JANUARY 30, 2025 I N V E S T O R P R E S E N T A T I O N S E C O N D Q U A R T E R F I S C A L 2 0 2 5 Exhibit 99.2

Forward Looking Statements & Financial Measures 2 This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, and subsequent filings with the Securities and Exchange Commission, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: • the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, • the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, • the impact of changes in laws, regulations and government policies regarding financial institutions (including laws concerning taxation, banking, securities and insurance), • changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, • technological changes, • competition among financial services providers, and • the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exhaustive. Readers should not place any undue reliance on any forward looking statements, which speak only as of the date made. The Company does not undertake any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation.

Kearny Financial Corp. Company Overview NASDAQ: KRNY Founded: 1884 Assets: $7.7 billion Loans $5.8 billion Deposits $5.7 billion TBV Per Share: $9.75 Market Cap: $457.2 million1 1 As of June 30, 2024 2 As of June 30, 2024 Source: S&P Global Market Intelligence & Company Filings 3 Branch/Office Footprint Company Profile Top 10 New Jersey-based financial institution by assets & deposits 43 full-service branches in 12 counties throughout New Jersey and New York City Active acquirer, having completed 7 whole-bank acquisitions since 1999 Focus is on helping our clients achieve their financial goals for today and aspirations for tomorrow – creating communities that thrive Source: Company Filings 1 As of December 31, 2024. 3

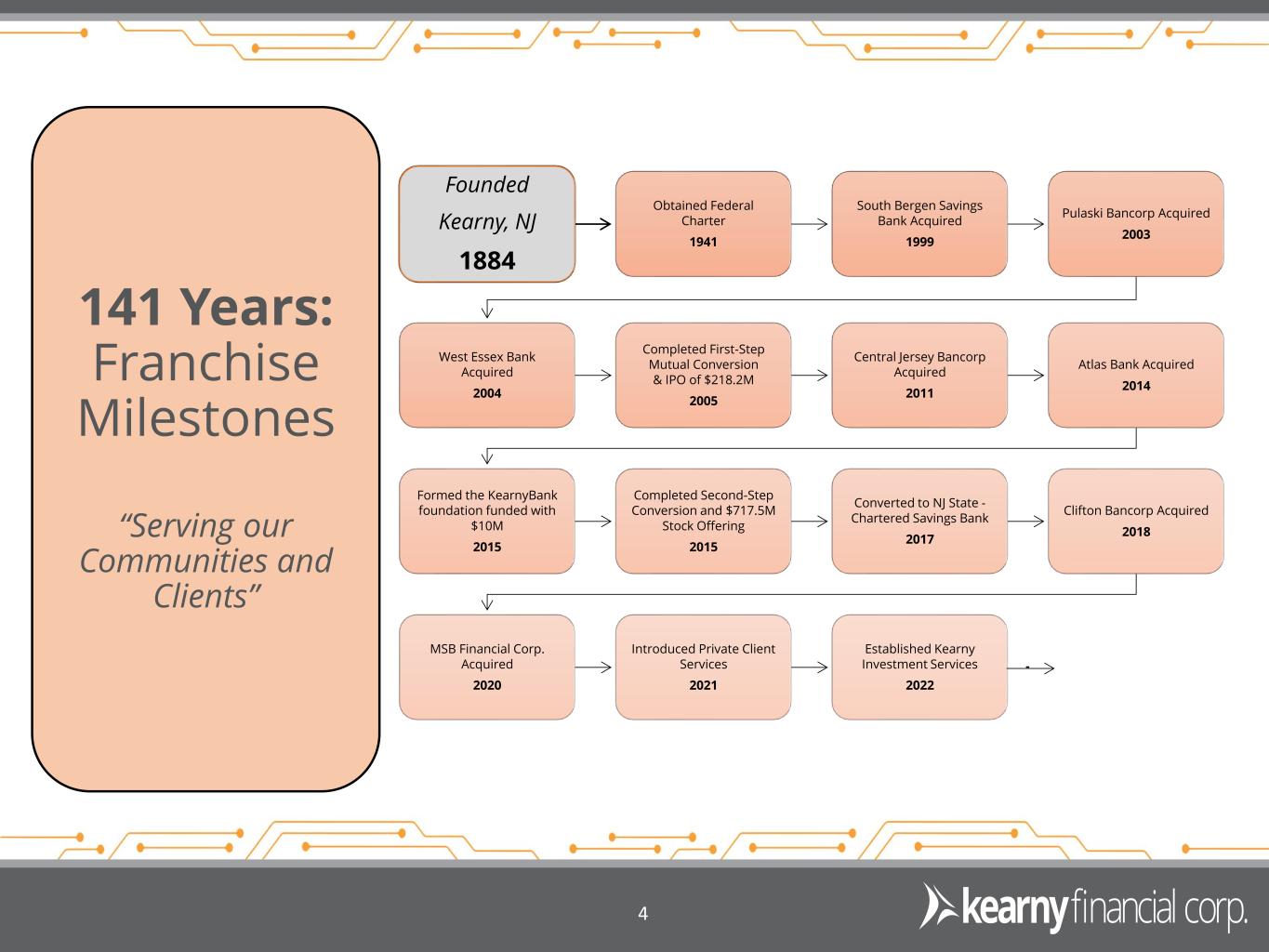

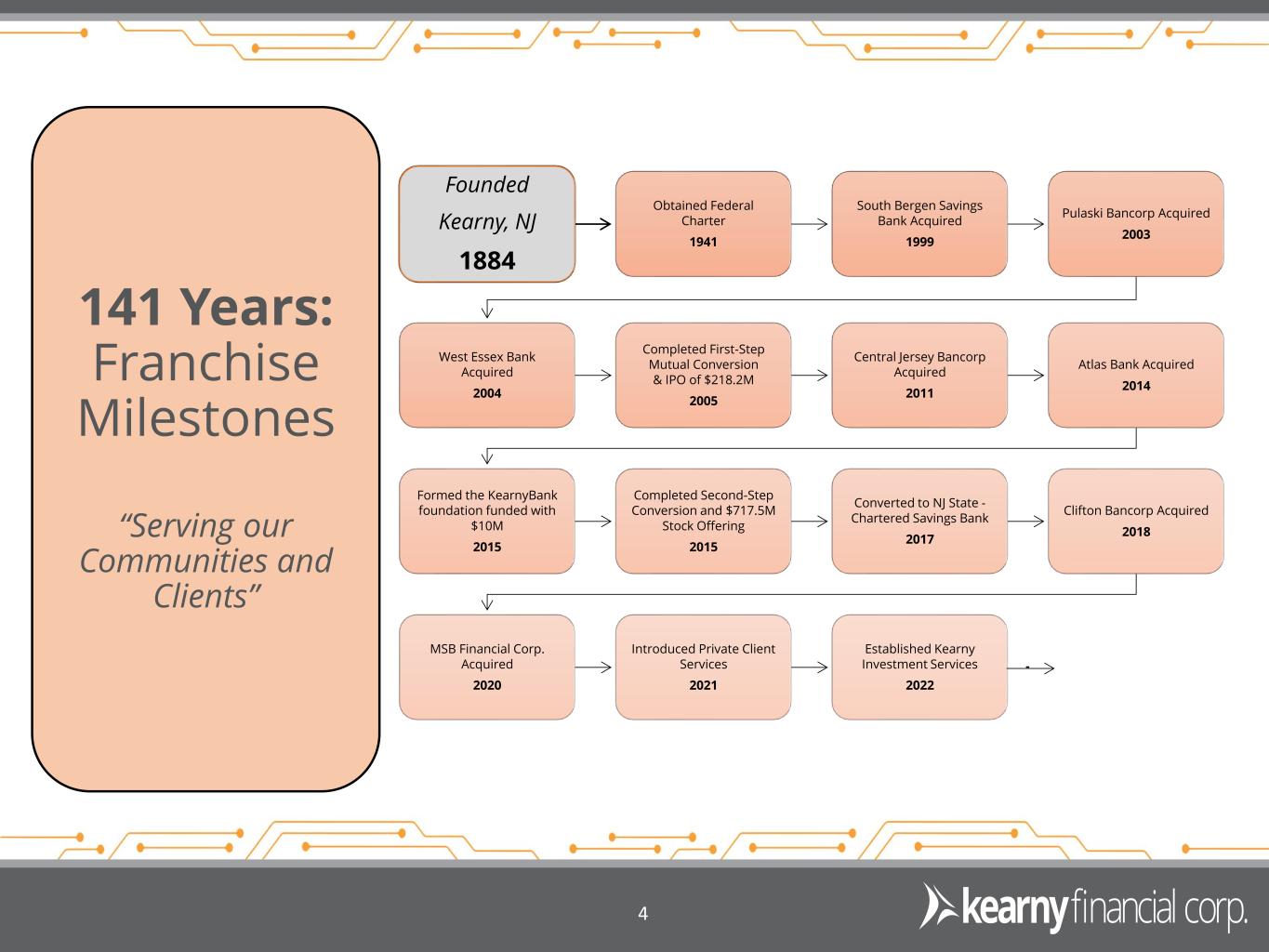

4 Founded Kearny, NJ 1884 Obtained Federal Charter 1941 South Bergen Savings Bank Acquired 1999 Pulaski Bancorp Acquired 2003 West Essex Bank Acquired 2004 Completed First-Step Mutual Conversion & IPO of $218.2M 2005 Central Jersey Bancorp Acquired 2011 Atlas Bank Acquired 2014 Formed the KearnyBank foundation funded with $10M 2015 Completed Second-Step Conversion and $717.5M Stock Offering 2015 Converted to NJ State - Chartered Savings Bank 2017 Clifton Bancorp Acquired 2018 MSB Financial Corp. Acquired 2020 Introduced Private Client Services 2021 Established Kearny Investment Services 2022 141 Years: Franchise Milestones “Serving our Communities and Clients” 4

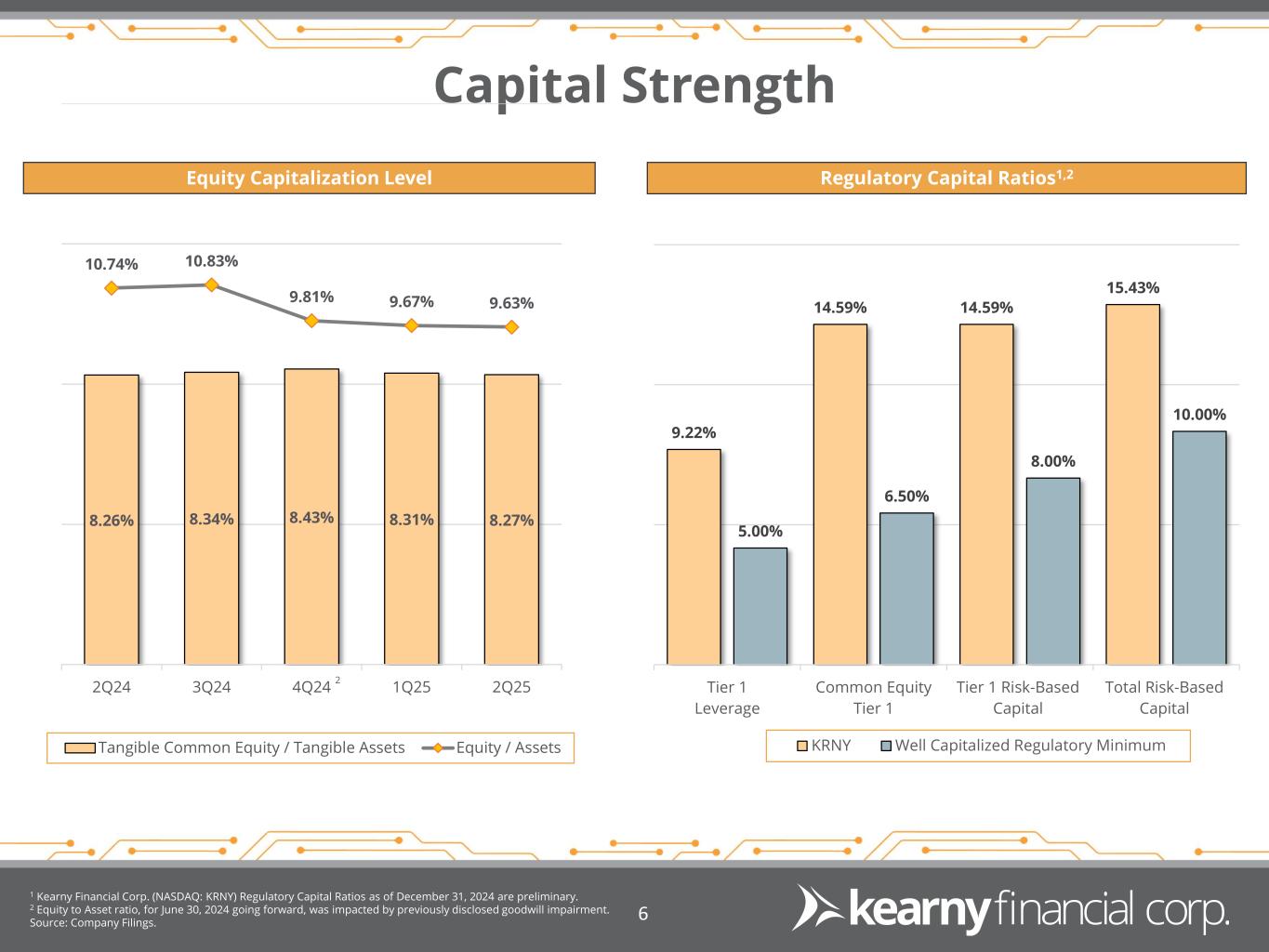

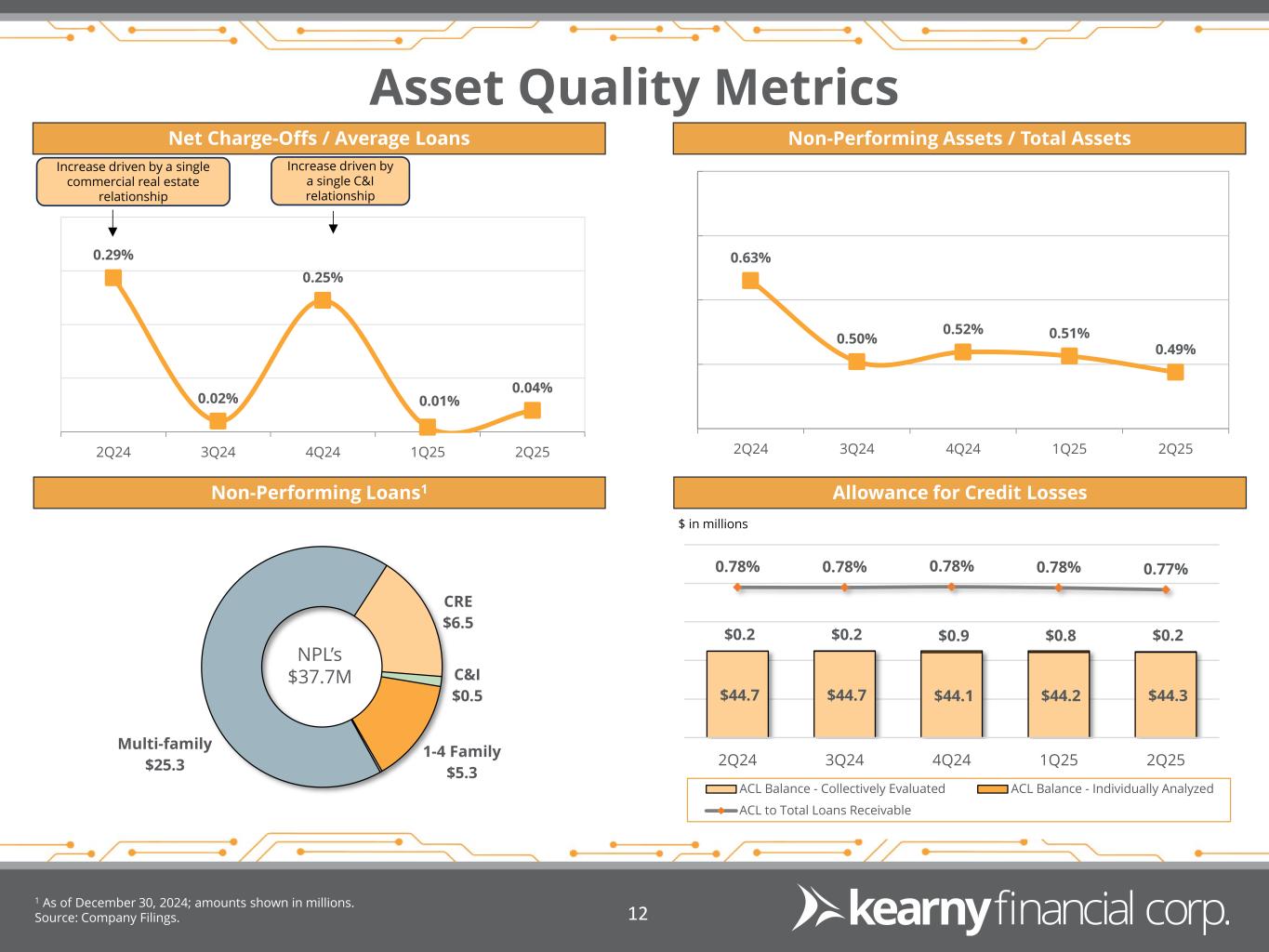

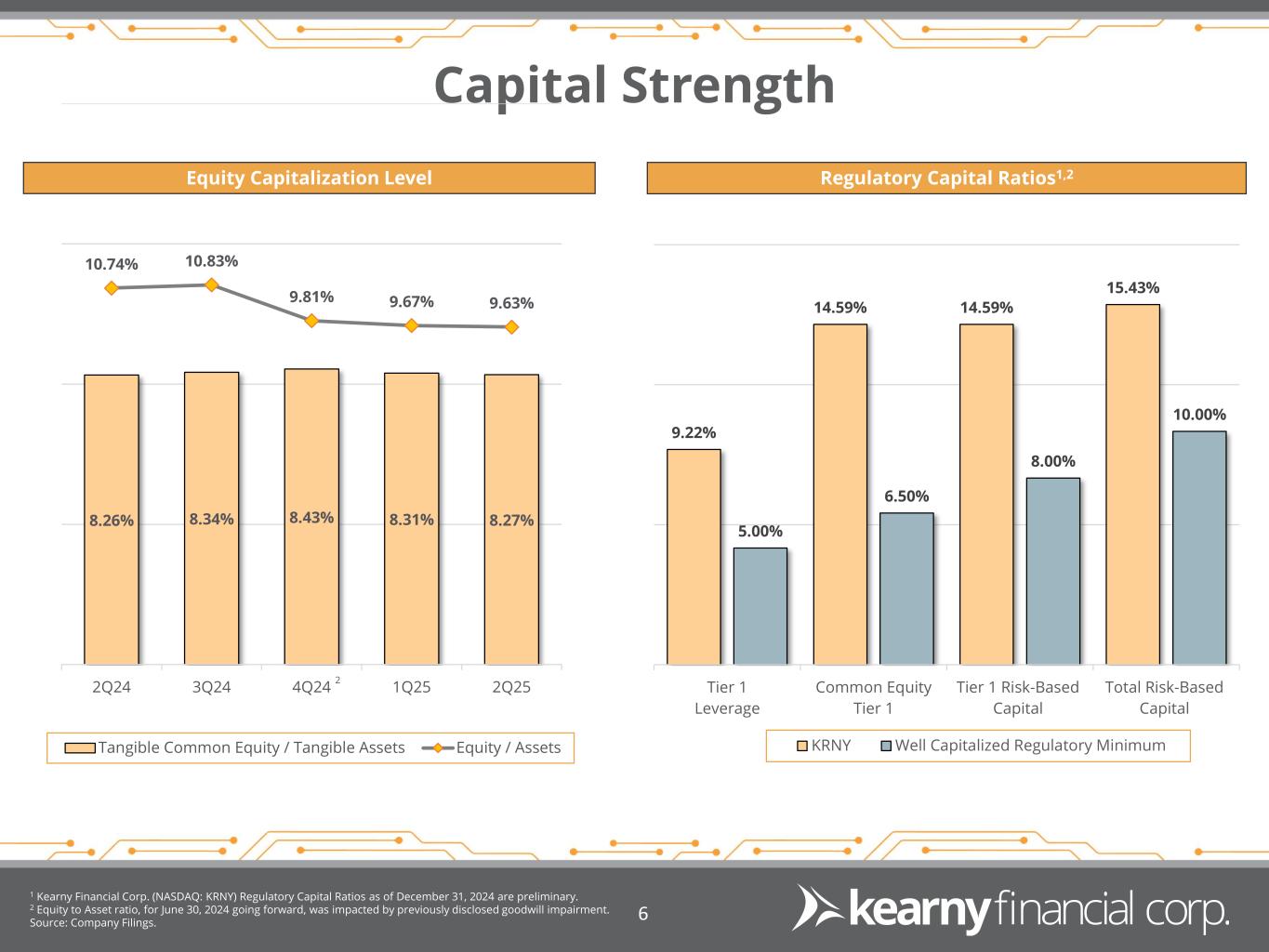

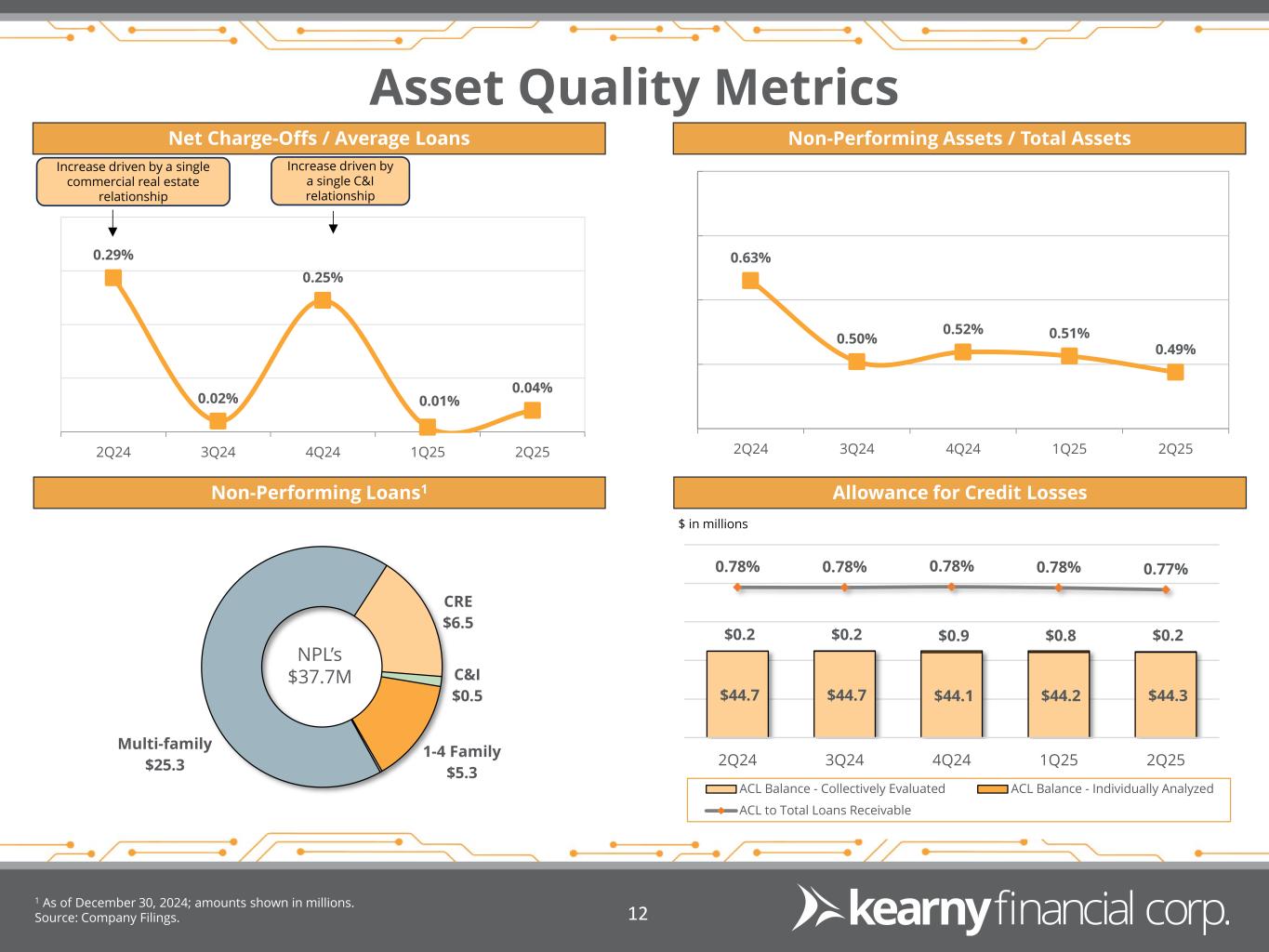

2Q25 Financial Highlights 1 GAAP to Adjusted reconciliation on page 19. 2 Excludes Yield Adjustments. Source: Company Filings. 5 Net Income GAAP Adjusted1 $6.6 million $6.6 million Basic/Diluted EPS GAAP Adjusted1 $0.11/$0.10 $0.11/$0.10 Net Interest Income CET-1 Ratio $32.6 million 14.59% Total Assets $7.7 billion Total Deposits Total Loans2 $5.7 billion $5.8 billion ASSET QUALITY Strong asset quality as non-performing assets improved to 0.49% of total assets compared to 0.51% in the quarter ended September 30, 2024. Net charge-offs totaled $573,000, or 0.04% of average loans, on an annualized basis, for the quarter ended December 31, 2024, which remains relatively low compared to our peers. EARNINGS Reported net income of $6.6 million for the quarter ended December 31, 2024, compared to $6.1 million for the quarter ended September 30, 2024. Earnings per basic and diluted share were $0.11 and $0.10, respectively, for the quarter ended December 31, 2024. For the quarter ending December 31, 2024, the net interest margin increased by two basis points to 1.82%, demonstrating sequential monthly growth throughout the period. BALANCE SHEET Total assets were $7.7 billion at December 31, 2024, a decrease of $41.0 million, or 0.5%, from September 30, 2024 primarily due to decrease in investment securities of $57.5 million. Deposits of $5.7 billion increased $200.5 million, driven by strong momentum across all deposit types. The increase in deposits has improved the Loan to Deposit ratio from 105.9% at September 30, 2024 to 101.4%, at December 31, 2024. Borrowings of $1.26 billion decreased $220.9 million, as result of deposit growth mentioned above. CAPITAL Capital ratios continue to remain well above regulatory minimums and peer comparisons with Common Equity Tier 1 Capital ratio of 14.59%, as of December 31, 2024.

Capital Strength Equity Capitalization Level 1 Kearny Financial Corp. (NASDAQ: KRNY) Regulatory Capital Ratios as of December 31, 2024 are preliminary. 2 Equity to Asset ratio, for June 30, 2024 going forward, was impacted by previously disclosed goodwill impairment. Source: Company Filings. 6 Regulatory Capital Ratios1,2 8.26% 8.34% 8.43% 8.31% 8.27% 10.74% 10.83% 9.81% 9.67% 9.63% 2Q24 3Q24 4Q24 1Q25 2Q25 Tangible Common Equity / Tangible Assets Equity / Assets 2 9.22% 14.59% 14.59% 15.43% 5.00% 6.50% 8.00% 10.00% Tier 1 Leverage Common Equity Tier 1 Tier 1 Risk-Based Capital Total Risk-Based Capital KRNY Well Capitalized Regulatory Minimum

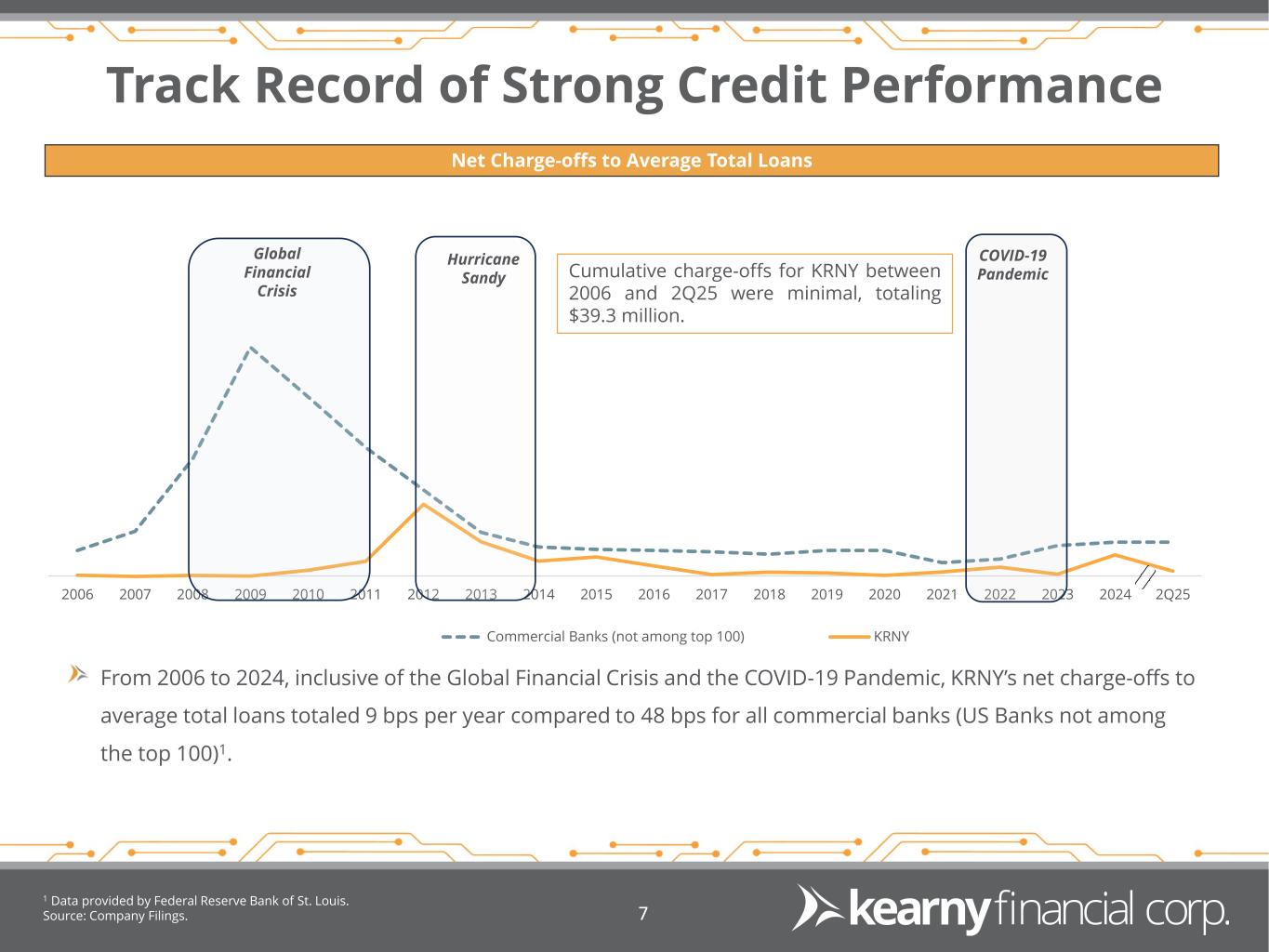

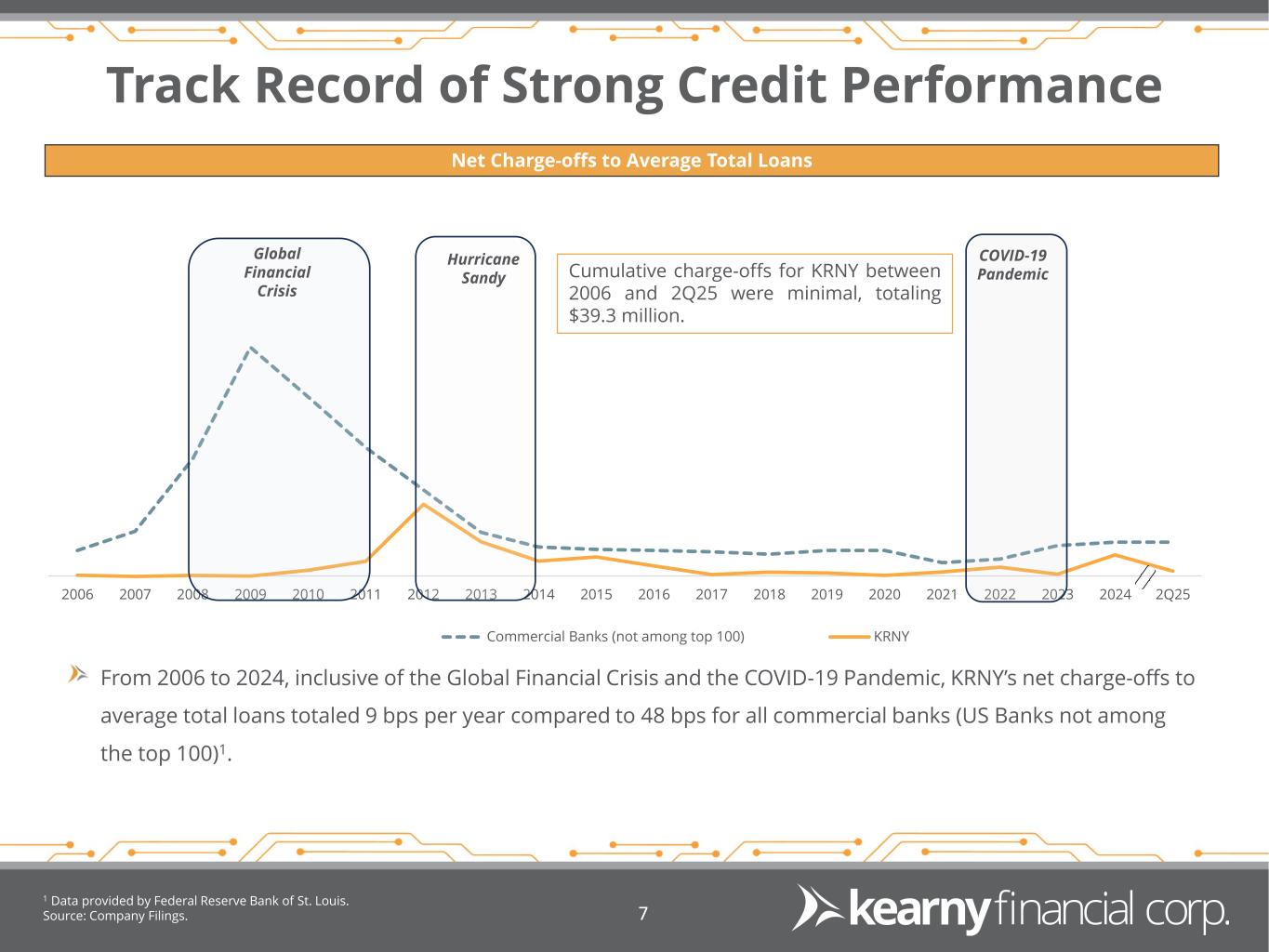

Track Record of Strong Credit Performance 1 Data provided by Federal Reserve Bank of St. Louis. Source: Company Filings. 7 From 2006 to 2024, inclusive of the Global Financial Crisis and the COVID-19 Pandemic, KRNY’s net charge-offs to average total loans totaled 9 bps per year compared to 48 bps for all commercial banks (US Banks not among the top 100)1. Net Charge-offs to Average Total Loans 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2Q25 Commercial Banks (not among top 100) KRNY Global Financial Crisis Hurricane Sandy COVID-19 PandemicCumulative charge-offs for KRNY between 2006 and 2Q25 were minimal, totaling $39.3 million.

Diversified Loan Portfolio Loan Composition1 Geographic Distribution1 Loan Trend 1 As of December 31, 2024. Source: S&P Global Market Intelligence & Company Filings. 8 ($ millions) 1-4 Family 30.4% Home Equity 0.8% Multi-family 46.9% CRE 16.4% Construction 3.1% C&I 2.3%QTD Yield on Loans 4.54% New York 33.0% New Jersey 55.8% Pennsylvania 6.2% Other 5.0% LTV 60.9% $1,746 $1,742 $1,756 $1,768 $1,765 $2,651 $2,645 $2,646 $2,646 $2,723 $947 $966 $948 $951 $950 $5,757 $5,775 $5,749 $5,786 $5,800 2Q24 3Q24 4Q24 1Q25 2Q25 1-4 Family Home Equity Multi-family CRE Construction C&I

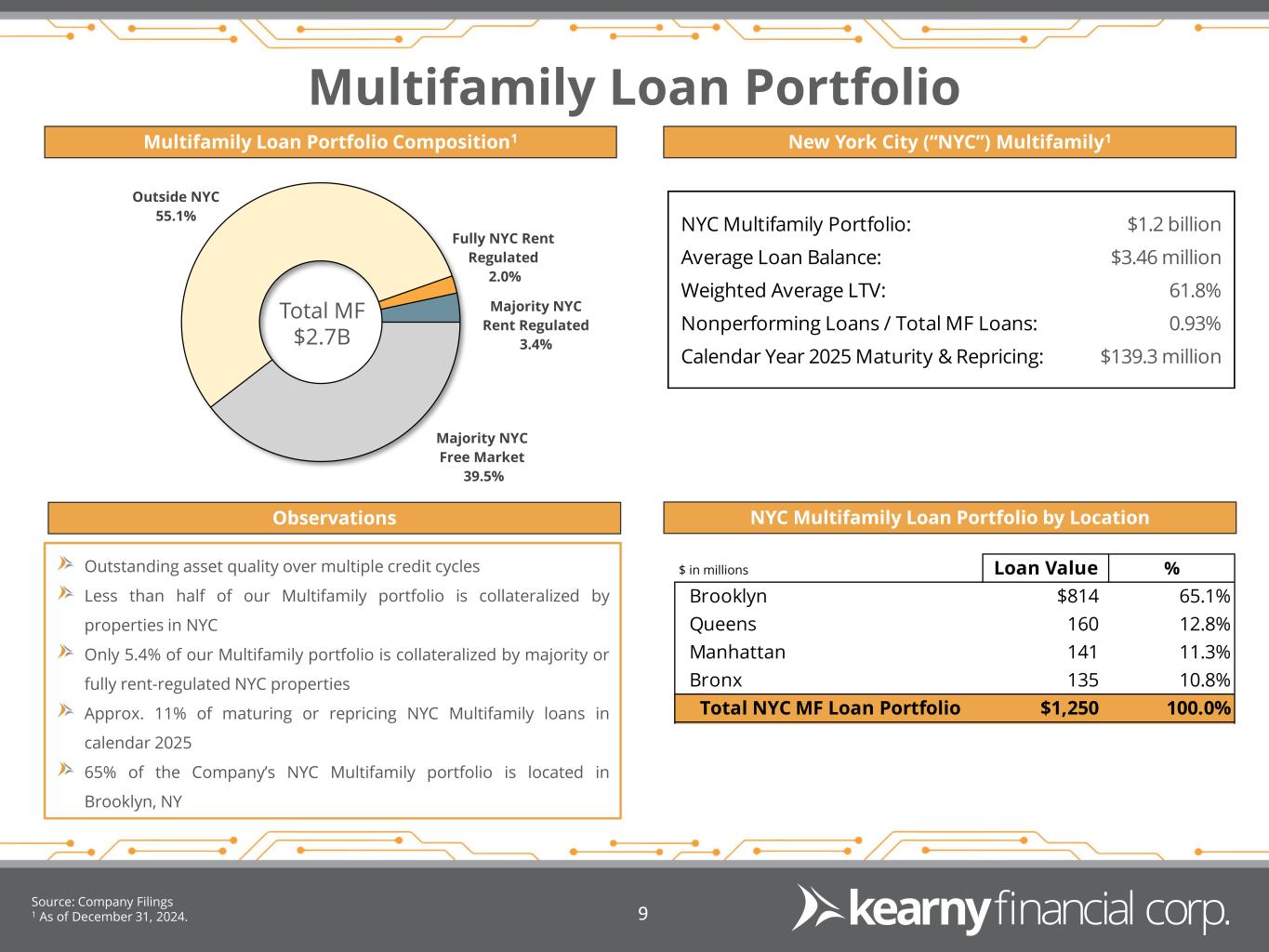

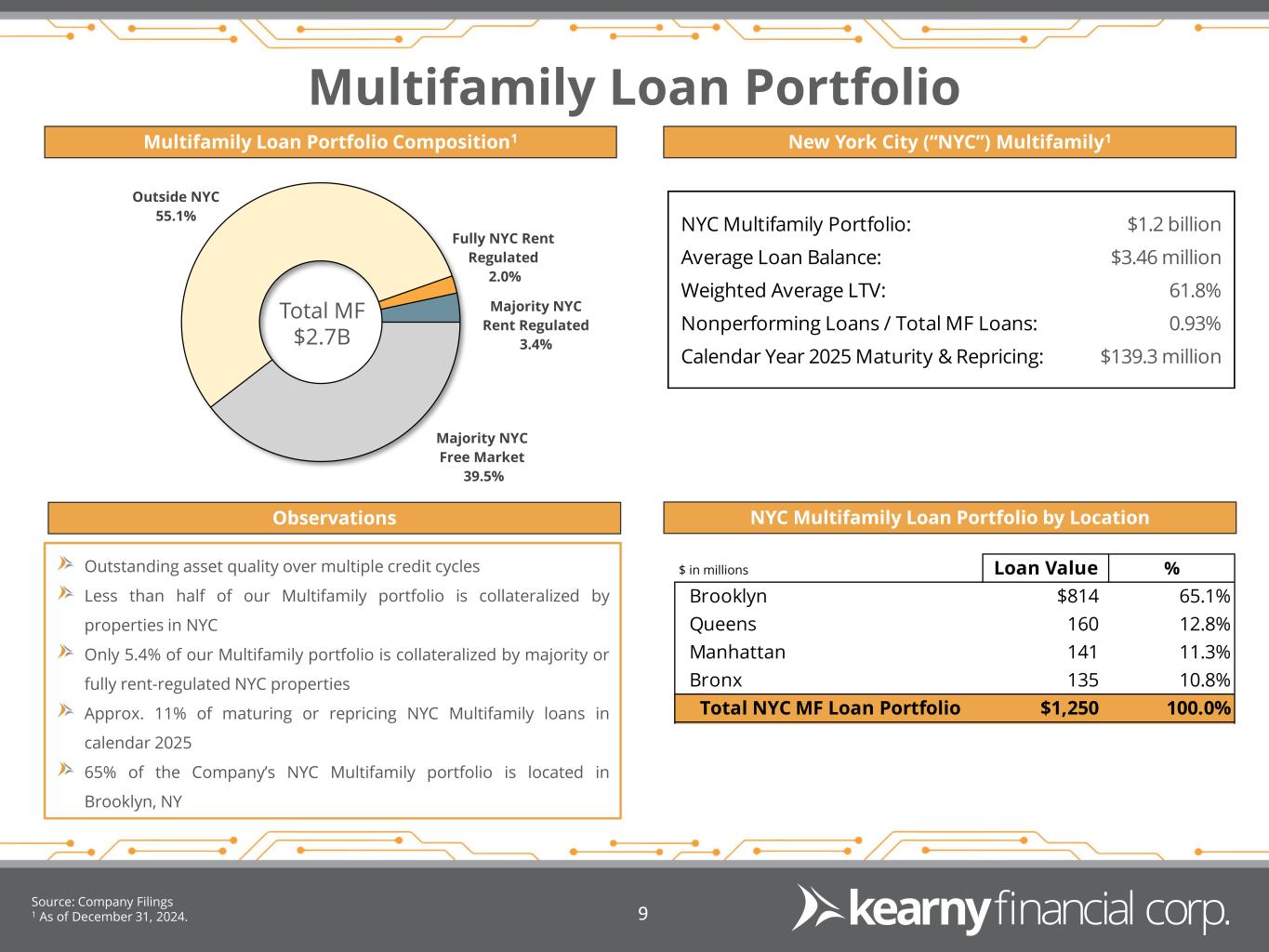

Multifamily Loan Portfolio Multifamily Loan Portfolio Composition1 New York City (“NYC”) Multifamily1 Source: Company Filings 1 As of December 31, 2024. 9 Outstanding asset quality over multiple credit cycles Less than half of our Multifamily portfolio is collateralized by properties in NYC Only 5.4% of our Multifamily portfolio is collateralized by majority or fully rent-regulated NYC properties Approx. 11% of maturing or repricing NYC Multifamily loans in calendar 2025 65% of the Company’s NYC Multifamily portfolio is located in Brooklyn, NY Observations Majority NYC Free Market 39.5% Outside NYC 55.1% Fully NYC Rent Regulated 2.0% Majority NYC Rent Regulated 3.4% Total MF $2.7B NYC Multifamily Portfolio: $1.2 billion Average Loan Balance: $3.46 million Weighted Average LTV: 61.8% Nonperforming Loans / Total MF Loans: 0.93% Calendar Year 2025 Maturity & Repricing: $139.3 million Loan Value % Brooklyn $814 65.1% Queens 160 12.8% Manhattan 141 11.3% Bronx 135 10.8% Total NYC MF Loan Portfolio $1,250 100.0% $ in millions NYC Multifamily Loan Portfolio by Location

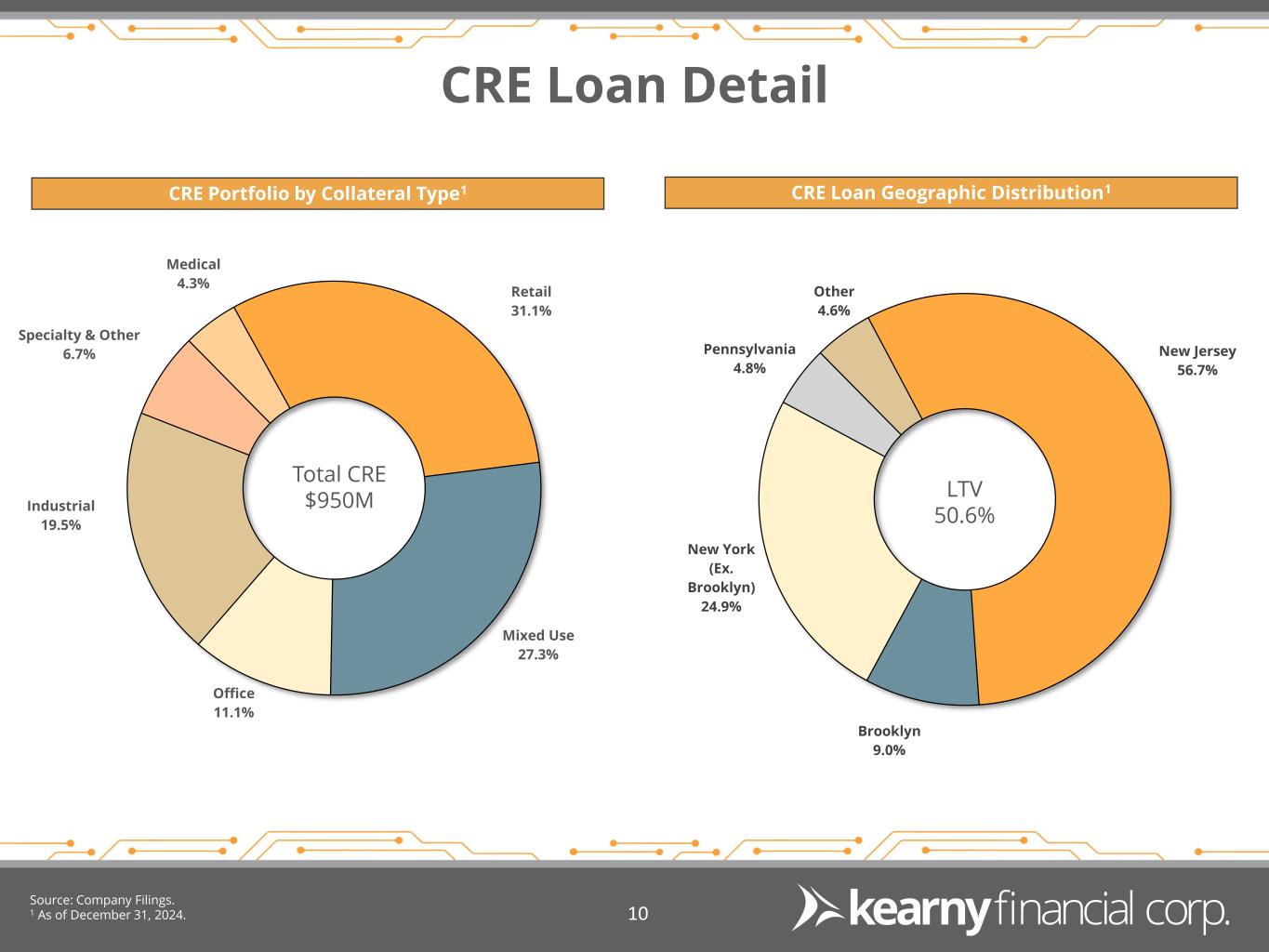

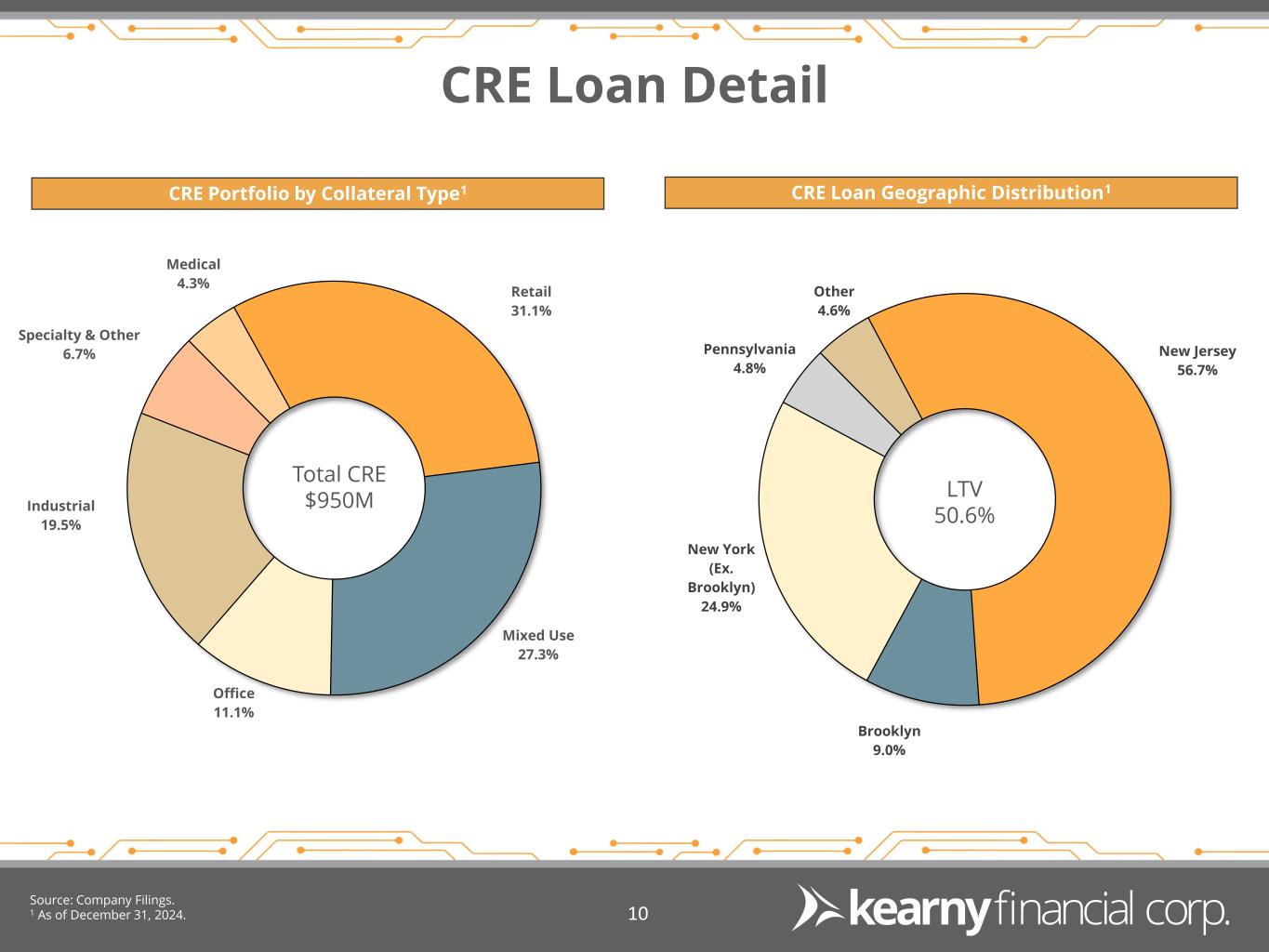

CRE Loan Detail Source: Company Filings. 1 As of December 31, 2024. 10 CRE Portfolio by Collateral Type1 CRE Loan Geographic Distribution1 New Jersey 56.7% Brooklyn 9.0% New York (Ex. Brooklyn) 24.9% Pennsylvania 4.8% Other 4.6% Retail 31.1% Mixed Use 27.3% Office 11.1% Industrial 19.5% Specialty & Other 6.7% Medical 4.3% Total CRE $950M LTV 50.6%

Office Portfolio 1 As of December 31, 2024. Source: Company Filings. 11 Office Portfolio by Contractual Maturity1 Office Portfolio Profile 11.1% of total CRE portfolio or $106 million Average loan size of $1.6 million ($ millions) Office Loan Geographic Distribution1 Manhattan 21.7% New York (Excl. Manhattan) 6.1% New Jersey 69.2% Other 2.9% LTV 47.7% DSCR 1.9x Total Office $106M $4 $9 $35 $17 $9 $32 2025 2026 2027 2028 2029 2030+

Asset Quality Metrics Non-Performing Assets / Total Assets Allowance for Credit Losses 1 As of December 30, 2024; amounts shown in millions. Source: Company Filings. 12 Net Charge-Offs / Average Loans Increase driven by a single commercial real estate relationship Increase driven by a single C&I relationship 0.29% 0.02% 0.25% 0.01% 0.04% 2Q24 3Q24 4Q24 1Q25 2Q25 0.63% 0.50% 0.52% 0.51% 0.49% 2Q24 3Q24 4Q24 1Q25 2Q25 $44.7 $44.7 $44.1 $44.2 $44.3 $0.2 $0.2 $0.9 $0.8 $0.2 0.78% 0.78% 0.78% 0.78% 0.77% 2Q24 3Q24 4Q24 1Q25 2Q25 ACL Balance - Collectively Evaluated ACL Balance - Individually Analyzed ACL to Total Loans Receivable Non-Performing Loans1 $ in millions Multi-family $25.3 CRE $6.5 C&I $0.5 1-4 Family $5.3 NPL’s $37.7M

$1,284 $1,235 $1,199 $1,216 $1,195 $457 $408 $408 $733 $752 $646 $630 $643 $682 $742 $2,347 $2,349 $2,310 $2,248 $2,380 $584 $586 $598 $592 $602 $5,320 $5,209 $5,158 $5,471 $5,671 2Q24 3Q24 4Q24 1Q25 2Q25 Retail CDs Wholesale CDs Savings Interest Bearing DDA Non-interest Bearing DDA Granular Deposit Franchise 1 As of December 31, 2024. Source: Company Filings. 13 Deposit Trend Non-Maturity Deposit Mix1 ($ millions) 21.1% 13.2% 13.1% 42.0% 10.6% Deposit Composition Consumer 64.5% Commercial 20.7% Government 14.8%

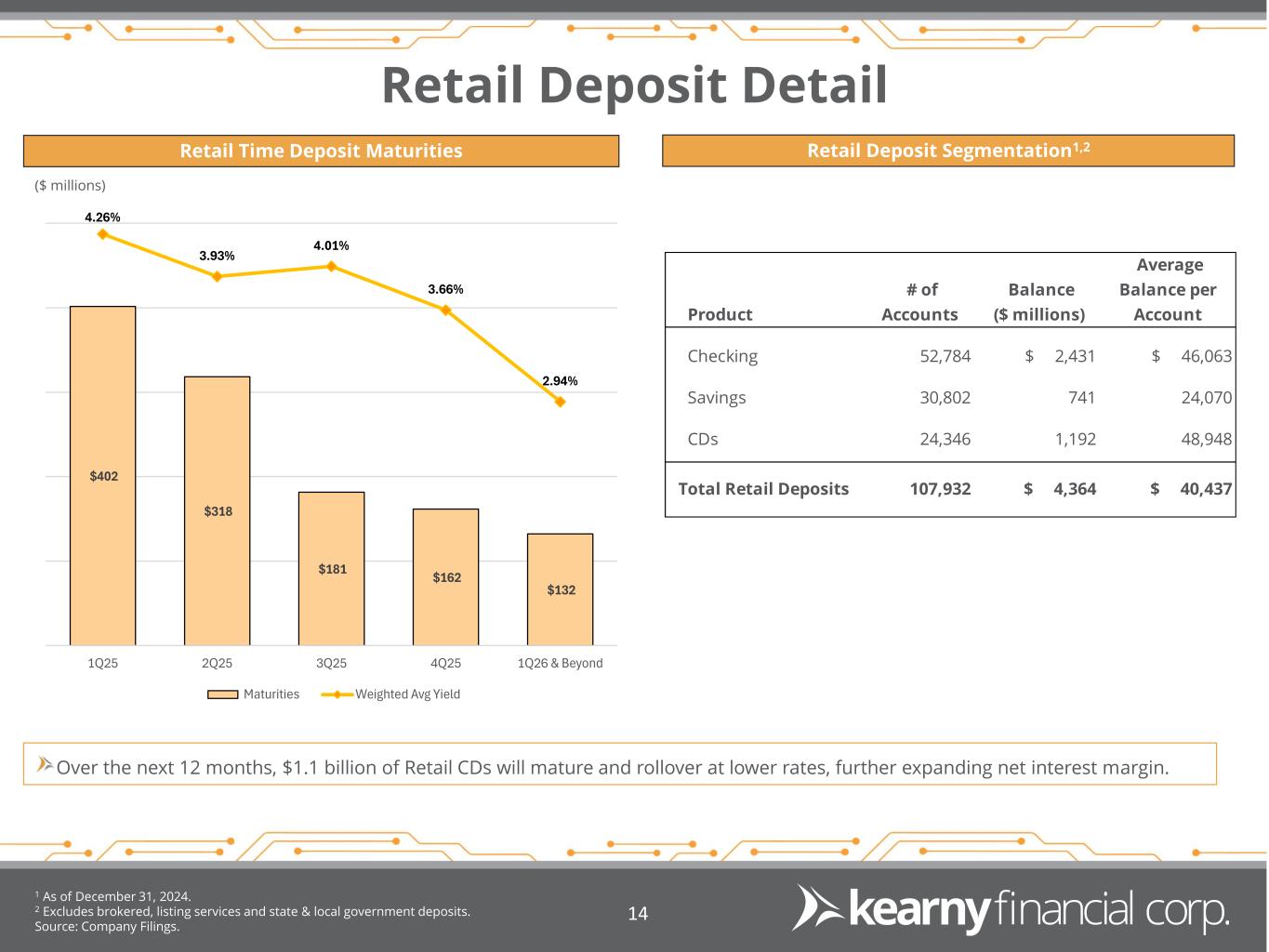

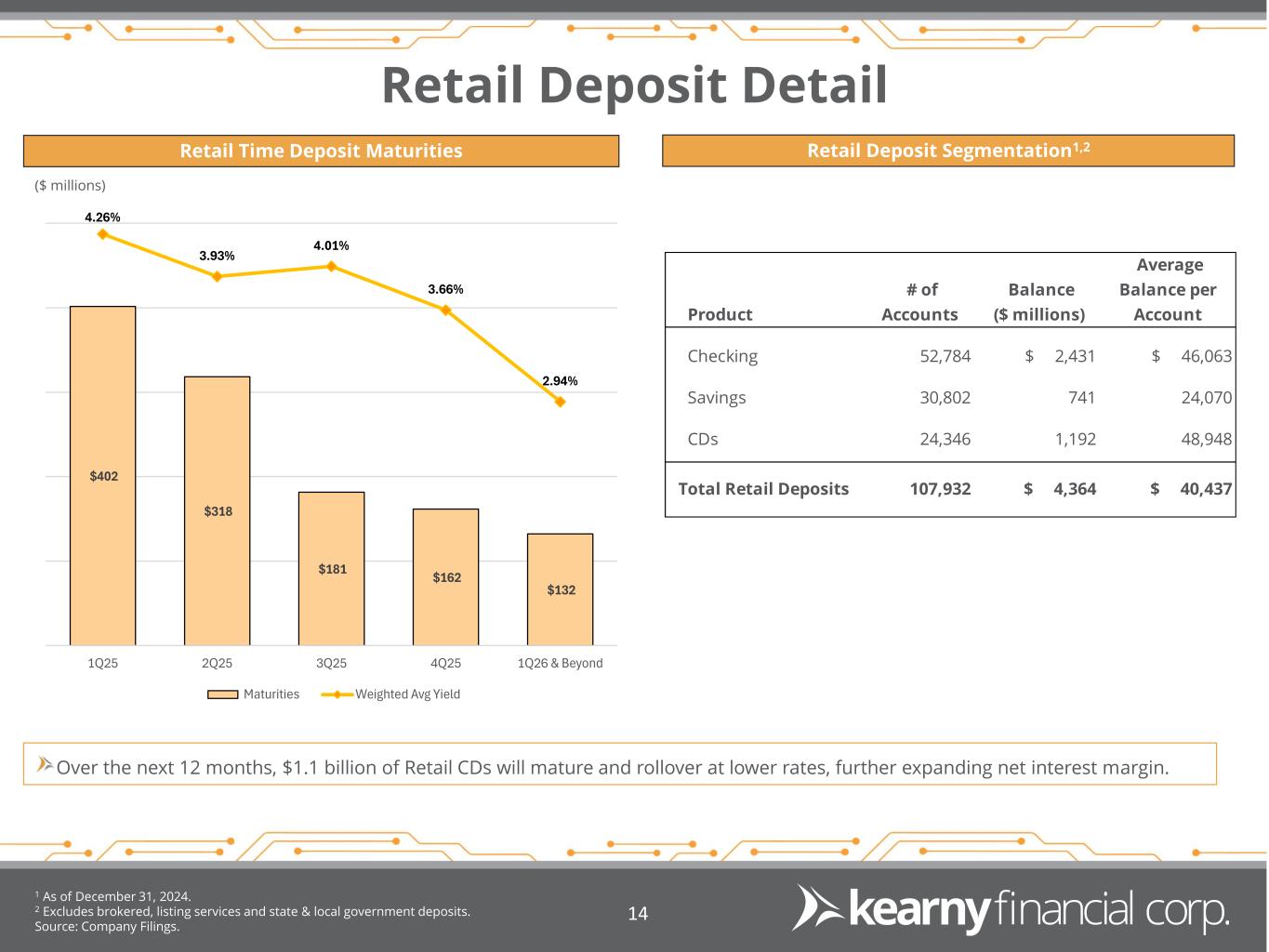

Retail Deposit Detail 1 As of December 31, 2024. 2 Excludes brokered, listing services and state & local government deposits. Source: Company Filings. 14 Retail Time Deposit Maturities Retail Deposit Segmentation1,2 ($ millions) Over the next 12 months, $1.1 billion of Retail CDs will mature and rollover at lower rates, further expanding net interest margin. $402 $318 $181 $162 $132 4.26% 3.93% 4.01% 3.66% 2.94% 1Q25 2Q25 3Q25 4Q25 1Q26 & Beyond Maturities Weighted Avg Yield Product # of Accounts Balance ($ millions) Average Balance per Account Checking 52,784 $ 2,431 $ 46,063 Savings 30,802 741 24,070 CDs 24,346 1,192 48,948 Total Retail Deposits 107,932 $ 4,364 $ 40,437

Liquidity Available for Uninsured Deposits Estimated Uninsured Deposits Analysis1,2 1 Estimated amount of uninsured deposits reported in December 31, 2024 Call Report. 2 As of December 31, 2024. 15 Available liquidity is 2.9x greater than estimated uninsured deposits (excluding items above) Total available capacity increased by $256 million from September 30, 2024 and represents 30% of total assets. Liquidity Capacity2 1 Estimated Uninsured Deposit Analysis ($ millions) Estimated Uninsured Deposits 1,936$ Less: Collateralized State & Local Government Deposits (539) Less: Bank's wholly-owned subsidiary & Holding Company Deposits (599) Estimated uninsured deposits excluding items above: 798$ Total Deposits 5,671$ Estimated uninsured deposits, excluding items above, as a % of Total Deposits 14.1% Sources of Liquidity ($ millions) Liquidity Capacity Funding Utilized Available Capacity Internal Sources: Free Securities and other 96$ -$ 96$ External Sources: FRB 1,605 - 1,605 FHLB 1,885 1,270 615 Total Liquidity 3,586$ 1,270$ 2,316$

Investment Securities 1 As of December 31, 2024. 2 Comprised entirely of securitized federal education loans with 97% U.S. government guarantees. 3 Assumes 29% marginal tax rate. Source: Company Filings. 16 Securities Composition1 Securities Average Balance & Yield Trend At December 31, 2024, the after-tax net unrecognized loss on securities held-to-maturity was $11.3 million, or 1.79% of tangible equity3 AFS/HTM & Effective Duration Corporate Bonds 12.0% CLO 29.1% ABS Student Loans 6.3% Agency MBS 51.8% Municipal Bonds 0.8% ($ millions) 2 $1,524 $1,397 $1,357 $1,327 $1,296 4.42% 4.46% 4.39% 4.36% 4.28% 2Q24 3Q24 4Q24 1Q25 2Q25 Securities Portfolio Yield on Investments AFS 88.9% HTM 11.1% Total Effective Duration ≈ 3.4 years Floating rate securities ≈ 34.4%

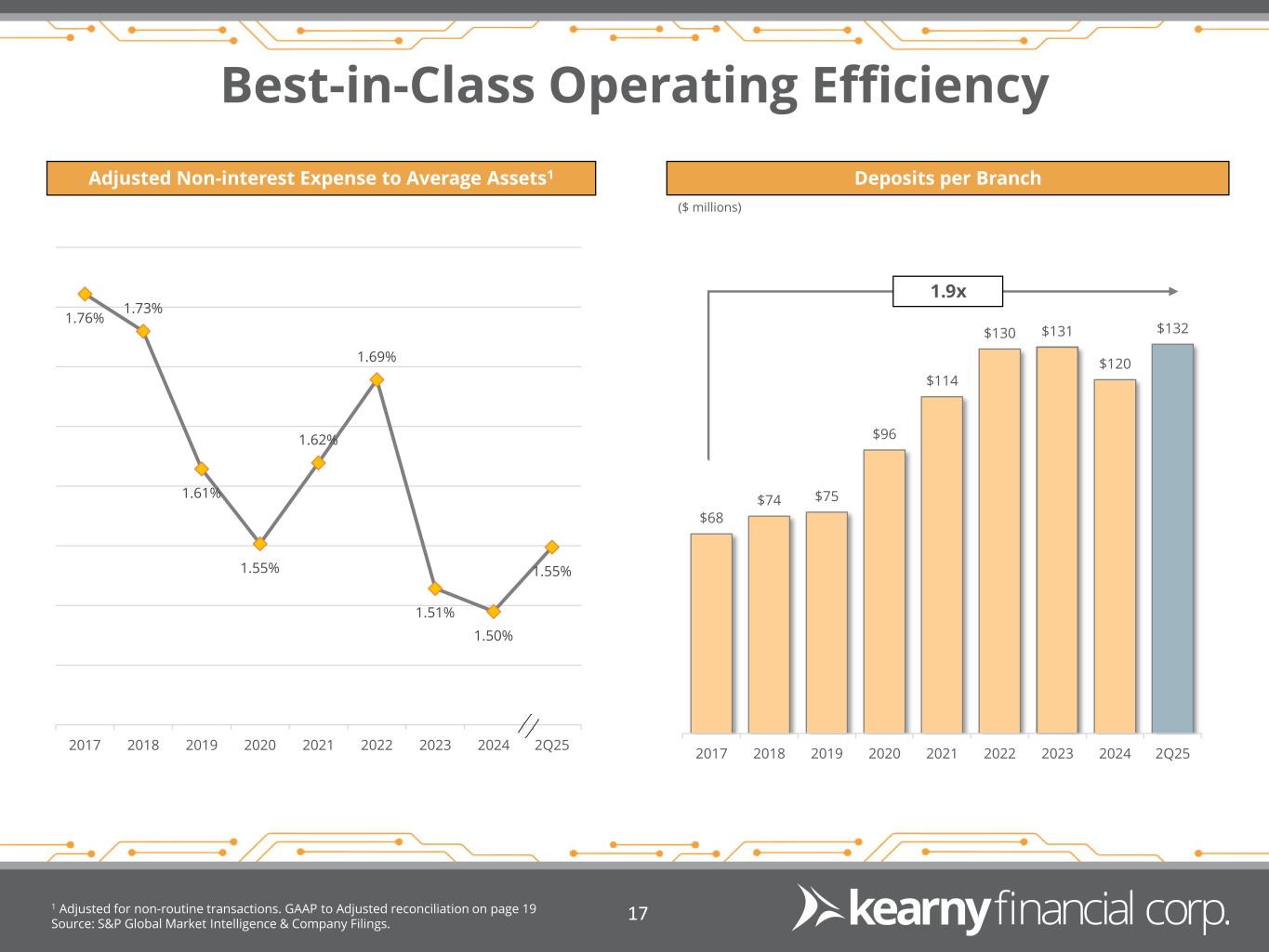

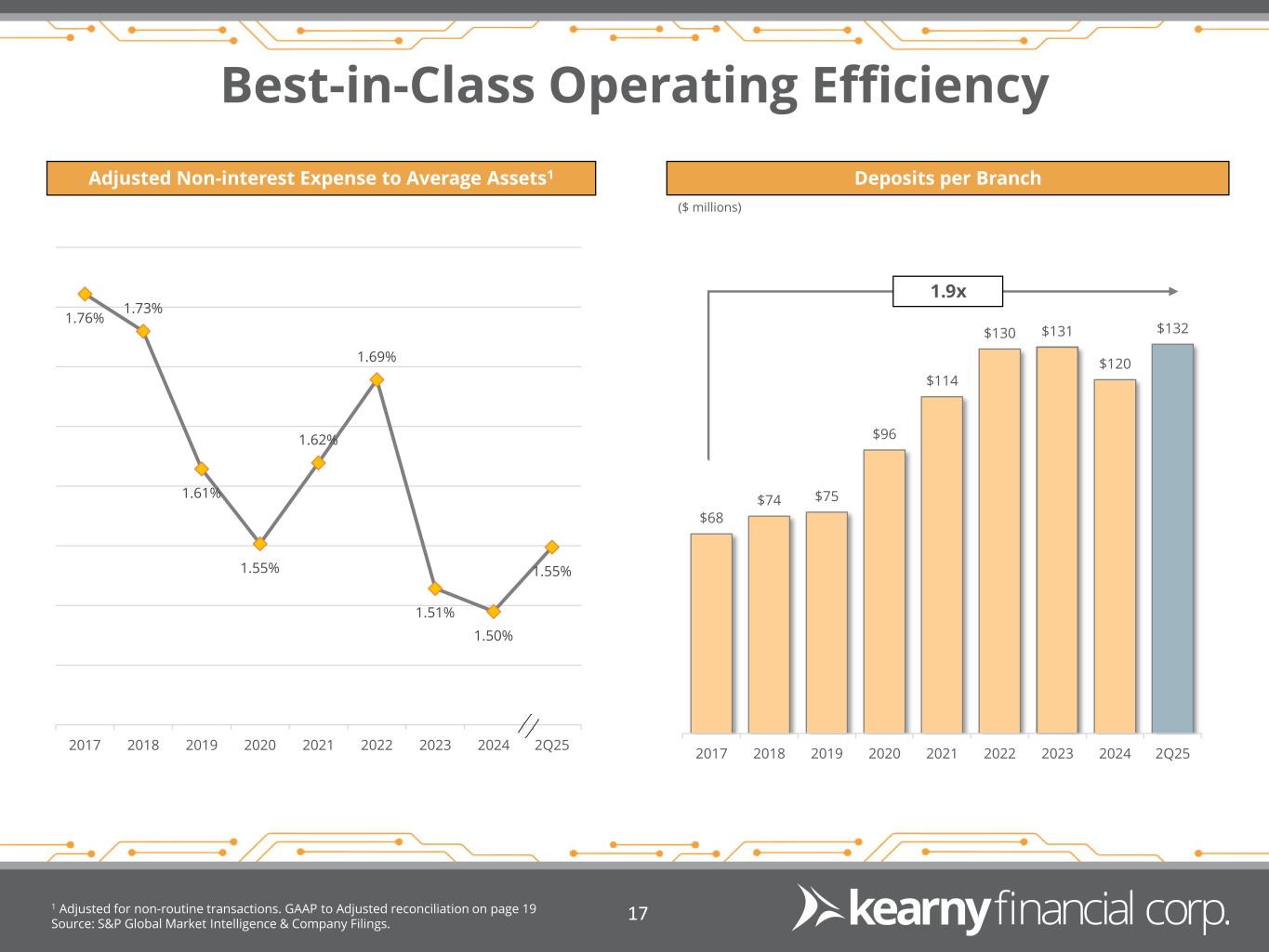

Best-in-Class Operating Efficiency 1 Adjusted for non-routine transactions. GAAP to Adjusted reconciliation on page 19 Source: S&P Global Market Intelligence & Company Filings. 17 Adjusted Non-interest Expense to Average Assets1 Deposits per Branch 1.76% 1.73% 1.61% 1.55% 1.62% 1.69% 1.51% 1.50% 1.55% 2017 2018 2019 2020 2021 2022 2023 2024 2Q25 $68 $74 $75 $96 $114 $130 $131 $120 $132 1 21 41 61 81 101 121 2017 2018 2019 2020 2021 2022 2023 2024 2Q25 1.9x ($ millions)

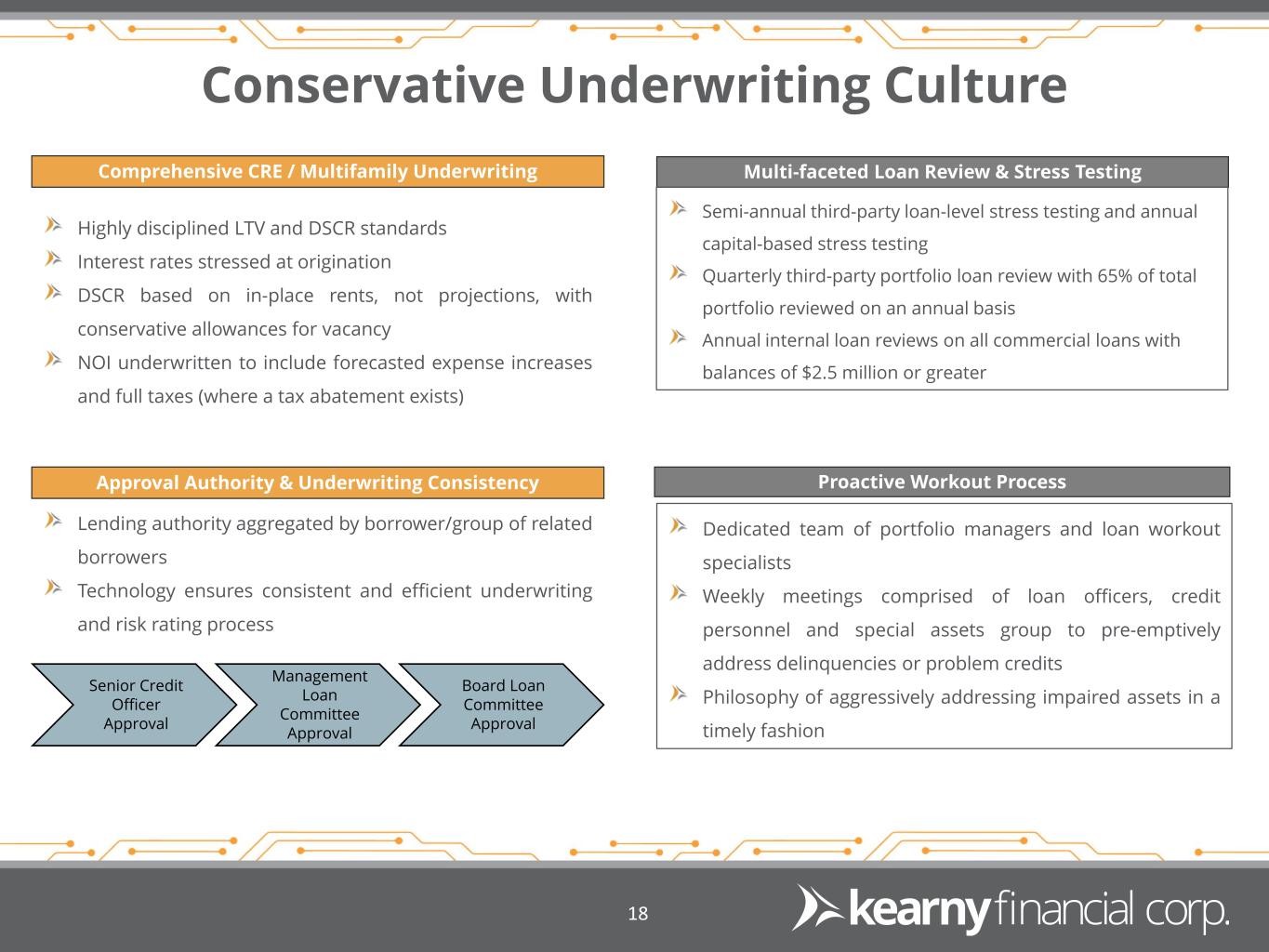

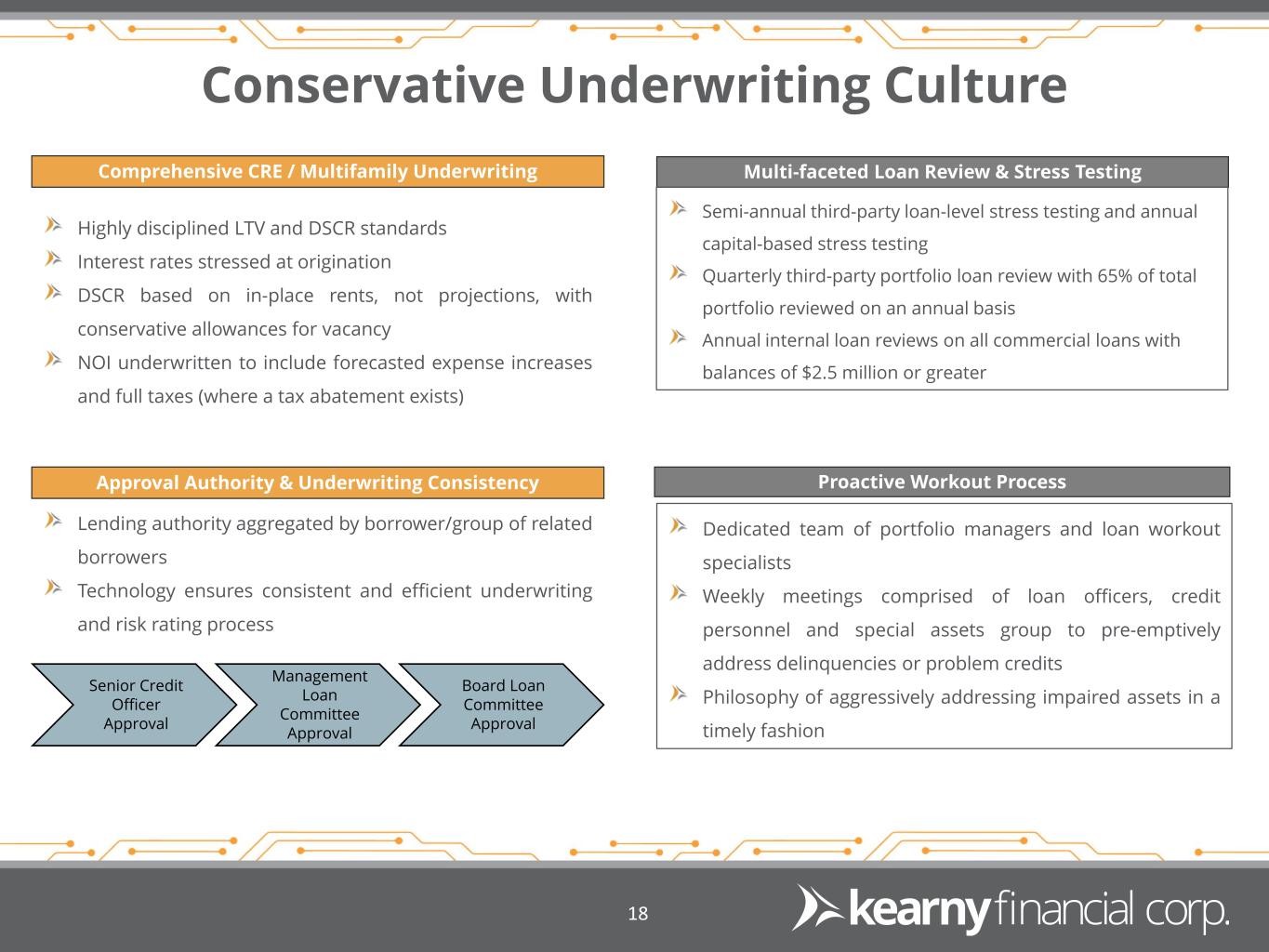

18 Conservative Underwriting Culture Comprehensive CRE / Multifamily Underwriting Highly disciplined LTV and DSCR standards Interest rates stressed at origination DSCR based on in-place rents, not projections, with conservative allowances for vacancy NOI underwritten to include forecasted expense increases and full taxes (where a tax abatement exists) Approval Authority & Underwriting Consistency Lending authority aggregated by borrower/group of related borrowers Technology ensures consistent and efficient underwriting and risk rating process Multi-faceted Loan Review & Stress Testing Semi-annual third-party loan-level stress testing and annual capital-based stress testing Quarterly third-party portfolio loan review with 65% of total portfolio reviewed on an annual basis Annual internal loan reviews on all commercial loans with balances of $2.5 million or greater Proactive Workout Process Dedicated team of portfolio managers and loan workout specialists Weekly meetings comprised of loan officers, credit personnel and special assets group to pre-emptively address delinquencies or problem credits Philosophy of aggressively addressing impaired assets in a timely fashion Senior Credit Officer Approval Management Loan Committee Approval Board Loan Committee Approval

Non-GAAP Reconciliation 19 Reconciliation of GAAP to Non-GAAP For the quarter ended For the quarter ended For the quarter ended For the quarter ended For the quarter ended (Dollars and Shares in Thousands, Except Per Share Data) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Adjusted net income: Net income (loss) (GAAP) $6,566 $6,092 ($90,079) $7,397 ($13,827) Non-recurring transactions - net of tax: Net effect of sale and call of securities - - - - 12,876 Net effect of bank-owned life insurance restructure - - 392 - 6,286 Goodwill impairment - - 95,283 - - Adjusted net income $6,566 $6,092 $5,596 $7,397 $5,335 Calculation of pre-tax, pre-provision net revenue: Net income (loss) (GAAP) $6,566 $6,092 ($90,079) $7,397 ($13,827) Adjustments to net income (GAAP): Provision for income taxes $1,251 $1,086 ($917) $1,717 $1,782 Provision for (reversal of) credit losses $107 $108 $3,527 $349 $2,105 Pre-tax, pre-provision net revenue (non-GAAP) $7,924 $7,286 ($87,469) $9,463 ($9,940) Adjusted earnings per share: Weighted average common shares - basic 62,443 62,389 62,254 62,205 62,299 Weighted average common shares - diluted 62,576 62,420 62,330 62,211 62,367 Earnings per share - basic (GAAP) $0.11 $0.10 ($1.45) $0.12 ($0.22) Earnings per share - diluted (GAAP) $0.10 $0.10 ($1.45) $0.12 ($0.22) Adjusted earnings per share - basic (non-GAAP) $0.11 $0.10 $0.09 $0.12 $0.09 Adjusted earnings per share - diluted (non-GAAP) $0.10 $0.10 $0.09 $0.12 $0.09 Pre-tax, pre-provision net revenue per share: Pre-tax, pre-provision net revenue per share - basic (non-GAAP) $0.13 $0.12 ($1.41) $0.15 ($0.16) Pre-tax, pre-provision net revenue per share - diluted (non-GAAP) $0.13 $0.12 ($1.41) $0.15 ($0.16) Adjusted return on average assets: Total average assets $7,633,900 $7,688,433 $7,695,080 $7,851,721 $7,944,586 Return on average assets (GAAP) 0.34% 0.32% -4.68% 0.38% -0.70% Adjusted return on average assets (non-GAAP) 0.34% 0.32% 0.29% 0.38% 0.27% Adjusted return on average equity: Total average equity $747,850 $750,678 $751,070 $844,782 $838,714 Return on average equity (GAAP) 3.51% 3.25% -47.97% 3.50% -6.59% Adjusted return on average equity (non-GAAP) 3.51% 3.25% 2.98% 3.50% 2.54%