Subject to Completion.

Preliminary Prospectus Dated January 13, 2022.

Up to 44,788,667 American Depositary Shares

9F Inc.

Representing Up To 44,788,667 Class A Ordinary Shares

This prospectus relates to the offer and sale from time to time by a certain warrant holder identified in this prospectus or a supplement hereto (the “Selling Shareholder”) of up to 44,788,667 Class A ordinary shares, par value US$0.00001 per share, of 9F Inc., issuable to the Selling Shareholder upon the exercise of 44,788,667 warrants held by it (“Warrants”), including Class A ordinary shares represented by American depositary shares, each of which represents one Class A ordinary share (“ADSs”).

The Selling Shareholder may offer and sell all or part of the Class A ordinary shares or ADSs it receives from time to time through public or private transactions, or through other means described in the section entitled “Plan of Distribution” herein or in a supplement to this prospectus, at either prevailing market prices or at privately negotiated prices. The Selling Shareholder may sell Class A ordinary shares or ADSs through agents it selects or through underwriters and dealers it selects. The Selling Shareholder may also sell Class A ordinary shares or ADSs directly to investors. If the Selling Shareholder uses agents, underwriters or dealers to sell Class A ordinary shares or ADSs, we will name them and describe their compensation in a prospectus supplement. The registration of the Class A ordinary shares does not necessarily mean that the Selling Shareholder will exercise any of the Warrants or will offer or sell any Class A ordinary shares or ADSs.

We will not receive any of the proceeds from the sale of the Class A ordinary shares or ADSs by the Selling Shareholder.

We will bear all costs, expenses and fees in connections with the registration of the Class A ordinary shares and the ADSs. The Selling Shareholder will bear all commissions and discounts, if any, attributable to the sale of Class A ordinary shares and ADSs.

Our ADSs are listed on the Nasdaq Global Market under the symbol “JFU.” On January 12, 2022, the closing trading price of our ADSs, as reported on the Nasdaq Global Market, was US$1.1100 per ADS.

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements.

Investing in our Class A ordinary shares or ADSs involves risks. See “Risk Factors” beginning on page 25 for factors you should consider before buying our Class A ordinary shares or the ADSs.

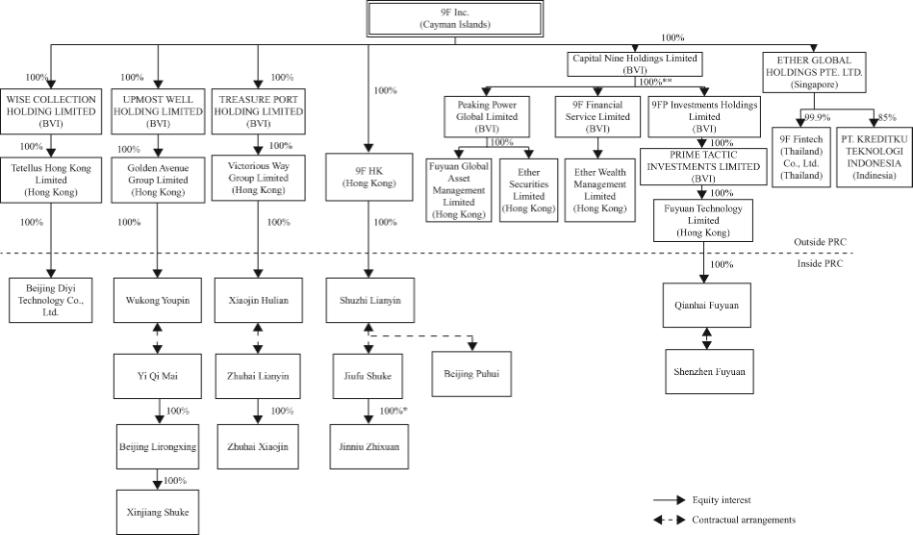

9F Inc. is not an operating company but a Cayman Islands holding company. A major part of our operations is conducted in China either by our subsidiaries in China or through our variable interest entities based in China (“VIEs”) with which we entered into certain contractual arrangements. PRC laws, regulations, and rules restrict and impose conditions on direct foreign investment in certain types of businesses, and we therefore operate these businesses in China through our VIEs. The majority of our assets in China, including licenses, are held by our VIEs and the majority of our revenue is generated by our VIEs. 9F Inc. does not own equity interest in the VIEs or their subsidiaries and rely on contractual arrangements entered into among our PRC subsidiaries, our VIEs and the respective nominee shareholders of our VIEs to control the business operations of our VIEs and their subsidiaries. For a summary of these contractual arrangements, see “Corporate History and Structure — Contractual Arrangements with Our VIEs and Their Shareholders.” The VIE structure is designed to enable 9F Inc. to have power to direct significant activities of the VIEs and to receive significant economic benefits from the VIEs where PRC law prohibits, restricts or imposes conditions on direct foreign investment in our VIEs. Investors in our ADSs thus are not acquiring equity interest in our VIEs but instead are acquiring interest in a Cayman Islands holding company. Further, investors may never directly hold equity interests in our VIEs. We believe that our VIEs should be treated as Variable Interest Entities under the Statement of Financial Accounting Standards Board Accounting Standards Codification 810 Consolidation and we should be regarded as the primary beneficiary of our VIEs. Accordingly, we treat our VIEs as our consolidated entities under U.S. GAAP and we consolidate the financial results of our VIEs in our consolidated financial statements in accordance with U.S. GAAP. There are uncertainties regarding potential future actions by the PRC government that could affect the enforceability of our contractual arrangements with our VIEs. If the PRC government finds that the contractual arrangements which establish the structure of certain of our business operations in China do not comply with PRC laws or regulations, or if these laws or regulations or their interpretations change in the future, we could be forced to relinquish our interests in those operations, which may result in our VIEs being deconsolidated. As a consequence, our operations and financial performance may be materially and adversely affected and our ADSs may significantly decline in value or become worthless. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Risk Factors — Risks Related to Our Corporate Structure.”

Cash may be transferred within our organization in the following manner: (i) we may transfer funds to our subsidiaries, including our PRC subsidiaries, by way of capital contributions or loans, through intermediate holding companies or otherwise; (ii) we and our subsidiaries may provide loans to our VIEs and vice versa; (iii) funds may be transferred between our VIEs and our subsidiaries, including our PRC subsidiaries, as service fees for services contemplated by the VIE agreements, as repayment of loan or pursuant to other commercial contracts; and (iv) our subsidiaries, including our PRC subsidiaries, may make dividends or other distributions to us, through intermediate holding companies or otherwise. For more details, see “Summary Consolidated Financial Data—Cash Transfers and Dividend Distribution,” and “Risk Factors – Risks Related to Our American Depositary Shares – Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our ADSs for return on your investment."

As used in this prospectus, “we,” “us,” “our company,” “our,” “9F,” or “9F Inc.” refers to (i) 9F Inc. and its subsidiaries in the context of describing our offerings of wealth management services (including internet securities service, fintech business and insurance brokerage service) outside China, and (ii) 9F Inc., its subsidiaries, the VIEs and their subsidiaries in China in the context of describing the general nature of our operations and our consolidated financial information.

The PRC government has significant authority to regulate or intervene in the China operations of an offshore holding company, such as us, at any time. We face various legal and operational risks and uncertainties associated with having a major part of our operations in China and with the complex and evolving PRC laws and regulations. For example, we face risks associated with the use of VIEs, PRC governmental authorities’ significant oversight and discretion over the businesses and financing activities of our VIEs and our PRC subsidiaries, the requirement of regulatory approvals for offerings conducted overseas by and foreign investment in China-based issuers, the enforcement of anti-monopoly regime, the regulatory oversight on cybersecurity and data privacy as well as the risk of the delisting of our ADSs or the prohibition of our ADSs from trading in the over-the-counter trading market in the United States due to the lack of PCAOB inspection on our auditors under the Holding Foreign Companies Accountable Act, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. These risks could also result in a material adverse change in our operations, significantly limit or completely hinder our ability and the ability of any holder of our ADSs or other securities of our company to offer or continue to offer such securities to investors, or cause such securities to significantly decline in value or become worthless. For a detailed description of risks related to doing business in China, see “Risk Factors — Risks Related to Doing Business in China and Hong Kong.”

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2022