Investor Presentation August 2024

Disclaimer This presentation has been prepared by us solely for information purposes. This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, completion and subsequent integration of our proposed acquisition of Cheney Bros., Inc. (the “Cheney Brothers Transaction”) and other nonhistorical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. The following factors, in addition to those discussed under the section entitled Item 1A Risk Factors in the Company’s Annual Report on Form 10-K for the fiscal year ended July 1, 2023 filed with the Securities and Exchange Commission (the “SEC”) on August 16, 2023 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 30, 2024 filed with the SEC on May 8, 2024, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, could cause actual future results to differ materially from those expressed in any forward-looking statements: economic factors, including inflation or other adverse changes such as a downturn in economic conditions or a public health crisis, negatively affecting consumer confidence and discretionary spending; our reliance on third-party suppliers; labor relations and cost risks and availability of qualified labor; costs and risks associated with a potential cybersecurity incident or other technology disruption; our reliance on technology and risks associated with disruption or delay in implementation of new technology; competition in our industry is intense, and we may not be able to compete successfully; we operate in a low margin industry, which could increase the volatility of our results of operations; we may not realize anticipated benefits from our operating cost reduction and productivity improvement efforts; our profitability is directly affected by cost inflation and deflation and other factors; we do not have long-term contracts with certain of our customers; group purchasing organizations may become more active in our industry and increase their efforts to add our customers as members of these organizations; changes in eating habits of consumers; extreme weather conditions, including hurricane, earthquake and natural disaster damage; volatility of fuel and other transportation costs; our inability to adjust cost structure where one or more of our competitors successfully implement lower costs; our inability to increase our sales in the highest margin portion of our business; changes in pricing practices of our suppliers; our growth strategy may not achieve the anticipated results; risks relating to acquisitions, including the risks that we are not able to realize benefits of acquisitions or successfully integrate the businesses we acquire; environmental, health, and safety costs, including compliance with current and future environmental laws and regulations relating to carbon emissions and climate change and related legal or market measures; our inability to comply with requirements imposed by applicable law or government regulations, including increased regulation of electronic cigarette and other alternative nicotine products; a portion of our sales volume is dependent upon the distribution of cigarettes and other tobacco products, sales of which are generally declining; the potential impact of product recalls and product liability claims relating to the products we distribute and other litigation; adverse judgments or settlements or unexpected outcomes in legal proceedings; negative media exposure and other events that damage our reputation; decrease in earnings from amortization charges associated with acquisitions; impact of uncollectibility of accounts receivable; increase in excise taxes or reduction in credit terms by taxing jurisdictions; the cost and adequacy of insurance coverage and increases in the number or severity of insurance and claims expenses; risks relating to our substantial outstanding indebtedness, including the impact of interest rate increases on our variable rate debt; our ability to raise additional capital on commercially reasonable terms or at all; and the following risks related to the Cheney Brothers Transaction: (i) the risk that U.S. federal antitrust clearance or other approvals required for the Cheney Brothers Transaction may be delayed or not obtained or are obtained subject to conditions (including divestitures) that are not anticipated that could require the exertion of our management’s time and our resources or otherwise have an adverse effect on us; (ii) the risk that we could owe a $115.2 million termination fee to Cheney Bros., Inc. (“Cheney Brothers”) under certain circumstances relating to a failure to obtain U.S. federal antitrust clearance or any other required antitrust or competition approvals; (iii) the possibility that certain conditions to the consummation of the Cheney Brothers Transaction will not be satisfied or completed on a timely basis and accordingly the Cheney Brothers Transaction may not be consummated on a timely basis or at all; (iv) uncertainty as to the expected financial performance of the combined company following completion of the Cheney Brothers Transaction; (v) the possibility that the expected synergies and value creation from the Cheney Brothers Transaction will not be realized or will not be realized within the expected time period; (vi) the exertion of our management’s time and our resources, and other expenses incurred and business changes required, in connection with complying with the undertakings in connection with U.S. federal antitrust clearance or other third party consents or approvals for the Cheney Brothers Transaction; (vii) the risk that unexpected costs will be incurred in connection with the completion and/or integration of the Cheney Brothers Transaction or that the integration of Cheney Brothers’ foodservice business will be more difficult or time consuming than expected; (viii) the availability of debt financing for the Cheney Brothers Transaction; (ix) a downgrade of the credit rating of our indebtedness, which could give rise to an obligation to redeem existing indebtedness; (x) unexpected costs, charges or expenses resulting from the Cheney Brothers Transaction; (xi) the inability to retain key personnel; (xii) disruption from the announcement, pendency and/or completion of the Cheney Brothers Transaction, including potential adverse reactions or changes to business relationships with customers, employees, suppliers, other business partners or regulators, making it more difficult to maintain business and operational relationships; and (xiii) the risk that, following the Cheney Brothers Transaction, the combined company may not be able to effectively manage its expanded operations. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in our filings with the SEC. Any forward-looking statement, including any contained herein, speaks only as of the time of this presentation and we do not undertake to update or revise them as more information becomes available or to disclose any facts, events, or circumstances after the date of this presentation that may affect the accuracy of any forward-looking statement, except as required by law. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA and Adjusted Diluted EPS. These metrics have important limitations and should not be considered in isolation or as a substitute for measures of the Company’s financial performance prepared in accordance with GAAP. In addition, these metrics, as presented by the Company may not be comparable to similarly titled measures of other companies due to varying methods of calculations. Please refer to the Appendix of this presentation for definitions of the non-GAAP financial measures included in this presentation. The Company owns or has rights to use a number of registered and common law trademarks, service marks and trade names in connection with its business, including Performance Foodservice, PFG Customized, Vistar, West Creek, Silver Source, Braveheart 100% Black Angus, Empire’s Treasure, Brilliance, Heritage Ovens, Village Garden, Guest House, Piancone, Luigi’s, Ultimo, Corazo, and Assoluti. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, service marks, and trade names. This presentation contains additional trademarks, service marks, and trade names of others, which are the property of their respective owners. All trademarks, service marks, and trade names appearing in this presentation are, to our knowledge, the property of their respective owners. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state. PFG / INVESTOR Presentation

Strategic M&A remains �core to PFG’s strategy PFG is announcing M&A activity for two strategic platforms Cheney Bros, Inc. - a leading broadline distributor in the Southeast U.S. José Santiago, Inc. - a leading broadline distributor in Puerto Rico Announced today Closed in July 2024 High quality and diverse customer base, including significant independent restaurant exposure 1 Opportunity to geographically expand into the Caribbean 1 State of the art facilities in attractive, growing markets 2 High-growth business 2 Diverse set of high-value end markets and product offerings 3 Unlocks further growth opportunities to the Caribbean 3 High quality and experienced management team, excellent cultural fit 4 Excellent management team and culture 4

Target Announcement Successful integration Accelerated growth Synergy realization July 2019 P P P May 2021 P P P Dec 2021 P P P Pfg has a strong track �record of M&A We have successfully completed numerous high-quality acquisitions, each adding capabilities and broadening our reach Demonstrated ability to continuously achieve highly strategic and successful M&A Consistently delivered successful integration and synergy realization

José Santiago, Inc. Overview Overall deal rationale and considerations Background José Santiago, Inc. is headquartered at its facility in Bayamon, Puerto Rico José Santiago is a leading independent broadline foodservice distributor with ~5,800 customers in Puerto Rico Employs ~530 employees, all based in Puerto Rico Geographical expansion for PFG Growth opportunities across the business Benefits Sales Mix By Product Sales Mix By End Market Transaction closed July 2024

Business description One of the most distinguished privately held foodservice distributors in the U.S. with over $3 billion in net sales1 State of the art facilities with excess capacity A leading private distributor serving independent restaurants and multi-unit establishments Offerings include frozen foods, dry goods, refrigerated commodities, boxed meats, and more Sales mix by product2 Sales breakdown by end market2 Cheney Brothers snapshot Source: Company information; Company website Note: 1 Company website; 2 TTM March 2024; 3 Includes Beverage, Seafood, CCI, Warewashing, Fresh Seafood, Disc Frozen, Chemicals and Ice Cream; 4 Includes Export, Grocery/Convenience, Italian/Pizzerias, School/Church, Healthcare, Cater/Concessions, Professional, Bakeries, Redistribution, Government, Cash Sales, Cruise/Ships and Chain Accounts Key Statistics 1,800 Tractors & trailers 23mm Miles traveled annually 9,910 Impressive average SKU count per facility

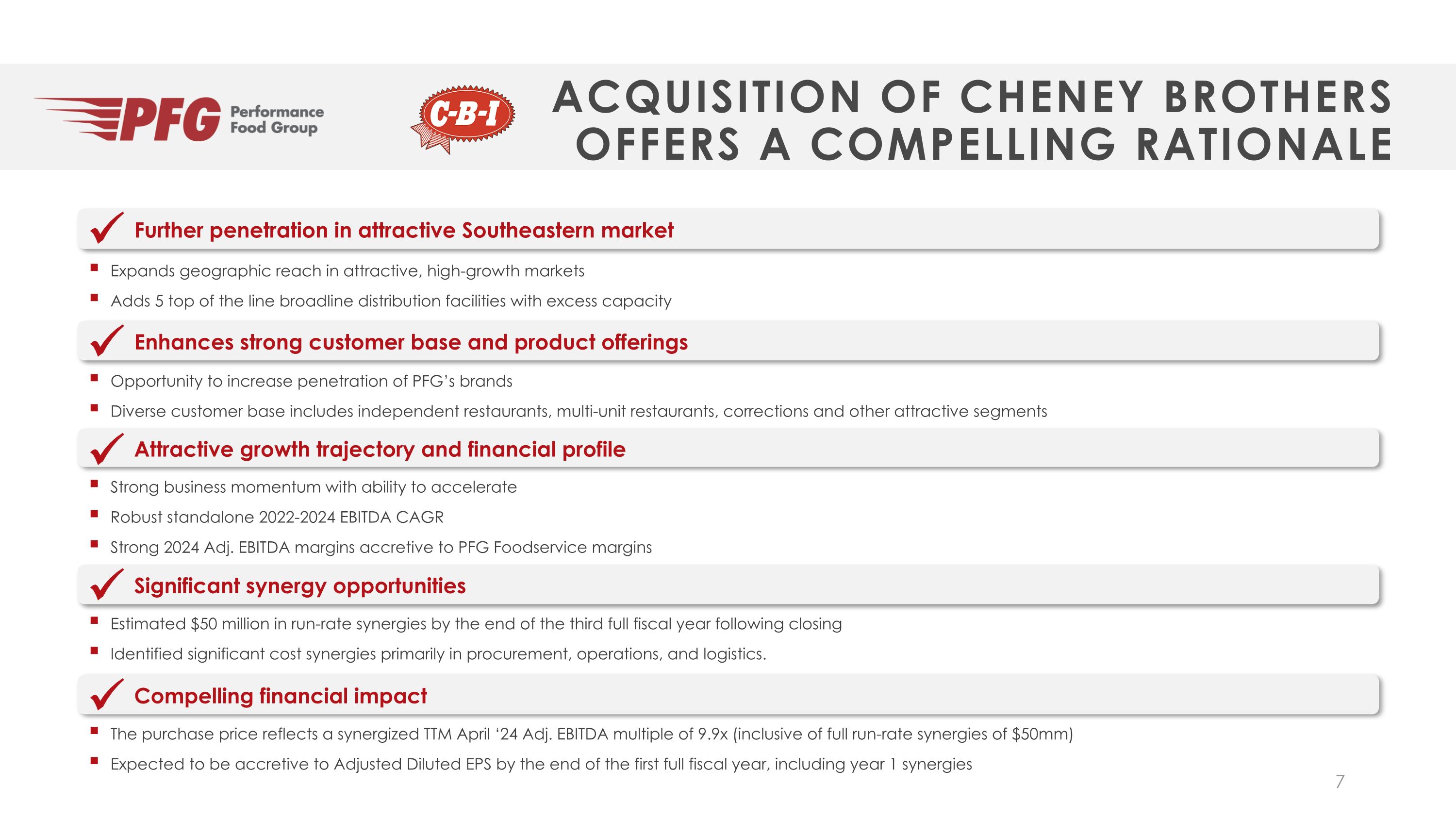

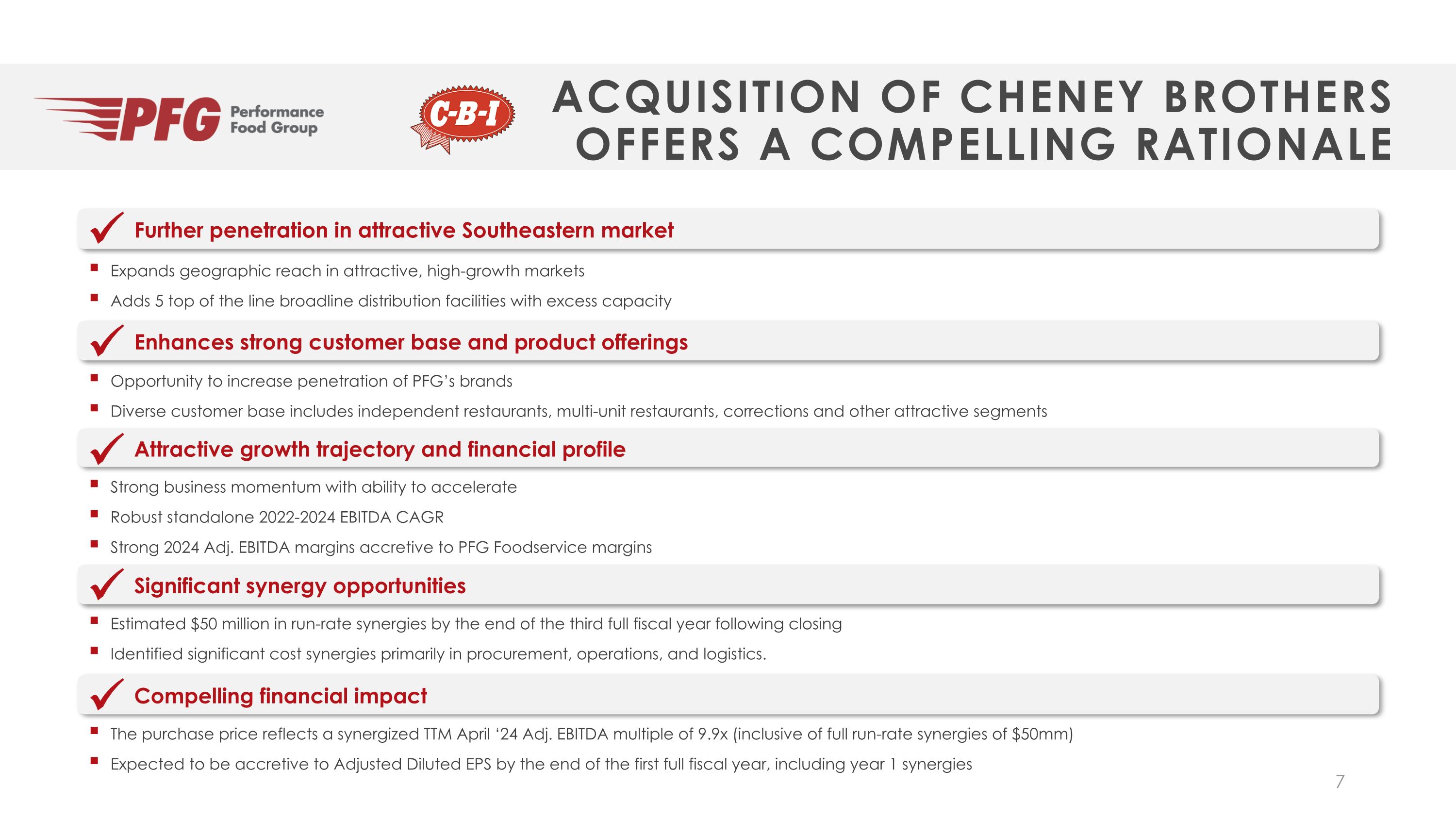

Acquisition of Cheney Brothers offers a compelling rationale Expands geographic reach in attractive, high-growth markets Adds 5 top of the line broadline distribution facilities with excess capacity Opportunity to increase penetration of PFG’s brands Diverse customer base includes independent restaurants, multi-unit restaurants, corrections and other attractive segments Estimated $50 million in run-rate synergies by the end of the third full fiscal year following closing Identified significant cost synergies primarily in procurement, operations, and logistics. The purchase price reflects a synergized TTM April ‘24 Adj. EBITDA multiple of 9.9x (inclusive of full run-rate synergies of $50mm) Expected to be accretive to Adjusted Diluted EPS by the end of the first full fiscal year, including year 1 synergies Further penetration in attractive Southeastern market Enhances strong customer base and product offerings Significant synergy opportunities Compelling financial impact Strong business momentum with ability to accelerate Robust standalone 2022-2024 EBITDA CAGR Strong 2024 Adj. EBITDA margins accretive to PFG Foodservice margins Attractive growth trajectory and financial profile

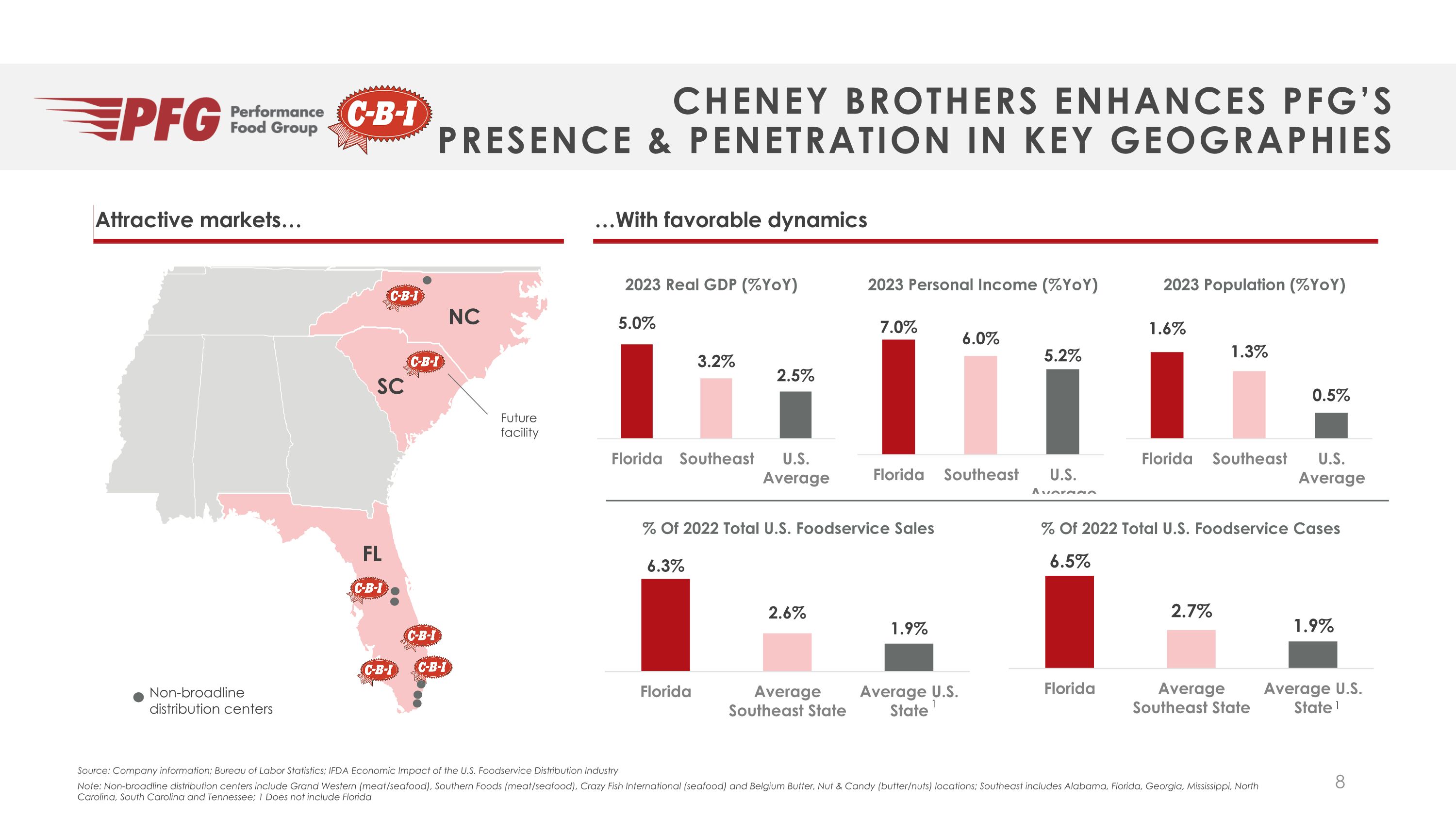

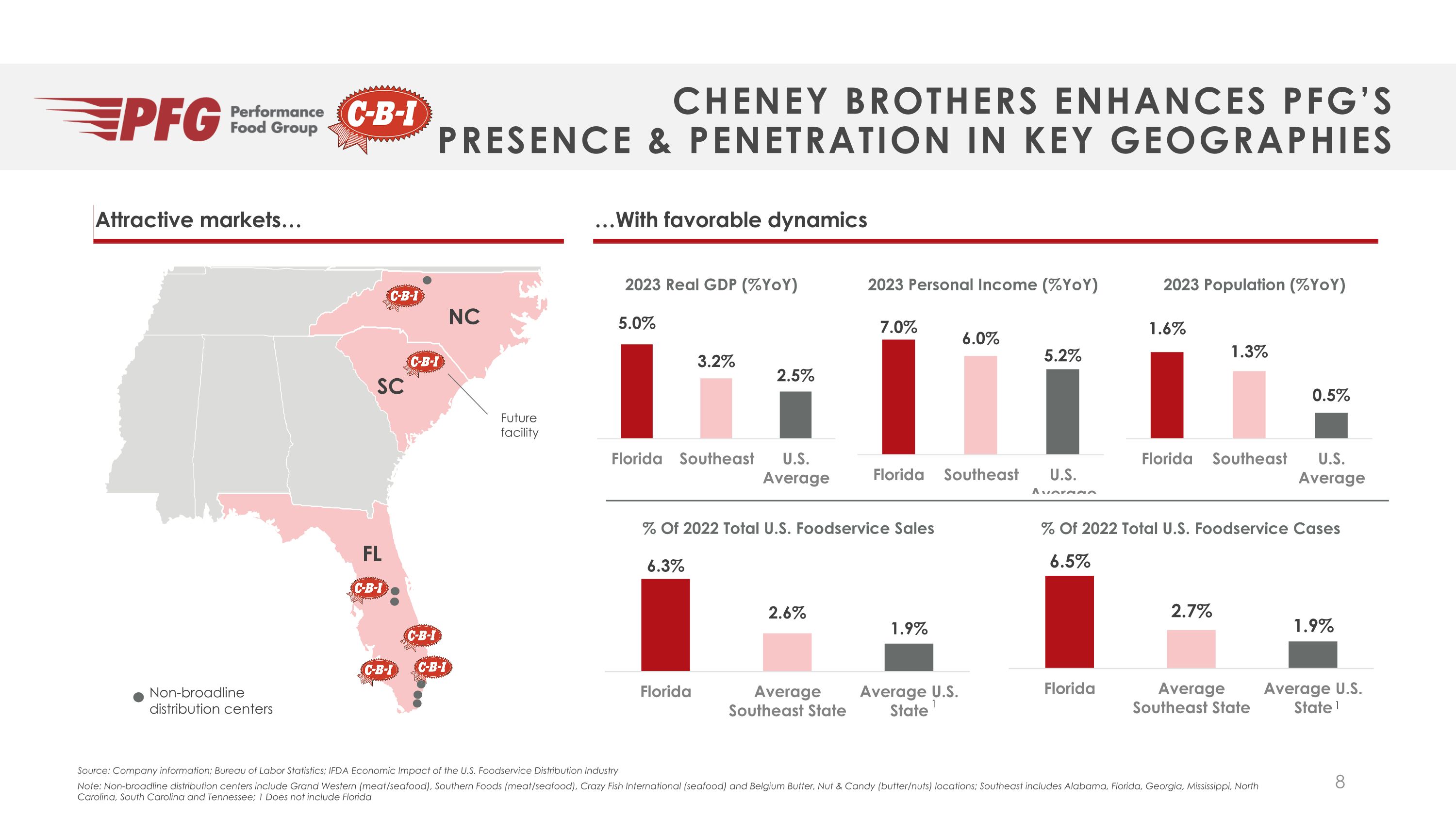

Cheney Brothers enhances PFG’s �presence & penetration in key geographies Source: Company information; Bureau of Labor Statistics; IFDA Economic Impact of the U.S. Foodservice Distribution Industry Note: Non-broadline distribution centers include Grand Western (meat/seafood), Southern Foods (meat/seafood), Crazy Fish International (seafood) and Belgium Butter, Nut & Candy (butter/nuts) locations; Southeast includes Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina and Tennessee; 1 Does not include Florida FL NC Non-broadline distribution centers Attractive markets… …With favorable dynamics SC Future facility 1 1 % Of 2022 Total U.S. Foodservice Sales % Of 2022 Total U.S. Foodservice Cases 2023 Personal Income (%YoY) 2023 Population (%YoY) 2023 Real GDP (%YoY)

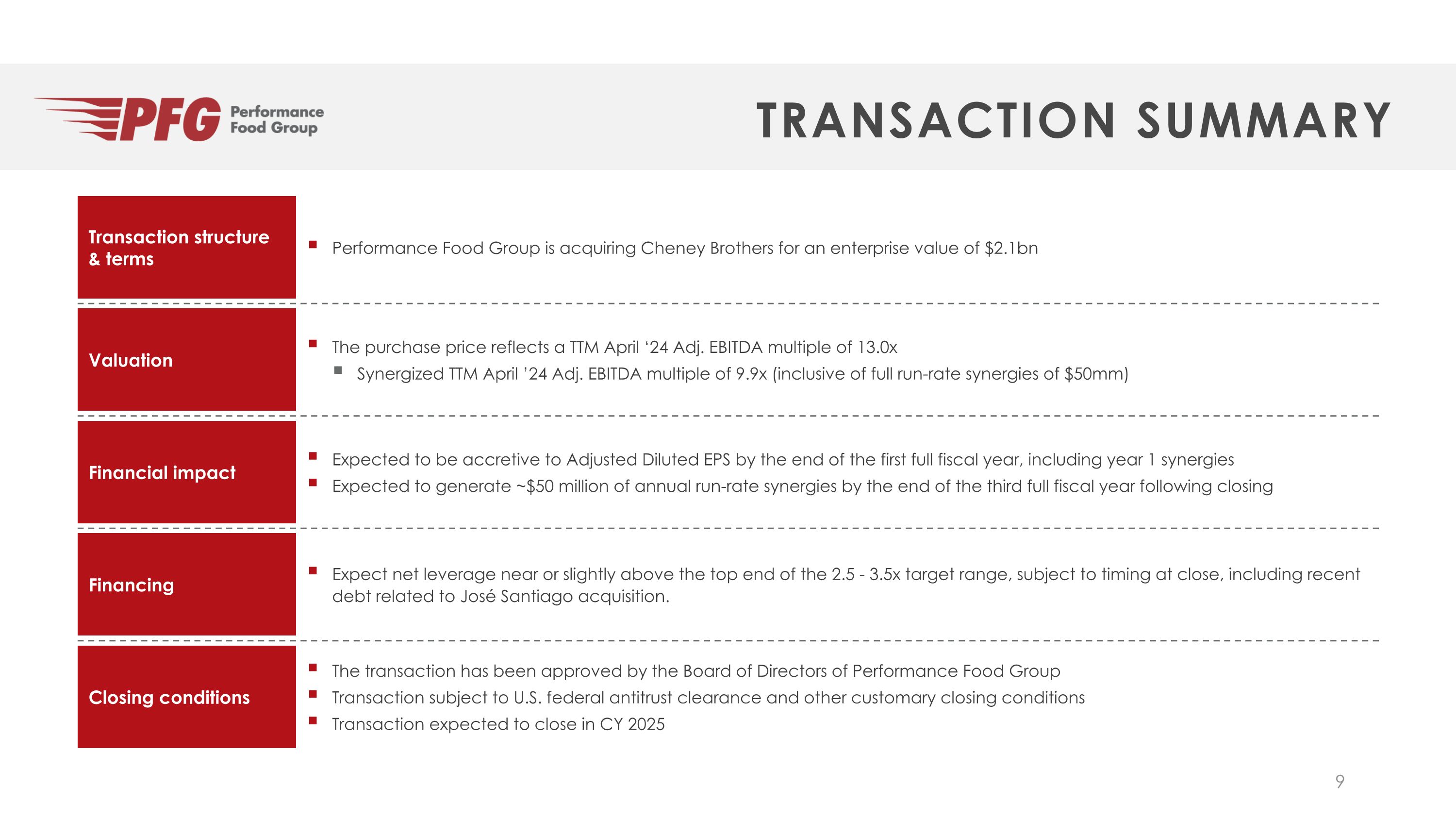

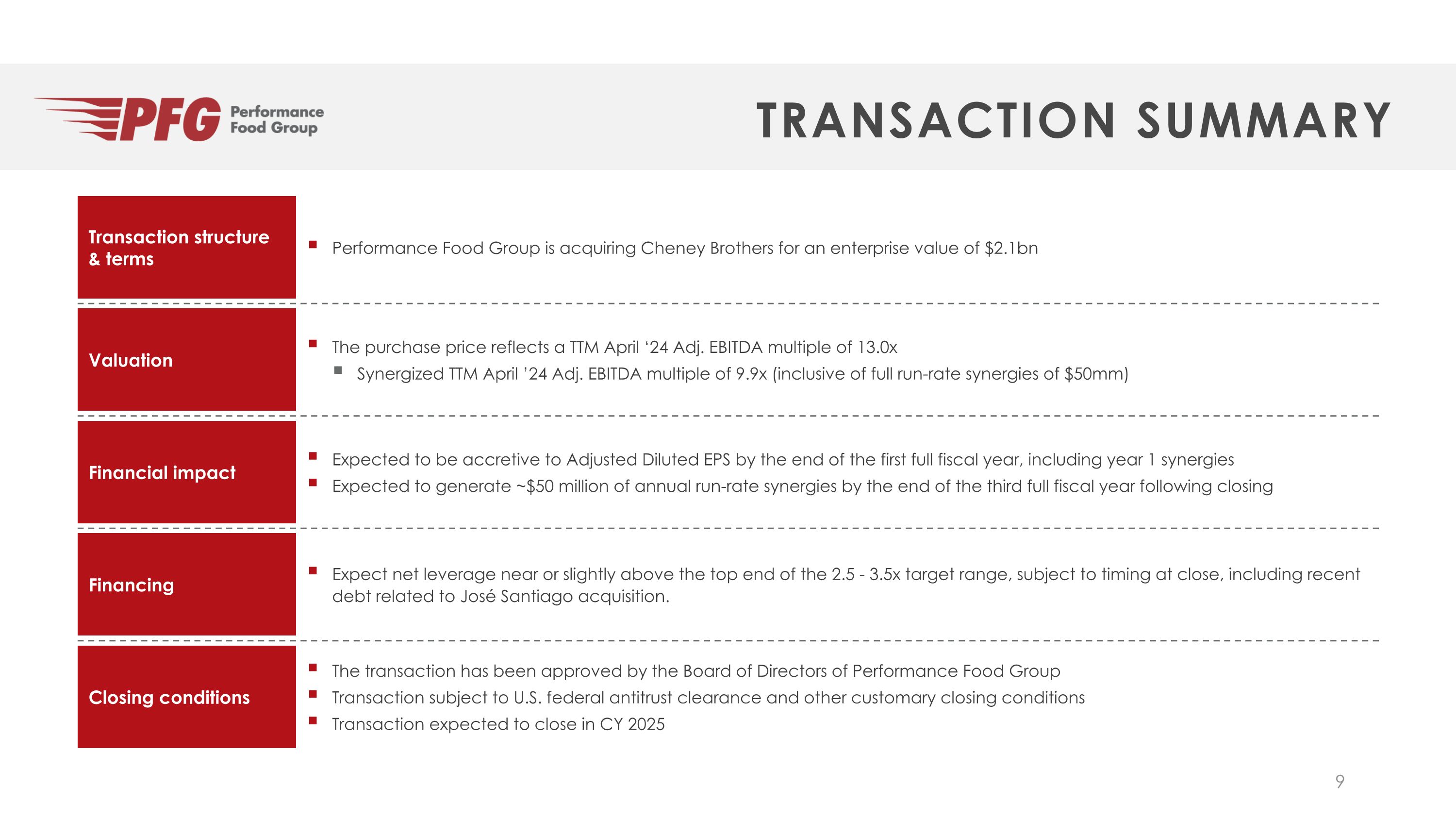

Transaction summary Performance Food Group is acquiring Cheney Brothers for an enterprise value of $2.1bn The purchase price reflects a TTM April ‘24 Adj. EBITDA multiple of 13.0x Synergized TTM April ’24 Adj. EBITDA multiple of 9.9x (inclusive of full run-rate synergies of $50mm) Expected to be accretive to Adjusted Diluted EPS by the end of the first full fiscal year, including year 1 synergies Expected to generate ~$50 million of annual run-rate synergies by the end of the third full fiscal year following closing Expect net leverage near or slightly above the top end of the 2.5 - 3.5x target range, subject to timing at close, including recent debt related to José Santiago acquisition. The transaction has been approved by the Board of Directors of Performance Food Group Transaction subject to U.S. federal antitrust clearance and other customary closing conditions Transaction expected to close in CY 2025 Transaction structure & terms Valuation Financial impact Financing Closing conditions

Appendix

Statement regarding non-GAAP financial measures This presentation includes financial measures that are not calculated in accordance with GAAP, including Adjusted EBITDA and Adjusted Diluted EPS. Such measures are not recognized terms under GAAP, should not be considered in isolation or as a substitute for net income or diluted EPS prepared in accordance with GAAP, and are not indicative of amounts as determined under GAAP. Adjusted EBITDA, Adjusted Diluted EPS, and other non-GAAP financial measures have limitations that should be considered before using these measures to evaluate the Company’s financial performance. Adjusted EBITDA and Adjusted Diluted EPS, as presented, may not be comparable to similarly titled measures of other companies because of varying methods of calculation. Management uses Adjusted EBITDA, defined as net income before interest expense, interest income, income and franchise taxes, and depreciation and amortization, further adjusted to exclude certain items we do not consider part of our core operating results. Such adjustments include certain unusual, non-cash, non-recurring, cost reduction, and other adjustment items permitted in calculating covenant compliance under the Company’s credit agreement and indenture (other than certain pro forma adjustments permitted under our credit agreement and indenture relating to the Adjusted EBITDA contribution of acquired entities or businesses prior to the acquisition date). Under PFG’s credit agreement and indenture, the Company’s ability to engage in certain activities such as incurring certain additional indebtedness, making certain investments, and making restricted payments is tied to ratios based on Adjusted EBITDA (as defined in the credit agreement and indenture). Management defines Adjusted EBTIDA margin as Adjusted EBITDA (see definition above) divided by Net Sales Management also uses Adjusted Diluted EPS, which is calculated by adjusting the most directly comparable GAAP financial measure by excluding the same items excluded in PFG’s calculation of Adjusted EBITDA, as well as amortization of intangible assets, to the extent that each such item was included in the applicable GAAP financial measure. For business combinations, the Company generally allocates a portion of the purchase price to intangible assets and such intangible assets contribute to revenue generation. The amount of the allocation is based on estimates and assumptions made by management and is subject to amortization over the useful lives of the intangible assets. The amount of the purchase price from an acquisition allocated to intangible assets and the term of its related amortization can vary significantly and are unique to each acquisition, and thus the Company does not believe it is reflective of ongoing operations. Intangible asset amortization excluded from Adjusted Diluted EPS represents the entire amount recorded within the Company’s GAAP financial statements; whereas, the revenue generated by the associated intangible assets has not been excluded from Adjusted Diluted EPS. Intangible asset amortization is excluded from Adjusted Diluted EPS because the amortization, unlike the related revenue, is not affected by operations of any particular period unless an intangible asset becomes impaired, or the estimated useful life of an intangible asset is revised. PFG believes that the presentation of Adjusted EBITDA and Adjusted Diluted EPS is useful to investors because these metrics provide insight into underlying business trends and year-over-year results and are frequently used by securities analysts, investors, and other interested parties in their evaluation of the operating performance of companies in PFG’s industry. PFG / INVESTOR Presentation