Exhibit 14.1 Policy Number: IC24.0 Code of Ethics Procedure Creation Date: October 2018 (GCIF) Procedure Reviewed As Of: Procedure Revised As Of: October 2018 (GCIF) Regulatory Rules: Rule 17j-1 under the Investment Company Act of 1940 and Rule 204A-1 under the Investment Advisers Act of 1940 BUSINESS UNIT RESPONSIBLE: Compliance Department COVERED ENTITIES: This Combined Code of Ethics adopted under Rule 17j-1 under the Investment Company Act of 1940 (the “1940 Act”) and Rule 204A-1 under the Investment Advisers Act of 1940 (the “Advisers Act”) covers the following companies: Funds • Guggenheim Credit Income Fund • Guggenheim Credit Income Fund 2016 T • Guggenheim Credit Income Fund 2019 PROCEDURE: Guggenheim Credit Income Fund, Guggenheim Credit Income Fund 2016 T, and Guggenheim Credit Income Fund 2019 (each a “Fund” and jointly the “Funds”, each a “Company,” jointly the “Companies,”, “Guggenheim Investments” or “GI”) are confident that their officers, trustees, directors and employees act with integrity and good faith. GI recognizes, however, that personal interests may conflict with a Fund’s interests where trustees, directors, officers or employees: . Know about present or future portfolio transactions or . Have the power to influence portfolio transactions; and . Engage in personal transactions in securities. In an effort to prevent these conflicts from arising and in accordance with Rule 17j-1(c)(1) under the 1940 Act and Rule 204A-1 under the Advisers Act, GI has adopted this Code of Ethics and all amendments thereto (together, the “Code”) to prohibit transactions that create, may create, or appear to create conflicts of interest, and to establish reporting requirements and enforcement procedures. Each trustee, director, officer and employee of GI should carefully read and review this Code. 1. About GI 1.1. The Funds are separately business development companies. Each Fund may consist of multiple investment portfolios (each a “Fund” and together, the “Funds”). 2. About this Code of Ethics 2.1. Transaction-Related and Reporting Provisions This Code sets forth specific prohibitions relating to securities transactions and also sets out certain reporting requirements. They cover the persons identified below: . All Company officers and directors; . Company employees who have access to nonpublic information regarding any client’s purchase or sale of securities or the portfolio holdings of any reportable fund, e.g., portfolio management and fund accounting personnel, or who are involved in making securities recommendations to clients, or have access to such recommendations that are nonpublic; Page 1 of 19 DB3/ 202101518.1

Policy Number: IC24.0 . Employees of any sub-adviser to the Funds who, in connection with their regular functions or duties, make, participate in, or obtain information regarding, the purchase or sale of a security by a Fund, or whose functions relate to the making of any recommendations with respect to such purchases or sales (“Sub- Advisor Access Persons”); . All Trustees of the Funds, both Interested and Independent; and . Natural persons in a control relationship with a Company who obtain information concerning recommendations made to a Fund or client about the purchase or sale of a security and are not specifically covered by any other section of the Code. In addition to the general principles and limitations set forth below, for the prohibitions and reporting requirements that specifically apply to you, please refer to Parts A-C, as indicated below. (Definitions of underlined terms are included in Appendix A.) . Independent Trustees of the Funds - Part A . Advisers Access Persons (Other than Independent Trustees of the Funds) - Part B . Natural Control Persons - Part C 2.2. Other Provisions The remainder of this Code sets forth general principles, required course of conduct, reporting obligations, and GI’s review, enforcement and recordkeeping responsibilities as well as other miscellaneous information and general limits. 3. Statement of General Principles In recognition of the trust and confidence placed in GI by its clients and shareholders of the Funds, and because GI believes that its operations should benefit clients and shareholders, GI has adopted the following universally applicable principles. 1. Shareholders’ and clients’ interests are paramount. You must place shareholder and client interests before your own. 2. You must accomplish all personal securities transactions in a manner that avoids an actual conflict or even the appearance of a conflict of your personal interests with those of a Company’s clients, including a Fund’s shareholders. 3. You must avoid actions or activities that allow (or appear to allow) you or your family to profit or benefit from your position with GI, or that bring into question your independence or judgment. 4. You must comply with all applicable federal securities laws, including the prohibitions against the misuse of material nonpublic information, in conducting yourself and the operations of GI. This Code does not attempt to identify all possible conflicts of interest, and literal compliance with each of its specific provisions will not shield investment personnel from liability for personal trading or other conduct that violates a fiduciary duty to a Company’s clients or a Fund’s shareholders. 4. Required Course of Conduct and General Limits 4.1. Prohibition Against Fraud, Deceit and Manipulation You may not, in connection with the purchase or sale, directly or indirectly, of a security held or to be acquired by any Fund or client account: a. employ any device, scheme or artifice to defraud the Fund or client account; b. make to a Fund or client any untrue statement of a material fact or omit to state to a Fund or client a material fact necessary in order to make the statements made, in light of the circumstances under which they are made, not misleading; c. engage in any act, practice or course of business which would operate as a fraud or deceit upon a Fund or client; or d. engage in any manipulative practice with respect to a Fund or client account. Two of the most common risks associated with personal securities transactions are front-running and trading opposite a Fund or client account. For example, front-running would include the purchase of a security any time within seven days ahead of when a Fund or client account purchases the same security or the sale of a security any time within seven days ahead of when a Fund or client account sells the same security. An example of trading opposite a Fund or client account would include the sale of a security any time within seven days after a Fund or client account purchases Page 2 of 19

Policy Number: IC24.0 the same security or the purchase of a security any time within seven days after a Fund or client account sells the same security. 4.2. Limits on Accepting or Receiving Gifts The Advisers and Distributor have separate policies with respect to limits on receipt of gifts and entertainment. Employees should refer to the applicable gifts and entertainment policy. 4.3 Limits on Service as a Director Prior approval by the Chief Compliance Officer is required in order for an employee to serve as a director, officer, general partner or managing member for one of the following that is not a Guggenheim entity: ▪ a for-profit company; ▪ a not-for-profit company with which Guggenheim has an existing business relationship; or ▪ a trade or industry association. Approval by the Guggenheim Capital Conflicts Review Committee (“CRC”) is also required in the event that it is determined a proposed or existing outside business activity involves one or more potential significant conflicts of interest. 4.4 Outside Business Activities The Funds’ Advisers and Distributor have separate policies with respect to employees’ outside business activities. Employees are prohibited from taking part in any outside employment without prior approval from their Supervisor and Compliance. Employees should refer to the applicable outside business activities policy. Employee participation in outside activities related to virtual currency (e.g., blockchain entities, bitcoin mining, etc.) requires pre-approval under the Advisers’ and Distributor’s outside business activities policy. 4.5. Excessive Trading Advisers Access Persons shall not engage in excessive trading or market timing of the Funds; provided, however, that this prohibition does not apply to the Tradable Funds. Such activity is inconsistent with the fiduciary principles of this Code, which require that Advisers Access Persons place the interests of clients above their own interests. Advisers Access Persons shall not make more than 60 securities trades in any calendar quarter. Transactions that do not require pre-clearance are not included in the 60 securities trades permitted during any calendar quarter. 4.6 Section 16 Reporting on Closed-End Fund Shares and Business Development Companies For all Trustees and Officers, please be reminded that Section 16 of the Securities Exchange Act of 1934 (“1934 Act”) imposes reporting requirements with respect to your ownership of the closed-end Funds and business development companies (the “Closed-End Funds”). Section 16(a) requires each Trustee and Officer to file (i) an initial report with the SEC on Form 3 disclosing his or her status as a reporting person under Section 16(a), and his or her beneficial ownership of all equity securities of the Closed-End Funds at the time of attaining such status; (ii) changes in such beneficial ownership on Form 4; and (iii) an annual statement of changes in beneficial ownership on Form 5 (if such changes were not previously reported on Forms 3 or 4). The Trustees and Officers should review the Closed-End Funds’ Section 16 policies and procedures for more information relating to their reporting requirements under those policies and procedures as well as Section 16 of the 1934 Act. 4.7 Use of Compliance Platform Page 3 of 19

Policy Number: IC24.0 GI utilizes an electronic Compliance Platform to manage certain reporting and certification obligations required of Access Persons. Access Persons are required to use the Compliance Platform specified by the GI Intermediary Compliance Department to complete reporting specified by the Code of Ethics. At the time of designation as an Access Person, Access Persons will be provided with login information and instructions for using the Compliance Platform. 5. Confidentiality All personal securities transactions reports and any other information filed with GI under this Code will be treated as confidential, provided, however, that such reports and related information may be produced to the U.S. Securities and Exchange Commission (the “SEC”) and other regulatory agencies or as otherwise required by law. 6. Interpretation of Provisions and Interrelationship with Other Codes of Ethics The Board of Trustees of the Funds may from time to time adopt such interpretations of this Code as they deem appropriate. To the extent that any of the Advisers delegate certain of their advisory responsibilities to an investment sub-adviser, such sub-adviser must: . establish, maintain and enforce a code of ethics that meets the minimum requirements set forth in Rule 204A-1 under the Advisers Act and Rule 17j-1 under the 1940 Act, and submit such code of ethics to the Fund’s Board of Trustees; . on a quarterly basis provide the appropriate Fund(s) or the Advisor of such Fund a written attestation that the sub-adviser is in compliance with its code of ethics adopted pursuant to Rule 17j-1 under the 1940 Act; . promptly report, in writing, to the appropriate Fund(s) any material amendments to such code(s) of ethics; . promptly furnish to such Fund or the Advisor to such Fund, upon request, copies of any reports made pursuant to such code of ethics by any person who is a Sub-Advisor Access Person; . immediately furnish to such Fund or the Advisor to such Fund, without request, all material information regarding any violation of such code of ethics by any person who is a Sub-Advisor Access Person; and . at least once a year, provide such Fund or the Advisor of such Fund a written report that describes any issue(s) that arose during the previous year under its code of ethics, including any material code violations and any resulting sanction(s), and a certification that it has adopted measures reasonably necessary to prevent its personnel from violating its code of ethics. The sub-adviser should also establish a policy or adopt in its code of ethics that Sub-Advisor Access Persons shall not engage in excessive trading. Such activity is inconsistent with the fiduciary principles of this Code, which require that Sub-Advisor Access Persons place the interests of clients above their own interests. 7. Acknowledgment of Receipt and Annual Certification Each director, officer, employee and member of the Companies will receive a copy of the Code and any subsequent amendments to the Code, and each such person must acknowledge receipt of the Code in writing. In addition, each such person is required to certify annually that he/she (i) has read and understands the Code, (ii) is aware that he/she is subject to the provisions of this Code, (iii) has complied with the Code at all times during the previous calendar year, and (iv) has, during the previous calendar year, reported all holdings and transactions that he/she is required to report pursuant to the Code. The acknowledgement of receipt and certification may be made electronically through a manner specified by the GI Intermediary Compliance Department. EXCEPTION HANDLING: The Compliance Officer, in his or her discretion, may exempt any person from any specific provision of the Code, if the Compliance Officer determines that: (a)granting the exemption does not detrimentally affect any client or the shareholders of the Funds, (b) the failure to grant the exemption will result in an undue burden on the person or limit the person’s ability to render services to GI and (c) the exception is consistent with Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Advisers Act. In order to request an exemption from a provision of the Code, an Advisers Access Person must submit a written request for the exemption to the Compliance Officer. If the exemption request relates to the access person’s beneficial interest in securities, the request should identify the securities, any account where they are Page 4 of 19

Policy Number: IC24.0 held, and the person or firm responsible for managing the securities. The request should also describe the nature of the access person’s interest in the securities and the basis on which the exemption is requested, i.e., the nature of the hardship. The Compliance Officer will prepare a report documenting the nature of any exemption granted, the persons involved, and the reasons for granting such exemption. REPORTING REQUIREMENTS: 1. Individual Reporting Obligations - See Parts A, B, or C as appropriate, for your specific reporting obligations. 1.1. Obligation to Report Violations of the Code - In addition to the individual reporting requirements referenced above, any violation of the Code must be promptly reported to the Compliance Officer. 1.2. Reports of individual securities transactions are required only if you knew at the time of the transaction or, in the ordinary course of fulfilling your official duties as a Trustee, should have known, that during the 15-calendar day period immediately preceding or following the date of your transaction, the same security was purchased or sold, or was being considered for purchase or sale, by a Fund. Note: The "should have known" standard does not: . Imply a duty of inquiry; . Presume you should have deduced or extrapolated from discussions or memoranda dealing with the Fund’s investment strategies; or . Impute knowledge from your prior knowledge of the Fund’s portfolio holdings, market considerations, or investment policies, objectives and restrictions. 2. Annual Written Report to the Boards of Trustees of the Funds - At least once a year or more frequently as deemed necessary by the Compliance Officer, the Compliance Officer, on behalf of the Companies that provide services to the Funds, including the Advisers, will provide the Board of Trustees of each Fund a written report that includes: 2.1. Issues Arising Under the Code - The Report will describe any issue(s) that arose during the previous year under the Code, including any material Code violations, and any resulting sanctions. 2.2. Certification - The Report will certify to the Boards of Trustees that each Company has adopted measures reasonably necessary to prevent its personnel from violating the Code currently and in the future. 3. Periodic Review and Reporting - The Compliance Officer (or his or her designee) will report to the Boards of Trustees at least annually as to the operation of this Code and will address in any such report the need (if any) for further changes or modifications to this Code. TESTING AND REVIEW: 1. Duties of the Compliance Officer and Compliance Administrator 1.1. The Compliance Administrator will, on a quarterly basis, review electronic reports generated by the Compliance Platform that compares all reported personal securities transactions with the Funds’ portfolio and client accounts, as applicable, transactions completed by the Advisor, and the restricted securities list, maintained by Central Compliance and GI, to determine whether a Code violation may have occurred. The Compliance Officer or their designee may request additional information or take any other appropriate measures that the Compliance Officer or their designee decides is necessary to aid in this determination. Before determining that a person has violated the Code, the Compliance Officer must give the person an opportunity to supply explanatory material. 1.2. If the Compliance Administrator determines that a Code violation may have occurred, the Compliance Administrator must submit the determination, together with any explanatory material provided by the person, to the Compliance Officer to make a determination. 1.3. No person is required to participate in a determination of whether he or she has committed a Code violation or of the imposition of any sanction against himself or herself. If a securities transaction of a Compliance Officer is under consideration, a separate Compliance Officer other than the individual under consideration will act for the President for purposes of this Section. 2. Sanctions - If the Compliance Officer finds that the person violated the Code, the Compliance Officer will impose upon the person sanctions that the Compliance Officer deems appropriate and will report the violation and the sanction imposed to the Board of Trustees of the Funds at the next regularly scheduled Board meeting unless, in the sole discretion of the Funds’ Compliance Officer, circumstances warrant an earlier report. All violations will be addressed with a letter of censure. Sanctions for multiple, consecutive, or egregious violations may include but are not limited to disgorgement of profits, suspension of trading privileges, or suspension or termination of employment of the violator. Page 5 of 19

Policy Number: IC24.0 RECORDKEEPING: The Companies will maintain records as set forth below. These records will be maintained in accordance with Rule 31a-2 under the 1940 Act and Rule 204-2(a)(12) under the Advisers Act and will be available for examination by representatives of the SEC. . A copy of this Code and any other code which is, or at any time within the past five years has been, in effect will be preserved in an easily accessible place; . A list of all persons who are, or within the past five years have been, required to submit reports under this Code will be maintained in an easily accessible place; . A copy of each report made by a person under this Code will be preserved for a period of not less than five years from the end of the fiscal year in which it is made, the first two years in an easily accessible place; . A copy of each duplicate brokerage confirmation and each periodic statement provided under this Code will be preserved for a period of not less than five years from the end of the fiscal year in which it is made, the first two years in an easily accessible place. . A record of any Code violation and of any sanctions taken will be preserved in an easily accessible place for a period of not less than five years following the end of the fiscal year in which the violation occurred; . A copy of each annual report to the Board of Trustees will be maintained for at least five years from the end of the fiscal year in which it is made, the first two years in an easily accessible place; . A copy of all Acknowledgements of Receipt and Annual Certifications as required by this Code for each person who is currently, or within the past five years was required to provide such Acknowledgement of Receipt or Annual Certification; and . The Companies will maintain a record of any decision, and the reasons supporting the decision, to approve the acquisition of securities in a private placement, for at least five years after the end of the fiscal year in which the approval is granted. DISCLOSURE: The Code of Ethics will be disclosed in accordance with the requirements of applicable federal law and all rules and regulations thereunder with the applicable disclosure documents. REVISIONS: These procedures shall remain in effect until amended, modified or terminated. The Boards of Trustees must approve any material amendments to the Code within six months of the amendment. Page 6 of 19

Policy Number: IC24.0 PART A PROCEDURES FOR INDEPENDENT TRUSTEES GENERAL OBLIGATIONS. 1. Limitations 1.1. You are subject to Sections 4.1 and 4.5 of the “Procedure” section of the Code. 2. Required Transaction Reports 2.1. On a quarterly basis you must report any securities transactions, unless such transaction is excepted from reporting as described in 2.2 below. If reporting is required, you must submit your report of securities transactions and information about the relevant securities account to the Compliance Officer no later than 30 calendar days after the end of the calendar quarter in which the transaction to which the report relates was effected. 2.2. Reports of individual securities transactions are required only if you knew at the time of the transaction or, in the ordinary course of fulfilling your official duties as a Trustee, should have known, that during the 15-calendar day period immediately preceding or following the date of your transaction, the same security was purchased or sold, or was being considered for purchase or sale, by a Fund. Note: The "should have known" standard does not: • imply a duty of inquiry; • presume you should have deduced or extrapolated from discussions or memoranda dealing with the Fund’s investment strategies; or • impute knowledge from your prior knowledge of the Fund’s portfolio holdings, market considerations, or investment policies, objectives and restrictions. 2.3. If you had no reportable transactions or did not open any securities accounts during the quarter, you are not required to submit a report. 3. What Securities Are Covered Under Your Quarterly Reporting Obligation? If the transaction is reportable because it came within Section (2), above, you must report all transactions in securities that: (i) you directly or indirectly beneficially own or (ii) because of the transaction, you acquire direct or indirect beneficial ownership. The report must also contain any investment account you established in which any securities were held during the quarter. You are not required to detail or list purchases or sales effected for any account over which you have no direct or indirect influence or control. You may include a statement in your report that the report shall not be construed as your admission that you have any direct or indirect beneficial ownership in the security included in the report. 4. Other Recommended Practices 5. Although not strictly prohibited, it is recommended that Independent Trustees refrain from trading in shares of the Funds they oversee for a period of seven calendar days before and after meetings of the Board of such Funds. In lieu of the sanctions contemplated under Section 2 of the “Testing and Review” section of the Code, Independent Trustees shall be subject to sanctions as determined by the Board of the relevant Fund. Page 7 of 19

Policy Number: IC24.0 PART B ADVISERS ACCESS PERSONS (OTHER THAN INDEPENDENT TRUSTEES OF THE FUNDS) GENERAL OBLIGATIONS 1. Providing a List of Securities – Initial and Annual Holdings Reports 1.1. Initial Holdings Reports. You must submit the initial listing within 10 calendar days of the date you first become an Adviser Access Person. The initial listing should be a complete listing of all investment accounts and securities you beneficially own as of a date no more than 45 days prior to the date you become an access person. 1.2. Annual Holdings Reports. In addition to the Initial Holdings Report, each following year, you must submit a revised list showing the investment accounts and securities you beneficially own as of December 31. You must submit each annual update listing no later than 30 calendar days after December 31. The Initial Holdings Report and Annual Holdings Reports, as applicable, will be submitted electronically, through the Compliance Platform. You will receive notification via email when the applicable report is due, including instructions on how to access the information and complete the report. You are not required to provide this list of securities if you are not currently affiliated with or employed by a Company covered by this Code. 2. Brokerage Accounts All investment accounts of new Access Persons and any investment accounts of current Access Persons must be maintained with brokerage firms designated and approved by Central Compliance. Existing investment accounts of new Access Persons which are not held at the permitted broker-dealers must be transferred within 90 calendar days from the date the Access Person is so designated; the failure to transfer within this time will be considered a violation of this Code. Any request to extend the 90-day transfer deadline must be accompanied by a written explanation by the current broker-dealer as to the reason for delay. GI Intermediary Compliance Department may grant specific exceptions in writing. Prior to opening a new reportable investment account, you are required to submit the Personal Account Pre- Clearance Form through the Compliance Platform to obtain written consent from the GI Intermediary Compliance Department. You are also required to notify in writing the broker-dealer or financial institution with which you are seeking to open such reportable investment account of your association with Guggenheim Investments. Upon opening a reportable investment account or obtaining an interest in an account that requires reporting, the account must be reported within 5 calendar days of funding the investment account. The investment account must be reported via the Compliance Platform or as otherwise permitted by Compliance, along with the title of the account, the name of the financial institution for the account, the date the account was established (or the date on which interest or authority that requires the account to be reported was gained) and the date reported. 3. Duplicate Brokerage Confirmations and Statements If your brokerage firm provides automatic feeds for your investment accounts to the Compliance Platform, the Advisor will obtain account information electronically, after the Access Person has completed the appropriate authorizations as required by the brokerage firm. Further you are required to provide duplicate statements upon request from the GI Intermediary Compliance Department or Guggenheim Employee Trading. If the brokerage firm does not provide automatic feeds to the Compliance Platform, you are responsible for providing duplicate statements such investment accounts to the GI Intermediary Compliance Department and the Guggenheim Employee Trading group within 20 days after Quarter End. 4. Required Transaction Reports – Quarterly Personal Securities Transaction Reports On a quarterly basis you must report transactions in securities, as well as any investment accounts. You must submit your report no later than 30 calendar days after the end of the calendar quarter in which the transaction to which the report relates was effected. The Quarterly Personal Securities Transaction Reports are required in addition to delivery of duplicate brokerage confirmations and statements (via automatic feed or hard copy). Access Persons must submit Quarterly Personal Securities Transaction Reports electronically, through the Compliance Platform. You will receive Page 8 of 19

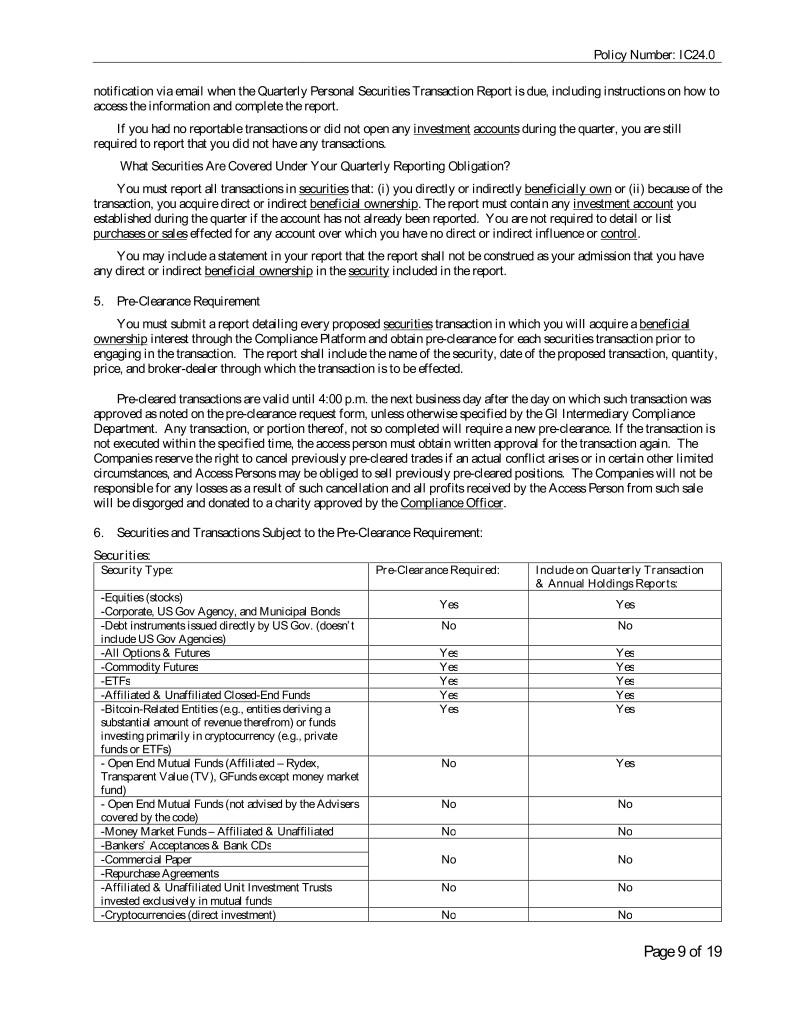

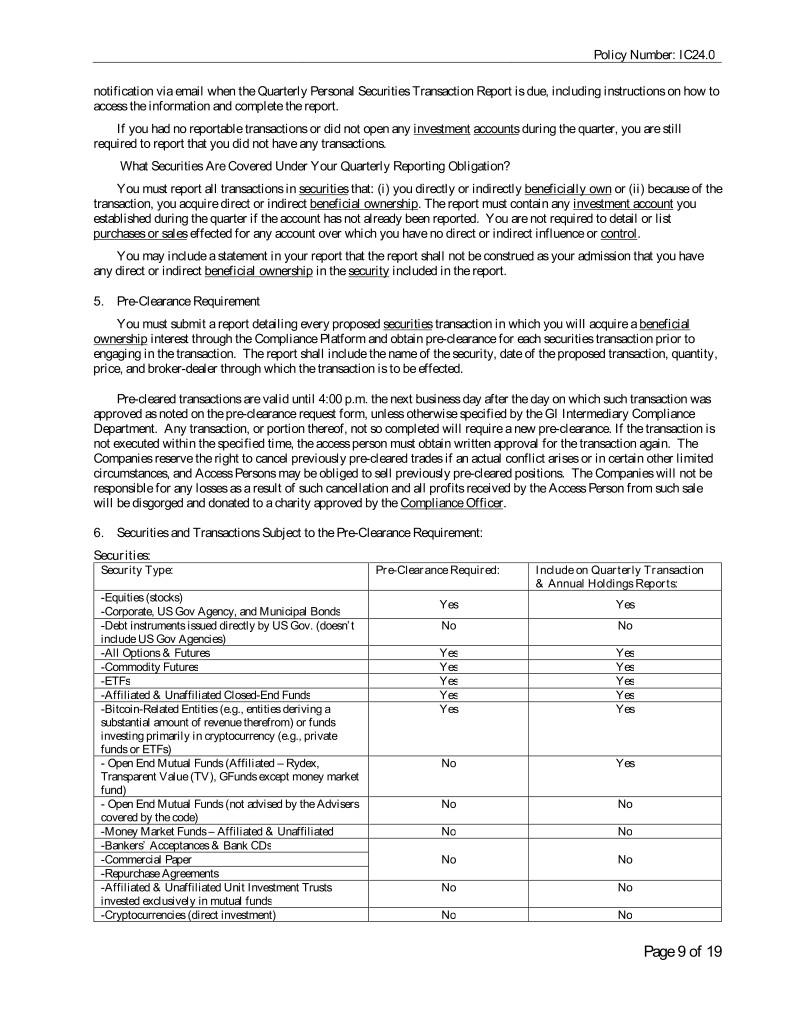

Policy Number: IC24.0 notification via email when the Quarterly Personal Securities Transaction Report is due, including instructions on how to access the information and complete the report. If you had no reportable transactions or did not open any investment accounts during the quarter, you are still required to report that you did not have any transactions. What Securities Are Covered Under Your Quarterly Reporting Obligation? You must report all transactions in securities that: (i) you directly or indirectly beneficially own or (ii) because of the transaction, you acquire direct or indirect beneficial ownership. The report must contain any investment account you established during the quarter if the account has not already been reported. You are not required to detail or list purchases or sales effected for any account over which you have no direct or indirect influence or control. You may include a statement in your report that the report shall not be construed as your admission that you have any direct or indirect beneficial ownership in the security included in the report. 5. Pre-Clearance Requirement You must submit a report detailing every proposed securities transaction in which you will acquire a beneficial ownership interest through the Compliance Platform and obtain pre-clearance for each securities transaction prior to engaging in the transaction. The report shall include the name of the security, date of the proposed transaction, quantity, price, and broker-dealer through which the transaction is to be effected. Pre-cleared transactions are valid until 4:00 p.m. the next business day after the day on which such transaction was approved as noted on the pre-clearance request form, unless otherwise specified by the GI Intermediary Compliance Department. Any transaction, or portion thereof, not so completed will require a new pre-clearance. If the transaction is not executed within the specified time, the access person must obtain written approval for the transaction again. The Companies reserve the right to cancel previously pre-cleared trades if an actual conflict arises or in certain other limited circumstances, and Access Persons may be obliged to sell previously pre-cleared positions. The Companies will not be responsible for any losses as a result of such cancellation and all profits received by the Access Person from such sale will be disgorged and donated to a charity approved by the Compliance Officer. 6. Securities and Transactions Subject to the Pre-Clearance Requirement: Securities: Security Type: Pre-Clearance Required: Include on Quarterly Transaction & Annual Holdings Reports: -Equities (stocks) Yes Yes -Corporate, US Gov Agency, and Municipal Bonds -Debt instruments issued directly by US Gov. (doesn’t No No include US Gov Agencies) -All Options & Futures Yes Yes -Commodity Futures Yes Yes -ETFs Yes Yes -Affiliated & Unaffiliated Closed-End Funds Yes Yes -Bitcoin-Related Entities (e.g., entities deriving a Yes Yes substantial amount of revenue therefrom) or funds investing primarily in cryptocurrency (e.g., private funds or ETFs) - Open End Mutual Funds (Affiliated – Rydex, No Yes Transparent Value (TV), GFunds except money market fund) - Open End Mutual Funds (not advised by the Advisers No No covered by the code) -Money Market Funds – Affiliated & Unaffiliated No No -Bankers’ Acceptances & Bank CDs -Commercial Paper No No -Repurchase Agreements -Affiliated & Unaffiliated Unit Investment Trusts No No invested exclusively in mutual funds -Cryptocurrencies (direct investment) No No Page 9 of 19

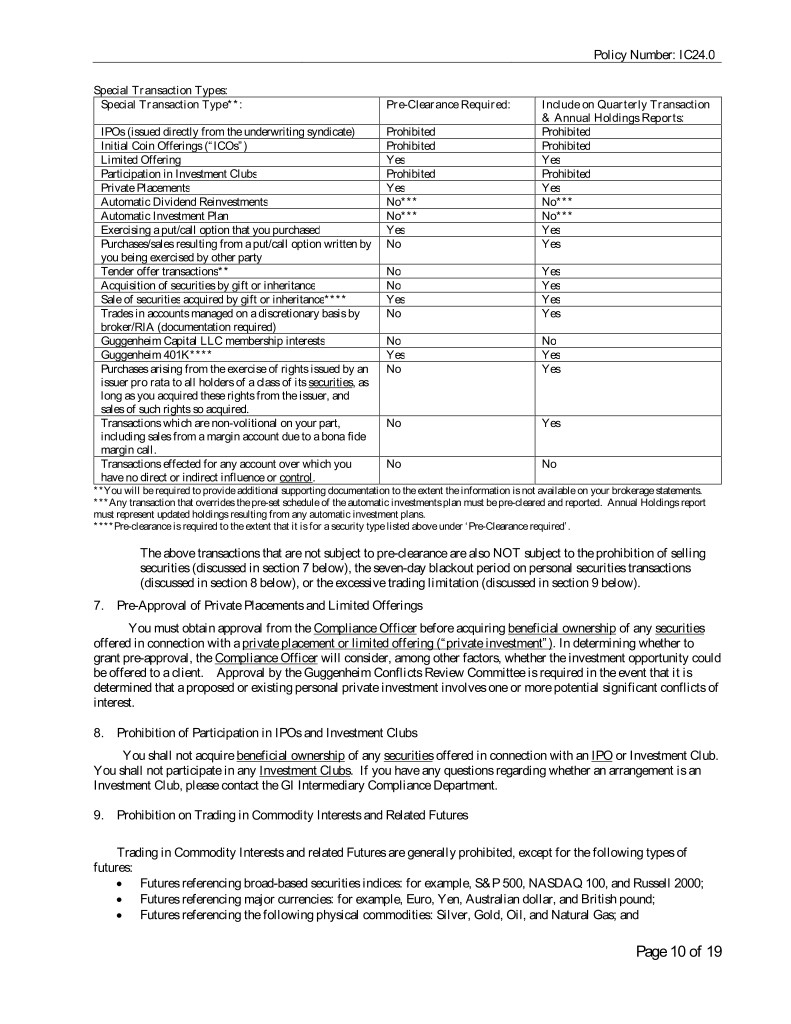

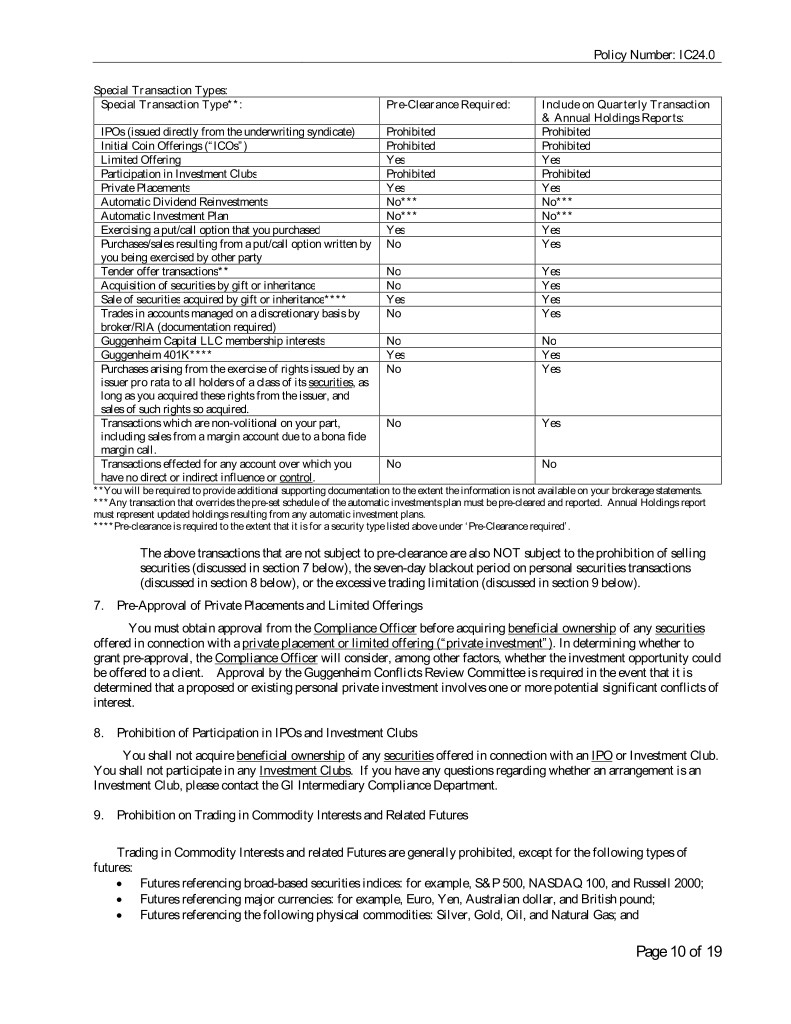

Policy Number: IC24.0 Special Transaction Types: Special Transaction Type**: Pre-Clearance Required: Include on Quarterly Transaction & Annual Holdings Reports: IPOs (issued directly from the underwriting syndicate) Prohibited Prohibited Initial Coin Offerings (“ICOs”) Prohibited Prohibited Limited Offering Yes Yes Participation in Investment Clubs Prohibited Prohibited Private Placements Yes Yes Automatic Dividend Reinvestments No*** No*** Automatic Investment Plan No*** No*** Exercising a put/call option that you purchased Yes Yes Purchases/sales resulting from a put/call option written by No Yes you being exercised by other party Tender offer transactions** No Yes Acquisition of securities by gift or inheritance No Yes Sale of securities acquired by gift or inheritance**** Yes Yes Trades in accounts managed on a discretionary basis by No Yes broker/RIA (documentation required) Guggenheim Capital LLC membership interests No No Guggenheim 401K**** Yes Yes Purchases arising from the exercise of rights issued by an No Yes issuer pro rata to all holders of a class of its securities, as long as you acquired these rights from the issuer, and sales of such rights so acquired. Transactions which are non-volitional on your part, No Yes including sales from a margin account due to a bona fide margin call. Transactions effected for any account over which you No No have no direct or indirect influence or control. **You will be required to provide additional supporting documentation to the extent the information is not available on your brokerage statements. ***Any transaction that overrides the pre-set schedule of the automatic investments plan must be pre-cleared and reported. Annual Holdings report must represent updated holdings resulting from any automatic investment plans. ****Pre-clearance is required to the extent that it is for a security type listed above under ‘Pre-Clearance required’. The above transactions that are not subject to pre-clearance are also NOT subject to the prohibition of selling securities (discussed in section 7 below), the seven-day blackout period on personal securities transactions (discussed in section 8 below), or the excessive trading limitation (discussed in section 9 below). 7. Pre-Approval of Private Placements and Limited Offerings You must obtain approval from the Compliance Officer before acquiring beneficial ownership of any securities offered in connection with a private placement or limited offering (“private investment”). In determining whether to grant pre-approval, the Compliance Officer will consider, among other factors, whether the investment opportunity could be offered to a client. Approval by the Guggenheim Conflicts Review Committee is required in the event that it is determined that a proposed or existing personal private investment involves one or more potential significant conflicts of interest. 8. Prohibition of Participation in IPOs and Investment Clubs You shall not acquire beneficial ownership of any securities offered in connection with an IPO or Investment Club. You shall not participate in any Investment Clubs. If you have any questions regarding whether an arrangement is an Investment Club, please contact the GI Intermediary Compliance Department. 9. Prohibition on Trading in Commodity Interests and Related Futures Trading in Commodity Interests and related Futures are generally prohibited, except for the following types of futures: • Futures referencing broad-based securities indices: for example, S&P 500, NASDAQ 100, and Russell 2000; • Futures referencing major currencies: for example, Euro, Yen, Australian dollar, and British pound; • Futures referencing the following physical commodities: Silver, Gold, Oil, and Natural Gas; and Page 10 of 19

Policy Number: IC24.0 • Futures referencing US Government debt obligations: for example, 30 year Treasury bond, 10/5 year Treasury notes and long-term Treasury bonds Access Persons should consult with GI Intermediary Compliance with regard to whether a particular instrument is a commodity interest. Senior management, together with the CCO, may grant exceptions to this prohibition on a case-by- case basis and approval will be conditioned on compliance with certain requirements. 10. Sixty-Day Prohibition on Selling/Buying Securities You cannot purchase and sell, or sell and purchase, the same security within 60 calendar days. This prohibition does not apply to securities and transactions that are not subject to the pre-clearance requirement (discussed in section 5 above). 11. Seven-Day Blackout Period on Personal Securities Transactions You cannot purchase or sell, directly or indirectly, any security in which you had (or by reason of such transaction acquire) any beneficial ownership, at any time within seven calendar days before or after the time that the same (or a related): (i) the security is being purchased or sold by any Fund; (ii) the security is being purchased for initial deposit in a Fund that is an unit investment trust or the security is in an unit investment trust is being terminated and is being sold prior to termination date. This prohibition does not apply to securities and transactions that are not subject to the pre-clearance requirement (discussed in section 6 above). 11.1. Exception to Blackout Period The seven-day blackout period does not apply to the purchase or sale of any security (i) of a company with a market capitalization in excess of $1 billion and (ii) made in dollar amounts less than $25,000. The exception to the blackout period does not apply to the purchase and sale of options, the GI restricted list and any other derivatives or futures. 12. Excessive Trading You shall not make more than 60 securities trades in any calendar quarter. Transactions that do not require pre- clearance are not included in the 60 securities trades permitted during any calendar quarter. 13. Cryptocurrencies Trading Cryptocurrency, virtual currency, ICOs, coins, tokens, and commodity or other derivative interests related thereto, are emerging areas for investment and the financial services industry. Purchases and sales of direct investments in cryptocurrency (e.g., virtual currency such as bitcoin) are not required to be pre-cleared or reported, however, trading in cryptocurrencies and securities and issuers that derive a substantial portion of their revenue from activities related to cryptocurrencies are subject to the following guidelines: • You may not acquire beneficial ownership of any cryptocurrencies offered in connection with an ICO; • You may not purchase or sell virtual coin futures or options; and • Investments in bitcoin-related entities (e.g., entities deriving a substantial amount of revenue therefrom) or funds investing primarily in cryptocurrency (e.g., private funds or ETFs) are permitted but must be pre- cleared prior to investment and reported in the Initial Holdings Report, Quarterly Personal Securities Transactions Report, and Annual Holdings Report. Access persons should consult with GI Intermediary Compliance with regard to whether a particular interest is a cryptocurrency for purposes of this Code. The CCO(s), in consultation with Senior Management and Legal as necessary, may grant exceptions to this prohibition on a case-by-case basis and approval may be conditioned on compliance with certain requirements. The standards above are subject to change depending on emerging regulatory requirements and firm and client activities and certain cryptocurrencies may be restricted and require pre-clearance and reporting in the future. Page 11 of 19

Policy Number: IC24.0 PART C NATURAL CONTROL PERSONS GENERAL OBLIGATIONS. 1. Providing a List of Securities – Initial and Annual Holdings Reports 1.1. Initial Holdings Reports. You must submit the initial listing within 10 calendar days of the date you first become an access person. The initial listing should be a complete listing of all investment accounts and securities you beneficially own as of a date no more than 45 days prior to the date you become an access person. 1.2. Annual Holdings Reports. In addition to the Initial Holdings Report, each following year, you must submit a revised list showing the investment accounts and securities you beneficially own as of December 31. You must submit each annual update listing no later than 30 calendar days after December 31. The Initial Holdings Report and Annual Holdings Reports, as applicable, will be submitted electronically, through the Compliance Platform. You will receive notification via email when the applicable report is due, including instructions on how to access the information and complete the report. You are not required to provide this list of securities if you are not currently affiliated with or employed by a Company covered by this Code. 2. Brokerage Accounts All investment accounts of new Access Persons and any investment accounts of current Access Persons must be maintained with brokerage firms designated and approved by Central Compliance. Existing investment accounts of new Access Persons which are not held at the permitted broker-dealers must be transferred within 90 calendar days from the date the Access Person is so designated; the failure to transfer within this time will be considered a violation of this Code. Any request to extend the 90-day transfer deadline must be accompanied by a written explanation by the current broker-dealer as to the reason for delay. GI Intermediary Compliance Department may grant specific exceptions in writing. Prior to opening a new reportable investment account you are required to obtain consent from the GI Intermediary Compliance Department. Upon opening a reportable investment account or obtaining an interest in an account that requires reporting, the account must be reported within 5 calendar days of funding the investment account. The investment account must be pre-cleared prior to opening and reported after the investment account is opened or interest is obtained via the Compliance Platform or as otherwise permitted by Compliance, along with the title of the account, the name of the financial institution for the account, the date the account was established (or the date on which interest or authority that requires the account to be reported was gained) and the date reported. 3. Duplicate Brokerage Confirmations and Statements If your brokerage firm provides automatic feeds for your investment accounts to the Compliance Platform, the Advisor will obtain account information electronically, after the Access Person has completed the appropriate authorizations as required by the brokerage firm. If the brokerage firm does not provide automatic feeds to the Compliance Platform, you are responsible for providing duplicate statements such investment accounts to the GI Intermediary Compliance Department and the Guggenheim Employee Trading group within 20 days after Quarter End. 4. Required Transaction Reports – Quarterly Personal Securities Transaction Reports On a quarterly basis you must report any securities transactions, as well as any investment accounts. You must submit your report no later than 30 calendar days after the end of the calendar quarter in which the transaction to which the report relates was effected. The Quarterly Personal Securities Transaction Reports are required in addition to delivery of duplicate brokerage confirmations and statements (via automatic feed or hard copy). Access Persons must submit Page 12 of 19

Policy Number: IC24.0 Quarterly Personal Securities Transactions Reports electronically, through the Compliance Platform. You will receive notification via email when the Quarterly Personal Securities Transaction Report is due, including instructions on how to access the information and complete the report. If you had no reportable transactions or did not open any securities accounts during the quarter, you are still required to report that you did not have any transactions. 5. What Securities Are Covered Under Your Quarterly Obligation? You must report all transactions in securities that: (i) you directly or indirectly beneficially own or (ii) because of the transaction, you acquire direct or indirect beneficial ownership. The report must also include any account you established in which securities were held during the quarter. You are not required to detail or list purchases or sales effected for any account over which you have no direct or indirect influence or control. You may include a statement in your report that the report shall not be construed as your admission that you have any direct or indirect beneficial ownership in the security included in the report. 6. Pre-Approval of Private Placements and Limited Offerings You must obtain approval from the Compliance Officer before acquiring beneficial ownership of any securities offered in connection with a private placement or limited offering (“private investment”). In determining whether to grant pre-approval, the Compliance Officer will consider, among other factors, whether the investment opportunity could be offered to a client. Approval by the Guggenheim Conflicts Review Committee is required in the event that it is determined that a proposed or existing personal private investment involves one or more potential significant conflicts of interest. 7. Prohibition in Participation in IPOs and Investment Clubs You shall not acquire beneficial ownership of any securities offered in connection with an IPO or Investment Club. You shall not participate in any Investment Clubs. If you have any questions regarding whether an arrangement is an Investment Club, please contact the Compliance Department. 8. Prohibition on Trading in Commodity Interests and Related Futures Trading in Commodity Interests and related Futures are generally prohibited, except for the following types of futures: • Futures referencing broad-based securities indices: for example, S&P 500, NASDAQ 100, and Russell 2000; • Futures referencing major currencies: for example, Euro, Yen, Australian dollar, and British pound; • Futures referencing the following physical commodities: Silver, Gold, Oil, and Natural Gas; and • Futures referencing US Government debt obligations: for example, 30-year Treasury bond, 10/5 year Treasury notes and long-term Treasury bonds Access Persons should consult with GI Intermediary Compliance with regard to whether a particular instrument is a commodity interest. Senior management, together with the CCO, may grant exceptions to this prohibition on a case-by- case basis and approval will be conditioned on compliance with certain requirements. 9. Cryptocurrencies Trading Cryptocurrency, virtual currency, ICOs, coins, tokens, and commodity or other derivative interests related thereto, are emerging areas for investment and the financial services industry. Purchases and sales of direct investments in cryptocurrency (e.g., virtual currency such as bitcoin) are not required to be pre-cleared or reported, however, trading in cryptocurrencies and securities and issuers that derive a substantial portion of their revenue from activities related to cryptocurrencies are subject to the following guidelines: • You may not acquire beneficial ownership of any cryptocurrencies offered in connection with an ICO; • You may not purchase or sell virtual coin futures or options; and • Investments in bitcoin-related entities (e.g., entities deriving a substantial amount of revenue therefrom) or funds investing primarily in cryptocurrency (e.g., private funds or ETFs) are permitted but must be pre- cleared prior to investment and reported in the Initial Holdings Report, Quarterly Personal Securities Transactions Report, and Annual Holdings Report. Page 13 of 19

Policy Number: IC24.0 Access persons should consult with GI Intermediary Compliance with regard to whether a particular interest is a cryptocurrency for purposes of this Code. The CCO(s), in consultation with Senior Management and Legal as necessary, may grant exceptions to this prohibition on a case-by-case basis and approval may be conditioned on compliance with certain requirements. The standards above are subject to change depending on emerging regulatory requirements and firm and client activities and certain cryptocurrencies may be restricted and require pre-clearance and reporting in the future. Page 14 of 19

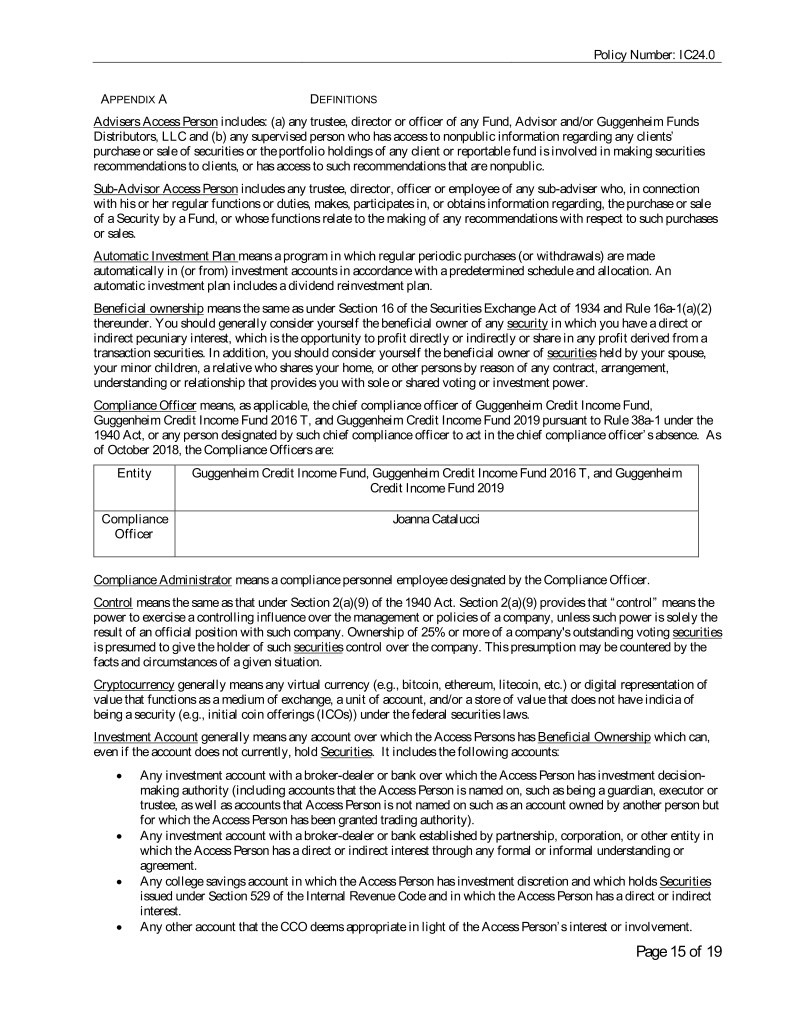

Policy Number: IC24.0 APPENDIX A DEFINITIONS Advisers Access Person includes: (a) any trustee, director or officer of any Fund, Advisor and/or Guggenheim Funds Distributors, LLC and (b) any supervised person who has access to nonpublic information regarding any clients’ purchase or sale of securities or the portfolio holdings of any client or reportable fund is involved in making securities recommendations to clients, or has access to such recommendations that are nonpublic. Sub-Advisor Access Person includes any trustee, director, officer or employee of any sub-adviser who, in connection with his or her regular functions or duties, makes, participates in, or obtains information regarding, the purchase or sale of a Security by a Fund, or whose functions relate to the making of any recommendations with respect to such purchases or sales. Automatic Investment Plan means a program in which regular periodic purchases (or withdrawals) are made automatically in (or from) investment accounts in accordance with a predetermined schedule and allocation. An automatic investment plan includes a dividend reinvestment plan. Beneficial ownership means the same as under Section 16 of the Securities Exchange Act of 1934 and Rule 16a-1(a)(2) thereunder. You should generally consider yourself the beneficial owner of any security in which you have a direct or indirect pecuniary interest, which is the opportunity to profit directly or indirectly or share in any profit derived from a transaction securities. In addition, you should consider yourself the beneficial owner of securities held by your spouse, your minor children, a relative who shares your home, or other persons by reason of any contract, arrangement, understanding or relationship that provides you with sole or shared voting or investment power. Compliance Officer means, as applicable, the chief compliance officer of Guggenheim Credit Income Fund, Guggenheim Credit Income Fund 2016 T, and Guggenheim Credit Income Fund 2019 pursuant to Rule 38a-1 under the 1940 Act, or any person designated by such chief compliance officer to act in the chief compliance officer’s absence. As of October 2018, the Compliance Officers are: Entity Guggenheim Credit Income Fund, Guggenheim Credit Income Fund 2016 T, and Guggenheim Credit Income Fund 2019 Compliance Joanna Catalucci Officer Compliance Administrator means a compliance personnel employee designated by the Compliance Officer. Control means the same as that under Section 2(a)(9) of the 1940 Act. Section 2(a)(9) provides that “control” means the power to exercise a controlling influence over the management or policies of a company, unless such power is solely the result of an official position with such company. Ownership of 25% or more of a company's outstanding voting securities is presumed to give the holder of such securities control over the company. This presumption may be countered by the facts and circumstances of a given situation. Cryptocurrency generally means any virtual currency (e.g., bitcoin, ethereum, litecoin, etc.) or digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value that does not have indicia of being a security (e.g., initial coin offerings (ICOs)) under the federal securities laws. Investment Account generally means any account over which the Access Persons has Beneficial Ownership which can, even if the account does not currently, hold Securities. It includes the following accounts: • Any investment account with a broker-dealer or bank over which the Access Person has investment decision- making authority (including accounts that the Access Person is named on, such as being a guardian, executor or trustee, as well as accounts that Access Person is not named on such as an account owned by another person but for which the Access Person has been granted trading authority). • Any investment account with a broker-dealer or bank established by partnership, corporation, or other entity in which the Access Person has a direct or indirect interest through any formal or informal understanding or agreement. • Any college savings account in which the Access Person has investment discretion and which holds Securities issued under Section 529 of the Internal Revenue Code and in which the Access Person has a direct or indirect interest. • Any other account that the CCO deems appropriate in light of the Access Person’s interest or involvement. Page 15 of 19

Policy Number: IC24.0 • Any account in which the Access Person’s Immediate Family is the owner. Access Persons are presumed to have investment decision-making authority for, and therefore should report, any investment account of a member of their Immediate Family if they live in the same household. • Any 401(k) accounts from a previous employer which can or offer the ability to hold Securities. Independent Trustee means a trustee or director of a Fund who is not an “interested person” of the Fund within the meaning of Section 2(a)(19) of the 1940 Act. Initial public offering (“IPO”) means an offering of securities registered under the Securities Act of 1933, the issuer of which, immediately before registration, was not subject to the reporting requirements of Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Interested Trustee means a trustee or director of a Fund who is an “interested person” of the Fund within the meaning of Section 2(a)(19) of the 1940 Act. Limited offering means an offering that is exempt from registration under the Securities Act of 1933 pursuant to Section 4(2) or Section 4(6) or pursuant to Rule 504, Rule 505, or Rule 506 under the Securities Act of 1933. Investment Club means a group of people who pool their money to make investments. Usually investment clubs are organized as partnerships and after the members study different investments, the group decides to buy or sell based on a majority vote of the members. Private placement means a non-public offering of securities conducted in reliance on an available exemption from registration under the Securities Act of 1933. Purchase or sale of a security includes, among other things, the writing of an option to purchase or sell a security. Reportable fund means any fund, except money market funds, for which an Advisor serves as investment adviser, any fund whose investment adviser or principal underwriter controls, is controlled by, or is under common control with the Advisers, or any closed-end fund regardless of affiliation. For purposes of this Code definition, control has the same meaning as it does above. Security means the same as that set forth in Section 2(a)(36) of the 1940 Act, except that it does not include direct obligations of the U.S. Government, bankers’ acceptances, bank certificates of deposit, commercial paper, shares of registered open-end mutual funds other than reportable funds, and high quality short-term debt instruments, including repurchase agreements. A high quality short-term debt instrument is an instrument that has a maturity at issuance of less than 366 days and that is rated in one of the two highest rating categories by a NRSRO. For purposes of this Code, a security includes shares issued by exchange-traded funds, futures, index futures, commodities futures, commodities, options on futures, and other types of derivatives. A security also includes options on securities and single stock futures. A security also does not include shares issued by UITs that are invested exclusively in one or more unaffiliated open-end funds, none of which are reportable funds. A security held or to be acquired by any Fund or any client account means any security which, within the most recent 15 days, (i) is or has been held by any Fund or any client account or (ii) is being or has been considered by an Advisor or sub-adviser for purchase by a Fund or client account, and any option to purchase or sell, and any security convertible into or exchangeable for any security. A security is being purchased or sold by a Fund or a client account from the time a purchase or sale program has been communicated to the person who places buy and sell orders for the Fund or client account until the program has been fully completed or terminated. Tradable Funds are those Funds that are designed for active trading and do not impose limits on shareholder transactions. Page 16 of 19

Policy Number: IC24.0 Code of Ethics Certification of Compliance This is to certify that I have reviewed the Code of Ethics ("Code") and that I understand its terms and requirements. I hereby certify that: • I have complied with the Code during the course of my association with the entities covered by the Code; • I will continue to comply with the Code in the future; • I will promptly report to a Compliance Officer any violation or possible violation of the Code of which I become aware; and • I understand that a violation of the Code may be grounds for disciplinary action or termination of my employment and may also be a violation of federal and/or state securities laws. Name: ________________________ Signature: ________________________ Date: ________________ Page 17 of 19