Exhibit 99.1

SETH MOLOD , CFO JULY 2019 LIGHTSTONE REAL ESTATE INCOME TRUST 1

Forward Looking Statements This presentation contains forward - looking statements, including discussion and analysis of the financial condition of the Company and its subsidiaries and other matters. These forward - looking statements are not historical facts but are the intent, belief or current expectations of the Company’s management based on their knowledge and understanding of the Company’s business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward - looking statements. We intend that such forward - looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the Company’s control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements. Forward - looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward - looking statements, which reflect management's view only as of the date of this presentation. We undertake no obligation to update or revise forward - looking statements to reflect changed assumptions the occurrence of unanticipated events or changes to future operating results. The presentation should be read in conjunction with our public filings filed with the United States Securities and Exchange Commission .

Agenda • Overview • Asset Review • Net Asset Value • Share Repurchase Program • Distribution Policy • Strategy and Investment Opportunity • Questions 3

Overview 4

Overview Background • Lightstone Real Estate Income Trust is a Maryland corporation formed on September 9, 2014. • The Company elected to qualify to be taxed as a REIT for U.S. federal income tax purposes beginning with the taxable year ending December 31, 2016. • An affiliate of The Lightstone Group, LLC, or Lightstone, serves as the Company’s Advisor. Lightstone is majority owned by David Lichtenstein. • Subject to the oversight of the Company’s Board of Directors, the Advisor has primary responsibility for making investment decisions and managing the day - to - day operations. 5

Overview Initial Public Offering • Commenced on February 26, 2015 and terminated on March 31, 2017. • Raised aggregate gross proceeds of approximately $85.6 million, including $2.0 million of shares purchased by an affiliate of Lightstone. • On March 16, 2016, the Company entered into subordinated unsecured loan agreement with an affiliate of Lightstone, pursuant to which the company borrowed an aggregate of $ 12.6 million to pay organization and offering expenses, selling commissions and dealer fees. • The loan bears interest at a rate of 1.48%, but no interest or principal is due and payable until the Company’s common stockholders have received liquidation distributions equal to their respective net investments plus a cumulative, pre - tax, non - compounded annual return of 8.0% on their net investments . • The Company’s DRIP was terminated effective May 15, 2017. 6

Overview 7 Portfolio Summary (as of May 31 , 2019) • We own an unconsolidated 22.5 % membership interest in a joint venture that owns and operates The Cove at Tiburon, a multi - family complex consisting of 281 - units located in Tiburon, CA. • We own a preferred equity investment in an affiliate of Lightstone , which owns, developed and constructed the 343 - room Marriott Moxy Chelsea NYC hotel on a parcel of land located at 105 - 109 W. 28 th Street in the Chelsea neighborhood of New York City (“Marriott Moxy Chelsea”). Our investment provides for monthly preferred distributions at a rate of 12% per annum. The joint venture is an affiliate of Lightstone .

Overview 8 Portfolio Summary (as of May 31, 2019) • We own an unconsolidated 33.3 % membership interest in 40 East End Avenue Pre Member LLC, a joint venture with affiliates of Lightstone. The joint venture is constructing a luxury residential project known as 40 East End Ave. located in the Upper East Side neighborhood of New York City consisting of 29 condominium units (“40 East End Avenue”). 40 East End Ave. was under construction as of June 30, 2019. • We own corporate bonds that are publicly traded on the Tel Aviv Stock Exchange and denominated in New Israeli Shekel. The bonds were acquired throughout H1 2019.

Asset Review 9

Marriott Moxy Chelsea Marriott Moxy Chelsea – Preferred Equity Investment • The Company invested $37 million in a preferred equity investment in the Marriott Moxy Chelsea Hotel project. • Upon stabilization of the hotel and refinancing of the construction loan, t he initial construction loan has been refinanced and net proceeds were used to repay an aggregate $ 26.5 million of our preferred investment during Q1 2019, reducing the outstanding balance to $10.5 million. • The hotel opened in February 2019 and is exceeding underwritten expectations. • If not already repaid in full, the preferred investment is redeemable at our option beginning November 25, 2020. 10

Marriott Moxy Chelsea 11

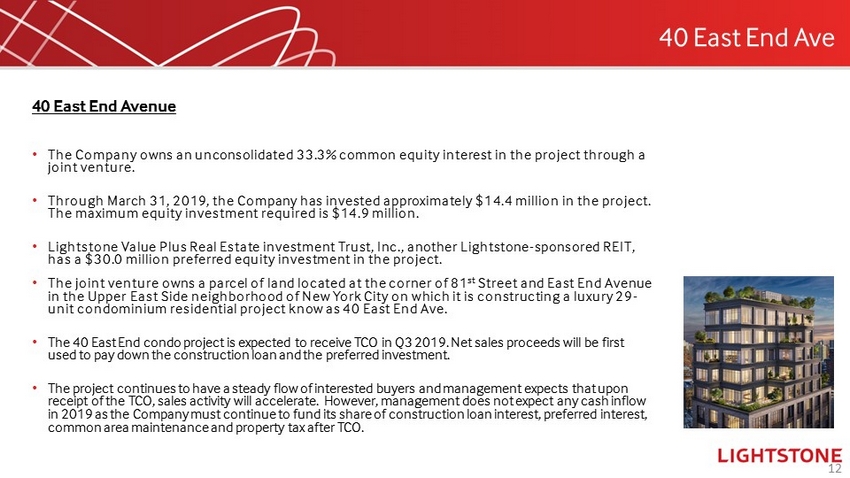

40 East End Ave 12 40 East End Avenue • The Company owns an unconsolidated 33.3 % common equity interest in the project through a joint venture. • Through March 31, 2019, the Company has invested approximately $14.4 million in the project. The maximum equity investment required is $14.9 million. • Lightstone Value Plus Real Estate investment Trust, Inc., another Lightstone - sponsored REIT, has a $30.0 million preferred equity investment in the project. • The joint venture owns a parcel of land located at the corner of 81 st Street and East End Avenue in the Upper East Side neighborhood of New York City on which it is constructing a luxury 29 - unit condominium residential project know as 40 East End Ave. • The 40 East End condo project is expected to receive TCO in Q3 2019. Net sales proceeds will be first used to pay down the construction loan and the preferred investment. • The project continues to have a steady flow of interested buyers and management expects that upon receipt of the TCO, sales activity will accelerate. However, management does not expect any cash inflow in 2019 as the Company must continue to fund its share of construction loan interest, preferred interest, common area maintenance and property tax after TCO.

The Cove at Tiburon The Cove at Tiburon – Common Equity Investment • The Cove at Tiburon is a 281 - unit luxury waterfront multifamily property located in Tiburon, CA. • Tiburon, an affluent suburb of San Francisco, is a 30 - minute drive over the Golden Gate Bridge to the heart of San Francisco. • The Cove at Tiburon is an entirely free market multifamily community. • The Company paid $20 million to acquire a 22.5% unconsolidated membership interest in the property through a joint venture. • The ongoing extensive renovation of the property is now substantially completed . 13

The Cove at Tiburon Operations Update • Occupancy was 92% as of March 31, 2019 compared to 89% as of March 31, 2018. • Annualized revenue per unit increased slightly for the first quarter 2019 compared to the same period in 2018. Refinancing • Refinanced the acquisition loan with a new $180 million loan in May 2019. • The new term is 5 years with interest - only payments at LIBOR + 2.15% . • The refinancing is expected to reduce annual interest expense for the property by $2.9 million and the Company’s share is $0.6 million. We believe that over the long term, the property will perform well and achieve strong rental growth due to its irreplaceable location, extremely high barriers to entry, and the high income levels in the marketplace. 14

Corporate Bonds 15 Corporate Bond Investment • During the first half of 2019 , Management identified certain corporate bonds traded on the Tel - Aviv Exchange (“TASE ”) as an investment opportunity. • T he Company acquired approximately $4.5 million of these bonds during H1 2019 at a weighted average price of 80% to face value. The bond’s annual coupon is 6.9% (8.6% at our discounted average price). • The bonds are denominated in New Israeli Shekel and are subject to fluctuations in foreign currency exchange rates . The bonds provide for semi - annual interest and annual principal payments, and mature in November 2023. • The expected IRR is approximately 21%, assuming payment in full and the bonds are held until maturity. • As of June 30, 2019, the bonds were trading at 80.71% to face value, with one principal payment already received. • We continue to monitor market conditions and may acquire additional Israeli Bonds.

Net Asset Value 16

Net Asset Value 17 • On March 14, 2019, the Board of Directors established and approved the NAV per Share of $10.00 as of December 31, 2018. • NAV is after aggregate principal advances of $12.6 million made to us by an affiliate of Lightstone pursuant to the Subordinated Agreement. • Marshall & Stevens Incorporated, an independent valuation firm, assisted us in the calculation of the NAV as of December 31, 2018 .

Share Repurchase Program 18

Share Repurchase P rogram • We have a Share Repurchase Program which may provide our stockholders with limited, interim liquidity by enabling them to sell their shares of common stock back to us, subject to certain restrictions . • The repurchase price is: – For repurchases due to the death of a stockholder, the current NAV. – For repurchases for any other reason, the below percentages of the price paid to acquire the shares : ▪ 92.5 % for stockholders who have continuously held their shares for at least one year; ▪ 95 % for stockholders who have continuously held their shares for at least two years; ▪ 97.5 % for stockholders who have continuously held their shares for at least three years; and ▪ 100 % for stockholders who have continuously held their shares for at least four years. 19

Share Repurchase P rogram • Our Board of Directors may amend the terms, suspend, or terminate the Share Repurchase Program by providing advance written notice to our stockholders. • The Board of Directors has decided to maintain the Share R epurchase Program but expects limited cash to be available for non - priority hardships during the restructuring phase of the Company. 20

Distribution Policy 21

Distribution Policy 22 • Distributions are authorized at the discretion of our Board of Directors . • On October 28, 2015, our Board of Directors authorized and we declared our first distribution in an amount equal to a 8.0% annualized rate for the period from June 12, 2015 (the date of breaking escrow) through November 30, 2015 (the end of the month following our initial property acquisition ). This distribution was paid on December 15, 2015. • Subsequent distributions in an amount equal to a 8.0% annualized rate have been declared on a monthly basis thereafter and have been paid on or about the 15th day following each month end. • Monthly distributions at a 8.0% annualized rate have been declared through June 2019.

Distribution Policy 23 • Upon the recommendation of management, on July 11, 2019, our Board of Directors authorized a reduction in the monthly distributions from an 8.0% to a 4.0% annualized rate, for each of the months in the three - month period ending September 30, 2019. • The Board will continue to evaluate its distribution policy quarterly on a go - forward basis. • Factors that impact the Board of Directors’ recommendation are: – Liquidity of the Company; – Actual and anticipated operating cash flows; – General financial and market conditions; – Proceeds and taxable income generated from repayment of preferred equity investment and timing of condominium sales; – The previous annual 8% distribution rate is not currently supported by expected MFFO; and – Potential repositioning of our investments.

Strategy and Investment Opportunity 24

Strategy Strategy • Management has identified a significant investment opportunity in a development project. • Proceeds from Marriott Moxy Chelsea and 40 East End Ave will be redeployed into this and other higher yielding investments. • The Cove completed a refinancing, resulting in significant interest expense savings, which is expected to improve MFFO 25

Investment Opportunity Investment in Marriott Moxy Williamsburg • Management has identified a ~15,900 square foot lot in Williamsburg, Brooklyn for a real estate development project. • Management’s development plan is to build a 210 - key Marriott Moxy Hotel with over 11,200 square feet of F&B space. • This development property is situated in a prime New York location with significant demand drivers and barriers to entry, and will benefit from management’s considerable prior expertise in development of Marriott Moxy properties. 26

Investment Opportunity Investment in Marriott Moxy Williamsburg • The Company funded $18 million of equity upon closing in July 2019 and owns 100% of the common equity in this project. • Management expects a total of ~$45 million of common equity required over the life of the project, with the expected opening date of the hotel targeted for December 2021. • The site is in a prime intersection of Williamsburg, an emerging market poised for demand growth with high accessibility and proximity to public transaction. 27

INVESTOR SERVICES: 888 - 808 - 7348 Questions 28