Free Writing Prospectus

Filed Pursuant To Rule 433

RegistrationNo. 333-206640

February 2, 2017

MarketWatch

Biggest gold ETF gets a sequel that removes

dollar headwind

By Ryan Vlastelica

Published: Jan 30, 2017 4:08 p.m. ET

Gold bugs are facing a mixed 2017.

Prices for the precious metal have risen thus far this year and are expected to stay in an uptrend as investors seek a measure of safety in an uncertain environment. At the same time, the U.S. dollar is also expected to rise as interest rates are hiked and the newly inaugurated President Donald Trump enacts fiscal stimulus policies that could stoke inflation.

The two trends, assuming they play out, could work against each other as gold and the dollar typically have an inverse relationship. According to data from State Street Global Advisors, gold priced in U.S. dollars fell 5% between the end of 2013 and the end of 2016, a period when the U.S. dollar index rose 25.5%. When priced in the euro, on the other hand, gold rose 25% over that period.

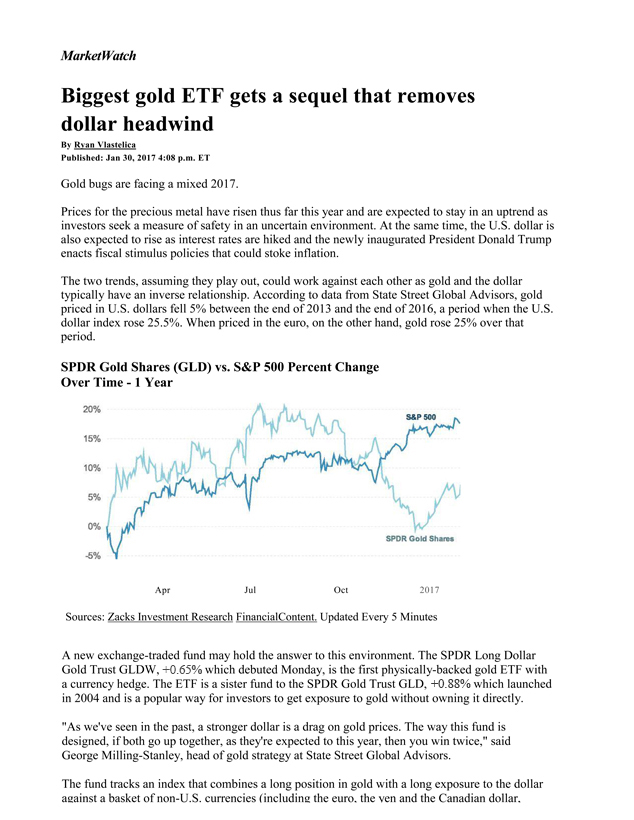

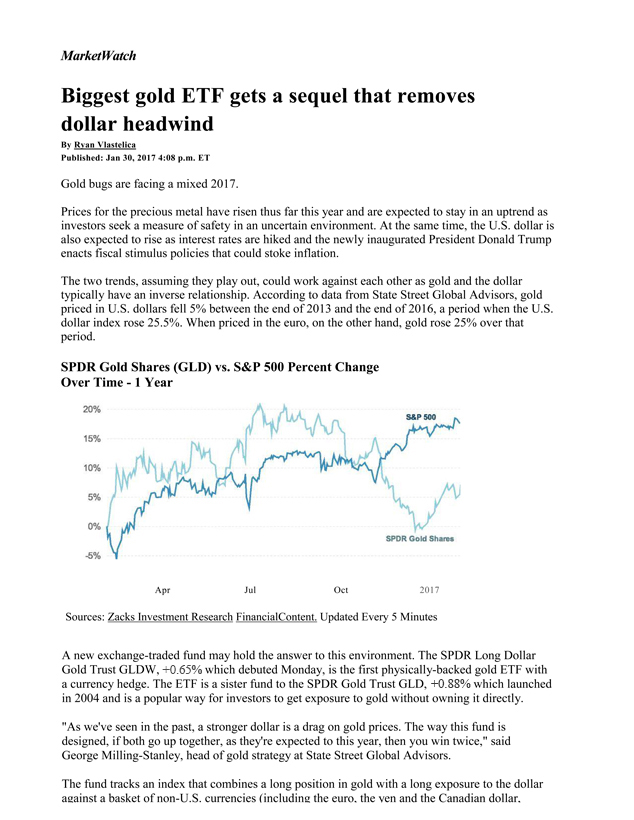

SPDR Gold Shares (GLD) vs. S&P 500 Percent Change

Over Time—1 Year

Apr Jul Oct 2017

Sources: Zacks Investment Research FinancialContent. Updated Every 5 Minutes

A new exchange-traded fund may hold the answer to this environment. The SPDR Long Dollar Gold Trust GLDW, +0.65% which debuted Monday, is the first physically-backed gold ETF with a currency hedge. The ETF is a sister fund to the SPDR Gold Trust GLD, +0.88% which launched in 2004 and is a popular way for investors to get exposure to gold without owning it directly. “As we’ve seen in the past, a stronger dollar is a drag on gold prices. The way this fund is designed, if both go up together, as they’re expected to this year, then you win twice,” said George Milling-Stanley, head of gold strategy at State Street Global Advisors.

The fund tracks an index that combines a long position in gold with a long exposure to the dollar

among others). The ETF is designed to rise when the price of gold in U.S. dollars rises, or when

the value of the dollar increases against its rivals.

The fund dipped 0.1% in its first day of trading, with about 104,000 shares exchanging hands. The SPDR Gold Trust rose 0.4% while gold prices GCZ7, +1.13% were up about 0.5%, extending theiryear-to-date rise to 3.7%. The U.S. dollar index DXY, -0.30% which is up about 2.2% over the past three months, was unchanged on the day.

Milling-Stanley forecast that gold, which currently trades around $1,194 an ounce but has long traded in a range of $1,050 to $1,350, could test the high end of that range and possibly break through it this year.

“The only thing I can see clearly is that this year will be marked by uncertainty, and that atmosphere will not dissipate anytime soon,” he said. “Meanwhile, equities have gone up for a long time and are starting to look fully or richly overdone, while bonds will of course suffer as yields rise. In an environment like that, gold is a logical place to turn.”

SPDR® Long Dollar Gold Trust (the “Fund”) has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offerings to which this communication relates. The Fund has also filed the prospectus with the National Futures Association. Before you invest, you should read the prospectus in the registration statement and other documents the Fund has filed with the SEC for more complete information about the Fund and these offerings. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Fund or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053.