UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant¨ | Filed by a Party other than the Registrant¨ |

Check the appropriate box:

| x | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| | | |

Nexvet Biopharma

public limited company |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

| | | | | |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

October , 2015

Dear Nexvet Shareholder:

You are cordially invited to attend this year’s annual general meeting of shareholders of Nexvet Biopharma public limited company on Thursday, November 19, 2015, beginning at 4.00 p.m. The meeting will be held at the offices of Matheson, located at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland. The matters to be acted on at the meeting are more fully described in the accompanying Notice of Annual General Meeting of Shareholders and proxy statement.

A copy of our annual report to shareholders is also enclosed for your information.

Whether or not you plan to attend the meeting, your vote is very important and we encourage you to vote promptly. After reading the proxy statement, please vote by telephone, by Internet, or by marking your vote on the enclosed proxy card, signing and dating the proxy card, and returning it to us in the enclosed postage-paid envelope. Instructions regarding all three methods of voting are provided on the proxy card. If you attend the meeting you will, of course, have the right to revoke the proxy and vote your shares in person.

We look forward to seeing you at the meeting.

| | Sincerely yours, |

| | |

| | |

| | |

| | Mark Heffernan, Ph.D. |

| | Chief Executive Officer |

Notice of 2015 Annual GENERAL Meeting of Shareholders

To Be Held Thursday, November 19, 2015

The 2015 annual general meeting of shareholders (the “Meeting”) of Nexvet Biopharma public limited company, an Irish public limited company (the “Company”), will be held on Thursday, November 19, 2015, beginning at 4.00 p.m., local time, at the offices of Matheson, located at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland, for the following purposes:

| | 1. | To elect four (4) Class I directors to hold office until the 2017 Annual General Meeting of Shareholders and until their successors are duly elected and qualified or until their earlier resignation or removal; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2016 and statutory auditor until the close of the next annual general meeting of shareholders, and to authorize the board of directors acting through the Audit Committee to fix its remuneration; |

| | 3. | To approve amendments to the Memorandum of Association of the Company and adopt revised Articles of Association of the Company; and |

| | 4. | To consider any other business properly presented at the Meeting or any adjournment or postponement thereof. |

The Company’s Irish statutory financial statements for the fiscal year ended June 30, 2015, including the reports of the directors and auditors thereon, will be presented and considered at the Meeting. There is no requirement under Irish law that such statements be approved by the shareholders, and no such approval will be sought at the Meeting.

Under the Company’s articles of association, Proposal 1, Proposal 2 and the receipt and consideration of the Irish statutory financial statements by the Company at the Meeting are deemed to be ordinary business, and Proposal 3 is deemed to be a special resolution.

If you were a shareholder of record at the close of business on October 15, 2015, you are entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof. At the Meeting and for ten days prior to the Meeting, a complete list of shareholders entitled to vote at the Meeting will be available for examination by any shareholder, for any purpose relating to the Meeting, during ordinary business hours at our principal offices located at NIBRT (National Institute for Bioprocessing Research & Training), Foster's Avenue, Mount Merrion, Blackrock, Co. Dublin, Ireland.

| | By order of the Board of Directors, |

| | |

| | /s/ Geraldine Farrell |

| | |

| | Geraldine Farrell |

| | Corporate Secretary |

October , 2015

| IMPORTANT: We hope you can join us at the Meeting. Regardless of whether you plan to attend, please read the enclosed Proxy Statement and vote by telephone, by Internet or by marking your vote on the enclosed proxy card, signing and dating the proxy card, and returning it to us in the enclosed postage-paid envelope. Your vote is important, so please return your proxy card or vote by telephone or by Internet promptly. If you attend the Meeting, you may choose to vote in person even if you have previously voted your shares. |

| If your shares are held through a broker, bank or other nominee and you wish to vote in person at the Meeting, you must obtain a legal proxy issued in your name from your broker, bank or other nominee. |

Proxy Statement for 2015 Annual General Meeting of Shareholders

Table of Contents

Nexvet Biopharma public limited company

National Institute for Bioprocessing

Research and Training

Foster’s Avenue, Mount Merrion

Blackrock, Co. Dublin, Ireland

Proxy Statement for the 2015 Annual GENERAL Meeting of Shareholders

The Board of Directors of Nexvet Biopharma public limited company is soliciting your proxy for the 2015 Annual General Meeting of Shareholders to be held on Thursday, November 19, 2015, and any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. This proxy statement and related materials are first being mailed to shareholders on or about October , 2015. References in this proxy statement to “we,” “us,” “our,” “Nexvet,” “Nexvet Biopharma plc” or the “Company” are to Nexvet Biopharma public limited company, and references to the “annual meeting” are to the 2015 Annual General Meeting of Shareholders. When we refer to the Company’s fiscal year, we mean the annual period ending on June 30th. This proxy statement covers our 2015 fiscal year, which was from July 1, 2014 through June 30, 2015.

Solicitation and Voting

Record Date

Only holders of record of ordinary shares at the close of business on October 15, 2015, which we refer to as the “record date,” will be entitled to notice of and to vote at the meeting and any adjournment thereof. As of the record date, ordinary shares were outstanding and entitled to vote.

Quorum

A majority of the ordinary shares issued and outstanding as of the record date must be represented at the meeting, either in person or by proxy, to constitute a quorum for the transaction of business at the meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the annual meeting in person. Abstentions and “broker non-votes” (shares held by a broker, bank or other nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for purposes of determining the presence of a quorum.

Vote Required to Adopt Proposals

Each of our ordinary shares outstanding on the record date is entitled to one vote on the Class I director nominee and one vote on each other matter. Directors will be elected by the affirmative vote of a majority of the shares present and entitled to vote. This means that the votes cast “for” a Class I director nominee must exceed the number of votes cast “against” that nominee. Under our Memorandum of Association (our “Memorandum”) and our Articles of Association (our “Articles,” and together with our Memorandum, our “Constitution”). The proposal to amend of our Constitution requires the affirmative vote of 75% of the votes cast at the annual meeting. With respect to each of the other proposals, approval of the proposal requires the affirmative vote of a majority of the votes cast at the annual meeting.

Effect of Abstentions and Broker Non-Votes

Abstentions and broker non-votes will not be considered votes cast at the annual meeting. Because the approval of all of the proposals is based on the votes cast at the annual meeting, abstentions and broker non-votes will not have any effect on the outcome of voting on the proposals.

If you are a beneficial owner and hold your shares in “street name,” it is critical that you complete the voting instruction form provided by your broker, bank or other nominee if you want your vote to count. Under the rules governing brokers, banks and other nominees who are members of the Financial Industry Regulatory Authority, Inc., such brokers, banks and other nominees may vote uninstructed shares in their discretion on routine matters, but not on non-routine matters. Routine matters include the ratification of the appointment of the independent registered public accounting firm. Non-routine matters include the election of directors. Accordingly, unless you provide voting instructions, your broker, bank or other nominee may be unable to vote on non-routine proposals at the meeting. We encourage you to vote promptly, even if you plan to attend the annual meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Voting Instructions

If you complete and submit your proxy card or voting instructions, the persons named as proxies will follow your instructions. If you are a shareholder of record and you submit a proxy card or voting instructions but do not direct how to vote on each item, the persons named as proxies will vote as our board of directors recommends on each proposal. If you are a beneficial owner and you return your signed voting instruction form but do not indicate your voting preferences, please see “Effect of Abstentions and Broker Non-Votes” regarding whether your broker, bank, or other nominee may vote your uninstructed shares on a particular proposal.

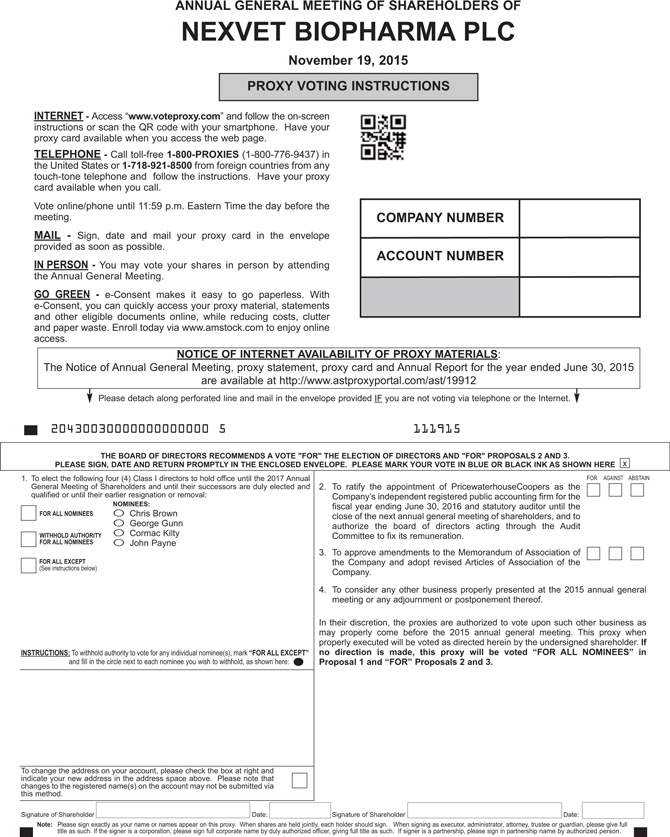

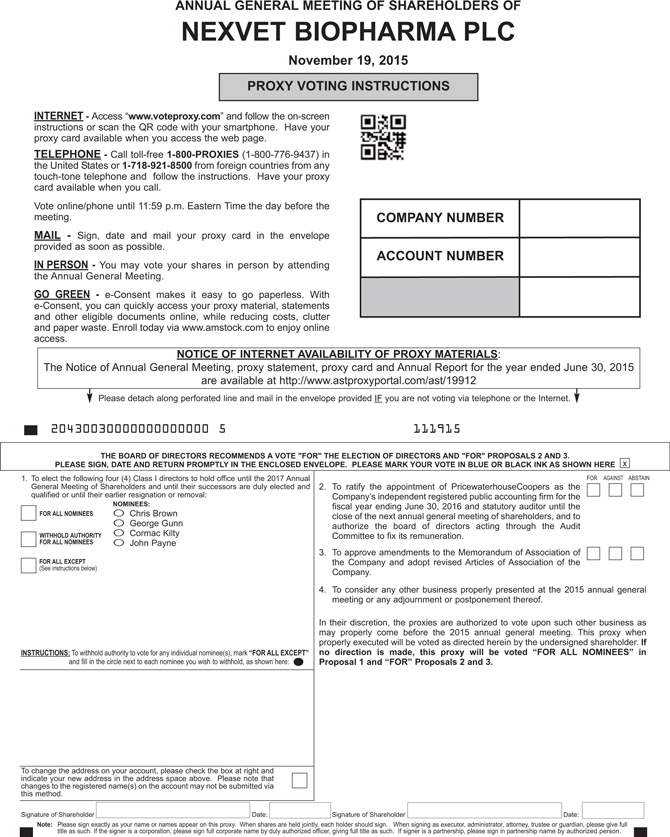

Vote by Internet. You can vote by Internet. The website address for Internet voting can be accessed through the website printed on your proxy card or voting instruction form. You will need to use the control number appearing on your proxy card or voting instruction form. You can use the Internet to transmit your voting instructions until 11:59 p.m. Eastern Time on the day of the annual meeting. Internet voting is available 24 hours a day. If you vote by Internet, you do NOT need to vote by telephone or by mail.

Vote by Telephone. You can vote by telephone by calling the toll-free telephone number appearing on your proxy card or voting instruction form. You will need to use the control number appearing on your proxy card or voting instruction form. In order to cast your vote telephonically, you may transmit your voting instructions from any touch tone telephone until 11:59 p.m. Eastern Time on the day of the annual meeting. Telephone voting is available 24 hours a day. If you vote by telephone, you do NOT need to vote by Internet or by mail.

Vote by Mail. You can vote by mail by completing, signing, and dating the proxy card or voting instruction form and returning it in the prepaid return envelope. If you vote by returning a proxy card or voting instruction form, you do NOT need to vote by Internet or by telephone.

Vote in Person at the Annual Meeting. All shareholders as of the close of business on the record date can vote in person at the annual meeting. You can also be represented by another person at the annual meeting by executing a proper proxy designating that person to vote on your behalf. Even if you plan to attend the annual meeting, we recommend that you also vote either by telephone, by Internet, or by mail so that your vote will be counted if you later decide not to attend.

Nexvet is incorporated under Irish law, which permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the shareholder. The electronic voting procedures provided for the annual meeting are designed to authenticate each shareholder by use of a control number to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

If you are a shareholder of record, you may revoke your proxy and change your vote at any time before the polls close by returning a later-dated proxy card, by voting again by Internet or by telephone as more fully detailed on your proxy card, or by delivering written instructions to the Corporate Secretary before the annual meeting. Attendance at the annual meeting will not in and of itself cause your previously voted proxy to berevoked unless you specifically so request or vote again at the annual meeting. If your shares are held by a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your broker, bank or other nominee, or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares, by attending the annual meeting and voting in person.

Solicitation of Proxies

We will bear the entire cost of soliciting proxies, including printing and mailing. In addition, we may reimburse brokers, banks or other nominees holding our ordinary shares beneficially owned by others for their reasonable, out-of-pocket costs of forwarding solicitation materials to such beneficial owners. We may use the services of our officers, directors and employees to solicit proxies, personally or by telephone, without additional compensation.

Voting Results

We will announce preliminary voting results at the annual meeting. We will report final results in a Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”).

Proposal No. 1

Election of Directors

We have a classified board of directors currently consisting of four Class I directors and four Class II directors, who will serve until the annual meetings of shareholders to be held in 2015 and 2016, respectively, and until their respective successors are duly elected and qualified or until their earlier resignation or removal. At each annual meeting of shareholders, directors are elected for a term of two years to succeed those directors whose terms expire on the annual meeting dates.

The term of the Class I directors will expire on the date of the upcoming annual meeting. Accordingly, four people are to be elected to serve as a Class I directors of our board of directors at the annual meeting. Our board of directors has nominated Dr. George Gunn, Chris Brown, Dr. Cormac Kilty and John Payne, each current Class I directors, for reelection by our shareholders. If elected, each will serve as a Class I director until our annual general meeting of shareholders in 2017 and until his successor is duly elected and qualified or until his earlier resignation or removal.

Our board of directors has no reason to believe that the nominees listed above will be unable to serve as a director. If, however, any nominee becomes unavailable, the proxies will have discretionary authority to vote for a substitute nominee. There are no family relationships among any of our directors or executive officers.

The following table sets forth information regarding our current directors.

| Name | | Age | |

| | | | |

| Class I Directors whose terms expire at the 2015 annual meeting: | | | | |

| Chris Brown | | | 57 | |

| George Gunn, BVM&S, DVSM, MRCVS, Ph.D. | | | 65 | |

| Cormac Kilty, Ph.D. | | | 61 | |

| John Payne | | | 67 | |

| | | | | |

| Class II Directors whose terms expire at the 2016 annual meeting: | | | | |

| Ashraf Hanna, Ph.D., M.D. | | | 48 | |

| Mark Heffernan, Ph.D. | | | 39 | |

| Joseph McCracken, DVM, MS | | | 62 | |

| Rajiv Patel | | | 44 | |

Director Nominees

Background information on Dr. Gunn, Mr. Brown, Dr. Kilty and Mr. Payne, the Class I director nominees, appears below under “Corporate Governance — Our Board of Directors.”

Vote Required and Board of Directors’ Recommendation

Our Articles provide that directors will be elected by the affirmative vote of a majority of the votes cast at the annual meeting. This means that the votes cast “for” a Class I director nominee must exceed the number of votes cast “against” that nominee. Because abstentions and broker non-votes will not be considered votes cast at the annual meeting, abstentions and broker non-votes will not have any effect on the outcome of voting on this proposal, although broker non-votes will be counted as present for purposes of determining a quorum.

We are asking shareholders to approve the following resolutions as ordinary resolutions of the Company at the annual meeting:

RESOLVEDthat the shareholders elect, by separate resolutions, the following individuals as Class I directors of the Company to hold office until the 2017 Annual General Meeting of Shareholders and until his successor is duly elected and qualified or until his earlier resignation or removal:

Our board of directors unanimously recommends a vote “FOR” the reelection of the Class I director nominees named above. Unless authority to do so is withheld, the persons named as proxies will vote FOR the election of each of the Class I director nominees to hold office until the 2017 annual general meeting of shareholders and until his successor is duly elected and qualified or until his earlier resignation or removal.

Corporate Governance

Our Board of Directors

The following is a brief description of each nominee who is currently a member of our board of directors and each director of Nexvet whose term of office will continue after the annual meeting:

Class I Directors for Election at the 2015 Annual Meeting of Shareholders

Chris Brownhas served as a member of our board of directors since November 2013 and served as our Chairman of the Board from November 2013 to April 2015. He is a Director of Preshafood Pty Ltd, a juice company, and served as its Chairman from December 2010 until July 2014. Since June 2015 Mr. Brown has served as the Chairman and Director of CV Check Ltd, an Australian–listed screening and verification company. Mr. Brown has served as the principal of Gibbs Hill Pty Ltd., a corporate finance and strategic business advisory firm, since October 2006. Mr. Brown served as Director (Investment Banking) of Investec Wentworth, a financial services business from July 2002 to March 2006, a Director and Melbourne Head of Corporate Finance of Rothschild Australia, a financial services firm, from January 1994 to October 2000, and a Director and Co-head of Mergers & Acquisitions (Australia) at Merrill Lynch, a financial services firm, from July 1992 to January 1994. Mr. Brown was a Director and Chairman of Senetas Corporation, an Australian-listed public information technology encryption company, from May 2011 to April 2013 and the Founding Chairman of The Conversation Media Group Ltd, a not-for-profit academic news organization, from April 2010 to September 2012. Mr. Brown has a Bachelor of Laws from University of Adelaide, South Australia. We believe Mr. Brown is qualified to serve as a member of our board of directors based on his extensive experience as a corporate advisor, guiding multiple companies through their transition into being a public company, strategic transactions and growth in their industries.

George Gunn, BVM&S, DVSM, MRCVS, Ph.D., has served as a member of our board of directors and as our Chairman of the Board since April 2015. Dr. Gunn is a Director of Phibro Animal Health Corporation, an animal health company, a position he has held since May 2015. Since August 2015, he has also been a Director of Diversigen, Inc., a U.S.-based metagenomic service provider, and a Director of Pharmaq Holding AS, a Swedish-based company involved in aquaculture. Dr. Gunn served as Division Head of Novartis Animal Health and a member of the Novartis Executive Committee through January 2015. Dr. Gunn joined Novartis in 2003 as Head of Novartis Animal Health, North America and became global head of the Animal Health Business Unit in 2004. In addition to this role, he was Division Head, Novartis Consumer Health, from September 2008 to March 2011 and served as Head of Corporate Social Responsibility from March 2011 to March 2014. Before joining Novartis, Dr. Gunn was president of U.S.-based Pharmacia Animal Health. His previous positions included various healthcare executive roles over the course of 18 years as well as nine years as a veterinary surgeon. Dr. Gunn has a bachelor of veterinary medicine and surgery and a diploma in veterinary state medicine from the Royal (Dick) School of Veterinary Studies in the United Kingdom. In 2008, he received an honorary doctorate in veterinary medicine and surgery from the University of Edinburgh. We believe Dr. Gunn is qualified to serve as a member of our board of directors based on his extensive animal health background as well as his executive experience and industry leadership.

Cormac Kilty, Ph.D.,has served as a member of our board of directors since November 2013. Dr. Kilty was employed as Chief Executive Officer of Argutus Medical Ltd. from March 2008 to December 2010 and as a scientific advisor to EKF Diagnostics Ltd., which acquired Argutus Medical. Dr. Kilty was the founder of Biotrin Holdings Ltd., a virology diagnostics company, which was sold in 2008 to DiaSorin S.p.A. Dr. Kilty is also a founder and past Chairman of the Irish BioIndustry Association from 2003 to 2007. From 2005 to 2009, Dr. Kilty served as co-founder and Chairman of Opsona. From February 1986 to June 1990, Dr. Kilty served as the Group Leader and subsequently Director of Research and Development and Technology Planning Assessment in Switzerland for Baxter Healthcare’s Diagnostics Division. Since 2011, Dr. Kilty has served as an Adjunct Associate Professor of Medicine and Medicinal Chemistry at University College Dublin, Ireland. Dr. Kilty has a B.Sc. in Zoology and a Ph.D. in Zoology and Biochemistry from University College Dublin. He carried out post-doctoral research in protein chemistry and immunology at the University of Texas at Austin and at University College Dublin. We believe Dr. Kilty is qualified to serve as a member of our board of directors based on his scientific background as well as his extensive executive experience and leadership in the biopharmaceutical industry.

John Paynehas served as a member of our board of directors since December 2013. Since September 2014, Mr. Payne has served as the President and Chief Executive Officer of Veterinary Specialists of North America, LLC a group of specialty veterinary practices located in New Jersey, Pennsylvania and New York. Since January 2012, Mr. Payne has also served as founder and Chief Executive Officer of Pet Health Innovations, LLC, an animal health consulting company. From 2005 to January 2012, Mr. Payne was employed with MMI, Inc., which operates the Banfield, Pet Hospital, where he served as a Senior Vice President from 2005 to 2006, as Executive Vice President from 2006 to 2007 and as President and Chief Executive Officer from 2007 to January 2012. While serving as President and Chief Executive Officer of MMI, Mr. Payne also served as a member of the Mars Global Petcare team from 2009 to January 2012. From 2000 to 2005, Mr. Payne served as President and General Manager for North America of Bayer Health Care, Animal Health Division, and as a member of the Human and Animal Health Division’s Global Health Care Team. Mr. Payne is the current chairman of the American Humane Association, dedicated to the protection of animals and children from cruelty, abuse and neglect. Mr. Payne has a B.A. in Secondary Education from St. Bernard College and an M.B.A. from Rockhurst University. We believe Mr. Payne is qualified to serve as a member of our board of directors based on his 40 years of experience in the veterinary care industry, guiding some of the world’s largest consumer companion animal care and veterinary service brands.

Class II Directors Continuing in Office until the 2016 Annual Meeting of Shareholders

Ashraf Hanna, Ph.D., M.D.,has served as a member of our board of directors since September 2014. Dr. Hanna has served as the Vice President of Commercial and Medical Affairs Finance at Genentech Inc., a biotechnology company, since March 2009 and served as its Vice President of Alliance Management and Portfolio Planning from January 2006 to March 2009. He also served as the Chief Financial Officer for the Genentech Foundation from January 2006 to March 2009. Prior to Genentech, Dr. Hanna served as Vice President of Strategic Planning at Tanox, Inc. from August 2001 to December 2005, and prior to that he served as senior associate and Engagement Manager at McKinsey and Company, a management consulting firm. Dr. Hanna has a B.A. in Physics from the University of Chicago, attended the Harvard Business School, has a Ph.D. in Physics from Harvard University and has an M.D. from the University of Massachusetts. We believe Dr. Hanna is qualified to serve as a member of our board of directors based on his significant finance and management experience in biopharmaceutical companies, including public companies.

Mark Heffernan, Ph.D.,one of our co-founders, has served as our Chief Executive Officer and a member of our board of directors since April 2011. In 2003, Dr. Heffernan co-founded Opsona Therapeutics Ltd., an Irish biotechnology company focused on human monoclonal antibodies (“mAbs”) and other molecules for inflammatory diseases and cancer, where he served as founder and Chief Executive Officer from January 2004 to March 2011 and as a Director from January 2004 to December 2011. Prior to co-founding Opsona Therapeutics, Dr. Heffernan worked in research and development and business development roles for Antisense Therapeutics Limited and Metabolic Pharmaceuticals Pty Ltd., spin-outs from Circadian Technologies Limited in Australia. Dr. Heffernan has a B.Sc. (Hons.) in Biochemistry and Pharmacology and a Ph.D. in Biochemistry from Monash University in Australia. We believe Dr. Heffernan is qualified to serve as a member of our board of directors based on his executive experience in the biopharmaceutical industry, his extensive knowledge of our company, his experience developing and commercializing mAbs for inflammatory diseases and his experience in raising capital for biotechnology companies.

Joseph McCracken, DVM,has served as a member of our board of directors since September 2014. Since September 2013, Dr. McCracken has worked as a consultant to and served on the boards of directors of several biopharmaceutical companies focusing on the design and implementation of corporate strategy and business development initiatives. From February 2011 to September 2013, Dr. McCracken served as the Vice President and Global Head of Business Development and Licensing for Hoffmann-La Roche Inc., a research-focused healthcare company, where he was responsible for global licensing activities, and from October 2009 to February 2011 he served as General Manager, Roche Pharma Japan and Asia Regional Head, Roche Partnering, for F. Hoffman- LaRoche Ltd., a subsidiary of F. Hoffmann-La Roche AG and was based in Tokyo. From August 2000 to October 2009, Dr. McCracken served as Vice President, Business Development at Genentech. From November 1997 to August 2000, Dr. McCracken served as Vice President of Worldwide Business and Technology Development at Rhone-Poulenc Rorer S.A., a French chemical and pharmaceutical company, and Vice President of Technology Licensing and Alliances at Aventis Pharma, a pharmaceutical company. Dr. McCracken has a B.S. in Microbiology, an M.S. in Pharmacology and a Doctorate of Veterinary Medicine from The Ohio State University. We believe

Dr. McCracken is qualified to serve as a member of our board of directors based on his extensive biopharmaceutical company operational experience and veterinary qualifications, including with international and public companies.

Rajiv Patelhas served as a member of our board of directors since February 2015. Mr. Patel is currently a Managing Member, portfolio manager and member of the global investment committee at Farallon Capital Management, L.L.C., an investment management firm that he joined in 1997. From 1993 to 1995, Mr. Patel worked at Donaldson, Lufkin & Jenrette as an investment banker in the project finance department, specializing in infrastructure, shipping and satellites. Mr. Patel has an M.B.A. from Stanford University’s Graduate School of Business and a B.S. in Operations Research and Industrial Engineering from Cornell University. We believe Mr. Patel, who is associated with a significant shareholder with which we have an important relationship, is qualified to serve as a member of our board of directors based on his extensive professional experience in investment management and the financial markets.

Director Independence

The NASDAQ Stock Market (“Nasdaq”) rules require that independent directors comprise a majority of a listed company’s board of directors within a specified period of the completion of an initial public offering. Our board of directors has reviewed its composition, the composition of its committees and the independence of each director. Our board of directors has determined that all of our directors satisfy the requirements of independence under the Nasdaq listing standards and the heightened independence standard for audit and compensation committee members set out under applicable rules of the SEC, except for Dr. Heffernan, our Chief Executive Officer. In making this determination, our board of directors considered the general definitions and criteria for determining the independence of members of the Board and other eligibility requirements of Nasdaq in determining their independence.

Board Leadership Structure

Our Articles, as well as our Corporate Governance Guidelines, provide our board of directors with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure is in the best interests of our company. We have currently separated these positions with Dr. Gunn serving as Chairman of the Board and Dr. Heffernan serving as Chief Executive Officer. Our board of directors believes that the separation of these positions strengthens the independence of our board of directors. The Chairman of the Board facilitates communications between members of our board of directors and works with management in the preparation of the agenda for each meeting of our board of directors. All of our directors are encouraged to make suggestions for agenda items.

Our board of directors has concluded that our current leadership structure is appropriate at this time. However, our board of directors periodically reviews our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Our board of directors’ role in risk oversight includes receiving reports from members of management regarding material risks faced by us and applicable mitigation strategies and activities, at least on a quarterly basis. The reports cover the critical areas of operations, sales and marketing, technology, and legal and financial affairs. Our board of directors and its committees consider these reports, discuss matters with management and identify and evaluate strategic or operational risks, and determine appropriate initiatives to address those risks.

Executive Sessions

The independent directors meet in executive session regularly and, in any event, at least semi-annually. The independent directors may choose one director annually to preside at all executive sessions, establish a procedure by which a presiding director will be selected, or otherwise select a presiding director for any particular executive session.

Meetings of the Board of Directors and Committees

Our board of directors held 25 meetings during fiscal year 2015, including seven meetings of the board of directors of our predecessor company, Nexvet Australia Pty Ltd (formerly known as Nexvet Biopharma Pty Ltd (“Nexvet Australia”)). Our board of directors has three standing committees: an audit committee (the “Audit Committee”), a compensation committee (the “Compensation Committee”) and a nominating and corporate governance committee (the “Nominating Committee”). During the last fiscal year, each of our directors attended at least 75% of the aggregate number of meetings of our board of directors and all of the committees of our board of directors on which such director served during that period.

Board Committees

The following table sets forth the standing committees of our board of directors and the members of each committee:

| Name of Director | | Audit | | Compensation | | Nominating |

| Chris Brown | | X | | | | |

| George Gunn, BVM&S, DVSM, MRCVS, Ph.D. | | | | | | Chair |

| Ashraf Hanna, Ph.D., M.D. | | Chair | | | | |

| Cormac Kilty, Ph.D. | | X | | | | X |

| Joseph McCracken, DVM, MS | | | | Chair | | X |

| John Payne | | | | X | | |

| Raj Patel | | | | X | | |

Audit Committee

The members of the Audit Committee are Mr. Brown, Dr. Hanna and Dr. Kilty. Dr. Hanna serves as chairman of the Audit Committee. Each member of our Audit Committee satisfies the financial literacy, independence and other membership requirements under the applicable rules of the SEC and Nasdaq as they apply to audit committee members, including Rule 10A-3(b)(1) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our board of directors has determined that Dr. Hanna is an “audit committee financial expert” as defined under the applicable rules of the SEC and has the requisite financial sophistication under Nasdaq rules. In arriving at these determinations, our board of directors examined each Audit Committee member’s scope of experience and the nature of his employment in corporate finance, accounting and related areas. The Audit Committee appoints our independent registered public accounting firm to perform audit services and any permissible non-audit services; evaluates the objectivity and independence of our independent registered public accounting firm and the individuals assigned to the engagement team as required by law; reviews our annual and quarterly consolidated financial statements and reports and discusses our consolidated financial statements and reports with our independent registered public accounting firm and management; reviews with our registered public accounting firm and management any significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our internal controls and disclosure controls and procedures; establishes procedures for the receipt, retention and treatment of complaints received by us regarding internal controls, accounting or auditing matters; establishes procedures for the confidential, anonymous submissions by employees regarding accounting, internal controls or accounting matters; and reviews and, if appropriate, approves proposed related party transactions. The Audit Committee held five meetings during fiscal year 2015 (including one meeting of the Audit Committee of the board of directors of our predecessor company, Nexvet Australia). Additional information regarding the Audit Committee is set forth in the Report of the Audit Committee immediately following Proposal No. 2.

Compensation Committee

The members of the Compensation Committee are Dr. McCracken, Mr. Payne and Mr. Patel. Our board of directors has determined that each member of the Compensation Committee satisfies the independence and other membership requirements under the applicable rules of the SEC and Nasdaq listing standards as they apply to compensation committee members. Our board of directors has also determined that all of the members of our Compensation Committee are independent directors under the applicable rules and regulations of the SEC and

Nasdaq, a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act, and an “outside director” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee reviews and makes recommendations to our board of directors with respect to the compensation of our Chief Executive Officer and reviews and approves the compensation of our other executive officers, reviews and approves corporate and personal performance goals and objectives relevant to executive compensation, reviews and makes recommendations to our board of directors with respect to the adoption of equity-based compensation, incentive compensation and other employee benefit plans, administers the issuance of options and other equity incentive arrangements under our equity incentive plans, establishes executive compensation policies and reviews and approves any employment agreements or arrangements with our executive officers. The Compensation Committee held 10 meetings during fiscal year 2015.

Nominating and Corporate Governance Committee

The members of the Nominating Committee are Dr. Gunn, Dr. Kilty and Dr. McCracken. Our board of directors has determined that each member of the Nominating Committee satisfies the independence and other membership requirements under the applicable rules of the SEC and Nasdaq as they apply to nominating committee members. The Nominating Committee determines criteria for identifying, evaluating and recommending candidates for our board of directors and its committees; identifies, evaluates, and recommends individuals for membership on our board of directors and its applicable committees; considers shareholder nominations of candidates for election to our board of directors; reviews and evaluates director performance on our board of directors and applicable committees of our board of directors and determines whether continued service on our board of directors or on such committees of our board of directors is appropriate; develops, reviews and recommends a set of corporate governance policies and principles; and reviews our governing documents, including our Constitution, and recommends changes to our board of directors. The Nominating Committee held three meetings during fiscal year 2015.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is, or has at any time during the past year been, one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of our board of directors or Compensation Committee of any entity that has one or more executive officers serving on our board of directors or Compensation Committee.

Director Nominations

Our Nominating Committee considers nominees recommended by directors, officers, employees, shareholders, and others based upon each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in members of our board of directors. Nominees for our board of directors must be committed to enhancing long-term shareholder value and possess a high level of personal and professional ethics, sound business judgment, appropriate experience and achievements, personal character and integrity. Members of our board of directors are expected to understand our business and the industry in which we operate, regularly attend meetings of our board of directors and its committees, participate in meetings and decision making processes in an objective and constructive manner and be available to advise our officers and management. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates, as appropriate.

We do not have a formal policy regarding the consideration of diversity in identifying nominees for directors. Once our Nominating Committee has determined that an individual is appropriately qualified to serve on our board of directors, our Nominating Committee then considers the extent to which the membership of the candidate on our board of directors would promote a diversity of perspectives, backgrounds and experiences among the directors, including expertise and experience in a diversity of substantive matters pertaining to our business. However, our board of directors does not believe the subjective and varying nature of this nomination process lends itself to a formal policy or fixed rules with respect to the diversity of our board of directors.

Our Nominating Committee will consider director candidates recommended by shareholders and will evaluate director candidates in light of several factors, including the general criteria set forth above. Shareholders who wish to recommend individuals for consideration by our Nominating Committee to become nominees for election to our board of directors at an annual meeting of shareholders must do so in accordance with the procedures

set forth in the “Shareholder Proposals or Nominations to be Presented at Next Annual Meeting” section of this proxy statement and in compliance with our Articles. Each submission must set forth: the name and address of the shareholder on whose behalf the submission is made; the class and number of our shares that are owned beneficially by such shareholder as of the date of the submission; a representation by such shareholder that it is a registered holder of shares entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such nomination; a statement as to whether such shareholder intends or is part of a group that intends (i) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of our outstanding share capital required to approve or elect the nominee and/or (ii) otherwise to solicit proxies from shareholders in support of such nomination; the full name of the proposed candidate; a description of the proposed candidate’s business experience for at least the previous five years; complete biographical information for the proposed candidate; a description of the proposed candidate’s qualifications as a director; and any other information described in our Articles. Pursuant to our Articles, notwithstanding a proper submission, if the submitting shareholder, or a qualified representative of such submitting shareholder does not appear at the annual meeting to present such nomination, such nomination will be disregarded.

Communications with Directors

Individuals may communicate with our board of directors by contacting:

Corporate Secretary

NIBRT (National Institute for Bioprocessing Research & Training),

Foster's Avenue, Mount Merrion, Blackrock, Co. Dublin, Ireland

Telephone: +353 (1) 901 0339

Our Corporate Secretary will forward all appropriate correspondence to our board of directors, except for items that are unrelated to our directors’ duties, such as spam, junk mail, mass mailings, solicitations, resumes and job inquiries, and patently offensive or otherwise inappropriate material.

Director Attendance at Annual Meetings

We attempt to schedule our annual meetings of shareholders at a time and date to accommodate attendance by directors, taking into account the directors’ schedules. All directors are encouraged to attend our annual meetings of shareholders.

Committee Charters and Other Corporate Governance Materials

Our board of directors has adopted a written charter for each of the Audit Committee, the Compensation Committee and the Nominating Committee. Each charter is available on our website at www.nexvet.com.

We have adopted a Code of Business Conduct and Ethics (the “Code”), that applies to all of our employees, officers and directors. The Code is available on our website at www.nexvet.com. Any substantive amendment to or waiver of any provision of the Code may be made only by our board of directors, and will be disclosed on our website as well as via any other means then required by Nasdaq listing standards or applicable law.

We have adopted Corporate Governance Guidelines that address the composition of our board of directors, criteria for board membership and other board governance matters. These guidelines are available on our website at www.nexvet.com.

The information contained on our website, including our committee charters, the Code, and our Corporate Governance Guidelines, is not incorporated by reference into this proxy statement, and inclusion in this proxy statement of our website address and references to information accessible on our website are inactive textual references only.

Executive Officers

The following table sets forth information regarding our executive officers:

| Name | | Position | | Age |

| Mark Heffernan, Ph.D. | | Chief Executive Officer and Director | | 39 |

| Jürgen Horn,Dr. med.ret., Ph.D. | | Chief Product Development Officer | | 45 |

| David Gearing, Ph.D. | | Chief Scientific Officer | | 54 |

| Damian Lismore | | Chief Financial Officer | | 56 |

| Geraldine Farrell | | Vice President Operations and General Counsel | | 46 |

Mark Heffernan, Ph.D.Biographical information is set forth above in the section titled “Corporate Governance – Our Board of Directors – Class II Directors for Election at the 2016 Annual Meeting of Shareholders.”

Jürgen Horn, Dr. med.ret., Ph.D., has served as our Chief Product Development Officer since August 2015. From January 2015 to August 2015, Dr. Horn served as Senior Director of Global Innovation Strategy at Elanco, a large animal health company. Prior to joining Elanco, Dr. Horn served as Head of Global Pharmaceuticals Development at Novartis Animal Health, a large animal health company, from August 2008 to December 2014. Dr. Horn previously served in a series of marketing, research and development and project management roles at Novartis Animal Health as well as the Novartis Institute for Biomedical Research, following his training as a veterinary surgeon and time in small animal and equine practices. Dr. Horn has a doctorate in veterinary medicine from the Ludwig-Maximilians-University of Munich in Germany, a Ph.D. from the Royal Veterinary College at the University of London, and an MBA from the London Business School and Columbia Business School. His primary veterinary training was conducted at the Ludwig-Maximilians-University of Munich and the University of Sydney in Australia.

David Gearing, Ph.D.,one of our co-founders, has served as our Chief Scientific Officer since September 2010. From January 2000 to September 2007, Dr. Gearing served as the Chief Research Officer and Director of Research at CSL Ltd, a specialty biopharmaceutical company based in Melbourne, Australia. From January 1996 to January 2000, he served as Vice President and founder at Millennium Biotherapeutics, Inc., a biopharmaceutical company. From August 1994 to December 1995, Dr. Gearing served as Director of Molecular Biology at SyStemix, a stem cell and gene therapy company. From January 1990 to August 1994, he served as a staff scientist at Immunex Corporation, a biopharmaceutical company. Dr. Gearing has also served as an entrepreneur-in-residence at the Queensland Brain Institute, University of Queensland and as a Professor at the Monash Institute of Medical Research. Dr. Gearing has a B.Sc. (Hons.) in Biochemistry from Leeds University and a Ph.D. in Biochemistry and Molecular Biology from Monash University and also trained at the Cancer Research Unit of the Walter and Eliza Hall Institute in Melbourne, Australia.

Damian Lismorehas served as our Chief Financial Officer since November 2013. From August 2005 to August 2013, Mr. Lismore served as Chief Financial Officer and Company Secretary of Biota Holdings Limited, an Australian-listed biotechnology company. From April 2002 to August 2005, he served as Managing Director of MNT Innovations, the commercial arm of the Cooperative Research Centre for MicroTechnology, a partnership of research, industry and government focused on developing new technologies. Mr. Lismore served as General Manager Australia of Analytica Limited from February 2001 to April 2002. From May 2000 to December 2000, he served as Chief Operating Officer of MebWeb Limited. From April 1996 to May 2000, Mr. Lismore was a member of the Group Executive Committee and served as Group Financial Controller and General Manager of Buying and Finance at Sigma Company Limited, an Australian-listed pharmaceutical wholesaler and manufacturer. From 1986 to 1996, Mr. Lismore served in various roles, the most recent as Senior Manager with Price Waterhouse (now PricewaterhouseCoopers) in Australia, and from 1980 to 1986 he served in various accounting roles at Deloitte Haskins & Sells (now Deloitte LLP) in the United Kingdom. He is a member of the Institute of Chartered Accountants in Australia, a Fellow of the Institute of Chartered Accountants in Ireland, and is a graduate of the Australian Institute of Company Directors. Mr. Lismore has a Bachelor of Accountancy with Honors from University of Ulster.

Geraldine Farrellhas served as our Vice President Operations and General Counsel since August 2013. Ms. Farrell served as a senior lawyer at Griffith Hack, an intellectual property firm in Australia, from November 2008 to July 2013. Prior to joining Griffith Hack, Ms. Farrell was an attorney at Freehills (now Herbert Smith Freehills) and Minter Ellison, both large Australian law firms. Ms. Farrell has more than 18 years’ experience as an intellectual property and commercial lawyer. Ms. Farrell is a graduate of the Australian Institute of Company Directors, and has served as a director on several private company boards of directors, government organizations and not-for-profit entities. Ms. Farrell has a Bachelor of Science in Pharmacology and Physiology, a Bachelor of Laws, and a Master of Laws (Intellectual Property), all from Monash University.

Proposal No. 2

Ratification of Appointmentof IndependentRegistered PublicAccountingFirmand StatutoryAuditorand Authorization to Fixits Remuneration

The Audit Committee of our board of directors has appointed PricewaterhouseCoopers to serve as our independent registered public accounting firm to audit our consolidated financial statements and to perform the Irish statutory audit of Nexvet Biopharma plc for the fiscal year ending June 30, 2016. We are asking our shareholders to ratify this appointment and to authorize our board of directors acting through the Audit Committee to fix the remuneration of PricewaterhouseCoopers.

PricewaterhouseCoopers has acted as our independent registered public accounting firm since its appointment in July 2014. A representative of PricewaterhouseCoopers is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Shareholder ratification of the appointment of PricewaterhouseCoopers as our independent registered public accounting firm and statutory auditor and authorization to fix its remuneration is not required by our Articles or otherwise. However, our board of directors is submitting this proposal to shareholders as a matter of good corporate governance practice. If the shareholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain that firm. Even if the appointment is ratified, the Audit Committee at its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of Nexvet and our shareholders.

Fees for Professional Services

The following table sets forth the aggregate fees billed to us for the fiscal years ended June 30, 2015 and 2014 by PricewaterhouseCoopers:

| | | Fiscal 2015

($) | | | Fiscal 2014

($) | |

| Audit fees (1) | | | 306,000 | | | | 215,000 | |

| Audit-related fees (2) | | | 597,000 | | | | — | |

| Tax fees (3) | | | — | | | | — | |

| All other fees (4) | | | — | | | | — | |

| | | | | | | | | | |

| (1) | Audit fees consist of fees billed for professional services rendered for the audit of our consolidated annual financial statements, the review of the interim consolidated financial statements included in quarterly reports and other services that are normally provided by the independent registered public accounting firm, such as services in connection with subsidiary audits, statutory and regulatory filings or engagements, acquisitions and SEC registration statements. |

| | |

| (2) | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit fees.” |

| | |

| (3) | Tax fees consist of fees billed for professional services rendered for tax compliance, tax advice and tax planning (domestic and international). These services include assistance regarding federal, state and international tax compliance, acquisitions and international tax planning. |

| | |

| (4) | All other fees consist of fees for products and services other than the services reported above. |

Our independent registered public accounting firm has not provided any services resulting in audit-related fees, tax fees, or all other fees, as described above (whether or not pursuant to a waiver by the Audit Committee of the pre-approval provisions set forth in applicable rules of the SEC). The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast on the proposal at the annual meeting. Because abstentions and broker non-votes will not be considered votes cast at the annual meeting, abstentions and broker non-votes will not have any effect on the outcome of voting on this proposal, although broker non-votes will be counted as present for purposes of determining a quorum

Accordingly, we are asking shareholders to approve the following resolution as an ordinary resolution of the Company at the annual meeting:

RESOLVEDthat the shareholders ratify the appointment of PricewaterhouseCoopers as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2016 and statutory auditor until the close of the next annual general meeting of shareholders, and to authorize the board of directors acting through the Audit Committee to fix its remuneration.

Our board of directors unanimously recommends a vote “FOR” the ratification of PricewaterhouseCoopers as our independent registered public accounting firm and statutory auditor for the fiscal year ending June 30, 2016 and the authorization of our board of directors acting through the Audit Committee to fix its remuneration.

Report of the Audit Committee

The Audit Committee (the “Audit Committee”) of the board of directors (the “Board”) of Nexvet Biopharma public limited company (“Nexvet”) currently consists of three directors, each of whom the Board has determined to satisfy the financial literacy and independence requirements under applicable rules of the U.S. Securities and Exchange Commission and the Nasdaq Global Market as they apply to audit committee members. The Audit Committee acts pursuant to a written charter that has been adopted by the Board. A copy of the charter is available on Nexvet’s website at www.nexvet.com. The information contained on Nexvet’s website, including the charter, is not incorporated by reference into this report or into Nexvet’s proxy statement in which this report appears, and inclusion of Nexvet’s website address and references to information accessible on Nexvet’s website are inactive textual references only.

The Audit Committee oversees Nexvet’s financial reporting process on behalf of the Board. The Audit Committee is responsible for retaining Nexvet’s independent registered public accounting firm, evaluating its independence, qualifications and performance and approving in advance the engagement of the independent registered public accounting firm for all audit and non-audit services. Management has the primary responsibility for the financial statements and the financial reporting process, including internal control systems, and procedures designed to ensure compliance with applicable laws and regulations. Nexvet’s independent registered public accounting firm, PricewaterhouseCoopers, is responsible for expressing an opinion as to the conformity of Nexvet’s audited financial statements with generally accepted accounting principles.

The Audit Committee has reviewed and discussed Nexvet’s audited financial statements with management. The Audit Committee has discussed with Nexvet’s independent registered public accounting firm the matters required to be discussed by the Auditing Standard No. 16,Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board. In addition, the Audit Committee has met with the independent registered public accounting firm, with and without management present, to discuss the overall scope of the independent registered public accounting firm’s audit, the results of its examinations, internal controls matters and the overall quality of Nexvet’s financial reporting.

The Audit Committee has received the written disclosures and the letter from Nexvet’s independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to Nexvet’s board of directors that Nexvet’s audited financial statements be included in Nexvet’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015.

| | AUDIT COMMITTEE |

| | Chris Brown |

| | Ashraf Hanna, Ph.D., M.D. |

| | Cormac Kilty, Ph.D. |

Pursuant to the Instruction to Item 407(d), the foregoing Report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Nexvet specifically incorporates such information by reference in such filing.

Proposal No. 3

Amendments to Memorandumof Associationand Adoptionof RevisedArticlesof Association

Background and Description

Holders of our ordinary shares are being asked to consider and approve certain amendments to our Constitution (as amended, the “Amended Constitution”) which take into account the comprehensive consolidation, with amendments, of company law in Ireland effected by the new Irish Companies Act 2014, which came into force on June 1, 2015 (the “2014 Act”). The Amended Constitution is being proposed as a special resolution pursuant to Article 67 of our Articles. Our board of directors has unanimously approved the Amended Constitution and recommends adoption by our shareholders.

Following the introduction of the 2014 Act, we are proposing the Amended Constitution to align our Constitution with the new act and to minimize the impact on our company’s historical practices. We have set out below a summary of the changes to our Constitution we are proposing, which include:

| · | Allowing directors to use our company property, subject to conditions approved by the board of directors and the provisions of the Amended Constitution, the 2014 Act and other applicable law; |

| · | Clarifying that prior board approval is required in circumstances where a director may have obligations to a party other than the Company that impact his or her ability to exercise independent judgment; |

| · | Providing for new requirements and opting out of optional provisions regarding the Irish statutory accounting records and financial statements; |

| · | Maintaining the disapplication of optional sections under the new 2014 Act; and |

| · | Updates to cross-references and statutory references throughout our Constitution. |

Article 117 of the Amended Constitution would permit directors to continue to use company property in accordance with our policies and applicable agreements. Under Section 228(1)(d) of the 2014 Act, the use of company property by a director for his or her own benefit is prohibited unless expressly permitted in the company’s constitution or approved by resolution of the company’s shareholders. We have historically permitted our chief executive officer, who also serves as a member of our board of directors, and other executive officers to make reasonable personal use of company-provided laptops, mobile phones and other technology resources, such as for personal email, telephone calls and text messaging, provided that such incidental use does not interfere with the executive’s duties, is reasonable in scope and duration, does not conflict with our business and does not violate any of our policies, including our Technology Use Policy. We believe such incidental personal use is reasonable, especially when the roles of our executive officers require frequent domestic and international travel.

Article 125 of the Amended Constitution makes it clear that Sections 228(1)(e) and 228(2), which were added by the 2014 Act, will not restrict anything which may be done by any director in accordance with the prior authorization of the board of directors or a committee thereof. In addition, Article 125 would prohibit any individual director from entering into a commitment that might otherwise be permitted by Section 228(2) of the 2014 Act without the prior approval of the board of directors or a committee thereof.

Articles 83 and Articles 171 to 176 of the Amended Constitution would provide for the new requirements regarding the maintenance of Irish statutory accounting records set out in Chapter 2 of Part 6 of the 2014 Act. Article 176 of the Amended Constitution would allow the board of directors to send shareholders summary financial statements in lieu of the full Irish statutory financial statements. However, when the board of directors elects to do so, any shareholder may request a full copy of the full Irish statutory financial statements.

Article 1.1 of the Amended Constitution would disapply optional sections of the 2014 Act. The 2014 Act adopts a new approach in regard to the articles of association of all companies. Instead of making provisions for an optional model set of articles of association, the 2014 Act now contains specific sections which apply to all

companies unless specifically excluded by the articles of association. Our existing Articles already disapply these provisions, but Article 1.1 of the Amended Constitution is necessary to maintain this approach.

The Constitution would also be revised throughout to make minor amendments that update statutory references consistent with the 2014 Act.

The full text of the proposed Amended Constitution, with the proposed changes reflected therein, is attached to this proxy statement as Appendix A. We urge you to read the text of the Amended Constitution in its entirety. The foregoing description of the proposed changes is qualified in its entirety by reference to Appendix A.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of at least 75% of the votes cast on the proposal at the annual meeting. Because abstentions and broker non-votes will not be considered votes cast at the annual meeting, abstentions and broker non-votes will not have any effect on the outcome of voting on this proposal, although broker non-votes will be counted as present for purposes of determining a quorum.

Accordingly, we are asking shareholders to approve the following resolutions as special resolutions of the Company at the annual meeting:

RESOLVEDthat the wording in the Memorandum of Association of the Company be updated as follows:

(a) By the deletion in paragraph 2 of the words “The Company is to be a public limited company” and the substitution therefor of the words “The Company is to be a public limited company registered under Part 17 of the Companies Act 2014”;

(b) In paragraph 3(p), by the deletion of the words “as defined by Section 155 of the Companies Act 1963 or another subsidiary as defined by the said Section” and the substitution therefor of the words “as defined by sections 7 and 8 of the Companies Act 2014 or another subsidiary as defined by the said section”; and

(c) By the re-numbering of each of the existing sub-paragraphs 3(a) to 3(jj) as sub-paragraphs 3.1 to 3.36.

RESOLVEDthat the Articles of Association produced to the meeting (a copy of which is attached to this proxy statement as Appendix A) be adopted as the new Articles of Association of the Company in substitution for and to the exclusion of the existing Articles of Association of the Company.

Our board of directors unanimously recommends a vote “FOR” the amendments to our Memorandum and the adoption of revised Articles.

Executive Compensation

As an “emerging growth company” as defined in the JOBS Act, we are not required to include a Compensation Discussion and Analysis section and have elected to comply with the scaled disclosure requirements applicable to emerging growth companies. The following is a discussion of compensation arrangements of our named executive officers (“NEOs”), which consist of our principal executive officer and the next two most highly compensated executive officers, for fiscal year 2015. Our NEOs for fiscal year 2015 were as follows:

·Mark Heffernan, Ph.D., Chief Executive Officer;

·David Gearing, Ph.D., Chief Scientific Officer; and

·Damian Lismore, Chief Financial Officer

Summary Compensation Table – 2015 and 2014

The following table sets forth the compensation awarded to, earned by or paid for services in all capacities by our NEOs during fiscal years 2015 and 2014. The compensation described in this table and throughout this section does not include medical, group life insurance or other benefits that are available to all of our salaried employees.

| Name and Principal Position | | Year | | Salary(1) | | | Bonus(1)(2) | | | Option

Awards(1)(3) | | | Stock

Awards(1)(3) | | | All Other

Compensation(4) (1) | | | Total(1) | |

| Mark Heffernan, Ph.D. | | 2015 | | $ | 353,549 | | | $ | 109,379 | | | $ | 289,504 | | | $ | 51,584 | | | $ | | | | $ | 806,016 | |

| Chief Executive Officer | | 2014 | | | 244,852 | | | | 90,810 | | | | 143,192 | | | | — | | | | 53,543 | (4) | | | 532,397 | |

| David Gearing, Ph.D. | | 2015 | | | 282,858 | | | | 74,392 | | | | 271,788 | | | | 39,844 | | | | | | | | 668,882 | |

| Chief Scientific Officer | | 2014 | | | 240,673 | | | | 89,036 | | | | 143,192 | | | | — | | | | — | | | | 472,901 | |

| Damian Lismore | | 2015 | | | 280,693 | | | | 77,191 | | | | 261,605 | | | | 42,690 | | | | | | | | 662,179 | |

| Chief Financial Officer | | 2014 | | | 149,650 | (5) | | | 39,469 | | | | 110,148 | | | | — | | | | — | | | | 299,267 | |

| (1) | Dollar amounts reflect the U.S. dollar equivalent of the amounts paid to our NEOs. The amounts were converted to U.S. dollars from Australian dollars using the applicable exchange rates for A$ into US$. Of this amount, Australian residents received superannuation (a government-required retirement program) contributions at the statutory rate of 9.25% and 9.5% of base salary in fiscal years 2014 and 2015, respectively. |

| | |

| (2) | Represents amounts earned in the relevant fiscal year as bonuses awarded by our board of directors based on the achievement of company goals related to financing and corporate activities and advancement of our development programs. |

| | |

| (3) | Represents the grant date fair value of all awards (other than the award to Dr. Heffernan for his service as a director) made during the relevant fiscal year calculated using the assumptions described in the notes to our consolidated financial statements included in our annual report on Form 10-K. The Option Awards compensation for each NEO includes $148,927 in respect of a non-statutory share option to purchase 100,000 ordinary shares at $15.00 per share, which vested 25% through May 2015 and thereafter in equal quarterly installments on the last day of the next 15 calendar quarters. |

| | |

| (4) | Represents $21,417 in cash and $32,126 in the grant date fair value of options received by Dr. Heffernan in fiscal year 2014 for his service as a director. The option grant date fair value was determined using the assumptions described in the notes to our consolidated financial statements included in our annual report on Form 10-K. |

| | |

| (5) | Mr. Lismore joined us in November 2013 and the amount for fiscal year 2014 reflects a partial year of service. |

Outstanding Equity Awards as of June 30, 2015

The following table sets forth information regarding outstanding option awards held by our NEOs as of June 30, 2015.

| | | | | Option Awards |

| Name | | Grant Date | | Exercisable

(#) | | | Unexercisable

(#) | | | Option

Exercise

Price

($) | | | Option

Expiration Date |

| Mark Heffernan Ph.D. | | 11/05/2013 | | | 6,135 | | | | 12,271 | (1) | | | 0.125 | | | 11/04/2020 |

| | | 09/18/2014 | | | — | | | | 21,750 | | | | 0.125 | | | 07/01/2019 |

| | | 08/19/2014 | | | — | | | | 52,040 | | | | 6.35 | | | 02/28/2018 |

| | | 05/18/2015 | | | 30,000 | | | | 70,000 | | | | 15.00 | | | 02/10/2022 |

| David Gearing Ph.D. | | 11/05/2013 | | | 6,135 | | | | 12,271 | (1) | | | 0.125 | | | 11/04/2020 |

| | | 09/18/2014 | | | — | | | | 16,800 | | | | 0.125 | | | 07/01/2019 |

| | | 08/19/2014 | | | — | | | | 46,372 | | | | 6.35 | | | 02/28/2018 |

| | | 05/18/2015 | | | 30,000 | | | | 70,000 | | | | 15.00 | | | 02/10/2022 |

| Damian Lismore | | 11/05/2013 | | | 4,719 | | | | 9,440 | (1) | | | 0.125 | | | 11/04/2020 |

| | | 09/18/2014 | | | — | | | | 18,000 | | | | 0.125 | | | 07/01/2019 |

| | | 05/18/2015 | | | 30,000 | | | | 70,000 | | | | 15.00 | | | 02/10/2022 |

| (1) | Grant vested or will vest, as applicable, in equal annual installments as to 33% of the underlying ordinary shares on each of November 5, 2014, 2015 and 2016. |

Employment Agreements

The following summarizes the employment agreements of our NEOs, which we entered into in December 2014. The employment agreements set forth the terms and conditions of employment that have been in effect following the closing of our initial public offering, including base salary, bonuses, eligibility to receive our standard employee benefit plans, equity awards and the acceleration of the vesting of share options held by the NEO upon the occurrence of certain conditions. Dr. Heffernan and Mr. Lismore have each signed our standard proprietary information and inventions agreement, and Dr. Gearing’s employment agreement contains standard confidential information, invention assignment and non-competition provisions. Our board of directors has instructed Dr. Heffernan and Mr. Lismore to remain in Melbourne, Australia for the foreseeable future and has initiated contractual discussions with both parties regarding deferral of their relocation to the San Francisco Bay Area contemplated under their employment agreements.

Mark Heffernan, Ph.D.

Dr. Heffernan has served as our Chief Executive Officer since April 2011 and as a member of our board of directors since August 2014. Following completion of our initial public offering, he has continued to serve in that role in an “at will” capacity, will continue to be nominated by us for election to our board of directors and is expected to be based in the San Francisco Bay Area. Dr. Heffernan’s annual base salary is $450,000. He is also eligible for an annual cash bonus of up to 45% of his annual base salary for the year in which the bonus is granted, based on his achievement of personal objectives and our achievement of corporate objectives determined by our board of directors or Compensation Committee. Contingent on his relocation to the San Francisco Bay Area by a date agreed to by our board of directors, Dr. Heffernan will be entitled to a one-time relocation allowance pursuant to which we will reimburse up to $119,700 of his relocation expenses (which he must repay to us if he voluntarily resigns without “good reason” within 12 months of the completion of our initial public offering), as well as reimbursement of up to $25,000 for vacation travel in each of fiscal years 2016, 2017 and 2018.

Pursuant to his employment agreement, we granted Dr. Heffernan a nonstatutory share option to purchase 100,000 of our ordinary shares at the greater of $15.00 per share or the public offering price, which vested 25% in May 2015 and thereafter in substantially equal quarterly installments on the last day of each of the next 15 calendar

quarters. Dr. Heffernan is also be eligible to receive annual equity awards of up to $1.0 million in value, which may vest on service, performance or other conditions established by our board of directors. Upon a “change in control,” all equity awards held by Dr. Heffernan will become 100% vested and exercisable in full.

David Gearing, Ph.D.

Dr. Gearing has served as our Chief Scientific Officer since September 2010. Following completion of our initial public offering, he has continued to serve in that role and is expected to continue to be based in Melbourne, Australia. Dr. Gearing’s annual base salary is $325,000 (inclusive of statutory superannuation fund contributions, currently at a rate of 9.5%). He is also eligible for an annual cash bonus of up to 40% of his annual base salary for the year in which the bonus is granted, based on his achievement of personal objectives and our achievement of corporate objectives determined by our board of directors.

Pursuant to his employment agreement, we granted Dr. Gearing a nonstatutory share option to purchase 100,000 of our ordinary shares at the greater of $15.00 per share or the public offering price, which vested 20% upon closing of our initial public offering and thereafter in substantially equal quarterly installments on the last day of each of the next 16 calendar quarters. Dr. Gearing is also eligible to receive annual equity awards of up to $300,000 in value, which may vest on service, performance or other conditions established by our board of directors. Upon a “change in control,” all equity awards held by Dr. Gearing will become 100% vested and exercisable in full.

Damian Lismore