As filed with the Securities and Exchange Commission on November 25, 2014

Registration Statement No. 333-198955

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVRAZ NORTH AMERICA LIMITED

(Exact name of registrant as specified in its charter)

| | | | |

| England and Wales | | 3312 | | 98-1086136 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

20-22 Bedford Row

London WC1R 4JS

United Kingdom

Telephone: +1 312 533 3555

Facsimile: +1 312 533 3611

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Copies to:

| | | | |

James A. McDonald Skadden, Arps, Slate, Meagher and Flom (UK) LLP 40 Bank Street London E14 5DS United Kingdom Telephone: +44 20 7519 7000 Facsimile: +44 20 7519 7070 | | Michael J. Zeidel Skadden, Arps, Slate, Meagher and Flom LLP 4 Times Square New York, New York 10036 United States of America Telephone: +1 212 735 3000 Facsimile: +1 212 735 2000 | | Marc D. Jaffe Senet S. Bischoff Latham & Watkins LLP 885 Third Avenue New York, New York 10022 United States of America Telephone: +1 212 906 1200 Facsimile: +1 212 751 4864 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, or the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | |

|

Title of each class of securities to be registered | | Proposed maximum aggregate offering price(1)(2) | | Amount of registration fee(3) |

Ordinary shares, nominal value $0.01 per share | | $100,000,000 | | $12,880 |

|

|

| (1) | Includes additional ordinary shares that may be sold upon exercise of a purchase option to be granted to the underwriters. |

| (2) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 25, 2014

PRELIMINARY PROSPECTUS

Shares

EVRAZ NORTH AMERICA LIMITED

Ordinary Shares

$ per Share

This is the initial public offering of ordinary shares, nominal value $0.01 per share, of EVRAZ NORTH AMERICA LIMITED. We are offering ordinary shares in this offering.

We expect the public offering price to be between $ and $ per ordinary share. Prior to this offering, there has been no public market for our ordinary shares. We are in the process of applying to list our ordinary shares on the Nasdaq Global Select Market, or Nasdaq, under the symbol “ENA.”

Upon completion of this offering, Evraz Group S.A. and its affiliates will control approximately % of the aggregate voting power of our ordinary shares, or approximately % if the underwriters exercise their option to purchase up to additional ordinary shares in full. Accordingly, we will be a “controlled company” under the rules of Nasdaq.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 18.

| | | | | | | | |

| | | Per Share | | | Total | |

Public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions | | $ | | | | $ | | |

Proceeds to us, before expenses | | $ | | | | $ | | |

We refer you to “Underwriting” for additional information regarding underwriting compensation.

The underwriters have an option to purchase up to additional ordinary shares from us at the initial public offering price, less the underwriting discount, within 30 days from the date of this prospectus.

The underwriters expect to deliver the ordinary shares to purchasers on or about , 2014.

Neither the United States Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

| Citigroup | | Goldman, Sachs & Co. |

Prospectus dated , 2014

TABLE OF CONTENTS

Neither we nor the underwriters (nor any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters (nor any of our or their respective affiliates) are making an offer to sell the ordinary shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial position, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Neither we nor any of the underwriters have taken any action to permit a public offering of the ordinary shares outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ordinary shares and the distribution of this prospectus outside the United States.

i

Until , 2014 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade in our ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotment or subscription.

PRESENTATION OF FINANCIAL DATA

We present our consolidated financial statements in accordance with United States Generally Accepted Accounting Principles, or GAAP. All references in this prospectus to “USD”, “U.S. dollars” or “$” are to the legal currency of the United States of America unless otherwise noted. All references in this prospectus to “CAD” or “Canadian dollars” are to the legal currency of Canada unless otherwise noted. When used in percentage columns in tables in this prospectus, the abbreviation “N/M” means “not meaningful”.

INDUSTRY AND MARKET DATA

Certain information relating to our industry and market position used or referenced in this prospectus was obtained from internal analysis, surveys, market research, publicly available information and industry publications. Unless otherwise indicated, all sources for industry data and statistics are estimates or forecasts contained in or derived from internal or industry sources we believe to be reliable. Market data used throughout this prospectus was obtained from independent industry publications and other publicly available information. Such data, as well as internal surveys, industry forecasts and market research, while believed to be reliable, have not been independently verified. In addition, in certain cases we have made statements in this prospectus regarding our industry and position in the industry based on our experience and our own investigation of market conditions. We cannot assure you that any of these assumptions are accurate or correctly reflect our position in the industry, and none of our internal surveys or information has been verified by independent sources.

Market data and statistics are inherently predictive and speculative and are not necessarily reflective of actual market conditions. Such statistics are based on market research, which itself is based on sampling and subjective judgments by both the researchers and the respondents, including judgments about what types of products and transactions should be included in the relevant market. In addition, the value of comparisons of statistics for different markets is limited by many factors, including that (i) the markets are defined differently, (ii) the underlying information was gathered by different methods and (iii) different assumptions were applied in compiling the data. Accordingly, the market statistics included in this prospectus should be viewed with caution.

ENFORCEMENT OF CIVIL LIABILITIES

We are incorporated under the laws of England and Wales. Several of our directors may reside outside the United States and all or a substantial portion of the assets of such persons may be located outside the United States. As a result, it may be difficult for you to serve legal process on us or our directors or have any of them appear in a U.S. court. The United States and the United Kingdom do not currently have a treaty providing for the recognition and enforcement of judgments, other than arbitration awards, in civil and commercial matters. The enforceability of any judgment of a U.S. federal or state court in the United Kingdom will depend on the laws and any treaties in effect at the time, including conflicts of laws principles (such as those bearing on the question of whether a U.K. court would recognize the basis on which a U.S. court had purported to exercise jurisdiction over a defendant). In this context, there is doubt as to the enforceability in the United Kingdom of civil liabilities based solely on the federal securities laws of the United States. In addition, awards for punitive damages in actions brought in the United States or elsewhere may be unenforceable in the United Kingdom. An award for monetary damages under the U.S. securities laws would likely be considered punitive if it did not seek to compensate the claimant for loss or damage suffered and was intended to punish the defendant.

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that reflect our current expectations and views of future events. Forward-looking statements are contained principally in the sections titled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Industry” and “Business.” Some of these forward-looking statements can be identified by terms and phrases such as “anticipate,” “aim,” “should,” “likely,” “foresee,” “believe,” “estimate,” “expect,” “intend,” “continue,” “could,” “may,” “plan,” “project,” “predict,” “will,” “shall” and similar expressions. These forward-looking statements include, but are not limited to, statements relating to:

| | • | | our goals and strategies; |

| | • | | expected trends in the steel industry; |

| | • | | expected trends in the industries served by our products, including the development of the railroad market and energy development and transportation; |

| | • | | our expected capital expenditures and commitments; |

| | • | | our future business development, results of operations and financial position; |

| | • | | developments in, or changes to, the laws, regulation and governmental policies governing our business and industry, including environmental regulations, “Buy America” policies, “Made in Canada” preferences, import regulations, trade tariffs and quotas, and the business and industry of our customers, suppliers and major shareholders; |

| | • | | expected trends in pricing and availability of our raw materials and energy used in our production operations; |

| | • | | expected global and regional economic development; and |

| | • | | our expectations with respect to our future pension obligations. |

While we always intend to express our best judgment when we make statements about what we believe will occur in the future, and although we base these statements on assumptions that we believe to be reasonable when made, these forward looking statements are not a guarantee of performance, and you should not place undue reliance on such statements. These statements are only predictions based upon our current expectations and projections about future events. Forward looking statements are subject to many uncertainties and other variable circumstances, many of which are outside of our control, that could cause our actual results and experience to differ materially from those we thought would occur.

These forward-looking statements speak only as of the date of this prospectus. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should read this prospectus and the documents filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks provided under “Risk Factors” in this prospectus.

CERTAIN TERMS USED IN THIS PROSPECTUS

In this prospectus, except as otherwise indicated or the context otherwise requires:

| | • | | “ABL Credit Facility” refers to the Credit Agreement, by and between EVRAZ Inc. NA, EVRAZ Inc. NA Canada, Canadian National Steel Corporation, EVRAZ Claymont Steel, Inc., Colorado and |

iii

| | Wyoming Railway Company, CF&I Steel, L.P. Camrose Pipe Corporation, OSM Distribution, Inc., Oregon Steel Mills Processing Inc. and New CF&I, Inc., as the Borrowers, and General Electric Capital Corporation, Bank of America, N.A., UBS Securities LLC, and the other financial institutions party hereto, as lenders, dated as of December 23, 2011, as amended on December 21, 2012, and as further amended on November 7, 2014; |

| | • | | “API” refers to the American Petroleum Institute; |

| | • | | “apparent demand” is calculated as domestic shipments plus imports minus exports; |

| | • | | “Bakken” refers to the oil and gas producing region in North Dakota; |

| | • | | “CAGR” refers to compound annual growth rate; |

| | • | | “Class I railroad” refers to the United States railroad classification by the Interstate Commerce Commission, which defines railroads as Class I if they have annual carrier operating revenues of $250 million or more after adjusting for inflation; |

| | • | | “Code” refers to the Internal Revenue Code of 1986, as amended; |

| | • | | “EAF” refers to an electric arc furnace, a furnace that melts scrap steel and alloys by means of an electric arc; |

| | • | | “effective capacity” refers to capacity of production assets taking into account the effect of the product mix; |

| | • | | “EGSA” refers to Evraz Group S.A. a Luxembourg société anonyme wholly owned by EVRAZ plc, having its registered office at 46A, avenue J.F. Kennedy, L-1855 Luxembourg and being registered with the Luxembourg Trade and Companies Register under number B 105615; |

| | • | | “EICA” refers to EVRAZ Inc. NA Canada, a corporation incorporated pursuant to the Canada Business Corporations Act and, immediately after completion of this offering, a wholly owned subsidiary of the Company, together with its subsidiaries; |

| | • | | “EINA” refers to EVRAZ Inc. NA, a Delaware corporation and wholly owned subsidiary of the Company, together with its subsidiaries; |

| | • | | “ERW” refers to the electric resistance welding process where heat to form the weld is generated by the electrical resistance of material combined with the time and the force used to hold the materials together during welding; |

| | • | | “EVRAZ Camrose” refers to Camrose Pipe Corporation, a Delaware corporation and a wholly owned subsidiary of EINA; |

| | • | | “EVRAZ Group” refers to EVRAZ plc, a public company limited by shares organized under the laws of England and Wales, together with its direct and indirect subsidiaries; |

| | • | | “EVRAZ KGOK” refers to Joint Stock Company “EVRAZ Kachkanarsky Ore Mining and Processing Plant”, an EVRAZ plc subsidiary; |

| | • | | “EVRAZ NORTH AMERICA,” “ENA”, the “Company” and “we,” “us,” “our” and other similar terms refer to the consolidated business of EVRAZ NORTH AMERICA LIMITED and all of its consolidated subsidiaries post-Reorganization; |

| | • | | “HSAW” refers to helical submerged arc welding, a technology commonly used in the production of large diameter spiral pipe; |

| | • | | “HSR” refers to High Speed Rail defined typically as dedicated rail lines supporting a range of speeds over 110 miles per hour; |

iv

| | • | | “Kt” refers to a unit of weight or capacity equal to 1,000 (one thousand) short tons; |

| | • | | “LD Pipe” refers to large diameter pipe with an outside diameter of above 24”; |

| | • | | “Lean Manufacturing” refers to a set of methodologies that aim to maximize value and minimize waste in the manufacturing process; |

| | • | | “LSAW” refers to longitudinal submerged arc welding, a technology commonly used in the production of large diameter pipe; |

| | • | | “Midwest” refers to the geography recognized by the United States Census Bureau as the region consisting of 12 states in the north central United States: Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin; |

| | • | | “MMBTU” refers to a million British thermal units. One British thermal unit energy is equal to about 1055 joules; |

| | • | | “North America” refers to the United States, Canada, and Mexico; |

| | • | | “NTMK” refers to EVRAZ Nizhniy Tagil Iron and Steel Works, a wholly-owned subsidiary of EGSA. NTMK products are sold by East Metals AG, a wholly-owned subsidiary of EGSA, acting as agent for NTMK; |

| | • | | “OCTG” refers to oil country tubular goods, which include pipe and tube products used in the oil and gas exploration and production, such as drill pipe, casing and tubing; |

| | • | | “operating subsidiaries” refers to EICA and EINA and their respective subsidiaries; |

| | • | | “Pacific Northwest” refers to the region in western North America that consists of the United States states of Oregon, Washington, and the Canadian province of British Columbia; |

| | • | | “PFIC” refers to passive foreign investment company within the meaning of section 1297(a) of the Code; |

| | • | | “Rockies” refers to the oil and gas producing region comprising of the United States states of Colorado, Wyoming, Utah, and Montana; |

| | • | | “SD Pipe” refers to small diameter line pipe with an outside diameter of 24” and below; |

| | • | | “tons” refers to short tons, a unit of weight equivalent to 2,000 pounds; |

| | • | | “West Coast” refers to the United States states and Canadian provinces that border the Pacific Ocean; |

| | • | | “Western Canada” refers to the provinces of Alberta, British Columbia and Saskatchewan; |

| | • | | “Western North America” refers to Western Canada and Western United States; |

| | • | | “Western Plate Market” refers to the region comprised of the United States states of Arizona, California, Colorado, Idaho, Montana, Nevada, North Dakota, Oregon, Utah, Washington, and Wyoming; as well as the Canadian provinces of British Columbia and Alberta; |

| | • | | “Western rail demand” refers to rail demand from the Western railroads and short line and distribution volumes sold in Western North America and Mexico; |

| | • | | “Western railroads” refers to Burlington Northern Santa Fe, Union Pacific, Canadian Pacific and Ferromex; and |

| | • | | “Western United States” and “West” refer to states west of the Mississippi River. |

PRESENTATION OF INFORMATION IN THIS PROSPECTUS

Unless otherwise indicated, the information in this prospectus assumes:

| | • | | that we own a majority interest, 51%, in EICA, and 100% of EINA; |

| | • | | no exercise of the underwriters’ option to purchase up to additional ordinary shares from us; and |

| | • | | an initial public offering price of $ per ordinary share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus. |

v

SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding whether to invest in our ordinary shares, you should carefully read this entire prospectus, especially the risks of investing in our ordinary shares discussed under the heading “Risk Factors.”

Overview

We are a leading North American producer of engineered steel products for the rail, energy, and industrial end markets. We are the largest producer by volume in the North American rail market and in the North American LD Pipe market, with estimated market shares of 39% and 47%, respectively, in 2013. We also held leading positions in the Western Canada OCTG, SD Pipe, and West Coast plate markets in 2013.

We operate six production sites strategically located close to key markets demonstrating favorable growth dynamics, including the Western North American LD Pipe, OCTG, and rail markets. Rail and energy (exploration, production, and transmission) products, collectively, represented approximately 66% of our shipments by volume in 2013. Collectively, our facilities have an effective annual capacity of approximately 3.5 million tons of finished steel products. In addition to our rail, LD Pipe and OCTG mills, we operate the only plate mill on the West Coast, a wire rod mill in Pueblo, Colorado, and we process scrap in several Canadian provinces and in Colorado and North Dakota, which, collectively, provide approximately a third of the scrap used in our steel making operations.

Our focus on engineered products and our strong customer relations favorably positions us to benefit from volume and margin growth in our key markets. The close proximity of our production sites to our customers provides us with freight and other logistical benefits that support our position as a low cost producer on a delivered basis. We serve a diversified and high quality customer base, much of which is comprised of well-known industry leaders. We have longstanding relationships and technical partnerships with many of our key customers, and believe we are the preferred supplier for many of our key customers’ critical applications. Taken together, these factors constitute competitive advantages that support our leadership positions in the markets we serve.

We organize our operations into three segments: Long Division, Tubular Division, and Flat Division.

| | • | | Long Division:Our Long Division, based in Pueblo, Colorado, is the largest domestic United States producer of premium rail and the only rail producer in Western North America, a region that we believe accounted for a majority of North American rail demand in 2013. We operate an EAF furnace, round billet caster, and hot-rolling mills that produce rail, seamless pipe, and wire rod. As the only large consumer of scrap in Colorado, we believe that we enjoy a cost advantage on shredded scrap (our largest raw material by volume) compared to the industry benchmark for Midwest shredded scrap prices. In 2013, total sales volume for our Long Division was 983Kt. |

| | • | | Tubular Division: Our Tubular Division is the largest North American producer of LD Pipe, which is used in oil and gas transmission, and the only supplier of fully “Made in Canada” LD Pipe. We expect that development of oil sands and shale formations in Western Canada and the United States will lead to significant near term investments in infrastructure, including new pipelines, in order to access key energy markets. We are also the largest OCTG producer in Western Canada, where we operate the only OCTG heat treat line in the region. This gives us the ability to produce heat treated pipe typically required in the demanding non-conventional drilling applications used in shale and oil sands exploration. Our Tubular Division has sites in three regions: Saskatchewan, Alberta, and Oregon. In Regina, Saskatchewan, our site consists of two EAFs and a slab caster that feeds a mill that primarily |

1

| | rolls slab into coiled plate used in our pipe facilities. At this site we also operate four HSAW LD Pipe mills and two straight seam ERW mills. In Alberta, we operate sites in Calgary, Red Deer, and Camrose with a total of three straight seam ERW pipe mills, three API and two premium threading lines, a heat treat facility, and one LSAW LD Pipe mill. In Portland, Oregon, we operate two HSAW LD Pipe mills. In 2013, total sales volume for our Tubular Division was 1,023Kt. |

| | • | | Flat Division:Our Flat Division, based in Portland, Oregon, operates the only plate mill on the West Coast. Our proximity to deep water ports allows us to cost effectively source slabs from foreign suppliers. At this site we also operate a structural tube mill, a slitting line, and a quench and tempering facility for plate. In 2013, total sales volume for our Flat Division was 798Kt. |

We have a high degree of vertical integration across our operations that enhances operational efficiency, reduces logistics costs, and makes us less reliant on outside suppliers. Our recycling operations supply us with approximately a third of our scrap needs. We produce substantially all of the billets used in our rail, seamless, and wire rod mills. In 2013, we produced substantially all the slab consumed at our Regina site and the coil and plate consumed by our tubular mills.

For the nine months ended September 30, 2014, we sold 2.1 million tons of steel products which generated total sales of $2,358.8 million, Adjusted EBITDA of $234.9 million, net income attributable to EVRAZ NORTH AMERICA LIMITED of $55.3 million, and net cash used in continuing operating activities of $127.5 million.

For the nine months ended September 30, 2013, we sold 1.9 million tons of steel products which generated total sales of $2,010.1 million, Adjusted EBITDA of $127.1 million, net loss attributable to EVRAZ NORTH AMERICA LIMITED of $6.6 million, and net cash provided by continuing operating activities of $60.6 million.

In 2013, we sold 2.5 million tons of steel products which generated total sales of $2,748.9 million, Adjusted EBITDA of $176.0 million, net loss attributable to EVRAZ NORTH AMERICA LIMITED of $709.3 million, and net cash provided by continuing operating activities of $116.1 million. Adjusted EBITDA is a non-GAAP financial measure. See “Summary Consolidated Financial Information and Other Data—Adjusted EBITDA” for a description of how we define and calculate Adjusted EBITDA and for a reconciliation of Adjusted EBITDA to net income (loss) attributable to EVRAZ NORTH AMERICA LIMITED.

Competitive Strengths

Leading positions across the markets we serve

We currently have the number one positions in North American rail, North American LD Pipe, Western Canada OCTG, and Western North American plate markets.

Rail—We are the largest producer of rail in North America based on volume with approximately 39% share of the North American market in 2013 and approximately 55% share of the Western North America market in 2013, where we are the only rail producer. We believe that our customers, Class I railroads, regard us as the preferred domestic source of highly engineered premium rail, which reduces our customers’ lifecycle cost and improves rail safety. We believe that our technical and product development capabilities and our next generation of premium rail products, that are in the process of being launched, provide us with a strong and defensible position. Our leading position in the North American rail market has allowed us to achieve consistently high utilization rates at our rail-producing facilities.

LD Pipe—We are the largest producer of LD Pipe in North America, with an estimated market share of approximately 47% in 2013 based on volume. We are also the only producer of LD Pipe in Canada and the only source of fully “Made in Canada” LD Pipe, which we believe is a significant advantage in Canada as we believe

2

our customers value locally produced LD Pipe.We also believe that our customers value the high quality of our products and our strong technical capabilities.Furthermore, operating LD Pipe mills in three locations (Regina, Saskatchewan; Camrose,Alberta; and Portland, Oregon), gives us the unique ability to produce the specific type of LD Pipe our customers require in an optimal location.

OCTG—We are the largest OCTG producer in Western Canada, where in 2013 our facilities accounted for approximately 72% of the total finished OCTG production capacity in the region. We produce a range of casing and tubing products used by our customers in many of their oil and gas exploration and production applications. We believe that we are regarded as a high quality supplier. We are also the only OCTG producer in Western Canada with a heat treat facility to supply the heat-treated pipe and premium connections required in that market. We have a wide range of products, including our own proprietary premium connections, and have over 20 years of experience with premium connections required by the thermal wells drilled in the oil sands of Alberta.

Plate—We are the only plate producer in the West Coast and have consistently operated at nearly full effective capacity since 2010. We believe our ability to roll custom sizes within short lead times is a competitive advantage compared to other domestic producers and to imports. We believe we held the leading position in the West Coast market and that we were the largest supplier of plate for most of our customers’ purchases in the region in 2013.

Operations strategically located to benefit from growth in the energy and rail markets

We forecast strong growth of LD Pipe demand to support increased oil and gas production in Canada and the United States. We estimate that in 2013, LD Pipe demand in the United States and Canada was 930Kt. We estimate that the announced projects that pipeline operators expect to put in service between 2016 and 2018 will require approximately 4.9 million tons of LD Pipe. Projects announced in Western Canada alone are expected to require 2.3 million tons of LD Pipe. We believe that our close relationships with key customers, track record of product performance, lower transportation costs as compared to those of our competitors (due to the location of our facilities), and expertise in meeting low temperature impact requirements will enable us to capture a significant share of these volumes.

Growth of unconventional drilling in Western Canada and the United States is expected to result in higher OCTG use. Metal Bulletin Research estimates United States and Canadian OCTG demand will grow at a 5% CAGR between 2014 and 2020. Our OCTG mills are optimally located to supply three large oil and gas producing regions in North America: Western Canada, the Bakken, and the Rockies, which collectively consumed approximately 2.0 million tons of OCTG in 2013 (approximately 29% of the overall United States and Canada OCTG demand). We estimate that the location of our OCTG mills provided us with a freight advantage to serve Western Canada of approximately $100 per ton in 2013 compared to OCTG mills located in Texas, as well as a freight advantage compared to Asian imports.

We believe that North American rail demand growth will be in the range of 3% to 4% annually between 2014 and 2018, primarily due to increased annual investments by Class I railroads. Class I railroads’ investments in infrastructure and equipment increased from $6.0 billion in 2000 to $15.5 billion in 2013, underpinning growth in rail demand. We also expect that the North American market will continue shifting towards premium rail, as railroads seek to alleviate rail corridor congestion, operate with increased axle loads, and support increased shipments volumes related to the energy market and intermodal freight.

Western rail demand accounted for approximately 58% of the overall North American rail demand in 2013. Our recently upgraded rail mill in Pueblo, Colorado is the only North American rail producer located west of the Mississippi River and has direct access to the Burlington Northern Santa Fe and the Union Pacific railroads, our two largest customers, resulting in low delivery costs to these customers.

3

Engineered products portfolio

A significant proportion of our product mix is comprised of engineered products such as rail, LD Pipe, heat treated OCTG pipe, premium connections, high-carbon wire rod, and armor and wear resistant plate. In these markets, our customers value quality and performance and pay a price premium for products that reduce risk and lifecycle costs. Many of our customers face significant costs of failure, particularly in the LD Pipe and rail markets. As a result, our customers are highly conscious of the value of supplier reliability and of the risks associated with switching suppliers and typically require suppliers to undergo qualification periods that may span several years.

We continue to shift our product mix further towards engineered products and are investing in incrementally expanding our capacity and capabilities. Our three technology centers support product and process design, full-scale testing, and work closely with our customers to build upon our position as their technical partner. This allows us to gain important insights into the dynamics of our end markets and proactively adjust our product portfolio to meet changing demands.

In rail, demand continues to shift towards premium products that extend track life and reduce failure risks. As a result, premium rail in North America represented approximately 66% of rail demand in 2012 compared to 60% in 2010. Premium rail is typically priced at a premium to standard rail, reflecting the value customers ascribe to lifecycle cost and risk reduction associated with premium rail. We believe that our customers perceive us as a high quality domestic producer of premium rail, particularly deep head-hardened rail. Since we introduced head hardened rail 20 years ago, we have developed strong technical partnerships (engineering, maintenance, and research and development) with our customers. Currently, we are in the testing stages of our sixth generation of premium rail, which offers enhanced wear resistance and fracture toughness.

In OCTG, the increase in unconventional drilling for oil and gas requires high performance pipe products to withstand significant thermal and mechanical stresses and highly corrosive conditions. To meet these challenges, drilling companies use heat treated pipe to provide higher yield strength and utilize premium connections to provide seal integrity under the most demanding conditions. We operate the only OCTG heat treating line in Western Canada and have a portfolio of proprietary premium connections that are designed for applications in the Alberta oil sands and for other non-conventional drilling.

In LD Pipe, our customers continue to seek to improve weldability and enhance the safety of their pipelines. We leverage our research and development capabilities and work closely with customers to develop new steel chemistries and manufacturing processes to achieve higher levels of product performance, and to reduce the risk of pipeline incidents.

Defensible market positions and operations with low delivered costs

We believe that our leading market positions are highly defensible as a result of our engineered product know-how and design capabilities, existing product qualifications and track record of quality and reliability, established customer relationships with industry leaders, as well as the proximity of our facilities to customer demand and the significant investment required to replicate our asset base.

We believe that we are a low cost North American producer on a delivered basis for our key products in our key markets. Our operations are located in close proximity to our customers, giving us freight and other logistical advantages. We also believe that our high levels of utilization and productivity reduce our overall labor and fixed costs per ton.

Our recently upgraded rail mill in Pueblo, Colorado, is the only North American rail mill located in the Western United States. It also benefits from direct access to our largest rail customers. As a result, we incur minimal delivery costs for rail delivered to these railroads.

4

We utilize EAF technology at our melt shops in Regina and Pueblo, where we have cost-advantaged sources of local scrap that provide us with a significant portion of our raw material needs. Our recycling facilities supplied 46% of our Regina and 25% of our Pueblo scrap requirements in 2013. In addition, our recycling operations provide us with insight into the scrap market pricing dynamics. Our plate mill in Portland benefits from close proximity to a deep water port and access to the overseas slab market.

New market entrants face significant challenges and significant capital investments in order to establish themselves. For example, entering the rail market requires significant scale of operations, long qualification periods, and slow adoption rates by railroad customers. The LD Pipe market is primarily project-based, making it challenging for new entrants to secure sufficient production volumes to establish themselves. Additionally, LD Pipe customers favor producers with an established track record of quality and reliability.

Financial strength with volume growth and continued margin enhancement

Between 2011 and 2013 we achieved annual average Adjusted EBITDA of $320.3 million, annual average net cash provided by continuing operating activities of $298.3 million, annual average net loss of $184.1 million and annual average Adjusted EBITDA per ton of $128.

Our diversified product portfolio allows us to adjust our product mix to respond to changes in market dynamics, resulting in our melt shops in Regina and Pueblo historically operating at high utilization rates. Our Long Division can flex volume allocation across rail, wire rod and seamless pipe to maximize profitability based on market dynamics. Similarly, our Tubular Division’s Regina site can flex volumes across OCTG, SD Pipe, LD Pipe, plate and coil. Our steelmaking capacity can be supplemented with coil, plate, or billet purchases.

We have a track record of growth through organic investments focused on our existing customers and markets. For example, in 2013, we completed the upgrade and expansion of our Pueblo rail mill and steelmaking facilities, increasing our rail annual capacity to 580Kt. In addition, we upgraded our OCTG premium product capabilities with the addition of premium threading lines. We are currently also in the process of expanding our OCTG heat treat capacity at our Calgary site, and considering a number of other investments that will enable us to continue shifting our mix towards engineered products. In addition, in LD Pipe, we have 310Kt of unused capacity that we expect to utilize as demand in that market continues to grow.

Experienced operating team, supportive shareholder and commitment to strong corporate governance

Our senior management team brings significant experience in strategy and industrial manufacturing. We repositioned our leadership team in 2013 with a number of internal promotions including Conrad Winkler, our Chief Executive Officer and former Executive Vice President of the Long Division. Under Mr. Winkler’s leadership, the management team has sharpened its focus on our core operations and developed a strategy to increase profitability across all of our segments.

EVRAZ Group is a committed and supportive shareholder and will continue to hold a controlling interest in us following the completion of this offering. We believe we will continue to benefit from our relationship with EVRAZ Group, through EVRAZ Group’s global perspective, industry experience and operational execution. Our cooperation with EVRAZ Group is also demonstrated by our slab supply arrangement with EVRAZ Group.

We and EVRAZ Group are committed to strong corporate governance consistent with United States corporate standards, and following the offering will have a Board of Directors comprised of a majority of independent Directors as defined under the Nasdaq rules.

5

Business Strategy

Grow in the markets we lead

We intend to fully utilize the production capacity of our Portland and Camrose LD Pipe facilities to meet market demand, while investing in further improving quality across our steel value chain. In addition to fully utilizing our current capacity at Portland and Camrose, we intend to make incremental investments in our LD Pipe mills and steelmaking facilities to further improve our capabilities and quality to meet the growing demand.

We are increasing OCTG heat treat capacity in Western Canada and expanding the production of high-value premium connections. We are currently expanding our heat treat capacity at Calgary, and evaluating installing heat treat capacity in Red Deer to increase output. In addition, we are expanding our premium connections portfolio to fully utilize the capacity of our threading lines in Red Deer.

We are leveraging our recent rail technology center and rail mill investments to increase our profitability. We are utilizing the capabilities of our recently upgraded rail mill and steel making assets to achieve 580Kt annual shipments and to continue increasing the proportion of premium rail in our sales mix. We aim to continue investing in improving the performance of our rail through development of next generation products and improved processing methods.

Expand our portfolio of engineered products and technical partnerships

We will continue to leverage our technology centers to deepen technical relationships with our customers and continue developing cost-effective engineered products that meet their demanding requirements.

We intend to deepen our technical relations with our rail and LD Pipe customers to develop products that deliver superior reliability and lifecycle cost.

We are expanding our premium OCTG connections portfolio in order to develop a more complete coverage of sizes and applications.

We plan to commercialize our sixth generation of premium rail, which offers superior wear resistance and fracture toughness. We expect to complete testing and work with our Class I railroad customers to fully achieve the lifecycle benefits of the higher wear resistance and fracture toughness in our next generation rail products.

Continuously improve our safety, quality and cost

We intend to become an industry leader in safety practices and relentlessly pursue an injury free workplace. We have reduced our lost time incident rate by more than 80% since 2010 and aim to continue improving on this position through close employee engagement.

We aim to extend our lead in quality across our operations through the application of our quality system, new process technology, and an expanded quality organization. We intend to continue working closely with our customers to continue offering a highly reliable supply chain.

We are focusing our resources on continuously improving yield and throughput to maintain our low cost position in the markets we serve. We believe that our ability to improve operations through Lean Manufacturing and other techniques will continue to allow us to make significant strides across our businesses in the coming years.

We continue to capitalize on the cost advantages of our vertical integration. We intend to improve upon our already favorable raw material costs by optimizing our rolling schedules, scrap recipes, and sourcing among our recycling business, local third party scrap purchases, and scrap substitutes.

6

Risk Factors

Investing in our ordinary shares involves risks. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our ordinary shares. If any of these risks actually occurs, our business, financial position or results of operations would likely be materially adversely affected. In such case, the trading price of our ordinary shares would likely decline, and you may lose all or part of your investment. The following is a summary of some of the principal risks we face:

| | • | | cyclical changes in market supply and demand for steel and conditions affecting steel consumption; |

| | • | | increased competition brought about by excess North American and global steelmaking capacity; |

| | • | | increased imports of steel into North America, including as a result of United States, Canadian or foreign trade policy affecting the amount of foreign imported steel, or adverse outcomes of pending and future trade cases alleging unlawful practices in connection with steel imports; |

| | • | | adverse conditions in the industries served by our products, including as a result of economic conditions, government regulations or other factors; |

| | • | | competition from other companies serving our end markets; |

| | • | | changes in the availability or cost of raw materials, including slabs, pig iron, iron concentrate, or other raw materials or supplies, which we use in our production processes; |

| | • | | periodic fluctuations in the availability and cost of electricity, natural gas, or other utilities; |

| | • | | the occurrence of planned or unanticipated equipment failures and plant outages; |

| | • | | margin compression resulting from our inability to pass increases in costs of raw materials and supplies to our customers; |

| | • | | loss of one or more of our major customers or key suppliers; |

| | • | | the impact of, or changes in, environmental law or in the application of other legal or regulatory requirements upon our production processes or costs of production or upon those of our suppliers or customers, including actions by government agencies, such as the United States Environmental Protection Agency, Environment Canada or related state, provincial, and local agencies, on pending or future environmentally related construction or operating permits; |

| | • | | increased governmental regulation of our business, industry or our products or the business and industry of our customers, suppliers or major shareholders; |

| | • | | future changes in tax laws or the Company not being treated as a foreign corporation for United States federal income tax purposes; and |

| | • | | labor unrest, work stoppages and/or strikes involving our own workforce, those of our important suppliers or customers, or those affecting the steel industry in general. |

Company Information

The Company was incorporated in England on November 28, 2012 under the name Viscaria Limited, pursuant to the laws of England and Wales. On August 19, 2014, the Company was renamed EVRAZ NORTH AMERICA LIMITED. Prior to the consummation of this offering, EVRAZ NORTH AMERICA LIMITED will be converted into an English public company limited by shares and renamed EVRAZ NORTH AMERICA PLC, as more fully described in “Our Structure and Reorganization.”

Our principal executive offices are located at 200 East Randolph Street, Suite 7800, Chicago, IL 60601. Our telephone number at this address is +1 (312) 533 3555. The Company’s registered address is at 20-22 Bedford Row, London WC1R 4JS, United Kingdom. The Company’s agent in the United States is Evraz Inc. NA, c/o Corporation Services Company, and its address is at 2711 Centerville Rd, Suite 400, Wilmington, DE 19808.

7

Reorganization and Corporate Structure Following the Completion of this Offering

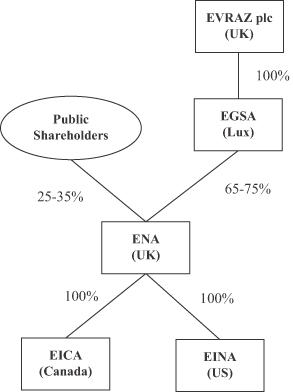

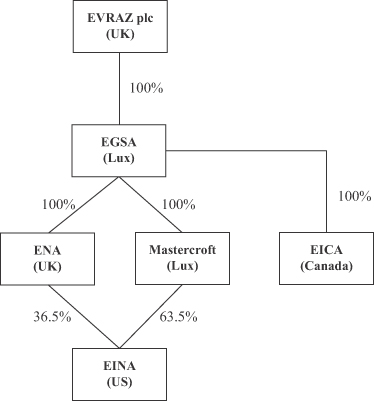

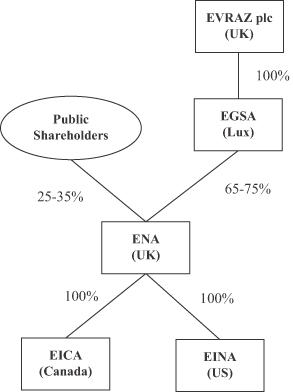

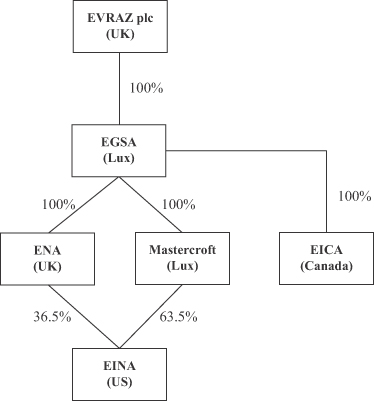

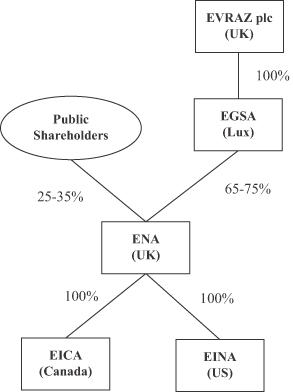

The Company and EICA have each historically been direct or indirect wholly owned subsidiaries of EGSA, which in turn is wholly owned by EVRAZ plc. Prior to the Reorganization, EINA was 36.5% owned by ENA and 63.5% owned by Mastercroft S.à r.l., a Luxembourgsociété anonyme a responsabilité limitée, having its registered office at 46A, avenue J.F. Kennedy, L-1855 Luxembourg and being registered with the Luxembourg Trade and Companies Register under number B 186304, or Mastercroft, a direct wholly owned subsidiary of EGSA. Following the completion of the Reorganization and our acquisition of the remaining EICA stake using the proceeds of this offering, EICA and EINA will each be wholly owned subsidiaries of the Company. See “Our Structure and Reorganization” for a detailed summary of the steps that will be taken in the Reorganization and “Summary Consolidated Financial Information and Other Data” for an illustration of the pro forma effect of the acquisition of the remaining EICA stake.

Following the completion of the Reorganization, we will be a holding company and will conduct our operations through EICA, EINA and their subsidiaries.

Following completion of this offering, EGSA will hold approximately % of our issued and outstanding ordinary shares.

8

Following completion of the Reorganization and the application of the use of proceeds from this offering, our structure and ownership will be as summarized in the following condensed structure chart:

9

THE OFFERING

Issuer | EVRAZ NORTH AMERICA LIMITED (to be renamed EVRAZ NORTH AMERICA PLC prior to the completion of this offering). |

Public offering price | We currently expect that the initial public offering price will be between $ and $ per ordinary share. |

Ordinary shares being offered | ordinary shares. |

Ordinary shares outstanding before this offering | ordinary shares. |

Ordinary shares outstanding immediately after this offering | ordinary shares. |

Underwriters’ purchase option | We have granted the underwriters the right to purchase up to additional ordinary shares within 30 days from the date of this prospectus. |

Use of proceeds | We estimate that our net proceeds from this offering, after deducting the underwriting discount and estimated offering expenses, will be approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional ordinary shares in full) assuming the ordinary shares are offered at $ per share, the mid-point of the estimated offering price range set forth on the cover page of this prospectus. A $ increase/(decrease) in the assumed initial public offering price of $ per share would increase/(decrease) the net proceeds to us from this offering by approximately $ million, assuming the number of ordinary shares offered by us as set forth on the cover page of this prospectus remains the same and after deducting the underwriting discounts and commissions. |

| | We intend to use the first $ million of the net proceeds from this offering, excluding the net proceeds from any exercise of the underwriters’ option to purchase additional ordinary shares, to complete the acquisition of EICA. |

| | To the extent we raise any additional net proceeds in this offering, excluding any net proceeds received by us from the exercise by underwriters of their option to purchase additional ordinary shares, we intend to use such additional net proceeds to make equity contributions to EICA, which EICA will use to repay amounts outstanding under Loan Contract No. KGOK-EICA-03, or Note 3, or for general corporate purposes. Note 3 is due June 30, 2020 and carries a fixed interest rate of 8.25%, and had a balance of CAD 431.6 million outstanding as of November 14, 2014. We used the proceeds from Note 3 to repay Note 1 and Note 2. We used the proceeds from Note 1 and Note 2 to finance the business acquisition of EVRAZ Inc. NA Canada assets. See “Related Party Transactions.” |

10

| | We also intend to use the net proceeds received by us from the exercise of the underwriters’ option to purchase additional ordinary shares either to make an equity contribution to EICA, which EICA will use to repay additional amounts outstanding under its loans from EVRAZ KGOK, or for general corporate purposes. |

Payment and settlement | Our ordinary shares are expected to be delivered against payment on , 2014. |

Dividend policy | We currently intend to pay dividends on our ordinary shares at a dividend yield and schedule comparable with that of our North American peers. However, any future determination as to the declaration and payment of dividends, if any, will be made at the discretion of our Board of Directors and will depend on then existing conditions, including our results of operations, financial position, contractual restrictions, capital requirements, business prospects and other factors our Board of Directors may deem relevant. Under English law, we may pay dividends only out of our accumulated, realized profits, so far as not previously utilized by distribution or capitalization, less our accumulated, realized losses, so far as not previously written off in a reduction or reorganization of capital duly made. Because we are a holding company and have no direct operations, we will only be able to pay dividends from our available cash on hand and any funds we receive from our operating subsidiaries. |

Risk factors | See “Risk Factors” included elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

Listing | We are in the process of applying for the listing of our ordinary shares on Nasdaq under the symbol “ENA.” |

We base the number of ordinary shares outstanding following the completion of this offering on the number of ordinary shares outstanding as of the date of this prospectus.

11

SUMMARY CONSOLIDATED FINANCIAL INFORMATION AND OTHER DATA

The summary consolidated historical financial and operating data as of December 31, 2012 and 2013 and for the years ended December 31, 2011, 2012 and 2013 presented below (except for the unaudited pro forma financial information on the statement of operations for the year ended December 31, 2013 prepared under Article 11 of Regulation S-X) have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated historical unaudited financial and operating data for the nine months ended September 30, 2013 and as of and for the nine months ended September 30, 2014 (except for the unaudited pro forma financial information for the nine months ended September 30, 2014 prepared under Article 11 of Regulation S-X) has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus and includes all adjustments (consisting of normal recurring adjustments) that we consider necessary for a fair presentation of the financial position and the results of operations for these periods. Our historical results for any prior period are not necessarily indicative of results expected in any future period. Additionally, the summary historical unaudited consolidated financial and operating data at and for the nine months ended September 30, 2014 are not necessarily indicative of the results expected at and for the year ending December 31, 2014 or for any future period.

You should read the summary consolidated historical financial and operating data set forth below in conjunction with the sections entitled “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

| | | ($ in millions, except per share amounts, tons in thousands) | |

Sales: | | | | | | | | | | | | | | | | | | | | |

Product sales | | $ | 1,896.5 | | | $ | 2,235.6 | | | $ | 2,896.6 | | | $ | 2,768.5 | | | $ | 2,584.9 | |

Freight | | | 113.6 | | | | 123.2 | | | | 150.5 | | | | 135.9 | | | | 164.0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2,010.1 | | | | 2,358.8 | | | | 3,047.1 | | | | 2,904.4 | | | | 2,748.9 | |

| | | | | | | | | | | | | | | | | | | | |

Costs and Expenses: | | | | | | | | | | | | | | | | | | | | |

Cost of sales | | | 1,841.3 | | | | 2,060.5 | | | | 2,576.7 | | | | 2,505.2 | | | | 2,513.0 | |

Selling, general and administrative expenses | | | 174.0 | | | | 186.0 | | | | 230.2 | | | | 232.3 | | | | 235.5 | |

Impairment of assets | | | — | | | | — | | | | - | | | | - | | | | 468.6 | |

Loss (gain) on disposal of assets | | | 0.6 | | | | (0.2 | ) | | | (0.5 | ) | | | 2.3 | | | | 1.6 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2,015.9 | | | | 2,246.3 | | | | 2,806.4 | | | | 2,739.8 | | | | 3,218.7 | |

| | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (5.8 | ) | | | 112.5 | | | | 240.7 | | | | 164.6 | | | | (469.8 | ) |

Other (expense) income: | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (53.1 | ) | | | (47.5 | ) | | | (96.5 | ) | | | (62.0 | ) | | | (70.6 | ) |

Dividend and interest income | | | 0.2 | | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.1 | |

Foreign exchange gains (losses) | | | 0.2 | | | | (9.3 | ) | | | (12.3 | ) | | | 15.7 | | | | (4.0 | ) |

Loss on extinguishment of debt | | | — | | | | — | | | | (6.3 | ) | | | - | | | | - | |

Other income, net | | | 1.2 | | | | 3.4 | | | | 5.0 | | | | 2.8 | | | | 2.2 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before income taxes | | | (57.3 | ) | | | 59.2 | | | | 130.8 | | | | 121.3 | | | | (542.1 | ) |

Income tax benefit | | | 52.2 | | | | 6.4 | | | | 5.5 | | | | 13.6 | | | | 52.8 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (5.1 | ) | | | 65.6 | | | | 136.3 | | | | 134.9 | | | | (489.3 | ) |

Loss from discontinued operations before income taxes | | | (44.9 | ) | | | (16.0 | ) | | | (1.3 | ) | | | (123.8 | ) | | | (391.4 | ) |

Income tax benefit | | | 22.2 | | | | 5.8 | | | | 11.0 | | | | 22.7 | | | | 121.2 | |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income from discontinued operations(1) | | | (22.7 | ) | | | (10.2 | ) | | | 9.7 | | | | (101.1 | ) | | | (270.2 | ) |

Less net loss (income) attributable to non-controlling interest(1) | | | 21.2 | | | | (0.1 | ) | | | (3.6 | ) | | | (19.2 | ) | | | 50.2 | |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to EVRAZ NORTH AMERICA LIMITED(1) | | $ | (6.6 | ) | | $ | 55.3 | | | $ | 142.4 | | | $ | 14.6 | | | $ | (709.3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings per share from continuing operations(1) | | | 16,047 | | | | 11,634 | | | | 132,648 | | | | 115,726 | | | | (438,660 | ) |

Basic and diluted (loss) earnings per share from discontinued operations(1) | | | (22,676 | ) | | | (1,809 | ) | | | 9,779 | | | | (101,078 | ) | | | (269,941 | ) |

Basic and diluted earnings (loss) per share attributable to EVRAZ NORTH AMERICA LIMITED shareholders(1) | | | (6,629 | ) | | | 9,825 | | | | 142,427 | | | | 14,648 | | | | (708,601 | ) |

| | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(2) | | $ | 127.1 | | | $ | 234.9 | | | $ | 437.9 | | | $ | 347.0 | | | $ | 176.0 | |

Capital expenditures(3) | | $ | 66.6 | | | $ | 46.5 | | | $ | 59.1 | | | $ | 67.3 | | | $ | 84.2 | |

| | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Total tons sold | | | 1,851 | | | | 2,076 | | | | 2,500 | | | | 2,503 | | | | 2,518 | |

Product sales per ton | | $ | 1,025 | | | $ | 1,077 | | | $ | 1,159 | | | $ | 1,106 | | | $ | 1,027 | |

Adjusted EBITDA per ton(2) | | $ | 69 | | | $ | 113 | | | $ | 175 | | | $ | 139 | | | $ | 70 | |

12

| (1) | The table below represents the anticipated impact of the acquisition of the remaining 49% in EICA on our consolidated statements of operations, retroactively reflecting the acquisition as if the acquisition was completed at the beginning of each period presented (See “Our Structure and Reorganization”): |

| | | | | | | | | | | | |

| Pro forma Information: | | | | | | | | | | | | |

| | | Nine months ended

September 30, 2014 | |

| | | Actual | | | Pro forma

Adjustments | | | Pro

forma | |

Net income | | | 55.4 | | | | — | | | | 55.4 | |

Less net income attributable to noncontrolling interest | | | (0.1 | ) | | | (6.9 | ) | | | (7.0 | ) |

| | | | | | | | | | | | |

Net income attributable to EVRAZ NORTH AMERICA LIMITED | | | 55.3 | | | | (6.9 | ) | | | 48.4 | |

| | | | | | | | | | | | |

Earnings (loss) per share: | | | | | | | | | | | | |

Basic and diluted earnings per share from continuing operations | | | 11,634 | | | | | | | | 10,396 | |

Basic and diluted loss per share from discontinued operations | | | (1,809 | ) | | | | | | | (1,809 | ) |

Basic and diluted earnings per share attributable to EVRAZ NORTH AMERICA LIMITED shareholders | | | 9,825 | | | | | | | | 8,587 | |

| |

| | | Year Ended December 31, 2013 | |

| | | Actual | | | Pro forma

Adjustments | | | Pro

forma | |

Net loss | | | (759.5 | ) | | | — | | | | (759.5 | ) |

Less net loss (income) attributable to noncontrolling interest | | | 50.2 | | | | (50.5 | ) | | | (0.3 | ) |

| | | | | | | | | | | | |

Net loss attributable to EVRAZ NORTH AMERICA LIMITED | | | (709.3 | ) | | | (50.5 | ) | | | (759.8 | ) |

| | | | | | | | | | | | |

Earnings (loss) per share: | | | | | | | | | | | | |

Basic and diluted loss per share from continuing operations | | | (438,660 | ) | | | | | | | (489,055 | ) |

Basic and diluted loss per share from discontinued operations | | | (269,941 | ) | | | | | | | (269,941 | ) |

Basic and diluted loss per share attributable to EVRAZ NORTH AMERICA LIMITED shareholders | | | (708,601 | ) | | | | | | | (758,996 | ) |

| (2) | Adjusted EBITDA and Adjusted EBITDA per ton are non-GAAP financial measures. See “—Adjusted EBITDA” for the definition of these measures and for the reconciliation of Adjusted EBITDA to our net income (loss) attributable to EVRAZ NORTH AMERICA LIMITED. |

| (3) | Capital expenditures are measured on a cash basis and represent expenditures on fixed assets that are capitalized rather than expensed at the time of incurrence. |

| | | | | | | | | | | | |

| | | December 31, | | | September 30,

2014 | |

| | | 2012 | | | 2013 | | |

| | | ($ in millions) | |

Balance Sheets Data: | | | | | | | | | | | | |

Assets | | | | | | | | |

Other current assets | | $ | 1,060.1 | | | $ | 996.9 | | | $ | 1,074.5 | |

Property, plant, and equipment, net | | | 1,301.6 | | | | 1,224.2 | | | | 1,149.9 | |

Goodwill | | | 1,596.3 | | | | 1,082.1 | | | | 1,047.3 | |

Intangibles, net | | | 522.2 | | | | 444.8 | | | | 392.7 | |

Assets held for sale | | | 430.0 | | | | 18.2 | | | | 3.2 | |

Other assets | | | 19.9 | | | | 16.4 | | | | 13.6 | |

| | | | | | | | | | | | |

Total assets | | $ | 4,930.1 | | | $ | 3,782.6 | | | $ | 3,681.2 | |

| | | | | | | | | | | | |

Liabilities and equity | | | | | | | | | | | | |

Total current liabilities | | $ | 443.0 | | | $ | 443.5 | | | $ | 393.9 | |

Long-term debt (including related-party loans) | | | 1,130.9 | | | | 874.4 | | | | 913.4 | |

Deferred income taxes | | | 400.3 | | | | 265.9 | | | | 242.5 | |

Deferred employee benefits | | | 226.7 | | | | 140.9 | | | | 128.2 | |

Environmental liability, net of current portion | | | 28.9 | | | | 28.7 | | | | 26.0 | |

Other long-term liabilities | | | 28.3 | | | | 18.9 | | | | 12.5 | |

| | | | | | | | | | | | |

Total liabilities | | | 2,258.1 | | | | 1,772.3 | | | | 1,716.5 | |

| | | | | | | | | | | | |

Total equity(4) | | $ | 2,672.0 | | | $ | 2,010.3 | | | $ | 1,964.7 | |

| | | | | | | | | | | | |

Total liabilities and equity(4) | | $ | 4,930.1 | | | $ | 3,782.6 | | | $ | 3,681.2 | |

| | | | | | | | | | | | |

13

| (4) | The table below represents the anticipated impact of the acquisition of the remaining 49% in EICA on our consolidated balance sheets, retroactively reflecting the acquisition as if the acquisition was completed at the beginning of the period presented (See “Our Structure and Reorganization”): |

ProForma Information:

| | | | | | | | | | | | |

| | | September 30, 2014 | |

| | | Actual | | | Pro forma

Adjustments | | | Pro

forma | |

| | | ($ in millions) | |

EQUITY: | | | | | | | | | | | | |

Common stock | | | — | | | | — | | | | — | |

Additional paid-in capital | | | 3,036.5 | | | | 400.0 | | | | 3,436.5 | |

Accumulated deficit | | | (1,354.2 | ) | | | (99.8 | ) | | | (1,454.0 | ) |

Accumulated other comprehensive income (loss): | | | | | | | | | | | | |

Cumulative foreign currency translation adjustment | | | 5.8 | | | | — | | | | 5.8 | |

Pension and post retirement benefit plans, net of tax | | | (67.1 | ) | | | (29.2 | ) | | | (96.3 | ) |

| | | | | | | | | | | | |

Total EVRAZ NORTH AMERICA LIMITED Equity | | | 1,621.0 | | | | 271.0 | | | | 1,892.0 | |

Noncontrolling interest | | | 343.7 | | | | (271.0 | ) | | | 72.7 | |

| | | | | | | | | | | | |

Total equity | | | 1,964.7 | | | | — | | | | 1,964.7 | |

| | | | | | | | | | | | |

Total liabilities and equity | | | 3,681.2 | | | | — | | | | 3,681.2 | |

| | | | | | | | | | | | |

Adjusted EBITDA

We use Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization, or Adjusted EBITDA, and Adjusted EBITDA per ton ratios presented in this prospectus to evaluate our operating performance and to enhance comparability between periods. These measures are not required by, nor are they presented in accordance with GAAP. Neither Adjusted EBITDA nor Adjusted EBITDA per ton are measurements of financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of liquidity.

We present Adjusted EBITDA and Adjusted EBITDA per ton because we consider them important supplemental measures of our performance and believe them to be frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. We define Adjusted EBITDA as net income (loss) attributable to EVRAZ NORTH AMERICA LIMITED plus interest expense, income tax benefit, depreciation and amortization, other income (net), foreign exchange (losses) gains, dividend and interest income, loss on extinguishment of debt, loss (gain) on disposal of assets, impairment of assets, net loss (income) from discontinued operations and net loss (income) attributable to noncontrolling interest. We calculate Adjusted EBITDA per ton by dividing Adjusted EBITDA by tons sold. You should not infer from our presentation of Adjusted EBITDA or Adjusted EBITDA per ton that our future results will be unaffected by unusual or nonrecurring items.

Adjusted EBITDA and Adjusted EBITDA per ton have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations are:

| | • | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

14

| | • | | Adjusted EBITDA is not adjusted for all non-cash income or expense items that are reflected in our statements of operations; and |

| | • | | other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures. |

Because of these limitations, Adjusted EBITDA and Adjusted EBITDA per ton should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and secondarily using Adjusted EBITDA.

The following table reconciles our net income (loss) attributable to EVRAZ NORTH AMERICA LIMITED to Adjusted EBITDA for the nine months ended September 30, 2013 and 2014 and years ended December 31, 2011, 2012 and 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Nine months

ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

| | | ($ in millions) | |

Net (loss) income attributable to EVRAZ NORTH AMERICA LIMITED | | $ | (6.6 | ) | | $ | 55.3 | | | $ | 142.4 | | | $ | 14.6 | | | $ | (709.3 | ) |

Plus: | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | 53.1 | | | | 47.5 | | | | 96.5 | | | | 62.0 | | | | 70.6 | |

Income tax benefit | | | (52.2 | ) | | | (6.4 | ) | | | (5.5 | ) | | | (13.6 | ) | | | (52.8 | ) |

Depreciation and amortization expense | | | 132.3 | | | | 122.6 | | | | 197.7 | | | | 180.1 | | | | 175.6 | |

Other income, net | | | (1.2 | ) | | | (3.4 | ) | | | (5.0 | ) | | | (2.8 | ) | | | (2.2 | ) |

Foreign exchange (gains) losses | | | (0.2 | ) | | | 9.3 | | | | 12.3 | | | | (15.7 | ) | | | 4.0 | |

Dividend and interest income | | | (0.2 | ) | | | (0.1 | ) | | | (0.2 | ) | | | (0.2 | ) | | | (0.1 | ) |

Loss on extinguishment of debt | | | — | | | | — | | | | 6.3 | | | | — | | | | — | |

Loss (gain) on disposal of assets | | | 0.6 | | | | (0.2 | ) | | | (0.5 | ) | | | 2.3 | | | | 1.6 | |

Impairment of assets | | | — | | | | — | | | | — | | | | — | | | | 468.6 | |

Net loss (income) from discontinued operations | | | 22.7 | | | | 10.2 | | | | (9.7 | ) | | | 101.1 | | | | 270.2 | |

Net (loss) income attributable to noncontrolling interest | | | (21.2 | ) | | | 0.1 | | | | 3.6 | | | | 19.2 | | | | (50.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 127.1 | | | $ | 234.9 | | | $ | 437.9 | | | $ | 347.0 | | | $ | 176.0 | |

| | | | | | | | | | | | | | | | | | | | |

The following table presents our Adjusted EBITDA per ton calculation for the nine months ended September 30, 2013 and 2014 and years ended December 31, 2011, 2012 and 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Nine months

ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

Adjusted EBITDA (millions) | | $ | 127.1 | | | $ | 234.9 | | | $ | 437.9 | | | $ | 347.0 | | | $ | 176.0 | |

Total tons sold (thousands) | | | 1,851 | | | | 2,076 | | | | 2,500 | | | | 2,503 | | | | 2,518 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA dollars per ton | | $ | 69 | | | $ | 113 | | | $ | 175 | | | $ | 139 | | | $ | 70 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted operating income (loss)

We use Adjusted operating income (loss) at a segment level to evaluate the operating performance of our segments and to enhance segment comparability between periods. This measure is not required by, nor is it presented in accordance with GAAP. Adjusted operating income (loss) is not a measurement of financial performance under GAAP and should not be considered as an alternative to net income, operating income or any

15

other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of liquidity.

We present Adjusted operating income (loss) because we consider it an important supplemental measure of our performance. We define Adjusted operating income (loss) as operating income (loss) plus depreciation and amortization, impairment of assets and loss (gain) on disposal of assets. You should not infer from our presentation of Adjusted operating income (loss) that our future results will be unaffected by unusual or nonrecurring items. We use Adjusted operating income (loss) at segment level instead of Adjusted EBITDA used at a consolidated level as certain items used to calculated our Adjusted EBITDA are not allocated to our segments.

Adjusted operating income (loss) has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our operating results or cash flows as reported under GAAP. Some of these limitations are:

| | • | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted operating income (loss) does not reflect any cash requirements for such replacements; |

| | • | | Adjusted operating income (loss) is not adjusted for all non-cash income or expense items that are reflected in our statements of operations; and |

| | • | | other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. |

Because of these limitations, Adjusted operating income (loss) should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and secondarily using Adjusted operating income (loss).

The following table reconciles our operating income (loss) to Adjusted operating income for our Long Division for the nine months ended September 30, 2013 and 2014 and the years ended December 31, 2011, 2012, and 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Nine months ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

| | | ($ in millions) | |

Operating income (loss) | | $ | 48.2 | | | $ | 69.8 | | | $ | 128.6 | | | $ | 119.4 | | | $ | (12.1 | ) |

Plus: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization expense | | | 30.3 | | | | 31.9 | | | | 46.3 | | | | 41.8 | | | | 42.1 | |

Impairment of assets | | | — | | | | — | | | | — | | | | — | | | | 77.5 | |

Loss (gain) on disposal of assets | | | 0.3 | | | | 0.4 | | | | (0.2 | ) | | | 0.4 | | | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted operating income | | $ | 78.8 | | | $ | 102.1 | | | $ | 174.7 | | | $ | 161.6 | | | $ | 108.5 | |

| | | | | | | | | | | | | | | | | | | | |

16

The following table reconciles our operating income (loss) to Adjusted operating income for our Tubular Division for the nine months ended September 30, 2013 and 2014 and for the years ended December 31, 2011, 2012 and 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Nine months ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

| | | ($ in millions) | |

Operating (loss) income | | $ | (50.2 | ) | | $ | 5.5 | | | $ | 83.9 | | | $ | 53.5 | | | $ | (105.0 | ) |

Plus: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization expense | | | 66.8 | | | | 62.6 | | | | 99.5 | | | | 90.7 | | | | 88.3 | |

Impairment of assets | | | — | | | | — | | | | — | | | | — | | | | 55.0 | |

Loss (gain) on disposal of assets | | | 0.4 | | | | 0.1 | | | | (0.2 | ) | | | 0.4 | | | | 0.6 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted operating income | | $ | 17.0 | | | $ | 68.2 | | | $ | 183.2 | | | $ | 144.6 | | | $ | 38.9 | |

| | | | | | | | | | | | | | | | | | | | |

The following table reconciles our operating income (loss) to Adjusted operating income for our Flat Division for the nine months ended September 30, 2013 and 2014 and for the years ended December 31, 2011, 2012 and 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Nine months ended

September 30, | | | Year ended

December 31, | |

| | | 2013 | | | 2014 | | | 2011 | | | 2012 | | | 2013 | |

| | | ($ in millions) | |