B + Exhibit 99.2

` Q4 2024 Shareholder Letter 1

Q4 2024 Shareholder Letter 2

To Our Shareholders Despite 2024 being another year of persistently diminishing hiring across America, we were able to make substantial advancements in our marketplace. In 2024, we introduced compelling employer products such as ZipIntro and our next-generation Resume Database. We also completed our acquisition and initial U.S. rollout of Breakroom, our employer ratings site. We’re gaining share in job seeker traffic. Total web traffic in Q4 2024 grew by 15% year-over-year, which is at least 10 percentage points more than any of our largest competitors.1 We believe that market share shifts in job seeker traffic will, over time, be followed by market share shifts in employer revenue dollars. We made these advancements while facing a difficult hiring environment. Seasonally adjusted hires have declined on a year-over-year basis for 28 consecutive months, surpassing the Great Recession of 2008. Fueling the decline is a steep drop in the Quits Rate among the currently employed. The Quits Rate remains near its lowest level since 2015, excluding the onset of the COVID pandemic. As a result of the labor market backdrop, 2024 revenue of $474.0 million declined 27% year-over-year. However, our business remains resilient, demonstrating the strength of our brand and business model. We were able to manage down operating expenses while still making material investments to improve our marketplace. Net loss in 2024 was ($12.9) million, equating to a (3)% net loss margin, while Adjusted EBITDA was $78.0 million, equating to a 16% Adjusted EBITDA margin. This was towards the high end of the low-to-mid teens Adjusted EBITDA margin range we shared at the beginning of the year. Despite the difficult macroeconomic environment in 2024, we enter 2025 with cautious optimism for an improving labor market backdrop. The NFIB’s Small Business Optimism Index in December posted its highest reading since October 2018, which can be a leading indicator for employer hiring plans.2 There are other encouraging underlying signs internally, such as an uptick in employer account reactivations. These trends inform our Q1 revenue guidance of $109 million at the midpoint, which is down 2% versus Q4’24. By contrast, Q1 revenue declined sequentially by 13% and 10% in 2023 and 2024, respectively. Despite these positive signals, business 2 December 2024 report from National Federation of Independent Business, released on January 14, 2025. 1 Similarweb Market Intelligence Platform. Fastest growing online employment marketplace defined by number of total U.S. visits. Results shown are from Oct 2024 - Dec 2024 compared to Oct 2023 - Dec 2023 for individual domains of ZipRecruiter.com, Glassdoor.com, CareerBuilder.com, Linkedin.com, and Indeed.com and not for parent companies, subsidiary sites, partner sites or subchannels. Q4 2024 Shareholder Letter 3

uncertainty lingers over employer hiring plans. We will continue to let data guide our decision-making, and are poised to increase investment in ROI-positive Sales & Marketing initiatives if a recovery in hiring activity crystallizes. Through all labor market cycles, our mission of actively connecting people to their next great opportunity remains the foundation of our strategy. We remain acutely focused on improving the value of ZipRecruiter’s marketplace for both employers and job seekers. We remain nimble and our balance sheet provides a solid foundation to capture market share when hiring activity returns. _____________________ ________________________ ________________________ Ian Siegel David Travers Tim Yarbrough Chief Executive Officer President Chief Financial Officer Q4 2024 Shareholder Letter 4

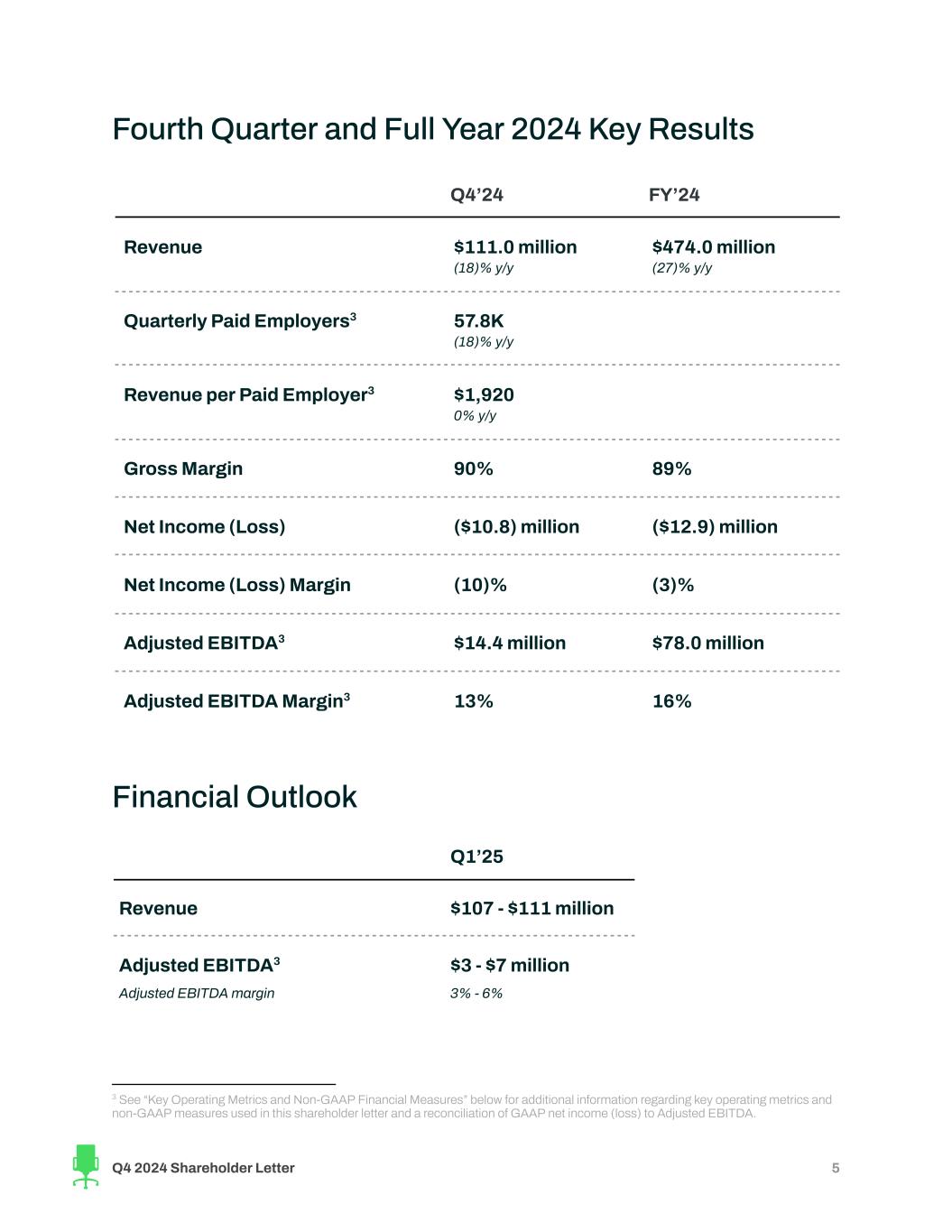

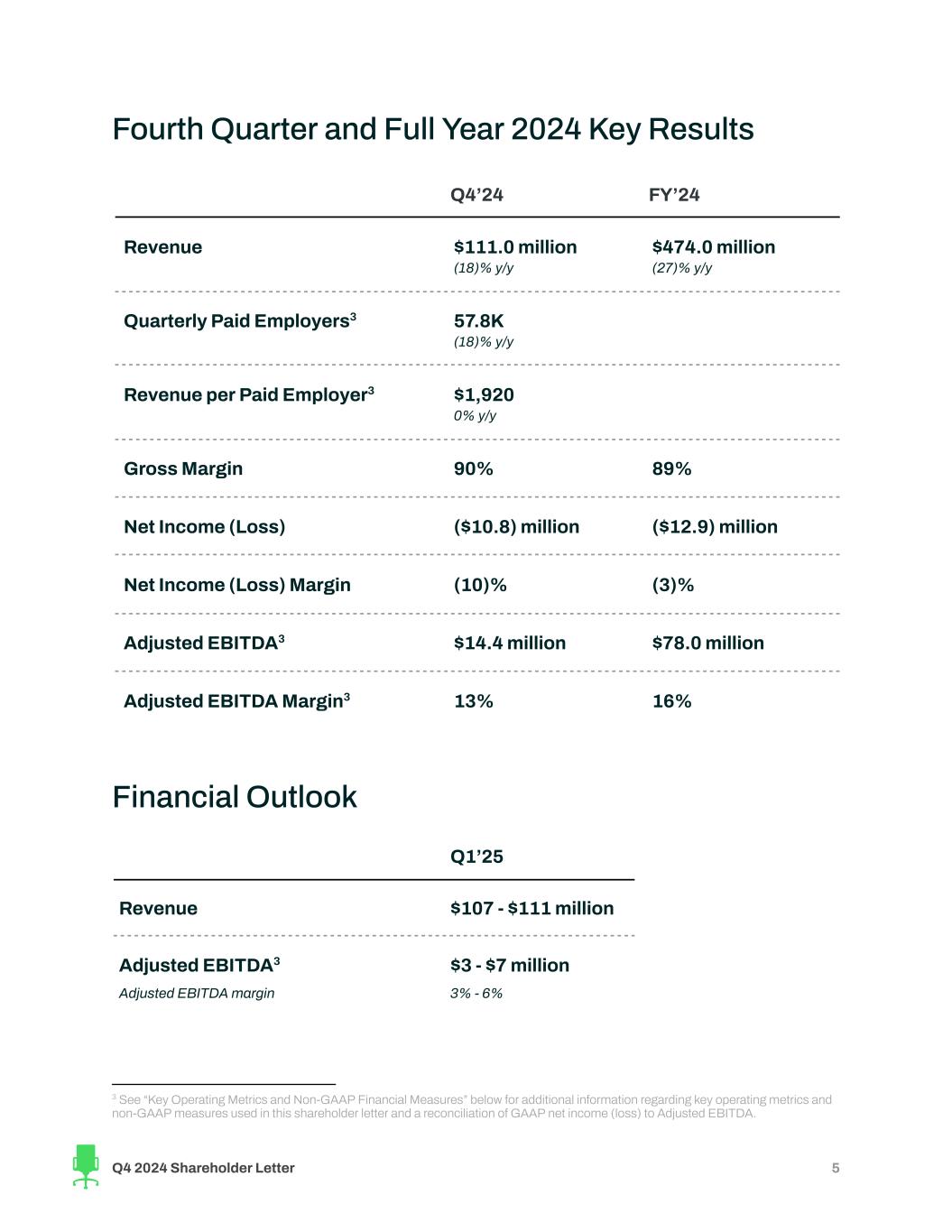

Fourth Quarter and Full Year 2024 Key Results Q4’24 FY’24 Revenue $111.0 million (18)% y/y $474.0 million (27)% y/y Quarterly Paid Employers3 57.8K (18)% y/y Revenue per Paid Employer3 $1,920 0% y/y Gross Margin 90% 89% Net Income (Loss) ($10.8) million ($12.9) million Net Income (Loss) Margin (10)% (3)% Adjusted EBITDA3 $14.4 million $78.0 million Adjusted EBITDA Margin3 13% 16% Financial Outlook Q1’25 Revenue $107 - $111 million Adjusted EBITDA3 Adjusted EBITDA margin $3 - $7 million 3% - 6% 3 See “Key Operating Metrics and Non-GAAP Financial Measures” below for additional information regarding key operating metrics and non-GAAP measures used in this shareholder letter and a reconciliation of GAAP net income (loss) to Adjusted EBITDA. Q4 2024 Shareholder Letter 5

Business Highlights ZipRecruiter remains focused on product and technology investments that increase value for both employers and job seekers. Specifically, we are making product improvements designed to drive better matching, as well as increased engagement between employers and job seekers. We believe that over time, this focus will translate into more Paid Employers, increasing Revenue per Paid Employer, and more job seekers. Quarterly Paid Employers in 2024 Challenged by Labor Market Backdrop. We finished 2024 with 57,833 Quarterly Paid Employers in Q4’24, down 18% year-over-year and down 11% sequentially. The decrease year-over-year is primarily driven by an overall reduction in demand for hiring, particularly from SMBs, which make up the vast majority of our Paid Employers. The sequential decline in Paid Employers in Q4’24 is consistent with the seasonal pattern we’ve seen historically. Employers Across Annual Cohorts Continue to Spend More Over Time. Our long-term cohort trends remained largely intact. However, we saw a slower rate of growth in Average Monthly Revenue per Paid Employer given the hiring environment in 2024. While cooling demand from employers impacted the growth in Revenue per Paid Employer across particular cohorts, we see this as a temporary interruption to the longstanding, positive trend in our ability to increase monetization as we increase the value provided to employers. Over the long-term, we believe that there is meaningful opportunity to grow revenue from large customers. Q4 2024 Shareholder Letter 6

Total Revenue Per Paid Employer Remains Stable. Total Revenue per Paid Employer for Q4’24 was $1,920, in-line with the prior year but up 7% sequentially. The quarter-over-quarter increase in Q4’24 is primarily due to the seasonal mix shift from subscription revenue to performance revenue. Product-Led Focus Leads to Continued Job Seeker Traffic Gains. According to Similarweb, ZipRecruiter web traffic grew by 15% year-over-year in Q4’24, which is at least 10 percentage points higher than any of our largest competitors. In 2024, ZipRecruiter web traffic grew by 19% year-over-year.4 This growth was driven by continued gains in organic job seeker visits, which 4 Similarweb Market Intelligence Platform. Fastest growing online employment marketplace defined by number of total U.S. visits. Results shown are from Jan 2024 - Dec 2024 compared to Jan 2023 - Dec 2023 for individual domains of ZipRecruiter.com, Glassdoor.com, CareerBuilder.com, Linkedin.com, and Indeed.com and not for parent companies, subsidiary sites, partner sites or subchannels. Q4 2024 Shareholder Letter 7

grew 30% year-over-year in 2024. We attribute job seeker traffic gains not only to our focus on delivering a superior product, but also our strong and building brand awareness. While increasing web traffic demonstrates that we’re increasingly top-of-mind for job seekers, total engagement within our marketplace saw a modest decline, demonstrating the impact of ongoing reduced employer demand in the U.S. economy, which offset the increased number of job seekers. In 2024 we had an average of 55.7 million unique job seeker interactions per quarter, down 4% from 58.1 million in 2023. We’re confident in our ability to grow engagement over time through product improvements and with the return of more normalized levels of total hiring activity. Momentum With the Next-Generation Resume Database. Launched in Q3’24, our next-generation Resume Database (RDB) helps employers find candidates in minutes. The new Resume Database features cutting-edge search and filtering capabilities, instant access to candidate contact info, and fresh workflow management tools. After searching for the right candidates, employers can unlock the resumes and contact info of qualified candidates. Employers using the Resume Database recognize its value. We’ve seen double-digit percentage increases in both the number of employers who are using the Resume Database for the first time, and in the average number of resume unlocks for existing RDB users. ZipIntro Driving More Face-to-Face Connections. We continue to see a strong reception to our rollout of ZipIntro. With ZipIntro, job seekers can get matched to roles and have the opportunity to make a strong first impression in a video screening session. This enables employers to hire faster than ever before—with most employers receiving their first application in under 20 minutes. Utilization of ZipIntro continues to increase, and we continue to see strong satisfaction with both employers and job seekers. Breakroom Roll Out Begins in the U.S. In Q3’24, we acquired Breakroom, a UK-based employer review site that collects data from workers on pay, hours, flexibility, work conditions, culture, and more to provide community-powered ratings for jobs. Q4 2024 Shareholder Letter 8

These insights help job seekers apply for the jobs that best suit their individual needs. Breakroom is focused on frontline workers, which comprise approximately 70% of the workforce in the United States.5 In Q4’24, we began our initial roll out of Breakroom in the United States. Using the data we’ve collected from reviews, we’ve published over 1,500 employer pages as of February 2025. These pages provide job seekers with a rich set of data, helping them to better understand what it’s like to work at specific companies. Introduced New Applicant Tracking System (ATS) Integration with Paradox. Recruiting teams using the Paradox Conversational ATS can now use a new integration to access ZipRecruiter’s millions of job seekers and easy application experience for their open roles. This new ATS integration will give Paradox clients access to ZipApply, a frictionless application process job seekers can access from any device that saves an average of 30 minutes of application time. Employers who use ZipApply receive 3x more applications for their roles6 and get their first five candidates 4x faster.7 ZipRecruiter’s over 180 ATS integrations are an investment a decade in the making, making hiring more seamless for enterprise employers. 7 ZipRecruiter Internal Data for new job listings only, Sep 1 - Dec 31, 2024. 6 ZipRecruiter Internal Data, average Jan 1 to Dec 31, 2024. 5 McKinsey analysis based on Bureau of Labor Statistics, 2019 data https://www.mckinsey.com/featured-insights/diversity-and-inclusion/race-in-the-workplace-the-frontline-experience Q4 2024 Shareholder Letter 9

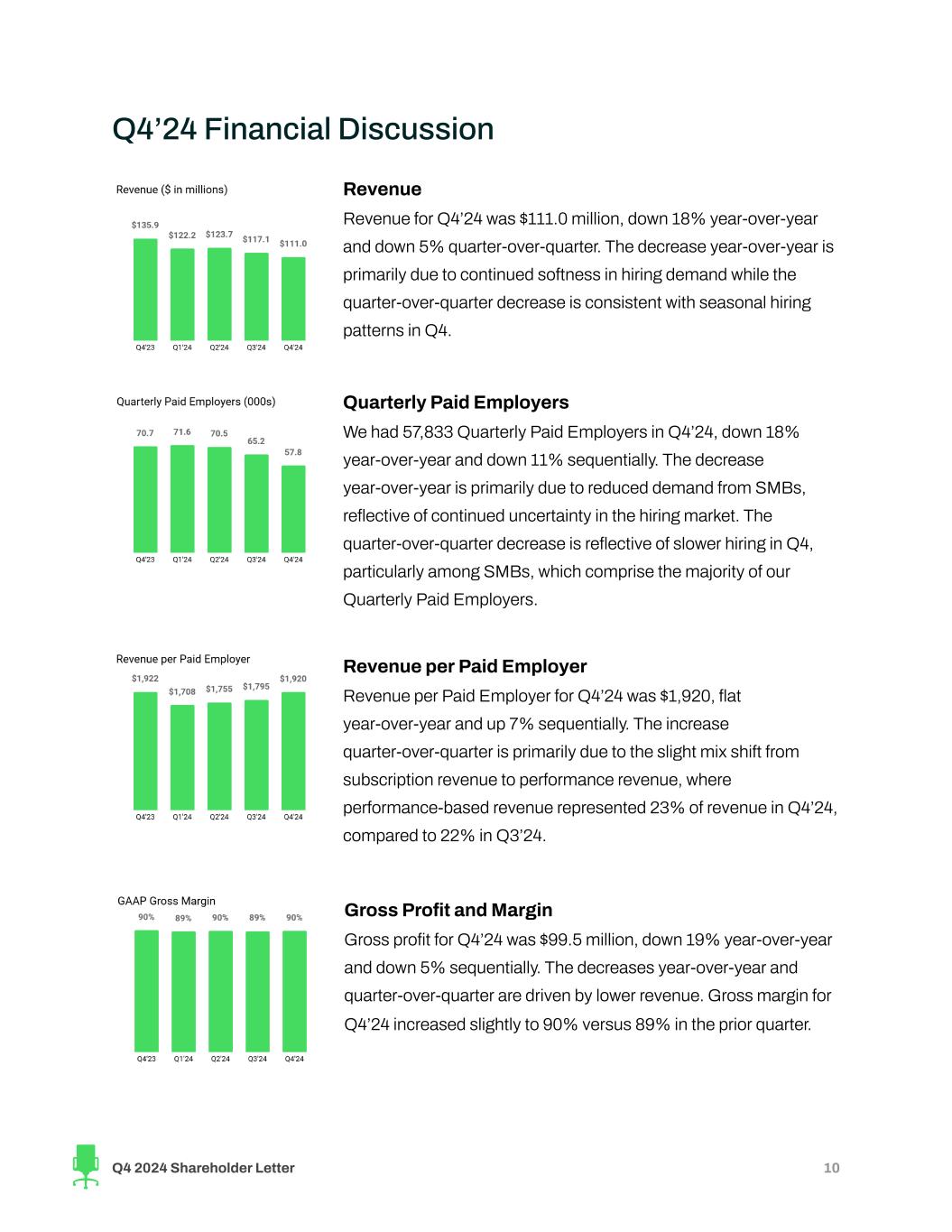

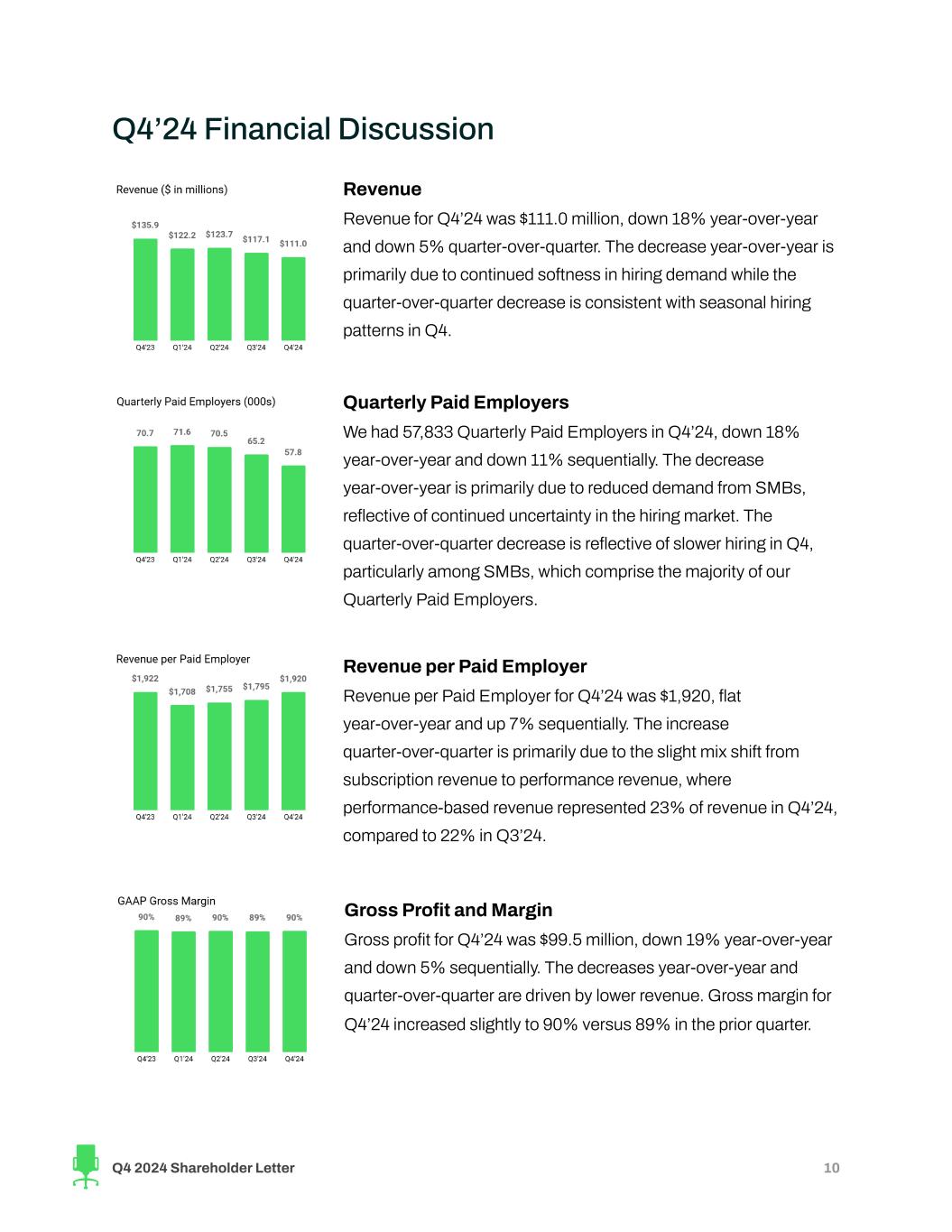

Q4’24 Financial Discussion Revenue Revenue for Q4’24 was $111.0 million, down 18% year-over-year and down 5% quarter-over-quarter. The decrease year-over-year is primarily due to continued softness in hiring demand while the quarter-over-quarter decrease is consistent with seasonal hiring patterns in Q4. Quarterly Paid Employers We had 57,833 Quarterly Paid Employers in Q4’24, down 18% year-over-year and down 11% sequentially. The decrease year-over-year is primarily due to reduced demand from SMBs, reflective of continued uncertainty in the hiring market. The quarter-over-quarter decrease is reflective of slower hiring in Q4, particularly among SMBs, which comprise the majority of our Quarterly Paid Employers. Revenue per Paid Employer Revenue per Paid Employer for Q4’24 was $1,920, flat year-over-year and up 7% sequentially. The increase quarter-over-quarter is primarily due to the slight mix shift from subscription revenue to performance revenue, where performance-based revenue represented 23% of revenue in Q4’24, compared to 22% in Q3’24. Gross Profit and Margin Gross profit for Q4’24 was $99.5 million, down 19% year-over-year and down 5% sequentially. The decreases year-over-year and quarter-over-quarter are driven by lower revenue. Gross margin for Q4’24 increased slightly to 90% versus 89% in the prior quarter. Q4 2024 Shareholder Letter 10

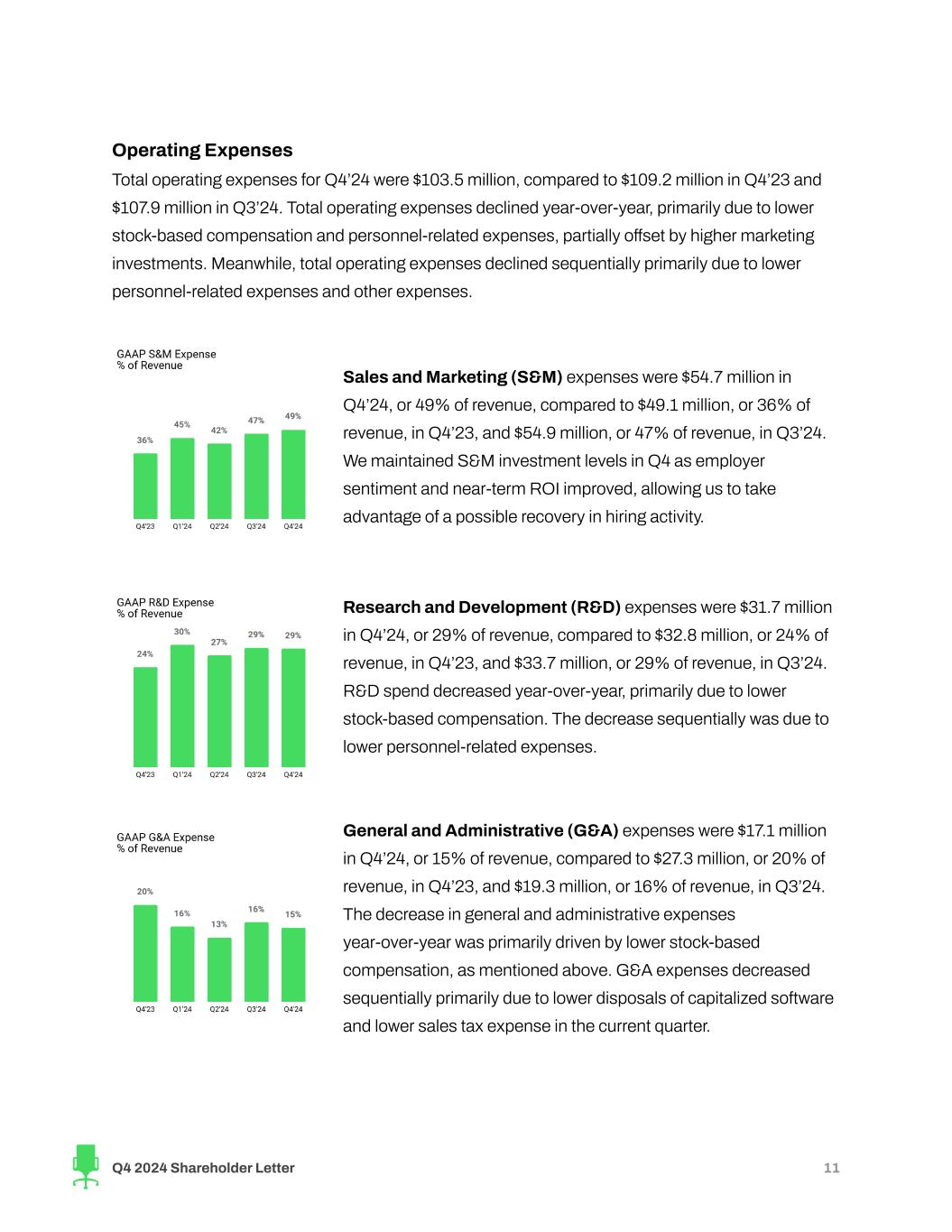

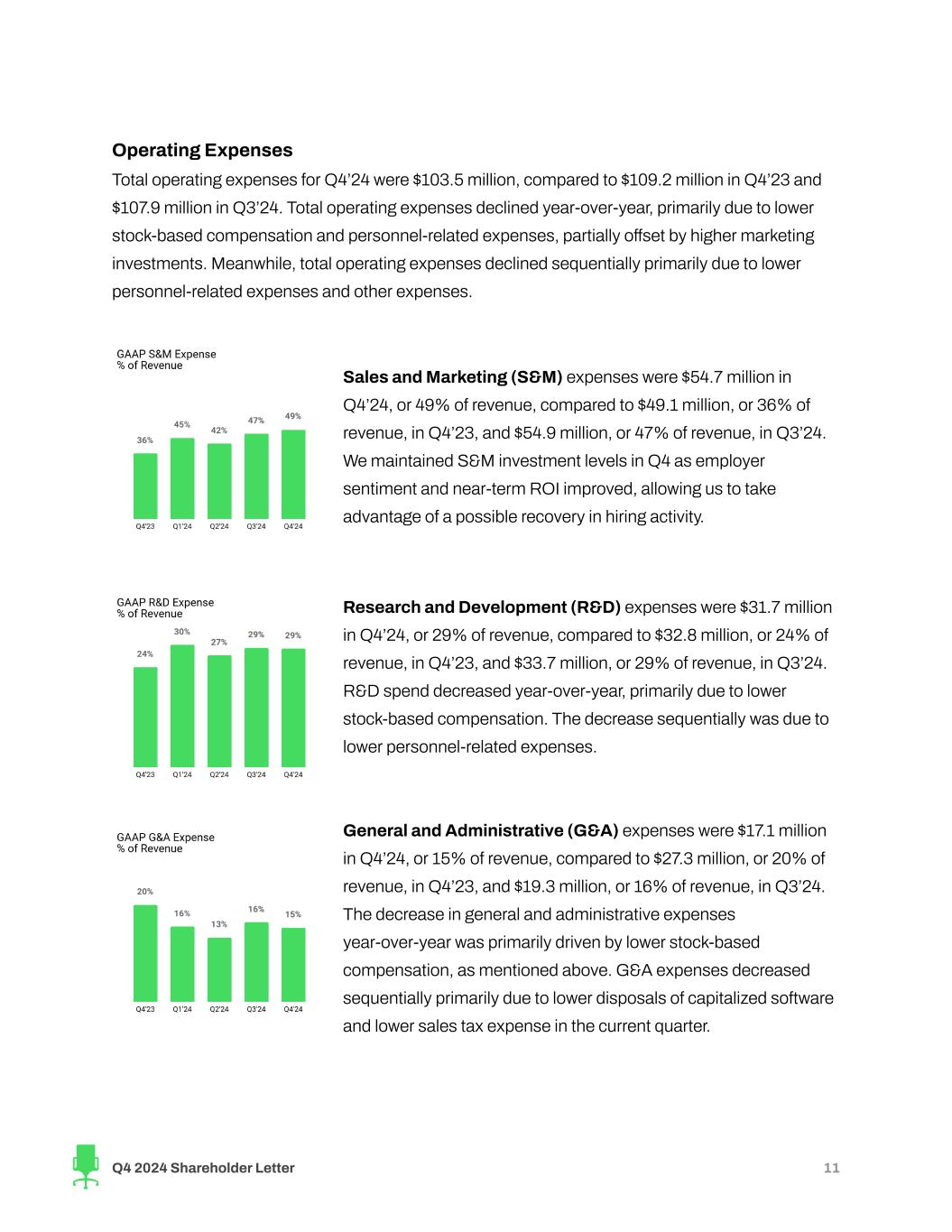

Operating Expenses Total operating expenses for Q4’24 were $103.5 million, compared to $109.2 million in Q4’23 and $107.9 million in Q3’24. Total operating expenses declined year-over-year, primarily due to lower stock-based compensation and personnel-related expenses, partially offset by higher marketing investments. Meanwhile, total operating expenses declined sequentially primarily due to lower personnel-related expenses and other expenses. Sales and Marketing (S&M) expenses were $54.7 million in Q4’24, or 49% of revenue, compared to $49.1 million, or 36% of revenue, in Q4’23, and $54.9 million, or 47% of revenue, in Q3’24. We maintained S&M investment levels in Q4 as employer sentiment and near-term ROI improved, allowing us to take advantage of a possible recovery in hiring activity. Research and Development (R&D) expenses were $31.7 million in Q4’24, or 29% of revenue, compared to $32.8 million, or 24% of revenue, in Q4’23, and $33.7 million, or 29% of revenue, in Q3’24. R&D spend decreased year-over-year, primarily due to lower stock-based compensation. The decrease sequentially was due to lower personnel-related expenses. General and Administrative (G&A) expenses were $17.1 million in Q4’24, or 15% of revenue, compared to $27.3 million, or 20% of revenue, in Q4’23, and $19.3 million, or 16% of revenue, in Q3’24. The decrease in general and administrative expenses year-over-year was primarily driven by lower stock-based compensation, as mentioned above. G&A expenses decreased sequentially primarily due to lower disposals of capitalized software and lower sales tax expense in the current quarter. Q4 2024 Shareholder Letter 11

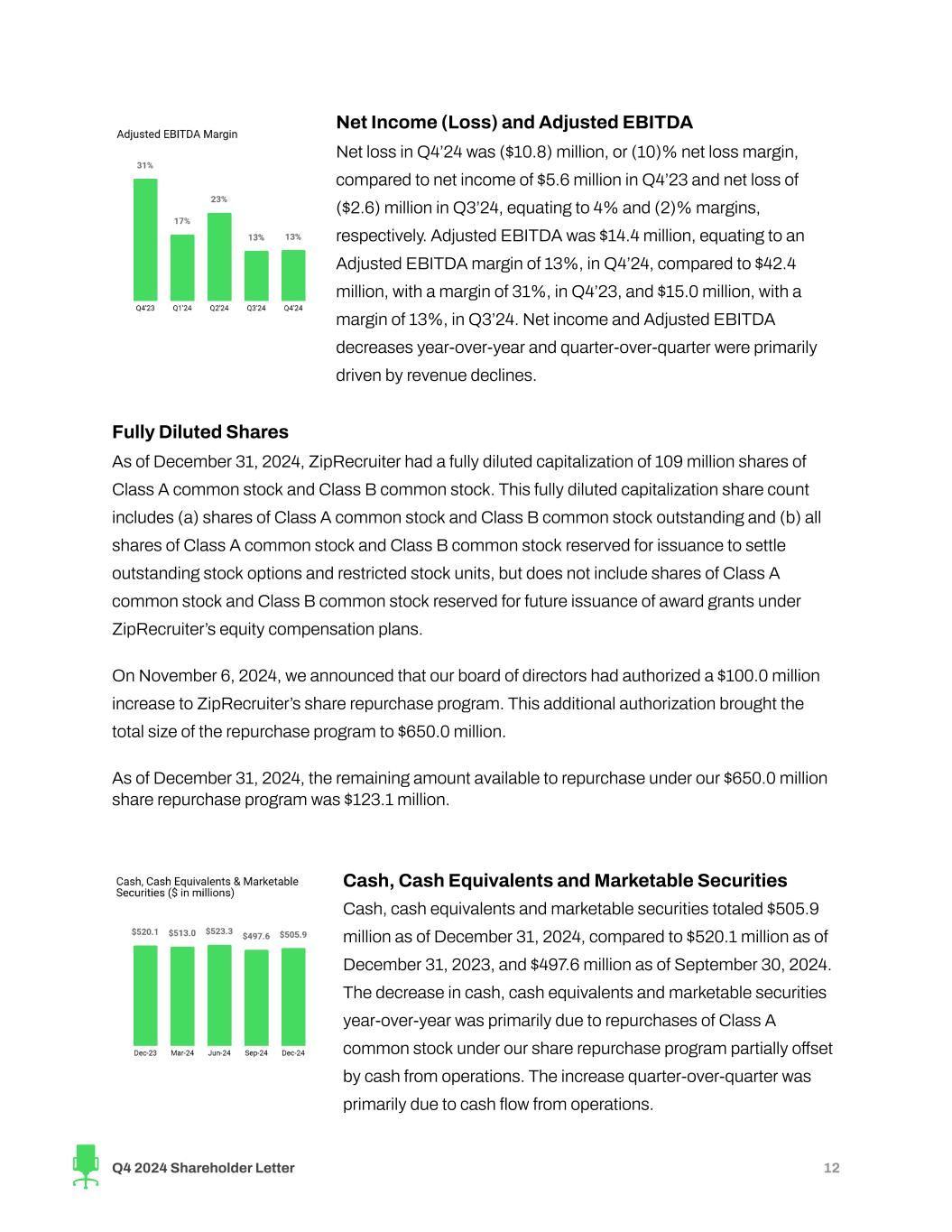

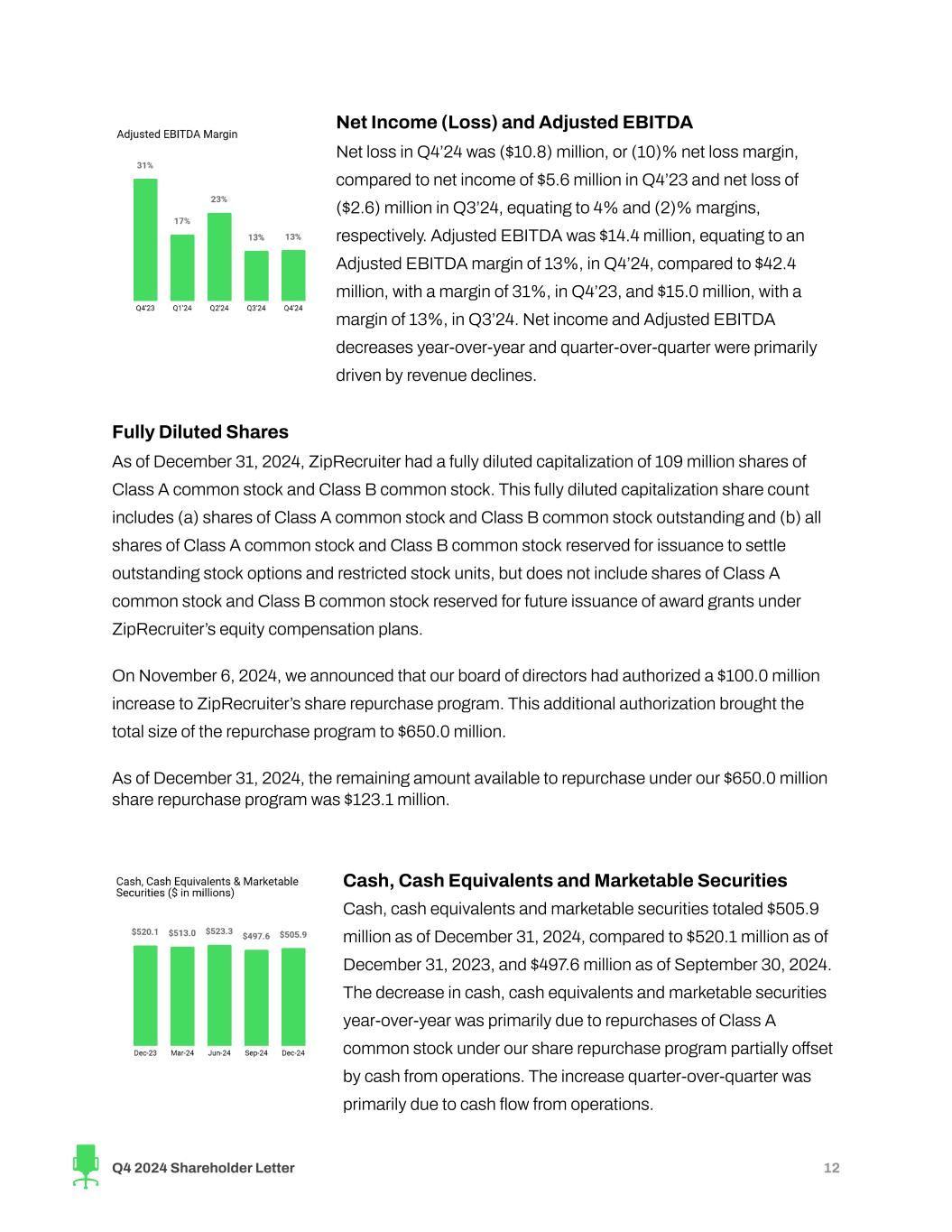

Net Income (Loss) and Adjusted EBITDA Net loss in Q4’24 was ($10.8) million, or (10)% net loss margin, compared to net income of $5.6 million in Q4’23 and net loss of ($2.6) million in Q3’24, equating to 4% and (2)% margins, respectively. Adjusted EBITDA was $14.4 million, equating to an Adjusted EBITDA margin of 13%, in Q4’24, compared to $42.4 million, with a margin of 31%, in Q4’23, and $15.0 million, with a margin of 13%, in Q3’24. Net income and Adjusted EBITDA decreases year-over-year and quarter-over-quarter were primarily driven by revenue declines. Fully Diluted Shares As of December 31, 2024, ZipRecruiter had a fully diluted capitalization of 109 million shares of Class A common stock and Class B common stock. This fully diluted capitalization share count includes (a) shares of Class A common stock and Class B common stock outstanding and (b) all shares of Class A common stock and Class B common stock reserved for issuance to settle outstanding stock options and restricted stock units, but does not include shares of Class A common stock and Class B common stock reserved for future issuance of award grants under ZipRecruiter’s equity compensation plans. On November 6, 2024, we announced that our board of directors had authorized a $100.0 million increase to ZipRecruiter’s share repurchase program. This additional authorization brought the total size of the repurchase program to $650.0 million. As of December 31, 2024, the remaining amount available to repurchase under our $650.0 million share repurchase program was $123.1 million. Cash, Cash Equivalents and Marketable Securities Cash, cash equivalents and marketable securities totaled $505.9 million as of December 31, 2024, compared to $520.1 million as of December 31, 2023, and $497.6 million as of September 30, 2024. The decrease in cash, cash equivalents and marketable securities year-over-year was primarily due to repurchases of Class A common stock under our share repurchase program partially offset by cash from operations. The increase quarter-over-quarter was primarily due to cash flow from operations. Q4 2024 Shareholder Letter 12

Financial Outlook Quarterly Guidance Our Q1’25 revenue guidance of $109 million at the midpoint represents an 11% decline year-over-year, and down 2% quarter-over-quarter. This trend is reflective of a more typical seasonal pattern, and would represent our strongest change in sequential revenue from Q4 to Q1 since 2022. Additionally we have seen favorable underlying trends in the business quarter-to-date, such as an increase in employer reactivations, leaving us cautiously optimistic as we begin 2025. Our Adjusted EBITDA guidance for Q1’25 is $5 million at the midpoint, or a 5% Adjusted EBITDA margin. Our Q1’25 guidance embeds both a sequential and year-over-year increase in Sales & Marketing dollars as we lean into the positive signs we’ve seen year-to-date. That said, we remain disciplined in deploying marketing dollars towards campaigns we believe will drive a strong ROI, letting data guide our decision making as we continue to build the ZipRecruiter brand and marketplace. Looking beyond Q1, qualitative improvement in sentiment, from both employers in our marketplace and indicators from external data sources, make us cautiously optimistic about the outlook for 2025 after the 28 month consecutive decline in U.S. hiring activity. While we remain ready for a wide range of macroeconomic scenarios, current trends suggest employer sentiment may result in the beginnings of a recovery in hiring activity over the coming year. If these trends hold, we believe a likely scenario would be achieving year-over-year quarterly revenue growth by Q4’25, driven by the advances in our products and technology and increased opportunities for investment in ROI-positive Sales & Marketing initiatives. In this scenario, we would expect to generate Adjusted EBITDA margins in the mid-single digits for 2025. Conversely, if hiring demand further erodes (in contrast to the positive sentiment we’ve discussed earlier) we would adjust our operating expenses and generate higher Adjusted EBITDA margins, consistent with our long-standing and disciplined approach to managing the business through economic cycles. We remain confident in the long-term growth opportunity, and in all scenarios will continue to invest in our product and technology with the goal of increasing value for both sides of our marketplace. Q4 2024 Shareholder Letter 13

Forward-Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our market opportunity, market share and expected hiring activity; statements under the section titled “Financial Outlook”; statements regarding our expected financial performance and operational performance for the first quarter of 2025; statements regarding our expected future revenue growth, Adjusted EBITDA profitability and key strategies and investments; statements regarding the performance of our product improvements; statements regarding the long term health of the U.S. labor market; statements regarding our new products, including Applicant Tracking System and ZipIntro, and the expected performance thereof; statements regarding job seeker engagement levels, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important risk factors more fully discussed and described in documents we have filed with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2024 that we will file with the SEC. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this shareholder letter relate only to events or information as of the date on which the statements are made in this letter. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Q4 2024 Shareholder Letter 14

Conference Call Details We will host a conference call to discuss our financial results on Tuesday, February 25, 2025, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website. An archived version will be available on the website two hours after the call. Investors and analysts can participate in the conference call by dialing +1 (888) 440-4199, or +1 (646) 960-0818 for callers outside the United States, and using the conference ID 9351892. A telephonic replay of the conference call will be available until Tuesday, March 4, 2025. To listen to the replay please dial +1 (800) 770-2030 or +1 (609) 800-9909 for callers outside the United States and use the Conference ID 9351892. Q4 2024 Shareholder Letter 15

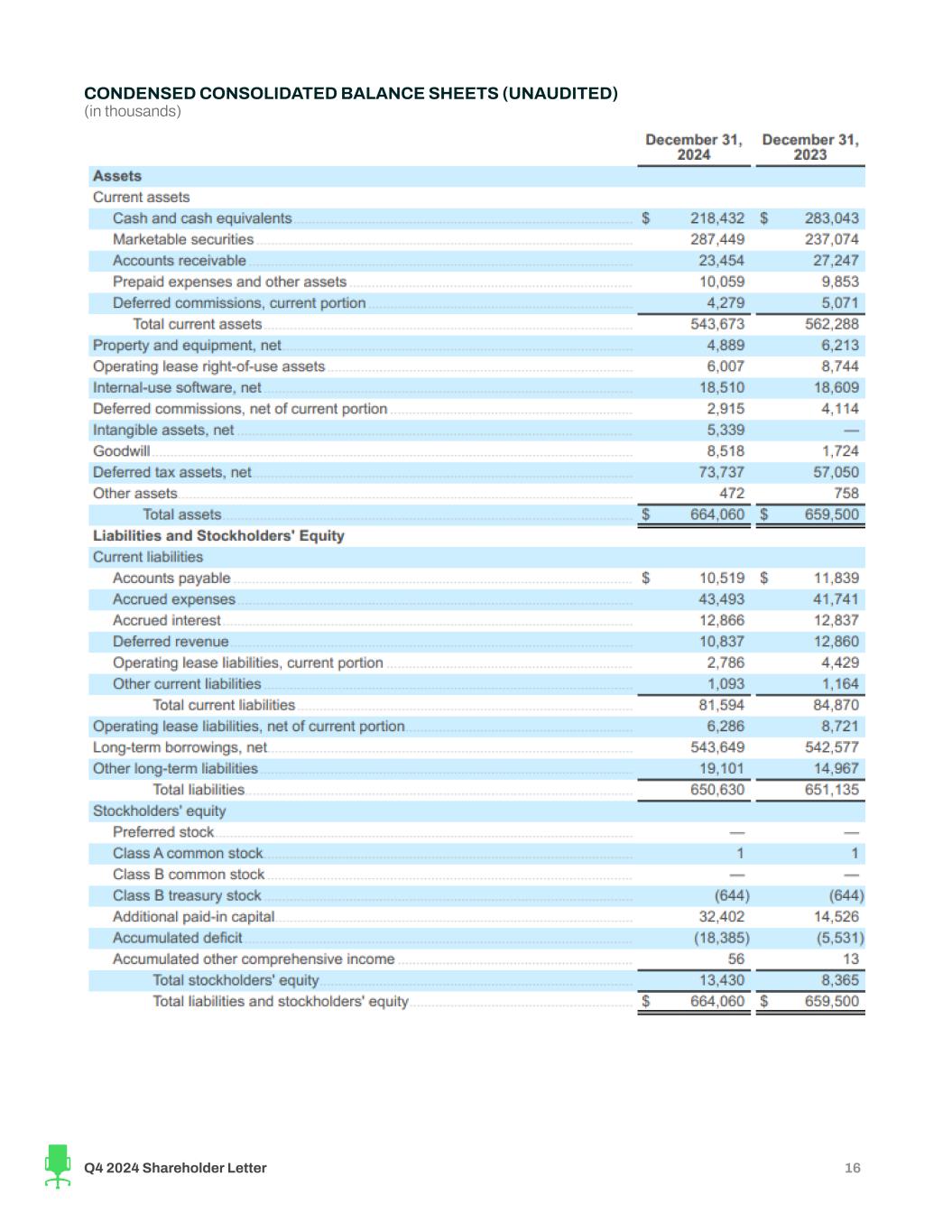

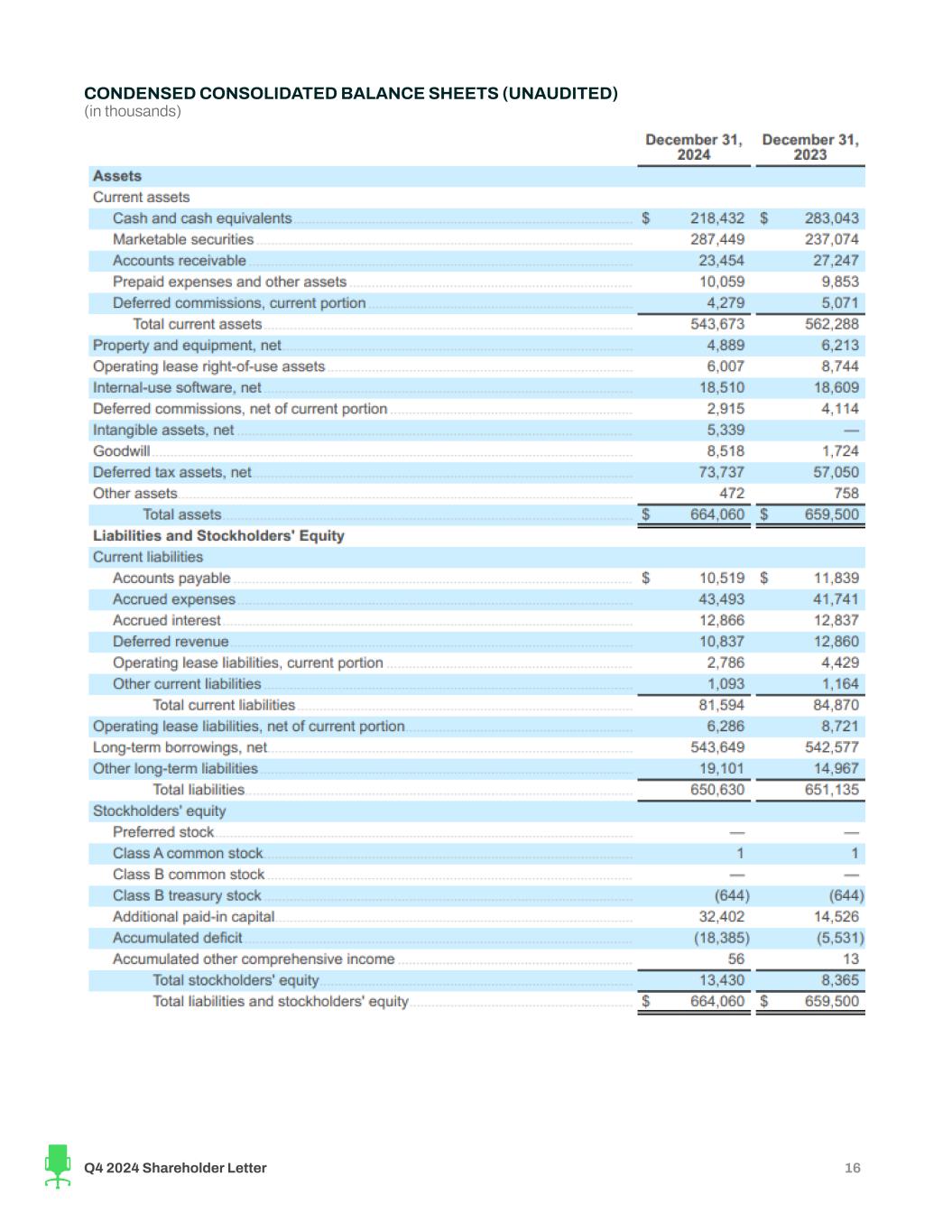

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands) Q4 2024 Shareholder Letter 16

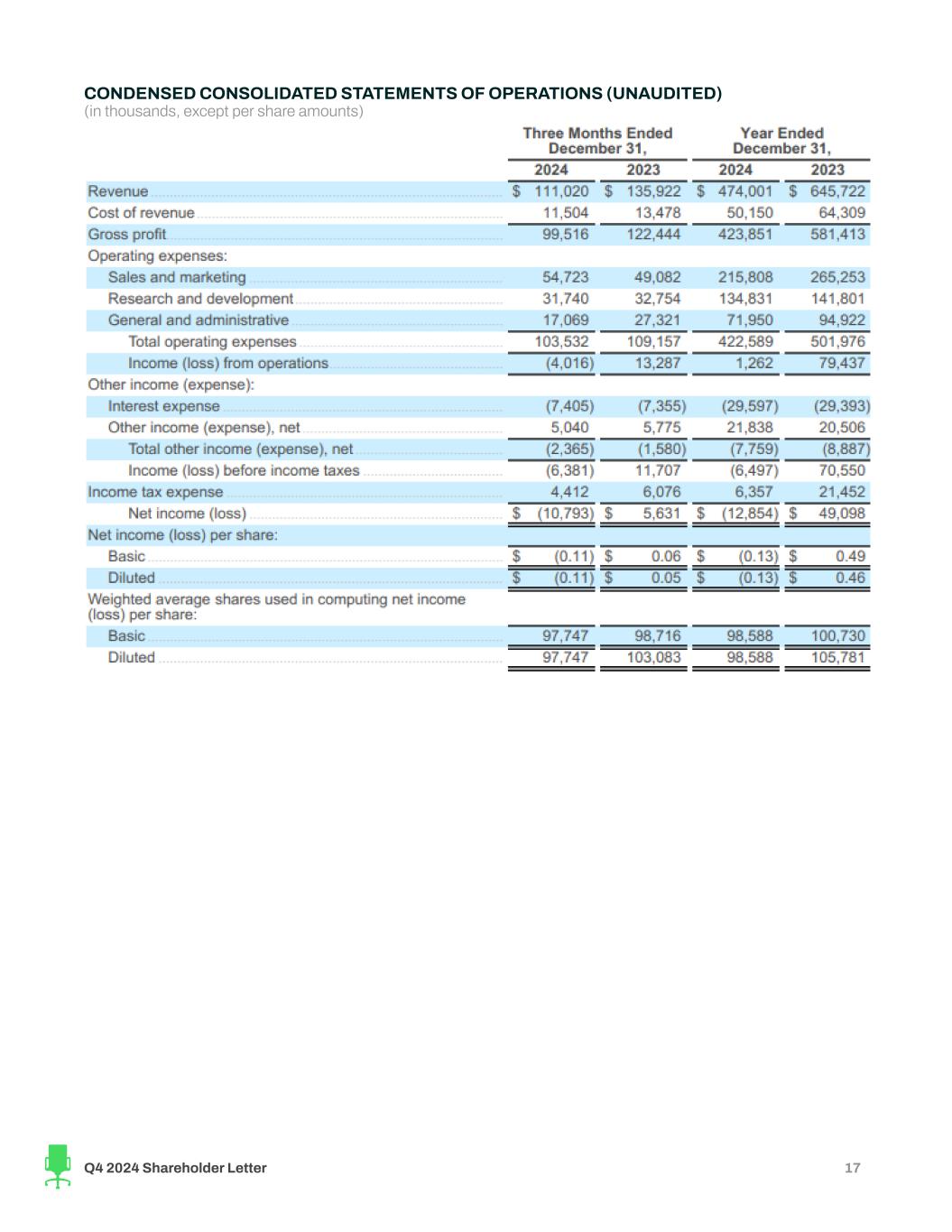

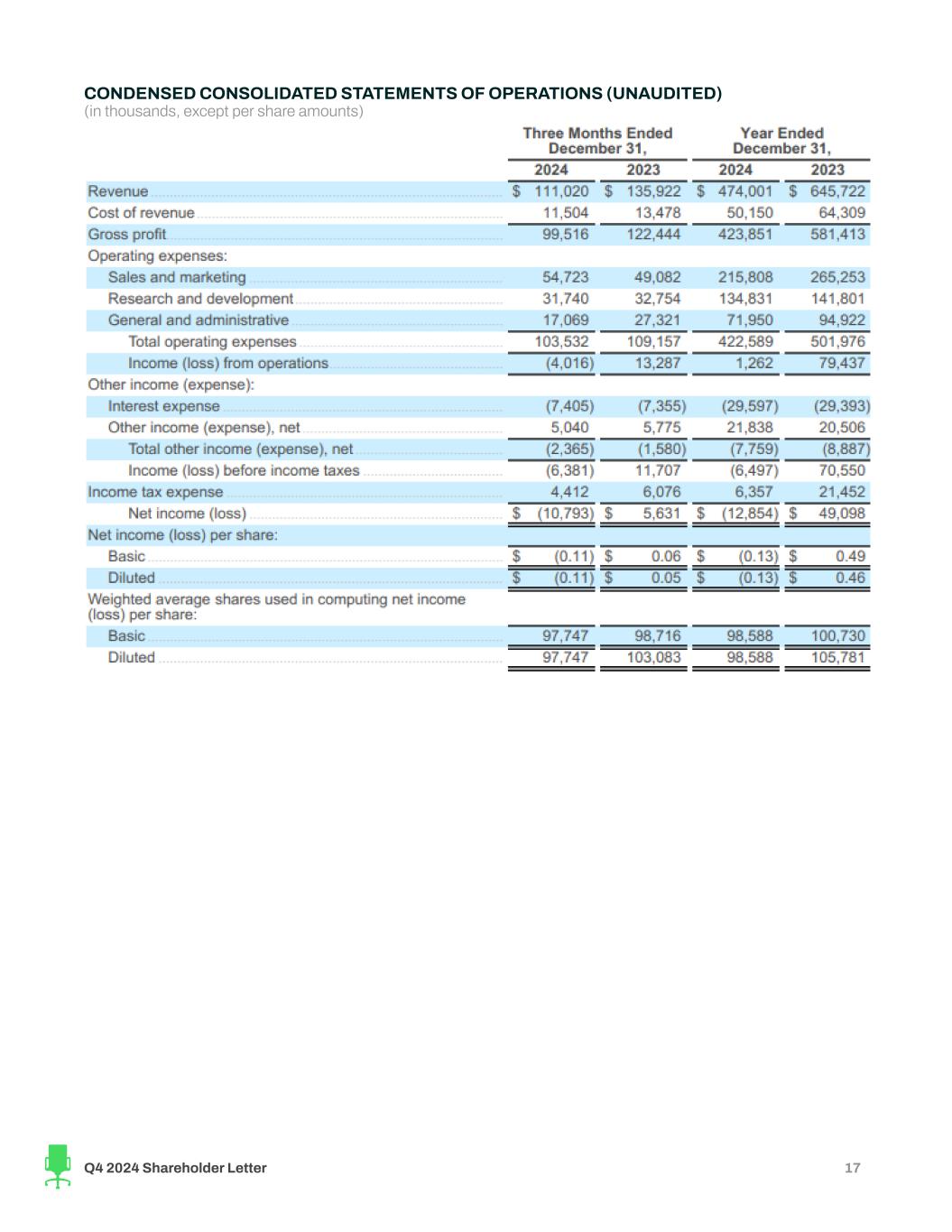

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (in thousands, except per share amounts) Q4 2024 Shareholder Letter 17

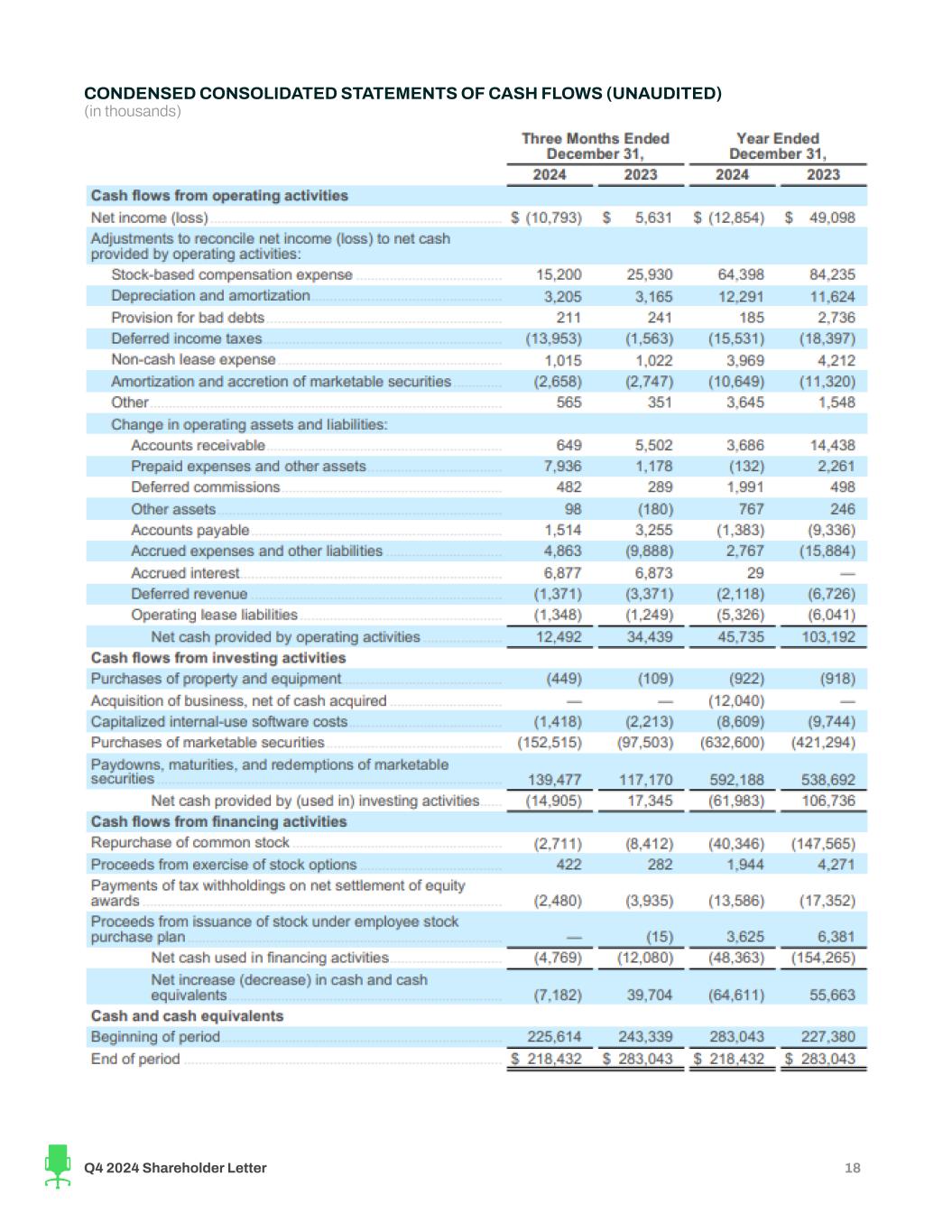

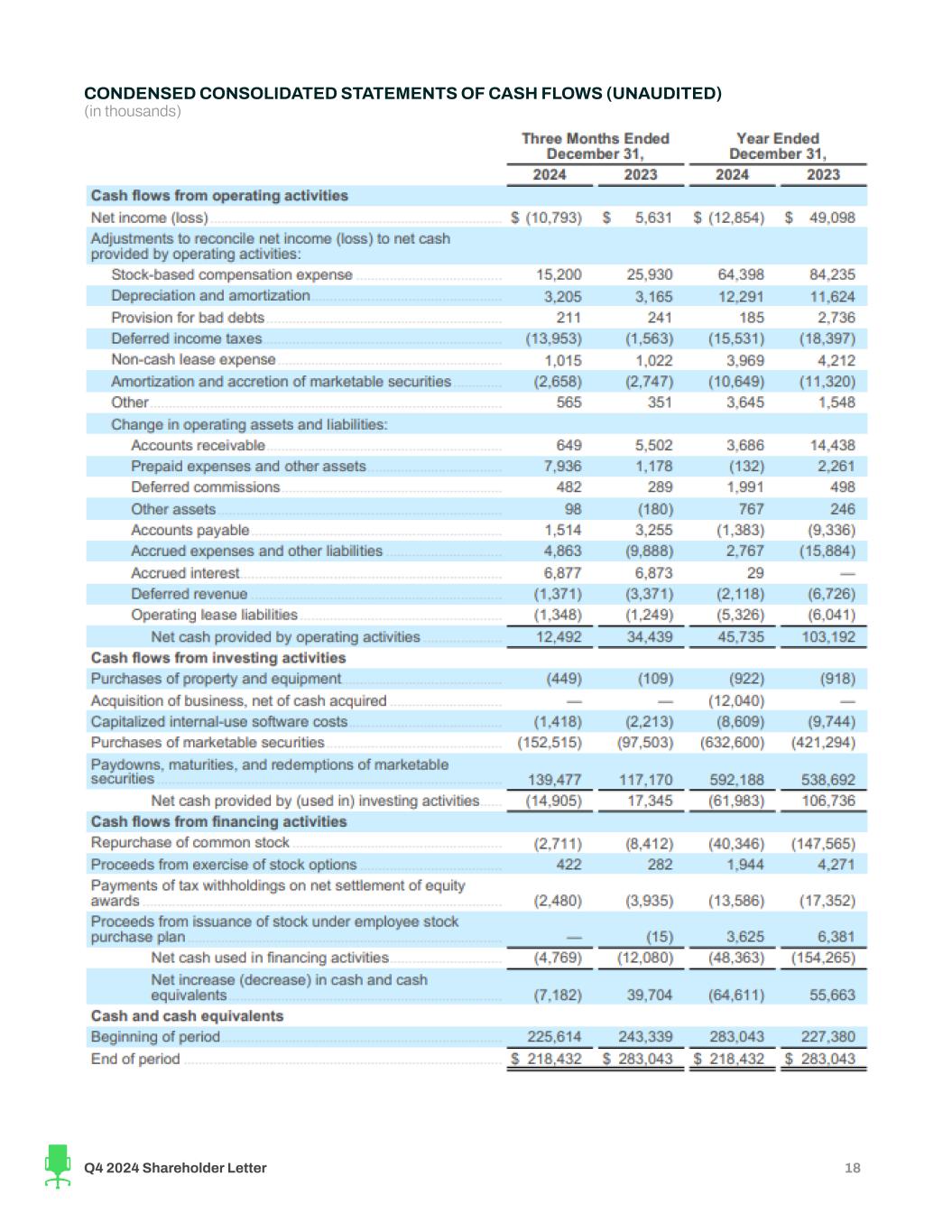

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands) Q4 2024 Shareholder Letter 18

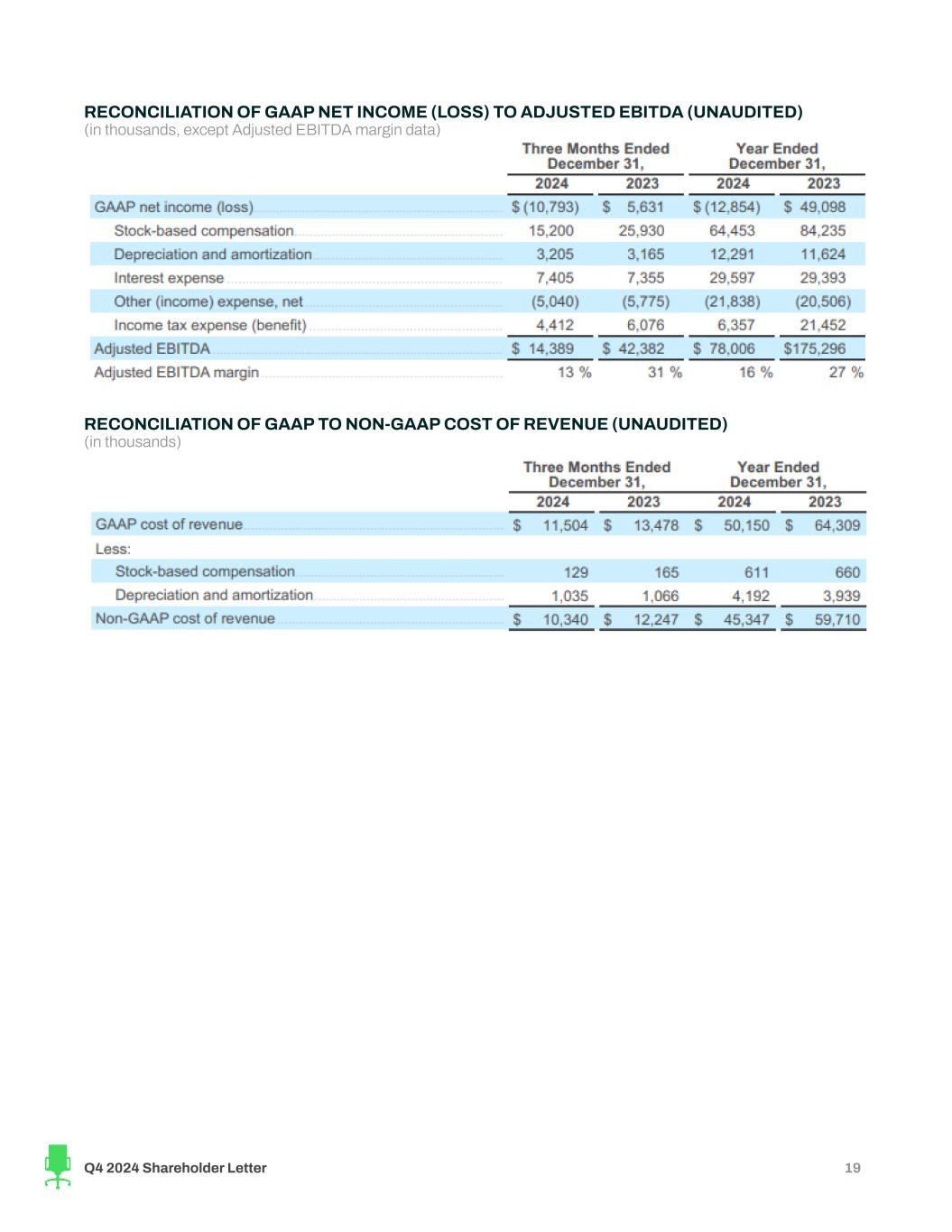

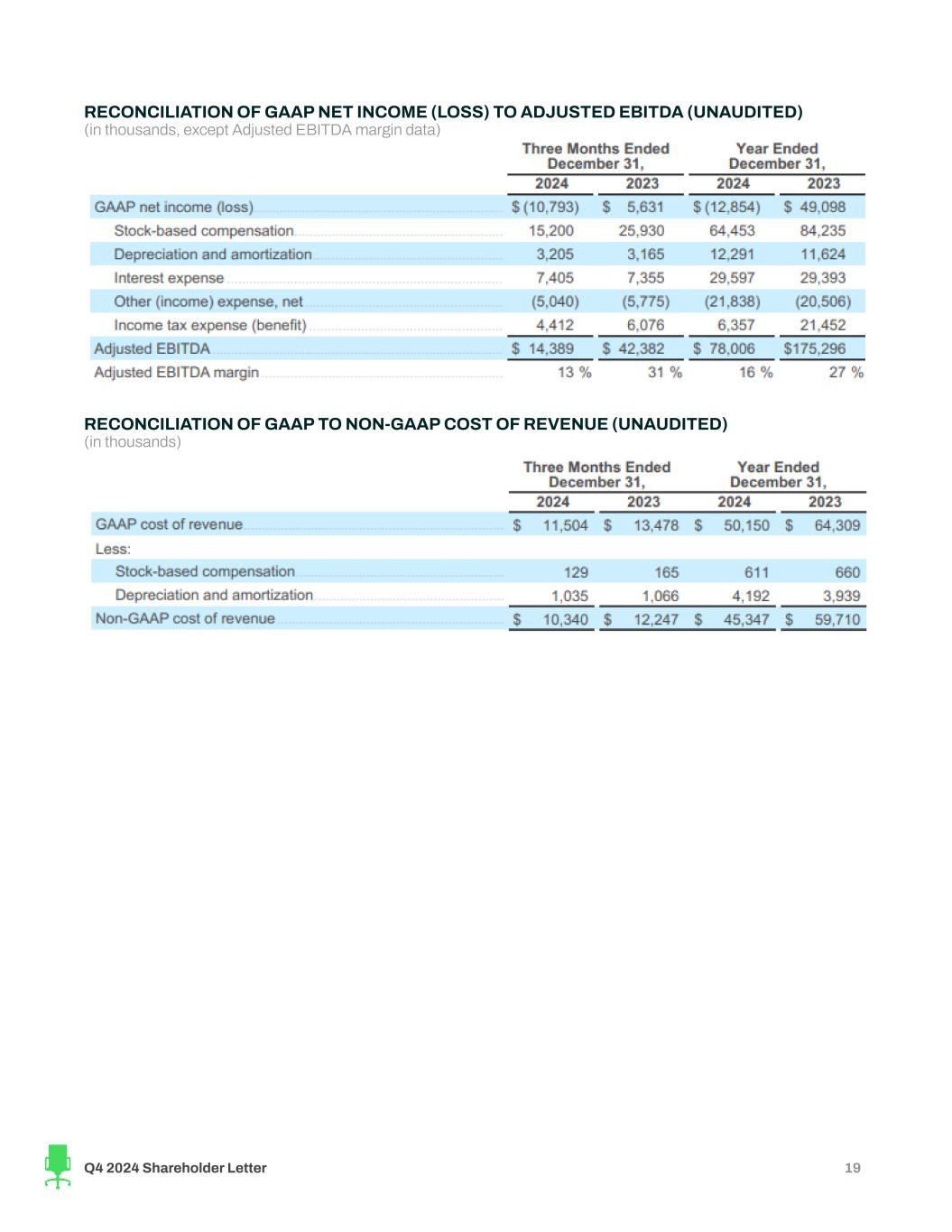

RECONCILIATION OF GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA (UNAUDITED) (in thousands, except Adjusted EBITDA margin data) RECONCILIATION OF GAAP TO NON-GAAP COST OF REVENUE (UNAUDITED) (in thousands) Q4 2024 Shareholder Letter 19

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES (UNAUDITED) (in thousands) FULLY DILUTED SHARES (UNAUDITED) (in thousands) Q4 2024 Shareholder Letter 20

Key Operating Metrics and Non-GAAP Financial Measures This shareholder letter includes certain key operating metrics, including Quarterly Paid Employers and Revenue per Paid Employer, and non-GAAP financial measures, including Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin. We define Paid Employers as any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial. Job Distribution Partners are defined as third-party sites who have a relationship with us and advertise jobs from our marketplace. Quarterly Paid Employers means, with respect to any fiscal quarter, the count of Paid Employers during such fiscal quarter. Revenue per Paid Employer is the total company revenue in a particular period divided by the count of Quarterly Paid Employers in the same period. We define Non-GAAP cost of revenue as our cost of revenue before stock-based compensation expense, and depreciation and amortization. We define Non-GAAP operating expenses as our operating expenses before stock-based compensation expense, and depreciation and amortization. We define Adjusted EBITDA as our net income (loss) before interest expense, other (income) expense, net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue for the same period. Management and our board of directors use these key operating metrics and non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these key operating metrics and non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business. Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAP measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business. These non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized including our capitalized internal use software. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDA margin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDA margin used herein are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin for Q1’25 or the full fiscal year 2025 to net income (loss) and net income (loss) margin, the comparable GAAP measures, respectively, because certain items that are excluded from non-GAAP financial measures cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of stock-based compensation or amortization of internal-use software, as applicable, without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, GAAP measures in the future. See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. Q4 2024 Shareholder Letter 21