Period ended September 30, 2024

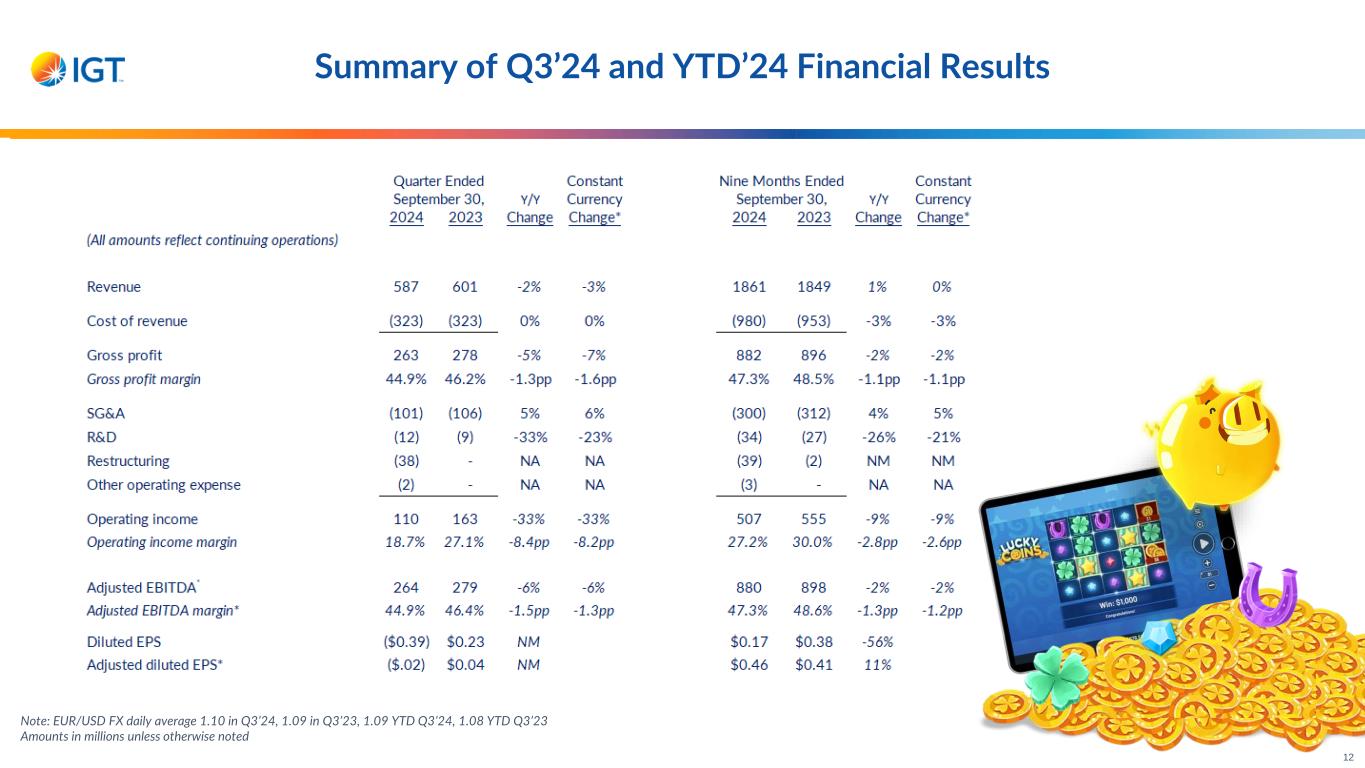

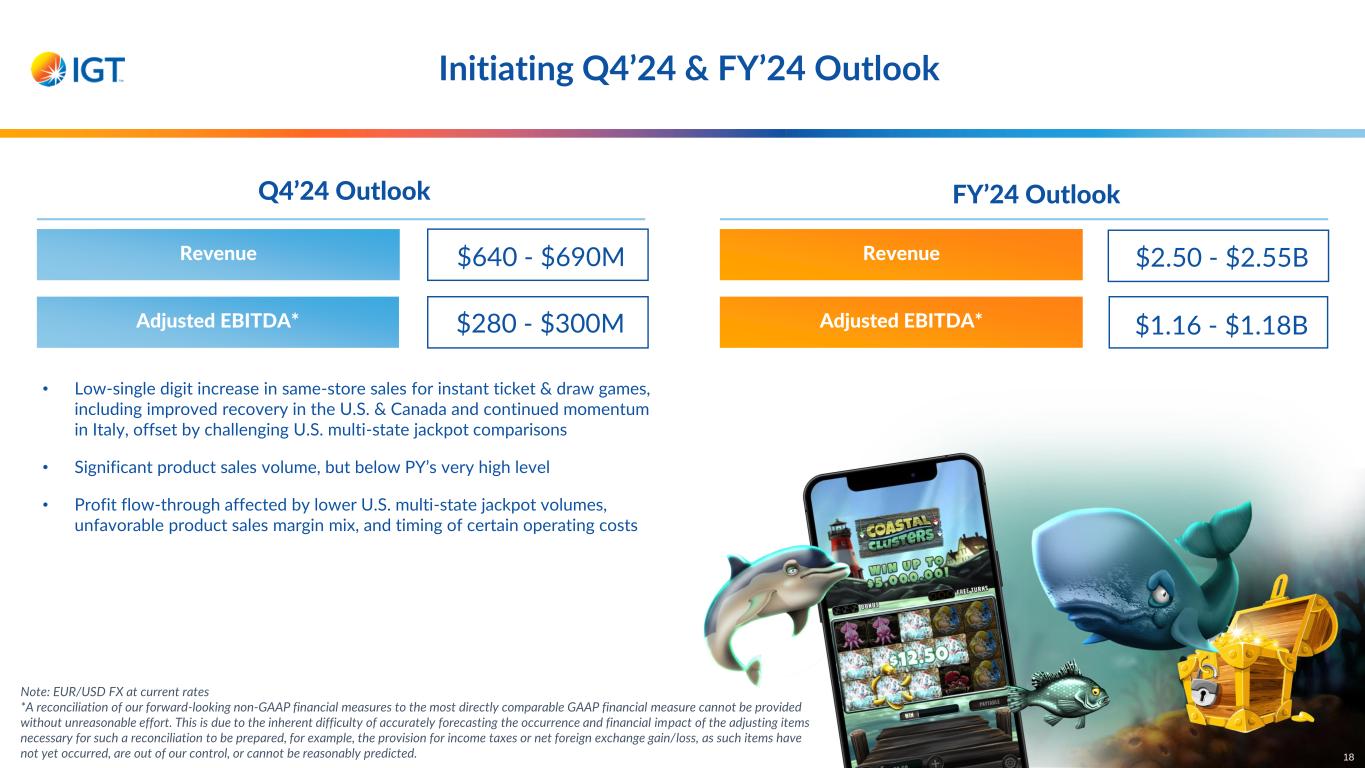

2 Cautionary Statement Regarding Forward-Looking Statements This presentation may contain forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning International Game Technology PLC and its consolidated subsidiaries (the “Company”) and other matters, including with respect to the proposed sale of the Gaming & Digital business to funds managed by affiliates of Apollo Global Management, Inc. (the “Buyer”). These statements may discuss goals, intentions, and expectations as to future plans and strategies, transactions, including the sale of Gaming & Digital to the Buyer, trends, events, dividends, results of operations, and/or financial condition and measures, including our expectations on the future release of revenue, Adjusted EBITDA, and any other future financial performance guidance for continuing oeprations, based on current beliefs of the management of the Company as well as assumptions made by, and information currently available to, such management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,” “shall,” “continue,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “outlook,” “possible,” “potential,” “predict,” “project” or the negative or other variations of them. These forward-looking statements speak only as of the date on which such statements are made and are subject to various risks and uncertainties, many of which are outside the Company’s control. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may differ materially from those predicted in the forward-looking statements and from past results, performance, or achievements. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include (but are not limited to) the factors and risks described in the Company’s annual report on Form 20-F for the financial year ended December 31, 2023 and other documents filed or furnished from time to time with the SEC, which are available on the SEC’s website at www.sec.gov and on the investor relations section of the Company’s website at www.IGT.com. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements. You should carefully consider these factors and other risks and uncertainties that may affect the Company’s business, including management’s discussion and analysis of potential or actual impacts to operations and financial performance. Nothing in this presentation is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the financial performance of International Game Technology PLC for the current or any future financial years will necessarily match or exceed the historical published financial performance of International Game Technology PLC, as applicable. All forward-looking statements contained in this presentation are qualified in their entirety by this cautionary statement. All subsequent written or oral forward-looking statements attributable to International Game Technology PLC, or persons acting on its behalf, are expressly qualified in their entirety by this cautionary statement. Comparability of Results All figures presented in this presentation are prepared under U.S. GAAP, unless noted otherwise. Non-GAAP Financial Measures Management supplements the reporting of financial information, determined under GAAP, with certain non-GAAP financial information. Management believes the non-GAAP information presented provides investors with additional useful information, but it is not intended to, nor should it be considered in isolation or as a substitute for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. The Company encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Adjusted EBITDA represents net income (loss) from continuing operations (a GAAP measure) before income taxes, interest expense, net, foreign exchange gain (loss), net, other non-operating expenses (e.g., gains/losses on extinguishment and modifications of debt, etc.), net, depreciation, impairment losses, amortization (service revenue, purchase accounting, and non-purchase accounting), restructuring expenses, stock-based compensation, litigation expense (income), and certain other non- recurring items. Other non-recurring items are infrequent in nature and are not reflective of ongoing operational activities. Adjusted EBITDA margin represents Adjusted EBITDA divided by revenue. Adjusted EPS represents diluted earnings per share (a GAAP measure), excluding the effects of foreign exchange, impairments, amortization from purchase accounting, discrete tax items, and other significant non-recurring adjustments that are not reflective of on-going operational activities (e.g., gains/losses on sale of business, gains/losses on extinguishment and modifications of debt, etc.). Adjusted EPS is calculated using diluted weighted-average number of shares outstanding, including the impact of any potentially dilutive common stock equivalents that are anti-dilutive to GAAP net income (loss) per share but dilutive to Adjusted EPS. Management believes that Adjusted EPS is useful in providing period-to-period comparisons of the results of the Company's ongoing operational performance. Net debt is a non-GAAP financial measure that represents debt (a GAAP measure, calculated as long-term obligations plus short-term borrowings) minus capitalized debt issuance costs and cash and cash equivalents, including cash and cash equivalents held for sale. Cash and cash equivalents, including cash and cash equivalents classified as held for sale, are subtracted from the GAAP measure because they could be used to reduce the Company’s debt obligations. Management believes that net debt is a useful measure to monitor leverage and evaluate the balance sheet. Net debt leverage is a non-GAAP financial measure that represents the ratio of Net debt as of a particular balance sheet date to Adjusted EBITDA for the last twelve months (“LTM”) prior to such date. Management believes that net debt leverage is a useful measure to assess IGT's financial strength and ability to incur incremental indebtedness when making key investment decisions. Free cash flow is a non-GAAP financial measure that represents cash flow from operations (a GAAP measure) less capital expenditures. Management believes free cash flow is a useful measure of liquidity and an additional basis for assessing IGT’s ability to fund its activities, including debt service and distribution of earnings to shareholders. Constant currency is a non-GAAP financial measure that expresses the current financial data using the prior-year/period exchange rate (i.e., the exchange rate used in preparing the financial statements for the prior year). Management believes that constant currency is a useful measure to compare period-to-period results without regard to the impact of fluctuating foreign currency exchange rates. A reconciliation of the non-GAAP measures to the corresponding amounts prepared in accordance with GAAP appears in the tables in this release. The tables provide additional information as to the items and amounts that have been excluded from the adjusted measures. Outlook for Fiscal 2024 and Guidance Policy The Company's updated guidance for fiscal 2024 is: • Total revenue of approximately $2.50 - $2.55 billion; • Adjusted EBITDA of $1.16 - $1.18 billion The Company provides guidance of select information related to its financial and operating performance, and such measures may differ from year to year. The guidance is only an estimate of what the Company believes is realizable as of the date of this release. Actual results will vary from the guidance and the variations may be material. The Company undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law. A reconciliation of our forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure cannot be provided without unreasonable effort. This is due to the inherent difficulty of accurately forecasting the occurrence and financial impact of the adjusting items necessary for such a reconciliation to be prepared, for example, the provision for income taxes or net foreign gain/loss, as such items have not yet occurred, are out of our control, or cannot be reasonably predicted.

3

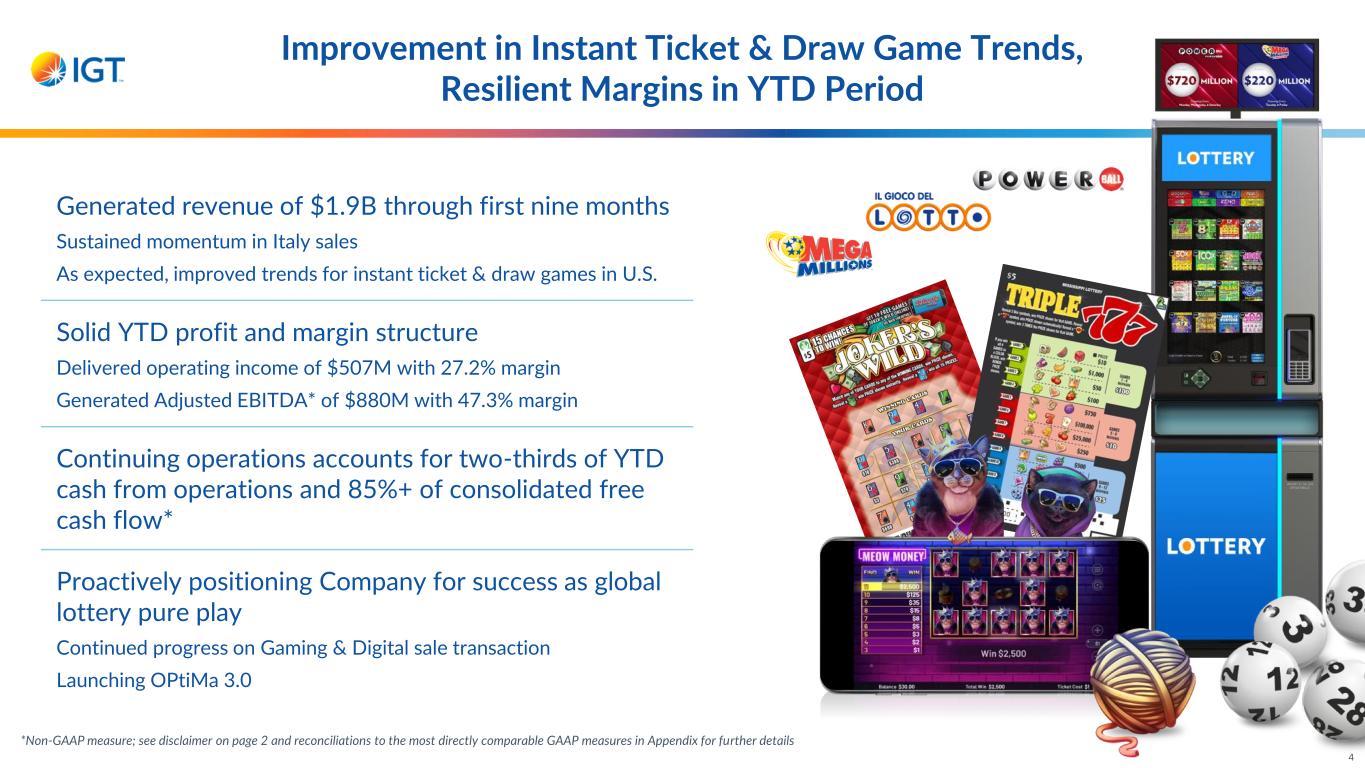

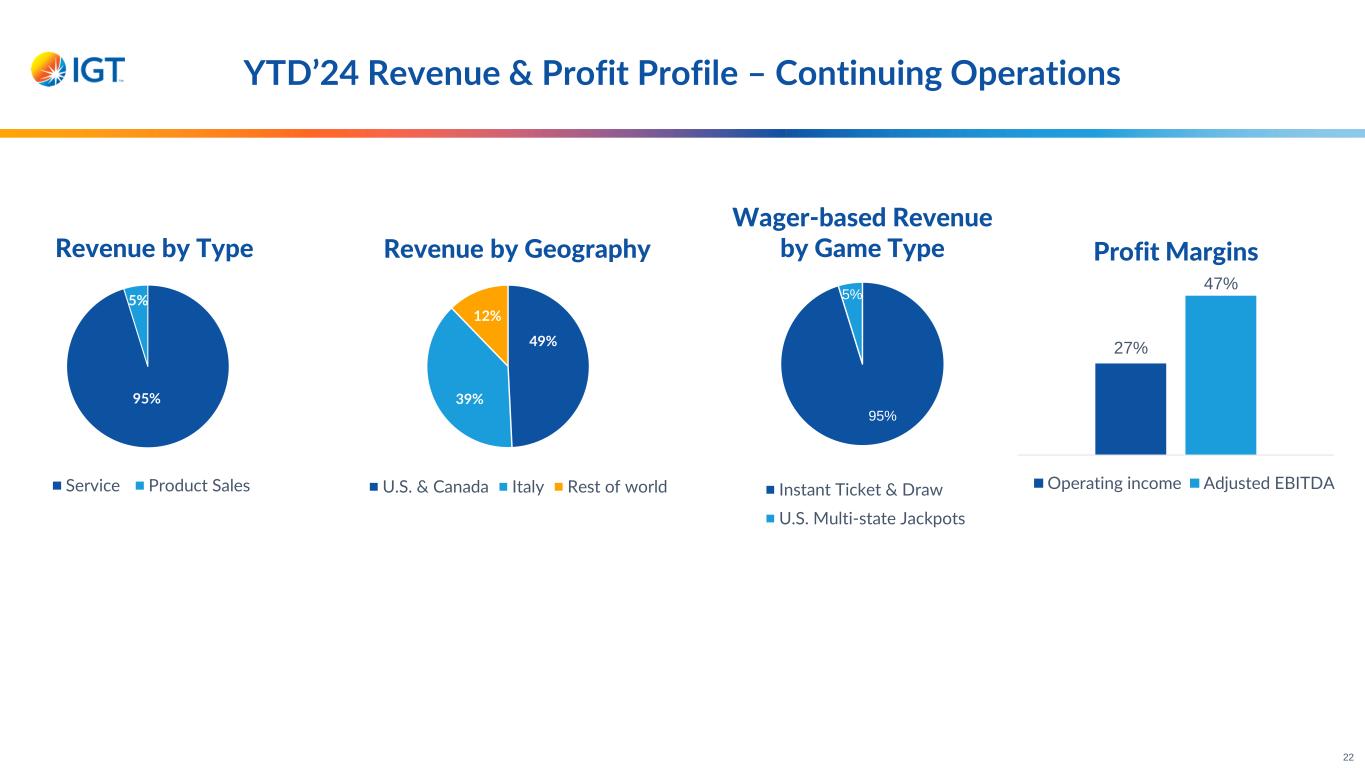

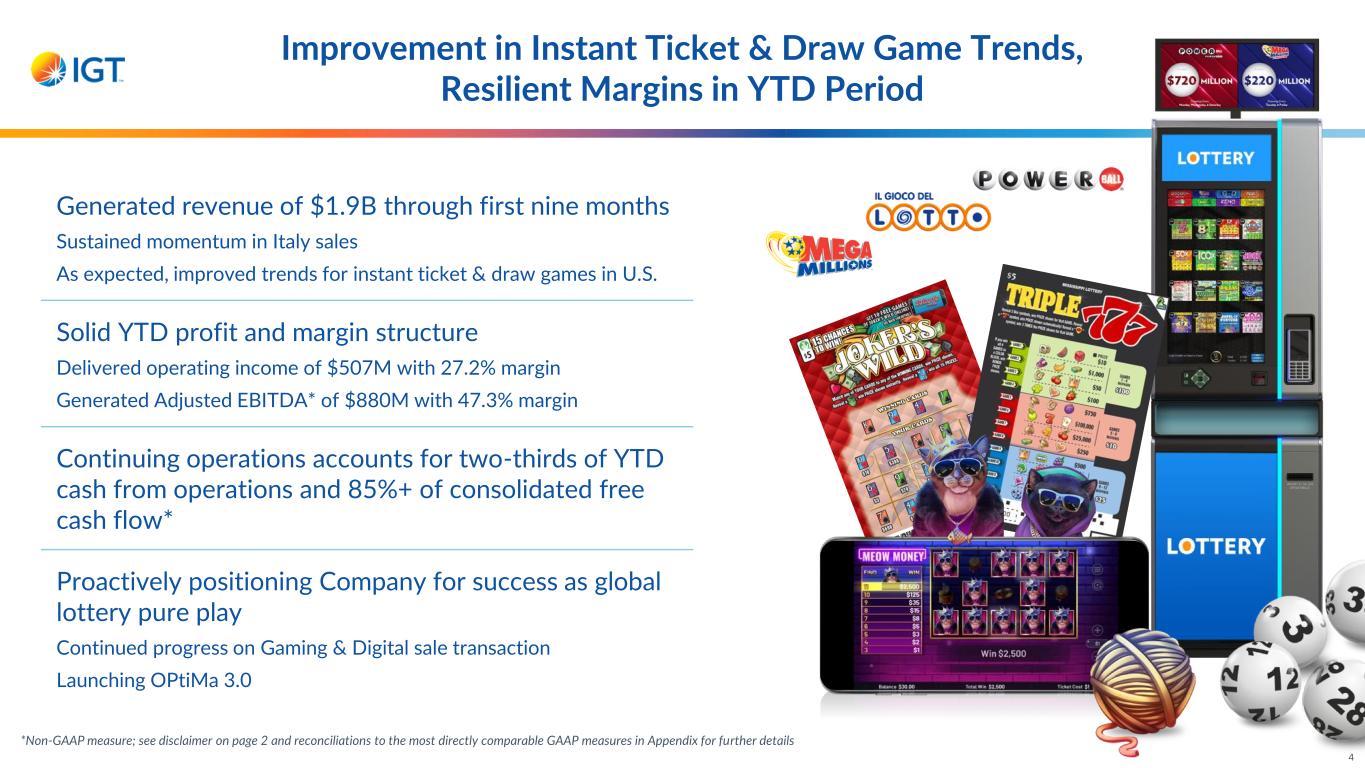

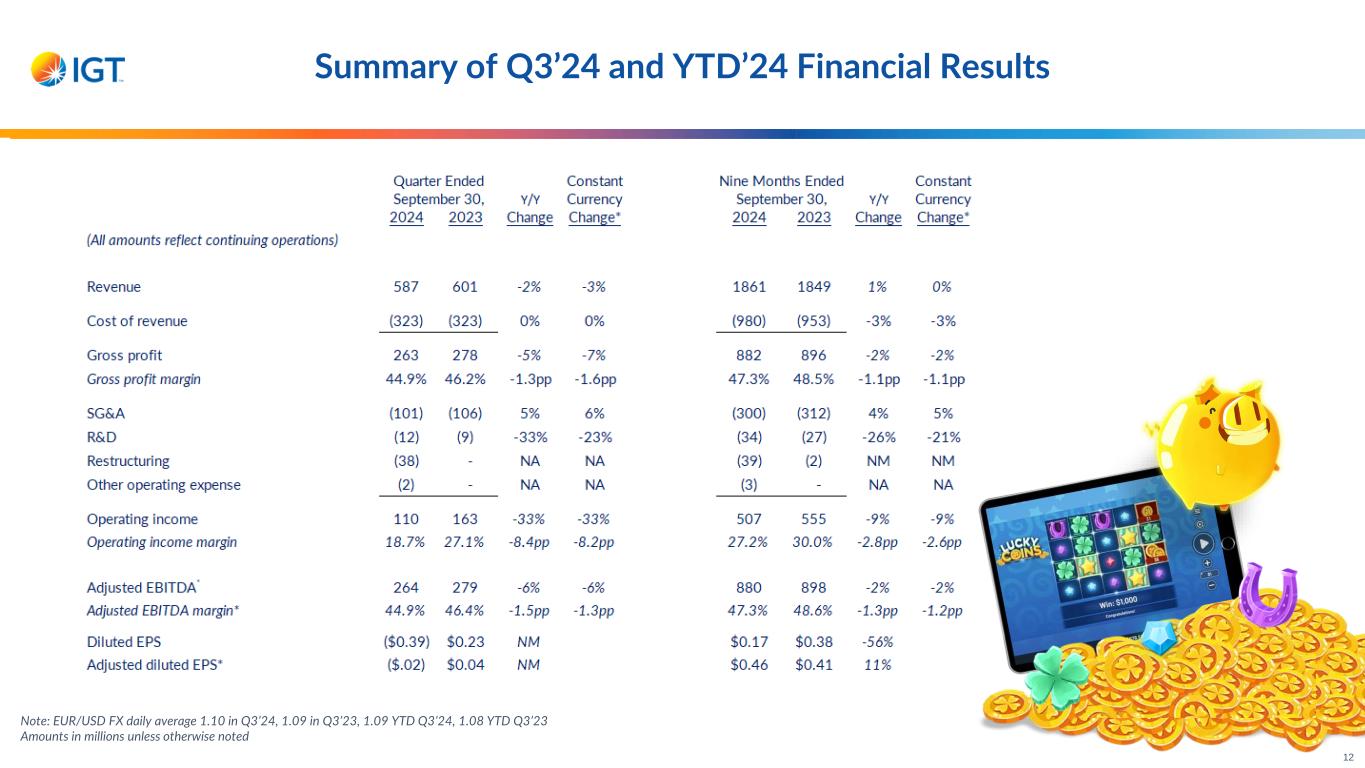

Improvement in Instant Ticket & Draw Game Trends, Resilient Margins in YTD Period Generated revenue of $1.9B through first nine months Sustained momentum in Italy sales As expected, improved trends for instant ticket & draw games in U.S. Solid YTD profit and margin structure Delivered operating income of $507M with 27.2% margin Generated Adjusted EBITDA* of $880M with 47.3% margin Continuing operations accounts for two-thirds of YTD cash from operations and 85%+ of consolidated free cash flow* Proactively positioning Company for success as global lottery pure play Continued progress on Gaming & Digital sale transaction Launching OPtiMa 3.0 *Non-GAAP measure; see disclaimer on page 2 and reconciliations to the most directly comparable GAAP measures in Appendix for further details 4

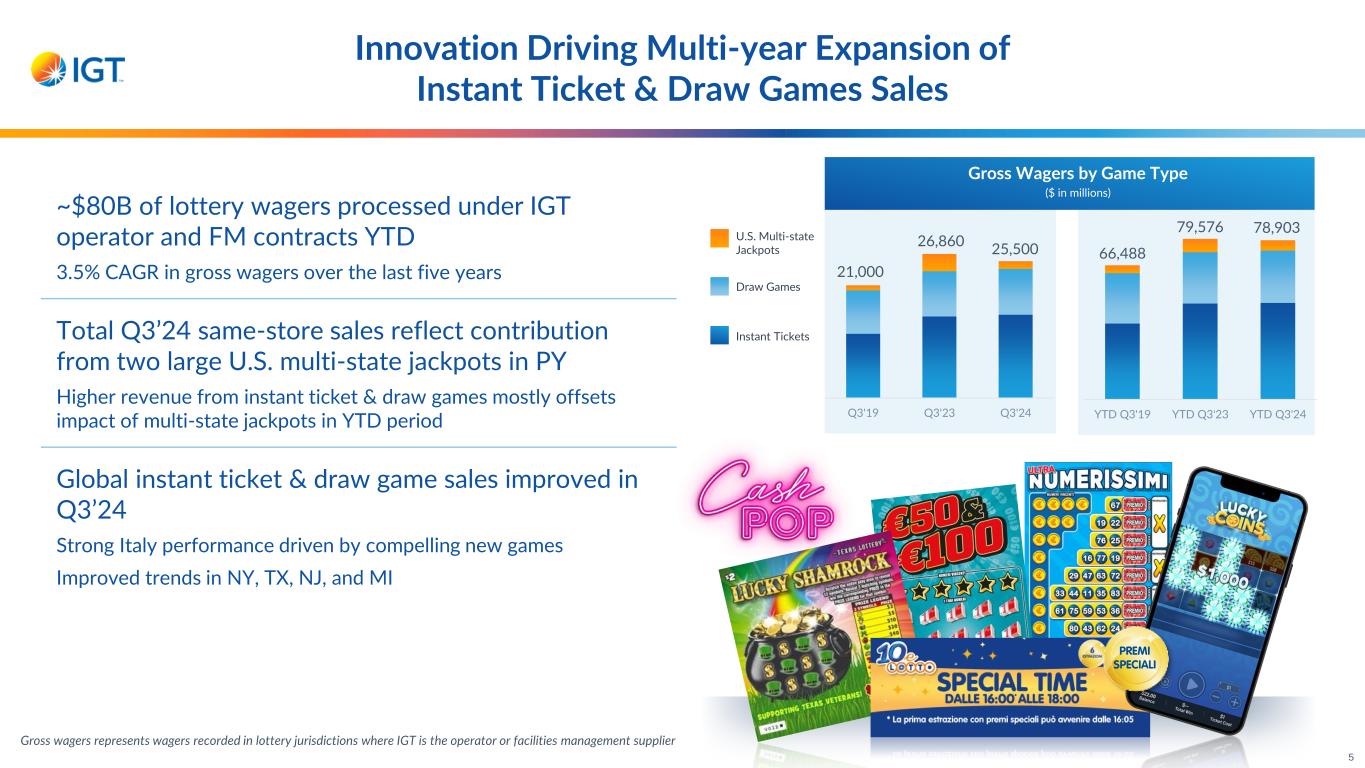

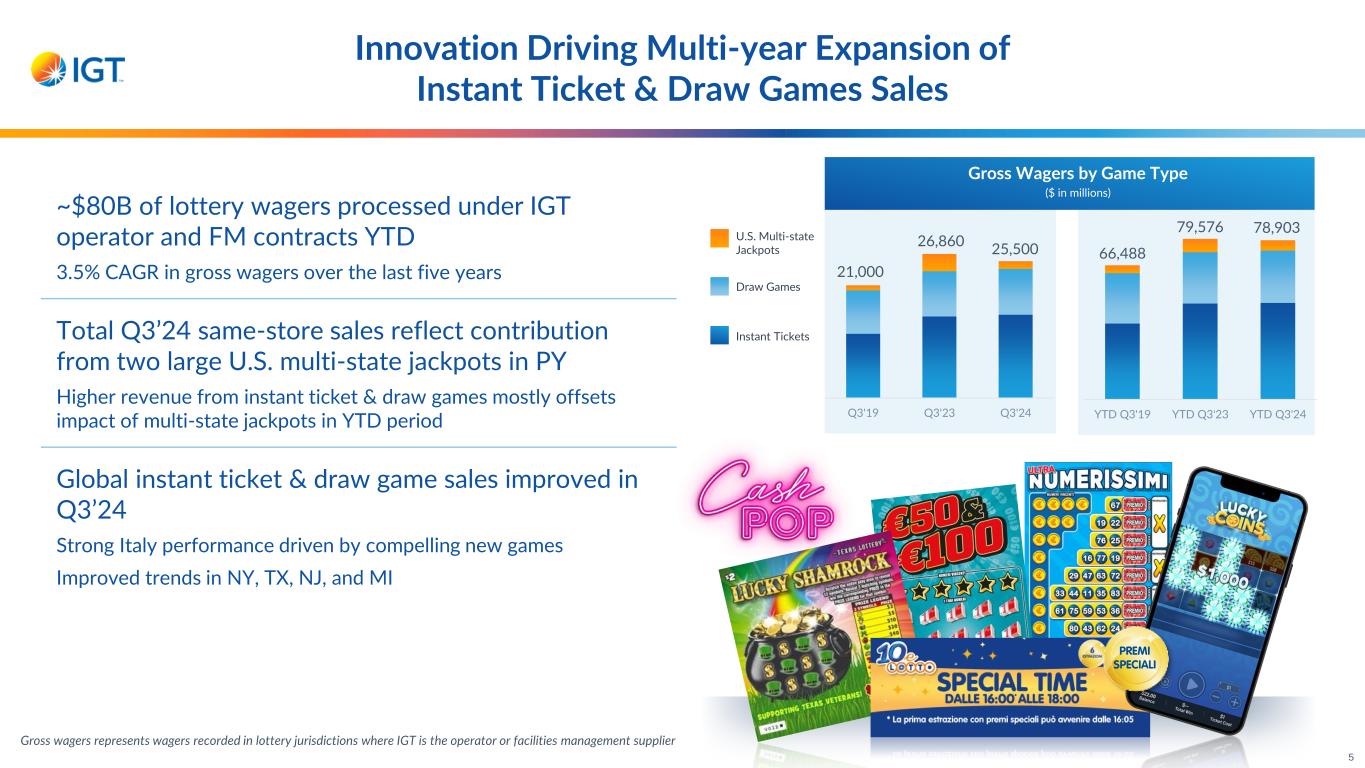

Innovation Driving Multi-year Expansion of Instant Ticket & Draw Games Sales 5 66,488 79,576 78,903 YTD Q3'19 YTD Q3'23 YTD Q3'24 Gross Wagers by Game Type ($ in millions) Gross wagers represents wagers recorded in lottery jurisdictions where IGT is the operator or facilities management supplier ~$80B of lottery wagers processed under IGT operator and FM contracts YTD 3.5% CAGR in gross wagers over the last five years Total Q3’24 same-store sales reflect contribution from two large U.S. multi-state jackpots in PY Higher revenue from instant ticket & draw games mostly offsets impact of multi-state jackpots in YTD period Global instant ticket & draw game sales improved in Q3’24 Strong Italy performance driven by compelling new games Improved trends in NY, TX, NJ, and MI 21,000 26,860 25,500 Q3'19 Q3'23 Q3'24 U.S. Multi-state Jackpots Draw Games Instant Tickets U.S. Multi-state Jackpots Draw Games Instant Tickets

Awarded 10-year contract extension in NC iLottery focus driving continued growth Wagers up 26%+ QTD and YTD, fueled by top-performing games Broadening content distribution with non-platform customers New platform launch in CT Expanding instant ticket printing footprint Secured three-year primary contract with SCML in Portugal Awarded three-year contract with FDJ in France Investing in new, state-of-the-art press, increasing capacity by 50%+ Important Progress on Key Strategic Initiatives 6

NASPL & WLS Highlights: “Future Forward, Growth Driven” 7 ConnectCheck TM Retailer-To-Go S2 Digital Menu Board LotteryLinkTM GameFlex 48 Infinity InstantsTMeInstants

Strong, Experienced Management Team; OPtiMa 3.0 Focused on Supporting Key Growth Objectives 8 Vince Sadusky CEO Renato Ascoli CEO, Global Lottery Max Chiara EVP, CFO Wendy Montgomery SVP, Marketing, Communications & Sustainability Christopher Spears EVP, General Counsel Robert Vincent Chairperson, IGT Global Solutions Corporation Dorothy Costa SVP, People & Transformation Executive management team to remain largely intact following sale of Gaming & Digital business OPtiMa 3.0 focused on right-sizing organization while supporting long-term growth objectives New lottery leadership structure includes important new roles and reallocation/acquisition of best-in-class industry talent in key areas Fabio Celadon(1) EVP, Strategy & Corporate Development Scott Gunn SVP, Corporate Public Affairs & N.A. Strategic Projects (1) Fabio Celadon to become CFO of the new gaming entity once the transaction closes

Continued progress on Gaming & Digital sale transaction 9 A Strong Foundation to Build Upon Well-positioned to capitalize on attractive lottery industry dynamics Commitment to innovation and strategic product initiatives to drive growth Proactively building a leaner, more focused, and stronger organization

10

Financial Reporting Changes Due to Announced Sale of Gaming & Digital Income statement Gaming & Digital results reflected as discontinued operations for all periods presented Separation & divestiture costs now reflected in discontinued operations Purchase price amortization related to Gaming intangible assets included in discontinued operations Interest expense attributable to ~$2B of committed debt reduction allocated to discontinued operations Balance sheet Gaming & Digital assets and liabilities classified as held for sale Cash Flow Gaming & Digital cash flows classified as discontinued operations Net debt Cash excludes cash balances classified as held for sale 11

Summary of Q3’24 and YTD’24 Financial Results Note: EUR/USD FX daily average 1.10 in Q3’24, 1.09 in Q3’23, 1.09 YTD Q3’24, 1.08 YTD Q3’23 Amounts in millions unless otherwise noted 12

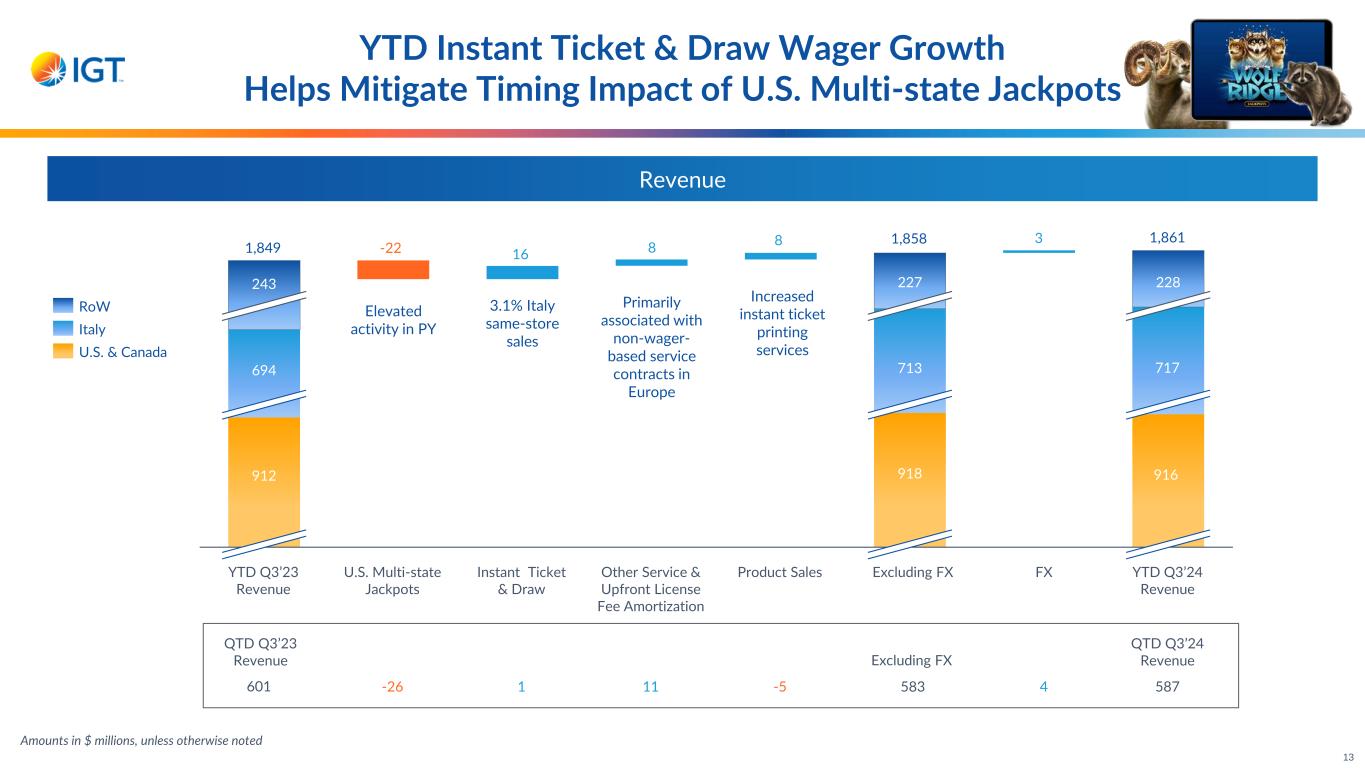

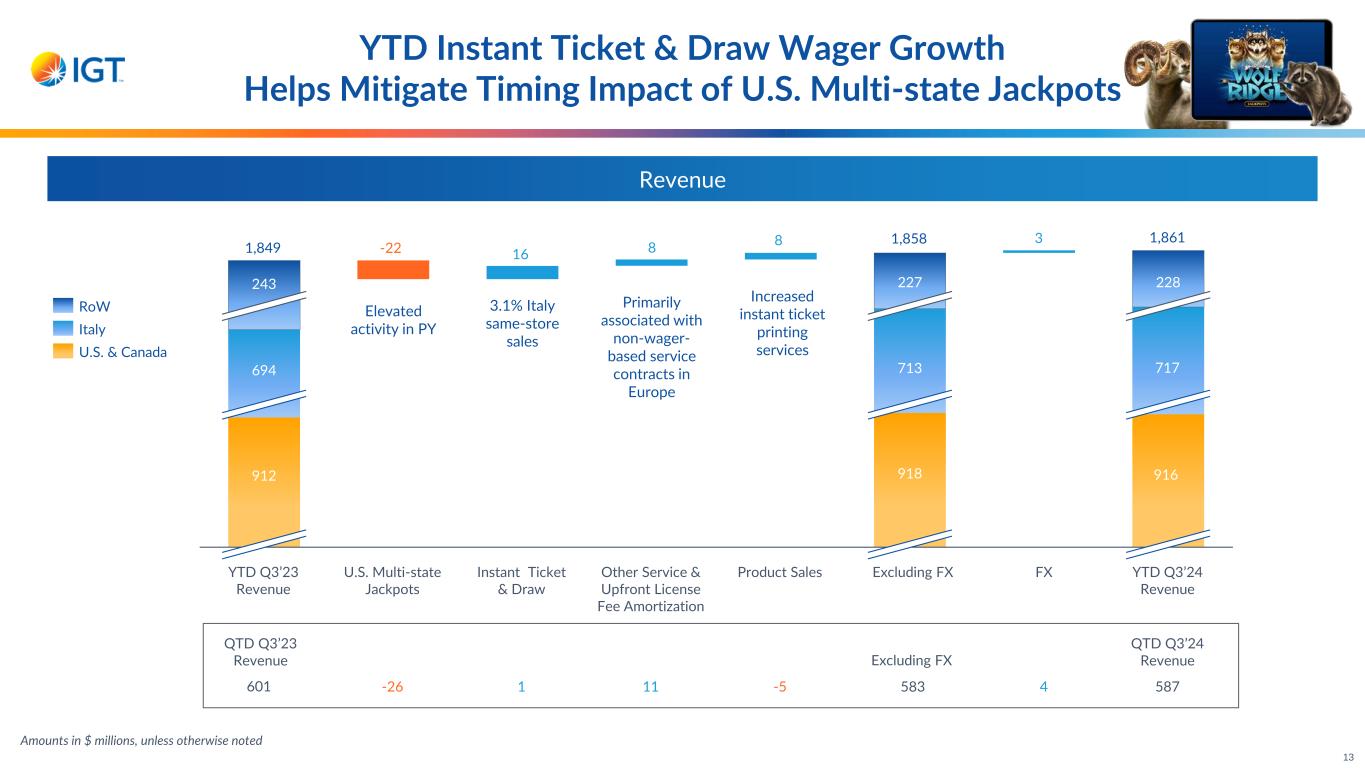

3.1% Italy same-store sales U.S. Multi-state Jackpots Instant Ticket & Draw Other Service & Upfront License Fee Amortization Product Sales 694 713 717 Excluding FX 916 YTD Q3’24 Revenue 1,858 1,861 FXYTD Q3’23 Revenue 912 918 243 227 228 1,849 YTD Instant Ticket & Draw Wager Growth Helps Mitigate Timing Impact of U.S. Multi-state Jackpots 13 Amounts in $ millions, unless otherwise noted RoW Italy U.S. & Canada Revenue 16-22 8 8 3 Elevated activity in PY Primarily associated with non-wager- based service contracts in Europe Increased instant ticket printing services -26 1 11 -5 4 QTD Q3’24 Revenue 601 Excluding FX 583 587 QTD Q3’23 Revenue

Sustained, Strong Margin Profile in YTD Period 555 507 YTD Q3’23 OI YTD Q3’24 OI YTD Q3’23 Adj. EBITDA Service Gross Margin Product Sales Gross Margin SG&A R&D Excluding FX FX YTD Q3’24 Adj. EBITDA 898 880 880 30.0% 48.6% 47.3%27.4% High flow- through from elevated jackpots in PY and inflationary impact on payroll and benefit costs in CY Higher margin mix in PY Disciplined cost management and lower legal costs Investment in growth initiativesY/Y change primarily driven by $38M in restructuring Adjusted EBITDAOperating Income -24 -6 16 -5 1 Margins Margins -6 QTD Q3’24 OI -52 QTD Q3’23 OI 163 110 7 -2 1 QTD Q3’24 Adj. EBITDAExcluding FX 263 264 QTD Q3’23 Adj. EBITDA -16279 Amounts in $ millions, unless otherwise noted 14

Launching OPtiMa 3.0 to Reduce Structural Costs 15 OPtiMa 1.0 Delivered $200M+ in cost savings Mainly focused on reducing Gaming industrial footprint 2020-2021 OPtiMa 3.0 Targeting $40M in cost savings Solely applies to continuing operations 2025-2026 OPtiMa 2.0 Achieved $150M in cost savings Extension of OPtiMa 1.0 initiatives as well as interest & tax savings 2022-2023 Realigning and optimizing costs to position Company for success as global lottery pure play Immediately addresses stranded corporate costs associated with sale of Gaming & Digital business $38M in restructuring expense ($27M after tax) recognized in Q3’24 OPtiMa 1.0 and 2.0 primarily focused on Gaming & Digital; OPtiMa 3.0 addresses continuing operations Targeting $40M in annualized savings by end of 2026; 50% to be realized by end of 2025 ~3% reduction in workforce; started in Q3’24 with completion in next 12-18 months Optimization of real estate footprint Reductions in other indirect costs associated with a leaner business structure

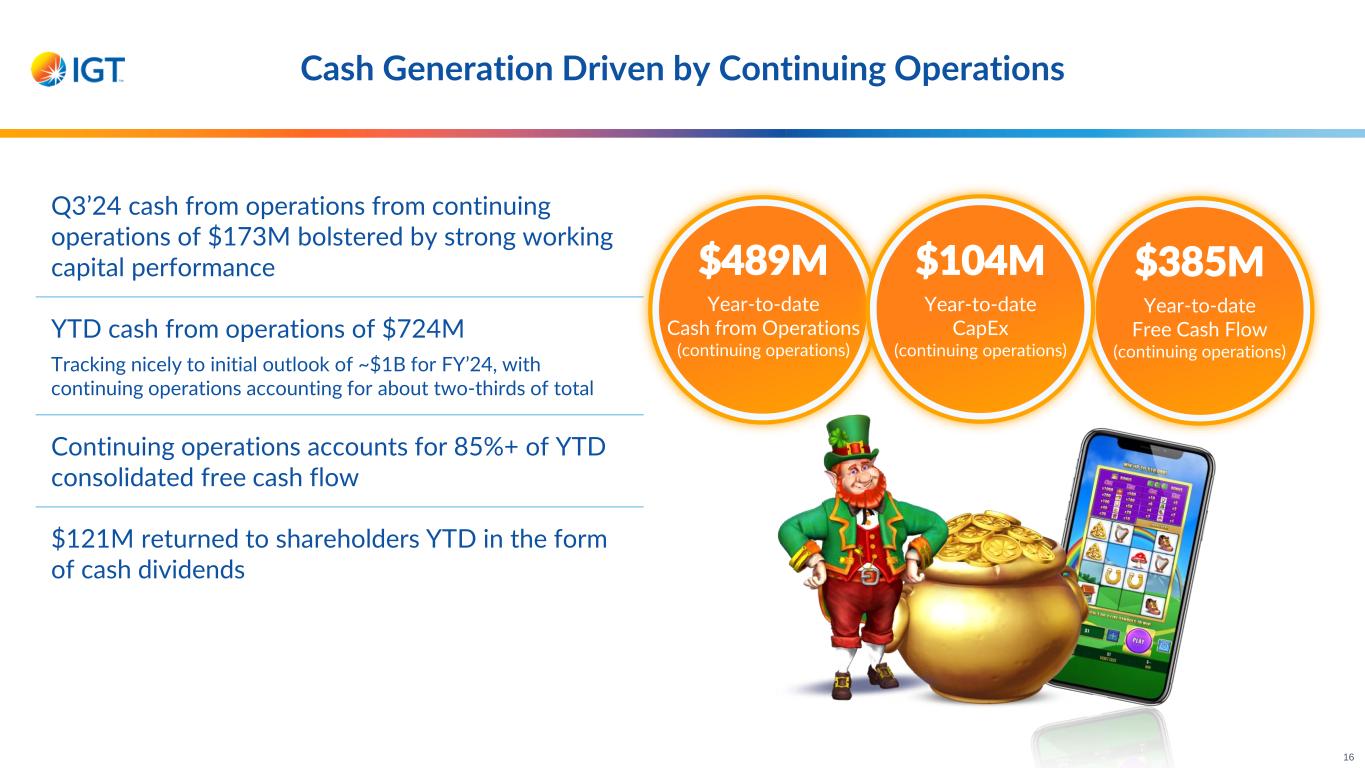

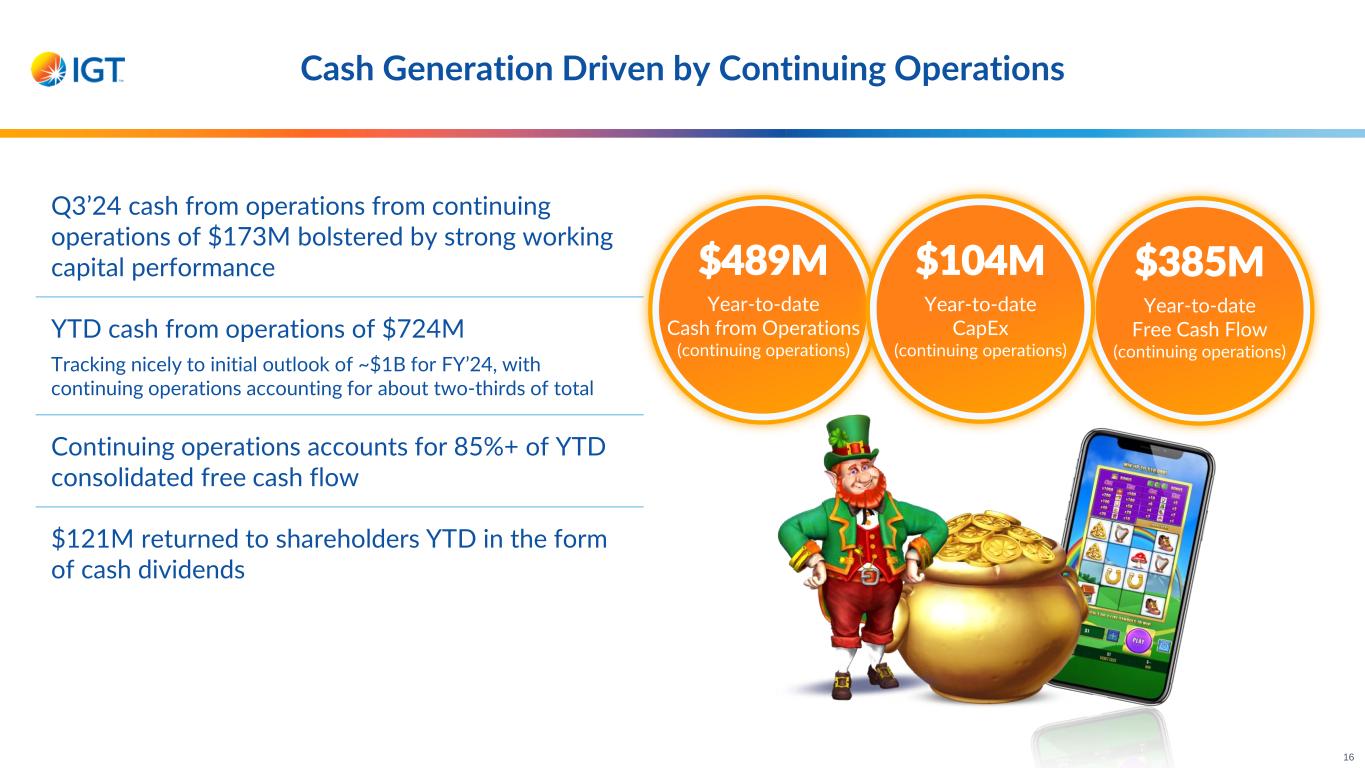

16 $489M Year-to-date Cash from Operations (continuing operations) $385M Year-to-date Free Cash Flow (continuing operations) $104M Year-to-date CapEx (continuing operations) Cash Generation Driven by Continuing Operations Q3’24 cash from operations from continuing operations of $173M bolstered by strong working capital performance YTD cash from operations of $724M Tracking nicely to initial outlook of ~$1B for FY’24, with continuing operations accounting for about two-thirds of total Continuing operations accounts for 85%+ of YTD consolidated free cash flow $121M returned to shareholders YTD in the form of cash dividends

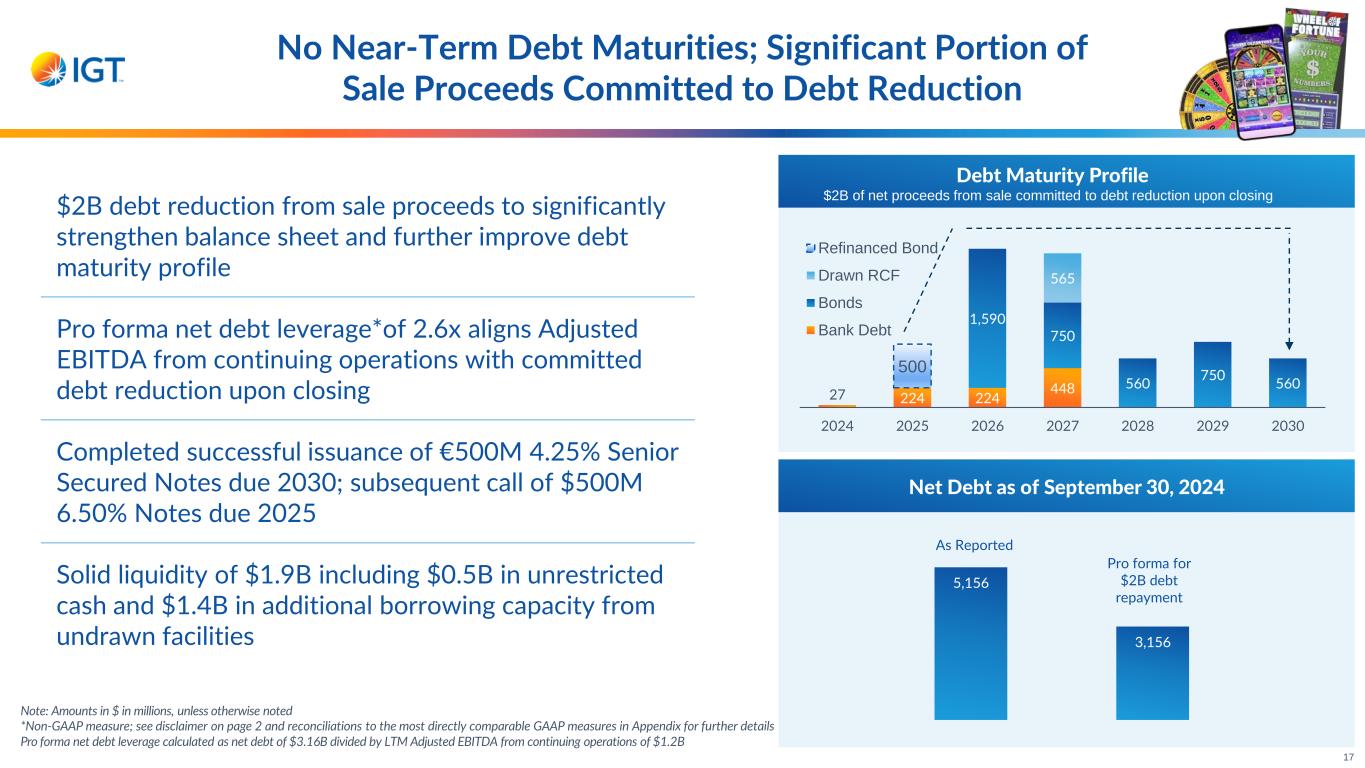

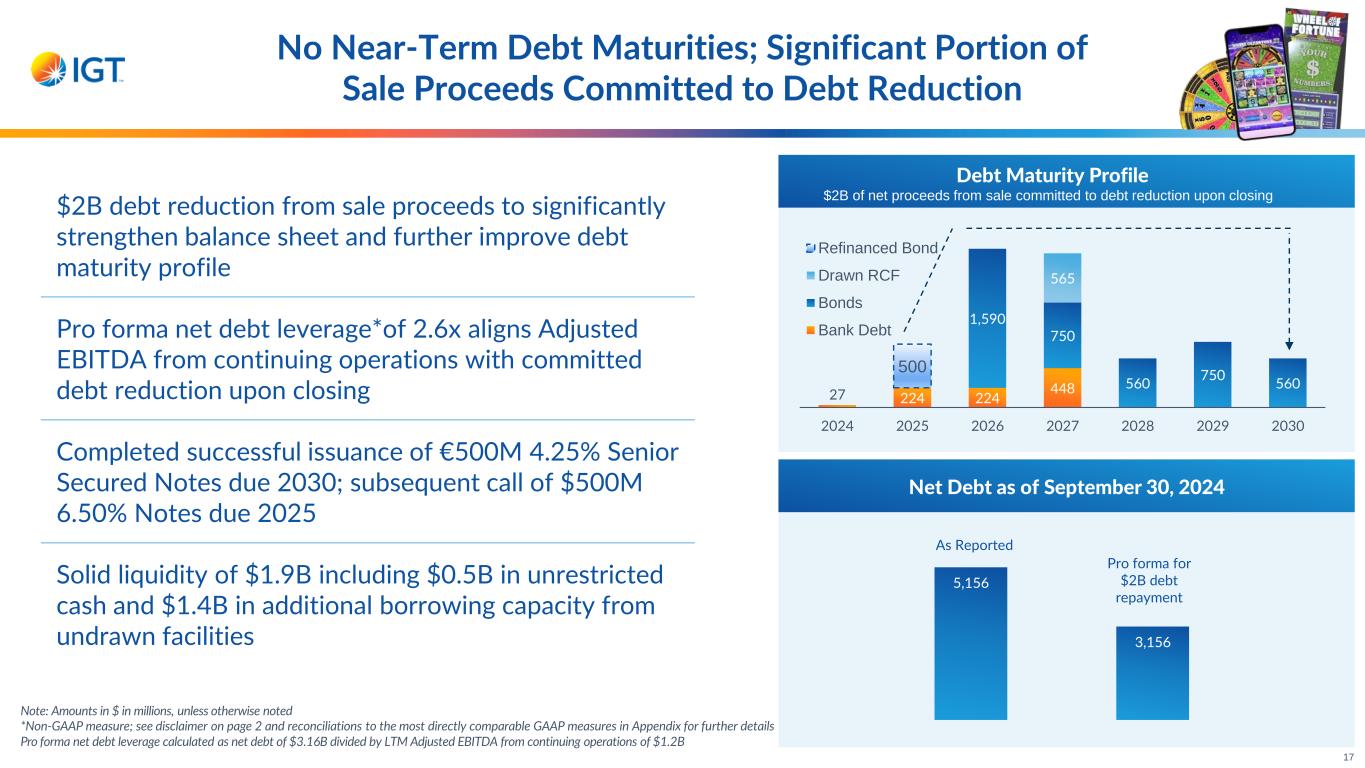

Net Debt as of September 30, 2024 Note: Amounts in $ in millions, unless otherwise noted *Non-GAAP measure; see disclaimer on page 2 and reconciliations to the most directly comparable GAAP measures in Appendix for further details Pro forma net debt leverage calculated as net debt of $3.16B divided by LTM Adjusted EBITDA from continuing operations of $1.2B No Near-Term Debt Maturities; Significant Portion of Sale Proceeds Committed to Debt Reduction 27 224 224 448 1,590 750 560 750 560 565 500 2024 2025 2026 2027 2028 2029 2030 Refinanced Bond Drawn RCF Bonds Bank Debt Debt Maturity Profile $2B debt reduction from sale proceeds to significantly strengthen balance sheet and further improve debt maturity profile Pro forma net debt leverage*of 2.6x aligns Adjusted EBITDA from continuing operations with committed debt reduction upon closing Completed successful issuance of €500M 4.25% Senior Secured Notes due 2030; subsequent call of $500M 6.50% Notes due 2025 Solid liquidity of $1.9B including $0.5B in unrestricted cash and $1.4B in additional borrowing capacity from undrawn facilities $2B of net proceeds from sale committed to debt reduction upon closing 5,156 3,156 Pro forma for $2B debt repayment As Reported 17

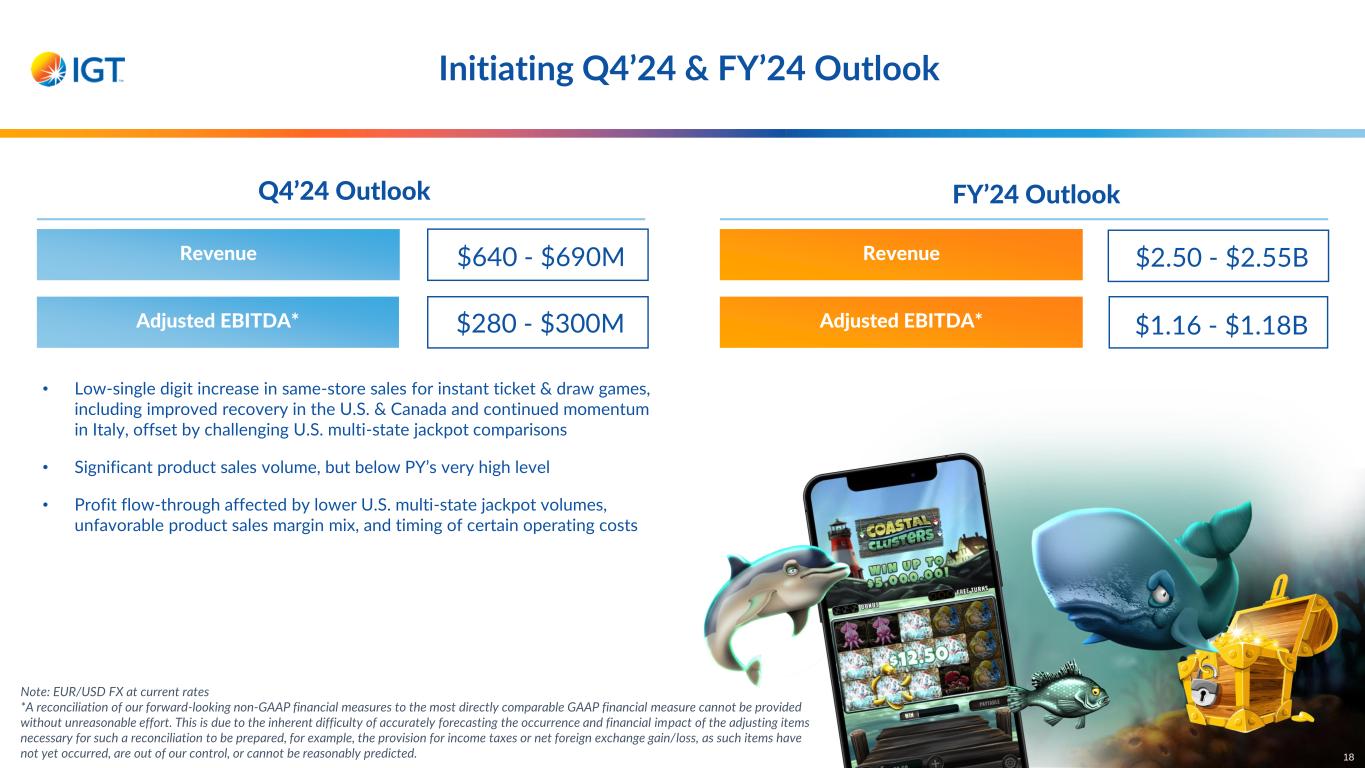

Initiating Q4’24 & FY’24 Outlook Note: EUR/USD FX at current rates *A reconciliation of our forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure cannot be provided without unreasonable effort. This is due to the inherent difficulty of accurately forecasting the occurrence and financial impact of the adjusting items necessary for such a reconciliation to be prepared, for example, the provision for income taxes or net foreign exchange gain/loss, as such items have not yet occurred, are out of our control, or cannot be reasonably predicted. • Low-single digit increase in same-store sales for instant ticket & draw games, including improved recovery in the U.S. & Canada and continued momentum in Italy, offset by challenging U.S. multi-state jackpot comparisons • Significant product sales volume, but below PY’s very high level • Profit flow-through affected by lower U.S. multi-state jackpot volumes, unfavorable product sales margin mix, and timing of certain operating costs Revenue Adjusted EBITDA* FY’24 OutlookQ4’24 Outlook Revenue Adjusted EBITDA* $2.50 - $2.55B$640 - $690M $280 - $300M $1.16 - $1.18B 18

19 Resilient YTD Results; Business Value Enhanced by Low Leverage Profile & Proactive Cost Initiatives Solid Q3’24 and YTD’24 Financial Results Launched OPtiMa 3.0 to Align Costs with New Business Structure Strong Cash Generation Fueled by Free Cash Flow from Continuing Operations Initiating Q4’24 & FY’24 Outlook for Continuing Operations

20

21

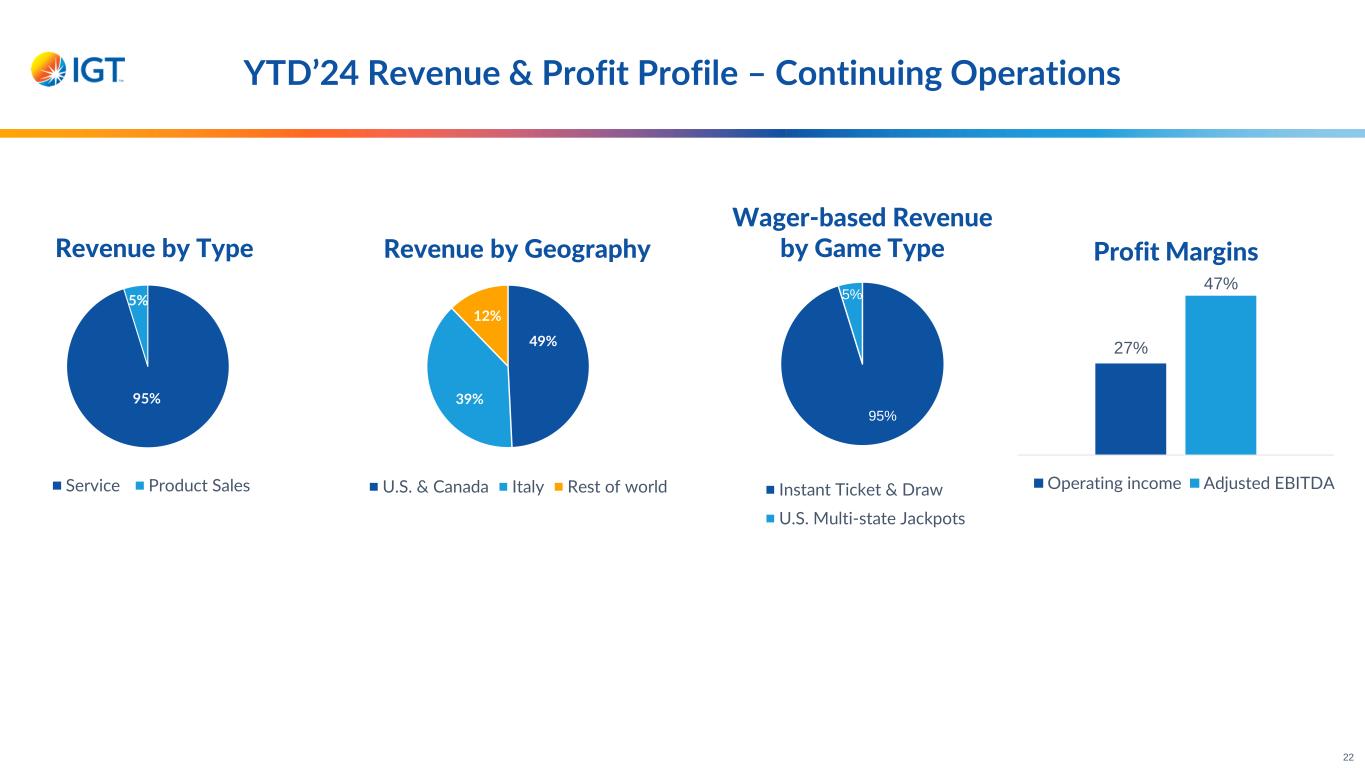

41% 95% 5% Service Product Sales 49% 39% 12% U.S. & Canada Italy Rest of world 27% 47% Operating income Adjusted EBITDA Revenue by Type Revenue by Geography Profit Margins YTD’24 Revenue & Profit Profile – Continuing Operations 22 Wager-based Revenue by Game Type 95% 5% Instant Ticket & Draw U.S. Multi-state Jackpots

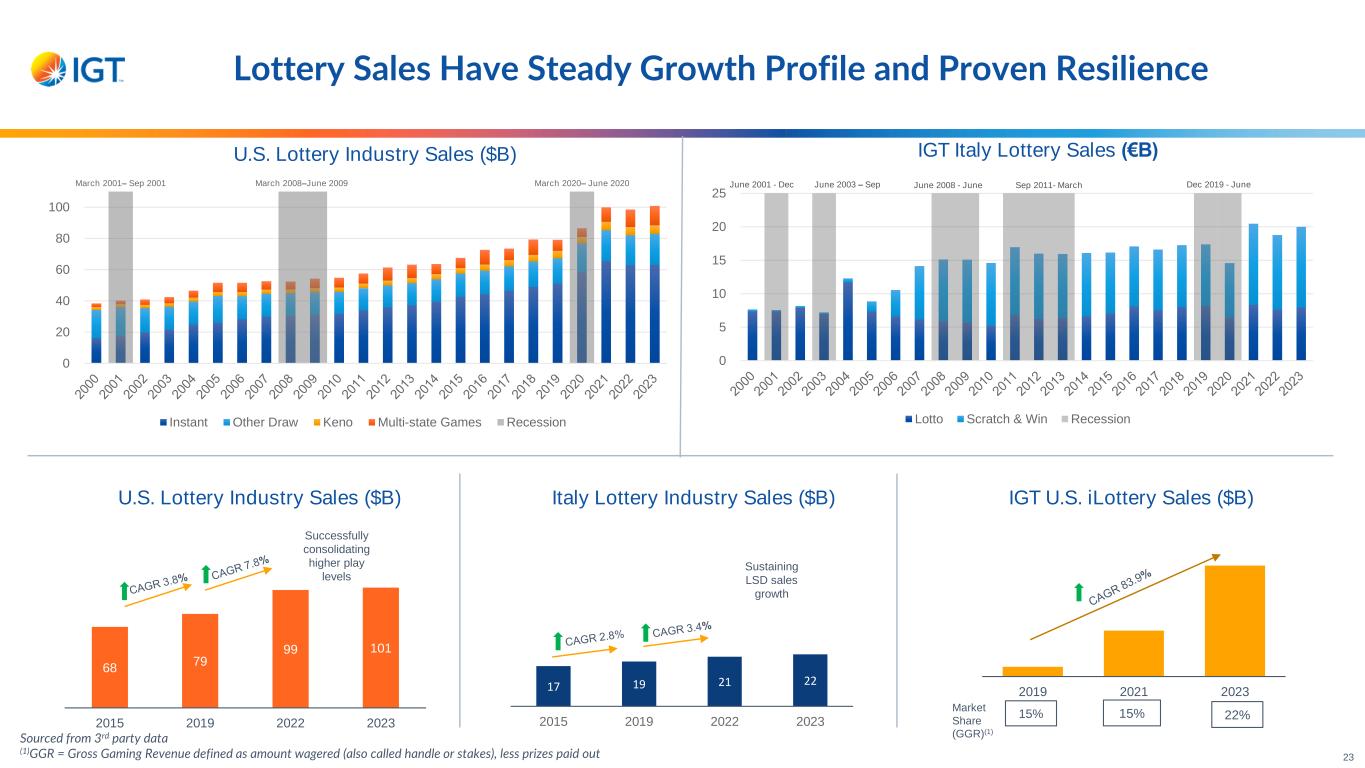

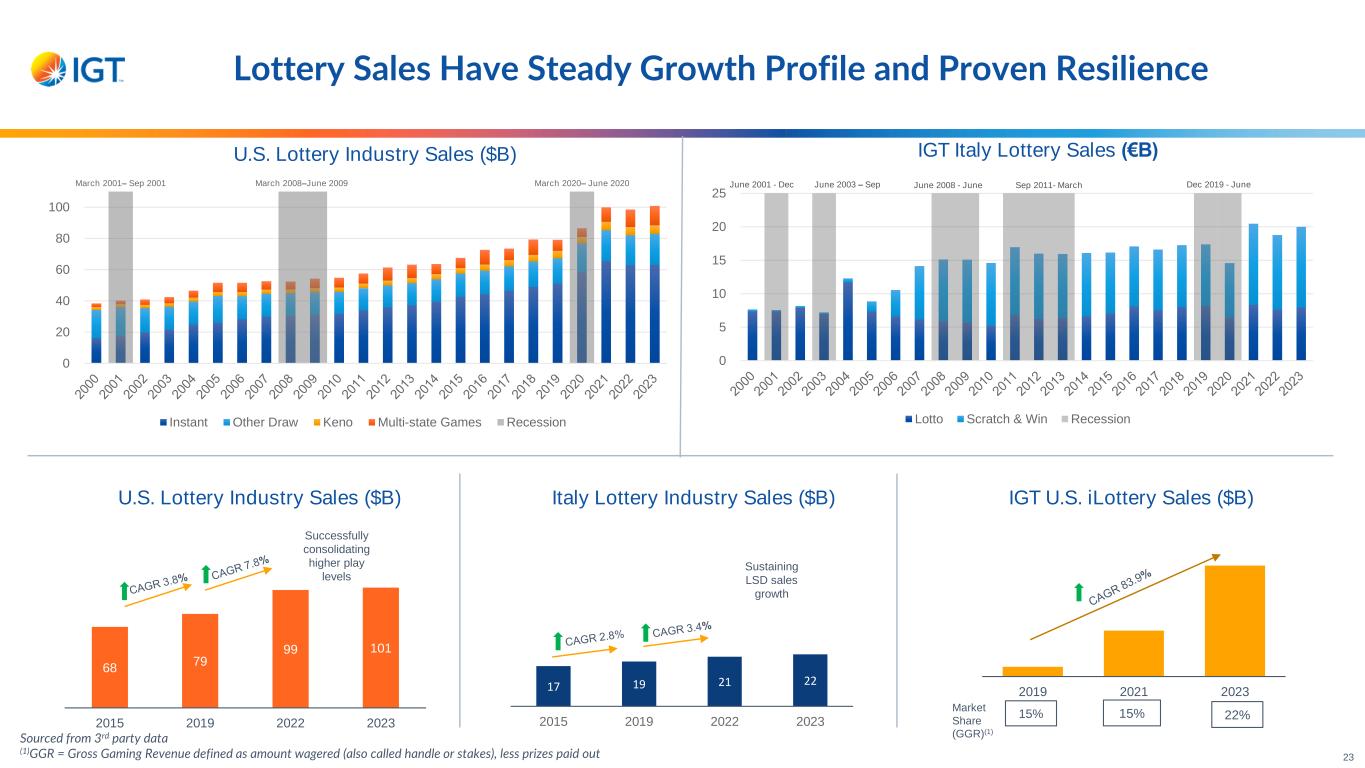

IGT Italy Lottery Sales (€B)U.S. Lottery Industry Sales ($B) 17 19 21 22 2015 2019 2022 2023 Lottery Sales Have Steady Growth Profile and Proven Resilience 23 68 79 99 101 2015 2019 2022 2023 2019 2021 2023 15% 22%15% Market Share (GGR)(1) Successfully consolidating higher play levels March 2001– Sep 2001 March 2008–June 2009 March 2020– June 2020 0 20 40 60 80 100 Instant Other Draw Keno Multi-state Games Recession June 2001 - Dec June 2003 – Sep June 2008 - June Sep 2011- March Dec 2019 - June 0 5 10 15 20 25 Lotto Scratch & Win Recession Sustaining LSD sales growth Italy Lottery Industry Sales ($B) IGT U.S. iLottery Sales ($B)U.S. Lottery Industry Sales ($B) Sourced from 3rd party data (1)GGR = Gross Gaming Revenue defined as amount wagered (also called handle or stakes), less prizes paid out

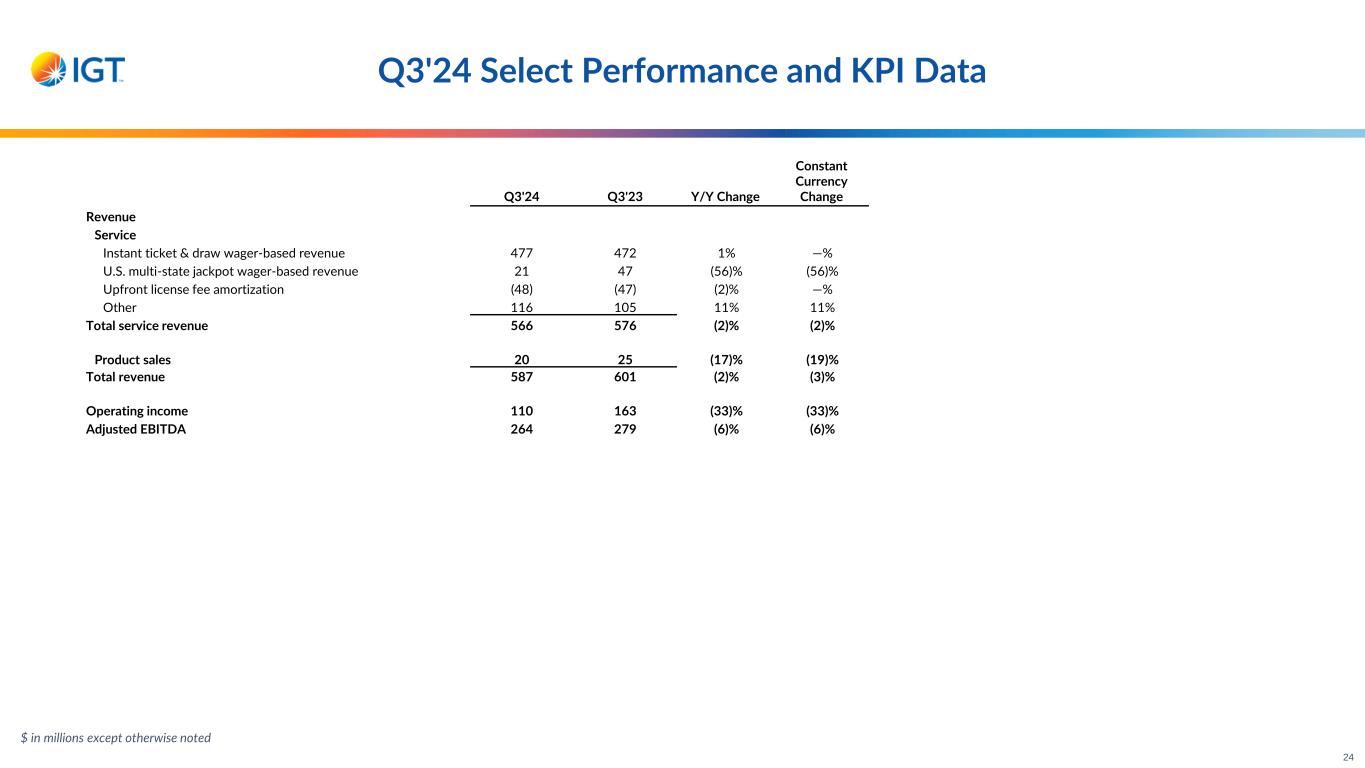

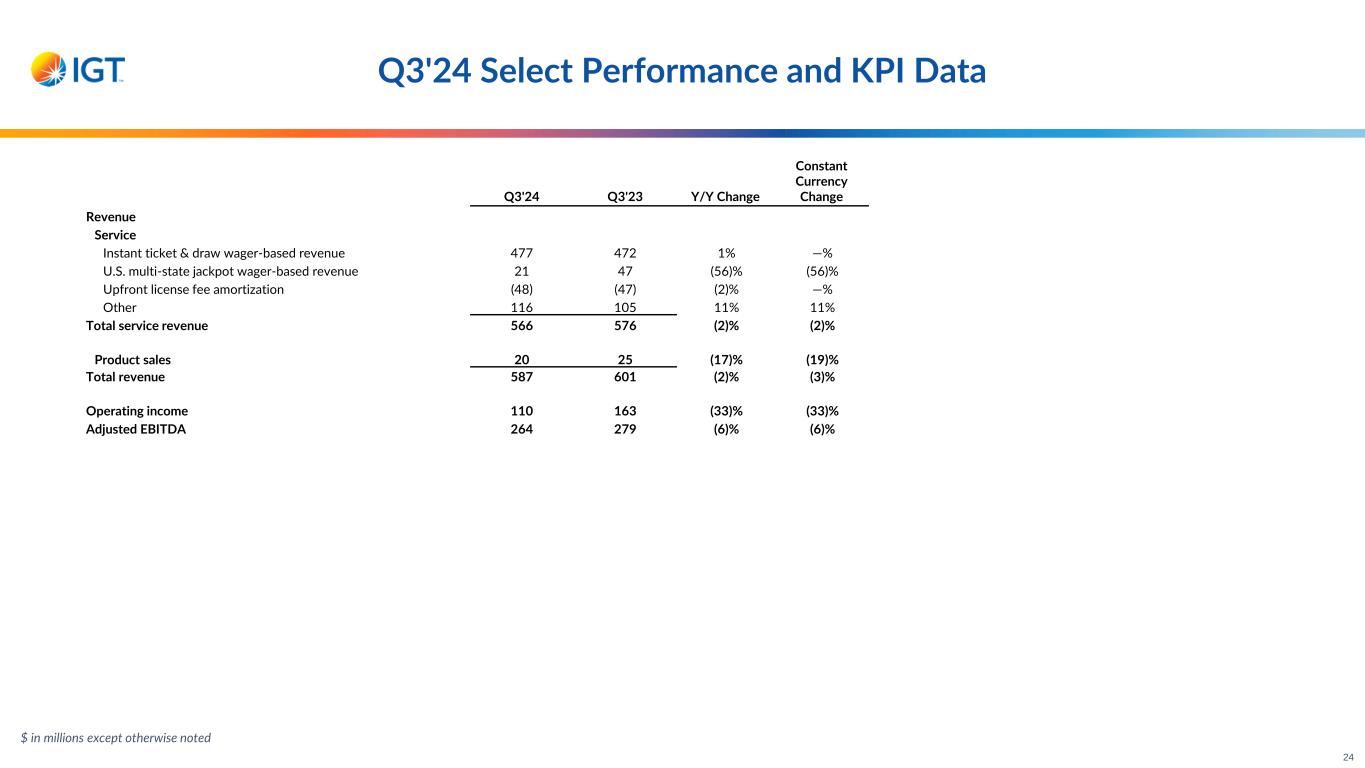

$ in millions except otherwise noted Q3'24 Select Performance and KPI Data Q3'24 Q3'23 Y/Y Change Constant Currency Change Revenue Service Instant ticket & draw wager-based revenue 477 472 1% —% U.S. multi-state jackpot wager-based revenue 21 47 (56)% (56)% Upfront license fee amortization (48) (47) (2)% —% Other 116 105 11% 11% Total service revenue 566 576 (2)% (2)% Product sales 20 25 (17)% (19)% Total revenue 587 601 (2)% (3)% Operating income 110 163 (33)% (33)% Adjusted EBITDA 264 279 (6)% (6)% 24

Q3'24 Select Performance and KPI Data Same-store sales (SSS) growth (%) (Wager-based growth) (1) Q3'24 Constant Currency Change Q3'23 Constant Currency Change Global Instant ticket & draw games 1.0% (0.8)% U.S. multi-state jackpots (55.2)% 43.6% Total (5.8)% 3.1% U.S. & Canada Instant ticket & draw games 0.2% (1.0)% U.S. multi-state jackpots (55.2)% 43.6% Total (9.8)% 4.9% Italy Instant ticket & draw games 2.7% 4.7% Rest of world Instant ticket & draw games 1.9% (6.9)% (1) Same-store sales represents the change in wagers recorded in lottery jurisdictions where IGT is the operator or facilities management supplier, using the same lottery jurisdictions and perimeter for comparisons between periods 25 Revenue (by geography) Q3'24 Q3'23 Y/Y Change Constant Currency Change U.S. & Canada 284 306 (7)% (7)% Italy 228 218 5% 3% Rest of world 75 77 (3)% (3)% Total revenue 587 601 (2)% (3)%

Q3'24 Summarized Income Statement For the three months ended For the nine months ended September 30, September 30, All amounts from continuing operations 2024 2023 Y/Y Change 2024 2023 Y/Y Change Service revenue 566 576 (2)% 1,771 1,767 —% Product sales 20 25 (17)% 89 82 9% Total revenue 587 601 (2)% 1,861 1,849 1% Total operating expenses 477 438 (9)% 1,354 1,294 (5)% Operating income 110 163 (33)% 507 555 (9)% Interest expense, net 53 54 160 154 Foreign exchange loss (gain), net 39 (36) 23 (9) Other non-operating expense, net 2 3 9 9 Total non-operating expenses 94 21 192 155 Income before provision for income taxes 15 142 315 400 Provision for income taxes 61 65 161 209 Net income 43 123 256 280 Less: Net income attributable to non-controlling interests 34 31 120 115 Net income attributable to IGT PLC 7 94 130 164 Net income attributable to IGT PLC per common share - diluted $(0.39) $0.23 $0.17 $0.38 Adjusted net income attributable to IGT PLC per common share - diluted $(0.02) $0.04 $0.46 $0.41 $ in millions except per share amounts 26

Summarized Cash Flow Statement For the three months ended For the nine months ended September 30, September 30, 2024 2023 2024 2023 Net cash provided by operating activities from continuing operations 173 226 489 620 Capital expenditures (30) (31) (104) (104) Free Cash Flow 144 195 385 516 Cash flow provided by discontinued operations 24 1 69 (165) Debt Proceeds / (Repayment), Net 1 60 (52) 71 Shareholder dividends paid (40) (40) (121) (120) Minority distribtions, net (10) (10) (214) (206) Other, Net (2) (67) (80) (90) Other Investing / Financing (27) (56) (397) (510) Net Cash Flow 117 139 (13) 6 Effect of Exchange Rates/Other 17 (32) (14) (24) Net Change in Cash and Restricted Cash 134 108 (26) (18) $ in millions 27

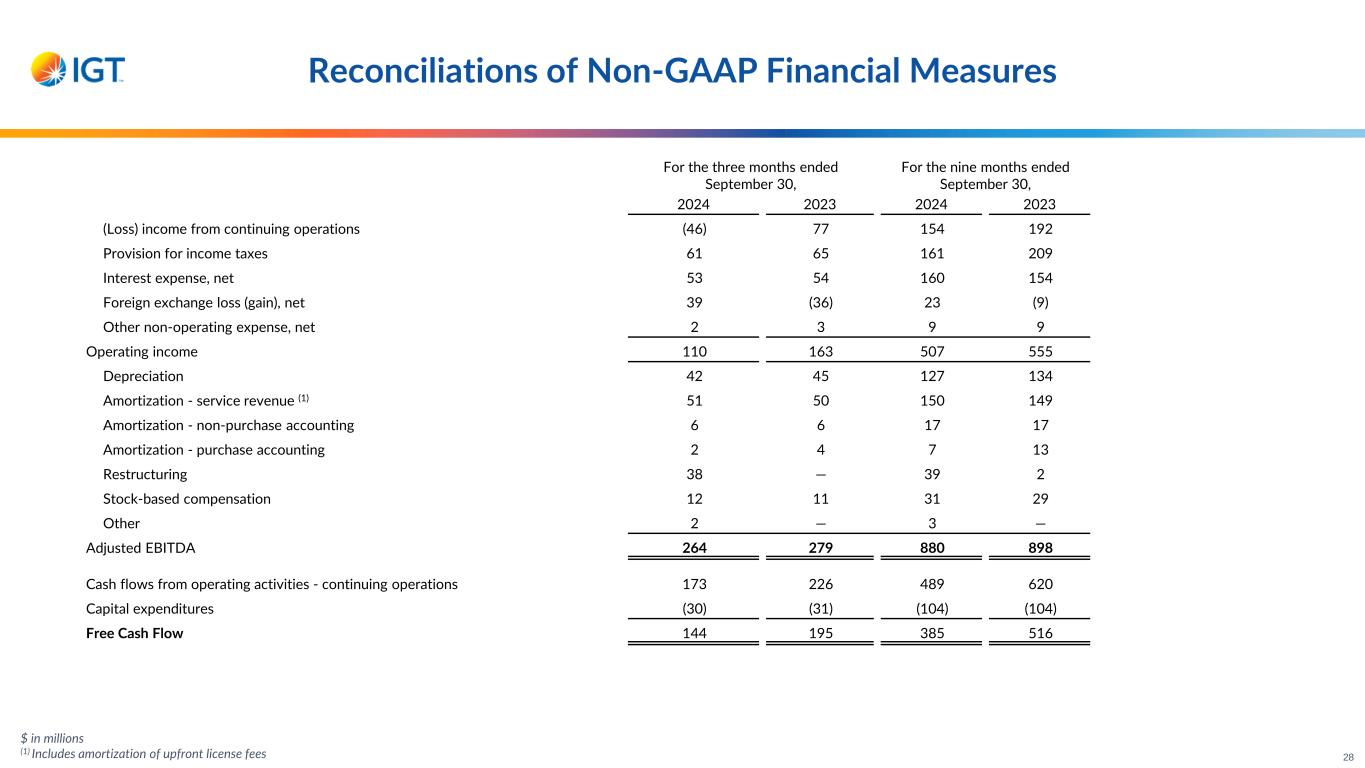

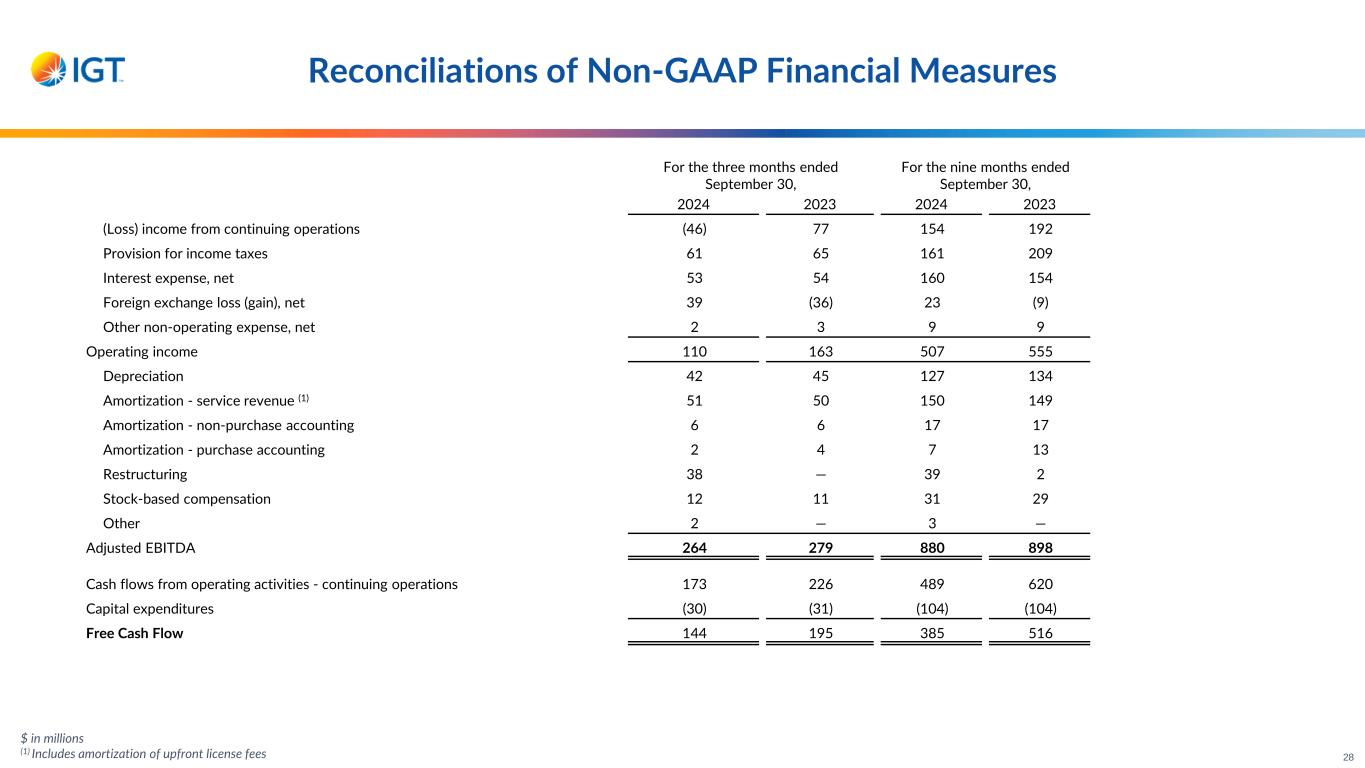

For the three months ended September 30, For the nine months ended September 30, 2024 2023 2024 2023 (Loss) income from continuing operations (46) 77 154 192 Provision for income taxes 61 65 161 209 Interest expense, net 53 54 160 154 Foreign exchange loss (gain), net 39 (36) 23 (9) Other non-operating expense, net 2 3 9 9 Operating income 110 163 507 555 Depreciation 42 45 127 134 Amortization - service revenue (1) 51 50 150 149 Amortization - non-purchase accounting 6 6 17 17 Amortization - purchase accounting 2 4 7 13 Restructuring 38 — 39 2 Stock-based compensation 12 11 31 29 Other 2 — 3 — Adjusted EBITDA 264 279 880 898 Cash flows from operating activities - continuing operations 173 226 489 620 Capital expenditures (30) (31) (104) (104) Free Cash Flow 144 195 385 516 $ in millions (1) Includes amortization of upfront license fees Reconciliations of Non-GAAP Financial Measures 28

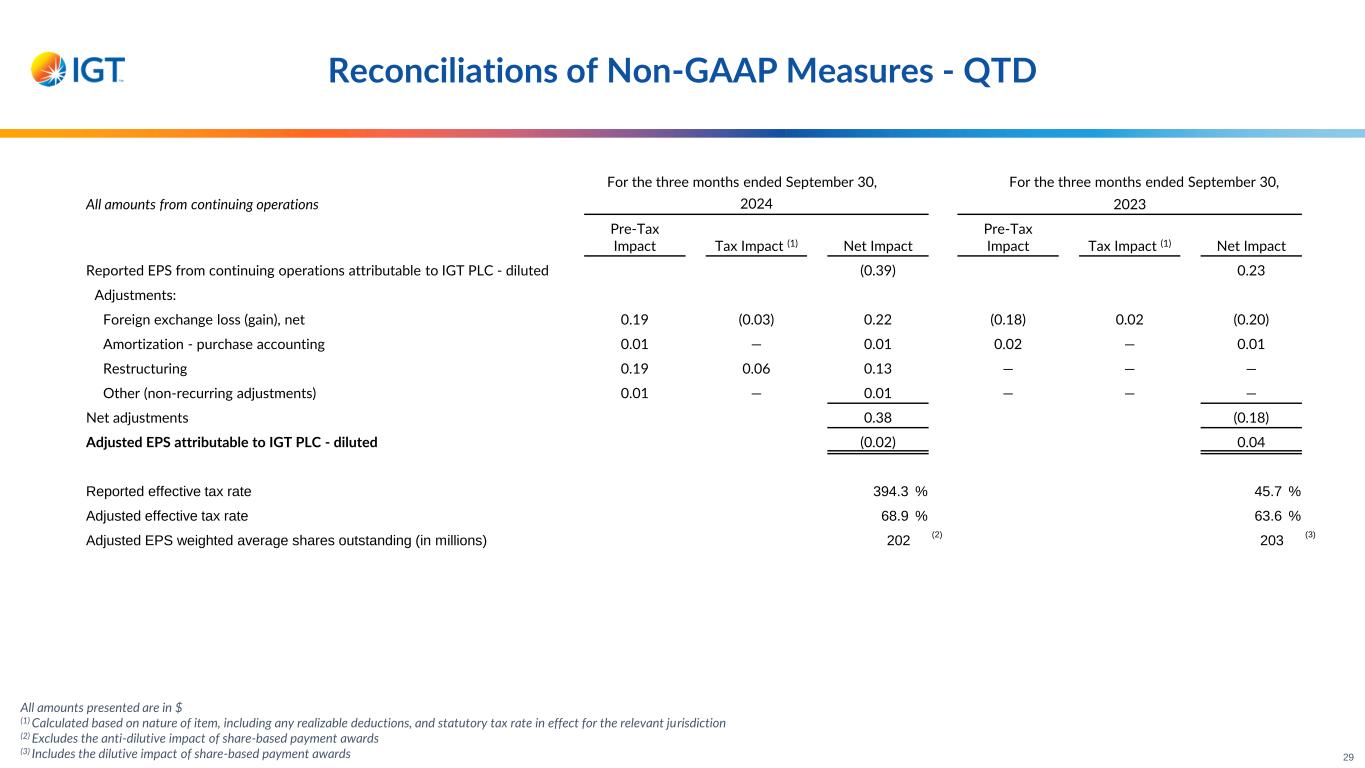

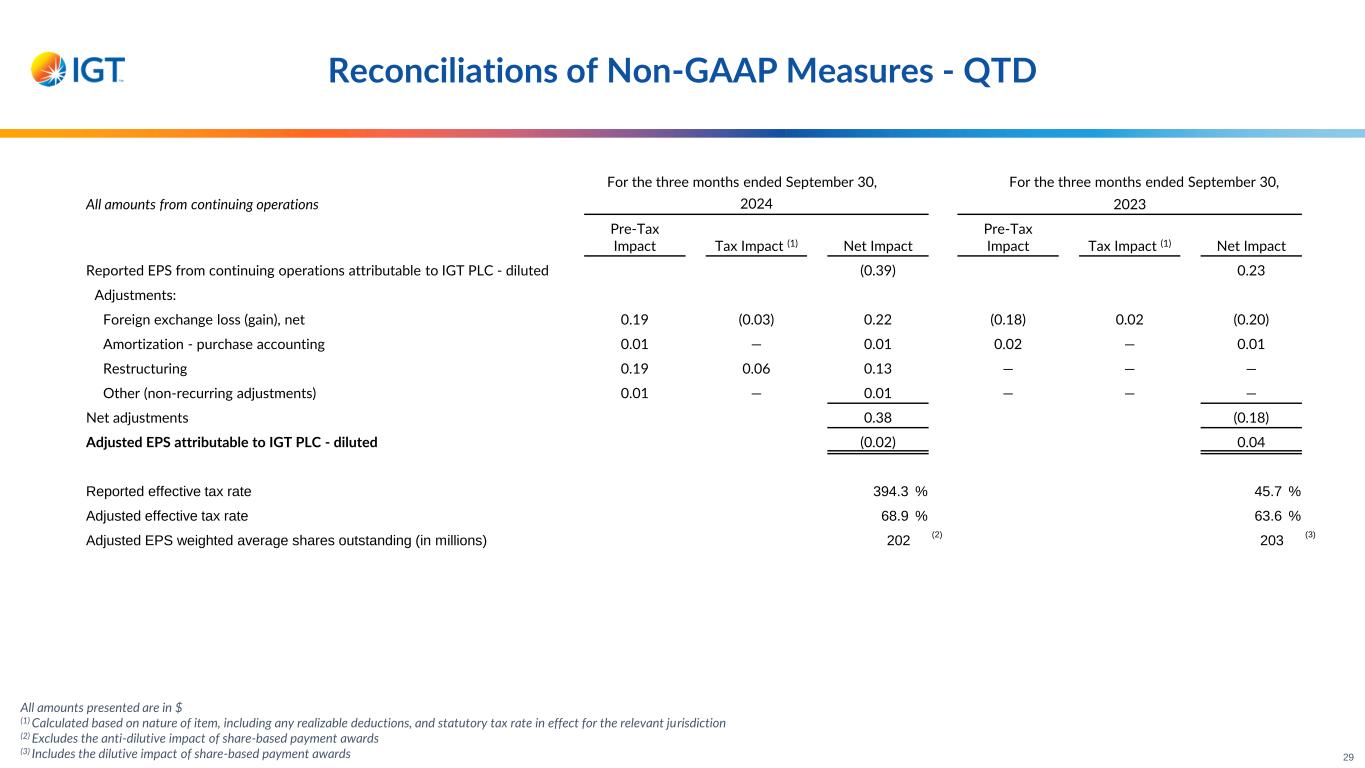

For the three months ended September 30, For the three months ended September 30, All amounts from continuing operations 2024 2023 Pre-Tax Impact Tax Impact (1) Net Impact Pre-Tax Impact Tax Impact (1) Net Impact Reported EPS from continuing operations attributable to IGT PLC - diluted (0.39) 0.23 Adjustments: Foreign exchange loss (gain), net 0.19 (0.03) 0.22 (0.18) 0.02 (0.20) Amortization - purchase accounting 0.01 — 0.01 0.02 — 0.01 Restructuring 0.19 0.06 0.13 — — — Other (non-recurring adjustments) 0.01 — 0.01 — — — Net adjustments 0.38 (0.18) Adjusted EPS attributable to IGT PLC - diluted (0.02) 0.04 Reported effective tax rate 394.3 % 45.7 % Adjusted effective tax rate 68.9 % 63.6 % Adjusted EPS weighted average shares outstanding (in millions) 202 (2) 203 (3) Reconciliations of Non-GAAP Measures - QTD All amounts presented are in $ (1) Calculated based on nature of item, including any realizable deductions, and statutory tax rate in effect for the relevant jurisdiction (2) Excludes the anti-dilutive impact of share-based payment awards (3) Includes the dilutive impact of share-based payment awards 29

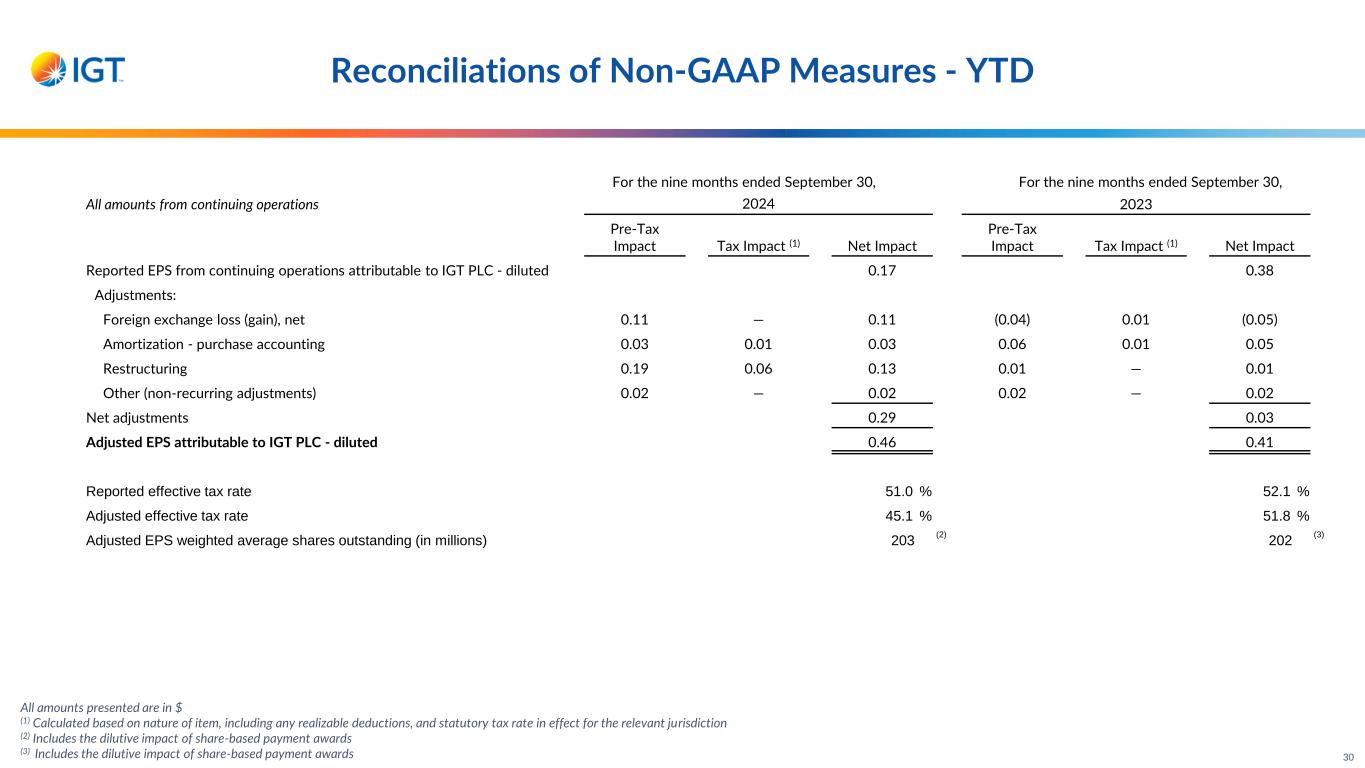

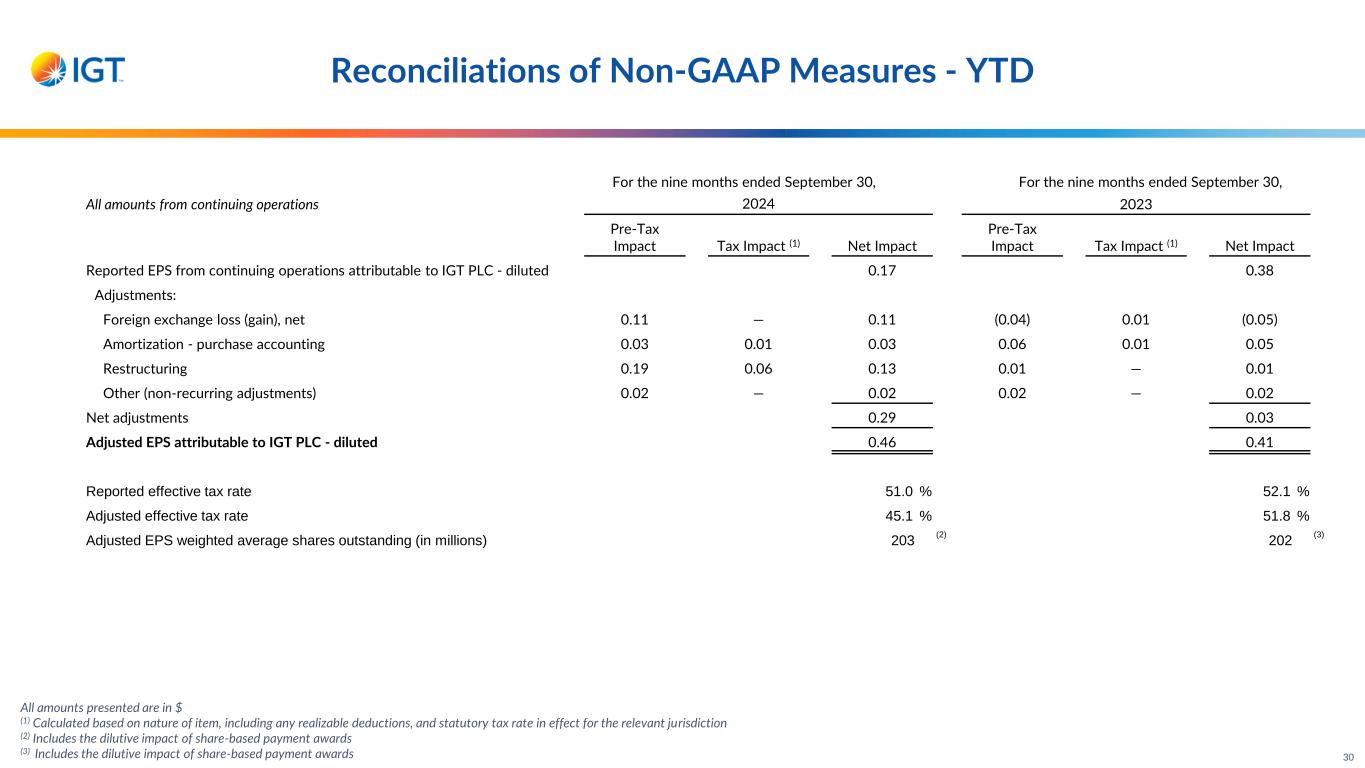

For the nine months ended September 30, For the nine months ended September 30, All amounts from continuing operations 2024 2023 Pre-Tax Impact Tax Impact (1) Net Impact Pre-Tax Impact Tax Impact (1) Net Impact Reported EPS from continuing operations attributable to IGT PLC - diluted 0.17 0.38 Adjustments: Foreign exchange loss (gain), net 0.11 — 0.11 (0.04) 0.01 (0.05) Amortization - purchase accounting 0.03 0.01 0.03 0.06 0.01 0.05 Restructuring 0.19 0.06 0.13 0.01 — 0.01 Other (non-recurring adjustments) 0.02 — 0.02 0.02 — 0.02 Net adjustments 0.29 0.03 Adjusted EPS attributable to IGT PLC - diluted 0.46 0.41 Reported effective tax rate 51.0 % 52.1 % Adjusted effective tax rate 45.1 % 51.8 % Adjusted EPS weighted average shares outstanding (in millions) 203 (2) 202 (3) Reconciliations of Non-GAAP Measures - YTD All amounts presented are in $ (1) Calculated based on nature of item, including any realizable deductions, and statutory tax rate in effect for the relevant jurisdiction (2) Includes the dilutive impact of share-based payment awards (3) Includes the dilutive impact of share-based payment awards 30