As filed with the Securities and Exchange Commission on March 30, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

T-Mobile US, Inc.

T-Mobile USA, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | | | | 20-0836269 | |

Delaware | | | 4812 | | | 91-1983600 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Additional Registrants

(See Table of Additional Registrants on next page)

12920 SE 38th Street

Bellevue, Washington 98006

(425) 378-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David A. Miller

Executive Vice President,

General Counsel and Secretary

T-Mobile US, Inc.

12920 SE 38th Street

Bellevue, Washington 98006

(425) 378-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Daniel J. Bursky

Mark Hayek

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

(212) 859-8000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | | ☑ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☐ | | | Smaller reporting company | | | ☐ |

| | | | | Emerging growth company | | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | | Amount to be registered | | | Proposed maximum offering price per unit(1) | | | Proposed maximum aggregate offering price(1) | | | Amount of registration fee(2) |

3.500% Senior Secured Notes due 2025(3) | | | $3,000,000,000 | | | 100% | | | $3,000,000,000 | | | $327,300 |

Guarantees of the 3.500% Senior Secured Notes due 2025(4) | | | $3,000,000,000 | | | N/A | | | N/A | | | N/A |

1.500% Senior Secured Notes due 2026(3) | | | $1,000,000,000 | | | 100% | | | $1,000,000,000 | | | $109,100 |

Guarantees of the 1.500% Senior Secured Notes due 2026(4) | | | $1,000,000,000 | | | N/A | | | N/A | | | N/A |

3.750% Senior Secured Notes due 2027(3) | | | $4,000,000,000 | | | 100% | | | $4,000,000,000 | | | $436,400 |

Guarantees of the 3.750% Senior Secured Notes due 2027(4) | | | $4,000,000,000 | | | N/A | | | N/A | | | N/A |

2.050% Senior Secured Notes due 2028(3) | | | $1,750,000,000 | | | 100% | | | $1,750,000,000 | | | $190,925 |

Guarantees of the 2.050% Senior Secured Notes due 2028(4) | | | $1,750,000,000 | | | N/A | | | N/A | | | N/A |

3.875% Senior Secured Notes due 2030(3) | | | $7,000,000,000 | | | 100% | | | $7,000,000,000 | | | $763,700 |

Guarantees of the 3.875% Senior Secured Notes due 2030(4) | | | $7,000,000,000 | | | N/A | | | N/A | | | N/A |

2.550% Senior Secured Notes due 2031(3) | | | $2,500,000,000 | | | 100% | | | $2,500,000,000 | | | $272,750 |

Guarantees of the 2.550% Senior Secured Notes due 2031(4) | | | $2,500,000,000 | | | N/A | | | N/A | | | N/A |

2.250% Senior Secured Notes due 2031(3) | | | $1,000,000,000 | | | 100% | | | $1,000,000,000 | | | $109,100 |

Guarantees of the 2.250% Senior Secured Notes due 2031(4) | | | $1,000,000,000 | | | N/A | | | N/A | | | N/A |

4.375% Senior Secured Notes due 2040(3) | | | $2,000,000,000 | | | 100% | | | $2,000,000,000 | | | $218,200 |

Guarantees of the 4.375% Senior Secured Notes due 2040(4) | | | $2,000,000,000 | | | N/A | | | N/A | | | N/A |

3.000% Senior Secured Notes due 2041(3) | | | $2,500,000,000 | | | 100% | | | $2,500,000,000 | | | $272,750 |

Guarantees of the 3.000% Senior Secured Notes due 2041(4) | | | $2,500,000,000 | | | N/A | | | N/A | | | N/A |

4.500% Senior Secured Notes due 2050(3) | | | $3,000,000,000 | | | 100% | | | $3,000,000,000 | | | $327,300 |

Guarantees of the 4.500% Senior Secured Notes due 2050(4) | | | $3,000,000,000 | | | N/A | | | N/A | | | N/A |

3.300% Senior Secured Notes due 2051(3) | | | $3,000,000,000 | | | 100% | | | $3,000,000,000 | | | $327,300 |

Guarantees of the 3.300% Senior Secured Notes due 2051(4) | | | $3,000,000,000 | | | N/A | | | N/A | | | N/A |

3.600% Senior Secured Notes due 2060(3) | | | $1,000,000,000 | | | 100% | | | $1,000,000,000 | | | $109,100 |

Guarantees of the 3.600% Senior Secured Notes due 2060(4) | | | $1,000,000,000 | | | N/A | | | N/A | | | N/A |

Total | | | $31,750,000,000 | | | $3,463,925 | | | $31,750,000,000 | | | $3,463,925 |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(f) under the Securities Act of 1933, as amended. |

| (3) | The 3.500% Senior Secured Notes due 2025, the 1.500% Senior Secured Notes due 2026, the 3.750% Senior Secured Notes due 2027, the 2.050% Senior Secured Notes due 2028, the 3.875% Senior Secured Notes due 2030, the 2.550% Senior Secured Notes due 2031, the 2.250% Senior Secured Notes due 2031, the 4.375% Senior Secured Notes due 2040, the 3.000% Senior Secured Notes due 2041, the 4.500% Senior Secured Notes due 2050, the 3.300% Senior Secured Notes due 2051 and the 3.600% Senior Secured Notes due 2060 will be the obligations of T-Mobile USA, Inc. |

| (4) | T-Mobile US, Inc. and the registrants listed on the Table of Additional Registrants will guarantee the obligations of T-Mobile USA, Inc. under the 3.500% Senior Secured Notes due 2025, the 1.500% Senior Secured Notes due 2026, the 3.750% Senior Secured Notes due 2027, the 2.050% Senior Secured Notes due 2028, the 3.875% Senior Secured Notes due 2030, the 2.550% Senior Secured Notes due 2031, the 2.250% Senior Secured Notes due 2031, the 4.375% Senior Secured Notes due 2040, the 3.000% Senior Secured Notes due 2041, the 4.500% Senior Secured Notes due 2050, the 3.300% Senior Secured Notes due 2051 and the 3.600% Senior Secured Notes due 2060. The guarantees are not traded separately. Pursuant to Rule 457(n) under the Securities Act of 1933, as amended, no additional registration fee is due with respect to the guarantees. |

TABLE OF ADDITIONAL REGISTRANTS

Exact name of registrant as specified in its charter(1) | | | State or other jurisdiction of incorporation or organization | | | I.R.S. Employer Identification Number |

Alda Wireless Holdings, LLC | | | Delaware | | | 48-1165243 |

American Telecasting Development, LLC | | | Delaware | | | 84-1265444 |

American Telecasting of Anchorage, LLC | | | Delaware | | | 84-1262010 |

American Telecasting of Columbus, LLC | | | Delaware | | | 84-1262011 |

American Telecasting of Denver, LLC | | | Delaware | | | 84-1261970 |

American Telecasting of Fort Myers, LLC | | | Delaware | | | 59-3062505 |

American Telecasting of Ft. Collins, LLC | | | Delaware | | | 84-1261954 |

American Telecasting of Green Bay, LLC | | | Delaware | | | 84-1266405 |

American Telecasting of Lansing, LLC | | | Delaware | | | 84-1261958 |

American Telecasting of Lincoln, LLC | | | Delaware | | | 84-1261960 |

American Telecasting of Little Rock, LLC | | | Delaware | | | 84-1261961 |

American Telecasting of Louisville, LLC | | | Delaware | | | 84-1261962 |

American Telecasting of Medford, LLC | | | Delaware | | | 84-1295907 |

American Telecasting of Michiana, LLC | | | Delaware | | | 84-1261952 |

American Telecasting of Monterey, LLC | | | Delaware | | | 84-1266408 |

American Telecasting of Redding, LLC | | | Delaware | | | 84-1295911 |

American Telecasting of Santa Barbara, LLC | | | Delaware | | | 84-1261969 |

American Telecasting of Seattle, LLC | | | Delaware | | | 54-1540851 |

American Telecasting of Sheridan, LLC | | | Delaware | | | 84-1295909 |

American Telecasting of Yuba City, LLC | | | Delaware | | | 84-1295906 |

APC Realty and Equipment Company, LLC | | | Delaware | | | 52-2013278 |

Assurance Wireless of South Carolina, LLC | | | Delaware | | | Not applicable |

Assurance Wireless USA, L.P. | | | Delaware | | | 94-3410099 |

ATI Sub, LLC | | | Delaware | | | 26-2670017 |

Broadcast Cable, LLC | | | Delaware | | | 35-1751776 |

Clear Wireless LLC | | | Nevada | | | 26-3821888 |

Clearwire Communications LLC | | | Delaware | | | 26-3783012 |

Clearwire Hawaii Partners Spectrum, LLC | | | Nevada | | | Not applicable |

Clearwire IP Holdings LLC | | | New York | | | Not applicable |

Clearwire Legacy LLC | | | Delaware | | | 26-3791581 |

Clearwire Spectrum Holdings II LLC | | | Nevada | | | Not applicable |

Clearwire Spectrum Holdings III LLC | | | Nevada | | | Not applicable |

Clearwire Spectrum Holdings LLC | | | Nevada | | | Not applicable |

Clearwire XOHM LLC | | | Delaware | | | 26-3791783 |

Fixed Wireless Holdings, LLC | | | Delaware | | | 75-3120884 |

Fresno MMDS Associates, LLC | | | Delaware | | | Not applicable |

IBSV LLC | | | Delaware | | | 91-2116910 |

Kennewick Licensing, LLC | | | Delaware | | | 36-4165282 |

Layer3 TV, LLC | | | Delaware | | | 46-3757801 |

L3TV Chicagoland Cable System, LLC | | | Delaware | | | 32-0513278 |

L3TV Colorado Cable System, LLC | | | Delaware | | | 30-0960088 |

L3TV Dallas Cable System, LLC | | | Delaware | | | 61-1811814 |

L3TV DC Cable System, LLC | | | Delaware | | | 36-4854339 |

L3TV Detroit Cable System, LLC | | | Delaware | | | 36-4906175 |

L3TV Los Angeles Cable System, LLC | | | Delaware | | | 37-1852327 |

L3TV Minneapolis Cable System, LLC | | | Delaware | | | 32-0590383 |

L3TV New York Cable System, LLC | | | Delaware | | | 61-1854933 |

Exact name of registrant as specified in its charter(1) | | | State or other jurisdiction of incorporation or organization | | | I.R.S. Employer Identification Number |

L3TV Philadelphia Cable System, LLC | | | Delaware | | | 37-1906122 |

L3TV San Francisco Cable System, LLC | | | Delaware | | | 32-0575200 |

L3TV Seattle Cable System, LLC | | | Delaware | | | 36-4919336 |

MetroPCS California, LLC | | | Delaware | | | 68-0618381 |

MetroPCS Florida, LLC | | | Delaware | | | 68-0618383 |

MetroPCS Georgia, LLC | | | Delaware | | | 68-0618386 |

MetroPCS Massachusetts, LLC | | | Delaware | | | 20-8303630 |

MetroPCS Michigan, LLC | | | Delaware | | | 20-2509038 |

MetroPCS Networks California, LLC | | | Delaware | | | 20-4956821 |

MetroPCS Networks Florida, LLC | | | Delaware | | | 20-4957100 |

MetroPCS Nevada, LLC | | | Delaware | | | 20-8303430 |

MetroPCS New York, LLC | | | Delaware | | | 20-8303519 |

MetroPCS Pennsylvania, LLC | | | Delaware | | | 20-8303570 |

MetroPCS Texas, LLC | | | Delaware | | | 20-2508993 |

MinorCo, LLC | | | Delaware | | | 48-1165243 |

Nextel Communications of the Mid-Atlantic, Inc. | | | Delaware | | | 52-1653244 |

Nextel of New York, Inc. | | | Delaware | | | 22-3130302 |

Nextel Retail Stores, LLC | | | Delaware | | | 54-2021574 |

Nextel South Corp. | | | Georgia | | | 58-2038468 |

Nextel Systems, LLC | | | Delaware | | | 54-1878330 |

Nextel West Corp. | | | Delaware | | | 84-1116272 |

NSAC, LLC | | | Delaware | | | 54-1879079 |

PCTV Gold II, LLC | | | Delaware | | | 06-1419676 |

PCTV Sub, LLC | | | Delaware | | | 26-2671511 |

People’s Choice TV of Houston, LLC | | | Delaware | | | 74-2629878 |

People’s Choice TV of St. Louis, LLC | | | Delaware | | | 43-1654858 |

PRWireless PR, LLC | | | Delaware | | | 20-5942061 |

PushSpring, Inc. | | | Delaware | | | 46-2545203 |

SFE 1, LLC | | | Delaware | | | 46-5109647 |

SIHI New Zealand Holdco, Inc. | | | Kansas | | | 73-1651896 |

SpeedChoice of Detroit, LLC | | | Delaware | | | 06-1419673 |

SpeedChoice of Phoenix, LLC | | | Delaware | | | 86-0771395 |

Sprint (Bay Area), LLC | | | Delaware | | | 59-3155549 |

Sprint Capital Corporation | | | Delaware | | | 48-1132866 |

Sprint Communications Company L.P. | | | Delaware | | | 43-1408007 |

Sprint Communications Company of New Hampshire, Inc. | | | New Hampshire | | | 43-1532102 |

Sprint Communications Company of Virginia, Inc. | | | Virginia | | | 75-2019023 |

Sprint Communications, Inc. | | | Kansas | | | 48-0457967 |

Sprint Corporation | | | Delaware | | | 46-1170005 |

Sprint eBusiness, Inc. | | | Kansas | | | 48-1219671 |

Sprint Enterprise Network Services, Inc. | | | Kansas | | | 74-2845682 |

Sprint eWireless, Inc. | | | Kansas | | | 48-1238831 |

Sprint International Communications Corporation | | | Delaware | | | 04-2509782 |

Sprint International Holding, Inc. | | | Kansas | | | 74-2808272 |

Sprint International Incorporated | | | Delaware | | | 13-3020365 |

Sprint International Network Company LLC | | | Delaware | | | Not applicable |

Sprint PCS Assets, L.L.C. | | | Delaware | | | 33-0783958 |

Sprint Solutions, Inc. | | | Delaware | | | 47-0882463 |

Sprint Spectrum Holding Company, LLC | | | Delaware | | | 48-1165242 |

Exact name of registrant as specified in its charter(1) | | | State or other jurisdiction of incorporation or organization | | | I.R.S. Employer Identification Number |

Sprint Spectrum L.P. | | | Delaware | | | 48-1165245 |

Sprint Spectrum Realty Company, LLC | | | Delaware | | | 43-1746021 |

Sprint/United Management Company | | | Kansas | | | 48-1077227 |

SprintCom, Inc. | | | Kansas | | | 48-1187511 |

T-Mobile Central LLC | | | Delaware | | | 91-1973799 |

T-Mobile Financial LLC | | | Delaware | | | 47-1324347 |

T-Mobile Innovations LLC | | | Delaware | | | Not applicable |

T-Mobile Leasing LLC | | | Delaware | | | 47-5079638 |

T-Mobile License LLC | | | Delaware | | | 91-1917328 |

T-Mobile Northeast LLC | | | Delaware | | | 52-2069434 |

T-Mobile PCS Holdings LLC | | | Delaware | | | 91-2159335 |

T-Mobile Puerto Rico Holdings LLC | | | Delaware | | | 20-2209577 |

T-Mobile Puerto Rico LLC | | | Delaware | | | 66-0649631 |

T-Mobile Resources LLC | | | Delaware | | | 91-1909782 |

T-Mobile South LLC | | | Delaware | | | 20-3945483 |

T-Mobile West LLC | | | Delaware | | | 36-4027581 |

TDI Acquisition Sub, LLC | | | Delaware | | | 26-2671363 |

Theory Mobile, Inc. | | | Delaware | | | 81-2501674 |

TMUS International LLC | | | Delaware | | | 91-2116909 |

Transworld Telecom II, LLC | | | Delaware | | | 26-2670333 |

TVN Ventures LLC | | | Delaware | | | Not applicable |

USST of Texas, Inc. | | | Texas | | | 43-1499027 |

Utelcom LLC | | | Kansas | | | 48-0940607 |

VMU GP, LLC | | | Delaware | | | Not applicable |

WBS of America, LLC | | | Delaware | | | 26-2671254 |

WBS of Sacramento, LLC | | | Delaware | | | 36-3939511 |

WBSY Licensing, LLC | | | Delaware | | | 36-4046585 |

WCOF, LLC | | | Delaware | | | 26-2436251 |

Wireless Broadband Services of America, L.L.C. | | | Delaware | | | 36-4196556 |

Wireline Leasing Co., Inc. | | | Delaware | | | 26-3945313 |

| (1) | The address of each registrant is 12920 SE 38th Street, Bellevue, Washington 98006, and the telephone number is (425) 378-4000. |

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 30, 2021PRELIMINARY PROSPECTUS

T-Mobile USA, Inc.

OFFER TO EXCHANGE ITS

3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026,

3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028,

3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031,

2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040,

3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050,

3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060

that have been registered under the Securities Act of 1933, as amended (the “Securities Act”),

FOR AN EQUAL AMOUNT OF ITS OUTSTANDING

3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026,

3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028,

3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031,

2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040,

3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050,

3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060,

as applicable, that were issued and sold in transactions exempt from registration under the Securities Act.

T-Mobile USA, Inc., a Delaware corporation (“T-Mobile USA” or the “Issuer”) and a direct wholly-owned subsidiary of T-Mobile US, Inc. (“T-Mobile US” or “Parent”), hereby offers to exchange, upon the terms and conditions set forth in this prospectus and the accompanying letter of transmittal, up to $3,000,000,000 in aggregate principal amount of its 3.500% Senior Secured Notes due 2025 (the “2025 Exchange Notes”), $1,000,000,000 in aggregate principal amount of its 1.500% Senior Secured Notes due 2026 (the “2026 Exchange Notes”), $4,000,000,000 in aggregate principal amount of its 3.750% Senior Secured Notes due 2027 (the “2027 Exchange Notes”), $1,750,000,000 in aggregate principal amount of its 2.050% Senior Secured Notes due 2028 (the “2028 Exchange Notes”), $7,000,000,000 in aggregate principal amount of its 3.875% Senior Secured Notes due 2030 (the “2030 Exchange Notes”), $2,500,000,000 in aggregate principal amount of its 2.550% Senior Secured Notes due 2031 (the “February 2031 Exchange Notes”), $1,000,0000,000 in aggregate principal amount of its 2.250% Senior Secured Notes due 2031 (the “November 2031 Exchange Notes”), $2,000,000,000 in aggregate principal amount of its 4.375% Senior Secured Notes due 2040 (the “2040 Exchange Notes”), $2,500,000,000 in aggregate principal amount of its 3.000% Senior Secured Notes due 2041 (the “2041 Exchange Notes”), $3,000,000,000 in aggregate principal amount of its 4.500% Senior Secured Notes due 2050 (the “2050 Exchange Notes”), $3,000,000,000 in aggregate principal amount of its 3.300% Senior Secured Notes due 2051 (the “2051 Exchange Notes”), and $1,000,000,000 in aggregate principal amount of its 3.600% Senior Secured Notes due 2060 (the “2060 Exchange Notes” and, together with the 2025 Exchange Notes, the 2026 Exchange Notes, the 2027 Exchange Notes, the 2028 Exchange Notes, the 2030 Exchange Notes, the February 2031 Exchange Notes, the November 2031 Exchange Notes, the 2040 Exchange Notes, the 2041 Exchange Notes, the 2050 Exchange Notes and the 2051 Exchange Notes, the “Exchange Notes”) for an equal amount of its outstanding 3.500% Senior Secured Notes due 2025 (the “2025 Original Notes”), 1.500% Senior Secured Notes due 2026 (the “2026 Original Notes”), 3.750% Senior Secured Notes due 2027 (the “2027 Original Notes”), 2.050% Senior Secured Notes due 2028 (the “2028 Original Notes”), 3.875% Senior Secured Notes due 2030 (the “2030 Original Notes”), 2.550% Senior Secured Notes due 2031 (the “February 2031 Original Notes”), 2.250% Senior Secured Notes due 2031 (the “November 2031 Original Notes”), 4.375% Senior Secured Notes due 2040 (the “2040 Original Notes”), 3.000% Senior Secured Notes due 2041 (the “2041 Original Notes”), 4.500% Senior Secured Notes due 2050 (the “2050 Original Notes”), 3.300% Senior Secured Notes due 2051 (the “2051 Original Notes”) and 3.600% Senior Secured Notes due 2060 (the “2060 Original Notes” and together with the 2025 Original Notes, the 2026 Original Notes, the 2027 Original Notes, the 2028 Original Notes, the 2030 Original Notes, the February 2031 Original Notes, the November 2031 Original Notes, the 2040 Original Notes, the 2041 Original Notes, the 2050 Original Notes and the 2051 Original Notes, the “Original Notes”). We refer to the Original Notes and the Exchange Notes, collectively, as the “Notes.”

The Issuer’s obligations under the Original Notes are, and under the Exchange Notes will be, guaranteed (such guarantees, the “Guarantees”) by T-Mobile US and each wholly-owned subsidiary of the Issuer that is not an Excluded Subsidiary and is or becomes an obligor of the Credit Agreement (as defined herein) or issues or guarantees certain capital markets debt securities, other than certain Excluded Subsidiaries that do not guarantee the Original Notes and will not guarantee the Exchange Notes, and any future direct or indirect subsidiary of T-Mobile US or any subsidiary thereof that owns capital stock of the Issuer. The Guarantees are provided (in the case of the Original Notes) and will be provided (in the case of the Exchange Notes) on a senior secured basis except for the Unsecured Guarantees of Sprint Corporation, Sprint Communications, Inc. and Sprint Capital Corporation (the “Unsecured Guarantors”), which are provided (in the case of the Original Notes) and will be provided (in the case of Exchange Notes) on a senior unsecured basis (the “Unsecured Guarantees”).

The Original Notes and the Guarantees thereof are, and the Exchange Notes and the Guarantees thereof will be, the Issuer’s and the guarantors’ unsubordinated obligations; secured (except for the Unsecured Guarantees) by a first priority security interest, subject to permitted liens, in substantially all of the Issuer’s and such guarantors’ present and future assets other than Excluded Assets (as defined herein) on an equal and ratable basis with the obligations under the Credit Agreement and obligations under any other existing and future permitted first priority secured obligations; senior in right of payment to any future indebtedness of the Issuer or any guarantor to the extent that such future indebtedness provides by its terms that it is subordinated in right of payment to the Notes and the Guarantees; effectively senior to all existing and future unsecured indebtedness of the Issuer or any guarantor (other than the Unsecured Guarantors) and any future indebtedness of the Issuer or any guarantor (other than the Unsecured Guarantors) secured by a junior lien on the collateral, in each case to the extent of the value of the collateral securing the obligations under the Notes; equal in right of payment with any of the Issuer’s and the guarantors’ existing and future indebtedness and other liabilities that are not by their terms subordinated in right of payment to the Notes, including, without limitation, obligations under the Credit Agreement, the Existing T-Mobile Unsecured Notes (as defined herein) and the Existing Sprint Unsecured Notes (as defined herein); and structurally subordinated to all of the liabilities and other obligations of the subsidiaries of T-Mobile US that are not obligors with respect to the Notes, including the Existing Sprint Spectrum-Backed Notes (as defined herein), factoring arrangements and tower obligations. Assets excluded from the collateral securing the Notes will include, among other things, Permitted Receivables Financing Assets (as defined herein). In addition, the Sprint Spectrum Portfolio (as defined herein) securing the existing Sprint Spectrum-Backed Notes is pledged to secure such indebtedness and does not secure the Original Notes and will not secure the Exchange Notes.

The terms of the Exchange Notes are substantially identical to the terms of the Original Notes, except that the Exchange Notes will generally be freely transferable and do not contain certain terms with respect to registration rights and additional interest. The Exchange Notes will be issued under the indentures governing the Original Notes. For a description of the principal terms of the Exchange Notes, see “Description of Notes.”

The exchange offer will expire at 5:00 p.m., New York City time, on , 2021, unless we extend the offer. At any time prior to the expiration time, you may withdraw your tender of any Original Notes; otherwise, such tender is irrevocable. We will receive no cash proceeds from the exchange offer.

The Exchange Notes constitute new issues of securities for which there is no established trading market. Any Original Notes not tendered and accepted in the exchange offer will remain outstanding. To the extent Original Notes are tendered and accepted in the exchange offer, your ability to sell untendered, and tendered but unaccepted, Original Notes could be adversely affected. Following consummation of the exchange offer, the Original Notes will continue to be subject to their existing transfer restrictions and we will generally have no further obligations to provide for the registration of the Original Notes under the Securities Act. We cannot guarantee that an active trading market will develop or give assurances as to the liquidity of the trading market for either the Original Notes or the Exchange Notes. We do not intend to apply for listing of either the Original Notes or the Exchange Notes on any exchange or market.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act (or, to the extent permitted by law, make available a prospectus meeting the requirements of the Securities Act to purchasers) in connection with any resale of such Exchange Notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of the Exchange Notes received in exchange for the Original Notes where such Original Notes were acquired by such broker-dealer as a result of market-making or other trading activities. We have agreed that, for a period of 90 days following the effective date of the registration statement of which this prospectus forms a part, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Investing in the Exchange Notes involves certain risks. Please read “Risk Factors” beginning on page 17 of this prospectus.

This prospectus and the letter of transmittal are first being mailed to all holders of the Original Notes on or about , 2021.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021.

This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. Documents incorporated by reference are available from us without charge upon written or oral request. Any person, including any beneficial owner, to whom this prospectus is delivered may obtain documents incorporated by reference in, but not delivered with, this prospectus by requesting them by telephone or in writing at the following address:

T-Mobile US, Inc.

12920 SE 38th Street

Bellevue, Washington 98006

(425) 378-4000

Attn.: Investor Relations

To obtain timely delivery, you must request these documents no later than five business days before the expiration time of the exchange offer, or , 2021.

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide you with information different from that contained in this prospectus. We are offering to exchange Original Notes for Exchange Notes only in jurisdictions where such offer is permitted. You should not assume that the information in the incorporated documents or this prospectus is accurate as of any other date other than the date on the front of these documents.

Unless stated otherwise or the context indicates otherwise, references to “T-Mobile,” the “Company,” “our Company,” “we,” “our,” “ours” and “us” refer to T-Mobile US, Inc. together with its direct and indirect domestic subsidiaries, including T-Mobile USA and its subsidiaries and, on and after April 1, 2020, Sprint Corporation, a Delaware corporation (“Sprint”) and its subsidiaries. References to “T-Mobile USA” and the “Issuer” refer to T-Mobile USA, Inc. only. T-Mobile USA’s corporate parent is T-Mobile US, Inc., which we refer to in this prospectus on a stand-alone basis as “T-Mobile US” or “Parent.” T-Mobile US has no operations separate from its investment in T-Mobile USA. Accordingly, unless otherwise noted, all of the business and financial information in this prospectus, including the factors identified under “Risk Factors” beginning on page 17, is presented for Parent on a consolidated basis.

No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained or incorporated by reference in this prospectus in connection with the exchange offer, and, if given or made, such information or representations must not be relied upon as having been authorized by T-Mobile. This prospectus does not constitute an offer of any securities other than those to which it relates or an offer or a solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation in such jurisdiction. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstance create an implication that there has been no change in the affairs of our Company since the date hereof of this prospectus.

i

Certain statements in this prospectus, the documents incorporated by reference or our other public statements include forward-looking statements. All statements, other than statements of historical fact, including information concerning our future results of operations, are forward-looking statements. These forward-looking statements are generally identified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could” or similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. The following important factors, along with the risk factors identified under “Risk Factors” and the risk factors incorporated by reference herein, could affect future results and cause those results to differ materially from those expressed in the forward-looking statements:

| • | natural disasters, public health crises, including the COVID-19 pandemic, terrorist attacks or similar incidents; |

| • | adverse economic, political or market conditions in the U.S. and international markets, including those caused by the COVID-19 pandemic; |

| • | competition, industry consolidation and changes in the market condition for wireless services; |

| • | data loss or other security breaches; |

| • | the scarcity and cost of additional wireless spectrum, and regulations relating to spectrum use; |

| • | our inability to retain or motivate key personnel, hire qualified personnel or maintain our corporate culture; |

| • | our inability to take advantage of technological developments on a timely basis; |

| • | system failures and business disruptions, allowing for unauthorized use of or interference with our network and other systems; |

| • | the impacts of the actions we have taken and conditions we have agreed to in connection with the regulatory proceedings and approvals of the Transactions (as defined below), including the prepaid transaction, the complaint and proposed final judgment (the “Consent Decree”) agreed to by us, Deutsche Telekom AG (“DT”), Sprint, SoftBank Group Corp. (“SoftBank”) and DISH Network Corporation (“DISH”) with the U.S. District Court for the District of Columbia, which was approved by the Court on April 1, 2020, the proposed commitments filed with the Secretary of the Federal Communications Commission (“FCC”), which we announced on May 20, 2019, certain national security commitments and undertakings, and any other commitments or undertakings entered into including but not limited to those we have made to certain states and nongovernmental organizations (collectively, the “Government Commitments”), and the challenges in satisfying the Government Commitments in the required time frames and the significant cumulative cost incurred in tracking, monitoring and complying with them; |

| • | our inability to manage the ongoing commercial and transition services arrangements that we entered into with DISH in connection with the prepaid transaction, which we completed on July 1, 2020, and known or unknown liabilities arising in connection therewith; |

| • | the effects of any future acquisition, investment, or merger involving us; |

| • | any disruption or failure of our third parties (including key suppliers) to provide products or services for the operation of our business; |

| • | the occurrence of high fraud rates or volumes related to device financing, customer payment cards, third-party dealers, employees, subscriptions, identities or account takeover fraud; |

| • | our substantial level of indebtedness and our inability to service our debt obligations in accordance with their terms or to comply with the restrictive covenants contained therein; |

| • | adverse changes in the ratings of our debt securities or adverse conditions in the credit markets; |

iii

| • | the risk of future material weaknesses we may identify while we work to integrate and align policies, principles and practices of the two companies following the Merger (as defined below), or any other failure by us to maintain effective internal controls, and the resulting significant costs and reputational damage; |

| • | any changes in regulations or in the regulatory framework under which we operate; |

| • | laws and regulations relating to the handling of privacy and data protection; |

| • | unfavorable outcomes of existing or future legal proceedings; |

| • | our offering of regulated financial services products and exposure to a wide variety of state and federal regulations; |

| • | new or amended tax laws or regulations or administrative interpretations and judicial decisions affecting the scope or application of tax laws or regulations; |

| • | the possibility that we may be unable to renew our spectrum leases on attractive terms or the possible revocation of our existing licenses in the event that we violate applicable laws; |

| • | interests of our significant stockholders that may differ from the interests of other stockholders; |

| • | future sales of our common stock by DT and SoftBank and our inability to attract additional equity financing outside the United States due to foreign ownership limitations by the FCC; |

| • | the volatility of our stock price and our lack of plan to pay cash dividends in the foreseeable future; |

| • | failure to realize the expected benefits and synergies of the merger (the “Merger”) with Sprint, pursuant to the Business Combination Agreement with Sprint and the other parties named therein (as amended, the “Business Combination Agreement”) and the other transactions contemplated by the Business Combination Agreement (collectively, the “Transactions”) in the expected timeframes or in the amounts anticipated; |

| • | any delay and costs of, or difficulties in, integrating our business and Sprint's business and operations, and unexpected additional operating costs, customer loss and business disruption, including maintaining relationships with employees, customers, suppliers or vendors; |

| • | unanticipated difficulties, disruption, or significant delays in our long-term strategy to migrate Sprint's legacy customers onto T-Mobile's existing billing platforms; and |

| • | changes to existing or the issuance of new accounting standards by the Financial Accounting Standards Board or other regulatory agencies. |

Additional information concerning these and other risk factors is contained in the documents incorporated herein by reference.

Forward-looking statements in this prospectus or the documents incorporated by reference speak only as of the date of this prospectus or the applicable document incorporated by reference (or such earlier date as may be specified in the applicable document), as applicable, are based on assumptions and expectations as of such dates, and involve risks, uncertainties and assumptions, many of which are beyond our ability to control or predict, including the factors above. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. For more information, see the section entitled “Where You Can Find More Information.” The results presented for any period may not be reflective of results for any subsequent period.

You should carefully read and consider the cautionary statements contained or referred to in this section in connection with any subsequent written or oral forward-looking statements that may be issued by us or persons acting on our behalf, and all future written and oral forward-looking statements attributable to us are expressly qualified in their entirety by the foregoing cautionary statements.

iv

This summary contains basic information about us and this exchange offer. It does not contain all of the information that you should consider before deciding to participate in the exchange offer. You should carefully read this prospectus and the documents incorporated by reference herein for a more complete understanding of our business. Additionally, you should read the “Risk Factors” section of this prospectus and in documents incorporated by reference into this prospectus before making an investment decision.

Our Company

We are the Un-carrier. Through our Un-carrier strategy, we have disrupted the wireless communications services industry, by actively engaging with and listening to our customers and eliminating their existing pain points, including providing them with added value, an exceptional experience and implementing signature Un-carrier initiatives that have changed the wireless industry. We ended annual service contracts, overages, unpredictable international roaming fees, data buckets and much more. We are inspired by a relentless customer experience focus, consistently leading the wireless industry in customer care by delivering an excellent customer experience with our “Team of Experts,” which drives our record-high customer satisfaction levels while enabling operational efficiencies.

The Un-carrier was supercharged upon the completion of our Merger with Sprint on April 1, 2020, which resulted in Sprint and its subsidiaries becoming wholly owned consolidated subsidiaries of T-Mobile. Through the Merger, we acquired Sprint’s customers and 2.5 GHz mid-band spectrum, among other assets. As the supercharged Un-carrier, we are on a mission to build America’s best 5G network, offering customers unrivalled coverage and capacity where they live, work and play. Our network is the foundation of our success and powers everything we do. As one company, we have begun to combine our mid-band spectrum licenses, including Advanced Wireless Services (“AWS”), Personal Communications Services (“PCS”) and 2.5 GHz, our millimeter-wave licenses and our foundational layer of low-band spectrum, including 600 MHz, 700 MHz and 800 MHz, to create a “layer cake” of spectrum and provide an unmatched 5G experience to our customers. We believe this layer cake will broaden and deepen our nationwide 5G network enabling accelerated innovation and increased competition in the U.S. wireless, video and broadband industries. We have achieved and expect to continue to achieve significant synergies and cost reductions by eliminating redundancies within the combined network as well as other business processes and operations.

Our 4G Long-Term Evolution (“LTE”) network covers 328 million people (99% of the U.S. population). Additionally, our 5G network is America’s largest, covering 1.6 million square miles, 280 million people and 9,100 cities and towns across the United States, including Puerto Rico and the U.S. Virgin Islands, as of December 31, 2020.

We continue to expand the footprint and improve the quality of our network, providing outstanding wireless experiences for customers who will not have to compromise on quality and value. Going forward, it is this network that will allow us to deliver new, innovative products and services with the same customer experience focus and industry-disrupting mentality that has redefined the wireless communications services industry in the United States in the customers’ favor.

As of December 31, 2020, we provide wireless services to 102.1 million postpaid and prepaid customers and generate revenue by providing affordable wireless communications services to these customers, as well as a wide selection of wireless devices and accessories. Our most significant expenses relate to operating and expanding our network, providing a full range of devices, acquiring and retaining high-quality customers and compensating employees. We provide service, devices and accessories across our flagship brands, T-Mobile and Metro by T-Mobile, through our owned and operated retail stores, as well as through our websites (www.t-mobile.com and www.metrobyt-mobile.com), T-Mobile app and customer care channels. In addition, we sell devices to dealers and other third-party distributors for resale through independent third-party retail outlets and a variety of third-party websites. The information on our websites is not incorporated into or part of this prospectus (except for our SEC reports expressly incorporated by reference herein).

Corporate Information

Our corporate headquarters and principal executive offices are located at 12920 SE 38th Street, Bellevue, Washington 98006. Our telephone number is (425) 378-4000. We maintain a website at www.T-Mobile.com where our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

1

all amendments to those reports are available without charge, as soon as reasonably practicable following the time they are filed with or furnished to the SEC. The information on or accessible through our website is not incorporated into or part of this prospectus (except for our SEC reports expressly incorporated by reference herein).

This prospectus may include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

Corporate Ownership and Structure

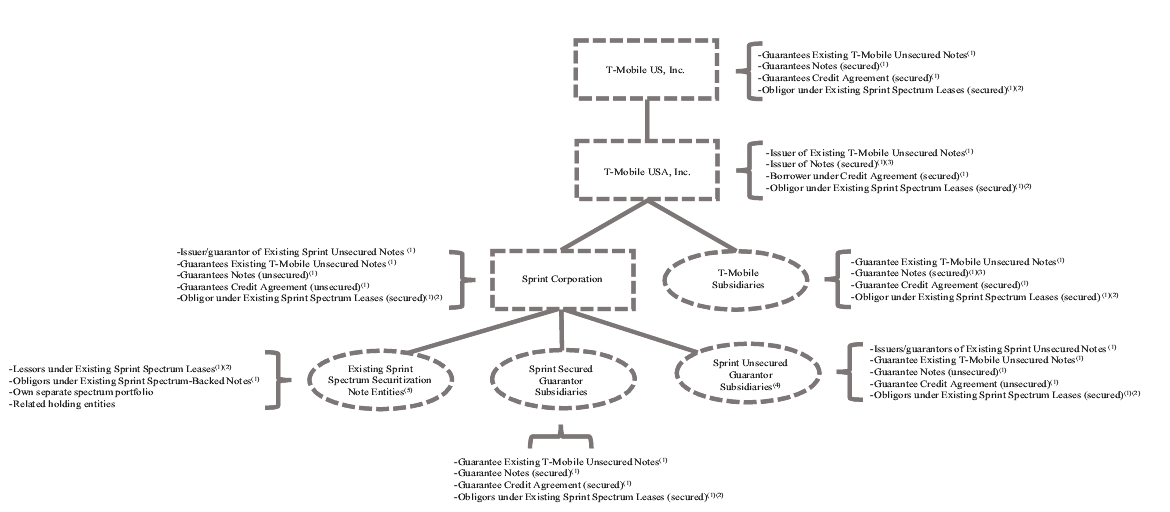

The diagram below illustrates our current ownership and corporate structure:

| (1) | See “Description of Other Indebtedness and Certain Financing Transactions.” |

| (2) | Spectrum lease payments from a Sprint subsidiary, Sprint Communications, Inc., are used to service the indebtedness under the Existing Sprint Spectrum-Backed Notes (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing Sprint Spectrum Note Facility”). This lease payment obligation is secured by a first priority security interest in the Collateral (as defined under “Description of Notes—Collateral—Assets Pledged as Collateral”) (with such security capped at $3.5 billion), shared with the Notes and other permitted first priority secured obligations. |

| (3) | Certain subsidiaries of the Issuer do not provide guarantees of the Original Notes, the Existing T-Mobile Unsecured Notes (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing T-Mobile Unsecured Notes”) and the Existing T-Mobile Secured Notes (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing T-Mobile Secured Notes”) and will not provide guarantees of the Exchange Notes (such as special purpose finance entities, a reinsurance subsidiary and immaterial subsidiaries). See “Description of Notes—Brief Description of the Notes and the Note Guarantees—The Note Guarantees.” Assuming that on December 31, 2020, we had completed the Q1 Notes Issuances (as defined under “—Recent Developments—Notes Issuances”) and the Q1 Redemption (as defined under “—Recent Developments—Redemption”), subsidiaries that do not provide guarantees of the Original Notes and will not provide guarantees of the Exchange Notes that were included in Parent’s consolidated financial statements as of such date had approximately $12.2 billion of total assets and approximately $6.7 billion in indebtedness and Tower Obligations (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing T-Mobile Tower Transactions”) outstanding. |

| (4) | Assuming that on December 31, 2020, we had completed the Q1 Notes Issuances and the Q1 Redemption, the Unsecured Guarantors would have had approximately $0.3 billion of total assets and approximately $69.4 billion in indebtedness that they had issued or guaranteed on an unsecured basis, $0 in indebtedness that they had issued or guaranteed on a secured basis, and approximately $4.6 billion in payment obligations under the Existing Sprint Spectrum Lease that they had guaranteed. |

| (5) | The Existing Sprint Spectrum Note Entities (as defined under “Description of Notes—Certain Definitions”) own a separate pool of 2.5 GHz and 1.9 GHz spectrum which has been pledged to secure indebtedness under the Sprint Spectrum Note Facility (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing Sprint Spectrum Note Facility”). This spectrum will not secure the Notes or any other permitted first priority secured obligations. As of December 31, 2020, an aggregate principal amount of $4.6 billion of Existing Sprint Spectrum-Backed Notes was outstanding under the Sprint Spectrum Note Facility. |

Recent Developments

Notes Issuances

On January 14, 2021, T-Mobile USA issued $1.00 billion in aggregate principal amount of its 2.250% Senior Notes due 2026, $1.00 billion in aggregate principal amount of its 2.625% Senior Notes due 2029 and $1.00 billion in aggregate principal amount of its 2.875% Senior Notes due 2031, and on March 23, 2021,

2

T-Mobile USA issued $1.20 billion in aggregate principal amount of its 2.625% Senior Notes due 2026, $1.25 billion in aggregate principal amount of its 3.375% Senior Notes due 2029 and $1.35 billion in aggregate principal amount of its 3.500% Senior Notes due 2031 (such issuances on January 14, 2021 and March 23, 2021 collectively, the “Q1 Notes Issuances”).

Redemption

On March 27, 2021, T-Mobile USA redeemed the full $2.0 billion outstanding principal amount of its 6.500% Senior Notes due 2026 (the “Q1 Redemption”).

Summary of the Exchange Offer

On April 9, 2020, T-Mobile USA issued $3.0 billion in aggregate principal amount of its 3.500% Senior Secured Notes due 2025, $4.0 billion in aggregate principal amount of its 3.750% Senior Secured Notes due 2027, $7.0 billion in aggregate principal amount of its 3.875% Senior Secured Notes due 2030, $2.0 billion in aggregate principal amount of its 4.375% Senior Secured Notes due 2040 Notes and $3.0 billion in aggregate principal amount of its 4.500% Senior Secured Notes due 2050, each with related guarantees.

On June 24, 2020, T-Mobile USA issued $1.0 billion in aggregate principal amount of its 1.500% Senior Secured Notes due 2026, $1.25 billion in aggregate principal amount of its 2.050% Senior Secured Notes due 2028 and $1.75 billion in aggregate principal amount of its 2.550% Senior Secured Notes due 2031, each with related guarantees.

On October 6, 2020, T-Mobile USA issued $500 million in aggregate principal amount of its 2.050% Senior Secured Notes due 2028, $750 million in aggregate principal amount of its 2.550% Senior Secured Notes due 2031, $1.25 billion in aggregate principal amount of its 3.000% Senior Secured Notes due 2041 and $1.5 billion in aggregate principal amount of its 3.300% Senior Secured Notes due 2051, each with related guarantees.

On October 28, 2020, T-Mobile USA issued $1.0 billion in aggregate principal amount of its 2.250% Senior Secured Notes due 2031, $1.25 billion in aggregate principal amount of its 3.000% Senior Secured Notes due 2041, $1.5 billion in aggregate principal amount of its 3.300% Senior Secured Notes due 2051 and $1.0 billion in aggregate principal amount of its 3.600% Senior Secured Notes due 2060, each with related guarantees.

In connection with each offering of Original Notes described above, we entered into registration rights agreements with the initial purchasers of the Original Notes in which we agreed (i) to use commercially reasonable efforts to cause an exchange offer registration statement of which this prospectus is a part to be filed with the SEC within 30 calendar days (the “target filing date”) following the due date for the Parent’s Annual Report on Form 10-K for the year in which Sprint and its subsidiaries have been included in the consolidated results of Parent for at least nine months, which was the year ended December 31, 2020 and to have such registration statement declared effective promptly thereafter, and (ii) to use commercially reasonable efforts to complete the exchange offer not later than 60 days after such effective date.

The Exchange Notes will be accepted for clearance through The Depository Trust Company (“DTC”) with a new CUSIP and ISIN number and common code for each series of the Exchange Notes. You should read the discussions under the headings “The Exchange Offer” and “Description of Notes,” respectively, for more information about the exchange offer and Exchange Notes. After the exchange offer is completed, you will no longer be entitled to any exchange or, with limited exceptions, registration rights for your Original Notes.

The Exchange Offer

T-Mobile USA is offering to exchange any and all of its 3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026, 3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028, 3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031, 2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040, 3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050, 3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060, all of which have been registered under the Securities Act, for an

3

equal amount of its outstanding unregistered 3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026, 3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028, 3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031, 2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040, 3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050, 3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060, as applicable. Original Notes may only be exchanged in a principal amount of $2,000 or an integral multiple of $1,000 in excess thereof.

As of the date of this prospectus, $3,000,000,000 in aggregate principal amount of the unregistered 3.500% Senior Secured Notes due 2025, $1,000,000,000 in aggregate principal amount of the unregistered 1.500% Senior Secured Notes due 2026, $4,000,000,000 in aggregate principal amount of the unregistered 3.750% Senior Secured Notes due 2027, $1,750,000,000 in aggregate principal amount of the unregistered 2.050% Senior Secured Notes due 2028, $7,000,000,000 in aggregate principal amount of the unregistered 3.875% Senior Secured Notes due 2030, $2,500,000,000 in aggregate principal amount of the unregistered 2.550% Senior Secured Notes due 2031, $1,000,000,000 in aggregate principal amount of the unregistered 2.250% Senior Secured Notes due 2031, $2,000,000,000 in aggregate principal amount of the unregistered 4.375% Senior Secured Notes due 2040, $2,500,000,000 in aggregate principal amount of the unregistered 3.000% Senior Secured Notes due 2041, $3,000,000,000 in aggregate principal amount of the unregistered 4.500% Senior Secured Notes due 2050, $3,000,000,000 in aggregate principal amount of the unregistered 3.300% Senior Secured Notes due 2051, and $1,000,000,000 in aggregate principal amount of the unregistered 3.600% Senior Secured Notes due 2060 are outstanding.

The terms of the Exchange Notes are identical in all material respects to those of the Original Notes, except the Exchange Notes will not be subject to transfer restrictions and holders of the Exchange Notes, with limited exceptions, will have no registration rights. Also, the Exchange Notes will not include provisions contained in the Original Notes that required payment of additional interest in the event we failed to satisfy our registration obligations with respect to the Original Notes.

Original Notes that are not tendered for exchange will continue to be subject to transfer restrictions and, with limited exceptions, will not have registration rights. Therefore, the market for secondary resales of Original Notes that are not tendered for exchange is likely to be

4

substantially limited. However, no market currently exists for the Exchange Notes and we can offer no assurance that such a market will develop.

T-Mobile USA will issue registered Exchange Notes promptly after the expiration of the exchange offer.

The exchange offer is not subject to any federal or state regulatory requirements or approvals other than securities laws and blue sky laws.

Expiration Time

The exchange offer will expire at 5:00 p.m., New York City time, on , 2021, unless we decide to extend the expiration time. Please read “The Exchange Offer—Extensions, Delay in Acceptance, Termination or Amendment” for more information about extending the expiration time.

Withdrawal of Tenders

You may withdraw your tender of Original Notes at any time prior to the expiration time. We will return to you, without charge, promptly after the expiration or termination of the exchange offer any Original Notes that you tendered but that were not accepted for exchange.

Conditions to the Exchange Offer

The exchange offer is subject to certain customary conditions, which we may amend or waive. We have the right, in our sole discretion, to terminate or withdraw the exchange offer if any of the conditions described in this prospectus are not satisfied or waived. The exchange offer is not conditioned on any minimum aggregate principal amount of Original Notes being tendered.

Please read “The Exchange Offer—Conditions to the Exchange Offer” for more information about the conditions to the exchange offer.

Procedures for Tendering Original Notes

If your Original Notes are held through DTC and you wish to participate in the exchange offer, you may do so through DTC’s automated tender offer program. If you tender under this program, you will agree to be bound by the letter of transmittal that we are providing with this prospectus as though you had signed the letter of transmittal. By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things:

| • | any Exchange Notes that you receive will be acquired in the ordinary course of your business; |

| • | you have no arrangement or understanding with any person to participate in a distribution (within the meaning of the Securities Act) of the Exchange Notes in violations of the Securities Act; |

| • | you are not an “affiliate,” as defined in Rule 405 under the Securities Act, of us or any |

5

guarantor, or if you are such an affiliate, you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable;

| • | you are not engaged in and do not intend to engage in a distribution of the Exchange Notes; and |

| • | if you are a broker-dealer that will receive Exchange Notes for your own account in exchange for Original Notes that were acquired as a result of market-making or other trading activities and that you will deliver a prospectus meeting the requirements of the Securities Act (or, to the extent permitted by law, make available a prospectus meeting the requirements of the Securities Act to purchasers) in connection with any resale of such Exchange Notes. |

Special Procedures for Beneficial Owner

If you own a beneficial interest in Original Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the Original Notes in the exchange offer, please contact the registered holder as soon as possible and instruct the registered holder to tender on your behalf and to comply with our instructions described in this prospectus.

Resales

Except as indicated in this prospectus, we believe that the Exchange Notes will be freely transferable by holders other than our affiliates after the exchange offer without further registration under the Securities Act if:

| • | you are acquiring the Exchange Notes in the ordinary course of your business; |

| • | you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate in the distribution of the Exchange Notes; and |

| • | you are not an affiliate of the Issuer or any guarantor. |

Our belief is based on existing interpretations of the Securities Act by the SEC staff set forth in several no-action letters to third parties that are not related to us. We do not intend to seek our own no-action letter, and there is no assurance that the SEC staff would make a similar determination with respect to the Exchange Notes. If this interpretation is inapplicable, and you transfer any Exchange Notes without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from such

6

requirements, you may incur liability under the Securities Act. We do not assume, or indemnify holders against, such liability.

Each broker-dealer that is issued Exchange Notes for its own account in exchange for Original Notes that were acquired by the broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act (or, to the extent permitted by law, make available a prospectus meeting the requirements of the Securities Act to purchasers) in connection with any resale of the Exchange Notes. See “Plan of Distribution.”

United States Federal Income Tax

Considerations

The exchange of Original Notes for Exchange Notes will not be a taxable exchange for United States federal income tax purposes. Please see “Material U.S. Federal Income Tax Considerations.”

Use of Proceeds

We will not receive any proceeds from the issuance of the Exchange Notes pursuant to the exchange offer. We will pay certain expenses incident to the exchange offer. See “The Exchange Offer—Transfer Taxes.”

Registration Rights

If we fail to complete the exchange offer as required by the registration rights agreement, we may be obligated to pay additional interest to holders of the Original Notes. Please see “The Exchange Offer—Additional Interest” for more information regarding your rights as a holder of the Original Notes.

The Exchange Agent

We have appointed Deutsche Bank Trust Company Americas as exchange agent for the exchange offer. Please direct questions and requests for assistance and requests for additional copies of this prospectus or of the letter of transmittal to the exchange agent. As described in more detail under the caption “The Exchange Offer—Procedures for Tendering,” if you are not tendering under DTC’s automated tender offer program, you should send the letter of transmittal and any other required documents to the exchange agent as follows:

Deutsche Bank Trust Company Americas

Please email all inquiries to

transfer.operations@db.com

For Information or to Confirm by Telephone:

(877) 735-7777, Option 2

By Mail, Overnight Mail or Courier:

Transfer Operations

DB Services Americas, Inc.

COO Corporate & Investment Banking Technology and Operations

5022 Gate Parkway, Suite 200

Jacksonville, FL 32256

7

The Exchange Notes

The form and terms of the Exchange Notes to be issued in the exchange offer are substantially identical to the form and terms of the Original Notes, except that the Exchange Notes will be registered under the Securities Act and, therefore, will not bear legends restricting their transfer, will not contain terms providing for additional interest if we fail to perform our registration obligations with respect to the Original Notes and, with limited exceptions, will not be entitled to registration rights. The following summarizes the material terms of the Exchange Notes, which will evidence the same debt as the Original Notes, and both the Original Notes and the Exchange Notes are governed by the same indentures.

Issuer

T-Mobile USA, Inc.

Securities

$3,000,000,000 in aggregate principal amount of 3.500% Senior Secured Notes due 2025.

$1,000,000,000 in aggregate principal amount of 1.500% Senior Secured Notes due 2026.

$4,000,000,000 in aggregate principal amount of 3.750% Senior Secured Notes due 2027.

$1,750,000,000 in aggregate principal amount of 2.050% Senior Secured Notes due 2028.

$7,000,000,000 in aggregate principal amount of 3.875% Senior Secured Notes due 2030.

$2,500,000,000 in aggregate principal amount of 2.550% Senior Secured Notes due 2031.

$1,000,0000,000 in aggregate principal amount of 2.250% Senior Secured Notes due 2031.

$2,000,000,000 in aggregate principal amount of 4.375% Senior Secured Notes due 2040.

$2,500,000,000 in aggregate principal amount of 3.000% Senior Secured Notes due 2041.

$3,000,000,000 in aggregate principal amount of 4.500% Senior Secured Notes due 2050.

$3,000,000,000 in aggregate principal amount of 3.300% Senior Secured Notes due 2051.

$1,000,000,000 in aggregate principal amount of 3.600% Senior Secured Notes due 2060.

Maturity

The 2025 Exchange Notes will mature on April 15, 2025.

The 2026 Exchange Notes will mature on February 15, 2026.

The 2027 Exchange Notes will mature on April 15, 2027.

The 2028 Exchange Notes will mature on February 15, 2028.

The 2030 Exchange Notes will mature on April 15, 2030.

The February 2031 Exchange Notes will mature on February 15, 2031.

8

The November 2031 Exchange Notes will mature on November 15, 2031.

The 2040 Exchange Notes will mature on April 15, 2040.

The 2041 Exchange Notes will mature on February 15, 2041.

The 2050 Exchange Notes will mature on April 15, 2050.

The 2051 Exchange Notes will mature on February 15, 2051.

The 2060 Exchange Notes will mature on November 15, 2060.

Interest Payment Dates

Each series of Exchange Notes will have the same interest payment dates as the corresponding series of Original Notes for which they are being offered in exchange. With respect to each series of Exchange Notes, interest will accrue from the date of original issuance or, if interest has already been paid on the corresponding Original Notes exchanged therefor, the date it was most recently paid on such Original Notes.

Interest on the 2025 Exchange Notes, the 2027 Exchange Notes, the 2030 Exchange Notes, the 2040 Exchange Notes and the 2050 Exchange Notes will be payable on April 15 and October 15 of each year.

Interest on the 2026 Exchange Notes, the 2028 Exchange Notes, the February 2031 Exchange Notes, the 2041 Exchange Notes and the 2051 Exchange Notes will be payable on February 15 and August 15 of each year.

Interest on the November 2031 Exchange Notes and the 2060 Exchange Notes will be payable on May 15 and November 15 of each year.

Optional Redemption

The Issuer may redeem some or all of the Exchange Notes (i) at any time prior to the applicable date indicated in the table below at a price equal to 100% of the principal amount of such Exchange Notes being redeemed and a “make whole” premium and (ii) on or after the applicable date indicated in the table below at a price equal to 100% of the principal amount of such Exchange Notes being redeemed; plus, in the case of both (i) and (ii), accrued and unpaid interest, if any, to, but not including, the redemption date, as described in this prospectus:

2025 Notes | | | March 15, 2025 |

2026 Notes | | | January 15, 2026 |

2027 Notes | | | February 15, 2027 |

2028 Notes | | | December 15, 2027 |

2030 Notes | | | January 15, 2030 |

February 2031 Notes | | | November 15, 2030 |

9

November 2031 Notes | | | August 15, 2031 |

2040 Notes | | | October 15, 2039 |

2041 Notes | | | August 15, 2040 |

2050 Notes | | | October 15, 2049 |

2051 Notes | | | August 15, 2050 |

2060 Notes | | | May 15, 2060 |

Intercreditor Agreement

We have entered into a collateral trust and intercreditor agreement (the “Intercreditor Agreement”) with the Collateral Trustee (as defined under “Description of Notes—General”), the agent and holder representative under the Credit Agreement (as defined under “Description of Other Indebtedness and Certain Financing Obligations—Credit Agreement”), the holder representative under the Existing Sprint Spectrum Lease (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing Sprint Spectrum Note Facility”) and the holder representative under the indentures governing the Original Notes, to which the holder representative under the indentures governing the Exchange Notes will become a party. The Intercreditor Agreement sets forth the rights of, and relationship among, the applicable holder representatives under all existing and future parity and junior lien debt in respect of exercise of rights and remedies against the Issuer and the secured guarantors and certain other matters.

Ranking

The Exchange Notes:

| • | will be general unsubordinated obligations of the Issuer; |

| • | will be secured by liens on the Collateral on an equal and ratable basis with the obligations under any Original Notes that remain outstanding after the exchange offer and the Credit Agreement and any other existing (as discussed further herein) and future permitted first priority secured obligations, subject to permitted liens; |

| • | will be senior in right of payment to any future indebtedness of the Issuer to the extent that such future indebtedness provides by its terms that it is subordinated in right of payment to the Notes; |

| • | will be effectively senior to all existing and future unsecured indebtedness of the Issuer and any future indebtedness of the Issuer secured by a junior lien on the Collateral, in each case to the extent of the value of the Collateral securing the obligations under the Notes; |

10

| • | will rank equal in right of payment with any of the Issuer’s existing and future indebtedness and other liabilities that are not by their terms subordinated in right of payment to the Notes, including, without limitation, the obligations under any Original Notes that remain outstanding after the exchange offer and the Credit Agreement, the Existing T-Mobile Unsecured Notes, the Existing Sprint Unsecured Notes (as defined under “Description of Other Indebtedness and Certain Financing Transactions—Existing Sprint Unsecured Notes”) and the Tower Obligations; |

| • | will be effectively subordinated to all existing and future indebtedness that is secured by liens on assets that do not constitute Collateral, to the extent of the value of such assets; |

| • | will be structurally subordinated to all of the liabilities and other obligations of the Issuer’s subsidiaries that are not obligors with respect to the Notes, including the Existing Sprint Spectrum-Backed Notes, factoring arrangements and tower obligations; and |

| • | will be unconditionally guaranteed on (i) a senior secured basis by the Secured Guarantors (as defined under “Description of Notes—Certain Definitions”) and (ii) a senior unsecured basis by the Unsecured Guarantors. |

See “Risk Factors—Risks Related to the Notes—The Notes and the Guarantees will be structurally subordinated to the indebtedness and other liabilities of the Issuer’s non-guarantor subsidiaries.”

Assuming that on December 31, 2020, we had completed the Q1 Notes Issuances and the Q1 Redemption, we would have had approximately $81.4 billion of outstanding indebtedness and other obligations, excluding letter of credit obligations, including $31.8 billion of pari passu secured indebtedness, consisting of the Original Notes. In addition, we would have had $17.9 billion of outstanding unsecured indebtedness under the Existing T-Mobile Unsecured Notes, $19.8 billion of outstanding unsecured indebtedness under the Existing Sprint Unsecured Notes, and approximately $3.0 billion in unsecured Tower Obligations. We also would have had $5.5 billion of revolving borrowings available on a secured basis under the Credit Agreement.

11

As of December 31, 2020, an aggregate principal amount of $4.6 billion of Existing Sprint Spectrum-Backed Notes was outstanding and up to $2.4 billion remained available for issuance under the Sprint Spectrum Note Facility. The Existing Sprint Spectrum Note Entities own a separate pool of 2.5 GHz and 1.9 GHz spectrum which has been pledged to secure indebtedness under the Sprint Spectrum Note Facility. This spectrum will not secure the Exchange Notes or any other permitted first priority secured obligations.

Note Guarantees

The Exchange Notes will be guaranteed by Parent and any wholly-owned subsidiary of the Issuer that is not an Excluded Subsidiary and is or becomes an obligor of the Credit Agreement or issues or guarantees certain capital markets debt securities (including, for the avoidance of doubt, Sprint and its wholly-owned domestic subsidiaries, other than certain Excluded Subsidiaries that will not guarantee the Notes, and except that the Guarantees of Sprint, Sprint Communications, Inc. and Sprint Capital Corporation will be provided on a senior unsecured basis), and any future direct or indirect subsidiary of T-Mobile US or any subsidiary thereof that owns capital stock of T-Mobile USA. See “Description of Notes—Brief Description of the Notes and the Note Guarantees—The Note Guarantees.” Each Guarantee of the Exchange Notes by a guarantor:

| • | will be a general unsubordinated obligation of such guarantor; |

| • | with respect to Subsidiary Guarantors (as defined under “Description of Notes—Certain Definitions”) other than the Unsecured Guarantors, will be secured by liens on the Collateral on an equal and ratable basis with the obligations under any Original Notes that remain outstanding after the exchange offer and the Credit Agreement and obligations under any other existing (as further discussed herein) and future permitted first priority secured obligations, subject to permitted liens; will be senior in right of payment to any future indebtedness of that guarantor to the extent that such future indebtedness provides by its terms that it is subordinated in right of payment to such guarantor’s Guarantee; with respect to Subsidiary Guarantors other than the Unsecured Guarantors, will be effectively senior to all existing and future unsecured indebtedness of the guarantor and any future indebtedness of the guarantor secured by a junior lien on the Collateral, in each case to the extent of the value of the Collateral |

12

securing the obligations under the Guarantee; will be equal in right of payment with any of that guarantor’s existing and future indebtedness and other liabilities that are not by their terms subordinated in right of payment to the Notes, including, without limitation, obligations under any Original Notes that remain outstanding after the exchange offer, the Credit Agreement, the Existing T-Mobile Unsecured Notes and the Existing Sprint Unsecured Notes;

| • | will be effectively subordinated to any Unsecured Guarantor’s existing and future secured indebtedness to the extent of the value of the assets of such Unsecured Guarantor constituting collateral securing such Indebtedness (as defined under “Description of Notes—Certain Definitions”); |

| • | will be structurally subordinated to all of the indebtedness and other obligations of any subsidiaries of that guarantor that are not obligors with respect to the Notes; and |

| • | in the case of the Guarantees of Sprint, Sprint Communications, Inc. and Sprint Capital Corporation, which will be provided on a senior unsecured basis, will be effectively subordinated to such Unsecured Guarantors’ existing and future secured indebtedness, to the extent of the value of the collateral securing such debt. |

See “Risk Factors—Risks Related to the Notes—The Unsecured Guarantees will be unsecured and effectively subordinated to the Unsecured Guarantors’ existing and future secured indebtedness” and “Risk Factors—Risks Related to the Notes—The Notes and the Guarantees will be structurally subordinated to the indebtedness and other liabilities of the Issuer’s non-guarantor subsidiaries.”

Assuming that on of December 31, 2020, we had completed the Q1 Notes Issuances and the Q1 Redemption, subsidiaries that do not provide guarantees of the Original Notes and will not provide guarantees of the Exchange Notes that were included in Parent’s or Sprint’s consolidated financial statements, as applicable, as of such date had approximately $12.2 billion of total assets and approximately $6.7 billion in indebtedness and Tower Obligations outstanding. Assuming that on December 31, 2020, we had completed the Q1 Notes Issuances and the Q1 Redemption, the Unsecured Guarantors would have had approximately $0.3 billion of total assets and approximately $69.4 billion in

13

indebtedness that they had issued or guaranteed on an unsecured basis, $0 in indebtedness that they had issued or guaranteed on a secured basis, and approximately $4.6 billion in payment obligations under the Existing Sprint Spectrum Lease that they had guaranteed.

If Parent has achieved an investment grade corporate rating and an investment grade rating of the Exchange Notes after giving effect to the proposed release of the guarantees of its subsidiaries and the proposed release of the security interest in the Collateral from two of the following: Standard & Poor’s Financial Services LLC, Moody’s Investors Service, Inc. and Fitch Ratings, Inc. and certain other conditions are met, the Issuer may elect to have the guarantees of its subsidiaries permanently released. There can be no assurance that Parent or the Exchange Notes will ever be rated investment grade after giving effect to such releases, or that, if they are, Parent or the Exchange Notes will maintain these ratings. See “Description of Notes—Brief Description of the Notes and the Note Guarantees—The Note Guarantees.”

Security