UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2016

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-37480

UNIQUE FABRICATING, INC.

(Exact name of registrant as specified in its Charter)

|

| | | | |

| Delaware | | 001-37480 | | 46-1846791 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

Unique Fabricating, Inc.

800 Standard Parkway

Auburn Hills, MI 48326

(248)-853-2333

(Address including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports; and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of March 2, 2016 the registrant had 9,626,361 shares of common stock outstanding. As of June 28, 2015 the last business day of the registrant's most recently completed second fiscal quarter, there was no established public market for the registrant's common stock. The registrant's common stock began trading on the New York Stock Exchange MKT on July 1, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement related to the 2015 Annual Shareholders Meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

| |

| Part I | Page |

| |

| |

| |

| |

| |

| |

| Part II | |

| |

| |

| |

| |

| |

| |

| |

| |

| Part III | |

| |

| |

| |

| |

| |

| Part IV | |

| |

| |

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the exhibits being filed as part of this report, as well as other statements made by Unique Fabricating, Inc. (“Unique,” the “Company,” “we,” “us,” and “our”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. These forward-looking statements are contained principally in, but not limited to, the sections entitled “Business,” “Risk Factors,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements are based on management's beliefs and assumptions and on information currently available to us. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements. When used in this document the words “anticipate,” “believe,” “continue,” “could,” “seek,” “might,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “approximately,” “project,” “should,” “will,” “would,” or the negative or plural of these words or similar expressions, as they relate to our company, business and management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the future events and circumstances discussed may not occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date of this Form 10-K filing. Except as required by law, we assume no obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions based on new information, future events or otherwise. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

ITEM 1. BUSINESS

Overview

Unique is engaged in the engineering and manufacture of multi-material foam, rubber, and plastic components utilized in noise, vibration and harshness, acoustical management, water and air sealing, decorative and other functional applications. The Company combines a long history of organic growth with some more recent strategic acquisitions to diversify both product capabilities and markets served.

Unique’s markets served are the North America automotive and heavy duty truck, appliance, water heater and heating, ventilation, and air conditioning (HVAC) markets. Sales are conducted directly to major automotive and heavy duty truck, appliance, water heater and HVAC companies, referred throughout this report as original equipment manufacturers (OEMs), or indirectly to OEMs through the Tier 1 suppliers of these OEMs. The Company has its principal executive offices in Auburn Hills, Michigan and has sales, engineering and production facilities in Auburn Hills, Michigan, Concord, Michigan, LaFayette, Georgia, Louisville, Kentucky, Evansville, Indiana, Ft. Smith, Arkansas, Murfreesboro, Tennessee (through January 2016), Bryan, Ohio, Monterrey, Mexico, and Queretaro, Mexico.

Unique derives the majority of its net sales from the sales of foam, rubber and plastic automotive products. These products are produced using a variety of manufacturing processes including die cutting, compression molding, thermoforming, fusion molding and RIM molded polyurethane. We believe Unique has a broader array of processes and materials utilized than any of its direct competitors, based on our product offerings. By sealing out air noise and water intrusion, and by providing sound absorption and blocking, Unique’s products improve the interior comfort of a vehicle, increasing perceived vehicle quality and the overall experience of its passengers. Unique’s products improve thermal characteristics, reduce noise, and prolong the equipment life of appliances, water heaters and HVAC systems.

One of Unique’s primary strengths lies in its ability to manage over 3,000 active part numbers while maintaining a stellar track record of only 6 rejected parts per million and 99.3% on-time delivery for over three million parts manufactured and shipped on a daily basis. Furthermore, Unique focuses resources on the areas of its business that add value to customers, particularly in its commercial, engineering and supply chain activities. Design innovation and rapid prototyping set Unique apart from the majority of its competitors.

Our principal executive offices are currently located at 800 Standard Parkway, Auburn Hills, Michigan, 48326. UFI Acquisition, Inc, a Delaware Corporation (UFI), was formed in January 2013 to acquire 100% of the outstanding equity of Unique Fabricating, Inc., and its wholly-owned subsidiaries Unique Fabricating South, Inc. and Unique Fabricating de Mexico, S.A. de C.V. (collectively, the “Company” or “Unique”). In December 2013, through a newly formed subsidiary, Unique-

Prescotech, Inc., the Company acquired substantially all of the assets or the PTI Business, (PTI) of Prescotech Holdings, Inc. In February 2014 the Company acquired substantially all of the assets of Chardan Corp. or the Chardan Business (Chardan), through a newly formed subsidiary of Unique Fabricating NA, Inc., Unique-Chardan, Inc. In September 2014, UFI changed its name to Unique Fabricating, Inc. which is now the parent company of the group. As a result of the name change, the subsidiary previously named Unique Fabricating, Inc. became Unique Fabricating NA, Inc. In August 2015 the Company acquired substantially of all of the assets of Great Lakes Foam Technologies, Inc. (Great Lakes) through a newly created subsidiary, Unique Molded Foam Technologies, Inc.

Initial Public Offering (the "IPO")

On July 7, 2015, we completed our IPO of 2,702,500 shares of common stock at a price to the public of $9.50 per share, including 352,500 shares subject to an over-allotment option granted to the underwriters. After underwriting discounts, commissions, and approximate fees and expenses of the offering, as set forth in our registration statement for the IPO on Form S-1, we received net IPO proceeds of approximately $22.2 million. We used part of these proceeds to repay the $13.1 million principal amount of our 16% senior subordinated note together with accrued interest through the date of payment. We used the remaining proceeds to temporarily reduce borrowings under the revolver portion of our senior secured credit facility. Amounts paid under the facility will be available to be re-borrowed, subject to compliance with the terms of the facility. We also issued to the underwriters warrants to purchase up to 141,000 shares of common stock, as additional compensation in the IPO. The warrants are exercisable at a per share exercise price equal to 125% of the inital public offering price of $9.50 per share, and may be exercised commencing 1 year from the date of the IPO, until the date 5 years from the date of the IPO.

Automotive Industry Analysis and Industry Trends

The automotive parts industry provides components, systems, subsystems and modules to OEMs for the manufacture of new vehicles, and had approximately $245 billion of North American annual revenue in 2014 according to an April 2015 Bank of America Merrill Lynch report on the automotive supplier market. Within the automotive parts industry, North America is the Company’s core market. We manufacture multi-material foam, rubber, and plastic components utilized in noise, vibration and harshness management, acoustical management, water and air sealing, decorative and other functional applications.

Demand for automotive parts in the OEM market is generally a function of the number of new vehicles produced, which is primarily driven by macro-economic factors such as credit availability, interest rates, fuel prices, consumer confidence, employment and other trends. Although OEM demand is tied to actual vehicle production, participants in the automotive parts industry also have the opportunity to grow through increasing product content per vehicle by further penetrating business with existing customers and in existing markets, gaining new customers and increasing their presence in global markets. We believe that as a company with a North American presence and advanced technology, engineering, manufacturing and customer support capabilities, we are well-positioned to take advantage of these opportunities.

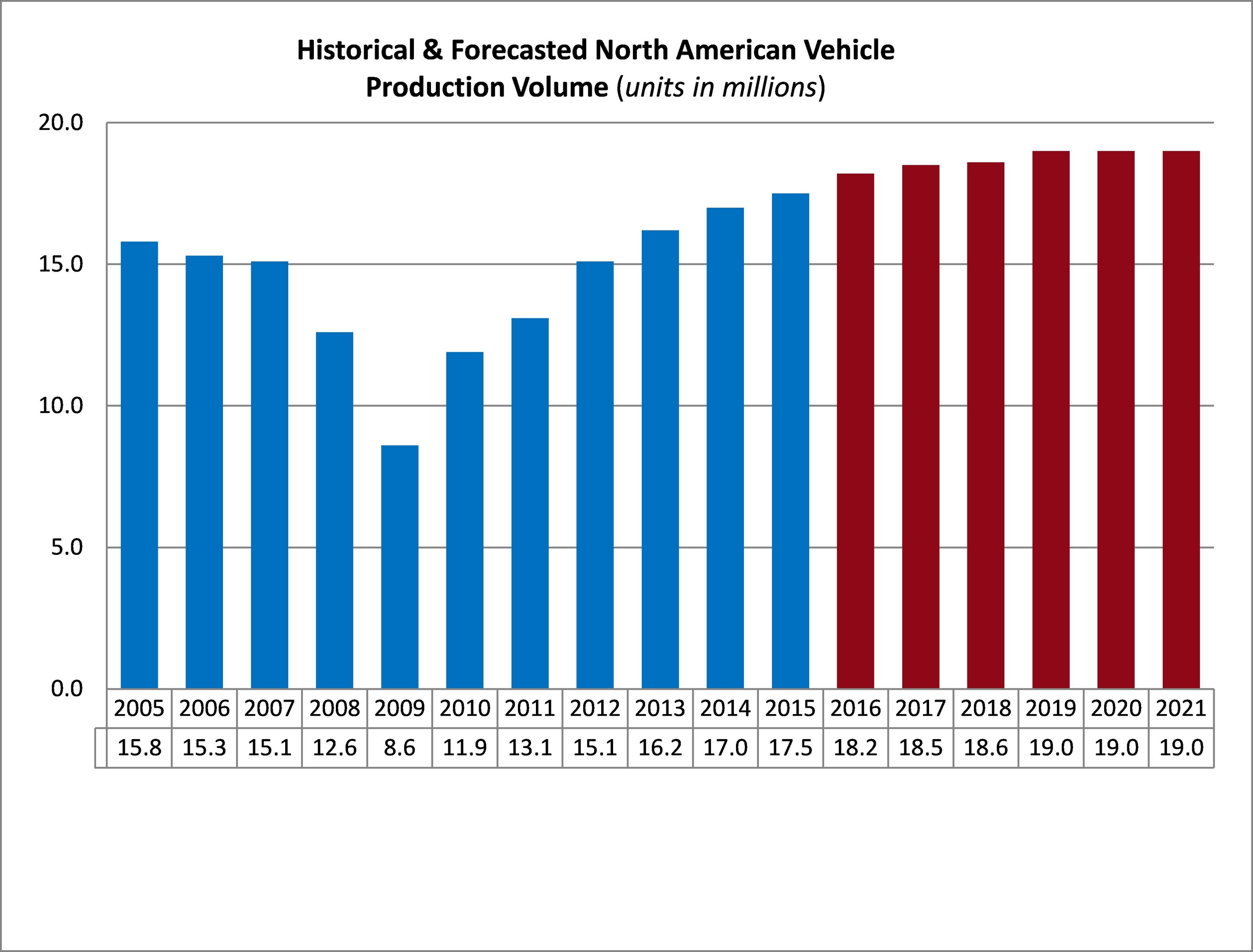

Overall, we expect long-term growth of vehicle sales and production in the OEM market. The automobile industry in the last seven years has seen increased customer sales and production schedules with production volumes in the last three years higher than OEM production volumes prior to the industry disruptions experienced after the financial market crisis of 2008. We anticipate that the North American automotive production will continue to recover from the low point experienced in 2009. According to IHS Automotive, North American vehicle production increased during 2015 to 17.5 million units, an expansion of approximately 3.4% compared to 2014. Bolstered by a wave of new vehicle introductions and favorable demographic trends, IHS projects continued growth in North American unit production volumes to 18.2 million units in 2016, an approximate 4.0% increase from 2015, and 19.0 million units in 2019, as depicted in the following chart. IHS Automotive currently predicts that production volumes will remain flat in 2020 and 2021 compared to 2019.

Source: IHS Automotive (December 2015)

In addition to the overall industry growth, we believe there are a variety of trends that are influencing the future of the global automotive market. We believe we positively are positioned to benefit from an increasing number of trends driven by market forces such as:

| |

| • | Fuel efficiency/vehicle light-weighting: Expanding government mandates on fuel efficiency and emission reductions, will continue to force the automotive industry to focus on improving the fuel economy of vehicles. In addition, the evolution of materials utilized in vehicles is moving away from conventional steel as the primary material, which comprised approximately 65% of vehicles content in 2010, and is expected to decrease to 10 – 20% by 2025, according to industry sources. Conventional steel is expected to be increasingly replaced by lighter weight materials with increasing use of plastics and foam materials per vehicle. |

| |

| • | Interior comfort: Comfort of interiors consistently rank in the top three factors that consumers consider when purchasing a new vehicle, and is a key area where vehicle manufactures can differentiate their vehicles. The comfort of the interior is an area of increased focus for the OEM manufacturers with each new generation of vehicles. This is expected to continue to increase the use of foam in seats and acoustical insulation in more and more vehicles. |

| |

| • | Telematics and Infotainment: The increasing use of telematics and infotainment requires increasingly quieter vehicles for the telematics systems to recognize voice commands and passengers to enjoy the infotainment options. Over the next four years, approximately 80% of all new vehicles are expected to include voice recognition systems, increasing the need for quiet interiors. The result will be increased use of acoustic insulation materials, more precise air seals and other noise, vibration and harshness products in all vehicles. |

| |

| • | Rapid pace of new vehicle launches: In order to meet consumers’ increasing demand for new products, the automotive market will see a significant number of new program launches from vehicle manufacturers over the next few years. Each new vehicle launch creates new product opportunities for us because of the OEMs need for noise, vibration and harshness solutions as they discover unplanned noise issues at the launch of production for a new vehicle program. |

| |

| • | Localization of production: Due to freight costs, currency fluctuations, logistic issues and protection of supply many foreign vehicle manufacturers have increased their production volumes in North America and are increasing local sourcing of vehicle components. We believe that Unique’s production facilities are situated in geographic proximity to the majority of North American vehicle assembly locations provides a competitive advantage. |

We believe these market trends create opportunities for us to achieve above market growth rates as a result of increased content per vehicle, higher production volumes, geographic shifts in vehicle production, and evolving customer sourcing strategies. Our challenge is to continue developing leading edge solutions focused on addressing these trends, and applying those solutions via products with sustainable margins that enable our customers to produce distinctive market-leading products.

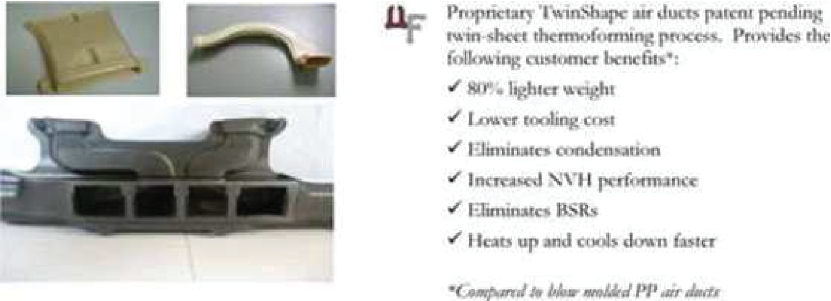

As an example of our innovative technical capabilities, we utilized our thermoforming process to develop and produce a line of lightweight flexible air duct systems for a leading OEM, providing an 80% weight reduction and enhanced functionality. This air duct system has developed into Unique’s patent pending TwinShape line of proprietary ducts. Unique has secured development and prototyping contracts with four additional OEMs for potential inclusion of this product in vehicle programs starting with model years 2017 and 2018 vehicles.

We generate a significant number of new sales opportunities from customer challenges, such as buzz, squeak, rattle (BSR) or noise, vibration and harshness issues (NVH), discovered during the launch of production for a new vehicle program. In many of these situations, we develop and begin supplying a solution within days, a level of responsiveness that avoids competitive requests for quotations and produces premium value for our customers. Given the projected rapid pace of new vehicle launches over the next three years, we expect to benefit from an increasing number of opportunities sourced late in the launch cycle.

Appliance, HVAC, and Water Heater Industries

We are a leading provider of fabricated, non-metallic components to a diverse group of OEMs and tiered suppliers in the appliance, HVAC, and water heater industries. These sales represented approximately 16.0% of net sales for the year ended January 3, 2016. These components are primarily manufactured from foam, adhesives, fiberglass, rubber and board-back material. We have extensive materials, engineering and fabrication expertise and deliver custom-designed, innovative solutions for our customers. Our component solutions primarily consist of products used in gasketing, heat deflection, packaging, insulation, water seals, noise reduction and vibration control. Demand for these end-market products is largely driven by the health of the housing sector. We believe that each respective industry will receive the positive benefits of a recovering economy and especially the benefits of a recovering residential real estate market. The National Association of Home Builders forecasts that there will be approximately 1.3 million new housing starts in 2016, approximately 13% more than 1.1 million new housing starts during 2015. We believe that the appliance, HVAC, and water heater industries are currently primed for favorable growth.

The United States appliance industry is forecast to show modest growth through 2017, as new and existing home sales, as well as home improvement spending, both of which have a direct impact on appliance industry sales, continue to show upward momentum. According to the latest Appliance Magazine’s Annual US Appliance Industry Forecast, forecasted unit shipments for this industry in the United States are expected to grow at a compounded annual growth rate of 3.5% through 2017 to reach approximately 46.4 million units per year, which would put the industry close to its peak sales years of 2004 – 2006. We believe these benefits will increase the demand for our products from clients such as GE and Whirlpool.

The HVAC and water heater industries are also poised to benefit from the gains in the housing and home improvement markets. According to the same Appliance Magazine Industry Forecast, shipments of heating and cooling units in the United States are expected to grow at a compounded annual growth rate of 2.4% through 2017, while shipments of residential and commercial water heaters are expected to grow at a compounded annual growth rate of 2.6% through 2017. We believe this trend will increase the demand for our products from clients such as AO Smith, Rheem and Trane.

Our Objectives

Our goals are to provide exceptional quality, reliable on-time delivery, competitive cost, and technical innovation with rapid engineering support. The objective is for Unique to be the easiest source for our customers to do business with, while being a great place to work for our team members. We seek to execute a business model that generates sustainable ongoing adjusted free cash flow, thereby providing flexibility for capital allocation. We also strive to achieve growth at above industry levels through strong competitive capabilities in engineering, manufacturing, and program management that contribute to leading positions in cost and quality. In addition, the Company will selectively continue to pursue opportunistic acquisitions that provide additional products and processes, as well as entrance into new growth markets.

We work together with our customers in various stages of production, including initial concept and development, routine engineering problem resolution during their product launches and ongoing value engineering. In addition, we work together with our customers on component sourcing, quality assurance, manufacturing and delivery in order to develop long-standing business relationships. We believe we are well-positioned to meet customer needs and have a strong, established reputation with customers for providing high-quality products at competitive prices, as well as for timely delivery and customer service. Given that both the automotive OEM business and the appliance/water heater OEM business involve long-term business awarded on a platform-by-platform basis, our intent is to leverage our strong technical expertise and customer relationships to obtain new platform awards.

Our Strengths

Our mission is to deliver innovative and timely customer solutions for noise, vibration, and harshness (NVH) management, water and air sealing and other functional and decorative applications. We employ our extensive knowledge of raw materials and adhesives, our engineering and creative resources and rapid response to deliver rapid technical innovation, exceptional quality, reliable on-time delivery and competitive costs. We believe the key to our core competitive strengths are as follows:

Strong technical expertise. We have tremendous depth of expertise and knowledge of materials, adhesives, manufacturing processes and the product applications of our customers. Our understanding of our customers’ design and performance needs, and how our products interface with their applications allows us to engineer effective product solutions. We believe that our engineering talent, test facilities and rapid prototyping capabilities distinguish us from our competitors and enable us to rapidly innovate and develop products that resolve customers’ problems, often within 24 to 48 hours. By understanding our customers’ products and processes, when we are confronted with a customer engineering challenge, we can conceptualize a design concept that allows us to capitalize on the optimum combination of materials to solve a given problem. We have the ability to create our own prototype tools in-house so that we can go directly from concept to hardware and quickly present tangible product solutions for our customers to evaluate. Our ability to rapidly address customer challenges and provide prototype parts that include the use of new materials, products or processes is one of our key competitive strengths.

Operational Excellence. We are dedicated to maintaining a culture of continuous improvement. We utilize lean manufacturing techniques and statistical methods to drive productivity and quality improvement. We use quality, delivery and speed-to-market as competitive advantages. Lean manufacturing not only improves overall costs and quality, it also improves product velocity through the manufacturing process. This leads to better response time and greater flexibility in scheduling. Our reputation for high quality, innovative products is attributable to a constant emphasis on engineering, including materials engineering, product and process engineering, and sales engineering, coupled with our dedication to lean manufacturing to ensure effective execution.

Depth of customer relationships. We have developed long-term relationships with a customer base that we target deliberately, each of which has substantial requirements for NVH management, water and air sealing, functional and decorative components. Due to our technical sophistication, raw material and adhesive innovation and rapid responsiveness, we have a reputation with our key customers as the supplier of choice for our core products within the North American automotive and appliance markets. Our sales engineers have developed deep relationships with the technical teams of our key customers. The customers’ engineers leverage our materials knowledge and utilize us as a resource to help them solve problems and/or pursue product enhancements. This enables us to become involved early in the design/development stage of new vehicles or appliances, leading to opportunities to introduce new products. In certain situations, we are able to influence the customer design specifications from which new business is awarded.

Key relationships with suppliers. We have long relationships with over 150 raw material and adhesive suppliers. We track new developments in materials, and pursue exclusive relationships with those suppliers that develop innovative raw materials and adhesives. Our key suppliers see us as a way to introduce their new products and technology to the marketplace and obtain the necessary customer approvals. This, in turn, can lead to Unique being first to market with certain products or materials. For example, this has led to us having exclusive access for our types of products to the only source of recycled polyol for polyurethane in the industry. While products incorporating these materials accounted for less than 1% of net sales for the year ended January 3, 2016, we believe these recycled materials are opening up opportunities for new product variations that other competitors cannot offer. We constantly collaborate with our suppliers to develop new materials and adhesive combinations that exhibit a cost, quality and/or performance enhancement for our customers.

Proximity to key customers. Our manufacturing facilities are strategically located to serve the North American automotive and appliance industries. Our primary manufacturing centers are in the Midwestern and Southeastern regions of the United States and Mexico. We believe that our manufacturing facilities are within approximately 500 miles of over 80.0% of North American vehicle production, and even closer to major appliance manufacturing locations. This is advantageous, because our products are light in weight, and transportation costs can be a significant portion of the delivered cost of products.

Our Strategy

Our business strategy is to be a valued partner in our customers’ product development and production processes by producing exceptional quality and providing reliable on-time delivery, competitive costs, and technical innovation with rapid engineering support. We utilize our extensive knowledge of raw materials and adhesives combined with our engineering development and rapid responsiveness to deliver innovative and timely customer solutions for NVH management, water and air sealing, decorative and other functional applications.

We attempt to align our internal human resources and technical capabilities to take advantage of industry mega trends, such as light weighting, telematics, and reduced energy consumption, which we believe will produce profitable revenue growth opportunities from our existing operations. In addition, our growth plan includes initiatives to develop certain new products and new markets which provide incremental growth opportunities. We believe that significant opportunities exist to continue to grow our business and increase profitability by focusing on the following:

Further Penetrate Existing Markets with Existing Products and Processes. We believe we are positioned to gain share and grow in existing markets with our current products and processes, capitalizing on the industry’s increasing demand for NVH management content coupled with our capabilities, including exclusive proprietary materials sold to existing customers and targeted new customers. As vehicles change materials to reduce weight, vehicles are utilizing more rubber and plastic components like those designed and supplied by Unique. In addition, the increasing use of telematics is driving a need for quieter interiors in vehicles at all levels. This is causing an increase in the amount of acoustical insulation and solutions per vehicle. Separately, the rate of increase in vehicle production is projected to be significantly higher in the Southern United States and Mexico than elsewhere in North America over the next five years. We hope to capitalize on our ability to service customers in different geographical locations through our manufacturing facilities in the Midwestern and Southeastern regions of the United States and Mexico.

Develop New Products and Processes for Existing Markets. We have developed and earned the reputation as a problem solver to our current customers. As a result, we are in the position to develop complementary products and processes that can be sold to the same purchasing and engineering groups that already do business with us. By adding products and processes to our portfolio that broaden our scope with existing engineers and purchasing groups, we can offer one stop shopping, that allows them to reduce their supply base and complexity, while increasing sales opportunities for Unique. We work closely with raw material and adhesive suppliers to develop innovative solutions that offer cost and performance improvement. We constantly focus on finding new applications for molded products utilizing thermoforming, compression and fusion molding. These activities frequently lead to the development of new or novel products not yet in common use. When this occurs, we actively explore the patentability of the product. Protection of our intellectual property is a conscious part of our strategy of using technology and innovation as a competitive advantage. An example of this is our patent pending for light weight TwinShape duct technology.

Create New Markets with Existing Products and Processes. While the specific products may vary, we have identified numerous opportunities to sell products fabricated using die cut and molding technology into new markets such as medical and not currently served industrial markets. We have demonstrated the ability to develop cost effective products utilizing various materials. Our recent acquisitions have provided the Company with credible access to a variety of new markets for our products. Because of our strategic acquisitions, we are currently developing new products for the appliance, water heater and HVAC industries utilizing our various molding technologies. We are also exploring increased opportunities for medical products. Raw material and adhesive suppliers rely on us to provide marketplace insight into new or emerging customer challenges. We have the capability to combine new materials with new processes to create cost effective products in new markets

Pursue Acquisitions. We expect to selectively pursue acquisitions that add new products and/or processes or geographic and market expansion to further expand our portfolio of customer solutions. Since December 2013, management has completed three accretive add-on acquisitions that added new markets and additional manufacturing processes to our capabilities. Management has a long history of identifying and successfully integrating new platforms. We will continue to use our relationship with Taglich Private Equity, LLC., which sponsored our formation, to identify evaluate and execute acquisition opportunities.

Products

Unique’s primary products, which are identified by manufacturing process — die cut products, thermoformed/compression molded products and fusion molded products — are highlighted below:

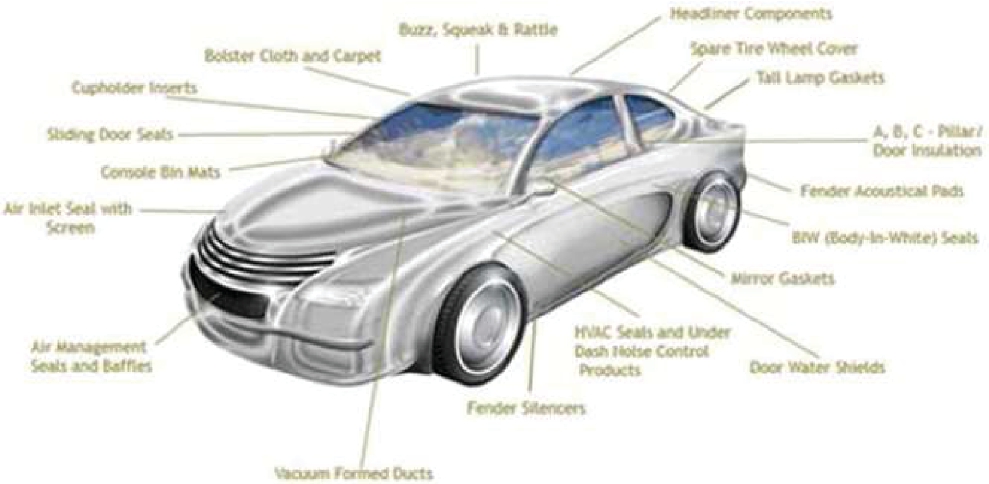

Automotive Product Applications

Unique’s rapid responsiveness and extensive product and process capabilities are valued by its customers. We believe Unique’s diverse product offerings, derived from a broad base of raw materials utilizing multiple manufacturing technologies, is the most comprehensive of similar companies operating in this industry. Based on our knowledge of our competitors, we believe that the companies we compete with offer fewer material choices and/or possess fewer manufacturing process alternatives than Unique. Unique’s access to broad production capabilities enables it to work with over 1,000 raw materials to develop the optimum solution for a given application. Unique’s broad product offerings results in it being a single-source supplier to many customers, which creates a competitive advantage.

Die Cut Products

Unique is primarily a supplier of die cut non-metallic materials and components. Historically, this has been the Company’s core business, within all of its markets, developed through its technical expertise, broad customer base, strategic manufacturing footprint, diverse material selection and strong quality and delivery performance. Unique leverages its market position in die cutting by offering more highly engineered, higher value products and processes such as thermoforming, compression molding, fusion molding and RIM molded polyurethane.

Die cut products are utilized in applications such as air and water sealing, insulation, NVH performance and BSR conditions. Management estimates that the average light vehicle utilizes approximately $38.00 of non-metallic die cut components, based on typical product usage, implying a total North American automotive market of approximately $600 million. Unique is a market leader in this product area. The following diagram highlights examples of its die cut products:

Examples of Die Cut Products

|

| | | | | | | | |

| Product: | | HVAC Seal | | Trim Insulation | | Headliner Insulation | | Fender Acoustical Pad |

| Purpose: | | Air & Water Sealing | | NVH | | NVH | | NVH |

| Material: | | PUR Foam | | PUR Foam | | Non-Woven PP | | Thinsulate Fiber |

|

| | | | | | | | |

| Product: | | A/B/C Pillar Cover | | Dashboard Seal | | Cup Holder Base | | Under Hood Insulation |

| Purpose: | | Decorative (Class A) | | NVH | | Decorative | | NVH |

| Material: | | Laminated Vinyl | | EPDM | | Santoprene TPE | | Vinyl Nitrile |

Thermoformed/Compression Molded Products

In 2005, Unique began expanding its product offerings to include thermoformed and compression molded products. Unique leveraged its position as a manufacturer of core die cut products to gain traction with customers who wanted a single-source solution for other related products, such as thermoformed, compression molded and fusion molded components. The company recently added RIM polyuerethane components to its portfolio.

Management seeks to continue the development of molded products that are complementary to the Company’s die cut products. These products have a higher engineering content and provide increased sales and potential margin growth. These products also differentiate Unique and Unique believes, will make it more valuable to its target customers. The Company’s development efforts in this area have led to innovative product solutions such as Unique’s existing and patent pending thermoformed HVAC duct modules, and Unique’s proprietary TwinShape duct line. The TwinShape line is currently in production at one vehicle OEM, has been selected by another OEM for a model year 2017 vehicle, and is being evaluated in development programs for four other OEMs.

Unique’s thermoformed and compression molded products include HVAC air ducts, door watershields, evaporator liners, console bin mats and fender insulators, among others. Unique believes there is significant room to grow within each of its thermoformed and compression molded product areas. The following diagram highlights examples of Unique’s thermoformed and compression molded products:

Examples of our Thermoformed/Compression Molded Products

|

| | | | | | | | |

| | | | | | | | | |

| Product: | | HVAC Duct Module | | Door Watershield | | Console Bin Mat | | Air Duct |

| Purpose: | | Functional | | Air & Water Sealing | | Decorative | | Functional |

| Material: | | Cross Linked PP | | Cross Linked PP/PE | | PVC | | Cross Linked PP |

The following highlights Unique’s TwinShape line of innovative twin-sheet thermoformed air duct technology:

TwinShape Twin-Sheet Thermoformed Air Duct Technology

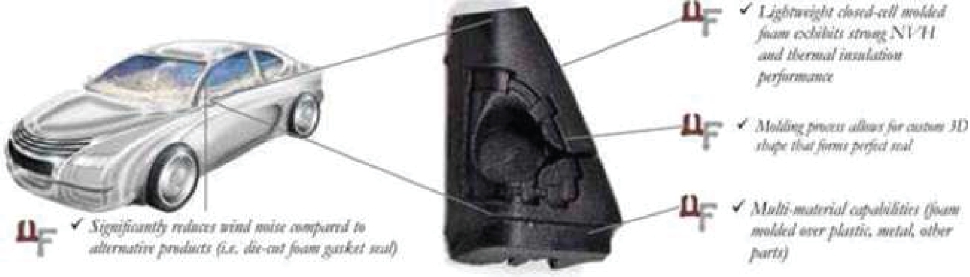

Fusion Molded Products

In 2008, Unique began to expand its product portfolio to include fusion molded components through an exclusive supply relationship with Chardan Corp. In February 2014, Unique purchased the Chardan Business, bringing the fusion molding capability in-house. Fusion molding is an innovative foam molding process used to manufacture precise three dimensional components that are lightweight and provide excellent thermal and acoustic performance. Primarily used for NVH management and body sealing applications, the fusion molded products are complementary to Unique’s other product lines and give Unique additional options to provide light-weighting and NVH management solutions to its customers.

In Europe, the market for fusion molded products is fairly developed; BMW, Mercedes and VW have integrated the technology in their vehicles for several years. The North American market for fusion molding is growing rapidly as European OEMs source more fusion molded products in their North American vehicles and the technology gains traction with domestic OEMs such as Fiat Chrysler Automobiles (FCA) and GM. In addition, since there are a very limited number of North American suppliers with the engineering and manufacturing capabilities to produce fusion molded components, Unique is well positioned to capitalize on the growth in the North American market.

Unique’s fusion molded products include exterior mirror seals, cowl-to-hood seals, cowl-to-fender seals, and other NVH management and sealing applications like fillers, spacers and gaskets. The following diagram highlights examples of Unique’s fusion molded products:

Examples of our fusion molded products

|

| | | | | | | | |

| | | | | | | | | |

| Product: | | Interior Mirror Seal | | Body-In-White Seal | | Cowl to Hood Seal | | Cowl to Fender Seal |

| Purpose: | | NVH | | NVH | | NVH | | NVH |

| Material: | | Cross Linked PE | | Cross Linked PE | | Cross Linked PE | | Cross Linked PE |

The following highlights the Unique’s fusion molding technology:

Fusion Molding Technology

Interior Mirror Seal

Significant Customers

The Company’s customers are principally engaged in the North American automotive industry (approximately 77.8% of our net sales for the year ended January 3, 2016), as well as in the manufacturing of durable residential housing and some commercial products as a result of our acquisition of PTI (approximately 16.0% of our net sales for the year ended January 3, 2016). In the automotive market, the Company’s sales are primarily directly to Tier 1 suppliers to the OEMs. Approximately 11.6% of our net sales for the year ended January 3, 2016 were made directly to vehicle OEMs. Sales of Company products, directly and indirectly through Tier I suppliers, to General Motors, FCA and Ford Motor Company represented approximately 15%, 15% and 15%, respectively, of our total net sales for the year ended January 3, 2016. No single customer accounted for more than 10% of our net sales for the year ended January 3, 2016.

Competitive Environment

We believe that customer sourcing decisions are based on the responsiveness of a supplier and its ability to deliver innovative solutions, quality products and competitive pricing. In order to be awarded opportunities, Unique strives to develop mutually beneficial relationships with its customers through technical support and consistent/predictable performance. Unique differentiates itself through innovation in materials, rapid responsiveness and broad manufacturing capabilities.

Unique estimates the market for its core business for multi-material foam, rubber and plastic components utilized in NVH management, air and water sealing, functional and decorative applications to be approximately $600 million in North America. Unique believes that there is not any dominant supplier within the market, although Unique believes that it is the largest supplier, measured by net sales, within the market. There are significant barriers to entry into the market, including the complexities of managing production and ordering raw materials at the scale necessary and the difficulty, cost and length of time required to obtain acceptance by customers.

Liability and Insurance

We have liability and other insurance coverage which we believe is sufficient to cover our risks.

Employees

As of January 3, 2016, we had 734 full-time and 182 contract workers. In the Auburn Hills, Michigan facility, 139 of the hourly workers are represented by a labor union and are covered by a collective bargaining agreement which is effective through August 22, 2016. In the Louisville, Kentucky facility, 23 hourly workers are represented by a labor union and are covered by a collective bargaining agreement which is effective through January 31, 2017. We have never experienced a material work stoppage or disruption to our business relating to employee matters. We believe that our relationship with our employees is good.

ITEM 1A. RISK FACTORS

Set forth below are certain risks and uncertainties that could adversely affect our results of operations or financial condition and cause our actual results to differ materially from those expressed in forward-looking statements made by the Company. Also refer to the Special Note Regarding Forward-Looking Statements in Item 1 of this Annual Report on Form 10-K.

RISKS RELATED TO OUR BUSINESS

We have substantial debt and if we were to default on paying our debt or fail to comply with the covenants, our lender could take action that would likely cause our stockholders to lose their entire investment in us.

As of January 3, 2016, we had approximately $30.7 million of debt outstanding under our senior secured credit facility. Substantially all of our assets are pledged to the lender to secure this outstanding debt. In the event that we are unable to make principal, interest or other payments due under, or we do not comply with the covenants contained in the senior secured credit facility, the lender could declare an event of default, accelerate all amounts outstanding and seek to foreclose on the collateral securing such indebtedness. In such event, we could be forced to file for bankruptcy protection and stockholders would likely lose their entire investment in us.

The agreement governing our senior secured credit facility contains financial covenants and other covenants that may restrict our current and future operations, particularly our ability to respond to changes in our business or to take certain actions. If we are unable to comply with these covenants, our business, results of operations and liquidity could be materially and adversely affected.

Our ability to comply with the covenants in the senior secured credit facility agreement may be affected by economic or business conditions beyond our control. If we are not able to comply with these covenants when required and we are unable to obtain necessary waivers or amendments from the lender, we would be precluded from borrowing under the credit facility. If we are unable to borrow under the credit facility, we will need to meet our liquidity requirements using other sources. Alternative sources of liquidity may not be available on acceptable terms, if at all. In addition, if we do not comply with the financial or other covenants in the credit facility when required, the lender could declare an event of default under the credit facility, and our indebtedness thereunder could be declared immediately due and payable. The lender would also have the right in these circumstances to terminate any commitments it has to provide further borrowings. Any of these events would have a material adverse effect on our business, financial condition and liquidity.

In addition, the credit facility contains covenants that, among other things, restrict our ability to:

| |

| • | incur or assume additional debt or guarantees or issue preferred stock; |

| |

| • | pay dividends, or make redemptions and repurchases, with respect to capital stock; |

| |

| • | make loans and investments; |

| |

| • | make capital expenditures; |

| |

| • | engage in mergers, acquisitions, asset sales, sale/leaseback transactions and transactions with affiliates; and |

| |

| • | change the business conducted by us or our subsidiaries. |

The operating and financial restrictions and covenants in this debt agreement and any future financing agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities.

Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness.

Our substantial level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due with respect to our indebtedness. Our indebtedness could have other important consequences to you as a stockholder. For example, it could:

| |

| • | make it more difficult for us to satisfy our obligations with respect to our indebtedness and any failure to comply with the obligations of any of our debt instruments, including financial and other restrictive covenants, could result in an event of default under the senior secured credit facility; |

| |

| • | make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; |

| |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flows to fund working capital, capital expenditures, acquisitions and other general corporate purposes; |

| |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| |

| • | limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other purposes. |

Any of the above listed factors could materially adversely affect our business, financial condition and results of operations.

The senior secured credit facility contains restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of our debt.

Our major customers may exert significant influence over us.

The vehicle component supply industry has traditionally been highly fragmented and serves a limited number of large OEMs. As a result, OEMs have historically had a significant amount of leverage over their outside suppliers. Our contracts with major OEM and Tier 1 customers frequently provide for an annual productivity cost reduction. Historically, cost reductions through product design changes, increased productivity and similar programs with our suppliers have generally offset these customer-imposed productivity cost reduction requirements. However, if we are unable to generate sufficient production cost savings in the future to offset price reductions, our gross margin and profitability would be adversely affected. In addition, changes in our customers’ purchasing policies or payment practices could have an adverse effect on our business.

The loss or insolvency of any of our major customers would adversely affect our future results.

We are dependent on several principal customers. Our three largest customers, in the aggregate, accounted for approximately 19.0% of our net sales for the year ended January 3, 2016. We have not entered into long-term agreements with any of our customers. Instead, we enter into a number of purchase order commitments with our customers, based on their current or projected needs. We have in the past lost, and may in the future, lose customers due to the highly competitive conditions in the automotive supply industry, including pricing pressures. A decision by any significant customer, whether motivated by competitive conditions, financial difficulties or otherwise, to materially decrease the amount of products purchased from us, to change their manner of doing business with us or to stop doing business with us could have a material adverse effect on our business, financial condition and results of operations.

We have no long-term contracts with customers.

We supply our products based on purchase orders placed by our customers from time to time but have no long-term contracts with our customers. We will commit to end-product pricing for a specified quantity of product for the duration of the vehicle’s production, generally three to five years. In the past, we successfully mitigated price volatility though aggressive supplier management and alternative material substitution strategies. Typically, our products are refreshed during a vehicle’s production life creating opportunities to modify pricing if material costs have risen. However, there can be no assurance that we will be able to implement or sustain such strategies in the future or modify pricing to pass potential increases in material costs to customers. Our inability to do so could materially adversely affect our business, financial condition and results of operation.

Our inability to compete effectively in the highly competitive vehicle component supply industry could result in lower prices for our products, reduced gross margins and loss of market share, which could have an adverse effect on our revenues and operating results.

The vehicle component supply industry is highly competitive. Our products primarily compete on the basis of price, breadth of product offerings, product quality, technical expertise and development capability, product delivery and product service. Increased competition may lead to price reductions resulting in reduced gross margins and loss of market share.

Current and future competitors may make strategic acquisitions or establish cooperative relationships among themselves or with others, foresee the course of market development more accurately than we do, develop products that are superior to our

products, produce similar products at lower cost than we can or adapt more quickly to new technologies, industry or customer requirements. By doing so, they may enhance their ability to meet the needs of our customers or potential future customers. These developments could limit our ability to obtain revenues from new customers and to maintain existing revenues from our existing customer base. We may not be able to compete successfully against current and future competitors and the failure to do so may have a material adverse effect on our business, operating results and financial condition.

We rely on raw materials suppliers in our business and significant shortages, supplier capacity constraints or supplier production disruptions could adversely affect our financial condition and operating results.

Our reliance on suppliers to secure raw materials exposes us to volatility in the prices and availability of our products. A disruption in deliveries from suppliers could have a material adverse effect on our ability to meet our commitments to customers or could increase our operating costs. Moreover, the cost of raw materials used in the production of our products, represents a significant portion of our direct manufacturing costs. The number of customers to which we are not able to pass on such price increases may increase in the future. We believe that our supply management and production practices are based on an appropriate balancing of the foreseeable risks and the costs of alternative practices. Nonetheless, price increases, supplier capacity constraints, supplier production disruptions or the unavailability of some raw materials may have a material adverse effect on our cash flows, competitive position, financial condition or results of operations. If we are not able to buy raw materials at fixed prices or pass on price increases to our customers, we may lose orders or enter into orders with less favorable terms, any of which could have a material adverse effect on our business, financial condition, and results of operations.

We conduct certain of our manufacturing in Mexico and, therefore, are subject to risks associated with doing business outside the United States, including the possible effects of currency exchange rate fluctuations.

We have two manufacturing facilities in Mexico. There are a number of risks associated with doing business in Mexico, including, exposure to local economic and political conditions, social unrest, including risks of terrorism or other hostilities, export and import restrictions, and the potential for shortages of trained labor. Our sales are denominated in U.S. dollars. Because a portion of our manufacturing costs are incurred in Mexican pesos, fluctuations in the U.S. dollar/Mexican peso exchange rate may have a material effect on our profitability, cash flows, financial position, and may significantly affect the comparability of our results between financial periods. Any depreciation in the value of the U.S. dollar in relation to the value of the Mexican peso will adversely affect the cost of our Mexican operations when remeasured into U.S. dollars. Similarly, any appreciation in the value of the U.S. dollar in relation to the value of the Mexican peso will decrease the cost of our Mexican operations when remeasured into U.S. dollars. These risks may materially adversely impact our business, results of operations and financial condition.

Prior periods of weakness in the global economy, the global credit markets and the financial services industry severely and negatively affected demand for automobiles and automobile parts and our business, financial condition, results of operations and cash flows.

Demand for and pricing of our products are subject to economic conditions and other factors present in the various markets where our products are sold. The level of demand for our products depends primarily upon the level of consumer demand for new vehicles that are manufactured with our products. The level of new vehicle purchases is cyclical, affected by such factors as general economic conditions, interest rates, consumer confidence, consumer preferences, patterns of consumer spending, fuel costs and the automobile replacement cycle.

The global economic crisis that prevailed throughout 2008 and 2009 resulted in delayed and reduced purchases of durable consumer goods, such as automobiles. Although the global economic climate has improved since 2009, if the global economy were to take another significant downturn, depending upon its length, duration and severity, our business, financial condition, results of operations and cash flow would again be materially adversely affected.

Our business is cyclical in nature and downturns in the automotive industry could reduce the sales and profitability of its business.

The demand for our products is largely dependent on the North American production of automobiles. The markets for our products have been cyclical, because new vehicle demand is dependent on, among other things, consumer spending and is tied closely to the overall strength of the economy. Because our products are used principally in the production of vehicles for the automotive market, our net sales, and therefore results of operations, are significantly dependent on the general state of the economy and other factors which affect these markets. A decline in vehicle production would adversely impact our results of operations and financial condition. In addition, the North American automotive market experienced a downturn during 2008 and 2009 as a result of general weakness in the North American economy. Although North American vehicle production

continued to recover in 2015 over the prior year periods, we cannot provide any assurance as to the length or level of the recovery from the recent decline, and any extended downturn could again materially affect our business, financial condition and results of operations.

We are a holding company with no operations of our own, and we depend on our subsidiaries for cash to fund all of our operations and expenses, including to make future dividend payments, if any.

Our operations are conducted entirely through our subsidiaries and our ability to generate cash to fund all of our operations and expenses and to pay dividends or to meet any debt service obligations of the holding company is highly dependent on the earnings and the receipt of funds from our subsidiaries via dividends or intercompany loans. We currently expect to continue to pay dividends on our common stock; however, none of our subsidiaries will be obligated to make funds available to us for the payment of dividends. Further, the agreement governing our senior credit facility, for which our subsidiary, Unique Fabricating NA, Inc. is the borrower, restricts the ability of our subsidiaries to pay dividends, make loans or otherwise transfer assets to us. In addition, the laws of the jurisdictions in which our subsidiaries are organized may impose requirements that may restrict the ability of subsidiaries to pay dividends to us.

We may pursue acquisitions that involve inherent risks, any of which may cause us to not realize anticipated benefits.

Our business strategy includes the potential acquisition of businesses that we expect will complement and expand our business. For example, we acquired substantially all of the assets of PTI, Chardan, and Great Lakes. We may not be able to successfully identify suitable acquisition opportunities or complete any particular acquisition, combination or other transaction on acceptable terms. Our identification of suitable acquisition candidates involves risks inherent in assessing the values, strengths, weaknesses, risks and profitability of these opportunities including their effects on our business, diversion of our management’s attention and risks associated with unanticipated problems or unforeseen liabilities. If we are successful in pursuing future acquisitions, we may be required to expend significant funds, incur additional debt, or issue additional shares of common stock, which may materially and adversely affect our results of operations and be dilutive to our stockholders. If we spend significant funds or incur additional debt, our ability to obtain financing for working capital or other purposes could decline and we may be more vulnerable to economic downturns and competitive pressures. In addition, we cannot guarantee that we will be able to finance additional acquisitions or that we will realize any anticipated benefits from acquisitions that we complete. Should we successfully acquire other businesses, the process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of our existing business. Our failure to identify suitable acquisition opportunities may restrict our ability to grow our business.

We may experience increased costs and other disruptions to our business associated with labor unions.

As of January 3, 2016, we had 734 full-time employees, of whom 540 are hourly and 194 are salaried. 162 of our hourly employees are represented by labor unions and covered by collective bargaining agreements. A collective bargaining agreement covering 139 hourly workers employed at our Auburn Hills, Michigan facility terminates in August 2016. We cannot assure you that we will negotiate successfully a new collective bargaining agreement in our Auburn Hills facility, or other of our employees will not be represented by a labor organization in the future or that any of our facilities will not experience a work stoppage or other labor disruption. Many of our customers and their suppliers also have unionized work forces. Work stoppages or slow-downs experienced by customers or their other suppliers could result in slow-downs or closures of assembly plants where our products are included in assembled commercial vehicles. Any work stoppage or other labor disruption involving our employees, employees of our customers (many of which customers have employees who are represented by unions), or employees of our suppliers could have a material adverse effect on our business, financial condition or results of operations by disrupting our ability to manufacture our products or reducing the demand for our products.

We would be adversely affected by the loss of key personnel.

Our success is dependent upon the continued services of our senior management team and other key employees. Although certain key members of our senior management have employment agreements for their continued services, there is no guaranty that each such person will choose to remain with us. The loss of any key employees (including such members of our senior management team) could materially adversely affect our business, results of operations and financial condition.

In addition, our success depends in part on our ability to attract, hire, train and retain qualified managerial, engineering, sales and marketing personnel. We face significant competition for these types of employees in our industry. We may be unsuccessful in attracting and retaining the personnel we require to conduct our operations successfully. The loss of any member of our senior management team or other key employees could impair our ability to execute our business plans and

strategic initiatives, cause us to lose customers and experience reduced net sales, or lead to employee morale problems and/or the loss of other key employees. In any such event, our financial condition, results of operations, internal control over financial reporting, or cash flows could be adversely affected.

Our results of operations may be negatively impacted by product liability lawsuits and claims.

Our automotive products expose us to potential product liability risks that are inherent in the design, manufacture, sale and use of our products. While we currently maintain what we believe to be suitable product liability insurance, we cannot assure you that we will be able to maintain this insurance on acceptable terms, that this insurance will provide adequate protection against potential liabilities or that our insurance providers will successfully weather the current economic downturn. One or more successful claims against us could materially and adversely affect our reputation and our financial condition, results of operations and cash flows.

Our businesses are subject to statutory environmental and safety regulations in multiple jurisdictions, and the impact of any changes in regulation and/or the violation of any applicable laws and regulations by our businesses could result in a material and adverse effect on our financial condition and results of operations.

We are subject to foreign, federal, state, and local laws and regulations governing the protection of the environment and occupational health and safety, including laws regulating: air emissions, wastewater discharges, the generation, storage, handling, use and transportation of hazardous materials; the emission and discharge of hazardous materials into the soil, ground or air; and the health and safety of our colleagues. We are also required to obtain permits from governmental authorities for certain of our operations. We cannot assure you that we are, or have been, in complete compliance with such environmental and safety laws, regulations and permits. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators. In some instances, such a fine or sanction could have a material and adverse effect on us. The environmental laws to which we are subject have become more stringent over time, and we could incur material expenses in the future to comply with environmental laws. We are also subject to laws imposing liability for the cleanup of contaminated property. Under these laws, we could be held liable for costs and damages relating to contamination at our past or present facilities and at third party sites to which we sent waste containing hazardous substances. The amount of such liability could be material.

Certain of our operations generate hazardous substances and wastes. If a release of such substances or wastes occurs at or from our properties, or at or from any offsite disposal location to which substances or wastes from our current or former operations were taken, or if contamination is discovered at any of our current or former properties, we may be held liable for the costs of cleanup and for any other response by governmental authorities or private parties, together with any associated fines, penalties or damages. In most jurisdictions, this liability would arise whether or not we had complied with environmental laws governing the handling of hazardous substances or wastes.

We may be adversely affected by the impact of government regulations on our customers.

Although the products we manufacture and supply to vehicle customers are not subject to significant government regulation, our business is indirectly impacted by the extensive governmental regulation applicable to vehicle customers. These regulations primarily relate to emissions and noise standards imposed by the Environmental Protection Agency, or EPA, state regulatory agencies, such as the California Air Resources Board, or CARB, and other regulatory agencies around the world. Vehicle customers are also subject to the National Traffic and Motor Vehicle Safety Act and Federal Motor Vehicle Safety Standards promulgated by the National Highway Traffic Safety Administration. Changes in emission standards and other proposed governmental regulations could impact the demand for vehicles and, as a result, indirectly impact our operations. For example, emission standards governing heavy-duty (Class 8) diesel engines that went into effect in the United States on October 1, 2002 and January 1, 2007 resulted in significant purchases of new trucks by fleet operators prior to such date and reduced short term demand for such trucks in periods immediately following such date. New emission standards for truck engines used in Class 5 to 8 trucks imposed by the EPA and CARB became effective in 2010. To the extent that current or future governmental regulation has a negative impact on the demand for vehicles, our business, financial condition or results of operations could be adversely affected.

We have only limited protection for our proprietary rights in our intellectual property, which makes it difficult to prevent third parties from infringing upon our rights.

Our success depends to a certain degree on our ability to protect our intellectual property and to operate without infringing on the proprietary rights of third parties. We have not been issued patents and have not registered trademarks with respect to our products. Our competitors could duplicate our designs, processes or other intellectual property or design around any

processes or designs on which we may obtain patents or trademark protection in the future. In addition, it is possible that third parties may have or acquire licenses for other technology or designs that we may use or desire to use, so that we may need to acquire licenses to, or to contest the validity of, such patents or trademarks of third parties. Such licenses may not be made available to us on acceptable terms, if at all, and we may not prevail in contesting the validity of third party rights.

We protect trade secrets, know-how and other confidential information against unauthorized use by others or disclosure by persons who have access to them, such as our employees, through contractual or other arrangements. These arrangements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. If we are unable to maintain the proprietary nature of our technologies, our revenues could be materially adversely affected.

RISKS RELATED TO OUR COMMON STOCK

We may not be able to pay dividends.

We have paid and currently plan to pay dividends quarterly. However, our ability to pay dividends will be affected by our results and our needs for funds for use in our operations and to expand our business. In addition, our senior secured credit facility contains financial covenants which may have the effect of precluding or limiting the amounts that we can pay as dividends.

If our executive officers, directors and principal stockholders choose to act together, they will be able to exert significant influence over us and our significant corporate decisions and may act in a manner that advances their best interests and not necessarily those of other stockholders.

Our executive officers, directors, and beneficial owners of 5% or more of our outstanding common stock and their affiliates beneficially own approximately 32.4% of our outstanding common stock. As a result, these persons, if they were to act together, have the ability to significantly influence the outcome of all matters requiring stockholder approval, including the election and removal of directors and any merger, consolidation, or sale of all or substantially all of our assets, and they could act in a manner that advances their best interests and not necessarily those of other stockholders, by among other things:

| |

| • | delaying, deferring or preventing a change in control of us; |

| |

| • | entrenching our management and/or our board of directors; |

| |

| • | impeding a merger, consolidation, takeover or other business combination involving us; |

| |

| • | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us; or |

| |

| • | causing us to enter into transactions or agreements that are not in the best interests of all stockholders. |

Securities analysts may not initiate or continue coverage of our common stock or may issue negative reports, which may have a negative impact on the market price of our common stock.

To date since our initial public offering, there has been limited coverage of our common stock by securities analysts. Securities analysts may elect not to provide research coverage of our common stock. If securities analysts do not cover our common stock, the lack of research coverage may cause the market price of our common stock to decline, or adversely affect the trading volume for our common stock. The trading market for our common stock may be affected in part by the research and reports that industry or financial analysts publish about our business. If one or more of the analysts who elect to cover us downgrade our stock, our stock price would likely decline rapidly. If one or more of these analysts cease coverage of us, we could lose visibility in the market, which in turn could cause our stock price to decline. In addition, under the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and a global settlement among the Securities and Exchange Commission, or the SEC, other regulatory agencies and a number of investment banks, which was reached in 2003, many investment banking firms are required to contract with independent financial analysts for their stock research. It may be difficult for a company such as ours, with a smaller market capitalization, to attract independent financial analysts that will cover our common stock. This could have a negative effect on the market price of and trading volume for our stock.

Future sales of our common stock in the public market may cause our stock price to decline and impair our ability to raise future capital through the sale of our equity securities.

As of January 3, 2016, we had outstanding 9,591,860 shares of common stock, including 2,702,500 shares of our common stock issued in our initial public offering and 6,585,841 shares of common stock owned by non-affiliates and issued in private

placements, in each case more than one year ago. The shares owned by non-affiliates can be traded without restriction under Rule 144 or otherwise at this time. In addition, 3,006,019 shares of common stock are owned by affiliates but can be traded subject to restrictions under Rule 144. In addition, we have registered all shares that may be issued pursuant to our 2013 Stock Incentive Plan and the 2014 Omnibus Performance Award Plan. Sales of a large number of these securities on the public market or the perception that a large number of shares may be sold could reduce the market price of our common stock or impair our ability to raise capital.

Anti-takeover provisions in our organizational documents and Delaware law may discourage or prevent a change in control, even if an acquisition would be beneficial to our stockholders, which could affect our stock price adversely and prevent attempts by our stockholders to replace or remove our current management.

Our restated certificate of incorporation and restated bylaws contain provisions that could discourage, delay or prevent a merger, acquisition or other change in control of our company or changes in our board of directors that our stockholders might consider favorable, including transactions in which you might receive a premium for your shares. These provisions also could limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price of our common stock. Stockholders who wish to participate in these transactions may not have the opportunity to do so. Furthermore, these provisions could prevent or frustrate attempts by our stockholders to replace or remove management. These provisions:

| |

| • | allow the authorized number of directors to be changed only by resolution of our board of directors; |

| |

| • | provide for a classified board of directors, such that not all members of our board will be elected at one time; |

| |

| • | prohibit our stockholders from filling board vacancies, limit who may call stockholder meetings, and prohibit the taking of stockholder action by written consent; and |

| |

| • | require advance written notice of stockholder proposals that can be acted upon at stockholders meetings and of director nominations to our board of directors. |

In addition, we are subject to the provisions of Section 203 of the Delaware General Corporation Law, which may prohibit certain business combinations with stockholders owning 15% or more of our outstanding voting stock. Any delay or prevention of a change in control transaction or changes in our board of directors could cause the market price of our common stock to decline.

RISKS RELATED TO PUBLIC COMPANIES

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups (JOBS) Act of 2012 and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including (1) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, (2) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (3) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. In addition, as an emerging growth company, we have only included two years, rather than the customary three, of audited financial statements and two years, rather than the customary five, of selected financial data in this Annual Report on Form 10-K. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to delay such adoption of new or revised accounting standards on the relevant dates on which adoption of such standards is required for private companies. As a result of this election, our financial statements may not be comparable to the financial statements of other public companies that comply with all public company accounting standards.