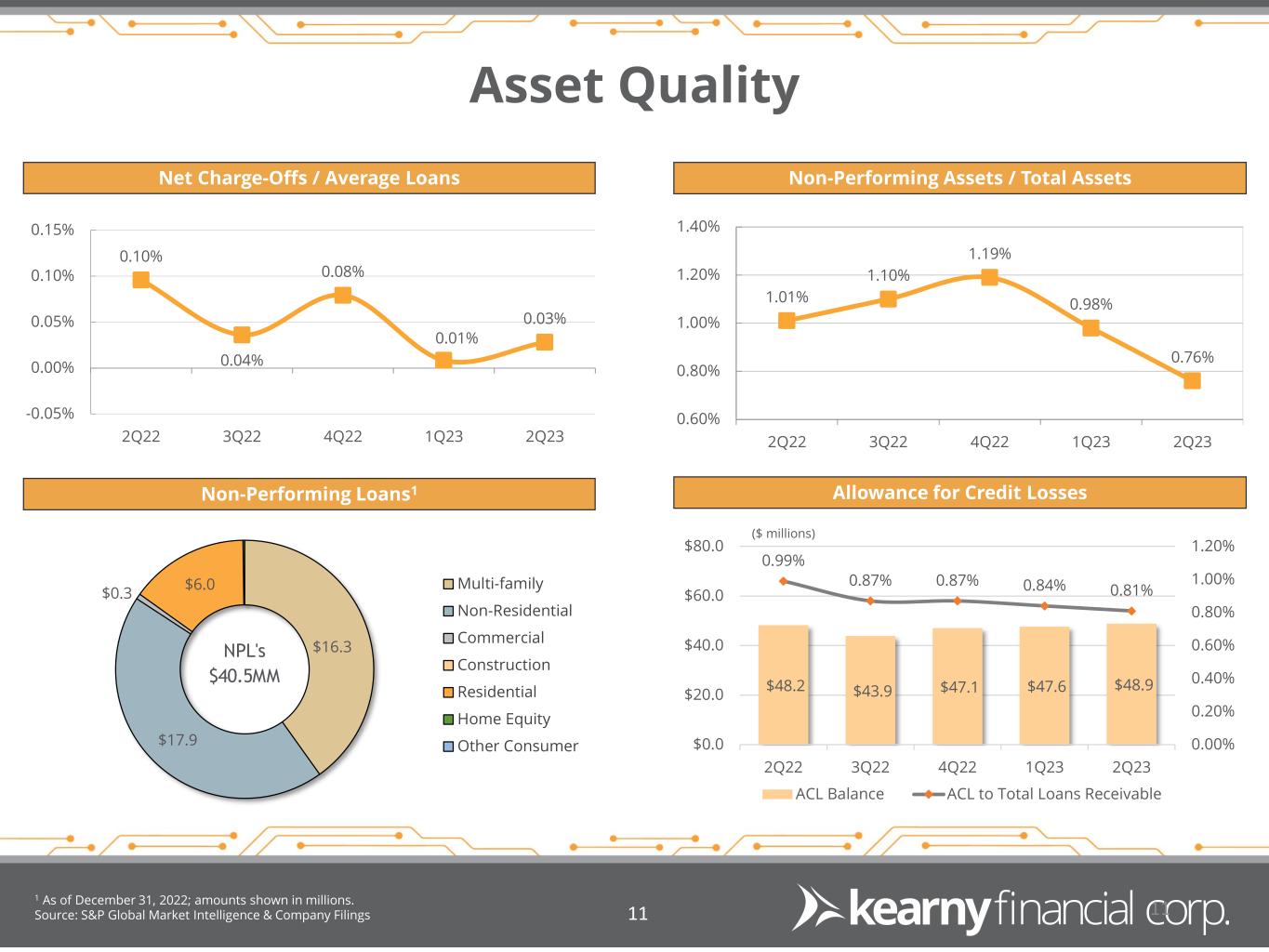

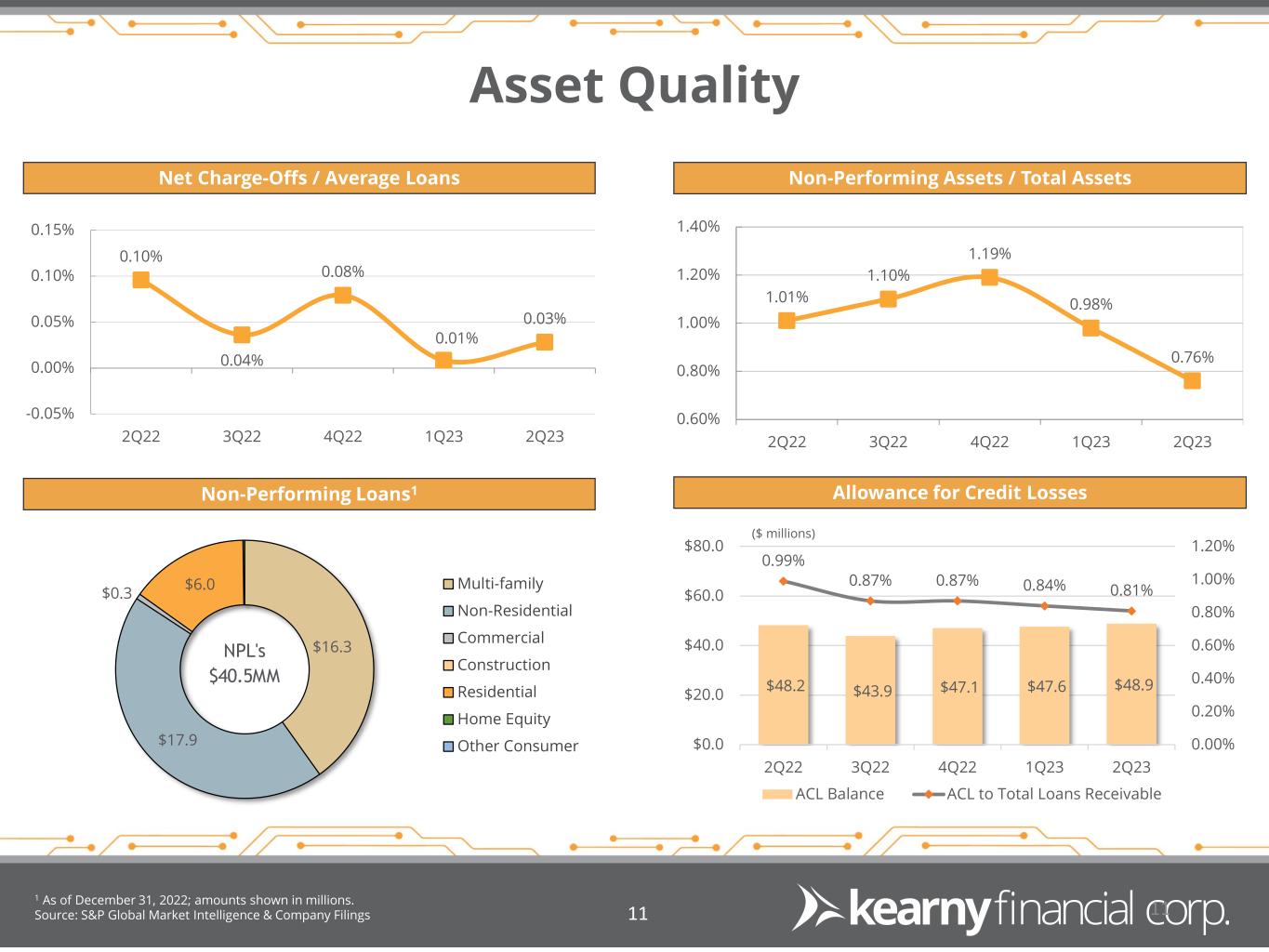

Asset Quality Net Charge-Offs / Average Loans Non-Performing Assets / Total Assets Non-Performing Loans1 Allowance for Credit Losses 1 As of December 31, 2022; amounts shown in millions. Source: S&P Global Market Intelligence & Company Filings 1.01% 1.10% 1.19% 0.98% 0.76% 0.60% 0.80% 1.00% 1.20% 1.40% 2Q22 3Q22 4Q22 1Q23 2Q23 $48.2 $43.9 $47.1 $47.6 $48.9 0.99% 0.87% 0.87% 0.84% 0.81% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% $0.0 $20.0 $40.0 $60.0 $80.0 2Q22 3Q22 4Q22 1Q23 2Q23 ACL Balance ACL to Total Loans Receivable ($ millions) 1111 NPL's $40.5MM $16.3 $17.9 $0.3 $6.0 Multi-family Non-Residential Commercial Construction Residential Home Equity Other Consumer 0.10% 0.04% 0.08% 0.01% 0.03% -0.05% 0.00% 0.05% 0.10% 0.15% 2Q22 3Q22 4Q22 1Q23 2Q23

M&A History and Strategy Experienced and disciplined acquirer and integrator Opportunistic acquisition strategy with an emphasis on: Low premium deals Similar or complementary business models Expansion in existing or contiguous markets Cultural compatibility Focus on limiting tangible book value dilution and earn-back periods while generating strong EPS accretion and operating leverage 1212

Select Technology Partners 1313