As filed with the Securities and Exchange Commission on January 14, 2015

Registration No. 333-200972

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PATRIOT NATIONAL, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 6411 | | 46-4151376 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

401 East Las Olas Boulevard, Suite 1650

Fort Lauderdale, Florida 33301

(954) 670-2900

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Steven M. Mariano

President and Chief Executive Officer

401 East Las Olas Boulevard, Suite 1650

Fort Lauderdale, Florida 33301

(954) 670-2900

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| | | | |

Gary Horowitz, Esq. Lesley Peng, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 | | Christopher A. Pesch, Esq. Executive Vice President, General Counsel, Chief Legal Officer and Secretary 401 East Las Olas Boulevard, Suite 1650 Fort Lauderdale, Florida 33301 (954) 670-2900 | | Glenn R. Pollner, Esq. Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, New York 10166 (212) 351-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be Registered | | Amount to be

Registered(1) | | Proposed

Maximum

Aggregate

Offering

Price per

Share | | Proposed Maximum Aggregate Offering Price(1)(2) | | Amount of

Registration Fee(3) |

Common Stock, $0.001 par value per share | | 9,563,055 shares | | $18.00 | | $172,134,990 | | $20,003 |

|

|

| (1) | | Includes shares of common stock subject to the underwriters’ option to purchase additional shares, solely to cover over-allotments, if any. See “Underwriting (Conflicts of Interest).” |

| (2) | | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) promulgated under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | |

| PRELIMINARY PROSPECTUS | | Subject to Completion | | January 14, 2015 |

8,315,700 Shares

COMMON STOCK

This is the initial public offering of shares of our common stock. No public market currently exists for our common stock. We are offering 7,350,000 shares of our common stock and the selling stockholders named in this prospectus are offering 965,700 shares of our common stock. We expect the initial public offering price to be between $16.00 and $18.00 per share. We will not receive any proceeds from the sale of the shares by the selling stockholders.

Our common stock has been approved for listing, subject to official notice of issuance, on the New York Stock Exchange (the “NYSE”) under the symbol “PN.”

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and in future reports after consummation of this offering. See “Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 24 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | |

| | | Per Share | | Total |

| Public offering price | | $ | | $ |

| Underwriting discounts and commissions(1) | | $ | | $ |

| Proceeds, before expenses, to us | | $ | | $ |

| Proceeds, before expenses, to the selling stockholders | | $ | | $ |

| (1) | | See “Underwriting (Conflicts of Interest)” for additional information regarding underwriter compensation. |

The underwriters may also purchase first, from us, up to an additional 1,102,500 shares of our common stock and second, from the selling stockholders, up to an additional 144,855 shares of our common stock, in each case at the public offering price, less the underwriting discounts and commissions, solely to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ million and our total proceeds, before expenses, will be $ million.

The underwriters are offering the common stock as set forth under “Underwriting (Conflicts of Interest).” Delivery of the shares will be made on or about , 2015.

| | | | |

| | |

| UBS Investment Bank | | BMO Capital Markets | | SunTrust Robinson Humphrey |

| | |

| |

| JMP Securities | | William Blair |

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may authorize to be distributed to you. We and the underwriters have not authorized anyone to provide you with additional or different information. Neither we nor the underwriters take responsibility for, nor can provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the shares of our common stock or possession or distribution of this prospectus in any such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus applicable to that jurisdiction.

TABLE OF CONTENTS

i

MARKET AND INDUSTRY DATA

This prospectus includes industry and market data derived from internal analyses based upon publicly available data or other proprietary research and analysis, surveys or studies conducted by third parties and industry and general publications, including those by the National Council on Compensation Insurance, SNL Financial and Moody’s Investors Service. While we believe our internal analyses are reliable, they have not been verified by any independent sources. Any such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

GLOSSARY

Unless otherwise specified or the context requires otherwise, in this prospectus:

| Ø | | references to “Patriot National,” “our company,” “we,” “us” or “our” refer to Patriot National, Inc. and its direct and indirect subsidiaries, unless otherwise indicated; and |

| Ø | | all share and per share information have been adjusted to reflect a 15-to-1 split of our capital stock that will be effected immediately prior to the effectiveness of the registration statement relating to this offering. |

Unless otherwise specified or the context requires otherwise, the following terms used in this prospectus have the meanings ascribed to them below:

| Ø | | references to the “Acquisitions” refer to both the GUI Acquisition and Patriot Care Management Acquisition together; |

| Ø | | references to “alternative market” refer to arrangements (1) in which workers’ compensation insurance policies are written by our clients and their policyholder or another party bears a substantial portion of the underwriting risk through a reinsurance arrangement between the client and a reinsurance entity or (2) through which our clients share underwriting risk with their policyholders through large deductible policies, retrospectively-rated policies and policyholder dividend arrangements; |

| Ø | | references to “combined ratio” refer to the combined ratio comprised of (i) the ratio calculated by dividing net incurred losses plus loss adjustment expenses by net earned premiums and (ii) the ratio calculated by dividing net operating expenses by net written premiums. The combined ratio is a measure of the profitability of an insurance company, and a combined ratio below 100 percent is indicative of an underwriting profit; |

| Ø | | references to “Guarantee Insurance” refer to Guarantee Insurance Company and references to “Guarantee Insurance Group” refer to Guarantee Insurance Group, Inc. (f/k/a Patriot National Insurance Group, Inc.), the parent company of Guarantee Insurance, entities that are both controlled by Steven M. Mariano, our founder, Chairman, President and Chief Executive Officer; |

| Ø | | references to the “GUI Acquisition” refer to our acquisition, effective August 6, 2014, of contracts to provide marketing, underwriting and policyholder services and related assets and liabilities from a subsidiary of Guarantee Insurance Group, as described in “Business—Our History and Organization” and “Unaudited Pro Forma Financial Information;” |

| Ø | | references to the “Patriot Care Management Acquisition” refer to our acquisition, effective August 6, 2014, of a business that provides nurse case management and bill review services (the “Patriot Care Management Business”), as described in “Business—Our History and Organization” and “Unaudited Pro Forma Financial Information;” |

ii

| Ø | | references to “reference premiums written” refer to the aggregate premiums, grossed up for large deductible credits, written by or for our insurance carrier partners in respect of the policies we produce and service on their behalf; |

| Ø | | references to “reinsurance captives” or “reinsurance captive entities” refer to segregated portfolio cell captive entities that assume underwriting risk written initially by an insurance carrier client; and |

| Ø | | references to the “Reorganization” refer to Patriot National’s incorporation in Delaware in November 2013 as a holding company and the consolidation of various entities operating our business that had been under the common control of Mr. Mariano, and the separation of our insurance services business from the insurance operations of Guarantee Insurance. |

iii

Prospectus Summary

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

OVERVIEW

We are a national provider of comprehensive outsourcing solutions within the workers’ compensation marketplace for insurance companies, employers, local governments and reinsurance captives. We offer an end-to-end portfolio of services to increase business production, contain costs and reduce claims experience for our clients. We leverage our strong distribution relationships, proprietary business processes, advanced technology infrastructure and management expertise to deliver valuable solutions to our clients. We strive to deliver these value-added services to our clients in order to help them navigate the workers’ compensation landscape, ensure compliance with state regulations, handle all aspects of the claims process and ultimately contain costs.

We work with leading insurance carriers to design workers’ compensation programs according to their preferred risk parameters and specifications. We market the programs through our broad distribution network of over 1,000 independent retail agencies, and underwrite and bind coverage on behalf of our clients. We play a central role in controlling the underwriting, production and administration process, which we believe gives us flexibility in the event of a change in carrier relationships.

Once an insurance program is established with an insurance carrier client, we offer a full suite of additional services, including claims administration and adjudication, cost containment, nurse case management, fraud investigation and subrogation services. We also offer these services individually or as a customized package of services to our other clients such as employers, local governments and reinsurance captives, based on a client’s particular needs. We believe that our proactive approach to claims administration, including our proprietary Swift Working Assessment and Rapid Methodology, or SWARM™ process, results in higher than average claims closure rates versus the industry. Our technology platform provides timely information to our employees and our clients, which allows rapid initial case analysis and response to claims as well as direct access to information across our internal organization. We believe this proactive approach to our business, combined with our industry expertise and distribution relationships, makes us a valued outsourcing partner for our clients.

We generate fee revenue for our services, and we do not write any insurance policies or bear underwriting risk. On a pro forma basis, after giving effect to the Acquisitions, this offering and the application of use of proceeds therefrom, our revenue was $101.1 million for the nine months ended September 30, 2014 and $93.0 million for the year ended December 31, 2013. Our net income (loss) on a pro forma basis for such periods was $14.5 million and $(15.2) million, respectively. See “Unaudited Pro Forma Financial Information” for additional information.

1

OUR SERVICES

We offer two types of services: brokerage, underwriting and policyholder services (or our “brokerage and policyholder services”) and claims administration services (or our “claims administration services”).

Our brokerage and policyholder services include general agency services and specialty underwriting and policyholder services provided to our insurance carrier clients. For these carrier partners, we produce and administer alternative market and traditional workers’ compensation insurance programs within risk classes and geographies specified by our insurance carrier clients, and earn fees based on a percentage of the premiums for the policies we produce and service. We do not write any insurance policies or bear underwriting risk.

We place the workers’ compensation insurance products of our carrier partners through a national network of over 1,000 independent retail agencies nationwide. Through this independent agency network, we also offer reinsurance captive entity design and management services. We earn fees for management and other services performed for reinsurance captive entities that we design and form.

Our claims administration services relate to the administration and resolution of workers’ compensation claims that are designed to reduce costs for our clients. We provide a comprehensive claims administration platform to our carrier partners that revolves around our proprietary SWARM process. The SWARM process is a high-touch, front-end loaded approach to claims processing that employs a multi-faceted, team-based rapid response to all new claims. When a claim is compensable, our claims management process is designed to result in an optimal net claim cost while ensuring that the injured worker’s medical care is provided in an effective and efficient manner, promoting the early return to work through consistent contact with medical providers and employers and providing appropriate and prompt payment of benefits.

In addition to the full suite of services provided to our insurance carrier clients, we also provide a variety of specialty services individually to our other clients such as employers, local governments and reinsurance captives, as well as insurance carrier clients who may not purchase brokerage and policyholder services from us. These services include:

| Ø | | healthcare cost containment services, including nurse case management and medical bill review, which are designed to contain healthcare costs associated with workers’ compensation claims, a significant and growing component of claim costs, through early intervention and ongoing review of healthcare services and pricing; |

| Ø | | investigation services, including onsite investigations into fraud and compensability and evaluation of subrogation opportunities designed to limit claim exposures for our clients and comply with regulatory requirements, certain of which we offer through outside service providers; |

| Ø | | loss control services designed to proactively mitigate potential claims costs prior to the occurrence of a compensable injury, including onsite hazard assessments, preemptive evaluation of risk exposures, review of workplace safety policy and procedures and ongoing education, certain of which we offer through outside service providers; |

| Ø | | transportation and translation services, including the capability to handle various transportation needs of claimants (such as wheelchair, advanced life support and air ambulance) and onsite and telephonic translation and transcription in connection with claims, which we offer through outside service providers; |

| Ø | | lien resolution services in the state of California, including lien negotiation, disputed bill analysis, claim consultation and analysis and bulk settlement services; and |

2

| Ø | | legal bill review services designed to provide cost saving opportunities for claims departments of insurance companies, which we offer through outside service providers. |

INDUSTRY OUTLOOK

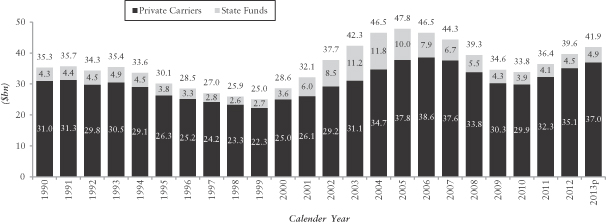

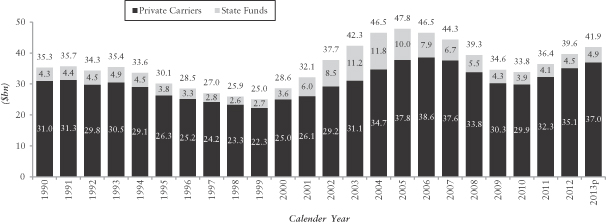

Workers’ compensation in the United States is a mandated, state-legislated, no-fault insurance program that requires employers to fund medical expenses, lost wages and other costs resulting from work-related injuries and illness. According to the National Council on Compensation Insurance’sState of theWorkersCompensation Line 2014 (the “NCCI Report”), projected total net premium written by state funds and private carriers of workers’ compensation insurance in the United States was $41.9 billion in 2013, an increase from $33.8 billion in 2010, representing a compound annual growth rate of 7.4% over that period, and according to data compiled by SNL Financial, total direct premium written by workers’ compensation insurance carriers in the United States, which includes the amount of premium reinsured by insurance carriers, was $52.5 billion in 2013, an increase from $40.4 billion in 2010, representing a compound annual growth rate of 9.2% over that period. In the past several years, premium growth in the workers’ compensation industry has been predominantly driven by the recovery of employment levels to generally at or near pre-recession levels, as well as increasing premium rates.

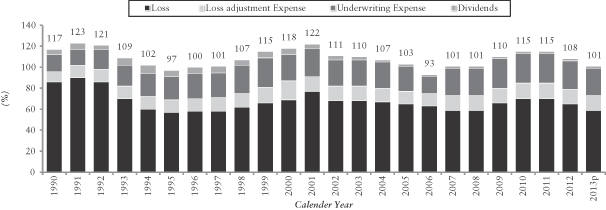

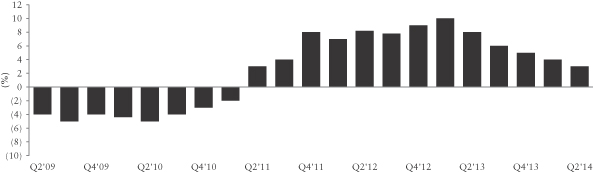

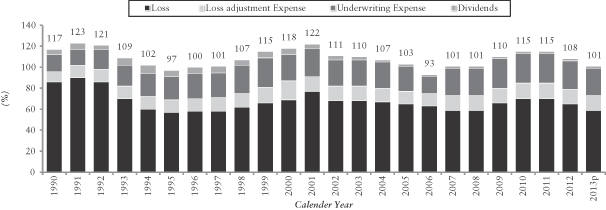

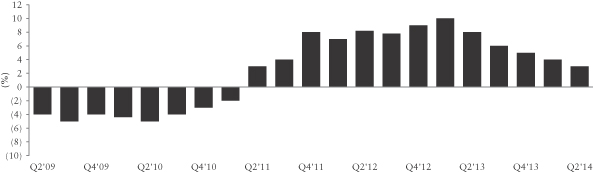

Like other sectors of the insurance industry, the workers’ compensation sector experiences underwriting cyclicality, which generally underpins changes in premium rates. This cyclicality is caused by a number of factors. First, ultimate loss costs become more difficult to predict when claims remain open for longer periods and they are exposed to wage and medical cost inflation. For example, the NCCI Report indicates that medical costs per claim increased by approximately 6.5% on average per year from 1995 through 2013. Second, the amount of investment income insurance carriers earn, which is a significant contributor of their overall targets, may also influence such carrier’s underwriting practices. Given that workers’ compensation claims have a long duration, insurers can write at higher combined ratios because they are able to invest the assets over a long period and earn significant investment income. This is reflected in a greater than 100% combined ratio for all but two years from 1990 to 2013. However, in periods of low interest rates, similar to the current investment environment, insurance carriers cannot generate sufficient investment income to offset underwriting losses, and as a result have demanded higher premium rates. This has led to a modest “hardening” of the workers’ compensation market. According to the reportUS Workers’ Compensation: Sector Profile by Moody’s Investors Service (the “Moody’s Report”), rates in 2013 increased 8% and are expected to rise 5.5% in 2014.

Today, the attractive combination of rising employment and an improved underwriting environment has driven new entrants into the market, and caused industry participants who had decreased their activity levels during the previous “soft” market cycle to re-enter the market as macro-economic conditions and the profit outlook for the industry improve.

Because insurance carriers adjust their growth appetite based on the prevailing macro-economic and underwriting cycle, we believe outsourcing certain functions to a company like us is attractive because it allows carriers to maintain production flexibility in response to market conditions without burdensome investment in, or management of, certain necessary services and fixed costs. We are able to take advantage of the current improving market and provide services to carriers who may have previously exited the workers’ compensation market and no longer have the systems in place to resume writing business. Furthermore, we believe the profitability challenges faced by the workers’ compensation insurance industry creates opportunities for specialty service providers like us who can reduce costs and also provide access to alternative market options.

In addition to providing flexibility to carriers, enabling them to opportunistically write workers’ compensation business in an attractive market, we also help our clients navigate the complex state-regulated industry landscape. Ensuring state-by-state compliance is time consuming and expensive,

3

particularly for a carrier whose primary business is not in workers’ compensation. We believe our national presence and experience with each state’s guidelines and requirements position us to deliver significant value and cost savings for our clients.

OUR COMPETITIVE STRENGTHS

We believe we have the following competitive strengths:

| Ø | | National Provider of FullSpectrum of Services Focused on Workers’ Compensation. We provide a complete range of services, from originating and underwriting policies to claims adjudication, focused exclusively on the workers’ compensation insurance industry. We are able to efficiently deploy these services nationwide on a coordinated and proactive basis. We believe our sector focus and our nationwide footprint allow us to provide superior services and products, higher efficiencies and better cost containment to our clients relative to multiline insurance service providers. In addition, due to the expertise required to comply with a complex, state-based regulatory regime, we believe that we have a business model that is difficult to replicate. |

| Ø | | State-of-the-Art Technology Infrastructure. We developed and implemented our WorkersCompExpert (“WCE”) system, a scalable technology platform that handles the entire billings and claims administration process, from the initial issuance of policies to settlement of claims. Our WCE system is the cornerstone of our services, and we believe it provides: |

| | · | | reduced cost associated with policy initiation by fully automating issuance and underwriting of new policies; |

| | · | | real-time analysis and communication capabilities across functional areas to enhance speed of claims response and resolution; |

| | · | | enhanced data collection and quality, information analysis and identification of trends through ease-of-use and single data-entry principle; and |

| | · | | comprehensive predictive modeling and analytics capabilities. |

The WCE system was designed with a robust, modular architecture to provide flexibility to integrate new carriers and acquired businesses. For example, the WCE system is compatible with the legacy systems of our clients. We believe this compatibility allows us to reduce the time required for systems integration and to provide enhanced day-to-day operational interactions securely and with relative ease. We also believe that it can be utilized in lines of business outside of the workers’ compensation insurance industry.

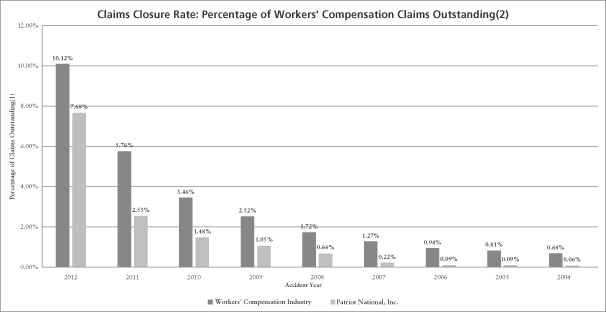

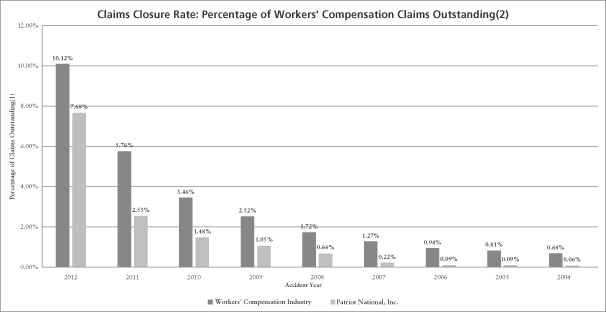

| Ø | | Proven Proprietary ClaimsManagement Process. Through our proprietary SWARM process, we provide our clients with a high quality, high-touch claims management program that has proven to be effective at settling claims and reducing associated costs. By simultaneously deploying multiple functional areas of expertise, such as claims adjustment, fraud investigation, healthcare cost containment, nurse case management and subrogation, we ensure that appropriate personnel can review and respond to the claim rapidly. The SWARM process enables us to favorably influence the outcome of the claim by addressing potential issues early in its lifecycle, resulting in claims closure rates consistently better than industry averages. For example, as of December 31, 2013, only 0.7% of our claims that occurred in the accident year 2008 remained open, as compared to the industry average of 1.7%, and only 9.0% of our claims that occurred in the accident year 2012 remained open, as compared to the industry average of 10.1%, as reported by A.M. Best’s Global Insurance Database. We believe that rapidly closing claims reduces exposure to litigation risk, medical cost inflation and other factors and will ultimately reduce claims costs for our carrier partners. |

4

| Ø | | Strong Distribution Relationships. We maintain relationships with our network of over 1,000 independent, non-exclusive retail agencies in all 50 states by emphasizing personal interaction and superior service and maintaining an exclusive focus on workers’ compensation services. Our experienced underwriting service personnel work closely with our independent retail agencies to market the products of our carrier partners and serve the needs of prospective policyholders. We believe that we distinguish ourselves from larger insurance company and brokerage competitors by forming close relationships with these independent retail agencies and focusing on small to mid-sized businesses. We strive to provide excellent customer service to our agencies and potential policyholders, including fast turnaround of policy submissions, in order to attract and retain business. |

| Ø | | Philosophy of Customer Service through Innovation. A core tenet of our culture is a commitment to innovation and customer service focused on finding solutions to deliver superior results for our clients. Since the inception of our workers’ compensation insurance business in 2003, we have continued to develop and expand our capabilities, transforming our individual services into an integrated end-to-end offering on a national scale. We also seek to drive efficiencies in our operations to provide better solutions for our clients. For example, we created our proprietary SWARM claims administration process which brings together our claims management capabilities in a proactive way to drive value for our clients. In addition, we developed our scalable WCE technology platform to enable us to deliver our full suite of services in a cost-efficient manner. |

| Ø | | Experienced Management. Our senior management team is comprised of experienced executives with a track record of financial and operational success, deep experience through multiple industry cycles and strong relationships with our carrier partners. Mr. Mariano, our founder, Chairman, President and Chief Executive Officer, has guided the creation and growth of our company, including the Reorganization and the Acquisitions, as discussed under “—Our History and Organization” below. The members of our senior management team average over 20 years of insurance industry experience, and have developed a proven ability to identify, evaluate and execute successful growth strategies. We foster an entrepreneurial culture focused on customer service, innovation and business generation and have aligned the incentives of our key employees through a merit-based compensation system, which we believe has enabled us to attract and retain superior talent and produce strong results for our clients and our company. |

OUR GROWTH STRATEGY

We intend to leverage our competitive strengths to drive sales and profit growth through the following key strategies:

| Ø | | Expand Our Insurance Carrier Client Business Relationships. We currently offer a broad range of our insurance services to our insurance carrier clients who outsource all or part of their workers’ compensation insurance programs to us. In addition to our primary insurance carrier clients Guarantee Insurance, Zurich Insurance Group Ltd. (“Zurich”) and Scottsdale Insurance Company (“Scottsdale”), we are focused on engaging and establishing relationships with other insurance carriers, including carriers that have not historically written workers’ compensation insurance. We intend to take advantage of the current attractive dynamics in the workers’ compensation industry of increasing employment and premium rates to create partnerships with new or opportunistic market entrants. For example, Scottsdale recently became our insurance carrier client and began writing workers’ compensation insurance at that time. In addition, we recently formed a relationship with American International Group, Inc. (“AIG”), and we expect AIG to become one of our primary insurance carrier clients over time. We continue to seek to expand our carrier partner business relationships. |

| Ø | | Continue to Grow Our Client Base for Individual Services. We also provide a variety of specialty services individually or as a customized package of services, such as onsite investigations into fraud |

5

| | and compensability and evaluation of subrogation opportunities; loss control services; transportation and translation services; and legal bill review services. While these services are generally provided as part of our integrated claims administration service to our insurance carrier clients, we have grown this business to include more than 80 third-party clients. We intend to continue to focus on marketing these service offerings to new third-party clients, such as other insurance carriers and service providers, self-insured employers and local governments, as well as insurance carriers who do not purchase our brokerage and policyholder services offerings. |

| Ø | | Leverage Our Existing Infrastructure. We serve our clients and policyholders through regional offices in seven states, each of which has been staffed to accommodate growth in our business. Further, we have developed and implemented a robust, vertically integrated modularized information technology platform that is designed to help us grow. This system is highly scalable and adaptable to additional opportunities, with substantial excess capacity, allowing us to grow and service additional clients without the need for substantial additional investment. We plan to realize economies of scale in our workforce and technology infrastructure. |

| Ø | | Continue to Develop and Offer Innovative Solutions. We believe that we can continue to provide superior services and products, higher efficiencies and cost containment to our clients by developing innovative solutions for our clients. For example, we recently began offering workers’ compensation lien resolution services in order to address a specific need for our clients in the state of California, including lien negotiation, disputed bill analysis, claim consultation and analysis and bulk settlement services. We believe that our focus on continuing to seek opportunities to provide potential and existing clients with new services and solutions will allow us to leverage our existing infrastructure to further drive our organic growth. |

| Ø | | Acquire Complementary Operations. We believe there are significant opportunities, through the acquisition of complementary operations, to continue to expand the range of services that we offer to our clients. For example, through our recently completed Patriot Care Management Acquisition, we acquired the capability to provide nurse case management and bill review services, both as a part of our full suite of services that we provide to our insurance carrier clients and also individually or as a customized package of services to third-party clients. We continue to evaluate the possibility of acquiring outsourced services and new complementary services or businesses to further drive the growth of our business. |

OUR HISTORY AND ORGANIZATION

Mr. Mariano, our founder, Chairman, President and Chief Executive Officer, initially started our workers’ compensation insurance business and acquired Guarantee Insurance in 2003.

Patriot National, Inc. (f/k/a Old Guard Risk Services, Inc.) was incorporated in Delaware in November 2013 to consolidate certain insurance services entities controlled by Mr. Mariano. These transactions, which we refer to as our “Reorganization,” separated our insurance services business from the insurance risk taking operations of Guarantee Insurance Group.

Effective August 6, 2014, we acquired certain contracts to provide marketing, underwriting and policyholder services to certain of our insurance carrier clients, as well as related assets and liabilities, from a subsidiary of Guarantee Insurance Group. We also acquired a contract to provide a limited subset of our brokerage and policyholder services to Guarantee Insurance, the balance of which had historically been provided without a contract as GUI is a subsidiary of Guarantee Insurance. We refer to the acquisition of these contracts and related assets and liabilities as the “GUI Acquisition.” Immediately following the GUI Acquisition, we entered into a new agreement to provide all of our brokerage and policyholder services to Guarantee Insurance.

6

We further expanded our business effective August 6, 2014, through our acquisition from MCMC LLC (“MCMC”) of its managed care risk services business that provides nurse case management and bill review services. This business, which we refer to as the “Patriot Care Management Business,” had been previously controlled by Mr. Mariano until it was sold to MCMC in 2011. We refer to this acquisition as the “Patriot Care Management Acquisition,” and the GUI Acquisition and the Patriot Care Management Acquisition together as the “Acquisitions.”

Our historical financial results for all periods presented in this prospectus include the results of the various businesses previously under the common control of Mr. Mariano and to which we succeeded in connection with the Reorganization, as well as the revenues and expenses associated with the contracts and certain other assets acquired and liabilities assumed through the GUI Acquisition. Revenues and expenses associated with the new agreement we entered into in August 2014 to provide all of our brokerage and policyholder services to Guarantee Insurance, as well as the financial results associated with the Patriot Care Management Business, are included in our historical financial results beginning August 6, 2014 and are not reflected in our historical financial statements as of or for any earlier period.

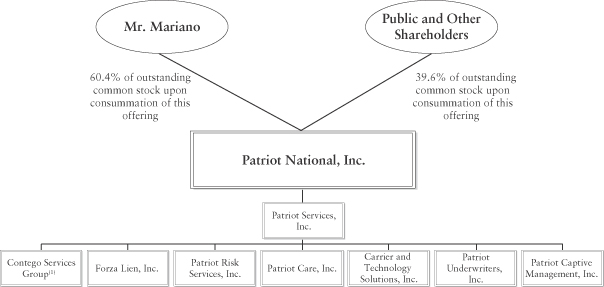

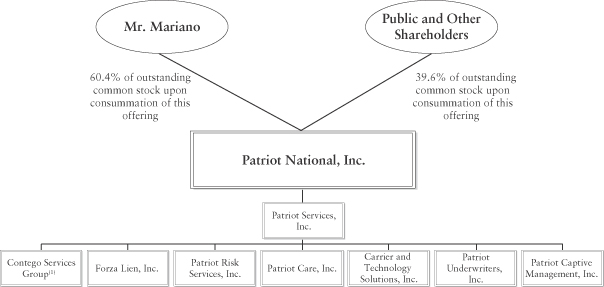

Following the Reorganization and the Acquisitions, we own 100% of the subsidiaries that comprise our insurance services business, with the exception of Contego Services Group, LLC, in which Mr. Mariano maintains a 3% membership interest.

For additional information about our history, the Reorganization and the Acquisitions, see “Business—Our History and Organization.”

7

The organizational chart below summarizes our corporate structure and material subsidiaries as of December 31, 2014 after giving effect to the Reorganization, the Acquisitions and this offering.

| (1) | | Represents Contego Services Group, LLC, Contego Recovery LLC and Contego Investigative Services, Inc. Mr. Mariano maintains a 3% direct membership interest in Contego Services Group, LLC (of which Contego Recovery LLC is a subsidiary). |

RECENT DEVELOPMENTS

Proposed Senior Secured Credit Facilities

In connection with this offering, we expect to enter into a new senior secured credit facility (the “senior secured credit facility”) in the aggregate principal amount of up to $80.0 million, comprised of a $40.0 million revolving credit facility and a $40.0 million term loan facility, with BMO Harris Bank N.A., an affiliate of BMO Capital Markets Corp., as administrative agent. We have received a commitment letter from BMO Harris Bank N.A. relating to this senior secured credit facility. We cannot assure you that we will enter into this senior secured credit facility on terms acceptable to us or at all, or that if we do so that we will be able to borrow all or any of the amounts committed thereunder. The closing of this offering is not conditioned upon our entry into the senior secured credit facility. Concurrently with the consummation of this offering, assuming we enter into the senior secured credit facility, we intend to make borrowings of $40.0 million (or approximately $37.7 million net of loan fees). We intend to use these borrowings, together with the net proceeds from this offering, to repay outstanding amounts under our existing loan agreements and for general corporate purposes. See “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Indebtedness—Senior Secured Credit Facility” and “Underwriting (Conflicts of Interest).”

Reference Premium Written

Reference premium written for the year ended December 31, 2014 was $359.8 million compared to $357.4 million for the year ended December 31, 2013. The reference premium written for the year ended December 31, 2014 is a preliminary estimate and subject to change. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Measures—Reference Premium Written.”

8

Our principal executive offices are located at 401 East Las Olas Boulevard, Suite 1650, Fort Lauderdale, Florida 33301, and our telephone number at that location is (954) 670-2900. Our website address is www.patnat.com. Neither our website nor any information contained on our website is part of this prospectus.

9

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced disclosure and reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies that are not emerging growth companies.

As an emerging growth company, we intend to take advantage of the following provisions of the JOBS Act:

| Ø | | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; |

| Ø | | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board (the “PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and financial statements; |

| Ø | | less extensive disclosure requirements about our executive compensation arrangements; and |

| Ø | | no requirement for shareholder non-binding advisory vote on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until the end of the fiscal year following the fifth anniversary of our initial public offering or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of (i) the last day of the fiscal year in which our annual gross revenues exceed $1.0 billion, (ii) the last day of the fiscal year that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months and (iii) the date on which we have issued more than $1.0 billion in non-convertible debt during the preceding three-year period. For as long as we take advantage of the reduced disclosure obligations, the information that we provide stockholders may be different than information provided by other public companies.

The JOBS Act also provides that an emerging growth company can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to take advantage of this extended transition period, and, as a result, our financial statements may not be comparable to those of companies that comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for companies that are not emerging growth companies.

CERTAIN RISK AND CHALLENGES

Our company, our business and the industry in which we operate are subject to numerous risks as more fully described in the section of this prospectus entitled “Risk Factors.” As part of your evaluation of our business and prospects, you should consider the challenges and risks we face in implementing our business strategies, including that:

| Ø | | because we have a limited operating history as a stand-alone, combined company and business, our historical and pro forma financial condition and results of operations are not necessarily representative of the results we would have achieved as a stand-alone, combined, publicly-traded company and may not be a reliable indicator of our future results; |

10

| Ø | | our business may be materially adversely impacted by general economic and labor market conditions; |

| Ø | | the workers’ compensation insurance industry is cyclical in nature, which may affect our overall financial performance, and we may be more vulnerable to negative developments in the workers’ compensation industry; |

| Ø | | our revenues and income are currently substantially dependent on our relationships with Guarantee Insurance and a small number of other insurance carrier clients; |

| Ø | | our relationship with Guarantee Insurance may create conflicts of interest, and we cannot be certain that all our transactions with Guarantee Insurance will be conducted on the same terms as those available from unaffiliated third parties; and |

| Ø | | we are subject to extensive regulation and supervision and our failure to comply with such regulation or adapt to new regulatory and legislative initiatives may adversely impact our business. |

Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock.

11

THE OFFERING

Common stock offered by us | 7,350,000 shares. |

Common stock offered by the selling stockholders | 965,700 shares. |

Common stock to be outstanding after this offering | 25,424,715 shares (or 26,527,215 shares if the underwriters exercise in full their over-allotment option). |

Over-allotment option | The underwriters have an option for a period of 30 days to purchase first, from us, up to an additional 1,102,500 shares of our common stock and second, from the selling stockholders, up to an additional 144,855 shares of our common stock, in each case to cover over-allotments. |

Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $113.2 million (or approximately $130.6 million if the underwriters exercise in full their over-allotment option), based an assumed initial public offering price of $17.00 per share. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. |

| | We intend to use the net proceeds from this offering, together with borrowings under the senior secured credit facility or cash on hand, to repay all outstanding amounts under our PennantPark Loan Agreement (as defined in “Use of Proceeds”) and our UBS Credit Agreement (as defined in “Use of Proceeds”), in each case including accrued interest and applicable prepayment premiums. We will use any remaining net proceeds of this offering for working capital and for general corporate purposes. See “Use of Proceeds.” |

Dividend policy | We do not currently anticipate paying any dividends on our common stock immediately following this offering. Following this offering and upon repayment of the PennantPark Loan Agreement and the UBS Credit Agreement, we may reevaluate our dividend policy. Any future determinations relating to our dividend policies will be made at the discretion of our board of |

12

| | directors and will depend on various factors, including any restrictions on dividends contained in the senior secured credit facility. See “Dividend Policy.” |

Concentration of ownership | Upon consummation of this offering, we expect that Mr. Mariano, our founder, Chairman, President and Chief Executive Officer, will own approximately 60.4% of our outstanding common stock. As a result, he will be able to exert substantial influence on us and on all matters involving a vote of our shareholders. Mr. Mariano also owns substantially all of the outstanding equity of Guarantee Insurance Group, the parent company of Guarantee Insurance, which may cause a conflict of interest. We have a significant business relationship with Guarantee Insurance. See “Certain Relationship and Related Party Transactions—Relationship and Transactions with Guarantee Insurance Group and Guarantee Insurance” for additional information. |

Directed share program | At our request, the underwriters have reserved up to 5% of the common stock being offered by this prospectus for sale at the initial public offering price to our directors, director nominees, officers, employees and other individuals associated with us and members of their families. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same terms as the other shares of common stock. Participants in the directed share program who purchase more than $1 million of shares shall be subject to a 25-day lock-up with respect to any shares sold to them pursuant to that program. Any shares sold in the directed share program to our directors, director nominees or executive officers shall be subject to 180-day lock-ups. Any of these lock-up agreements will have similar restrictions to the lock-up agreements described herein. See “Underwriting (Conflicts of Interest)—Directed Share Program.” |

Conflicts | Because UBS Securities LLC is a lender under the UBS Credit Agreement and will receive more than 5% of the net proceeds of this offering due to the repayment of borrowings thereunder, UBS Securities LLC is deemed to have a conflict of interest within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering will be conducted in |

13

| | accordance with Rule 5121, which requires, among other things, that a “qualified independent underwriter” participate in the preparation of, and exercise the usual standards of “due diligence” with respect to, the registration statement and this prospectus. SunTrust Robinson Humphrey, Inc. has agreed to act as a qualified independent underwriter for this offering and to undertake the legal responsibilities and liabilities of an underwriter under the Securities Act, specifically including those inherent in Section 11 thereof. SunTrust Robinson Humphrey, Inc. will not receive any additional fees for serving as a qualified independent underwriter in connection with this offering. We have agreed to indemnify SunTrust Robinson Humphrey, Inc. against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. See “Underwriting (Conflicts of Interest)—Conflicts of Interest.” |

Risk factors | Investing in our common stock involves risks. You should read carefully the “Risk Factors” section of this prospectus for a discussion of factors that you should carefully consider before deciding to invest in shares of our common stock. |

Proposed ticker symbol | “PN” |

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| Ø | | assumes no exercise of the underwriters’ over-allotment option; |

| Ø | | assumes an initial public offering price of $17.00 per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus; |

| Ø | | does not reflect 965,700 shares of common stock that will be issued upon the exercise of outstanding warrants held by the selling stockholders (or 1,110,555 shares if the underwriters exercise in full their over-allotment option) at an exercise price of $2.67 per share as of September 30, 2014, which shares are being offered hereby; and |

| Ø | | does not reflect (1) 475,658 restricted shares of common stock (292,900 shares of which vest within 180 days of this offering), 125,020 restricted stock units and stock options to acquire 1,030,591 shares of common stock, with an exercise price equal to the price at which shares of common stock are sold in this offering, all of which we intend to issue in connection with this offering under the Patriot National, Inc. 2014 Omnibus Incentive Plan (the “2014 Plan”); and (2) an additional 1,193,699 shares of common stock available for future issuance under our 2014 Plan. See “Management—Executive Compensation—Compensation Arrangements to be Adopted in Connection with this Offering.” |

14

SUMMARY HISTORICAL AND PRO FORMA COMBINED FINANCIAL DATA

The following table sets forth our summary historical and pro forma combined financial and other data as of the dates and for the periods indicated below. We have derived the summary historical combined financial data as of December 31, 2013 and 2012 and for the years then ended from our audited combined financial statements, which are included elsewhere in this prospectus. The summary historical interim combined financial data as of September 30, 2014 and for the nine months ended September 30, 2014 and 2013 was derived from our unaudited interim combined financial statements, which are also included elsewhere in this prospectus. Our unaudited interim combined financial statements have been prepared on the same basis as our audited combined financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair presentation of the unaudited interim combined financial statements. These historical results are not necessarily indicative of results to be expected in any future period.

The combined financial statements of Patriot National are comprised of (1) the financial statements of us and our subsidiaries, which became our subsidiaries in the Reorganization, (2) the results of the Patriot Care Management Business, which are reflected in our combined financial statements from August 6, 2014, the effective date of the Patriot Care Management Acquisition, and (3) the revenues and expenses associated with the contracts and certain other assets acquired and liabilities assumed effective August 6, 2014 in the GUI Acquisition from GUI, a wholly owned subsidiary of Guarantee Insurance Group and a related party by virtue of common control between us and Guarantee Insurance Group. Because we and the subsidiaries we acquired in the Reorganization are under common control, and the contracts acquired in the GUI Acquisition were acquired from an entity under common control, our combined financial statements are presented as if all of these companies and businesses, were owned by us for all of the periods presented, as further described in the notes to our combined financial statements included elsewhere in this prospectus.

We have derived the summary unaudited pro forma condensed combined financial data as of and for the nine months ended September 30, 2014 from our unaudited combined financial statements, which is included elsewhere in this prospectus, and the unaudited consolidated financial statements of Patriot Care Holdings, Inc. (f/k/a MCRS Holdings, Inc.), our subsidiary operating the Patriot Care Management Business (“PCM”). We have derived the summary unaudited pro forma condensed combined financial data for the year ended December 31, 2013 from our audited combined financial statements and the audited consolidated financial statements of PCM, both of which are also included elsewhere in this prospectus. We have derived the summary unaudited pro forma condensed combined statement of operations data for the twelve months ended September 30, 2014 by adding the summary unaudited pro forma condensed combined statement of operations data for the nine months ended September 30, 2014 and for the year ended December 31, 2013 and subtracting the summary unaudited pro forma condensed combined statement of operations data for the nine months ended September 30, 2013, each of which are included elsewhere in this prospectus; such compilation has not been audited or reviewed.

The unaudited pro forma condensed combined balance sheet data as of September 30, 2014 gives effect, in the manner described under “Unaudited Pro Forma Financial Information” and the notes thereto, to this offering, anticipated borrowings under the senior secured credit facility and the application of a portion of the net proceeds therefrom to repay outstanding indebtedness as described under “Use of Proceeds” as if such events had been completed as of September 30, 2014.

15

The unaudited pro forma condensed combined statement of operations data for the nine and twelve months ended September 30, 2014 and for the year ended December 31, 2013 gives effect, in the manner described under “Unaudited Pro Forma Financial Information” and the notes thereto, to:

| Ø | | the additional statement of operations impact of the financing we incurred in connection with the GUI Acquisition, including the issuance of additional warrants to the lenders; |

| Ø | | the Patriot Care Management Acquisition; and |

| Ø | | this offering, anticipated borrowings under the senior secured credit facility and the application of a portion of the net proceeds therefrom to repay outstanding indebtedness as described under “Use of Proceeds,” |

as if all such events had been completed as of January 1, 2013.

The unaudited pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable under the circumstances. The summary unaudited pro forma condensed combined financial data is presented for informational purposes only and is not necessarily indicative of and does not purport to represent what our financial position or results of operations would actually have been had the transactions been consummated as of the dates indicated. In addition, the summary unaudited pro forma condensed combined financial data is not necessarily indicative of our future financial condition or results of operations.

16

This summary historical and pro forma combined financial data should be read in conjunction with the disclosures set forth under “Capitalization,” “Unaudited Pro Forma Financial Information,” “Selected Historical Combined Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Pro Forma(1) | |

| | | Nine Months

Ended

September 30, | | | Year Ended

December 31, | | | Nine Months

Ended

September 30, | | | Year

Ended

December 31, | | | Twelve

Months

Ended

September 30, | |

In thousands, except per share

data | | 2014 | | | 2013 | | | 2013 | | | 2012 | | | 2014 | | | 2013 | | | 2014 | |

| | | (Unaudited) | | | | | | (Unaudited) | |

| Combined Statement of Operations Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fee income | | $ | 37,896 | | | $ | 36,845 | | | $ | 46,486 | | | $ | 25,821 | | | $ | 53,925 | | | $ | 75,797 | | | $ | 71,469 | |

Fee income from related party(2) | | | 24,589 | | | | 5,238 | | | | 9,387 | | | | 12,546 | | | | 32,668 | | | | 17,133 | | | | 38,658 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total fee income and fee income from related party | | | 62,485 | | | | 42,083 | | | | 55,873 | | | | 38,367 | | | | 86,593 | | | | 92,930 | | | | 110,127 | |

Net investment income | | | 496 | | | | 7 | | | | 87 | | | | 62 | | | | 496 | | | | 87 | | | | 576 | |

Net realized gains (losses) on investments | | | 14,038 | | | | (50 | ) | | | (50 | ) | | | 3 | | | | 14,038 | | | | (50 | ) | | | 14,038 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Revenues | | | 77,019 | | | | 42,040 | | | | 55,910 | | | | 38,432 | | | | 101,127 | | | | 92,967 | | | | 124,741 | |

| | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Salaries and salary related expenses | | | 17,907 | | | | 12,097 | | | | 15,985 | | | | 13,189 | | | | 22,532 | | | | 23,742 | | | | 28,038 | |

Commission expense | | | 9,491 | | | | 6,651 | | | | 8,765 | | | | 3,216 | | | | 9,491 | | | | 8,765 | | | | 11,605 | |

Management fees to related party for administrative support services(3) | | | 5,390 | | | | 9,200 | | | | 12,139 | | | | 8,007 | | | | 7,152 | | | | 15,079 | | | | 9,828 | |

Outsourced services | | | 3,118 | | | | 2,378 | | | | 3,303 | | | | 4,452 | | | | 7,512 | | | | 10,606 | | | | 10,404 | |

Allocation of marketing, underwriting and policy issuance costs from related party(4) | | | 1,872 | | | | 3,449 | | | | 4,687 | | | | 2,774 | | | | 1,872 | | | | 4,687 | | | | 3,110 | |

Other operating expenses | | | 7,701 | | | | 3,247 | | | | 4,557 | | | | 4,587 | | | | 11,105 | | | | 6,896 | | | | 12,956 | |

Interest expense | | | 5,427 | | | | 606 | | | | 1,174 | | | | 299 | | | | 1,069 | | | | 11,662 | | | | 6,815 | |

Depreciation and amortization | | | 3,699 | | | | 1,550 | | | | 2,607 | | | | 1,330 | | | | 12,130 | | | | 15,794 | | | | 16,484 | |

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Pro Forma | |

| | | Nine Months

Ended

September 30, | | | Year Ended

December 31, | | | Nine Months

Ended

September 30, | | | Year

Ended

December 31, | | | Twelve

Months

Ended

September 30, | |

In thousands, except per share

data | | 2014 | | | 2013 | | | 2013 | | | 2012 | | | 2014 | | | 2013 | | | 2014 | |

| | | (Unaudited) | | | | | | (Unaudited) | |

Amortization of loan discounts and loan costs | | | 1,295 | | | | 702 | | | | 5,553 | | | | 211 | | | | 3,312 | | | | 8,419 | | | | 8,879 | |

Loss on exchange of units and warrants | | | — | | | | — | | | | 152 | | | | — | | | | — | | | | 152 | | | | — | |

Increase (decrease) in fair value of warrant redemption liability | | | (2,257 | ) | | | 300 | | | | — | | | | — | | | | (2,257 | ) | | | — | | | | (2,405 | ) |

Provision for uncollectible fee income | | | 100 | | | | 2,544 | | | | 2,544 | | | | — | | | | 210 | | | | 4,255 | | | | 223 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Expenses | | | 53,743 | | | | 42,724 | | | | 61,466 | | | | 38,065 | | | | 74,128 | | | | 110,057 | | | | 105,937 | |

| | | | | | | |

Net Income (Loss) Before Income Tax Expense | | | 23,276 | | | | (684 | ) | | | (5,556 | ) | | | 367 | | | | 26,999 | | | | (17,090 | ) | | | 18,804 | |

Income tax expense | | | 10,401 | | | | 31 | | | | 712 | | | | — | | | | 12,409 | | | | (1,771 | ) | | | 13,396 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income (Loss) Including Non-Controlling Interest in Subsidiary | | | 12,875 | | | | (715 | ) | | | (6,268 | ) | | | 367 | | | | 14,590 | | | | (15,319 | ) | | | 5,408 | |

Net income (loss) attributable to non-controlling interest in subsidiary | | | 68 | | | | 19 | | | | (82 | ) | | | 23 | | | | 68 | | | | (82 | ) | | | (33 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income (Loss) | | $ | 12,807 | | | $ | (734 | ) | | $ | (6,186 | ) | | $ | 344 | | | $ | 14,522 | | | $ | (15,237 | ) | | $ | 5,441 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income (Loss) Per Common Share(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | .85 | | | $ | (.05 | ) | | $ | (.43 | ) | | $ | .02 | | | $ | .57 | | | $ | (.62 | ) | | $ | .20 | |

Diluted | | $ | .65 | | | $ | (.05 | ) | | $ | (.43 | ) | | $ | .02 | | | $ | .46 | | | $ | (.62 | ) | | $ | .11 | |

Weighted Average Common Shares Outstanding(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 14,981 | | | | 14,288 | | | | 14,288 | | | | 14,288 | | | | 25,374 | | | | 24,681 | | | | 25,374 | |

Diluted | | | 16,183 | | | | 14,288 | | | | 14,288 | | | | 14,420 | | | | 26,926 | | | | 24,681 | | | | 26,926 | |

18

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | Pro Forma(6) | | | | | |

| | | September 30, | | | | | | December 31, | | | September 30, | | | | | |

| In thousands | | 2014 | | | | | | 2013 | | | 2012 | | | 2014 | | | | | |

| | | (Unaudited) | | | | | | | | | | | | (Unaudited) | | | | | |

Combined Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 8,026 | | | | | | | $ | 1,661 | | | $ | 1,684 | | | $ | 29,926 | | | | | |

Restricted cash(7) | | | 5,107 | | | | | | | | 4,435 | | | | 145 | | | | 5,107 | | | | | |

Goodwill | | | 59,385 | | | | | | | | 9,953 | | | | 9,953 | | | | 59,385 | | | | | |

Total Assets | | | 136,997 | | | | | | | | 35,979 | | | | 28,430 | | | | 155,497 | | | | | |

Liabilities and stockholders’ deficit | | | | | | | | | | | | | | | | | | | | | | | | |

Total debt | | $ | 119,156 | | | | | | | $ | 45,330 | | | $ | 4,712 | | | $ | 45,341 | | | | | |

Stockholders’ equity (deficit) | | | (38,701 | ) | | | | | | | (30,888 | ) | | | 8,801 | | | | 61,969 | | | | | |

| | | |

| | | | | | | | | Pro Forma |

| | | Nine Months

Ended September 30, | | | Year Ended

December 31, | | | Nine Months

Ended

September 30, | | | Year Ended December 31, | | Twelve

Months

Ended

September 30, |

In thousands, except

percentages | | 2014 | | | 2013 | | | 2013 | | | 2012 | | | 2014 | | | 2013 | | 2014 |

| | | (Unaudited) | | | | | | (Unaudited) |

Other Financial and Operating Measures | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(8) | | $ | 17,334 | | | $ | 5,049 | | | $ | 6,606 | | | $ | 2,181 | | | $ | 27,357 | | | $23,324 | | $34,795 |

Adjusted EBITDA margins(8) | | | 27.7 | % | | | 12.0 | % | | | 11.8 | % | | | 5.7 | % | | | 31.6 | % | | 25.1% | | 31.6% |

Reference premium written(9) | | $ | 277,941 | | | $ | 277,314 | | | $ | 357,376 | | | $ | 305,692 | | | $ | 277,941 | | | $357,376 | | $358,003 |

(footnotes on following page)

19

| (1) | | Reflects anticipated borrowings of $37.7 million (net of loan fees) under the proposed senior secured credit facility that we intend to enter into concurrently with this offering, and application of a portion of such borrowings, together with the net proceeds from this offering, to the repayment of all outstanding amounts under the PennantPark Loan Agreement and the UBS Credit Agreement. Assuming that we do not enter into the senior secured credit facility, or do not make such borrowings, and that $37.7 million of borrowings remain outstanding under the UBS Credit Agreement, for the twelve months ended September 30, 2014, our pro forma interest expense would be $10.1 million, our pro forma net income would be $3.4 million and our pro forma basic net income per common share would be $.14. See “Unaudited pro Forma Financial Information” for more information on the effect of such changes on other periods. Based on our estimated cash and cash equivalents (excluding restricted cash) as of December 31, 2014, we believe that we will be in a position to repay all amounts under the PennantPark Loan Agreement and the UBS Credit Agreement with the net proceeds from this offering together with cash on hand. |

| (2) | | Represents service fees from Guarantee Insurance, a related party. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Principal Components of Financial Statements—Revenue.” |

| (3) | | Represents historical fees paid by us to Guarantee Insurance Group for management oversight, legal, accounting, human resources and technology support services provided to us. Our administrative functions have been separated from Guarantee Insurance Group and from August 6, 2014, such payments are longer made by us in respect of such services. |

| (4) | | Represents historical payments made by us to Guarantee Insurance Group as reimbursements for allocated portions of rent and certain administrative costs incurred by Guarantee Insurance Group on our behalf. Our administrative functions have been separated from Guarantee Insurance Group and from August 6, 2014, such reimbursements are no longer made by us in respect of such costs. |

| (5) | | See “Prospectus Summary—The Offering” on page 14 of this prospectus for more detail regarding the number of outstanding shares presented. |

| (6) | | Reflects anticipated borrowings of $37.7 million (net of loan fees) under the proposed senior secured credit facility that we intend to enter into concurrently with this offering, and application of a portion of such borrowings, together with the net proceeds from this offering, to the repayment of all outstanding amounts under the PennantPark Loan Agreement and the UBS Credit Agreement and of the remaining portion to cash and cash equivalents. Assuming that we do not enter into the senior secured credit facility, or do not make such borrowings, and that $37.7 million of borrowings remain outstanding under the UBS Credit Agreement, as of September 30, 2014, our pro forma cash would be $30.3 million and our pro forma total debt would be $43.0 million. |

| (7) | | Represents amounts received from our clients to be used exclusively for the payment of claims on behalf of those clients. |

| (8) | | To provide investors with additional information regarding our financial results, we have presented Adjusted EBITDA and Adjusted EBITDA margins, both of which represent non-GAAP financial measures. Adjusted EBITDA is defined by us as net income before interest expense, income tax expense (benefit), depreciation and amortization and amortization of loan discounts and loan costs, further adjusted for the effects of net realized losses (gains) on investments, loss on exchange of units and warrants and changes in fair value of warrant redemption liability. We have provided below a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP financial measure. Adjusted EBITDA margins are calculated as Adjusted EBITDA divided by the sum of fee income and fee income from related party. |

20

We have presented Adjusted EBITDA and Adjusted EBITDA margins in this prospectus because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short and long-term operational plans. In particular, we believe that the exclusion of the amounts eliminated in calculating Adjusted EBITDA and Adjusted EBITDA margins can provide useful measures for period-to-period comparisons of our core business. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margins provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Adjusted EBITDA and Adjusted EBITDA margins have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are as follows:

| | Ø | | although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future; |

| | Ø | | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs or tax payments that may represent a reduction in cash available to us; and |

| | Ø | | other companies, including companies in our industry, may calculate Adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure. |

(footnotes continued on following page)

21

Because of these and other limitations, you should consider Adjusted EBITDA and Adjusted EBITDA margins together with other GAAP-based financial performance measures, including our GAAP financial results. The following table presents a reconciliation of Adjusted EBITDA to net income for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Pro Forma | |

| | | Nine Months

Ended

September 30, | | | Year Ended

December 31, | | | Nine Months

Ended

September 30, | | | Year

Ended

December 31, | | | Twelve

Months

Ended

September 30, | |

In thousands, except

percentages | | 2014 | | | 2013 | | | 2013 | | | 2012 | | | 2014 | | | 2013 | | | 2014 | |

| | | (Unaudited) | | | | | | (Unaudited) | |

Net income (loss) | | $ | 12,807 | | | $ | (734 | ) | | $ | (6,186 | ) | | $ | 344 | | | $ | 14,522 | | | $ | (15,237 | ) | | $ | 5,441 | |

Interest expense | | | 5,427 | | | | 606 | | | | 1,174 | | | | 299 | | | | 1,069 | | | | 11,662 | | | | 6,815 | |

Income tax expense | | | 10,401 | | | | 31 | | | | 712 | | | | — | | | | 12,409 | | | | (1,771 | ) | | | 13,396 | |

Depreciation and amortization | | | 3,699 | | | | 1,550 | | | | 2,607 | | | | 1,330 | | | | 12,130 | | | | 15,794 | | | | 16,484 | |

Amortization of loan discounts and loan costs(a) | | | 1,295 | | | | 702 | | | | 5,553 | | | | 211 | | | | 3,312 | | | | 8,419 | | | | 8,879 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 33,629 | | | | 2,155 | | | | 3,860 | | | | 2,184 | | | | 43,442 | | | | 18,867 | | | | 51,015 | |

Net realized losses (gains) on investments(b) | | | (14,038 | ) | | | 50 | | | | 50 | | | | (3 | ) | | | (14,038 | ) | | | 50 | | | | (14,038 | ) |

Loss on exchange of units and warrants(c) | | | — | | | | — | | | | 152 | | | | — | | | | — | | | | 152 | | | | — | |

Increase (decrease) in fair value of common stock and warrant redemption liability(d) | | | (2,257 | ) | | | 300 | | | | — | | | | — | | | | (2,257 | ) | | | — | | | | (2,405 | ) |

Provision for uncollectible fee income(e) | | | — | | | | 2,544 | | | | 2,544 | | | | — | | | | 210 | | | | 4,255 | | | | 223 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (unaudited) | | $ | 17,334 | | | $ | 5,049 | | | $ | 6,606 | | | $ | 2,181 | | | $ | 27,357 | | | $ | 23,324 | | | $ | 34,795 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | | Represents amortization of loan discounts and loan costs associated with loan agreements, and of the estimated value of equity interests issued to lenders pursuant to such loan agreements. |

| | (b) | | Represents, for the nine months ended September 30, 2014, the net gain realized upon the redemption of preferred equity issued by MCMC in connection with the Patriot Care Management Acquisition. |

| | (c) | | Represents a non-recurring loss recorded as part of the Reorganization in connection with the exchange by Advantage Capital Community Development Fund, L.L.C. (“Advantage Capital”), one of our prior lenders, of its common units and detachable common stock warrants issued by certain of our subsidiaries for detachable common stock warrants of ours, which had a higher value. |

| | (d) | | Represents the change in estimated fair value of the detachable common stock warrants issued to the lenders in connection with (i) the Initial Tranche of the PennantPark Loan Agreement and (ii) the exchange described in (c) above. We recorded this warrant redemption liability, and |

22

| | reflect the changes in the estimated fair value thereof, because the warrant holders may require us to redeem the warrants for cash, in an amount equal to the estimated fair value of the warrants less the total exercise price of the redeemed warrants. |

| | (e) | | Represents a provision for uncollectible fee income recorded in connection with the liquidation in May 2013 of Ullico Casualty Company (“Ullico”), one of our insurance carrier clients from April 2009 until we terminated the contract effective March 26, 2012. See “Risk Factors—Our total fee income and fee income from related party are currently substantially dependent on our relationships with Guarantee Insurance and a small number of other insurance carrier clients.” |

| (9) | | Reference premium written represents the aggregate premium, grossed up for large deductible credits, written by or for our insurance carrier partners in respect of the policies we produce and service on their behalf. |

23

Risk Factors