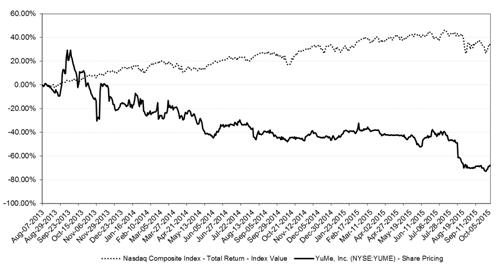

Since the IPO, while the NASDAQ Index Has Soared, YuMe’s Stock Has Plummeted.

On August 7, 2013, YuMe began trading at $9.00 per share. From that date until October 6, 2015, one trading day prior to the filing of our Schedule 13D, YuMe’s stock price had declined by 68%.

Management Has Repeatedly Missed Self-Imposed Financial Targets.

Since the IPO, CEO Jayant Kadambi has consistently missed guidance and self-imposed financial targets with respect to the Company’s programmatic business. The following excerpts are from transcripts from YuMe’s earnings calls and, when compared to actual results, paint a picture of a problematic culture desperately in need of accountability.

What Kadambi said on 2014 guidance:

| | - | “For the full year 2014, we expect revenue in the range of $190 million to $200 million.” (4Q13 - February 27, 2014) |

| | - | “We believe the outlook remains strong and we are reiterating our full year guidance.” “For the full year of 2014, we continue to expect revenue to be in the range of $190 million to $200 million.” (1Q14 - May 13, 2014) |

| | - | “For the full year 2014 we expect revenue between $180 million to $190 million.” (2Q14 - August 13, 2014) |

Reality à Even after the Company lowered its guidance by $10 million in August 2014, the Company ultimately generated $178 million of revenues in 2014, or $17 million short of the midpoint of the guidance originally given and $8 million short of the midpoint of the revised guidance given.

What Kadambi said on 2015 guidance:

| | - | “For full year 2015 we expect revenue in the range of $196 million to $206 million. We expect adjusted EBITDA to be in the range of breakeven to $4 million.” (4Q14 - February 18, 2015) |

| | - | “For the full year 2015 we continue to expect revenue in the range of $196 million to $206 million. We continue to expect gross margin to remain within our long-term operating model range. We expect adjusted EBITDA to be in the range of breakeven to $4 million.” (1Q15 - May 10, 2015) |

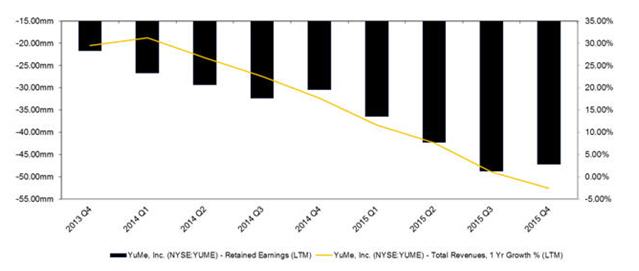

Reality à In 2015, the Company generated $173.3 million of revenues, which is $27.7 million short of the guidance given. Adjusted EBITDA was a loss of $1.6 million, or $3.6 million short of the midpoint of the guidance.

What Kadambi said on the Company’s programmatic business:

| | - | “We are not seeing any movement towards our TV that we feel is infringing or impinging on our existing business. That’s why the growth rates remain strong.” (4Q13 - February 27, 2014) |

| | - | “In terms of what we think could be accretive for next year...I think we have maintained regularly that we believe that there will be significant contribution from the programmatic side of the business going forward and we continue to think that the combination of our direct business and the complementary nature of programmatic business will turn into a pretty good annual growth rate next year.” (2Q14 - August 13, 2014) |

| | - | “We continue to believe that our programmatic initiatives will contribute to our 2015 financial performance in a meaningful way.” (3Q14 - November 8, 2014) |

Reality à The Company generated between $1 million and $2 million of programmatic revenue in 4Q15, the seasonally strongest quarter that typically accounts for over 30% of annual sales. In fiscal 2015, total revenue declined by 2.5% year over year. Fiscal 2015 ended up being the worst year in the Company’s history.

Given this disastrous track record, what did Kadambi have to say for himself for repeatedly missing guidance?

“I mean frankly I didn’t manage this closely enough because of the focus on programmatic growth opportunities...Fundamentally on the sale side it’s just enthusiasm in programmatic and a little bit of my taking the eye off the ball.” - 2Q15 August 10, 2015 |

Despite admitting to “taking [his] eye off the ball,” the Board compensated Mr. Kadambi $1.72 million in 2015. Clearly this Board just doesn’t get it. VIEX firmly believes there is an urgent need for a reconstituted Board that will hold itself and management accountable to stockholders and establish appropriate return on investment metrics to justify the significant spending on the Company’s programmatic business and international operations, which have not translated into any stock price appreciation.

The YuMe Board Has Failed to Align Management’s Interests with Stockholders.

The YuMe Board has awarded management excessive compensation despite unacceptable performance.

| · | From 2013 to 2015, CEO Jayant Kadambi has been paid almost $5 million, while the Company has suffered approximately $20.1 million in cumulative losses since its IPO in August 2013. Mr. Kadambi’s compensation packages over the past 3 years have also included more than $725,000 in non-equity incentive plan compensation and discretionary bonuses which were not tied to any specific performance targets. To date, the Company has failed to disclose any performance metrics to justify paying Mr. Kadambi such substantial compensation packages. |

| · | In 2015, the Company’s three named executive officers were paid, in the aggregate, approximately $3.94 million, despite the Company suffering net losses of approximately $16.75 million. Similarly, in 2014, the Company’s three named executive officers were paid, in the aggregate, approximately $2.9 million, while the Company suffered net losses of approximately $8.75 million. |

The YuMe Board has approved excessive grants of stock to management which has significantly diluted YuMe stockholders.

| · | Despite abysmal fiscal 2015 operating performance, a period during which all of the analysts following YuMe downgraded the Company's stock, financial targets were missed and the stock declined by nearly 50%, the Board shockingly rewarded management by granting nearly 2% of the Company’s stock to its top five executives. |

| · | And this was on top of similar inexplicable equity grants during the prior fiscal year. We believe any rational investor would question these egregious grants. Let us be perfectly clear on this point: The Board approved stock grants as a reward for destroying stockholder value, failing to achieve stated milestones, and having analysts issue downgrades. For these glaring, and unquestionable failures, management has received nearly 4% of the Company for free in addition to cash compensation. |

| · | Since the IPO, YuMe has registered approximately 10.1 million shares of common stock subject to options or other equity awards issued or reserved for future issuance under the Company’s equity incentive plans, constituting almost 30% of the Company’s outstanding stock as of February 29, 2016. |

We Need Stockholder Representatives on the Board to Truly Represent Your Interests.

We believe the Board has failed to demonstrate a stockholder-focused mindset, has failed to hold management or itself accountable, and has failed to place the best interests of its stockholders ahead of the personal interests of Company insiders, because it has no “skin in the game.” Based upon our review of the Company’s public filings, the Board’s six independent directors own approximately 1.6% of the Company’s outstanding stock, which stock was primarily acquired through equity awards granted to such directors in their capacities as directors of the Company and not through direct investment. VIEX, on the other hand, owns approximately 15.8% of the Company’s outstanding stock. It seems apparent to us that with so little at personal stake, the Board does not have the same commitment to stockholder value as we do.

We note further that 50% of the shares owned by all independent directors, are owned by just one director, Daniel Springer (the Lead Independent Director). This leaves the remaining five independent directors owning just 0.82% of the shares outstanding.

We Need a Proactive Board at YuMe – Not a Reactive Board.

The Board has taken action only when faced with significant stockholder pressure. Only after we repeatedly called upon the Company to return value to stockholders, which was echoed by other stockholders publicly, did the Board approve a $10 million stock buyback program. We believe that the program falls short in size and timing. If the Board was quicker to act, it could have taken advantage of an even lower stock price than today, making its buyback more efficient. Further, at the size approved by the Board, the Company will remain overcapitalized.

Most recently, due to our involvement, the Board agreed to accept our non-binding resolution requesting that the Board take all necessary steps to declassify the Board.

We need a Board that feels a sense of urgency to act to address the significant challenges facing the Company, not a Board that takes action only when challenged with a proxy fight.

Real Change and Board Accountability is Needed Now!

In order to properly address the Company’s prolonged underperformance, we have strongly, and repeatedly, expressed to management our view that the Company must:

| | o | reduce its cost structure; |

| | o | implement stringent metrics to ensure that operating expenses conform to realistic revenue opportunities; |

| | o | utilize the Company’s overcapitalized balance sheet to increase value for all stockholders; |

| | o | revise compensation practices to align executive interests with those of the stockholders; and |

| | o | improve its corporate governance. |

These fundamental issues are central to protecting all stockholders and are key to improving stockholder value.

We believe that YuMe’s corporate governance needs significant upgrade and that the Company’s policies are the result of an explicit desire by the Company’s leadership to suppress stockholder input and avoid accountability. We have therefore introduced a proposal to declassify the Board that we recommend YuMe stockholders support and that we think is a necessary step in bringing some accountability to the boardroom. We further believe that the Board must be reconstituted immediately to provide meaningful stockholder representation through new directors who will bring a fresh perspective and a strong commitment to represent stockholders' interests.

Our Nominees Will Act in Your Best Interest.

Working entirely from a stockholder perspective, our two nominees will ensure Board integrity and accountability for all stockholders. We will work diligently to prevent the abuses and incompetence that have pervaded the operations of YOUR COMPANY. We will not tolerate the mismanagement and failure that has plagued YuMe since its IPO. Rather, we will be a powerful and relentless driving force for accountability and positive change.

The VIEX nominees are:

Elias N. Nader, age 50, has served as chief financial officer and secretary of Sigma Designs, Inc. ("Sigma Designs"), a provider of intelligent media platforms for use in the home entertainment and control markets, since April 2014. Mr. Nader previously served as Sigma Designs' interim chief financial officer and secretary from March 2013 to April 2014 and as its corporate controller from October 2012 to March 2013. Prior to joining Sigma Designs, Mr. Nader served as a chief financial officer consultant with various companies in Europe and the Middle East from October 2011 to September 2012. From June 2010 to September 2011, Mr. Nader served as group chief financial officer with Imperial Jet, a VIP business aircraft company based in Europe and the Middle East. From June 2005 to June 2010, Mr. Nader served as corporate controller at Dionex Corporation, a chromatography company.

Eric Singer, age 42, has served as the managing member of each of VIEX GP, LLC, the general partner of VIEX Opportunities Fund, LP – Series One (“Series One”) and VIEX Opportunities Fund, LP – Series Two (Series Two”), VIEX Special Opportunities GP II, LLC, the general partner of VIEX Special Opportunities Fund II, LP (“VSO II”), and VIEX Capital Advisors, LLC, the investment manager of Series One, Series Two, VSO II and certain other investment funds, since May 2014. The principal business of Series One, Series Two and VSO II is investing in securities. From March 2012 until September 2014, Mr. Singer served as co-managing member of Potomac Capital Management III, L.L.C., the general partner of Potomac Capital Partners III, L.P. (“PCP III”), and Potomac Capital Management II, L.L.C., the general partner of Potomac Capital Partners II, L.P. (“PCP II”) and served as an advisor to Potomac Capital Management, L.L.C. and its related entities from May 2009 until September 2014. The principal business of PCP III and PCP II is investing in securities. From July 2007 to April 2009, Mr. Singer was a senior investment analyst at Riley Investment Management. He managed private portfolios for Alpine Resources, LLC from January 2003 to July 2007. Mr. Singer currently serves on the board of directors of Numerex Corp., a provider of managed machine-to-machine (M2M) enterprise solutions enabling the Internet of Things (IoT), since March 2016, TigerLogic Corporation, a global provider in engagement solutions, including Postano social media aggregation, display and fan engagement platform and Omnis mobile development platform, since January 2015, and IEC Electronics Corp., a provider of electronic manufacturing services to advanced technology companies primarily in the military and aerospace, medical, industrial and communications sectors, since February 2015. Mr. Singer previously served as a director of Meru Networks, Inc., a Wi-Fi network solutions company, from January 2014 until January 2015, PLX Technology, Inc, a semiconductor company, from December 2013 until its sale in August 2014, Sigma Designs, Inc., a semiconductor company, from August 2012 until December 2013, including as its Chairman of the Board from January 2013 until December 2013, and Zilog Corporation, a semiconductor company, from August 2008 until its sale in February 2010.

PROTECT YOUR INVESTMENT

Vote for Change – Please sign, date and return the enclosed GOLD proxy card today.

Sincerely,

Eric B. Singer

VIEX Opportunities Fund, LP – Series One

If you have any questions, or require assistance with your vote, please contact our proxy solicitor:

Banks and Brokerage Firms Call: (203) 658-9400 Stockholders Call Toll Free: (800) 662-5200 E-mail: VIEX@morrowco.com |