OCTOBER 24, 2024 I N V E S T O R P R E S E N T A T I O N F I R S T Q U A R T E R F I S C A L 2 0 2 5 Exhibit 99.1

Forward Looking Statements & Financial Measures 2 This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, and subsequent filings with the Securities and Exchange Commission, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: • the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, • the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, • the impact of changes in laws, regulations and government policies regarding financial institutions (including laws concerning taxation, banking, securities and insurance), • changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, • technological changes, • competition among financial services providers, and • the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exhaustive. Readers should not place any undue reliance on any forward looking statements, which speak only as of the date made. The Company does not undertake any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation.

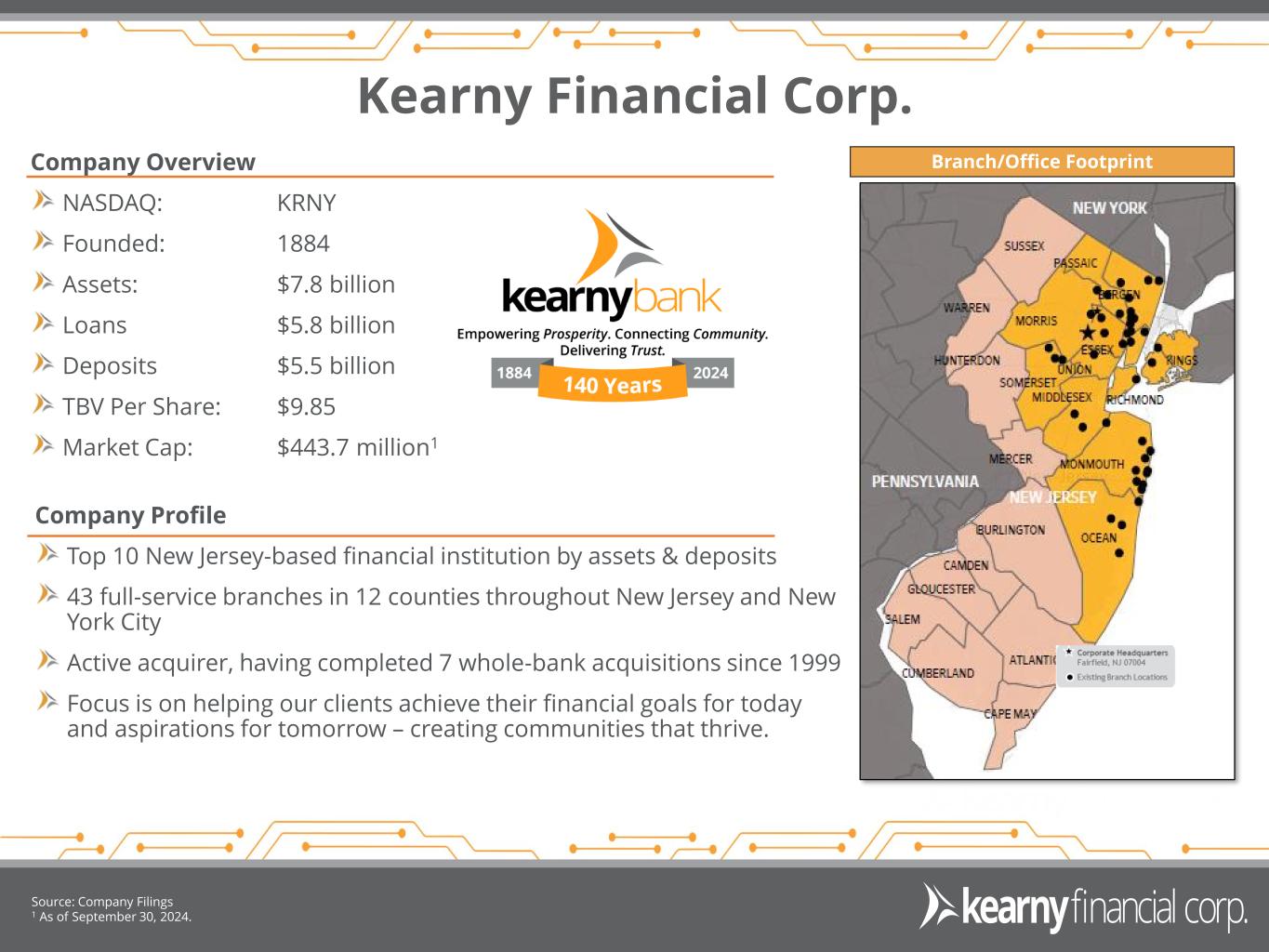

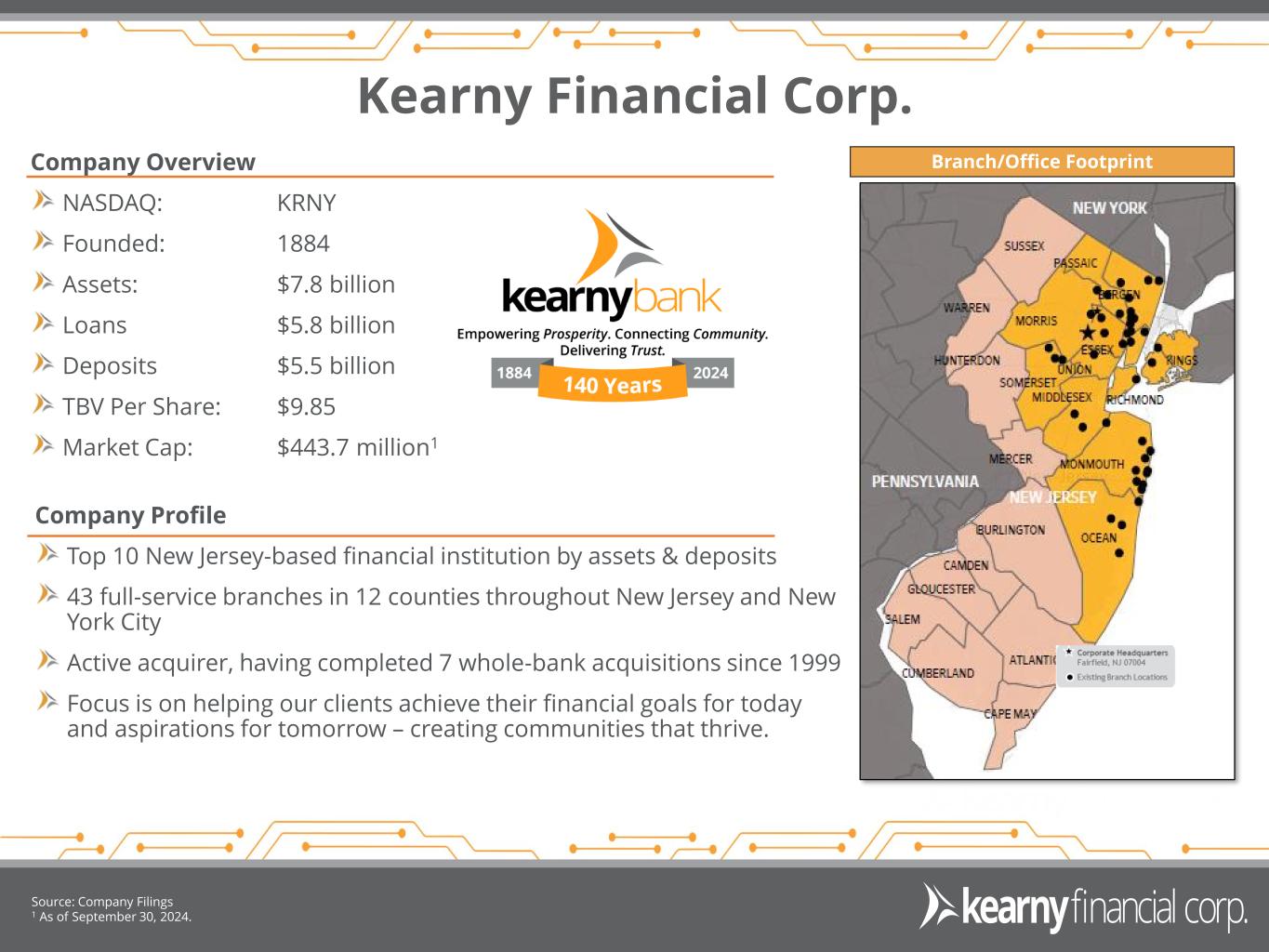

Kearny Financial Corp. Company Overview NASDAQ: KRNY Founded: 1884 Assets: $7.8 billion Loans $5.8 billion Deposits $5.5 billion TBV Per Share: $9.85 Market Cap: $443.7 million1 1 As of June 30, 2024 2 As of June 30, 2024 Source: S&P Global Market Intelligence & Company Filings 3 Branch/Office Footprint Company Profile Top 10 New Jersey-based financial institution by assets & deposits 43 full-service branches in 12 counties throughout New Jersey and New York City Active acquirer, having completed 7 whole-bank acquisitions since 1999 Focus is on helping our clients achieve their financial goals for today and aspirations for tomorrow – creating communities that thrive. Source: Company Filings 1 As of September 30, 2024.

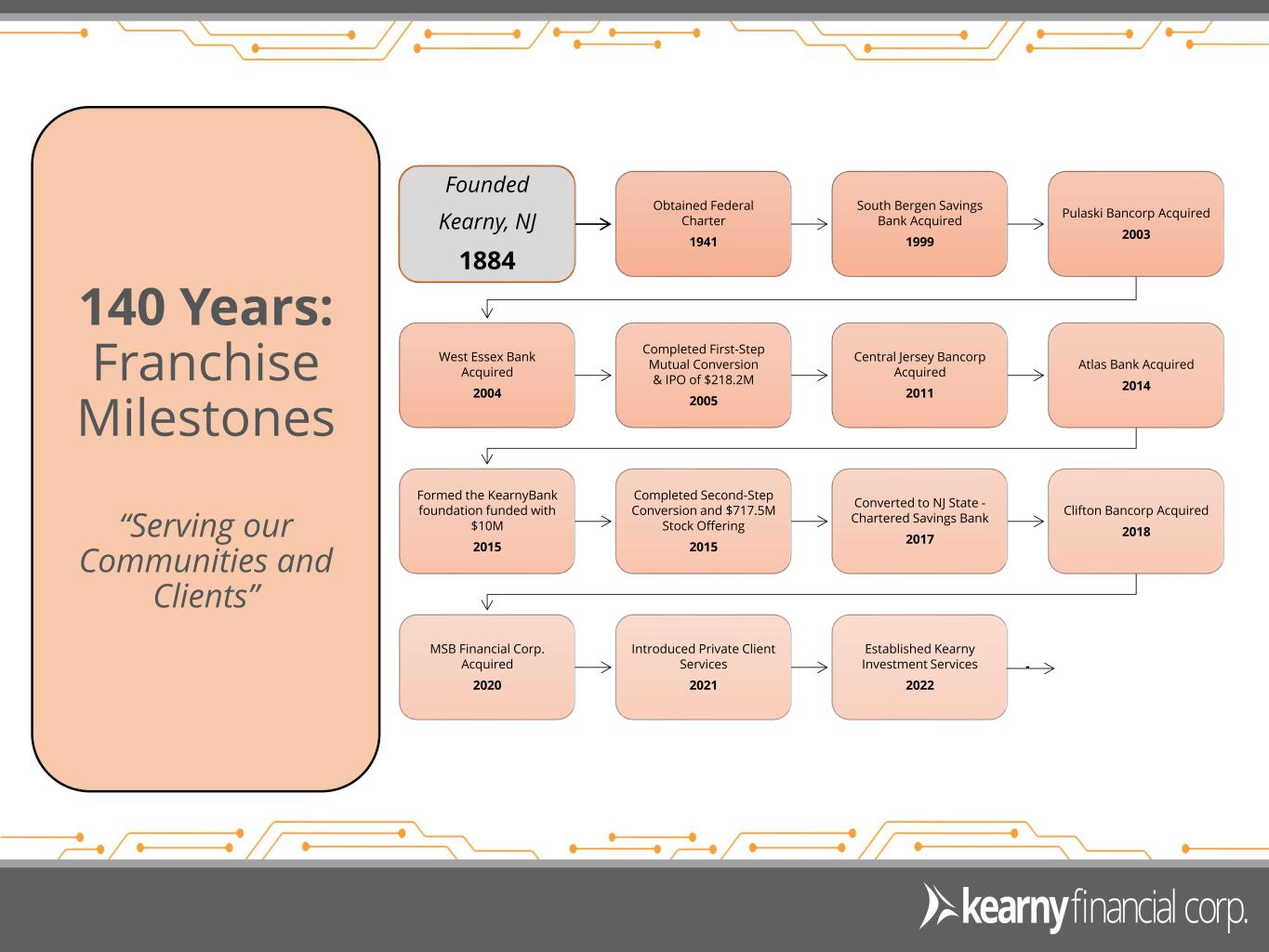

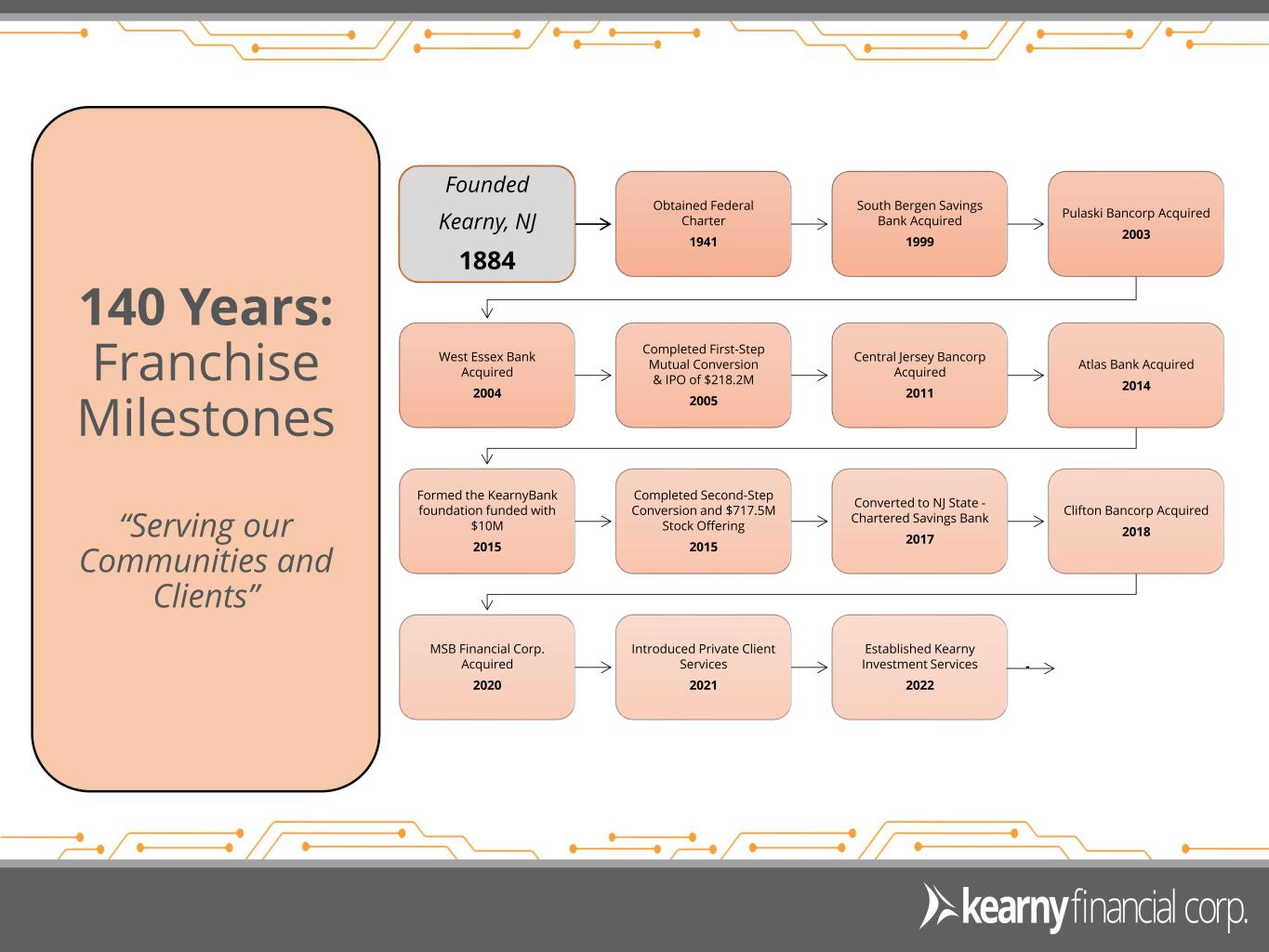

4 Founded Kearny, NJ 1884 Obtained Federal Charter 1941 South Bergen Savings Bank Acquired 1999 Pulaski Bancorp Acquired 2003 West Essex Bank Acquired 2004 Completed First-Step Mutual Conversion & IPO of $218.2M 2005 Central Jersey Bancorp Acquired 2011 Atlas Bank Acquired 2014 Formed the KearnyBank foundation funded with $10M 2015 Completed Second-Step Conversion and $717.5M Stock Offering 2015 Converted to NJ State - Chartered Savings Bank 2017 Clifton Bancorp Acquired 2018 MSB Financial Corp. Acquired 2020 Introduced Private Client Services 2021 Established Kearny Investment Services 2022 140 Years: Franchise Milestones “Serving our Communities and Clients”

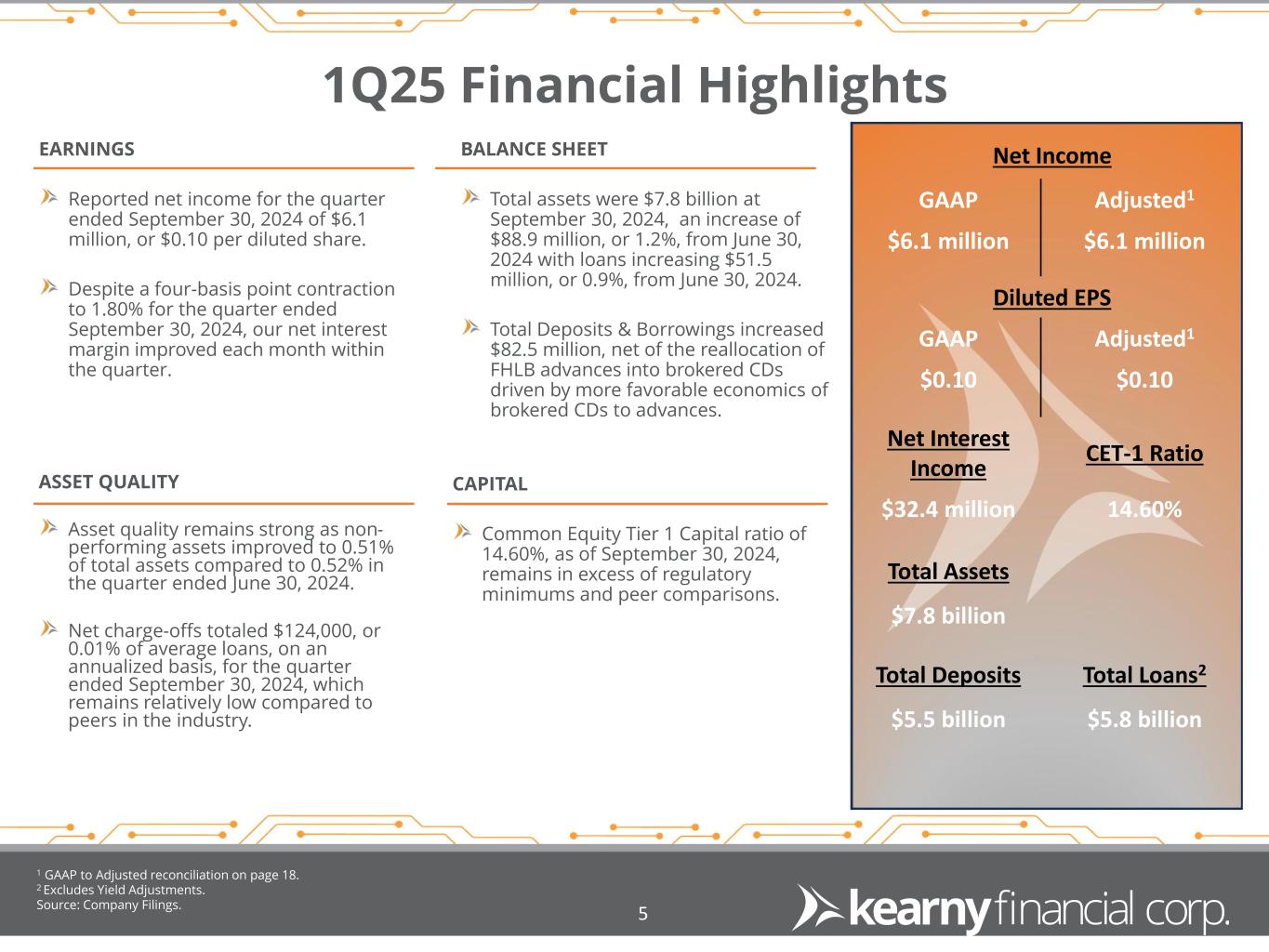

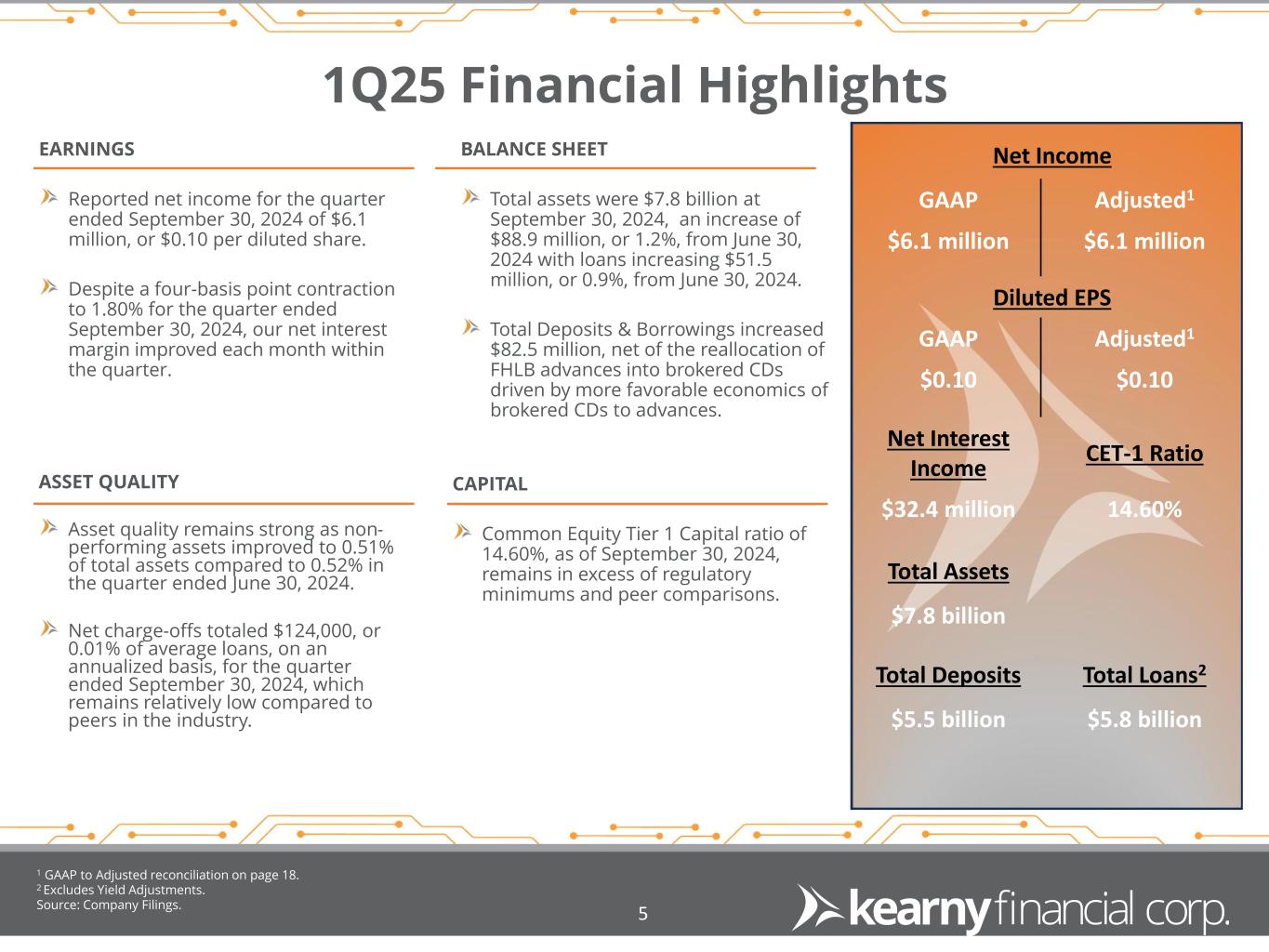

1Q25 Financial Highlights 1 GAAP to Adjusted reconciliation on page 18. 2 Excludes Yield Adjustments. Source: Company Filings. 5 Net Income GAAP Adjusted1 $6.1 million $6.1 million Diluted EPS GAAP Adjusted1 $0.10 $0.10 Net Interest Income CET-1 Ratio $32.4 million 14.60% Total Assets $7.8 billion Total Deposits Total Loans2 $5.5 billion $5.8 billion ASSET QUALITY Asset quality remains strong as non- performing assets improved to 0.51% of total assets compared to 0.52% in the quarter ended June 30, 2024. Net charge-offs totaled $124,000, or 0.01% of average loans, on an annualized basis, for the quarter ended September 30, 2024, which remains relatively low compared to peers in the industry. EARNINGS Reported net income for the quarter ended September 30, 2024 of $6.1 million, or $0.10 per diluted share. Despite a four-basis point contraction to 1.80% for the quarter ended September 30, 2024, our net interest margin improved each month within the quarter. BALANCE SHEET Total assets were $7.8 billion at September 30, 2024, an increase of $88.9 million, or 1.2%, from June 30, 2024 with loans increasing $51.5 million, or 0.9%, from June 30, 2024. Total Deposits & Borrowings increased $82.5 million, net of the reallocation of FHLB advances into brokered CDs driven by more favorable economics of brokered CDs to advances. CAPITAL Common Equity Tier 1 Capital ratio of 14.60%, as of September 30, 2024, remains in excess of regulatory minimums and peer comparisons.

Capital Strength Equity Capitalization Level 1 Kearny Financial Corp. (NASDAQ: KRNY) Regulatory Capital Ratios as of September 30, 2024 are preliminary. 2 Equity to Asset ratio, for September 30, 2024 going forward, was impacted by previously disclosed goodwill impairment. Source: Company Filings. 6 Regulatory Capital Ratios1,2 8.20% 8.26% 8.34% 8.43% 8.31% 10.65% 10.74% 10.83% 9.81% 9.67% 1Q24 2Q24 3Q24 4Q24 1Q25 Tangible Common Equity / Tangible Assets Equity / Assets 2 9.14% 14.60% 14.60% 15.46% 5.00% 6.50% 8.00% 10.00% Tier 1 Leverage Common Equity Tier 1 Tier 1 Risk-Based Capital Total Risk-Based Capital KRNY Well Capitalized Regulatory Minimum

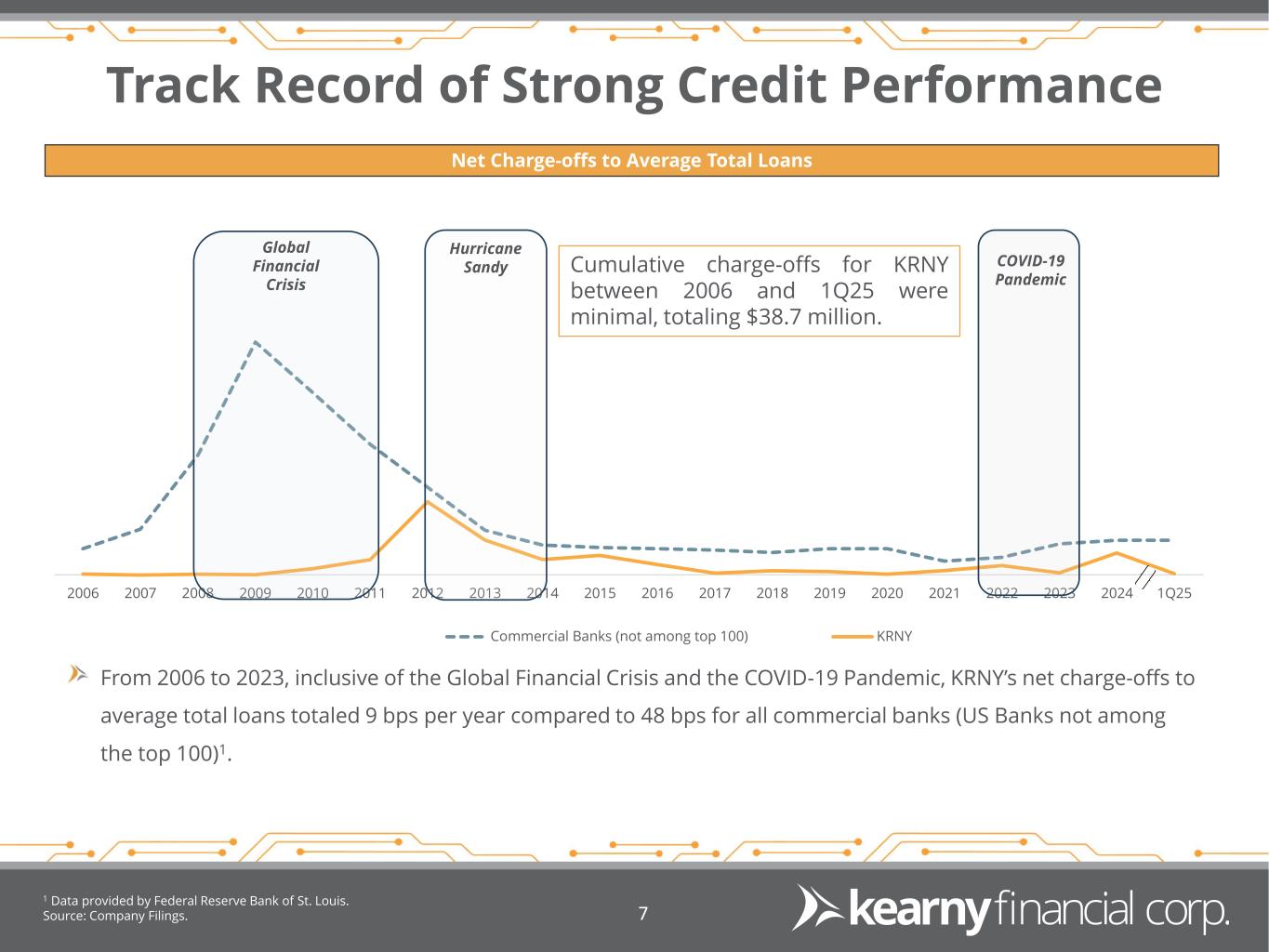

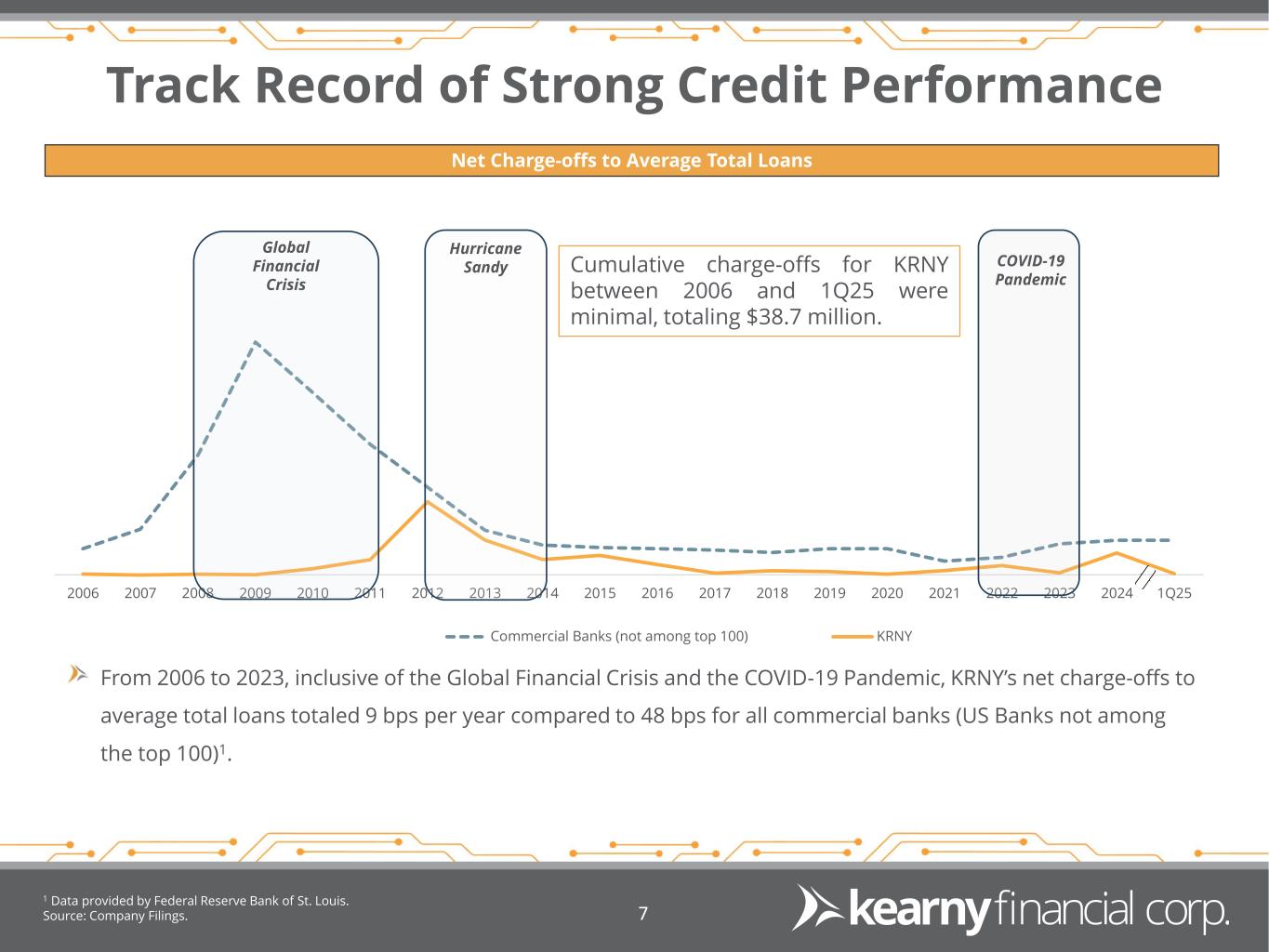

Track Record of Strong Credit Performance 1 Data provided by Federal Reserve Bank of St. Louis. Source: Company Filings. 7 From 2006 to 2023, inclusive of the Global Financial Crisis and the COVID-19 Pandemic, KRNY’s net charge-offs to average total loans totaled 9 bps per year compared to 48 bps for all commercial banks (US Banks not among the top 100)1. Net Charge-offs to Average Total Loans 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 Commercial Banks (not among top 100) KRNY Global Financial Crisis Hurricane Sandy COVID-19 Pandemic Cumulative charge-offs for KRNY between 2006 and 1Q25 were minimal, totaling $38.7 million.

Diversified Loan Portfolio Loan Composition1 Geographic Distribution1 Loan Trend 1 As of September 30, 2024. Source: S&P Global Market Intelligence & Company Filings. 8 ($ millions) $1,689 $1,746 $1,742 $1,756 $1,768 $2,699 $2,651 $2,645 $2,646 $2,646 $947 $947 $966 $948 $951 $5,760 $5,757 $5,775 $5,749 $5,786 1Q24 2Q24 3Q24 4Q24 1Q25 1-4 Family Home Equity Multi-family CRE Construction C&I New York 33.5% New Jersey 55.7% Pennsylvania 5.9% Other 4.9% 1-4 Family 30.6% Home Equity 0.8% Multi-family 45.7% CRE 16.4% Construction 3.9% C&I 2.5% QTD Yield on Loans 4.61% LTV 60.9%

Multifamily Loan Portfolio Multifamily Loan Portfolio Composition1 New York City (“NYC”) Multifamily1 Source: Company Filings 1 As of September 30, 2024. 9 Outstanding asset quality over multiple credit cycles Less than half of our Multifamily portfolio is collateralized by properties in NYC Only 5.5% of our Multifamily portfolio is collateralized by majority or fully rent-regulated NYC properties There is a minimal amount of maturing or repricing NYC Multifamily loans in calendar 2024 and 2025 66.4% of the Company’s NYC Multifamily portfolio is located in Brooklyn, NY NYC Multifamily Loan Portfolio Loan Value % Brooklyn $816 66.4% Queens 155 12.6% Manhattan 140 11.4% Bronx 117 9.5% Total NYC MF Loan Portfolio $1,229 100.0% Observations Majority NYC Free Market 40.9% Outside NYC 53.6% Fully NYC Rent Regulated 2.2% Majority NYC Rent Regulated 3.3%Total MF $2.6B NYC Multifamily Portfolio: $1.2 billion Average Loan Balance: $3.48 million Weighted Average LTV: 62.1% Nonperforming Loans / Total MF Loans: 0.83% Oct to Dec 2024 Maturity & Repricing: $25.8 million Calendar Year 2025 Maturity & Repricing: $115.3 million

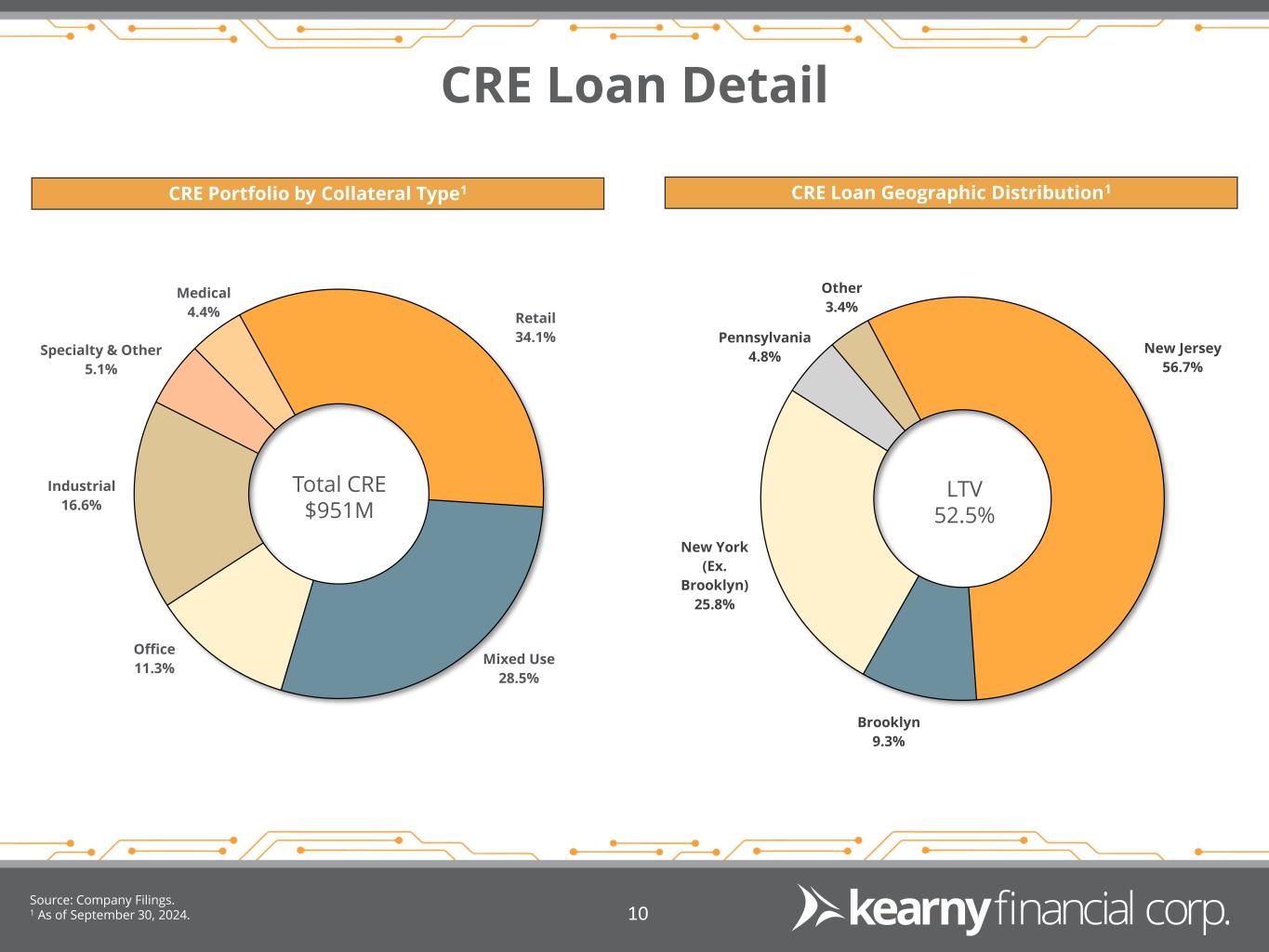

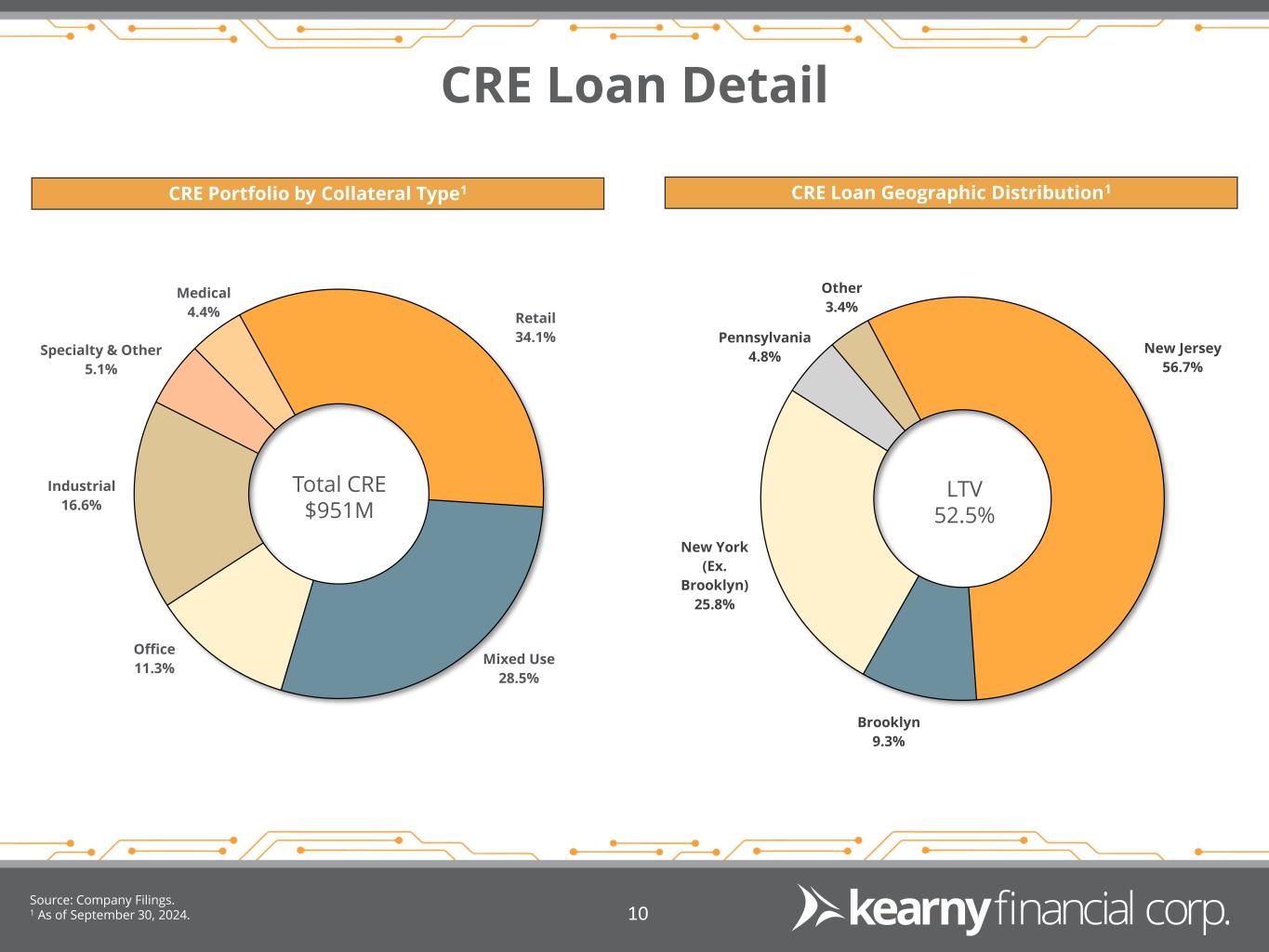

CRE Loan Detail Source: Company Filings. 1 As of September 30, 2024. 10 CRE Portfolio by Collateral Type1 CRE Loan Geographic Distribution1 Retail 34.1% Mixed Use 28.5% Office 11.3% Industrial 16.6% Specialty & Other 5.1% Medical 4.4% New Jersey 56.7% Brooklyn 9.3% New York (Ex. Brooklyn) 25.8% Pennsylvania 4.8% Other 3.4% Total CRE $951M LTV 52.5%

Office Portfolio 1 As of September 30, 2024. Source: Company Filings. 11 Office Portfolio by Contractual Maturity1 Office Portfolio Profile 11.3% of total CRE portfolio or $107 million Average loan size of $1.6 million ($ millions) Office Loan Geographic Distribution1 $0 $3 $9 $35 $18 $9 $31 $0 $10 $20 $30 $40 2024 2025 2026 2027 2028 2029 2030+ Manhattan 21.7% New York (Excl. Manhattan) 6.1% New Jersey 69.4% Other 2.9% LTV 47.9% DSCR 1.9x Total Office $107M

Asset Quality Metrics Non-Performing Assets / Total Assets Non-Performing Loans1 Allowance for Credit Losses 1 As of September 30, 2024; amounts shown in millions. Source: S&P Global Market Intelligence & Company Filings. 12 Net Charge-Offs / Average Loans $ in millions 0.64% 0.63% 0.50% 0.52% 0.51% 0.45% 0.55% 0.65% 0.75% 1Q24 2Q24 3Q24 4Q24 1Q25 Multi-family $22.0 CRE $9.2 C&I $0.6 1-4 Family $8.1 0.15% 0.29% 0.02% 0.25% 0.01% 0.00% 0.10% 0.20% 0.30% 0.40% 1Q24 2Q24 3Q24 4Q24 1Q25 Increase driven by a single commercial real estate relationship Increase driven by a single C&I relationship $45.0 $44.7 $44.7 $44.1 $44.2 $1.9 $0.2 $0.2 $0.9 $0.8 0.81% 0.78% 0.78% 0.78% 0.78% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 1Q24 2Q24 3Q24 4Q24 1Q25 ACL Balance - Collectively Evaluated ACL Balance - Individually Analyzed ACL to Total Loans Receivable NPL’s $39.9M

Granular Deposit Franchise 1 As of September 30, 2024. 2 Excludes wholesale and state & local government deposits. Source: S&P Global Market Intelligence & Company Filings. 13 Deposit Trend Non-Maturity Deposit Mix1 ($ millions) $1,300 $1,284 $1,235 $1,199 $1,216 $612 $458 $408 $408 $733 $689 $646 $630 $643 $682 $2,237 $2,347 $2,350 $2,309 $2,248 $595 $584 $586 $598 $592 $5,434 $5,320 $5,209 $5,158 $5,471 1Q24 2Q24 3Q24 4Q24 1Q25 Retail CDs Wholesale CDs Savings Interest Bearing DDA Non-interest Bearing DDA Consumer 64.2% Commercial 22.0% Government 13.8% 22.2% 13.4% 12.5% 41.1% 10.8% Deposit Composition Product # of Accounts Balance ($ millions) Average Balance per Account Checking 52,843 $ 2,361 $ 44,684 Savings 30,590 $ 674 22,018 CDs 24,707 $ 1,212 49,079 Total Retail Deposits 108,140 $ 4,247 $ 39,276 Deposit Segmentation1,2

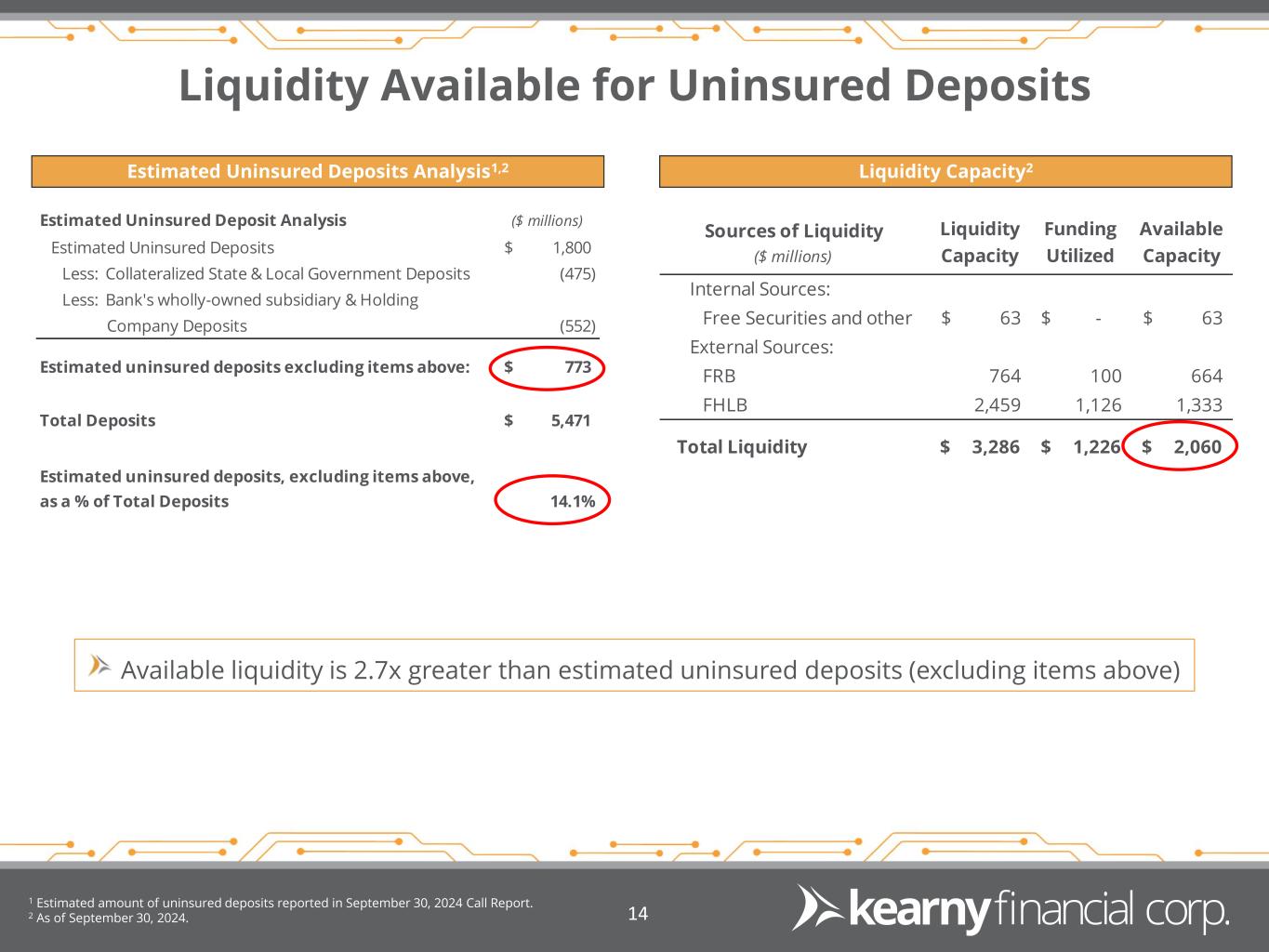

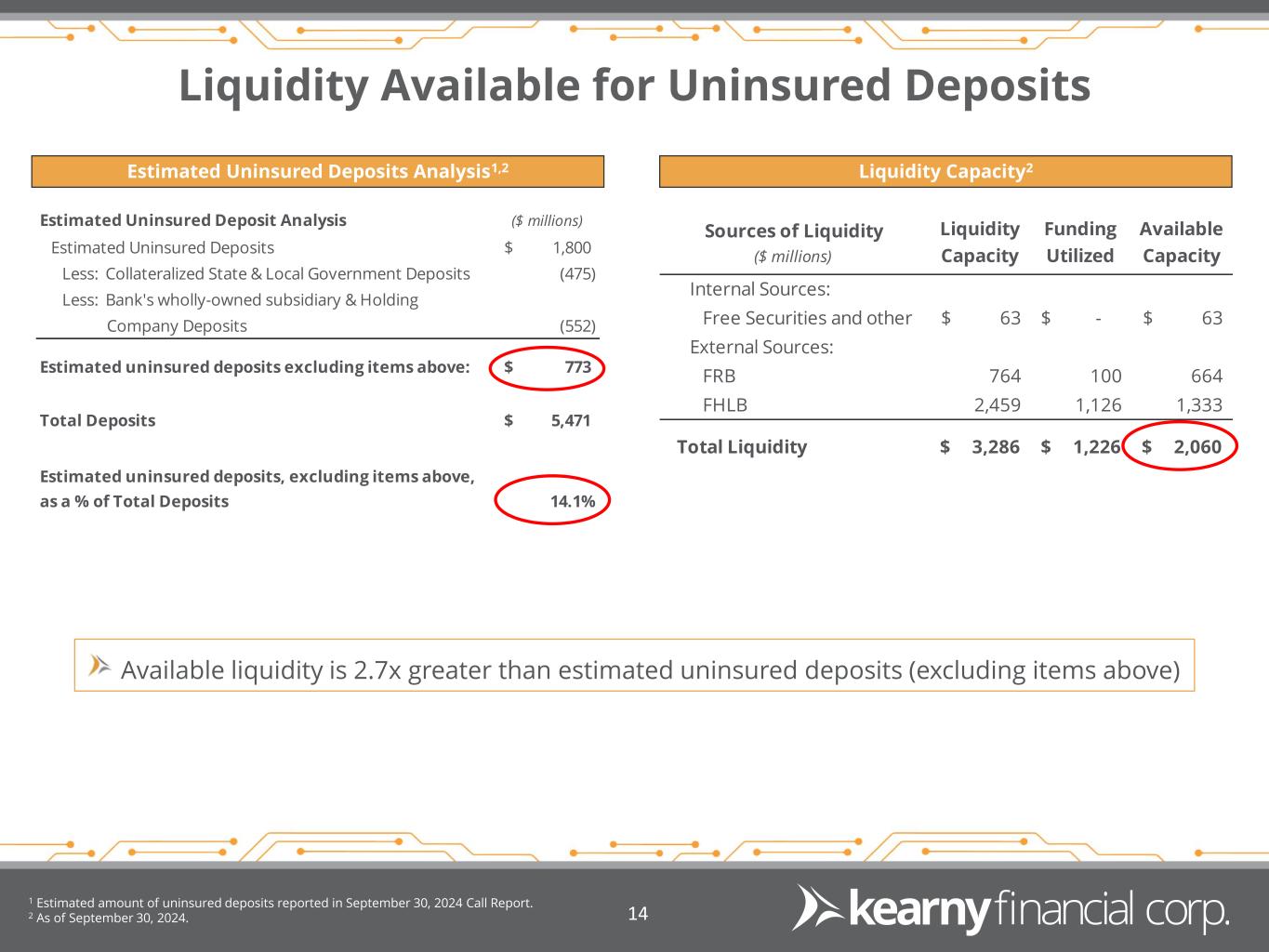

Liquidity Available for Uninsured Deposits Estimated Uninsured Deposits Analysis1,2 1 Estimated amount of uninsured deposits reported in September 30, 2024 Call Report. 2 As of September 30, 2024. 14 Available liquidity is 2.7x greater than estimated uninsured deposits (excluding items above) Liquidity Capacity2 1 Estimated Uninsured Deposit Analysis ($ millions) Estimated Uninsured Deposits 1,800$ Less: Collateralized State & Local Government Deposits (475) Less: Bank's wholly-owned subsidiary & Holding Company Deposits (552) Estimated uninsured deposits excluding items above: 773$ Total Deposits 5,471$ Estimated uninsured deposits, excluding items above, as a % of Total Deposits 14.1% Sources of Liquidity ($ millions) Liquidity Capacity Funding Utilized Available Capacity Internal Sources: Free Securities and other 63$ -$ 63$ External Sources: FRB 764 100 664 FHLB 2,459 1,126 1,333 Total Liquidity 3,286$ 1,226$ 2,060$

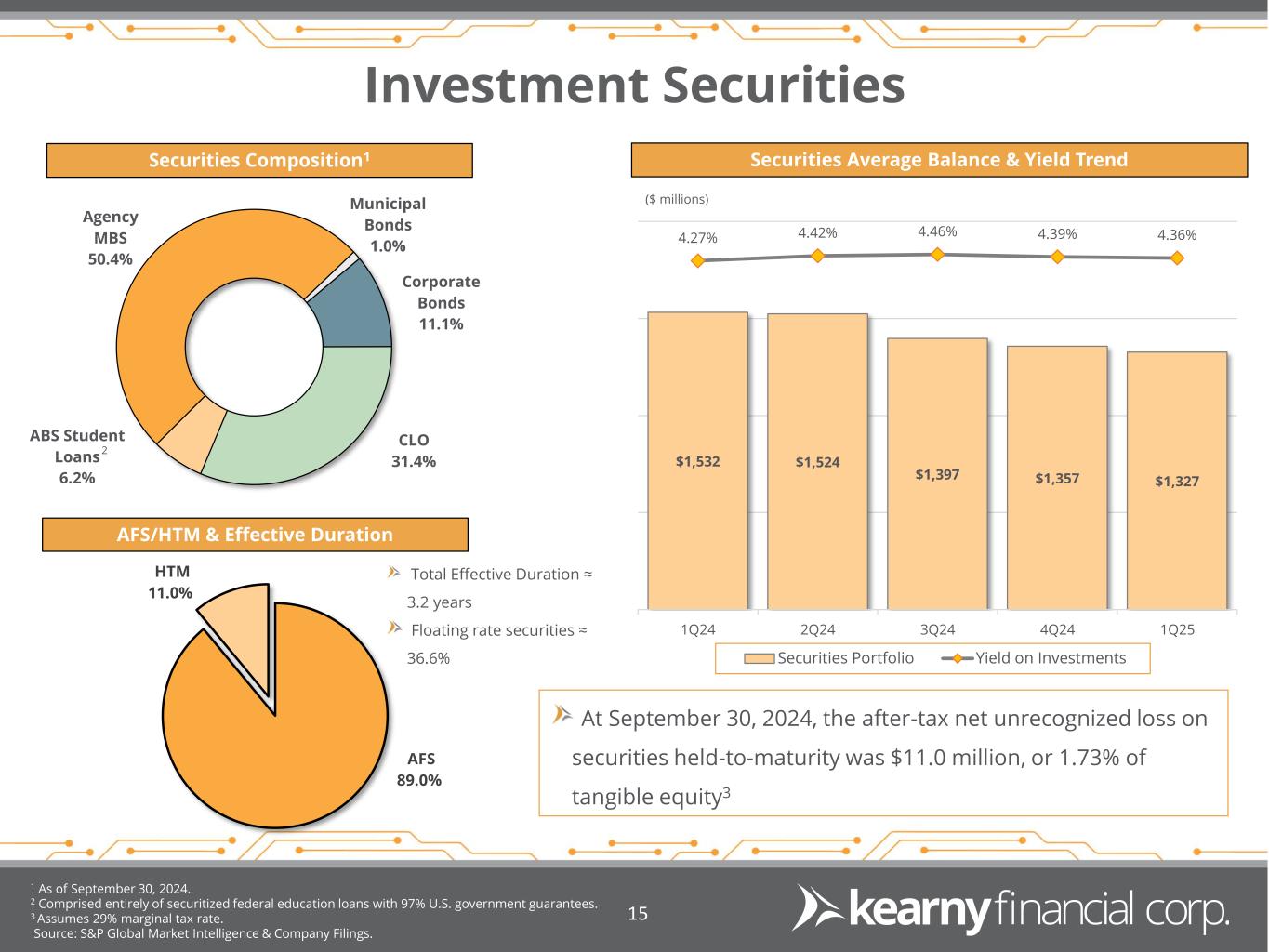

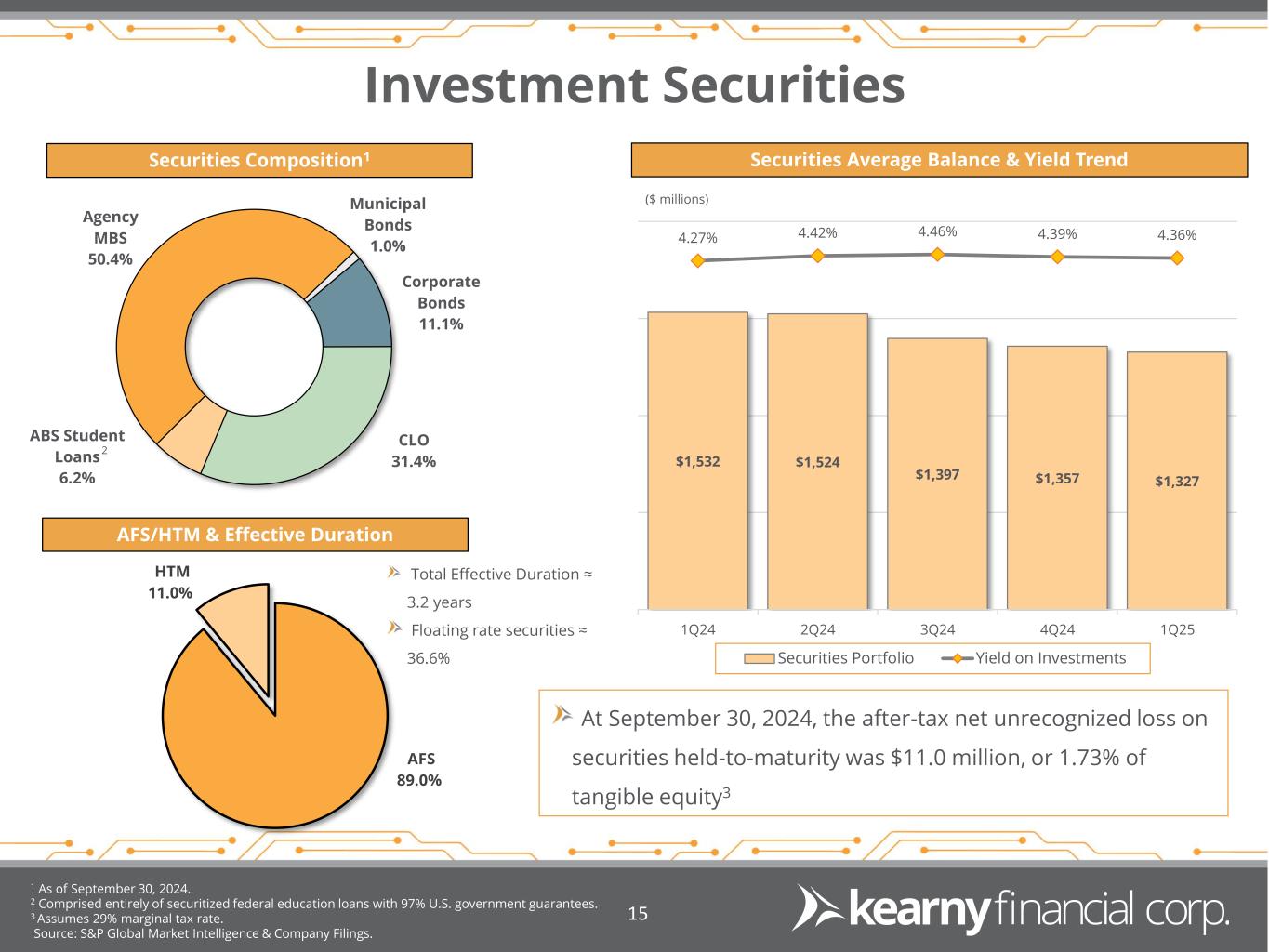

Investment Securities 1 As of September 30, 2024. 2 Comprised entirely of securitized federal education loans with 97% U.S. government guarantees. 3 Assumes 29% marginal tax rate. Source: S&P Global Market Intelligence & Company Filings. 15 Securities Composition1 Securities Average Balance & Yield Trend Total Effective Duration ≈ 3.2 years Floating rate securities ≈ 36.6% At September 30, 2024, the after-tax net unrecognized loss on securities held-to-maturity was $11.0 million, or 1.73% of tangible equity3 Corporate Bonds 11.1% CLO 31.4% ABS Student Loans 6.2% Agency MBS 50.4% Municipal Bonds 1.0% AFS 89.0% HTM 11.0% $1,532 $1,524 $1,397 $1,357 $1,327 4.27% 4.42% 4.46% 4.39% 4.36% 1Q24 2Q24 3Q24 4Q24 1Q25 Securities Portfolio Yield on Investments AFS/HTM & Effective Duration ($ millions) 2

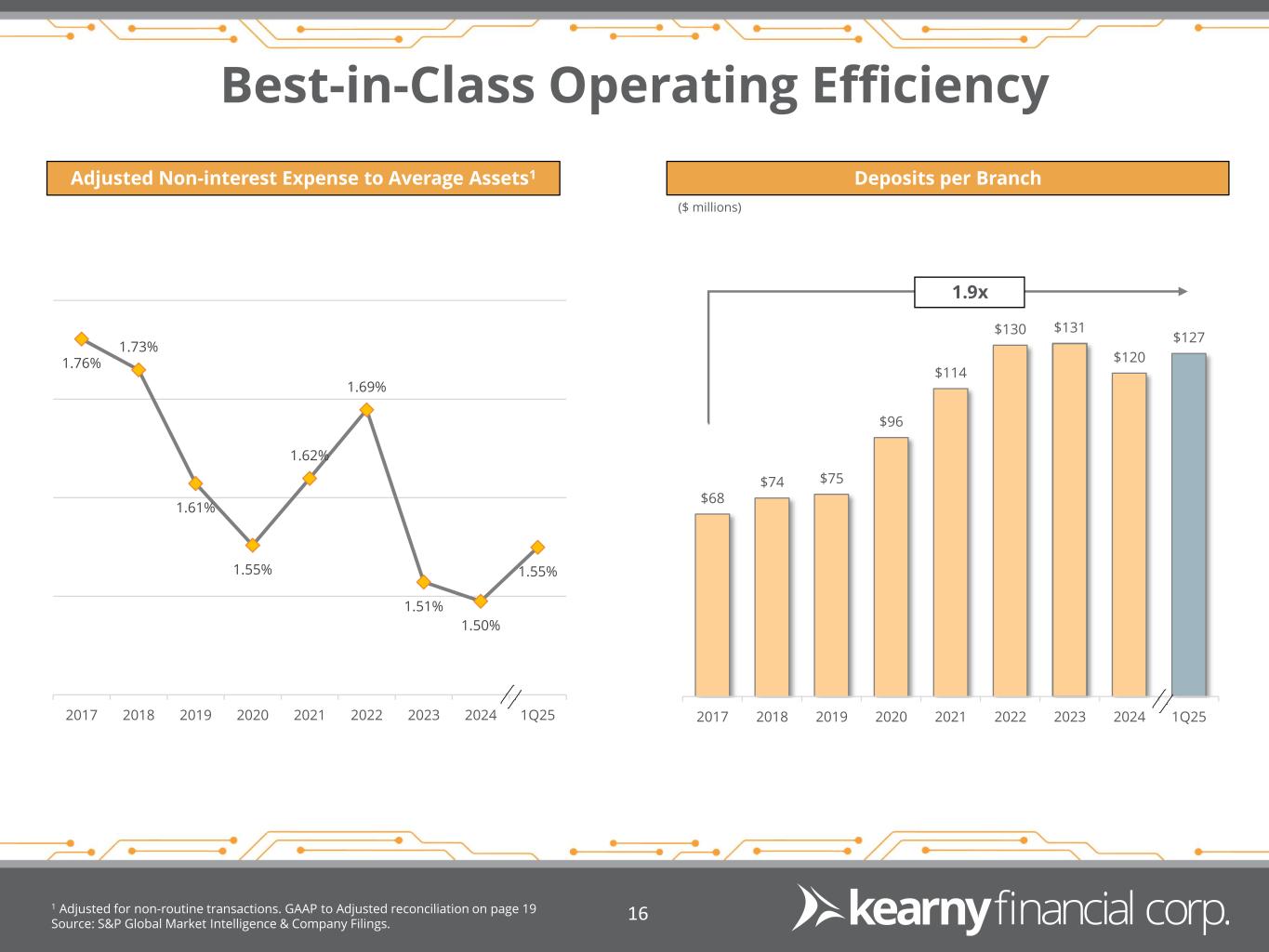

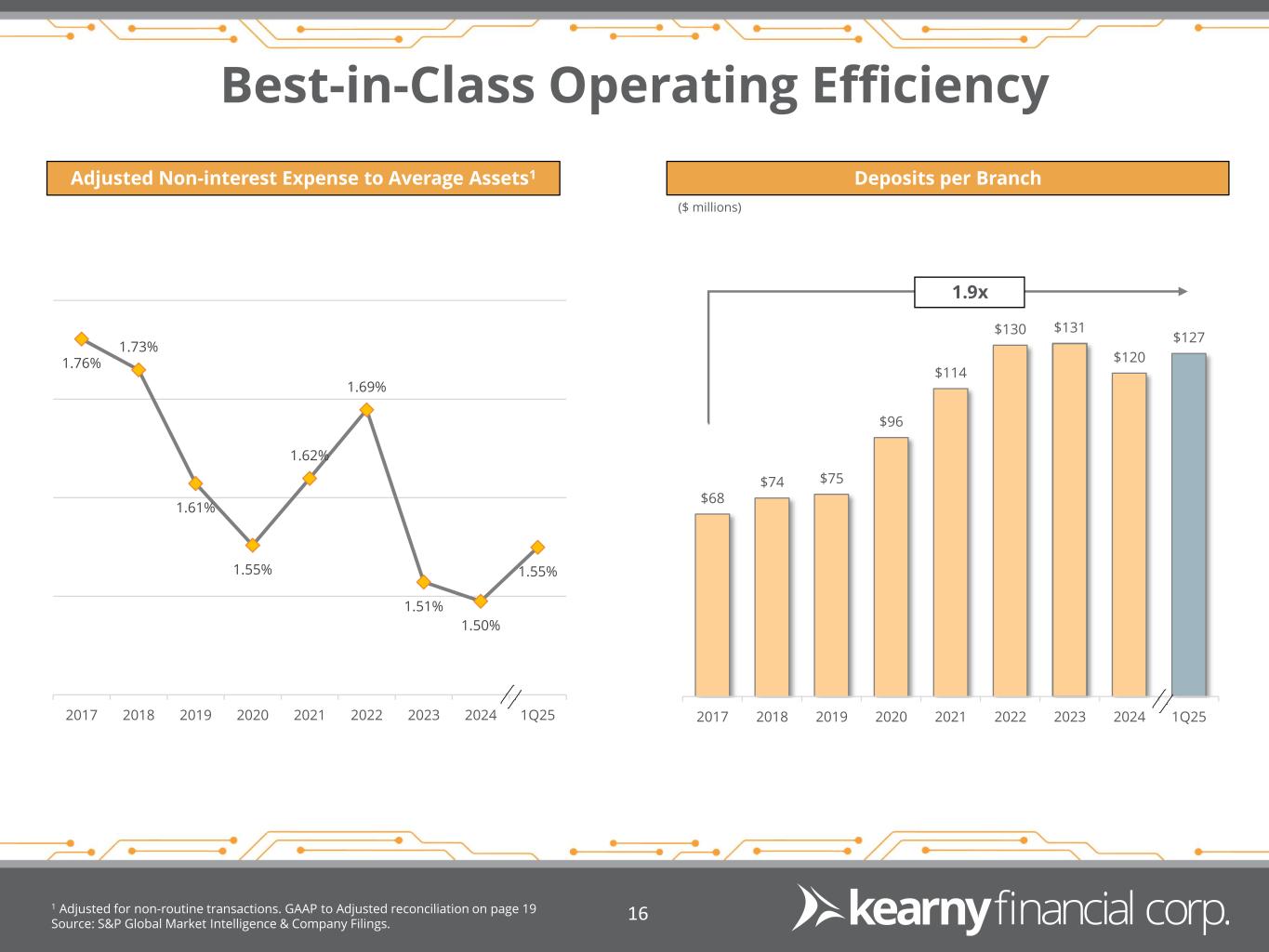

Best-in-Class Operating Efficiency 1 Adjusted for non-routine transactions. GAAP to Adjusted reconciliation on page 19 Source: S&P Global Market Intelligence & Company Filings. 16 Adjusted Non-interest Expense to Average Assets1 Deposits per Branch 1.76% 1.73% 1.61% 1.55% 1.62% 1.69% 1.51% 1.50% 1.55% 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 $68 $74 $75 $96 $114 $130 $131 $120 $127 1 21 41 61 81 101 121 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 1.9x ($ millions)

17 Conservative Underwriting Culture Comprehensive CRE / Multifamily Underwriting Highly disciplined LTV and DSCR standards Interest rates stressed a minimum of +300bps at origination DSCR based on in-place rents, not projections, with conservative allowances for vacancy NOI underwritten to include forecasted expense increases and full taxes (where a tax abatement exists) Approval Authority & Underwriting Consistency Lending authority aggregated by borrower/group of related borrowers Technology ensures consistent and efficient underwriting and risk rating process Multi-faceted Loan Review & Stress Testing Semi-annual third-party loan-level stress testing and annual capital-based stress testing Quarterly third-party portfolio loan review with 65% of total portfolio reviewed on an annual basis Annual internal loan reviews on all commercial loans with balances of $2.5 million or greater Proactive Workout Process Dedicated team of portfolio managers and loan workout specialists Weekly meetings comprised of loan officers, credit personnel and special assets group to pre-emptively address delinquencies or problem credits Philosophy of aggressively addressing impaired assets in a timely fashion Senior Credit Officer Approval Management Loan Committee Approval Board Loan Committee Approval

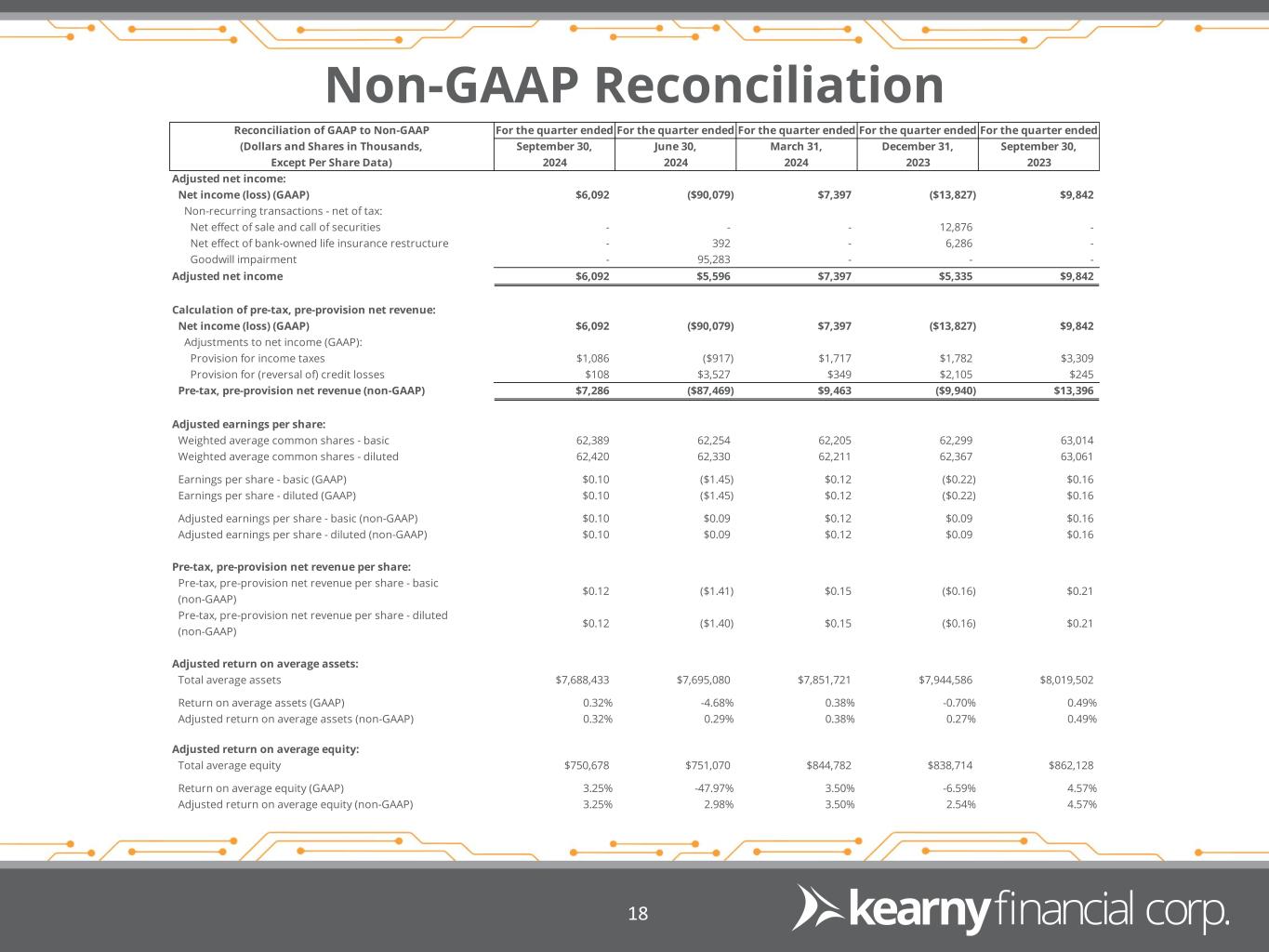

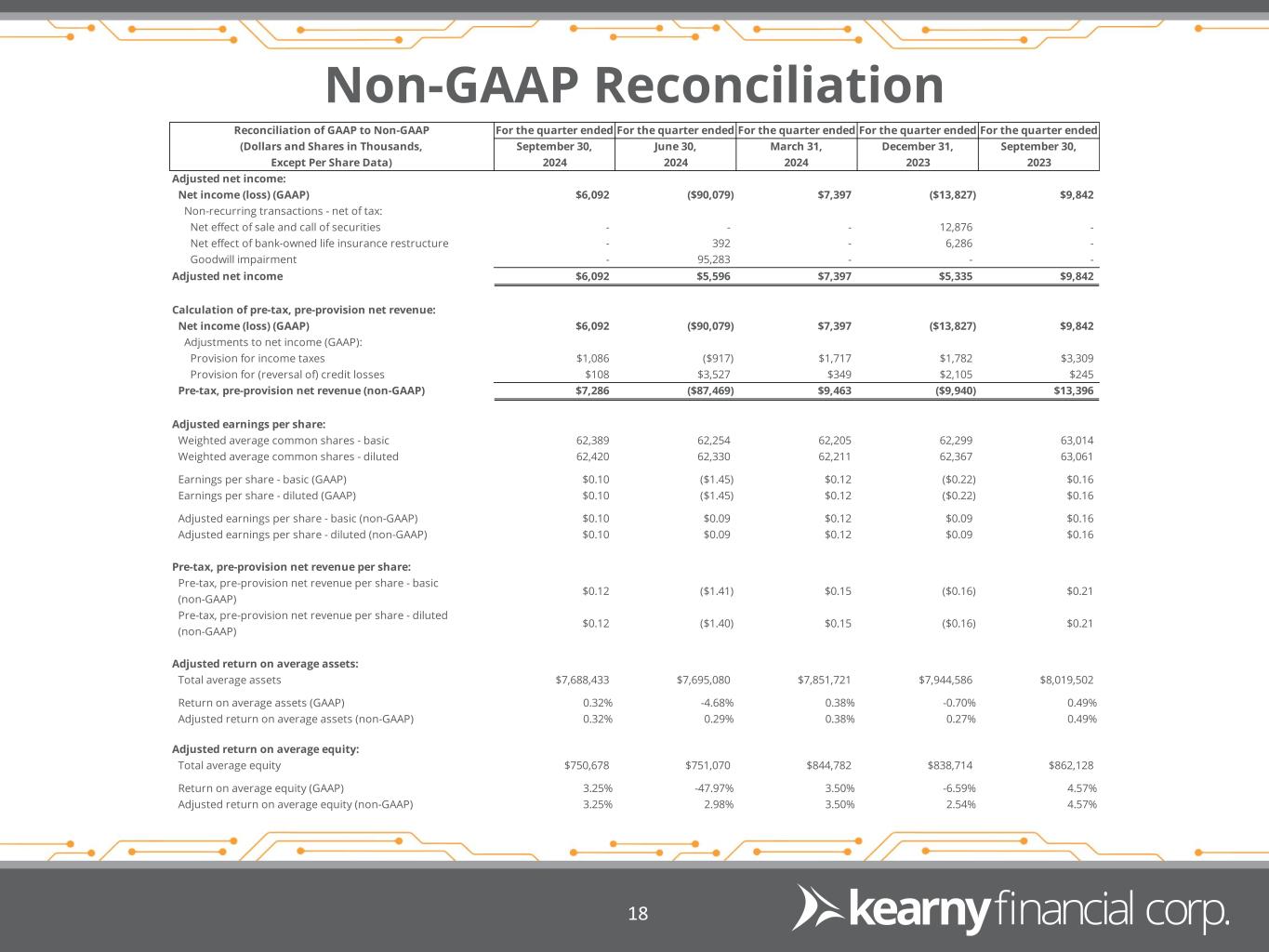

Non-GAAP Reconciliation 18 Reconciliation of GAAP to Non-GAAP For the quarter ended For the quarter ended For the quarter ended For the quarter ended For the quarter ended (Dollars and Shares in Thousands, Except Per Share Data) September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 Adjusted net income: Net income (loss) (GAAP) $6,092 ($90,079) $7,397 ($13,827) $9,842 Non-recurring transactions - net of tax: Net effect of sale and call of securities - - - 12,876 - Net effect of bank-owned life insurance restructure - 392 - 6,286 - Goodwill impairment - 95,283 - - - Adjusted net income $6,092 $5,596 $7,397 $5,335 $9,842 Calculation of pre-tax, pre-provision net revenue: Net income (loss) (GAAP) $6,092 ($90,079) $7,397 ($13,827) $9,842 Adjustments to net income (GAAP): Provision for income taxes $1,086 ($917) $1,717 $1,782 $3,309 Provision for (reversal of) credit losses $108 $3,527 $349 $2,105 $245 Pre-tax, pre-provision net revenue (non-GAAP) $7,286 ($87,469) $9,463 ($9,940) $13,396 Adjusted earnings per share: Weighted average common shares - basic 62,389 62,254 62,205 62,299 63,014 Weighted average common shares - diluted 62,420 62,330 62,211 62,367 63,061 Earnings per share - basic (GAAP) $0.10 ($1.45) $0.12 ($0.22) $0.16 Earnings per share - diluted (GAAP) $0.10 ($1.45) $0.12 ($0.22) $0.16 Adjusted earnings per share - basic (non-GAAP) $0.10 $0.09 $0.12 $0.09 $0.16 Adjusted earnings per share - diluted (non-GAAP) $0.10 $0.09 $0.12 $0.09 $0.16 Pre-tax, pre-provision net revenue per share: Pre-tax, pre-provision net revenue per share - basic (non-GAAP) $0.12 ($1.41) $0.15 ($0.16) $0.21 Pre-tax, pre-provision net revenue per share - diluted (non-GAAP) $0.12 ($1.40) $0.15 ($0.16) $0.21 Adjusted return on average assets: Total average assets $7,688,433 $7,695,080 $7,851,721 $7,944,586 $8,019,502 Return on average assets (GAAP) 0.32% -4.68% 0.38% -0.70% 0.49% Adjusted return on average assets (non-GAAP) 0.32% 0.29% 0.38% 0.27% 0.49% Adjusted return on average equity: Total average equity $750,678 $751,070 $844,782 $838,714 $862,128 Return on average equity (GAAP) 3.25% -47.97% 3.50% -6.59% 4.57% Adjusted return on average equity (non-GAAP) 3.25% 2.98% 3.50% 2.54% 4.57%