Exhibit C.IV Discussion materials June 9, 2021 0Exhibit C.IV Discussion materials June 9, 2021 0

Topics for discussion 1 Update on equity offering and upsize of the Revolving Credit Facility 2 Update on exploration of interest in Ocala 3 Valuation update 1Topics for discussion 1 Update on equity offering and upsize of the Revolving Credit Facility 2 Update on exploration of interest in Ocala 3 Valuation update 1

Update on equity offering and upsize of the Revolving Credit Facility 2Update on equity offering and upsize of the Revolving Credit Facility 2

Public market snapshot Year-to-date price performance Public market overview Summary price performance to date $mm, except per share data YTD 5/3 Board Investor Day INOV 76% 5% 4% 200% Share price as of 06/08/21 $32.02 S&P 500 13% 1% 2% 5/3 5/18 As % of 52-week high 99% Board Meeting Investor Day Diluted shares (mm) 156 +76% 175% Market cap $5,000 Firm value $5,786 150% FYE 12/31 CY20A CY21E CY22E Revenue $668 $764 $860 % growth 4% 15% 12% 125% Adj. EBITDA¹ $231 $271 $311 +13% % margin 35% 35% 36% 100% Trading multiples CY21E CY22E FV / Revenue 7.6x 6.7x FV / Adj. EBITDA¹ 21.4x 18.6x 75% Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 3 Source: FactSet as of 06/08/21; Company filings ¹ Adjusted EBITDA excludes SBC, acquisition costs, and other non-comparable items Public market snapshot Year-to-date price performance Public market overview Summary price performance to date $mm, except per share data YTD 5/3 Board Investor Day INOV 76% 5% 4% 200% Share price as of 06/08/21 $32.02 S&P 500 13% 1% 2% 5/3 5/18 As % of 52-week high 99% Board Meeting Investor Day Diluted shares (mm) 156 +76% 175% Market cap $5,000 Firm value $5,786 150% FYE 12/31 CY20A CY21E CY22E Revenue $668 $764 $860 % growth 4% 15% 12% 125% Adj. EBITDA¹ $231 $271 $311 +13% % margin 35% 35% 36% 100% Trading multiples CY21E CY22E FV / Revenue 7.6x 6.7x FV / Adj. EBITDA¹ 21.4x 18.6x 75% Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 3 Source: FactSet as of 06/08/21; Company filings ¹ Adjusted EBITDA excludes SBC, acquisition costs, and other non-comparable items

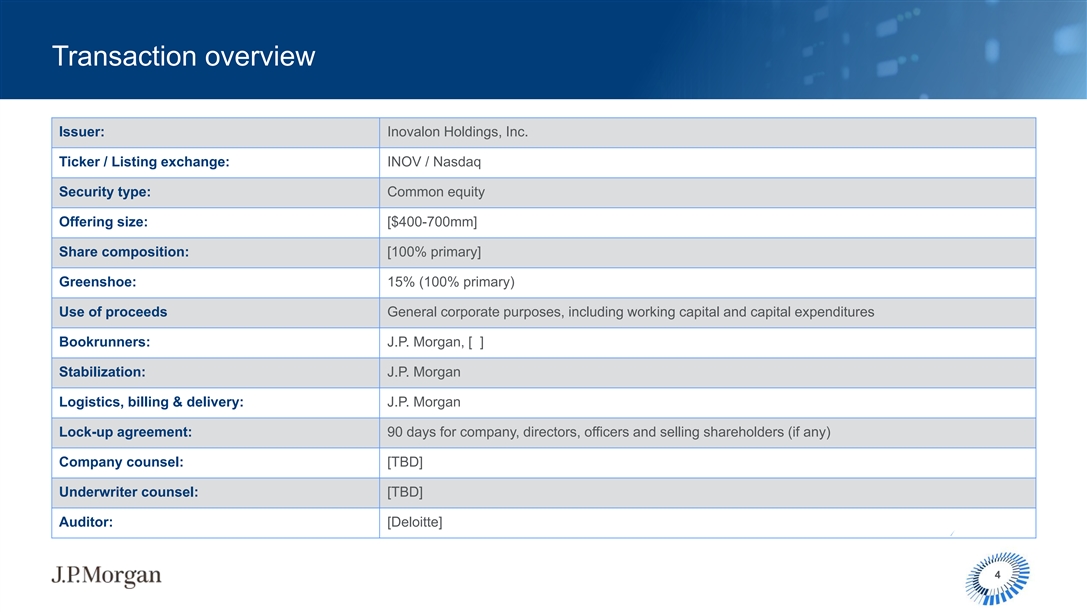

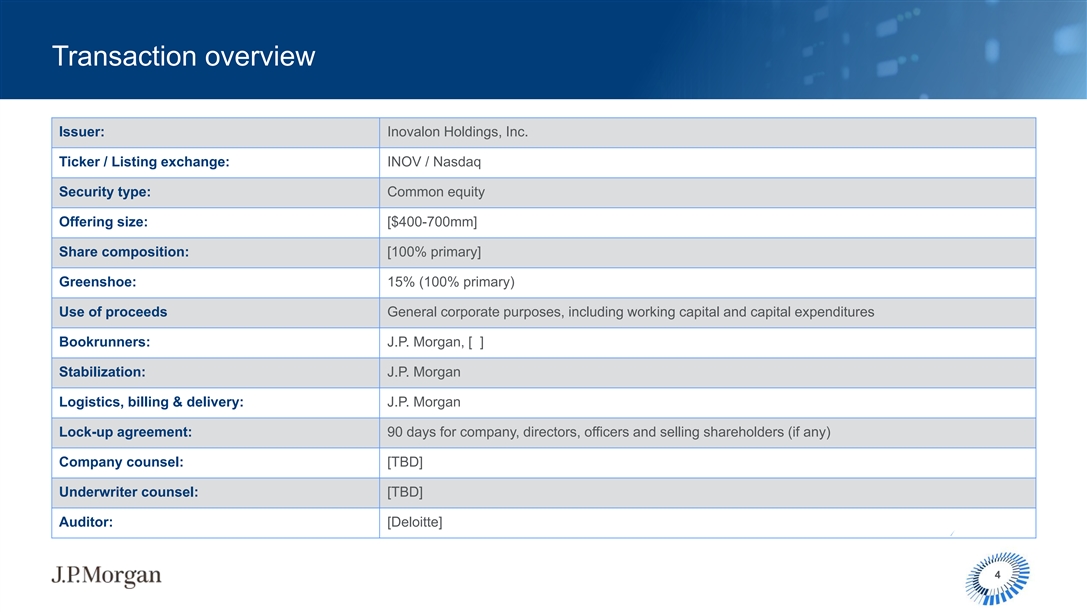

Transaction overview Issuer: Inovalon Holdings, Inc. Ticker / Listing exchange: INOV / Nasdaq Security type: Common equity Offering size: [$400-700mm] Share composition: [100% primary] Greenshoe: 15% (100% primary) Use of proceeds General corporate purposes, including working capital and capital expenditures Bookrunners: J.P. Morgan, [ ] Stabilization: J.P. Morgan Logistics, billing & delivery: J.P. Morgan Lock-up agreement: 90 days for company, directors, officers and selling shareholders (if any) Company counsel: [TBD] Underwriter counsel: [TBD] Auditor: [Deloitte] 4Transaction overview Issuer: Inovalon Holdings, Inc. Ticker / Listing exchange: INOV / Nasdaq Security type: Common equity Offering size: [$400-700mm] Share composition: [100% primary] Greenshoe: 15% (100% primary) Use of proceeds General corporate purposes, including working capital and capital expenditures Bookrunners: J.P. Morgan, [ ] Stabilization: J.P. Morgan Logistics, billing & delivery: J.P. Morgan Lock-up agreement: 90 days for company, directors, officers and selling shareholders (if any) Company counsel: [TBD] Underwriter counsel: [TBD] Auditor: [Deloitte] 4

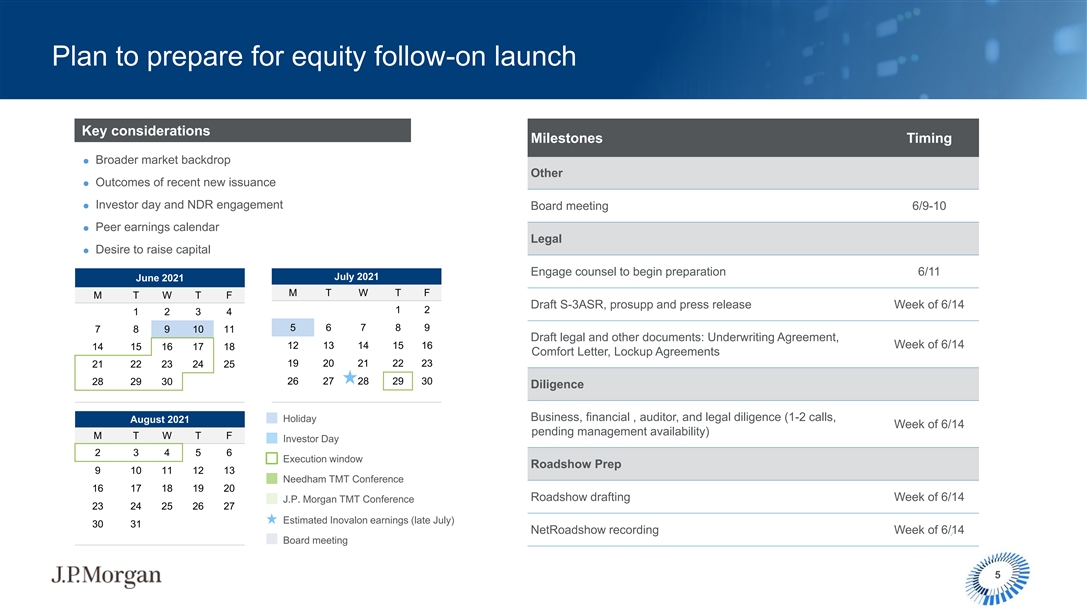

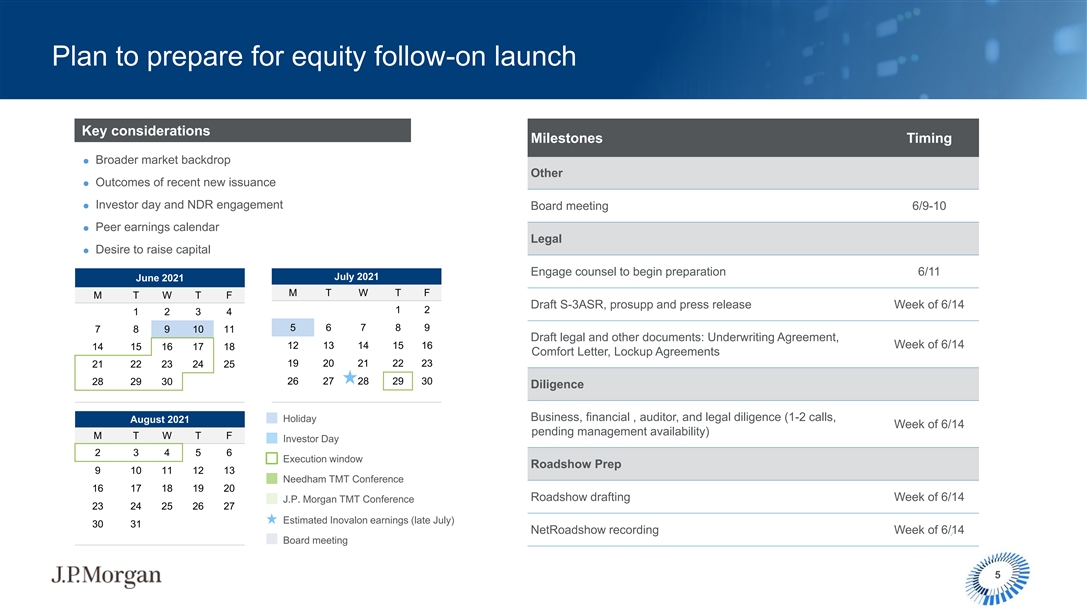

Plan to prepare for equity follow-on launch Key considerations Milestones Timing = Broader market backdrop Other = Outcomes of recent new issuance = Investor day and NDR engagement Board meeting 6/9-10 = Peer earnings calendar Legal = Desire to raise capital Engage counsel to begin preparation 6/11 July 2021 June 2021 M T W T F M T W T F Draft S-3ASR, prosupp and press release Week of 6/14 1 2 1 2 3 4 5 6 7 8 9 7 8 9 10 11 Draft legal and other documents: Underwriting Agreement, Week of 6/14 12 13 14 15 16 14 15 16 17 18 Comfort Letter, Lockup Agreements 19 20 21 22 23 21 22 23 24 25 28 29 30 26 27 28 29 30 Diligence Business, financial , auditor, and legal diligence (1-2 calls, Holiday August 2021 Week of 6/14 pending management availability) M T W T F Investor Day 2 3 4 5 6 Execution window Roadshow Prep 9 10 11 12 13 Needham TMT Conference 16 17 18 19 20 Roadshow drafting Week of 6/14 J.P. Morgan TMT Conference 23 24 25 26 27 Estimated Inovalon earnings (late July) 30 31 NetRoadshow recording Week of 6/14 Board meeting 5Plan to prepare for equity follow-on launch Key considerations Milestones Timing = Broader market backdrop Other = Outcomes of recent new issuance = Investor day and NDR engagement Board meeting 6/9-10 = Peer earnings calendar Legal = Desire to raise capital Engage counsel to begin preparation 6/11 July 2021 June 2021 M T W T F M T W T F Draft S-3ASR, prosupp and press release Week of 6/14 1 2 1 2 3 4 5 6 7 8 9 7 8 9 10 11 Draft legal and other documents: Underwriting Agreement, Week of 6/14 12 13 14 15 16 14 15 16 17 18 Comfort Letter, Lockup Agreements 19 20 21 22 23 21 22 23 24 25 28 29 30 26 27 28 29 30 Diligence Business, financial , auditor, and legal diligence (1-2 calls, Holiday August 2021 Week of 6/14 pending management availability) M T W T F Investor Day 2 3 4 5 6 Execution window Roadshow Prep 9 10 11 12 13 Needham TMT Conference 16 17 18 19 20 Roadshow drafting Week of 6/14 J.P. Morgan TMT Conference 23 24 25 26 27 Estimated Inovalon earnings (late July) 30 31 NetRoadshow recording Week of 6/14 Board meeting 5

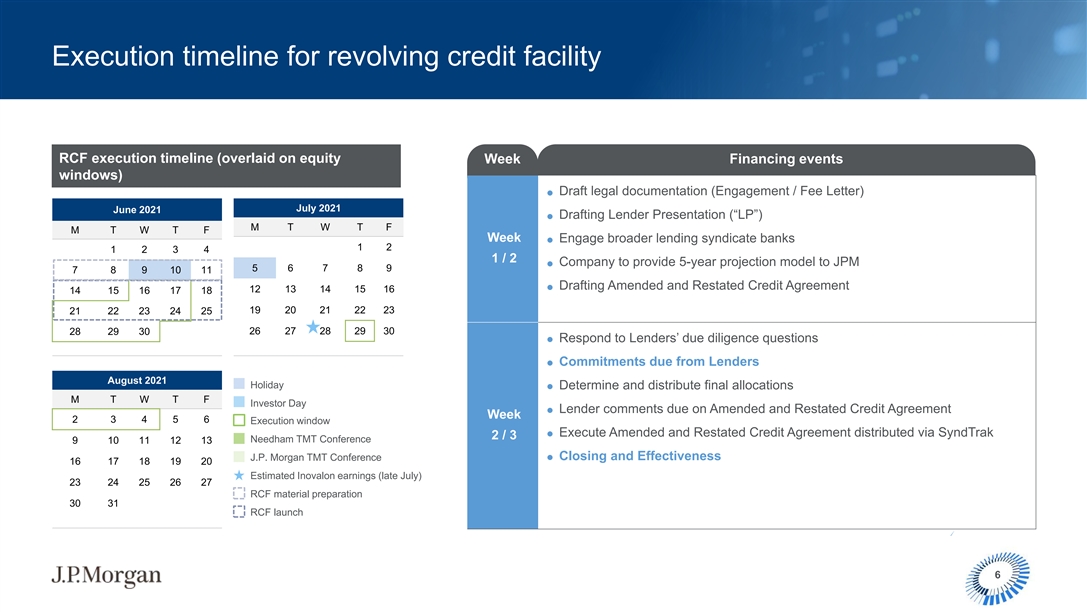

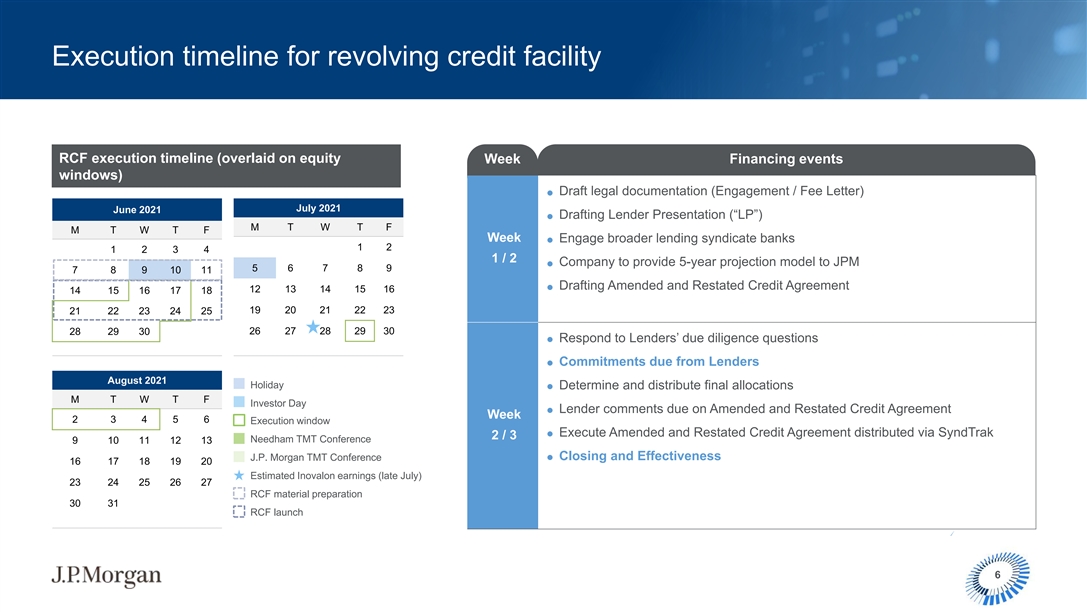

Execution timeline for revolving credit facility RCF execution timeline (overlaid on equity Week Financing events windows) Draft legal documentation (Engagement / Fee Letter) = July 2021 June 2021 = Drafting Lender Presentation (“LP”) M T W T F M T W T F Week = Engage broader lending syndicate banks 1 2 1 2 3 4 1 / 2 Company to provide 5-year projection model to JPM = 5 6 7 8 9 7 8 9 10 11 = Drafting Amended and Restated Credit Agreement 12 13 14 15 16 14 15 16 17 18 19 20 21 22 23 21 22 23 24 25 26 27 28 29 30 28 29 30 = Respond to Lenders’ due diligence questions = Commitments due from Lenders August 2021 Holiday = Determine and distribute final allocations M T W T F Investor Day = Lender comments due on Amended and Restated Credit Agreement Week 2 3 4 5 6 Execution window = Execute Amended and Restated Credit Agreement distributed via SyndTrak 2 / 3 Needham TMT Conference 9 10 11 12 13 = Closing and Effectiveness J.P. Morgan TMT Conference 16 17 18 19 20 Estimated Inovalon earnings (late July) 23 24 25 26 27 RCF material preparation 30 31 RCF launch 6

Update on exploration of interest in Ocala 7Update on exploration of interest in Ocala 7

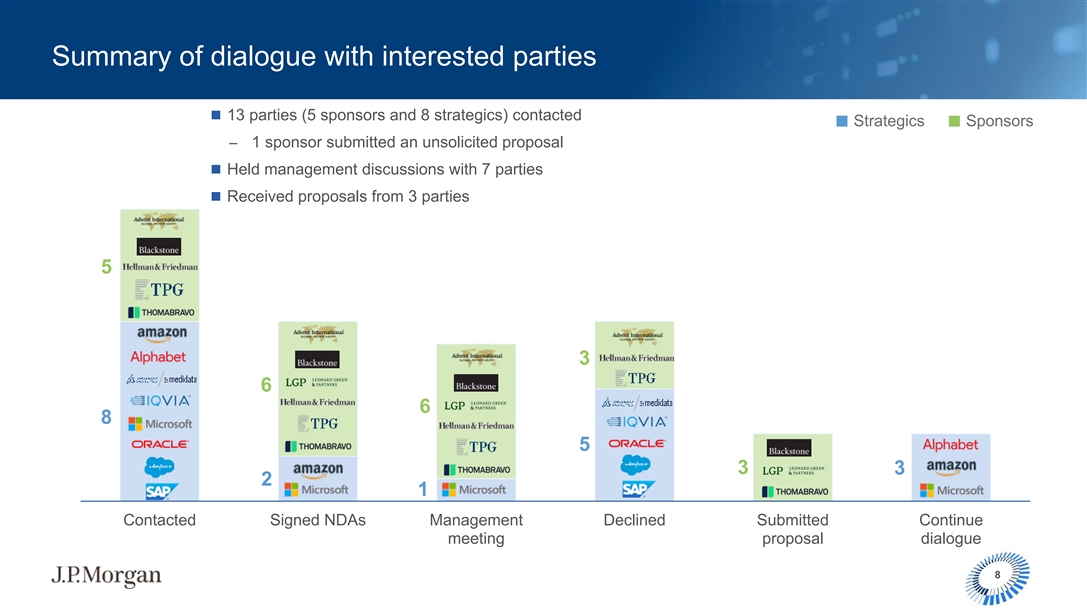

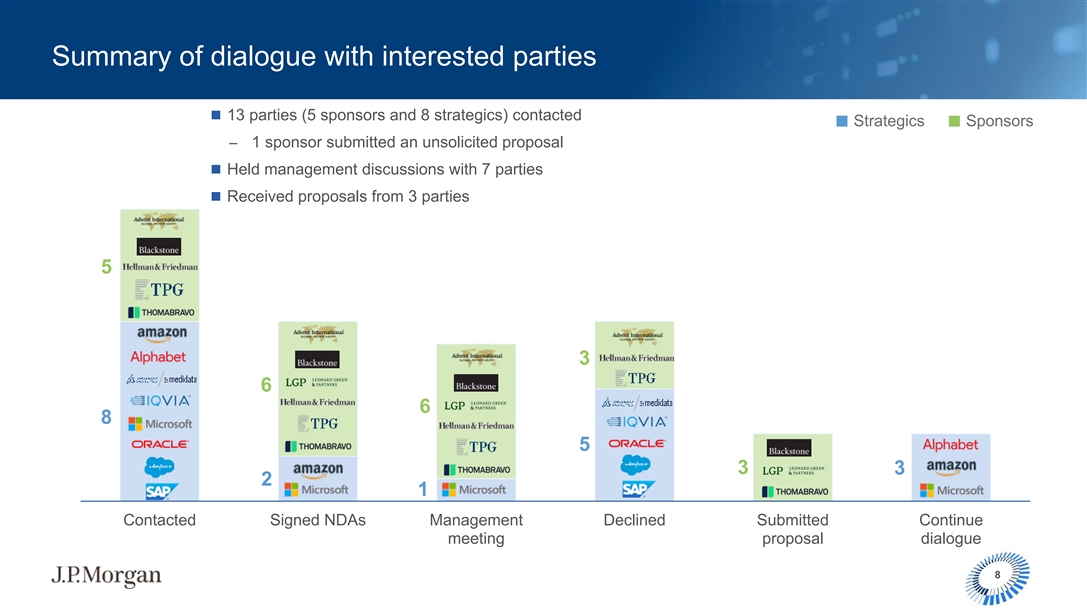

Summary of dialogue with interested parties n 13 parties (5 sponsors and 8 strategics) contacted Strategics Sponsors – 1 sponsor submitted an unsolicited proposal n Held management discussions with 7 parties n Received proposals from 3 parties 5 3 6 6 8 5 3 3 2 1 Contacted Signed NDAs Management Declined Submitted Continue meeting proposal dialogue 8Summary of dialogue with interested parties n 13 parties (5 sponsors and 8 strategics) contacted Strategics Sponsors – 1 sponsor submitted an unsolicited proposal n Held management discussions with 7 parties n Received proposals from 3 parties 5 3 6 6 8 5 3 3 2 1 Contacted Signed NDAs Management Declined Submitted Continue meeting proposal dialogue 8

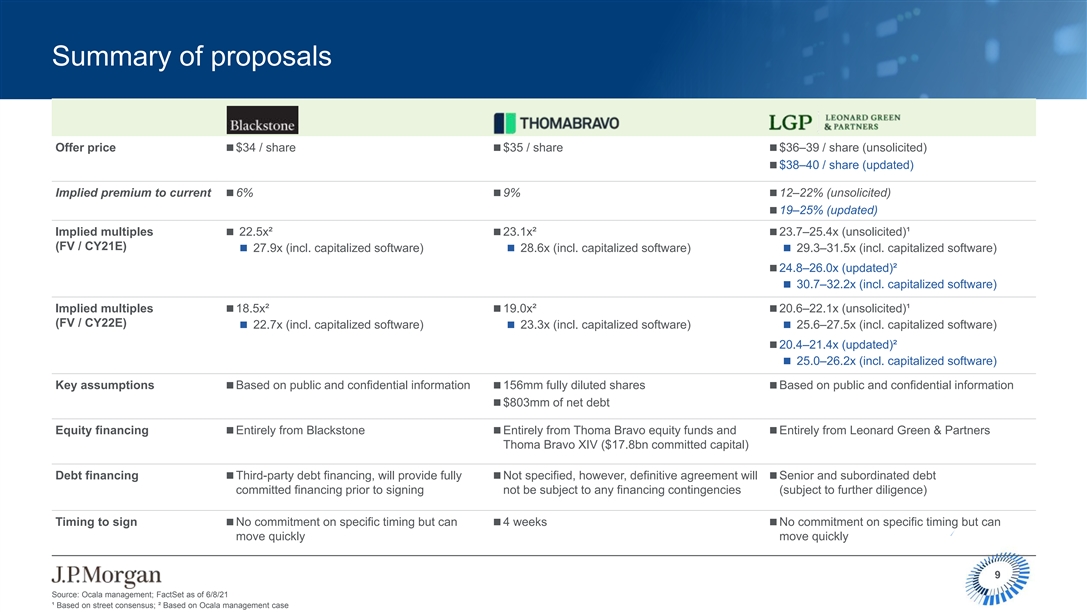

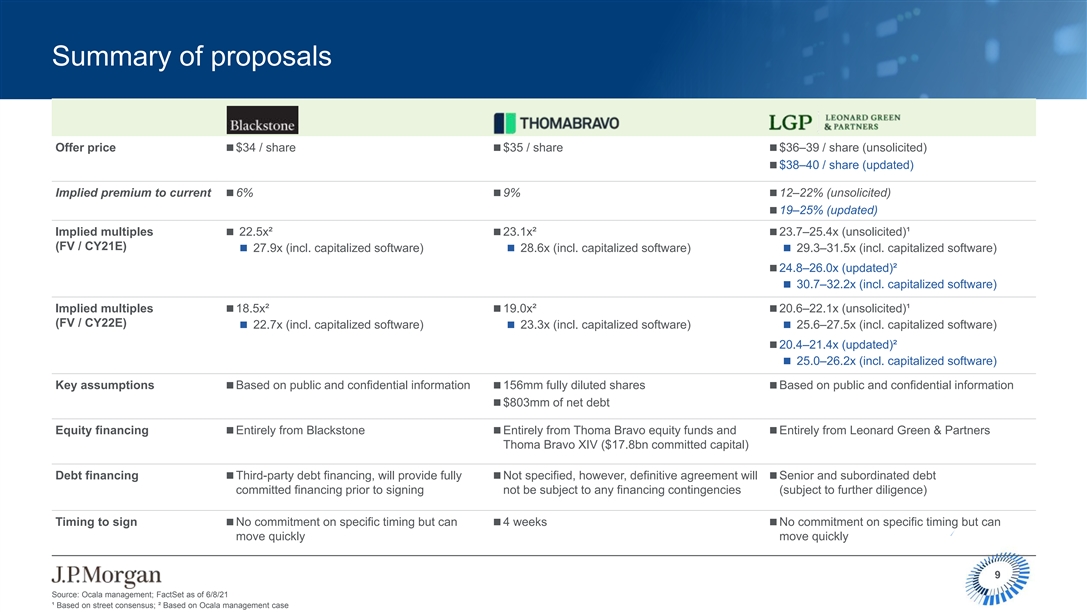

Summary of proposals Offer pricen $34 / sharen $35 / sharen $36–39 / share (unsolicited) n $38–40 / share (updated) Implied premium to currentn 6%n 9%n 12–22% (unsolicited) n 19–25% (updated) Implied multiples n 22.5x² n 23.1x² n 23.7–25.4x (unsolicited)¹ (FV / CY21E) n 27.9x (incl. capitalized software)n 28.6x (incl. capitalized software)n 29.3–31.5x (incl. capitalized software) n 24.8–26.0x (updated)² n 30.7–32.2x (incl. capitalized software) Implied multiples 18.5x² 19.0x² 20.6–22.1x (unsolicited)¹ nnn (FV / CY22E) n 22.7x (incl. capitalized software)n 23.3x (incl. capitalized software)n 25.6–27.5x (incl. capitalized software) n 20.4–21.4x (updated)² n 25.0–26.2x (incl. capitalized software) Key assumptionsn Based on public and confidential informationn 156mm fully diluted sharesn Based on public and confidential information n $803mm of net debt Equity financingn Entirely from Blackstonen Entirely from Thoma Bravo equity funds and n Entirely from Leonard Green & Partners Thoma Bravo XIV ($17.8bn committed capital) Debt financingn Third-party debt financing, will provide fully n Not specified, however, definitive agreement will n Senior and subordinated debt committed financing prior to signing not be subject to any financing contingencies (subject to further diligence) Timing to signn No commitment on specific timing but can n 4 weeksn No commitment on specific timing but can move quickly move quickly 9 Source: Ocala management; FactSet as of 6/8/21 ¹ Based on street consensus; ² Based on Ocala management caseSummary of proposals Offer pricen $34 / sharen $35 / sharen $36–39 / share (unsolicited) n $38–40 / share (updated) Implied premium to currentn 6%n 9%n 12–22% (unsolicited) n 19–25% (updated) Implied multiples n 22.5x² n 23.1x² n 23.7–25.4x (unsolicited)¹ (FV / CY21E) n 27.9x (incl. capitalized software)n 28.6x (incl. capitalized software)n 29.3–31.5x (incl. capitalized software) n 24.8–26.0x (updated)² n 30.7–32.2x (incl. capitalized software) Implied multiples 18.5x² 19.0x² 20.6–22.1x (unsolicited)¹ nnn (FV / CY22E) n 22.7x (incl. capitalized software)n 23.3x (incl. capitalized software)n 25.6–27.5x (incl. capitalized software) n 20.4–21.4x (updated)² n 25.0–26.2x (incl. capitalized software) Key assumptionsn Based on public and confidential informationn 156mm fully diluted sharesn Based on public and confidential information n $803mm of net debt Equity financingn Entirely from Blackstonen Entirely from Thoma Bravo equity funds and n Entirely from Leonard Green & Partners Thoma Bravo XIV ($17.8bn committed capital) Debt financingn Third-party debt financing, will provide fully n Not specified, however, definitive agreement will n Senior and subordinated debt committed financing prior to signing not be subject to any financing contingencies (subject to further diligence) Timing to signn No commitment on specific timing but can n 4 weeksn No commitment on specific timing but can move quickly move quickly 9 Source: Ocala management; FactSet as of 6/8/21 ¹ Based on street consensus; ² Based on Ocala management case

Summary of dialogue with interested parties Sponsors Strategics 1 • Strong interest 1• Very slow to engage 2 2 • Engaging senior leadership and healthcare & • Disconnect between senior leadership and software industry-focused teams industry / business development teams 3 3 • Good understanding of market opportunity, growth • Limited knowledge of Ocala acceleration and margin improvement potential 4 • Focus on understanding product differentiation 4 • Able to move and perform deep analysis quickly and go-to-market strategy 5 • Some over focus on legacy-related issues (services, risk-scoring, etc.) 6 • Conflict with other large deals in the market 10Summary of dialogue with interested parties Sponsors Strategics 1 • Strong interest 1• Very slow to engage 2 2 • Engaging senior leadership and healthcare & • Disconnect between senior leadership and software industry-focused teams industry / business development teams 3 3 • Good understanding of market opportunity, growth • Limited knowledge of Ocala acceleration and margin improvement potential 4 • Focus on understanding product differentiation 4 • Able to move and perform deep analysis quickly and go-to-market strategy 5 • Some over focus on legacy-related issues (services, risk-scoring, etc.) 6 • Conflict with other large deals in the market 10

Valuation update 11

Summary valuation perspectives of Ocala Implied equity value per share For reference only For reference only PV of analyst Discounted 52-week range Trading multiples Transaction multiples price targets¹ cash flow $51.75 $49.25 $41.50 $41.00² $37.50 $32.50 $33.00 $31.00 $31.50 $22.00² Current share price: $32.02 $20.25 $17.50 Metrics CY22E Adj. EBITDA³ ($mm) NTM Revenue ($mm)⁴ Discount rate $330 $806 7.75%–8.75% Multiples (x) CY22E FV / Adj. EBITDA³ FV / NTM Revenue Terminal growth 18.0–22.0x 7.0–11.0x 3.0%–4.0% 12 Source: Ocala management; FactSet as of 6/8/21 Note: Ocala FYE of 12/31; PV of analyst price targets and DCF assume valuation date as of 3/31/21; Reflects total debt of $915mm and cash and cash equiv. of $129mm; DCF assumes mid-period discount convention All analyses marked as “for reference only” are illustrative and presented for informational purposes only; Share prices rounded to the nearest $0.25; Current share price reflects as of 6/8/21 ¹ Discounted one year using cost of equity of 9.0%; ² Represents actual price targets; ³ Adjusted EBITDA excludes SBC, acquisition costs, and other non-comparable items; ⁴ NTM as of 3/31/21Summary valuation perspectives of Ocala Implied equity value per share For reference only For reference only PV of analyst Discounted 52-week range Trading multiples Transaction multiples price targets¹ cash flow $51.75 $49.25 $41.50 $41.00² $37.50 $32.50 $33.00 $31.00 $31.50 $22.00² Current share price: $32.02 $20.25 $17.50 Metrics CY22E Adj. EBITDA³ ($mm) NTM Revenue ($mm)⁴ Discount rate $330 $806 7.75%–8.75% Multiples (x) CY22E FV / Adj. EBITDA³ FV / NTM Revenue Terminal growth 18.0–22.0x 7.0–11.0x 3.0%–4.0% 12 Source: Ocala management; FactSet as of 6/8/21 Note: Ocala FYE of 12/31; PV of analyst price targets and DCF assume valuation date as of 3/31/21; Reflects total debt of $915mm and cash and cash equiv. of $129mm; DCF assumes mid-period discount convention All analyses marked as “for reference only” are illustrative and presented for informational purposes only; Share prices rounded to the nearest $0.25; Current share price reflects as of 6/8/21 ¹ Discounted one year using cost of equity of 9.0%; ² Represents actual price targets; ³ Adjusted EBITDA excludes SBC, acquisition costs, and other non-comparable items; ⁴ NTM as of 3/31/21

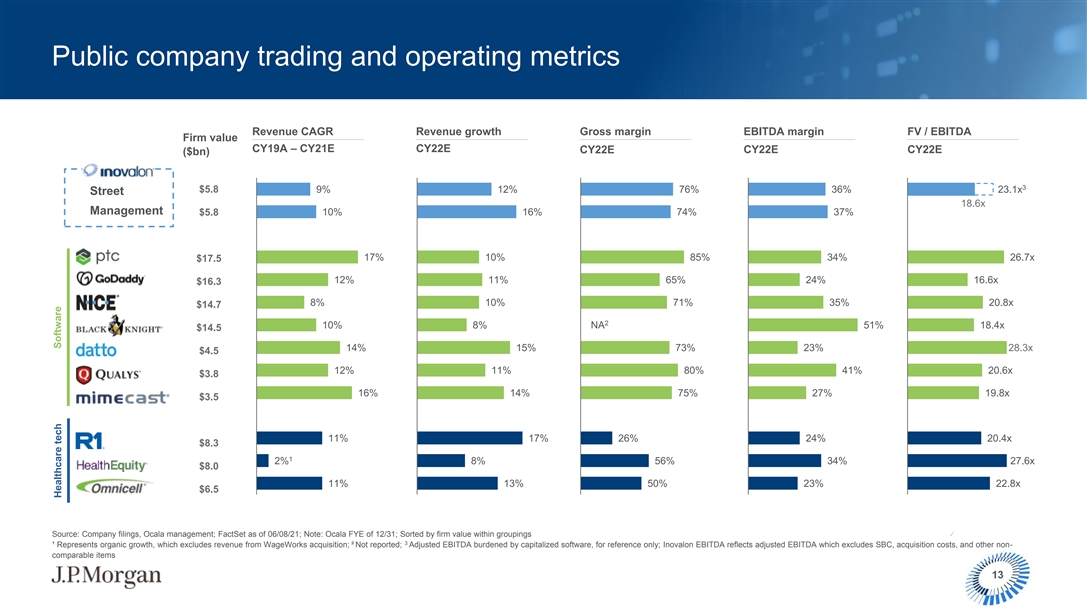

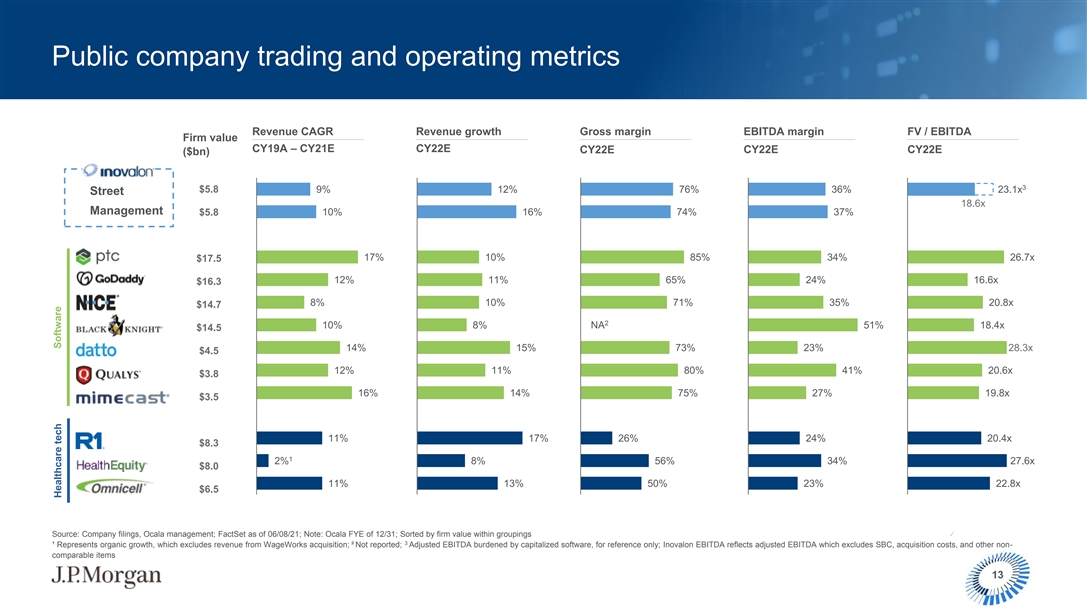

Public company trading and operating metrics Revenue CAGR Revenue growth Gross margin EBITDA margin FV / EBITDA Firm value CY19A – CY21E CY22E CY22E CY22E CY22E ($bn) 3 $5.8 9% 12% 76% 36% 23.1x Street 18.6x Management 10% 16% 74% 37% $5.8 17% 10% 85% 34% 26.7x $17.5 12% 11% 65% 24% 16.6x $16.3 8% 10% 71% 35% 20.8x $14.7 2 10% 8% NA 51% 18.4x $14.5 14% 15% 73% 23% 28.3x $4.5 12% 11% 80% 41% 20.6x $3.8 16% 14% 75% 27% 19.8x $3.5 11% 17% 26% 24% 20.4x $8.3 1 2% 8% 56% 34% 27.6x $8.0 11% 13% 50% 23% 22.8x $6.5 Source: Company filings, Ocala management; FactSet as of 06/08/21; Note: Ocala FYE of 12/31; Sorted by firm value within groupings 3 ¹ Represents organic growth, which excludes revenue from WageWorks acquisition; ² Not reported; Adjusted EBITDA burdened by capitalized software, for reference only; Inovalon EBITDA reflects adjusted EBITDA which excludes SBC, acquisition costs, and other non- comparable items 13 Healthcare tech Software

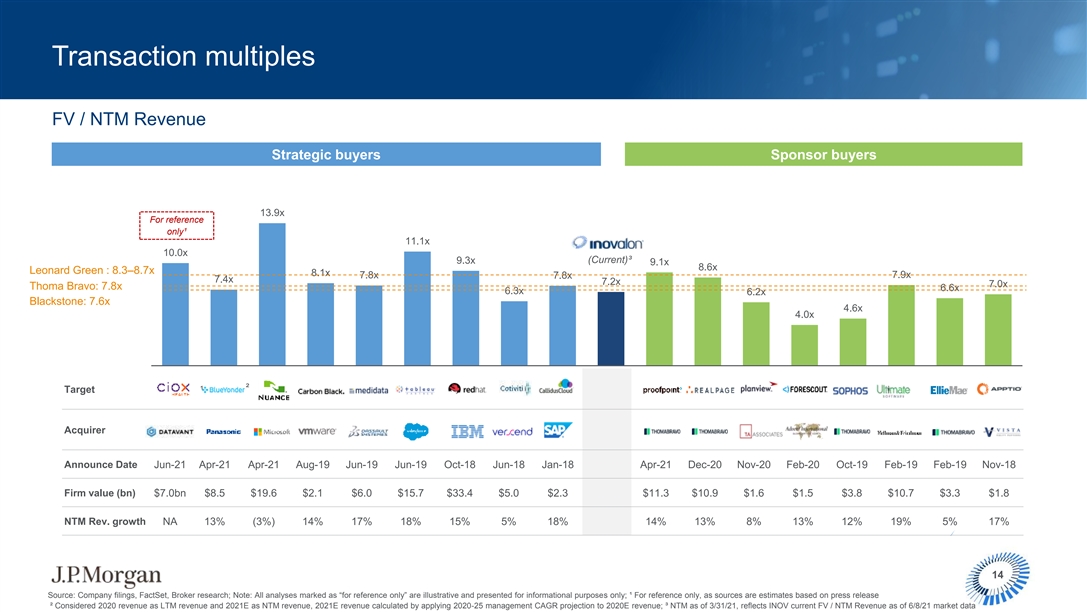

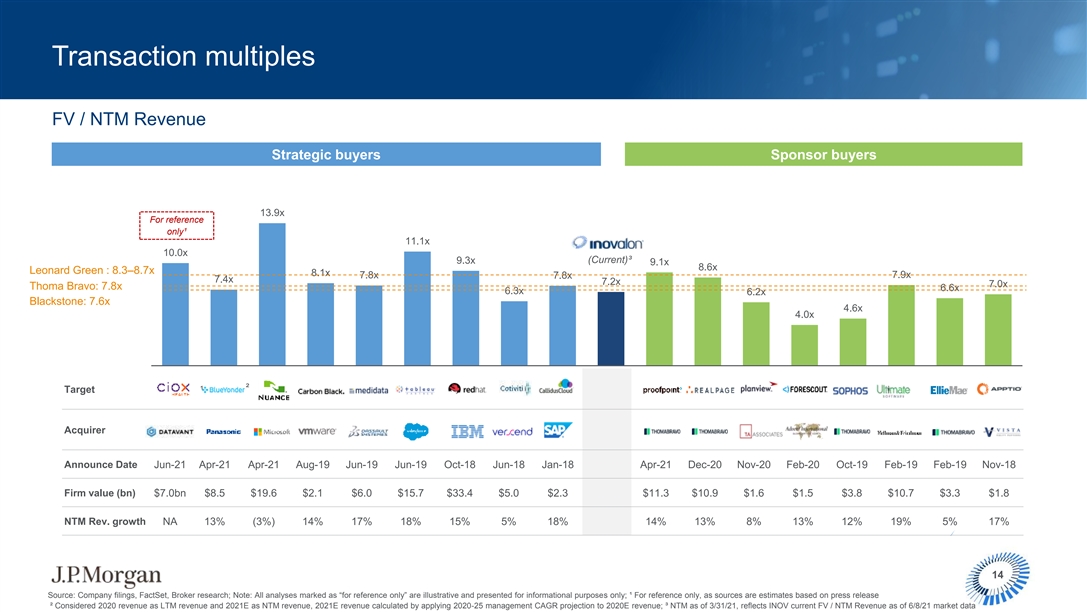

Transaction multiples FV / NTM Revenue Strategic buyers Sponsor buyers 13.9x For reference only¹ 11.1x 10.0x (Current)³ 9.3x 9.1x 8.6x Leonard Green : 8.3–8.7x 8.1x 7.8x 7.9x 7.8x 7.4x 7.2x 7.0x Thoma Bravo: 7.8x 6.6x 6.3x 6.2x Blackstone: 7.6x 4.6x 4.0x ² Target ¹ Acquirer Announce Date Jun-21 Apr-21 Apr-21 Aug-19 Jun-19 Jun-19 Oct-18 Jun-18 Jan-18 Apr-21 Dec-20 Nov-20 Feb-20 Oct-19 Feb-19 Feb-19 Nov-18 Firm value (bn) $7.0bn $8.5 $19.6 $2.1 $6.0 $15.7 $33.4 $5.0 $2.3 $11.3 $10.9 $1.6 $1.5 $3.8 $10.7 $3.3 $1.8 NTM Rev. growth NA 13% (3%) 14% 17% 18% 15% 5% 18% 14% 13% 8% 13% 12% 19% 5% 17% 14 Source: Company filings, FactSet, Broker research; Note: All analyses marked as “for reference only” are illustrative and presented for informational purposes only; ¹ For reference only, as sources are estimates based on press release ² Considered 2020 revenue as LTM revenue and 2021E as NTM revenue, 2021E revenue calculated by applying 2020-25 management CAGR projection to 2020E revenue; ³ NTM as of 3/31/21, reflects INOV current FV / NTM Revenue as of 6/8/21 market data Transaction multiples FV / NTM Revenue Strategic buyers Sponsor buyers 13.9x For reference only¹ 11.1x 10.0x (Current)³ 9.3x 9.1x 8.6x Leonard Green : 8.3–8.7x 8.1x 7.8x 7.9x 7.8x 7.4x 7.2x 7.0x Thoma Bravo: 7.8x 6.6x 6.3x 6.2x Blackstone: 7.6x 4.6x 4.0x ² Target ¹ Acquirer Announce Date Jun-21 Apr-21 Apr-21 Aug-19 Jun-19 Jun-19 Oct-18 Jun-18 Jan-18 Apr-21 Dec-20 Nov-20 Feb-20 Oct-19 Feb-19 Feb-19 Nov-18 Firm value (bn) $7.0bn $8.5 $19.6 $2.1 $6.0 $15.7 $33.4 $5.0 $2.3 $11.3 $10.9 $1.6 $1.5 $3.8 $10.7 $3.3 $1.8 NTM Rev. growth NA 13% (3%) 14% 17% 18% 15% 5% 18% 14% 13% 8% 13% 12% 19% 5% 17% 14 Source: Company filings, FactSet, Broker research; Note: All analyses marked as “for reference only” are illustrative and presented for informational purposes only; ¹ For reference only, as sources are estimates based on press release ² Considered 2020 revenue as LTM revenue and 2021E as NTM revenue, 2021E revenue calculated by applying 2020-25 management CAGR projection to 2020E revenue; ³ NTM as of 3/31/21, reflects INOV current FV / NTM Revenue as of 6/8/21 market data

Appendix 15Appendix 15

Preliminary Inovalon valuation summary (as presented at last Board meeting) For illustrative purposes only Sponsor 52-week Analyst Trading Premiums Discounted Discounted Transaction ability to pay² range price targets multiples equity value¹ cash flow multiples paid $55.00 $54.25 $53.75 $48.50 $47.75 $44.75 $35.00 $39.75 $38.75 $31.00 $35.25 $35.00 $34.25 $34.50 Current share price: $29.78 $22.00 $15.25 Metrics '22E EBITDA ($mm) '23E–'24E EBITDA ($mm) Discount rate NTM Revenue ($mm) Revenue CAGR ('20A-'26E) Current share price $321 $382–$431 7.5%–8.5% $789 11.0%–15.0% $29.78 Multiples (x) '22E FV / EBITDA '22E FV / EBITDA Terminal growth FV / NTM Revenue EBITDA margin ('26E) 1-day premiums paid 20.0–25.0x 20.0–25.0x 2.5%–3.5% 8.0–12.0x 40.0%–45.0% 30%–60% to current At 22.5x exit multiple and 20% required IRR 16 Note: Share prices rounded to the nearest $0.25; Current share price reflects as of 4/29/21; Based on adjusted street case; ¹ Assumes 8.0% discount rate; ² Assumes transaction entry date of 12/31/21 and exit of 12/31/26, 7.5x max pro forma net debtPreliminary Inovalon valuation summary (as presented at last Board meeting) For illustrative purposes only Sponsor 52-week Analyst Trading Premiums Discounted Discounted Transaction ability to pay² range price targets multiples equity value¹ cash flow multiples paid $55.00 $54.25 $53.75 $48.50 $47.75 $44.75 $35.00 $39.75 $38.75 $31.00 $35.25 $35.00 $34.25 $34.50 Current share price: $29.78 $22.00 $15.25 Metrics '22E EBITDA ($mm) '23E–'24E EBITDA ($mm) Discount rate NTM Revenue ($mm) Revenue CAGR ('20A-'26E) Current share price $321 $382–$431 7.5%–8.5% $789 11.0%–15.0% $29.78 Multiples (x) '22E FV / EBITDA '22E FV / EBITDA Terminal growth FV / NTM Revenue EBITDA margin ('26E) 1-day premiums paid 20.0–25.0x 20.0–25.0x 2.5%–3.5% 8.0–12.0x 40.0%–45.0% 30%–60% to current At 22.5x exit multiple and 20% required IRR 16 Note: Share prices rounded to the nearest $0.25; Current share price reflects as of 4/29/21; Based on adjusted street case; ¹ Assumes 8.0% discount rate; ² Assumes transaction entry date of 12/31/21 and exit of 12/31/26, 7.5x max pro forma net debt

This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan's policies on data privacy can be found at http://www.jpmorgan.com/pages/privacy. J.P. Morgan is a party to the SEC Research Settlement and as such, is generally not permitted to utilize the firm's research capabilities in pitching for investment banking business. All views contained in this presentation are the views of J.P. Morgan’s Investment Bank, not the Research Department. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. Changes to Interbank Offered Rates (IBORs) and other benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https://www.jpmorgan.com/global/disclosures/interbank_offered_rates JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. J.P. Morgan is a marketing name for investment businesses of JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. Securities, syndicated loan arranging, financial advisory, lending, derivatives and other investment banking and commercial banking activities are performed by a combination of J.P. Morgan Securities LLC, J.P. Morgan Securities plc, J.P. Morgan AG, JPMorgan Chase Bank, N.A. and the appropriately licensed subsidiaries and affiliates of JPMorgan Chase & Co. worldwide. J.P. Morgan deal team members may be employees of any of the foregoing entities. J.P. Morgan Securities plc is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. J.P. Morgan AG is authorized by the German Federal Financial Supervisory Authority (BaFin) and regulated by BaFin and the German Central Bank (Deutsche Bundesbank). For information on any J.P. Morgan German legal entity see: https://www.jpmorgan.com/country/US/en/disclosures/legal-entity-information#germany. For information on any other J.P. Morgan legal entity see: https://www.jpmorgan.com/country/GB/EN/disclosures/investment-bank-legal-entity-disclosures. JPMS LLC intermediates securities transactions effected by its non-U.S. affiliates for or with its U.S. clients when appropriate and in accordance with Rule 15a-6 under the Securities Exchange Act of 1934. Please consult: www.jpmorgan.com/securities-transactions This presentation does not constitute a commitment by any J.P. Morgan entity to underwrite, subscribe for or place any securities or to extend or arrange credit or to provide any other services. Copyright 2021 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability. 17This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan's policies on data privacy can be found at http://www.jpmorgan.com/pages/privacy. J.P. Morgan is a party to the SEC Research Settlement and as such, is generally not permitted to utilize the firm's research capabilities in pitching for investment banking business. All views contained in this presentation are the views of J.P. Morgan’s Investment Bank, not the Research Department. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. Changes to Interbank Offered Rates (IBORs) and other benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https://www.jpmorgan.com/global/disclosures/interbank_offered_rates JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. J.P. Morgan is a marketing name for investment businesses of JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. Securities, syndicated loan arranging, financial advisory, lending, derivatives and other investment banking and commercial banking activities are performed by a combination of J.P. Morgan Securities LLC, J.P. Morgan Securities plc, J.P. Morgan AG, JPMorgan Chase Bank, N.A. and the appropriately licensed subsidiaries and affiliates of JPMorgan Chase & Co. worldwide. J.P. Morgan deal team members may be employees of any of the foregoing entities. J.P. Morgan Securities plc is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. J.P. Morgan AG is authorized by the German Federal Financial Supervisory Authority (BaFin) and regulated by BaFin and the German Central Bank (Deutsche Bundesbank). For information on any J.P. Morgan German legal entity see: https://www.jpmorgan.com/country/US/en/disclosures/legal-entity-information#germany. For information on any other J.P. Morgan legal entity see: https://www.jpmorgan.com/country/GB/EN/disclosures/investment-bank-legal-entity-disclosures. JPMS LLC intermediates securities transactions effected by its non-U.S. affiliates for or with its U.S. clients when appropriate and in accordance with Rule 15a-6 under the Securities Exchange Act of 1934. Please consult: www.jpmorgan.com/securities-transactions This presentation does not constitute a commitment by any J.P. Morgan entity to underwrite, subscribe for or place any securities or to extend or arrange credit or to provide any other services. Copyright 2021 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability. 17