Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-206640

PROSPECTUS SUPPLEMENT NO. 3

(to Prospectus dated December 29, 2017, as supplemented by Prospectus Supplement No. 1 dated March 7, 2018 and Prospectus Supplement No. 2 dated April 20, 2018)

5,000,000 Shares of Beneficial Interest

SPDR® LONG DOLLAR GOLD TRUST, A SERIES OF WORLD GOLD TRUST

The World Gold Trust (the “Trust”) is organized as a Delaware statutory trust with multiple series. Each seriesof the Trust issues shares of beneficial interest, or Shares, which represent units of fractional undivided beneficial interest in and ownership of such series only. A single series of the Trust, the SPDR® Long Dollar Gold Trust, is offered pursuant to this Prospectus. Unless the context otherwise requires, references in this Prospectus to the “Fund” refer to the SPDR® Long Dollar Gold Trust. References to “Shares” refer to shares of the Fund. References to “Series” refer to the Fund and/or the other Series of the Trust, as applicable.

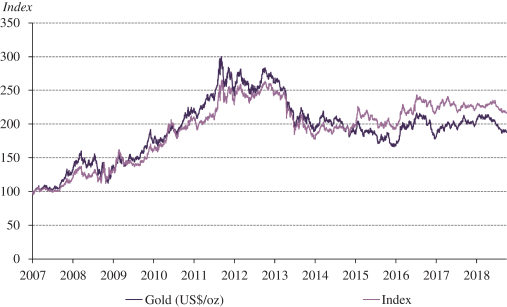

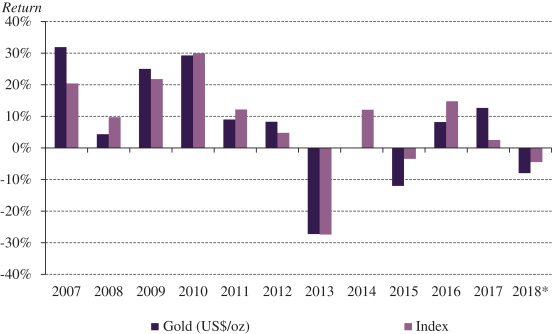

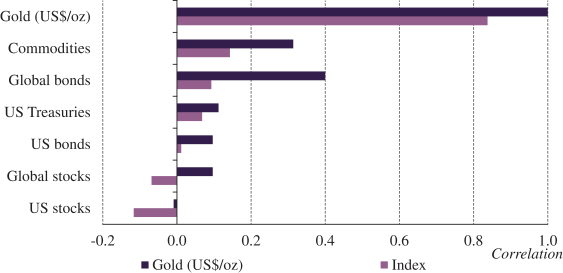

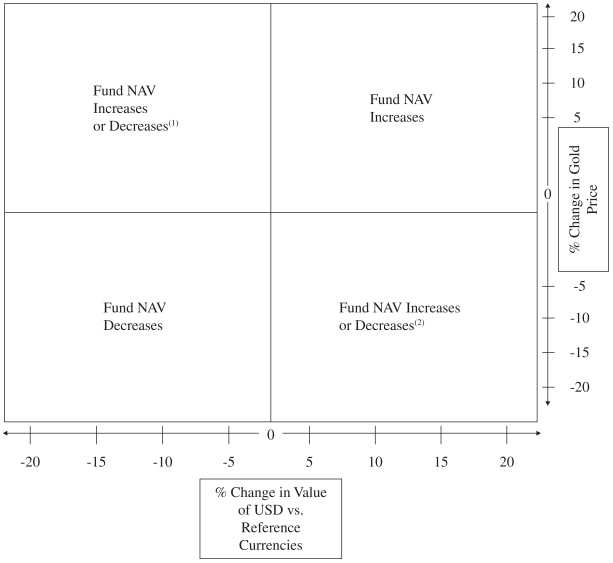

The Fund seeks to track the performance of the Solactive GLD® Long USD Gold Index (the “Index”), less fund expenses. The Index is a transparent, rules-based index published by Solactive AG (the “Index Provider”). The Index seeks to track the daily performance of a long position in physical gold (as represented by the Gold Price) and a short position in a basket (the “FX Basket”) ofnon-U.S. currencies (i.e., a long USD exposure versus the FX Basket). Thosenon-U.S. currencies consist of the following which are weighted according to the Index: euro, Japanese yen, British pound sterling, Canadian dollar, Swedish krona and Swiss franc (each, a “Reference Currency”). If the Gold Price increases and the value of the U.S. Dollar (“USD”) against the Reference Currencies comprising the FX Basket increases, the Index Level is intended to increase. Conversely, if the Gold Price decreases and the value of the USD against the Reference Currencies comprising the FX Basket declines, the Index Level is intended to decrease. In certain cases, the appreciation of the Gold Price or the depreciation of one or more of the Reference Currencies comprising the FX Basket may be offset by the appreciation of one or more of the Reference Currencies comprising the FX Basket or the depreciation of the Gold Price, as applicable. The net impact of these changes determines the value of the Fund on a daily basis. See the Risk Factor titled “The value of the Shares relates directly to the value of the gold and the value of the Reference Currencies comprising the FX Basket against the USD. Fluctuations in the price of gold and/or the value of the Reference Currencies comprising the FX Basket could materially adversely affect an investment in the Shares.”

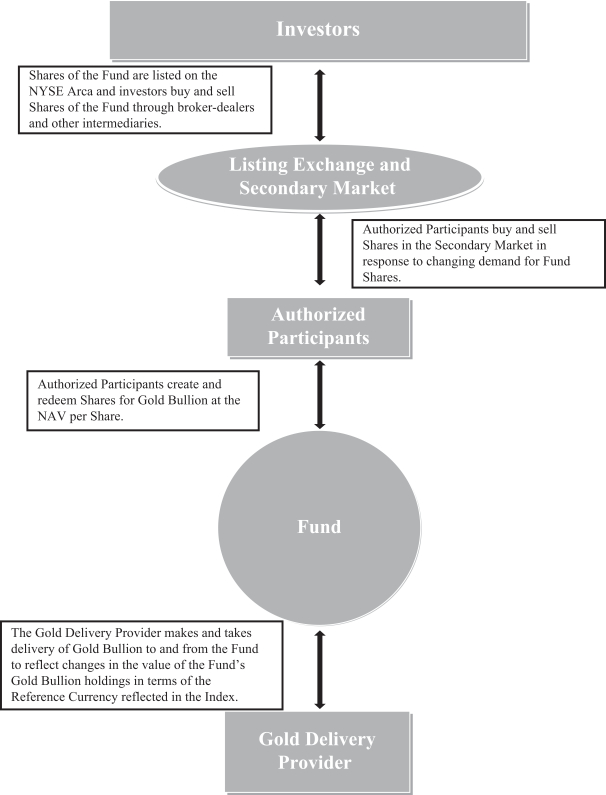

The Fund issues Shares on a continuous basis. The Shares may be purchased from the Fund only in one or more blocks of 1,000 Shares (a block of 1,000 Shares is called a “Creation Unit”). The Fund issues Shares in Creation Units to institutional investors referred to as “Authorized Participants” on an ongoing basis as described in “Plan of Distribution.” Creation Units are offered continuously at the net asset value (“NAV”) for 1,000 Shares on the day that an order to create a Creation Unit is accepted by the Fund. Fund Shares are listed on NYSE Arca under the symbol “GLDW.”

WGC USA Asset Management Company, LLC is the Sponsor of the Trust (the “Sponsor”) and is the Commodity Pool Operator (the “CPO”) of the Fund. The Trust was formed pursuant to an Agreement and Declaration of Trust dated as of August 27, 2014, as amended and restated on June 30, 2016 and further amended and restated on September 13, 2016 and January 6, 2017, between the Sponsor and the Trustee (referred to herein as the “Declaration of Trust”).

BNY Mellon Asset Servicing, a division of The Bank of New York Mellon (“BNYM”) is the Administrator (the “Administrator”) and Transfer Agent(the “Transfer Agent”) of the Trust. BNYM also serves as the custodian of the Trust’s cash, if any. HSBC Bank plc is the custodian (the “Custodian”) of the Trust’s Gold Bullion (as defined below). Merrill Lynch International is the Gold Delivery Provider to the Trust (the “Gold Delivery Provider”). Delaware Trust Company is the trustee of the Trust (the “Trustee”). State Street Global Advisors Funds Distributors, LLC is the marketing agent of the Trust (the “Marketing Agent”).

The Trust is an “emerging growth company” subject to reduced public company reporting requirements under U.S. federal securities laws.

Investing in the Shares involves significant risks. See “Risk Factors” starting on page 15.

Neither the Securities and Exchange Commission nor any state securities commissions have approved or disapproved of the securities offered in this Prospectus, or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

The Fund issues and redeems Shares from time to time in Creation Units only to Authorized Participants in exchange for the delivery to the Fund, or the distribution by the Fund, of the amount of Gold Bullion represented by the Creation Units being created or redeemed. This amount is based on the combined NAV of the number of Shares included in the Creation Units being created or redeemed, as applicable, determined on the day the order to create or redeem Creation Units is accepted, as described in “Creation and Redemption of Shares.” The Shares are sold to the public at varying prices to be determined by reference to, among other considerations, the price of gold, the price of the Reference Currencies and the trading price of the Shares on NYSE Arca at the time of each sale.

The Shares are neither interests in nor obligations of the Sponsor, the Trustee, the Administrator, the Transfer Agent, the Custodian, the Gold Delivery Provider, the Index Provider, the Marketing Agent or their respective affiliates.

The date of this Prospectus Supplement No. 3 is December 14, 2018.