- EVFM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Evofem Biosciences (EVFM) PRE 14APreliminary proxy

Filed: 23 Sep 24, 4:48pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

EVOFEM BIOSCIENCES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. |

| ☐ | Fee previously paid with preliminary materials. |

| ☒ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1 |

Letter to Our Stockholders

To My Fellow Stockholders:

You are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting” or “Meeting”) of Evofem Biosciences, Inc. (“Evofem”, the “Company”, “we” or “our”) which will be held at 9:00 a.m. Pacific Time on [date], 2024 at the offices of our outside counsel, Procopio, Cory, Hargreaves & Savitch LLP, at 12544 High Bluff Drive, Suite 400, San Diego, California 92130.

We intend to first mail the Notice and make this Proxy Statement and the form of proxy available to stockholders on or about [date], 2024.

The purpose of the Meeting is as follows:

| ● | To consider and vote upon a proposal to approve the transactions contemplated under the Amended and Restated Merger Agreement dated as of July 12, 2024 (the “Merger Agreement”), with Aditxt, Inc., a Delaware corporation (“Aditxt”) and Adifem, Inc., a Delaware corporation and a wholly-owned Subsidiary of Aditxt (“Merger Sub”), pursuant to which, and on the terms and subject to the conditions thereof, the Merger Sub will merge with and into the Company, with the Company surviving as a wholly owned subsidiary of Aditxt (the “Merger”). A copy of the Merger Agreement is attached to this proxy as Annex A. This Proposal is referred to as the “Merger Proposal” or “Proposal No. 1”; and | |

| ● | To consider and vote upon a proposal to approve the adjournment of the Meeting by the chair of Evofem’s Board of Directors to a later date, if necessary, under certain circumstances, including for the purpose of soliciting additional proxies in favor of the foregoing Proposal, in the event the Company does not receive the requisite stockholder vote to approve the Proposal. This Proposal is called the “Adjournment Proposal” or “Proposal No. 2.” |

The close of business on October 3, 2024 has been fixed as the Record Date for determining stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponement thereof. For at least ten days prior to the Meeting, a complete list of stockholders entitled to vote at the Meeting will be open to any stockholder’s examination during ordinary business hours at the offices of our outside counsel, Procopio, Cory, Hargreaves & Savitch LLP, at 12544 High Bluff Drive, Suite 400, San Diego, California 92130.

As discussed in detail in this proxy statement, our Board of Directors strongly recommends you vote “FOR” each of the proposals.

You are strongly encouraged to carefully review the proxy statement. Whether or not you plan to attend the Special Meeting in person, we urge you to vote as soon as possible by authorizing a proxy as described in the enclosed materials to ensure that your shares are represented. You may vote online, by phone or by mail by following the instructions on the proxy card or voting instruction form sent to you. If you attend the Special Meeting and wish to change your proxy vote, you may do so by voting in person at the Special Meeting.

Today we are asking for your support to further our mission of delivering innovation in women’s healthcare and improving choices for women everywhere, with access to greater resources that can accelerate our growth trajectory as a subsidiary of Aditxt. To do this, we need your vote at our upcoming Special Meeting of Stockholders. Please vote promptly online, by phone or by mail following the instructions on the proxy card or voting instruction form sent to you.

Thank you,

Saundra Pelletier

President and Chief Executive Officer

[Date], 2024

| www.evofem.com | 2 |

Notice of Special Meeting of Stockholders

| Date and Time [date], 2024 9:00 a.m. Pacific Time |  | Location 12544 High Bluff Drive, Suite 400 San Diego, CA 92130 |  | Who Can Vote Record owners of Evofem Biosciences, Inc. common stock and our Series E-1 Convertible Preferred Stock at the close of business on October 3, 2024 |

| Voting Item | ||||||

| Proposal | Board Vote Recommendation | For Further Details | ||||

| 1. To consider and vote upon a proposal to approve the transactions contemplated under the Amended and Restated Merger Agreement dated as of July 12, 2024 (the “Merger Agreement”), with Aditxt, Inc., a Delaware corporation (“Aditxt”) and Adifem, Inc., a Delaware corporation and a wholly-owned Subsidiary of Aditxt (“Merger Sub”), pursuant to which the Merger Sub will merge with and into the Company, with the Company surviving as a wholly- owned subsidiary of Aditxt (the “Merger”), subject to the right of the Board to abandon the Merger if the board determines it to be in the best interests of the shareholders | “FOR” | Page 37 | ||||

| 2. To consider and vote upon a proposal to authorize our Board, in its discretion, to adjourn the Meeting to another place or later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the proposal listed above at the time of the Meeting. | “FOR” | Page 45 |

All stockholders are cordially invited to attend the Meeting.

Whether you plan to attend the Special Meeting or not, we urge you to read the proxy statement and to vote as quickly as possible to ensure your vote is recorded.

| 3 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Notice of 2024 Special Meeting of Stockholders

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Evofem Biosciences, Inc., a Delaware corporation (the “Company,” “Evofem,” “we” or “us”), for use at the special meeting of stockholders (the “Meeting”) of the Company, to be held on [date], at 9:00 a.m. Pacific Time. For further information about the Meeting, please see the important Information About the Meeting section of this Proxy Statement. This Proxy Statement and the enclosed proxy card will be made available to our stockholders on or about [date], 2024.

Holders of Evofem common stock and Series E-1 convertible Preferred Stock will be asked to approve the Amended and Restated Merger Agreement dated as of July 12, 2024, as amended (the “Merger Agreement”), by and among Aditxt, Inc. a Delaware corporation (“Aditxt”), Adifem, Inc., a Delaware corporation, and a wholly-owned Subsidiary of Aditxt (“Merger Sub”), pursuant to which the Merger Sub, will merge with and into the Company, with the Company surviving as a wholly owned subsidiary of Aditxt (the “Merger”). Aditxt was founded with a mission of bringing stakeholders together, to transform promising innovations into products and services that could address some of the most challenging needs.

The transactions contemplated under the Merger Agreement relating to the Merger are referred to in this proxy statement as the “Merger” and the Company having merged with Merger Sub and surviving at Closing is referred to in this proxy statement as the “Surviving Company.”

Pursuant to the Merger Agreement, the following actions will be taken, and the following consideration will be paid, in connection with the Merger:

Treatment of Evofem Securities

Company Common Stock

At the time the Merger Agreement shall be deemed effective (the “Effective Time”), all shares of Company common stock issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares), shall automatically be converted into the rights to receive, on a pro rata basis, an aggregate amount (the “Common Merger Consideration”) equal to $1,800,000 less an amount equal to the product of (x) the number of Dissenting Shares represented by Company common stock and (y) the product of 1,800,000 divided by the number of shares of common stock issued and outstanding immediately prior to the Effective Time (the “Common Exchange Ratio”).

All such shares of Company common stock, when so converted, shall automatically be cancelled and cease to exist. Each holder of a share of Company common stock that was outstanding immediately prior to the Effective Time (other than Cancelled Shares and Dissenting Shares) shall cease to have any rights with respect thereto except the right to receive the Common Merger Consideration to be paid in consideration therefor upon the surrender of any Certificates or Book-Entry Shares, as applicable.

Company Preferred Stock

Each share of the Company’s Series E-1 Convertible Preferred Stock issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares) shall automatically be converted into the right to receive, from Aditxt, one share of Aditxt Preferred Stock having the rights, powers and preferences set forth in the form of Certificate of Designations attached to the Merger Agreement as Exhibit C.

Each share of Company common stock or Company preferred stock held by Parent or Merger Sub, or by any wholly-owned Subsidiary of Parent, Merger Sub or the Company immediately, prior to the Effective Time shall automatically be cancelled and retired and shall cease to exist as of the Effective Time, and no consideration shall be deliverable in exchange therefor.

Company Stock Options

At the Effective Time, all options to acquire Company common stock held immediately prior to the Effective Time, whether or not vested, will be automatically extinguished and canceled without the right to receive any consideration (with no payment being made hereunder with respect thereto).

Company Convertible Note Holders

Prior to Closing, the Company shall assist the Parent in obtaining the agreement (the “Exchange Agreements”) of the Company Convertible Noteholders to exchange such Company Convertible Notes and purchase rights they hold for an aggregate (for all Company Convertible Note Holders) of not more than 88,161 shares of Parent Preferred Stock on terms acceptable to Parent.

Company Warrants

The Company shall have received agreements from all of the holders of the Company’s warrants, other than the Other Company Warrants (all holders of Company Warrants, collectively, the “Warrant Holders”) duly executed agreements (“Warrant Holder Agreements”) to exchange such Company Warrants as they hold for an aggregate (for all Warrant Holders) of not more than 930.336 shares of Parent Preferred Stock on terms acceptable to Parent in its reasonable discretion. The Company shall have cashed out any Other Warrant Holder who has not provided a Warrant Holder Agreement; provided, however, that the aggregate amount of such cash out for any and all Other Warrant Holders who have not provided a Warrant Holder Agreement shall not exceed $150,000.

Merger Sub Securities

At the Effective Time, each issued and outstanding share of Merger Sub common stock shall be canceled and retired and shall cease to exist. Immediately following the Effective Time, the Surviving Company shall issue to Parent a number of shares of common stock, par value $0.001 per share, of the Surviving Company equal to the number of shares of Merger Sub common stock outstanding immediately prior to the Effective Time upon payment by Parent to the Surviving Company of an amount equal to the product of (x) the number of shares of the Surviving Company issued to Parent and (y) the par value of such shares.

| www.evofem.com | 4 |

Notice of 2024 Special Meeting of Stockholders

Immediately upon consummation of the Merger, the Surviving Company will be a wholly-owned Subsidiary of Aditxt.

Only stockholders of record at the close of business on October 3, 2024 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting. At the close of business on the Record Date, [share count] shares of Evofem’s common stock, par value $0.001 per share, were issued and outstanding. At the close of business on the Record Date, outstanding shares of Evofem’s common stock were held by approximately [number] stockholders of record. Shares cannot be voted at the Meeting unless the holder thereof is present or represented by proxy. The presence, virtually or by proxy, of the holders of one-third of the voting power of all issued and outstanding shares of common stock of Evofem as of the Record Date will constitute a quorum for the transaction of business at the Meeting and any adjournment or postponement thereof.

Our Board has selected Saundra Pelletier to serve as the holder of proxies for the Meeting. The shares of common stock represented by each executed and returned proxy will be voted by Ms. Pelletier in accordance with the directions indicated on the proxy. If you sign your proxy card without giving specific instructions, Ms. Pelletier will vote your shares “FOR” each of the Proposals. The proxy also confers discretionary authority to vote the shares authorized to be voted thereby on any matter that may be properly presented for action at the Meeting; we currently know of no other business to be presented.

Any proxy given may be revoked by the person giving it at any time before it is voted at the Meeting. If you have not voted through your broker, there are three ways for you to revoke your proxy and change your vote. First, you may send a written notice to the Company’s Secretary stating that you would like to revoke your proxy. Second, you may complete and submit a new proxy card, but it must bear a later date than your original proxy card. Third, you may vote in person at the Meeting. However, your attendance at the Meeting will not, by itself, revoke your proxy. If you have instructed a broker to vote your shares, you must follow the directions you receive from your broker to change your vote. Your last submitted proxy will be the proxy that is counted. Please note that dissenters’ rights are not available with respect to any of the proposals to be voted on at the Meeting.

We will provide copies of this Proxy Statement and accompanying materials to brokerage firms, fiduciaries, and custodians for forwarding to beneficial owners and will reimburse these persons for their costs of forwarding these materials. Our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal solicitation. We will not pay additional compensation for any of these services.

You may change or revoke your proxy at any time before it is voted at the meeting. If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Under Delaware law, stockholders who do not vote in favor of the adoption of the Merger Proposal will have the right to seek appraisal of the fair value of their shares of common stock or Series E-1 Convertible Preferred Stock as determined by the Delaware Court of Chancery if the Merger is completed, but only if such Company Stockholder submits a written demand for appraisal prior to the vote on the Merger Proposal and complies with the other Delaware law procedures for exercising statutory appraisal rights, which are summarized in the section titled “Dissenters Rights” in the accompanying Proxy Statement.

If you would like to request documents, please do so no later than [date] to receive them before the Meeting. Please be sure to include your complete name and address in your request. Please see “Where You Can Find Additional Information” to find out where you can find more information about Evofem and Aditxt.

If you have any questions or require any assistance with completing your proxy, please contact Evofem Biosciences’ investor relations by email at ir@evofem.com. A list of stockholders of record as of the Record Date will be available at the Special Meeting and during the 10 days prior to the Special Meeting at the offices of our outside counsel, Procopio, Cory, Hargreaves & Savitch LLP, at 12544 High Bluff Drive, Suite 400, San Diego, California 92130.

Whether you plan to attend the Special Meeting or not, it is important that you cast your vote either in person or by proxy.

BY ORDER OF THE BOARD OF DIRECTORS

Ivy Zhang

Secretary and Chief Financial Officer

[Date], 2024

| 5 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Table of Contents

| www.evofem.com | 6 |

Special Note About Forward-Looking Statements

This proxy statement and the documents incorporated by reference herein include statements regarding future plans, expectations, beliefs, intentions and prospects that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this proxy statement. The words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding our focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this proxy statement involves risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section titled “Risk Factors” of our Forms 10-K and 10-Q.

Examples of forward-looking statements include, among others, statements made in this proxy statement regarding the proposed transactions contemplated by the Merger Agreement, including the benefits of the Merger, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, other performance metrics, projections of market opportunity, expected management and governance of the Surviving Company, and expected timing of the Merger. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, these statements are based on various assumptions, whether or not identified in this proxy statement, and on the current expectations of Evofem’s and Aditxt’s respective management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company and/or Aditxt. Some important factors that could cause actual results to differ materially from those in any forward-looking statements could include changes in domestic and foreign business, market, financial, political and legal conditions.

Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the following: (1) the occurrence of any event, change or other circumstances that could give rise to an amendment or termination of the Merger Agreement and the proposed transaction contemplated thereby; (2) the inability to complete the transactions contemplated by the Merger Agreement due to the failure to obtain approval of Evofem’s stockholders, or to meet other conditions to closing the Merger Agreement; (3) costs related to the Merger and magnitude thereof; (4) the outcome of any legal proceedings that may be instituted against the parties to the Merger Agreement; (5) changes in applicable laws or regulations; (6) the ability of Aditxt to meet its post-closing financial and strategic goals due to competition, among other things; (7) the ability of the Surviving Company to grow and manage growth profitability and retain its key employees; (8) the possibility that the Surviving Company may be adversely affected by other economic, business and/or competitive factors; (9) risks relating to the successful retention of Evofem’s customers; and (10) other risks and uncertainties described herein. Evofem cautions that the foregoing list of factors is not exclusive. If any of these risks materialize or Evofem’s or Aditxt’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Evofem nor Aditxt presently know, or that Evofem and Aditxt currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Evofem’s and Aditxt’s current expectations, plans and forecasts of future events and views as of the date hereof. Nothing in this proxy statement and the attachments hereto should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. Investors and securityholders of Evofem should not place undue reliance on forward-looking statements in this proxy statement and the attachments hereto, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein and the risk factors of Evofem and Aditxt. Evofem and Aditxt anticipate that subsequent events and developments will cause their assessments to change undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this proxy statement, except as required by law.

| 7 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Where You Can Find Additional Information

This document constitutes a notice of meeting and a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to the Special Meeting, at which Evofem stockholders will be asked to consider and vote upon a proposal to approve Merger by the approval and adoption of the Merger Agreement, among other matters.

You should rely only on the information contained or incorporated by reference into this proxy statement. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this proxy statement. This proxy statement is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this proxy statement is accurate as of any date other than that date. You should not assume that the information incorporated by reference into this proxy statement is accurate as of any date other than the date of such incorporated document. Neither the mailing of this proxy statement to Evofem stockholders nor the issuance of Parent Preferred Stock in connection with the Merger will create any implication to the contrary.

Information contained in this proxy statement regarding Aditxt has been provided by Aditxt.

This proxy statement does not constitute an offer to sell or a solicitation of an offer to buy any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

Each of Aditxt and Evofem files reports, proxy statements/prospectuses and other information with the SEC as required by the Exchange Act. You can read both Aditxt’s and Evofem’s SEC filings, including this proxy statement, over the Internet at the SEC’s website at http://www.sec.gov.

If you would like additional copies of this proxy statement or if you have questions about the business combination or the proposals to be presented at the Special Meeting, you should contact us by telephone or in writing:

Evofem Biosciences, Inc.

7770 Regents Rd

Suite 113-618

San Diego, California 92122

Attention: Investor Relations

Tel: (858) 550-1900 x4

Email: ir@evofem.com

Certain information contained in this Proxy Statement relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Evofem’s and Aditxt’s own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this Proxy Statement, we have not independently verified the market and industry data contained in this Proxy Statement or the underlying assumptions relied on therein. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source.

This document contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this Proxy Statement may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| www.evofem.com | 8 |

Important Information

Important Information About the Special Meeting and Voting

The following are answers to some questions that you, as a stockholder of Evofem, may have regarding the Proposals being considered at the Special Meeting. We urge you to read carefully the remainder of this Proxy Statement because the information in this section does not provide all the information that might be important to you with respect to the Proposals and the other matters being considered at the Special Meeting. Additional important information is also contained in the annexes to and the documents incorporated by reference into this proxy statement. The “Company,” “Evofem” “we” or “us” as used herein all refer to Evofem Biosciences, Inc.

In this Proxy Statement, unless the context otherwise requires:

| ● | “Closing” means a date that is two Business Days following the satisfaction or waiver in accordance with the Merger Agreement of all conditions required to be satisfied or other date as Parent and Company may agree in writing. |

| ● | “Effective Time” means such date and time the Merger becomes effective. |

| ● | “Merger” means the business combination through a merger of Merger Sub with and into the Company, with the Company being the Surviving Company. |

| ● | “Merger Agreement” means the Amended and Restated Merger Agreement by and among the Company, Aditxt and Merger Sub, dated July 12, 2024, as amended. |

| ● | “Parent” means Aditxt, Inc. |

| ● | “Parent Preferred Stock” means the Aditxt preferred stock having the rights, powers and preferences set forth in the form Certificate of Designation attached to the Merger Agreement as Exhibit C. |

| ● | “Series E-1” means the Company’s Series E-1 Convertible Preferred Stock. |

| ● | “Surviving Company” means the Company, as the Surviving Company in the Merger. |

Other capitalized terms are as defined in the Merger Agreement.

Why is the Company Soliciting My Proxy?

The Board is soliciting your proxy to vote at the Special Meeting of Stockholders (the “Special Meeting”) of the Company to be held at the offices of our outside counsel, Procopio, Cory, Hargreaves & Savitch LLP, at 12544 High Bluff Drive, Suite 400, San Diego, California 92130 on [date], at 9:00 a.m. Pacific Time and any adjournments of the meeting, which we refer to as the Special Meeting. The proxy statement along with the accompanying Notice of Special Meeting of Stockholders (the “Notice”) summarizes the purposes of the meeting and the information you need to know to vote at the Special Meeting.

We have made available to you on the Internet or have sent you this Proxy Statement, the Notice and the proxy card because you owned shares of the Company’s common stock on the Record Date. The Company intends to commence distribution of the Proxy materials to stockholders on or about [date].

What is the Transaction?

The Company and Aditxt have entered into a definitive Merger Agreement, pursuant to and subject to the terms and conditions of which Aditxt will acquire the Company through the merger of a wholly-owned subsidiary of Aditxt with and into the Company. The Company will be the Surviving Company in the Merger and will become, as of Closing, a wholly-owned subsidiary of Aditxt.

What will an Evofem stockholder receive when the Merger occurs?

For every share of Company common stock held at the time of the Merger, Company common stockholders will be entitled to receive payment based on the total consideration for common shareholders of $1.8 million, less an amount equal to the product of (i) the number of Dissenting Shares represented by Evofem common stock and (ii) the Common Exchange Ratio (as defined I the A&R Merger Agreement, divided by the number of shares outstanding immediately prior to the closing of the Merger. This does not apply to shares held by Company stockholders, if any, who have perfected their appraisal rights under Delaware law. Additionally, each share of the Series E-1 issued and outstanding as of the Effective Time shall automatically be converted into the right to receive, from Aditxt, one share of Parent Preferred Stock.

What will happen in the Merger to Evofem’s current stock options?

Upon the Effective Time, options to acquire Company common stock immediately prior to the Effective Time, whether or not vested, will be automatically extinguished and canceled without the right to receive any consideration (with no payment being made hereunder with respect thereto).

When do you expect the Merger to be completed?

We expect the Merger to be completed in the second half of 2024. However, the Merger is subject to various closing conditions, including Evofem stockholder approval and regulatory approvals, and it is possible that the failure to timely meet these closing conditions or other factors outside of our control could require us to complete the Merger at a later time or not at all.

Who Can Vote?

Only stockholders who owned our common stock, and/or our Series E-1 at the close of business on October 3, 2024 are entitled to vote at the Special Meeting. On this Record Date, there were (1) [share count] shares of our common stock outstanding and entitled to vote and (2) [share count] shares of our Series E-1 entitled to vote.

You do not need to attend the Special Meeting to vote your shares. Shares represented by valid proxies, received in time for the Special Meeting and not revoked prior to the Special Meeting, will be voted at the Special Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote on Proposal 1: the Merger Agreement and Proposal 2: Adjournment.

Each one share of Series E-1 has voting rights equal to the number of shares of common stock into which the Series E-1 were convertible, subject to customary 4.99% or 9.99% beneficial ownership limitations, as of the Record Date on Proposal 1: the Merger Agreement and Proposal 2: Adjournment.

How Do I Vote?

Whether you plan to attend the Special Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed online or by phone. You may specify whether your shares should be voted for, against or abstain with respect to the proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Special Meeting. If your shares are registered directly in your name through our stock transfer agent, Pacific Stock Transfer, Inc., or you have stock certificates registered in your name, you may vote:

| ● | Online (www.proxyvote.com). Use the Internet to transmit your voting instructions and for electronic delivery of information. Have your proxy card and 12-digit control number(s) in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| ● | By phone (1-800-690-6903). Use any touch-tone phone to transmit your voting instructions. Have your proxy card and 12-digit control number(s) in hand when you call and then follow the instructions. |

| ● | By mail. If you received a proxy card by mail, you may vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. |

| ● | In person at the meeting. If you attend the meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting. |

Telephone and online voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on [date].

| 9 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Important Information

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted.

Telephone and online voting will also be offered to stockholders owning shares through certain banks and brokers.

If your shares are not registered in your own name and you plan to vote your shares in person at the Special Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it to the Special Meeting in order to vote.

How Does the Board Recommend That I Vote on the Proposals?

The Board recommends that you vote as follows:

| ● | “FOR” the Merger Agreement in order to approve the closing of the Merger with Aditxt. |

| ● | “FOR” the authorization of the Board to Adjourn the Special Meeting, in their discretion, to solicit additional proxies. |

If any other matter is presented at the Special Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on or that would be brought before the Special Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Special Meeting. You may change or revoke your proxy in any one of the following ways:

| ● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| ● | by re-voting online or by telephone as instructed above; |

| ● | by notifying the Company’s Secretary in writing before the Special Meeting that you have revoked your proxy; or |

| ● | by attending the Special Meeting in person and voting in person. Attending the Special Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Special Meeting that it be revoked. |

Your most current vote, whether submitted by phone, online or proxy card, is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock and/or our Series E-1 in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?”

If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares does not have the authority to vote your unvoted shares on the proposal set forth in this proxy statement without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Special Meeting. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you.

| www.evofem.com | 10 |

Important Information

What Vote is Required to Approve the Proposals and How are Votes Counted?

| Proposal 1: Merger Agreement | The affirmative vote of a majority of the combined voting power of the outstanding shares of common stock and Series E-1, voting together as a single class as of the Record Date, at a meeting at which a quorum is present, is required to approve the Merger Agreement. Abstentions and broker non-votes will be counted as entitled to vote and will, therefore, have the same effect as a vote “against” this proposal. | |

| Proposal 2: Adjournment | The affirmative vote of a majority of the votes cast, either affirmatively or negatively, at a meeting at which a quorum is present, is required to approve this Adjournment proposal. Abstentions will have no effect on the results of this vote. | |

Where Can I Find the Voting Results of the Special Meeting?

The preliminary voting results will be announced at the Special Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Special Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

We have engaged Campaign Management to act as our proxy solicitor in connection with the proposals to be acted upon at our annual meeting. For those services we will pay Campaign Management approximately $10,500 plus expenses.

What Constitutes a Quorum for the Special Meeting?

The presence, in person or by proxy, of the holders of one-third of the voting power of all outstanding shares of our common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Votes of stockholders of record who are present at the Special Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

In accordance with our amended and restated bylaws, the chairperson of the Special Meeting or a majority of the shares so represented may adjourn the Special Meeting from time to time, whether or not there is such a quorum.

Attending the Special Meeting

The Special Meeting will be held at 9:00 a.m., Pacific Time, on [date], at the offices of our outside counsel, Procopio, Cory, Hargreaves & Savitch LLP, at 12544 High Bluff Drive, Suite 400, San Diego, California 92130. You do not need to attend the Special Meeting in order to vote.

As always, we encourage you to vote your shares as early as possible prior to the Special Meeting.

Am I Entitled to Appraisal Rights in Connection with the Merger?

Stockholders are entitled to appraisal rights under Section 262 of the General Corporation Law of the State of Delaware, which we refer to as Delaware law, provided they satisfy the special criteria and conditions set forth in Section 262 of Delaware law. For more information regarding appraisal rights, see “Appraisal Rights” on page 19. In addition, a copy of Section 262 of Delaware law is attached as Annex E to this proxy statement.

What Are the Material Federal Income Tax Consequences of the Merger to Me?

The exchange of shares of common stock for cash pursuant to the Merger will be treated as a taxable sale of such shares. Furthermore, the exchange of each share of Company Series E-1 for one share of Aditxt Preferred Stock will be treated as a taxable sale of such shares. A stockholder will generally recognize capital gain or loss on the sale of shares of common stock or Company Series E-1 pursuant to the Merger equal to the difference between (a) the sum of cash and the fair market value of other consideration received; and (b) the holder’s adjusted tax basis in common stock or Company Series E-1 sold pursuant to the Merger. If (a) is greater than (b) with respect to a stockholder, such stockholder will recognize a capital gain, and if (b) is greater than (a), such stockholder will recognize a capital loss. Stockholders should consult their tax advisors to determine the particular tax consequences to them (including the application and effect of any state, local or foreign income and other tax laws) of the merger.

Should I Send in my Stock Certificates Now?

No. After the Merger is completed, you will be sent a letter of transmittal with detailed written instructions for exchanging your shares of Company common stock or Series E-1 for the Merger consideration. If your shares are held in “street name” by your brokerage firm, bank, trust or other nominee, you will receive instructions from your brokerage firm, bank, trust or other nominee as to how to effect the surrender of your “street name” shares in exchange for the merger consideration. PLEASE DO NOT SEND IN YOUR CERTIFICATES NOW.

What Happens if I Sell my Shares of Company Common Stock Before the Special Meeting?

The Record Date for stockholders entitled to vote at the Special Meeting is earlier than the date of the Special Meeting and the expected closing date of the Merger. If you transfer your shares of Company common stock after the Record Date but before the Special Meeting, you will, unless special arrangements are made, retain your right to vote at the Special Meeting but will transfer the right to receive the Merger consideration to the person to whom you transfer your shares. In addition, if you sell your shares prior to the Special Meeting or prior to the Effective Time of the Merger, you will not be eligible to exercise your appraisal rights in respect of the Merger. For a more detailed discussion of your appraisal rights and the requirements for perfecting your appraisal rights, see “Appraisal Rights” in this document and Annex E.

Householding of Annual Disclosure Documents

U.S. Securities and Exchange Commission (SEC) rules concerning the delivery of proxy statements allow us or your broker to send a single set of proxy materials or, if applicable, a single set of proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single set of proxy materials, but you would prefer to receive your own copy, please contact our transfer agent, Pacific Stock Transfer, Inc., by calling their toll-free number, 1-800-785-7782.

If you do not wish to participate in householding and would like to receive your own Notice or, if applicable, set of the Company’s proxy materials in future years, please follow the instructions described below. Conversely, if you share an address with another Company stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

| ● | If your Company shares are registered in your own name, please contact our transfer agent, Pacific Stock Transfer, Inc., and inform them of your request by calling them at 1-800-785-7782, emailing them at info@pacificstocktransfer.com, or writing them at Pacific Stock Transfer, Inc., 6725 Via Austi Pkwy Suite 300, Las Vegas, NV 89119. |

| ● | If a broker or other nominee holds your Company shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

Stockholder Proposals for the Special Meeting

Stockholders of the Company may submit proposals that they believe should be voted upon at the Special Meeting.

Pursuant to Rule 14a-8 under the Exchange Act, stockholder proposals meeting certain requirements may be eligible for inclusion in the Company’s proxy statement for the Company’s Special Meeting. To be eligible for inclusion in the Company’s proxy statement, any such stockholder proposals must be submitted in writing to the Secretary the Company no later than [date] in addition to complying with certain rules and regulations promulgated by the SEC. The submission of a stockholder proposal does not guarantee that it will be included in the Company’s proxy statement.

Notices of any proposals or nominations for the Company’s Special Meeting should be sent to the Secretary of the Company at 7770 Regents Rd, Suite 113-618, San Diego, CA, 92122.

Who do I Contact if I have Questions?

If you have any questions or need assistance completing your proxy or voting instruction form, please call our proxy solicitor, Campaign Management, at (855) 246-4705 (toll-free within North America) or (212) 632-8422 (call collect outside of North America), or email info@campaign-mgmt.com. If your brokerage firm, bank, trust or other nominee holds your shares in “street name,” you should also call your brokerage firm, bank, trust or other nominee for additional information.

| 11 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Summary of the Proxy Statement

Summary of the Proxy Statement

This summary highlights selected information from this proxy statement but may not contain all of the information that may be important to you. Accordingly, Evofem encourages you to read carefully this entire proxy statement, including the Merger Agreement attached as Appendices A-D. Please read these documents carefully as they are the legal documents that govern the Merger and your rights in the Merger.

The Parties to the Merger

Aditxt, Inc.

Aditxt, Inc (“Aditxt”) was incorporated in the State of Delaware on September 28, 2017, and their headquarters are in Richmond, Virginia. The company was founded with a mission of bringing stakeholders together, to transform promising innovations into products and services that could address some of the most challenging needs. The socialization of innovation through engaging stakeholders in every aspect of it is key to transforming more innovations, more rapidly, and more efficiently. At inception, the first innovation Aditxt took on was an immune modulation technology titled ADI/Adimune with a focus on prolonging life and enhancing life quality of people who have undergone organ transplants. Since then, Aditxt expanded its portfolio of innovations, and continues to evaluate a variety of promising health innovations.

Aditxt is not about a single idea or a single molecule. It is about making sure the right innovation is made possible. Aditxt’s business model has three main components:

| (1) | Securing an Innovation: The process begins with identifying and securing innovations through licensing or acquisition of an innovation asset. Assets come from a variety of sources including research institutions, government agencies, and private organizations. |

| (2) | Growing an Innovation: Once an innovation is secured, Aditxt surrounds it with activation resources that take a systemized approach to bringing that idea to life. Activation resources include innovation, operations, commercialization, finance, content and engagement, personnel, and administration. |

| (3) | Monetizing an Innovation: The goal is for each innovation to become commercial-stage and financially and operationally self-sustainable, to create shareholder value. |

Aditxt engages various stakeholders for each program on every level. This includes identifying researchers and research institution partners, such as Stanford University; leading health institutions to get critical trials underway, such as Mayo Clinic; manufacturing partners who enable Aditxt to take innovations from preclinical to clinical; municipalities and governments, such as the city of Richmond and the state of Virginia and public health agencies who work with Aditxt to launch our program, Pearsanta’s laboratory; and thousands of shareholders around the globe. Aditxt seeks to enable promising innovation to become purposeful products that have the power to change lives.

Aditxt’s shares of common stock are currently listed and traded on Nasdaq under the symbol “ADTX.” As Aditxt has disclosed in their applicable filings, even though they are currently in compliance with Nasdaq continued listing requirements, they remain subject to a panel monitor of their ongoing compliance until December 29, 2024 and if they fail to comply with such requirements during the panel monitor, it could result in the delisting of the ADTX securities by Nasdaq.

| www.evofem.com | 12 |

Summary of the Proxy Statement

Merger Sub

Merger Sub Inc. is a Delaware corporation that will be formed for the sole purpose of entering into the Merger Agreement and completing the Transactions. Merger Sub Inc. is a wholly owned subsidiary of Parent and has not engaged in any business except for activities incidental to its formation and as contemplated by the Merger Agreement. Upon completion of the Merger, Merger Sub Inc. will cease to exist and the Company will continue as the corporation surviving the Merger (the “Surviving Company”).

Evofem Biosciences, Inc.

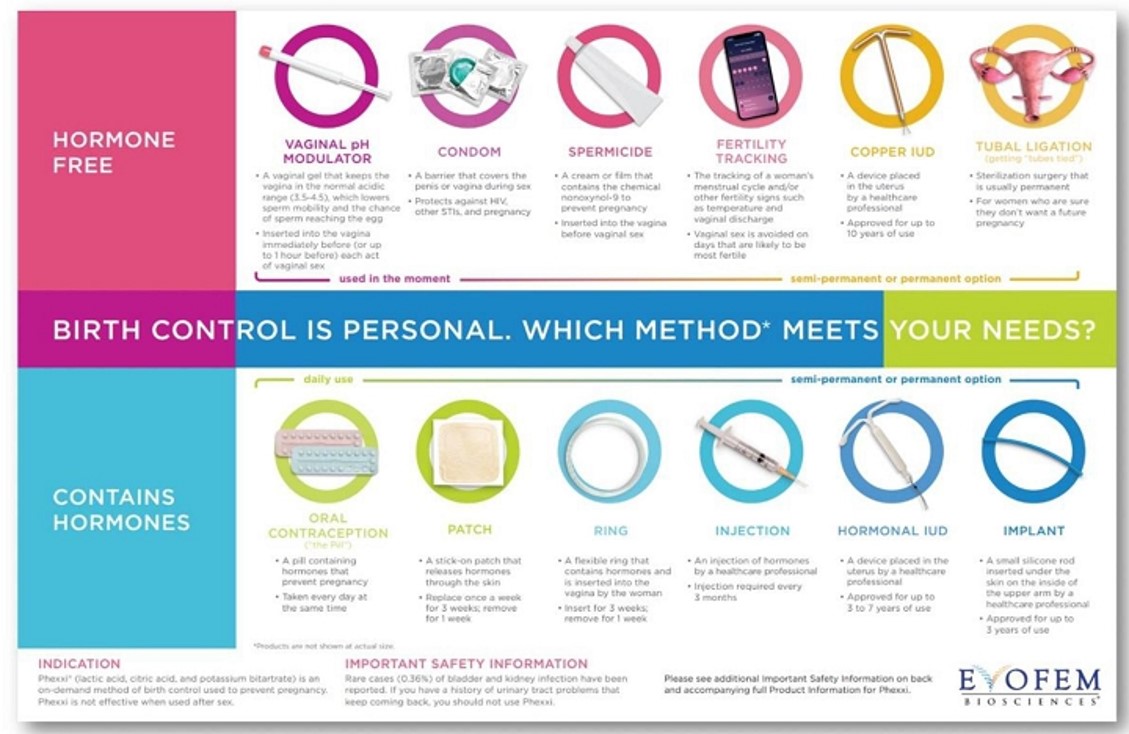

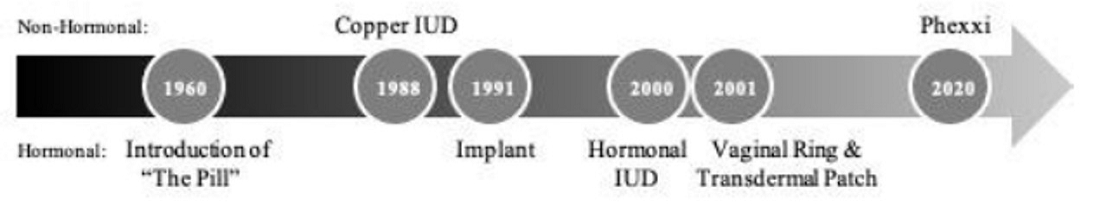

Evofem Biosciences, Inc. (the “Company”) is a San Diego-based, commercial-stage biopharmaceutical company committed to commercializing innovative products to address unmet needs in women’s sexual and reproductive health. The Company’s first commercial product, Phexxi® (lactic acid, citric acid, and potassium bitartrate) vaginal gel (Phexxi), was approved by the U.S. Food and Drug Administration (FDA) on May 22, 2020, and is the first and only FDA-approved, hormone-free, woman-controlled, on-demand prescription contraceptive gel for women. The Company commercially launched Phexxi in September 2020.

On July 14, 2024, the Company acquired global rights from Lupin Inc. (“Lupin”) to SOLOSEC® (secnidazole) 2g granules, which is approved by the FDA to treat two common sexual health infections: bacterial vaginosis and trichomoniasis. The Company also assumed all of Lupin’s rights, title and obligations under that certain Omnibus Acquisition Agreement, dated May 1, 2017 by and among Lupin, Saker Merger Sub LLC, a Delaware limited liability company, Symbiomix Therapeutics, LLC, a Delaware limited liability company, and Shareholder Representative Services LLC, a Colorado limited liability company (the “OAA”). Evofem re-launched SOLOSEC in September 2024 in the U.S. leveraging its commercial sales organization.

The current (pre-Merger) subsidiary and ownership structure of Evofem is as follows:

Merger Agreement

On July 14, 2024 the Company entered into an Amended and Restated Agreement and Plan of Merger (the “A&R Merger Agreement”) with Aditxt, Inc., a Delaware corporation (“Aditxt”), and Adifem, Inc., a Delaware corporation and wholly-owned Subsidiary of Aditxt (Merger Sub), pursuant to which, and on the terms and subject to the conditions thereof, Merger Sub will merge with and into the Company, with the Company surviving as a wholly owned subsidiary of Aditxt (the Merger). The Merger is currently expected to be closed in late 2024.

| 13 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Summary of the Proxy Statement

As consideration for the Merger, the Parent will pay, ratably, to holders of Evofem common stock an amount equal to one million eight hundred thousand dollars ($1,800,000) less an amount equal to the product of (x) the number of Dissenting Shares represented by Company common stock and (y) the Common Exchange Ratio (as defined in the A&R Merger Agreement) (the “Common Consideration”).

Additionally, each share of the Company’s Series E-1, issued and outstanding as of the Effective Time (as defined in the A&R Merger Agreement) shall automatically be converted into the right to receive from Aditxt one (1) share Parent Preferred Stock (the “Preferred Merger Consideration” and together with the Common Consideration the “Merger Consideration”).

At the Effective Time of the Merger:

| (i) | the Company Convertible Note Holders will enter into an Exchange Agreement, pursuant to which these Note Holders will exchange the value of their then-outstanding Company Convertible Notes and purchase rights for an aggregate of not more than 88,161 shares of Parent Preferred Stock.; |

| (ii) | each stock option of the Company (“Options”) that was outstanding and unexercised immediately prior to the Effective Time will be cancelled without the right to receive any consideration. |

| (iii) | all shares of Company common stock or Company Preferred Stock held by Parent or Merger Sub, or by any wholly-owned Subsidiary thereof, shall be automatically cancelled and retired and shall cease to exist and no consideration shall be delivered or deliverable in exchange therefor; |

Further, Aditxt agreed to, on or prior to:

| a) | July 12, 2024, purchase 500 shares of the Company’s Series F-1 Preferred Stock, par value $0.0001 per share (the “F-1 Preferred Stock”) for an aggregate purchase price of $500,000 (the “Initial Parent Equity Investment”); | |

| b) | August 9, 2024, purchase an additional 500 shares of F-1 Preferred Stock for an aggregate purchase price of $500,000 (the “Second Parent Equity Investment”); | |

| c) | the earlier of August 30, 2024 or five business days of the closing of a public offering by Aditxt resulting in aggregate net proceeds to Aditxt of no less than $20,000,000, purchase an additional 2,000 shares of F-1 Preferred Stock for an aggregate purchase price of $2,000,000 (the “Third Parent Equity Investment”); and | |

| d) | September 30, 2024, purchase an additional 1,000 shares of F-1 Preferred Stock at an aggregate purchase price of $1,000,000 (the “Fourth Parent Equity Investment”). |

On August 16, 2024, the Company, Aditxt and Merger Sub entered into the first amendment to the A&R Merger Agreement (the “First Amendment”), to amend the funding date for the Third Parent Equity Investment from August 30, 2024 to the earlier of (i) September 6, 2024 or (ii) five (5) business days of the closing of a public offering by Parent resulting in aggregate net proceeds to Parent of no less than $20,000,000.

On September 6, 2024, the Company, Aditxt and Merger Sub entered into the second amendment to the A&R Merger Agreement (the “Second Amendment”), to (i) change the date of the Third Parent Equity Investment Date and Fourth Parent Equity Investment Date (as defined in the A&R Merger Agreement) from September 6, 2024 and September 30, 2024 to September 30, 2024 and October 31, 2024, respectively and (ii) to change the required consummation date to November 29, 2024.

The consummation of the Merger is conditioned upon, among other things: (i) approval by the Company’s Shareholders in accordance with applicable Law; (ii) no governmental entity having jurisdiction over any party shall have issue any order, decree, ruling injunction or other action that is in effect restraining the Merger; (iii) a voting agreement shall have been executed and delivered by the parties thereto; (iv) all Company preferred stock shall have been converted to Company common stock except for the Unconverted Company Preferred Stock (as defined by the A&R Merger Agreement); (v) the Company shall have received agreements from all of the holders of the Company’s warrants, duly executed, containing waivers with respect to any fundamental transaction, change in control or other similar rights that such warrant holders may have under any such Company warrants and exchange such Company warrants as they hold for an aggregate of not more than 930.336 shares of Parent Preferred Stock (as defined in the A&R Merger Agreement); (vi) the Company shall have cashed out any other warrant holder who has not provided a warrant holder agreement, provided, however, that the aggregate amount of such cash out for any and all other warrant holders who have not provided a warrant holder agreement shall not exceed $150,000; (vii) the Company shall have obtained waivers from holders of Company convertible notes of the original principal amount thereof with respect to any fundamental transaction rights such Company convertible note holders may have under any such Company convertible notes, including any right to vote, consent or otherwise approve or veto any of the transaction contemplated by this A&R Merger Agreement; (viii) Aditxt shall have received sufficient financing to satisfy its payment obligations under the A&R Merger Agreement (ix) the requisite stockholder approval shall have been obtained by Aditxt at a special meeting of its stockholders to approve the Parent Stock Issuance (as defined in the A&R Merger Agreement) (x) Aditxt shall have received a compliance certificate from the Company certifying Company complied with all reps and warranties in the A&R Merger Agreement; (xi) Aditxt shall have received waivers from the parties to the agreements listed in Section 7.2(f) of the A&R Merger Agreement Parent Disclosure Letter of the issuance of securities in a “Variable Rate Transaction” (as such term in defined in such agreements); (xii) Parent shall have received a certificate certifying that no interest in the Company is a U.S. real property interest, as required under U.S. treasury regulation section 1.897-2(h) and 1.1445-3(c); (xiii) Aditxt shall have paid, in full, the Repurchase Price, as defined in that certain Securities Purchase and Security Agreement, dated as of April 23, 2020, as amended by that First Amendment to the Securities Purchase and Security Agreement, dated as of November 20, 2021, that Second Amendment to the Securities Purchase and Security Agreement, dated as of March 21, 2022, that Third Amendment to Securities Purchase and Security Agreement dated as of September 15, 2022, and that Fourth Amendment to Securities Purchase and Security Agreement, dated as of September 8, 2023, by and among the Company, Baker Brothers Life Sciences, L.P., 667, L.P. and Bakers Bros. Advisors LP, as assigned to Future Pak, LLC (xv) there shall be no more than 4,141,434 dissenting shares that are Company common stock or 98 dissenting shares that are Company Series E-1 (xiv) Company shall have received from Aditxt a compliance certificate certifying that Parent has complied with all representations and warranties, (xv) that Aditxt shall be incompliance with stockholders’ equity requirements in Nasdaq listing rule 5550(b)(1).

| www.evofem.com | 14 |

Summary of the Proxy Statement

In connection with the Merger Agreement, Aditxt, the Company and the holders (the “Holders”) of certain senior indebtedness of Evofem (the “Notes”) entered into an Assignment Agreement dated December 11, 2023 (the “December Assignment Agreement”), pursuant to which the Holders assigned the Notes to Aditxt in consideration for the issuance by Aditxt of (i) an aggregate principal amount of $5,000,000 in secured notes of Aditxt due on January 2, 2024 (the “January 2024 Secured Notes”), (ii) an aggregate principal amount of $8,000,000 in secured notes of Aditxt due on September 30, 2024 (the “September 2024 Secured Notes”), and (iii) an aggregate principal amount of $5,000,000 in ten-year unsecured notes (the “Unsecured Notes”).

On February 26, 2024, Aditxt and the Holders entered into an Assignment Agreement (the “February Assignment Agreement”), pursuant to which the Company consented to the assignment of all remaining amounts due under the Notes from Aditxt back to the Holders.

| 15 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Summary of the Proxy Statement

The Merger is currently expected to be consummated in late 2024 after obtaining the required approval by the stockholders of Evofem and the satisfaction of certain other customary closing conditions.

Post-closing entity structure

Merger Consideration

At the Effective Time, all shares of Company common stock issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares), shall automatically be converted into the rights to receive, on a pro rata basis, an aggregate amount (the “Common Merger Consideration”) equal to $1,800,000 less an amount equal to the product of (x) the number of Dissenting Shares represented by Company common stock and (y) the product of 1,800,000 divided by the number of issued and outstanding common stock issued and outstanding immediately prior to the Effective Time (the “Common Exchange Ratio”).

Each Share of the Company’s Series E-1 issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares) shall automatically be converted into the right to receive, from Aditxt, one share of Aditxt Preferred Stock having the rights, powers and preferences set forth in the form Certificate of Designations attached to the Merger Agreement as Exhibit C.

All shares of Company common stock or Company Preferred Stock held by Aditxt or Merger Sub and any wholly-owned subsidiary of Aditxt or Merger Sub shall be automatically cancelled and retired and shall cease to exist.

Treatment of Securities

Company Common Shares

At the Effective Time, all shares of Company common stock issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares), shall automatically be converted into the rights to receive, on a pro rata basis, an aggregate amount (the “Common Merger Consideration”) equal to $1,800,000 less an amount equal to the product of (x) the number of Dissenting Shares represented by Company common stock and (y) the product of 1,800,000 divided by the number of issued and outstanding common stock issued and outstanding immediately prior to the Effective Time (the “Common Exchange Ratio”).

All such shares of Company common stock, when so converted, shall automatically be cancelled and cease to exist. Each holder of a share of Company common stock that was outstanding immediately prior to the Effective Time (other than Cancelled Shares and Dissenting Shares) shall cease to have any rights with respect thereto, except the right to receive the Common Merger Consideration to be paid in consideration therefor upon the surrender of any Certificates or Book-Entry Shares, as applicable.

Company Preferred Stock

Each share of the Company’s Series E-1 issued and outstanding immediately prior to the Effective Time (excluding Cancelled Shares and Dissenting Shares) shall automatically be converted into the right to receive, from Aditxt, one share of Aditxt Preferred Stock having the rights, powers and preferences set forth in the form Certificate of Designations attached to the Merger Agreement as Exhibit C.

Each share of Company common stock or Company Preferred Stock held by Parent or Merger Sub, or by any wholly-owned subsidiary of Parent, Merger Sub or the Company, immediately prior to the Effective Time shall automatically be cancelled and retired and shall cease to exist as of the Effective Time and no consideration shall be deliverable in exchange therefor.

Company Stock Options

Upon the Effective Time, options to acquire Company common stock immediately prior to the Effective Time, whether or not vested, will be automatically extinguished and cancelled without the right to receive any consideration (with no payment being made hereunder with respect thereto).

Company Convertible Note Holders

Prior to Closing, the Company shall assist Parent in obtaining the agreement (the “Exchange Agreements”) of the Company Convertible Noteholders to exchange such Company Convertible Notes and purchase rights they hold for an aggregate (for all Company Convertible Note Holders) of not more than 88,161 shares of Parent Preferred Stock on terms acceptable to Parent.

Company Warrants

The Company shall have received from all of the holders of the Company’s warrants (other than the Other Company Warrants (all holders of Company Warrants, collectively, the “Warrant Holders”) duly executed agreements (“Warrant Holder Agreements”) to exchange such Company Warrants as they hold for an aggregate (for all Warrant Holders) of not more than 930.336 shares of Parent Preferred Stock on terms acceptable to Parent in its reasonable discretion. The Company shall have cashed out any Other Warrant Holder who has not provided a Warrant Holder Agreement; provided, however, that the aggregate amount of such cash out for any and all Other Warrant Holders who have not provided a Warrant Holder Agreement shall not exceed $150,000.

Merger Sub Securities

At the Effective Time, each issued and outstanding share of Merger Sub common stock shall be cancelled and retired and shall cease to exist. Immediately following the Effective Time, the Surviving Company shall issue to Parent a number of shares of common stock, par value $0.0001 per share, of the Surviving Company equal to the number of shares of Merger Sub common stock outstanding immediately prior to the Effective Time upon payment by Parent to the Surviving Company of an amount equal to the product of (x) the number of shares of the Surviving Company issued to Parent and (y) the par value of such shares.

| www.evofem.com | 16 |

Summary of the Proxy Statement

Representations and Warranties

The Merger Agreement contains customary representations and warranties of the parties thereto with respect to, among other things: (a) organization, standing and power; (b) capital structure; (c) authorization to enter into the Merger Agreement and related transactions; (d) consents and governmental authorization; (e) SEC documents, financial statements, internal controls and procedures; (f) absence of certain changes or events; (g) no undisclosed material liabilities; (h) company permits and compliance with applicable laws; (i) compensation and benefits; (j) employment and labor matters; (k) tax matters; (l) litigation; (m) intellectual property; (n) real property; (o) material contracts; (p) insurance; (q) environmental matters; (r) brokers; (s) state takeover statue; (t) investment company act; (u) related party transactions; and (v) FDA regulatory. Aditxt has additional representations and warranties, including (a) ownership of company capital stock (b) Investment Company Act and (c) Related Party Transactions

Covenants

The Merger Agreement includes customary covenants of the parties with respect to operation of their respective businesses prior to consummation of the Merger and efforts to satisfy conditions to consummation of the Merger. The Merger Agreement also contains additional covenants of the parties, including, among others, (a) conduct of business, (b) access to information, (c) notice of certain events, restrictions on making loans or capital expenditures, (d) cooperation and use of reasonable best efforts to defend against shareholder litigation, the (e) preparation of a proxy statement by the Company, (f) to obtain all requisite approvals of each party’s respective stockholders (g) taking all actions necessary to delist Company common stock upon effective time of the agreement and (h) that Evofem shall assist Aditxt in obtaining an agreement with the Company Convertible Noteholders to exchange such Company Convertible Notes and purchase rights they hold for an aggregate (for all Company Convertible Note Holders) of not more than 88,161 shares of Aditxt Preferred Stock on terms acceptable to Aditxt in its reasonable discretion.

Aditxt has additional covenants such as (a) indemnification of Directors and Officers Insurance (b) employee matters (c) Aditxt equity investments (d) the transfer of taxes (e) the use of the Company’s cash receipts

Conditions to Closing

The Merger Agreement is subject to certain closing conditions and contains customary representations, warranties and covenants.

The consummation of the Merger is conditioned upon, among other things: (i) the Company Shareholder approval shall have been obtained in accordance with applicable Law; (ii) no governmental entity having jurisdiction over any party shall have issue any order, decree, ruling injunction or other action that is in effect restraining the Merger; (iii) a voting agreement shall have been executed and delivered by the parties thereto; (iv) all Company preferred stock shall have been converted to Company common stock except for the Unconverted Company Preferred Stock (as defined by the Agreement); (v) the Company shall have received agreements from all of the holders of the Company’s warrants, duly executed, containing waivers with respect to any fundamental transaction, change in control or other similar rights that such warrant holders may have under any such Company warrants and exchange such Company warrants as they hold for an aggregate of not more than 930.336 shares of Aditxt Preferred Stock; (vi) the Company shall have cashed out any other warrant holder who has not provided a warrant holder agreement, provided, however, that the aggregate amount of such cash out for any and all other warrant holders who have not provided a warrant holder agreement shall not exceed $150,000; (vii) the Company shall have obtained waivers from holders of Company convertible notes of the original principal amount thereof with respect to any fundamental transaction rights such Company convertible note holders may have under any such Company convertible notes, including any right to vote, consent or otherwise approve or veto any of the transaction contemplated by this Merger Agreement; (viii) the outstanding balance of the senior secured loan plus all accrued and unpaid interest thereon, in an amount not to exceed the Repurchase Price (as defined in the Securities Purchase Agreement) shall have been paid in full; (ix) Aditxt shall have received a compliance certificate from the Company certifying Company complied with all its representations and warranties in the Merger Agreement; (x) Aditxt shall have received waivers from the parties to the agreements listed in Section 7.2(f) to the Aditxt Disclosure Letter of the issuance of securities in a “Variable Rate Transaction” (xi)Aditxt shall have received a certificate certifying that no interest in the Company is a U.S. real property interest, as required under U.S. treasury regulation section 1.897-2(h) and 1.1445-3(c); (xii) Company shall have received from Aditxt a compliance certificate certifying that Aditxt has complied with all its representations and warranties in the Merger Agreement, that Aditxt common stock included in the Merger Shares have been approved for listing on the Nasdaq, and Aditxt shall have regained compliance with the stockholders equity requirement in Nasdaq listing rule 5550(b)(1) (xiii) There shall be no more than 4,141,434 Dissenting Shares that are Company common stock or 98 Dissenting Shares that are Company Preferred Stock.

Further, the Board reserves the right to abandon the Merger if the Board determines it to be in the best interests of the shareholders.

Termination

The Merger Agreement may be terminated as follows, before or after the Company Shareholder Approval:

(a) by mutual written consent of the Company and Parent;

(b) by either the Company or Parent:

(i) if any Governmental Entity of competent jurisdiction shall have issued a final and non-appealable order, decree, ruling or injunction or taken any other action permanently restraining, enjoining or otherwise prohibiting the consummation of the Merger, or if there shall have been adopted prior to the Effective Time any law that permanently makes the consummation of the Merger illegal or otherwise permanently prohibited;

(ii) if the Merger shall not have been consummated on or before 5:00 p.m. Eastern Time, on September 30, 2024 (such date being the “End Date”); provided, that the right to terminate shall not be available to any party whose breach of any representation, warranty, covenant or agreement contained in the Merger Agreement has been the primary cause of or resulted in the failure of the Merger to occur on or before such date;

| 17 | Evofem Biosciences, Inc. | 2024 Proxy Statement |

Summary of the Proxy Statement

(iii) in the event of a breach by the other party (treating Parent and Merger Sub as one party) of any covenant or other agreement contained in the Merger Agreement or if any representation and warranty of the other party contained in the Merger Agreement fails to be true and correct which (x) would give rise to the failure of a condition set forth in Section 7.2(a) or (b) or Section 7.3(a) or (b), as applicable, if it were continuing as of the Closing Date and (y) cannot be or has not been cured (or is incapable of becoming true or does not become true) by the earlier of (1) the End Date and (2) the date that is 30 days after the giving of written notice to the breaching party of such breach or failure to be true and correct and the basis for such notice (a “Terminable Breach”); provided, however, that the terminating party is not then in Terminable Breach of any representation, warranty, covenant or other agreement contained in the Merger Agreement; or

(iv) if the Company Shareholder Approval shall not have been obtained at a duly held Company Meeting of Stockholders (including any adjournment or postponement thereof) at which a vote on the approval of this Agreement and the Transactions, including the Merger, was taken; or

(c) by Parent prior to the time the Company Shareholder Approval is obtained, if the Company Board shall have effected a Company Change of Recommendation;

(d) by the Company at any time after there has been a Company Change of Recommendation; provided, that the Company has provided Parent ten (10) calendar days’ prior written notice thereof and has negotiated in good faith with Parent to provide a competing offer;

(e) by the Company if the Parent common stock is no longer listed for trading on NASDAQ;

(f) by the Company if any of: (i) the Initial Parent Equity Investment has not been made by the Initial Parent Equity Investment Date, (ii) the Second Parent Equity Investment has not been made by the Second Parent Equity Investment Date, (iii) the Third Parent Equity Investment has not been made by the Third Parent Equity Investment Date or (iv) the Fourth Parent Equity Investment has not been made by the Fourth Parent Equity Investment Date;

(g) by the Parent in the event that the Parent determines, in its reasonable discretion, that the acquisition of the Company pursuant to this Agreement could result in a materially adverse amount of cancellation of indebtedness income to Parent for federal income-tax purposes recognized and attributable to any modification, restructuring, or purchase of the indebtedness of the Company or the purchase of the Company. Determining whether any income is “materially adverse” shall take into account both (i) whether such income is offset by any available current operating losses and net operating loss and other tax attributes carryforwards, and (ii) the materiality of the amount of tax attributable to such income, net of all offsets, deductions, credits and other reductions in the amount of tax actually payable as a result thereof.

Effect of Termination