Exhibit 99.1

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. INVESTOR PRESENTATION November 2017 Origo Acquisition Corp. NASDAQ: OACQ +

“… the authentic, original and trusted media pioneer in the legal cannabis industry with 4 3 years of operations , hundreds of published magazines, and an unparalleled brand recognition.” 2

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 3 DISCLAIMERS & IMPORTANT NOTICES GENERAL Neither the U . S . Securities and Exchange Commission nor any state or non - U . S . securities commission has reviewed or passed upon the accuracy or adequacy of this presentation or the merits of the merger transaction (the “Merger”) described herein . Any representation to the contrary is unlawful . This presentation is not an offer to sell to any person, or a solicitation to any person to buy, shares of common equity of either Origo Acquisition Corp . (“ORIGO”), Hightimes Holding Corp . (“HTH”) or Hightimes Media Corporation, the surviving corporation following the Merger (the “Surviving Company”) in any state or jurisdiction in which such an offer would be prohibited by law or to any person who is not an “accredited investor” under the U . S . federal securities laws . USE OF PROJECTIONS This presentation contains financial forecasts with respect to the Surviving Company’s projected revenues, EBITDA, pre - tax profit and net income for the years 2017 - 2019 . These projections are unaudited and should not be relied upon as being necessarily indicative of future results . In this presentation, certain of the above - mentioned projected information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data . The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Surviving Company or that actual results will not differ materially from those presented in the prospective financial information . Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . Forward - looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Such forward looking statements include projected financial information as discussed above . Readers are cautioned that a number of factors could cause actual results or outcomes to differ materially from those indicated by such forward - looking statements . These factors include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger ; ( 2 ) the outcome of any legal proceedings that may be instituted against ORIGO, HTH or others following announcement of the Merger and the transactions contemplated therein ; ( 3 ) the inability to complete the transactions contemplated by the Merger due to the failure to obtain approval of the shareholders of ORIGO or HTH or other conditions to closing in the Merger ; ( 4 ) the risk that we may be unable to secure a U . S . national exchange listing for Surviving Company ; ( 5 ) the risk that the proposed Merger disrupts current plans and operations as a result of the announcement and consummation of the Merger and the transactions described herein ; ( 6 ) the risk that HTH may be unable to recognize the anticipated benefits of the Merger, which may be affected by, among other things, competition, the ability of the Surviving Company operate as a public company and to grow and manage growth profitably, maintain relationships with customers and retain its key employees ; ( 7 ) costs related to the proposed Merger ; ( 8 ) changes in applicable laws or regulations or their interpretation or application (including, notably, federal and state laws related to the use, cultivation and distribution of cannabis - based products and cannabis - related products) ; ( 9 ) the possibility that ORIGO or HTH may be adversely affected by other economic, business, and/or competitive factors ; ( 10 ) future exchange and interest rates ; ( 11 ) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Merger ; and ( 12 ) other risks and uncertainties indicated in the proxy statement to be filed by ORIGO with the U . S . Securities and Exchange Commission (“SEC”), including those under “Risk Factors” therein, and other filings with the SEC by ORIGO or HTH . These factors are not intended to be an all - encompassing list of risks and uncertainties . The forward - looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on ORIGO and HTH . Future developments affecting ORIGO and HTH may not be those that we have anticipated . These forward - looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements . Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward - looking statements . We undertake no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . We caution you that forward - looking statements are not guarantees of future performance and that our actual results of operations, financial condition and results of operations, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward - looking statements contained in this presentation . In addition, even if our results or operations, financial condition and results of operations, and developments in the industry in which we operate are consistent with the forward - looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods . USE OF NON - GAAP FINANCIAL MEASURES This presentation includes financial measures of HTH, including EBITDA, that are not prepared in accordance with U . S . generally accepted accounting principles (“GAAP”) . In this presentation, “EBITDA” means net income (loss) before interest expense, income taxes and depreciation and amortization . HTH has presented these financial measures in this presentation because they are considered as key measures used by HTH management to understand and evaluate HTH’s operating performance and trends, and HTH believes that those measures are frequently used by analysts, investors and other interested parties in the evaluation of companies . Other companies may calculate these financial measures differently than HTH, and these measures have limitations as analytical tools . Therefore, you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP . For a reconciliation of these non - GAAP measures to the GAAP financial statements of HTH, see Slide 24 . INDUSTRY AND MARKET DATA In this presentation, HTH relies on and refers to information and statistics regarding market sizes in the sectors in which it competes and other industry data . HTH obtained this information and statistics from third - party sources, and HTH has supplemented this information where necessary with information from HTH’s own internal estimates, taking into account publicly available information about otxher industry participants and HTH’s management’s best view as to information that is not publicly available . However, neither ORIGO nor HTH makes any representation as to the absolute accuracy of such information and statistics . ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT In connection with the proposed business combination, ORIGO will file a preliminary proxy statement with the SEC and will mail a definitive proxy statement and other relevant documents to its shareholders . Investors and security holders of ORIGO are advised to read, when available, the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with ORIGO’s solicitation of proxies for its extraordinary shareholders’ meeting to be held to approve the proposed Merger and related matters because the proxy statement will contain important information about the proposed business combination and the parties to the Merger . The definitive proxy statement will be mailed to stockholders of ORIGO as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at www . sec . gov . PARTICIPANTS IN SOLICITATION ORIGO, HTH, and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of ORIGO shareholders in connection with the proposed Merger . Investors and security holders may obtain more detailed information regarding the names, affiliations and interests in ORIGO of directors and officers of ORIGO in ORIGO’s proxy statement as described above . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the ORIGO’s shareholders in connection with the proposed Merger will be set forth in the proxy statement for the proposed Merger when available . Information concerning the interests of ORIGO’s and HTH’s participants in the solicitation, which may, in some cases, be different than those of ORIGO’s and HTH’s equity holders generally, will be set forth in the proxy statement relating to the proposed Merger when it becomes available . CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 .

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 4 TABLE OF CONTENTS Company Overview Market overview Financial Overview Management Team & Board of Directors Additional Transaction Details Executive Summary 09 19 22 26 29 05 Appendix 33

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 5 E x ecuti v e Summa r y ORIGO ACQUISITION CORP. NASDAQ: OACQ +

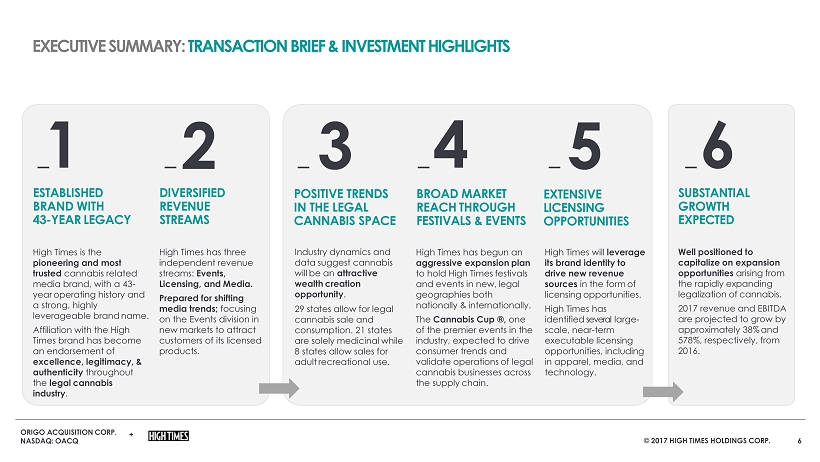

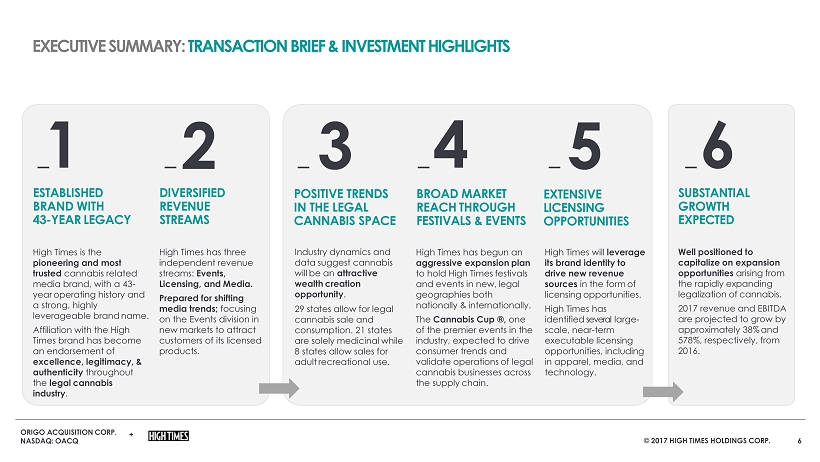

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY : TRANSACTION BRIEF & INVESTMENT HIGHLIGHTS High Times has three independent revenue streams: Events, Licensing, and Media. Prepared for shifting media trends; focusing on the Events division in new markets to attract customers of its licensed products. Well positioned to capitalize on expansion opportunities arising from the rapidly expanding legalization of cannabis. 2017 revenue and EBITDA are projected to grow by approximately 38 % and 578 %, respectively, from 2016. High Times is the pioneer ing and most trusted cannabis related media brand, with a 4 3 - year operating history and a strong, highly leverageable brand name. Affiliation with the High Times brand has become an endorsement of excellence, legitimacy, & authenticity throughout the legal cannabis industry . High Times has begun an aggressive expansion plan to hold High Times festivals and events in new, legal geographies both nationally & internationally. The Cannabis Cup ®, one of the premier events in the industry, expected to drive consumer trends and validate operations of legal cannabis businesses across the supply chain. Industry dynamics and data suggest cannabis will be an attractive wealth creation opportunity . 29 states allow for legal cannabis sale and consumption. 21 states are solely medicinal while 8 states allow sales for adult recreational use . High Times will leverage its brand identity to drive new revenue sources in the form of licensing opportunities. High Times has identified several large - scale, near - term executable licensing opportunities, including in apparel, media, and technology. ESTABLISHED BRAND WITH 4 3 - YEAR LEGACY DIVERSIFIED REVENUE STREAMS EXTENSIVE LICENSING OPPORTUNITIES POSITIVE TRENDS IN THE LEGAL CANNABIS SPACE SUBSTANTIAL GROWTH EXPECTED 1 2 3 4 5 6 6 BROAD MARKET REACH THROUGH FESTIVALS & EVENTS

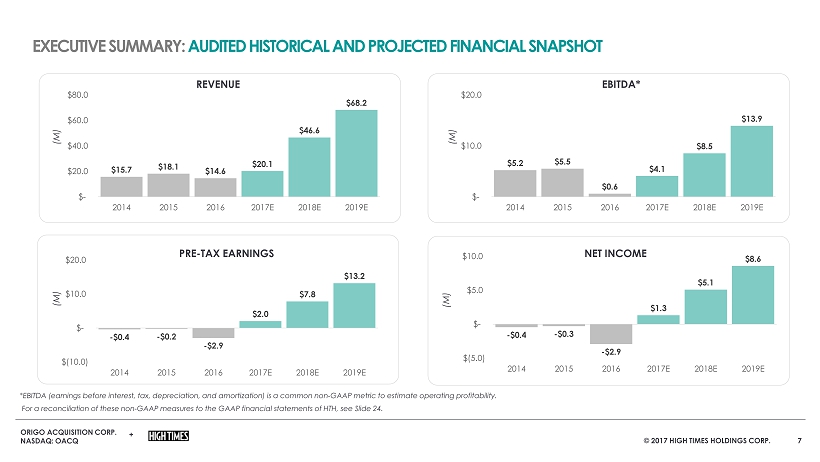

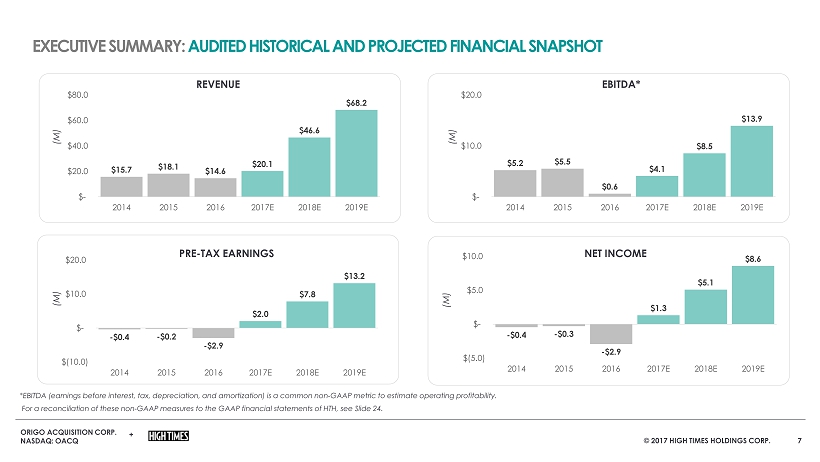

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. - $0.4 - $0.3 - $2.9 $1.3 $5.1 $8.6 $(5.0) $- $5.0 $10.0 2014 2015 2016 2017E 2018E 2019E - $0.4 - $0.2 - $2.9 $2.0 $7.8 $13.2 $(10.0) $- $10.0 $20.0 2014 2015 2016 2017E 2018E 2019E $5.2 $5.5 $0.6 $4.1 $8.5 $13.9 $- $10.0 $20.0 2014 2015 2016 2017E 2018E 2019E $15.7 $18.1 $14.6 $20.1 $46.6 $68.2 $- $20.0 $40.0 $60.0 $80.0 2014 2015 2016 2017E 2018E 2019E 7 REVENUE (M) EBITDA* (M) PRE - TAX EARNINGS (M) NET INCOME (M) * EBITDA (earnings before interest, tax, depreciation, and amortization) is a common non - GAAP metric to estimate operating profita bility . For a reconciliation of these non - GAAP measures to the GAAP financial statements of HTH, see Slide 24. EXECUTIVE SUMMARY : AUDITED HISTORICAL AND PROJECTED FINANCIAL SNAPSHOT

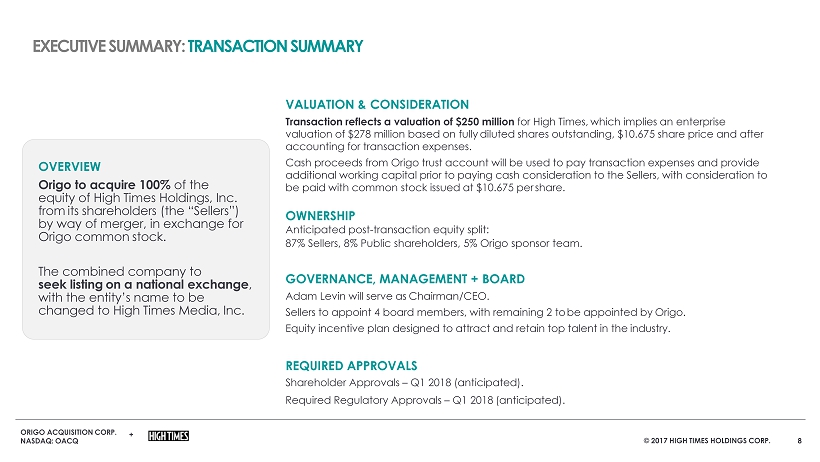

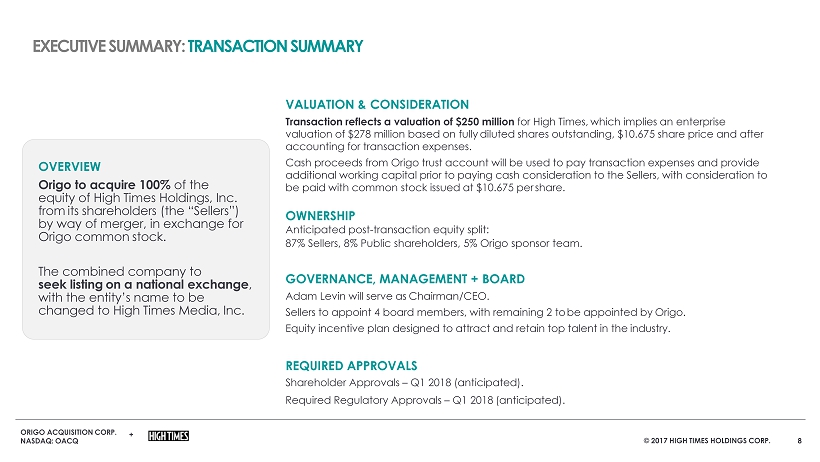

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. OVERVIEW Origo to acquire 100% of the equity of High Times Holdings, Inc. from its shareholders (the “Sellers”) by way of merger, in exchange for Origo common stock. The c ombined company to seek listing on a national exchange , with the entity’s name to be changed to High Times Media, Inc. VALUATION & CONSIDERATION Transaction reflects a valuation of $250 million for High Times, which implies an enterprise valuation of $2 78 million based on fully diluted shares outstanding, $10. 675 share price and after accounting for transaction expenses. Cash proceeds from Origo trust account will be used to pay transaction expenses and provide additional working capital prior to paying cash consideration to the Sellers, with consideration to be paid with common stock issued at $10. 675 per share. OWNERSHIP Anticipated post - transaction equity split: 8 7 % Sellers , 8 % Public shareholders , 5% Origo sponsor team . GOVERNANCE, MANAGEMENT + BOARD Adam Levin will serve as Chairman/CEO. Seller s to appoint 4 board members, with remaining 2 to be appointed by Origo. Equity incentive plan designed to attract and retai n top talent in the industry. REQUIRED APPROVALS Shareholder Approvals – Q 1 201 8 (anticipated). Required Regulatory Approvals – Q 1 201 8 (anticipated). 8 EXECUTIVE SUMMARY : TRANSACTION SUMMARY

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 9 Company Ove r view ORIGO ACQUISITION CORP. NASDAQ: OACQ +

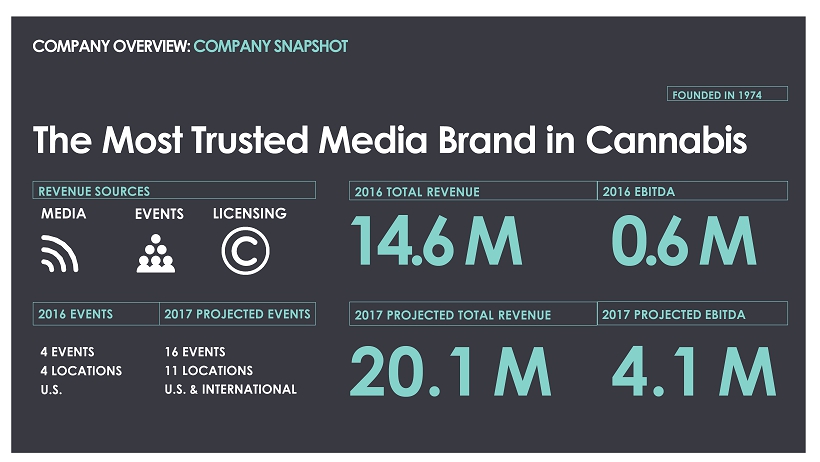

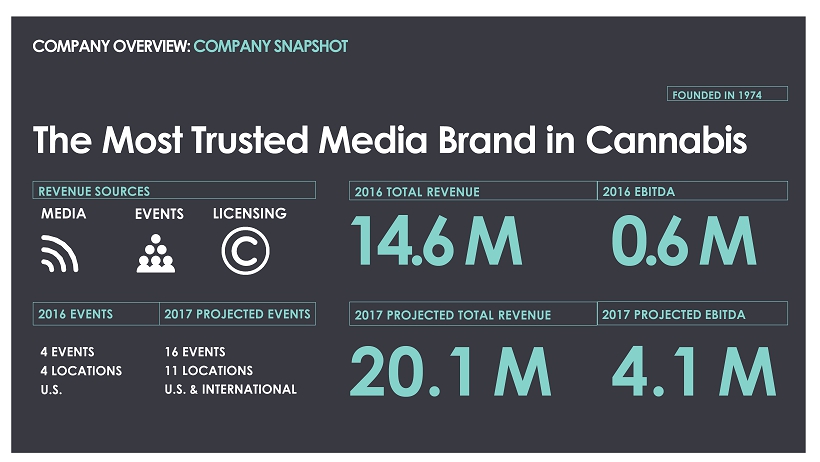

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. The Most Trusted Media Brand in Cannabis 4 EVENTS 4 LOCATIONS U.S. 16 EVENTS 11 LOCATIONS U.S. & INT ERNATIONAL FOUNDED IN 1974 2017 PROJECTED TOTAL REVENUE 2017 PROJECTED EBITDA 14.6 M 0.6 M 20.1 M 4.1 M 10 201 6 TOTAL REVENUE 201 6 EBITDA 2016 EVENTS 2017 PROJECTED EVENTS REVENUE SOURCES EVENTS MEDIA LICENSING COMPANY OVERVIEW: COMPANY SNAPSHOT

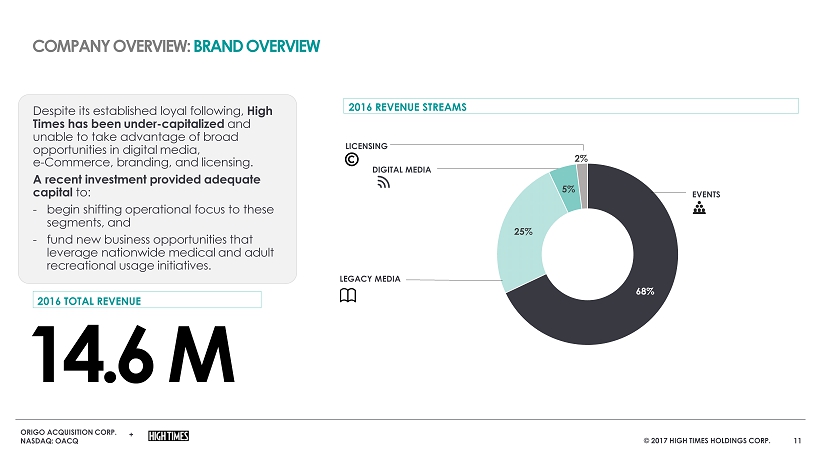

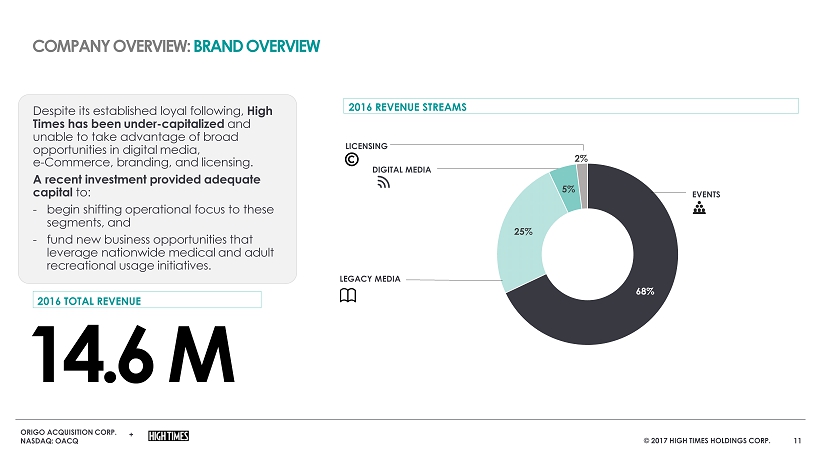

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 68% 25% 5% 2% Despite its established loyal following, High Times has been under - capitalized and unable to take advantage of broad opportunities in digital media, e - Commerce, branding , and licensing. A recent investment provided adequate capital to : - begin shifting operational focus to these segments , and - fund new business opportunities that leverage nationwide medical and adult recreational usage initiatives. 2016 REVENUE STREAMS 1 4.6 M 2016 TOTAL REVENUE 11 EVENTS LICENSING DIGITAL MEDIA LEGACY MEDIA COMPANY OVERVIEW: BRAND OVERVIEW

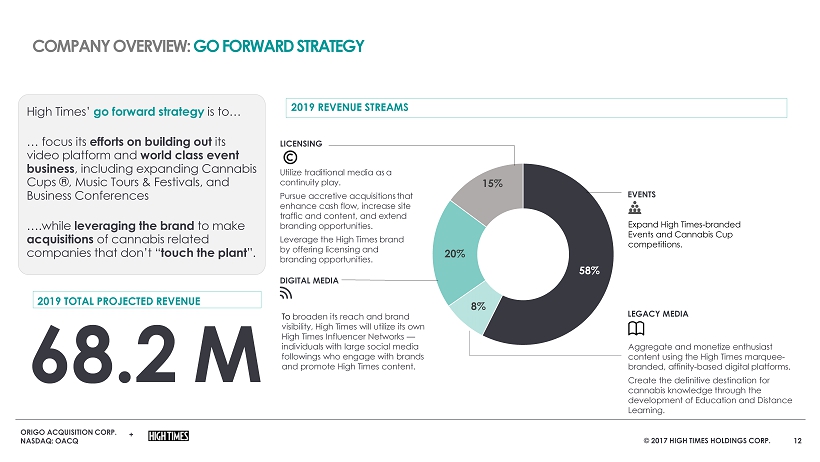

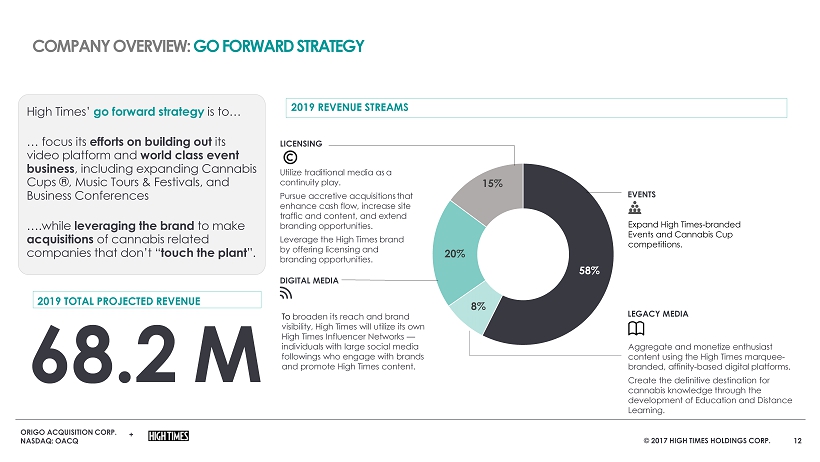

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 58% 8% 20% 15% High Times’ go forward strategy is to… … focus its efforts on building out its video platform and world class event business , including expanding Cannabis Cups ® , Music Tours & Festivals, and Business Conferences ….while leveraging the brand to make acquisitions of cannabis related companies that don · t “ touch the plant ”. 2019 REVENUE STREAMS Utilize traditional media as a continuity play. Pursue accretive acquisitions that enhance cash flow, increase site traffic and content, and extend branding opportunities. Leverage the High Times brand by offering licensing and branding opportunities. EVENTS Expand High Times - branded Events and Cannabis Cup competitions. DIGITAL MEDIA Aggregate and monetize enthusiast content using the High Times marquee - branded, affinity - based digital platforms. Create the definitive destination for cannabis knowledge through the development of Education and Distance Learning. LEGACY MEDIA 2019 TOTAL PROJECTED REVENUE 68.2 M 12 LICENSING COMPANY OVERVIEW: GO FORWARD STRATEGY To broaden its reach and brand visibility, High Times will utilize its own High Times Influencer Networks — individuals with large social media followings who engage with brands and promote High Times content.

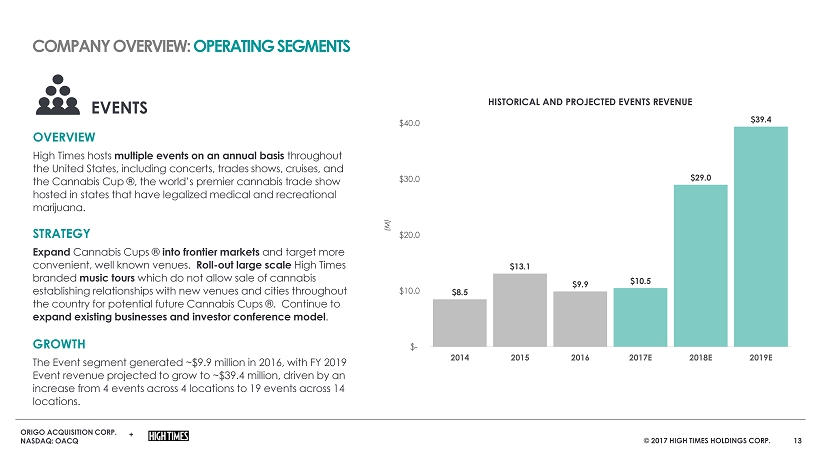

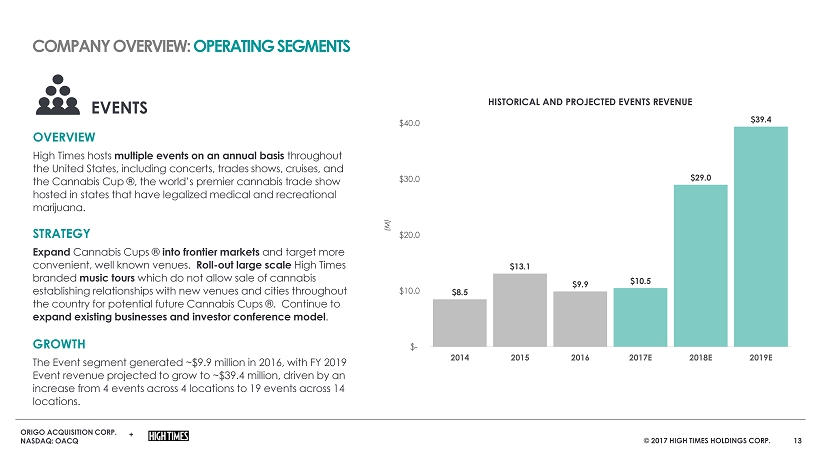

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. $8.5 $13.1 $9.9 $10.5 $29.0 $39.4 $- $10.0 $20.0 $30.0 $40.0 2014 2015 2016 2017E 2018E 2019E OVERVIEW High Times hosts multiple events on an annual basis throughout the United States, including concerts, trades shows, cruises, and the Cannabis Cup ® , the world’s premier cannabis trade show hosted in states that have legalized medical and recreational marijuana. STRATEGY Expand Cannabis Cups ® into frontier markets and target more convenient, well known venues. Roll - out large scale High Times branded music tours which do not allow sale of cannabis establishing relationships with new venues and cities throughout the country for potential future Cannabis Cups ®. Continue to expand existing businesses and investor conference model . GROWTH The Event segment generated ~$ 9.9 million in 2016, with FY 201 9 Event revenue projected to grow to ~$39.4 million, driven by an increase from 4 events across 4 locations to 19 events across 14 locations. EVENTS HISTORICAL AND PROJECTED EVENTS REVENUE 13 (M) COMPANY OVERVIEW: OPERATING SEGMENTS

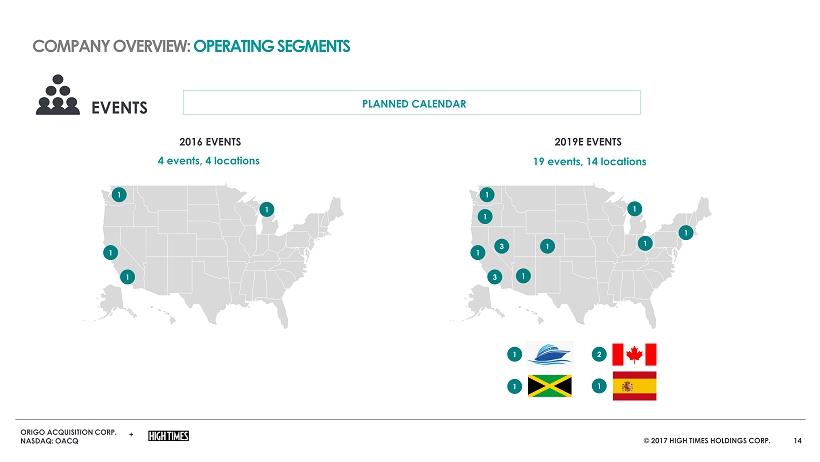

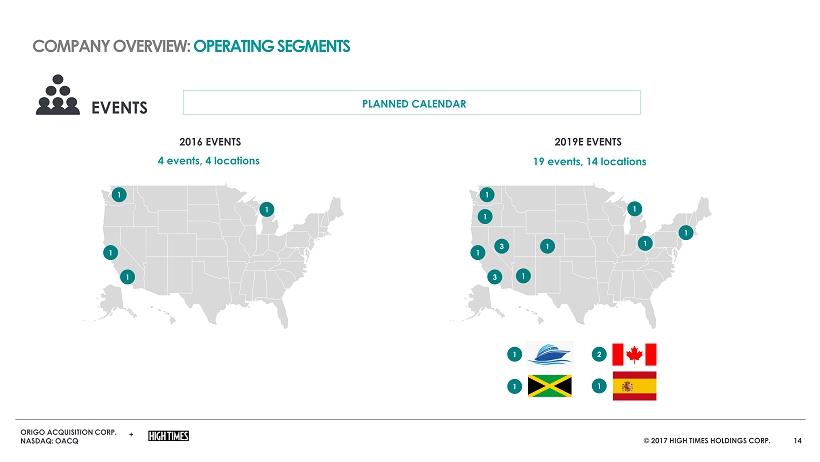

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 14 PLANNED CALENDAR 2 1 1 1 1 1 1 1 3 1 1 1 1 1 3 1 1 1 4 events, 4 locations 19 events, 14 locations 2019E EVENTS 2016 EVENTS EVENTS COMPANY OVERVIEW: OPERATING SEGMENTS

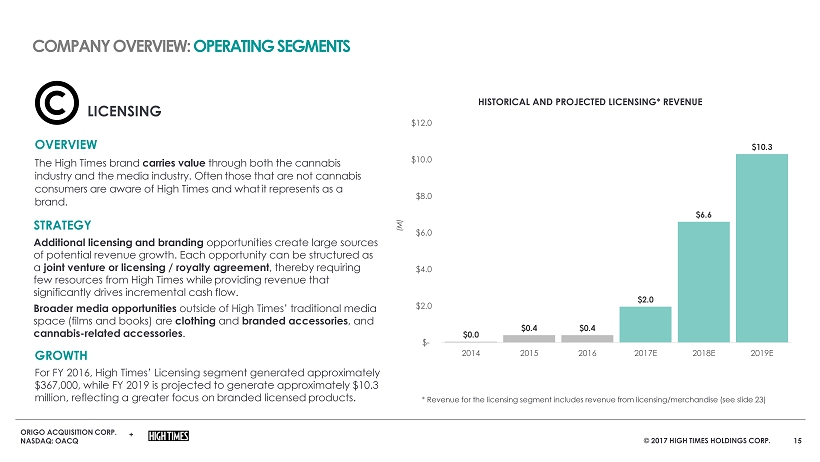

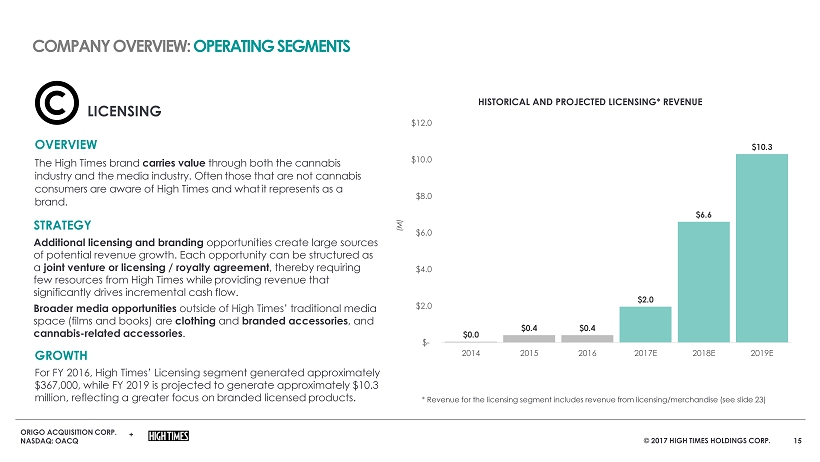

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. OVERVIEW The High Times brand carries value through both the cannabis industry and the media industry. Often those that are not cannabis consumers are aware of High Times and what it represents as a brand. STRATEGY Additional licensing and branding opportunities create large sources of potential revenue growth. Each opportunity can be structured as a joint venture or licensing / royalty agreement , thereby requiring few resources from High Times while providing revenue that significantly drives incremental cash flow. Broader media opportunities outside of High Times’ traditional media space (films and books) are clothing and branded accessories , and cannabis - related accessories . GROWTH For FY 2016, High Times’ Licensing segment generated approximately $ 367 ,000, while FY 201 9 is projected to generate approximately $ 10 . 3 million, reflecting a greater focus on branded licensed products. LICENSING 15 (M) HISTORICAL AND PROJECTED LICENSING* REVENUE $0.0 $0.4 $0.4 $2.0 $6.6 $10.3 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2014 2015 2016 2017E 2018E 2019E * Revenue for the licensing segment includes revenue from licensing/merchandise (see slide 23) COMPANY OVERVIEW: OPERATING SEGMENTS

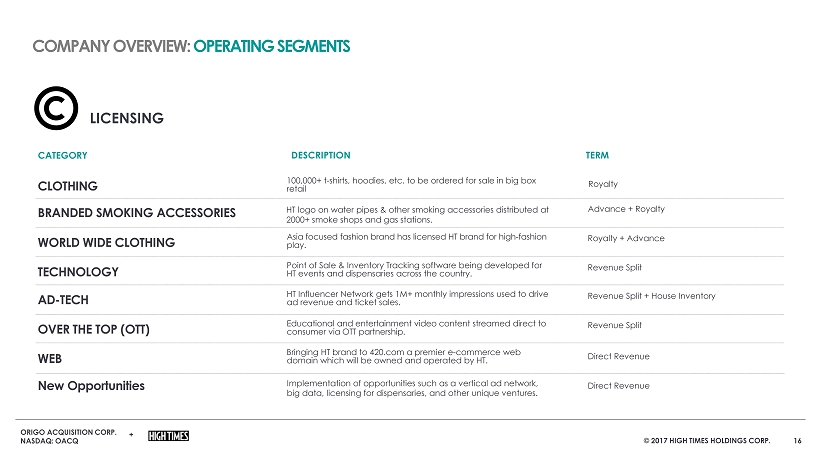

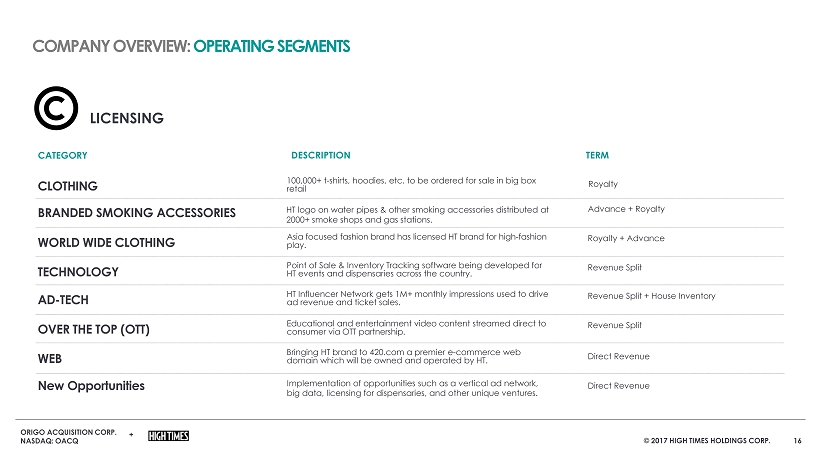

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 16 CLOTHING 100,000+ t - shirts, hoodies, etc. to be ordered for sale in big box retail BRANDED SMOKING ACCESSORIES HT logo on water pipes & other smoking accessories distributed at 2000+ smoke shops and gas stations. WORLD WIDE CLOTHING TECHNOLOGY Asia focused fashion brand has licensed HT brand for high - fashion play. AD - TECH Point of Sale & Inventory Tracking software being developed for HT events and dispensaries across the country. Royalty Advance + Royalty Royalty + Advance Revenue Split Revenue Split + House Inventory Revenue Split DESCRIPTION TERM CATEGORY OVER THE TOP (OTT) HT Influencer Network gets 1M+ monthly impressions used to drive ad revenue and ticket sales. WEB Educational and entertainment video content streamed direct to consumer via OTT partnership. Bringing HT brand to 420.com a premier e - commerce web domain which will be owned and operated by HT. Direct Revenue LICENSING COMPANY OVERVIEW: OPERATING SEGMENTS New Opportunities Implementation of opportunities such as a vertical ad network, big data, licensing for dispensaries, and other unique ventures. Direct Revenue

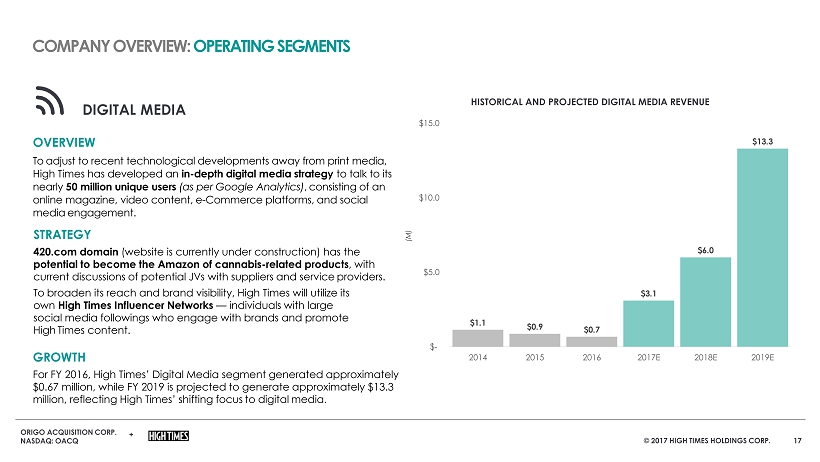

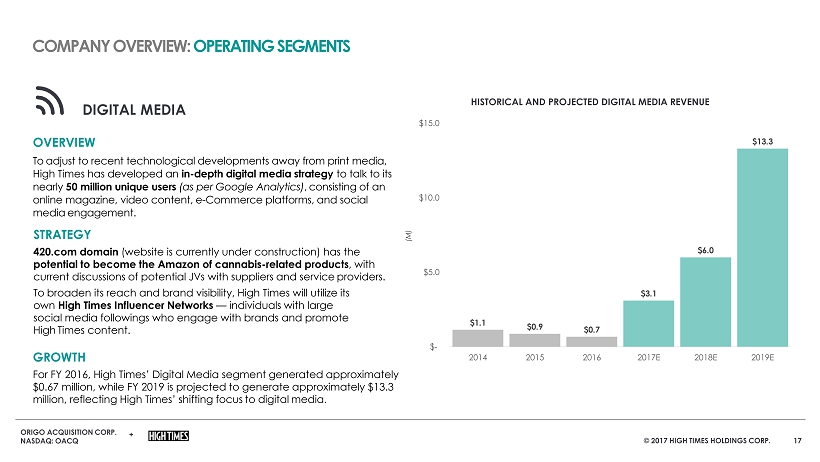

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. $1.1 $0.9 $0.7 $3.1 $6.0 $13.3 $- $5.0 $10.0 $15.0 2014 2015 2016 2017E 2018E 2019E OVERVIEW To adjust to recent technological developments away from print media, High Times has developed an in - depth digital media strategy to talk to its nearly 50 million unique users (as per Google Analytics) , consisting of an online magazine, video content, e - Commerce platforms, and social media engagement. STRATEGY 420.com domain (website is currently under construction) has the potential to become the Amazon of cannabis - related products , with current discussions of potential JVs with suppliers and service providers. To broaden its reach and brand visibility, High Times will utilize its own High Times Influencer Networks — individuals with large social media followings who engage with brands and promote High Times content. GROWTH For FY 2016, High Times’ Digital Media segment generated approximately $ 0.67 million, while FY 201 9 is projected to generate approximately $ 13.3 million, reflecting High Times’ shifting focus to digital media. DIGITAL MEDIA 17 (M) HISTORICAL AND PROJECTED DIGITAL MEDIA REVENUE COMPANY OVERVIEW: OPERATING SEGMENTS

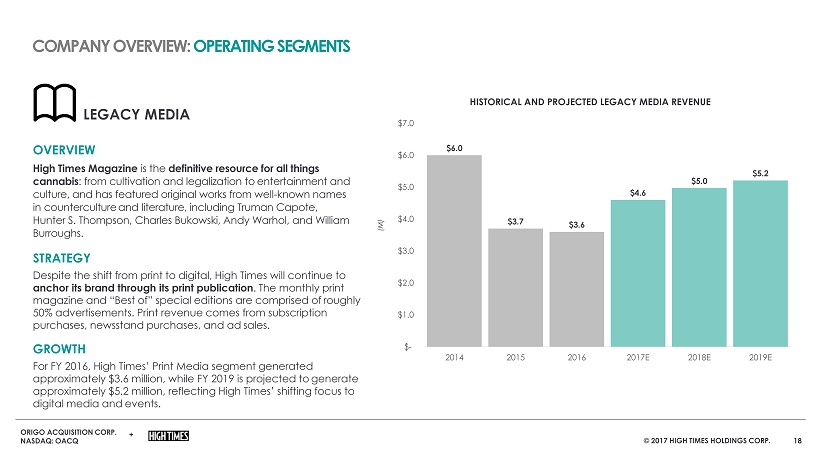

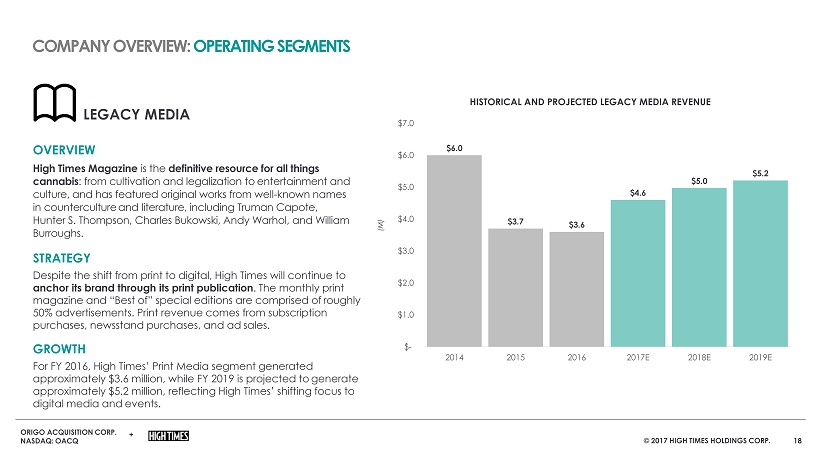

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. $6.0 $3.7 $3.6 $4.6 $5.0 $5.2 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2014 2015 2016 2017E 2018E 2019E OVERVIEW High Times Magazine is the definitive resource for all things cannabis : from cultivation and legalization to entertainmen t and culture , and has featur ed original works from well - known names in counterculture and literature, including Truman Capote, Hunter S. Thompson, Charles Bukowski, Andy Warhol, and William Burroughs. STRATEGY Despite the shift from print to digital, High Times will continue to anchor its brand through its print publication . The monthly print magazine and “Best of” special editions are comprised of roughly 50% advertisements. Print revenue comes from subscription purchases, newsstand purchases, and ad sales. GROWTH For FY 2016, High Times’ Print Media segment generated approximately $ 3.6 million, while FY 201 9 is projected to generate approximately $5. 2 million, reflecting High Times’ shifting focus to digital media and events. LEGACY MEDIA 18 (M) HISTORICAL AND PROJECTED LEGACY MEDIA REVENUE COMPANY OVERVIEW: OPERATING SEGMENTS

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY TK TRANSACTION BRIEF & INVESTMENT HIGHLIGHTS ORIGO ACQUISITION CORP. + NASDAQ: OACQ Market O v e r v i e w ORIGO ACQUISITION CORP. NASDAQ: OACQ + 19

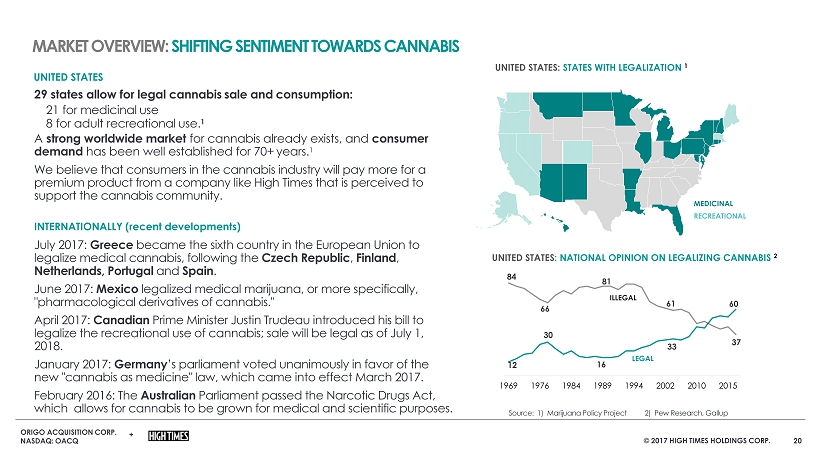

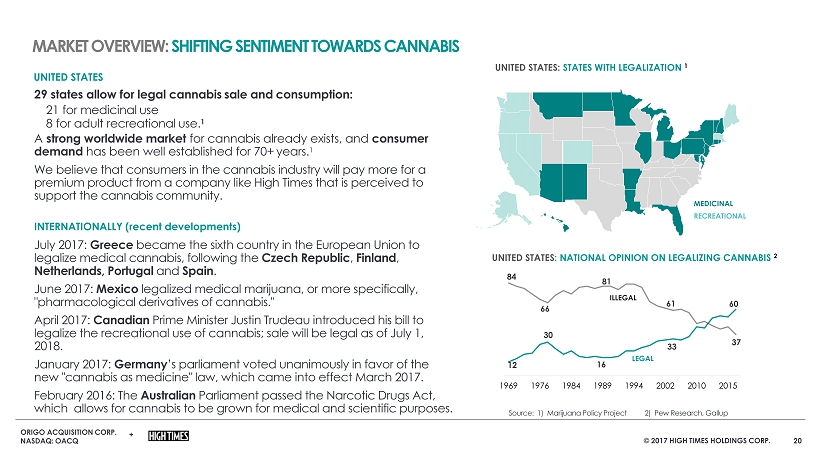

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY UNITED STATES 29 states allow for legal cannabis sale and consumption: 21 for medicinal use 8 for adult recreational use. 1 A strong worldwide market for cannabis already exists, and consumer demand has been well established for 70+ years. 1 We believe that consumers in the cannabis industry will pay more for a premium product from a company like High Times that is perceived to support the cannabis community. INTERNATIONALLY (recent developments) July 2017: Greece became the sixth country in the European Union to legalize medical cannabis, following the Czech Republic , Finland , Netherlands, Portugal and Spain . June 2017: Mexico legalized medical marijuana, or more specifically, "pharmacological derivatives of cannabis." April 2017: Canadian Prime Minister Justin Trudeau introduced his bill to legalize the recreational use of cannabis; sale will be legal as of July 1, 2018. January 2017: Germany ’s parliament voted unanimously in favor of the new "cannabis as medicine" law, which came into effect March 2017. February 2016: The Australian Parliament passed the Narcotic Drugs Act, which allows for cannabis to be grown for medical and scientific purposes. UNITED STATES : NATIONAL OPINION ON LEGALIZING CANNABIS 2 12 30 16 33 60 84 66 81 61 37 1969 1976 1984 1989 1994 2002 2010 2015 LEGAL UNITED STATES: STATES WITH LEGALIZATION 1 MEDICINAL 20 MARKET OVERVIEW: SHIFTING SENTIMENT TOWARDS CANNABIS Source: 1) Marijuana Policy Project 2) Pew Research, Gallup

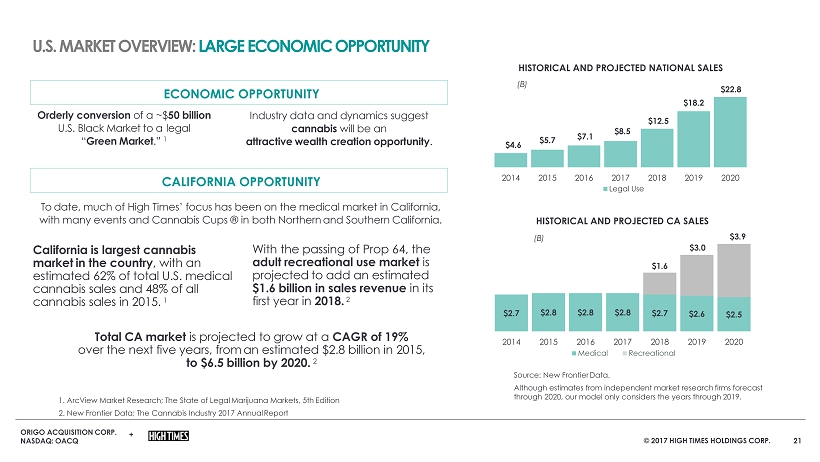

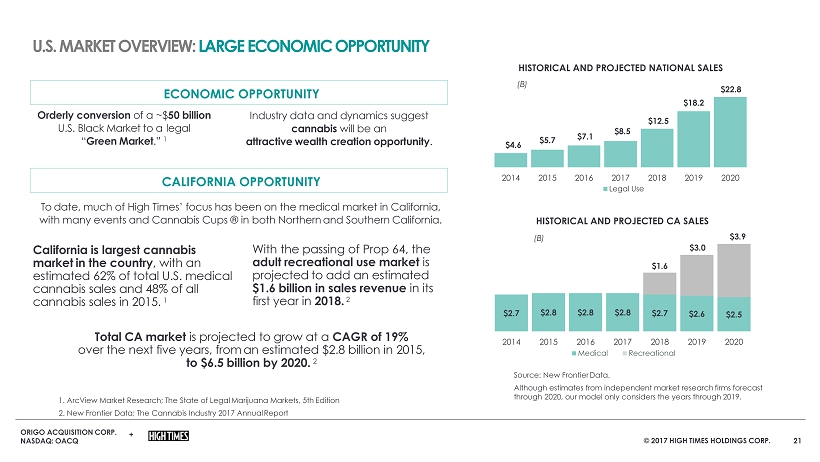

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY Orderly conversion of a ~$ 50 billion U.S. Black Market to a legal “ Green Market .” 1 Industry data and dynamics suggest cannabis will be an attractive wealth creation opportunity . To date, much of High Times’ focus has been on the medical market in California, with many events and Cannabis Cups ® in both Northern and Southern California. California is largest cannabis market in the country , with an estimated 62% of total U.S. medical cannabis sales and 48% of all cannabis sales in 2015. 1 With the passing of Prop 64, the adult recreational use market is projected to add an estimated $1.6 billion in sales revenue in its first year in 2018. 2 T otal CA market is projected to grow at a CAGR of 19% over the next five years, from an estimated $2.8 billion in 2015, to $6.5 billion by 2020. 2 1. ArcView Market Research; The State of Legal Marijuana Markets, 5th Edition 2. New Frontier Data; The Cannabis Industry 2017 Annual Report Source: New Frontier Data. Although estimates from independent market research firms forecast through 2020, our model only considers the years through 2019. HISTORICAL AND PROJECTED NATIONAL SALES $4.6 $5.7 $7.1 $8.5 $12.5 $18.2 $22.8 2014 2015 2016 2017 2018 2019 2020 Legal Use ( B ) HISTORICAL AND PROJECTED CA SALES $2.7 $2.8 $2.8 $2.8 $2.7 $2.6 $2.5 $1.6 $3.0 $3.9 2014 2015 2016 2017 2018 2019 2020 Medical Recreational ( B ) 21 U.S. MARKET OVERVIEW: LARGE ECONOMIC OPPORTUNITY ECONOMIC OPPORTUNITY CALIFORNIA OPPORTUNITY

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY TK TRANSACTION BRIEF & INVESTMENT HIGHLIGHTS ORIGO ACQUISITION CORP. + NASDAQ: OACQ © 2017 HIGH TIMES HOLDINGS CORP. 5 22 Financial Overview ORIGO ACQUISITION CORP. NASDAQ: OACQ +

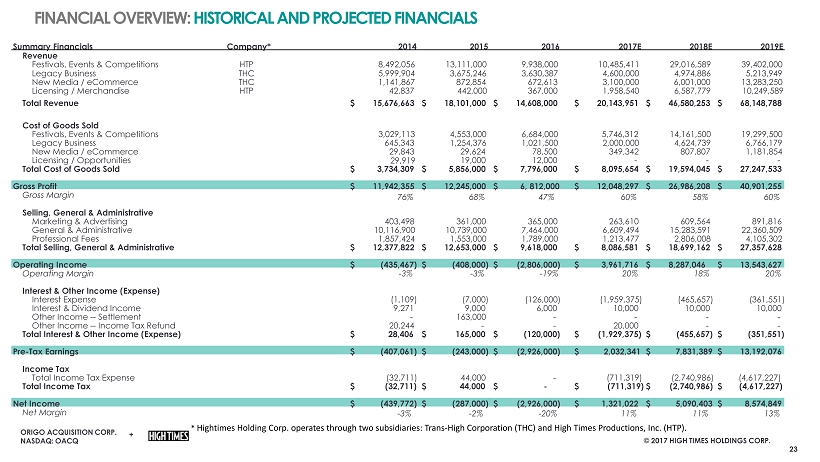

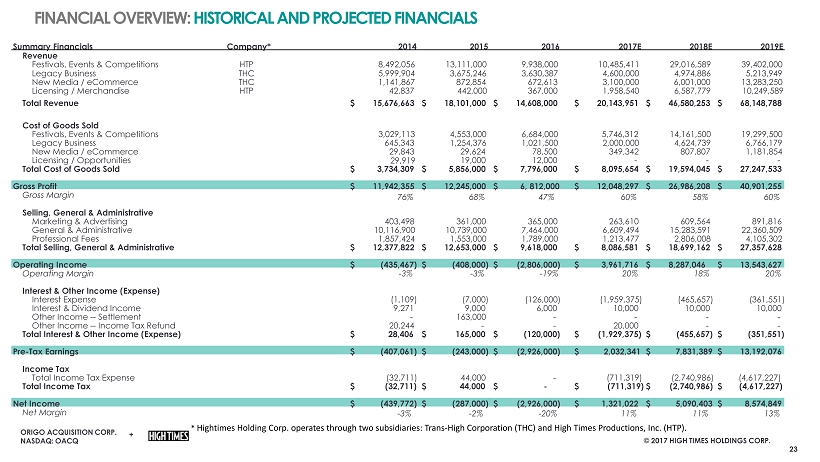

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 23 FINANCIAL OVERVIEW: HISTORICAL AND PROJECTED FINANCIALS EXECUTIVE SUMMARY Summary Financials Company* 2014 2015 2016 2017E 2018E 2019E Revenue Festivals, Events & Competitions HTP 8,492,056 13,111,000 9,938,000 10,485,411 29,016,589 39,402,000 Legacy Business THC 5,999,904 3,675,246 3,630,387 4,600,000 4,974,886 5,213,949 New Media / eCommerce THC 1,141,867 872,854 672,613 3,100,000 6,001,000 13,283,250 Licensing / Merchandise HTP 42,837 442 ,000 367,000 1,958,540 6,587,779 10,249,589 Total Revenue 15,676,663 $ 18,101,000 $ 14,608,000 $ 20,143,951 $ 46,580,253 $ 68,148,788 $ Cost of Goods Sold Festivals, Events & Competitions 3,029,113 4,553,000 6,684,000 5,746,312 14,161,500 19,299,500 Legacy Business 645,343 1,254,376 1,021,500 2,000,000 4,624,739 6,766,179 New Media / eCommerce 29,843 29,624 78,500 349,342 807,807 1,181,854 Licensing / Opportunities 29,919 19,000 12,000 - - - Total Cost of Goods Sold 3,734,309 $ 5,856,000 $ 7,796,000 $ 8,095,654 $ 19,594,045 $ 27,247,533 $ Gross Profit 11,942,355 $ 12,245,000 $ 6, 812,000 $ 12,048,297 $ 26,986,208 $ 40,901,255 $ Gross Margin Selling, General & Administrative Marketing & Advertising 403,498 361,000 365,000 263,610 609,564 89 1,816 General & Administrative 10,116,900 10,739,000 7,464,000 6,609,494 15,283,591 22,360,509 Professional Fees 1,857,424 1,553,000 1,789,000 1,213,477 2,806,008 4,105,302 Total Selling, General & Administrative 12,377,822 $ 12,653,000 $ 9,618,000 $ 8,086,581 $ 18,699,162 $ 27,357,628 $ Operating Income (435,467) $ (408,000) $ (2,806,000) $ 3,961,716 $ 8,287,046 $ 13,543,627 $ Operating Margin - 3% - 3% - 19 % 20% 18 % 20 % Interest & Other Income (Expense) Interest Expense (1,109) (7,000) (126,000) (1,959,375) (465,657) (361,551) Interest & Dividend Income 9,271 9,000 6 ,000 10,000 10,000 10,000 Other Income -- Settlement - 163,000 - - - - Other Income -- Income Tax Refund 20,244 - - 20,000 - - Total Interest & Other Income (Expense) 28,406 $ 165 ,000 $ (120,000) $ (1,929,375) $ (455,657) $ (351,551) $ Pre - Tax Earnings (407,061) $ (243,000) $ (2,926,000) $ 2,032,341 $ 7,831,389 $ 13,192,076 $ Income Tax Total Income Tax Expense (32,711) 44,000 - (711,319) (2,740,986) ( 4,617,227 ) Total Income Tax (32,711) $ 44,000 $ - $ (711,319) $ (2,740,986) $ ( 4,617,227 ) $ Net Income (439,772) $ ( 287 ,000) $ (2,926,000) $ 1,321,022 $ 5,090,403 $ 8,574,849 $ Net Margin - 3% - 2% - 20% 11% 11% 13 % 76% 68 % 47% 60% 58% 60% * Hightimes Holding Corp. operates through two subsidiaries: Trans - High Corporation (THC) and High Times Productions, Inc. (HTP).

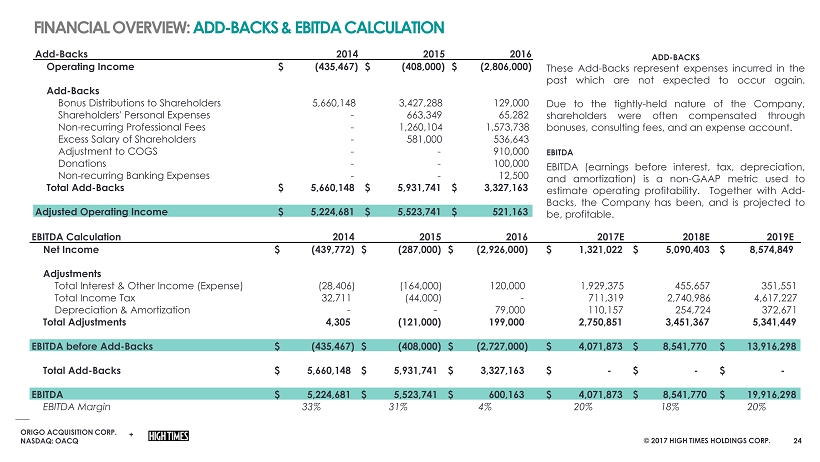

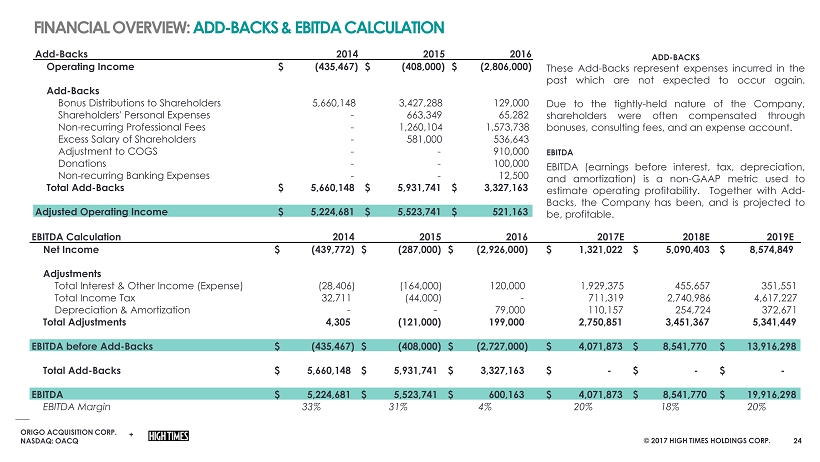

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY 24 ADD - BACKS These Add - Backs represent expenses incurred in the past which are not expected to occur again . Due to the tightly - held nature of the Company, shareholders were often compensated through bonuses, consulting fees, and an expense account . EBITDA EBITDA (earnings before interest, tax, depreciation, and amortization) is a non - GAAP metric used to estimate operating profitability . Together with Add - Backs, the Company has been, and is projected to be, profitable . FINANCIAL OVERVIEW: ADD - BACKS & EBITDA CALCULATION Add - Backs 2014 2015 2016 Operating Income (435,467) $ (408,000) $ (2,806,000) $ Add - Backs Bonus Distributions to Shareholders 5,660,148 3,427,288 129,000 Shareholders' Personal Expenses - 663,349 65,282 Non - recurring Professional Fees - 1,260,104 1,573,738 Excess Salary of Shareholders - 581,000 536,643 Adjustment to COGS - - 910,000 Donations - - 100,000 Non - recurring Banking Expenses - - 12,500 Total Add - Backs 5,660,148 $ 5,931,741 $ 3,327,163 $ Adjusted Operating Income 5,224,681 $ 5,523,741 $ 521,163 $ EBITDA Calculation 2014 2015 2016 2017E 2018E 2019E Net Income (439,772) $ ( 287 ,000) $ (2,926,000) $ 1,321,022 $ 5,090,403 $ 8,574,849 $ Adjustments Total Interest & Other Income (Expense) (28,406) (164,000) 120,000 1,929,375 455,657 351,551 Total Income Tax 32,711 (44,000) - 711,319 2,740,986 4,617,227 Depreciation & Amortization - - 79,000 110,157 254,724 372,671 Total Adjustments 4,305 (121,000) 199 ,000 2,750,851 3,451,367 5,341,449 EBITDA before Add - Backs (435,467) $ (408,000) $ ( 2,727 ,000) $ 4,071,873 $ 8,541,770 $ 13,916,298 $ Total Add - Backs 5,660,148 $ 5,931,741 $ 3,327,163 $ - $ - $ - $ EBITDA 5,224,681 $ 5,523,741 $ 600,163 $ 4,071,873 $ 8,541,770 $ 19,916,298 $ EBITDA Margin 33% 31% 4 % 20% 18 % 20 %

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 25 FINANCIAL OVERVIEW: 6 - MONTHS 2017 FINANCIAL PERFORMANCE Financial Performance Company * 1/31/2017 2/28/2017 3/31/2017 4/30/2017 5/31/2017 6/30/2017 6M 2017 Revenue Festivals, Events & Competitions HTP 277,034 573,057 2,361,888 1,257,127 153,405 3,583,714 8,206,224 Legacy Business THC 289,344 313,509 364,291 327,021 333,522 235,654 1,863,342 New Media / eCommerce THC 17,368 5,253 19,223 11,671 7,530 (9,506) 51,540 Licensing / Merchandise HTP 607 7 587 8,300 115 - 9,617 Total Revenue 584,353 891,827 2,745,989 1,604,119 494,572 3,809,863 10,130,723 Cost of Goods Sold 151,591 219,129 1,508,729 1,753,448 118,991 2,702,895 6,454,784 Gross Profit $ 432,762 $ 672,697 $ 1,237,260 $ (149,329) $ 375,581 $ 1,106,968 $ 3,675,938 Gross Margin 74.1% 75.4% 45.1% - 9.3% 75.9% 29.1% 36.3% Total THC & HTP Operating Expenses 405,322 7,517,677 932,109 482,834 469,468 1,085,627 10,893,036 Operating Income $ 27,440 $ (6,844,980) $ 305,151 $ (632,163) $ (93,887) $ 21,341 $ (7,217,098) Operating Income Margin 4.7% - 767.5% 11.1% - 39.4% - 19.0% 0.6% - 71.2% Total THC & HTP Other Income (Expense) (18,636) (673,133) (554,223) (385,805) (396,119) (350,732) (2,378,648) Pre - Tax Earnings $ 8,804 $ (7,518,113) $ (249,072) $ (1,017,968) $ (490,006) $ (329,392) $ (9,595,747) Provisions for Income Tax - - - - - - - Net Income $ 8,804 $ (7,518,113) $ (249,072) $ (1,017,968) $ (490,006) $ (329,392) $ (9,595,747) * Hightimes Holding Corp. operates through two subsidiaries: Trans - High Corporation (THC) and High Times Productions, Inc. (HTP).

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 26 Management & Board of Directors ORIGO ACQUISITION CORP. NASDAQ: OACQ +

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 27 ADAM LEVIN CEO • Mr . Levin is the founder of Hightimes Holdings and has served as its Chairman and CEO, since its inception in December 2016 . In March, 2017 , Mr . Levin led the acquisition of Trans - High Corporation and has served as CEO of the Hightimes Group since March 2017 . • He brings over 15 years of leadership experience running Internet - based technology and e - commerce companies to his role as Chairman and CEO . • Mr . Levin is Managing Director of Oreva Capital Corp and was Managing Director of Vert Capital Corp . • He has extensive experience in the fields of mobile, social networking, entertainment as well as venture capital and merger and acquisition strategies . • Mr . Levin has been a featured speaker at CES, MIPTV, MONY Conference, CTIA, Wireless Influencers, and has been featured in The Wall Street Journal, The NY Times, Fortune, Bloomberg and Entrepreneur Magazine . He has appeared on CNN, NPR, MSNBC, HBO and Fox News . • Mr . Levin currently serves on the board of directors of Pride Media, Inc . , and previously served as the Chairman of the Board of Directors of Pixelmags , and was CEO and director of Bebo . com, Inc . • Mr . Levin earned a BA from Thomas Edison State College . DAVID NEWBERG VP of Finance, Interim CFO • Mr . Newberg has over 25 years experience and is a veteran in executive finance, having overseen and advised many companies’ finance and business operations . • Previously, he served as VP of Finance at Rhino Entertainment, a subsidiary of Warner Music where he directed company accounting and finance operations for all business units, growing from a $ 20 million independent company to over $ 600 million globally . • Prior to Rhino Entertainment, Mr . Newberg was Chief Financial Officer of Live Universe Inc . , a start - up company that owned over 40 social/music media, websites, where he was responsible for directing all company accounting, finance, and human resource functions . • Mr . Newberg was also Chief Financial Officer of Delta Entertainment Corporation, a self - distributing entertainment company that wholesales audio/video products . • He has been involved with providing CFO consulting with SMC Entertainment (a public OTC music label), NXTM, Scopely, and The Wrap . Mr . Newberg has a BS in Accounting and Finance, and a MS in Finance from CSU - Long Beach . He has an active CPA license and is also a CMA, CFM, and CFP . SAMEEN AHMAD VP of Events • Ms . Ahmad curates, manages and produces the Company’s events from top to bottom around the country, with a decade of experience in festival and event production . • Previously an Investment Banking Analyst with the Blackstone Group laying the foundation to join the global expansion team for Starwood Hotel & Resort’s W and St . Regis spa division . • Worked for Austin City Limits Live and opened Brooklyn Bowl’s London and Las Vegas outposts . DAVID PECK VP of Business Development • Mr . Peck was previously the Director of Digital Operations at Sock Panda LLC, an Angel backed E - commerce company in Venice, California, where he was responsible for tripling revenues through corporate partnerships with Girl Scouts of America, Facebook, and Amazon . • In addition to Social Media Marketing and an innovative E - Commerce subscription strategy, Mr . Peck was responsible for driving a charitable program in conjunction with the department of Veterans Affairs to supply socks to homeless veterans across the United States . • Before Sock Panda, Mr . Peck was the Manager of Digital Networks for Sony Pictures Television (SPT), where he was responsible for negotiating distribution deals, acquisitions, programming, marketing, operations and managing relationships with partners on behalf of Crackle, the studio’s multi - platform video entertainment network worldwide . • He holds an MBA from USC and a Bachelors from Brown University . MANAGEMENT TEAM

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. STORMY SIMON Director • Ms . Simon served as the President of Overstock . com Inc . since July 27 , 2016 and Co - President from February 22 , 2013 to April 10 , 2014 . Ms . Simon served as Senior Vice President of Customer and Partner Care at Overstock . com Inc . until February 22 , 2013 . She served as Senior Vice President of Customer Care, Public Relations & Branding of Overstock . com Inc . • Ms . Simon served as Vice President of Books, Music and Videos of Overstock . com Inc . since February 19 , 2004 , and also served as its Senior Vice President BMV and Off - Line Advertising and Chief of Staff . • She served as Vice President, BMMG ; Travel and Off - Line Advertising of Overstock . com Inc . Ms . Simon headed Overstock . com BMV category and was responsible for all offline marketing including television, radio and print advertising . JUSTIN EHRLICH Director • Partner in VE Equities LLC, a full - service real estate company . • Completed over $ 10 billion of luxury mixed - use and condominium projects in Manhattan and is also currently developing several mixed - use projects in California . • Partner in Churchill Real Estate Holdings LLC, an alternative investment platform offering short term debt products to institutional and private clients . • Mr . Ehrlich is currently on the Board of Directors for A Caring Hand and BDS Analytics . 28 ADAM LEVIN C hairman • Mr . Levin is the founder of Hightimes Holdings and has served as its Chairman and CEO, since its inception in December 2016 . In March, 2017 , Mr . Levin led the acquisition of Trans - High Corporation and has served as CEO of the Hightimes Group since March 2017 . • He brings over 15 years of leadership experience running Internet - based technology and e - commerce companies to his role as Chairman and CEO . • Mr . Levin is Managing Director of Oreva Capital Corp and was Managing Director of Vert Capital Corp . • He has extensive experience in the fields of mobile, social networking, entertainment as well as venture capital and merger and acquisition strategies . • Mr . Levin has been a featured speaker at CES, MIPTV, MONY Conference, CTIA, Wireless Influencers, and has been featured in The Wall Street Journal, The NY Times, Fortune, Bloomberg and Entrepreneur Magazine . He has appeared on CNN, NPR, MSNBC, HBO and Fox News . • Mr . Levin currently serves on the board of directors of Pride Media, Inc . , and previously served as the Chairman of the Board of Directors of Pixelmags , and was CEO and director of Bebo . com, Inc . • Mr . Levin earned a BA from Thomas Edison State College . BOARD OF DIRECTORS EDWARD J. FRED Director • Mr . Fred is the CEO of Origo Acquisition Corp . He brings over 35 years of experience in the executive and financial management of publicly - traded and privately - held companies, including aerospace and defense industry . Mr . Fred retired as CEO of CPI Aerostructures , Inc . (NYSE : CVU) in March 2014 having been an officer of the company since 1995 . • For approximately ten years prior to joining CPI, Mr . Fred served in various positions for the international division of Grumman . • Mr . Fred serves on the Board of Trustees of Island Harvest and is active in The March of Dimes, the Sid Jacobson Community Center, 1 in 9 Breast Cancer Action Coalition - Hewlett House, the Salvation Army, the Coalition Against Child Abuse & Neglect, the Children’s Sports Connection, and The Cradle of Aviation . JEFF GUTOVICH Director • Mr . Gutovich brings over 30 years of entrepreneurial and executive experience that includes financial services, aviation and aerospace buy - out and operations . • Mr . Gutovich is the Chairman of the Board of Advisors for Genexa Health, a company that creates healthier medicines, Founder and CEO of Sentry Financial Services Group, Inc . , a Los Angeles - based firm specialized in wealth preservation, tax minimization, and insurance strategies across a broad asset spectrum and a co - founder of Financial Resources Group . a professional services practice specialized in insurance, retirement and estate planning, employee benefits, and asset management firm . • Mr . Gutovich was a partner in the leverage buyout team that acquired four operating companies from Lear Siegler, a Fortune 500 company . Mr . Gutovich began his career in 1975 as a corporate pilot .

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 29 Additional Transaction Details ORIGO ACQUISITION CORP. NASDAQ: OACQ +

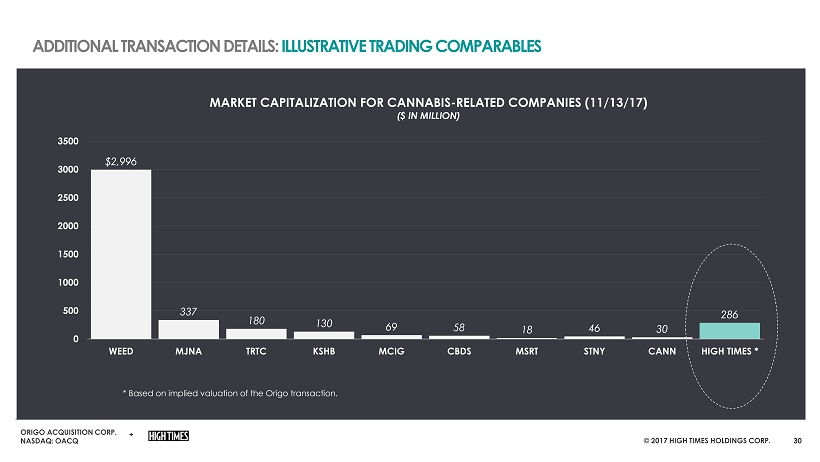

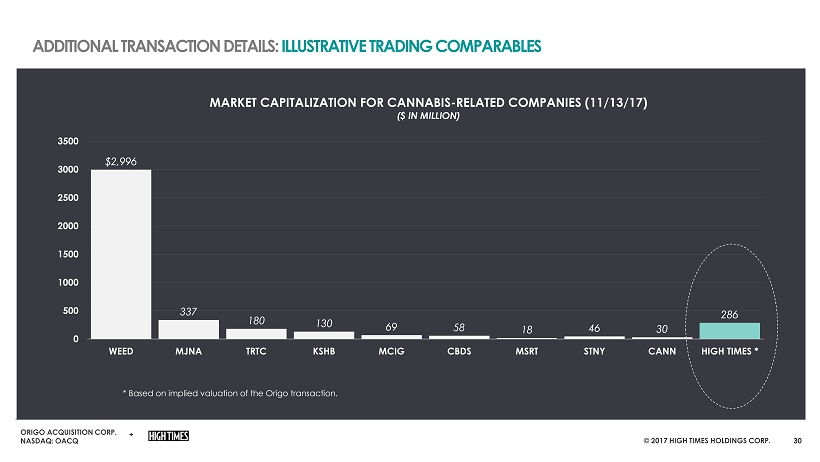

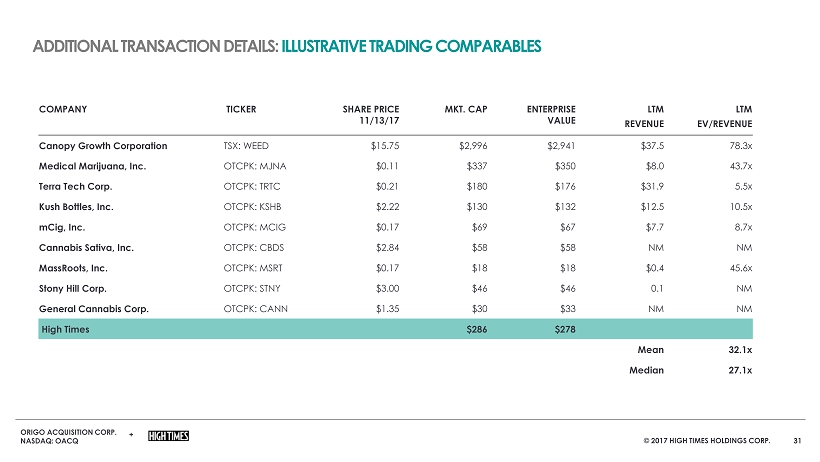

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. $2,996 337 180 130 69 58 18 46 30 286 0 500 1000 1500 2000 2500 3000 3500 WEED MJNA TRTC KSHB MCIG CBDS MSRT STNY CANN HIGH TIMES * MARKET CAPITALIZATION FOR CANNABIS - RELATED COMPANIES (11/13/17) ($ IN MILLION) 30 (M) * Based on implied valuation of the Origo transaction. ADDITIONAL TRANSACTION DETAILS: ILLUSTRATIVE TRADING COMPARABLES

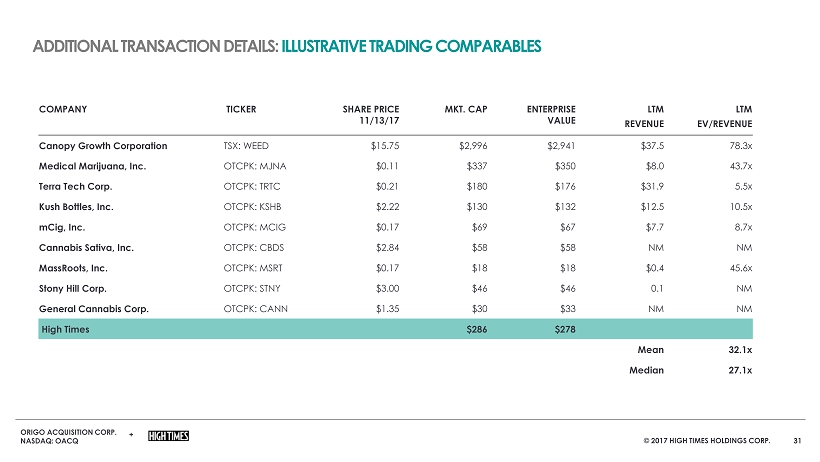

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY COMPANY TICKER SHARE PRICE 11/13/17 MKT. CAP ENTERPRISE VALUE LTM LTM REVENUE EV/REVENUE Canopy Growth Corporation TSX: WEED $15.75 $2,996 $2,941 $37.5 78.3x Medical Marijuana, Inc. OTCPK: MJNA $0.11 $337 $350 $8.0 43.7x Terra Tech Corp. OTCPK: TRTC $0.21 $180 $176 $31.9 5.5x Kush Bottles, Inc. OTCPK: KSHB $2.22 $130 $132 $12.5 10.5x mCig , Inc. OTCPK: MCIG $0.17 $69 $67 $7.7 8.7x Cannabis Sativa, Inc. OTCPK: CBDS $2.84 $58 $58 NM NM MassRoots , Inc. OTCPK: MSRT $0.17 $18 $18 $0.4 45.6x Stony Hill Corp. OTCPK: STNY $3.00 $46 $46 0.1 NM General Cannabis Corp. OTCPK: CANN $1.35 $30 $33 NM NM High Times $286 $278 Mean 32.1x Median 27.1x 31 ADDITIONAL TRANSACTION DETAILS: ILLUSTRATIVE TRADING COMPARABLES

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. July 27, 2 01 7 Transaction announced Q1 2 018 Hold shareholder vote for SPAC Q1 2 018 Close transaction and NASDAQ listing 32 ADDITIONAL TRANSACTION DETAILS: ANTICIPATED TRANSACTION TIMELINE November 13, 2 017 Preliminary S - 4 filed with the SEC

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. 33 Appendix ORIGO ACQUISITION CORP. NASDAQ: OACQ +

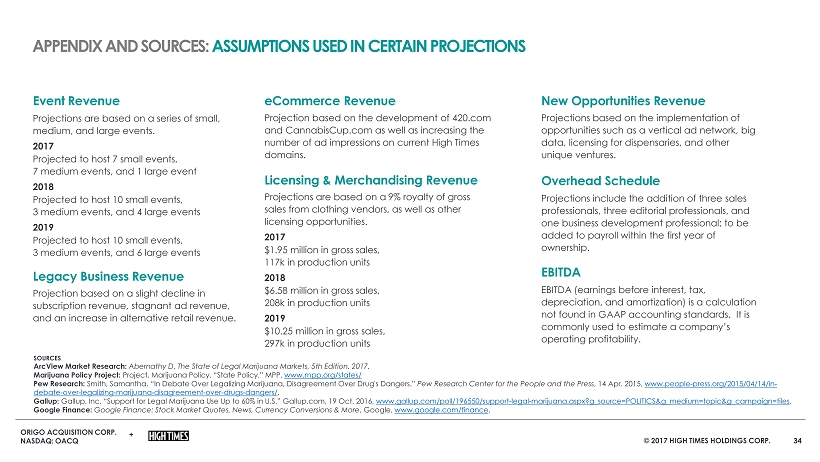

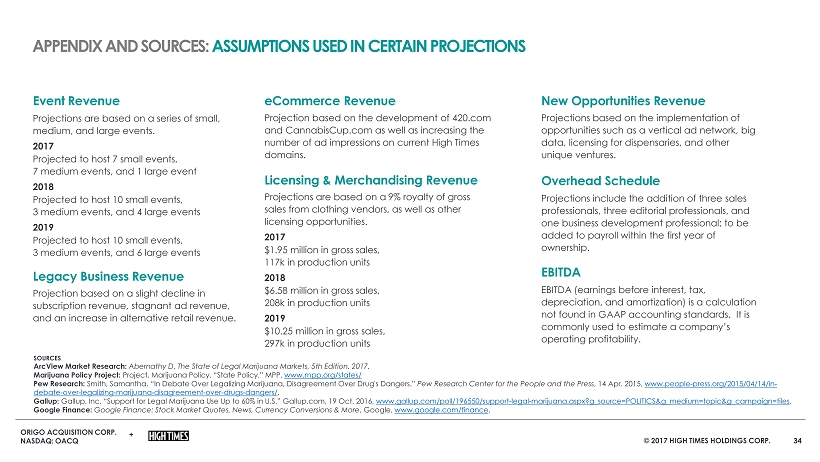

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY 34 Event Revenue Project ions are based on a series of small, medium, and large events. 2017 Projected to host 7 small events, 7 medium events, and 1 large event 2018 Projected to host 10 small events, 3 medium events, and 4 large events 2019 Projected to host 10 small events, 3 medium events, and 6 large events Legacy Business Revenue Projection based on a slight decline in subscription revenue, stagnant ad revenue, and an increase in alternative retail revenue. SOURCES ArcView Market Research: Abernathy D. The State of Legal Marijuana Markets, 5th Edition. 2017. Marijuana Policy Project: Project, Marijuana Policy. “State Policy.” MPP, www.mpp.org/states/ Pew Research: Smith, Samantha. “In Debate Over Legalizing Marijuana, Disagreement Over Drug's Dangers.” Pew Research Center for the People and the Press , 14 Apr. 2015, www.people - press.org/2015/04/14/in - debate - over - legalizing - marijuana - disagreement - over - drugs - dangers/ . Gallup: Gallup, Inc. “Support for Legal Marijuana Use Up to 60% in U.S.” Gallup.com , 19 Oct. 2016, www.gallup.com/poll/196550/support - legal - marijuana.aspx?g_source=POLITICS&g_medium=topic&g_campaign=tiles . Google Finance: Google Finance: Stock Market Quotes, News, Currency Conversions & More , Google, www.google.com/finance . eCommerce Revenue Projection based on the development of 420.com and CannabisCup.com as well as increasing the number of ad impressions on current High Times domains. Licensing & Merchandising Revenue Projections are based on a 9% royalty of gross sales from clothing vendors, as well as other licensing opportunities. 2017 $1.95 million in gross sales, 117k in production units 2018 $6.58 million in gross sales, 208k in production units 2019 $10.25 million in gross sales, 297k in production units New Opportunities Revenue Projections based on the implementation of opportunities such as a vertical ad network, big data, licensing for dispensaries, and other unique ventures. Overhead Schedule Projections include the addition of three sales professionals, three editorial professionals, and one business development professional; to be added to payroll within the first year of ownership. EBITDA EBITDA (earnings before interest, tax, depreciation, and amortization) is a calculation not found in GAAP accounting standards. It is commonly used to estimate a company’s operating profitability. APPENDIX AND SOURCES: ASSUMPTIONS USED IN CERTAIN PROJECTIONS

ORIGO ACQUISITION CORP. NASDAQ: OACQ + © 201 7 HIG H TIMES HOLDING S CORP. EXECUTIVE SUMMARY HIGH TIMES HOLDING CORP. Adam Levin Chief Executive Officer adam@hightimes.com ORIGO ACQUISITION CORP. Edward J. Fred Chief Executive Officer ejfr ed22@verizon.net MEDIA High Times Media Team 516 - 996 - 4200 mediateam@hightimes.com FINANCIAL ADVISOR EarlyBirdCapital , Inc. 212 - 661 - 0200 INVESTOR RELATIONS Lena Cati The Equity Group Vice President 212 - 836 - 9611 lcati@equityny.com 35 CONTACT US