Investor Presentation Summer 2017 Waldorf Astoria Orlando Hilton Chicago Hilton Hawaiian Village Waikiki Beach Resort Exhibit 99.1

Mission To be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy, while maintaining a strong and flexible balance sheet 2 park hotels & resorts Mission To be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy, while maintaining a strong and flexible balance sheet

Park Hotels & Resorts Overview Casa Marina, a Waldorf Astoria Resort

Preserve a strong and flexible balance sheet, with a targeted leverage ratio of 3x to 5x Maintain strong liquidity across lodging cycle and access to multiple types of financing Aspire to achieve investment grade rating Strong and Flexible Balance Sheet Continually improve property level operating performance Consistently implement revenue management initiatives to optimize market pricing / segment mix Allocate capital effectively by leveraging scale, liquidity and M&A expertise to create value throughout all phases of the lodging cycle Employ an active capital recycling program—expanding our presence in target markets with a focus on brand and operator diversification, while reducing exposure to slower growth assets/markets Target value enhancement projects with strong unlevered ROI yields Pillars of our Corporate Strategy Aggressive Asset Management Prudent Capital Allocation

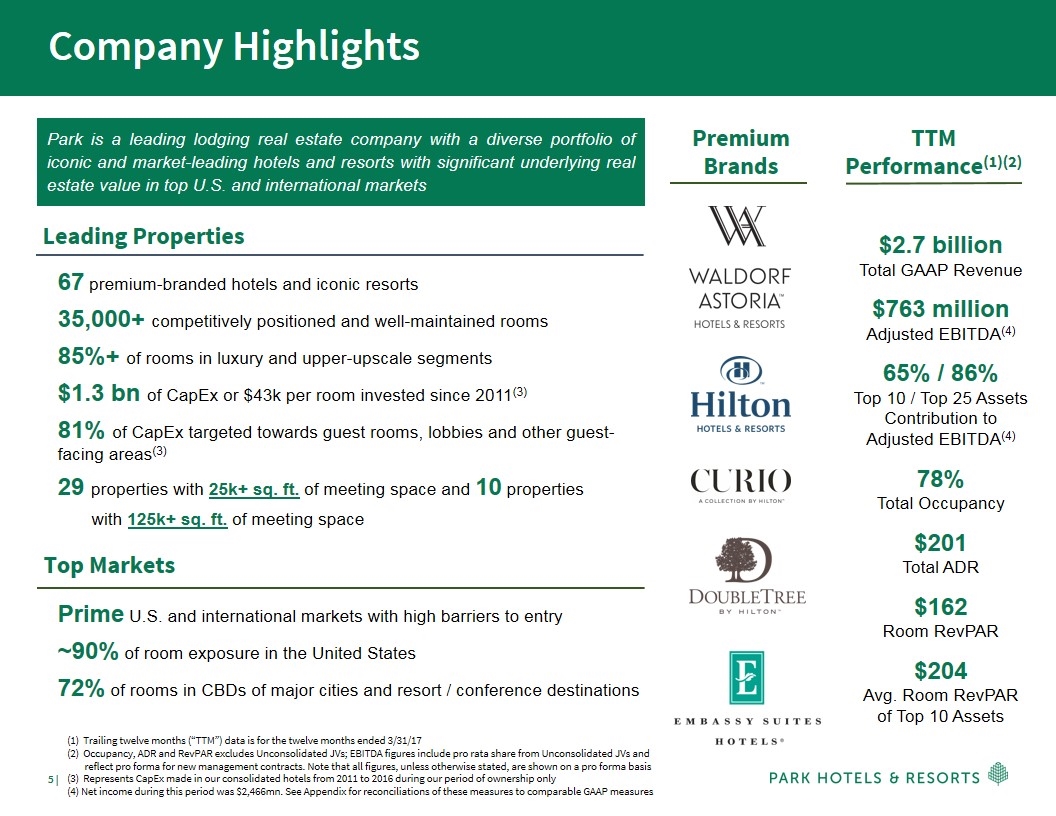

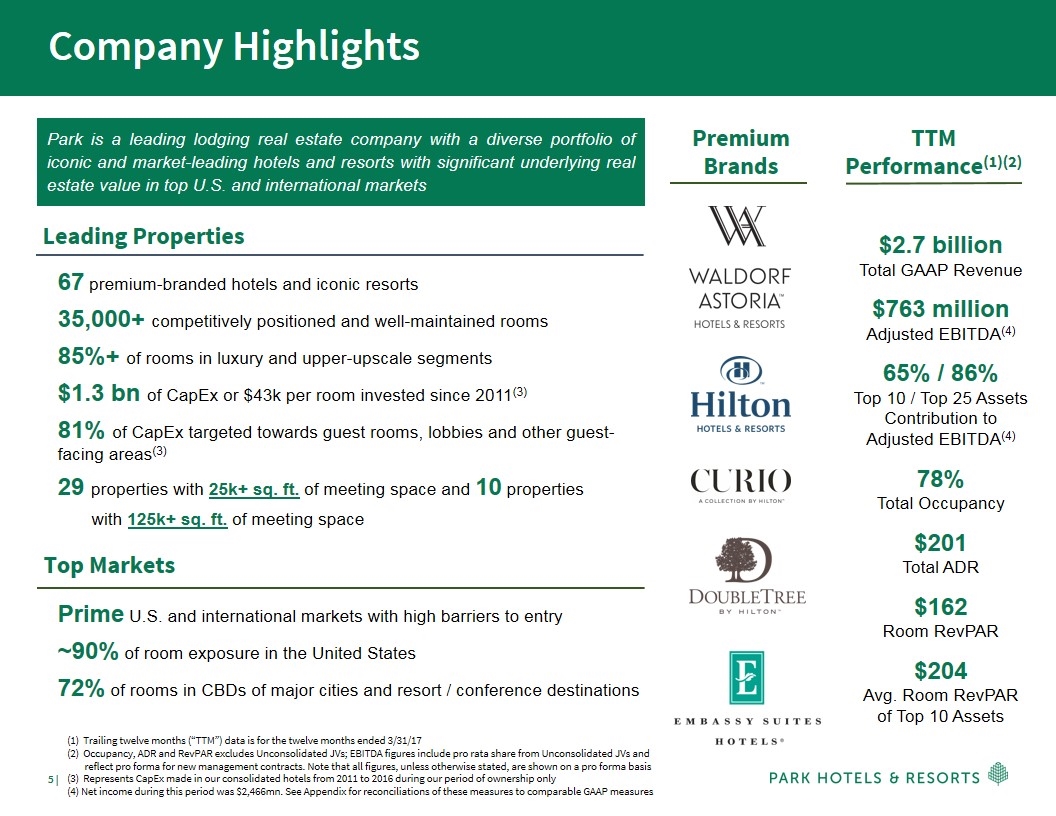

Company Highlights Park is a leading lodging real estate company with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value in top U.S. and international markets Leading Properties 67 premium-branded hotels and iconic resorts 35,000+ competitively positioned and well-maintained rooms 85%+ of rooms in luxury and upper-upscale segments $1.3 bn of CapEx or $43k per room invested since 2011(3) 81% of CapEx targeted towards guest rooms, lobbies and other guest-facing areas(3) 29 properties with 25k+ sq. ft. of meeting space and 10 properties with 125k+ sq. ft. of meeting space Top Markets Prime U.S. and international markets with high barriers to entry ~90% of room exposure in the United States 72% of rooms in CBDs of major cities and resort / conference destinations Premium Brands TTM Performance(1)(2) $2.7 billion Total GAAP Revenue $763 million Adjusted EBITDA(4) 65% / 86% Top 10 / Top 25 Assets Contribution to Adjusted EBITDA(4) 78% Total Occupancy $201 Total ADR $162 Room RevPAR $204 Avg. Room RevPAR of Top 10 Assets (1) Trailing twelve months (“TTM”) data is for the twelve months ended 3/31/17 (2) Occupancy, ADR and RevPAR excludes Unconsolidated JVs; EBITDA figures include pro rata share from Unconsolidated JVs and reflect pro forma for new management contracts. Note that all figures, unless otherwise stated, are shown on a pro forma basis (3) Represents CapEx made in our consolidated hotels from 2011 to 2016 during our period of ownership only (4) Net income during this period was $2,466mn. See Appendix for reconciliations of these measures to comparable GAAP measures

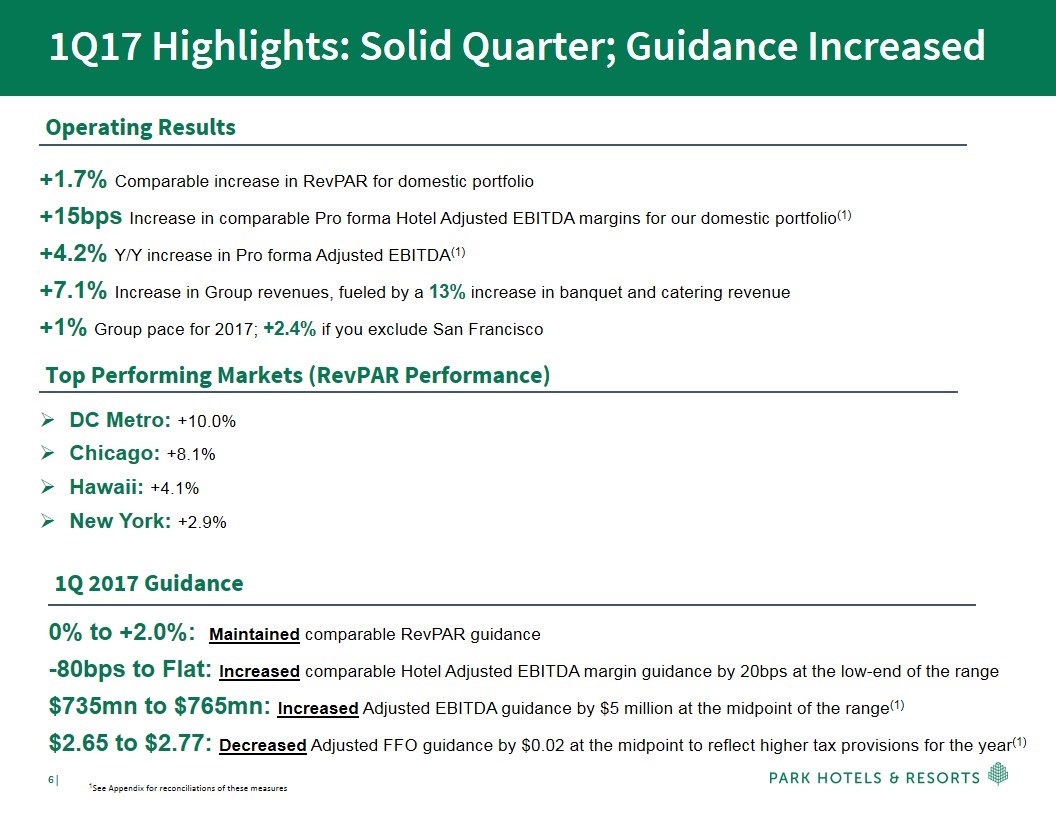

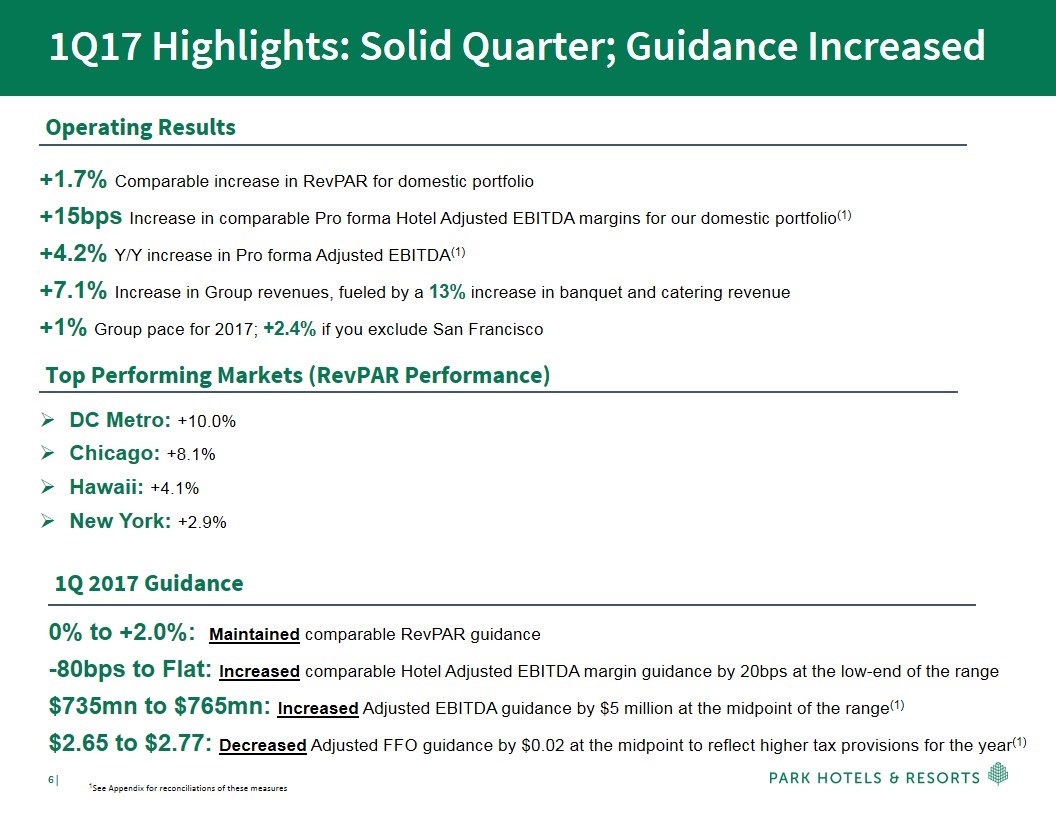

1Q17 Highlights: Solid Quarter; Guidance Increased +1.7% Comparable increase in RevPAR for domestic portfolio +15bps Increase in comparable Pro forma Hotel Adjusted EBITDA margins for our domestic portfolio(1) +4.2% Y/Y increase in Pro forma Adjusted EBITDA(1) +7.1% Increase in Group revenues, fueled by a 13% increase in banquet and catering revenue +1% Group pace for 2017; +2.4% if you exclude San Francisco Top Performing Markets (RevPAR Performance) 1Q 2017 Guidance 0% to +2.0%: Maintained comparable RevPAR guidance -80bps to Flat: Increased comparable Hotel Adjusted EBITDA margin guidance by 20bps at the low-end of the range $735mn to $765mn: Increased Adjusted EBITDA guidance by $5 million at the midpoint of the range(1) $2.65 to $2.77: Decreased Adjusted FFO guidance by $0.02 at the midpoint to reflect higher tax provisions for the year(1) DC Metro: +10.0% Chicago: +8.1% Hawaii: +4.1% New York: +2.9% Operating Results 1See Appendix for reconciliations of these measures

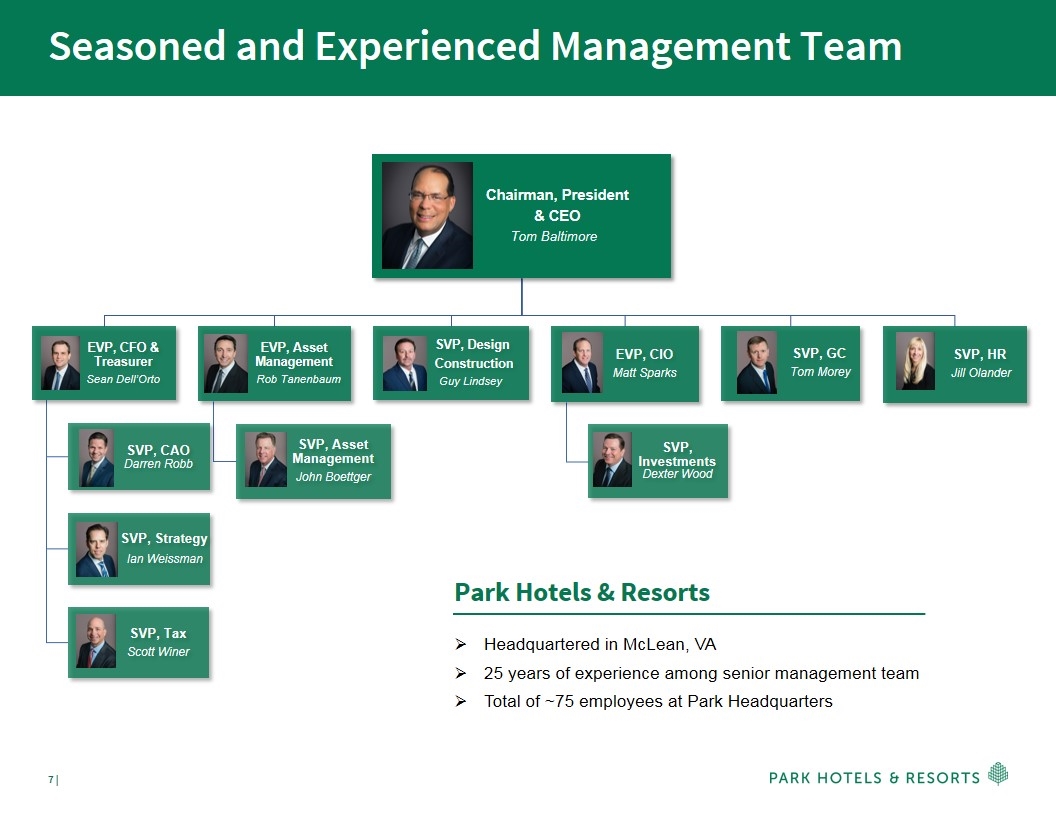

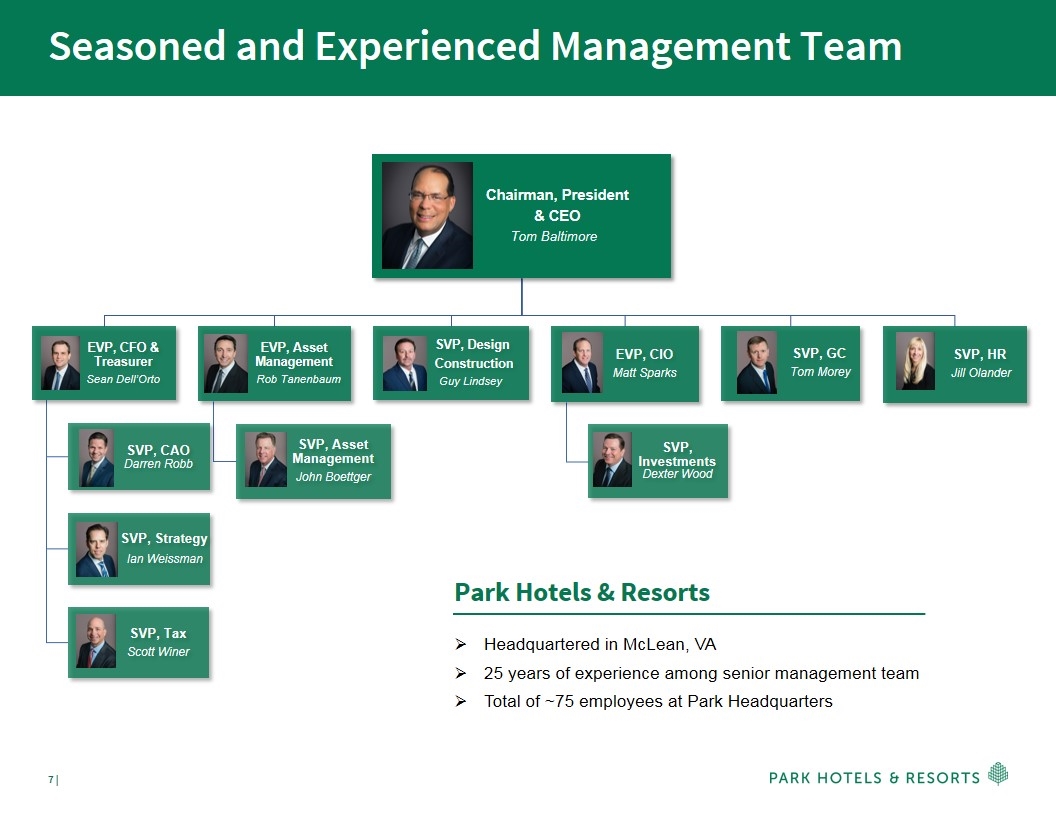

Seasoned and Experienced Management Team Headquartered in McLean, VA 25 years of experience among senior management team Total of ~75 employees at Park Headquarters Park Hotels & Resorts Chairman, President & CEO Tom Baltimore SVP, HR Jill Olander EVP, Asset Management Rob Tanenbaum EVP, CFO & Treasurer Sean Dell’Orto SVP, GC Tom Morey EVP, CIO Matt Sparks SVP, Design Construction Guy Lindsey SVP, CAO Darren Robb SVP, Strategy Ian Weissman SVP, Tax Scott Winer SVP, Asset Management John Boettger SVP, Investments Dexter Wood

Portfolio Overview Hilton San Francisco Union Square

New York Hilton Midtown 1,929 rooms (1) Hilton San Francisco Union Square 1,919 rooms Hilton Chicago 1,544 rooms Hilton New Orleans 1,622 rooms Hilton Hawaiian Village 2,860 rooms Hilton Waikoloa Village 1,244 rooms (2) Waldorf Astoria Casa Marina 311 rooms Waldorf Astoria Orlando / Hilton Orlando Bonnet Creek 1,511 rooms Hilton Short Hills 304 Rooms Hilton Boston Logan 599 rooms Hilton Miami Airport 508 rooms Hilton McLean, VA 458 rooms Diversified Exposure to Attractive Markets High Barrier to Entry Urban and Convention Hotels Landmark Resorts Select Suburban and Strategic Airport Hotels 1 As of 3/31/17; includes approximately 25 rooms that became part of Hilton Grand Vacations as part of the spin-off and that we have exclusive rights to occupy and operate through September 2017. 2 As of 3/31/17; includes approximately 600 rooms that became part of Hilton Grand Vacations as part of the spin-off and that we reserved exclusive rights to occupy and operate. On various dates until December 2019, we are required to release these rooms back to Hilton Grand Vacations for its renovation and use.

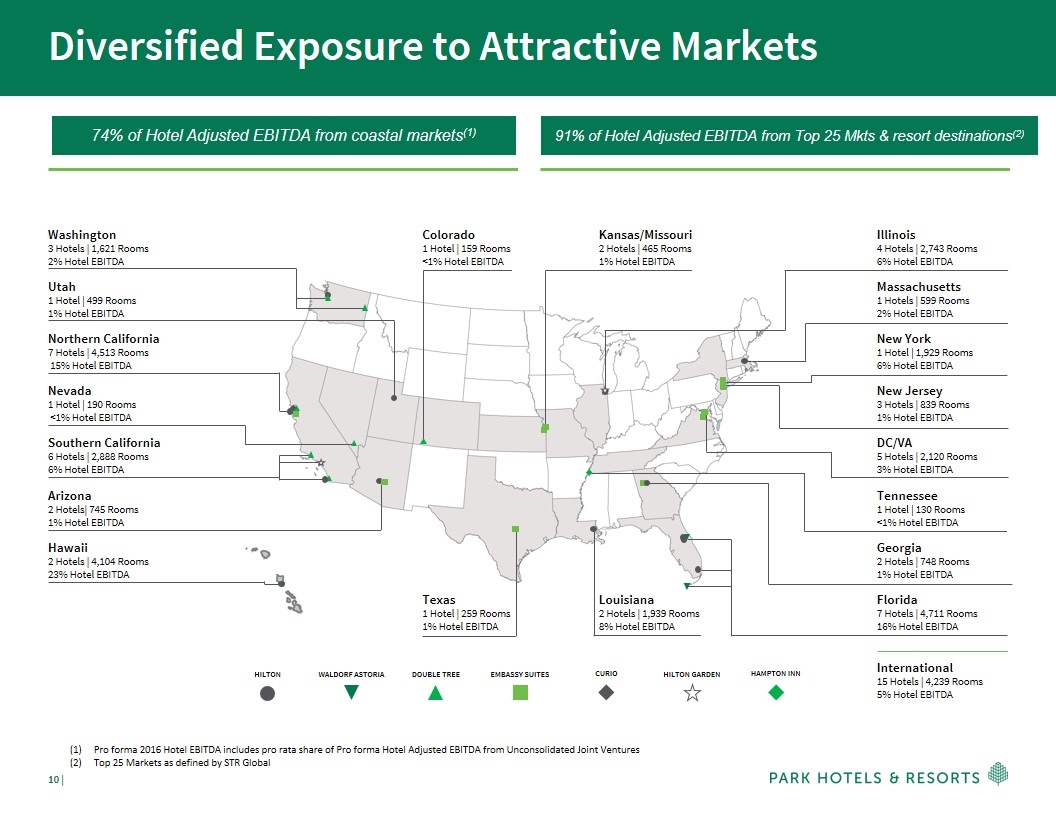

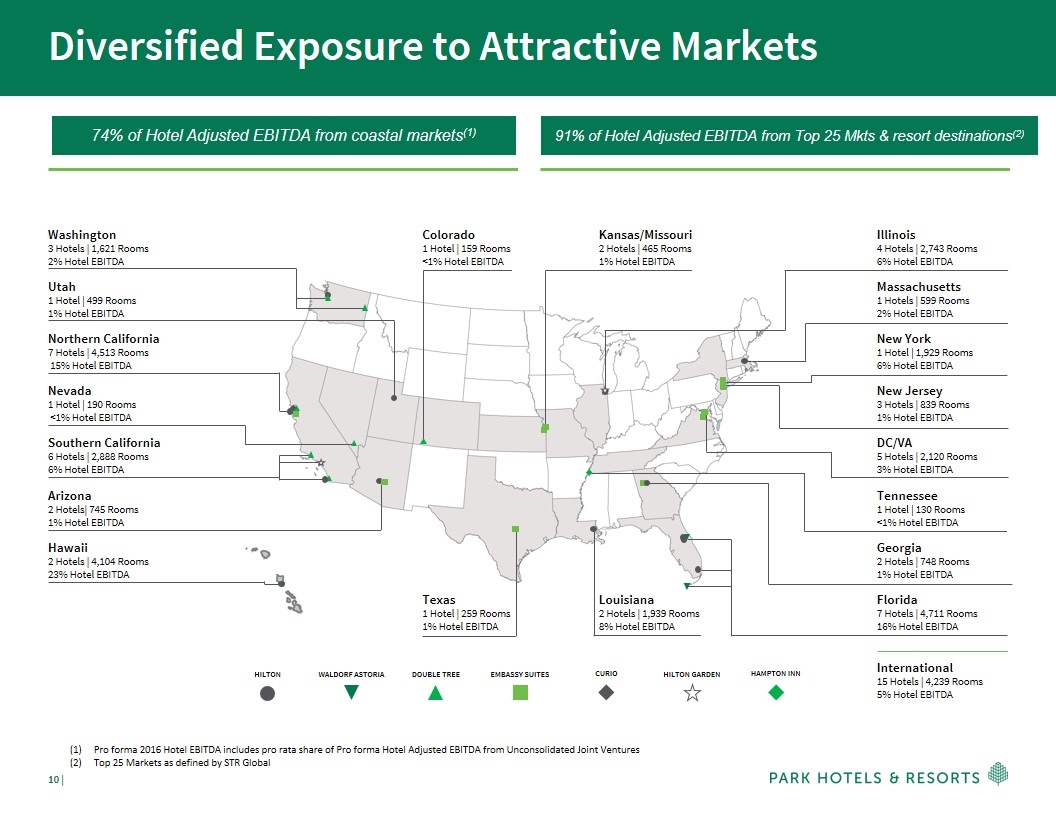

Diversified Exposure to Attractive Markets Washington 3 Hotels | 1,621 Rooms 2% Hotel EBITDA Utah 1 Hotel | 499 Rooms 1% Hotel EBITDA Northern California 7 Hotels | 4,513 Rooms 15% Hotel EBITDA Nevada 1 Hotel | 190 Rooms <1% Hotel EBITDA Southern California 6 Hotels | 2,888 Rooms 6% Hotel EBITDA Arizona 2 Hotels| 745 Rooms 1% Hotel EBITDA Hawaii 2 Hotels | 4,104 Rooms 23% Hotel EBITDA Illinois 4 Hotels | 2,743 Rooms 6% Hotel EBITDA Massachusetts 1 Hotels | 599 Rooms 2% Hotel EBITDA New York 1 Hotel | 1,929 Rooms 6% Hotel EBITDA New Jersey 3 Hotels | 839 Rooms 1% Hotel EBITDA DC/VA 5 Hotels | 2,120 Rooms 3% Hotel EBITDA Tennessee 1 Hotel | 130 Rooms <1% Hotel EBITDA Georgia 2 Hotels | 748 Rooms 1% Hotel EBITDA Colorado 1 Hotel | 159 Rooms <1% Hotel EBITDA Kansas/Missouri 2 Hotels | 465 Rooms 1% Hotel EBITDA WALDORF ASTORIA HILTON DOUBLE TREE EMBASSY SUITES CURIO HILTON GARDEN HAMPTON INN Florida 7 Hotels | 4,711 Rooms 16% Hotel EBITDA International 15 Hotels | 4,239 Rooms 5% Hotel EBITDA Texas 1 Hotel | 259 Rooms 1% Hotel EBITDA Louisiana 2 Hotels | 1,939 Rooms 8% Hotel EBITDA 74% of Hotel Adjusted EBITDA from coastal markets(1) 91% of Hotel Adjusted EBITDA from Top 25 Mkts & resort destinations(2) Pro forma 2016 Hotel EBITDA includes pro rata share of Pro forma Hotel Adjusted EBITDA from Unconsolidated Joint Ventures Top 25 Markets as defined by STR Global

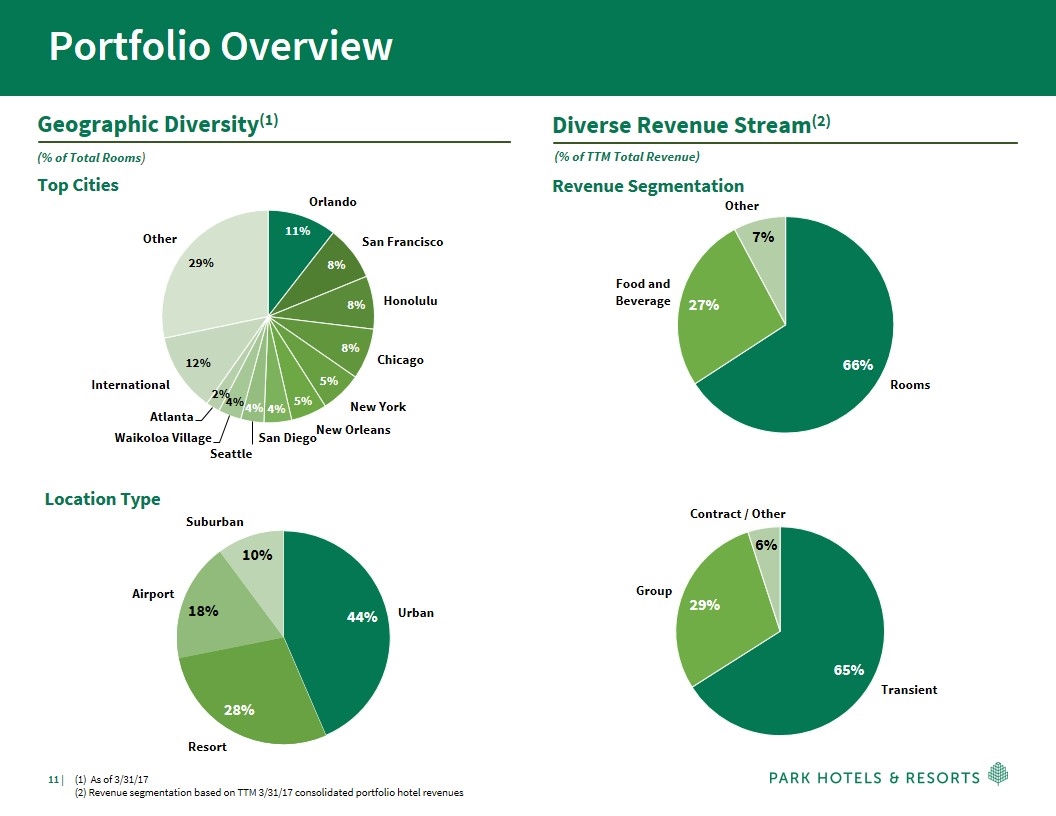

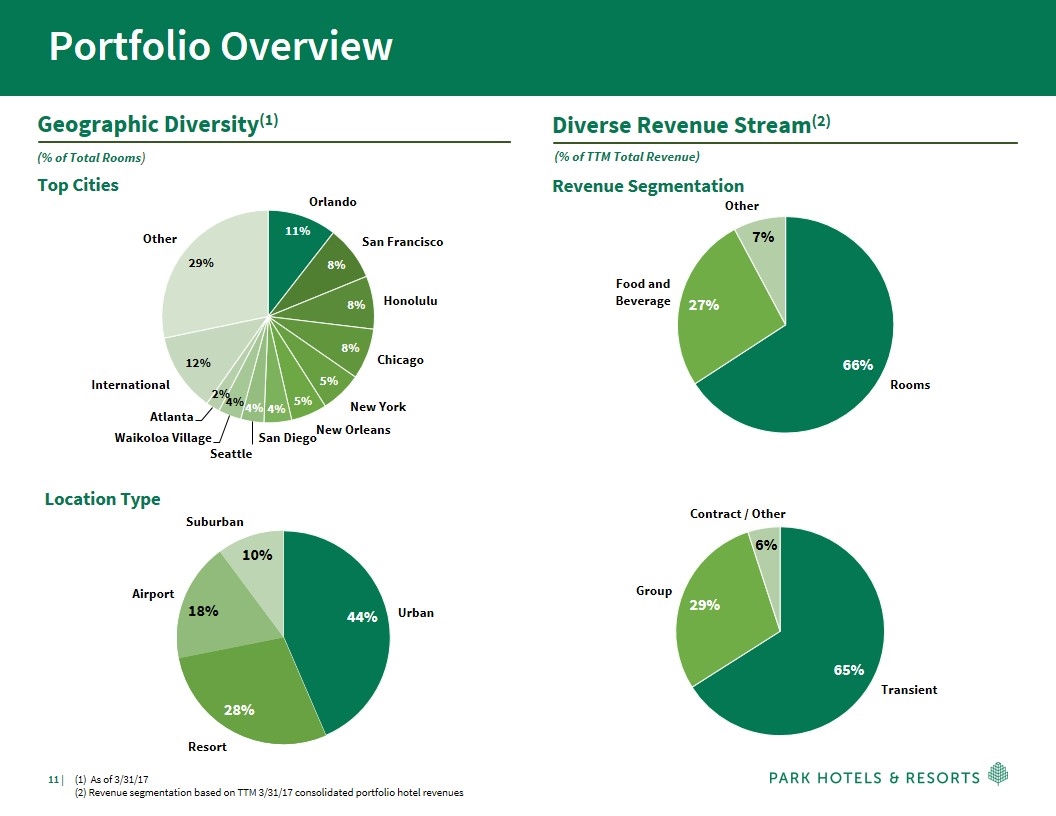

Portfolio Overview Geographic Diversity(1) (% of Total Rooms) Top Cities Location Type Diverse Revenue Stream(2) (% of TTM Total Revenue) Revenue Segmentation (1) As of 3/31/17 (2) Revenue segmentation based on TTM 3/31/17 consolidated portfolio hotel revenues

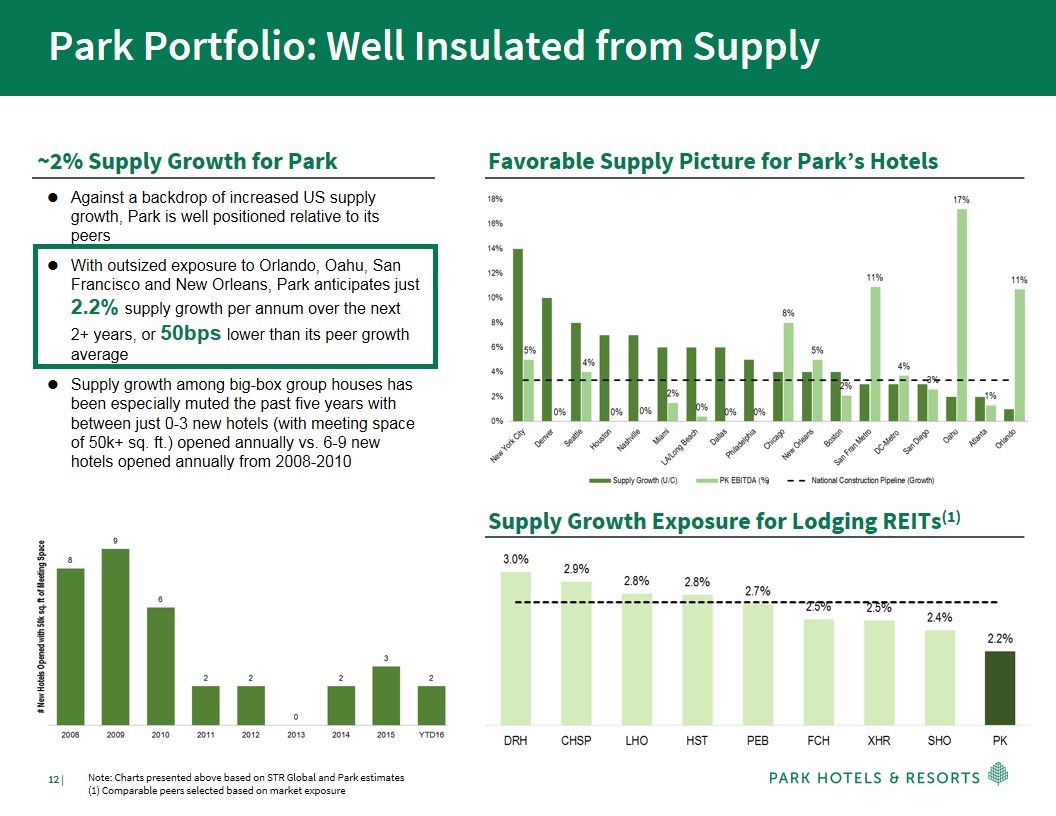

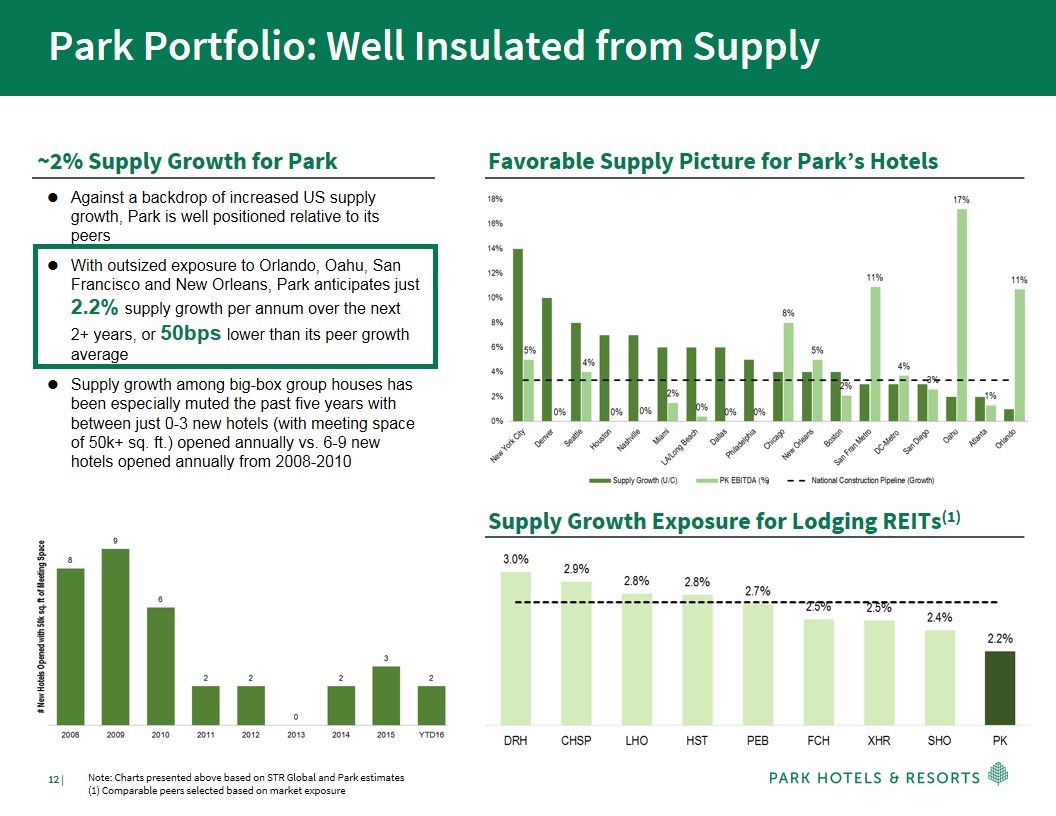

Park Portfolio: Well Insulated from Supply ~2% Supply Growth for Park Against a backdrop of increased US supply growth, Park is well positioned relative to its peers With outsized exposure to Orlando, Oahu, San Francisco and New Orleans, Park anticipates just 2.2% supply growth per annum over the next 2+ years, or 50bps lower than its peer growth average Supply growth among big-box group houses has been especially muted the past five years with between just 0-3 new hotels (with meeting space of 50k+ sq. ft.) opened annually vs. 6-9 new hotels opened annually from 2008-2010 Favorable Supply Picture for Park’s Hotels Supply Growth Exposure for Lodging REITs(1) Note: Charts presented above based on STR Global and Park estimates (1) Comparable peers selected based on market exposure

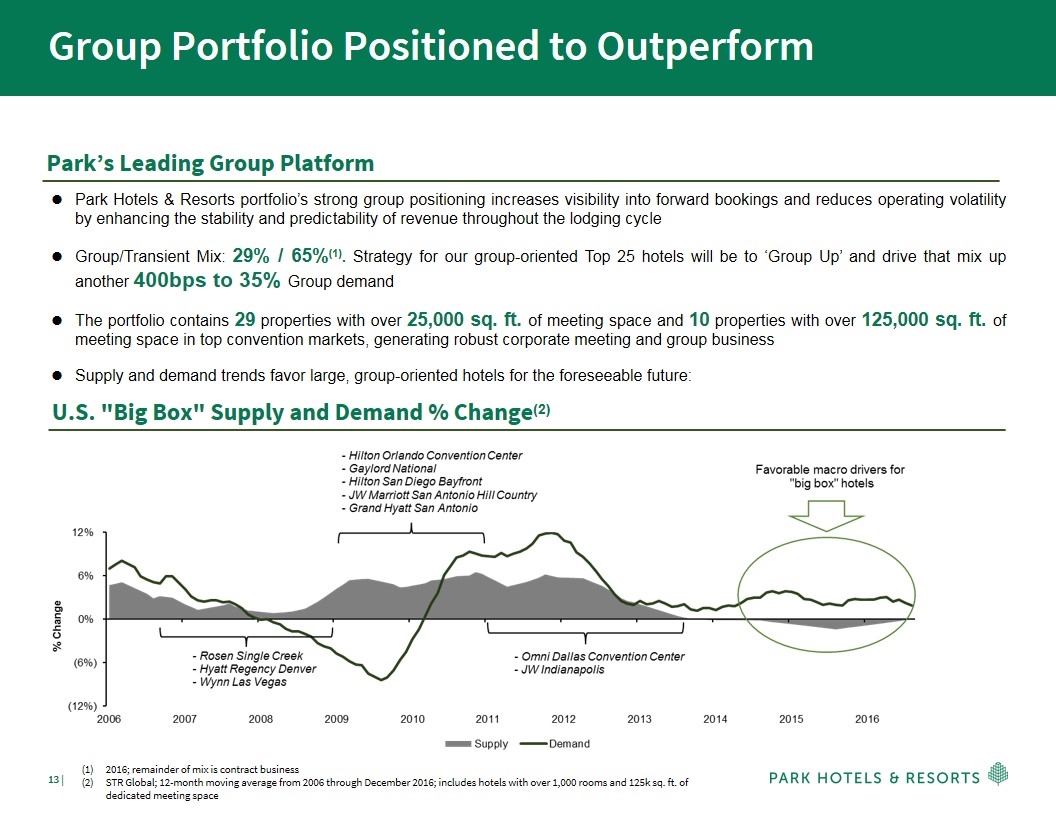

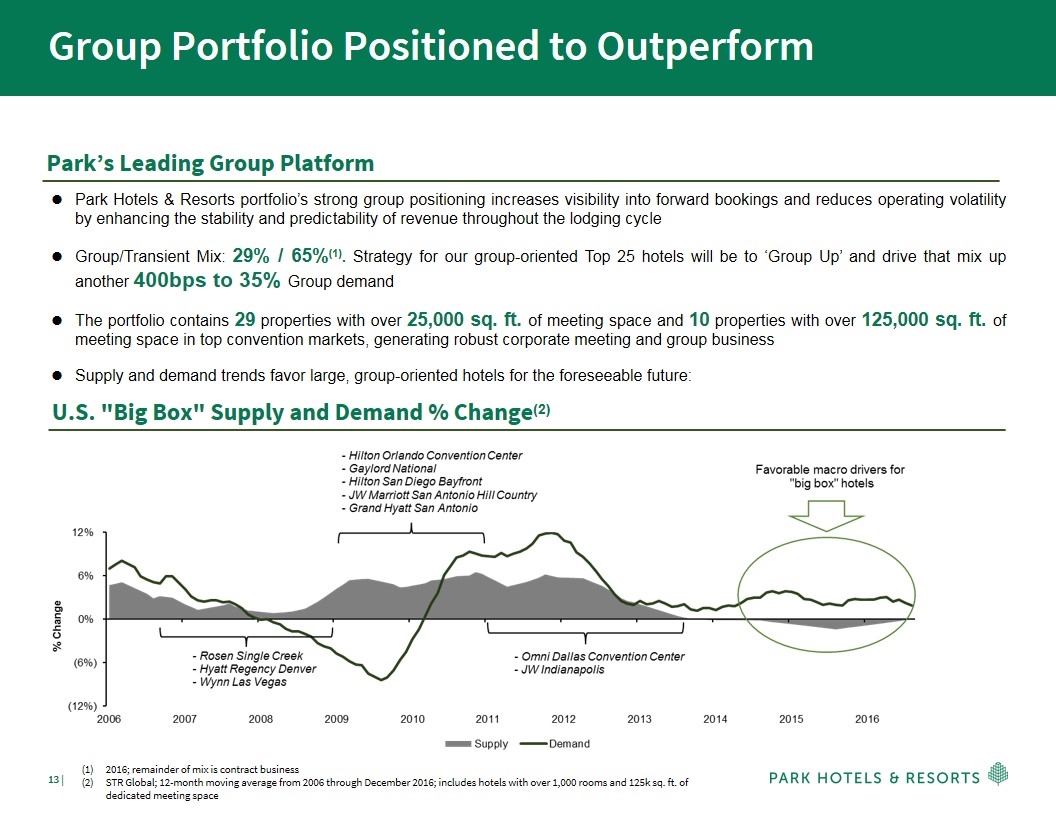

Group Portfolio Positioned to Outperform Park’s Leading Group Platform Park Hotels & Resorts portfolio’s strong group positioning increases visibility into forward bookings and reduces operating volatility by enhancing the stability and predictability of revenue throughout the lodging cycle Group/Transient Mix: 29% / 65%(1). Strategy for our group-oriented Top 25 hotels will be to ‘Group Up’ and drive that mix up another 400bps to 35% Group demand The portfolio contains 29 properties with over 25,000 sq. ft. of meeting space and 10 properties with over 125,000 sq. ft. of meeting space in top convention markets, generating robust corporate meeting and group business Supply and demand trends favor large, group-oriented hotels for the foreseeable future: U.S. "Big Box" Supply and Demand % Change(2) 2016; remainder of mix is contract business STR Global; 12-month moving average from 2006 through December 2016; includes hotels with over 1,000 rooms and 125k sq. ft. of dedicated meeting space

Investment Highlights Hilton New York Midtown

Investment Highlights 1 2 3 4 5 Size and Scale of Park Creates Competitive Advantage Significant Growth Profile: Acquisitions and ROI Opportunities Enhanced Profitability with Aggressive Asset Management Iconic Assets in Key US Cities and Geographic Diversity Strong and Flexible Balance Sheet

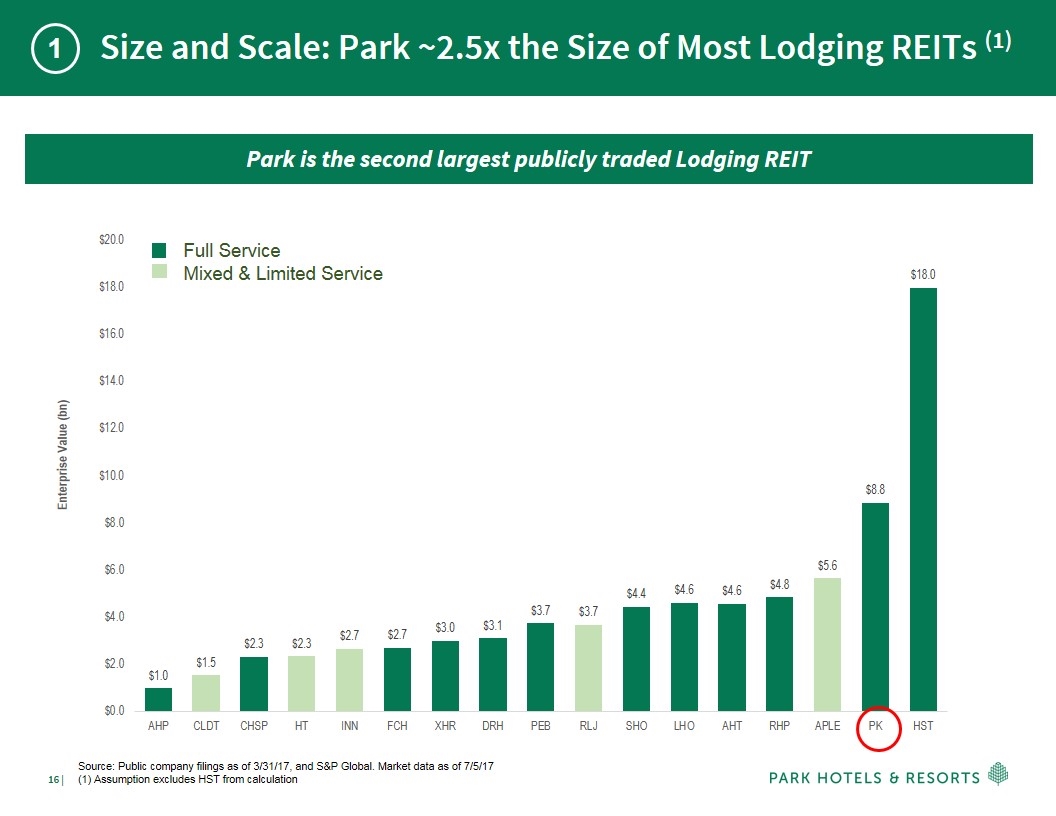

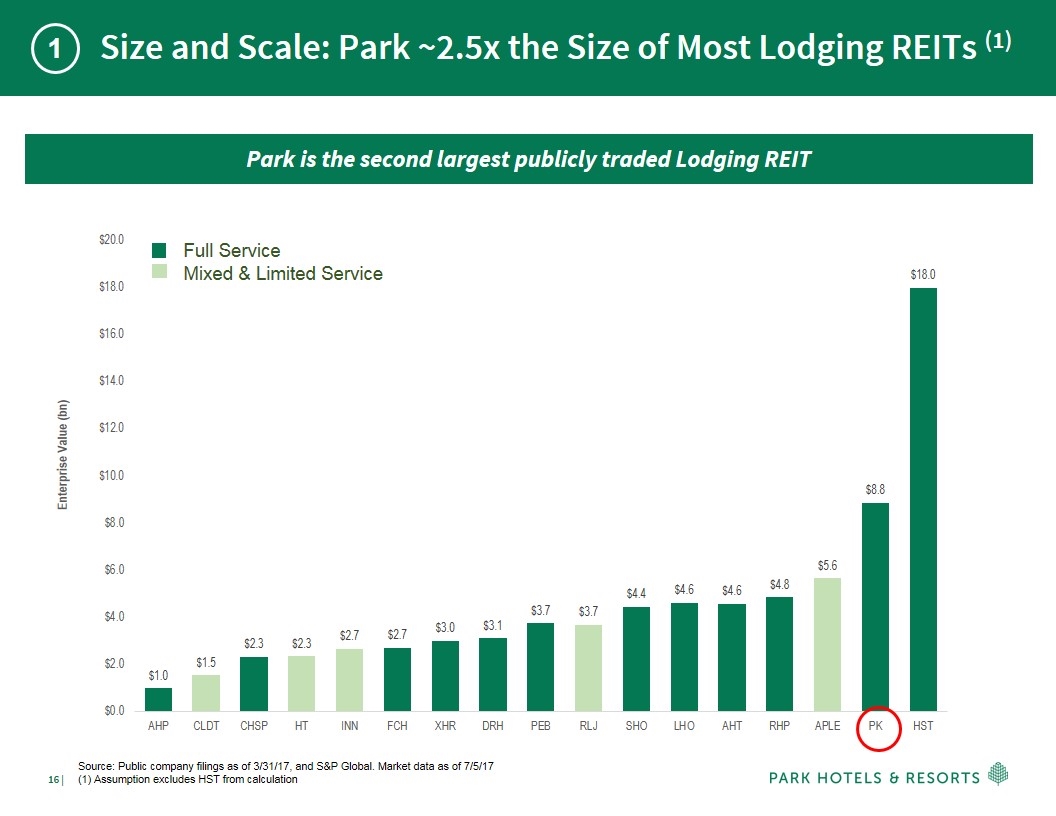

Full Service Mixed & Limited Service Park is the second largest publicly traded Lodging REIT 1 Size and Scale: Park ~2.5x the Size of Most Lodging REITs (1) Source: Public company filings as of 3/31/17, and S&P Global. Market data as of 7/5/17 (1) Assumption excludes HST from calculation

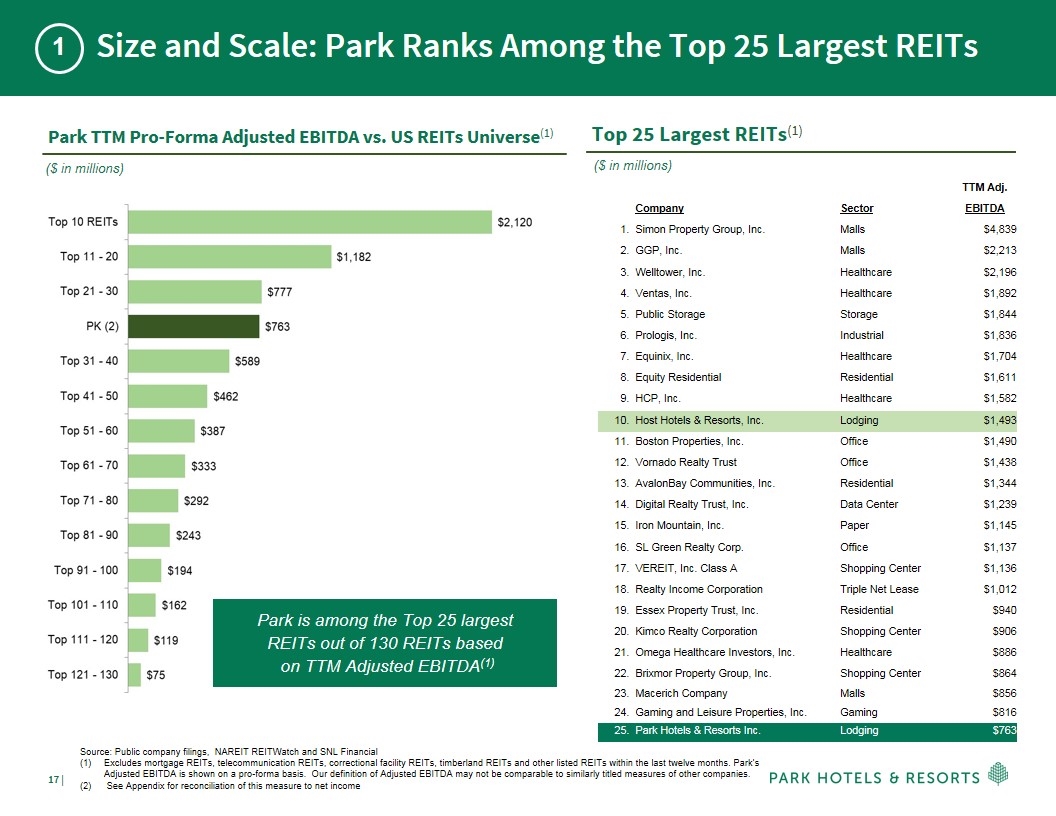

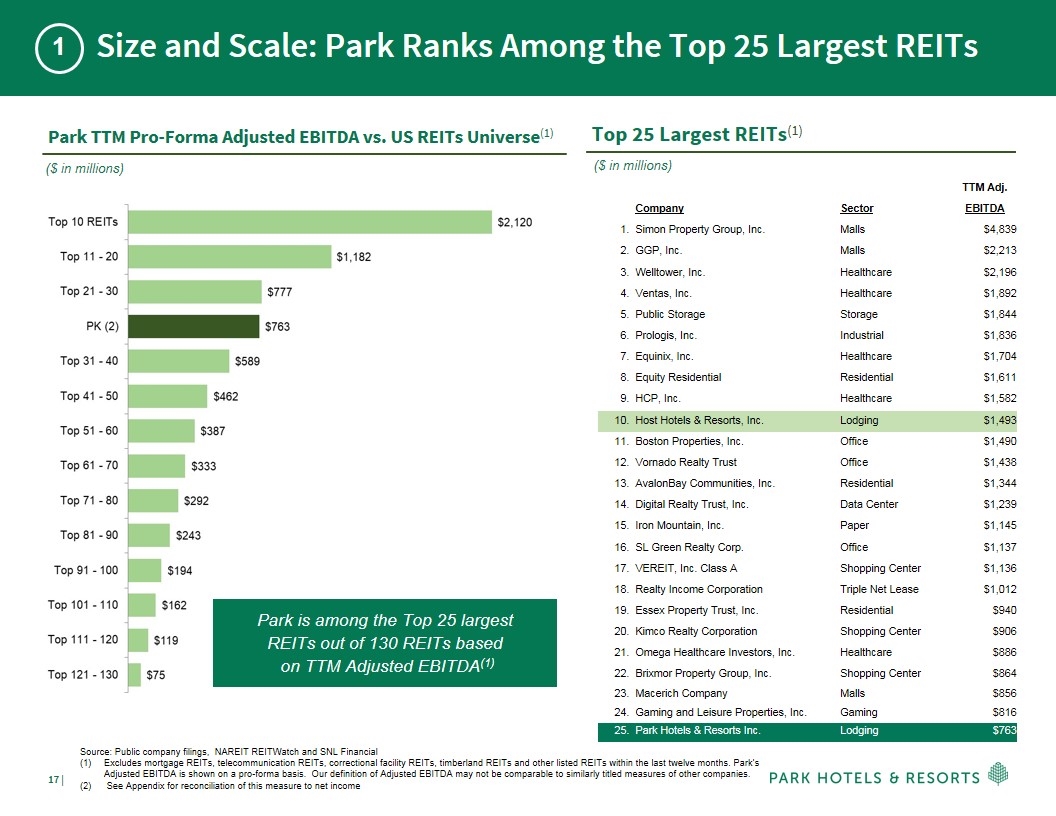

Size and Scale: Park Ranks Among the Top 25 Largest REITs Park TTM Pro-Forma Adjusted EBITDA vs. US REITs Universe(1) ($ in millions) Top 25 Largest REITs(1) ($ in millions) Park is among the Top 25 largest REITs out of 130 REITs based on TTM Adjusted EBITDA(1) 1 Source: Public company filings, NAREIT REITWatch and SNL Financial Excludes mortgage REITs, telecommunication REITs, correctional facility REITs, timberland REITs and other listed REITs within the last twelve months. Park’s Adjusted EBITDA is shown on a pro-forma basis. Our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See Appendix for reconciliation of this measure to net income TTM Adj. Company Sector EBITDA 1. Simon Property Group, Inc. Malls $4,839 2. GGP, Inc. Malls $2,213 3. Welltower, Inc. Healthcare $2,196 4. Ventas, Inc. Healthcare $1,892 5. Public Storage Storage $1,844 6. Prologis, Inc. Industrial $1,836 7. Equinix, Inc. Healthcare $1,704 8. Equity Residential Residential $1,611 9. HCP, Inc. Healthcare $1,582 10. Host Hotels & Resorts, Inc. Lodging $1,493 11. Boston Properties, Inc. Office $1,490 12. Vornado Realty Trust Office $1,438 13. AvalonBay Communities, Inc. Residential $1,344 14. Digital Realty Trust, Inc. Data Center $1,239 15. Iron Mountain, Inc. Paper $1,145 16. SL Green Realty Corp. Office $1,137 17. VEREIT, Inc. Class A Shopping Center $1,136 18. Realty Income Corporation Triple Net Lease $1,012 19. Essex Property Trust, Inc. Residential $940 20. Kimco Realty Corporation Shopping Center $906 21. Omega Healthcare Investors, Inc. Healthcare $886 22. Brixmor Property Group, Inc. Shopping Center $864 23. Macerich Company Malls $856 24. Gaming and Leisure Properties, Inc. Gaming $816 25. Park Hotels & Resorts Inc. Lodging $763

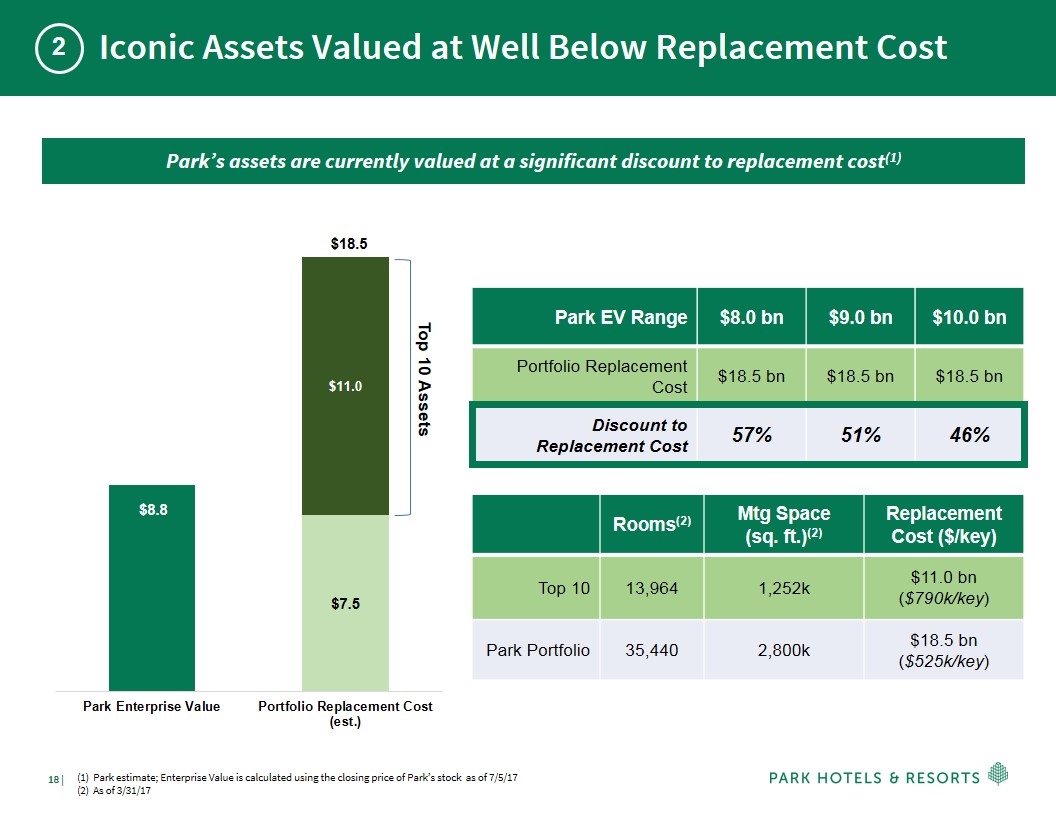

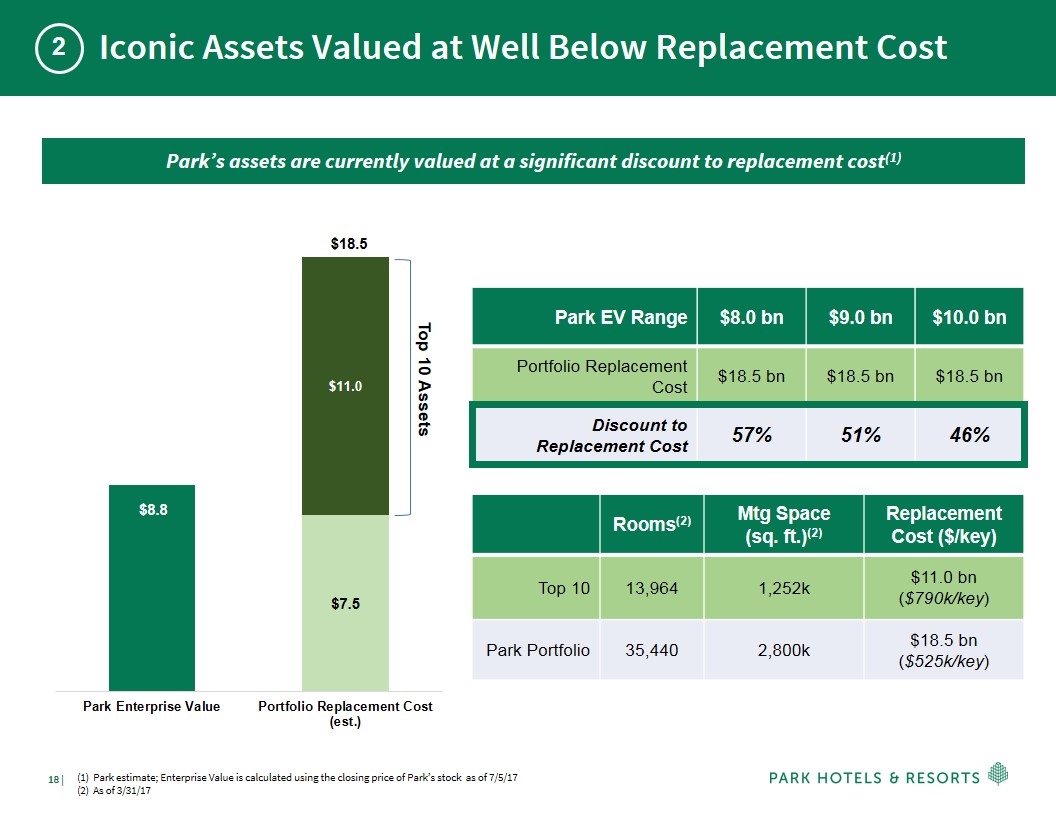

Iconic Assets Valued at Well Below Replacement Cost 2 Park’s assets are currently valued at a significant discount to replacement cost(1) Park EV Range $8.0 bn $9.0 bn $10.0 bn Portfolio Replacement Cost $18.5 bn $18.5 bn $18.5 bn Discount to Replacement Cost 57% 51% 46% Rooms(2) Mtg Space (sq. ft.)(2) Replacement Cost ($/key) Top 10 13,964 1,252k $11.0 bn ($790k/key) Park Portfolio 35,440 2,800k $18.5 bn ($525k/key) Top 10 Assets (1) Park estimate; Enterprise Value is calculated using the closing price of Park’s stock as of 7/5/17 (2) As of 3/31/17

Growth through Disciplined Allocation 3 Focus on building portfolio of Upper Upscale and Luxury branded assets in Top 25 markets and premium resort destinations Diversify brand and operator mix to include other global manager / franchisors Pursue larger scale deals (assets and portfolios) that offer significant value add opportunities Opportunistically recycle capital , selling out of slower growth, non-core assets and reinvest in higher growth markets

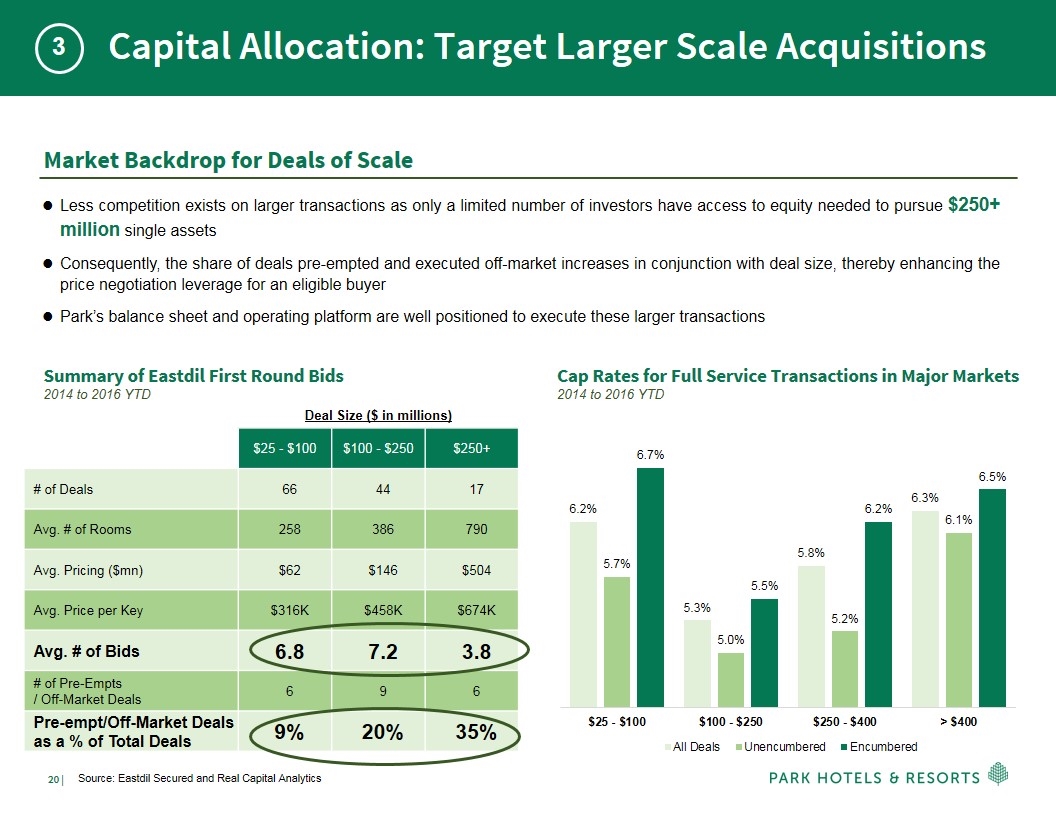

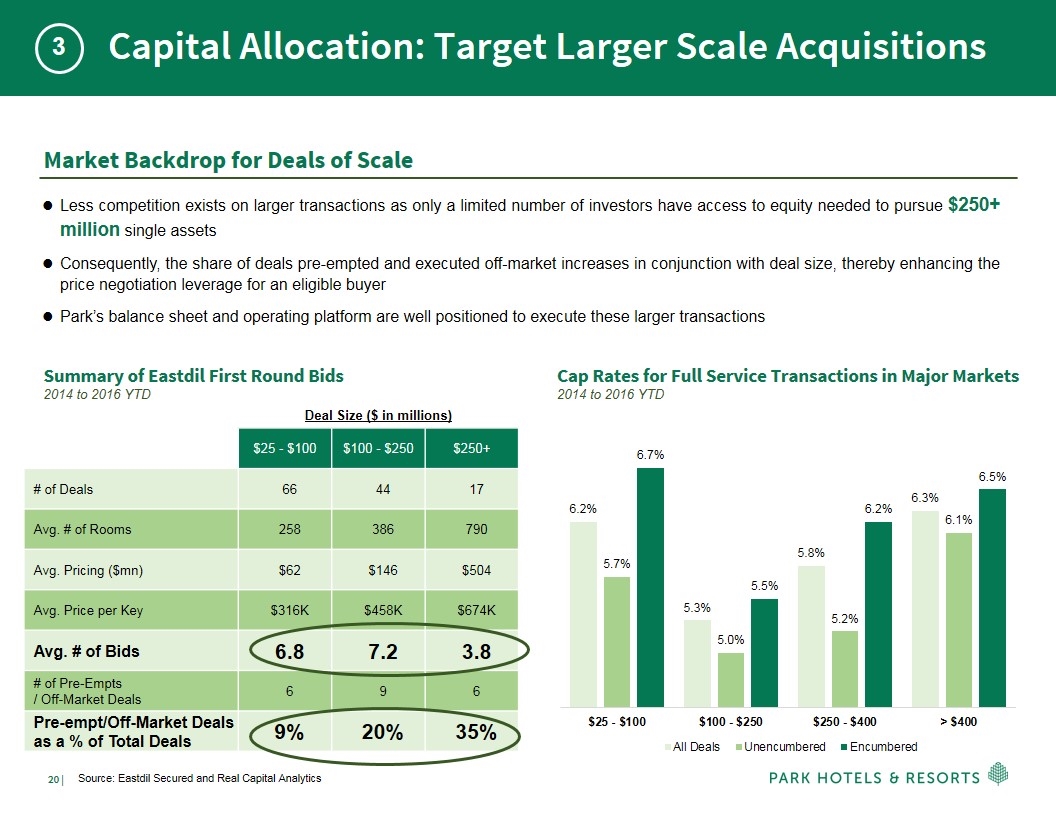

Capital Allocation: Target Larger Scale Acquisitions Market Backdrop for Deals of Scale Less competition exists on larger transactions as only a limited number of investors have access to equity needed to pursue $250+ million single assets Consequently, the share of deals pre-empted and executed off-market increases in conjunction with deal size, thereby enhancing the price negotiation leverage for an eligible buyer Park’s balance sheet and operating platform are well positioned to execute these larger transactions Summary of Eastdil First Round Bids 2014 to 2016 YTD Deal Size ($ in millions) $25 - $100 $100 - $250 $250+ # of Deals 66 44 17 Avg. # of Rooms 258 386 790 Avg. Pricing ($mn) $62 $146 $504 Avg. Price per Key $316K $458K $674K Avg. # of Bids 6.8 7.2 3.8 # of Pre-Empts / Off-Market Deals 6 9 6 Pre-empt/Off-Market Deals as a % of Total Deals 9% 20% 35% Cap Rates for Full Service Transactions in Major Markets 2014 to 2016 YTD 3 Source: Eastdil Secured and Real Capital Analytics

Brand Strategy Maximizes Revenue and Profitability Brands Matter: Park will focus on owning hotels and resorts in the luxury and upper upscale segments Benefits of Partnering with Brands Consistent quality through a branded product should allow Park to achieve higher RevPAR and margins as a result of: Recognizable product compared to independent hotels struggling to differentiate their offerings Worldwide reservation systems Loyalty programs help to drive recurring sales, while lowering new customer acquisition costs Hilton (~65mn members) and Marriott, including Starwood (~100mn members), have ~50% of sales stemming from customers within loyalty programs Ability to achieve increased direct-to-consumer sales minimizing OTA / wholesale commissions and increasing revenue to Park Significantly lower distribution costs for OTA business given negotiating power of brands More effective competition against Airbnb, particularly with respect to frequent travelers who appreciate the reliability and security of branded hotels 3 Worldwide Group Sales Strong Loyalty Programs Worldwide Reservation Systems Effective Brand Segmentation RevPAR Premiums

Asset Management Waldorf Astoria Orlando

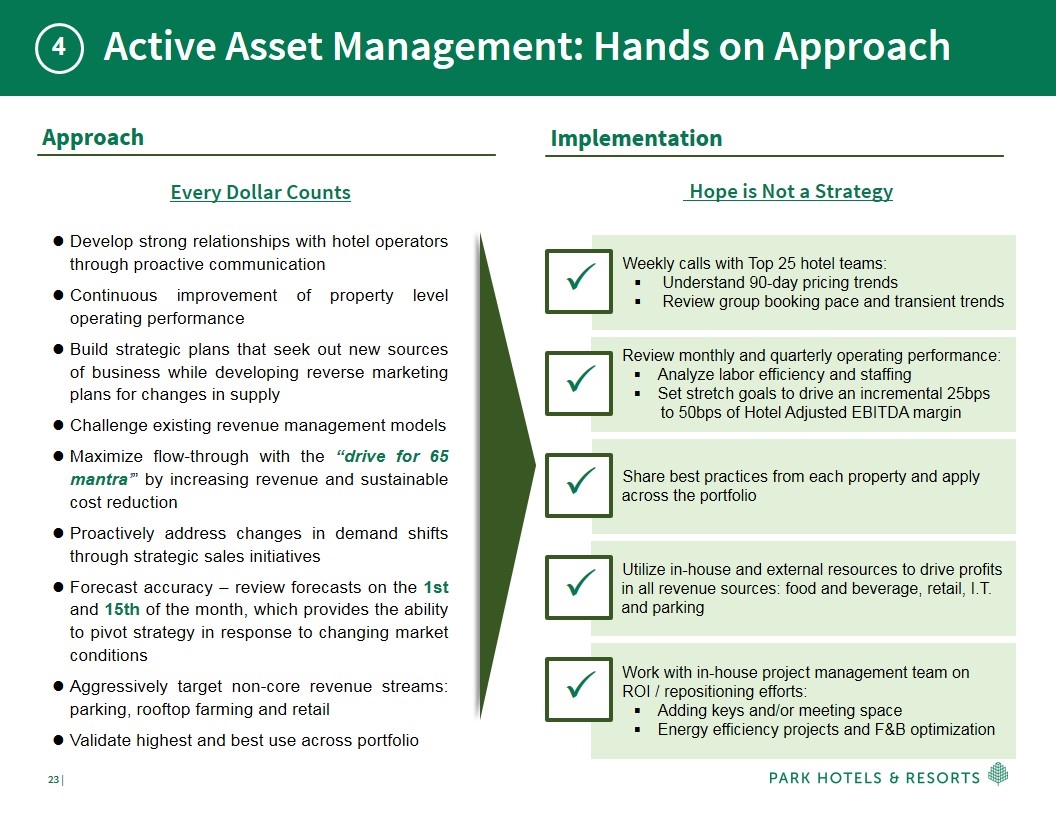

Work with in-house project management team on ROI / repositioning efforts: Adding keys and/or meeting space Energy efficiency projects and F&B optimization Utilize in-house and external resources to drive profits in all revenue sources: food and beverage, retail, I.T. and parking Share best practices from each property and apply across the portfolio Review monthly and quarterly operating performance: Analyze labor efficiency and staffing Set stretch goals to drive an incremental 25bps to 50bps of Hotel Adjusted EBITDA margin Weekly calls with Top 25 hotel teams: Understand 90-day pricing trends Review group booking pace and transient trends Active Asset Management: Hands on Approach Approach Develop strong relationships with hotel operators through proactive communication Continuous improvement of property level operating performance Build strategic plans that seek out new sources of business while developing reverse marketing plans for changes in supply Challenge existing revenue management models Maximize flow-through with the “drive for 65 mantra’” by increasing revenue and sustainable cost reduction Proactively address changes in demand shifts through strategic sales initiatives Forecast accuracy – review forecasts on the 1st and 15th of the month, which provides the ability to pivot strategy in response to changing market conditions Aggressively target non-core revenue streams: parking, rooftop farming and retail Validate highest and best use across portfolio Implementation Hope is Not a Strategy P P P P P Every Dollar Counts 4

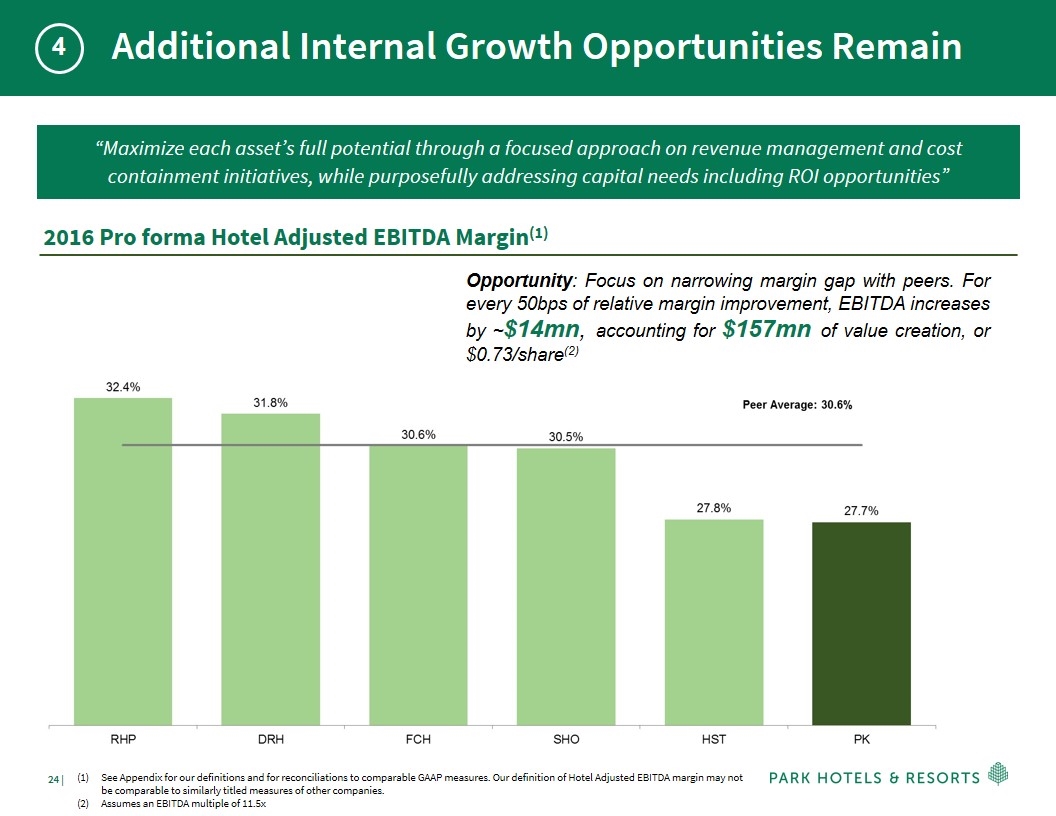

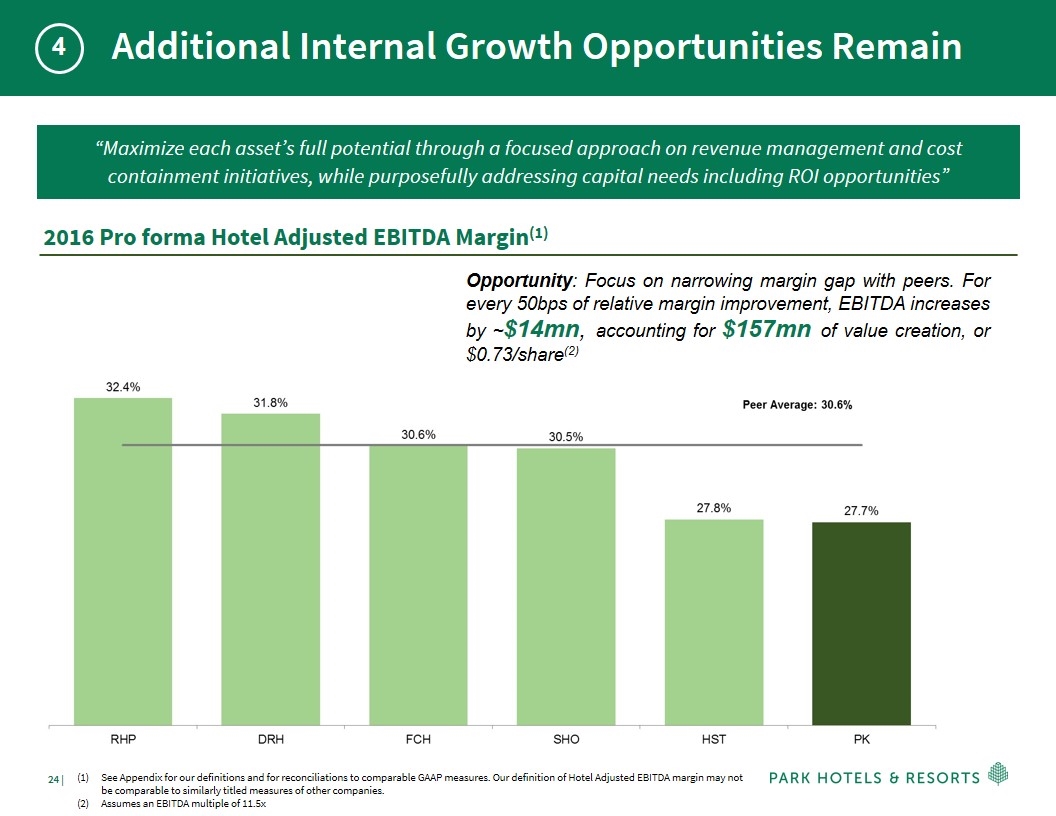

Additional Internal Growth Opportunities Remain “Maximize each asset’s full potential through a focused approach on revenue management and cost containment initiatives, while purposefully addressing capital needs including ROI opportunities” 2016 Pro forma Hotel Adjusted EBITDA Margin(1) Opportunity: Focus on narrowing margin gap with peers. For every 50bps of relative margin improvement, EBITDA increases by ~$14mn, accounting for $157mn of value creation, or $0.73/share(2) 4 See Appendix for our definitions and for reconciliations to comparable GAAP measures. Our definition of Hotel Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies. Assumes an EBITDA multiple of 11.5x

Active Asset Management: The Margin Story 4 Revenue Management Opportunities Remixing the Mix: Look to increase Group business across our Top 25 hotels 400bps to 35% over the next two years, capitalizing on Park’s expertise with large group hotels Layer in select base contract business in certain markets to reduce volatility in transient demand Institute premium room pricing at select hotels and during select periods or events Incremental Revenue Opportunities Drive for 65 mantra: push to maximize flow-through Roll out Grab ‘N Go’s at select hotels to increase daily guest spend capture and also reduce labor costs Institute menu engineering by reviewing menu offerings to maximize profitability Analyze ancillary fees and increase pricing or modify offerings Targeted Expansions Perform facilities analyses and potentially add keys and meeting space, thereby adding more profitable sources of revenue Added 12 keys at the Hilton Bonnet Creek and Waldorf Astoria Orlando complex (currently 1,511 rooms combined) Retail Opportunities Engage Park’s new Director of Retail Leasing to focus on all non-core hotel revenue streams including retail, parking, roof top antennas and car rental facilities We estimate there is 150-200bps of embedded margin growth in the portfolio to be captured over time

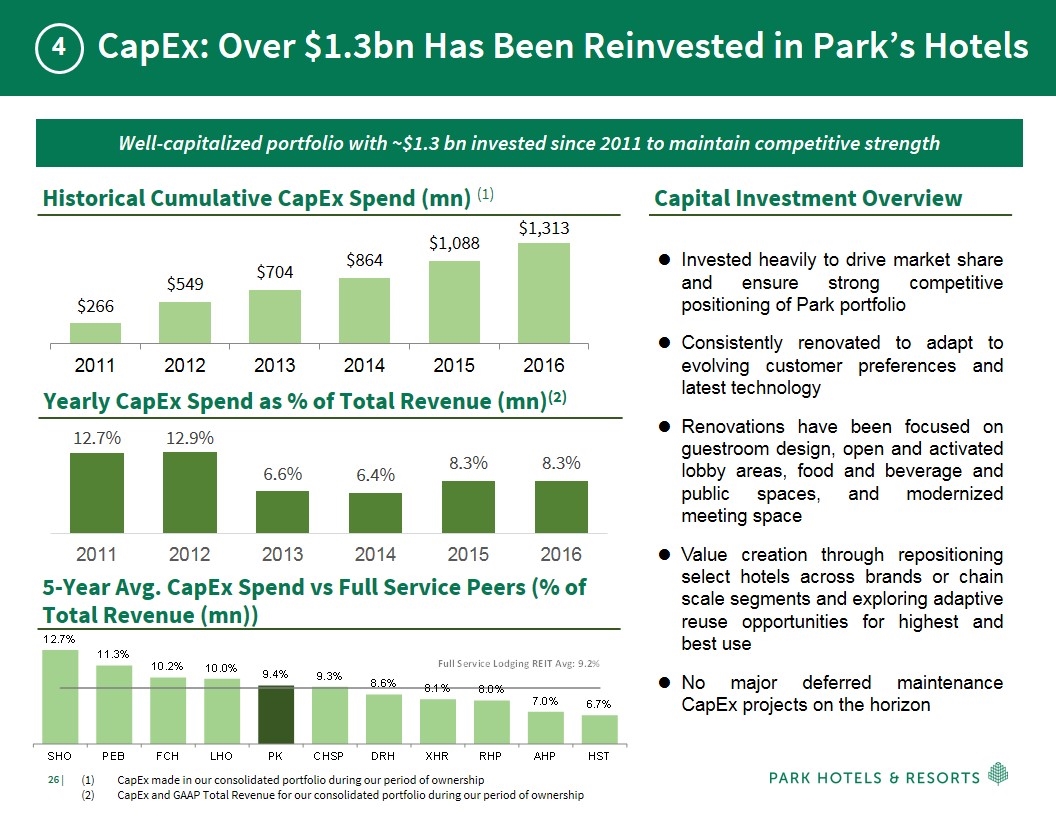

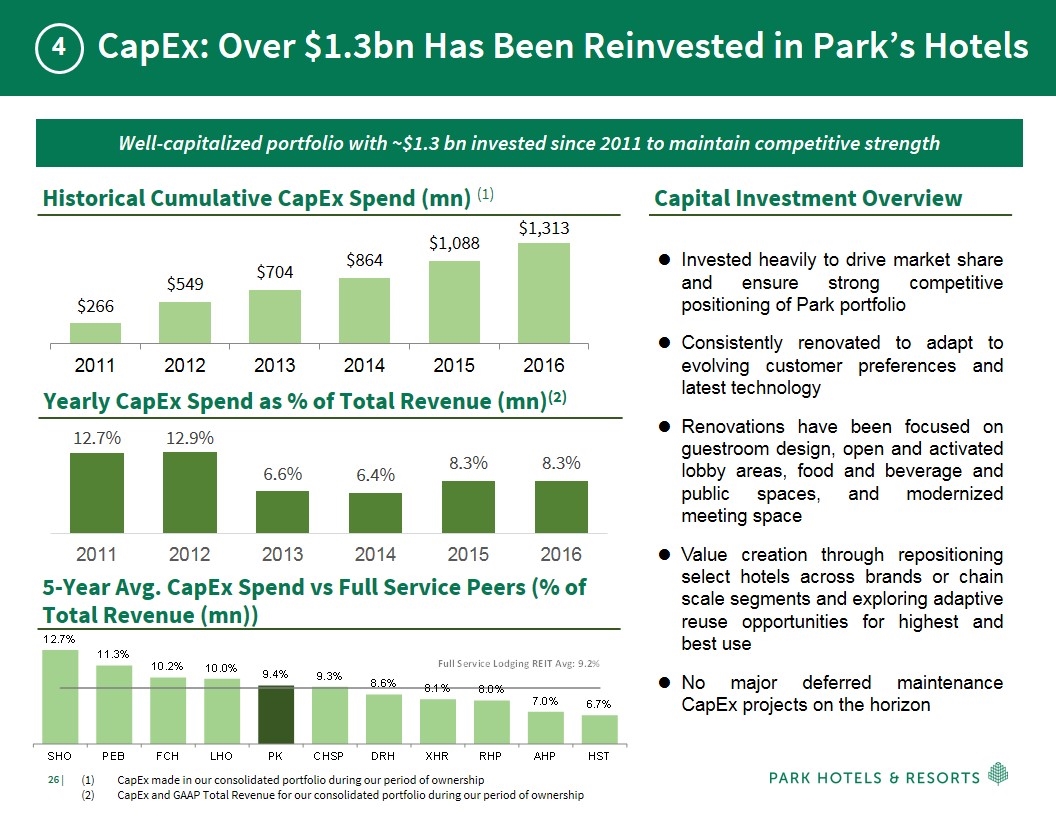

CapEx: Over $1.3bn Has Been Reinvested in Park’s Hotels 4 Well-capitalized portfolio with ~$1.3 bn invested since 2011 to maintain competitive strength Historical Cumulative CapEx Spend (mn) (1) Yearly CapEx Spend as % of Total Revenue (mn)(2) 5-Year Avg. CapEx Spend vs Full Service Peers (% of Total Revenue (mn)) Capital Investment Overview Invested heavily to drive market share and ensure strong competitive positioning of Park portfolio Consistently renovated to adapt to evolving customer preferences and latest technology Renovations have been focused on guestroom design, open and activated lobby areas, food and beverage and public spaces, and modernized meeting space Value creation through repositioning select hotels across brands or chain scale segments and exploring adaptive reuse opportunities for highest and best use No major deferred maintenance CapEx projects on the horizon CapEx made in our consolidated portfolio during our period of ownership CapEx and GAAP Total Revenue for our consolidated portfolio during our period of ownership

Future ROI Projects: New Orleans Hilton New Orleans Riverside: Development Rights/Land Sale Hilton New Orleans Riverside 1,622 room hotel with 130,000 sq. ft. of meeting space Adjacent to the 1.1 million sq. ft. New Orleans Ernest N. Morial Convention Center (NOCC) – 7th largest in the US Opportunity: Excess Land Whale Lot: 8-acre parking lot separates Hilton Riverside and NOCC Potential site for future expansion of NOCC Significant FAR (Floor Area Ratio) available for a future hotel, meeting space, and/or retail WTC Garage ‘Whale’ Lot 4

Future ROI Projects: Orlando Bonnet Creek: Development Rights Hilton Bonnet Creek and Waldorf Astoria Orlando The 1,009-room Hilton and the adjacent 502-room Waldorf Astoria Orlando feature a combined 174,000 sq. ft. of meeting space, a 3-acre Florida-style lazy river pool, a luxurious spa, a renowned championship golf course, fitness center and nearly a dozen dining and lounge options Opportunity: Additional Meeting Space Optimize meeting platform with potential to build 40,000 sq. ft. of additional multi-purpose space $50mn investment expected to generate an additional $10mn of EBITDA per annum starting in 2020 4

Balance Sheet Hilton New Orleans Riverside

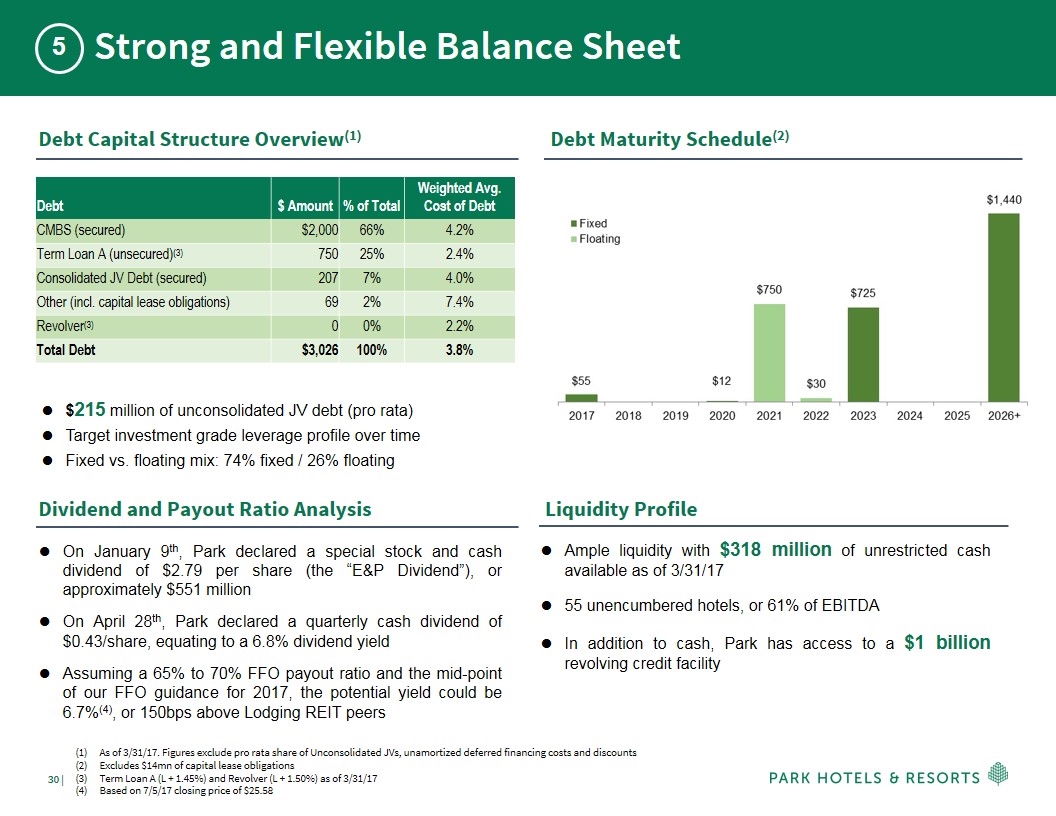

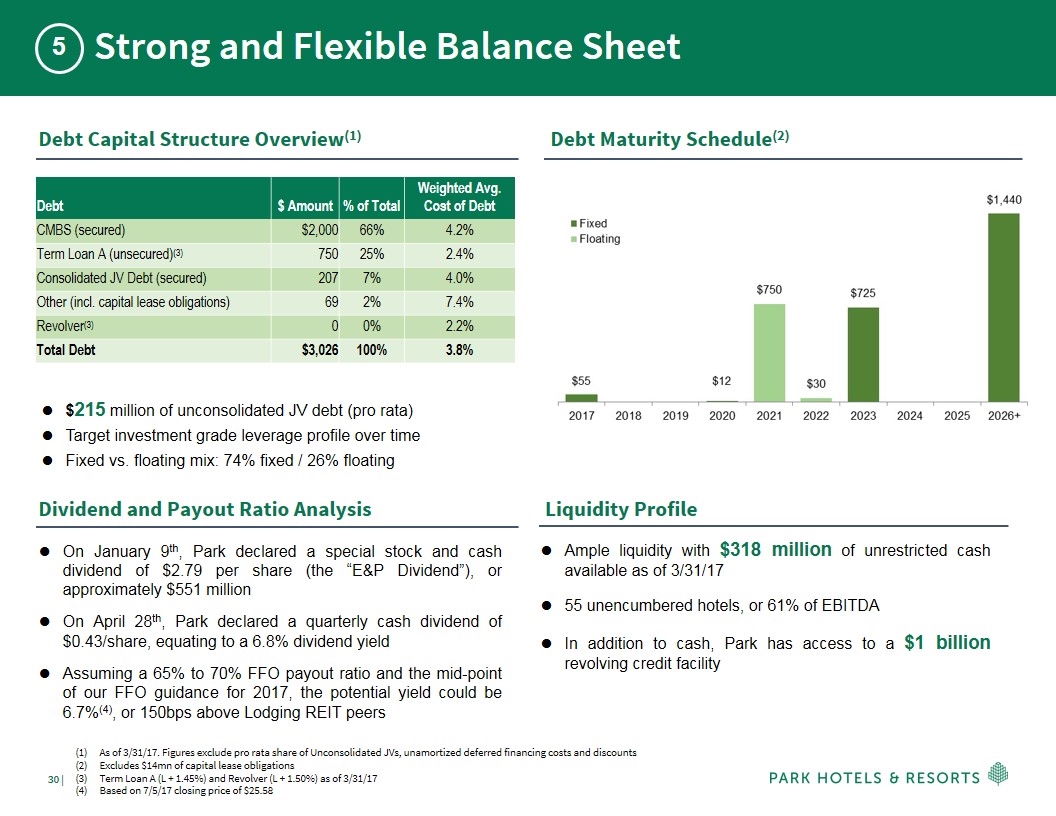

Strong and Flexible Balance Sheet 5 Debt Capital Structure Overview(1) $215 million of unconsolidated JV debt (pro rata) Target investment grade leverage profile over time Fixed vs. floating mix: 74% fixed / 26% floating Dividend and Payout Ratio Analysis On January 9th, Park declared a special stock and cash dividend of $2.79 per share (the “E&P Dividend”), or approximately $551 million On April 28th, Park declared a quarterly cash dividend of $0.43/share, equating to a 6.8% dividend yield Assuming a 65% to 70% FFO payout ratio and the mid-point of our FFO guidance for 2017, the potential yield could be 6.7%(4), or 150bps above Lodging REIT peers Debt Maturity Schedule(2) Liquidity Profile Ample liquidity with $318 million of unrestricted cash available as of 3/31/17 55 unencumbered hotels, or 61% of EBITDA In addition to cash, Park has access to a $1 billion revolving credit facility As of 3/31/17. Figures exclude pro rata share of Unconsolidated JVs, unamortized deferred financing costs and discounts Excludes $14mn of capital lease obligations Term Loan A (L + 1.45%) and Revolver (L + 1.50%) as of 3/31/17 Based on 7/5/17 closing price of $25.58 Debt $ Amount % of Total Weighted Avg. Cost of Debt CMBS (secured) $2,000 66% 4.2% Term Loan A (unsecured)(3) 750 25% 2.4% Consolidated JV Debt (secured) 207 7% 4.0% Other (incl. capital lease obligations) 69 2% 7.4% Revolver(3) 0 0% 2.2% Total Debt $3,026 100% 3.8%

In Focus: Hawaii Casa Marina, The Waldorf Astoria Collection

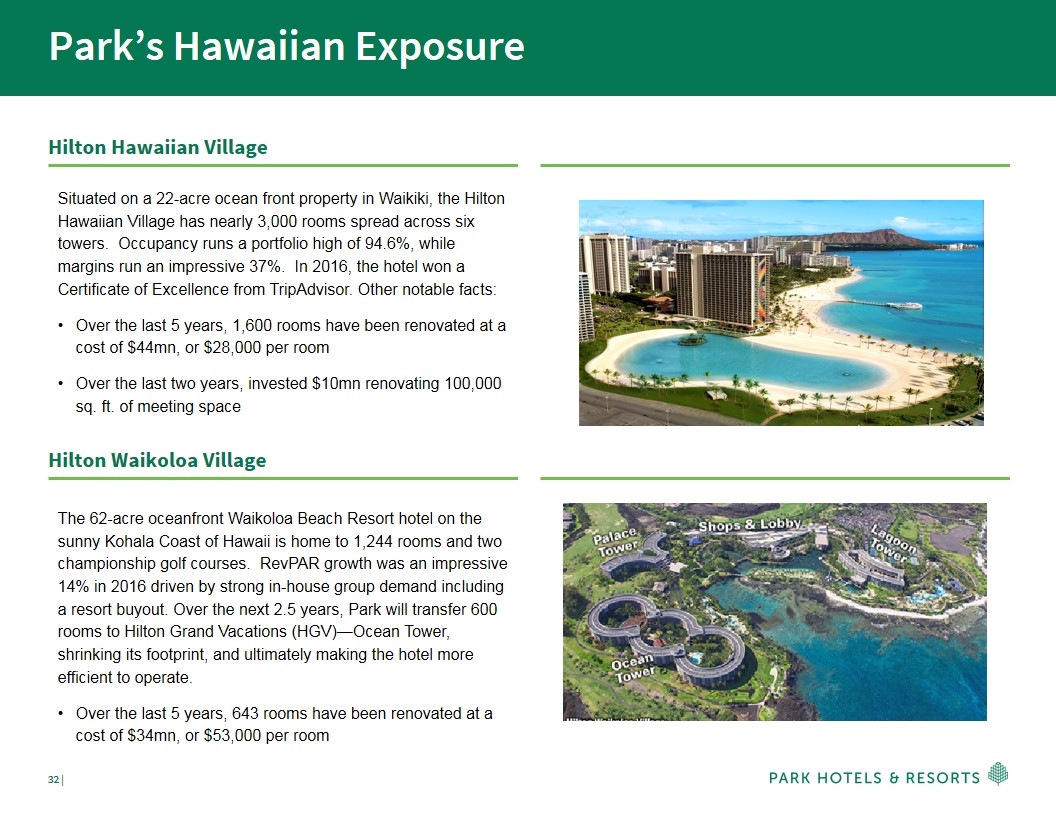

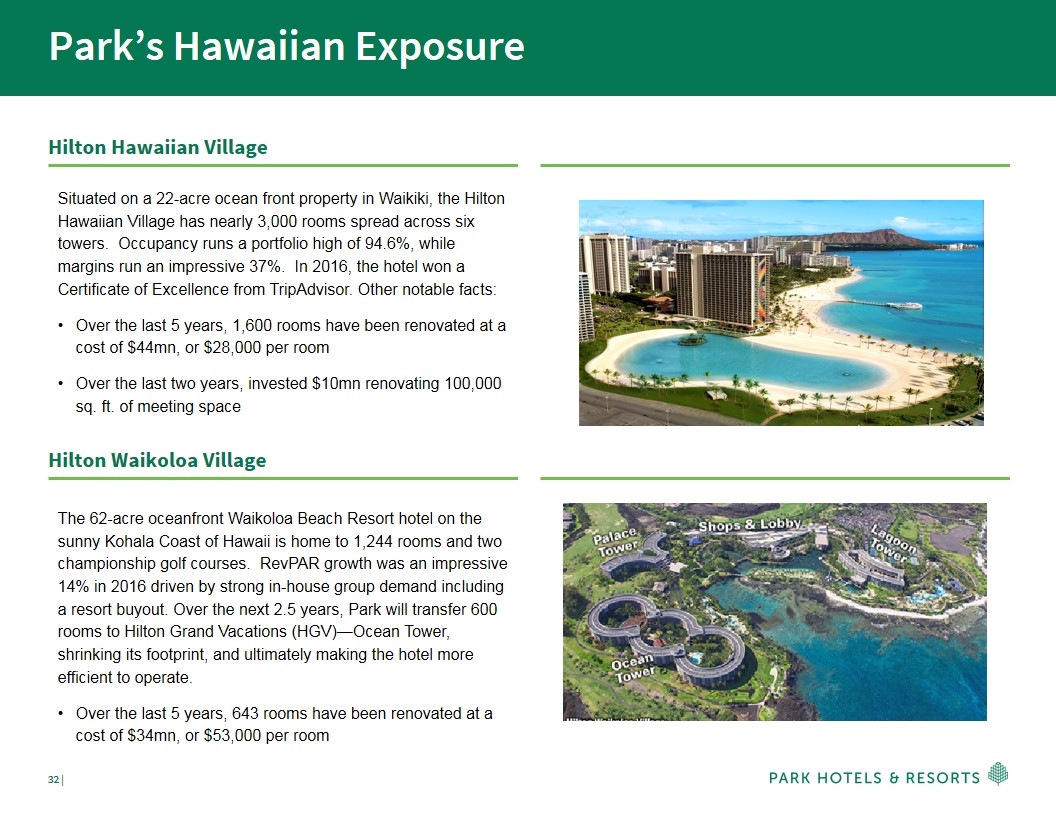

Park’s Hawaiian Exposure Situated on a 22-acre ocean front property in Waikiki, the Hilton Hawaiian Village has nearly 3,000 rooms spread across six towers. Occupancy runs a portfolio high of 94.6%, while margins run an impressive 37%. In 2016, the hotel won a Certificate of Excellence from TripAdvisor. Other notable facts: Over the last 5 years, 1,600 rooms have been renovated at a cost of $44mn, or $28,000 per room Over the last two years, invested $10mn renovating 100,000 sq. ft. of meeting space Hilton Hawaiian Village The 62-acre oceanfront Waikoloa Beach Resort hotel on the sunny Kohala Coast of Hawaii is home to 1,244 rooms and two championship golf courses. RevPAR growth was an impressive 14% in 2016 driven by strong in-house group demand including a resort buyout. Over the next 2.5 years, Park will transfer 600 rooms to Hilton Grand Vacations (HGV)—Ocean Tower, shrinking its footprint, and ultimately making the hotel more efficient to operate. Over the last 5 years, 643 rooms have been renovated at a cost of $34mn, or $53,000 per room Hilton Waikoloa Village

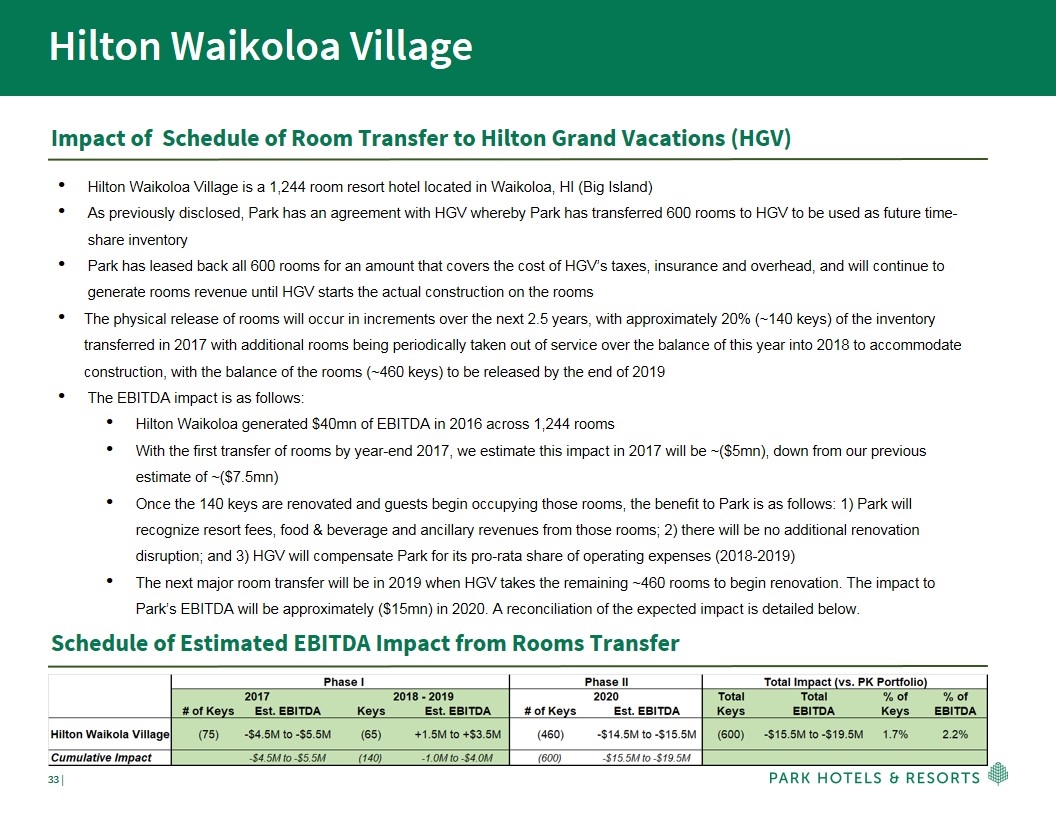

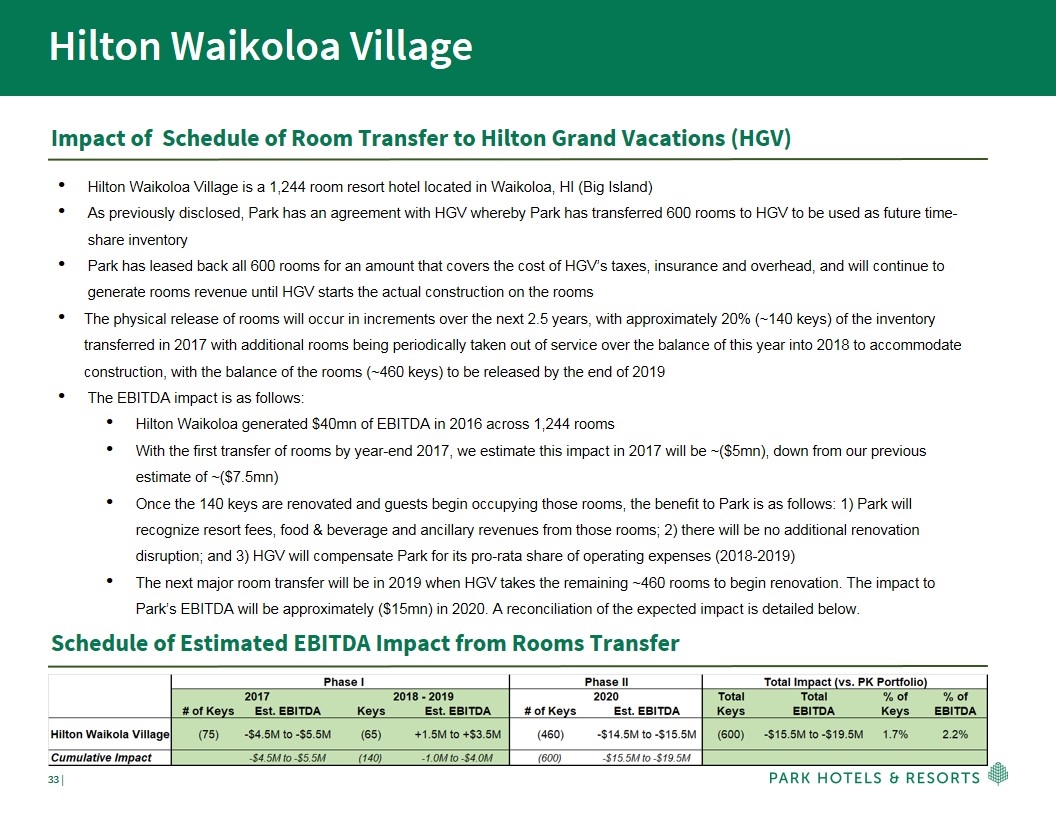

Hilton Waikoloa Village Hilton Waikoloa Village is a 1,244 room resort hotel located in Waikoloa, HI (Big Island) As previously disclosed, Park has an agreement with HGV whereby Park has transferred 600 rooms to HGV to be used as future time-share inventory Park has leased back all 600 rooms for an amount that covers the cost of HGV’s taxes, insurance and overhead, and will continue to generate rooms revenue until HGV starts the actual construction on the rooms The physical release of rooms will occur in increments over the next 2.5 years, with approximately 20% (~140 keys) of the inventory transferred in 2017 with additional rooms being periodically taken out of service over the balance of this year into 2018 to accommodate construction, with the balance of the rooms (~460 keys) to be released by the end of 2019 The EBITDA impact is as follows: Hilton Waikoloa generated $40mn of EBITDA in 2016 across 1,244 rooms With the first transfer of rooms by year-end 2017, we estimate this impact in 2017 will be ~($5mn), down from our previous estimate of ~($7.5mn) Once the 140 keys are renovated and guests begin occupying those rooms, the benefit to Park is as follows: 1) Park will recognize resort fees, food & beverage and ancillary revenues from those rooms; 2) there will be no additional renovation disruption; and 3) HGV will compensate Park for its pro-rata share of operating expenses (2018-2019) The next major room transfer will be in 2019 when HGV takes the remaining ~460 rooms to begin renovation. The impact to Park’s EBITDA will be approximately ($15mn) in 2020. A reconciliation of the expected impact is detailed below. Impact of Schedule of Room Transfer to Hilton Grand Vacations (HGV) Schedule of Estimated EBITDA Impact from Rooms Transfer

Appendix Casa Marina, The Waldorf Astoria Collection

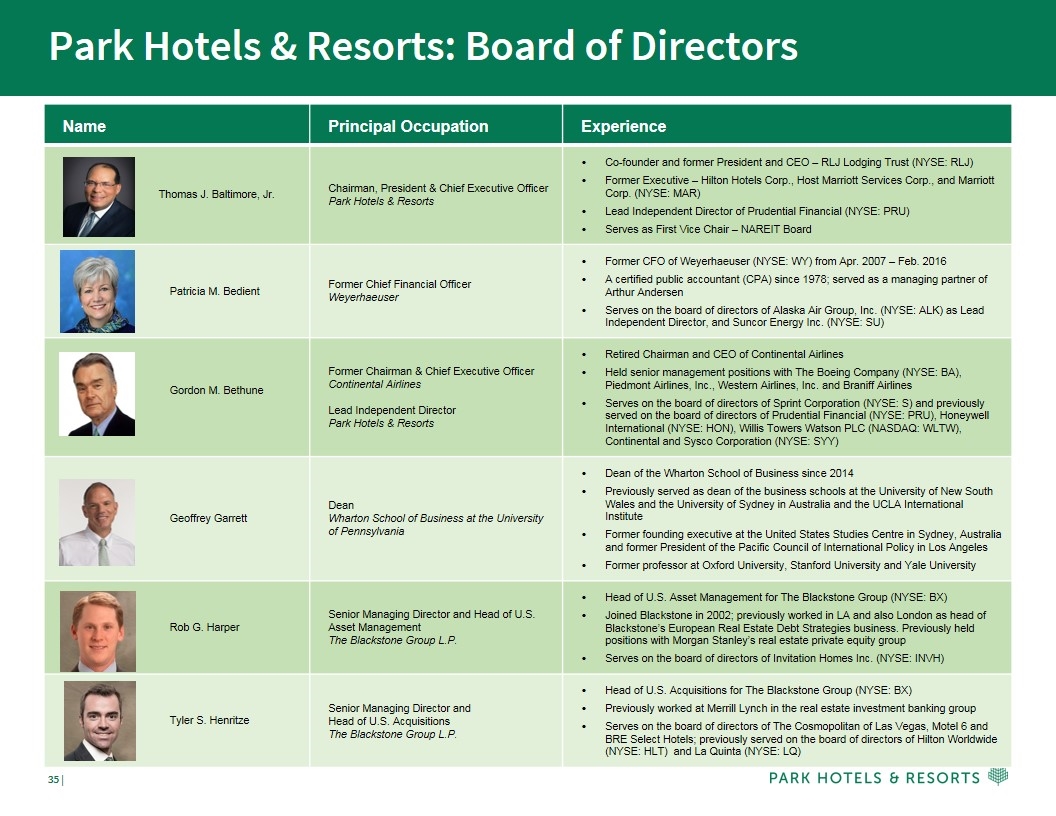

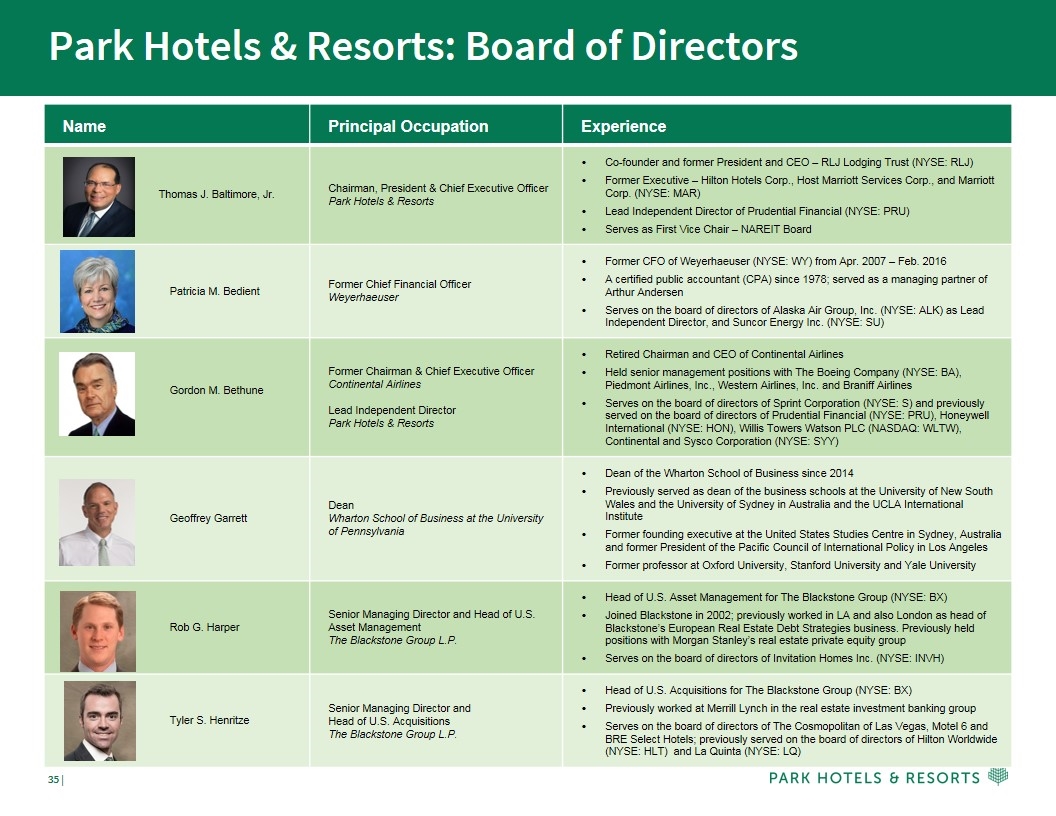

Park Hotels & Resorts: Board of Directors Name Principal Occupation Experience Thomas J. Baltimore, Jr. Chairman, President & Chief Executive Officer Park Hotels & Resorts Co-founder and former President and CEO – RLJ Lodging Trust (NYSE: RLJ) Former Executive – Hilton Hotels Corp., Host Marriott Services Corp., and Marriott Corp. (NYSE: MAR) Lead Independent Director of Prudential Financial (NYSE: PRU) Serves as First Vice Chair – NAREIT Board Patricia M. Bedient Former Chief Financial Officer Weyerhaeuser Former CFO of Weyerhaeuser (NYSE: WY) from Apr. 2007 – Feb. 2016 A certified public accountant (CPA) since 1978; served as a managing partner of Arthur Andersen Serves on the board of directors of Alaska Air Group, Inc. (NYSE: ALK) as Lead Independent Director, and Suncor Energy Inc. (NYSE: SU) Gordon M. Bethune Former Chairman & Chief Executive Officer Continental Airlines Lead Independent Director Park Hotels & Resorts Retired Chairman and CEO of Continental Airlines Held senior management positions with The Boeing Company (NYSE: BA), Piedmont Airlines, Inc., Western Airlines, Inc. and Braniff Airlines Serves on the board of directors of Sprint Corporation (NYSE: S) and previously served on the board of directors of Prudential Financial (NYSE: PRU), Honeywell International (NYSE: HON), Willis Towers Watson PLC (NASDAQ: WLTW), Continental and Sysco Corporation (NYSE: SYY) Geoffrey Garrett Dean Wharton School of Business at the University of Pennsylvania Dean of the Wharton School of Business since 2014 Previously served as dean of the business schools at the University of New South Wales and the University of Sydney in Australia and the UCLA International Institute Former founding executive at the United States Studies Centre in Sydney, Australia and former President of the Pacific Council of International Policy in Los Angeles Former professor at Oxford University, Stanford University and Yale University Rob G. Harper Senior Managing Director and Head of U.S. Asset Management The Blackstone Group L.P. Head of U.S. Asset Management for The Blackstone Group (NYSE: BX) Joined Blackstone in 2002; previously worked in LA and also London as head of Blackstone’s European Real Estate Debt Strategies business. Previously held positions with Morgan Stanley’s real estate private equity group Serves on the board of directors of Invitation Homes Inc. (NYSE: INVH) Tyler S. Henritze Senior Managing Director and Head of U.S. Acquisitions The Blackstone Group L.P. Head of U.S. Acquisitions for The Blackstone Group (NYSE: BX) Previously worked at Merrill Lynch in the real estate investment banking group Serves on the board of directors of The Cosmopolitan of Las Vegas, Motel 6 and BRE Select Hotels; previously served on the board of directors of Hilton Worldwide (NYSE: HLT) and La Quinta (NYSE: LQ)

Park Hotels & Resorts: Board of Directors (cont’d) Name Principal Occupation Experience Christie B. Kelly EVP and Chief Financial Officer Jones Lang LaSalle Incorporated Chair of Audit Committee Park Hotels and Resorts Executive Vice President and Chief Financial Officer of Jones Lang LaSalle (NYSE: JLL) since 2013 Executive Vice President and Chief Financial Officer of Duke Realty (NYSE: DRE) from 2009 until June 2013 Former Senior Vice President, global real estate at Lehman Brothers Serves on the board of Kite Realty Trust (NYSE: KRG) Senator Joseph I. Lieberman Senior Counsel Kasowitz, Benson & Torres LLP Senior counsel with Kasowitz, Benson & Torres LLP Served 24 years in the U.S. Senate (Connecticut), retiring in January 2013; served as Chairman of the Committee on Homeland Security and Government Affairs, helping to shape legislation for homeland security, foreign policy, fiscal policy, environmental protection, human rights, health care, trade, energy, cyber security and taxes Attorney General of the State of Connecticut - 1983 until 1988 Xianyi Mu Chief Investment Officer HNA Holding Group Co., Ltd. Chief Investment Officer of HNA Holding Group Co., Ltd. since December 2016 Previously served as the President of HNA Investment Group Co. Ltd. from 2015 until 2016 and as the Vice President and Chief Financial Officer of HNA Hotel Group Co., Ltd. from 2011 until 2014 Served on the board of directors of NH Hotel Group SA from 2013 until 2016 Timothy J. Naughton Chairman, Chief Executive Officer and President AvalonBay Communities, Inc. Chair of Nominating and Corporate Governance Committee Chairman, Chief Executive Officer and President of AvalonBay Communities (NYSE: AVB). Has served as Chairman of AvalonBay since May 2013, as Chief Executive Officer since January 2012 and as President since February 2005 Serves on the board of directors of Welltower (NYSE: HCN) Serves as Chair of NAREIT, is a member of The Real Estate Round Table and is a member and past Chairman of the Multifamily Council of the ULI Stephen I. Sadove Founding Partner JW Levin Management Partners LLC Chair of Compensation Committee Founding partner of JW Levin Management Partners LLC, a private management and investment firm, since 2015 Chairman and Chief Executive Officer of Saks Incorporated from 2007 until 2013 President of Bristol-Myers (NYSE: BMY) from 1991 until 2001 Serves on the board of directors of Colgate-Palmolive Company (NYSE: CL), Ruby Tuesday (NYSE: RT), and Aramark (NYSE: ARMK). Also serves as the chairman of the Board of Trustees of Hamilton College

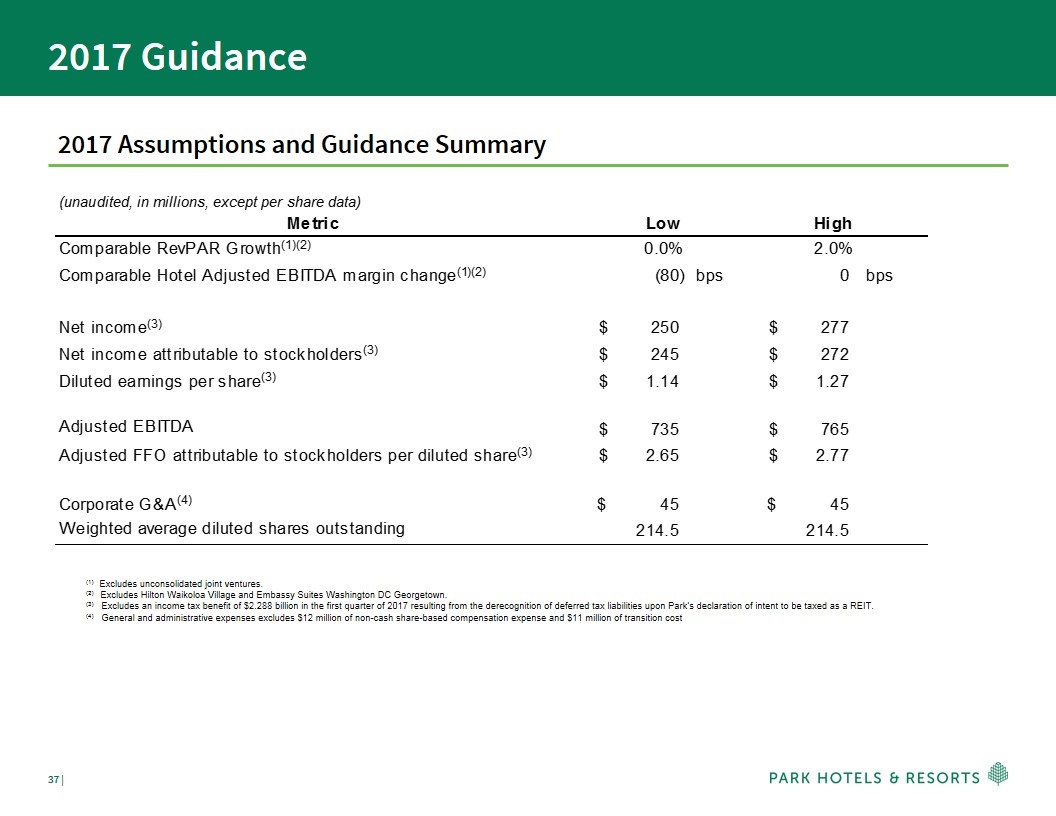

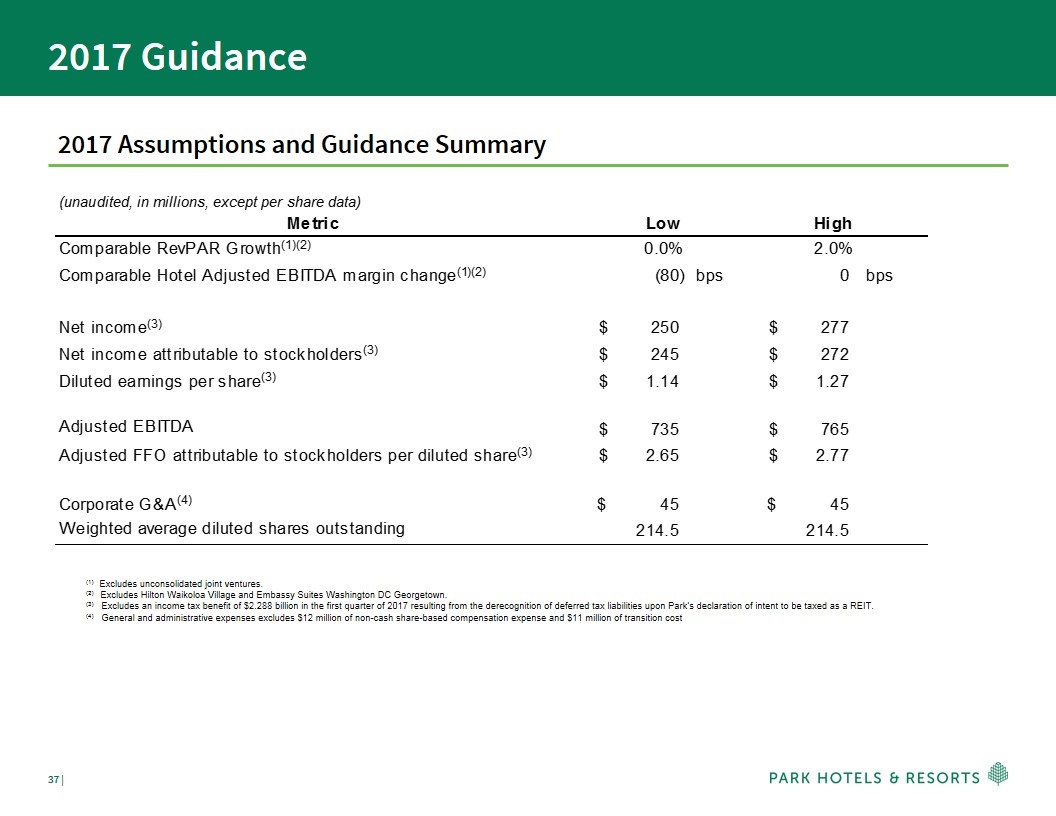

2017 Guidance 2017 Assumptions and Guidance Summary (1) Excludes unconsolidated joint ventures. (2) Excludes Hilton Waikoloa Village and Embassy Suites Washington DC Georgetown. (3) Excludes an income tax benefit of $2.288 billion in the first quarter of 2017 resulting from the derecognition of deferred tax liabilities upon Park’s declaration of intent to be taxed as a REIT. (4) General and administrative expenses excludes $12 million of non-cash share-based compensation expense and $11 million of transition cost (unaudited, in millions, except per share data) Metric Low High Comparable RevPAR Growth(1)(2) 0.0% 2.0% Comparable Hotel Adjusted EBITDA margin change(1)(2) (80) bps 0 bps Net income(3) $ 250 $ 277 Net income attributable to stockholders(3) $ 245 $ 272 Diluted earnings per share(3) $ 1.14 $ 1.27 Adjusted EBITDA $ 735 $ 765 Adjusted FFO attributable to stockholders per diluted share(3) $ 2.65 $ 2.77 Corporate G&A(4) $ 45 $ 45 Weighted average diluted shares outstanding 214.5 214.5

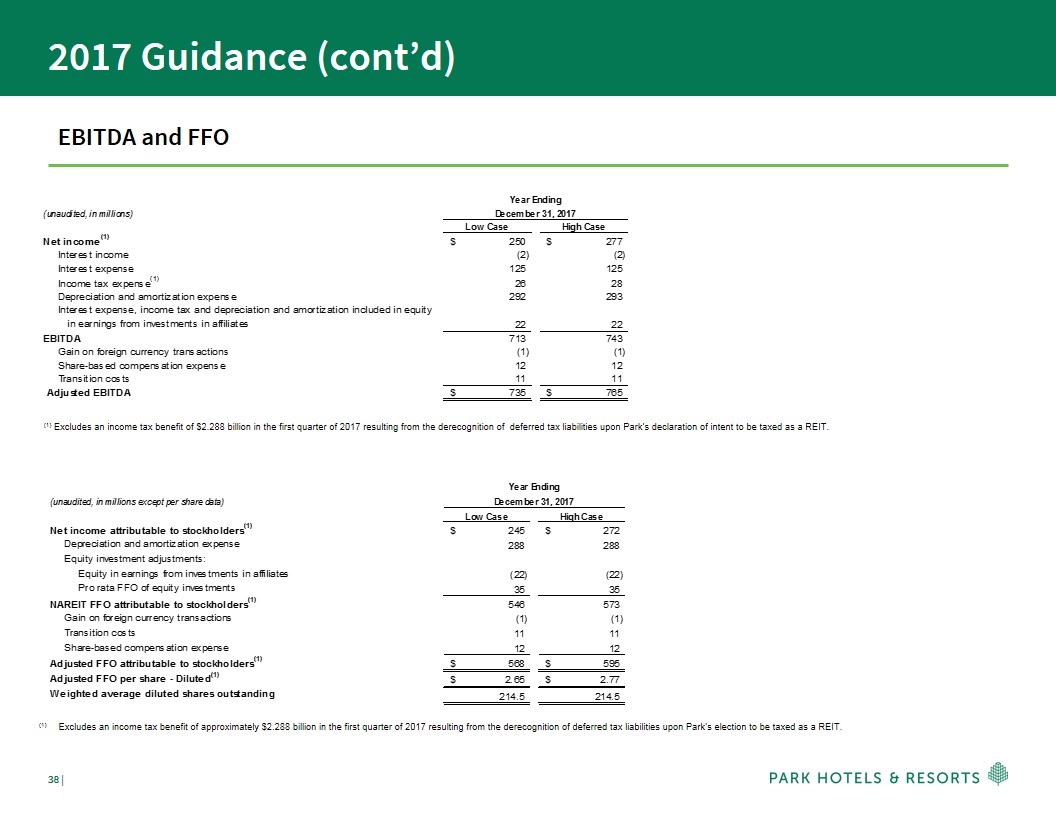

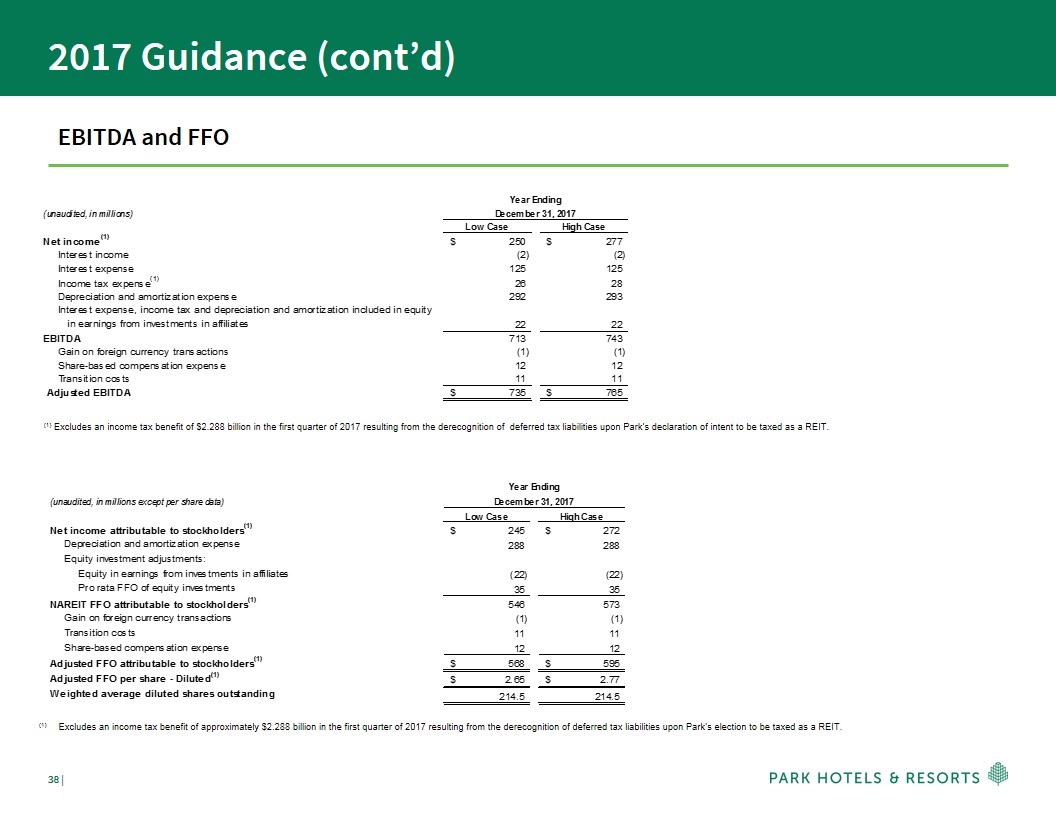

2017 Guidance (cont’d) EBITDA and FFO (1) Excludes an income tax benefit of $2.288 billion in the first quarter of 2017 resulting from the derecognition of deferred tax liabilities upon Park’s declaration of intent to be taxed as a REIT. (1)Excludes an income tax benefit of approximately $2.288 billion in the first quarter of 2017 resulting from the derecognition of deferred tax liabilities upon Park’s election to be taxed as a REIT. Year Ending December 31, 2017 (unaudited, in millions) Low Case High Case Net income(1) 250 $ 277 $ Interest income (2) (2) Interest expense 125 125 Income tax expense(1) 26 28 Depreciation and amortization expense 292 293 Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates 22 22 EBITDA 713 743 Gain on foreign currency transactions (1) (1) Share-based compensation expense 12 12 Transition costs 11 11 Adjusted EBITDA 735 $ 765 $ Year Ending December 31, 2017 (unaudited, in millions) (unaudited, in millions except per share data) Low Case High Case Net income attributable to stockholders(1) 245 $ 272 $ Depreciation and amortization expense 288 288 Equity investment adjustments: Equity in earnings from investments in affiliates (22) (22) Pro rata FFO of equity investments 35 35 NAREIT FFO attributable to stockholders(1) 546 573 Gain on foreign currency transactions (1) (1) Transition costs 11 11 Share-based compensation expense 12 12 Adjusted FFO attributable to stockholders(1) 568 $ 595 $ Adjusted FFO per share - Diluted(1) 2.65 $ 2.77 $ Weighted average diluted shares outstanding 214.5 214.5

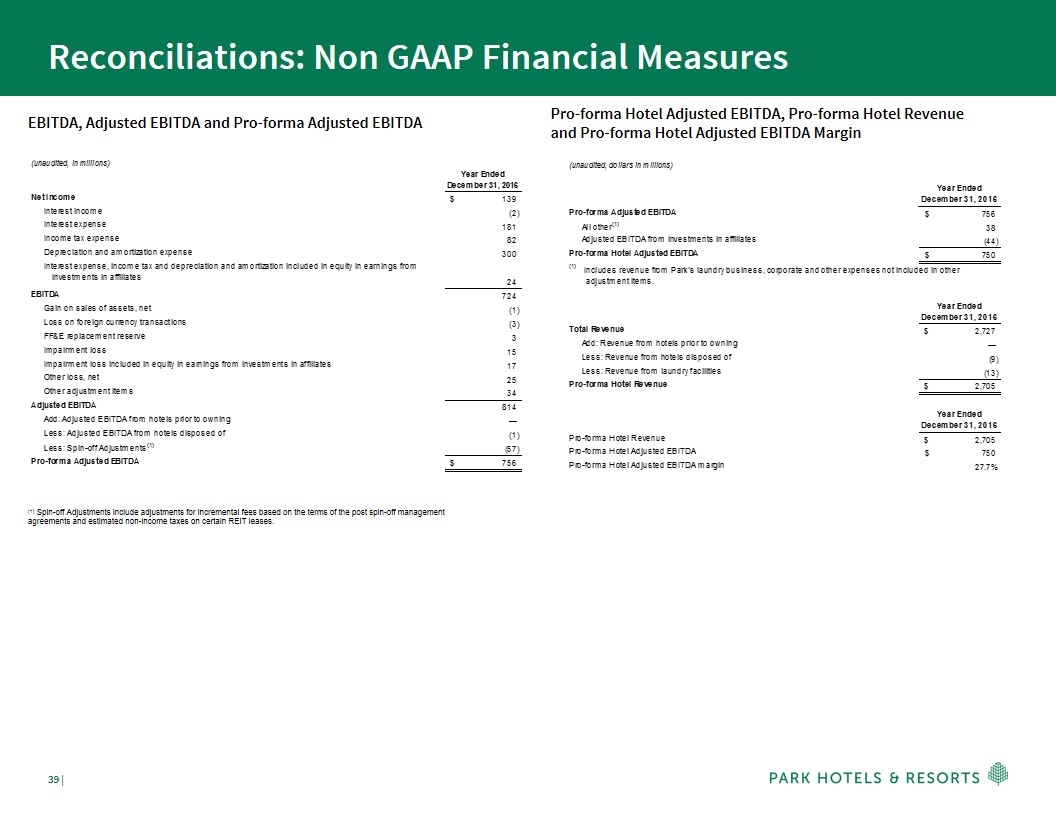

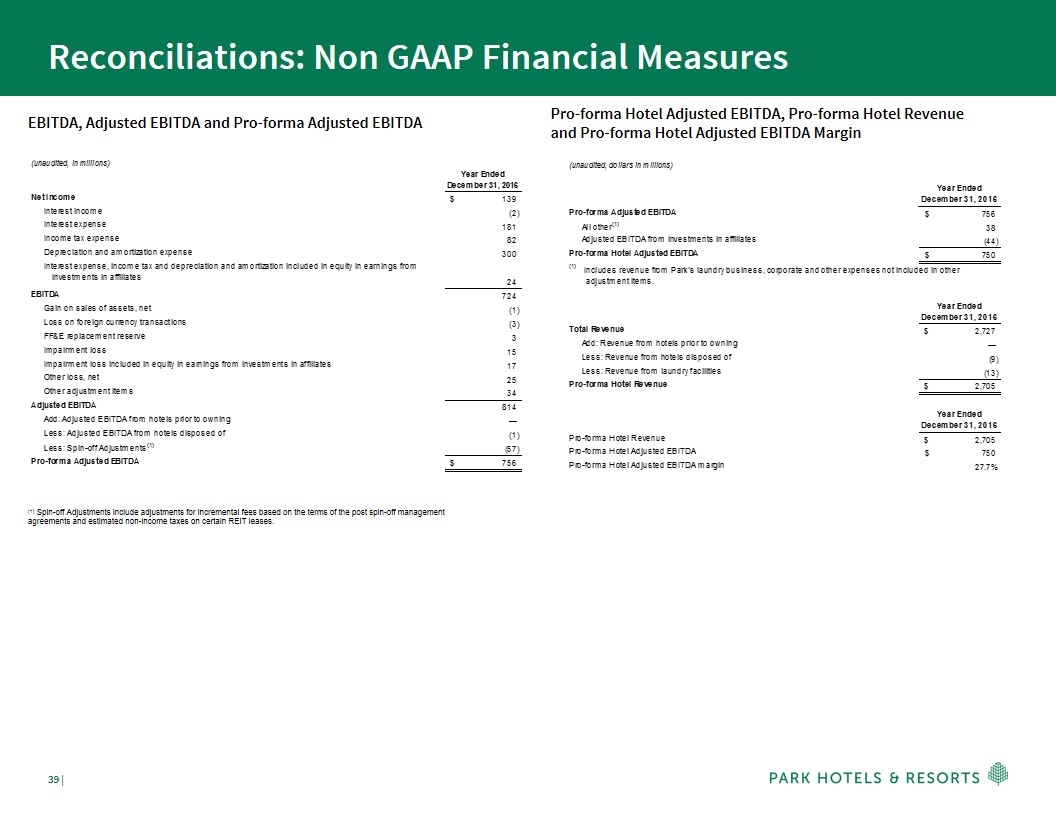

EBITDA, Adjusted EBITDA and Pro-forma Adjusted EBITDA Pro-forma Hotel Adjusted EBITDA, Pro-forma Hotel Revenue and Pro-forma Hotel Adjusted EBITDA Margin (1) Spin-off Adjustments include adjustments for incremental fees based on the terms of the post spin-off management agreements and estimated non-income taxes on certain REIT leases. Reconciliations: Non GAAP Financial Measures (unaudited, in millions) Year Ended December 31, 2016 Net income 139 $ Interest income (2) Interest expense 181 Income tax expense 82 Depreciation and amortization expense 300 Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates 24 EBITDA 724 Gain on sales of assets, net (1) Loss on foreign currency transactions (3) FF&E replacement reserve 3 Impairment loss 15 Impairment loss included in equity in earnings from investments in affiliates 17 Other loss, net 25 Other adjustment items 34 Adjusted EBITDA 814 Add: Adjusted EBITDA from hotels prior to owning — Less: Adjusted EBITDA from hotels disposed of (1) Less: Spin-off Adjustments(1) (57) Pro-forma Adjusted EBITDA 756 $ (unaudited, dollars in millions) Year Ended December 31, 2016 Pro-forma Adjusted EBITDA 756 $ All other(1) 38 Adjusted EBITDA from investments in affiliates (44) Pro-forma Hotel Adjusted EBITDA 750 $ (1) Includes revenue from Park's laundry business, corporate and other expenses not included in other adjustment items. Year Ended December 31, 2016 Total Revenue 2,727 $ Add: Revenue from hotels prior to owning — Less: Revenue from hotels disposed of (9) Less: Revenue from laundry facilities (13) Pro-forma Hotel Revenue 2,705 $ Year Ended December 31, 2016 Pro-forma Hotel Revenue 2,705 $ Pro-forma Hotel Adjusted EBITDA 750 $ Pro-forma Hotel Adjusted EBITDA margin 27.7%

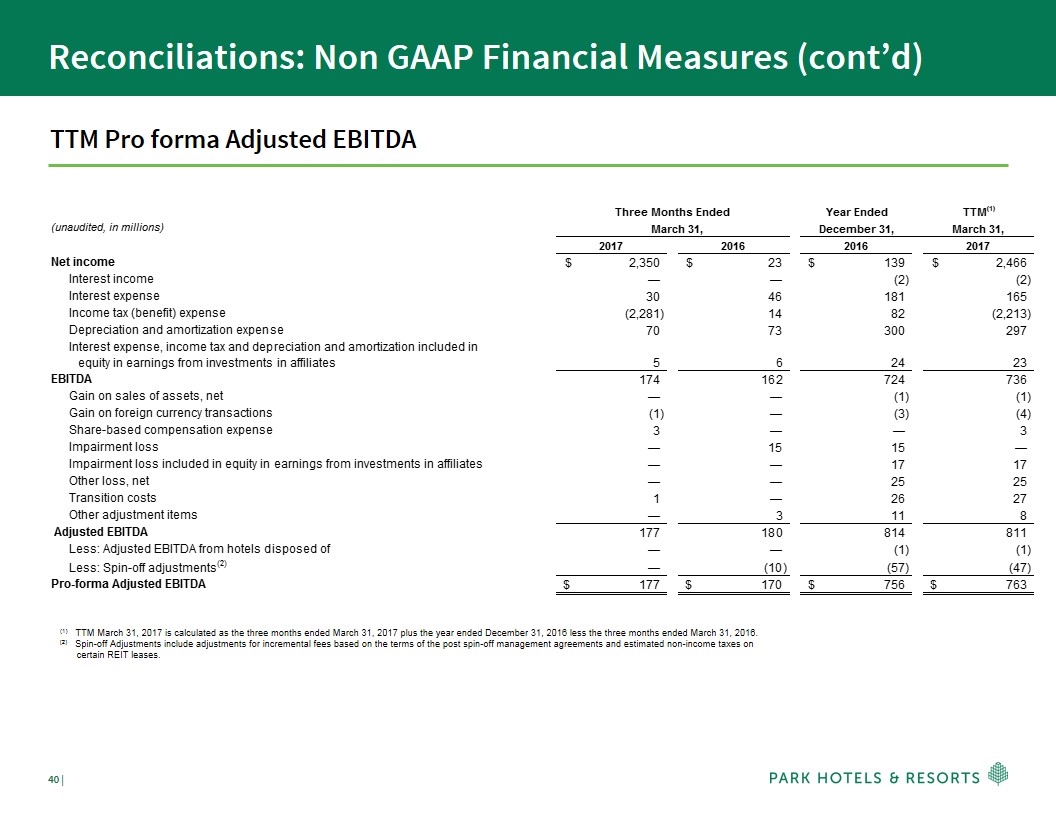

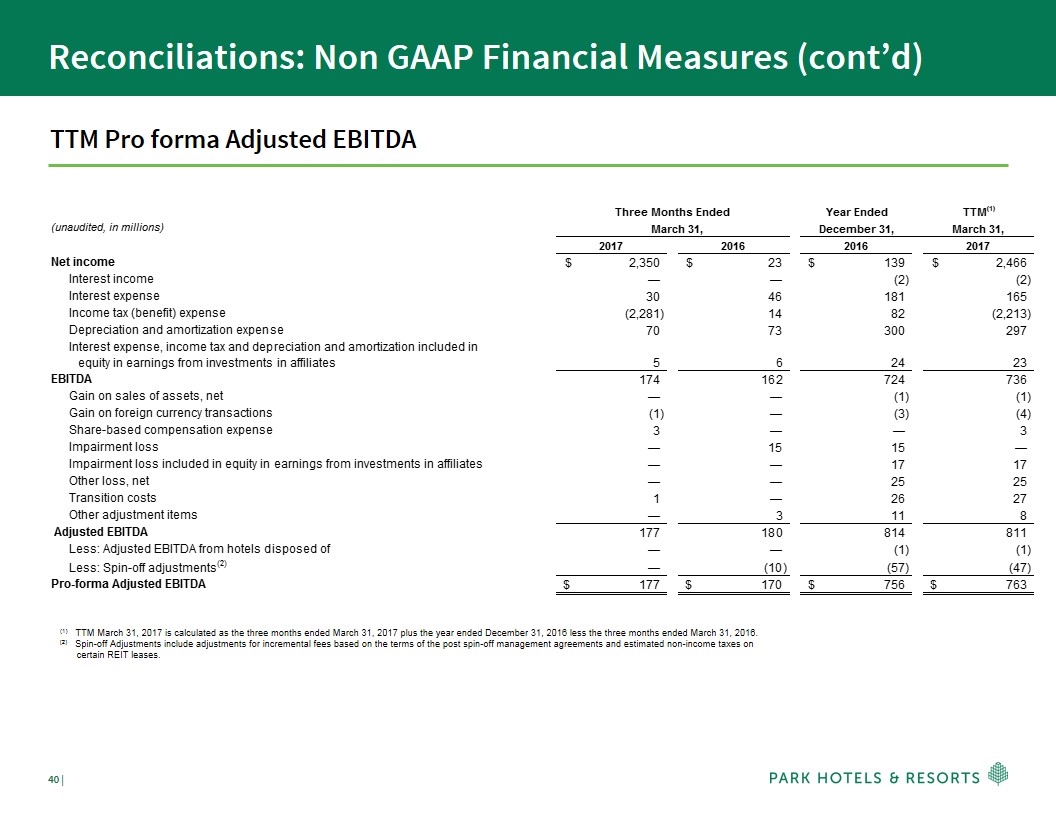

Reconciliations: Non GAAP Financial Measures (cont’d) TTM Pro forma Adjusted EBITDA (1) TTM March 31, 2017 is calculated as the three months ended March 31, 2017 plus the year ended December 31, 2016 less the three months ended March 31, 2016. (2) Spin-off Adjustments include adjustments for incremental fees based on the terms of the post spin-off management agreements and estimated non-income taxes on certain REIT leases. Three Months Ended March 31, Year Ended TTM(1) (unaudited, in millions) December 31, March 31, 2017 2016 2016 2017 Net income 2,350 $ 23 $ 139 $ 2,466 $ Interest income — — (2) (2) Interest expense 30 46 181 165 Income tax (benefit) expense (2,281) 14 82 (2,213) Depreciation and amortization expense 70 73 300 297 Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates 5 6 24 23 EBITDA 174 162 724 736 Gain on sales of assets, net — — (1) (1) Gain on foreign currency transactions (1) — (3) (4) Share-based compensation expense 3 — — 3 Impairment loss — 15 15 — Impairment loss included in equity in earnings from investments in affiliates — — 17 17 Other loss, net — — 25 25 Transition costs 1 — 26 27 Other adjustment items — 3 11 8 Adjusted EBITDA 177 180 814 811 Less: Adjusted EBITDA from hotels disposed of — — (1) (1) Less: Spin-off adjustments(2) — (10) (57) (47) Pro-forma Adjusted EBITDA 177 $ 170 $ 756 $ 763 $

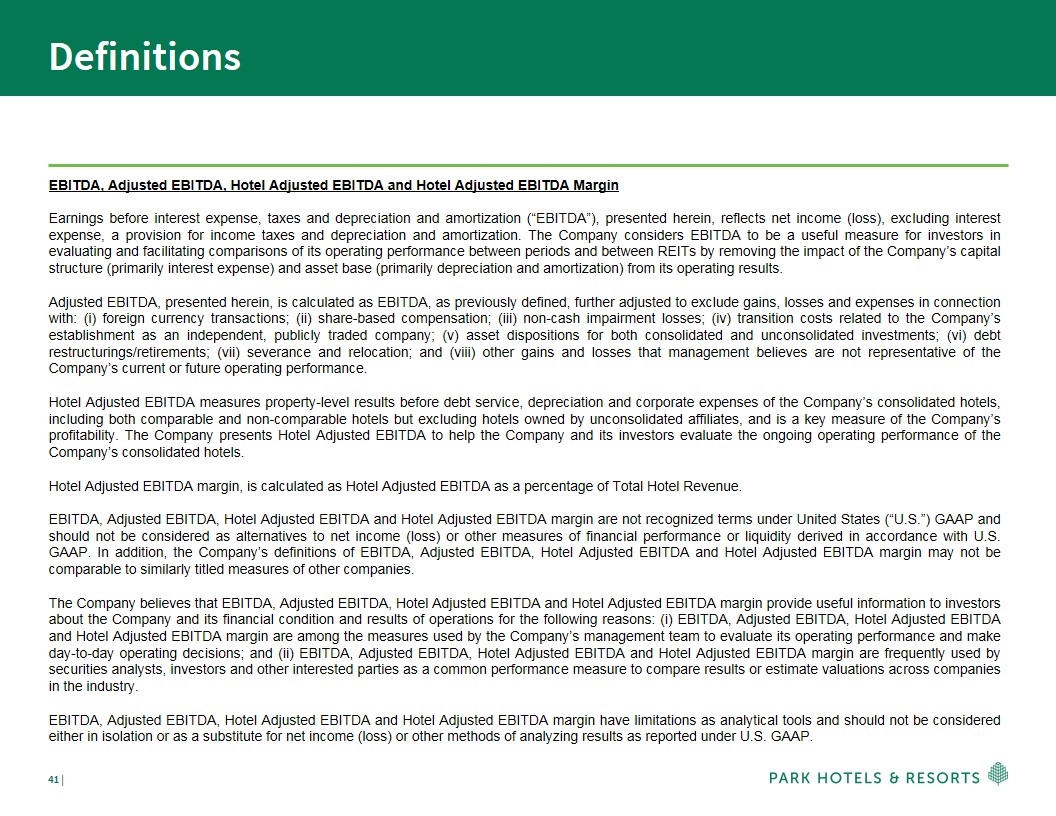

Definitions EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA Margin Earnings before interest expense, taxes and depreciation and amortization (“EBITDA”), presented herein, reflects net income (loss), excluding interest expense, a provision for income taxes and depreciation and amortization. The Company considers EBITDA to be a useful measure for investors in evaluating and facilitating comparisons of its operating performance between periods and between REITs by removing the impact of the Company’s capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from its operating results. Adjusted EBITDA, presented herein, is calculated as EBITDA, as previously defined, further adjusted to exclude gains, losses and expenses in connection with: (i) foreign currency transactions; (ii) share-based compensation; (iii) non-cash impairment losses; (iv) transition costs related to the Company’s establishment as an independent, publicly traded company; (v) asset dispositions for both consolidated and unconsolidated investments; (vi) debt restructurings/retirements; (vii) severance and relocation; and (viii) other gains and losses that management believes are not representative of the Company’s current or future operating performance. Hotel Adjusted EBITDA measures property-level results before debt service, depreciation and corporate expenses of the Company’s consolidated hotels, including both comparable and non-comparable hotels but excluding hotels owned by unconsolidated affiliates, and is a key measure of the Company’s profitability. The Company presents Hotel Adjusted EBITDA to help the Company and its investors evaluate the ongoing operating performance of the Company’s consolidated hotels. Hotel Adjusted EBITDA margin, is calculated as Hotel Adjusted EBITDA as a percentage of Total Hotel Revenue. EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are not recognized terms under United States (“U.S.”) GAAP and should not be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, the Company’s definitions of EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies. The Company believes that EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin provide useful information to investors about the Company and its financial condition and results of operations for the following reasons: (i) EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are among the measures used by the Company’s management team to evaluate its operating performance and make day-to-day operating decisions; and (ii) EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in the industry. EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin have limitations as analytical tools and should not be considered either in isolation or as a substitute for net income (loss) or other methods of analyzing results as reported under U.S. GAAP.

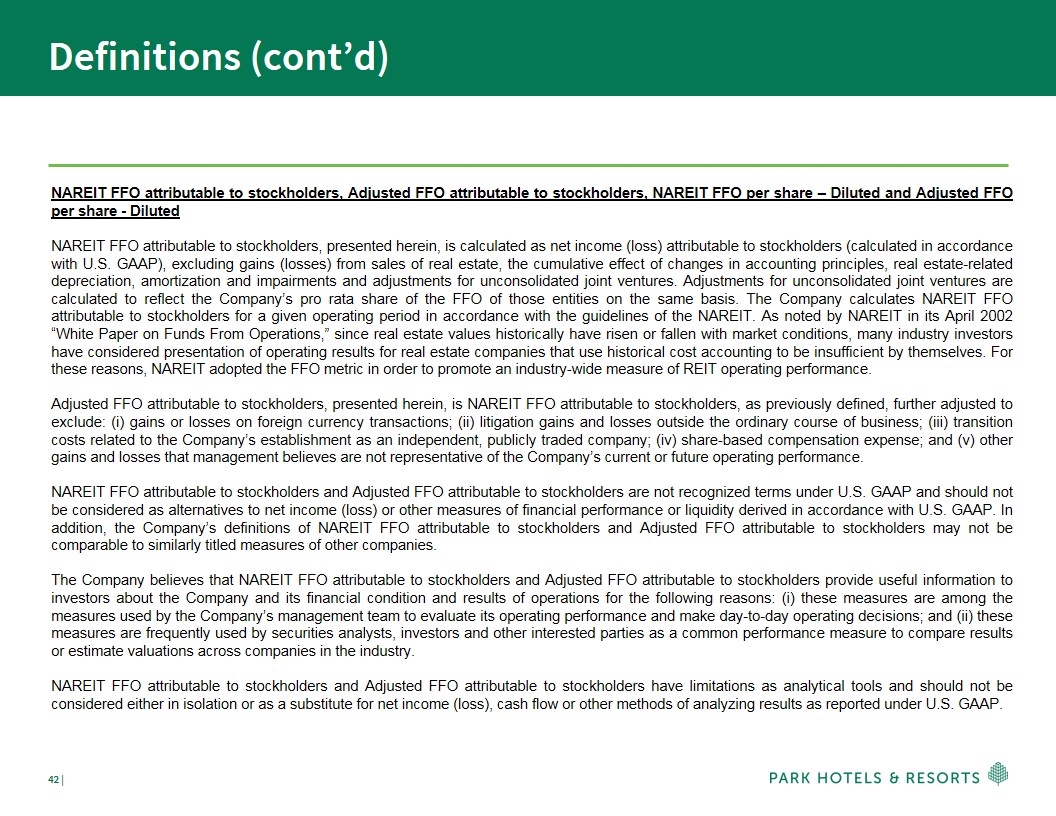

Definitions (cont’d) NAREIT FFO attributable to stockholders, Adjusted FFO attributable to stockholders, NAREIT FFO per share – Diluted and Adjusted FFO per share - Diluted NAREIT FFO attributable to stockholders, presented herein, is calculated as net income (loss) attributable to stockholders (calculated in accordance with U.S. GAAP), excluding gains (losses) from sales of real estate, the cumulative effect of changes in accounting principles, real estate-related depreciation, amortization and impairments and adjustments for unconsolidated joint ventures. Adjustments for unconsolidated joint ventures are calculated to reflect the Company’s pro rata share of the FFO of those entities on the same basis. The Company calculates NAREIT FFO attributable to stockholders for a given operating period in accordance with the guidelines of the NAREIT. As noted by NAREIT in its April 2002 “White Paper on Funds From Operations,” since real estate values historically have risen or fallen with market conditions, many industry investors have considered presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For these reasons, NAREIT adopted the FFO metric in order to promote an industry-wide measure of REIT operating performance. Adjusted FFO attributable to stockholders, presented herein, is NAREIT FFO attributable to stockholders, as previously defined, further adjusted to exclude: (i) gains or losses on foreign currency transactions; (ii) litigation gains and losses outside the ordinary course of business; (iii) transition costs related to the Company’s establishment as an independent, publicly traded company; (iv) share-based compensation expense; and (v) other gains and losses that management believes are not representative of the Company’s current or future operating performance. NAREIT FFO attributable to stockholders and Adjusted FFO attributable to stockholders are not recognized terms under U.S. GAAP and should not be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, the Company’s definitions of NAREIT FFO attributable to stockholders and Adjusted FFO attributable to stockholders may not be comparable to similarly titled measures of other companies. The Company believes that NAREIT FFO attributable to stockholders and Adjusted FFO attributable to stockholders provide useful information to investors about the Company and its financial condition and results of operations for the following reasons: (i) these measures are among the measures used by the Company’s management team to evaluate its operating performance and make day-to-day operating decisions; and (ii) these measures are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in the industry. NAREIT FFO attributable to stockholders and Adjusted FFO attributable to stockholders have limitations as analytical tools and should not be considered either in isolation or as a substitute for net income (loss), cash flow or other methods of analyzing results as reported under U.S. GAAP.

Definitions (cont’d) NAREIT FFO per share – Diluted, presented herein, is calculated as the Company’s NAREIT FFO, as previously defined, divided by the number of fully diluted shares outstanding during a period. Adjusted FFO per share – Diluted, presented herein, is Adjusted FFO per share, as previously defined, divided by the number of fully diluted shares outstanding during a period. Net Debt Net debt, presented herein, is a non-GAAP financial measure that the Company uses to evaluate its financial leverage. Net debt is calculated as (i) long-term debt, including current maturities and excluding unamortized deferred financing costs; and (ii) the Company’s share of investments in affiliate debt, excluding unamortized deferred financing costs; reduced by (a) cash and cash equivalents; and (b) restricted cash and cash equivalents. The Company believes Net debt provides useful information about its indebtedness to investors as it is frequently used by securities analysts, investors and other interested parties to compare the indebtedness of companies. Net debt should not be considered as a substitute to debt presented in accordance with U.S. GAAP. Net debt may not be comparable to a similarly titled measure of other companies. Net Debt to Adjusted EBITDA Ratio Net debt to Adjusted EBITDA ratio, presented herein, is a non-GAAP financial measure and is included as it is frequently used by securities analysts, investors and other interested parties to compare the financial condition of companies. Net debt to Adjusted EBITDA ratio should not be considered as an alternative to measures of financial condition derived in accordance with U.S. GAAP and it may not be comparable to a similarly titled measure of other companies. Comparable Hotels The Company presents certain data for its hotels on a comparable hotel basis as supplemental information for investors. The Company defines its comparable hotels as those hotels that: (i) were active and operating in the Company’s portfolio since January 1st of the previous year; and (ii) have not sustained substantial property damage, business interruption, undergone large-scale capital projects or for which comparable results are not available. The Company presents comparable hotel results to help the Company and its investors evaluate the ongoing operating performance of its comparable hotels. Due to the conversion, or planned conversions, of a significant number of rooms at the Hilton Waikoloa Village in 2017 and Embassy Suites Washington DC Georgetown in 2016 to HGV timeshare units, the results from these properties were excluded from comparable hotels.

Definitions (cont’d) Occupancy Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels. Occupancy measures the utilization of the Company’s hotels’ available capacity. Management uses occupancy to gauge demand at a specific hotel or group of hotels in a given period. Occupancy levels also help management determine achievable Average Daily Rate (“ADR”) levels as demand for hotel rooms increases or decreases. Average Daily Rate ADR represents rooms revenue divided by total number of room nights sold in a given period. ADR measures average room price attained by a hotel and ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a hotel or group of hotels. ADR is a commonly used performance measure in the hotel industry, and management uses ADR to assess pricing levels that the Company is able to generate by type of customer, as changes in rates have a more pronounced effect on overall revenues and incremental profitability than changes in occupancy, as described above. Revenue per Available Room Revenue per Available Room (“RevPAR”) represents rooms revenue divided by total number of room nights available to guests for a given period. Management considers RevPAR to be a meaningful indicator of the Company’s performance as it provides a metric correlated to two primary and key factors of operations at a hotel or group of hotels: occupancy and ADR. RevPAR is also a useful indicator in measuring performance over comparable periods for comparable hotels. References to RevPAR and ADR are presented on a currency neutral basis (prior periods are reflected using the current period exchange rates), unless otherwise noted. Pro-forma Certain financial measures and other information have been adjusted for the Company’s historical debt and related balances and interest expense to give the net effect to financing transactions that were completed prior to spin-off, incremental fees based on the terms of the post spin-off management agreements, adjustments to income tax expense based on the Company’s post spin-off REIT tax structure, the removal of costs incurred related to the spin-off and the establishment of Park as a separate public company and the estimated excise taxes on certain REIT leases. Further adjustments have been made to reflect the effects of hotels disposed of or acquired during the periods presented. When presenting such information, the amounts are identified as “Pro-forma.”

About Park Hotels & Resorts and Safe Harbor Disclosure About Park Hotels & Resorts Inc. Park (NYSE: PK) is a leading lodging real estate company with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park’s portfolio consists of 67 premium-branded hotels and resorts with over 35,000 rooms located in prime U.S. and international markets with high barriers to entry. Over 85% of Park’s rooms are luxury and upper upscale and nearly 90% are located in the United States. Park is focused on driving premium long-term total returns by continuing to enhance the value of its existing hotels and utilizing its scale to efficiently allocate capital to drive growth while maintaining a strong and flexible balance sheet. Visit www.pkhotelsandresorts.com for more information. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements related to Park’s current expectations regarding the performance of its business, financial results, liquidity and capital resources, the effects of competition and the effects of future legislation or regulations and other non-historical statements. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by the use of forward-looking terminology such as the words “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward-looking statements. You should not put undue reliance on any forward-looking statements in this presentation. Additional factors that could cause Park’s results to differ materially from those described in the forward-looking statements can be found under the sections entitled “Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (or similar captions) in Park’s Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC, as such factors may be updated from time to time in Park’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Forward-looking statements speak only as of the date on which they are made and Park undertakes no obligation to update or revise publicly any guidance or other forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. Supplemental Financial Information Park refers to certain non-generally accepted accounting principles (“GAAP”) financial measures in this presentation, including Funds from Operations (“FFO”) calculated in accordance with the guidelines of the National Association of Real Estate Investment Trusts (“NAREIT”), Adjusted FFO, FFO per share, Adjusted FFO per share, Earnings before interest expense, taxes and depreciation and amortization (“EBITDA”), Adjusted EBITDA, Hotel Adjusted EBITDA, Hotel Adjusted EBITDA margin, Net debt and Net debt to Adjusted EBITDA ratio. These non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of its operating performance. Please see the schedules included in this presentation including the “Definitions” section for additional information and reconciliations of such non-GAAP financial measures.