1 Effective as of February 13, 2025 PARK HOTELS & RESORTS INC. INSIDER TRADING POLICY Policy Summary This Insider Trading Policy is important because the federal securities laws prohibit trading in a company’s stock on the basis of material nonpublic information. Penalties for violations of insider trading laws include embarrassment and liability for Park Hotels & Resorts as well as disciplinary, civil and criminal sanctions for individuals, including incarceration. • Board members and Associates of Park Hotels & Resorts are prohibited from trading in the Company’s stock if they are in possession of material nonpublic information. • Board members, executive officers and certain other persons may not trade in the Company’s stock during specified blackout periods. • A subset of the group that is subject to blackout periods, including board members and executive officers, also must pre-clear their trades with the General Counsel Office or CFO. • Although the main focus of this policy is the prohibition of insider trading with respect to Park Hotels & Resorts securities, the laws may prohibit trading on certain inside information with respect to any public company’s securities, including those of suppliers, customers and other publicly-traded real estate investment trusts engaged primarily in the business of owning (but not the business of operating, managing and/or franchising) hotel properties (“Competitors”). Accordingly, Park Associates must be mindful that any third-party confidential information they learn in the course of employment with Park Hotels & Resorts may be subject to insider trading considerations, as set forth in more detail in this policy. • This policy also outlines procedures and provides templates to support compliance with all requirements. All Associates must read the entire Insider Trading Policy. ___________________________________________ 1. BACKGROUND AND PURPOSE Park Hotels & Resorts Inc. and its subsidiaries (collectively, the “Company”) are committed to compliance with all applicable laws, including laws governing trading in the Company’s securities. EXHIBIT 19

2 Federal securities laws prohibit any member of the Board of Directors (a “Board Member”) or employee of the Company including employees of all hotels owned or operated by the Company whether or not they are employed by the Company (collectively “Associates”), and those other persons and entities identified in Section 2.1 herein from purchasing or selling Company securities on the basis of material nonpublic information (referred to as “MNPI”) concerning the Company, or from tipping MNPI to others. These laws impose severe sanctions on individuals who violate them. In addition, the Securities and Exchange Commission (the “SEC”) has the authority to impose large fines on the Company and on Board Members, executive officers and controlling stockholders if the Company’s employees engage in insider trading and the Company has failed to take appropriate steps to prevent it (referred to as “controlling person liability”). This Insider Trading Policy (this “Policy”) is being adopted in light of these legal requirements, and with the goal of: • preventing inadvertent violations of the insider trading laws; • fostering compliance with applicable reporting obligations under Schedule 13 and Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”); • avoiding even the appearance of impropriety on the part of those employed by, or associated with, the Company; • protecting the Company from controlling person liability; and • protecting the reputation of the Company, its Board Members, and its employees. As detailed below, this Policy applies to family members and certain other persons and entities with whom Board Members and Associates have relationships. However, nothing in this Policy is applicable to transactions by the Company itself. 1.1 What Type of Information Is “Material”? Information is “material” if it is likely that a reasonable investor would consider it important in making a decision to buy, sell, or hold a security or where it is likely to have a significant effect on the market price of the security. Both positive and negative information may be material. While it is not possible to compile an exhaustive list, information concerning any of the following items should be reviewed carefully to determine whether such information is material: • the Company's key financial metrics and results, including, but not limited to, revenues, FFO, quarterly or annual results, EBITDA, adjusted EBITDA, RevPAR, occupancy, ADR, and all GAAP equivalents, including net income and earnings per share; • guidance on earnings estimates and changing or confirming such guidance on a later date, or other projections of future financial performance; • significant mergers, acquisitions, dispositions, joint ventures, tender offers or other significant changes in assets of the Company; • changes in control or in management or the Board of Directors of the Company;

3 • incurrence, refinancing, cancellation or repayment of or any other significant transaction involving the Company’s corporate debt, including changes to any key debt terms, such as amounts, interest rates and maturities, or any other key change to the Company’s capital structure; • a significant change in the strategic direction of the Company; • a Company decision to commence or terminate the payment of cash dividends; • developments regarding customers or suppliers including the acquisition or loss of an important contract; • any financing transactions out of the ordinary course; • changes in compensation policy; • the establishment of a program to repurchase securities of the Company; • a default on outstanding debt of the Company or a bankruptcy filing, corporate restructuring or receivership; • legal or regulatory matters; • updates or changes to corporate governance practices; • change in or dispute with the Company’s independent registered public accounting firm; • financings and other events regarding the Company’s securities (e.g., defaults on securities, calls of securities for redemption, repurchase plans, stock splits, public or private sales of securities, changes in dividends and changes to the rights of security holders); • significant write-offs; or • a conclusion by the Company or a notification from its independent auditor that any of the Company's previously issued financial statements or auditor’s report regarding such financial statements should no longer be relied upon. This list is illustrative only and is not intended to provide a comprehensive list of circumstances that could give rise to material information. Any person covered by this Policy should resolve any question concerning materiality of particular information in favor of materiality, and thus the activities described in Section 2.2 should be avoided until such information has been publicly disclosed or it has been determined that such information is not, or has ceased to be, material. The SEC takes a broad view as to what information is considered material. If you have any questions as to whether certain information is material, please contact the General Counsel Office. 1.2 When Is Information “Nonpublic”? Information concerning the Company is considered nonpublic if it has not been disseminated in a manner making it available to investors and the public generally. For purposes of this Policy, information is “Nonpublic” until three criteria have been satisfied: (1) the information has been widely disseminated in one or more of the following ways: it has been carried in a

4 “financial” news service such as the Dow Jones Broad Tape, it has been carried in a “general” news service such as the Associated Press, it has been carried by a national television news service, it has appeared in a public filing made with the SEC (such as a Report on Form 10-K, Form 10-Q or Form 8-K), it has been made at a conference or during a call to which the public has been granted access by telephonic or electronic transmission or by any other means, which, after consultation with the General Counsel Office, is believed to provide broad, non-exclusionary distribution of the information to the public in a manner satisfying applicable rules and regulations; (2) the information disclosed was some form of “official” announcement (the fact that rumors, speculation, or statements attributed to unidentified sources are public is insufficient to be considered widely disseminated even when the information is accurate) and (3) a sufficient amount of time has passed so that the information has had an opportunity to be absorbed by the marketplace. 2. PROHIBITIONS RELATING TO TRANSACTIONS IN THE COMPANY’S SECURITIES 2.1 Persons Covered by this Policy. This Policy applies to the following persons or entities, hereafter referred to as “Covered Persons”: • all Board Members; • all Associates; • all family members of Board Members and Associates, which, for purposes of this Policy, means those family members who reside with a Board Member or an Associate and any family member who does not reside in the Board Member’s or Associate’s household but whose transactions in the Company’s securities are directed by the Board Member or Associate or are subject to the Board Member’s or Associate’s influence or control (“Family Members”); and • all corporations, partnerships, trusts, or other entities controlled by any of the above persons, unless the entity has implemented policies or procedures designed to ensure that such person cannot influence transactions by the entity involving Company securities (all hereafter referred to as “Related Entities”). 2.2 Prohibition on Trading While Aware of MNPI. Except as provided in Section 4, no Covered Person may: • purchase, sell, or donate any securities of the Company or engage in any other transaction to acquire, transfer or dispose of securities of the Company, including market option exercises, exercises of stock options granted under the Company’s stock plans, sales of stock acquired upon the exercise of options and trades made under an employee benefit plan such as a 401(k) plan, while he or she is aware of any MNPI concerning the Company or recommend to another person that they do so; • disclose to any other person any MNPI concerning the Company if such person may misuse that information, such as by purchasing or selling Company securities, or tipping that information to others; • purchase, sell, or donate any securities of any of the following: (i) another company with which the Company does business, including a supplier or customer, or (ii) Competitors (each, a “Covered Company”), or engage in any other transaction to acquire, transfer or dispose of securities of a Covered Company while he or she is aware of any MNPI concerning such Covered Company that he or she learned in the course of his or her service as a Board Member or an Associate of the Company or recommend to another person that they do so; or

5 • disclose to any other person any MNPI concerning a Covered Company to the extent that such MNPI was learned in the course of his or her service as a Board Member or an Associate of the Company if such person may misuse that information, such as by purchasing or selling securities of such Covered Company, or tipping that information to others; or • comment on stock price movements or rumors of other corporate developments (including discussions in Internet chat rooms, on message boards, social media websites, news groups or any other similar forums) that are of possible significance to the investing public except in the ordinary course of business consistent with the guidelines set forth in this Policy, the Park Hotels & Resorts Public Communications, Public Disclosure and Regulation FD Policy and the Park Hotels & Resorts Business Practices Policy. 3. ADDITIONAL PROHIBITIONS APPLICABLE TO DIRECTORS, EXECUTIVES AND DESIGNATED EMPLOYEES 3.1 This Section 3 imposes additional requirements on certain persons in the Company who may have access to MNPI as part of their ordinary course roles and responsibilities (“Access Persons”). For purposes of this Policy, Access Persons are designated as follows: • all Board Members; • all “officers”, as defined under Section 16 of the Exchange Act (“Section 16 Officers”); • all members of the Company’s Executive Committee (“EC Members”); • all Associates at the level of Senior Vice President and above; • Associates in the following Company departments at the designated levels: • Finance Department – all Associates at the Vice President level and above, plus for the Investor Relations and Financial Reporting divisions of the Finance Department, Associates at all levels are included; • Legal Department – all Associates at the Manager level and above; • any other Associate who is notified by the Company that he or she is an Access Person; • all Family Members of the above listed Access Persons; and • all Related Entities of the above listed Access Persons. All Access Persons must submit to the General Counsel Office an acknowledgment in the form attached hereto as Schedule I. 3.2 Blackout Periods. (a) Regular Blackout Periods. Except as provided in Section 4, no Access Person may purchase, sell, or donate any securities of the Company during the period beginning on the last trading day that

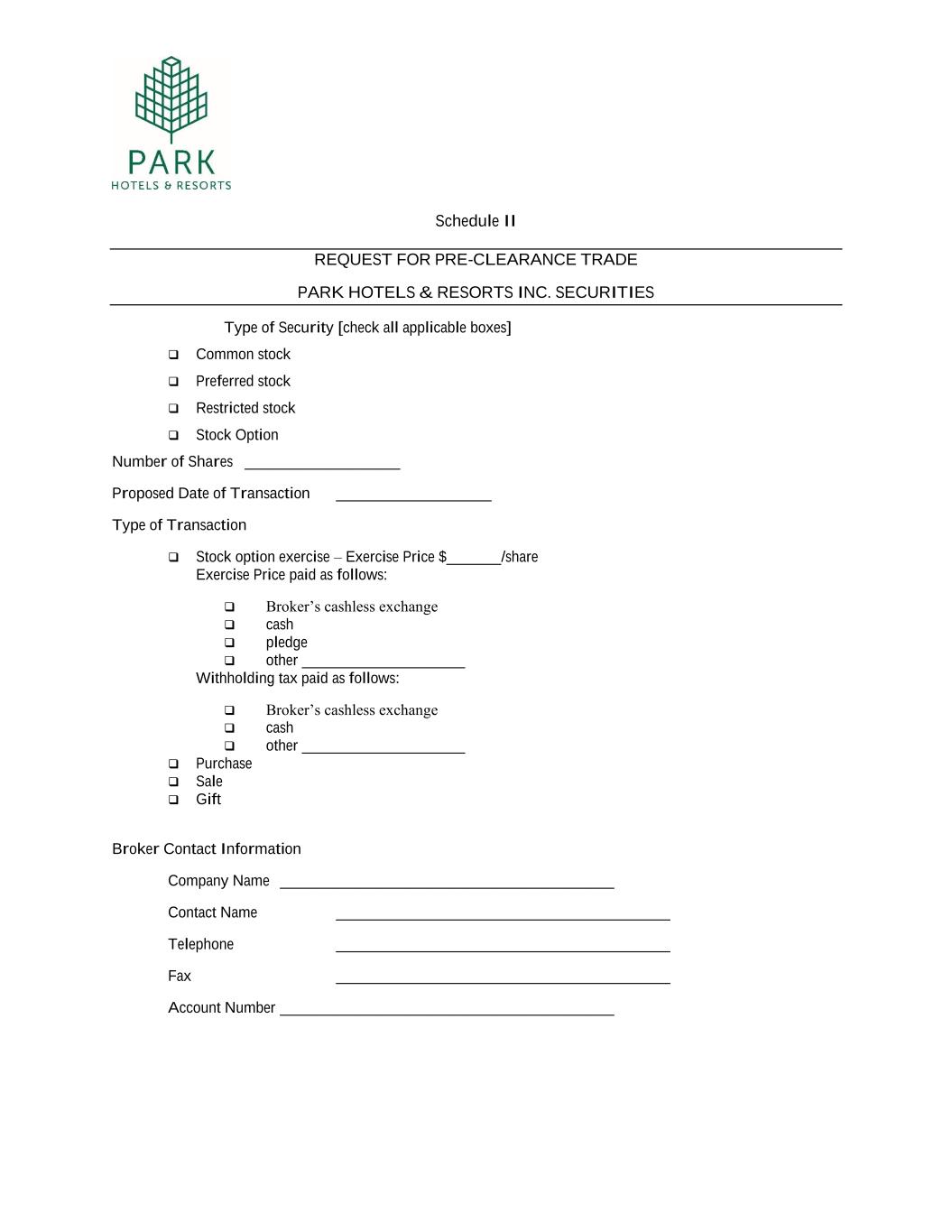

6 is two weeks prior to the end of each fiscal quarter and ending upon the completion of the first full trading day after the public announcement of earnings for such quarter (a “Regular Blackout Period”). (b) Corporate News Blackout Periods. The Company may from time to time notify Board Members, Section 16 Officers and other specified Associates that an additional blackout period (a “Special Blackout Period”) is in effect in view of significant events or developments involving the Company. In such event, except as provided in Section 4, no such individual may purchase, sell, or donate any securities of the Company during such Special Blackout Period or inform anyone else that a Special Blackout Period is in effect. In this Policy, Regular Blackout Periods and Special Blackout Periods are each referred to as a “Blackout Period.” (c) Notification of Blackout Periods. The Company will deliver an e-mail (or other communication) notifying all Access Persons when a Regular Blackout Period will begin and end. In the case of a Special Blackout Period, the Company will notify Board Members, Section 16 Officers and specified Associates by e-mail (or other communication) when the Special Blackout Period begins and when it ends. The Company’s delivery or nondelivery of these e-mails (or other communications) does not relieve any Access Person of the obligation to only trade in securities of the Company in full compliance with this Policy. 3.3 Notice and Pre-Clearance of Transactions. Certain Access Persons are required to obtain pre-clearance of any trading activity as described in this Section 3.3. (a) Pre-Transaction Clearance. No Board Member, Section 16 Officer or EC Member (a “Pre-Clearance Person”) may purchase or sell or otherwise acquire or dispose of securities of the Company, other than in a transaction permitted under Section 4 (excluding a bona fide gift, which does require pre- transaction clearance pursuant to this Section 3.3(a)), unless such person pre-clears the transaction with either the Chief Financial Officer or the General Counsel. A request for pre-clearance shall be made at least two business days in advance of the proposed transaction and by completing a “Request for Pre-Clearance” form, which is attached hereto as Schedule II, and submitting it to the General Counsel Office. Pre-Clearance must be in writing, dated and signed, specifying the securities involved. The Chief Financial Officer and the General Counsel shall have sole discretion to decide whether to clear any contemplated transaction. The General Counsel shall have sole discretion to decide whether to clear transactions by the Chief Financial Officer or persons or entities subject to this Policy as a result of their relationship with the Chief Financial Officer, and the Chief Financial Officer shall have sole discretion to decide whether to clear transactions by the General Counsel or persons or entities subject to this Policy as a result of their relationship with the General Counsel. All trades that are pre-cleared must be effected within two business days of receipt of the pre- clearance unless a specific exception has been granted by the General Counsel and the Chief Financial Officer. A pre-cleared trade (or any portion of a pre-cleared trade) that has not been effected during the two business day period must be pre-cleared again prior to execution. Notwithstanding receipt of pre-clearance, if the Pre- Clearance Person becomes aware of MNPI or becomes subject to a Blackout Period before the transaction is effected, the transaction may not be completed. (b) Post-Transaction Notice. To facilitate public reporting requirements, each Board Member and Section 16 Officer shall also notify the General Counsel (or his or her designee) of the occurrence of any purchase, sale or other acquisition or disposition of securities of the Company as soon as possible following the transaction, but in any event within one business day after the transaction. Such notification may be oral or in writing (including by email) and should include the identity of the covered person, the type of transaction, the date of the transaction, the number of shares involved and the purchase or sale price.

7 (c) Deemed Time of a Transaction. For purposes of this Section 3.3, a purchase, sale, or other acquisition or disposition shall be deemed to occur at the time the person becomes irrevocably committed to it (for example, in the case of an open market purchase or sale, this occurs when the trade is executed, not when it settles). 4. EXCEPTIONS 4.1 Exceptions. The prohibitions in Sections 2.2 and 3.2 on purchases, sales and donations of Company securities do not apply to: • exercises of stock options or other equity awards that would otherwise expire or the surrender to or withholding by the Company of shares in payment of the exercise price or in satisfaction of any tax withholding obligations, in each case in a manner permitted by the applicable equity award agreement; provided, however, that the securities so acquired may not be sold (either outright or in connection with a “cashless” exercise transaction through a broker) while the Associate or Board Member is aware of MNPI or, in the case of an Access Person, during a Blackout Period; • transferring of shares to an entity that does not involve a change in the beneficial ownership of the shares (for example, to an inter vivos trust of which you are the sole beneficiary during your lifetime); • the execution of transactions pursuant to a trading plan that complies with SEC Rule 10b5-1 and that has been approved by the Company; • bona fide gifts of Company securities (including transfers of Company securities made to trusts for estate planning purposes), unless the person making the gift has reason to believe that the recipient intends to sell the Company securities while the person making the gift is aware of MNPI concerning the Company, provided that the restrictions in Section 3.3 still apply to any such transactions; • to the extent the Company offers its securities as an investment option in the Company’s 401(k) plan, the purchase of stock through the Company’s 401(k) plan through regular payroll deductions; however, the sale of any such stock and the election to transfer funds into or out of, or a loan with respect to amounts invested in, the stock fund is subject to this Policy; • to the extent the Company offers its securities as an investment option in an employee stock purchase plan, the purchase of stock through the Company’s employee stock purchase plan; however, the sale of any such stock and changing instruction regarding the level of withholding contributions that are used to purchase stock are subject to this Policy; and • to the extent the Company offers a dividend reinvestment plan (“DRIP”), the purchase of stock through the DRIP resulting from reinvestment of dividends paid on the Company’s securities; however, (i) a voluntary purchase of the Company’s securities that results from additional contributions a participant chooses to make to the DRIP, and to a participant’s election to participate, cease participation or otherwise alter his or her participation in the DRIP, and (ii) a participant’s sale of any of the Company’s securities purchased pursuant to the DRIP, are subject to this Policy. 4.2 10b5-1 Plans. The prohibitions in Sections 2.2 and 3.2 on purchases, sales and donations of Company securities do not apply to purchases or sales made pursuant to a binding contract, written plan or specific instruction that is adopted and operated in compliance with Rule 10b5-1 (a “Trading Plan”); provided

8 such Trading Plan: (1) is in writing; (2) was submitted to the Company for review by the Company and pre- cleared by the General Counsel prior to its adoption; (3) was not adopted while the employee or Board Member was aware of MNPI or, in the case of an Access Person, during a Blackout Period; and (4) in the case of a Board Member or Section 16 Officer, requires the Board Member’s or Section 16 Officer’s broker to notify the Company before the close of business on the day after the execution of the transaction. All Trading Plans must be entered into in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1, and anyone entering into a Trading Plan must act in good faith with respect to such Trading Plan. (a) Modifications to or Terminations of Trading Plans. Modifications to or terminations of Trading Plans must be carefully considered and generally are discouraged absent compelling circumstances. In all cases, any modification to or termination of a Trading Plan must also comply with all of the above requirements, including pre-clearance by the General Counsel and occurrence outside of a Blackout Period. (b) Trade Commencement under Trading Plan. No sales under a Trading Plan of any Board Member or Section 16 Officer may commence prior to the expiration of a cooling-off period, ending on the later of (i) 90 days after adoption or modification of the Trading Plan or (ii) two business days following the filing of the Company's Form 10-Q or Form 10-K for the completed fiscal quarter in which the Trading Plan was adopted or modified. For all other Access Persons, if a Trading Plan is adopted (or modified) within two weeks prior to the commencement of a Regular Blackout Period, trades may not occur pursuant to such Trading Plan prior to the termination of such Regular Blackout Period. In addition, persons subject to this policy are not permitted to have more than one Trading Plan outstanding at any given time, unless permitted by the limited exceptions to Rule 10b5-1 and approved by the General Counsel. The Company reserves the right to withhold pre-clearance of any Trading Plan that the Company determines is not consistent with the rules regarding such plans. 4.3 Hardship Exemptions. Those subject to Blackout Periods may request a hardship exemption for periods during a blackout if they are not in possession of MNPI and are not otherwise prohibited from trading pursuant to this Policy. Hardship exemptions will be granted infrequently and only in exceptional circumstances. Any request for a hardship exemption shall be made to the Chief Financial Officer or the General Counsel. 4.4 Partnership Distributions. Nothing in this Policy is intended to limit the ability of a venture capital partnership or other similar entity with which a Board Member is affiliated to distribute Company securities to its partners, members, or other similar persons. It is the responsibility of each affected Board Member and the affiliated entity, in consultation with their own counsel (as appropriate), to determine the timing of any distributions, based on all relevant facts and circumstances and applicable securities laws. 4.5 Underwritten Public Offering. Nothing in this Policy is intended to limit the ability of any person to sell Company securities as a selling stockholder in an underwritten public offering pursuant to an effective registration statement in accordance with applicable securities law. 4.6 Application of Policy after Cessation of Service. For all Covered Persons, this Policy continues in effect until the end of the first Regular Blackout Period after termination of employment or other relationship with the Company, except that, unless otherwise notified by the Company, the pre-clearance requirements set forth in Section 3.3 continue to apply to Pre-Clearance Persons and their respective Family Members and Related Entities for six months after termination of their status with the Company. In addition, under certain circumstances, Section 16 of the Exchange Act may impose reporting obligations on Board Members and Section 16 Officers for six months following termination of their status with the Company.

9 5. REGULATION BTR If the Company is required to impose a “pension fund blackout period” under Regulation BTR, no Board Member or Section 16 Officer shall directly or indirectly sell, purchase or otherwise transfer during such blackout period any equity securities of the Company acquired in connection with his or her service as a director or officer of the Company, except as permitted by Regulation BTR. 6. PENALTIES FOR VIOLATION Violation of any of the foregoing rules is grounds for disciplinary action by the Company, including termination of employment. In addition to any disciplinary actions the Company may take, insider trading can also result in administrative, civil or criminal proceedings that can result in significant fines and civil penalties, being barred from service as an officer or director of a public company or being sent to jail. 7. COMPANY EDUCATION AND ASSISTANCE 7.1 Education. The Company shall take reasonable steps designed to ensure that all Board Members and Associates are educated about, and periodically reminded of, the federal securities law restrictions and Company policies regarding insider trading. 7.2 Assistance. The Company shall provide reasonable assistance to all Board Members and Section 16 Officers, as requested by such Board Members and Section 16 Officers, in connection with the filing of Forms 3, 4 and 5 under Section 16 of the Exchange Act. However, the ultimate responsibility, and liability, for timely filing remains with the Board Members and Section 16 Officers. 7.3 Limitation on Liability. None of the Company, the Chief Financial Officer, the General Counsel, or the Company’s other employees will have any liability for any delay in reviewing, or refusal of, a request to allow a pledge submitted pursuant to Section 2.3, a request for pre-clearance submitted pursuant to Section 3.3(a) or a trading plan submitted pursuant to Section 4.1. Notwithstanding any pre-clearance of a transaction pursuant to Section 3.3(a) or review of a trading plan pursuant to Section 4.1, none of the Company, the Chief Financial Officer, the General Counsel, or the Company’s other employees assumes any liability for the legality or consequences of such transaction or trading plan to the person engaging in or adopting such transaction or trading plan. Any decision by the Company to pre-clear a transaction under this Policy does not constitute legal advice, and it is your responsibility to ensure compliance with applicable securities laws when trading in the Company’s securities.

Schedule I ACKNOWLEDGMENT CONCERNING SECURITIES TRADING POLICY If you are an Access Person, we ask that you acknowledge that you have received and read this Insider Trading Policy. Park Hotels & Resorts Inc. may ask you to re-submit this acknowledgement on an annual basis, at such time as you have been notified that you are an Access Person or whenever the Insider Trading Policy is significantly updated. By my signature below, I acknowledge that I have read and received Park Hotels & Resorts Inc.’s Insider Trading Policy. Signature: ____________________________________ Name (printed): _______________________________ Date: ________________________________________

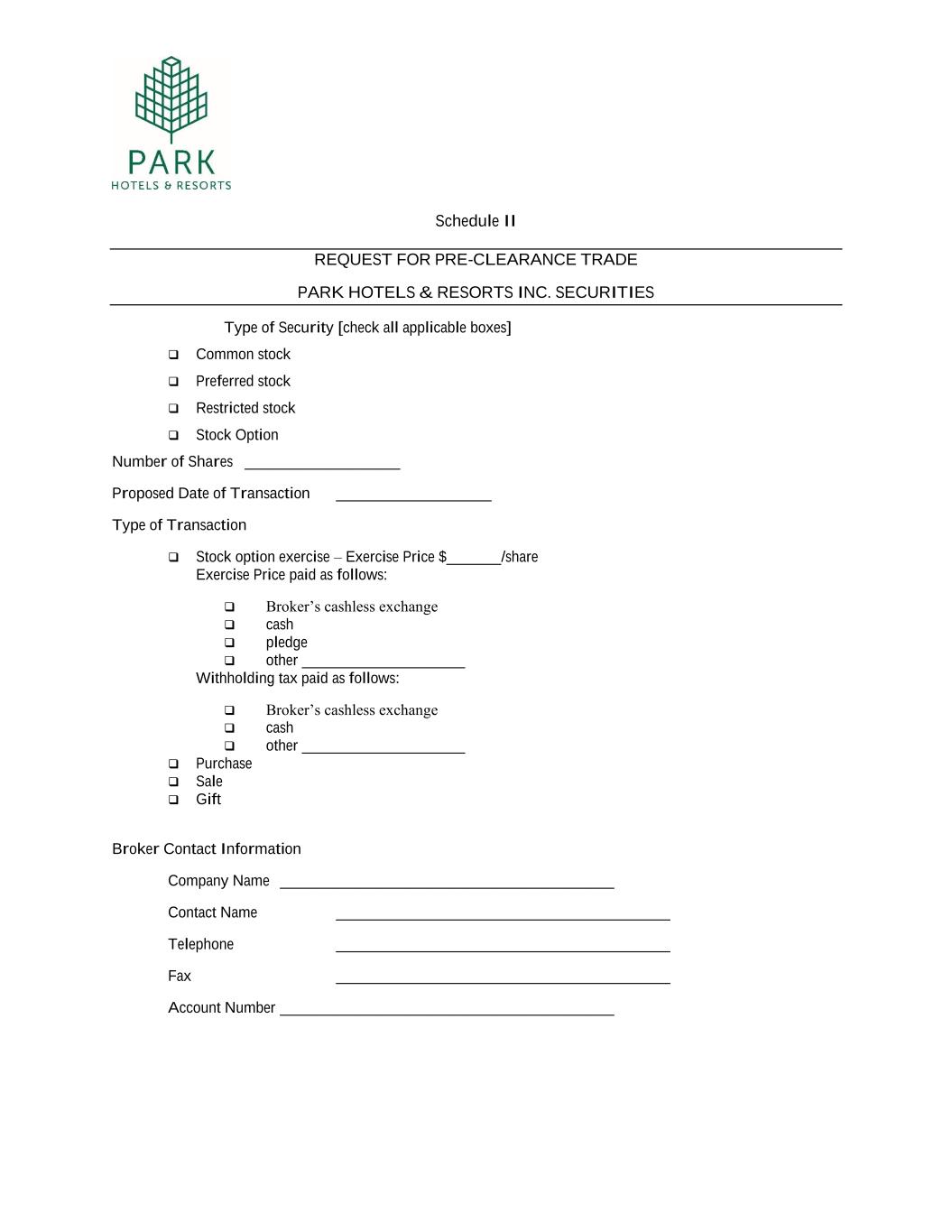

Schedule II REQUEST FOR PRE-CLEARANCE TRADE PARK HOTELS & RESORTS INC. SECURITIES Type of Security [check all applicable boxes] ❑ Common stock ❑ Preferred stock ❑ Restricted stock ❑ Stock Option Number of Shares ____________________ Proposed Date of Transaction ____________________ Type of Transaction ❑ Stock option exercise – Exercise Price $_______/share Exercise Price paid as follows: ❑ Broker’s cashless exchange ❑ cash ❑ pledge ❑ other _____________________ Withholding tax paid as follows: ❑ Broker’s cashless exchange ❑ cash ❑ other _____________________ ❑ Purchase ❑ Sale ❑ Gift Broker Contact Information Company Name ___________________________________________ Contact Name ___________________________________________ Telephone ___________________________________________ Fax ___________________________________________ Account Number ___________________________________________

Social Security or other Tax Identification Number __________________________ Status (check all applicable boxes) ❑ Executive Officer ❑ Board Member Filing Information (check all applicable boxes and complete blanks) Date of filing of last Form 3 or 4 _____________________________________ ❑ Is a Form 144 Necessary? Date of filing of last Form 144 _____________________________________ I am not currently in possession of any material non-public information relating to Park Hotels & Resorts Inc. and its subsidiaries. I hereby certify that the statements made on this form are true and correct. I understand that clearance may be rescinded prior to effectuating the above transaction if material non-public information regarding Park Hotels & Resorts Inc. arises and, in the reasonable judgment of Park Hotels & Resorts Inc., the completion of my trade would be inadvisable. I also understand that the ultimate responsibility for compliance with the insider trading provisions of the federal securities laws rests with me and that clearance of any proposed transaction should not be construed as a guarantee that I will not later be found to have been in possession of material non-public information. Signature _____________________________ Date ________________________ Print Name ____________________________ Telephone Number Where You May Be Reached ________________________ ❑ Request Approved (transaction must be completed within two business days after approval; notwithstanding this approval, if the person whose signature appears above becomes aware of material non-public information or becomes subject to a Blackout Period before the transaction is effected, the transaction may not be completed). ❑ Request Denied ❑ Request Approved with the following modification __________________________ Signature _____________________________ Date _____________________________