innovative, optimized, sustainable solutions Taglich Brothers Investment Conference May 2, 2022 Doug Cain, President and Chief Executive Officer Brian Loftus, Chief Financial Officer

Safe Harbor FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements in future filings with the SEC. We may also make forward-looking statements in our press releases or other public or stockholder communications. The forward-looking statements contained herein are based on management’s beliefs and assumptions and on information currently available to us. When used in this presentation, the words “anticipate,” “believe,” “continue,” “could,” “seek,” “might,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “approximately,” “project,” “should,” “will,” “would” or the negative or plural of these words or similar expressions, as they relate to our Company, business and management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the future events and circumstances discussed in this presentation may not occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements. All forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss these risks in greater detail in our Annual Report on Form 10-K for the year ended December 31, 2021, in the “Risk Factors” section and elsewhere therein, as well as in any updates to those Risk Factors filed from time to time in our periodic and current reports filed with the U.S. Securities and Exchange Commission. While we believe that our assumptions are reasonable, we caution that it is difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Any forward-looking statements relate to future events and involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to statements concerning: the effect of cyclicality of the automotive industry on our automotive sales and production and the viability and financial condition of our customers; cyclicality of the appliance industry affecting sales, production and the viability and financial condition of our customers; global economic uncertainty; loss of large customers or significant platforms; our ability to generate sufficient cash to service our indebtedness, and obtain future financing; operating and financial restrictions imposed on us by our credit agreements; supply shortages; the effects of supply chain disruptions, the semiconductor shortages, and the COVID-19 pandemic; escalating pricing pressures and decline of volume requirements from our customers; our ability to meet significant increases in demand; availability and increasing volatility in cost of raw materials; our ability to continue to compete successfully in the highly competitive automotive parts industry; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; product liability claims that may be brought against us; work stoppages or other labor conditions; natural disasters; our ability to meet our customers’ needs for new and improved products in a timely manner or cost- effective basis; our legal rights to our intellectual property portfolio; environmental and other regulations; the possible volatility of our annual effective tax rate; the possibility of future impairment charges to our goodwill and long-lived assets; and other factors, including those discussed in “Risk Factors” in our Annual Report on Form 10-K. Forward-looking statements speak only as of the date hereof. We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. Except as required by law, we assume no obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions based on new information, future events or otherwise. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. NYSE American: UFAB 2May 2, 2022

Key Messages May 2, 2022 NYSE American: UFAB 3 Continued focus on controlling cost structure, improving operating productivity & efficiency, and optimizing working capital requirements Completed Structural ChangesHighly capable leadership team in place with clear focus on near-term priorities and vision for future Transportation market conditions improving with low dealer inventories & consumer demand expected to drive long-term growth & stability Remain focused on growing with existing and new non-transportation customers to improve market diversification

Who We Are & What We Do May 2, 2022 NYSE American: UFAB 4 Multi-material & multi-process solution provider with rapid prototyping & focus on lowest total cost (quality, delivery, & logistics) for our varied customers Experienced, technically capable operations & engineering teams Wide process & materials expertise primarily focused on sealing, NVH, & BSR applications Innovative problem solvers Provide innovative, optimized, sustainable solutions enabling the success of our Transportation, Appliance, Consumer Goods, & Medical market customers while creating stakeholder valueMission Who We Are Integrity | Pride | Accountability | Commitment | Innovative Curiosity | AmbitionCore Values Participate in large & growing markets (transportation, appliance, consumer goods, & medical) Very few significant competitors enables opportunities for rapid market share gains Predominantly short gestation period – customer new business award to production Remains a relatively low capital-intensive business Capital expenditures focused on increasing productivity & improving material utilization Commercial Landscape

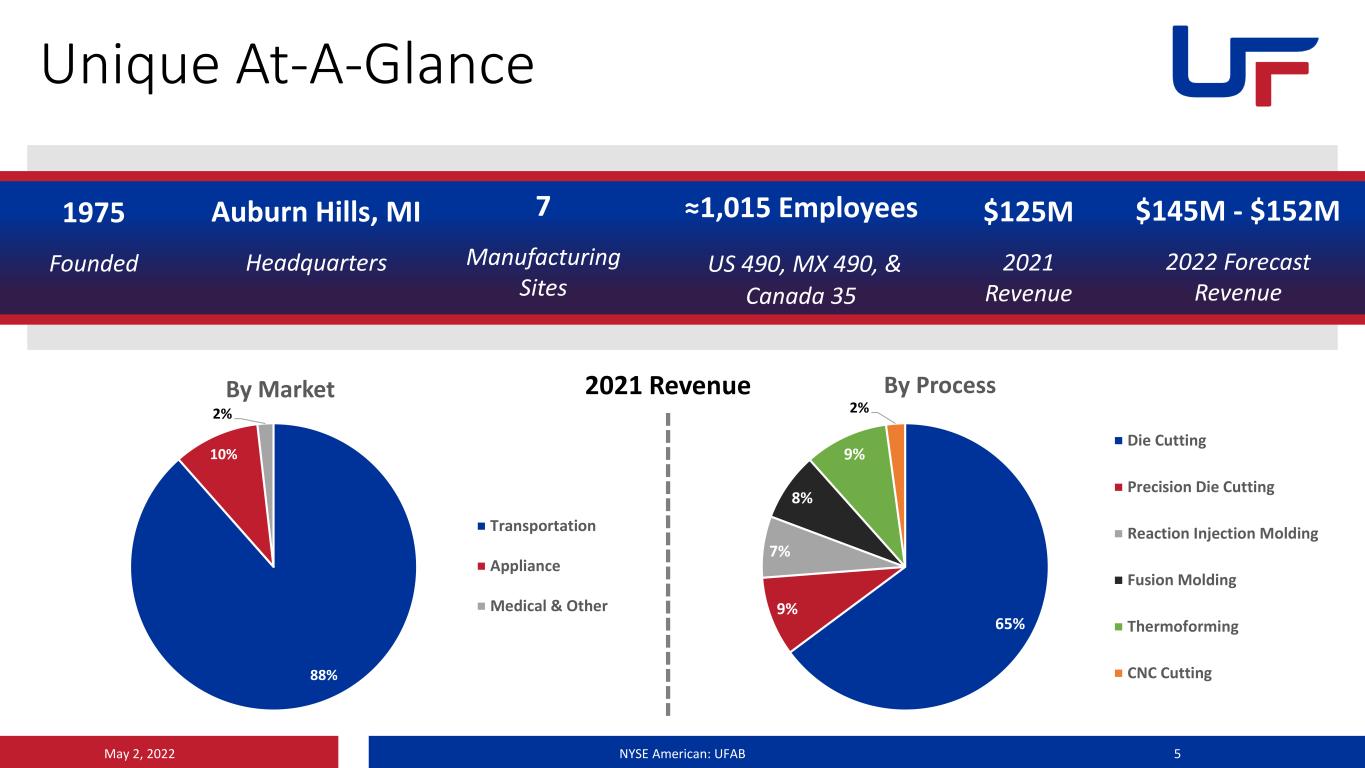

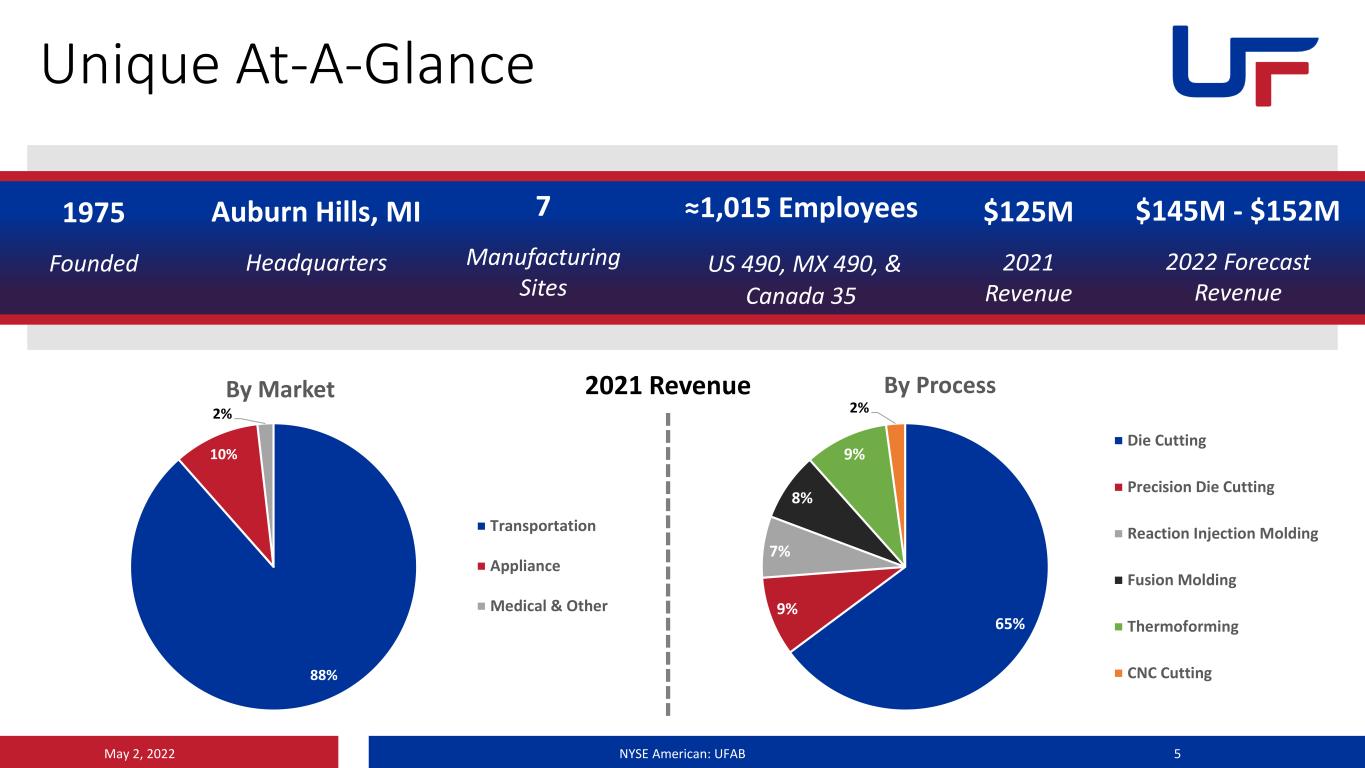

Unique At-A-Glance May 2, 2022 NYSE American: UFAB 5 1975 Founded Auburn Hills, MI Headquarters ≈1,015 Employees US 490, MX 490, & Canada 35 7 Manufacturing Sites $125M 2021 Revenue $145M - $152M 2022 Forecast Revenue 2021 Revenue 65% 9% 7% 8% 9% 2% By Process Die Cutting Precision Die Cutting Reaction Injection Molding Fusion Molding Thermoforming CNC Cutting88% 10% 2% By Market Transportation Appliance Medical & Other

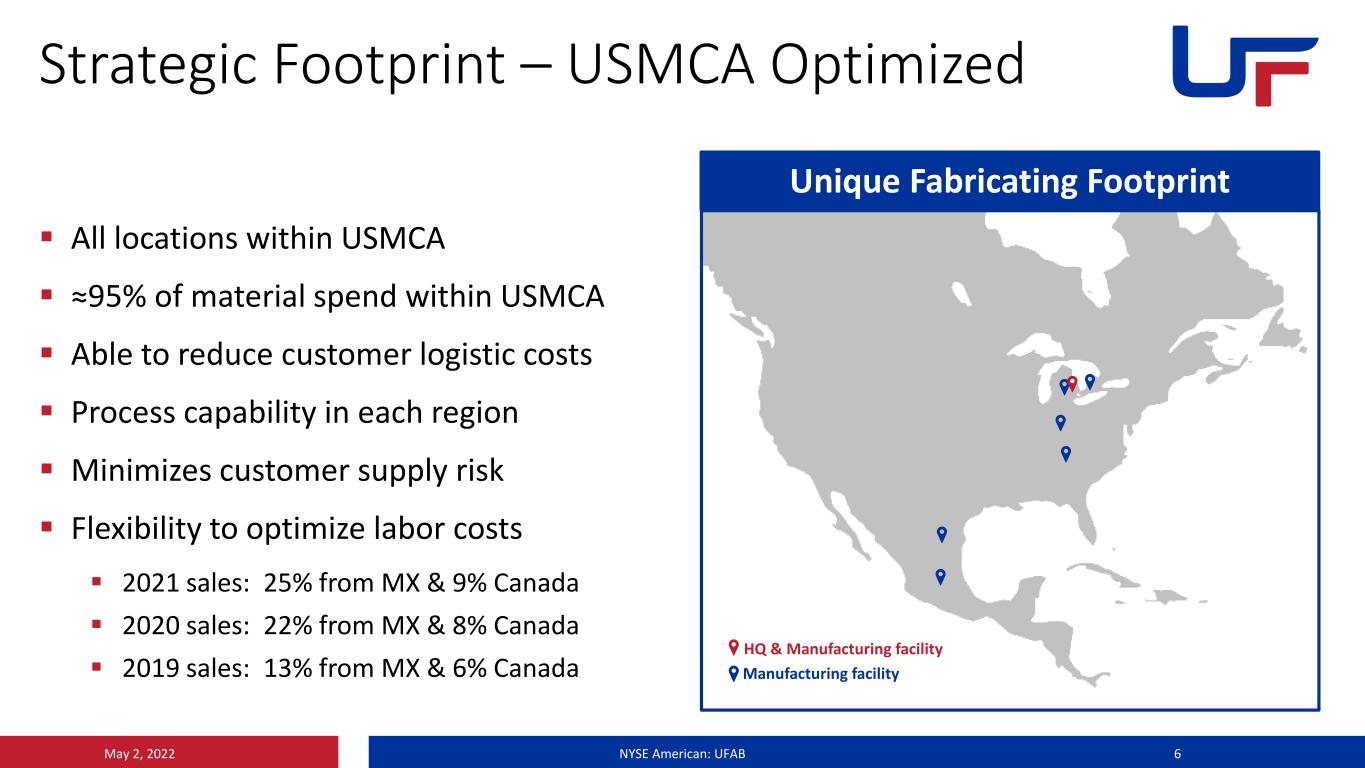

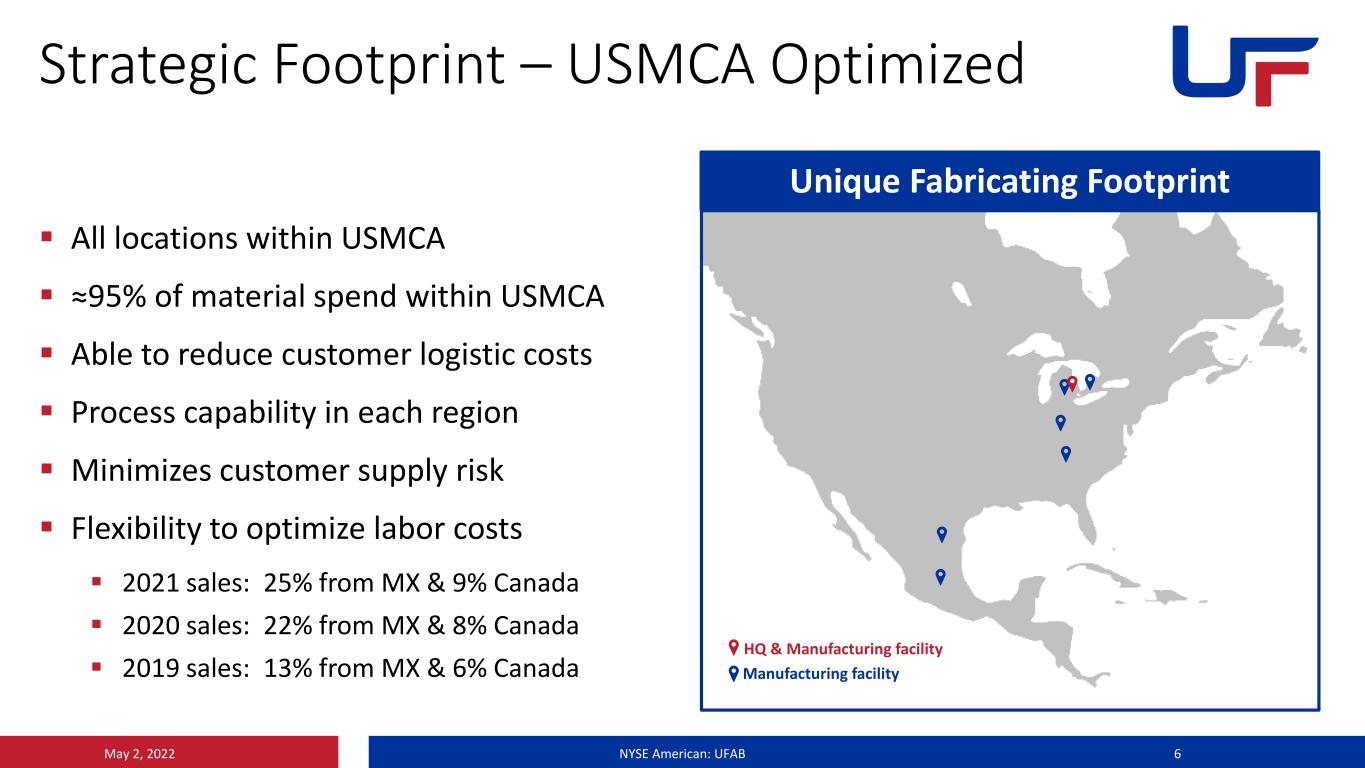

Strategic Footprint – USMCA Optimized Unique Fabricating Footprint NYSE American: UFAB 6May 2, 2022 HQ & Manufacturing facility Manufacturing facility All locations within USMCA ≈95% of material spend within USMCA Able to reduce customer logistic costs Process capability in each region Minimizes customer supply risk Flexibility to optimize labor costs 2021 sales: 25% from MX & 9% Canada 2020 sales: 22% from MX & 8% Canada 2019 sales: 13% from MX & 6% Canada

D e s p i t e a l l t h e O n g o i n g R i s k s a n d H e a d w i n d s … Consumer Demand Remains Strong Vehicle Inventories at Record Lows Billions of Dollars Being Invested in EV Technologies Merger and Acquisition Activities Continue A Look Into The Rearview Mirror May 2, 2022 NYSE American: UFAB 7 General Motors Strike Global COVID-19 Pandemic Q2 2020 Auto Shutdowns Work From Home Texas Deep Freeze Extreme Commodity Cost Increases & Shortages Suez Canal Blockage Labor Shortages The Great Resignation Shipping Port Gridlock Skyrocketing Container Costs Vaccine Mandates OEMs Unilaterally Revising T&Cs Inflationary Environment on Everything Trucker Convoy Blockade Accelerated Pace of Automotive Evolution (EVs) Russia Invades Ukraine Unprecedented Challenges Resilience in Automotive Supply Base

COVID-19 & Semiconductor Shortage Impact on North American Light Vehicle Production 16.3 16.7 16.6 15.1 17.1 16.9 13.9 17.2 17.2 13.0 15.2 17.2 14.7 16.5 13.0 2020 2021 2022 2023 Jan. 2021 Fcst. June 2021 Fcst Aug. 2021 Fcst Feb. 2022 Fcst Apr. 2022 Fcst May 2, 2022 NYSE American: UFAB 8 -20% -6% -12% -14% North American Light Vehicle Production Forecast millions of units North American Light Vehicle Production forecasts have continued to decline due to the ongoing impacts of COVID-19 and the semiconductor shortage: 2021 North America production volumes of 13.0M units, 20% or 3.3M units lower than the January 2021 forecast Two consecutive years of production volumes at 13.0M units 2022 production outlook stands at 14.7M units, 12% or 2.0M units lower than January 2021 forecast A return to sustained, normalized production activity has effectively been deferred to 2023 More than 5M units permanently removed over the 3-year period 2021-2023 Source: IHS Markit Light Vehicle Production Forecasts -4%

17.8 17.1 17.0 16.3 13.0 13.0 14.7 16.5 17.2 17.0 16.5 16.5 16.5 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 20.0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 M ill io ns Auto Industry Production – Forecast Update IHS North America Light Vehicle Production 2021 Actual LV Production: 13.0m 2022 IHS NA forecast dropped in March from 15.2m Current 2022 forecast: 14.7m 13% above 2021 actual LV production Quarterly run-rates: Q4 2021 = 3.29m actual Q1 2022 = 3.55m actual Q2 2022 = 3.59m forecast Q3 2022 = 3.83m forecast Q4 2022 = 3.77m forecast NA saleable inventory remains ~1.0m (1.5m less than March 2021; 2.4m less than March 2020) Forecast Commentary May 2, 2022 NYSE American: UFAB 9 Actual Forecast © April 2022 IHS Markit Inc. All rights reserved

Transportation Market Update 2022 Award Highlights Consumer demand remains very strong OEMs focused on production of higher margin vehicles (= increased NVH content) OEMs making significant investments in EV (= increased NVH content) Input costs continue to rise as inflationary pressures still affecting raw materials, labor, & transportation Unique’s Focus: Key customer growth – capitalizing on proximity, multiple process offerings, value-add process combination (die cut + molded) J-OEM & EV vehicle (diversification) Market Commentary May 2, 2022 NYSE American: UFAB 10 Lower Grille Seal (Precision Die Cut) – Rivian R1T (Launched March 2022) Stuffer Block (Die Cut) – Mercedes EQE (Launching September 2022) Roof Rail Reinforcement Tape (Precision Die Cut) – GM BrightDrop Zevo 600 (Launching October 2022) Fender Splash Shields (RIM) – Toyota Grand Highlander (Launching April 2023)

Transportation Market Products May 2, 2022 NYSE American: UFAB 11 Buzz, squeak & rattle NVH Components Acoustic Insulation Door Water Barriers Battery Thermal Pads & Tire Foams Fender Stuffers HVAC Seals & Dash Noise Control Air Management | Ducts Glove Box Liners & Bumper Pads Console Bin Mats & Cupholder Inserts Mirror Gaskets Seating Topper Pads Tail Lamp Gaskets Wheel Housing Liners Thermoformed | Compression Products Die Cut Products Manufacturing Process: Fusion Molded Products Attachment Tape (Precision Die Cut) Note: Illustrative examples, not model specific

Strategic Alliances with EV % update $50b in total with $11.4b on battery facilities in central KY and western TN $35b in total with $7b on facilities in Lansing & Orion, MI including battery plant $1b invest in Alabama including battery plant $5b on a new production facility in north Georgia $ $10b in "Giga Texas" in Austin, TX Unique has favorable proximity to these investment locations EVs demand additional emphasis on NVH + BSR, weight reduction, & climate control efficiency Unique’s sales attributable to EV applications expected to be ≈3% in 2022 and ≈5% in 2023 May 2, 2022 NYSE American: UFAB 12 Ford Mach-e Ford F-150 Lightning Mercedes EQE Mercedes EQS Tesla Model S Tesla Model 3 Tesla Model X Tesla Model Y Rivian R1S & R1T Rivian EDV Hummer EV Chevrolet Bolt Cadillac Lyriq Lucid Air Volkswagen ID.4

Appliance Market Update 2022 Award Highlights Consumer demand remains strong Customers are more collaborative Program life is longer compared to Transportation Significant Customer Activities: Haier $118M investment in Roper’s LaFayette, GA plant to expand capacity Haier $450M investment in GE Appliance’s Louisville, KY Appliance Park to onshore new models and expand capacity Unique has a presence in each of GE Appliance’s five U.S. production facilities adding Decatur, AL and Camden, SC over the past year with awarded business. Unique’s Focus: Continue to support key customers with immediate solutions to design, supply chain, and competitor quality issues Pursue growth opportunities in Mexico Market Commentary May 2, 2022 NYSE American: UFAB 13 Added Multidoor Content (Launched January 2022) Detergent Tank Gasket (Immediate Launch) Range/Oven Packaging Materials (Takeover May 2022)

Appliance Market Products May 2, 2022 NYSE American: UFAB 14 Foaming Gaskets Metal Sealing Gasketing EPDM Gasketing for Metal sealing Surface Protection Fiberglass Insulation Pad Insulating Foam Rings HVAC Refrigerator Water Heater Dishwasher Inner Door Silencer Pad T-Blanket Silencer Wrap Toe Kick Silencer Kit Fiberglass Insulation Skirt Dryer Gaskets for Lint Trap Assembly and Ducting

Consumer / Medical Market Update 2022 Award Highlights Consumer spending +8% YoY - rapidly rising inflation may impact growth. Medical device market spending expected to grow 7% (CAGR) through 2027 as post-pandemic demand increasing. Inflation starting to erode higher than average household savings, but rising wages helping to offset. Estimated ≈$2.3 trillion excess savings as of March 2022. Increase in opportunities related to customers needing to onshore manufacturing due to rising costs / lead time of overseas freight. Market Commentary May 2, 2022 NYSE American: UFAB 15 90% revenue increase expected over 2021 Key Program Launches ($1.0m 2022 impact) Jacuzzi bulk heads (Launching currently) N95 mask filters (Launching June 2022) Skeeter boat seat (Launching Aug 2022) Gentherm Medical 2-way tape (Launching Sept 2022) Zoll Life Vest (Launching Nov 2022)

Consumer Goods Market Products May 2, 2022 NYSE American: UFAB 16

Medical Market Products May 2, 2022 NYSE American: UFAB 17

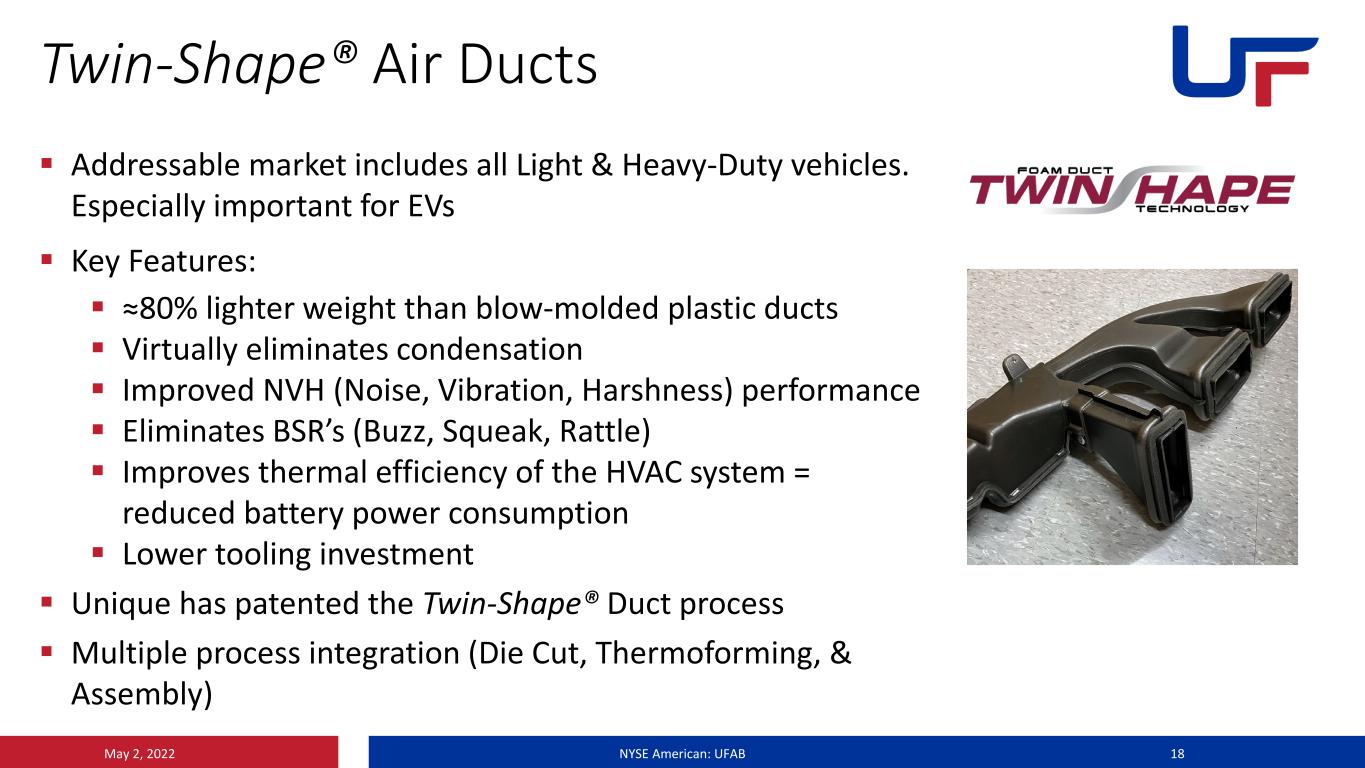

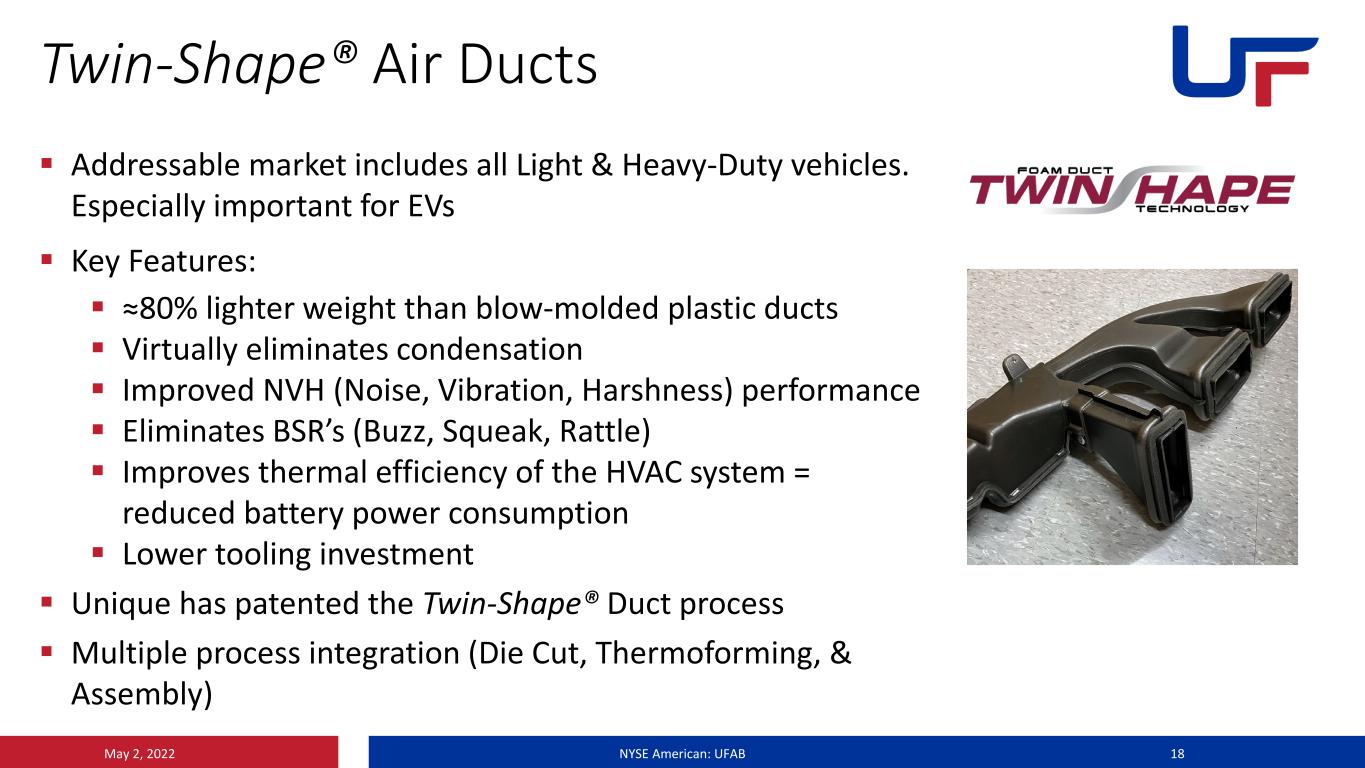

Twin-Shape® Air Ducts NYSE American: UFAB 18May 2, 2022 Addressable market includes all Light & Heavy-Duty vehicles. Especially important for EVs Key Features: ≈80% lighter weight than blow-molded plastic ducts Virtually eliminates condensation Improved NVH (Noise, Vibration, Harshness) performance Eliminates BSR’s (Buzz, Squeak, Rattle) Improves thermal efficiency of the HVAC system = reduced battery power consumption Lower tooling investment Unique has patented the Twin-Shape® Duct process Multiple process integration (Die Cut, Thermoforming, & Assembly)

Jacuzzi Spa Bulkhead Divider NYSE American: UFAB 19May 2, 2022 Addressable market includes consumer goods and medical device manufacturing Problem: Customer needs to fill space under spa tub with foam insulation but must contain the loose foam from escaping and contaminating the controls section. Foaming process must happen after tub assembly; thus, a flexible, but robust bulkhead is needed to separate tub insulation and control panel. Each spa model requires a different bulkhead design. Solution: Unique found a very flexible, but strong foam sheet. Laser cutting was used to quickly create multiple part SKUs on one machine; no tooling required. Bulkhead Divider Foam Divider in place separating tub and controls Tub Controls

Advanced Manufacturing Activities Laser CNC Cutting Key benefits: higher precision cuts (innovative), better material yields (optimization), eliminates dies (sustainability) First cell went operational in Q1 2022 with second cell becoming operational mid-2022 Reaction Injection Molding Robotics Key benefits: lower labor and more consistent quality (optimization), reduces usage of mold release (sustainability) First line in operation since Q4 2021 with additional lines becoming operational mid-2022 May 2, 2022 NYSE American: UFAB 20 L a s e r C N C C u t t i n g R I M R o b o t i c s

Serving Great Companies May 2, 2022 NYSE American: UFAB 21

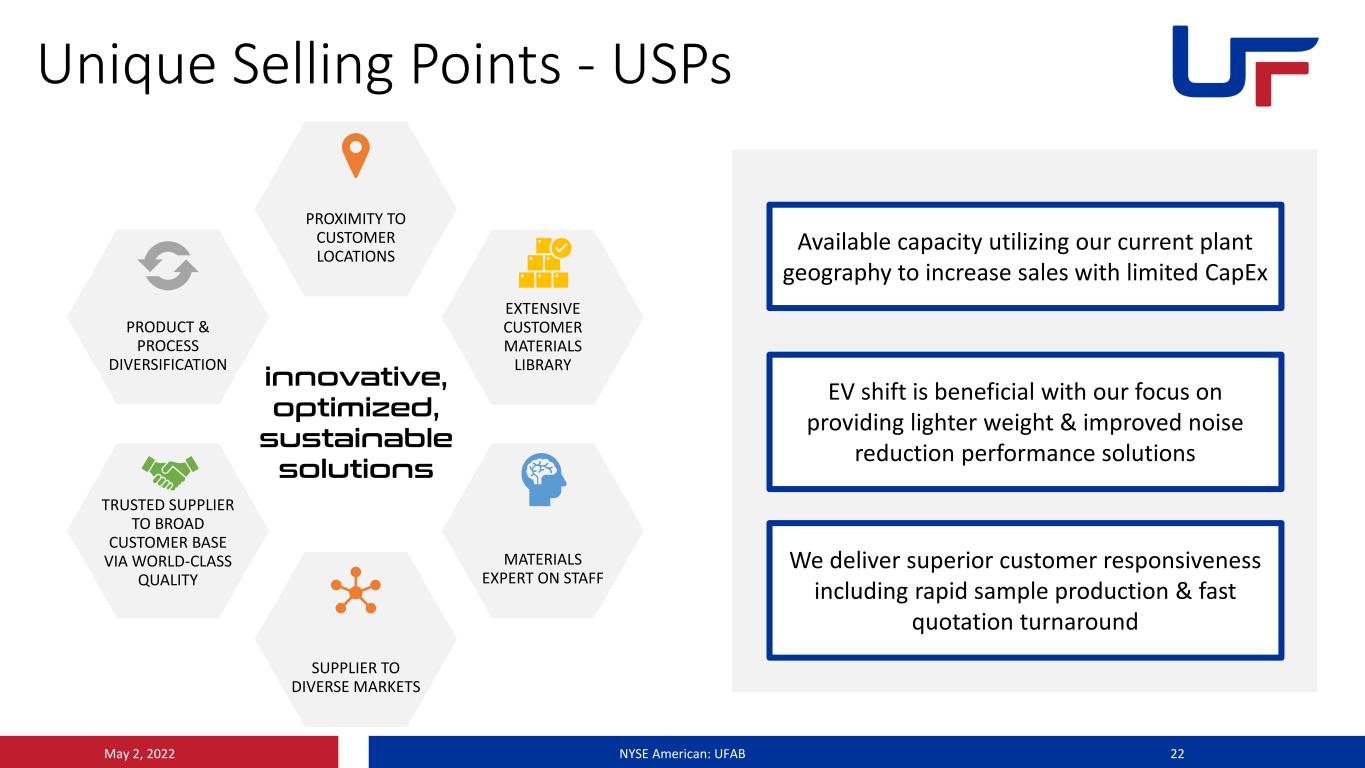

Unique Selling Points - USPs 22 We deliver superior customer responsiveness including rapid sample production & fast quotation turnaround May 2, 2022 NYSE American: UFAB EV shift is beneficial with our focus on providing lighter weight & improved noise reduction performance solutions Available capacity utilizing our current plant geography to increase sales with limited CapEx innovative, optimized, sustainable solutions PROXIMITY TO CUSTOMER LOCATIONS EXTENSIVE CUSTOMER MATERIALS LIBRARY MATERIALS EXPERT ON STAFF SUPPLIER TO DIVERSE MARKETS TRUSTED SUPPLIER TO BROAD CUSTOMER BASE VIA WORLD-CLASS QUALITY PRODUCT & PROCESS DIVERSIFICATION innovative, opti d, sust i ble solutions

Shareholder Value Realization May 2, 2022 NYSE American: UFAB 23 Grow OPERATING LEVERAGE LEADS TO INCREASED PROFITABILITY Reduce WORKING CAPITAL & SUPPLY CHAIN COSTS Unlock Shareholder Value Optimize PRODUCTIVITY, EFFICIENCY & MATERIAL UTILIZATION INTERNAL “SELF HELP” FOCUS PRESENTS GREATEST NEAR-TERM OPPORTUNITY TO UNLOCK SHAREHOLDER VALUE

Key Takeaways May 2, 2022 NYSE American: UFAB 24 Reduced fixed cost structure, improving operating efficiency & working capital optimization Highly capable leadership team with clear focus on near- term priorities & vision for future Transportation market conditions improving with expected longer-term growth & stability Market diversification initiative ongoing & gaining traction 1. 2. 3. 4.

Appendix May 2, 2022 NYSE American: UFAB 25

Quarterly Net Sales & Gross Profit May 2, 2022 NYSE American: UFAB 26 $8.3 $8.2 $7.2 $7.8 $5.6 $1.8 $8.2 $5.0 $5.9 $4.6 $3.3 $3.0 $ $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 (in m ill io ns ) Gross Profit (in millions) $39.5 $38.9 $38.6 $35.6 $34.7 $15.0 $35.6 $35.0 $34.8 $30.9 $29.9 $30.1 $ $5 $10 $15 $20 $25 $30 $35 $40 $45 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 (in m ill io ns ) Net Sales (in millions)

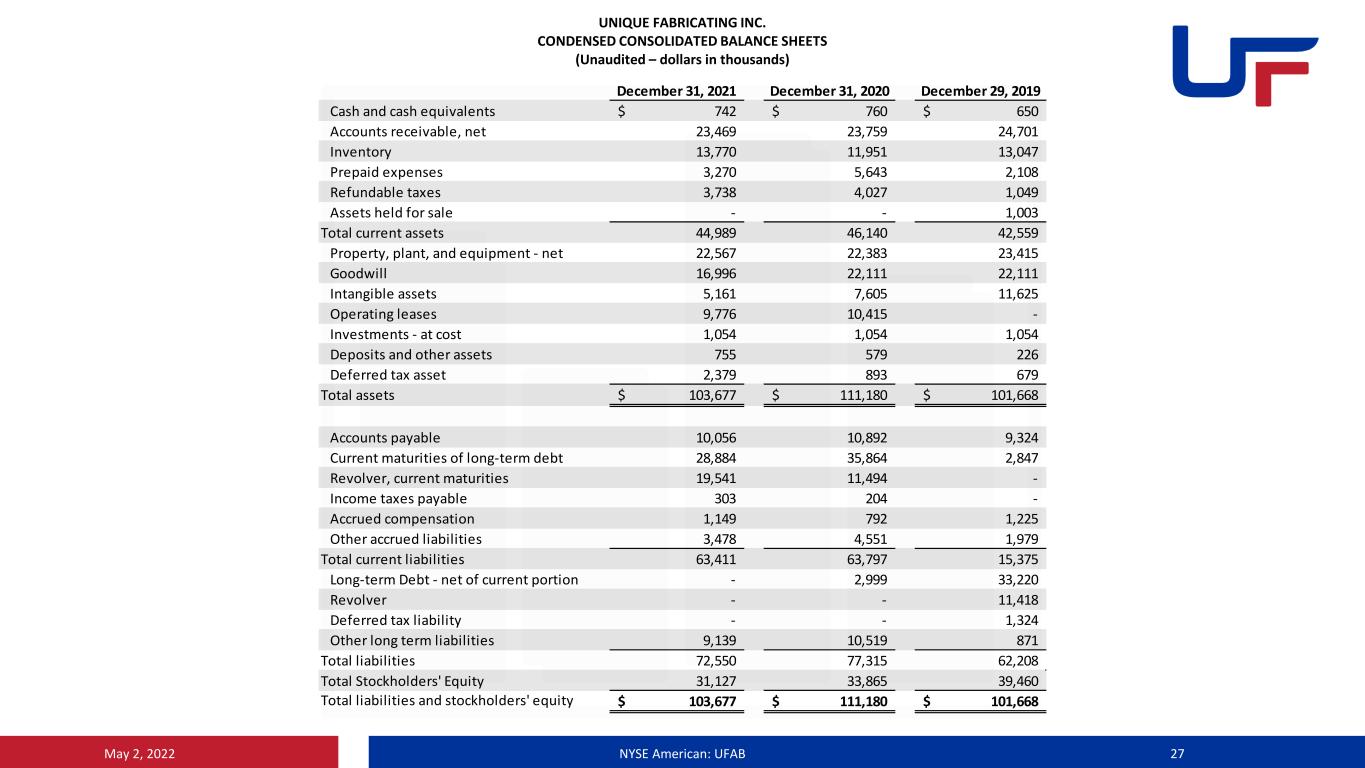

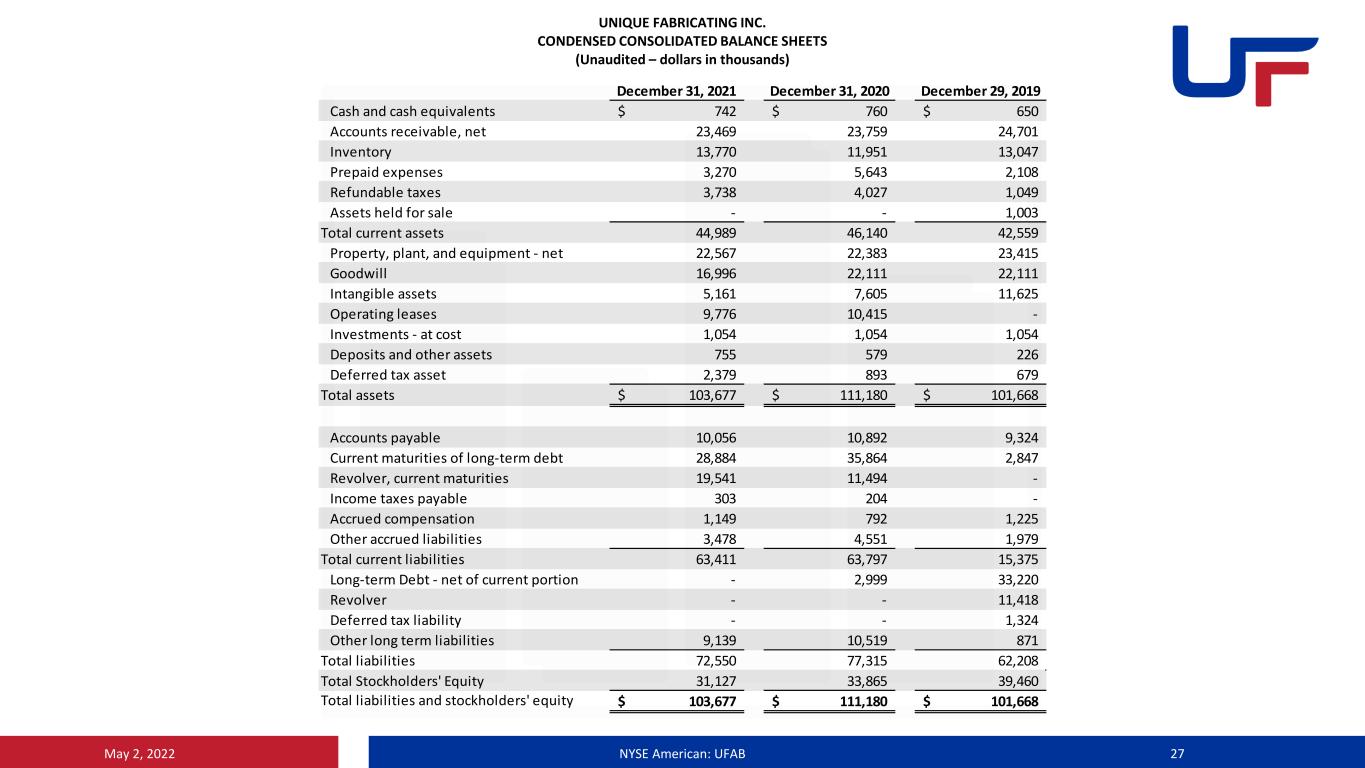

May 2, 2022 NYSE American: UFAB 27 UNIQUE FABRICATING INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited – dollars in thousands) December 31, 2021 December 31, 2020 December 29, 2019 Cash and cash equivalents 742$ 760$ 650$ Accounts receivable, net 23,469 23,759 24,701 Inventory 13,770 11,951 13,047 Prepaid expenses 3,270 5,643 2,108 Refundable taxes 3,738 4,027 1,049 Assets held for sale - - 1,003 Total current assets 44,989 46,140 42,559 Property, plant, and equipment - net 22,567 22,383 23,415 Goodwill 16,996 22,111 22,111 Intangible assets 5,161 7,605 11,625 Operating leases 9,776 10,415 - Investments - at cost 1,054 1,054 1,054 Deposits and other assets 755 579 226 Deferred tax asset 2,379 893 679 Total assets 103,677$ 111,180$ 101,668$ Accounts payable 10,056 10,892 9,324 Current maturities of long-term debt 28,884 35,864 2,847 Revolver, current maturities 19,541 11,494 - Income taxes payable 303 204 - Accrued compensation 1,149 792 1,225 Other accrued liabilities 3,478 4,551 1,979 Total current liabilities 63,411 63,797 15,375 Long-term Debt - net of current portion - 2,999 33,220 Revolver - - 11,418 Deferred tax liability - - 1,324 Other long term liabilities 9,139 10,519 871 Total liabilities 72,550 77,315 62,208 Total Stockholders' Equity 31,127 33,865 39,460 Total liabilities and stockholders' equity 103,677$ 111,180$ 101,668$

May 2, 2022 NYSE American: UFAB 28 UNIQUE FABRICATING INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited – dollars in thousands, except per share amounts) Year Ended Year Ended Year Ended December 31, 2021 December 31, 2020 December 29, 2019 Net sales 125,669$ 120,214$ 152,489$ Cost of sales 108,950 99,543 120,981 Gross profit 16,719 20,671 31,508 Selling, general, and administrative expense 22,566 25,484 26,751 Impairment 5,115 - 6,760 Restructuring expenses - 1,230 2,752 Operating income (loss) (10,962) (6,043) (4,755) Nonoperating income (expense) Other income 6,153 157 11 Interest expense (3,006) (3,608) (4,287) Other (expense) income, net 3,147 (3,451) (4,276) Loss before income taxes (7,815) (9,494) (9,031) Income tax expense (benefit) (852) (3,784) 37 Net loss (6,963)$ (5,710)$ (9,068)$ Net loss per share Basic (0.67)$ (0.58)$ (0.93)$ Diluted (0.67)$ (0.58)$ (0.93)$

May 2, 2022 NYSE American: UFAB 29 UNIQUE FABRICATING INC. CONDENSED CONSOLIDATED STATEMENTS OF CASHFLOWS (Unaudited – dollars in thousands) Year Ended December 31, 2021 Year Ended December 31, 2020 Year Ended December 29, 2019 Cash Flows from Operating Activities: Net loss (6,963)$ (5,710)$ (9,068)$ Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Impairment of goodwill 5,115 - 6,760 Inventory adjustment - - 1,742 Depreciation and amortization 5,599 7,085 6,863 Amortization of debt issuance costs 214 189 177 Loss (gain) on sale of assets (12) 464 68 Gain on extinguishment of debt (6,000) - - Bad debt expense (recovery) (307) 740 243 Loss (gain) on derivative instrument (625) 329 578 Stock option and warrant expense 388 115 129 Accrued in-kind interest on long term debt 121 - - Deferred income taxes (1,486) (1,539) (1,132) Changes in operating assets and liabilities that provided (used) cash: Accounts receivable 597 202 5,887 Inventory (1,819) 1,096 2,584 Prepaid expenses and other assets 2,486 (6,864) (570) Accounts payable (25) 1,236 (1,104) Other, net (935) 1287 (1,138) Net cash (used in) provided by operating activities (3,652) (1,370) 12,021 Cash Flows from Investing Activities: Purchases of property and equipment (3,429) (2,425) (2,759) Proceeds from sale of property and equipment 100 889 120 Net cash used in investing activities (3,329) (1,536) (2,639) Cash Flows from Financing Activities: Net change in bank overdraft (811) 332 (1,037) Proceeds from debt - - 1,300 Payments on term loans (4,200) (3,161) (3,350) Debt issuance costs - (151) - (Repayment) proceeds from revolving credit facilities, net 7,930 (3) (6,565) Distribution of cash dividends - - (489) Proceeds of PPP Note - 5,999 - Procceds from issuance of common stock and warrants 4,044 - - Net cash (used in) provided by financing activities 6,963 3,016 (10,141) Cash and Cash Equivalents: Net increase (decrease) in Cash and cash equivalents (18) 110 (760) Cash and Cash Equivalents - Beginning of period 760 650 1,410 Cash and Cash Equivalents - End of period 742$ 760$ 650$

Presenter Bios May 2, 2022 NYSE American: UFAB 30 Mr. Cain joined the Company on September 30, 2019, from Mubea Group (“Mubea”), a global market leader in the development and manufacture of automotive suspension, powertrain, and body components. Mr. Cain was employed by Mubea for over twelve years, including as the CEO of Mubea North America from January 2010 until June 2019 and as the Chief Commercial Officer from June 2019 to September 2019. Previous to Mubea, Mr. Cain worked at Alcoa Fujikura, and its successor company America Fujikura, a fiber optic telecommunications equipment wiring and connectivity service provider from 1997 to 2007 in a variety of executive management roles including Director of Finance, Director of Supply Chain, business unit General Manager, and Director of Compliance. Mr. Cain earned a Bachelor of Arts degree cum laude in Business Administration from Rhodes College and holds an active Certified Public Accountant license. Doug Cain President & CEO Mr. Loftus joined the Company on April 6, 2020, from Wabash National Corporation (“Wabash”), a publicly traded leader in the design and manufacturing of engineered solutions for the transportation, logistics, and distribution industries. Mr. Loftus was Wabash’s Corporate Controller since October 2018. Prior to Wabash, Mr. Loftus was the Corporate Controller for Horizon Global Corporation (“Horizon”), a publicly traded designer, manufacturer, and distributor of towing and trailering equipment from July 2015 to October 2018. Prior to Horizon, Mr. Loftus held various positions with TriMas Corporation, a diversified industrial manufacturer, from August 2009 to June 2015 including Controller for TriMas’ then subsidiary Cequent Performance Products, Inc., Segment Financial Manager, and Corporate Audit Manager. Mr. Loftus began his career in public accounting with Deloitte and Touche LLP. Mr. Loftus earned a Bachelor of Science in Business Administration in Accounting and a Master of Business Administration from Central Michigan University. Mr. Loftus is a Certified Public Accountant in the State of Michigan. Brian Loftus Chief Financial Officer

Contact Us Investor Relations | FNK IR Rob Fink rob@fnkir.com +1 (646) 809-0408 NYSE American: UFAB 31 innovative, optimized, sustainable solutions UniqueFab.com | NYSE: UFAB May 2, 2022