- PFGC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Performance Food (PFGC) DEF 14ADefinitive proxy

Filed: 9 Oct 20, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Performance Food Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

| ||

| STOCK EXCHANGE LISTING | |

Notice of 2020 Virtual Annual Meeting of Stockholders

|  |  | ||

| WHEN | WHERE | WHO CAN VOTE | ||

| Thursday, November 19, 2020 8:30 A.M. Eastern Time | Meeting live via the internet – please visit www.virtualshareholder meeting.com/PFGC2020 | You may vote at the Annual Meeting of Stockholders to be held on November 19, 2020 (the “Annual Meeting”) if you were a stockholder of record at the close of business on September 30, 2020. |

Items of Business

| Board Recommendation | ||||

| PROPOSAL 1 | To elect the four Class I and two Class II director nominees listed in the Proxy Statement. | FOR each director nominee | ||

| PROPOSAL 2 | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2021. | FOR | ||

| PROPOSAL 3 | To approve, in a non-binding advisory vote, the compensation paid to the named executive officers. | FOR |

Stockholders will also consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. Proxy votes must be received no later than 11:59 P.M., Eastern Time, on November 18, 2020.

If you plan to participate in the Annual Meeting, please see the instructions in the Question and Answer section of this Proxy Statement. Stockholders will be able to listen, vote electronically and submit questions online during the Annual Meeting. There will be no physical location for stockholders to attend. Stockholders may only participate online at www.virtualshareholdermeeting.com/PFGC2020.

This Proxy Statement, together with a form of proxy card and the Annual Report on Form 10-K for the fiscal year ended June 27, 2020 (the “Annual Report”) are first being sent to stockholders on or about October 9, 2020.

Your vote is important to us. Thank you for voting.

By Order of the Board of Directors,

You will need the 16-digit number included on your proxy card to obtain your records and to vote by internet.  BY TELEPHONE From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week. You will need the 16-digit number included on your proxy card in order to vote by telephone.  BY MAIL Mark your selections on the proxy card. Date and sign your name exactly as it appears on your proxy card. Mail the proxy card in the enclosed postage-paid envelope provided to you in time to be received before the deadline. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, NOVEMBER 19, 2020: This Proxy Statement and our Annual Report are available free of charge on the Annual Report and Proxy tab in the Financial Information section in the Investors section of our website (https:// investors.pfgc.com/financials/annual-reports/default.aspx; https://investors. pfgc.com/financials/proxy/default.aspx). |

2020 Proxy Statement | 1 |

Message from Our Chairman, President and Chief Executive Officer

|  |

| I could not be prouder of our organization and how it has responded to the challenging environment. I would like to thank each of our associates for their outstanding work. | |

|

Dear Fellow Stockholders:

Fiscal 2020 has been an extraordinary 12 months for Performance Food Group (“PFG”). We began the year by announcing the highly complementary acquisition of Reinhart FoodService L.L.C. (“Reinhart”), closing the transaction on December 30th. I am very pleased with our team’s execution integrating the Reinhart organization.

Meanwhile, as the COVID-19 pandemic has disrupted businesses around the world, our team has continued to drive results while gaining share in our core businesses. I could not be prouder of our organization and how it has responded to the challenging environment. I would like to thank each of our associates for their outstanding work.

Our fiscal 2020 financial results include:

| ● | Total case volume growth of 7.6% |

| ● | Net sales increased 27.1% to $25.1 billion |

| ● | Gross profit improved 14.2% to $2.9 billion |

| ● | Net loss of $114.1 million |

| ● | Adjusted EBITDA declined 14.7% to $405.5 million(1) |

| ● | Diluted loss per share of $1.01 |

| ● | Adjusted Diluted EPS declined 67.1% to $0.70(1) |

Acquisitions

Through its history, PFG has been a disciplined and proven acquirer and fiscal 2020 was no different. After announcing the acquisition of Reinhart to start the fiscal year, PFG closed the transaction on December 30th. Through the remainder of the fiscal year, PFG welcomed the associates from Reinhart and began a successful integration of the business into the PFG family. This transaction has transformed PFG into one of the largest food distributors in the U.S. with historical pro-forma net sales of approximately $30 billion.

PFG continued to welcome Eby-Brown into the PFG organization after a successful completion of that transaction in fiscal 2019. The Eby-Brown transaction has continued to provide stable results, particularly as the convenience store channel remained resilient through the COVID-19 pandemic.

Winning Business with Financial Strength

The COVID-19 pandemic will likely influence the business environment for many years to come. While the circumstances have provided a challenging external landscape, our organization has risen to the occasion. In April, we fortified our balance sheet by raising over $700 million through issuance of both equity and debt securities. As a result, we closed fiscal 2020 with over $2.1 billion of total liquidity including cash and availability on our ABL facility. With this strong financial position, we have supported our sales force and looked for new business opportunities.

The strength in our balance sheet allows our company to look for new opportunities to grow and thrive. We have already seen this materialize in market share gains through the back half of fiscal 2020. Our company’s focus on customer service is a key component to our past success and will lead us to a brighter future.

Sincerely,

| (1) | This Proxy Statement includes several metrics, including Adjusted EBITDA and Adjusted diluted EPS, that are not calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Please see Appendix A at the end of this Proxy Statement for the definitions of non-GAAP financial measures and reconciliations of such non-GAAP financial measures to their respective most comparable financial measures calculated in accordance with GAAP. |

| 2 |  |

This summary highlights information about Performance Food Group Company (the “Company” or “PFG”) and certain other information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider in voting your shares; therefore, you should read the entire Proxy Statement carefully before voting. Except where the context requires otherwise, references to “the Company,” “we,” “us” and “our” refer to Performance Food Group Company. Capitalized terms used but not defined herein have the meanings set forth in our Annual Report.

About Performance Food Group

| 2020 Net Sales = $25.1B | EBITDA by Segment | EBITDA Profit Margins |

| ||

| (1) | Percentages presented for segments exclude corporate overhead and other non-reportable segments. |

| (2) | Please see Appendix A at the end of this Proxy Statement for the definitions of non-GAAP financial measures and reconciliations of such non-GAAP financial measures to their respective most comparable financial measures calculated in accordance with GAAP. |

| 4 |  |

Proxy Summary

|  |  | ||||||||

Grow our independent | Pursue | Deliver consistent financial | ||||||||

2020 Proxy Statement | 5 |

Proxy Summary

Voting Roadmap

Proposal 01 | ||||

Election of Directors |  | Your Board of Directors recommends that you vote “FOR” the election of the four Class I and two Class II director nominees. »See page 12 for further information. | ||

The Board of Directors of Performance Food Group Company (the “Board” or “Board of Directors”)

|  |  |  | ||||||

George L. Holm | Barbara J. Beck | Matthew C. Flanigan | David V. Singer | ||||||

Age: 65 Director Since: 2002 | Age: 60 Director Since: 2019 | Age: 58 Director Since: 2019 | Age: 65 Director Since: 2019 | ||||||

|  |  |  | ||||||

Meredith Adler | Jeffrey M. Overly | William F. Dawson, Jr | Manuel A. Fernandez | ||||||

Age: 66 Director Since: 2016 | Age: 62 Director Since: 2013 | Age: 56 Director Since: 2002 | Age: 74 Director Since: 2017 | ||||||

|  | Keys | |||||||

IND Independent Committees:  Audit Committee Audit Committee Compensation and Human Compensation and HumanResources Committee  Nominating and Corporate Nominating and CorporateGovernance Committee  Technology Committee Technology Committee Chair Chair  Member Member |

Class:  Class I Directors Class I Directors Class II Directors Class II Directors Class III Directors Class III Directors | ||||||||

Kimberly S. Grant | Randall N. Spratt | ||||||||

Age: 49 Director Since: 2017 | Age: 68 Director Since: 2018 | ||||||||

| 6 |  |

Proxy Summary

Board Snapshot

Independence | Tenure | Gender | Age |

| 8 directors are independent  | 8 directors 2 directors | 3 directors are women  | 4 directors 5 directors 1 director |

Corporate Governance Highlights

Board Independence | ✓Fully independent Audit, Compensation and Human Resources, Nominating and Corporate Governance and Technology Committees ✓Regular executive sessions of independent directors | |

Board Performance | ✓Three of the four members of our Audit Committee qualify as an “audit committee financial expert” | |

Stockholder Rights | ✓Majority voting standard for the election of directors in uncontested elections ✓Proxy access bylaw provision enabling a stockholder who has owned a significant amount of our common stock for a significant amount of time to submit director nominees ✓Majority voting standard for amending our governing documents ✓Majority voting standard for removing directors ✓Right to call a special meeting | |

Other Board and Board | ✓Stock ownership requirements for executive officers and directors ✓Policies prohibiting hedging our shares ✓Since the 2019 annual meeting, directors are elected for 1-year terms. Commencing at the 2021 annual meeting, the Board will be declassified and all directors will be elected for 1-year terms. | |

Policies, Programs | ✓Corporate Governance Guidelines place limits on the number of public company directorships held by our directors |

2020 Proxy Statement | 7 |

Proxy Summary

Proposal 02 | ||||

Ratification of Independent Registered Public Accounting Firm |  | Your Board of Directors recommends that you vote “FOR” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2021. »See page 27 for further information. | ||

Proposal 03 | ||||

Advisory Vote on Named Executive Officer Compensation |  | Your Board of Directors recommends that you vote “FOR” the approval of the compensation paid to our named executive officers. »See page 32 for further information. | ||

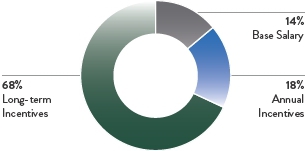

Framework of 2020 Named Executive Officer Compensation

| Compensation Element | Compensation Objectives Designed to be Achieved | ||

| Base Salary | Recognize ongoing performance of job responsibilities. | |

| Cash Bonus Opportunity | Compensation “at risk” and designed to encourage the achievement of annual business goals. | |

| Long-Term Equity Incentive Opportunity | Compensation “at risk” and designed to encourage the creation of stockholder value and the achievement of long-term business goals. |

2020 Executive Total Targeted Compensation Mix

| CEO Compensation Mix | Other NEO Compensation Mix | |

|  |

| 8 |  |

Proxy Summary

Compensation Practices

| What We Do |

| ● | Performance Driven Pay: We base a very high percentage of executive pay on Company performance through annual and long-term incentives that are capped. We require executives to achieve annual and long-term performance-based goals tied to stockholder value. |

| ● | Pay Aligned to Peers: We target median compensation levels and benchmark market data of our peer group companies when making executive compensation decisions. |

| ● | Annual Say-on-Pay: We hold an annual advisory Say-on-Pay vote concerning executive compensation. |

| ● | Clawbacks: Our clawback policy subjects sign-on grants, incentive cash and/or equity awards to clawbacks upon misconduct regardless of a restatement of the financial statements or an error in the calculation of such incentive-based or equity-based compensation. |

| ● | Stock Ownership Requirements: We apply mandatory stock ownership guidelines for executive officers and directors. |

| ● | Independent Compensation Consulting Firm reporting directly to the Compensation and Human Resources Committee (“Compensation Committee”): Our Board engages an independent compensation consulting firm, that does not provide any other services to our Company, to provide counsel, evaluate and manage risk in our compensation programs. |

| ● | Double-Trigger Severance Agreements: We maintain double-trigger equity award vesting acceleration upon involuntary termination following a Change in Control (“CIC”). |

| ● | Modest Perquisites: We provide our executive officers with limited and reasonable perquisites in order to attract and retain them. |

| What We Don’t Do |

| ● | No excise tax gross-ups |

| ● | No modified single-trigger or single-trigger CIC severance agreements (we only use double-trigger CIC severance provisions) |

| ● | No uncapped incentive compensation opportunities |

| ● | No hedging of shares by our directors or employees |

| ● | No excessive perquisites |

| ● | No repricing of underwater stock options |

| ● | No dividends provided on unearned performance awards |

2020 Proxy Statement | 9 |

| 10 |  |

Table of Contents

2020 Proxy Statement | 11 |

Corporate Governance at Performance Food Group

Election of Directors |  | Your board of directors recommends that you vote “FOR” the election of the four Class I and two Class II director nominees. | ||

Our Amended and Restated Certificate of Incorporation previously provided for a classified Board of Directors divided into three classes. At our 2018 Annual Meeting, our stockholders approved a proposal to declassify our Board of Directors and to make our directors subject to annual election beginning with the 2019 Annual Meeting and continuing thereafter, as the existing three-year terms of our directors expired in 2019 and 2020 and expire in 2021. Beginning in 2021, all of our directors will be subject to annual election. George L. Holm, Barbara J. Beck, Matthew C. Flanigan and David V. Singer constitute a class with a term that expires at the Annual Meeting (the “Class I Directors”); Meredith Adler and Jeffrey M. Overly constitute a class with a term that also expires at the Annual Meeting (the “Class II Directors”); and William F. Dawson, Jr., Manuel A. Fernandez, Kimberly S. Grant and Randall N. Spratt constitute a class with a term that expires at our 2021 Annual Meeting of Stockholders (the “Class III Directors”).

Upon the recommendation of the Nominating and Corporate Governance Committee, the full Board of Directors has considered and nominated the following slate of Class I Director nominees and Class II Director nominees to hold office for one year until our 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) and until their successors have been elected and qualified, subject to their earlier death, resignation or removal: George L. Holm, Barbara J. Beck, Matthew C. Flanigan, David V. Singer, Meredith Adler and Jeffrey M. Overly. Action will be taken at the Annual Meeting for the election of these four Class I Director nominees and two Class II Director nominees.

Unless otherwise instructed, the persons named in the form of proxy card (the “proxyholders”) included with this Proxy Statement intend to vote the proxies held by them “FOR” the election of George L. Holm, Barbara J. Beck, Matthew C. Flanigan, David V. Singer, Meredith Adler and Jeffrey M. Overly. Each of these nominees has indicated that he or she is willing and able to serve as a director. If any of these nominees ceases to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), such proxies may be voted by the proxyholders in accordance with the recommendation of the Board.

| Independence | Tenure | Gender | Age |

| 8 directors are independent | 8 directors <1-10 years | 3 directors are women | 4 directors 45 to 60 years |

|  |  |  |

2 directors | 5 directors | ||

|  | ||

1 director | |||

|

| 12 |  |

Corporate Governance at Performance Food Group

Nominees for Election to the Board of Directors

The following information describes the offices held, other public company directorships and the term of service of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities.”

Class I Director Nominees (If Elected, Term Will Expire at 2021 Annual Meeting)

George L. Holm | |||

Age: 65 Director since: 2002 Committees: ●None | BACKGROUND Mr. Holm has served as our President and Chief Executive Officer since September 2002, when he founded the Company and subsequently led the Company through its expansion into the broadline foodservice distribution industry with the Performance Food Group Company acquisition in May 2008. Additionally, in January 2019, Mr. Holm was named Chairman of the Board. Prior to joining the Company, he held various senior executive positions with Sysco Corporation, Alliant Foodservice and US Foods. Mr. Holm received a Bachelor of Science degree in business administration from Grand Canyon University. | ||

KEY EXPERIENCES  We considered Mr. Holm’s experience as an executive in the U.S. foodservice distribution industry. Furthermore, we also considered how his additional role as our Chief Executive Officer and President would bring management perspective to Board deliberations and provide valuable information about the status of our day-to-day operations. | |||

Barbara J. Beck | |||

Age: 60 Director since: 2019 Committees: ●Compensation and Human Resources ●Technology | BACKGROUND Ms. Beck retired in 2019 from her position as the Chief Executive Officer of Learning Care Group, Inc. (“LCG”), a global for-profit early childhood education provider. She served as Chief Executive Officer of LCG, from March 2011 until June 2019, and currently acts as an advisor to American Securities, the private equity owner of LCG. Ms. Beck also serves on the Executive Council of American Securities. Prior to joining LCG, Ms. Beck spent nine years as an executive of Manpower Inc., a world leader in the employment services industry, including as President of Manpower’s EMEA operations from 2006 to 2011. Prior to joining Manpower, Ms. Beck was an executive of Sprint Corporation, a global communications company, serving in various operating and leadership roles for 15 years. Since 2008, Ms. Beck has served on the board of directors of Ecolab Inc., a global provider of water, hygiene and energy technologies and services to food, energy, healthcare, industrial, hospitality and other markets. | ||

KEY EXPERIENCES  We considered Ms. Beck’s extensive general management and operational experience, including as a tenured CEO, allowing her to contribute to our strategic vision particularly as it relates to value creation strategies. Ms. Beck has significant knowledge of the impact of labor market trends on global and local economies and knowledge of employment services. Additionally, as an executive at Sprint, Ms. Beck gained expertise in the information technology field. | |||

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Financial | Foodservice Distribution Industry | HR | Innovation | Investment | Investor Relations | Leadership | Marketing | Operations | Public Company Governance | Public Reporting & Auditing | Restaurant | Risk Management | Strategic Planning | Technology |

2020 Proxy Statement | 13 |

Corporate Governance at Performance Food Group

Matthew C. Flanigan | |||

Age: 58 Director since: 2019 Committees: ●Audit (Chair) ●Technology | BACKGROUND Mr. Flanigan retired in 2019 from his role as Executive Vice President & Chief Financial Officer of Leggett & Platt, Incorporated, a global manufacturer of engineered components and products, where he also served on the Board of Directors for nearly 10 years. Mr. Flanigan was appointed Senior Vice President of Leggett & Platt in 2005 and became Chief Financial Officer in 2003. From 1999 until 2003, he served as President of the Office Furniture and Plastics Components Groups of Leggett & Platt. Mr. Flanigan currently serves as Vice Chairman of the Board and Lead Director of Jack Henry & Associates, Inc., a leading financial technology company. He has served on the board of directors of Jack Henry & Associates since 2007, and he was appointed Lead Director by the independent directors of Jack Henry & Associates in 2012. | ||

KEY EXPERIENCES  We considered Mr. Flanigan’s substantial executive experience of sixteen years as the Chief Financial Officer of a large, publicly-traded company in enabling him to bring important perspectives to our Board of Directors on performance management, business analytics, compliance, risk management, public reporting, and investor relations. | |||

David V. Singer | |||

Age: 65 Director since: 2019 Committees: ●Compensation and Human Resources ●Nominating and Corporate Governance | BACKGROUND Mr. Singer retired in 2013 as the Chief Executive Officer of Snyder’s-Lance, Inc., a manufacturer and marketer of snack foods throughout the United States and internationally. Mr. Singer served as Chief Executive Officer and as a director of Snyder’s-Lance from its formation in 2010 until his retirement in 2013. He was the President and Chief Executive Officer of Lance, Inc. from 2005 until its merger with Snyder’s of Hanover, Inc. in 2010. Mr. Singer also served as a director of Lance, Inc. from 2003 until its merger with Snyder’s. He previously served as Executive Vice President and Chief Financial Officer of Coca-Cola Bottling Co. Consolidated, a beverage manufacturer and distributor, from 2001 to 2005. Presently, Mr. Singer also serves on the board of directors of Brunswick Corporation and SPX Flow, Inc. | ||

KEY EXPERIENCES  We considered Mr. Singer’s experience as a chief financial officer and in board governance, management and financial experience, as well as his significant knowledge of the food and beverage industries. He also offers expertise in corporate finance and mergers and acquisition. | |||

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Financial | Foodservice Distribution Industry | HR | Innovation | Investment | Investor Relations | Leadership | Marketing | Operations | Public Company Governance | Public Reporting & Auditing | Restaurant | Risk Management | Strategic Planning | Technology |

| 14 |  |

Corporate Governance at Performance Food Group

Class II Directors (If Elected, Term Will Expire at the 2021 Annual Meeting)

Meredith Adler | |||

Age: 66 Director since: 2016 Committees: ●Audit ●Nominating and Corporate Governance | BACKGROUND Ms. Adler served as a Managing Director and Senior Equity Analyst at Barclays Capital, and at Lehman Brothers prior to its acquisition by Barclays, from 1996 until her retirement in July 2016. In her role at Barclays, Ms. Adler followed a wide range of consumer-oriented companies, including foodservice distributors, food and drug retailers, discounters and healthy living retailers. Ms. Adler graduated from Boston University and received an MBA degree from New York University’s Stern School of Business. | ||

KEY EXPERIENCES  We considered Ms. Adler’s knowledge of the foodservice industry and significant experience in financial matters and investor relations. | |||

Jeffrey M. Overly | |||

Age: 62 Director since: 2013 Committees: ●Compensation and Human Resources ●Nominating and Corporate Governance | BACKGROUND Mr. Overly retired as an Operating Partner at The Blackstone Group, one of the world’s leading investment firms (“Blackstone”), in August 2018. Before joining Blackstone in 2008, Mr. Overly was Vice President of Global Fixture Operations at Kohler Company. Prior to that, he served 25 years at General Motors Corporation and Delphi Corporation in numerous operations and engineering positions. Mr. Overly has a Bachelor of Science degree in Industrial Management from the University of Cincinnati and a Masters in Business from Central Michigan University. | ||

KEY EXPERIENCES  We considered Mr. Overly’s significant operational experience in public companies and his significant corporate governance expertise gained from his active involvement in Blackstone’s investments in numerous portfolio companies. | |||

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Financial | Foodservice Distribution Industry | HR | Innovation | Investment | Investor Relations | Leadership | Marketing | Operations | Public Company Governance | Public Reporting & Auditing | Restaurant | Risk Management | Strategic Planning | Technology |

2020 Proxy Statement | 15 |

Corporate Governance at Performance Food Group

Continuing Members of the Board of Directors

The following information describes the offices held and other public company directorships of our Class III Directors who are not subject to election this year. Beneficial ownership of equity securities for these directors is also shown under “Ownership of Securities.”

Class III Directors (Term Expires at 2021 Annual Meeting)

| William F. Dawson, Jr. | ||

Age: 56 Director since: 2002 Committees: ●None | BACKGROUND Mr. Dawson is the Chief Executive Officer of Wellspring Capital Management LLC, a leading private equity firm (“Wellspring”). He has served as the chair of Wellspring’s investment committee since 2004. Mr. Dawson has led or co-sponsored several of Wellspring’s most successful investments in distribution, consumer services, business services, healthcare, energy services and industrial companies. Prior to joining Wellspring, Mr. Dawson was a partner at Whitney & Co., where he was head of the middle-market buyout group. Prior to that, Mr. Dawson spent 14 years at Donaldson, Lufkin & Jenrette Securities Corporation where he was most recently a managing director at DLJ Merchant Banking. Mr. Dawson received a Bachelor of Science degree from St. Francis College and an MBA from Harvard Business School. KEY EXPERIENCES  We considered Mr. Dawson’s significant financial, investment, and operational experience from his involvement in Wellspring’s investments in numerous portfolio companies, as well as his seventeen years of experience as a director of the Company and its predecessor. | |

| Manuel A. Fernandez | ||

Age: 74 Director since: 2017 Committees: ●Compensation and Human Resources (Chair) ●Nominating and Corporate Governance ●Technology | BACKGROUND Mr. Fernandez serves as the Managing Director of SI Ventures, a venture capital firm focused on information technology and communications infrastructure. He has held that position with the firm since its inception in 1998. Mr. Fernandez served as Chief Executive Officer of Gartner, Inc., a leading research and advisory company, from 1991 to 1998, and Chairman of the Board of Directors of Gartner, Inc. from 1991 until 2001. He has also been Chairman and Chief Executive Officer of three technology-driven companies: Dataquest, Inc., Gavilan Computer Corporation and Zilog Incorporated. Mr. Fernandez currently serves on the board of directors of The Brunswick Corporation, where he is the Chairman of the Board, and Leggett & Platt, Incorporated. He previously served on the board of directors of Time, Inc. from 2014 to 2018, SPX Flow, Inc. from 2005 to 2014 and Sysco Corporation from 2006 to 2013. Mr. Fernandez graduated from the University of Florida with a degree in electrical engineering and completed post-graduate work in solid-state engineering at the University of Florida. KEY EXPERIENCES  We considered Mr. Fernandez’s extensive experience leading both public and private companies in foodservice and other industries, including three technology companies, allowing him to bring significant experience and knowledge to our Board regarding strategic planning, innovation, technology, acquisitions, corporate governance, distribution, operations and human resources. | |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Financial | Foodservice Distribution Industry | HR | Innovation | Investment | Investor Relations | Leadership | Marketing | Operations | Public Company Governance | Public Reporting & Auditing | Restaurant | Risk Management | Strategic Planning | Technology |

| 16 |  |

Corporate Governance at Performance Food Group

| Kimberly S. Grant | ||

Age: 49 Director since: 2017 Committees: ●Audit ●Nominating and Corporate Governance | BACKGROUND Ms. Grant is the Chief Strategy Officer and co-sponsor of FAST Acquisition Corporation, a publicly traded emerging growth company focused on affecting a business combination in the restaurant, hospitality, and related sectors in North America. Ms. Grant previously served as the Chief Executive Officer of ThinkFoodGroup, a global hospitality management company, which owns and operates innovative dining concepts created by two-star Michelin awarded chef José Andrés, from September 2014 to April 2020. From January 2014 to September 2014, Ms. Grant was Chief Operating Officer of ThinkFoodGroup. Prior to this role, Ms. Grant was with Ruby Tuesday Inc., a publicly traded restaurant company, for approximately 21 years. Her last positions at Ruby Tuesday Inc. were Chief Operations Officer and President from June 2002 to June 2013 and Vice President and Controller from 1998 to 2002. Ms. Grant earned a Master of Science in Banking and Financial Services Management from Boston University and a Bachelor of Science in Hotel and Restaurant Management from Thomas Edison State University, and she has attended Harvard Business School’s Executive Education program. KEY EXPERIENCES  We considered Ms. Grant’s knowledge, experience and expertise in the restaurant and hospitality industry and significant experience in operations and finance. Her over twenty years of experience in the restaurant and hospitality industry enables her to bring valuable perspectives of a foodservice industry customer to our Board of Directors. | |

| Randall N. Spratt | ||

Age: 68 Director since: 2018 Committees: ●Audit ●Technology (Chair) | BACKGROUND Mr. Spratt most recently served as the Executive Vice President, Chief Information Officer and Chief Technology Officer of McKesson Corporation, a global pharmaceutical distribution services and information technology company, from 2009 to 2015. Mr. Spratt joined McKesson in 1999 and held various executive positions at McKesson prior to becoming Chief Information Officer and Chief Technology Officer, including as Chief Information Officer from 2005 to 2009, Chief Process Officer for McKesson Provider Technologies from 2003 to 2005 and Senior Vice President, Imaging, Technology and Business Process Improvement from 2000 to 2003. Mr. Spratt previously served on the board of directors of Imperva Inc from May 2016 until the company was acquired by Thoma Bravo, LLC in January 2019. Mr. Spratt received a Bachelor of Science in biology from the University of Utah. KEY EXPERIENCES  We considered Mr. Spratt’s extensive experience leading the information technology functions of a multi-national large distributor, which allows him to provide invaluable advice and guidance to our management and Board of Directors. | |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Financial | Foodservice Distribution Industry | HR | Innovation | Investment | Investor Relations | Leadership | Marketing | Operations | Public Company Governance | Public Reporting & Auditing | Restaurant | Risk Management | Strategic Planning | Technology |

2020 Proxy Statement | 17 |

Corporate Governance at Performance Food Group

The Nominating and Corporate Governance Committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and recommends nominees for director to the Board for election. In considering candidates for the Board, the Nominating and Corporate Governance Committee also assesses the size, composition and combined expertise of the Board. As the application of these factors involves the exercise of judgment, the Nominating and Corporate Governance Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, although the Nominating and Corporate Governance Committee does at a minimum assess each candidate’s strength of character, judgment, industry knowledge or experience, independence of thought and his or her ability to work collegially with the other members of the Board. In addition, although the Board considers diversity in the broadest meaning of the word, the Board does not have a formal diversity policy. In identifying prospective director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management, stockholders and other sources, including third party recommendations. The Nominating and Corporate Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as directors of the Company. The Nominating and Corporate Governance Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral. When considering director candidates, the Nominating and Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

In connection with its annual recommendation of a slate of nominees, the Nominating and Corporate Governance Committee also may assess the contributions of those directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board.

When considering whether the nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focused primarily on each nominee’s current performance as a director and on the information discussed in each board member’s biographical information. We believe that our directors provide an appropriate mix of experience and skills relevant to the size and nature of our business.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the Securities and Exchange Commission (“SEC”) to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Secretary, Performance Food Group Company, 12500 West Creek Parkway, Richmond, Virginia 23238. All recommendations for nomination received by the Secretary that satisfy the requirements in our Amended and Restated Bylaws (the “Bylaws”) relating to director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent and information requirements set forth in our Bylaws. These requirements are also described under “Stockholder Proposals for the 2021 Annual Meeting.”

The Board does not have a policy to impose term limits or a mandatory retirement age for directors because such a policy may deprive the Board of the service of directors who have developed, through valuable experience over time, an increased insight into the Company and its operations.

The Board’s Role and Responsibilities

The Board directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company and its stockholders. In this oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the stockholders. The Board selects and oversees the members of senior management, who are charged by the Board with conducting the business of the Company.

| 18 |  |

Corporate Governance at Performance Food Group

The Board of Directors has extensive involvement in the oversight of risk management related to us and our business. The Board accomplishes this oversight both directly and through its committees, each of which assists the Board in overseeing a part of our overall risk management and regularly reports to the Board regarding risk and the related risk management. In addition, our Board receives periodic detailed operating performance reviews from management regarding certain risks and related risk management processes and procedures. | ||

| ⚫ | ||

The Audit Committee reviews our accounting, reporting and financial practices, including the integrity of our financial statements and the oversight of our financial controls. Through its regular meetings with management, including the finance, legal and internal audit functions, the Audit Committee reviews and discusses all significant areas of our business and summarizes for the Board all areas of risk and the appropriate mitigating factors. The Audit Committee oversees the Company’s enterprise risk management program. | The Compensation and Human Resources Committee considers, and discusses with management, management’s assessment of certain risks, including whether any risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on us. | The Nominating and Corporate Governance Committee oversees and evaluates programs and risks associated with Board organization, membership and structure, succession planning and corporate governance. The Nominating and Corporate Governance Committee oversees our compliance with our Code of Business Conduct and our ethics, quality assurance, safety and compliance programs. |

Management Succession Planning

The Board periodically reviews a succession plan relating to the Chief Executive Officer (“CEO”) and other executive officers that is developed by management. The Board may also delegate oversight of the succession plan developed by management to a committee of the Board. The succession plan includes, among other things, an assessment of the experience, performance and skills for possible successors to the CEO.

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of our Board of Directors, including the chair of our Board of Directors and each of the Audit, Compensation and Human Resources, Technology or Nominating and Corporate Governance Committees or to the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Secretary of the Company, 12500 West Creek Parkway, Richmond, Virginia 23238, who will forward such communication to the appropriate party.

We maintain a Code of Business Conduct that is applicable to all of our directors, officers and employees, including our Chairman, Chief Executive Officer (principal executive officer), Chief Financial Officer (principal financial officer), Chief Accounting Officer (principal accounting officer) and other senior financial officers. The Code of Business Conduct sets forth our policies and expectations on a number of topics, including conflicts of interest, corporate opportunities, confidentiality, compliance with laws (including insider trading laws), use of our assets and business conduct and fair dealing. This Code of Business Conduct also satisfies the requirements for a code of ethics, as defined by Item 406 of Regulation S-K promulgated by the SEC. The Code of Business Conduct may be found on our website at www.pfgc.com under Investors: Corporate Governance: Governance Documents: Code of Business Conduct.

We will disclose within four business days any substantive changes in or waivers of the Code of Business Conduct granted to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, or persons performing similar functions, by posting such information on our website as set forth above rather than by filing a Current Report on Form 8-K. In the case of a waiver for an executive officer or a director, the required disclosure also will be made available on our website within four business days of such determination.

2020 Proxy Statement | 19 |

Corporate Governance at Performance Food Group

The Board of Directors believes that, at this time, the combination of the offices of Chairman of the Board (“Chairman”) and the Company’s CEO is appropriate for the Company. The combination allows Mr. Holm to leverage his extensive knowledge of the Company and industry experience into the strategic vision for the management and direction of the Company at both the Board and management level in order to enhance stockholder value, grow and expand the Company’s business and execute the Company’s strategies. Mr. Holm is supported in the day-to-day management of the Company by our executive management team. Additionally, the Board believes it is appropriate to have a Lead Independent Director while Mr. Holm serves as Chairman of the Board in order to provide a leadership role for our independent directors. Mr. Fernandez brings a strong understanding of the Company and its business and our industry, as well as significant leadership, corporate governance and public company experience.

Selection of Chairman of the Board and Chief Executive Officer

The Board shall select its Chairman and the CEO in any way the Board considers to be in the best interests of the Company. Therefore, the Board does not have a policy on whether the role of Chairman and CEO should be separate or combined and, if it is to be separate, whether the Chairman should be selected from the independent directors. As indicated above, the Board believes that, at this time, the combination of the offices of Chairman of the Board and Chief Executive Officer, with Mr. Holm serving in such roles, is in the best interests of the Company.

Whenever the Chairman is also the Chief Executive Officer or is a director who does not otherwise qualify as an “independent director”, the independent directors will elect from among themselves a Lead Director of the Board (“Lead Director”). Following nomination by the Nominating and Corporate Governance Committee, each independent director will be given the opportunity to vote in favor of a Lead Director nominee or to write in a candidate of his or her own. The Lead Director will be elected by a plurality vote and will serve for a minimum of one year, or until replaced by the Board.

| 20 |  |

Corporate Governance at Performance Food Group

| ● | Preside over all meetings of the Board at which the Chairman is not present, including any executive sessions of the independent directors or the non-management directors; |

| ● | Assist in scheduling Board meetings and approve meeting schedules to ensure that there is sufficient time for discussion of all agenda items; |

| ● | Request the inclusion of certain materials for Board meetings; |

| ● | Serve as an ex-officio member of each Board committee and attend meetings of the various committees regularly; |

| ● | Seek to ensure effective communication among the Board committees; |

| ● | Collaborate with the Chairman to review and recommend to the Nominating and Corporate Governance Committee Board committee memberships and Chairmans; |

| ● | Communicate to the CEO, together with the Chairman of the Compensation and Human Resources Committee, the results of the Board’s evaluation of CEO performance; |

| ● | Collaborate with the CEO on Board meeting agendas and approve such agendas; |

| ● | Collaborate with the CEO in determining the need for special meetings of the Board; |

| ● | Lead the Board’s annual process of performance self-assessment, including feedback to individual directors; |

| ● | Meet with any director who is not adequately performing his or her duties as a member of the Board or any Board committee; |

| ● | Provide leadership and serve as temporary Chairman of the Board or CEO in the event of the inability of the Chairman of the Board or CEO to fulfill his/her role due to crisis or other event or circumstance which would make leadership by existing management inappropriate or ineffective, in which case the Lead Director shall have the authority to convene meetings of the full Board or management; |

| ● | Be available for consultation and direct communication if requested by major stockholders; |

| ● | Act as the liaison between the independent or non-management directors and the Chairman of the Board, as appropriate; |

| ● | Call meetings of the independent or non-management directors when necessary and appropriate; |

| ● | Recommend to the Board, in concert with the Chairmans of the respective Board committees, the retention of consultants and advisors who directly report to the Board, including such independent legal, financial or other advisors as he or she deems appropriate, without consulting or obtaining the advance authorization of any officer of the Company; and |

| ● | Perform such other duties as delegated from time to time by the independent and non-management directors. |

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and the rules of the New York Stock Exchange (“NYSE”), a director is not independent unless our Board of Directors affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries.

Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require our Board of Directors to review the independence of all directors at least annually.

In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, our Board of Directors will determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board of Directors has determined that each of Messrs. Fernandez, Flanigan, Overly, Singer and Spratt and Ms. Adler, Ms. Beck and Ms. Grant is independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and under all applicable NYSE guidelines, including with respect to committee membership. Our Board also has determined that each of Messrs. Singer and Spratt and Ms. Adler and Ms. Grant is “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and that each of Messrs. Fernandez, Overly and Singer and Ms. Beck is “independent” for purposes of Section 10C(a)(3) of the Exchange Act. Mr. Holm serves on our Board of Directors but, as our President and Chief Executive Officer, he cannot be deemed independent.

2020 Proxy Statement | 21 |

Corporate Governance at Performance Food Group

Executive sessions, which are meetings of the non-management members of the Board, are routinely scheduled during each regularly scheduled Board and Committee meeting. In addition, at least once a year, the independent directors will meet in a private session that excludes management and any non-independent directors. Our Lead Director, Mr. Fernandez, presides at the executive sessions.

The following table summarizes the current membership of each of the Board’s committees.

| Audit Committee | Compensation and Human Resources Committee | Nominating and Corporate Governance Committee | Technology Committee | |||||

| Meredith Adler |  |  | ||||||

| Barbara J. Beck |  |  | ||||||

| Manuel A. Fernandez |  |  |  | |||||

| Matthew C. Flanigan |  |  | ||||||

| Kimberly S. Grant |  |  | ||||||

| Jeffrey M. Overly |  |  | ||||||

| David V. Singer |  |  | ||||||

| Randall N. Spratt |  |  |

| Chair |

|  | Member |

| Audit Committee | |||

| MEMBERS | DUTIES AND RESPONSIBILITIES | ||

Meredith Adler Kimberly S. Grant Randall N. Spratt Matthew C. Flanigan (Chair) MEETINGS 7 meetings in fiscal 2020 ATTENDANCE | ●Overseeing the adequacy and integrity of our financial statements and our financial reporting and disclosure practices. ●Overseeing the soundness of our system of internal controls to assure compliance with financial and accounting requirements. ●Retaining and reviewing the qualifications, performance, and independence of our independent auditor. ●Reviewing and discussing with management and the independent auditor prior to public dissemination our annual audited financial statements, quarterly unaudited financial statements, earnings press releases and financial information and earnings guidance provided to analysts and rating agencies. ●Overseeing our guidelines and policies relating to risk assessment and risk management regarding financial risks, and management’s plan for financial risk monitoring and control. ●Oversees our enterprise risk management program. ●Overseeing our internal audit function. ●Reviewing and approving or ratifying all transactions between us and any “Related Person” (as defined in the federal securities laws and regulations) that are required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Exchange Act. | ||

All members of the Audit Committee have been determined to be “independent,” consistent with our Audit Committee charter, Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors in general and audit committees in particular. Our Board of Directors also has determined that each of the members of the Audit Committee is “financially literate” within the meaning of the listing standards of the NYSE. In addition, our Board of Directors has determined that each of Ms. Adler, Ms. Grant and Mr. Flanigan qualifies as an “audit committee financial expert” as defined by applicable SEC regulations.

The Audit Committee also prepares the report of the committee required by the rules and regulations of the SEC to be included in our annual proxy statement.

| 22 |  |

Corporate Governance at Performance Food Group

Our Audit Committee charter permits the committee to delegate any or all of its authority to one or more subcommittees. In addition, the Audit Committee has the authority under its charter to engage independent counsel and other advisors as it deems necessary or advisable.

| Compensation and Human Resources Committee | |||

| MEMBERS | DUTIES AND RESPONSIBILITIES | ||

Barbara J. Beck Jeffrey M. Overly David V. Singer Manuel A. Fernandez (Chair) MEETINGS 5 meetings in fiscal 2020 ATTENDANCE | ●Establishing and reviewing our overall compensation philosophy. ●Overseeing the goals, objectives and compensation of our CEO, including evaluating the performance of the CEO in light of those goals. ●Overseeing the compensation of our other executives and non-management directors. ●Reviewing all employment, severance, and termination agreements with our executive officers. ●Reviewing and approving, or recommending to the Board of Directors, our incentive-compensation plans and equity-based plans. ●Providing strategic review of the Company’s human resources strategies and initiatives to ensure the Company is seeking, developing and retaining human capital appropriate to the Company’s needs. ●Preparing and issuing the Compensation Committee Report for inclusion in our annual proxy statement. | ||

Messrs. Fernandez, Overly and Singer and Ms. Beck have been determined to be “independent” as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors in general and compensation committees in particular.

With respect to our reporting and disclosure matters, the responsibilities and duties of the Compensation Committee include overseeing the preparation of the Compensation Discussion and Analysis for inclusion in our annual proxy statement and Annual Report on Form 10-K in accordance with applicable rules and regulations of the SEC.

The charter of the Compensation Committee permits the committee to delegate any or all of its authority to one or more subcommittees and to delegate to one or more of our officers the authority to make awards to any non-Section 16 officer under our incentive compensation or other equity-based plans, subject to compliance with the plan and the laws of our state of jurisdiction. In addition, the Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable.

See “Executive Compensation—Compensation Discussion and Analysis—Compensation Determination Process” and “Compensation of Directors” for a description of our process for determining executive and director compensation, including the role of our compensation consultant.

| Nominating and Corporate Governance Committee | |||

| MEMBERS | DUTIES AND RESPONSIBILITIES | ||

Meredith Adler | ●Identifying and recommending nominees for election to the Board of Directors. ●Reviewing the composition and size of the Board of Directors. ●Overseeing an annual evaluation of the Board of Directors and each committee. ●Regularly reviewing our corporate governance documents, including our corporate charter and bylaws and Corporate Governance Guidelines. ●Recommending members of the Board of Directors to serve on committees of the Board. ●Overseeing and approving the management succession planning process. ●Overseeing compliance with our Code of Business Conduct and our ethics, quality assurance, safety and compliance programs. | ||

MEETINGS ATTENDANCE | |||

2020 Proxy Statement | 23 |

Corporate Governance at Performance Food Group

Each of Messrs. Fernandez, Overly and Singer and Ms. Adler and Ms. Grant has been determined to be “independent” as defined by our Corporate Governance Guidelines and the NYSE listing standards.

The charter of the Nominating and Corporate Governance Committee permits the committee to delegate any or all of its authority to one or more subcommittees. In addition, the Nominating and Corporate Governance Committee has the authority under its charter to retain outside counsel or other experts as it deems necessary or advisable.

| Technology Committee | |||

| MEMBERS | DUTIES AND RESPONSIBILITIES ●Reviewing the Company’s information technology planning and strategy. ●Reviewing significant information technology investments and expenditures. ●Receiving reports on existing and future trends in information technology and cybersecurity that may affect the Company’s strategic plans, including monitoring overall industry trends. ●Reviewing or discussing, as and when appropriate, with management the Company’s risk management and risk assessment guidelines and policies regarding information technology security, including the quality and effectiveness of the Company’s cybersecurity and the Company’s disaster recovery capabilities. | ||

Barbara J. Beck | |||

Manuel A. Fernandez | |||

Matthew C. Flanigan | |||

Randall N. Spratt (Chair) | |||

| |||

4 meetings in fiscal 2020 | |||

| |||

100% | |||

Each of Messrs. Fernandez, Flanigan and Spratt and Ms. Beck has been determined to be “independent” as defined by our Corporate Governance Guidelines and the NYSE listing standards.

From time to time, the Board may form and appoint members to special committees with responsibility to address topics designated at the time of such committee formation.

| 24 |  |

Corporate Governance at Performance Food Group

Board Practices, Processes and Policies

The Board of Directors and Certain Governance Matters

Our Board of Directors oversees our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board of Directors and four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Technology Committee.

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance include:

| Board Independence | ✓Fully independent Audit, Compensation, Nominating and Corporate Governance and Technology Committees ✓Regular executive sessions of independent directors | |

| Board Performance | ✓Three of the four members of our Audit Committee qualify as an “audit committee financial expert” | |

| Stockholder Rights | ✓Majority voting standard for the election of directors in uncontested elections ✓Proxy access bylaw provision enabling a stockholder who has owned a significant amount of our common stock for a significant amount of time to submit director nominees ✓Majority voting standard for amending the governing documents ✓Majority voting standard for removing directors ✓Right to call a special meeting | |

| Other Board and Board Committee Practices | ✓Stock ownership requirements for executive officers and directors ✓Policies prohibiting hedging our shares ✓Since the 2019 Annual Meeting, directors are elected for 1-year terms. Commencing at the 2021 Annual Meeting, the Board will be declassified and all directors will be elected for 1-year terms. | |

| Policies, Programs and Guidelines | ✓Corporate Governance Guidelines place limits on the number of public company directorships held by our directors |

Our Board of Directors evaluates the Company’s corporate governance policies and practices on an ongoing basis with a view toward maintaining appropriate corporate governance practices in the context of the Company’s current business environment. Additionally, the Board seeks to align our governance practices closely with the interests of our stockholders.

Our Board of Directors and management value the perspectives of our stockholders and encourage stockholders to communicate with the Board of Directors.

The Board currently plans at least four meetings each year, with further meetings to occur (or action to be taken by unanimous consent) at the discretion of the Board.

All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and the annual meeting of stockholders. During the fiscal year ended June 27, 2020, the Board held 13 meetings, the Audit Committee held 7 meetings, the Compensation Committee held 5 meetings, the Nominating and Corporate Governance Committee held 4 meetings and the Technology Committee held 4 meetings. In fiscal 2020, all incumbent directors then in office attended at least 75% of the aggregate number of meetings of our Board and of all committees on which they served during their respective terms of service. In addition, all incumbent directors then in office attended the 2019 Annual Meeting.

2020 Proxy Statement | 25 |

Corporate Governance at Performance Food Group

The Board, acting through the Nominating and Corporate Governance Committee, conducts a self-evaluation at least annually to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee periodically considers the mix of skills and experience that directors bring to the Board to assess whether the Board has the necessary tools to perform its oversight function effectively. Each committee of the Board conducts a self-evaluation at least annually and reports the results to the Board. Each committee’s evaluation must compare the performance of the committee with the requirements of its written charter.

Director Orientation and Continuing Education

Management, working with the Board, provides an orientation process for new directors and coordinates director continuing education programs. The orientation programs are designed to familiarize new directors with the Company’s businesses, strategies and challenges and to assist new directors in developing and maintaining skills necessary or appropriate for the performance of their responsibilities. As appropriate, management prepares additional educational sessions for directors on matters relevant to the Company and its business. Directors are also encouraged to participate in educational programs relevant to their responsibilities, including programs conducted by universities and other educational institutions.

Committee Charters and Corporate Governance Guidelines

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe our Board of Directors’ views and policies on a wide range of governance topics. These Corporate Governance Guidelines are reviewed from time to time by our Nominating and Corporate Governance Committee and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by our Board of Directors.

Our Corporate Governance Guidelines, Audit, Compensation, Nominating and Corporate Governance and Technology Committee charters, and other corporate governance information are available on our website at www.pfgc.com under Investors: Corporate Governance: Governance Documents. Any stockholder also may request them in print, without charge, by contacting the Secretary of Performance Food Group Company, 12500 West Creek Parkway, Richmond, Virginia 23238.

Transactions with Related Persons

Our Board of Directors has adopted a written statement of policy regarding transactions with related persons, which we refer to as our “related person transaction policy.” Our related person transaction policy requires that (i) any “related person transaction” (defined as any transaction, consistent with Item 404(a) of Regulation S-K in which we were or are to be a participant and the amount involved exceeds $120,000 and in which any related person had or will have a direct or indirect material interest) be approved or ratified by an approving body comprised of the disinterested members of our Board of Directors or any committee of the Board of Directors (provided that a majority of the members of the Board of Directors or such committee, respectively, are disinterested) and (ii) any employment relationship or transaction involving an executive officer and any related compensation be approved by the Compensation Committee or recommended by the Compensation Committee to the Board of Directors for its approval. It is our policy that directors interested in a related person transaction will recuse themselves from any vote on a related person transaction in which they have an interest.

FMR LLC (“Fidelity”) filed a Schedule 13G/A filed with the SEC on February 7, 2020 stating that it holds approximately 10.8% of the Company’s stock. An affiliate of Fidelity provides investment management and record keeping services to the Company’s 401(k) Plan. The participants in the 401(k) Plan paid $637,639.32 for record keeping services and $630,748.54 for investment management services to Fidelity in fiscal 2020. The investment management agreement was entered into on an arm’s-length basis.

| 26 |  |

Ratification of Independent Registered Public Accounting Firm |  | Your Board of Directors recommends that you vote “FOR” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2021. | ||

The Audit Committee has selected Deloitte & Touche LLP to serve as our independent registered public accounting firm for fiscal 2021.

Although ratification is not required by our Bylaws or otherwise, the Board is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification as a matter of good corporate governance and because we value our stockholders’ views on the Company’s independent registered public accounting firm. If our stockholders fail to ratify the selection, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting. The representative will also have the opportunity to make a statement if he or she desires to do so, and the representative is expected to be available to respond to appropriate questions.

The shares represented by your proxy will be voted “FOR” the ratification of the selection of Deloitte & Touche LLP unless you specify otherwise.

In connection with the audit of the fiscal 2020 financial statements, we entered into an agreement with Deloitte & Touche LLP which sets forth the terms by which Deloitte & Touche LLP will perform audit services for the Company.

The following table presents fees for professional services rendered by our independent registered public accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu Limited, and their respective affiliates (collectively, “Deloitte & Touche”) for the audits of our annual consolidated financial statements for the fiscal years ended June 27, 2020 and June 29, 2019:

| 2020 | 2019 | |||||

| Audit fees(1) | $ | 2,770,500 | $ | 1,695,000 | ||

| Audit-related fees(2) | $ | 77,330 | — | |||

| Total: | $ | 2,847,830 | $ | 1,695,000 | ||

| (1) | Includes the aggregate fees recognized in each of the last two fiscal years for professional services rendered for the audit of the Company’s annual financial statements and the reviews of financial statements and, the audit of the Company’s internal control over financial reporting. The fees are for services that are normally provided in connection with statutory or regulatory filings or engagements. |

| (2) | Includes fees billed in each of the last two fiscal years for services performed that are related to the Company’s SEC filings (including costs relating to the Company’s secondary offerings in December 2019 and April 2020) and other research and consultation services. |

2020 Proxy Statement | 27 |

Audit Matters

Pre-Approval Policy for Services of Independent Registered Public Accounting Firm

Consistent with SEC policies regarding auditor independence and the Audit Committee’s charter, the Audit Committee has responsibility for engaging, setting compensation for and reviewing the performance of the independent registered public accounting firm. In exercising this responsibility, the Audit Committee has established procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm and pre-approves all audit and permitted non-audit services provided by the independent registered public accounting firm prior to each engagement.

The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. A brief description of the primary responsibilities of the Audit Committee is included in this Proxy Statement under “The Board of Directors and Certain Governance Matters—Board Committees and Meetings—Audit Committee.” Under the Audit Committee charter, our management is responsible for the preparation, presentation and integrity of our financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

In the performance of its oversight function, the Audit Committee reviewed and discussed the audited financial statements of the Company with management and with the independent registered public accounting firm. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by the applicable auditing standards adopted by the Public Company Accounting Oversight Board. In addition, the Audit Committee received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and discussed with the independent registered public accounting firm their independence.

Based upon the review and discussions described in the preceding paragraph, the Audit Committee recommended to the Board that the audited financial statements of the Company be included in the Annual Report on Form 10-K for the fiscal year ended June 27, 2020 filed with the SEC.

Submitted by the Audit Committee of the Board of Directors:

Matthew C. Flanigan, Chair

Meredith Adler

Kimberly S. Grant

Randall N. Spratt

| 28 |  |

Executive Officers of the Company

Set forth below is certain information regarding each of our executive officers other than Mr. Holm, our Chairman, President and Chief Executive Officer, whose biographical information is presented under “Nominees for Election to the Board.”

| Patrick T. Hagerty | ||

| EXECUTIVE VICE PRESIDENT; PRESIDENT AND CHIEF EXECUTIVE OFFICER (VISTAR) Age: 62 Mr. Hagerty has served as our Executive Vice President and President and Chief Executive Officer of Vistar since January 2018. Prior to being named Executive Vice President, Mr. Hagerty was Senior Vice President of the Company and President and Chief Executive Officer of Vistar since September 2008. From May 2006 to September 2008, he was Vice President and Chief Operating Officer of Vistar. From November 1994 to May 2006, he was Vice President, Merchandising with the Company and its predecessor. | |

| James D. Hope | ||

| EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER Age: 60 Mr. Hope has served as our Executive Vice President and Chief Financial Officer since March 2018, after serving as our Executive Vice President, Operations since July 2014. Prior to joining the Company, he was with Sysco Corporation for approximately 30 years. His last positions at Sysco were Executive Vice President, Business Transformation from January 2010 to June 2013, Senior Vice President, Business Transformation from January 2009 to December 2009, and Senior Vice President, Sales and Marketing from July 2007 to December 2008. | |

| Craig H. Hoskins | ||

| EXECUTIVE VICE PRESIDENT; PRESIDENT AND CHIEF EXECUTIVE OFFICER (FOODSERVICE) Age: 59 Mr. Hoskins was named Executive Vice President and President & Chief Executive Officer of PFG’s Foodservice segment in January 2019. He became President & CEO of PFG Customized Distribution and a Senior Vice President of PFG in January 2012 after serving as President & Chief Operating Officer of Customized Distribution. He assumed additional responsibility for Performance Foodservice’s sales and marketing in January 2018. He served as Senior Vice President and President and Chief Operating Officer of PFG Customized from July 2011 to December 2011. Prior to that, he served as PFG’s Senior Vice President, Sales from October 2008 to July 2011 and at its predecessor. Prior to that, he served in various operating and customer facing leadership roles with our predecessor since joining in August 1990 as Marketing Manager. | |

2020 Proxy Statement | 29 |

Executive Officers of the Company

| A. Brent King | ||

| SENIOR VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY Age: 51 Mr. King has served as our Senior Vice President, General Counsel and Secretary since March 2016. Prior to joining the Company, he was Vice President, General Counsel and Secretary of Tredegar Corporation, a global manufacturer of plastic films and aluminum extrusions, from October 2008 to March 2016. From October 2005 until October 2008, he served as Vice President and General Counsel at Hilb Rogal & Hobbs Company, a former publicly traded insurance broker now part of Willis Group Holdings. He served as Vice President and Associate General Counsel for Hilb Rogal & Hobbs Company from October 2001 to October 2005. Prior to that, Mr. King was a corporate attorney with the Williams Mullen law firm from 1994 to 2001. Mr. King earned a bachelor of arts degree from the University of Virginia, and a law degree from the University of Richmond. | |

| Erika T. Davis | ||

| SENIOR VICE PRESIDENT AND CHIEF HUMAN RESOURCES OFFICER Age: 56 Ms. Davis has served as our Senior Vice President and Chief Human Resources Officer since July 2019. Prior to joining the Company, she was with Owens & Minor, a global healthcare supply chain company, since 1993. Her last positions at Owens & Minor were Senior Vice President and Chief Administrative Officer from October 2016 to July 2019, Senior Vice President and Chief of Staff from August 2015 to October 2016, Senior Vice President, Administration & Operations from August 2013 to August 2015, and Senior Vice President, Human Resources of Owens and Minor from 2001 to 2013. Ms. Davis earned her undergraduate degree from the University of Richmond, and a Master of Public Administration from the University of North Carolina at Chapel Hill. | |

| Donald S. Bulmer | ||

| SENIOR VICE PRESIDENT & CHIEF INFORMATION OFFICER Age: 55 Mr. Bulmer was named PFG’s Senior Vice President & Chief Information Officer in March 2019, after serving on Vistar’s senior leadership team as Vice President of Corporate Information Technology for six years. Before joining Vistar, he held IT leadership roles in multiple industries, including ProBuild Holdings, the nation’s largest supplier of building materials; Gates Corporation, a manufacturer/distributor of automotive parts; and Nupremis Inc., a start-up that provided hosting and managed services. Mr. Bulmer earned a bachelor’s degree in economics from Colorado State University and a master’s degree in management information systems from the University of Colorado at Denver. | |

| 30 |  |

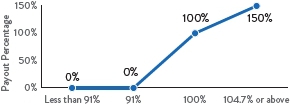

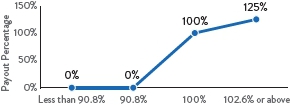

Corporate Social Responsibility