As filed with the Securities and Exchange Commission on September 11, 2014

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HILTON WORLDWIDE FINANCE LLC

HILTON WORLDWIDE FINANCE CORP.

(Exact name of registrant issuers as specified in their respective charters)

SEE TABLE OF REGISTRANT GUARANTORS

| | | | |

| Delaware | | 7011 | | 27-4384691 |

| Delaware | | 7011 | | 46-3492566 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

7930 Jones Branch Drive, Suite 1100

McLean, Virginia 22102

Telephone: (703) 883-1000

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Kristin A. Campbell

Executive Vice President and General Counsel

Hilton Worldwide Holdings Inc.

7930 Jones Branch Drive, Suite 1100

McLean, Virginia 22102

Telephone: (703) 883-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Edward P. Tolley III

Edgar J. Lewandowski

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000

Approximate date of commencement of proposed exchange offer: As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross Border Third Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum Offering Price Per Note | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee |

5.625% Senior Notes due 2021 | | $1,500,000,000 | | 100% | | $1,500,000,000 | | $193,200 |

Guarantees of the 5.625% Senior Notes due 2021(2) | | N/A(3) | | (3) | | (3) | | (3) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | See inside facing page for table of registrant guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF REGISTRANT GUARANTORS

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

Destination Resorts LLC | | Arizona | | 26-1284226 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree Hotel Systems LLC | | Arizona | | 26-1284504 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree Hotels LLC | | Arizona | | 26-1284359 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DT Management LLC | | Arizona | | 26-1284112 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DT Real Estate, Inc. | | Arizona | | 86-0594278 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Atlanta/Legacy, Inc. | | Arizona | | 86-0803816 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Coconut Grove, Inc. | | Arizona | | 86-0582711 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Largo, Inc. | | Arizona | | 86-0522306 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Maryland, Inc. | | Arizona | | 86-0636941 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Santa Clara LLC | | Arizona | | 26-1287115 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Walnut Creek, Inc. | | Arizona | | 86-0653973 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTR FCH Holdings, Inc. | | Arizona | | 86-0506692 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTR PAH Holding, Inc. | | Arizona | | 86-0843169 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTR San Antonio, Inc. | | Arizona | | 86-0803669 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTR TM Holdings, Inc. | | Arizona | | 86-0358342 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC Gaming California, Inc. | | California | | 93-1167073 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC San Pablo Limited, Inc. | | California | | 93-1167074 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC San Pablo, L.P. | | California | | 93-1167075 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton San Diego Corporation | | California | | 95-2395937 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

90210 Biltmore Management, LLC | | Delaware | | 34-1984747 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

90210 Desert Resorts Management Co., LLC | | Delaware | | 34-1984753 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

90210 Grand Wailea Management Co., LLC | | Delaware | | 34-1984759 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

90210 LLC | | Delaware | | 95-4747695 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

90210 Management Company, LLC | | Delaware | | 20-4146308 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Andiamo’s O’Hare, LLC | | Delaware | | 58-2669081 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Blue Bonnet Security, LLC | | Delaware | | 20-5118750 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Compris Hotel LLC | | Delaware | | 86-0471065 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad Franchise LLC | | Delaware | | 26-1094269 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad International Manage (CIS) LLC | | Delaware | | 26-1687344 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad Management LLC | | Delaware | | 26-1101184 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree DTWC LLC | | Delaware | | 95-4887049 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree Franchise LLC | | Delaware | | 26-1094339 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree LLC | | Delaware | | 86-0762415 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Doubletree Management LLC | | Delaware | | 26-1101270 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTWC Spokane City Center SPE, LLC | | Delaware | | 38-3657837 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

EJP LLC | | Delaware | | 62-1489071 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Development LLC | | Delaware | | 74-2479161 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Equity Development LLC | | Delaware | | 74-2479160 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Suites (Isla Verde), Inc. | | Delaware | | 62-1555786 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Suites Franchise LLC | | Delaware | | 26-1094388 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Syracuse Development LLC | | Delaware | | 62-1469277 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

EPAM Corporation | | Delaware | | 62-1401630 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Grand Vacations Realty, LLC | | Delaware | | 45-3639356 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

Grand Vacations Services LLC | | Delaware | | 27-5173651 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

Grand Vacations Title, LLC | | Delaware | | 45-3641303 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

Hampton Inns Franchise LLC | | Delaware | | 26-1094464 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hampton Inns LLC | | Delaware | | 62-1194362 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hampton Inns Management LLC | | Delaware | | 26-1101242 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HHC BC Orlando, LLC | | Delaware | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HHC One Park Boulevard, LLC | | Delaware | | 56-2543378 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC First Corporation | | Delaware | | 13-3210063 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC Holdings Corporation | �� | Delaware | | 13-3111964 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC Hotels U.S.A. Corporation | | Delaware | | 13-3435886 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC Racing Corporation | | Delaware | | 38-2697494 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HIC Second Corporation | | Delaware | | 13-3153590 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Beverage LLC | | Delaware | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Chicago Beverage I LLC | | Delaware | | 30-0800929 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Chicago Beverage II LLC | | Delaware | | 32-0422233 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Chicago Beverage III LLC | | Delaware | | 61-1724781 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Chicago Beverage IV LLC | | Delaware | | 90-1028957 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Corporate Director LLC | | Delaware | | 26-3551072 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton El Con Management LLC | | Delaware | | 26-3845802 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton El Con Operator LLC | | Delaware | | 26-3845852 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Electronic Distribution Systems, LLC | | Delaware | | 47-0849436 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Energy Investments, LLC | | Delaware | | 20-1412970 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

Hilton Franchise Holding LLC | | Delaware | | 26-1094575 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Franchise LLC | | Delaware | | 26-1094534 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Garden Inns Franchise LLC | | Delaware | | 26-1094420 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Garden Inns Management LLC | | Delaware | | 26-1126091 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Grand Vacations Club, LLC | | Delaware | | 59-3482975 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

Hilton Grand Vacations Company, LLC | | Delaware | | 59-3482978 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

Hilton Grand Vacations Financing, LLC | | Delaware | | 03-0398105 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: (407) 722-3100 |

Hilton Hawaii Corporation | | Delaware | | 99-6011945 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton HHonors Worldwide, L.L.C. | | Delaware | | 95-4635505 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Illinois Holdings LLC | | Delaware | | 13-0980760 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Inns LLC | | Delaware | | 36-6114932 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton International Holding Corporation | | Delaware | | 47-1062743 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Kingsland 1, LLC | | Delaware | | 20-2729807 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Management LLC | | Delaware | | 26-1101130 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton New Jersey Service Corp. | | Delaware | | 95-4761288 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton OPB, LLC | | Delaware | | 83-0440703 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Orlando Partners II, LLC | | Delaware | | 20-0133281 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Orlando Partners III, LLC | | Delaware | | 20-1274261 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Recreation LLC | | Delaware | | 95-4439247 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Resorts Corporation | | Delaware | | 95-4349751 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, Florida 32835 Telephone: 407-722-3100 |

Hilton Resorts Marketing Corp. | | Delaware | | 20-0061226 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Spring Corporation | | Delaware | | 95-4818997 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

Hilton Supply Management LLC | | Delaware | | 95-2502058 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Systems Solutions, LLC | | Delaware | | 71-0907647 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Systems, LLC | | Delaware | | 20-3659071 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Worldwide Holdings Inc. | | Delaware | | 27-4384691 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Worldwide, Inc. | | Delaware | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Audubon LLC | | Delaware | | 26-1292055 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT CA Hilton LLC | | Delaware | | 26-1246396 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Conrad Domestic LLC | | Delaware | | 26-1211490 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Conrad GP LLC | | Delaware | | 26-1251719 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Domestic JV Holdings LLC | | Delaware | | 26-1262961 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Domestic Owner LLC | | Delaware | | 26-1125973 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP Franchise LLC | | Delaware | | 26-3750690 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP International Franchise LLC | | Delaware | | 26-3750733 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP International Franchisor Corporation | | Delaware | | 26-3750889 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP International Manage LLC | | Delaware | | 26-3750974 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP International Management Corporation | | Delaware | | 26-3751149 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT ESP Manage LLC | | Delaware | | 26-3750936 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Franchise II Borrower LLC | | Delaware | | 26-1291125 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT HQ SPE LLC | | Delaware | | 26-1211665 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT HSM Holding LLC | | Delaware | | 26-1274784 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT HSS Holding LLC | | Delaware | | 26-1274883 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT JV Acquisition LLC | | Delaware | | 26-1276349 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

HLT JV I Borrower LLC | | Delaware | | 26-1263164 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle Franchise LLC | | Delaware | | 26-3748252 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle International Franchise LLC | | Delaware | | 26-3748344 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle International Franchisor Corporation | | Delaware | | 26-3748409 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle International Manage LLC | | Delaware | | 26-3748516 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle International Management Corporation | | Delaware | | 26-3750638 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Lifestyle Manage LLC | | Delaware | | 26-3748470 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Memphis Data LLC | | Delaware | | 26-1339888 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT O’Hare LLC | | Delaware | | 26-1125227 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Operate DTWC LLC | | Delaware | | 26-1201440 | �� | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Owned II Holding LLC | | Delaware | | 26-1254836 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Owned II-A Borrower LLC | | Delaware | | 26-1336277 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Palmer LLC | | Delaware | | 26-1211589 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Timeshare Borrower I LLC | | Delaware | | 26-1270279 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HLT Timeshare Borrower II LLC | | Delaware | | 26-1274283 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Homewood Suites Franchise LLC | | Delaware | | 26-1094183 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Homewood Suites Management LLC | | Delaware | | 26-1101306 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hotels Statler Company, Inc. | | Delaware | | 36-2550119 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HPP Hotels USA, Inc. | | Delaware | | 95-4214076 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HRC Islander LLC | | Delaware | | 61-1647041 | | 7011 | | 6355 Metrowest Blvd., Suite 180 Orlando, FL 32835 Telephone: (407) 722-3100 |

HTGV, LLC | | Delaware | | 75-2970804 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Innvision, LLC | | Delaware | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

Lockwood Palmer House, LLC | | Delaware | | 58-2669075 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

MeriTex, LLC | | Delaware | | 13-3977538 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Potter’s Bar Palmer House, LLC | | Delaware | | 58-2669080 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Hotel Services, Inc. | | Delaware | | 62-1602738 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Hotels Florida LLC | | Delaware | | 62-1602737 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Hotels LLC | | Delaware | | 62-1602678 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Hotels Minneapolis, Inc. | | Delaware | | 62-1619978 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Hotels Parent LLC | | Delaware | | 95-4766449 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus Operating LLC | | Delaware | | 62-1596939 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Promus/Kingston Development Corporation | | Delaware | | 62-1763505 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Samantha Hotel LLC | | Delaware | | 04-3070970 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Suite Life LLC | | Delaware | | 75-2123392 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Tex Holdings, Inc. | | Delaware | | 94-3400909 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

WA Collection International, LLC | | Delaware | | 95-4198421 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Waldorf Astoria Franchise LLC | | Delaware | | 26-1093977 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Waldorf=Astoria Management LLC | | Delaware | | 26-1101088 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Florida Conrad International Corp. | | Florida | | 20-1145249 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton-OCCC Hotel, LLC | | Florida | | 01-0697005 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton-OCCC Mezz Lender, LLC | | Florida | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Suites Club No. 1, Inc. | | Kansas | | 75-1947366 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hotel Clubs of Corporate Woods, Inc. | | Kansas | | 48-0930357 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Suites Club No. Three, Inc. | | Louisiana | | 62-1584888 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S.

Employer

Identification

Number | | Primary

Standard

Industrial

Classification

Code Number | | Address, Including Zip Code,

and Telephone Number,

Including Area Code, of

Registrant Guarantor’s

Principal Executive Offices |

International Rivercenter Lessee, L.L.C. | | Louisiana | | 20-0384946 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

DTM Cambridge, Inc. | | Massachusetts | | 86-0678310 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Chesterfield Village Hotel, LLC | | Missouri | | 36-4207568 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Bally’s Grand Property Sub I, LLC | | Nevada | | 88-0312339 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad International (Belgium) LLC | | Nevada | | 91-1930238 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad International (Egypt) Resorts Corporation | | Nevada | | 46-0468464 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad International (Indonesia) Corporation | | Nevada | | 95-4347974 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Conrad International Investment (Jakarta) Corporation | | Nevada | | 93-1221397 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Grand Vacations Management, LLC | | Nevada | | 58-2361323 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Holdings, LLC | | Nevada | | 88-0096156 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Hospitality, LLC | | Nevada | | 93-1218323 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Hilton Illinois, LLC | | Nevada | | 88-0345656 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

HPP International Corporation | | Nevada | | 95-4198421 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Peacock Alley Service Company, LLC | | New York | | 20-3470602 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Washington Hilton, L.L.C. | | New York | | 36-2058176 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Memphis Corporation | | Tennessee | | 62-1523545 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

Embassy Suites Club No. Two, Inc. | | Texas | | 75-1946866 | | 7011 | | 7930 Jones Branch Drive, Suite 1100 McLean, Virginia 22102 Telephone: (703) 883-1000 |

| | | | | | | | |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 11, 2014

PRELIMINARY PROSPECTUS

HILTON WORLDWIDE FINANCE LLC

HILTON WORLDWIDE FINANCE CORP.

Offer to Exchange (the “exchange offer”)

$1,500,000,000 aggregate principal amount of 5.625% Senior Notes due 2021 (the “exchange notes”), which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all outstanding unregistered 5.625% Senior Notes due 2021 (the “outstanding notes” and, together with the exchange notes, the “notes”).

The exchange notes will be joint and several obligations of Hilton Worldwide Finance LLC and Hilton Worldwide Finance Corp. fully and unconditionally guaranteed on a joint and several senior unsecured basis by our immediate parent company, Hilton Worldwide Holdings Inc., and each of our wholly owned domestic restricted subsidiaries that guarantee any of our indebtedness under our senior secured credit facilities and the outstanding notes.

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered outstanding notes for freely tradable exchange notes that have been registered under the Securities Act.

The Exchange Offer

| • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | | The exchange offer expires at 5:00 p.m., New York City time, on , 2014, which is the 21st business day after the date of this prospectus, unless extended. We do not currently intend to extend the expiration date. |

| • | | The exchange of the outstanding notes for the exchange notes in the exchange offer will not constitute a taxable event for U.S. federal income tax purposes. |

| • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Results of the Exchange Offer

| • | | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

You should carefully consider the “Risk Factors” beginning on page 23 of this prospectus before participating in the exchange offer.

Each broker dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired as a result of market making activities or other trading activities.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. This prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the federal securities laws. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under “Risk Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this prospectus. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

TRADEMARKS AND SERVICE MARKS

Hilton Hotels & Resorts™, Waldorf Astoria Hotels & Resorts™, Conrad Hotels & Resorts®, Curio-A Collection by Hilton™, DoubleTree by Hilton®, Embassy Suites Hotels®, Hilton Garden Inn®, Hampton Inn®, Homewood Suites by Hilton®, Home2 Suites by Hilton®, Hilton Grand Vacations®, Hilton Grand Vacations

i

Club®, The Hilton Club®, Hilton HHonors®, eforea®, OnQ®, LightStay®, the Hilton Hawaiian Village®, Requests Upon Arrival™ and other trademarks, trade names and service marks of Hilton and our brands appearing in this prospectus are the property of Hilton and our affiliates.

Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are without the® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. All trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners.

INDUSTRY AND MARKET DATA

Within this prospectus, we reference information and statistics regarding various industries and sectors. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Smith Travel Research (“STR”) and PKF Hospitality Research, LLC (“PKF-HR”) are the primary sources for third-party market data and industry statistics and forecasts, respectively, included in this prospectus. STR does not guarantee the performance of any company about which it collects and provides data. Nothing in the STR or PKF-HR data should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and independent sources. We believe that these external sources and estimates are reliable, but have not independently verified them.

BASIS OF PRESENTATION

Except where otherwise indicated, financial information included in this prospectus is of Hilton Worldwide Holdings Inc. (“Holdings”) and its subsidiaries on a consolidated basis. Holdings has no independent operations and has no assets other than its ownership of 100 percent of the equity interests in Hilton Worldwide Finance LLC, one of the Issuers of the notes. As a result, the financial information included in this prospectus with respect to Holdings is substantially the same as the financial information of the Issuers. Most of our owned U.S. hotels are operated through subsidiaries of the Issuers that are designated as “unrestricted subsidiaries” of the Issuers pursuant to the indenture governing the notes. We have provided certain financial data that distinguishes between the operations of the issuer and its restricted subsidiaries, which we sometimes refer to as our “restricted group” and the operations of these unrestricted subsidiaries.

“Holdings” refers to Hilton Worldwide Holdings Inc., a Delaware corporation that is the parent entity of the Issuers and the parent guarantor of the notes. “Issuer” refers to Hilton Worldwide Finance LLC, exclusive of its subsidiaries. “Issuers” refers to Hilton Worldwide Finance LLC and Hilton Worldwide Finance Corp., the issuers of the notes, and not Holdings or any of their respective subsidiaries. Except where the context requires otherwise, references in this prospectus to “Hilton,” “Hilton Worldwide,” “the Company,” “we,” “us,” and “our” refer to Holdings, together with its consolidated subsidiaries, including the Issuers.

“PropCo” or “Unrestricted U.S. Real Estate Subsidiaries” refers to the entity or entities which, as of June 30, 2014, held the following owned hotels in the U.S. (or holding the capital stock of entities owning such hotels): (i) Pointe Hilton Squaw Peak Resort (Phoenix, AZ); (ii) DoubleTree Hotel San Jose (San Jose, CA); (iii) Hilton Garden Inn LAX/El Segundo (El Segundo, CA); (iv) Hilton San Francisco Union Square (San Francisco, CA); (v) Embassy Suites Washington D.C. (Washington, D.C.); (vi) Hilton Miami Airport (Miami, FL); (vii) Hilton Orlando Lake Buena Vista (Orlando, FL); (viii) Hilton Atlanta Airport (Atlanta, GA); (ix) Hilton Hawaiian Village Beach Resort & Spa (Honolulu, HI); (x) Hilton Waikoloa Village (Waikoloa, HI); (xi) Hilton Chicago (Chicago, IL); (xii) Hilton Garden Inn Chicago/Oak Brook (Oakbrook Terrace, IL); (xiii) Hilton Suites Chicago/Oak Brook (Oakbrook Terrace, IL); (xiv) Hilton New Orleans Airport (Kenner, LA); (xv) Hilton New Orleans

ii

Riverside (New Orleans, LA); (xvi) Hilton Boston Logan Airport (Boston, MA); (xvii) Hilton Short Hills (Short Hills, NJ); (xviii) Hilton New York (New York, NY); (xix) The Waldorf Astoria New York (New York, NY); (xx) Caribe Hilton (San Juan, PR); (xxi) Hampton Inn & Suites Memphis—Shady Grove (Memphis, TN); (xxii) DoubleTree Hotel Crystal City—National Airport (Arlington, VA); (xxiii) Hilton McLean Tysons Corner (McLean, VA); and (xxiv) Hilton Seattle Airport & Conference Center (Seattle, WA).

“Timeshare Entities” refers to our wholly owned U.S. restricted subsidiaries that are prohibited from providing guarantees of the notes as a result of the agreements governing our revolving non-recourse timeshare notes credit facility and/or our notes backed by timeshare financing receivables.

Except where the context requires otherwise, references to our “properties,” “hotels” and “rooms” refer to the hotels, resorts and timeshare properties managed, franchised, owned or leased by us. Of these hotels, resorts and rooms, a portion are directly owned or leased by us or joint ventures in which we have an interest and the remaining hotels, resorts and rooms are owned by our third-party owners.

Investment funds associated with or designated by The Blackstone Group L.P. and their affiliates, our current majority owners, are referred to herein as “Blackstone” or “our Sponsor” and Blackstone, together with the other owners of Hilton Worldwide Holdings Inc. prior to our December 2013 initial public offering (“IPO”), are collectively referred to as our “pre-IPO owners.”

Reference to “ADR” or “Average Daily Rate” means hotel room revenue divided by total number of rooms sold in a given period and “RevPAR” or “Revenue per Available Room” represents hotel room revenue divided by room nights available to guests for a given period. References to “RevPAR index” measure a hotel’s relative share of its segment’s Revenue per Available Room. For example, if a subject hotel’s RevPAR is $50 and the RevPAR of its competitive set is $50, the subject hotel would have no RevPAR index premium. If the subject hotel’s RevPAR totaled $60, its RevPAR index premium would be 20 percent, which indicates that the subject hotel has outperformed other hotels in its competitive set. References to “global RevPAR index premium” means the average RevPAR index premium of our comparable hotels (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business and Financial Metrics Used by Management—Comparable Hotels” on page 63, but excluding hotels that do not receive competitive set information from STR, or do not participate with STR). The owner or manager of each Hilton comparable hotel exercises its discretion in identifying the competitive set of properties for such hotel, considering factors such as physical proximity, competition for similar customers, product features, services and amenities, quality and average daily rate, as well as STR rules regarding competitive set makeup. Accordingly, while the hotel brands included in the competitive set for any given Hilton comparable hotel depend heavily on market-specific conditions, the competitive sets for Hilton comparable hotels frequently include properties branded with the competing brands identified for the relevant Hilton comparable hotel listed under “Selected Competitors” on page 101. STR provides us with the relevant data for competitive sets that we submit for each of our comparable hotels, which we utilize to compute the RevPAR index for our comparable hotels.

iii

PROSPECTUS SUMMARY

This summary highlights information appearing elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the information set forth under the heading “Risk Factors” and our consolidated financial statements before participating in the exchange offer.

Hilton Worldwide

Hilton Worldwide is one of the largest and fastest growing hospitality companies in the world, with 4,202 hotels, resorts and timeshare properties comprising 693,980 rooms in 93 countries and territories. In the nearly 100 years since our founding, we have defined the hospitality industry and established a portfolio of 11 world-class brands. Our flagship full-service Hilton Hotels & Resorts brand is the most recognized hotel brand in the world. Our premier brand portfolio also includes our luxury hotel brands, Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts, our full-service hotel brands, Curio—A Collection by Hilton, DoubleTree by Hilton and Embassy Suites Hotels, our focused-service hotel brands, Hilton Garden Inn, Hampton Hotels, Homewood Suites by Hilton and Home2 Suites by Hilton and our timeshare brand, Hilton Grand Vacations. We own or lease interests in 152 hotels, many of which are located in global gateway cities, including iconic properties such as The Waldorf Astoria New York, the Hilton Hawaiian Village and the London Hilton on Park Lane. More than 155,000 employees proudly serve in our properties and corporate offices around the world, and we have approximately 42 million members in our award-winning customer loyalty program, Hilton HHonors.

We operate our business through three segments: (1) management and franchise; (2) ownership; and (3) timeshare. These complementary business segments enable us to capitalize on our strong brands, global market presence and significant operational scale. Through our management and franchise segment, which consists of 4,050 properties with 633,150 rooms, we manage hotels, resorts and timeshare properties owned by third parties and we license our brands to franchisees. Our ownership segment consists of 152 hotels with 60,830 rooms that we own or lease. Through our timeshare segment, which consists of 44 properties comprising 6,758 units, we market and sell timeshare intervals, operate timeshare resorts and a timeshare membership club and provide consumer financing.

Our competitive strengths, together with execution of our strategies and strong fundamentals in the global lodging industry, have contributed to our strong top- and bottom-line operating performance in recent periods and continued industry-leading unit growth.

| | • | | Our system-wide comparable RevPAR increased 5.2 percent on a currency neutral basis for the year ended December 31, 2013 compared to the year ended December 31, 2012 and increased 6.6 percent on a currency neutral basis for the six months ended June 30, 2014 compared to the six months ended June 30, 2013. |

| | • | | Adjusted EBITDA increased 13 percent for the year ended December 31, 2013 compared to the year ended December 31, 2012 and increased 15 percent for the six months ended June 30, 2014 compared to the six months ended June 30, 2013. |

| | • | | Net income attributable to Hilton stockholders and earnings per share each increased 18 percent for the year ended December 31, 2013 compared to the year ended December 31, 2012 and increased 76 percent and 70 percent, respectively, for the six months ended June 30, 2014 compared to the six months ended June 30, 2013. |

| | • | | Our capital light management and franchise segment experienced increases in Adjusted EBITDA of eight percent and 15 percent, respectively, for the year ended December 31, 2013 and the six months ended June 30, 2014 compared to the prior periods; and our capital light timeshare segment |

1

| | experienced increases in Adjusted EBITDA of 18 percent and 29 percent, respectively, for the year ended December 31, 2013 and the six months ended June 30, 2014 compared to the prior periods. |

| | • | | We have reduced our long-term debt by $2.1 billion through voluntary prepayments from December 12, 2013, the date of our IPO, through September 10, 2014. |

| | • | | We opened 34,000 new rooms during the year ended December 31, 2013, and increased the number of rooms in our system by over 25,000 rooms on a net basis, growing the number of rooms in our management and franchise segment in excess of four percent. During the six months ended June 30, 2014, we opened an additional 17,000 rooms and achieved net unit growth of over 15,000 rooms. |

| | • | | We approved 72,000 new rooms for development during the year ended December 31, 2013 and another 36,000 new rooms during the six months ended June 30, 2014. |

| | • | | Our industry-leading pipeline has grown at an average of 12 percent for each of the last three years and includes 1,230 hotels, consisting of approximately 210,000 rooms as of June 30, 2014, of which more than half, or 117,000 rooms, were located outside of the United States. All of the rooms in our pipeline are within our capital light management and franchise segment. |

| | • | | As of June 30, 2014, we had over 106,000 rooms under construction, representing the largest number of rooms under construction in the industry in every major region of the world based on STR data, as illustrated by the table below: |

| | | | | | | | |

| | | Hilton Worldwide Rooms

Under Construction | |

Market | | % of Total | | | Industry Rank | |

Americas | | | 20.4 | % | | | #1 | |

Europe | | | 19.7 | % | | | #1 | |

Middle East and Africa | | | 21.6 | % | | | #1 | |

Asia Pacific | | | 15.0 | % | | | #1 | |

Global | | | 17.9 | % | | | #1 | |

Source: STR Global New Development Pipeline (June 2014).

We expect that our #1 share of worldwide rooms under construction will allow us to continue to expand our share of worldwide rooms supply and build on our leading market position.

See “—Summary Historical Financial Data” for the definition of Adjusted EBITDA and a reconciliation of net income attributable to Hilton stockholders to Adjusted EBITDA.

Our Competitive Strengths

We believe the following competitive strengths provide the foundation for our position as a leading global hospitality company.

| | • | | World-Class Hospitality Brands. Our globally recognized, world-class brands have defined the hospitality industry. Our flagship Hilton Hotels & Resorts brand often serves as an introduction to our wider range of brands, including those in the luxury segment, upper midscale segment and everything in between, that are designed to accommodate any customer’s needs anywhere in the world. Our brands have achieved an average global RevPAR index premium of 15 percent for the twelve months ended June 30, 2014, based on STR data. This means that our brands achieve on average 15 percent more revenue per room than competitive properties in similar markets. The demonstrated strength of our brands makes us a preferred partner for hotel owners. |

2

| | • | | Leading Global Presence and Scale. We are one of the largest hospitality companies in the world with 4,202 properties and 693,980 rooms in 93 countries and territories. We have hotels in key gateway cities such as New York City, London, Dubai, Johannesburg, Tokyo, Shanghai and Sydney and 360 hotels located at or near airports around the world. Our global presence allows us to serve our loyal customers throughout the world and to introduce our award-winning brands to customers in new markets. These world-class brands facilitate system growth by providing hotel owners with a variety of options to address each market’s specific needs. In addition, the diversity of our operations reduces our exposure to business cycles, individual market disruptions and other risks. Our robust commercial services platform allows us to take advantage of our scale to more effectively deliver products and services that drive customer preference and enhance commercial performance on a global basis. |

| | • | | Large and Growing Loyal Customer Base. Serving our customers is our first priority. By continually adapting to customer preferences and providing our customers with superior experiences, we have improved our overall customer satisfaction ratings since 2007. We earned 34 first place awards in the J.D. Power North America Guest Satisfaction rankings since 1999, more than any multi-brand lodging company. Our hotels accommodated more than 133 million customer visits during the twelve months ended June 30, 2014, with members of our Hilton HHonors loyalty program contributing approximately 50 percent of the 175 million resulting room nights. Hilton HHonors unites all our brands, encourages customer loyalty and allows us to provide tailored promotions, messaging and customer experiences. Membership in our Hilton HHonors program continues to increase, and as of June 30, 2014, there were approximately 42 million Hilton HHonors members, an 11 percent increase from June 30, 2013. |

| | • | | Significant Embedded Growth. All of our segments are expected to grow through improvement in same-store performance driven by strong anticipated industry fundamentals. PKF-HR predicts that lodging industry RevPAR in the U.S., where 76 percent of our system rooms are located, will grow 8.2 percent in 2014 and 6.7 percent in 2015. Our management and franchise segment also is expected to grow through new room additions, as upon completion, our industry-leading development pipeline would result in a 30 percent increase in our room count with minimal capital investment from us. In addition, our franchise revenues should grow over time as franchise agreements renew at our published license rates, which are higher than our current effective rates. For the six months ended June 30, 2014, our weighted average effective license rate across our brands was 4.6 percent of room revenue and our weighted average published license rate was 5.4 percent as of June 30, 2014. We also expect our incentive management fees, which are linked to hotel profitability measures, to increase as a result of the expected improvements in industry fundamentals and new unit growth. In our ownership segment, we believe we will benefit from strong growth in bottom-line earnings as industry fundamentals continue to improve as a result of this segment’s operating leverage, and our large hotels with significant meeting space should benefit from recent improvements in group demand, which we expect will exhibit strong growth as the current stage of the lodging cycle advances. Finally, our timeshare business has nearly five years of projected interval supply at our current sales pace in the form of existing owned inventory and executed capital light projects, which should enable us to continue to grow our earnings from the segment with lower levels of capital investment from us. |

| | • | | Strong Cash Flow Generation. We generate significant cash flow from operating activities with an increasing percentage from our growing capital light management and franchise and timeshare segments. During the three-year period ended December 31, 2013, we generated an aggregate of $4.4 billion in cash flow from operating activities. Over this same period, we reduced our total indebtedness by $4.8 billion and during the six months ended June 30, 2014, we further reduced our long-term debt by $450 million through voluntary prepayments. Additionally, in July 2014, we made a $150 million voluntary prepayment to further reduce our long-term debt. We believe that our focus on cash flow generation, the relatively low investment required to grow our management and franchise and timeshare segments, and our disciplined approach to capital allocation position us to maximize opportunities for profitability and growth while continuing to reduce our indebtedness over time. |

3

| | • | | Iconic Hotels with Significant Underlying Real Estate Value. Our diverse global portfolio of owned and leased hotels includes a number of renowned properties in key gateway cities such as New York City, London, San Francisco, Chicago, São Paolo, Sydney and Tokyo. The portfolio also includes iconic hotels with significant embedded asset value, including: The Waldorf Astoria New York, a landmark luxury hotel with 1,413 rooms encompassing an entire city block in the heart of midtown Manhattan near Grand Central Terminal; the Hilton Hawaiian Village, a full-service beach resort with 2,860 rooms that sits on approximately 22 oceanfront acres along Waikiki Beach on the island of Oahu; and the London Hilton on Park Lane, a 453-room hotel overlooking Hyde Park in the exclusive Mayfair district of London. Our ten owned hotels with the highest Adjusted EBITDA contributed 56 percent of our ownership segment’s Adjusted EBITDA during the year ended December 31, 2013, which highlights the quality of our key flagship properties. In addition, we believe the iconic nature of many of these properties creates significant value for our entire system of properties by reinforcing the world-class nature of our brands. We continually focus on increasing the value and enhancing the market position of our owned and leased hotels and, over time, we believe we can unlock significant incremental value through opportunistically exiting assets or executing on adaptive reuse plans for all or a portion of certain hotels as retail, residential or timeshare uses. An example of this is the recent sale of a previously non-income producing parcel of land at the Hilton Hawaiian Village that had previously been used as a loading dock, along with corresponding entitlements, to a third party in connection with a planned timeshare development project that will not require any capital investment by us. Further, we have plans at the Hilton New York to redevelop the hotel’s retail platform to include over 10,000 square feet of street-level retail space, as well as to convert certain floors to timeshare units, which we expect will increase the value of the property. |

| | • | | Market-Leading and Innovative Timeshare Platform. Our timeshare business complements our other segments and provides an alternative hospitality product that serves an attractive customer base. Our timeshare customers are among our most loyal hotel customers, with estimated spend in our hotel system increasing approximately 40 percent after the purchase of their timeshare interests. Historically, we have concentrated our timeshare efforts in four key markets: Florida, Hawaii, New York City and Las Vegas, which has helped us to increase annual sales of timeshare intervals while yielding strong profit margins during a time when our competitors generally experienced declines in both sales and profit margins. As a result of this strong operating performance and the returns we were able to drive on our own timeshare developments, we began a transformation of our timeshare business to a capital light model in which third-party timeshare owners and developers provide capital for development while we act as sales and marketing agent and property manager. Through these transactions, we receive a sales and marketing commission and branding fees on sales of timeshare intervals, recurring fees to operate the homeowners’ associations and revenues from resort operations. We also earn recurring fees in connection with the points-based membership programs we operate that provide for exclusive exchange, leisure travel and reservation services, and through fees related to the servicing of consumer loans. We have increased the sales of intervals developed by third parties from zero in 2009 to 60 percent for the twelve months ended June 30, 2014, which has dramatically reduced the capital requirements of our timeshare segment while continuing to drive strong earnings and cash flows. |

| | • | | Performance-Driven Culture. We are an organization of people serving people, thus it is imperative that we attract and retain best-in-class talent to serve our various stakeholders. We have a performance-driven culture that begins with an intense alignment around our mission, vision, values and key strategic priorities. Our President and Chief Executive Officer, Christopher J. Nassetta, has nearly 30 years of experience in the hotel industry, previously serving as President and Chief Executive Officer of Host Hotels & Resorts, Inc., where he was named Institutional Investor’s 2007 REIT CEO of the Year. He and the balance of our executive management team have been instrumental in transforming our organization and installing a culture that develops leaders at all levels of the organization that are |

4

| | focused on delivering exceptional service to our customers every day. We rely on our over 155,000 employees to execute our strategy and continue to enhance our products and services to ensure that we remain at the forefront of performance and innovation in the lodging industry. |

Our Business and Growth Strategy

The following are key elements of our strategy to become the preeminent global hospitality company—the first choice of guests, employees and owners alike:

| | • | | Expand our Global Footprint. We intend to build on our leading position in the U.S. and expand our global footprint. In February 2006, we reacquired Hilton International Co., which had operated as a separate company since 1964, and in so doing, reacquired the international Hilton branding rights. Reuniting Hilton’s U.S. and international operations has provided us with the platform to grow our business and brands globally. As a result of the reacquisition and focus on global expansion, we currently rank number one in every major region of the world by rooms under construction, based on STR data. We aim to increase the relative contribution of our international operations by increasing the number of rooms in our system that are located outside of the U.S. As of June 30, 2014, 71 percent of our new rooms under construction are located outside of the U.S. We plan to continue to expand our global footprint by introducing the right brands with the right product positioning in targeted markets and allocating business development resources effectively to drive new unit growth in every region of the world. |

| | • | | Grow our Fee-Based Businesses. We intend to grow our higher margin, fee-based businesses. We expect to increase the contribution of our management and franchise segment, which already accounts for more than half of our aggregate segment Adjusted EBITDA, through new third-party hotel development and the conversion of existing hotels to our brands. Our industry-leading pipeline consisted of approximately 210,000 rooms as of June 30, 2014, all within our capital light management and franchise segment. Upon completion, this pipeline of new, third-party owned hotels would result in a 33 percent increase in our management and franchise segment’s room count with minimal capital investment from us. In addition, we aim to increase the average effective franchise fees we receive over time by renewing and entering into new franchise agreements at our current published franchise fee rates. |

| | • | | Continue to Increase the Capital Efficiency of our Timeshare Business. Traditionally, timeshare operators have funded 100 percent of the investment necessary to acquire land and construct timeshare properties. In 2010, we began sourcing timeshare intervals through sales and marketing agreements with third-party developers. These agreements enable us to generate fees from the sales and marketing of the timeshare intervals and club memberships and from the management of the timeshare properties without requiring us to fund acquisition and construction costs. Our supply of third-party developed timeshare intervals has increased to 88,000, or 82 percent of our total supply, as of June 30, 2014 and the percentage of sales of timeshare intervals developed by third parties has increased to 60 percent for the twelve months ended June 30, 2014. We continue to expand our capital light timeshare business through fee-for-service arrangements with third-party timeshare developers, including the sales and marketing and other timeshare related services agreement we announced in June 2014 for the development of a 37-story, 418-unit timeshare tower adjacent to the Hilton Hawaiian Village. We will continue to seek opportunities to grow our timeshare business through this capital light model. |

| | • | | Optimize the Performance of our Owned and Leased Hotels. In addition to utilizing our commercial services platform to enhance the revenue performance of our owned and leased assets, we have focused on maximizing the cost efficiency of the portfolio by implementing labor management practices and systems and reducing fixed costs to drive profitability. Through our disciplined approach to asset |

5

| | management, we have developed and executed on strategic plans for each of our hotels to enhance the market position of each property. We expect to continue to enhance the performance of our hotels by improving operating efficiencies, and believe there is an opportunity to drive further improvements in operating margins and Adjusted EBITDA. Further, at certain of our hotels, we are developing plans for the adaptive reuse of all or a portion of the property to residential, retail or timeshare uses similar to our plans for the Hilton New York. Finally, we believe we can create value over time by opportunistically exiting assets and restructuring or exiting leases. |

| | • | | Strengthen and Enhance our Brands and Commercial Services Platform. We intend to enhance our world-class brands through superior brand management by continuing to develop products and services that drive increased RevPAR premiums. We will continue to refine our luxury brands to deliver modern products and service standards that are relevant to today’s luxury traveler. We will continue to position our full-service operating model and product standards to meet evolving customer needs and drive financial results that support incremental owner investment in our hotels. In our focused-service brands, we will continue to position for growth in the U.S., and tailor our products as appropriate to meet the needs of customers and developers outside the U.S. We will continue to innovate and enhance our commercial services platform to ensure we have the most formidable sales, pricing, marketing and distribution platform in the industry to drive premium commercial performance to our entire system of hotels. We also will continue to invest in our Hilton HHonors customer loyalty program to ensure it remains relevant to our customers and drives customer loyalty and value to our hotel owners. |

Refinancing Transactions and Initial Public Offering

On October 25, 2013, we repaid in full all $13.4 billion in borrowings outstanding on such date under our senior mortgage loans and secured mezzanine loans with proceeds from: (1) our October 4, 2013 offering of the outstanding notes, the proceeds of which were released from escrow on October 25, 2013; (2) borrowings under our new senior secured credit facilities (the “Senior Secured Credit Facilities”), which initially consisted of a $7.6 billion term loan facility (the “Term Loans”) and an undrawn $1.0 billion revolving credit facility (the “Revolving Credit Facility”); (3) a $3.5 billion commercial mortgage-backed securities loan secured by 23 of our U.S. owned real estate assets (the “CMBS Loan”); and (4) a $525 million mortgage loan secured by our Waldorf Astoria New York property (the “Waldorf Astoria Loan”), together with additional borrowings under ournon-recourse timeshare financing receivables credit facility (the “Timeshare Facility”) and cash on hand. For more information, see “Description of Certain Other Indebtedness.” In addition, on October 25, 2013, Hilton Worldwide, Inc., our wholly owned subsidiary, issued a notice of redemption to holders of all of the outstanding $96 million aggregate principal amount of its 8 percent quarterly interest bonds due 2031 on November 25, 2013. The bonds were redeemed in full at a redemption price equal to 100 percent of the principal amount thereof and interest accrued and unpaid thereon, to, but not including November 25, 2013. We refer to the transactions discussed above as the “Debt Refinancing.”

On December 17, 2013, we completed our IPO in which Holdings sold 64,102,564 shares of its common stock and a selling stockholder sold 71,184,153 shares of common stock at an initial public offering price of $20.00 per share. The shares offered and sold in the offering were registered under the Securities Act pursuant to our Registration Statement on Form S-1, which was declared effective by the SEC on December 11, 2013. The common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “HLT” and began trading publicly on December 12, 2013. The offering generated net proceeds of approximately $1,243 million to us after underwriting discounts, expenses and transaction costs. We used the offering proceeds along with available cash to repay approximately $1,250 million of borrowings under the Term Loans.

6

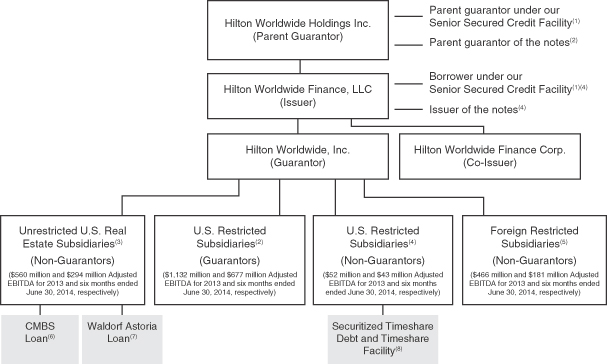

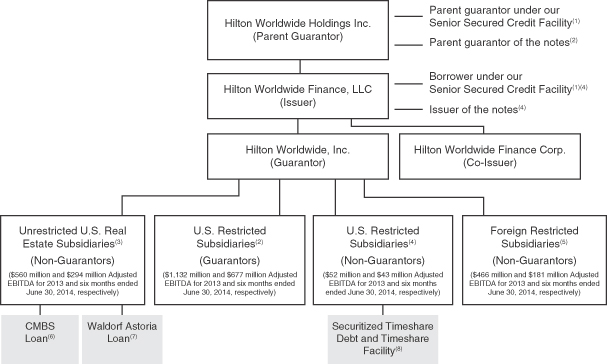

Our Structure

The following diagram illustrates our simplified organizational structure as of the date of this prospectus. This diagram is provided for illustrative purposes only and does not show all legal entities or obligations of such entities:

| (1) | Our Senior Secured Credit Facilities initially consisted of the $7.6 billion Term Loans and the $1.0 billion Revolving Credit Facility. On December 17, 2013 we repaid approximately $1.25 billion of borrowings under the Term Loans using proceeds from our IPO and available cash. Our Senior Secured Credit Facilities are secured by first priority liens on substantially all of the assets of the Issuers and guarantors of the notes, subject to certain exceptions and permitted liens. For a description of our Senior Secured Credit Facilities, see “Description of Certain Other Indebtedness—Senior Secured Credit Facilities.” |

| (2) | The notes are fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis, by Holdings and each of our existing wholly owned U.S. restricted subsidiaries that guarantee indebtedness under our Senior Secured Credit Facilities and any future wholly owned U.S. restricted subsidiaries that guarantee indebtedness under our Senior Secured Credit Facilities or other capital markets debt securities of the Issuers or any subsidiary guarantor. These guarantees are subject to release under specified circumstances. See “Description of the Notes.” |

| (3) | As of the date of this prospectus, our only unrestricted subsidiaries are our subsidiaries that constitute PropCo. For the year ended December 31, 2013, our Unrestricted U.S. Real Estate Subsidiaries represented $1,880 million or 19.3 percent of our total revenues, $186 million or 44.8 percent of net income attributable to Hilton stockholders and $560 million or 25.3 percent of our Adjusted EBITDA, and as of December 31, 2013, represented $8,649 million or 32.6 percent of our total assets and $6,496 million or 29.1 percent of our total liabilities. For the six months ended June 30, 2014, our Unrestricted U.S. Real Estate Subsidiaries represented $984 million or 19.6 percent of our total revenues, $64 million or 19.3 percent of net income attributable to Hilton stockholders and $294 million or 24.6 percent of our Adjusted EBITDA, and as of June 30, 2014, represented $8,640 million or 32.6 percent of our total assets and $6,499 million or 29.9 percent of our total liabilities. |

7

| (4) | The notes are not guaranteed by certain of our wholly owned domestic special purpose restricted subsidiaries or our non-wholly owned domestic restricted subsidiaries. |