PRELIMINARY OFFERING CIRCULAR DATED OCTOBER [___], 2015

WAYBETTER, INC.

205 East 42nd Street, 17th Floor

New York, NY 10017

www.waybetter.com

up to 20,000,000 shares of Series B Preferred Stock

SEE “SECURITIES BEING OFFERED” AT [PAGE XX]

| Price to Public | Underwriting

discount and

commissions** | Proceeds to

issuer | Proceeds to

other persons |

|

|

| Per share/unit | $1.00* | | | N/A |

| Total Minimum | $3,000,000 | | | N/A |

Total

Maximum | $20,000,000

|

|

| N/A

|

|

*We will provide final pricing information in a final or supplemental Offering Circular.

**See “Plan of Distribution” for details regarding the compensation payable to placement agents in connection with this offering. The company has engaged North Capital Private Securities Corporation to serve as its sole and exclusive placement agent to assist in the placement of its securities.

We expect that the amount of expenses of the offering that we will pay will be approximately $100,000, not including state filing fees.

This offer will terminate one year from the date this offering is qualified by the U.S. Securities and Exchange Commission, but we reserve the right to terminate the offering on an earlier date. The company has engaged [___________] as bank escrow agent to hold funds tendered by investors, and assuming we sell a minimum of $3 million in shares, may hold a series of closings at which we receive the funds from the escrow agent and issue the shares to investors. The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is one year from this offering being qualified by the Commission, or (3) the date at which the offering is earlier terminated by the company in our sole discretion. In the event we have not sold the minimum amount of shares by the date that is one year from the qualification of this offering with the Commission, or sooner terminated by the company, any money tendered by potential investors will be promptly returned by [__________] as bank escrow agent.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This offering is inherently risky. See “Risk Factors” on page [XX].

Sales of these securities will commence on approximately [date].

We are following the “Offering Circular” format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

2

TABLE OF CONTENTS

3

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE.

4

SUMMARY

The Company

Our Mission

WayBetter helps motivate people to adopt healthy behaviors through a combination of gamification, social support, and financial incentives.

Overview

We make games that drive healthy behaviors. Players in our games support, motivate, and hold each other accountable as they work in tandem towards a common goal.

Our first product is a social weight-loss game called DietBet that enables players to compete to lose weight with friends or strangers with real money on the line. The game is not winner-take-all as everyone who reaches the target splits the pot evenly. DietBet is accessible via the web and via mobile apps and comes in different formats, with different time horizons and targets, and with high-stakes and low-stakes games, so that our customers can choose the approach that best fits their goals. We use percentage-based weight targets so that men and women of all shapes and sizes can enjoy playing together on an even playing field.

Since we launched DietBet in 2012 through October 15, 2015, we have had over 300,000 unique paying players who have collectively logged a loss of over 3 million pounds in our games. During that time, we have processed over $22 million in transactions and winners have earned more than $14 million for reaching their targets (this does not count future payouts to players in live games).

We have seen the following growth to date (Gross Transaction Volume (GTV) represents the total dollar volume transacted by customers on the WayBetter platform. GTV is a non - GAAP measurement which differs from the presentation of revenues in the financial statements.):

| • | 2012 Gross Transaction Volume: $242,703 |

| • | 2013 Gross Transaction Volume: $4,142,192 |

| • | 2014 Gross Transaction Volume: $8,626,197 |

| • | 2015 Gross Transaction Volume: $6,453,888 through June 30th |

This is largely driven by jumps in user growth:

| • | 2012 Total Game Plays: 9,689 |

| • | 2013 Total Game Plays: 141,034 |

| • | 2014 Total Game Plays: 212,696 |

| • | 2015 Total Game Plays: 157,850 through June 30th |

5

Our Current Games

Everyone’s approach to weight loss is different, so we have created games that appeal to different people at different stages of their weight-loss journey.

| | • | DietBet Kickstarter is our most popular game for new players. This game gets players to commit to losing 4% of their starting weight over a period of four weeks. To date, we have had over 500,000 players in DietBet Kickstarter games (counting people who have played multiple games as multiple players) and the average payment has been $30. On average, winners in Kickstarter games have lost 9.3 pounds in a month. |

| | | |

| | • | DietBet Transformeris a longer-term game for players who are prepared to commit to lose 10% of their weight gradually over the course of six months. This game has six monthly Rounds, each with its own goal and pot. To date, we have had nearly 40,000 Transformer players whose average financial commitment per game has been $117. Players in Transformers can also purchase a $20 package of Weigh- In Tokens, a virtual product that enables them to do an official weigh-in with our Referees each week. More than half purchase Tokens, which has the effect of boosting our margins. |

| | | |

| | • | DietBet Maintaineris our newest game and is still in beta testing. This is a yearlong game for people who have reached a healthy BMI and who are focused on maintaining a healthy weight. In this game, the goal is to maintain your weight within a range of +1 to -10%. |

With this trio of DietBet games - Kickstarter, Transformer, and Maintainer - we aim to give people the motivation to get started, to lose weight at a healthy pace, and to keep it off. We believe our emphasis on gradual weight loss and long-term maintenance differentiates us from the many companies in the dieting world that sell quick fixes such as pills, shakes, and supplements. We believe that a sustainable weight-management solution must address underlying motivations and behaviors.

Our Plans for New WayBetter Products

Although we have focused on weight-related games to date, we aspire to be more than a weight-loss company. We believe our approach to social motivation and behavior change can be applied to other areas of healthy lifestyles. For this reason, in August 2014 we changed the name of our company from DietBet, Inc. to WayBetter, Inc. We believe WayBetter better reflects our aspiration of having a broad range of games that can help people live better, healthier lives through a mix of gamification, social support, and financial incentives.

To this end, we recently started testing a new game called StepBet that is similar to DietBet, but instead of losing weight, StepBet is designed to motivate people to walk more. Players compete with step data from their Fit bits as well as other step trackers. We are currently incorporating feedback we have received from over 300 alpha testers and we plan to launch a beta version of StepBet in 2016.

6

We aim to roll out products that address a wide range of behaviors and healthy lifestyles. Some ideas we have contemplated include CardioBet to exercise more; SleepBet to sleep better; CigaBet to quit smoking; LearnBet to acquire new skills; LingoBet to learn languages; and MedsBet to improve adherence to taking medications; among others.

We believe there is a need for a goal-oriented social network. We aim to meet this need by bringing together large numbers of people from all over the world to collaborate, compete, and inspire each other to attain their self-improvement goals in a new way-all within a fun, safe, supportive, and friendly community.

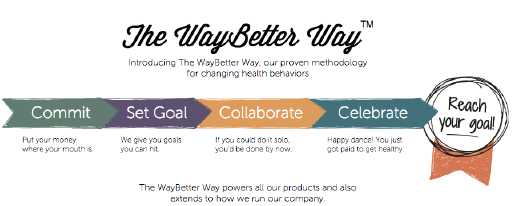

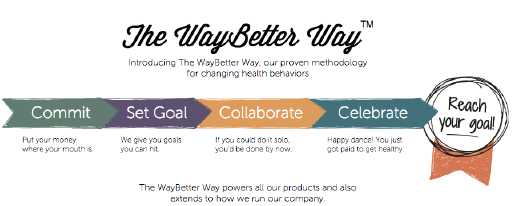

Our Differentiated Solution—The WayBetter Way

What makes our approach different is our emphasis on social motivation, gamification, and financial incentives. We call this The WayBetter Way and it is designed to enable our users to improve their health and fitness by:

| | • | Life becomes a game. Competitive people hate to lose and often find that it’s easier -and certainly more fun -to reduce their weight when they’re doing it as part of a social game. We effectively turn weight loss into a game: with a starting line, a finish line, clear predefined goals that need to be reached in order to win, and Referees. We even provide a leader board and history charts to inspire players as they track their progress. Over time we aim to gamify other areas of healthy living and behavior change, like exercising and walking more, sleeping better, and quitting smoking. |

| | | |

| | • | A shared journey. Unlike traditional social networks that connect people based on social ties, DietBet connects people based onshared goals. Players in our games can and often do bond with strangers into a cohesive group as they travel together on a shared weight-loss journey. A degree of anonymity in such situations, particularly where there can be a stigma with the behavior (as with being overweight) can be liberating, especially when your friends, family, and co-workers may not fully support or understand your desire to make certain healthy lifestyle changes. To facilitate camaraderie and empathy among players, we provide in-game forums where players can share photos, recipes, and updates with each other, and also blog about their successes and their struggles. We have designed all our games to emphasize friendly collaboration rather than cutthroat competition. They are never winner-take-all. |

| | | |

| | • | Carrots and sticks. Nobody likes to lose money and we require all our players to “put their money where their mouth is” at the start of the game by entering into a commitment contract. Players put money into the pot with the understanding that they will get their money back at the end, and likely a profit, too, if they successfully reach the game’s goal. The carrot and stick of winning and losing real money is a powerful motivator for many players. DietBet winners feel like they got paid to lose weight and this can build momentum and confidence and fuel a positive feedback loop of mounting rewards, both intrinsic rewards (improved health and well-being) and extrinsic rewards (making money). |

7

Our Competitive Strengths—What Sets Us Apart

We believe the following strengths will allow us to continue our growth trajectory:

| | • | A growing, recognizable brand. As a result of our singular focus to date on building a gamified social motivation platform, coupled with our early entrance into this market, we believe that the DietBet brand may become synonymous with weight-loss games. We have trademarked DietBet in the United States and own the URL in top-level domains in other countries around the world (e.g., dietbet.cn and dietbet.de). |

| | | |

| | • | Broad partnerships with health and wellness influencers.We have worked with over 200 influencers in the health and wellness industry, including celebrities with millions of followers on social media (such as Jillian Michaels), to lead DietBet games. These influencers have also helped to cost-effectively build awareness of our brand since each time a well-known influencer leads a DietBet game we get the branding benefits of being associated with them. |

| | | |

| | • | Publicity and word-of-mouth marketing.Our growth has come in large part from press coverage in dozens of media outlets in the United States and internationally, by partnering with respected influencers, and by word-of-mouth referrals from our customers. We see customer acquisition through increased investments in advertising as a substantial new potential growth opportunity that we intend to pursue in the future. |

| | | |

| | • | International market opportunity. Although we have not developed local language versions of our products, we have had players from over 70 countries and 10% of our users are outside the United States. We believe we can accelerate our penetration into foreign markets by translating our products into local languages and working with local influencers and media outlets to build our brand internationally. With this in mind, in October 2015 we signed a Memorandum of Understanding with a large weight-loss company in China to partner exclusively on launching our products in China. |

| | | |

| | • | Game design expertise.We have learned a great deal about designing games that foster behavior change and we consider this proprietary domain knowledge. Given our experience, we believe we are at an advantage relative to new entrants in our space and our expertise will help us as we attempt to pioneer new kinds of behavior-change games that relate to other aspects of healthy lifestyles (beyond weight loss). |

8

| | • | Direct relationship and continuous communication with our users.The nature of our game sallows us to learn about our users’ health and fitness goals and communicate the most relevant analysis, features, advice, and content to them throughout the day with our online dashboard, mobile apps, emails, and notifications. |

Our Growth Strategy

We intend to accelerate our growth by developing and launching new products. Key elements of our growth strategy include:

| | • | Continue to introduce innovative products. We plan to develop new and diverse health behavior games beyond DietBet. To do so, we expect to invest in research and development to strengthen our platform and interconnect with third-party platforms and devices, such as Google Health, Apple’s Healthkit, and Fitbit, to power new games like StepBet, SleepBet, and CardioBet. We are also continually looking for potential partners to provide data that could power behavior-based games like CigaBet (to quit smoking) and MedsBet (to improve adherence to taking medications). |

| | | |

| | • | Introduce new features and services.We plan to continue to introduce innovative new features and services to increase user engagement and revenue, and drive efficacy around successful and sustainable healthy behavior change. For example, in 2015 we launched alpha tests of two new games, StepBet and WayBetter Together. |

| | | |

| | • | Expand brand awareness and drive sales of our products and services.We intend to increase our marketing efforts to grow awareness of our brand and drive greater sales of our products and services. |

| | | |

| | • | Increase global distribution through select partners.We believe that international markets represent a significant growth opportunity for us and we intend to expand sales of our products and services globally through select partnerships, especially in Western Europe and China. |

| | | |

| | • | Push into the corporate wellness market.We intend to build relationships with employers, insurers, and wellness providers and grow revenue streams through employee wellness programs. |

Industry Background and Trends

In the United States alone, 145 million people are overweight, according to the CDC. Obesity costs the United States $147 billion in health care expenditures each year and businesses in the United States lose an estimated $8.7 billion annually in absenteeism and decreased productivity.

According to MarketData Enterprises, 108 million Americans go on an average of four-to-five diets a year and Americans spend over $60 billion a year on weight-loss products and services. Despite the size of this market, the weight-loss industry is highly fragmented and has been in a state of flux with the introduction of disruptive new technologies. Traditional weight-loss companies like Weight Watchers and Jenny Craig have suffered commercially (the stock price for Weight Watchers, for example, has ranged between $85 and $4 in the last five years). Apps such as MyFitnessPal, LoseIt, and DietBet have attracted millions of users. MyFitnessPal, a free app for calorie counting and activity tracking, claims 75 million downloads.

9

Several notable trends are driving the growth of the health and fitness market:

| | • | Individuals and employers are increasingly focused on health and fitness.A variety of factors, such as changing consumer lifestyles and demographics, combined with rising health care costs and employers’ increased emphasis on productivity, are leading individuals and employers to increasingly focus on health and fitness. Based on research from Fitbit, Inc., consumers spent over $200 billion in 2014 on health and fitness services, such as gym and health club memberships, commercial weight management services, and consumer health products, such as weight management products and dietary supplements. In addition, IBIS World estimates that the corporate wellness industry will grow from $7.4 billion in 2014 to $10.4 billion in 2018 in the United States. |

| | | |

| | • | Advances in technology have enabled the emergence of connected devices.Recent technological advances in sensors, lower power components, and longer-life batteries, combined with the introduction of wireless standards, such as Bluetooth low energy, have enabled the emergence of connected devices that are smaller, more power-efficient, and able to track a broader range of biometric data. We see these devices as enabling our expansion into new games that depend on wearable sensors, such as StepBet, CardioBet, and SleepBet. |

| | | |

| | • | Mobile devices have become the preferred platform for accessing information. Mobile devices have become the preferred platform for people to access information and manage their lives, as well as the primary hub to connect a variety of consumer devices. According to Gartner, by 2018 more than 50% of users will go to a tablet or smartphone first for all online activities. More than half our players interact with DietBet via a mobile device, which generally makes for a better user experience as players can weigh-in from the gym, read and reply to comments while waiting for the bus, and get inspiration whenever and wherever they need it. We believe this trend towards mobile computing is especially powerful for online games like ours that have offline elements. |

| | | |

| | • | More individuals are turning to technology solutions to improve health and fitness. Individuals are increasingly using mobile apps and other software to improve health and fitness, allowing consumers to directly manage and track their health and fitness in unprecedented ways. According to The NPD Group, over 25% of U.S. consumers reported using a fitness app on their smartphone. |

10

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| | • | We operate in a highly competitive market; |

| | • | We must successfully anticipate and satisfy consumer preferences and develop and timely introduce new products and services or enhance existing products and services to address these preferences; |

| | • | With certain new games, we will rely on partners like Fitbit, Apple, and Google for data, which could constrain us if they prove unable or unwilling to work with us; |

| | • | We could face new regulatory issues in the United States and/or in other countries which could classify our activities as gambling; |

| | • | We could encounter reputational issues if players lose trust in our weigh-in system and players think that others are cheating; |

| | • | We could become operationally burdened by opening the current fundraise to a large number of smaller investors; |

| | • | We could lose key employees and/or have difficulty filling key roles; |

| | • | The market for social motivation games is still in the early stages of growth and may not continue to develop as quickly as expected; |

| | • | An economic downturn or future economic uncertainty could adversely affect demand for our products and services; |

| | • | Our current and future products and services may experience quality problems from time to time that could result in adverse publicity, litigation, and/or regulatory proceedings; |

| | • | Material disruption or breach of our information technology systems or those of third-parties could materially damage user and business partner relationships; and |

The Offering

| Securities offered: | Minimum of 3,000,000 shares of Series B Preferred Stock |

| | Maximum of 20,000,000 shares of Series B Preferred Stock |

Offering price: $1 per share of Series B Preferred Stock

Minimum investment amount: $1,000

11

Terms of the securities: Series B Preferred Stock are non-voting and non-transferable. The only exit for investors is if the company redeems the shares, is liquidated, goes public, or is acquired; a transfer by will or intestate succession; or any transfers approved in advance by the majority of the Board. See “Securities being Offered.”

12

RISK FACTORS

The SEC requires us to identify risks that are specific to our business and our financial condition. We are subject to all the same risks that all companies in our business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently more risky than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

We are a startup and most startups fail.

WayBetter was incorporated in 2010 (as DietBet, Inc.) and made its first sales in January 2012. After five years we’re still small and we could get crushed by a bigger company, outmaneuvered by another startup, or fail simply because we make too many mistakes. We have a lot of passion but sometimes passion isn’t enough. If you’re investing in this company it’s because you believe in us and in our mission of helping people live better and healthier lives, because there’s no proof that we’ll be able to continue to grow the company.

Our limited track record is no guarantee of future performance.

We are what is called a development stage company, meaning we don’t have much of a financial track record. Our past performance doesn’t give you an idea of how we will perform financially in the future, and our future financial results will vary a lot as we build out our plans and our team and react to changes in our market.

We really only have one product (everything else is on the drawing board).

We have one product in the market that has generated millions of dollars in revenue: DietBet. Everything else we’re planning to launch is speculative. We have done alpha tests with several hundred users for StepBet but we don’t have nearly enough data to know if that will succeed. Products on our road map like CardioBet and SleepBet are still over the horizon.

If we cannot raise enough investment capital in the future, we’ll be in big trouble.

We are raising up to $20 million in this offering, and may close on as little as $3 million. Even if we raise $20 million, however, we might still run out of money down the road. Startups often depend on raising round after round of additional capital until they’re profitable and can fail if they’re unable to secure their next funding round on time. That could happen to us.

Our auditor has issued a “going concern” opinion.

Our auditor has issued a “going concern” opinion on our financial statements, which means they aren’t sure we’ll be able to succeed as a business without additional financing. The company has not generated profits since it was created, and has sustained net losses of $609,448 and $978,184 for the years ended December 31, 2014 and December 31, 2013, respectively. The audit report states that the company’s ability to continue as a going concern for the next twelve months is dependent upon our ability to generate sufficient cash flows from operations to meet our obligations, which the company has not been able to accomplish to date, and/or to obtain additional capital financing.

13

Future fund raising rounds could “cram you down”.

If we do manage to raise subsequent financing rounds, the terms of those rounds might be more favorable to new investors than to existing investors such as you. New equity investors or lenders could have greater rights over our financial resources than our current shareholders. Additional financings could also dilute your ownership stake, potentially drastically. See “Dilution” for more information.

We have a tiny team.

We currently depend on the skill and experience of four primary employees: James Rosen, Matthew Daniel, Alison Weick, and Sean Conrad. Each of these people play key roles and if one or more were to leave for any reason, we would have trouble operating. We also depend on a number of offshore and on-shore contractors to provide key engineering and IT services as well as other services, and we would also run into operation problems and delays if any of these contractors were to stop working with us.

Voting control is in the hands of a few large stockholders.

The class and voting structure of our stock will have the effect of concentrating voting control with a few people, including our directors, our executive officers and our significant stockholders, who currently together hold most of the voting power of our capital stock. In addition, the Series B Preferred Securities we are offering are non-voting, so you will not be able to influence corporate matters, including the election of directors, changes to our company’s governance documents, expanding the employee option pool, and any merger, consolidation, sale of all or substantially all of our assets, or other major action requiring stockholder approval.

We don’t know if people will want to buy what we’re selling.

The market size for our primary product, DietBet, is unclear given that DietBet is an emerging, alternative product to existing weight loss products and has only been around since 2012. There is even less visibility regarding the potential demand for the new products we’re hoping to launch, such as StepBet, SleepBet, CardioBet, and CigaBet. These products also depend on emerging technologies like activity trackers embedded in smartphones, smart watches, and fitness trackers (sometimes referred to as wearables). And people who do like our products today may get tired of them tomorrow. Weight loss and exercise products are notoriously short-lived, as fads come and go. We have a small sample of data from early tests to suggest there may be demand for some of our new products, but we really won’t know how big a hit they might be, if at all, until they have been out for a while.

Competitors could eat our lunch.

There are a number of existing apps, tools, websites, communities, and other products that could compete with us for market share. These competitors include HealthyWage, Stickk, Pact, SparkPeople, MyFitnessPal, Noom, LoseIt, and Weight Watchers, among many others, including some that may not even exist or be known to us today. In addition, companies that don’t look like competitors today could make lateral moves into our space, especially if we’re successful. This could include big wearables companies like Fitbit, fitness/sports companies like Nike, social network companies like Facebook, technology giants like Google, healthy lifestyle brands like Lululemon, or a traditional weight loss companies such as Weight Watchers. We operate in a new market and the competitive landscape is changing quickly. We could see rival products at a lower cost, or with cool new features, targeting the same customer base, which may force us to cut prices, lose market share, or both. All of this is even more applicable to our as-yet unlaunched new products given that we will be moving into new and unfamiliar competitive landscapes.

14

Our space is crowded and there are many competitors for share-of-wallet.

While we believe that DietBet is different from most other products in the weight-loss market, it is not the only way to motivate people to lose weight. We have to compete with a number of other approaches that wouldn’t even normally be considered competition, including health and fitness communities, tools and apps, gyms, personal trainers and coaches, books, videos, and a multitude of other companies in the health, wellness, and behavior-change space. These competitors may be better capitalized than us and outspend us, which would give them a significant advantage. Weight Watchers, for example, is a large public company with a well-established brand around the world; and MyFitnessPal and MapMyFitness (calorie counting and exercise tracking apps) are now part of Under Armour, another large public company. Fitbit raised over $700 million in a successful initial public offering, and Strava (a fitness-oriented community and app) has raised $34.6 million from private investors. There are many well-capitalized startups and also mature companies in our space.

We depend on credit cards and Paypal.

We rely heavily on credit cards to collect the initial payment, and almost exclusively on PayPal to process payouts to customers at the end of the games. If PayPal were to block us for any reason at its discretion - for example, if PayPal detected fraudulent activity related to WayBetter’s users - we would need to find a different method of getting winnings to our customers, such as cutting paper checks. Also, if PayPal were to increase its fees, we could face a reduction in our profits. We are in the process of diversifying our redemption options but we have not been able to find another potential payout partner with the market share of PayPal.

We could be regulated out of business.

Our business model involves a customer entering into a commitment contract as a means of providing motivation to reach a healthy goal (such as losing weight). Although we use the word “bet”, we do not believe that this kind of commitment contract is gambling because our games are fundamentally skill-based and the outcomes are generally under the player’s control. If our activities were deemed illegal or subject to gambling laws by appropriate authorities, however, especially in the United States, we could be squeezed. We also do not know how regulatory issues might affect our planned new products such as StepBet, CardioBet, SleepBet, CigaBet, etc. We also do not know how regulatory issues could affect our plans to expand into unfamiliar international jurisdictions, such as China.

15

We have to block cheaters.

With DietBet, we rely on a weight verification system that is not impossible to cheat. Players are required to submit two weigh-in photos for their official weigh-ins at the start and end of each game (or round of game, in the case of multi-month games). These photos are sent to our Referees who review them across a range of parameters to ensure compliance with our weigh-in rules. When appropriate, our Referees may reject a weigh-in submission and require the player to weigh in again. We also use algorithms to detect suspicious behavior and may require certain players to submit to greater scrutiny, such as with a video weigh-in (instead of photos). We also limit the number of games that any one player can player concurrently.

Despite our best efforts, however, people will attempt to cheat. While we have processed 6.5 million weigh-in photos and believe that cheating is reasonably under control now, if players came to feel that cheating is widespread, this could scare people away from playing, especially in games with strangers.

In addition, new as-yet unlaunched games will entail new methods of verification which we will have to invent and which may be similarly subjected to cheaters. We may find that it is hard, or even impossible, to deter cheating to a sufficient degree with certain new games.

We could be hacked.

We process financial transactions when we accept commitment contracts and pay out earnings, and run the risk of fraud and hacking. As a tiny company that handles substantial sums in large quantities of financial transactions every day, we could be an attractive target to criminals and hackers. We have experienced incidents of fraudulent activity in the past and may experience more fraud in the future. We conduct security audits and do our best to safeguard our systems and assets but we cannot guarantee that we will be able successfully repel future attempts to defraud us.

Our team is distributed.

Like many startups today, we work with an increasing number of contractors, employees, and other service providers who are located all over the world. A distributed workforce can offer cost-savings, the ability to hire higher-caliber talent without the limitations of geography, and better time-zone coverage, especially in the case of our Referees and customer service team, but it can also present formidable difficulties vis a vis communications, managing, hiring, oversight, building a company culture, and in the cohesiveness and morale of our team. Whatever benefits come from having a distributed team could be outweighed by the significant operational hazards and risks and could cause us to under perform or fail. Several of our most senior employees are or have been based remotely and we expect this distributed structure, not just with contractors but with employees, to continue.

We have no independent directors.

Our directors are currently all insiders who have invested in the company. In addition, the directors are connected by long-standing personal relationships preceding the launch of the company. This could lead to unintentional subjectivity in matters of corporate governance, especially in matters of compensation and related party transactions. We also do not benefit from the advantages of having an independent director, including bringing an outside perspective on strategy and control, adding new skills and knowledge that may not be available within the company, having extra checks and balances to prevent fraud and produce reliable financial reports.

16

We have no patents.

We have no patents, nor any patents pending. This opens us up to copycat competitors. We have trademarks and URLs related to DietBet and related properties but these may not be sufficient to insulate us from other companies introducing very similar competitive products.

We may not have enough cash on hand to reedem players’ winnings.

Players provide funds pursuant to their commitment contract directly to our bank account and Paypal account, where we hold the funds for the period of the game. At the end of the game, the player’s winnings are recorded as WayBetter Points. These points can be redeemed for cash, and will expire in one year with no activity. If all our players were to redeem their points at the same time, we may not have sufficient cash on hand.

As of June 30, 2015, we had cash on hand of $4,885,092, which was sufficient to cover the $3,324,874 of player’s winnings that was “deposited” in our bank account at that time. The company has no bank lines in the event that additional cash is needed on short notice in the future.

Managing many investors could be very difficult.

We are a small company and managing many investors, could take up our management’s time and limited resources. Furthermore, there may be additional issues relating to managing a company that has raised capital through a Regulation A offering to a large number of investors which prove to be burdensome. The revised Regulation A regime is new, and as one of the first companies to go through this process we may hit unanticipated operational, regulatory, legal, and investor management obstacles.

Once you buy Series B Preferred stock, you can’t resell it.

Our Series B Preferred Stock is non-transferable; as such, the shares may not be traded on the over-the-counter market. The only exit for investors is if the company redeems your shares, or the company goes public, is acquired, or is liquidated. Your investment could be tied up for years.

17

DILUTION

Dilution means a reduction in value, control, or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. Occasionally, strategic partners are also interested in investing at an early stage. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders, early employees, or investors from prior financings, which means that the cash value of your stake is diluted because each share of the same type is worth the same amount, and you paid more for your shares than earlier investors did for theirs.

The following table compares the price that new investors are paying for their shares with the effective cash price paid by existing shareholders, giving effect to full conversion of all outstanding stock options, and assuming that the shares are sold at $1. It reflects all transactions since inception, which gives investors a better picture of what they will pay for their investment compared to the company’s insiders than just including such transactions for the last 12 months, which is what the SEC requires.

18

| | | | | | | | | | | | Total Issued | | | | |

| | | | | | Issued | | | Potential | | | and Potential | | | Effective Price per | |

| | | Dates Issued | | | Shares | | | Shares | | | Shares | | | Share | |

| Founding Common Shares | | 8/2010 | | | 9,000,000 | | | | | | 9,000,000 | | $ | 0.00 | |

Friends and Family Round Common

Stock (conversions of convertible debt) | | 3/2011 | | | 1,000,000 | | | | | | 1,000,000 | | $ | 0.10 | |

| Series Seed Preferred Shares | | 7/2011 - 3/2012 | | | 3,703,773 | (2) | | | | | 3,703,773 | | $ | 0.27 | |

Series Seed Preferred Shares

(conversions of convertible debt) | | 8/2014 | | | 3,583,542 | (2) | | | | | 3,583,542 | | $ | 0.27 | |

| Series A Preferred Shares | | 8/2014 - 10/2014 | | | 5,830,306 | (2) | | | | | 5,830,306 | | $ | 0.48 | |

| Series A-1 Preferred Shares | | 10/2015 | | | 581,838 | (2) | | | | | 581,838 | | $ | 0.74 | |

| Grants: | | | | | | | | | | | | | | | |

| Stock Grant | | 2/2015 | | | 10,000 | | | | | | 10,000 | | $ | - | |

| Warrants: | | | | | | | | | | | | | | | |

| Friends and Family | | 9/2010 | | | 100,000 | | | | | | 100,000 | (3) | $ | 0.01 | |

| Guaranty 2013 | | 8/2013 | | | | | | 200,000 | | | 200,000 | (1) | $ | 0.27 | |

| Guaranty 2015 | | Q4 2015 | | | | | | 200,000 | | | 200,000 | (4) | $ | 0.48 | |

| Options: | | | | | | | | | | | | | | | |

| $0.2700 Options | | 1/2011 - 2/2015 | | | | | | 2,784,373 | | | 2,784,373 | (1) | $ | 0.27 | |

| $0.4758 Options | | 2/2015 - 6/2015 | | | | | | 452,500 | | | 452,500 | (1) | $ | 0.48 | |

| | | | | | | | | | | | | | | | |

| Total Common Shares | | | | | 23,809,459 | | | 3,636,873 | | | 27,446,332 | | $ | 0.23 | |

Investors in this offering, assuming

$20 Million raised | | | | | 20,000,000 | | | | | | 20,000,000 | | $ | 1.00 | |

| Total After Inclusion of this Offering | | | | | 43,809,459 | | | 3,636,873 | | | 47,446,332 | | $ | 0.56 | |

(1) Assumes conversion at exercise price of all outstanding warrants and options

(2) Assumes conversion to common stock of all issued preferred shares

(3) All Friends & Family Round Warrants were exercised in September 2015.

(4) Assumes conversion at exercise price. Warrants issued in Q4 of 2015.

The following table demonstrates the dilution that new investors will experience relative to the companys net tangible book value as of June 30, 2015 of $1,718,380, adjusted for the assumption of proceeds from conversion all other convertible instruments outstanding at current, and assuming exercise of all options (3,236,873 shares) and warrants (400,000 shares) outstanding through current, which provide $1,116,240 of proceeds from conversions resulting in the issuance of 3,636,873 shares of common stock (or convertible preferred shares), in addition to the 10,110,000 shares of common stock currently issued and outstanding and 13,699,459 shares of convertible preferred shares outstanding. Net tangible book value is the aggregate amount of the companys tangible assets, less its total liabilities. The table presents three scenarios: a $3 million raise from this offering (minimum offering), a $11.5 million raise from this offering (mid-point), and a fully subscribed $20 million raise from this offering (maximum offering).

19

| | | $ 3 Million Raise | | | $ 11.5 Million Raise | | | $ 20 Million Raise | |

| Price per Share | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

| Shares Issued | | 3,000,000 | | | 11,500,000 | | | 20,000,000 | |

| Capital Raised | $ | 3,000,000 | | $ | 11,500,000 | | $ | 20,000,000 | |

| Less: Offering Costs | $ | (325,000 | ) | $ | (962,500 | ) | $ | (1,600,000 | ) |

| Net Offering Proceeds | $ | 2,675,000 | | $ | 10,537,500 | | $ | 18,400,000 | |

| Net Tangible Book Value Pre-Financing | $ | 2,834,620 | (2) | $ | 2,834,620 | (2) | $ | 2,834,620 | (2) |

| Net Tangible Book Value Post-Financing | $ | 5,509,620 | | $ | 13,372,120 | | $ | 21,234,620 | |

| | | | | | | | | | |

Shares issued and outstanding pre-financing,

assuming full conversion | | 27,446,332 | (1) | | 27,446,332 | (1) | | 27,446,332 | (1) |

| Post-Financing Shares Issued and Outstanding | | 30,446,332 | | | 38,946,332 | | | 47,446,332 | |

| | | | | | | | | | |

| Net tangible book value per share prior to offering | $ | 0.103 | | $ | 0.103 | | $ | 0.103 | |

| | | | | | | | | | |

Increase/(Decrease) per share atributable to new

investors | $ | 0.078 | | $ | 0.240 | | $ | 0.344 | |

| Net tangible book value per share after offering | $ | 0.181 | | $ | 0.343 | | $ | 0.448 | |

| Dilution per share to new investors | $ | 0.819 | | $ | 0.657 | | $ | 0.552 | |

(1) Assumes conversion of all issued preferred shares to common stock, conversion of 400,000 outstanding stock warrants, and conversion of 3,236,873 outstanding stock options.

(2) Net Tangible Book Value is adjusted for conversion proceeds for the outstanding warrants and stock options discussed at (1).

20

The next table is the same as the previous, but removes the assumption of conversion of outstanding options and warrants, instead only presenting issued shares.

| | | $ 3 Million Raise | | | $ 11.5 Million Raise | | | $ 20 Million Raise | |

| | | | | | | | | | |

| Price per Share | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

| Shares Issued | | 3,000,000 | | | 11,500,000 | | | 20,000,000 | |

| Capital Raised | $ | 3,000,000 | | $ | 11,500,000 | | $ | 20,000,000 | |

| Less: Offering Costs | $ | (325,000 | ) | $ | (962,500 | ) | $ | (1,600,000 | ) |

| Net Offering Proceeds | $ | 2,675,000 | | $ | 10,537,500 | | $ | 18,400,000 | |

| Net Tangible Book Value Pre-Financing | $ | 1,718,380 | | $ | 1,718,380 | | $ | 1,718,380 | |

| Net Tangible Book Value Post-Financing | $ | 4,393,380 | | $ | 12,255,880 | | $ | 20,118,380 | |

| | | | | | | | | | |

| Shares Issued and Outstanding Pre-Financing | | 23,809,459 | (1) | | 23,809,459 | (1) | | 23,809,459 | (1) |

| Post-Financing Shares Issued and Outstanding | | 26,809,459 | | | 35,309,459 | | | 43,809,459 | |

| | | | | | | | | | |

| Net tangible book value per share prior to offering | $ | 0.072 | | $ | 0.072 | | $ | 0.072 | |

| | | | | | | | | | |

Increase/(Decrease) per share attributable to new

investors | $

| 0.092

|

| $

| 0.275

|

| $

| 0.387

|

|

|

| Net tangible book value per share after offering | $ | 0.164 | | $ | 0.347 | | $ | 0.459 | |

| Dilution per share to new investors | $ | 0.84 | | $ | 0.653 | | $ | 0.541 | |

* Assumes conversion of all issued preferred shares to common stock

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares, whether as part of a capital-raising event, or issued as compensation to the company’s employees or partners. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another crowd funding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most development stage companies do not pay dividends for some time).

21

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| | • | In June 2014 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| | | |

| | • | In December the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is nominally worth $200,000. |

| | | |

| | • | In June 2015 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share. In some cases, dilution can also completely wipe out the value of investments made by early investors, without any person being at fault.

Investors should understand how dilution works and the availability of anti-dilution protection.

Dilution Protection for Other Shareholders

Previous investors have protection from dilution that does not apply to investors in this offering. Significant Holders are granted a right of first refusal in Section 4 of the WayBetter, Inc. Investors’ Rights Agreement dated October 2015, as a form of protection from dilution. We grant “Significant Holders,” or those who own at least 250,000 outstanding shares of the company, prior to the Series B Preferred offering, the right of first refusal to purchase shares in new securities we may propose to sell after the date of that agreement. When we propose to undertake an issuance of new securities, such as the Series B Preferred Shares in this offering, we must give each Significant Holder written notice describing the type of new security, the price and the general terms. Each Significant Holder will have ten days after the notice is mailed or delivered to agree to purchase their pro rata share of the new securities. If a Significant Holder does not exercise their right of first refusal within the ten-day period, we have ninety days to sell or enter into an agreement to sell that portion of new securities. The right of first refusal in the agreement will end if we make an initial public offering.

22

USE OF PROCEEDS TO ISSUER

The net proceeds of this offering to the company, after expenses of the offering (payment to the placement agent for its services, professional fees and printing) will depend on the final commission paid to North Capital Private Securities.

Assuming proceeds of $7 million are raised, resulting in net proceeds of $6.475 million, the company plans to use these proceeds as follows:

| | • | Approximately $2.0 million for general operating expenses, including salaries, overhead (rent), capital expenditure (computers and office furniture). |

| | | |

| | • | Approximately $1.25 million for hiring additional team members, and transitioning away from reliance on contractors. |

| | | |

| | • | Approximately $1.5 million for developing and launching new products, including StepBet, SleepBet, CardioBet, and CigaBet. |

| | | |

| | • | Approximately $0.75 million for international expansion, including developing and expanding our strategic partnership with a large Chinese weight-loss company, China Showyu Healthy Group Limited. |

| | | |

| | • | Approximately $0.5 million in marketing and advertising, including direct marketing efforts, joint marketing efforts, brand awareness campaigns and other public relations activities. |

Approximately $0.475 million, or 7% of the net proceeds, would not be allocated for any particular purpose under this assumption.

If the maximum offering size of $20 million were raised, we would have $18.5 million in net proceeds. The amount not allocated for any particular purpose would be approximately $4.625 million, or 25% of the net proceeds.

Because the offering is a “best efforts” offering with a minimum offering size of $3 million, WayBetter may close the offering without sufficient funds for all the intended purposes set out above. If the offering size is $3 million, then the company estimates that the net proceeds to WayBetter will be $2.775 million and WayBetter will make the following adjustments to the above uses of proceeds:

| | • | Approximately $0.775 million for general operating expenses, including salaries, overhead (rent), capital expenditure (computers and office furniture). |

23

| | • | The remaining approximately $2.0 million will be used as follows: 30% for hiring additional team members; 35% for developing and launching new products; 15% for international expansion, and 20% for marketing and advertising. |

The company reserves the right to change the above use of proceeds if management believes it is in the best interests of the company.

24

OUR BUSINESS

Overview

We were founded in 2010, as DietBet, Inc. with the goal of developing a social game to help people lose weight. On August 13, 2014, we filed an Amended and Restated Certificate of Incorporation changing our name from DietBet, Inc. to WayBetter, Inc., to reflect a broader mission of using gamification, social support, and financial incentives to help people adopt a range of healthy behaviors, such as exercising more, quitting smoking, managing stress, sleeping better, breaking addictions, learning new skills and languages, etc. We are currently operational, and producing revenues, but have not yet realized steady profits.

Principal Products and Services

Our primary product is a social weight-loss game called DietBet which currently exists in three formats:

| | • | the DietBet Kickstarter is a 4-week game in which players commit to lose 4% of their weight in 4 weeks; |

| | | |

| | • | the DietBet Transformer is a 6-month game in which players commit to lose 10% of their weight in 6 months; and |

| | | |

| | • | the DietBet Maintainer is a 12-month game in which players commit to maintain their weight within a predefined range (currently +1% to -10%) for a year. |

Players can sign up for whichever game they wish to play, or multiple games at the same time. The games are offered via iOS and Android apps and via web browsers. Players then pay the amount set for that game in the form of a commitment contract. At the start and at certain points in the game, players verify their starting weights with our Referees using a weigh-in protocol that entails taking and submitting photos of themselves weighing in. The commitments from all the players are pooled in the pot. Players who meet their goals without getting disqualified end up splitting the pot, less our commission (normally between 10% and 25% of the pot). We convert winnings into WayBetter Points, which can be redeemed by the players for cash (normally via Paypal). Points, however, expire without reimbursement pursuant to our Terms of Use after 12 months if an account remains inactive during that period. We expect to parlay our experience and momentum with DietBet into other areas of healthy behaviors. For example, in 2015 we started alpha testing a new game, StepBet, with 300 players. StepBet is designed to motivate players to walk more by competing with step data from Fitbit and other step trackers. It is slated for beta testing with the public in 2016.

We plan to launch other new products in order to expand into other areas of healthy behavior and lifestyle change, such as CigaBet (to quit smoking), SleepBet (to improve sleep), and CardioBet (to exercise more), among others.

25

How DietBet works

We currently offer three formats of DietBet games. Our most popular is the Kickstarter, in which players commit to lose 4% of their starting weight in four weeks. We first launched the Kickstarter in 2012 as an invite-only beta test. In all of 2012 we had a 9,689 Kickstarters players. In January of 2013, after a year of testing and iterating, we officially launched the Kickstarter to the public. On January 4, 2013 our CEO was a guest on The Today Show and we signed up 11,239 paying Kickstarter players in January alone-more than the entire previous year. In 2013, we ended up having a total of 135,896 Kickstarter players. In 2014, building on this momentum, we had 190,942Kickstarter players, up 40.5% over 2013.This game has now facilitated meaningful weight loss for thousands of players. On average, winners in our Kickstarter games lose 9.3 pounds a month.

As we grew, we started getting requests from our users for a longer-term game with larger, but more gradual, weight loss goals. In response to this demand, in November 2013, we launched a six-month game called the Transformer. In this format, players commit to lose 10% of their weight in six months, with monthly milestones (and rewards) along the way. As of March 31, 2015,of the 39,497 players who had started a Transformer game, 25% had reached the 10% goal. These winners lost, on average, 24.6 pounds in a span of six months.

With thousands of our players having reached healthy body-mass indexes (BMIs), we have been receiving increasing requests for a new kind of game tokeep off the weight. To address this pent-up demand, we introduced another game format, The Maintainer,which challenges players tomaintain their weight overt he following year (within a range of +1% and -10%), with monthly weigh-ins and rewards. We launched it as a beta test in September 2015 with a first cohort of 299 players. That beta test is ongoing.

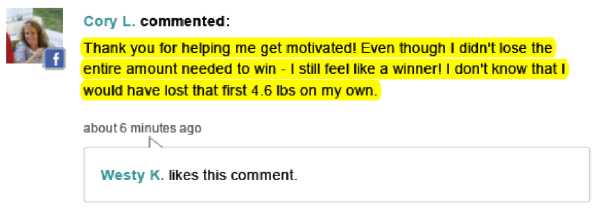

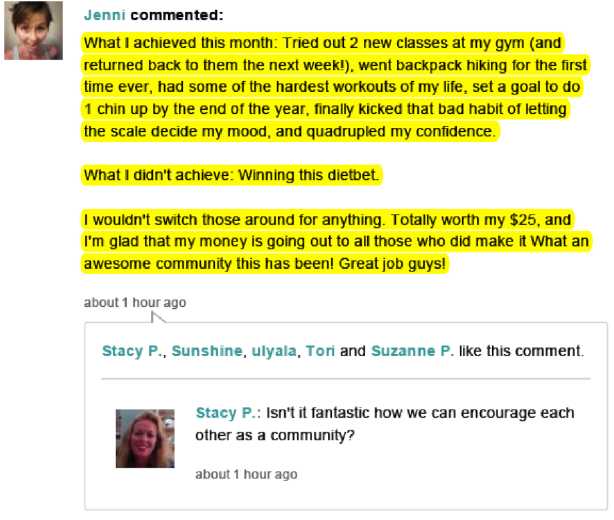

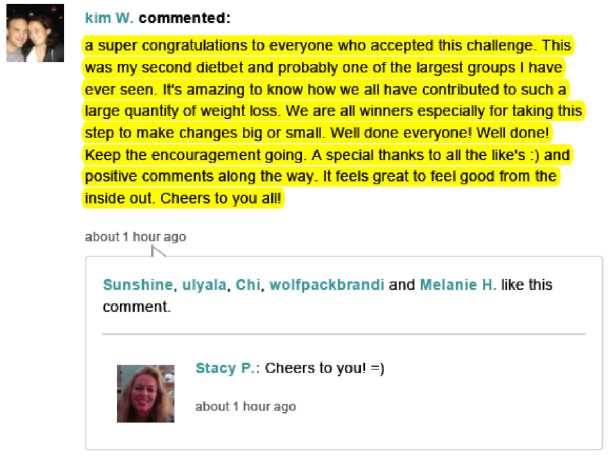

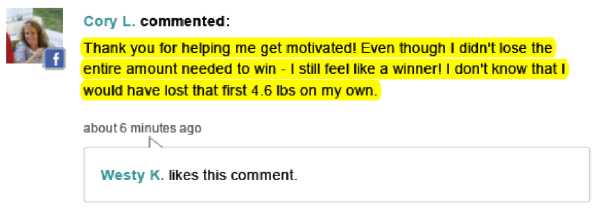

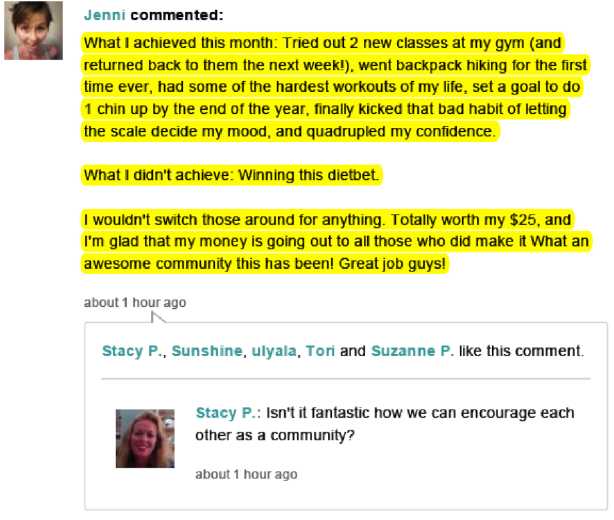

Our players are motivated by different factors. Some join with the primary motivation of winning money and competing but discover over time that they social bonds they make with their fellow “dietbetters” becomes the most sustainable aspect of the motivation. Here are some examples of interactions in our games (highlighting added by us):

26

27

28

How We Make Money and Verify Weights

At the end of our games, all the players who have reached the predefined goal, as verified by our Referees, split the pot evenly, after our cut. We make money by keeping a percentage of the pot as an administrative fee. This is normally from 10% to 25%; if all the players in a game reach their goal, we will forgo our cut in order to ensure that the winners get 100% of their deposit back. We call this our No-Lose Guarantee.

29

We verify starting and ending weights by having players submit photographic documentation of their weigh-ins to our team of Referees. Our “Refs” review these photos for compliance with our weigh-in guidelines (which include specific rules about what to wear and require a “weigh-in word,” written on a piece of paper, to appear in the photo, which serves as a timestamp).

Our Referees are all former DietBet players. In addition to overseeing our weigh-ins, they also handle customer service. We work hard to attain a high standard of quality and promptness in reviewing all weigh-in photos and in responding to customer service matters. We currently have 10 Refs who have, since our inception, reviewed 6.5 million weigh-in photos.

Our Refs are currently all based in North America and we consider them an integral part of our business, not just a machine for rote review of weigh-in photos. They play a key role in helping us to improve our products by relaying user feedback to our developers and game designers, identifying bugs and feature suggestions from players, and providing valuable player feedback. In their spare time, they also send personalized “Milestone” notes to players congratulating them on their weight-loss accomplishments.

30

We also use proprietary algorithms to help maintain the integrity of our games. Our algorithms are designed to detect suspicious activity and in some cases we require players to submit video documentation of their weigh-in instead of photos. We are continually updating and improving our algorithms to detect and prevent cheating.

You cannot play in a DietBet without putting money in the pot in the form of a commitment contract. As a result, we have generated revenue from nearly all our players since we launched. We also sell virtual products, the most popular being a $20 package of Weigh-In Tokens that lets players in our long-term games weigh-in regularly with our Referees to help them stay on track.

We anticipate that future revenue streams will continue to come from new products such as StepBet, selling advertising and sponsorships, selling curated products from our own store, and selling subscriptions to premium coaching services.

Our Most Valuable Asset: Our Community of Players

Through our game design we encourage healthy, gradual weight loss. For starters, we do this by not giving extra credit for losing the most weight, or for losing weight the fastest. Indeed, we disqualify players if they lose too much weight in a game (more than 3 times the goal amount). We also do not allow players to enter our games if their body-mass index, or BMI, is below 18.5 (considered underweight by the National Institues of Health) or if their BMI would be required to drop below 18.5 in order to reach their target. We offer money-back guarantees during the start of our games to let players try it out with no risk. We also have compassionate policies that allow players to drop out in certain cases when there is a medical necessity (such as a pregnancy).

Our users are core to our success, not just because we generate revenue from them. Our customers also volunteer to test our new products (when we have a new idea to test, we announce it in our games and get hundreds or sometimes thousands of applications for testers). They lead and host games as organizers and in the process invite their friends. They give us valuable feedback about bugs and new features. They even sometimeswork for us as we hire Referees from our player pool (we normally recruit Referees by posting job openings in our games). And they serve as testimonials: we feature over 150 players and their dramatic success stories on our home page. In addition, players who have lost weight with DietBet often become walking advertisements for DietBet as their friends and co-workers approach them to ask how they lost the weight. Many also blog and post on social media about their experiences with DietBet. This can lead to a positive feedback loop where the health and happiness of our players fuels the growth of our business.

31

To leverage the powerful network effects and collective wisdom of our community, we ask our players to complete a survey at the end of their games explaining how they lost the weight. We partnered with a team at Brown Medical School, led by Dr. Tricia Leahey, an obesity expert, to design this survey and analyze the data. (We have data from over 12,000 players to date). Our goal with this data collection is to create an objective and empirical data set on the efficacy and popularity of various diets, commercial weight-loss programs, apps, and devices. We call this The DietBetter Report and we plan to publish our findings in the future.

In addition, Dr. Leahey published a paper about the efficacy of DietBet in the Journal of Medical Internet Research: Serious Games,DietBet: A Web-Based Program that Uses Social Gaming and Financial Incentives to Promote Weight Loss. We also applied with Dr. Leahey for two NIH research grants to run randomized trials to assess our social approach to weight loss with scientific rigor. Those applications are pending.

Market

We believe the current market for our primary product, DietBet, is large. There are 108 million Americans who go on 4 to 5 diets a year, according to MarketData Enterprises. Americans spend over $60 billion annually on weight loss products and services and, according to MarketData, 83% of dieters prefer “do-it-yourself” solutions.

We believe that as we expand our services beyond weight loss to healthy lifestyle products like StepBet, we will be expanding our target audience to include people of healthy BMIs who want to be more active and use “wearables”, i.e. activity-tracking devices. The worldwide market for wearable devices is set to grow 238%, from 15.4 million units shipped in 2014 to over50 million in 2019, according to the International Data Corp. (IDC). In 2014, shipments of wearable devices more than tripled compared to the prior year, reaching a total of 21 million units. IDC expects the market for wearable devices will reach 114 million units shipped in 2018, representing a $33.7 billion worldwide revenue opportunity. IDC also reports that consumer spending on the wearable devices market is growing faster than on any segment in the global consumer electronics market. The potential growth of this market represents an opportunity for us as we plan to roll out new games in which players with these devices and sensors can compete to walk and exercise more, sleep better, etc.

32

In addition, we plan to expand internationally. According to the World Health Organization, 1.9 billion adults in the world are overweight and most of the world's population now lives in countries where overweight and obesity conditions kill more people than underweight conditions (all high-income and most middle-income countries). Over 10% of DietBet players are outside the United States and we believe there is a growing market for DietBet internationally. To this end, we recently signed a Memorandum of Understanding with a large weight-loss company in China, China Showyu Healthy Group Limited, to partner exclusively on developing the market in China. Showyu also made an equity investment in WayBetter.

Marketing/Distribution Channels

To attract players for our games, we offer a marketplace of DietBet games, where anyone with access to the Internet can find an assortment of DietBet games starting soon.

To lead these games and promote our brand, we have worked with over 200 health and wellness influencers as “game hosts”. This includes celebrities as well as a long-tail of bloggers, social media influencers, and authors. Celebrities include Jillian Michaels (former star of NBC’s The Biggest Loser television show), Chris and Heidi Powell (stars of ABC’s Extreme Weight Loss), Tim Ferriss (author), Tony Horton (star of P90X workout videos), and LailaAli (former boxer and the daughter of Muhammad Ali). Our largest Kickstarter game to date was hosted by the Powells in January 2015 with over 12,000 players and a pot of over $360,000.

In our hosted games we typically split our cut of the pot with the game host, thus giving our host-partner a financial incentive to lead large games with their fans. By enabling influencers to monetize their audiences, and to interact with their fans in an engaging way, we strive to foster partnerships that work sustain ably for our game hosts and us. Most hosts lead multiple games.

In addition, we allow our players to set up and organize their own games among friends and coworkers. In these organic games we do not normally share our cut with the game’s organizer and therefore our margins in these games are higher than in games with professional hosts.

We have also worked with magazines and other health and wellness brands like Fitness, Shape, Withings, and RunKeeper to lead games with their readers and customers. We also work with charities to host games as fund raisers, where a percentage of the pot can beset aside for the charity. In the case of charities, we will often reduce our cut to facilitate more of the pot going to the charity. We also let players in any game lose weight for a cause they support by pledging a percentage of their winnings to the charity of their choice.

33

New users are increasingly coming to us via word-of-mouth as players who have had positive experiences tell their friends about DietBet. We have also received press coverage in The Wall Street Journal, The New York Times, US Weekly, CNN, and on ABC News and The Today Show, in addition to other media outlets around the world.

We believe advertising can become a source of growth in the future, however, and we intend to increase our investment in marketing to boost brand awareness and new user acquisition in the future. We have been steadily increasing the lifetime value of each player as we launch new longer game formats that serve to retain customers for longer periods of time. An increase in lifetime value could make advertising a more cost-effective channel for us going forward.

Competition

We have competitors for our primary product, DietBet. Competitors include HealthyWage, Stickk, Pact, MyFitnessPal, Noom, LoseIt, Weight Watchers, and SparkPeople, among others. As we expand into other areas of healthy behaviors and lifestyle (beyond weight loss), we may also compete with other health and fitness companies that have communities, applications, and products to help motivate people to live healthier lives. Some competitors include FitBit, Nike, Under Armour (with its recent acquisitions of MyFitnessPal and MapMyRun), RunKeeper, Strava, Azumio, among others.

Pact, Stickk, and HealthyWage all promote commitment contracts as a way to increase your motivation and willpower. However, of these Pact does not currently offer a product specifically targeting weight loss. And none of these companies has comparable partnerships with large numbers of health and wellness influencers, an asset which we have spent years developing and cultivating.

Weight Watchers and SparkPeople both feature strong components of community support, but neither emphasizes gamification, competition, or financial incentives. In addition, Weight Watchers meetings are normally held offline, in places like church basements, schools, and in Weight Watchers’ shops. We believe such physical meetings do not appeal as much to younger consumers who are looking for more convenient, mobile solutions.

Certain other companies, such as MyFitnessPal, LoseIt, and Noom, offer sophisticated activity and nutrition tracking functionality but little by way of gamification and no financial incentives.

In addition, we may start to compete more with companies in the corporate wellness market. Such competitors include Stickk, Limeade, Keas, Rally, Retrofit, Wellcoin, Rise, and ShapeUp, among others. To penetrate the corporate wellness market we may seek partnerships with some or all of these companies rather than being direct competitors.

34

There are, of course, thousands of other companies in the highly fragmented weight-loss, fitness, and wellness space. While we would not consider most to be direct competitors, we do compete with them for mind share and share-of-wallet. Fortunately for all of the players, this is a large and fragmented space that can, and does already, support a diverse ecosystem of competing and complementary products and services. Consumers tend to try lots of approaches: gyms, commercial weight-loss programs, wearables, diet books, personal trainers and coaches, nutraceuticals, meal replacements, and apps and online tools. We believe the consumer appetite to try lots of solutions can work in our favor as a new entrant, especially if we can deliver a sustainable and efficacious solution for many of them.

Customers

To date we have had over 300,000 paying consumers who have registered a total of more than 3 million pounds lost with us. 10% of our users are outside the United States and we plan to invest in international growth. 15% of DietBet users are men, which is par for the industry and our average customer is 36 years old. The average starting weight is 236 pounds for our male users and 192 pounds for our female users.

We see a surge of customers every January, as people set their resolutions for the new year. We also see seasonal peaks in the spring as people want to get in shape for the summer and again in September and October as people return from their summer vacations. We also experience troughs during the summer and from Thanksgiving to Christmas as consumers tend focus on things other than weight loss. We believe that some of our new products, particularly StepBet, may balance out this seasonality as consumers (in the Northern Hemisphere) walk more during the warmer summer months.

Suppliers

We currently rely heavily on Paypal and credit card processors to collect payments, and we rely on PayPal to handle payouts to customers at the end of the games. We also work with several dozen vendors to provide various services, from sending out emails to customers with Mandrill, to managing business development leads with Sales force, to monitoring our servers 24/7 for outages with Pingdom, to tools that let us track and manage customer service requests like UserVoice. Whenever possible, we seek solutions that make it cheaper and faster for us to design, deploy, and maintain our products while we focus on growing our business.

Research and Development

We have invested $1,096,538 in research and development, and in new product development.

35

Employees

We currently have eight full-time employees and one part-time employee. We also currently work with over 20 contractors around the world, including technical teams in Moldova and India. As we grow, we plan to develop more technical expertise in-house and gradually reduce our reliance on technical contractors as we hire more engineers and migrate key technical functions in-house.

Intellectual Property

We have trademarks in the United States for DietBet and DietBetter and pending trademarks for WayBetter and The WayBetter Way. We own over 100 URLs that relate to our current and prospective products. We do not own any patents.

Litigation

We are not involved in any litigation.

THE COMPANY’S PROPERTY

We do not own any real estate or significant assets.

36

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Results of Operations

The sum of all monies paid by players to enter the various games (e.g. DietBet, StepBet) plus all monies paid to purchase virtual goods is defined as Gross Transaction Volume, or “GTV”. In essence GTV represents the total dollars transacted by customers on the WayBetter platform. GTV is a non-GAAP measurement which differs from the presentation of net revenues in the financial statements. The company’s net revenue refers to the sum of commissions retained by the company. The company’s commission ranges from 10-25% depending on the dollar amount of the commitment. For the vast majority of DietBet games, the company’s commission is 25%.

Other revenue includes the sale of virtual goods to players in DietBet games; the most common example of virtual goods is weigh-in tokens, which are offered to players in long-term DietBet games who are looking for weekly accountability

The company recognizes revenue according to the following guidelines:

| • | For games with a duration of 1 month or less, revenue is recognized at the conclusion of the game. |

| • | For games with a duration over 1 month, revenue is estimated monthly over the course of the game. At the conclusion of the game, revenue is adjusted as necessary. |

| • | Revenue from the sale of virtual goods is recognized at the time the virtual good is redeemed or when it expires. |

Pursuant to changes to the company's Terms of Use implemented in September 2015, we anticipate some number of WayBetter Points to expire and be forfeited starting in September 2016 by customers with WayBetter accounts that have been inactive for twelve months. If and when this happens, the company may be able to recognize as revenue some or all of the forfeited points at a rate of 1 point = $1.00. Because this is a new policy, the company has not estimated the amount of any potential incremental revenue from forfeited points.

GTV for the year ended December 31, 2014 (“FY 2014”) was $8,626,197, a 108% increase from GTV of $4,142,192 in FY 2013. The main driver of the GTV increase from FY 2013 was the increase in the company’s customer base. GTV for the six months ended June 2015 (“Interim 2015”) was $6,453,888.

The company’s net revenue for FY 2014 was $2,047,873, a 194% increase from $695,553 in 2013. The company’s net revenue for Interim 2015 was $1,560,979.

Cost of revenues consists of financial transaction costs, “affiliate” payments to partners who host DietBet games, the cost of prizes given away during games and data hosting fees. Cost of revenues were $978,045 in FY 2014, compared to $439,042 in FY 2013, resulting in gross margins of 52.2% and 36.9%, respectively. The improvement in gross margin was due to changes in the company’s commission structure implemented in 2013. Cost of revenues in Interim 2015 was $735,870, resulting in gross margin of 52.9%.

37

The company’s operating expenses consist of payroll, technology, sales and marketing, professional services (including contracted service providers), and general and administrative costs including rent. Operating expenses in FY 2014 amounted to $1,667,178, a 40% increase from $1,190,401 from FY 2013. The primary components of the increase from FY 2013 to FY 2014 were:

| | • | a 53% increase in general and administrative expenses, including rent and insurance; |

| • | a 245% increase in professional fees as the company utilized many more contracted service providers; and |