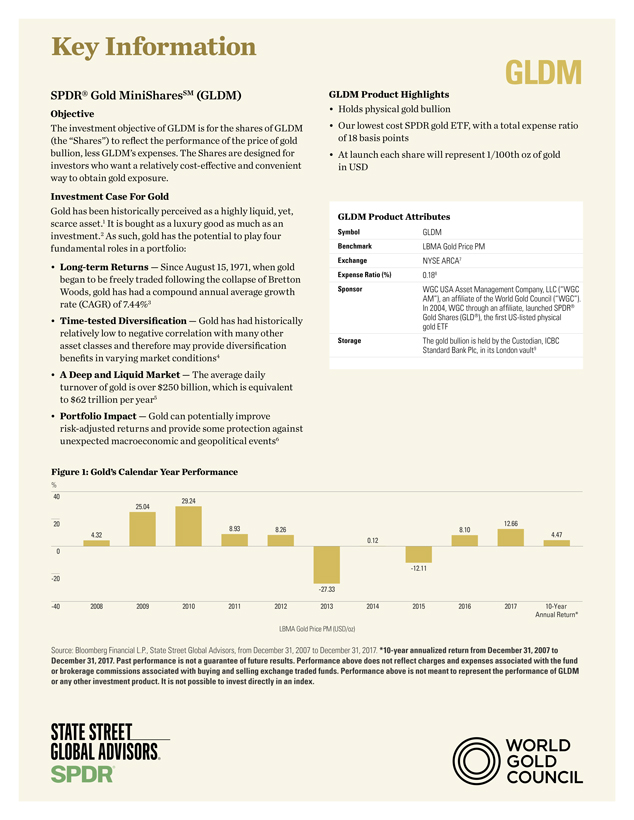

Key Information 1 Source: World Gold Council: Investment Update — Cryptocurrencies are no substitute for gold, Date as of January 25, 2018. 2 Source: World Gold Council: Gold Demand Trends Q2 2018, Date as of August 2, 2018. 3 Source: Bloomberg Financial, L.P., & State Street Global Advisors. Date as of September 30, 2018. 4 Data from September 30, 2008 to September 30, 2018. Gold’s correlation to S&P 500 Index, MSCI Japan Index and Bloomberg Barclay’s Aggregate Bond Index was 0.11,-0.16 and 0.44, respectively. Gold = LBMA Gold Price PM (USD/oz) Source: Bloomberg Finance, L.P., State Street Global Advisors. The correlation coefficient measures the strength and direction of a linear relationship between two variables. It measures the degree to which the deviations of one variable from its mean are related to those of a different variable from its respective mean with 0 being uncorrelated and 1 being perfectly correlated. 5 Source: A study carried out by London Bullion Market Association and overseen by the Bank of England and the Financial Conduct Authority; GFMS-Thomson Reuters, date as of December 31, 2017. 6 Source: World Gold Council — The Relevance of Gold as a Strategic Asset, Date as of January 23, 2018. 7 Minimum order is one share, and individual shareholders cannot interact directly with the fund under any circumstances. 8 This figure represents the fund’s gross expense ratio as well as its net expense ratio. A gross expense ratio is gross of any fee waivers or expense reimbursements. A net expense ratio is net of any fee waivers or expense reimbursements. 9 Unless otherwise agreed between GLDM and the Custodian, custody of the gold bullion deposited with and held for the account of GLDM is provided by the Custodian at its London, England vault or, when gold bullion has been allocated in a vault other than the Custodian’s London vault premises, by or for any subcustodian employed by the Custodian for the temporary custody and safekeeping of gold bullion until it can be transported to the Custodian’s London vault premises. Glossary Bretton Woods Agreement An agreement in 1944 that established a gold exchange standard for Western European nations and Japan once World War II was over. Under the pact, respective currencies were pegged to the US dollar and central banks could exchange dollar holdings into gold at the official exchange rate of $35 per ounce. In 1971, US President Richard Nixon terminated convertibility of the US dollar into gold, which marked the beginning of the floating fiat currency structure that remains in place today. The agreement is so named because it was negotiated in Bretton Woods, New Hampshire. Diversification A strategy of combining a broad mix of investments and asset class to potentially limit risk, although diversification does not guarantee protecting against a loss in falling markets. LBMA Gold Price The LBMA Gold Price is determined twice each business day (10:30 a.m. and 3:00 p.m. London time) by the participants in a physically settled, electronic and tradable auction. Return is anything a business or an investor reaps above principal amount of investment. Return is received in many different forms besides rising principal, such as interest and dividends. Return can also be linked to currencies, such as when a business holds foreign-currency savings accounts, In such cases, return includes the interest received and the benefit from the fluctuation of foreign currency rates. Risk The possibility that an investment’s return will differ from expected returns, especially the possibility of losing some or all of an investment. Risk is typically measured by calculating the standard deviation on historical, or average, returns of a given investment. Volatility The tendency of a market index or security to jump around in price. Volatility is typically expressed as the annualized standard deviation of returns. In modern portfolio theory, securities with higher volatility are generally seen as riskier due to higher potential losses. ssga.com | spdrgoldshares.com Important risk information Investing involves risk, and you could lose money on an investment in SPDR® Gold MiniSharesSM Trust (“GLDMSM”), a series of the World Gold Trust. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs’ net asset value. Brokerage commissions and ETF expenses will reduce returns. Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities. Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs. Diversification does not ensure a profit or guarantee against loss. Investing in commodities entails significant risk and is not appropriate for all investors. Important Information Relating to SPDR® Gold MiniSharesSM Trust (“GLDMSM”): The World Gold Trust has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the World Gold Trust has filed with the SEC for more complete information about GLDM and this offering. Please see the GLDM prospectus for a detailed discussion of the risks of investing in GLDM shares. The GLDM prospectus is available by clicking here. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053. GLDM is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders of GLDM do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA. GLDM shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of GLDM shares relates directly to the value of the gold held by GLDM (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. GLDM does not generate any income, and as GLDM regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Share will decline over time to that extent. The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council is not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of GLDM’s sponsor. MiniSharesSM and GLDMSM are service marks of WGC USA Asset Management Company, LLC used with the permission of WGC USA Asset Management Company, LLC. Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties makes any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto. For more information, please contact the Marketing Agent for GLDM: State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA, 02210; T: +1 866 320 4053 spdrgoldshares.com. © 2018 State Street Corporation. All Rights Reserved. State Street Global Advisors ID14464-2128578.1.2.AM.RTL 1018 Exp. Date: 01/31/2019