At September 30, 2019, the amount of gold owned by GLDM was 707,501.2 ounces, with a market value of $1,050,857,504 (cost — $931,609,406) based on the LBMA Gold Price PM on September 30, 2019 (in accordance with the Declaration of Trust).

At September 30, 2019, the Custodian held 697,523.6 ounces of gold in its vault, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $1,036,031,998 (cost — $916,789,900). Subcustodians did not hold any gold in their vaults on behalf of GLDM.

Trading in the Shares of GLDM commenced on June 26, 2018. In the fiscal period ended September 30, 2018, 19,300,000 Shares (193 Creation Units) were created in exchange for 185,949.5 ounces of gold, and 22.5 ounces of gold were sold to pay Sponsor fees.

At September 30, 2018, the amount of gold owned by GLDM was 192,923.7 ounces, with a market value of $229,048,719 (cost — $235,263,994) based on the LBMA Gold Price PM on September 28, 2018 (in accordance with the Declaration of Trust).

At September 30, 2018, the Custodian held 185,927 ounces of gold in its vault, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $220,741,876 (cost — $226,957,150). Subcustodians did not hold any gold in their vaults on behalf of GLDM.

On September 19, 2019, Inspectorate International Limited concluded the annual full count of GLDM’s gold bullion held by the Custodian. On October 2, 2019, Inspectorate International Limited concluded reconciliation procedures from September 19, 2019 through September 30, 2019. The results can be found on www.spdrgoldshares.com.

Cash Flow from Operations

GLDM had no net cash flow from operations in the year ended September 30, 2019 and the fiscal period ended September 30, 2018. Cash received in respect of gold sold to pay expenses in the year ended September 30, 2019 and the fiscal period ended September 30, 2018 was the same as those expenses, resulting in a zero cash balance at September 30, 2019 and 2018.

Off-Balance

Sheet Arrangements

Neither GLDM nor the Trust is a party to any

off-balance

sheet arrangements.

Cash Resources and Liquidity

At September 30, 2019 and 2018 GLDM did not have any cash balances. When selling gold to pay expenses, GLDM endeavors to sell the exact amount of gold needed to pay expenses in order to minimize GLDM’s holdings of assets other than gold or any gold receivable. As a consequence, we expect that GLDM will not record any net cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

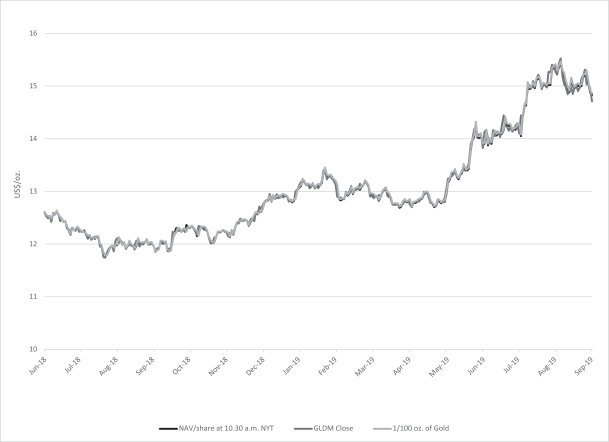

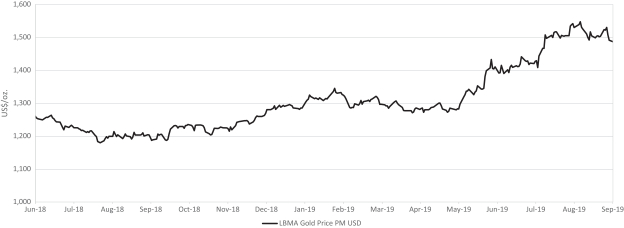

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Shares, it is important to understand the recent movements in the price of gold. However, past movements in the price of gold are not indicators of future movements.