The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and the Sponsor and the Trust are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | |

| PRELIMINARY PROSPECTUS | | Subject to Completion | | June 13, 2018 |

SPDR® Gold MiniSharesSM Trust — 80,000,000 SPDR® Gold MiniSharesSM

SPDR® GOLD MINISHARESSM TRUST, A SERIES OF WORLD GOLD TRUST

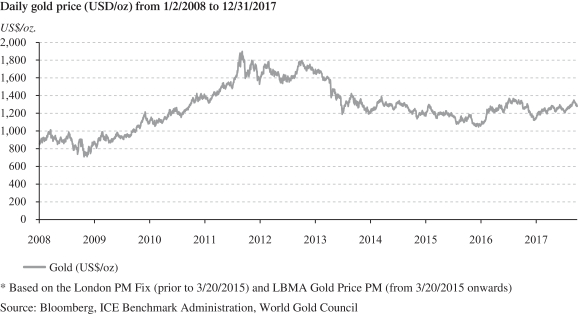

The World Gold Trust (the “Trust”) is organized as a Delaware statutory trust with multiple series. Each series of the Trust issues shares of beneficial interest, which represent units of fractional undivided beneficial interest in and ownership of such series only. A single series of the Trust, the SPDR® Gold MiniSharesSM Trust (also referred to as “GLDM”), is offered pursuant to this Prospectus. GLDM issues SPDR® Gold MiniSharesSM, which are referred to as “Shares” in this Prospectus, unless the context otherwise requires. References to “Series” refer to GLDM and/or the other Series of the Trust, as applicable. The investment objective of GLDM is for the Shares to reflect the performance of the price of gold bullion, less GLDM’s expenses. The assets of GLDM include only gold bullion, gold bullion receivables and cash, if any.

GLDM intends to issue Shares on a continuous basis. The Shares may be purchased from GLDM only in one or more blocks of 100,000 Shares (a block of 100,000 Shares is called a “Creation Unit”). GLDM will issue Shares in Creation Units to institutional investors referred to as “Authorized Participants” on an ongoing basis as described in “Plan of Distribution.” Creation Units will be offered continuously at the net asset value (“NAV”) for 100,000 Shares on the day that an order to create a Creation Unit is accepted by GLDM. GLDM Shares will be listed on NYSE Arca under the symbol “GLDM.”

GLDM is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended, and its sponsor is not subject to regulation by the Commodity Futures Trading Commission as a commodity pool operator with respect to GLDM or a commodity trading advisor with respect to GLDM.

WGC USA Asset Management Company, LLC is the Sponsor of the Trust (the “Sponsor”). The Trust was formed pursuant to an Agreement and Declaration of Trust dated as of August 27, 2014, as amended and restated on June 30, 2016 and further amended and restated on September 13, 2016, January 6, 2017 and April 16, 2018, between the Sponsor and the Trustee (referred to herein as the “Declaration of Trust”).

BNY Mellon Asset Servicing, a division of The Bank of New York Mellon, or “BNYM,” is the Administrator (the “Administrator”) and Transfer Agent (the “Transfer Agent”) of the Trust. BNYM also serves as the custodian of the Trust’s cash, if any. The Sponsor shall appoint ICBC Standard Bank Plc as the custodian (the “Custodian”) of the Trust’s Gold Bullion, as defined below. Delaware Trust Company is the trustee of the Trust (the “Trustee”). State Street Global Advisors Funds Distributors, LLC is the marketing agent of the Trust (the “Marketing Agent”).

The Trust is an “emerging growth company” subject to reduced public company reporting requirements under U.S. federal securities laws.

Investing in the Shares involves significant risks. See “Risk Factors” starting on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities offered in this Prospectus, or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

GLDM will issue and redeem Shares from time to time in Creation Units only to Authorized Participants in exchange for the delivery to GLDM, or the distribution by GLDM, of the amount of Gold Bullion represented by the Creation Units being created or redeemed. This amount is based on the combined NAV of the number of Shares included in the Creation Units being created or redeemed, as applicable, determined on the day the order to create or redeem Creation Units is accepted, as described in “Creation and Redemption of Shares.” The Shares will be sold to the public at varying prices to be determined by reference to, among other considerations, the price of gold and the trading price of the Shares on NYSE Arca at the time of each sale.

The Shares are neither interests in nor obligations of the Sponsor, the Trustee, the Administrator, the Transfer Agent, the Custodian, the Marketing Agent or their respective affiliates.

GLDM is offering up to $[XX] in Shares (the “Seed Creation Units”) through [XX], an affiliate of the Sponsor (also called the “Seed Capital Investor”), as underwriter. [The Seed Capital Investor and the Sponsor are under the common control of World Gold Council, an Association.] On [Date], the Seed Capital Investor, subject to conditions, purchased the Seed Creation Units at a per-Share price equal to [1/100th] of an ounce of gold, as described in “Seed Capital Investor” and “Plan of Distribution.” The price of gold was determined using the LBMA Gold Price PM on [Date]. The price per-Share and the LBMA Gold Price PM on [Date] were $[XX] and $[XX], respectively. Total proceeds to GLDM from the sale of the Seed Creation Units were [XX] ounces of gold. Delivery of the Seed Creation Units was made on [Date].

The price of the Seed Creation Units was determined as described above and such Shares could be sold at different prices if sold by the Seed Capital Investor at different times. Prior to this offering, there was no public market for the Shares.

The date of this Prospectus is [Date].