Exhibit 99.2

The testimonials included in this presentation were acquired by ZipRecruiter without compensation to these individuals’ employers, and may not be indicative of every user’s experience on ZipRecruiter. Some individuals were and some were not compensated for their participation.

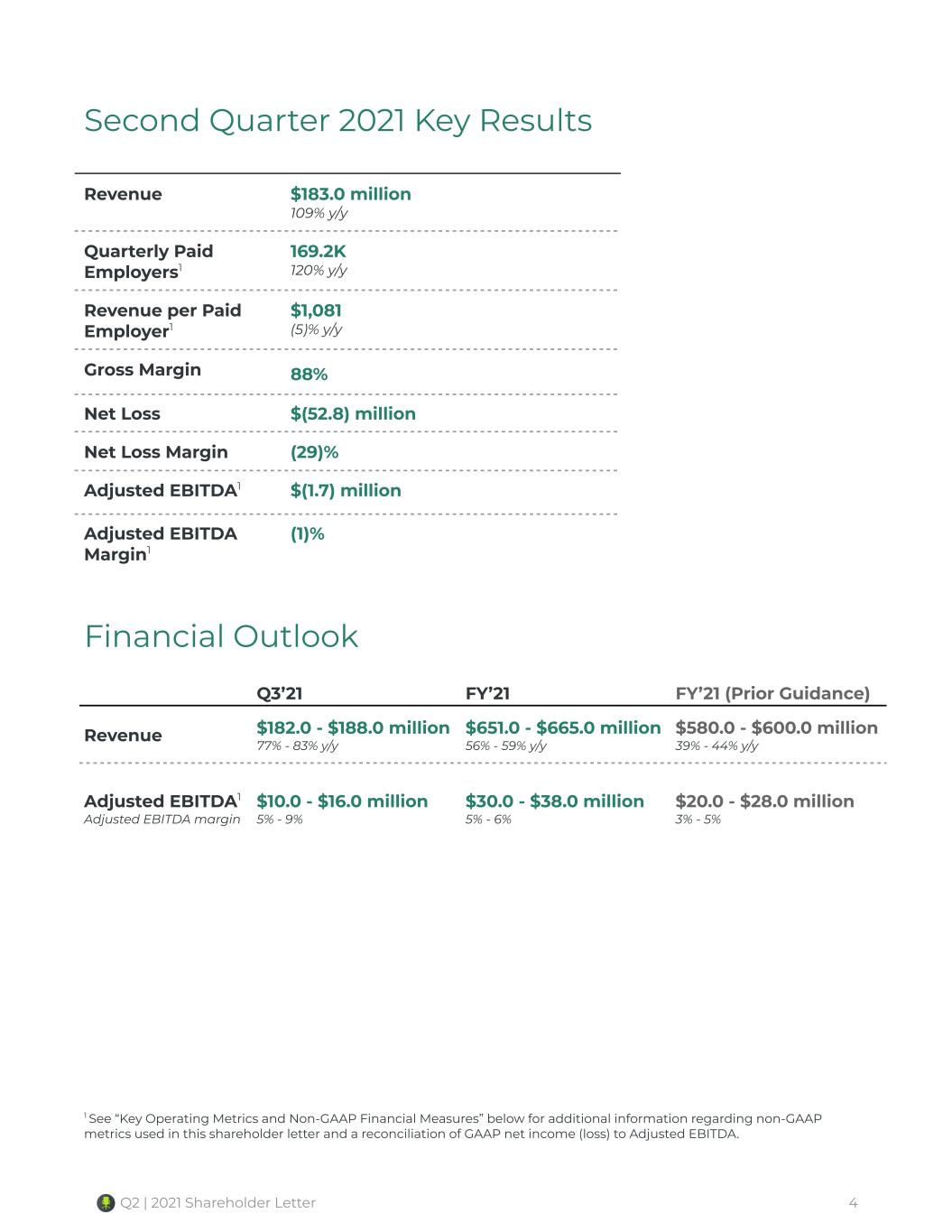

To Our Shareholders The second quarter of 2021 was exceptionally strong for ZipRecruiter. We generated $183.0 million in revenue, up 109% y/y and $23.0 million above the guidance provided in May prior to our direct listing. Revenue in Q2’21 represented a record high for ZipRecruiter and reflects our team’s strong execution of our long-term strategy: more jobs, more job seekers, and highly-effective matching technology to bring the two sides of our marketplace together. We posted a net loss of $(52.8) million and an Adjusted EBITDA loss of $(1.7) million, equating to a net margin of (29)% and an Adjusted EBITDA margin of (1)%. This exceeds the Adjusted EBITDA guidance we provided in May, while we still made significant long-term investments in building our marketplace. Both net loss and Adjusted EBITDA for the quarter included $31.9 million in non-recurring expenses related to our direct listing. In light of this quarter’s results and our updated outlook, we are raising guidance (detailed below) for both revenue and Adjusted EBITDA for the full year. Despite the success we experienced over the past quarter as measured by our financials and the positive feedback from job seekers and employers, we are still in the early stages of building a category-defining marketplace to achieve our Mission: to actively connect people to their next great opportunity. Q2 | 2021 Shareholder Letter 3

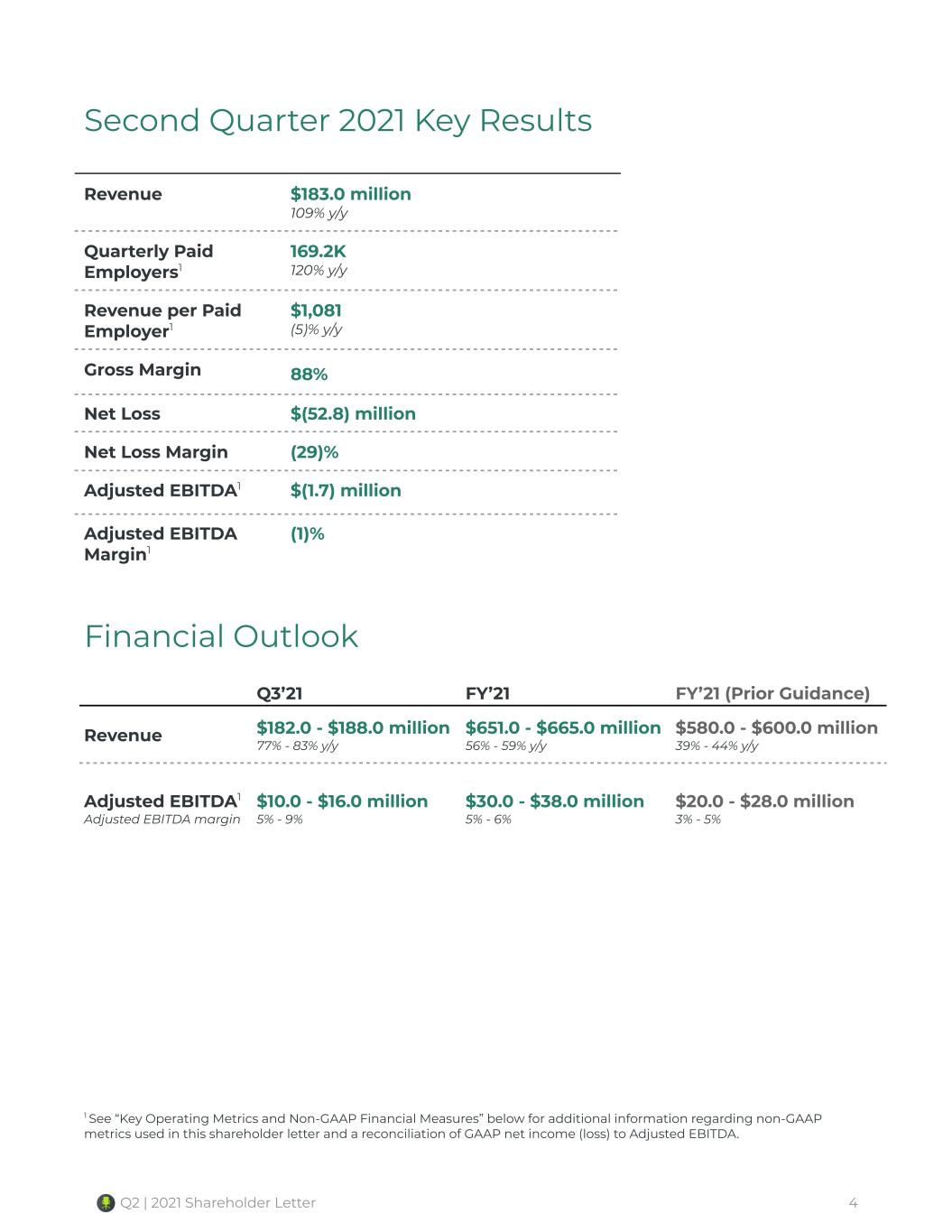

Second Quarter 2021 Key Results Revenue $183.0 million 109% y/y Quarterly Paid Employers1 169.2K 120% y/y Revenue per Paid Employer1 $1,081 (5)% y/y Gross Margin 88% Net Loss $(52.8) million Net Loss Margin (29)% Adjusted EBITDA1 $(1.7) million Adjusted EBITDA Margin1 (1)% Financial Outlook Q3’21 FY’21 FY’21 (Prior Guidance) Revenue $182.0 - $188.0 million 77% - 83% y/y $651.0 - $665.0 million 56% - 59% y/y $580.0 - $600.0 million 39% - 44% y/y Adjusted EBITDA1 Adjusted EBITDA margin $10.0 - $16.0 million 5% - 9% $30.0 - $38.0 million 5% - 6% $20.0 - $28.0 million 3% - 5% 1 See “Key Operating Metrics and Non-GAAP Financial Measures” below for additional information regarding non-GAAP metrics used in this shareholder letter and a reconciliation of GAAP net income (loss) to Adjusted EBITDA. Q2 | 2021 Shareholder Letter 4

Growth Strategies and Recent Progress There are three key pillars to our strategy to grow the ZipRecruiter marketplace, all three of which we continued to make steady progress toward in Q2’21. Growth Strategy #1: Increase the number of employers in the ZipRecruiter marketplace The first pillar of our growth strategy is driving more employers to the ZipRecruiter marketplace, from Fortune 500 companies to SMBs. We saw a dramatic increase in hiring activity throughout Q2’21. Specifically, the Labor Department data shows that the number of job openings nationwide was more than 30% higher in April and May than before the pandemic.1 While employers have come roaring back into the job market, job seekers have returned more slowly throughout Q2’21. This disequilibrium makes it all the more important for us to help employers succeed in a tough hiring market. Building on the record-setting results in Q1’21, Quarterly Paid Employers grew to 169,191 in Q2’21. American businesses are hiring again. We scaled up our sales and marketing efforts, resulting in an all-time high number of Quarterly Paid Employers in our marketplace. Julia Pollak ZipRecruiter Labor Economist According to July’s U.S. Jobs Report, released on August 6, 2021, the U.S. has now recovered almost 75% of the jobs lost during the pandemic.2 Large employment gains were driven by record-high activity growth in the service sector in July.3 For a detailed look at each month’s U.S. Jobs Report and labor insights from our economist, Julia Pollak, please visit our blog at www.ziprecruiter.com/blog/.4 We introduced several new employer-focused features in Q2’21. For example, we improved upon our popular Invite to Apply feature, with which employers can invite specific job seekers to apply for their open role. Now job seekers can choose to display an even more complete profile, including a photo, licenses, certifications, veteran status, and willingness to relocate. This gives employers even more useful data with which to decide whom they should invite to apply. 4The focus of these posts is macroeconomic in nature. Broad insights into the labor market from the millions of total jobs in our marketplace, including jobs from employers which are not Paid Employers, should not be taken as an indication of ZipRecruiter’s future financial performance. 3July 2021 Services ISM Report On Business, https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/july/ 2U.S. Bureau of Labor Statistics, Employment Situation, https://www.bls.gov/news.release/empsit.nr0.htm. 1U.S. Bureau of Labor Statistics, Job Openings and Labor Turnover Survey, https://data.bls.gov/timeseries/JTS000000000000000JOL. Q2 | 2021 Shareholder Letter 5

ZipRecruiter works for employers of all sizes. In an effort to fill roles faster, employers using their own applicant tracking system (ATS) want to minimize the obstacles job seekers have associated with applying to jobs. With this in mind, in Q2’21 we launched a new integration with Workday®, one of the largest human resource platforms in the United States. This integration allows job seekers to apply to jobs from Workday® customers with a single click on ZipRecruiter. It is partnerships like these that reduce the friction in the process of finding talent quickly. Q2 | 2021 Shareholder Letter 6

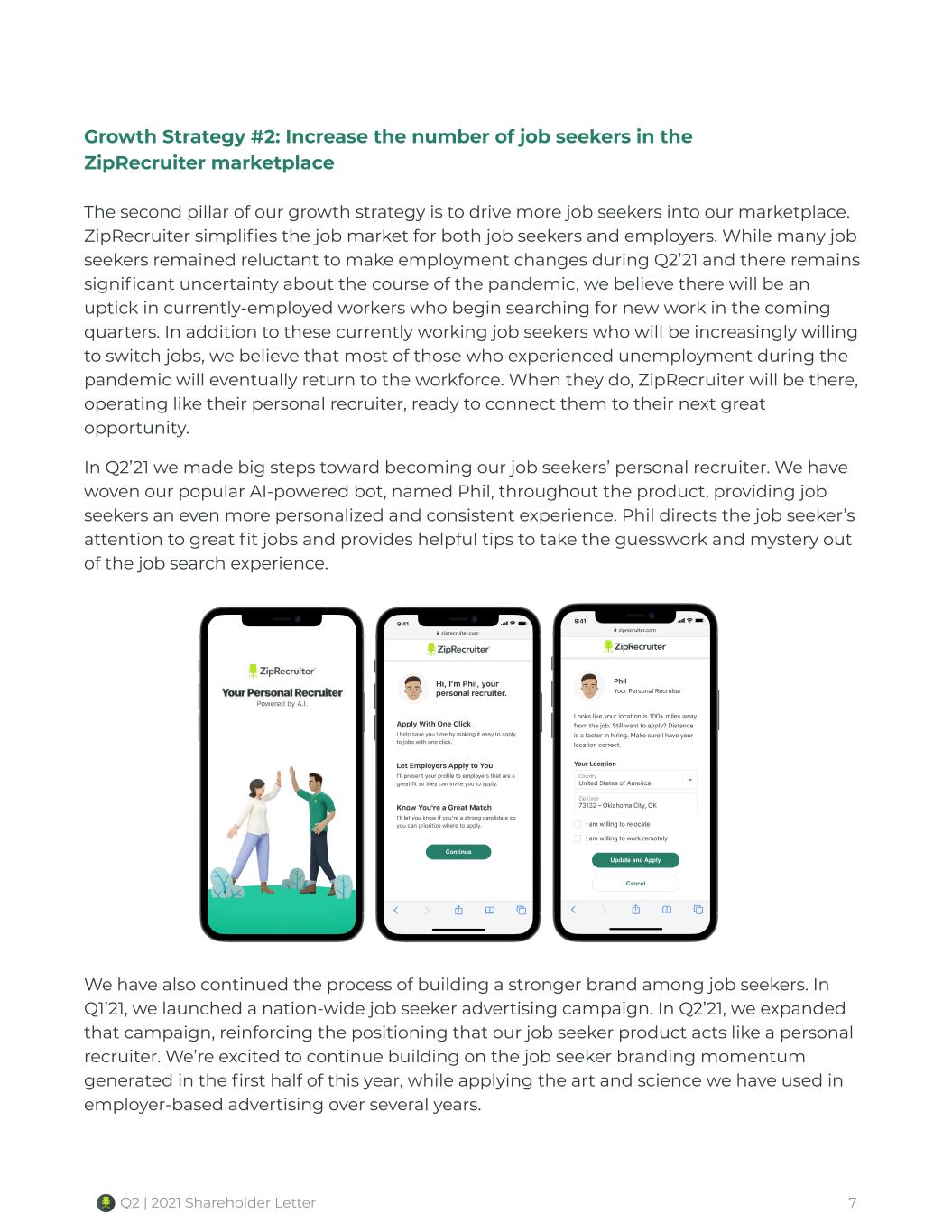

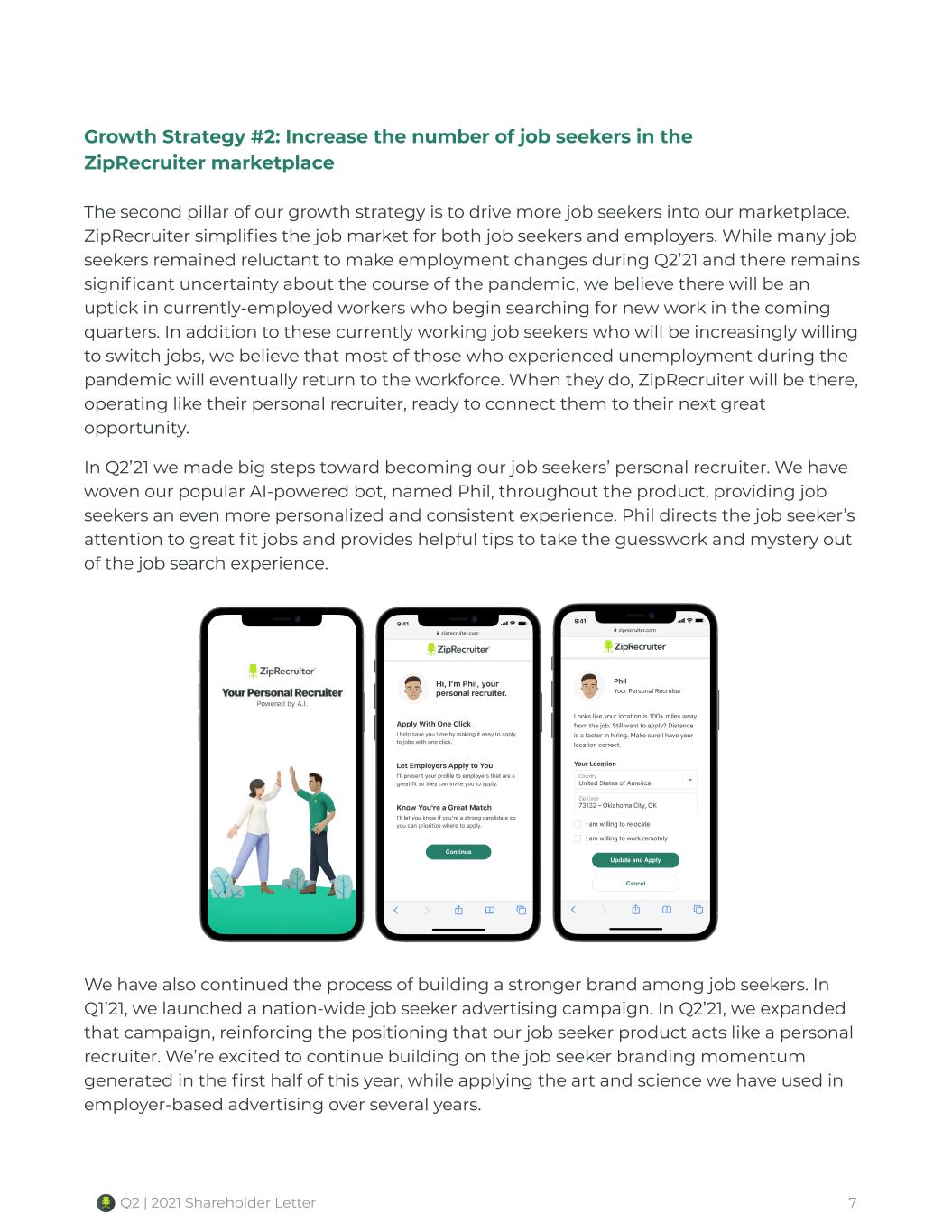

Growth Strategy #2: Increase the number of job seekers in the ZipRecruiter marketplace The second pillar of our growth strategy is to drive more job seekers into our marketplace. ZipRecruiter simplifies the job market for both job seekers and employers. While many job seekers remained reluctant to make employment changes during Q2’21 and there remains significant uncertainty about the course of the pandemic, we believe there will be an uptick in currently-employed workers who begin searching for new work in the coming quarters. In addition to these currently working job seekers who will be increasingly willing to switch jobs, we believe that most of those who experienced unemployment during the pandemic will eventually return to the workforce. When they do, ZipRecruiter will be there, operating like their personal recruiter, ready to connect them to their next great opportunity. In Q2’21 we made big steps toward becoming our job seekers’ personal recruiter. We have woven our popular AI-powered bot, named Phil, throughout the product, providing job seekers an even more personalized and consistent experience. Phil directs the job seeker’s attention to great fit jobs and provides helpful tips to take the guesswork and mystery out of the job search experience. We have also continued the process of building a stronger brand among job seekers. In Q1’21, we launched a nation-wide job seeker advertising campaign. In Q2’21, we expanded that campaign, reinforcing the positioning that our job seeker product acts like a personal recruiter. We’re excited to continue building on the job seeker branding momentum generated in the first half of this year, while applying the art and science we have used in employer-based advertising over several years. Q2 | 2021 Shareholder Letter 7

In collaboration with Facebook, in Q2’21 we launched a jobs marketplace specifically for job seekers credentialed through Facebook Career Programs, Facebook’s online learning courses, training programs and certifications. This collaboration makes it easier than ever for job seekers to find jobs that leverage their newly acquired skills. We anticipate continuing to introduce additional features and enhancements for job seekers in 2021. Nothing is more critical to our mission of actively connecting people to their next great opportunity than being ready to support job seekers as America gets back to work after the pandemic. Growth Strategy #3: Making our matching technology smarter over time The third pillar of our strategy is bringing both sides of our marketplace together, connecting people to their next great opportunity. For years we have been relentlessly developing our AI-driven job matching technology. That singular focus continues, and we maintain our dedication to helping job seekers find work and helping employers find the best talent, quickly. One of the many ways we connect job seekers to great opportunities is by suggesting jobs for which our matching technology deems them a great match. In Q2’21 we improved the algorithms behind these suggestions, resulting in an increase in job applications while we also maintained our top rating among job seeker apps in both iOS and Android for the past four years.5 Additionally, our job suggestions now provide context to job recommendations, explaining why job seekers are seeing a particular recommendation. The work of building highly-effective matching technology is ongoing, and still in its early stages. While we are pleased with our progress to date, we have increasing levels of conviction that we are just beginning to see the digital transformation of the hiring process that our matching technology has the potential to enable. Investing in our people and community We were delighted to be recognized during the quarter by Comparably as a “Best Company for Career Growth”. We take the development of our employees seriously, using a holistic approach to encourage, coach and provide feedback at every stage of one's career. We also launched several new employee resource groups (ERGs) in Q2’21. Joining the Black Professional Forum and Women in Leadership ERGs are Zip Families, ZipRecruiter 5Based on ratings information for the Google Play Store and Apple App Store from the AppFollow platform during the period of March 2017 to July 2021 for the job seeker apps of ZipRecruiter, CareerBuilder, Craigslist, Glassdoor, Indeed, LinkedIn and Monster. Q2 | 2021 Shareholder Letter 8

Asian-American Pacific-Islanders (ZAP) and Latinx in Tech (LIT). These ERGs provide employees with a place to come together around shared identities and values, provide awareness and education and build upon our company's great culture. The growing list of ZipRecruiter ERGs reflects our commitment to diversity and inclusion. Amidst the tightest labor market we have seen, we were thrilled to have spent the quarter adding many amazing new members to our own team. Specifically, we grew headcount in Q2’21 by 140, a record high for our company. We now have over 1,000 ZipRecruiter employees. Our secret in a challenging environment is not so secret: we use ZipRecruiter to find great hires! These hires include key additions in all of our teams, including technology, product management and sales. Q2 | 2021 Shareholder Letter 9

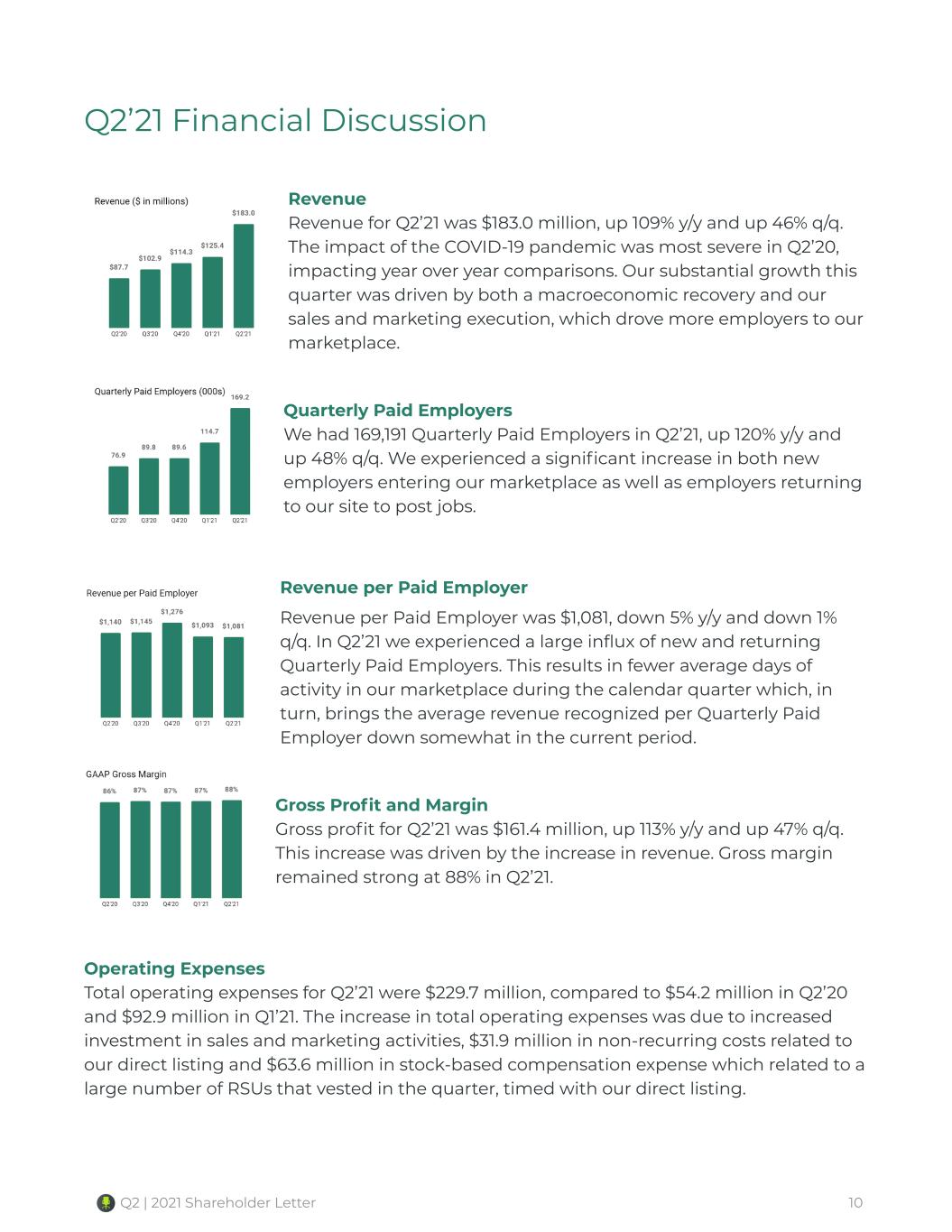

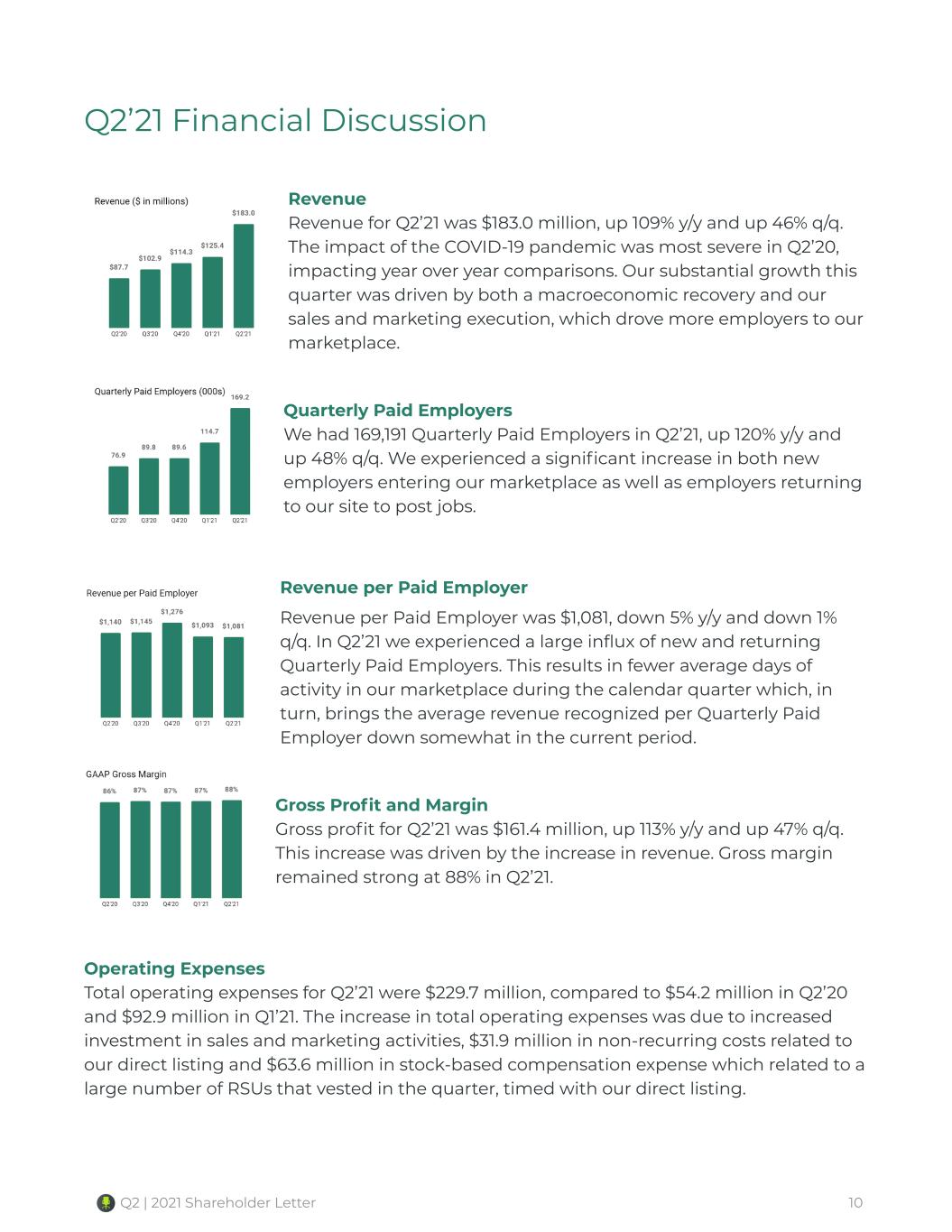

Q2’21 Financial Discussion Revenue Revenue for Q2’21 was $183.0 million, up 109% y/y and up 46% q/q. The impact of the COVID-19 pandemic was most severe in Q2’20, impacting year over year comparisons. Our substantial growth this quarter was driven by both a macroeconomic recovery and our sales and marketing execution, which drove more employers to our marketplace. Quarterly Paid Employers We had 169,191 Quarterly Paid Employers in Q2’21, up 120% y/y and up 48% q/q. We experienced a significant increase in both new employers entering our marketplace as well as employers returning to our site to post jobs. Revenue per Paid Employer Revenue per Paid Employer was $1,081, down 5% y/y and down 1% q/q. In Q2’21 we experienced a large influx of new and returning Quarterly Paid Employers. This results in fewer average days of activity in our marketplace during the calendar quarter which, in turn, brings the average revenue recognized per Quarterly Paid Employer down somewhat in the current period. Gross Profit and Margin Gross profit for Q2’21 was $161.4 million, up 113% y/y and up 47% q/q. This increase was driven by the increase in revenue. Gross margin remained strong at 88% in Q2’21. Operating Expenses Total operating expenses for Q2’21 were $229.7 million, compared to $54.2 million in Q2’20 and $92.9 million in Q1’21. The increase in total operating expenses was due to increased investment in sales and marketing activities, $31.9 million in non-recurring costs related to our direct listing and $63.6 million in stock-based compensation expense which related to a large number of RSUs that vested in the quarter, timed with our direct listing. Q2 | 2021 Shareholder Letter 10

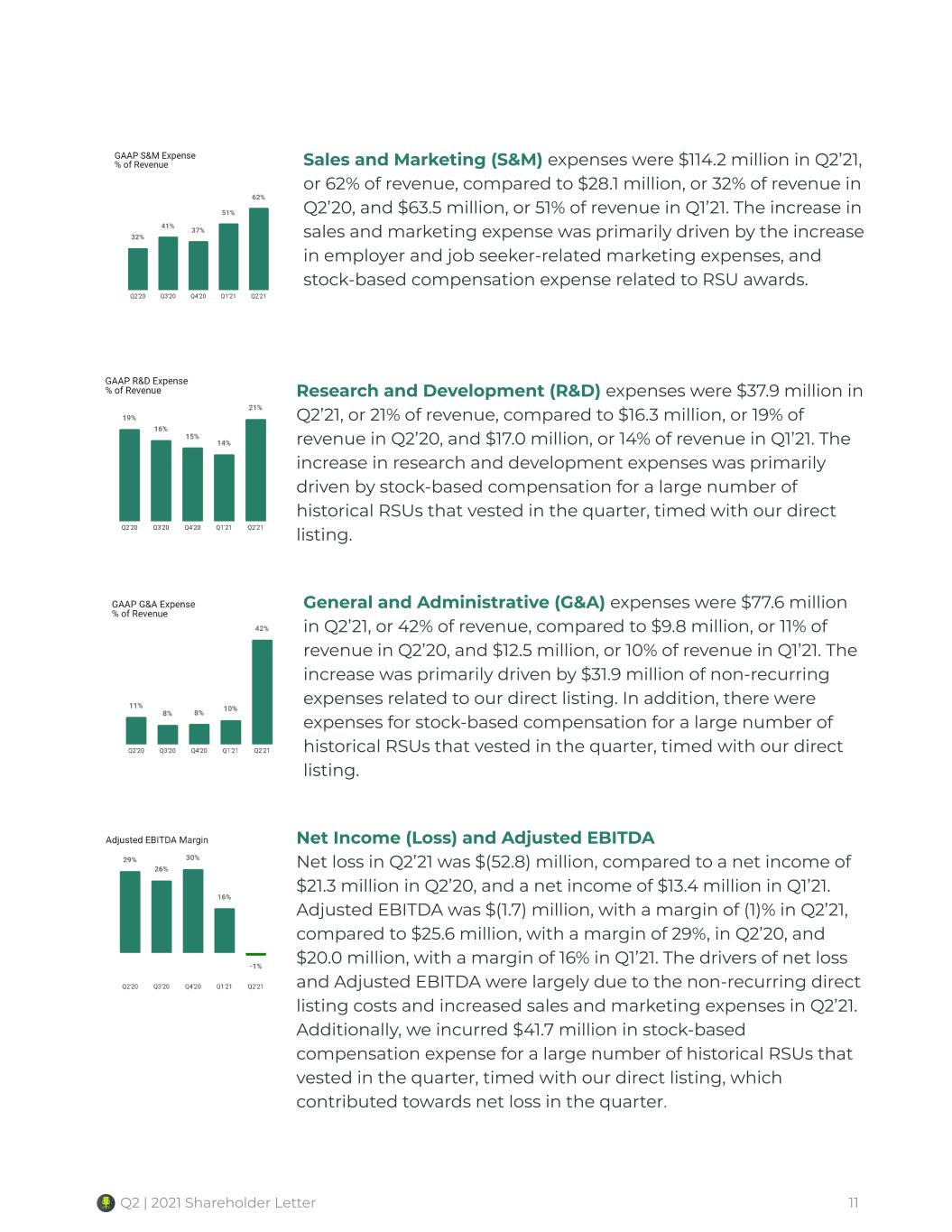

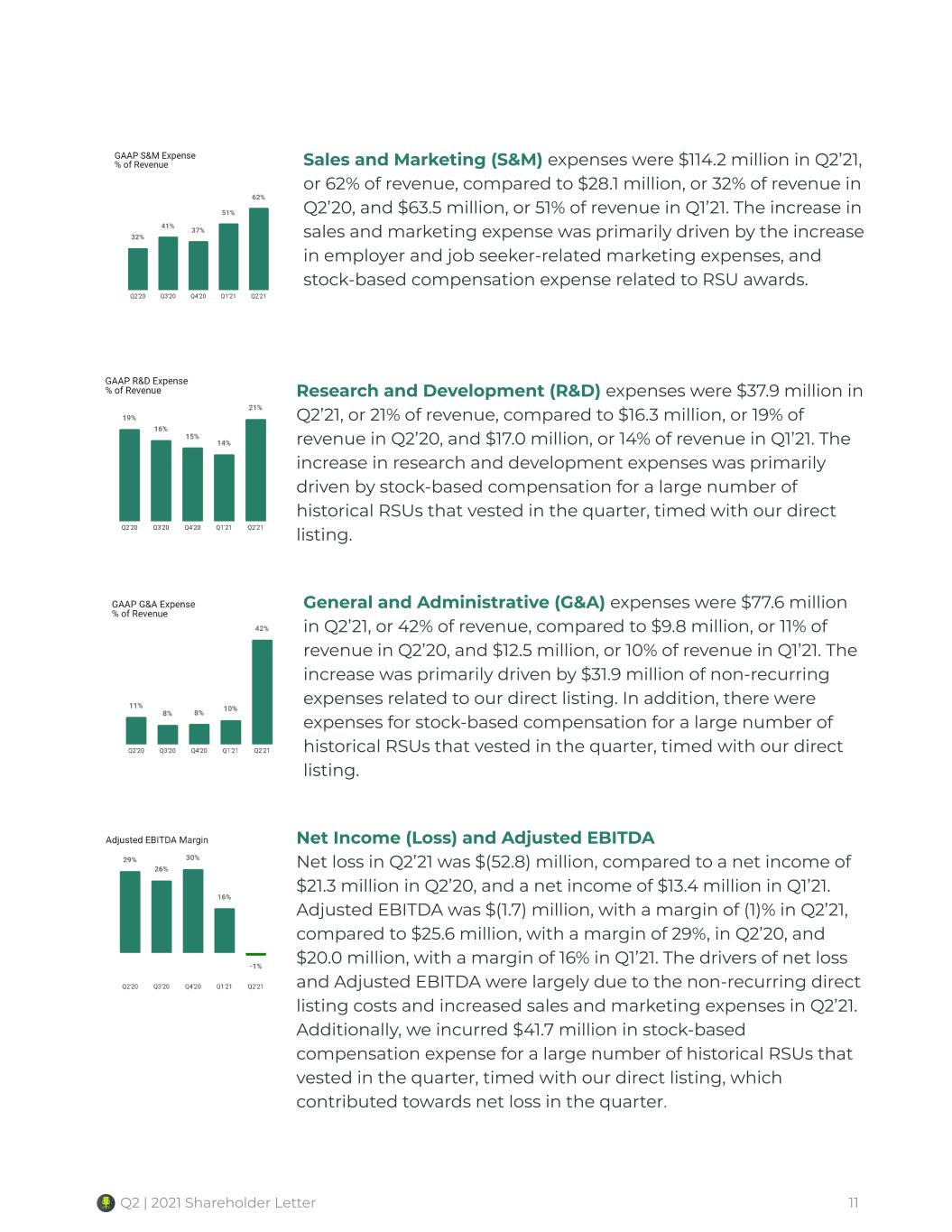

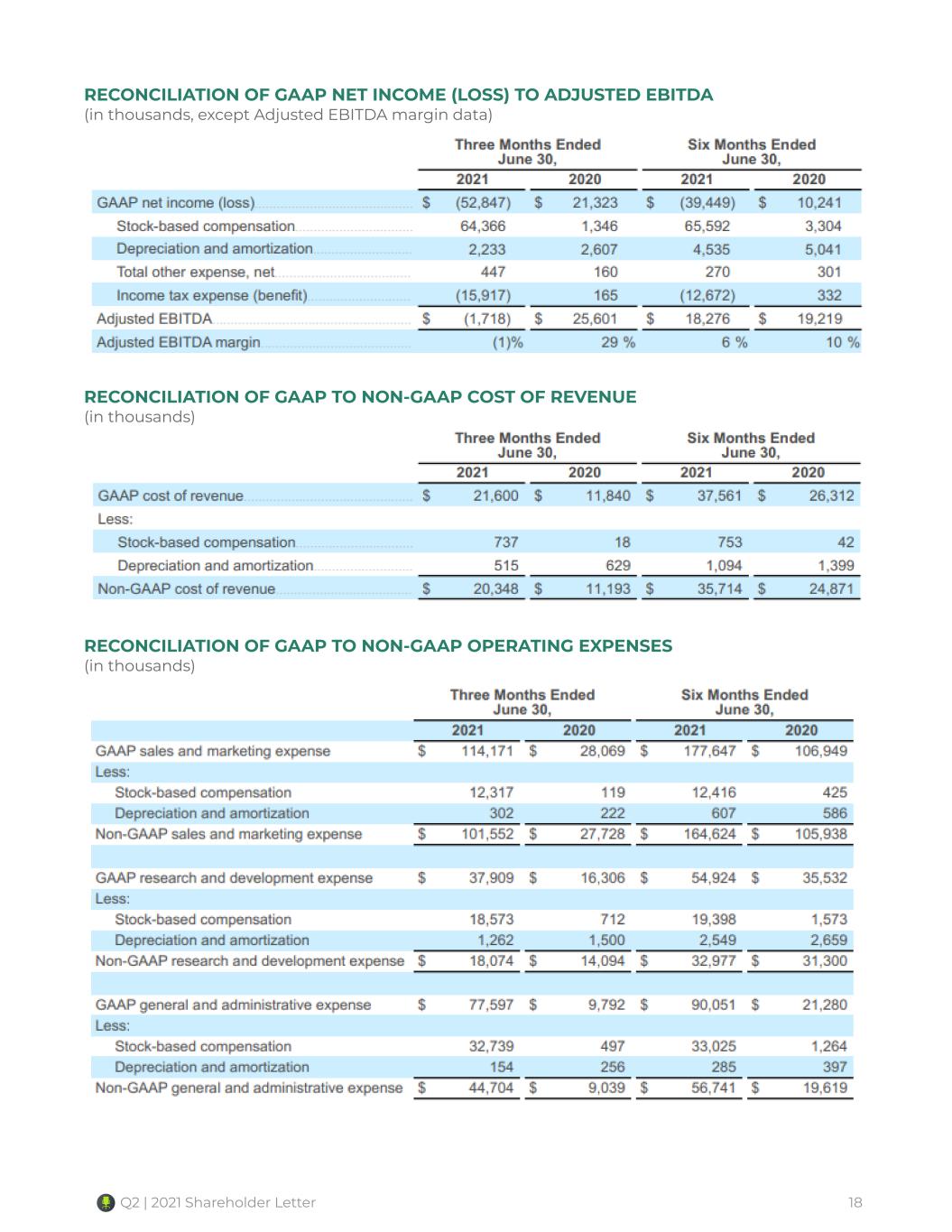

Sales and Marketing (S&M) expenses were $114.2 million in Q2’21, or 62% of revenue, compared to $28.1 million, or 32% of revenue in Q2’20, and $63.5 million, or 51% of revenue in Q1’21. The increase in sales and marketing expense was primarily driven by the increase in employer and job seeker-related marketing expenses, and stock-based compensation expense related to RSU awards. Research and Development (R&D) expenses were $37.9 million in Q2’21, or 21% of revenue, compared to $16.3 million, or 19% of revenue in Q2’20, and $17.0 million, or 14% of revenue in Q1’21. The increase in research and development expenses was primarily driven by stock-based compensation for a large number of historical RSUs that vested in the quarter, timed with our direct listing. General and Administrative (G&A) expenses were $77.6 million in Q2’21, or 42% of revenue, compared to $9.8 million, or 11% of revenue in Q2’20, and $12.5 million, or 10% of revenue in Q1’21. The increase was primarily driven by $31.9 million of non-recurring expenses related to our direct listing. In addition, there were expenses for stock-based compensation for a large number of historical RSUs that vested in the quarter, timed with our direct listing. Net Income (Loss) and Adjusted EBITDA Net loss in Q2’21 was $(52.8) million, compared to a net income of $21.3 million in Q2’20, and a net income of $13.4 million in Q1’21. Adjusted EBITDA was $(1.7) million, with a margin of (1)% in Q2’21, compared to $25.6 million, with a margin of 29%, in Q2’20, and $20.0 million, with a margin of 16% in Q1’21. The drivers of net loss and Adjusted EBITDA were largely due to the non-recurring direct listing costs and increased sales and marketing expenses in Q2’21. Additionally, we incurred $41.7 million in stock-based compensation expense for a large number of historical RSUs that vested in the quarter, timed with our direct listing, which contributed towards net loss in the quarter. Q2 | 2021 Shareholder Letter 11

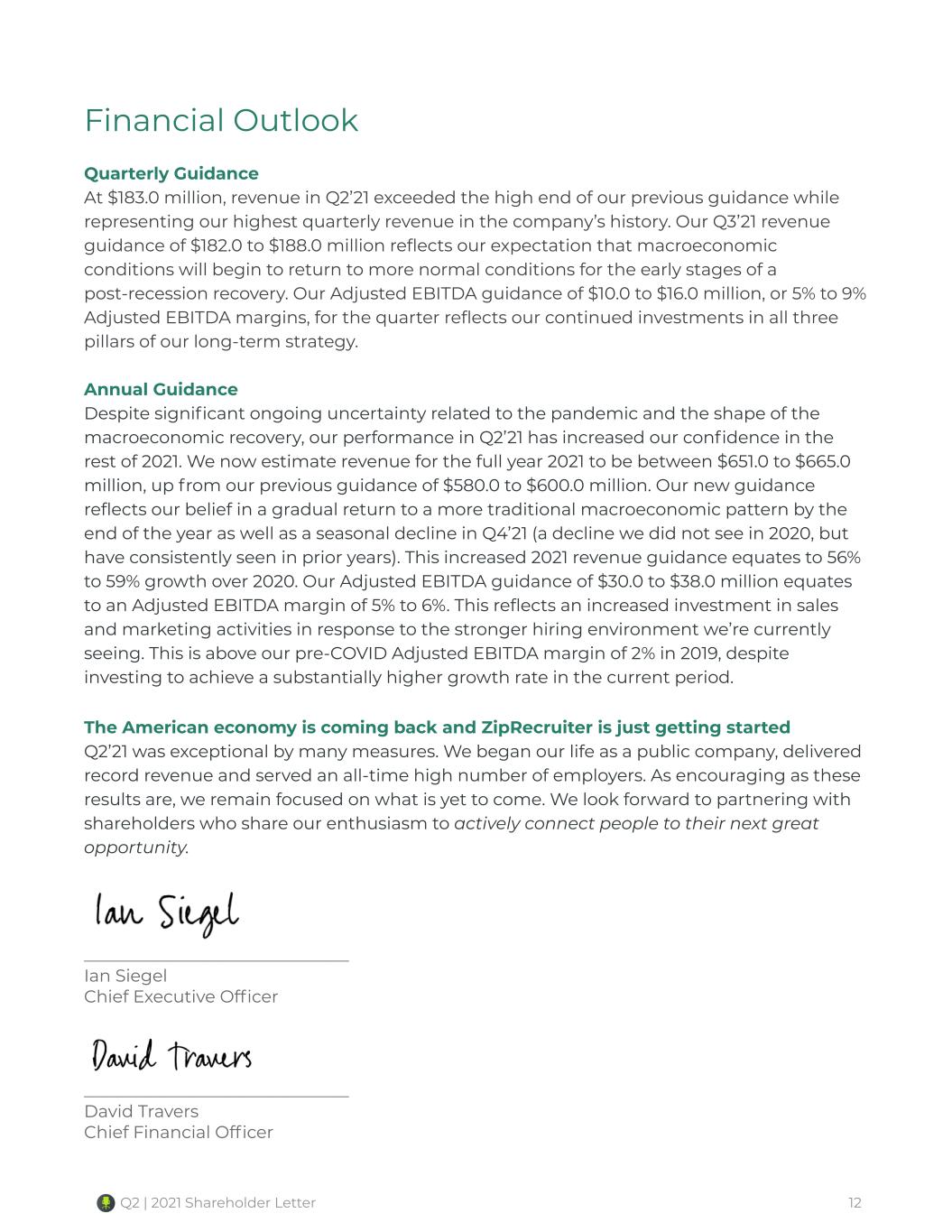

Financial Outlook Quarterly Guidance At $183.0 million, revenue in Q2’21 exceeded the high end of our previous guidance while representing our highest quarterly revenue in the company’s history. Our Q3’21 revenue guidance of $182.0 to $188.0 million reflects our expectation that macroeconomic conditions will begin to return to more normal conditions for the early stages of a post-recession recovery. Our Adjusted EBITDA guidance of $10.0 to $16.0 million, or 5% to 9% Adjusted EBITDA margins, for the quarter reflects our continued investments in all three pillars of our long-term strategy. Annual Guidance Despite significant ongoing uncertainty related to the pandemic and the shape of the macroeconomic recovery, our performance in Q2’21 has increased our confidence in the rest of 2021. We now estimate revenue for the full year 2021 to be between $651.0 to $665.0 million, up from our previous guidance of $580.0 to $600.0 million. Our new guidance reflects our belief in a gradual return to a more traditional macroeconomic pattern by the end of the year as well as a seasonal decline in Q4’21 (a decline we did not see in 2020, but have consistently seen in prior years). This increased 2021 revenue guidance equates to 56% to 59% growth over 2020. Our Adjusted EBITDA guidance of $30.0 to $38.0 million equates to an Adjusted EBITDA margin of 5% to 6%. This reflects an increased investment in sales and marketing activities in response to the stronger hiring environment we’re currently seeing. This is above our pre-COVID Adjusted EBITDA margin of 2% in 2019, despite investing to achieve a substantially higher growth rate in the current period. The American economy is coming back and ZipRecruiter is just getting started Q2’21 was exceptional by many measures. We began our life as a public company, delivered record revenue and served an all-time high number of employers. As encouraging as these results are, we remain focused on what is yet to come. We look forward to partnering with shareholders who share our enthusiasm to actively connect people to their next great opportunity. _______________________________ Ian Siegel Chief Executive Officer _______________________________ David Travers Chief Financial Officer Q2 | 2021 Shareholder Letter 12

Forward Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, our market opportunity for the remainder of 2021; our anticipated launch of several other features and enhancements for job seekers in 2021; our belief that we are just beginning our next stage of growth; our belief regarding our positioning to help companies of all sizes find great talent; the future of digital transformation of the hiring process that our matching technology can enable; statements under the section titled "Financial Outlook", statements regarding our expected financial performance and operational performance for the third quarter of 2021 and the fiscal year ended December 31, 2021, our expected future Adjusted EBITDA profitability, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management's current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to attract and retain employers and job seekers; our ability to achieve profitability; our ability to maintain and enhance our brand; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our marketplace; our dependence on the interoperability of our technology with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn caused by the COVID-19 pandemic that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our technology; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our ability to protect our intellectual property rights and to successfully halt the operations of copycat websites or misappropriation of data; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on relationships with payment partners, banks and disbursement partners; our dependence on our senior management and our ability to attract new talent; and the other important risk factors more fully discussed and described in documents we have filed with the Securities and Exchange Commission (“SEC”), including our Registration Statement on Form S-1/A filed with the SEC on April 30, 2021 and our Quarterly Report on Form 10-Q for the three months ended June 30, 2021 that we will file with the SEC. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this release relate only to events or information as of the date on which the statements are made in this release. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Q2 | 2021 Shareholder Letter 13

Conference Call Details We will host a conference call to discuss our financial results on Thursday, August 12, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website. An archived version will be available on the website two hours after the call. Investors and analysts can participate in the conference call by dialing +1 (833) 979-2842, or +1 (236) 714-2904 for callers outside the United States and mention the passcode, “ZipRecruiter”, or by referencing conference ID “5938228”. A telephonic replay of the conference call will be available until Thursday, August 19, 2021, beginning two hours after the end of the conference call. To listen to the replay please dial +1 (800) 585-8367 or +1 (416) 621-4642 for callers outside the United States and enter replay code “5938228”. Q2 | 2021 Shareholder Letter 14

CONSOLIDATED BALANCE SHEETS (in thousands) Q2 | 2021 Shareholder Letter 15

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) Q2 | 2021 Shareholder Letter 16

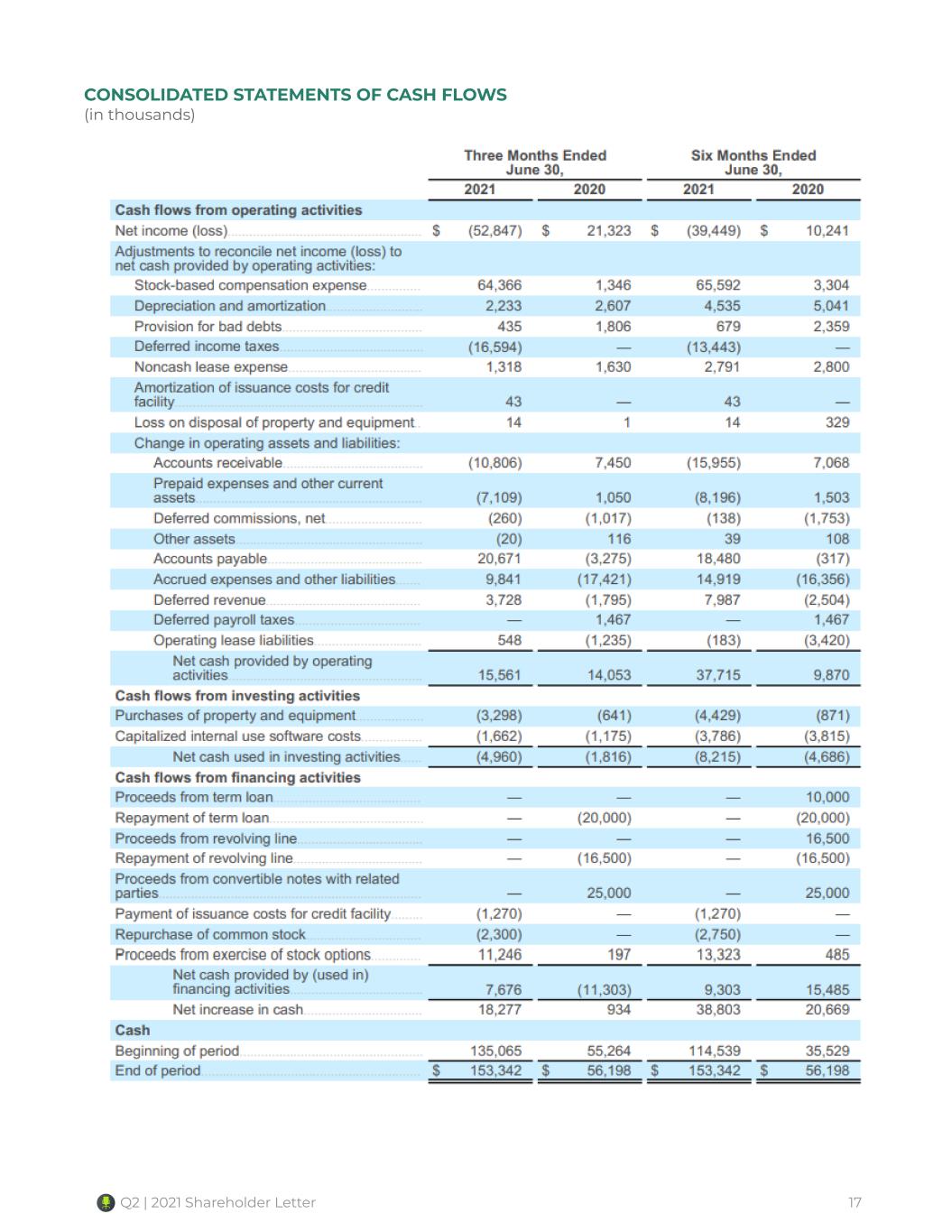

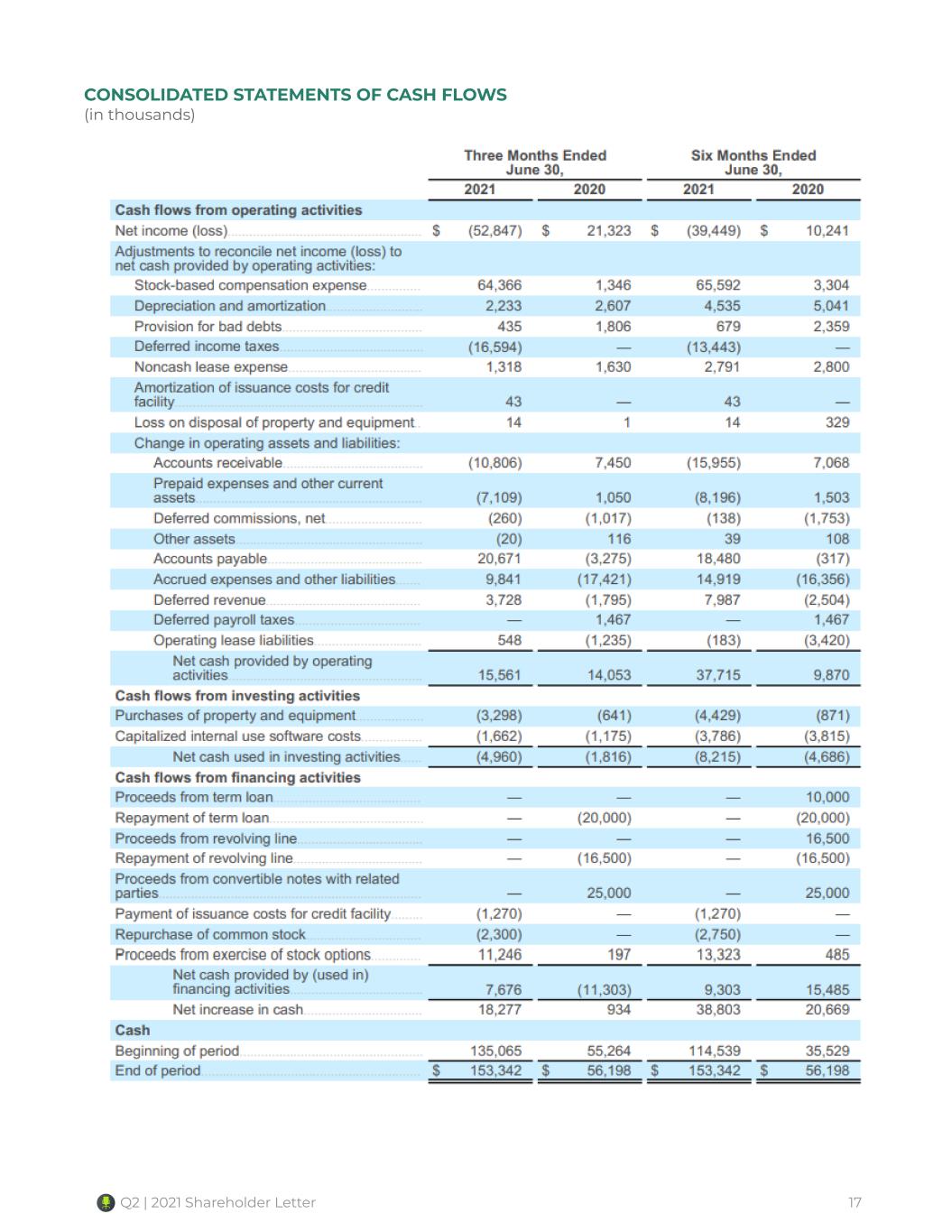

CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Q2 | 2021 Shareholder Letter 17

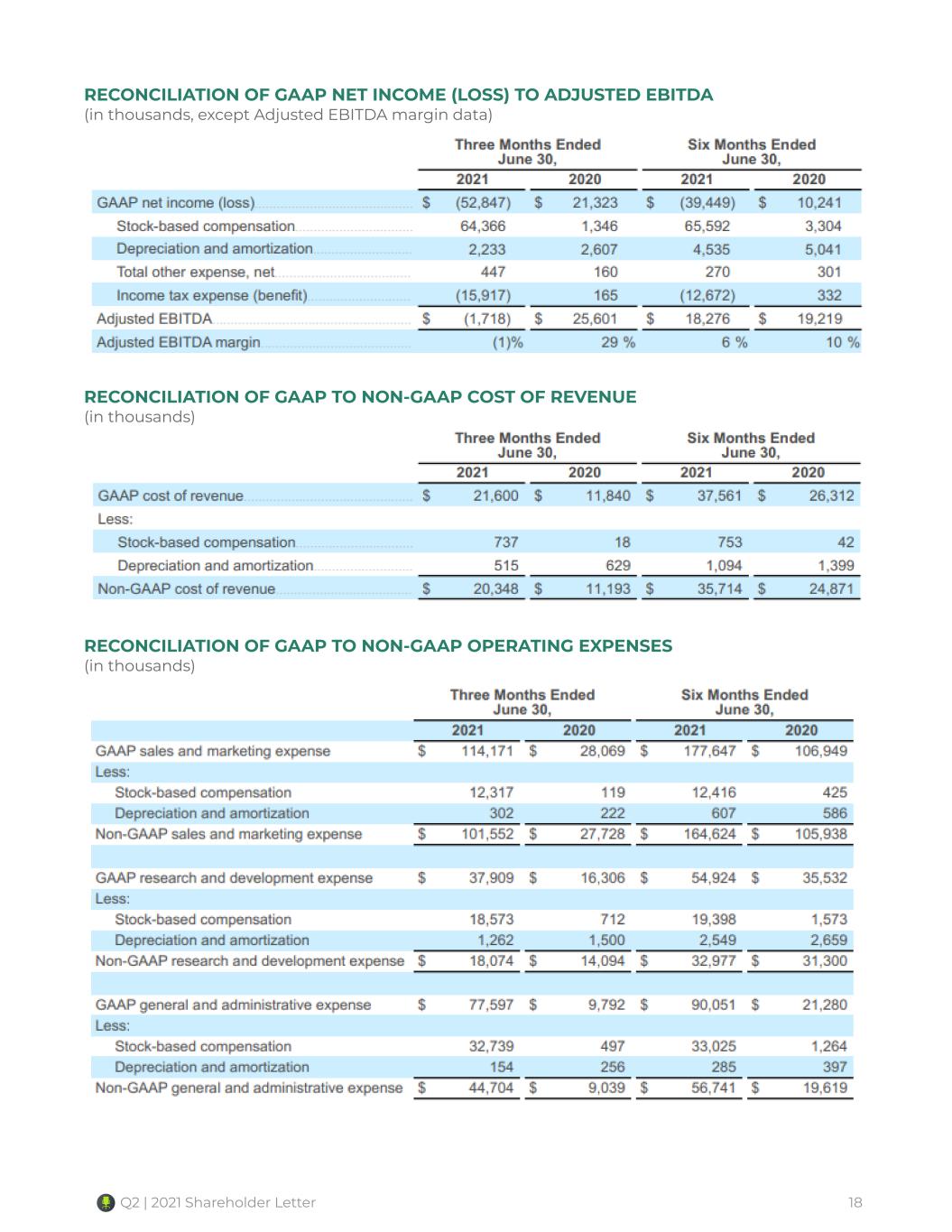

RECONCILIATION OF GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA (in thousands, except Adjusted EBITDA margin data) RECONCILIATION OF GAAP TO NON-GAAP COST OF REVENUE (in thousands) RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES (in thousands) Q2 | 2021 Shareholder Letter 18

Key Operating Metrics and Non-GAAP Financial Measures This shareholder letter includes certain key operating metrics, including Quarterly Paid Employers and Revenue per Paid Employer, and non-GAAP financial measures, including Non-GAAP operating expenses, Non-GAAP cost of revenue, Adjusted EBITDA and Adjusted EBITDA margin. We define Paid Employers as any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial. Job Distribution Partners are defined as third-party sites who have a relationship with us and advertise jobs from our marketplace. Quarterly Paid Employers means, with respect to any fiscal quarter, the count of Paid Employers during such fiscal quarter. Revenue per Paid Employer is the total company revenue in a particular period divided by the count of Quarterly Paid Employers in the same period. We define Non-GAAP cost of revenue as our cost of revenue before stock-based compensation expense, and depreciation and amortization. We define Non-GAAP operating expenses as our operating expenses before stock-based compensation expense, and depreciation and amortization. We define Adjusted EBITDA as our net income (loss) before total other income (expense), net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue for the same period. Management and our board of directors use these key operating metrics and non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these key operating metrics and non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business. Non-GAAP operating expenses, non-GAAP cost of revenue, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAP measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business. These non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDA margin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDA margin used herein are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin for Q3 or the full fiscal year 2021 to net income and net income margin, the comparable GAAP measures, respectively, because certain items that are excluded from non-GAAP financial measures cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of stock-based compensation or amortization of intangible assets, as applicable, without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, GAAP measures in the future. Q2 | 2021 Shareholder Letter 19

See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. Q2 | 2021 Shareholder Letter 20