- PFGC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Performance Food (PFGC) DEF 14ADefinitive proxy

Filed: 10 Oct 24, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ |

| Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

CHECK THE APPROPRIATE BOX: | ||

☐ |

| Preliminary Proxy Statement |

☐ |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ |

| Definitive Proxy Statement |

☐ |

| Definitive Additional Materials |

☐ |

| Soliciting Material under §240.14a-12 |

Performance Food Group Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

☑ |

| No fee required |

☐ |

| Fee paid previously with preliminary materials |

☐ |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF

ANNUAL

MEETING OF

STOCKHOLDERS

2024

PROXY

STATEMENT

At Performance Food Group, we are proud of the heritage, talent and local knowledge of our family of companies. Across all locations, our shared culture unites us and helps us to consistently deliver the goods. PFG In Action guides how we show up for each other, our customers and our communities. At PFG, our commitment to our associates, customers and communities can be summed up in a simple phrase: We Deliver the Goods.

\2023 PROXY STATEMENT NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice of 2024 Virtual

Annual Meeting of Stockholders

Logistics

| WHEN Wednesday, November 20, 2024 8:00 A.M. Eastern Time |

|

| WHERE Meeting live via the |

|

| WHO CAN VOTE You may vote at the Annual Meeting of Stockholders to be held on November 20, 2024 (the “Annual Meeting”) if you were a stockholder of record at the close of business on September 30, 2024. |

Items of Business

Proposal |

| BOARD | |

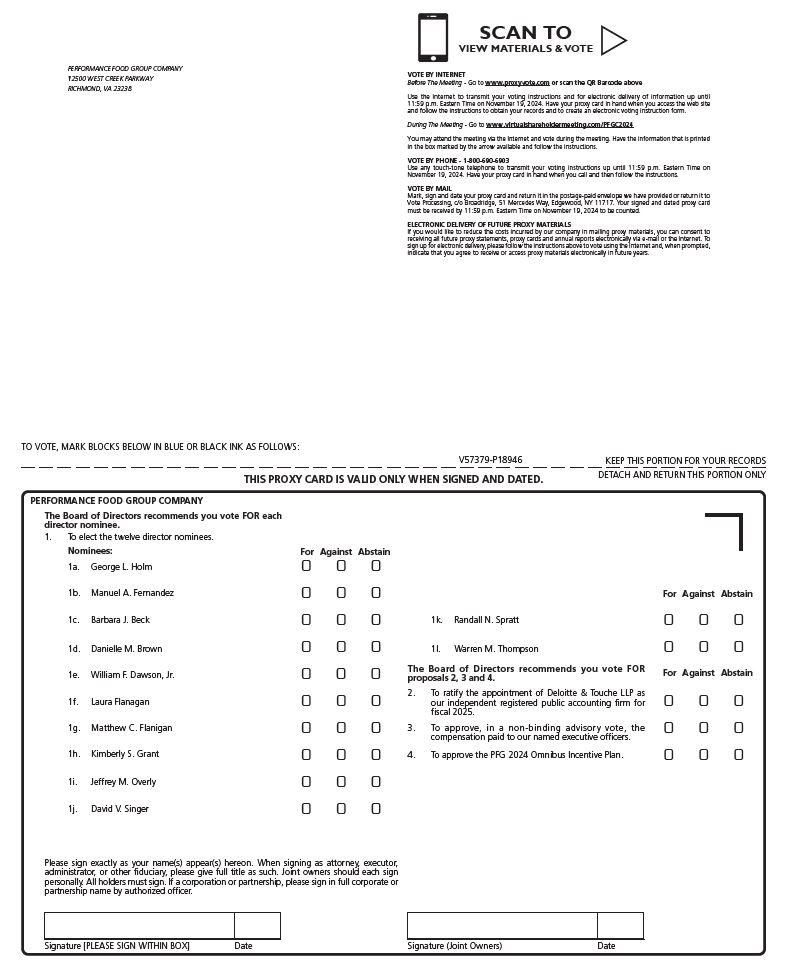

1 | To elect the 12 director nominees listed in this Proxy Statement. |

|

|

2 | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2025. |

|

|

3 | To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

|

|

4 | To approve the PFG 2024 Omnibus Incentive Plan. |

|

|

Stockholders will also consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. Proxy votes must be received no later than 11:59 P.M., Eastern Time, on November 19, 2024.

If you plan to participate virtually in the Annual Meeting, please see the instructions in the “Questions and Answers about Voting and the Annual Meeting” section of this Proxy Statement. Stockholders will be able to listen, vote electronically and submit questions online during the Annual Meeting. There will be no physical location for stockholders to attend. Stockholders may only participate online at www.virtualshareholdermeeting.com/PFGC2024.

This Proxy Statement, together with a form of proxy card and the Annual Report on Form 10-K for the fiscal year ended June 29, 2024 (the “Annual Report”), are first being sent to stockholders on or about October 10, 2024.

Your vote is important to us. Thank you for voting.

Ways To Vote Your Proxy

|

|

|

|

|

|

|

|

| BY INTERNET Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week. You will need the 16-digit number included on your proxy card to obtain your records and to vote by internet. |

|

| BY TELEPHONE From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week. You will need the 16-digit number included on your proxy card in order to vote by telephone. |

|

| BY MAIL Mark your selections on the proxy card. Date and sign your name exactly as it appears on your proxy card. Mail the proxy card in the enclosed postage-paid envelope provided to you in time to be received before the deadline. |

By Order of the Board of Directors,

A. BRENT KING | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, NOVEMBER 20, 2024: |

Message from Our

Chairman & CEO

Our Company had an outstanding fiscal year, achieving record profit results while continuing our journey as one of the leading distributors of food and foodservice products in the U.S. We have set ourselves apart by expanding into new and exciting markets and broadening our range of products. As a result, we are increasing our share of the food-away-from-home market and engagement with consumers.

Our sales growth has placed us among some of the largest companies in the country. In 2024, PFG moved higher on the Fortune 500 list, securing the No. 84 position. This marks the second consecutive year that we were among the top 100 largest companies in the U.S., according to Fortune.

We lead with our Foodservice segment, which is one of the country's largest suppliers of food to independent and chain restaurants. PFG’s substantial and expanding salesforce is an important competitive advantage, propelling our business to new heights. We have consistently increased our market share, especially in the independent restaurant space, which remains a significant and profitable opportunity. Through our continuous development of proprietary brands, we believe we are at the forefront of this important channel and have substantial room to grow.

In fiscal 2024, our Vistar segment also achieved solid growth by expanding into new and growing channels such as online fulfillment and e-commerce platforms. Vistar is uniquely positioned as one of the largest distributors of candy, snacks, and beverages to a range of customers including movie theaters, vending machine operators, retail stores, schools, and hotels, among others.

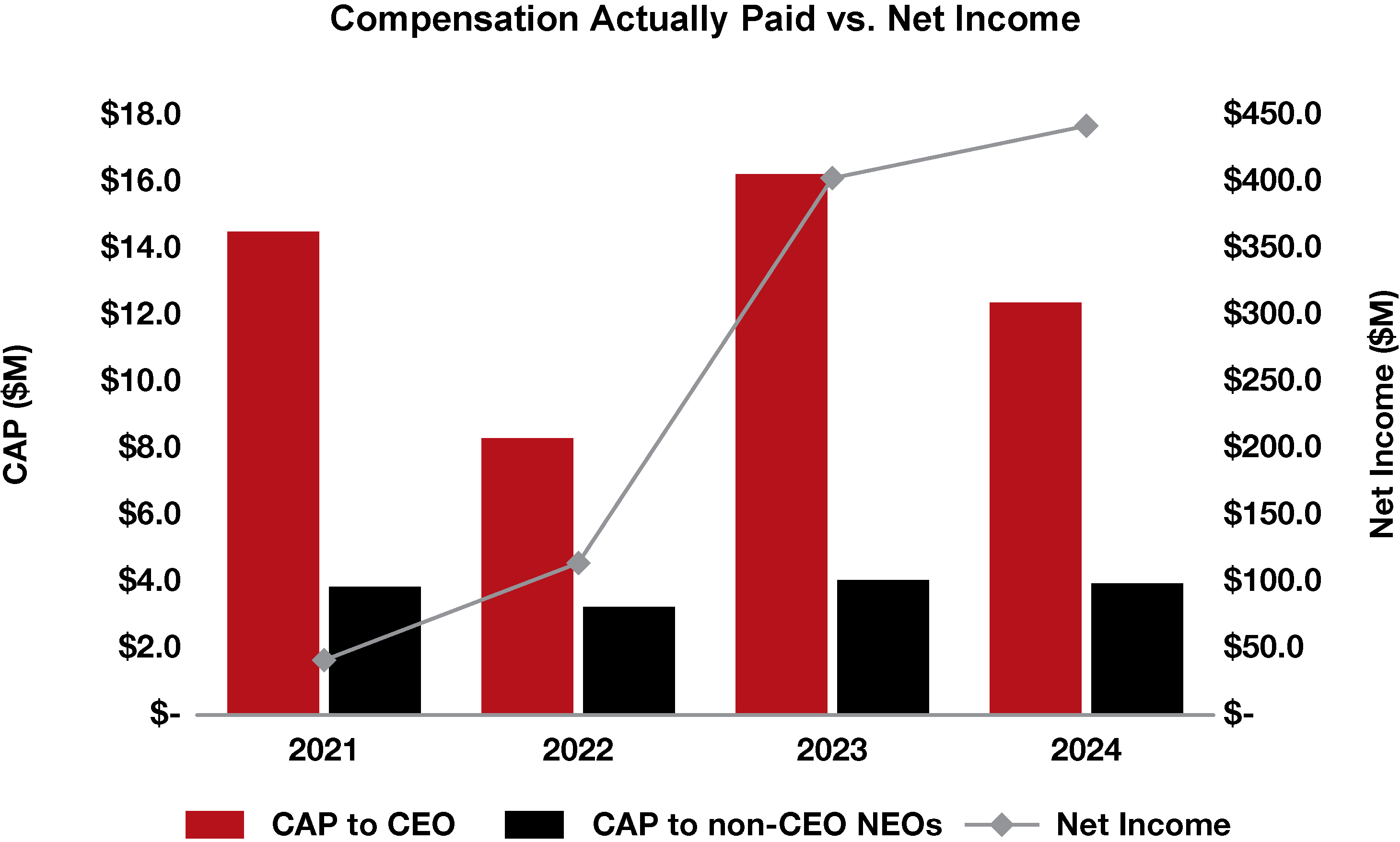

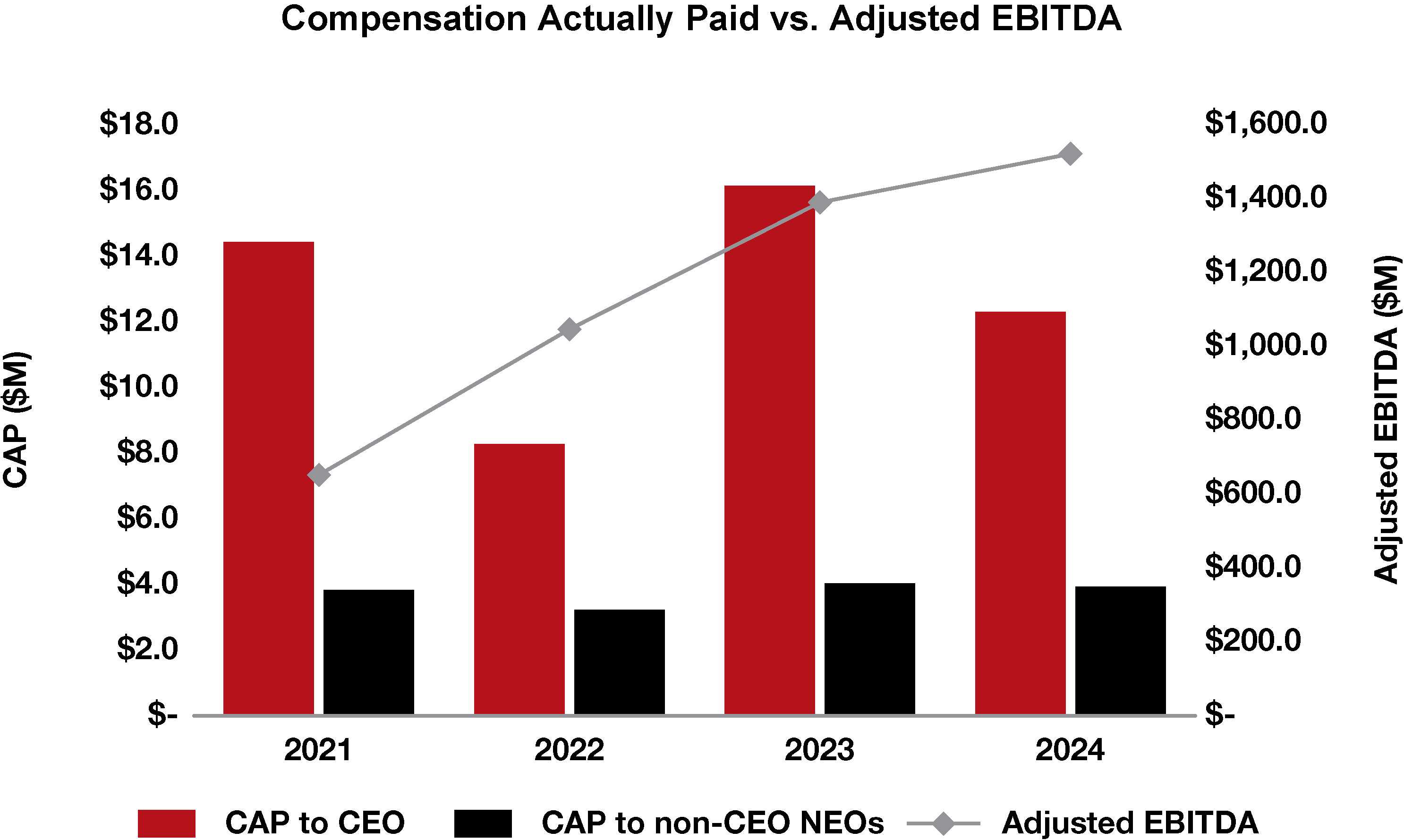

The Company achieved $58.3 billion in net revenue, $435.9 million in net income and $1.5 billion in Adjusted EBITDA(1) during fiscal 2024, marking solid growth in several areas, including excellent performance in independent restaurants.

Executing Strategic M&A

In addition to a strong organic performance, PFG successfully expanded our business through targeted acquisitions in key geographies. In July 2024, PFG acquired José Santiago, Inc., the largest foodservice distributor in Puerto Rico, marking our Company’s first operating company located in the Caribbean. We expect strong growth opportunities in the future from this acquisition. In August 2024, we announced our intention to acquire Cheney Bros, Inc., a leading foodservice distributor in the Southeastern U.S. We closed the transaction on October 8th, adding to our strong foodservice distribution platform. This acquisition increases our scale and geographic reach. We believe that these deals will build on PFG’s legacy strength and drive sales and profit growth in the long term.

2 |

|

|

“Our sales growth has placed us among some of the largest companies in the country. In 2024, PFG moved higher on the Fortune 500 list, securing the No. 84 position. This marks the second consecutive year that we were among the top 100 largest companies in the U.S., according to Fortune.”

George Holm, Chairman & CEO

Message from Our Chairman & CEO

In fiscal 2024, PFG also acquired Green Rabbit, a company focused on online order fulfillment that ships directly to consumers and businesses. The transaction added three warehouses dedicated to this business, effectively doubling PFG’s fulfillment facilities. We are optimistic about the prospects for this platform going forward.

Earlier in fiscal 2024, PFG also acquired OLM Foods, which is focused on developing and selling high- quality food products and programs. OLM has partnered with our Core-Mark business to sell in the convenience store channel. Convenience is an important growth vehicle for PFG, and OLM is another avenue for our company to capture this growth.

Making Progress on ESG Initiatives

Throughout fiscal 2024, we have also made substantial strides in achieving our environmental, social and governance (ESG) goals, encompassing areas such as responsible sourcing, energy efficiency, renewable energy, waste management, and associate engagement and development. Noteworthy accomplishments include reducing power consumption intensity and reaching our goal of an 80 percent diversion rate for operational waste seven years ahead of schedule. On the road, we’ve started a collaborative pilot program to use all-electric refrigeration technology on battery-electric trucks. We have also introduced zero-emission, heavy-duty yard trucks to reduce our carbon footprint and ensure the safety of our drivers. Additionally, in the workplace we established PFG’s first Inclusion Council and formed Associate Resource Groups (ARGs) to encourage important conversations. I am extremely impressed by the organization’s dedication to fulfilling our ESG commitments and our ability to adapt and evolve along the way.

PFG ended fiscal 2024 in a strong financial position. During fiscal 2024, we generated strong cash flow which allowed us to return cash to stockholders through strategic share repurchases and pursue M&A opportunities. We spent $395.6 million of capital expenditures to expand warehouse capacity and add to our fleet to keep pace with our growth trajectory. Additionally, we completed $307.7 million in acquisitions (excluding José Santiago, Inc.) and $78.1 million in share repurchases. We also used our cash flow to reduce our outstanding debt.

In summary, I am very proud of our Company’s achievements during fiscal 2024. More importantly, I am excited for the future and building upon the momentum we have gathered over the past several years.

Best regards,

George L. Holm

Chairman & CEO

| 2024 Proxy Statement | 3 |

LEADING FOOD AND FOODSERVICE DISTRIBUTOR

OVER

37,000

associates nationwide

OVER

372M

miles logged with one of the

nation’s largest truck fleets

MORE THAN

300,000

customer locations PFG

delivers to

144

distribution centers

APPROXIMATELY

250,000

national and proprietary

branded food and food-related

products PFG delivers

•

FOODSERVICE is one of the largest broadline distributors by net sales in the U.S., and markets and distributes food and food-related products to independent restaurants, chain restaurants, and other institutional “food-away-from-home” locations.

VISTAR is a leading national distributor of candy, snacks and beverages to vending and office coffee service distributors, retailers, theaters, hospitality providers and other channels.

•

•

CONVENIENCE is one of the largest foodservice and wholesale consumer products distributors in the convenience retail industry in North America.

PROXY SUMMARY

Proxy Summary

Performance Food Group Company is an industry leader and one of the largest food and foodservice distribution companies in North America with more than 150 locations. PFG’s success as a Fortune 100 company is achieved through our more than 37,000 dedicated associates committed to building strong relationships with the valued customers, suppliers and communities we serve.

This summary highlights information about Performance Food Group Company (the “Company” or “PFG”). This summary does not contain all of the information you should consider in voting your shares; therefore, you should read the entire Proxy Statement carefully before voting. Except where the context requires otherwise, references to “the Company,” "PFG," “we,” “us” and “our” refer to Performance Food Group Company and our subsidiaries. Capitalized terms used but not defined herein have the meanings set forth in our Annual Report.

PFG at a Glance

4 |

|

|

78

Foodservice

27

Vistar

39

Convenience

144

distribution

centers(1)

PROXY SUMMARY

Our Geographic Footprint

(1) Excludes José Santiago, Inc., which was acquired in July 2024.

Fiscal 2024 Performance Highlights(1)

| 2024 Proxy Statement | 5 |

PROXY SUMMARY

Voting Roadmap

| PROPOSAL 01: Election of Directors |

|

| |

| Your Board of Directors recommends that you vote FOR the election of the 12 director nominees. See page 13 for further information. | |||

Name |

| principal Occupation | A | HC | NCG | T | Independent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| George L. Holm Age: 69 Director Since: 2002 | Chairman and Chief Executive Officer of Performance Food Group Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Manuel A. Fernandez Age: 78 | Lead Independent Director. Managing Director of SI Ventures. Former Chief Executive Officer of Gartner, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Barbara J. Beck Age: 64 | Executive Advisor to American Securities LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DANIELLE M. BROWN Age: 53 Director Since: 2024 | Senior Vice President and Chief Information Officer of Whirlpool Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| William F. Dawson, Jr. Age: 60 | Chairman and Chief Executive Officer of Northway Partners LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Laura Flanagan Age: 56 | Chief Executive Officer of Ripple Foods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Matthew C. Flanigan Age: 62 | Former Executive Vice President and Chief Financial Officer of Leggett & Platt, Incorporated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kimberly S. Grant Age: 53 | Former Global Head of Restaurants and Bars for Four Seasons Hotels and Resorts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Jeffrey M. Overly Age: 66 | Former Operating Partner of The Blackstone Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| David V. Singer Age: 69 | Former Chief Executive Officer of Snyder’s-Lance, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Randall N. Spratt Age: 72 | Former Executive Vice President, Chief Information Officer and Chief Technology Officer of McKesson Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Warren M. Thompson Age: 65 | Chairman of the Board and President of Thompson Hospitality |

|

|

|

|

|

|

|

|

|

|

|

|

|

A Audit and Finance |

| HC Human Capital and Compensation | NCG Nominating and Corporate Governance | T Technology and Cybersecurity | |

| C Chair |

|

|

| |

6 |

|

|

PROXY SUMMARY

Board Snapshot

Corporate Governance Highlights

Stockholder Rights • Majority voting standard for the election of directors in uncontested elections • Proxy access bylaw provision enabling a stockholder who has owned a significant amount of our common stock for a significant amount of time to submit director nominees • Majority voting standard for amending our governing documents • Majority voting standard for removing directors • Right to call a special meeting |

| Board Independence • The Board has determined that all of our directors, other than our CEO, are independent under applicable New York Stock Exchange (“NYSE”) rules and our Corporate Governance Guidelines • Fully independent Audit and Finance, Human Capital and Compensation, Nominating and Corporate Governance and Technology and Cybersecurity Committees • Executive sessions of independent directors without members of management present at all regularly scheduled Board and committee meetings |

Board Expertise | ||

Other Board and Board Committee Practices • Stock ownership requirements for directors and executive officers | • Two members of our Audit and Finance Committee qualify as an “audit committee financial expert” | |

• Policies prohibiting hedging and pledging our shares • All of our directors are elected annually • Annual Board and committee self-evaluations • Nominating and Corporate Governance Committee oversight of ESG • Technology and Cybersecurity Committee oversight of our cybersecurity program | Policies and Guidelines • Corporate Governance Guidelines place limits on the number of public company directorships held by our directors • Any director who has a significant change in principal employment or occupation must offer to resign |

| 2024 Proxy Statement | 7 |

OUR ESG PROGRAM

As an industry leader and one of the largest foodservice distribution companies in North America, PFG strives to preserve the environment, strengthen our social impact, and execute effective governance. We intend to advance our ESG goals by continuing to develop procedures, programs, and partnerships across our value chain.

Our ESG strategy is focused on the following key areas important to our business and stakeholders:

Environmental

Stewardship

Social

Stewardship

Governance

PROXY SUMMARY

Corporate Social Responsibility

PFG is committed to preserving the environment, strengthening our social impact, and continuing effective governance. In fiscal 2024, we prioritized efforts to advance our ESG strategy and goals in our operations and throughout our value chain.

We have made consistent progress on our ESG goals since we began our ESG initiatives in 2021. In a relatively short span, we have not only set ambitious targets but have also made substantial strides towards achieving them.

PFG IN ACTION

Our shared culture unites us and helps us consistently deliver for our customers. This includes our dedication to sustainability. We are committed to doing the right thing and embracing ESG best practices while serving the communities where our customers, suppliers, and associates live and work.

We believe our ESG strategies are strong initial steps toward creating meaningful change, and we are making a tangible difference through our actions. Our inspired associates, innovative products, and impactful environmental policies are a testament to our commitment to making conscious and intentional steps toward creating a better world for all.

We know our success depends on strengthening the communities where we live and work and on preserving our environment. We continue to evaluate what we do and how we do it, and look for ways to become better every day.

| |||||||||

We do the • We act with integrity and communicate openly, even when it’s difficult. • We are considerate, treat others with dignity and respect, and act safely. • We are accountable for our decisions and actions. |

| We deliver for our customers. • We are committed to our customers’ success. • We respond to our customers’ needs by listening and questioning with curiosity. • We are action and solution oriented, determined to deliver on our customers’ expectations. |

| We win as a team. • We respect and care for each other. • We foster a culture of trust, opportunity, and inclusion through our decisions and actions. • We embrace individuality while working as one team, having fun and cheering on each other. |

| We embrace change with courage. • We encourage and support those that speak up and rally around solutions together. • We seek out and embrace new and different perspectives to make us better. • We are agile, good-natured and adapt to challenges with optimism and creativity. |

| We believe in better for all. • We are committed to the safety and wellbeing of our associates and their continued development. • We are committed to sustainability, responsible sourcing, and being good stewards of natural resources. • We believe everyone deserves healthy food and an equal opportunity to pursue their dreams. |

|

8 |

|

|

PROXY SUMMARY

| PROPOSAL 01: Election of Directors |

|

| |

| Your Board of Directors recommends that you vote "FOR" the election of the 12 director nominees. See page 13 for further information. | |||

| PROPOSAL 02 Ratification of Independent Registered Public Accounting Firm |

|

| |

| Your Board of Directors recommends that you vote "FOR" the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2025. See page 39 for further information. | |||

| PROPOSAL 03 Advisory Vote on Named Executive Officer Compensation |

|

| |

| Your Board of Directors recommends that you vote "FOR" the approval of the compensation paid to our named executive officers. See page 50 for further information. | |||

| PROPOSAL 04 Approval of 2024 Omnibus Incentive Plan |

|

| |

| Your Board of Directors recommends that you vote “FOR” the approval of the 2024 Omnibus Incentive Plan. See page 81 for further information. | |||

| 2024 Proxy Statement | 9 |

PROXY SUMMARY

Framework of 2024 Named Executive Officer Compensation

|

|

|

| Base Salary Compensation to recognize ongoing performance of job responsibilities. |

|

|

| ||

|

|

|

| |

|

|

| Cash Incentive Opportunity Compensation “at risk” and designed to encourage the achievement of annual business goals. | |

|

|

| ||

|

|

|

| |

|

|

| Long-Term Equity Incentive Opportunity Compensation “at risk” and designed to encourage the creation of stockholder value and the achievement of long-term business goals. | |

|

|

|

Compensation Practices

WHAT WE DO

|

| Performance-Driven Pay: We base a very high percentage of executive pay on Company performance through annual and long-term incentives that are capped. We require executives to achieve annual and long-term performance-based goals tied to stockholder value. |

|

|

|

|

| Pay Aligned to Peers: We target median compensation levels and benchmark market data of our peer group companies when making executive compensation decisions. |

|

|

|

|

| Annual Say-on-Pay: We hold an annual advisory Say-on-Pay vote concerning executive compensation. |

|

|

|

|

| Clawbacks: Our clawback policy subjects sign-on grants, incentive cash, and/or equity awards to clawbacks in the event of a restatement of the financial statements or an error in the calculation of such incentive-based or equity-based compensation, regardless of fraud or misconduct. |

|

|

|

|

| Stock Ownership Requirements: We apply mandatory stock ownership guidelines for executive officers and directors. |

|

|

|

|

| Independent Compensation Consulting Firm Reports Directly to the Human Capital and Compensation Committee (“Compensation Committee”): Our Compensation Committee engages an independent compensation consulting firm, that does not provide any other services to our Company, to provide counsel, make recommendations and evaluate risk in our compensation programs. |

|

|

|

|

| Double-Trigger Severance Agreements: We maintain double-trigger equity award vesting acceleration upon involuntary termination following a change in control (“CIC”). |

|

|

|

|

| Annual Risk Assessment: We perform an annual risk assessment of our compensation programs with the assistance of our independent compensation consulting firm. |

WHAT WE DON’T DO

|

| No excise tax gross-ups upon a CIC. |

|

| |

| No modified single-trigger or single-trigger CIC severance agreements (we only use double-trigger CIC severance provisions). | |

|

| |

| No uncapped incentive compensation opportunities. | |

|

| |

| No hedging of shares by our directors or employees, including our executive officers. | |

|

| |

| No pledging of shares by our directors or executive officers. | |

|

| |

| No excessive perquisites. | |

|

| |

| No repricing of underwater stock options. | |

|

| |

| No dividends provided on unearned performance awards. |

10 |

|

|

Table of Contents |

|

| |||

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

| 35 | ||

|

| ||||

|

|

|

| 35 | |

4 |

|

| 35 | ||

|

|

|

|

|

|

13 |

|

| 37 | ||

|

| 37 | |||

|

|

|

| 38 | |

13 |

|

|

|

| |

|

| 39 | |||

13 |

|

| PROPOSAL 02 | 39 | |

14 |

|

| |||

15 |

|

| |||

16 |

|

| 39 | ||

22 |

|

| Pre-Approval Policy for Services of Independent Registered Public Accounting Firm | 40 | |

22 |

|

| |||

|

|

|

|

|

|

22 |

|

| 40 | ||

22 |

|

|

|

| |

23 |

|

| 41 | ||

23 |

|

|

|

| |

23 |

|

| 43 | ||

24 |

|

| 43 | ||

24 |

|

| 44 | ||

24 |

|

| 44 | ||

25 |

|

| |||

Selection of Chairman of the Board and Chief Executive Officer | 25 |

|

| 45 | |

25 |

|

|

|

| |

26 |

|

| 50 | ||

27 |

|

|

|

| |

28 |

|

| PROPOSAL 03 | 50 | |

33 |

|

| |||

|

|

|

| ||

33 |

|

| 50 | ||

33 |

|

| 50 | ||

34 |

|

| 51 | ||

34 |

|

| 52 | ||

34 |

|

| 53 | ||

| 2024 Proxy Statement | 11 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

53 |

|

| Treatment of Equity Awards in Connection with a Change in Control or Qualifying Termination | 73 | |

54 |

|

| 76 | ||

55 |

|

| 76 | ||

56 |

|

|

|

| |

56 |

|

| |||

56 |

|

| 77 | ||

58 |

|

| 78 | ||

61 |

|

| |||

61 |

|

| 79 | ||

62 |

|

| 80 | ||

63 |

|

| |||

63 |

|

| 81 | ||

64 |

|

| 81 | ||

64 |

|

| |||

64 |

|

| |||

64 |

|

| 91 | ||

65 |

|

| 91 | ||

66 |

|

|

|

| |

66 |

|

| 93 | ||

66 |

|

| |||

|

|

|

|

|

|

67 |

|

| 94 | ||

|

|

|

|

|

|

67 |

|

| 95 | ||

|

|

|

|

|

|

67 |

|

| 95 | ||

68 |

|

| |||

Narrative to Summary Compensation Table and Fiscal 2024 Grants of Plan-Based Awards | 69 |

|

| 98 | |

69 |

|

| 99 | ||

71 |

|

|

|

| |

71 |

|

| A-1 | ||

71 |

|

| |||

|

|

|

| ||

72 |

|

| B-1 | ||

|

|

|

| ||

Certain statements in this Proxy Statement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current plans, estimates, expectations and projections, and are not guarantees of future performance. They are based on management’s beliefs, projections or expectations that involve a number of risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. For factors that could cause actual results to differ from expected results, see the risks and uncertainties described in our publicly filed reports, including our Annual Report on Form 10-K for the fiscal year ended June 29, 2024 filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2024, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date of this Proxy Statement. We undertake no obligation to publicly update or revise any forward-looking statement in this Proxy Statement.

12 |

|

|

CORPORATE GOVERNANCE

Corporate Governance

At Performance Food Group

| PROPOSAL 01: Election of Directors |

|

| |

| Your Board of Directors recommends that you vote "FOR" the election of the 12 director nominees. | |||

Upon the recommendation of the Nominating and Corporate Governance Committee, the full Board of Directors has considered and nominated the following slate of director nominees to hold office for one year until our 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) and until their successors have been elected and qualified, subject to their earlier death, resignation, or removal: George L. Holm, Barbara J. Beck, Danielle M. Brown, William F. Dawson, Jr., Manuel A. Fernandez, Laura Flanagan, Matthew C. Flanigan, Kimberly S. Grant, Jeffrey M. Overly, David V. Singer, Randall N. Spratt and Warren M. Thompson. Action will be taken at the Annual Meeting for the election of these 12 director nominees.

Unless otherwise instructed, the individuals named in the form of proxy card (the “proxyholders”) included with this Proxy Statement intend to vote the proxies held by them “FOR” the election of George L. Holm, Barbara J. Beck, Danielle M. Brown, William F. Dawson, Jr., Manuel A. Fernandez, Laura Flanagan, Matthew C. Flanigan, Kimberly S. Grant, Jeffrey M. Overly, David V. Singer, Randall N. Spratt, and Warren M. Thompson. Each of these nominees has indicated that he or she is willing and able to serve as a director, if elected. If any of these nominees ceases to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), proxies may be voted by the proxyholders in accordance with the recommendation of the Board.

THE BOARD OF DIRECTORS

| 2024 Proxy Statement | 13 |

CORPORATE GOVERNANCE

DIRECTOR NOMINATION PROCESS

The Nominating and Corporate Governance Committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and recommends nominees to the Board for election as director.

| CONSIDERATION AND ASSESSMENT OF CANDIDATES In considering candidates for the Board, the Nominating and Corporate Governance Committee also assesses the size, composition, and combined expertise of the Board. As the application of these factors involves the exercise of judgment, the Nominating and Corporate Governance Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, although the Nominating and Corporate Governance Committee does at a minimum assess each candidate’s strength of character, judgment, industry knowledge or experience, independence of thought, and his or her ability to work collegially with the other members of the Board. | |

|

| |

| ||

|

| IDENTIFICATION OF PROSPECTIVE DIRECTOR CANDIDATES In identifying prospective director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management, stockholders and other sources, including third-party recommendations. The Nominating and Corporate Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as directors of the Company. The Nominating and Corporate Governance Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral. |

|

| |

| ||

|

|

|

|

| DETERMINATION OF OVERALL BOARD EFFECTIVENESS |

|

| When considering director candidates, the Nominating and Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, |

| ||

| ||

| provide a blend of skills and experience to further enhance the Board’s effectiveness.

In connection with its annual recommendation of a slate of nominees, the Nominating and Corporate Governance Committee also may assess the contributions of those directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board. | |

|

|

|

|

| When considering whether the nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focuses primarily on each nominee’s current performance as a director (if applicable) and on the information discussed in each Board member’s or candidate’s biographical information and interviews (if applicable). |

We believe that our directors provide an appropriate mix of knowledge, judgment, experience and skills relevant to the size and nature of our business. | ||

| COMMITMENT TO DIVERSITY |

|

|

| |

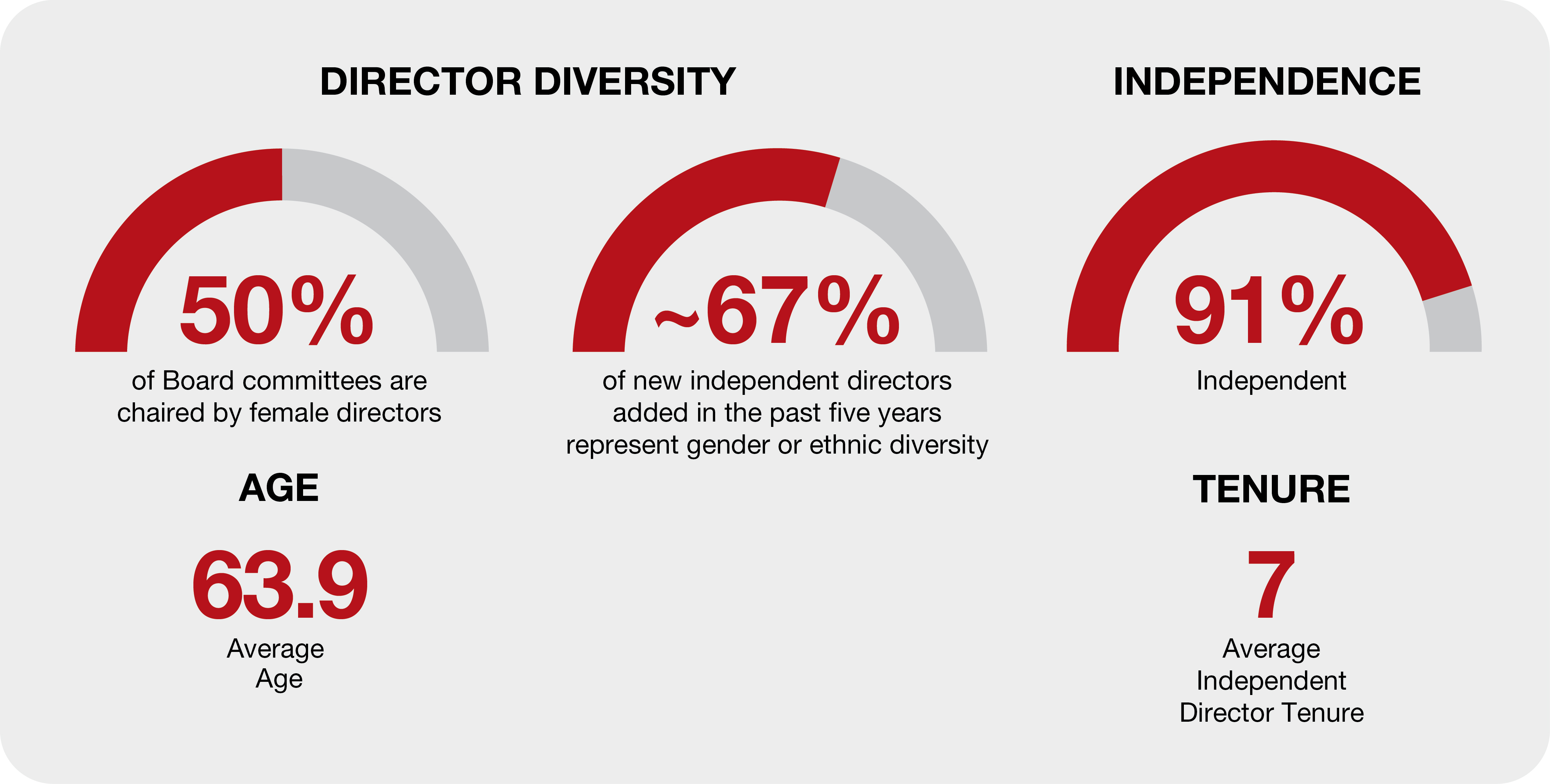

Although the Board does not have a formal diversity policy, the Nominating and Corporate Governance Committee considers diversity to be an important consideration when evaluating Board composition and recognizes the value of cultivating a Board with a diverse mix of perspectives, skills, experiences, and backgrounds. As such, when considering a director candidate, the Nominating and Governance Committee takes into account the candidate’s self-identified specific diversity characteristics, such as race, gender, ethnicity, religion, nationality, disability, sexual orientation or cultural background. Demonstrating PFG’s commitment to diversity at every level of our organization, four of our director nominees, or approximately 33%, are women and four of our director nominees, or approximately 33%, identify as ethnically diverse. Of the six new independent directors added in the past five years, four, or approximately 67%, represent gender or ethnic diversity. Additionally, 50% of our Board committees are chaired by female directors. Further, for each new director search, the Nominating and Corporate Governance Committee is committed to including female and racial or ethnic minority candidates in the candidate pool. | ||

14 |

|

|

CORPORATE GOVERNANCE

DIRECTOR QUALIFICATIONS AND EXPERTISE

The Nominating and Corporate Governance Committee is committed to ensuring that we have an experienced Board of Directors with diverse perspectives, strategic skill sets, and professional experience in areas relevant to our business and strategic objectives. The table below highlights the unique mix of key skills, qualifications and experiences that each director nominee brings to our Board of Directors. Because the table is a summary, it is not intended to be a complete description of all the key skills, qualifications, attributes, and experiences of each director. If an individual is not listed as having a particular attribute, it does not signify a director’s lack of ability to contribute in such area.

| Holm | Fernandez | Beck | Brown | Dawson, Jr. | Flanagan | Flanigan | Grant | Overly | Singer | Spratt | Thompson |

CEO Leadership |

|

|

|

|

|

|

|

|

|

|

|

|

Financial |

|

|

|

|

|

|

|

|

|

|

|

|

Foodservice Distribution Industry |

|

|

|

|

|

|

|

|

|

|

|

|

Human Capital Management |

|

|

|

|

|

|

|

|

|

|

|

|

Marketing and Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Operations and Logistics |

|

|

|

|

|

|

|

|

|

|

|

|

Other Public Company Boards |

|

|

|

|

|

|

|

|

|

|

|

|

Public Reporting or Auditing |

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant |

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management |

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Planning |

|

|

|

|

|

|

|

|

|

|

|

|

Technology and |

|

|

|

|

|

|

|

|

|

|

|

|

M&A/Integration |

|

|

|

|

|

|

|

|

|

|

|

|

Gender Identity | M | M | F | F | M | F | M | F | M | M | M | M |

Racial Diversity |

|

|

|

|

|

|

|

|

|

|

|

|

CEO Leadership Experience as a CEO of a large public or private organization brings unique perspectives and practical understanding of strategy, risk management, execution, and the operation and management of large organizations. Financial Directors with financial knowledge and experience allocating capital resources across a large complex organization provide important insights with respect to achieving our financial and strategic objectives. Foodservice Distribution Industry Experience in the foodservice distribution industry enables a director to provide valuable perspective and guidance on issues and opportunities specific to PFG’s industry, business, operations, and strategy. Human Capital Management Experience with human capital management is important to our strategy to attract, train, develop, and retain talented associates who contribute to PFG’s success. Marketing and Sales Directors with experience in marketing, brand management, marketing strategy and/or sales offer insight into evolving marketing practices and developing market opportunities. |

| Operations and Logistics Directors with experience leading complex operations can provide practical insights valuable to optimizing our operational capabilities and implementing our operational initiatives. Other Public Company Boards Experience serving as directors of other public companies, including responsibility overseeing sustainability initiatives, and/or corporate social responsibility, provides insight into best practices for corporate governance, functioning of the Board, and Board oversight of corporate strategy, ESG, and risk management. Public Reporting or Auditing Financial reporting and auditing experience is important for effective Board oversight of our accounting, reporting, and financial practices and internal controls. Restaurant Experience in the restaurant and hospitality industry brings valuable perspectives of a foodservice industry customer to the Board. |

| Risk Management Experience in risk management is important to the Board’s role in overseeing the management of strategic, financial, operational, compliance, and other significant risks affecting PFG and our business and anticipating risks that could impact PFG in the future. Strategic Planning Strategic planning experience assists the Board with oversight of the establishment and execution of PFG’s strategic vision and priorities. Technology and Cybersecurity Experience in technology and cybersecurity assists the Board in supporting the use of technology in the implementation of our strategic plans and overseeing the management of cybersecurity and information security risks. M&A/Integration Directors with experience managing complex strategic transactions, including significant acquisitions or other business combinations, as well as the successful integration of acquired businesses provide valuable guidance on how to develop and implement strategies for growing our business and implementing our strategy. |

| 2024 Proxy Statement | 15 |

CORPORATE GOVERNANCE

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

The following information describes the offices held, other public company directorships and the term of service of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities.”

Director Nominees

| George L. Holm | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Foodservice Distribution Industry • Human Capital Management |

| • Marketing and Sales • Operations and Logistics • Risk Management

|

| • Strategic Planning • M&A/Integration | ||

|

| |||||

BACKGROUND Mr. Holm has served as our Chief Executive Officer since September 2002, when he founded the Company and subsequently led the Company through its expansion into the broadline foodservice distribution industry with the Performance Food Group Company acquisition in May 2008. Additionally, in January 2019, Mr. Holm was named Chairman of the Board. Prior to joining the Company, he held various senior executive positions with Sysco Corporation, Alliant Foodservice and US Foods. Mr. Holm received a Bachelor of Science degree in business administration from Grand Canyon University. KEY EXPERIENCES We considered Mr. Holm’s experience as an executive in the U.S. foodservice distribution industry. Furthermore, we also considered how his additional role as our Chief Executive Officer brings management perspective to Board deliberations and provides valuable information about the status of our day-to-day operations. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 69 Director since: 2002 |

| Committees: None |

| Other Public Company Directorships: None | ||

| Manuel A. Fernandez | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Foodservice Distribution Industry • Human Capital Management • Marketing and Sales |

| • Operations and Logistics • Other Public Company Boards • Risk Management |

| • Strategic Planning • Technology and Cybersecurity • M&A/Integration • Financial | ||

|

| |||||

BACKGROUND Mr. Fernandez serves as the Managing Director of SI Ventures, a venture capital firm focused on information technology and communications infrastructure. He has held that position with the firm since its inception in 1998. Mr. Fernandez served as Chief Executive Officer of Gartner, Inc., a leading research and advisory company, from 1991 to 1998, and Chairman of the Board of Directors of Gartner, Inc. from 1991 until 2001. He has also been Chairman and Chief Executive Officer of three technology-driven companies: Dataquest, Inc., Gavilan Computer Corporation and Zilog Incorporated. Mr. Fernandez has served on the board of directors of Leggett & Platt, Incorporated ("Leggett & Platt") since 2014. He previously served on the board of directors of Brunswick Corporation from 1997 to 2020, Time, Inc. from 2014 to 2018, Flowers Foods, Inc. from 2005 to 2014, and Sysco Corporation from 2006 to 2013. Mr. Fernandez graduated from the University of Florida with a degree in electrical engineering and completed post-graduate work in solid-state engineering at the University of Florida. Mr. Fernandez currently serves as our Lead Independent Director. KEY EXPERIENCES We considered Mr. Fernandez’s extensive experience leading both public and private companies in foodservice and other industries, including three technology companies, allowing him to bring significant experience and knowledge to our Board regarding strategic planning, innovation, technology, acquisitions, corporate governance, distribution, operations, and human resources. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 78 Director since: 2017 |

| Committees: Human Capital and Compensation; Nominating and Corporate Governance; Technology and Cybersecurity |

| Other Public Company Directorships: Leggett & Platt, Incorporated Prior Public Company Directorships: Brunswick Corporation; Time, Inc.; Flowers Foods, Inc.; Sysco Corporation | ||

16 |

|

|

CORPORATE GOVERNANCE

| Barbara J. Beck | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Human Capital Management • Marketing and Sales |

| • Other Public Company Boards • Risk Management • Strategic Planning |

|

| ||

|

| |||||

BACKGROUND Ms. Beck serves as an Executive Advisor to American Securities LLC, after retiring from her position as Chief Executive Officer of Learning Care Group, Inc., a global for-profit early education provider, which she held from March 2011 to June 2019. Learning Care Group is a portfolio company of American Securities LLC. Prior to joining Learning Care Group, Ms. Beck spent nine years as an executive of Manpower Inc., a world leader in the employment services industry. From 2006 to 2011, Ms. Beck was President of Manpower’s EMEA operations, overseeing Europe (excluding France), the Middle East and Africa. She previously served as Executive Vice President of Manpower’s U.S. and Canada business unit from 2002 to 2005. Prior to joining Manpower, Ms. Beck was an executive of Sprint Corporation, a global communications company, serving in various operating and leadership roles for 15 years. From 2008 to 2024, Ms. Beck also served on the board of directors of Ecolab Inc., a global provider of water, hygiene, and energy technologies and services to food, energy, healthcare, industrial, hospitality, and other markets. KEY EXPERIENCES We considered Ms. Beck’s extensive general management and operational experience, including as a tenured Chief Executive Officer, allowing her to contribute to our strategic vision particularly as it relates to value creation and innovative business strategies. Ms. Beck has significant knowledge of the impact of labor market trends on global and local economies and expertise in human capital management. Additionally, as a former executive at Sprint Corporation, Ms. Beck also gained expertise in the information technology field. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 64 Director since: 2019 |

| Committees: Human Capital and Compensation (Chair); Nominating and Corporate Governance |

| Other Public Company Directorships: None

Prior Public Company Directorships: Ecolab Inc. | ||

| Danielle M. Brown | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• Operations & Logistics • Other Public Company Boards • Risk Management

|

| • Strategic Planning • Technology and Cybersecurity |

|

| ||

|

| |||||

BACKGROUND Ms. Brown has served as Senior Vice President and Chief Information Officer (CIO) of Whirlpool Corporation, a global kitchen and laundry appliance company, since November 2020. Ms. Brown has been in information technology leadership for more than 20 years, including serving as CIO of Brunswick Corporation, a global manufacturer of marine products, from 2016 to November 2020. Prior to her role at Brunswick, Ms. Brown served for 16 years in roles of increasing responsibility with DuPont Corporation, including CIO for a global business unit and head of global transformation and productivity. Ms. Brown served on the Board of Directors of PRA Group, Inc., a global leader in acquiring and collecting nonperforming loans, from 2019 to July 2024. Ms. Brown received her Bachelor of Science degree in computer science from Indiana University of Pennsylvania and holds a Master of Science degree in information science from Penn State University and an MBA from Drexel University. KEY EXPERIENCES We considered Ms. Brown's extensive experience in information technology leadership, including as CIO of large, publicly traded companies, which contributes significant technology, data management and cybersecurity expertise to our Board, as well as her experience on other public company boards. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 53 Director since: 2024 |

| Committees: Audit and Finance; Technology and Cybersecurity |

| Other Public Company Directorships: None

Prior Public Company Directorships: PRA Group, Inc. | ||

| 2024 Proxy Statement | 17 |

CORPORATE GOVERNANCE

| William F. Dawson, Jr. | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Human Capital Management • Operations and Logistics |

| • Risk Management • Strategic Planning • M&A/Integration |

|

| ||

|

| |||||

BACKGROUND Mr. Dawson has served as Chairman and Chief Executive Officer of Northway Partners LLC, a private investment firm, since 2022. Prior to Northway Partners LLC, Mr. Dawson spent 21 years at Wellspring Capital Management Group LLC (“Wellspring”), a leading middle-market private equity firm. He was Chief Executive Officer from 2014 to 2020 and then Co-Executive Chairman from 2020 to 2021, when he retired from Wellspring. While at Wellspring, he served as the chair of Wellspring’s investment committee for 17 years. Mr. Dawson led or co-sponsored several of Wellspring’s most successful investments in distribution, consumer services, business services, healthcare, energy services, and industrial companies. Prior to joining Wellspring, Mr. Dawson was a partner at Whitney & Co., where he was head of the middle-market buyout group. Prior to that, Mr. Dawson spent 14 years at Donaldson, Lufkin & Jenrette Securities Corporation where he was most recently a managing director at DLJ Merchant Banking. Mr. Dawson received a Bachelor of Science degree from St. Francis College and an MBA from Harvard Business School. KEY EXPERIENCES We considered Mr. Dawson’s significant financial, investment, capital market and operational experience from his involvement in Wellspring’s investments in numerous portfolio companies, as well as his many years of experience as a director of the Company and its predecessor. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 60 Director since: 2002 |

| Committees: Audit and Finance; Technology and Cybersecurity |

| Other Public Company Directorships: None | ||

| Laura Flanagan | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Foodservice Distribution Industry • Human Capital Management |

| • Marketing and Sales • Other Public Company Boards • Restaurant |

| • Risk Management • Strategic Planning • M&A/Integration • Operations and Logistics | ||

|

| |||||

BACKGROUND Ms. Flanagan is the Chief Executive Officer of Ripple Foods, a plant-based food and beverage company, and has served on the board of Topgolf Callaway Brands Corp. since 2018. Ms. Flanagan previously served on the board of Core-Mark Holding Company, Inc. from 2016 to 2021, serving on the Compensation Committee and as chair of the Nominating and Governance Committee. She served as Chief Executive Officer of Foster Farms, the West Coast leader in branded and private label poultry, from 2016 to February 2019. She was previously the President of the Snacks Division of ConAgra Foods, Inc. (“ConAgra”) from 2011 until 2014, and served as President of ConAgra’s Convenient Meals Division from 2008 until 2011. Prior to joining ConAgra in 2008, Ms. Flanagan was Vice President and Chief Marketing Officer for Tropicana® Shelf Stable Juices at PepsiCo Inc. from 2005 to 2008. Ms. Flanagan also held various marketing leadership positions at General Mills, Inc. and PepsiCo Inc. from 1996 to 2005. Ms. Flanagan has an MBA from Stanford Graduate School of Business and a B.S. in Engineering from Case Western Reserve University. KEY EXPERIENCES We considered Ms. Flanagan’s extensive general management and operational experience, including as a tenured Chief Executive Officer, and her knowledge, experience and expertise in the food and beverage industry, as well as her experience on other public company boards. Her over 25 years of experience in the food and beverage industry enables her to bring valuable perspectives of a food and beverage industry customer to our Board of Directors. She also has functional expertise in human capital management, strategic planning, consumer sales/marketing, consumer retail, mergers and acquisitions, operations and logistics, and ESG matters. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 56 Director since: 2021 |

| Committees: Audit and Finance; Technology and Cybersecurity |

| Other Public Company Directorships: Topgolf Callaway Brands Corp. Prior Public Company Directorships: Core-Mark Holding Company, Inc. | ||

18 |

|

|

CORPORATE GOVERNANCE

| Matthew C. Flanigan | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• Financial • Other Public Company Boards • Public Reporting or Auditing |

| • Risk Management • Strategic Planning • M&A/Integration |

| • Technology and Cybersecurity | ||

|

| |||||

BACKGROUND Mr. Flanigan retired in 2019 from his role as Executive Vice President & Chief Financial Officer of Leggett & Platt, a global manufacturer of engineered components and products, where he also served on the board of directors for nearly 10 years. Mr. Flanigan was appointed Senior Vice President of Leggett & Platt in 2005 and became Chief Financial Officer in 2003. From 1999 until 2003, he served as President of the Office Furniture and Plastics Components Groups of Leggett & Platt. Mr. Flanigan currently serves as Vice Chairman of the Board and Lead Director of Jack Henry & Associates, Inc., a leading financial technology company. He has served on the board of directors of Jack Henry & Associates since 2007, and he was appointed Lead Director by the independent directors of Jack Henry & Associates in 2012. He also served on the board of directors, including the audit committee and the transaction committee, of Fast Radius, Inc., a cloud manufacturing and digital supply chain company, in 2022. KEY EXPERIENCES We considered Mr. Flanigan’s substantial executive experience of 16 years as the Chief Financial Officer of a large, publicly-traded company in enabling him to bring important perspectives to our Board of Directors on financial matters, business analytics, compliance, risk management, public reporting, and investor relations. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 62 Director since: 2019 |

| Committees: Audit and Finance (Chair); Technology and Cybersecurity |

| Other Public Company Directorships: Jack Henry & Associates Prior Public Company Directorships: Fast Radius, Inc. | ||

| Kimberly S. Grant | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• Financial • Human Capital Management • Marketing and Sales |

| • Operations and Logistics • Restaurant • Risk Management |

| • Strategic Planning | ||

|

| |||||

BACKGROUND Ms. Grant is the former Global Head of Restaurants and Bars for Four Seasons Hotels and Resorts, where she served as the chief executive leading all worldwide food and beverage operations for the company from 2022 to 2023. Since 2023, Ms. Grant has served as a strategic advisor to premier multi-national private equity firms with portfolio company investments in hospitality, leisure, and the luxury travel sectors. Ms. Grant previously served as the Chief Executive Officer of ThinkFoodGroup, a global hospitality management company, which owns and operates innovative dining concepts created by two-star Michelin awarded chef José Andrés, from September 2014 to April 2020. Prior to this role, Ms. Grant was the President and Chief Operations Officer of Ruby Tuesday Inc., where she assumed various operations and finance leadership roles over her 21 years. Ms. Grant earned a Master of Science in Banking and Financial Services Management from Boston University and a Bachelor of Science in Hotel and Restaurant Management from Thomas Edison State University, and she has attended various executive education and corporate governance programs at UC Berkeley School of Law, Stanford Law School, National Association of Corporate Directors and Harvard Business School while a director of Performance Food Group. KEY EXPERIENCES We considered Ms. Grant’s knowledge, experience, and expertise in the restaurant and hospitality industry and her significant experience in operations, finance, sales, strategic planning, risk management, corporate governance and investments. Her over 25 years of experience in the restaurant and hospitality industry enables her to bring valuable perspectives of a foodservice industry customer to our Board of Directors. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 53 Director since: 2017 |

| Committees: Human Capital and Compensation; Nominating and Corporate Governance (Chair) |

| Other Public Company Directorships: None | ||

| 2024 Proxy Statement | 19 |

CORPORATE GOVERNANCE

| Jeffrey M. Overly | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• Operations and Logistics • Risk Management • M&A/Integration |

| • Other Public Company Boards • Strategic Planning |

|

| ||

|

| |||||

BACKGROUND Mr. Overly retired in 2018, having most recently served as an Operating Partner at The Blackstone Group (“Blackstone”) from 2008 to 2018. Before joining Blackstone in 2008, Mr. Overly was Vice President of Global Fixture Operations at Kohler Company. Prior to that, he served 25 years at General Motors Corporation and Delphi Corporation in numerous operations and engineering positions. He has served on the board of directors of several Blackstone portfolio companies, and currently serves as a director of Sona BLW Precision Forgings Limited (Sona Comstar), an Indian automotive technology company traded on the Bombay Stock Exchange and National Stock Exchange of India. Mr. Overly has a Bachelor of Science degree in Industrial Management from the University of Cincinnati and a Masters in Business from Central Michigan University. KEY EXPERIENCES We considered Mr. Overly’s significant operational, logistics, risk management, corporate governance and strategic planning experience in public companies from his active involvement in Blackstone’s investments in numerous portfolio companies. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 66 Director since: 2013 |

| Committees: Human Capital and Compensation; Nominating and Corporate Governance |

| Other Public Company Directorships: None (see above for directorships outside of the U.S.) | ||

| David V. Singer | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Foodservice Distribution Industry • Human Capital Management |

| • Marketing and Sales • Operations and Logistics • Other Public Company Boards |

| • Public Reporting or Auditing • Risk Management • Strategic Planning • M&A/Integration | ||

|

| |||||

BACKGROUND Mr. Singer retired in 2013 as the Chief Executive Officer of Snyder’s-Lance, Inc. (“Synder’s-Lance”), a manufacturer and marketer of snack foods throughout the United States and internationally. Mr. Singer served as Chief Executive Officer and as a director of Snyder’s-Lance from its formation in 2010 until his retirement in 2013. He was the President and Chief Executive Officer of Lance, Inc. from 2005 until its merger with Snyder’s of Hanover, Inc. (“Snyder’s”) in 2010. Mr. Singer also served as a director of Lance, Inc. from 2003 until its merger with Snyder’s. He previously served as Executive Vice President and Chief Financial Officer of Coca-Cola Bottling Co. Consolidated, a beverage manufacturer and distributor, from 2001 to 2005. Presently, Mr. Singer also serves on the board of directors of Brunswick Corporation, and also previously served on the board of directors of Flowers Foods, Inc., Hanesbrands, Inc. and SPX Flow, Inc. KEY EXPERIENCES We considered Mr. Singer’s experience as a Chief Executive Officer and Chief Financial Officer and his board governance, management and financial experience, as well as his significant knowledge of the food and beverage industries. He also offers expertise in corporate finance, risk management, human capital management and mergers and acquisitions. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 69 Director since: 2019 |

| Committees: Audit and Finance; Technology and Cybersecurity |

| Other Public Company Directorships: Brunswick Corporation Prior Public Company Directorships: Snyder’s-Lance, Inc.; Flowers Foods, Inc.; Hanesbrands, Inc.; SPX Flow, Inc. | ||

20 |

|

|

CORPORATE GOVERNANCE

| Randall N. Spratt | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• Operations and Logistics • Other Public Company Boards • Risk Management |

| • Strategic Planning • Technology and Cybersecurity • M&A/Integration |

|

| ||

|

| |||||

BACKGROUND Mr. Spratt is retired, having most recently served as the Executive Vice President, Chief Information Officer and Chief Technology Officer of McKesson Corporation (“McKesson”), a global pharmaceutical distribution services and information technology company, from 2009 to 2015. Mr. Spratt joined McKesson in 1999 and held various executive positions at McKesson prior to becoming Chief Information Officer and Chief Technology Officer, including as Chief Information Officer from 2005 to 2009, Chief Process Officer for McKesson Provider Technologies from 2003 to 2005 and Senior Vice President, Imaging, Technology and Business Process Improvement from 2000 to 2003. Mr. Spratt previously served on the board of directors of Imperva, Inc. from May 2016 until the company was acquired by Thoma Bravo, LLC in January 2019. Mr. Spratt received a Bachelor of Science in biology from the University of Utah. KEY EXPERIENCES We considered Mr. Spratt’s extensive experience leading the information technology functions of a multinational large distributor, which allows him to provide valuable oversight, advice and guidance to our management and Board of Directors, particularly relating to technology, data management, digital capabilities, artificial intelligence, cybersecurity and technology infrastructure. We also considered his significant experience in operations, strategic planning and risk management. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 72 Director since: 2018 |

| Committees: Audit and Finance; Technology and Cybersecurity (Chair) |

| Other Public Company Directorships: None Prior Public Company Directorships: Imperva, Inc. | ||

| Warren M. Thompson | |||||

|

|

|

|

| ||

SKILLS |

|

|

|

| ||

• CEO Leadership • Financial • Foodservice Distribution Industry • Human Capital Management |

| • Marketing and Sales • Operations and Logistics • Other Public Company Boards |

| • Restaurant • Risk Management • M&A/Integration • Strategic Planning | ||

|

| |||||

BACKGROUND Mr. Thompson is Chairman of the Board and President of Thompson Hospitality Services, LLC, a private retail food and facilities management firm that he founded in 1992. Mr. Thompson began his career with the Marriott Corporation in 1983, where he started with the Restaurant Fast Track Management Development Program and served in 15 positions in nine years, ending as Vice President Operations for the Host Division. Mr. Thompson served on the board of directors of Sizzle Acquisition Corp, from 2021 to 2024 and served on the board of directors of Duke Realty Corp. from 2019 until the company was acquired by Prologis, Inc. in October 2022. Mr. Thompson received his Bachelor of Arts degree in Managerial Economics from Hampden-Sydney College and holds an MBA from the University of Virginia’s Darden Graduate School of Business Administration. KEY EXPERIENCES We considered Mr. Thompson’s knowledge, experience, and expertise in the restaurant and hospitality industry and his significant experience in operations, sales and marketing, financial management, risk management, human capital management and strategic planning. His over 35 years of experience in the restaurant and hospitality industry enables him to bring valuable perspectives of a foodservice industry customer to our Board of Directors. | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age: 65 Director since: 2020 |

| Committees: Human Capital and Compensation; Nominating and Corporate Governance |

| Other Public Company Directorships: None Prior Public Company Directorships: Duke Realty Corp.; Federal Realty Investment Trust; Sizzle Acquisition Corp. | ||

| 2024 Proxy Statement | 21 |

CORPORATE GOVERNANCE

STOCKHOLDER NOMINATIONS

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the Securities and Exchange Commission (“SEC”) to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected.

Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Secretary, Performance Food Group Company, 12500 West Creek Parkway, Richmond, Virginia 23238. |

Stockholders may also nominate directors for election to the Board as described in the section entitled “Stockholder Proposals for the 2025 Annual Meeting.” Stockholder nominations must satisfy the notification, timeliness, consent and information requirements set forth in our Amended and Restated Bylaws (the “Bylaws”) as described under “Stockholder Proposals for the 2025 Annual Meeting.”

BOARD TENURE POLICY

The Board does not have a policy to impose term limits or a mandatory retirement age for directors because such a policy may deprive the Board of the service of directors who have developed, through valuable experience over time, an increased insight into the Company and its operations.

The Board’s Role and Responsibilities

The Board oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company and its stockholders. In this oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the stockholders. The Board selects and oversees the Chief Executive Officer (“CEO”). The CEO and the other members of senior management are charged with conducting the business of the Company.

Oversight of Strategy

One of the Board’s key responsibilities is overseeing and monitoring the Company's business strategy.

| Our Board actively engages with management to provide effective oversight of and guidance on the development and execution of our short and long-term strategic initiatives and related risks. This ongoing effort enables the Board to focus on Company performance over the short, intermediate and long term, as well as the quality of operations. In addition to financial and operational performance, non-financial measures, including ESG goals and safety initiatives, are discussed regularly by the Board and Board committees. The Board discusses the Company's opportunities, risks, key strategic initiatives and competitive and macroeconomic environment at each Board meeting, both in general and executive sessions. |

While the Board oversees strategic planning, our CEO and the other members of senior management are charged with developing and executing our strategic vision and updating our Board on progress throughout the fiscal year.

22 |

|

|

CORPORATE GOVERNANCE

Oversight of Risk Management The Board of Directors has extensive involvement in the oversight of risk management related to us and our business. The Board accomplishes this oversight both directly and through its committees, each of which assists the Board in overseeing a part of our overall risk management and reports to the Board at each Board meeting and throughout the year regarding risk and the related risk management. In addition, the Board receives periodic detailed operating performance and functional reviews from management regarding key risks and related risk management processes and procedures. | ||||||

| ||||||

Audit and Finance Committee | Human Capital and Compensation Committee | Nominating and Corporate Governance Committee | Technology and Cybersecurity Committee | |||

The Audit and Finance Committee reviews our accounting, reporting and financial practices, including the integrity of our financial statements and the oversight of our financial controls. Through its regular meetings with management, including the finance, legal, insurance and risk, real estate and internal audit functions, the Audit and Finance Committee reviews and discusses all significant areas of our business and summarizes for the Board all areas of risk and the appropriate mitigating factors. The Audit and Finance Committee oversees the Company’s enterprise risk management program ("ERM"). The Committee meets with the leaders of our ERM program twice each year and between meetings as needed. | The Human Capital and Compensation Committee considers, and discusses with management, management’s assessment of certain risks, including whether any risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on us. | The Nominating and Corporate Governance Committee oversees and evaluates programs and risks associated with Board organization, membership and structure, and corporate governance. The Nominating and Corporate Governance Committee oversees our compliance with our Code of Business Conduct and our environment, health and safety, corporate social responsibility, corporate governance and sustainability (ESG), ethics and quality assurance programs. | The Technology and Cybersecurity Committee reviews and discusses with management the Company’s risk management and risk assessment guidelines and policies regarding information technology security and the Company’s cybersecurity policies, controls and procedures. | |||

Oversight of Cybersecurity and Information Security

Cybersecurity is a key component of the Company’s enterprise risk management program. As indicated above, our Technology and Cybersecurity Committee oversees the Company’s risk assessment processes and risk management policies and mitigation regarding information technology security and the Company’s cybersecurity policies, controls, and procedures. Cybersecurity risks and initiatives to mitigate our risks are discussed at each meeting of the Technology and Cybersecurity Committee. For more information regarding the Board’s oversight of the Company’s information technology security and cybersecurity policies, controls, and procedures, please see Item 1C. Cybersecurity of our Annual Report.

Oversight of ESG Strategy

Our Nominating and Corporate Governance Committee has been given the responsibility of overseeing our ESG initiatives at the Board level and receives ESG progress reports on a quarterly basis from our C-Suite ESG Executive Committee and

| 2024 Proxy Statement | 23 |

CORPORATE GOVERNANCE

other cross-functional ESG committees. Please see the “Corporate Social Responsibility” section below for more information regarding Board oversight of ESG.

MANAGEMENT SUCCESSION PLANNING

The Board regularly reviews a succession plan relating to the CEO and other executive officer positions that is developed by management. The Board may also delegate oversight of the succession plan developed by management to a committee of the Board. The succession plan includes, among other things, an assessment of the experience, performance, and skills of possible successors to the CEO. Management development and succession planning remained top priorities of management and the Board in fiscal 2024.

COMMUNICATIONS WITH THE BOARD

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of the Board of Directors, including the Chairman of the Board of Directors ("Chairman"), our Lead Independent Director and each of the Audit and Finance, Human Capital and Compensation, Technology and Cybersecurity, or Nominating and Corporate Governance Committees or to the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Secretary of the Company, 12500 West Creek Parkway, Richmond, Virginia 23238, who will forward such communication to the appropriate party.

CODE OF BUSINESS CONDUCT

We maintain a Code of Business Conduct that is applicable to all of our directors, officers, and employees, including our Chairman and CEO (principal executive officer), Chief Financial Officer (principal financial officer), Chief Accounting Officer (principal accounting officer) and other senior financial officers. The Code of Business Conduct sets forth our policies and expectations on a number of topics, including conflicts of interest, corporate opportunities, confidentiality, compliance with laws (including insider trading laws), use of our assets, and business conduct and fair dealing. This Code of Business Conduct is intended to satisfy the requirements for a code of ethics, as defined by Item 406 of Regulation S-K promulgated by the SEC. The Code of Business Conduct may be found on our website at www.pfgc.com under Investors: Corporate Governance: Governance Documents: Code of Business Conduct.