Q1 2020 Earnings Supplement April 29, 2020

Cautionary Note Regarding Forward-Looking Statement Certain statements contained in this presentation constitute forward-looking statements within the meaning of, and are intended to be covered by the safe harbor provisions of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this presentation other than statements of historical fact, including but not limited to statements regarding the roll-out of any product or capability, the timing, performance characteristics and utility of any such product or capability, and the impact of any such product or capability on the healthcare industry, future results of operations and financial position, business strategy and plans, market growth, and objectives for future operations, are forward-looking statements. The words “believe,” “may,” “see,” “will,” “estimate,” “continue,” “anticipate,” “assume,” “intend,” “expect,” “project,” “look forward,” “promise” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this presentation include, but are not limited to, statements regarding expectations about future business plans, prospective performance and opportunities, strategies and business plans, expectations regarding future results, expectations regarding the size of our datasets, expectations regarding implementation timeframes, our ability to meet financial guidance for the second quarter and full year 2020, our ability to pay down outstanding indebtedness, expectations regarding interest payments and rates, expectations regarding tax rates, and statements with respect to visibility, revenue retention, recurring revenue, including ACV, and the impact of the COVID-19 pandemic on our business and operations. Inovalon has based these forward-looking statements largely on current expectations and projections about future events and trends that may affect financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date of this presentation. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, which could cause the future events and trends discussed in this presentation not to occur and could cause actual results to differ materially and adversely from those anticipated or implied in the forward-looking statements. These risks, uncertainties, and assumptions include, among others: the effects and potential effects of the COVID-19 pandemic on our business, cash flow, liquidity and results of operations due to, among other things, effects on the economy generally and on our customers, including the possible effects of significant rising unemployment, the inability of consumers to timely pay our customers and the resulting potential inability of our customers to pay the fees under our contracts on time or in full; the delay in the contracting for services by our customers as a result of the COVID-19 pandemic; potential other delays in the sales cycle for new customers and products; and other unforeseen impacts on our customers and potential customers and on our employees that could have a negative impact on us; the Company’s ability to continue and manage growth, including successfully integrating acquisitions; ability to grow the client base, retain and renew the existing client base and maintain or increase the fees and activity with existing clients; the effect of the concentration of revenue among top clients; the ability to innovate new services and adapt platforms and toolsets; the ability to successfully implement growth strategies, including the ability to expand into adjacent verticals, such as direct to consumer, growing channel partnerships, expanding internationally and successfully pursuing acquisitions; the ability to successfully integrate our acquisitions and the ability of the acquired business to perform as expected; the successful implementation and adoption of new platforms and solutions, including the Inovalon ONE ® Platform, ScriptMed ® Cloud, Clinical Data Extraction as a Service (CDEaaS™), Natural Language Processing as a Service (NLPaaS™), Elastic Container Technology (ECT™), Healthcare Data Lake, and the Telehealth configuration of the Inovalon ONE® Platform; the possibility of technical, logistical or planning issues in connection with the Company’s investment in and successful deployment of the Company’s products, services and technological advancements; the ability to enter into new agreements with existing or new platforms, products and solutions in the timeframes expected, or at all; the impact of pending M&A activity in the managed care industry, including potential positive or negative impact on existing contracts or the demand for new contracts; the effects of and costs associated with compliance with regulations applicable to the Company, including regulations relating to data protection and data privacy; the effects of changes in tax laws in the jurisdictions in which we operate; the ability to protect the privacy of clients’ data and prevent security breaches; the effect of competition on the business; the timing, size and effect of business realignment and restructuring charges; and the efficacy of the Company’s platforms and toolsets. Additional information is also set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 19, 2020, included under Part I, Item 1A, “Risk Factors,” in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2020, filed with the SEC on April 29, 2020, including under Part II, Item IA, “Risk Factors,” and in subsequent filings with the SEC. In addition, graphics, images or illustrations pertaining to or demonstrating our products, data, services and/or technology that may be used herein are intended for illustrative purposes only unless otherwise noted. The Company is under no duty to, and disclaims any obligation to, update any of these forward-looking statements after the date of this presentation or conform these statements to actual results or revised expectations, except as required by law. Non-GAAP Financial Measures: This presentation contains certain non-GAAP measures. These non-GAAP measures are in addition to, not a substitute for or necessarily superior to, measures of financial performance in accordance with U.S. GAAP. The GAAP measure most closely comparable to each non-GAAP measure used or discussed, and a reconciliation of the differences between each non-GAAP measure and the comparable GAAP measure, is available herein and within our public filings with the SEC. All data provided is as of March 31, 2020 unless stated otherwise. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 2

Contents 1 Overview 2 2020 Q1 & TTM Financial Results This presentation serves as a supplement to the Inovalon announcement on April 29, 2020 pertaining to first quarter (Q1) of 2020 3 2020 Financial Guidance results and guidance. 4 Appendix 1: Reconciliations INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 3

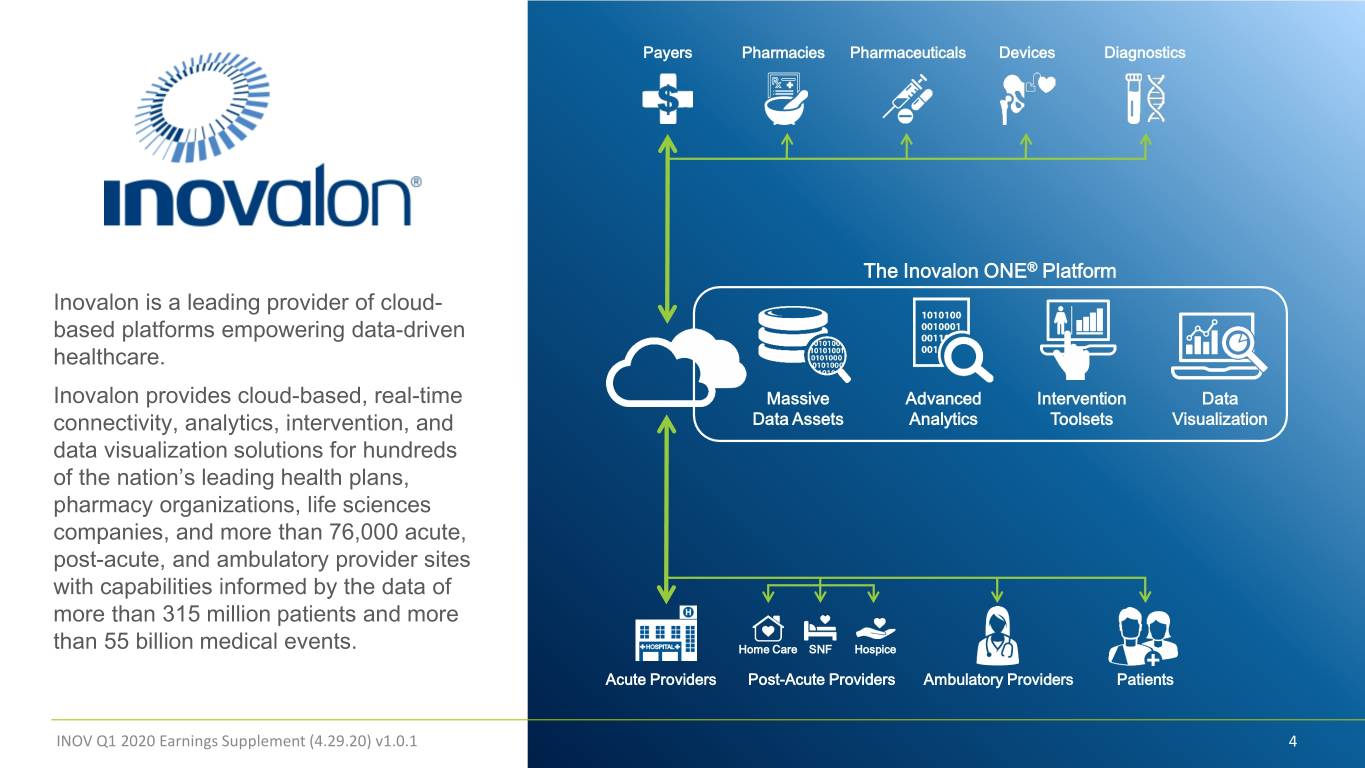

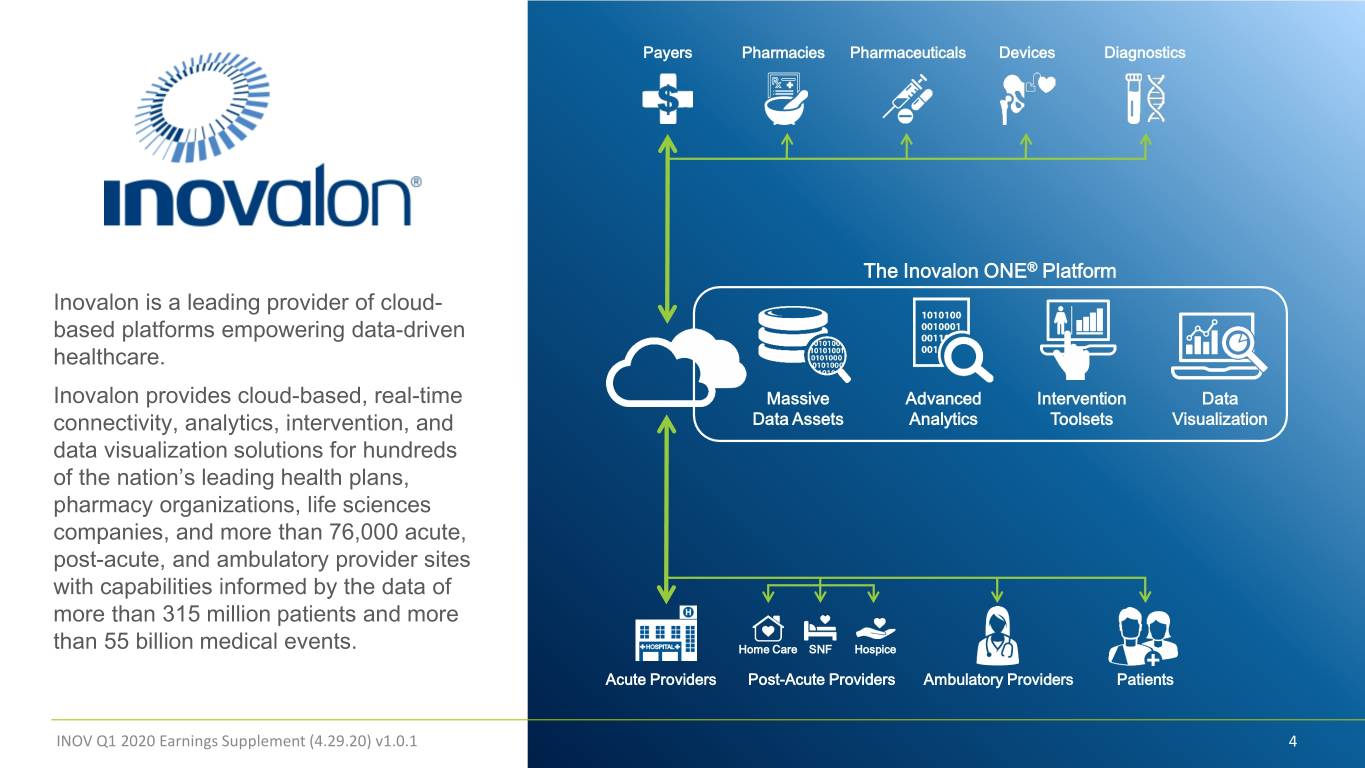

Payers Pharmacies Pharmaceuticals Devices Diagnostics The Inovalon ONE® Platform Inovalon is a leading provider of cloud- based platforms empowering data-driven healthcare. Inovalon provides cloud-based, real-time Massive Advanced Intervention Data connectivity, analytics, intervention, and Data Assets Analytics Toolsets Visualization data visualization solutions for hundreds of the nation’s leading health plans, pharmacy organizations, life sciences companies, and more than 76,000 acute, post-acute, and ambulatory provider sites with capabilities informed by the data of more than 315 million patients and more than 55 billion medical events. Home Care SNF Hospice Acute Providers Post-Acute Providers Ambulatory Providers Patients INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 4

Empowering Data-Driven Healthcare In Scale The reach of Inovalon’s platform has grown to touch the vast majority of the United States, able to empower the market’s largest data-driven healthcare initiatives. 100s Health Plans, Providers, Life Sciences, Pharmacy, and Diagnostics Organizations 315M+ Patients 76K+ Provider Sites INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 5

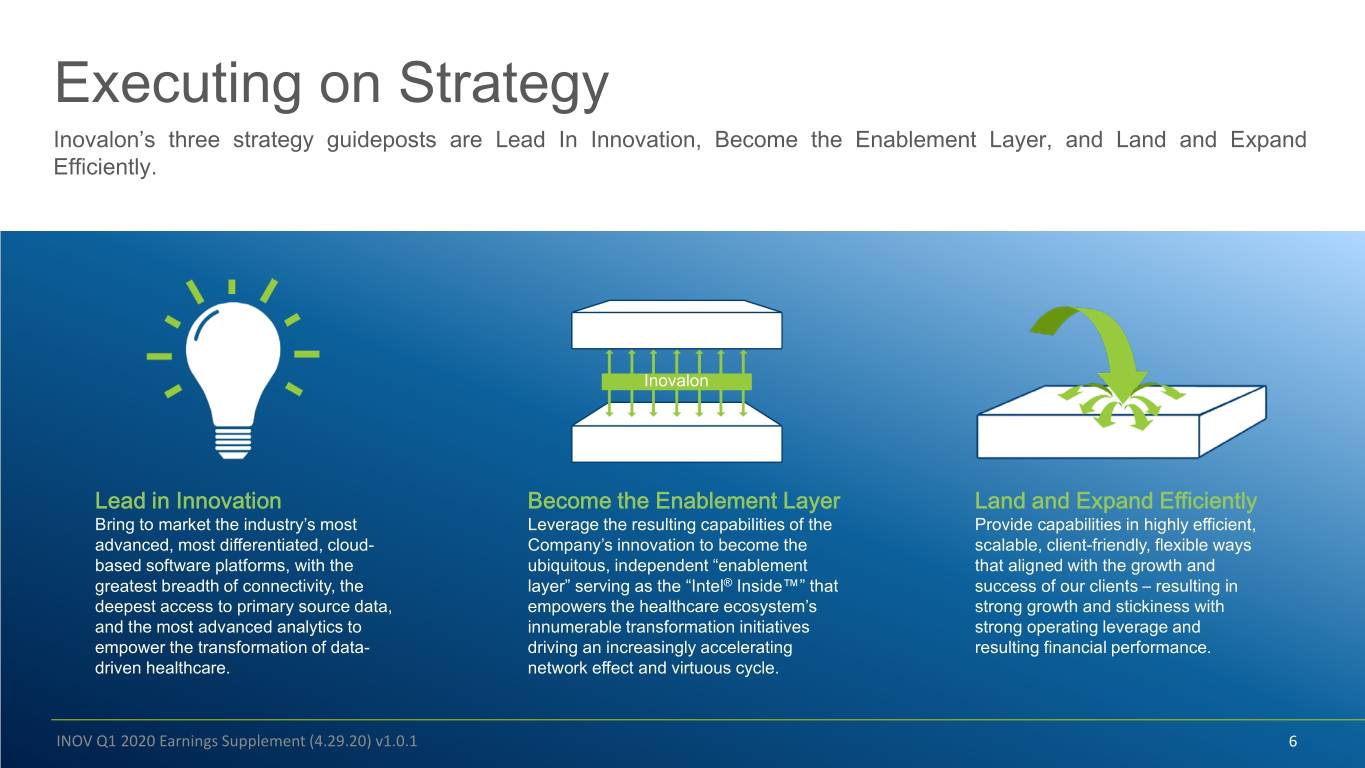

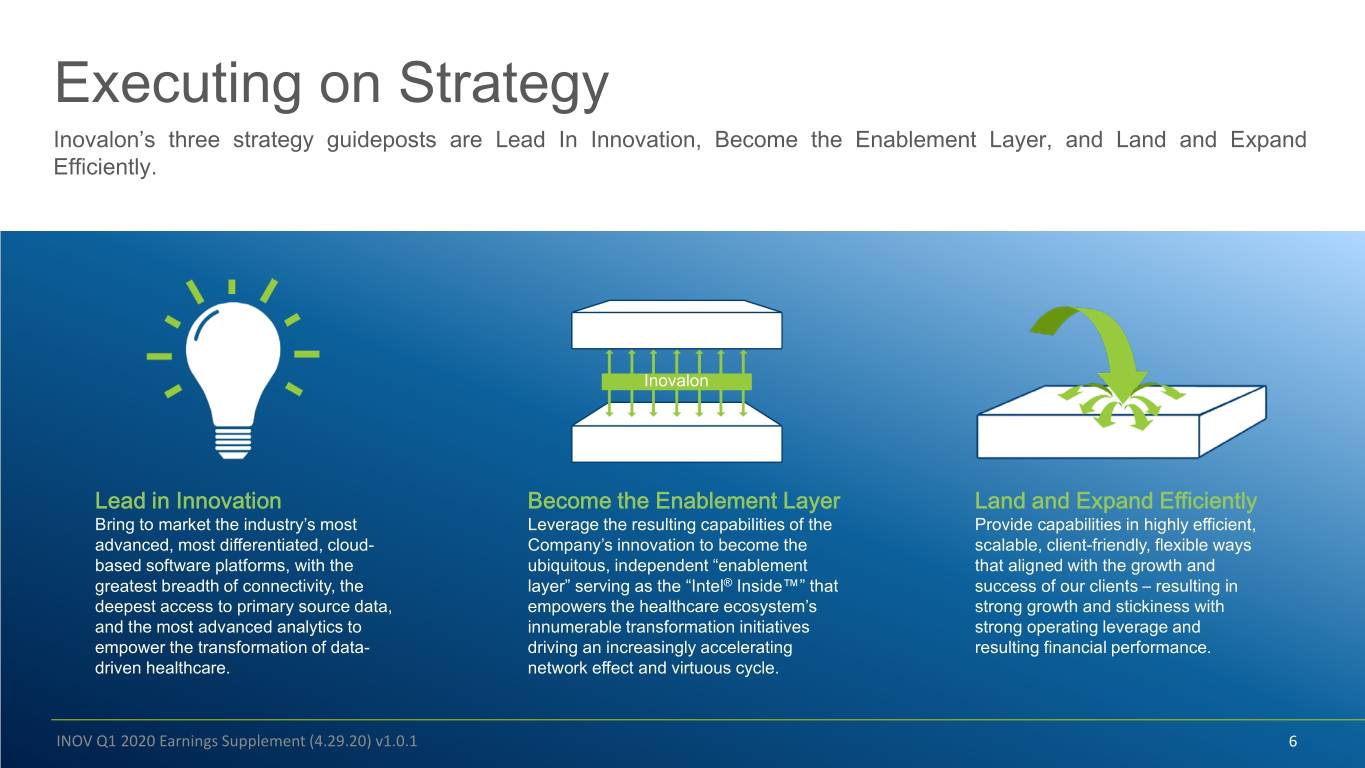

Executing on Strategy Inovalon’s three strategy guideposts are Lead In Innovation, Become the Enablement Layer, and Land and Expand Efficiently. Inovalon Lead in Innovation Become the Enablement Layer Land and Expand Efficiently Bring to market the industry’s most Leverage the resulting capabilities of the Provide capabilities in highly efficient, advanced, most differentiated, cloud- Company’s innovation to become the scalable, client-friendly, flexible ways based software platforms, with the ubiquitous, independent “enablement that aligned with the growth and greatest breadth of connectivity, the layer” serving as the “Intel® Inside™” that success of our clients – resulting in deepest access to primary source data, empowers the healthcare ecosystem’s strong growth and stickiness with and the most advanced analytics to innumerable transformation initiatives strong operating leverage and empower the transformation of data- driving an increasingly accelerating resulting financial performance. driven healthcare. network effect and virtuous cycle. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 6

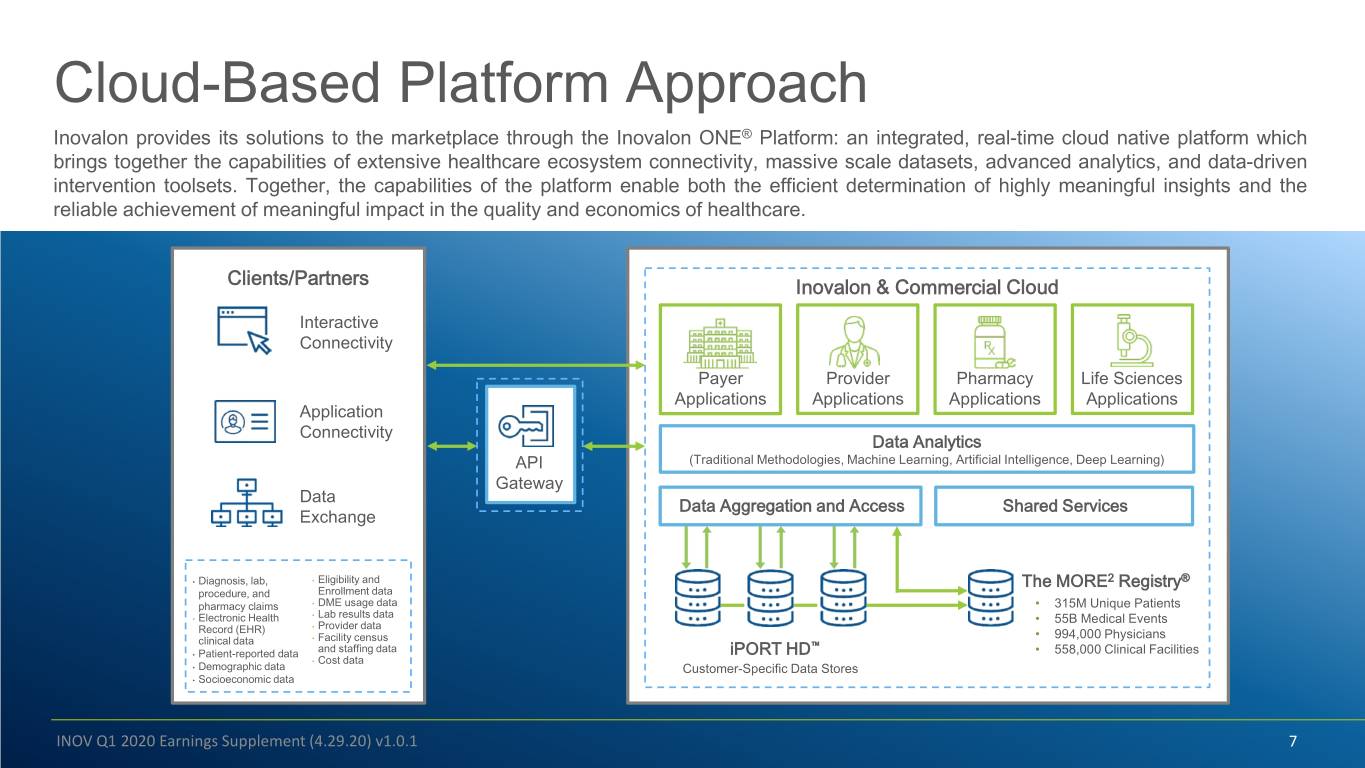

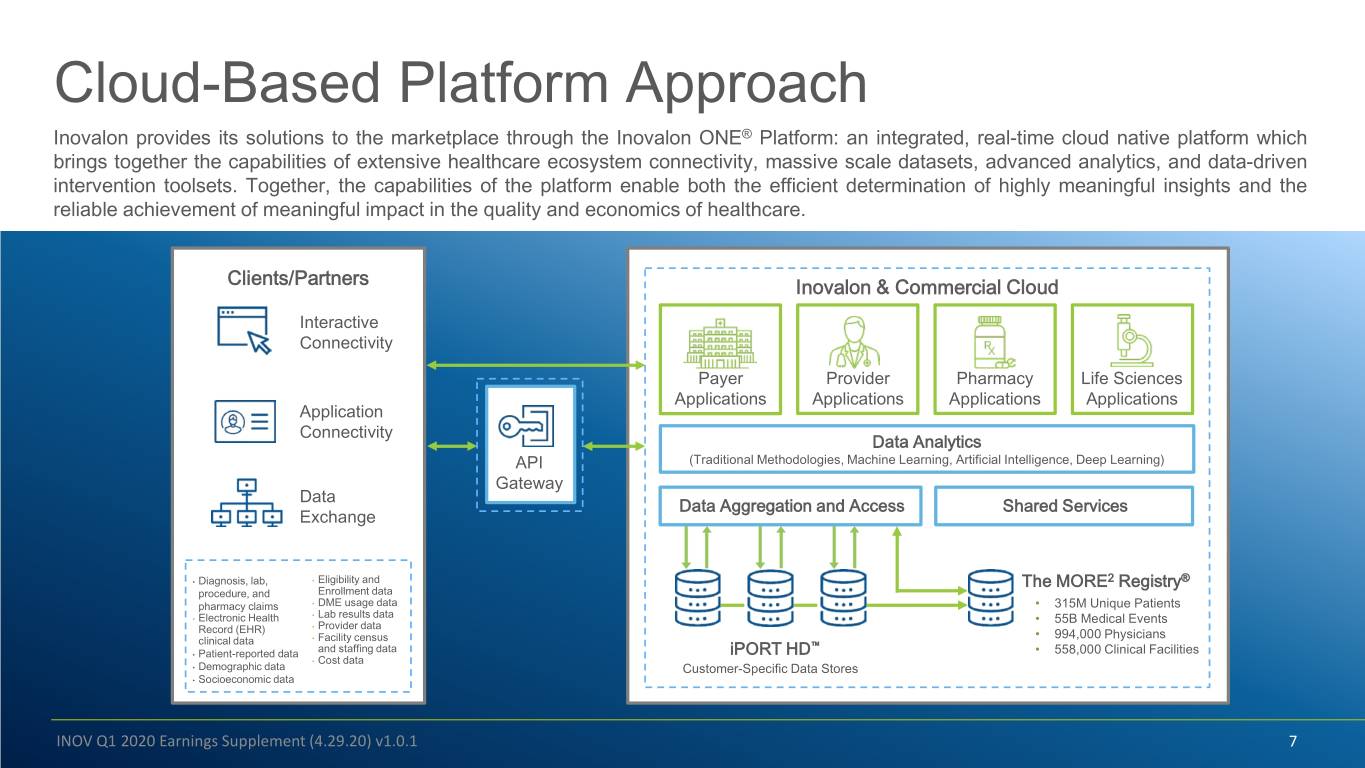

Cloud-Based Platform Approach Inovalon provides its solutions to the marketplace through the Inovalon ONE® Platform: an integrated, real-time cloud native platform which brings together the capabilities of extensive healthcare ecosystem connectivity, massive scale datasets, advanced analytics, and data-driven intervention toolsets. Together, the capabilities of the platform enable both the efficient determination of highly meaningful insights and the reliable achievement of meaningful impact in the quality and economics of healthcare. Clients/Partners Inovalon & Commercial Cloud Interactive Connectivity Payer Provider Pharmacy Life Sciences Applications Applications Applications Applications Application Connectivity Data Analytics API (Traditional Methodologies, Machine Learning, Artificial Intelligence, Deep Learning) Gateway Data Data Aggregation and Access Shared Services Exchange • 2 ® • Diagnosis, lab, Eligibility and The MORE Registry procedure, and Enrollment data pharmacy claims • DME usage data • 315M Unique Patients • Lab results data • Electronic Health • 55B Medical Events • Provider data Record (EHR) • 994,000 Physicians clinical data • Facility census and staffing data ™ • Patient-reported data iPORT HD • 558,000 Clinical Facilities • Cost data • Demographic data Customer-Specific Data Stores • Socioeconomic data INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 7

Massive Data 56 MORE2 REGISTRY® DATASET GROWTH Assets 54 52 Patient Count Medical Event Count 50 Inovalon leverages massive datasets to 48 deliver differentiated capabilities to its clients. 46 44 These datasets are expanding rapidly. As of the 42 40 2 ® end of Q1 2020, the MORE Registry dataset 38 58% 36 contained more than 315 million unique patient Medical Event Patient(millions) Count 34 counts and 55 billion medical event counts, 32 Count Expansion 320 increases of 16% and 23%, respectively, 30 (1Q17 - 1Q20 CAGR) 300 compared with March 31, 2019. 28 280 26 260 24 240 One of the industry’s largest independent healthcare 22 220 datasets, with more than 315M patients and more 20 200 than 55B medical events 18 180 16 160 Medical Event Event Count Medical (billions) Primary-sourced, fully linkable, longitudinally-matched 14 140 data from all major U.S. healthcare programs 12 120 10 100 Contains EHR, claims, scripts, labs, provider, 8 80 demographic data and more 6 60 4 40 Qualified Entity (QE) containing CMS’ Fee for Service 2 20 Medicare Data 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q20 Empowers and informs our industry-leading analytics and artificial intelligence, creating meaningful differentiation and client value INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 8

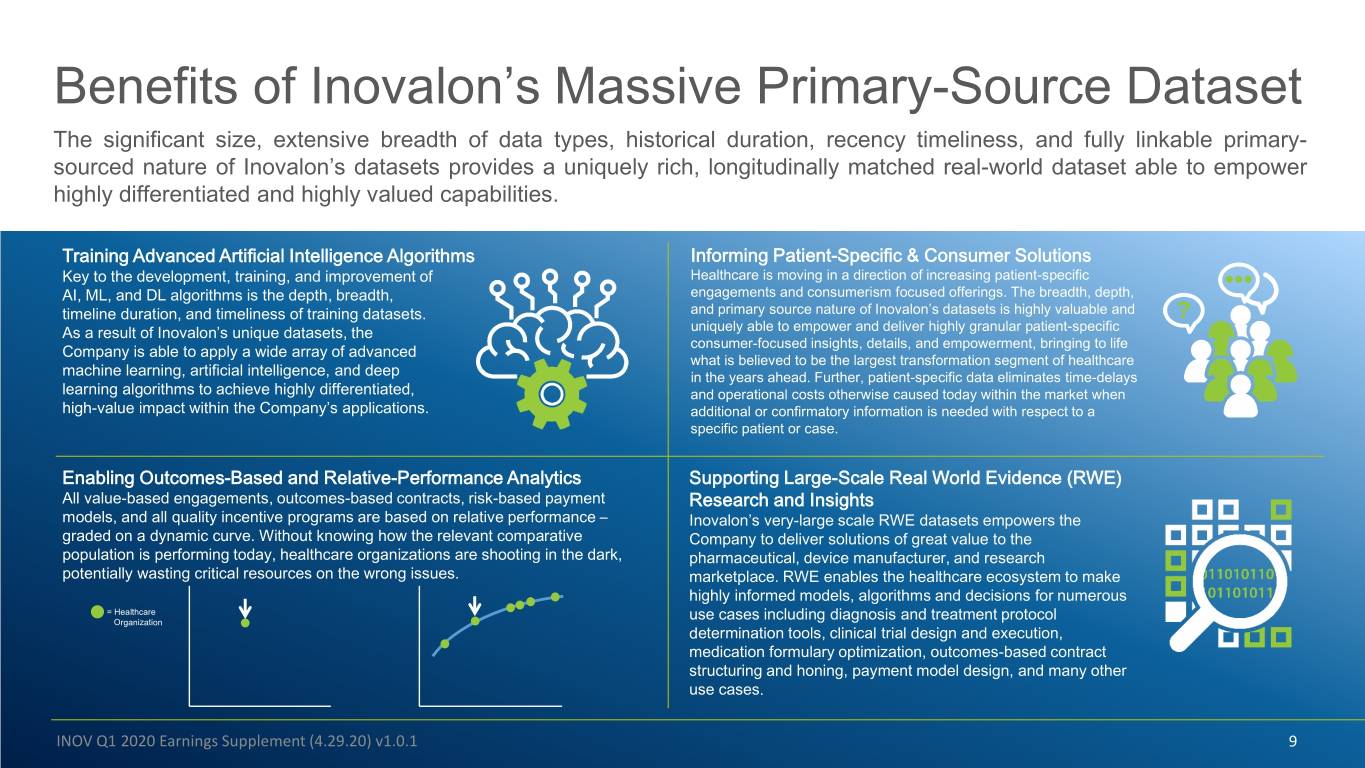

Benefits of Inovalon’s Massive Primary-Source Dataset The significant size, extensive breadth of data types, historical duration, recency timeliness, and fully linkable primary- sourced nature of Inovalon’s datasets provides a uniquely rich, longitudinally matched real-world dataset able to empower highly differentiated and highly valued capabilities. Training Advanced Artificial Intelligence Algorithms Informing Patient-Specific & Consumer Solutions Key to the development, training, and improvement of Healthcare is moving in a direction of increasing patient-specific AI, ML, and DL algorithms is the depth, breadth, engagements and consumerism focused offerings. The breadth, depth, timeline duration, and timeliness of training datasets. and primary source nature of Inovalon’s datasets is highly valuable and As a result of Inovalon’s unique datasets, the uniquely able to empower and deliver highly granular patient-specific consumer-focused insights, details, and empowerment, bringing to life Company is able to apply a wide array of advanced what is believed to be the largest transformation segment of healthcare machine learning, artificial intelligence, and deep in the years ahead. Further, patient-specific data eliminates time-delays learning algorithms to achieve highly differentiated, and operational costs otherwise caused today within the market when high-value impact within the Company’s applications. additional or confirmatory information is needed with respect to a specific patient or case. Enabling Outcomes-Based and Relative-Performance Analytics Supporting Large-Scale Real World Evidence (RWE) All value-based engagements, outcomes-based contracts, risk-based payment Research and Insights models, and all quality incentive programs are based on relative performance – Inovalon’s very-large scale RWE datasets empowers the graded on a dynamic curve. Without knowing how the relevant comparative Company to deliver solutions of great value to the population is performing today, healthcare organizations are shooting in the dark, pharmaceutical, device manufacturer, and research potentially wasting critical resources on the wrong issues. marketplace. RWE enables the healthcare ecosystem to make highly informed models, algorithms and decisions for numerous = Healthcare Organization use cases including diagnosis and treatment protocol determination tools, clinical trial design and execution, medication formulary optimization, outcomes-based contract structuring and honing, payment model design, and many other use cases. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 9

Highly Differentiated Within the Market A leader in providing cloud-based tools to support data-driven healthcare, Inovalon empowers clients to achieve their clinical quality and financial goals by bringing highly differentiated capabilities to bear – unavailable from any other platform provider. Market’s Largest Primary-Source Breadth of Connectivity: Dataset Enabling Meaningful 315M+ Inovalon has achieved wide Insight and Impact: Patients connectivity with hundreds of Deep data informs the most advanced thousands of physicians, payers, algorithms and translates into highly 994K+ EHRs, HIEs and the data differentiated insights that help to pertaining to hundreds of millions achieve the most advanced impact. Providers of patients. This connectivity Availability of data further reduces time- allows for real-time data capture, to-care, operational costs, and human 55B+ real-time application of resulting error rates. insights – driving real-time impact Medical Events and achievement of value. Industry-Leading Analytics: Scale, Speed & The Power of The extensive array of highly data-trained and time- Compute: tested algorithms developed and honed by Inovalon Sophisticated proprietary cloud provide for many steps within the inherently complex architectures and massive cloud-based processes of real-world healthcare operations to be compute environments allow for highly improved – thus achieving a superior, multi-faced advanced analyses of large datasets in real approach to improve care outcomes and economics. time, allowing clients to garner and apply The ongoing flow of data and access to outcomes the most advanced insights quickly - to feedback inherent to Inovalon’s platform further impact strategy, clinical care, and financial translates into a cycle of continuous improvement that has performance – allowing clients to win within meaningfully demonstrated substantive differentiation of Inovalon’s their highly competitive environments. analytics versus alternatives. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 10

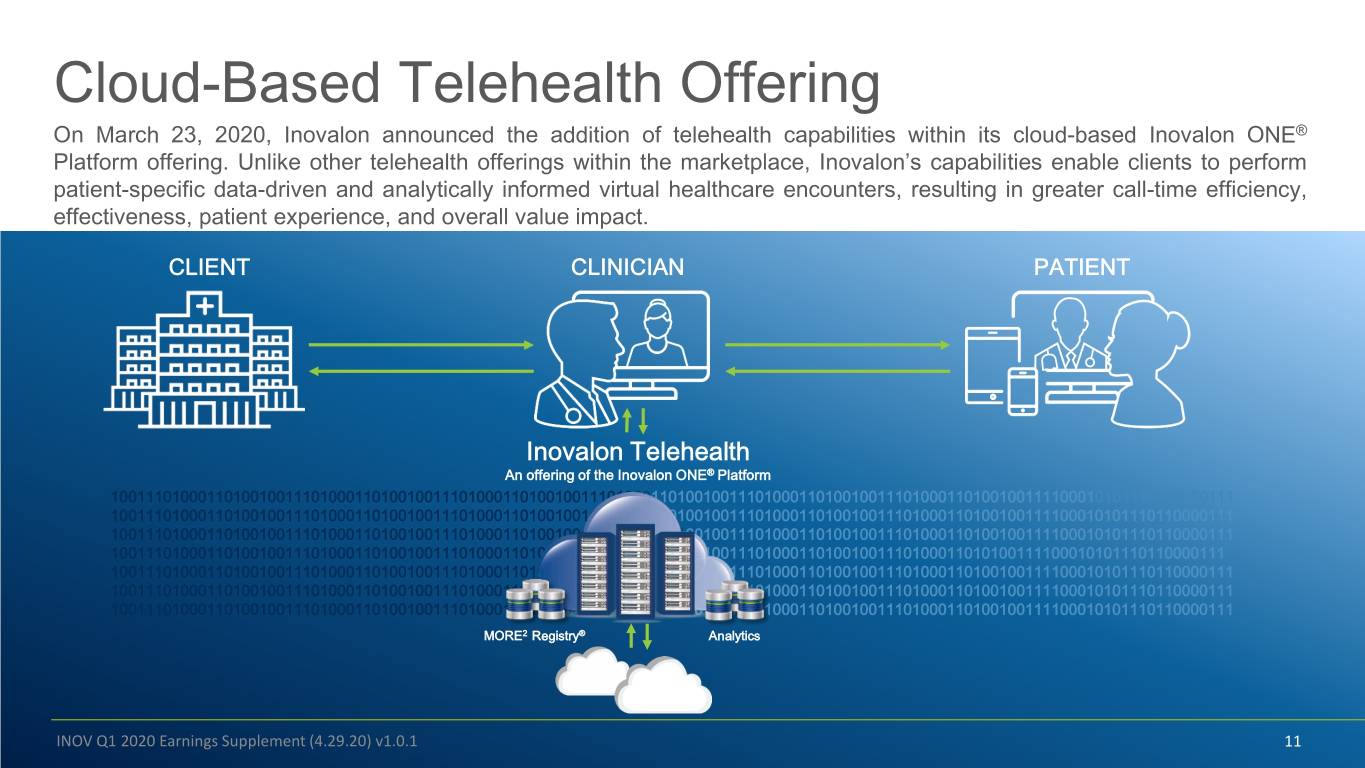

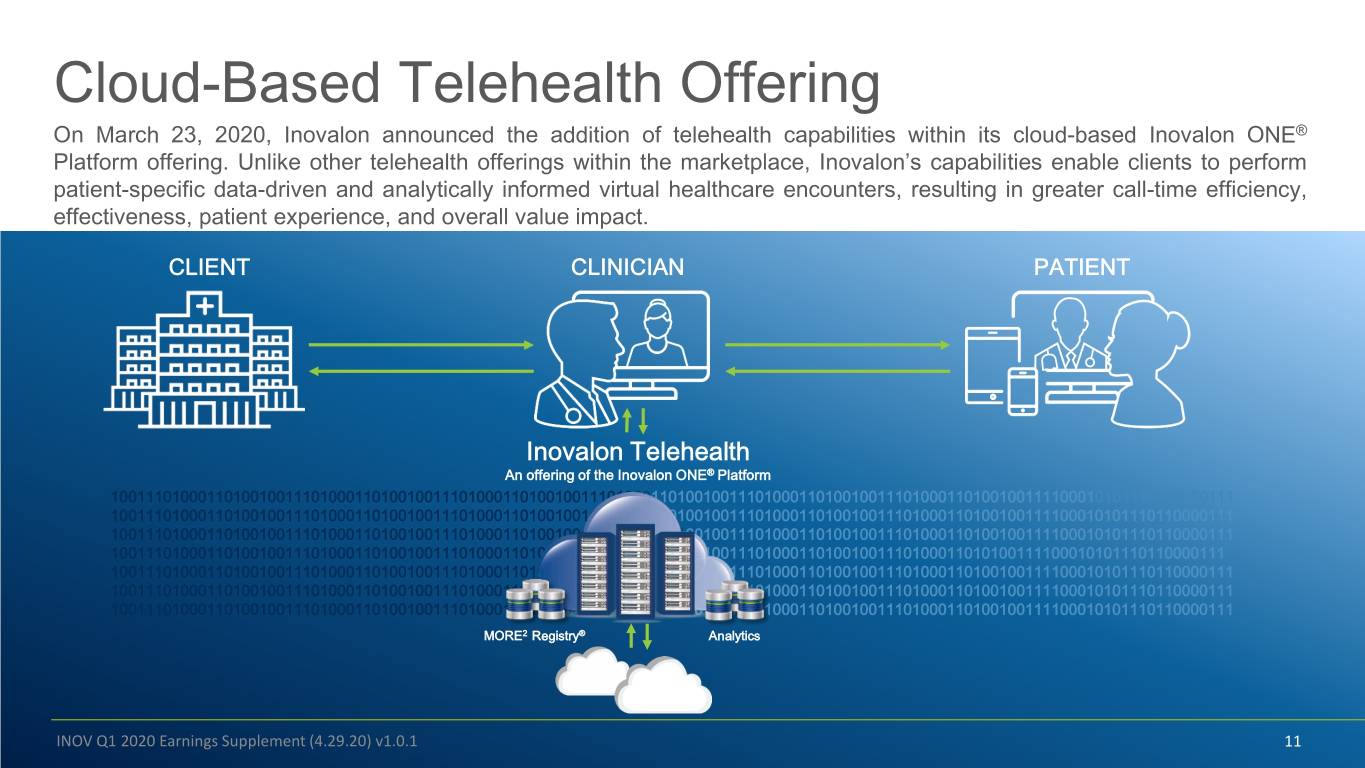

Cloud-Based Telehealth Offering On March 23, 2020, Inovalon announced the addition of telehealth capabilities within its cloud-based Inovalon ONE® Platform offering. Unlike other telehealth offerings within the marketplace, Inovalon’s capabilities enable clients to perform patient-specific data-driven and analytically informed virtual healthcare encounters, resulting in greater call-time efficiency, effectiveness, patient experience, and overall value impact. CLIENT CLINICIAN PATIENT Inovalon Telehealth An offering of the Inovalon ONE® Platform 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 10011101000110100100111010001101001001110100011010010011101000110100100111010001101001001110100011010100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 100111010001101001001110100011010010011101000110100100111010001101001001110100011010010011101000110100100111100010101110110000111 MORE2 Registry® Analytics INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 11

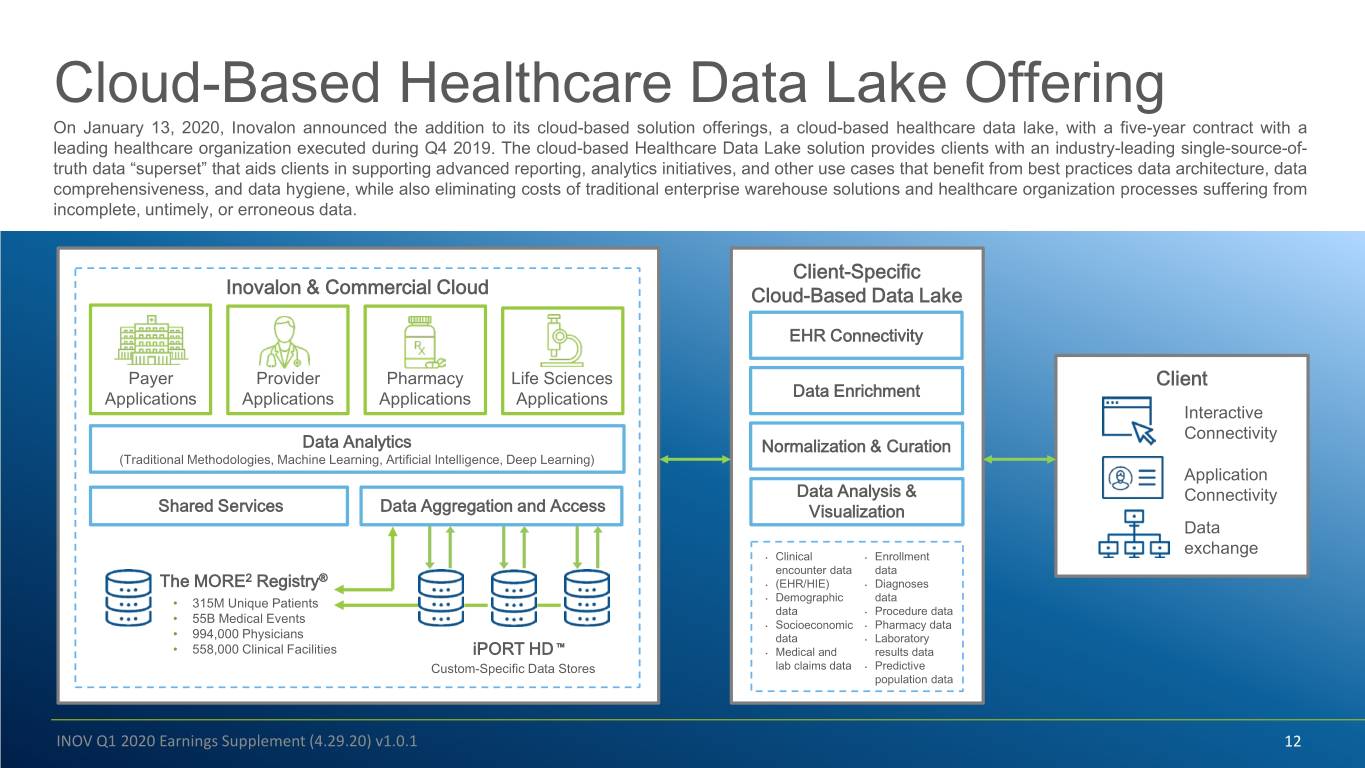

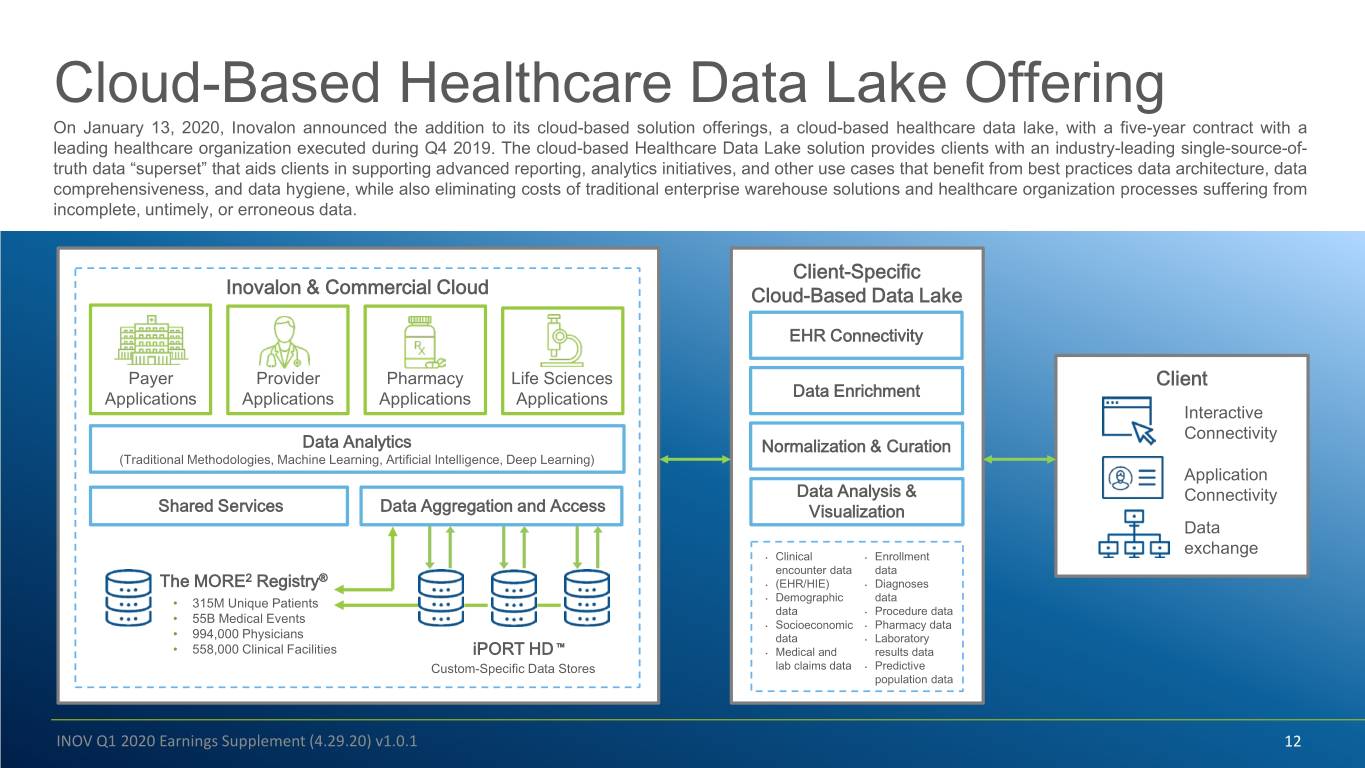

Cloud-Based Healthcare Data Lake Offering On January 13, 2020, Inovalon announced the addition to its cloud-based solution offerings, a cloud-based healthcare data lake, with a five-year contract with a leading healthcare organization executed during Q4 2019. The cloud-based Healthcare Data Lake solution provides clients with an industry-leading single-source-of- truth data “superset” that aids clients in supporting advanced reporting, analytics initiatives, and other use cases that benefit from best practices data architecture, data comprehensiveness, and data hygiene, while also eliminating costs of traditional enterprise warehouse solutions and healthcare organization processes suffering from incomplete, untimely, or erroneous data. Client-Specific Inovalon & Commercial Cloud Cloud-Based Data Lake EHR Connectivity Payer Provider Pharmacy Life Sciences Client Applications Applications Applications Applications Data Enrichment Interactive Connectivity Data Analytics Normalization & Curation (Traditional Methodologies, Machine Learning, Artificial Intelligence, Deep Learning) Application Data Analysis & Connectivity Shared Services Data Aggregation and Access Visualization Data exchange • Clinical • Enrollment encounter data data 2 ® The MORE Registry • (EHR/HIE) • Diagnoses • 315M Unique Patients • Demographic data data • Procedure data • 55B Medical Events • Socioeconomic • Pharmacy data • 994,000 Physicians data • Laboratory ™ • 558,000 Clinical Facilities iPORT HD • Medical and results data Custom-Specific Data Stores lab claims data • Predictive population data INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 12

Contents 1 Overview 2 2020 Q1 & TTM Financial Results This presentation serves as a supplement to the Inovalon announcement on April 29, 2020 pertaining to first quarter (Q1) of 2020 3 2020 Financial Guidance results and guidance. 4 Appendix 1: Reconciliations INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 13

Subscription-Based Cash & Cash Q1 2020 Platform Revenue of Equivalents Financial $137.1M Balance of Representing Revenue Growth of Highlights $182.9M During Q1 2020 Inovalon’s revenue grew 13% 6% year-over-year to $154.2 million, and year-over-year subscription-based platform revenue grew 13% year-over-year to $137.1 million, representing 89% of Q1 2020 total Adj EBITDA Growth to revenue. Strong operational leverage Non-GAAP EPS resulted in Q1 2020 Adjusted EBITDA of Growth of $47.5 million, representing an Adjusted $47.5M EBITDA margin of 31%. Non-GAAP EPS Representing a for the period was $0.11 per share, and 10% year-over-year to cash and cash equivalents at the end of the quarter was $182.9 million. 31% Adjusted EBITDA Margin $0.11 per share INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 14

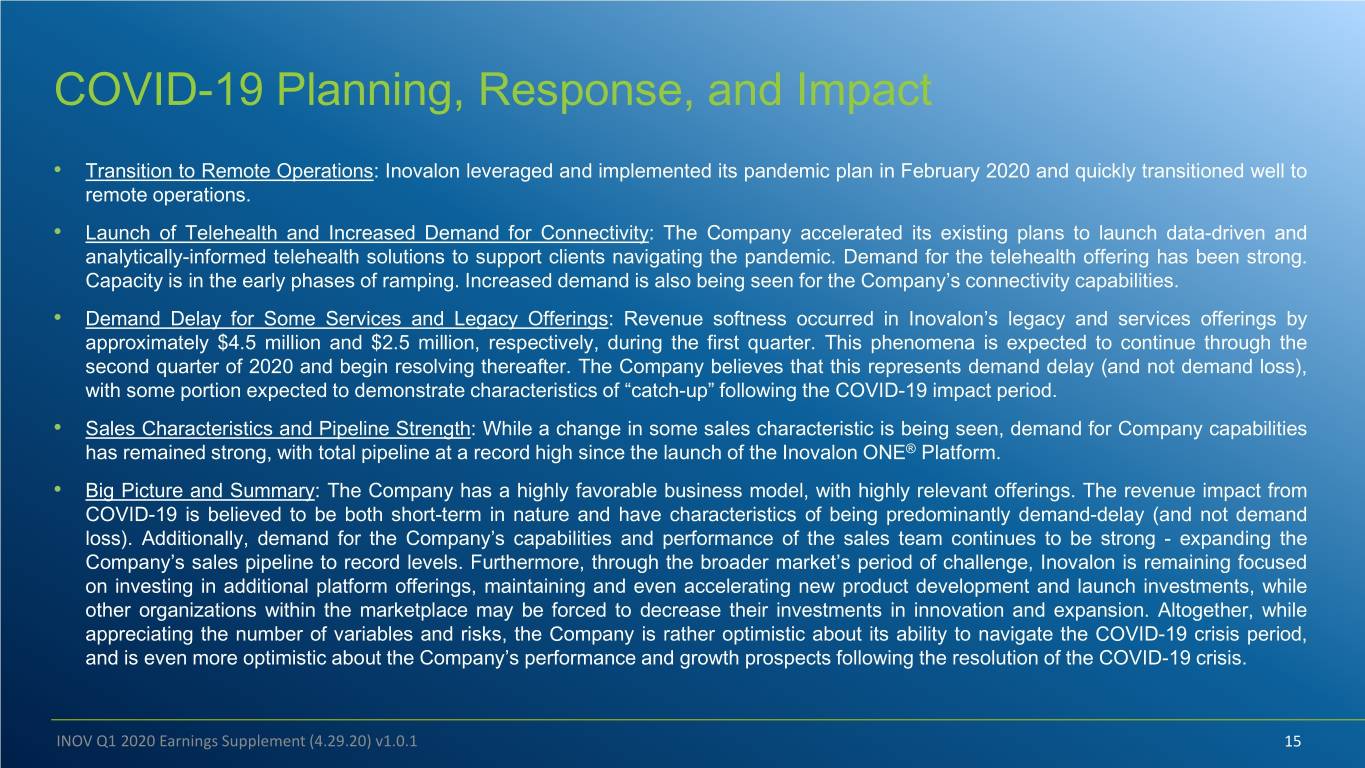

COVID-19 Planning, Response, and Impact • Transition to Remote Operations: Inovalon leveraged and implemented its pandemic plan in February 2020 and quickly transitioned well to remote operations. • Launch of Telehealth and Increased Demand for Connectivity: The Company accelerated its existing plans to launch data-driven and analytically-informed telehealth solutions to support clients navigating the pandemic. Demand for the telehealth offering has been strong. Capacity is in the early phases of ramping. Increased demand is also being seen for the Company’s connectivity capabilities. • Demand Delay for Some Services and Legacy Offerings: Revenue softness occurred in Inovalon’s legacy and services offerings by approximately $4.5 million and $2.5 million, respectively, during the first quarter. This phenomena is expected to continue through the second quarter of 2020 and begin resolving thereafter. The Company believes that this represents demand delay (and not demand loss), with some portion expected to demonstrate characteristics of “catch-up” following the COVID-19 impact period. • Sales Characteristics and Pipeline Strength: While a change in some sales characteristic is being seen, demand for Company capabilities has remained strong, with total pipeline at a record high since the launch of the Inovalon ONE® Platform. • Big Picture and Summary: The Company has a highly favorable business model, with highly relevant offerings. The revenue impact from COVID-19 is believed to be both short-term in nature and have characteristics of being predominantly demand-delay (and not demand loss). Additionally, demand for the Company’s capabilities and performance of the sales team continues to be strong - expanding the Company’s sales pipeline to record levels. Furthermore, through the broader market’s period of challenge, Inovalon is remaining focused on investing in additional platform offerings, maintaining and even accelerating new product development and launch investments, while other organizations within the marketplace may be forced to decrease their investments in innovation and expansion. Altogether, while appreciating the number of variables and risks, the Company is rather optimistic about its ability to navigate the COVID-19 crisis period, and is even more optimistic about the Company’s performance and growth prospects following the resolution of the COVID-19 crisis. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 15

Continued Solid Sales Performance The Company continued to see strong demand during the first quarter. Total sales pipeline grew to a record high since the launch of the Inovalon ONE® Platform. Despite a degree of some demand delay, new sales were solid during the period. Q1 2020 total new sales Annual Contract Value1 (ACV) was $45.5 million, with platform new sales, excluding Services, ACV totaling $29.0 million, reflecting an increase of 4% year-over-year. Total Quarterly New Sales ACV Total Quarterly Platform New Sales ACV (Excluding Services) $73.3 $73.5 $62.8 $58.9 $52.7 $54.8 $46.4 $47.9 $45.9 $44.1 $45.5 $38.7 $39.0 $33.0 $32.9 $28.1 $29.0 $26.0 $26.9 $27.8 $27.3 $21.6 $13.7 $13.2 $11.3 $6.2 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 Note: Please see appendix for definitions of the footnoted terms above. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 16

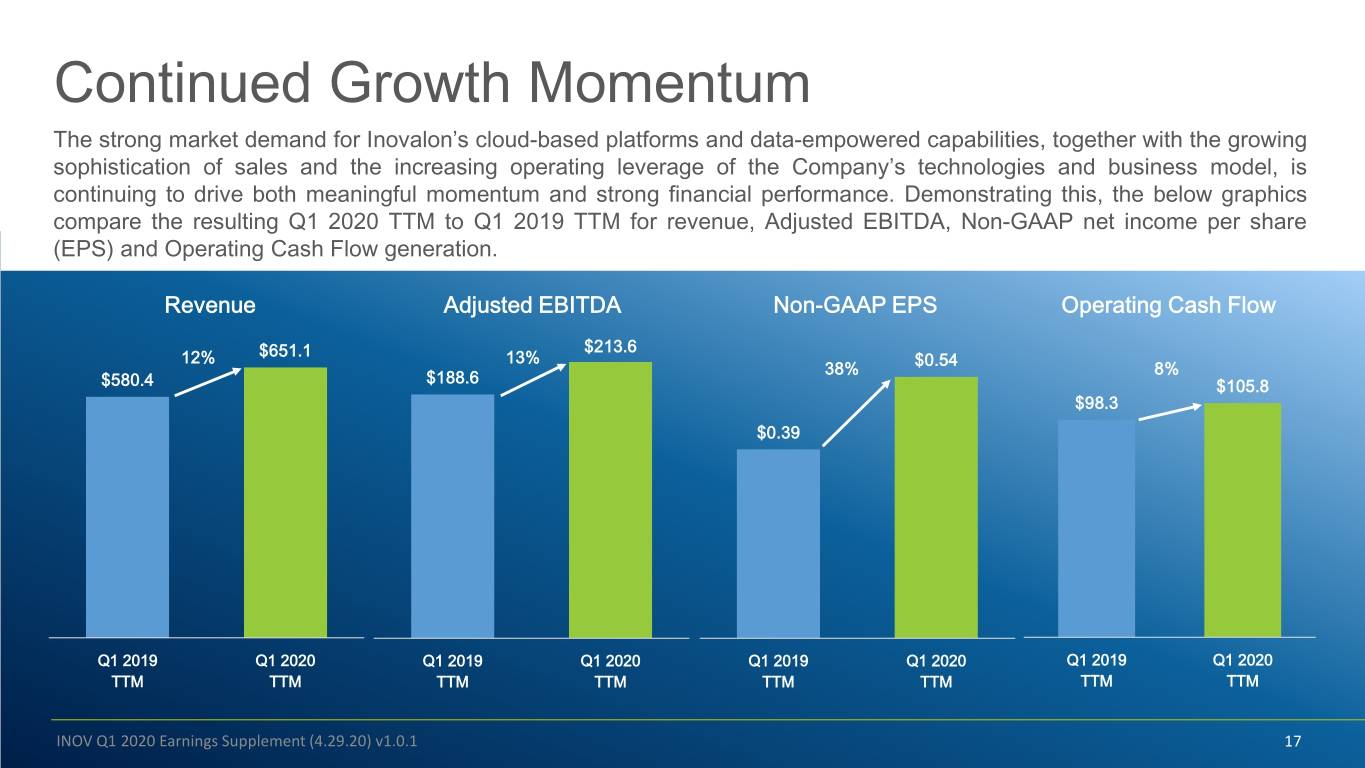

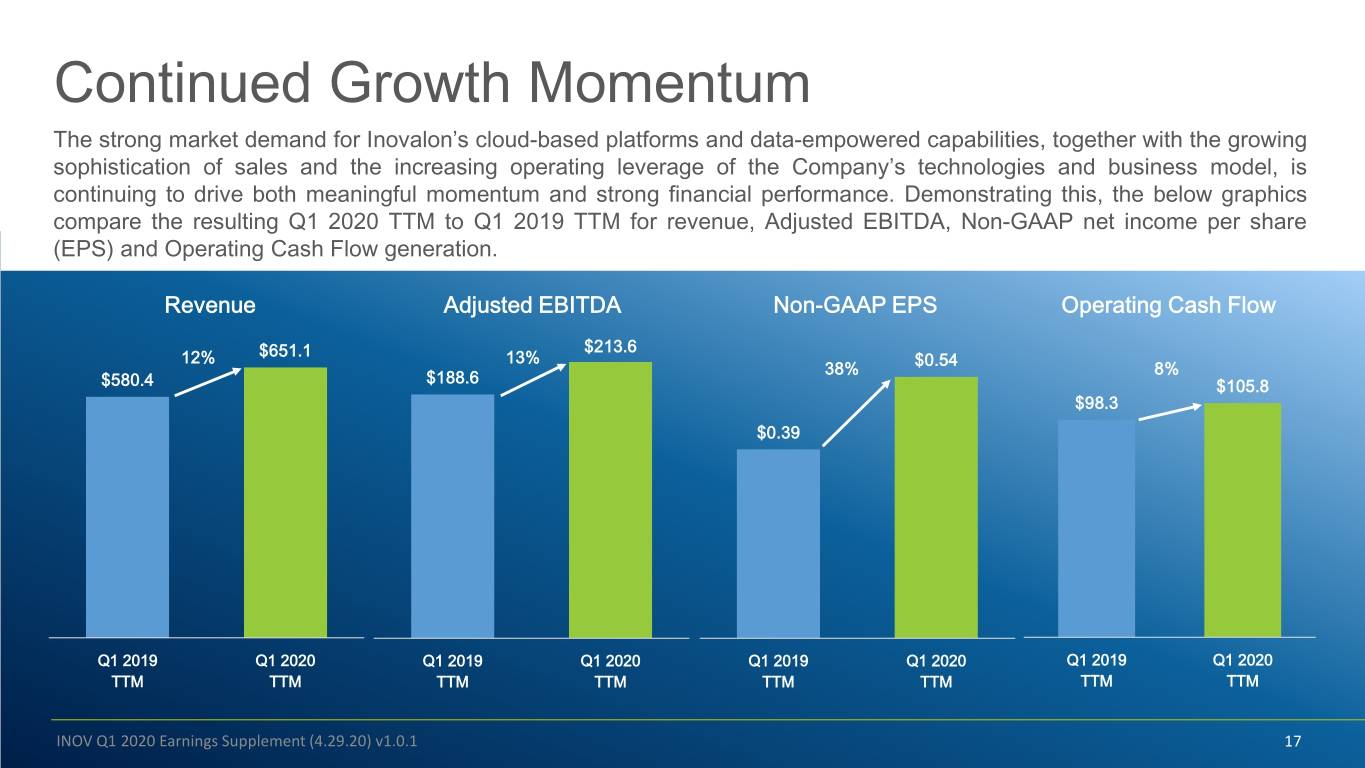

Continued Growth Momentum The strong market demand for Inovalon’s cloud-based platforms and data-empowered capabilities, together with the growing sophistication of sales and the increasing operating leverage of the Company’s technologies and business model, is continuing to drive both meaningful momentum and strong financial performance. Demonstrating this, the below graphics compare the resulting Q1 2020 TTM to Q1 2019 TTM for revenue, Adjusted EBITDA, Non-GAAP net income per share (EPS) and Operating Cash Flow generation. Revenue Adjusted EBITDA Non-GAAP EPS Operating Cash Flow $651.1 $213.6 12% 13% $0.54 38% 8% $188.6 $580.4 $105.8 $98.3 $0.39 Q1 2019 Q1 2020 Q1 2019 Q1 2020 Q1 2019 Q1 2020 Q1 2019 Q1 2020 TTM TTM TTM TTM TTM TTM TTM TTM INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 17

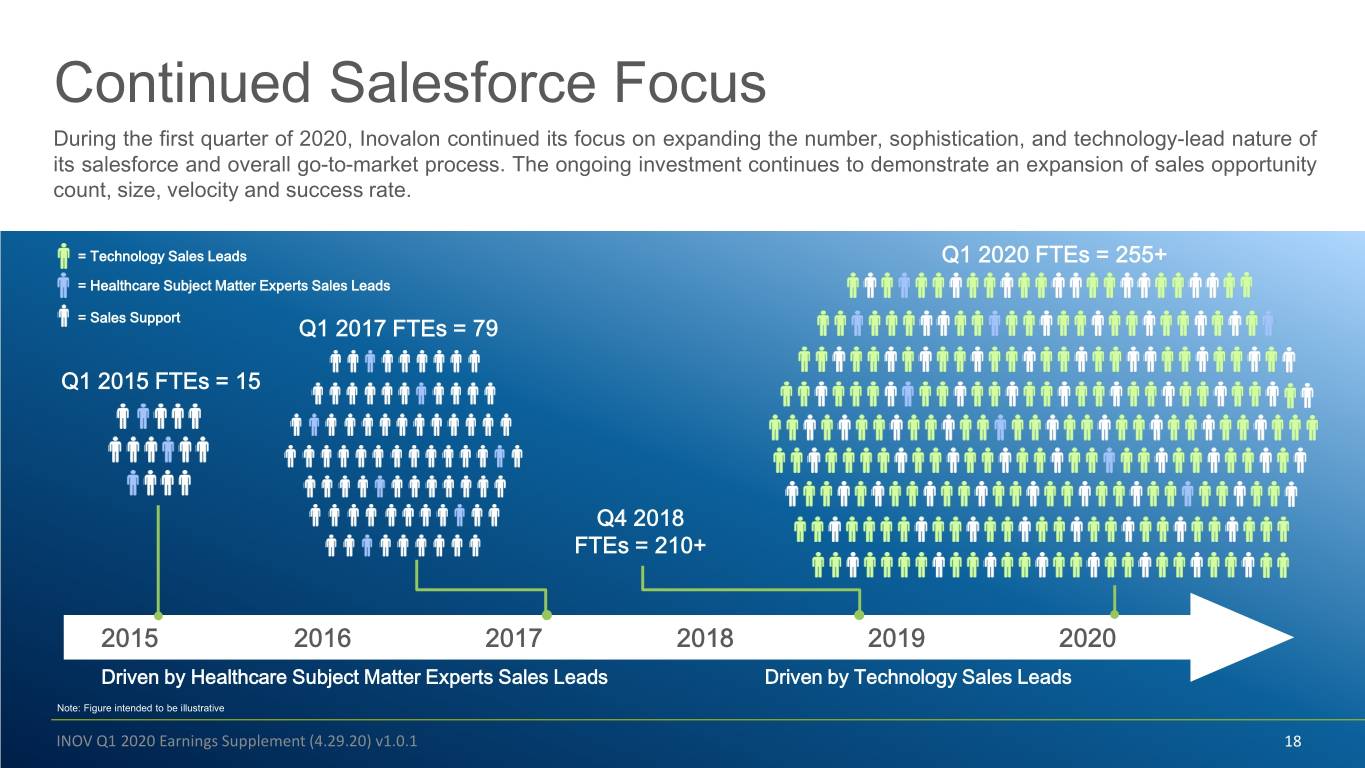

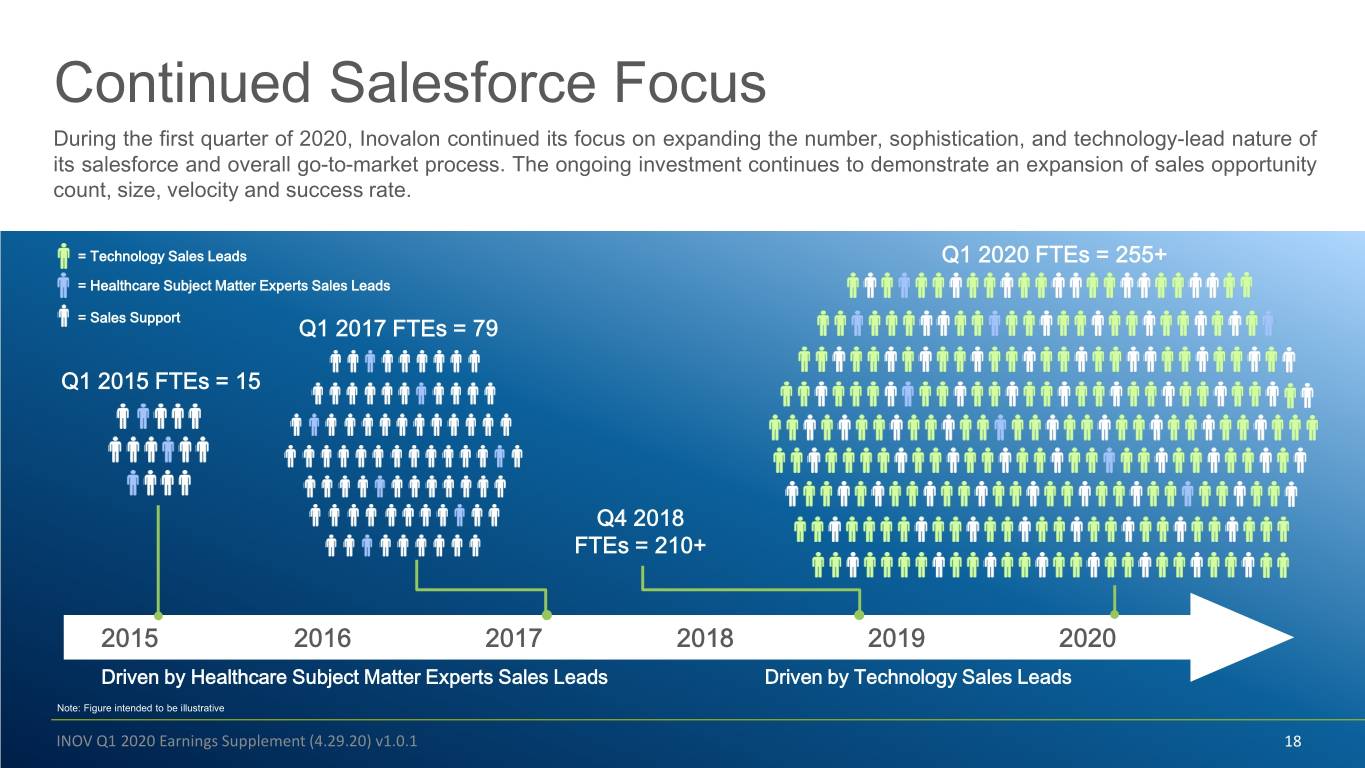

Continued Salesforce Focus During the first quarter of 2020, Inovalon continued its focus on expanding the number, sophistication, and technology-lead nature of its salesforce and overall go-to-market process. The ongoing investment continues to demonstrate an expansion of sales opportunity count, size, velocity and success rate. = Technology Sales Leads Q1 2020 FTEs = 255+ = Healthcare Subject Matter Experts Sales Leads = Sales Support Q1 2017 FTEs = 79 Q1 2015 FTEs = 15 Q4 2018 FTEs = 210+ 2015 2016 2017 2018 2019 2020 Driven by Healthcare Subject Matter Experts Sales Leads Driven by Technology Sales Leads Note: Figure intended to be illustrative INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 18

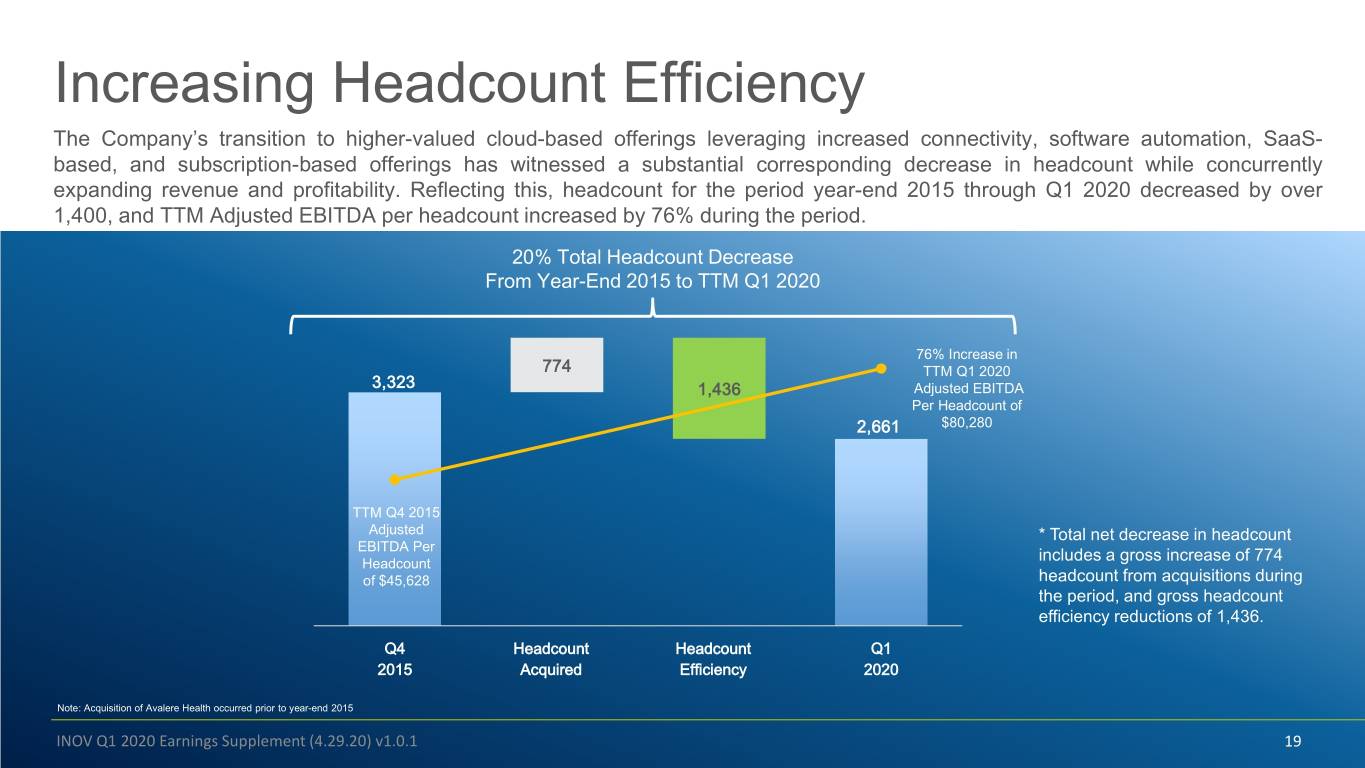

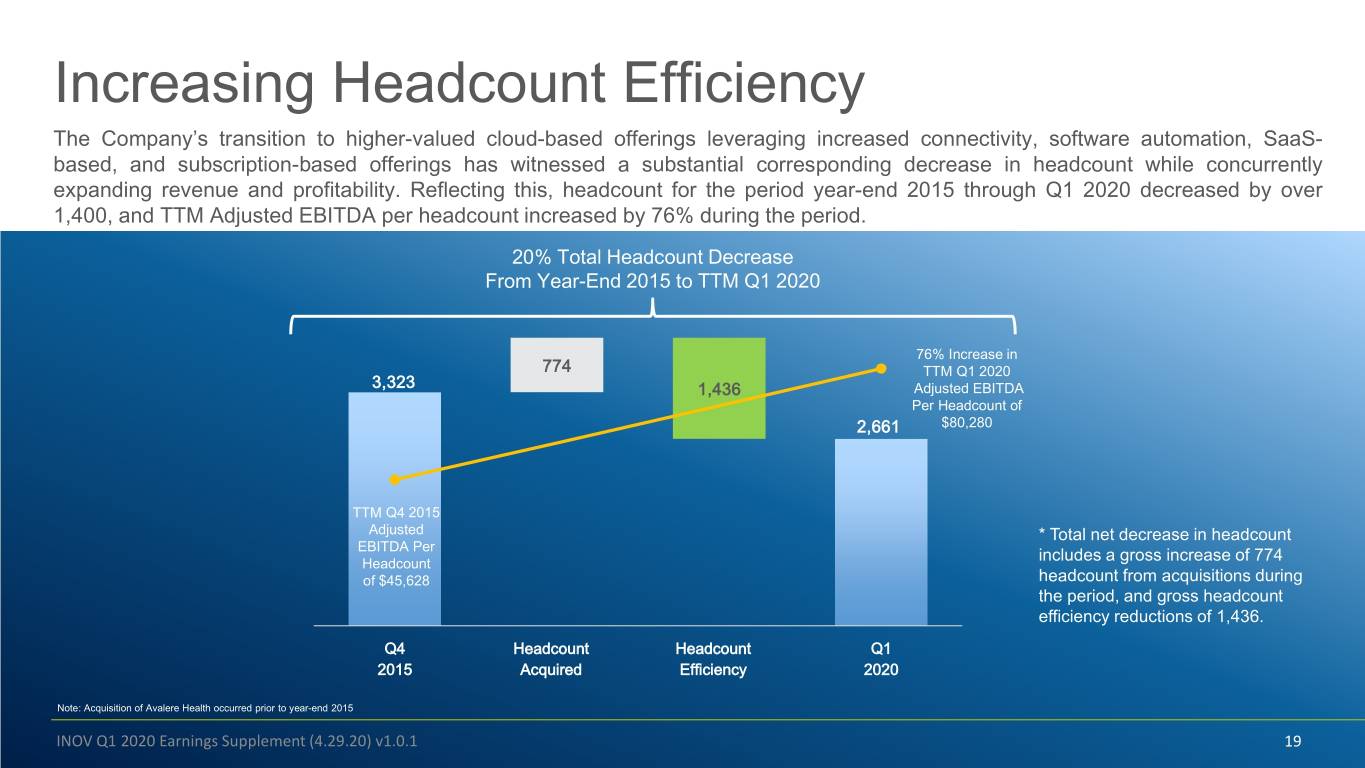

Increasing Headcount Efficiency The Company’s transition to higher-valued cloud-based offerings leveraging increased connectivity, software automation, SaaS- based, and subscription-based offerings has witnessed a substantial corresponding decrease in headcount while concurrently expanding revenue and profitability. Reflecting this, headcount for the period year-end 2015 through Q1 2020 decreased by over 1,400, and TTM Adjusted EBITDA per headcount increased by 76% during the period. 20% Total Headcount Decrease From Year-End 2015 to TTM Q1 2020 76% Increase in 774 TTM Q1 2020 3,323 1,436 Adjusted EBITDA Per Headcount of 2,661 $80,280 TTM Q4 2015 Adjusted * Total net decrease in headcount EBITDA Per Headcount includes a gross increase of 774 of $45,628 headcount from acquisitions during the period, and gross headcount efficiency reductions of 1,436. Q4 Headcount Headcount Q1 2015 Acquired Efficiency 2020 Note: Acquisition of Avalere Health occurred prior to year-end 2015 INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 19

Contents 1 Overview 2 2020 Q1 & TTM Financial Results This presentation serves as a supplement to the Inovalon announcement on April 29, 2020 pertaining to first quarter (Q1) of 2020 3 2020 Financial Guidance results and guidance. 4 Appendix 1: Reconciliations INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 20

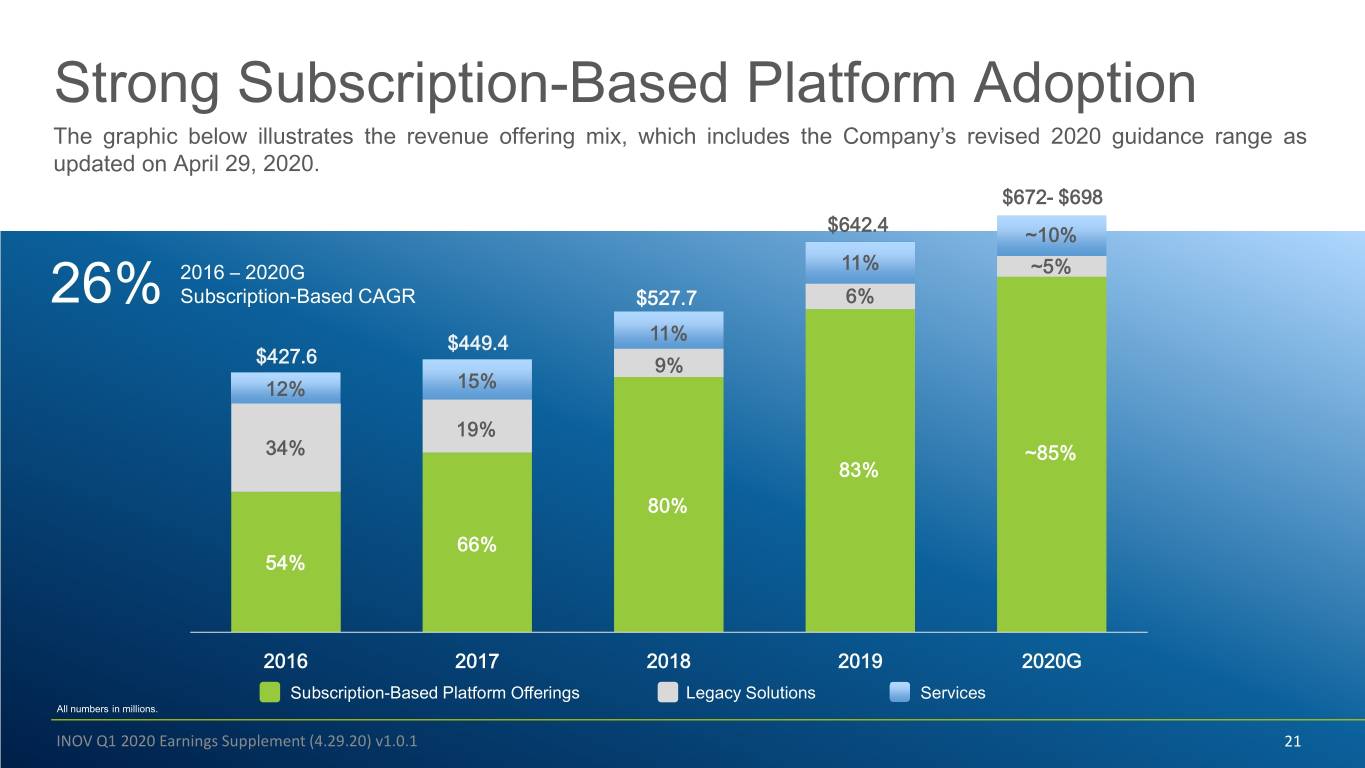

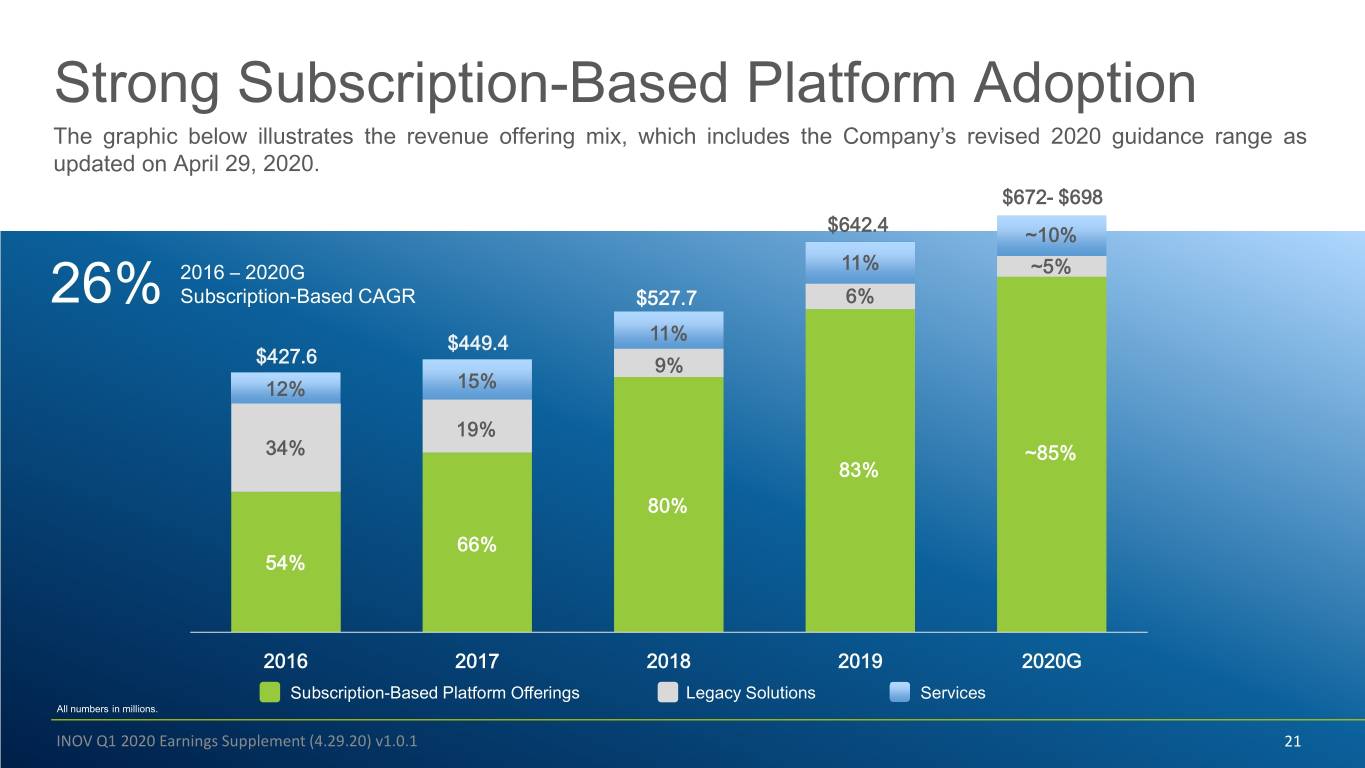

Strong Subscription-Based Platform Adoption The graphic below illustrates the revenue offering mix, which includes the Company’s revised 2020 guidance range as updated on April 29, 2020. $672- $698 $642.4 ~10% 2016 – 2020G 11% ~5% 26% Subscription-Based CAGR $527.7 6% $449.4 11% $427.6 9% 12% 15% 19% 34% ~85% 83% 80% 66% 54% 2016 2017 2018 2019 2020G Subscription-Based Platform Offerings Legacy Solutions Services All numbers in millions. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 21

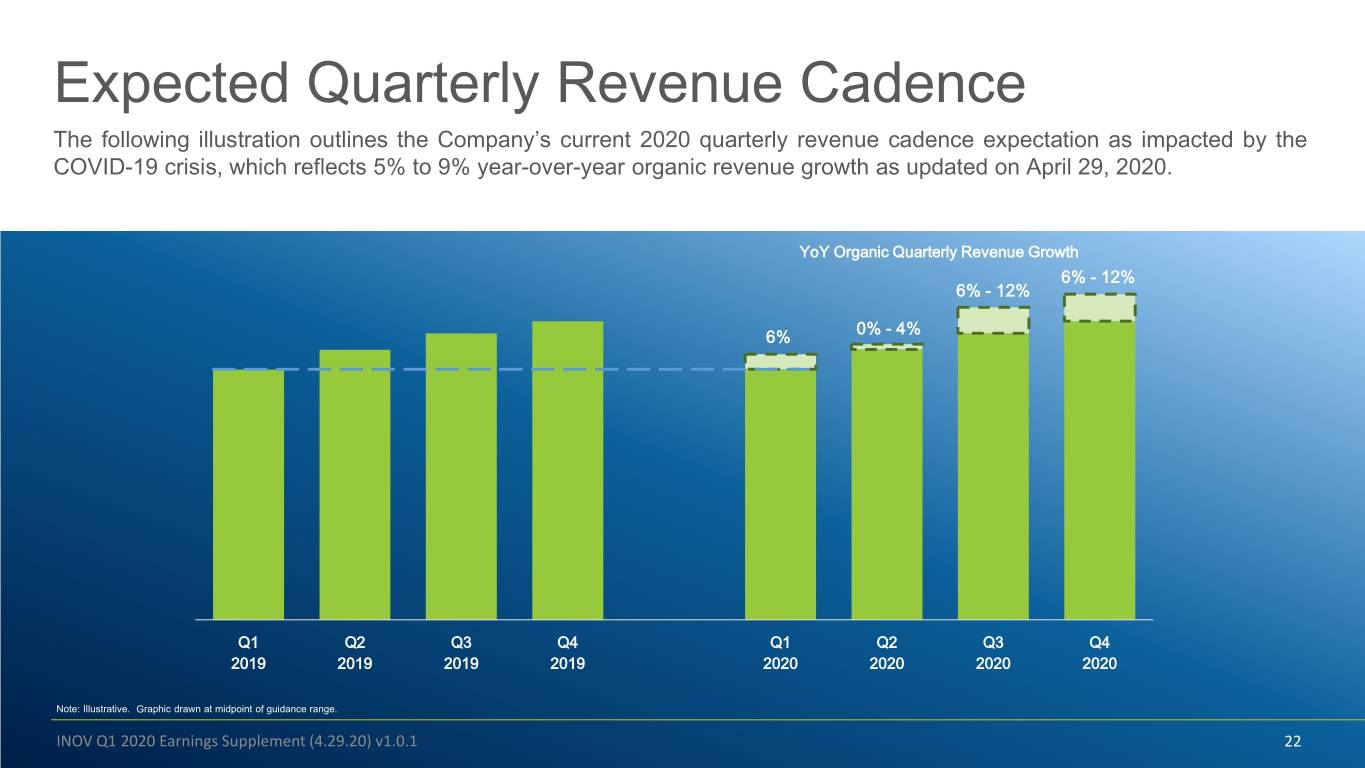

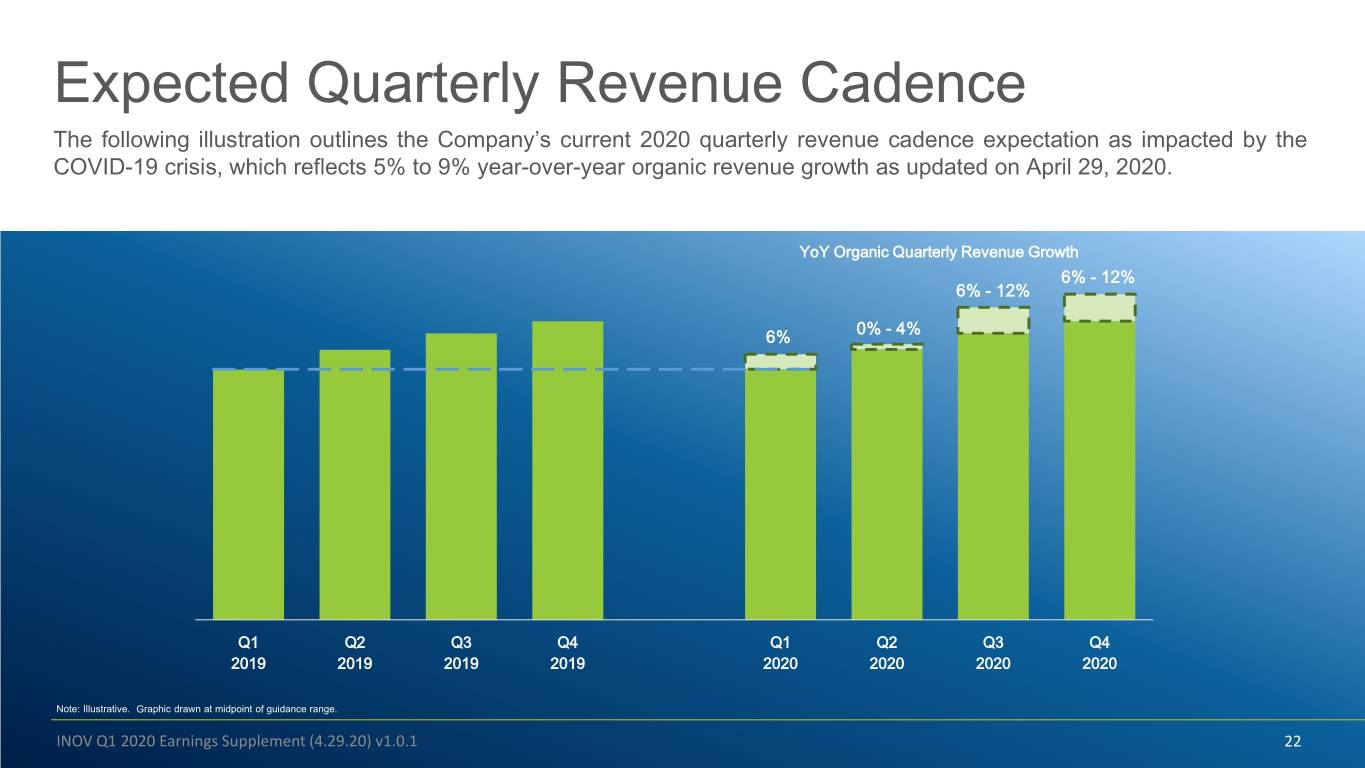

Expected Quarterly Revenue Cadence The following illustration outlines the Company’s current 2020 quarterly revenue cadence expectation as impacted by the COVID-19 crisis, which reflects 5% to 9% year-over-year organic revenue growth as updated on April 29, 2020. YoY Organic Quarterly Revenue Growth 6% - 12% 6% - 12% 6% 0% - 4% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2019 2019 2019 2019 2020 2020 2020 2020 Note: Illustrative. Graphic drawn at midpoint of guidance range. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 22

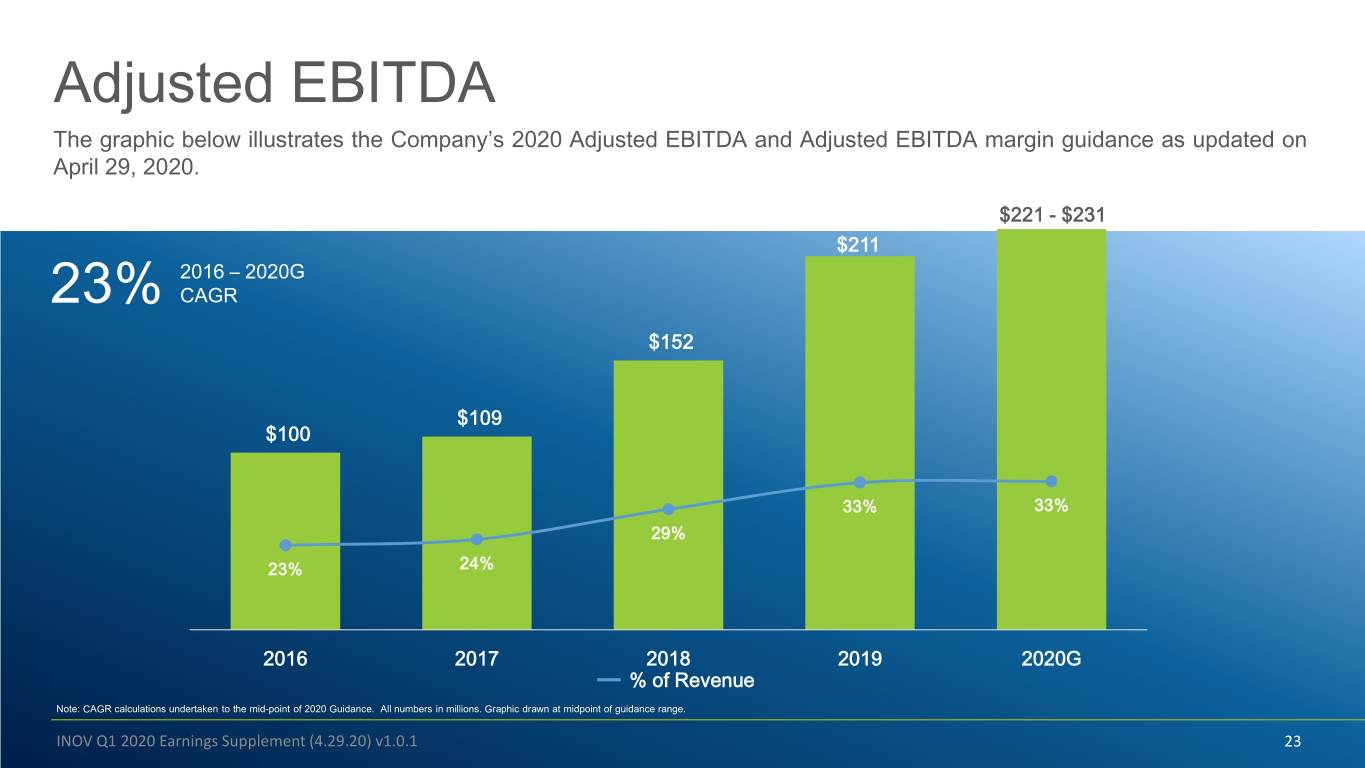

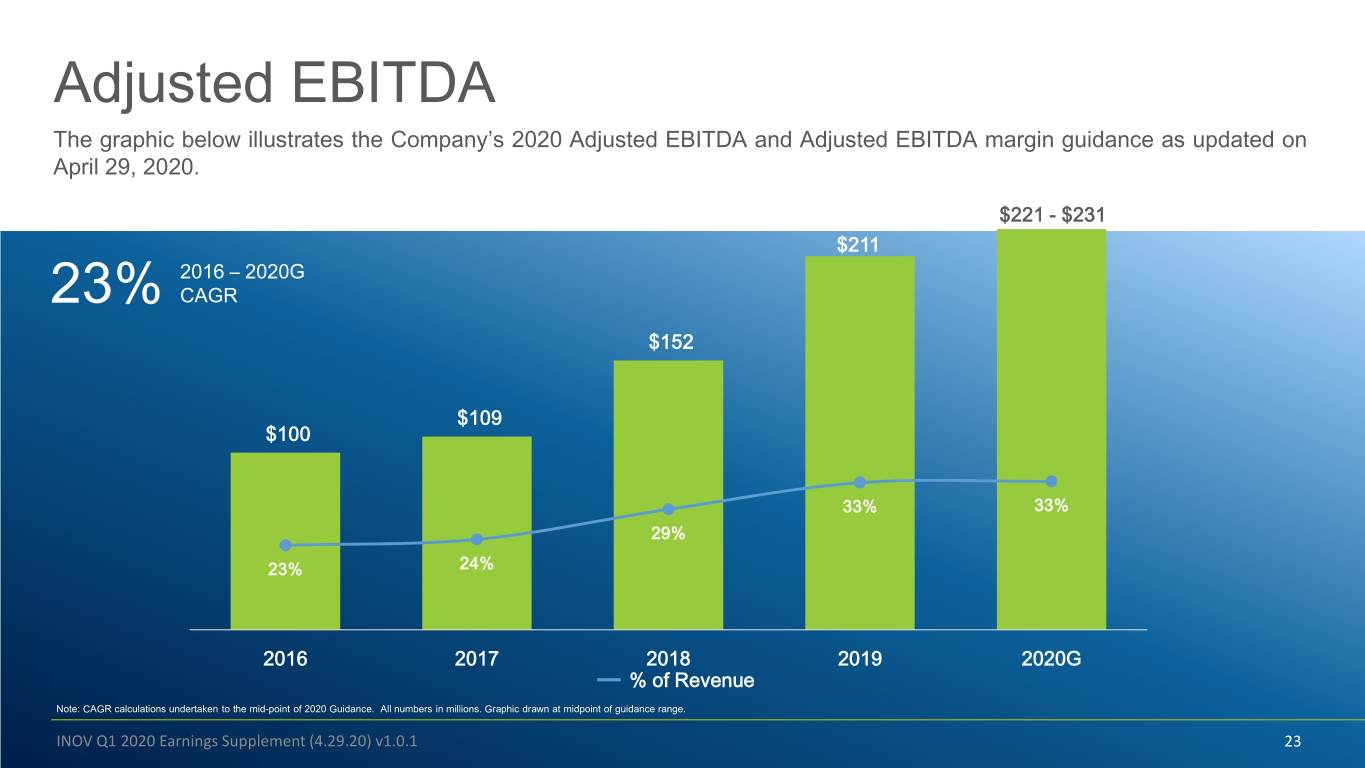

Adjusted EBITDA The graphic below illustrates the Company’s 2020 Adjusted EBITDA and Adjusted EBITDA margin guidance as updated on April 29, 2020. $221 - $231 $211 2016 – 2020G 23% CAGR $152 $109 $100 33% 33% 29% 23% 24% 2016 2017 2018 2019 2020G % of Revenue Note: CAGR calculations undertaken to the mid-point of 2020 Guidance. All numbers in millions. Graphic drawn at midpoint of guidance range. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 23

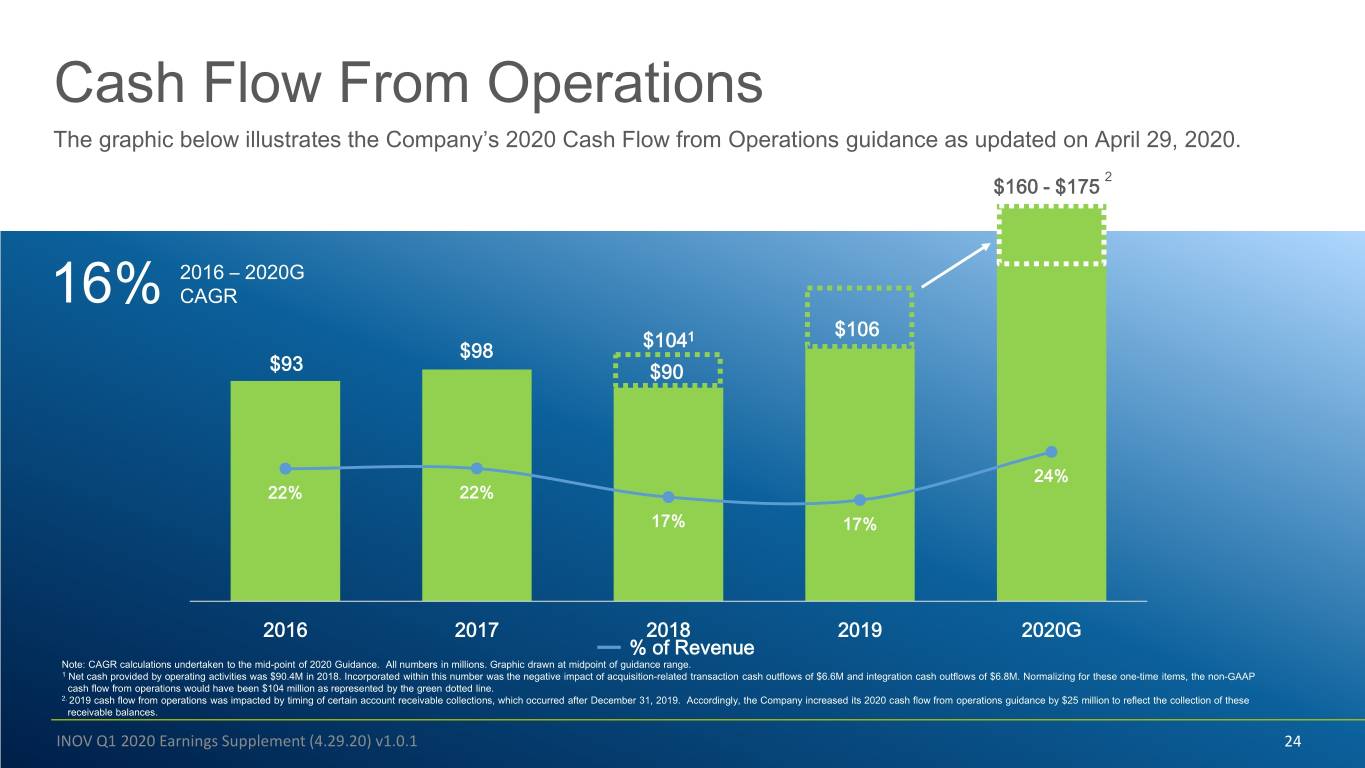

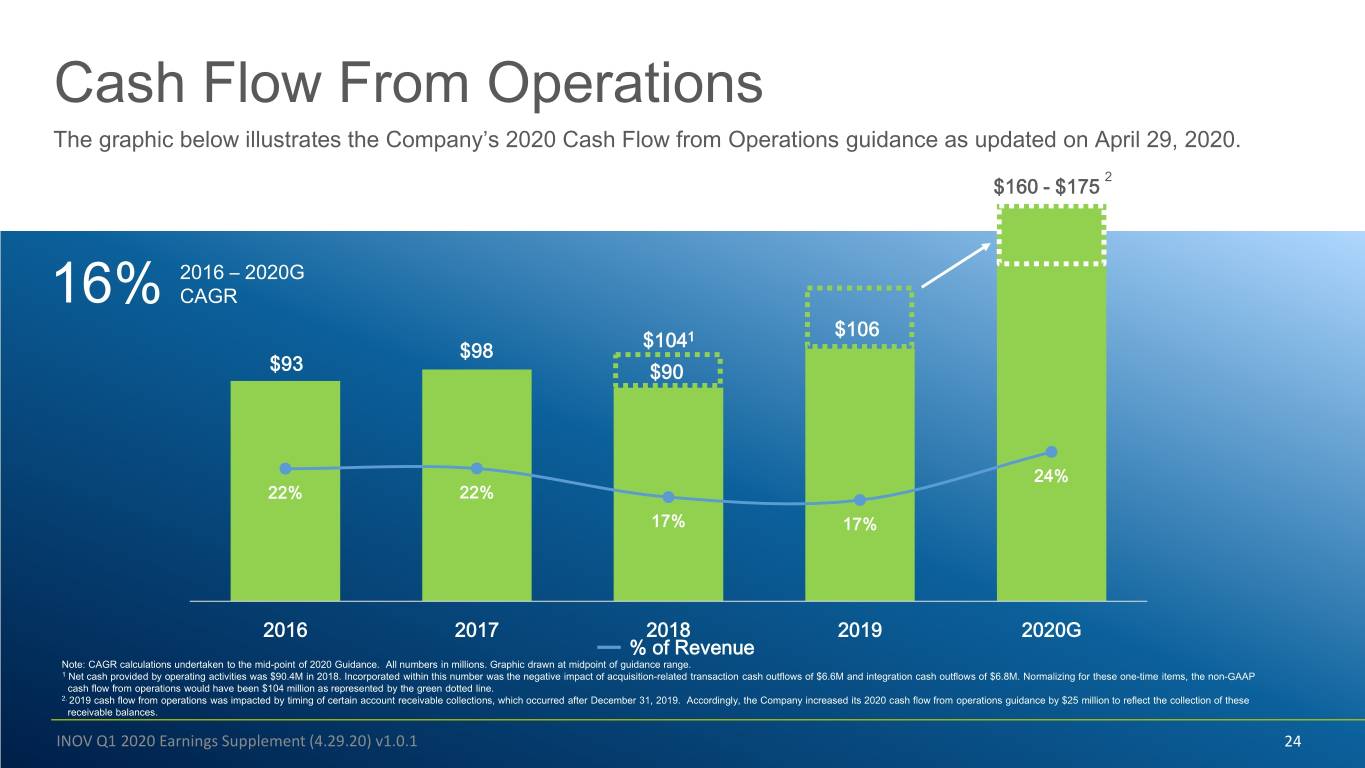

Cash Flow From Operations The graphic below illustrates the Company’s 2020 Cash Flow from Operations guidance as updated on April 29, 2020. 2 $160 - $175 2016 – 2020G 16% CAGR $106 $1041 $98 $93 $90 24% 22% 22% 17% 17% 2016 2017 2018 2019 2020G % of Revenue Note: CAGR calculations undertaken to the mid-point of 2020 Guidance. All numbers in millions. Graphic drawn at midpoint of guidance range. 1 Net cash provided by operating activities was $90.4M in 2018. Incorporated within this number was the negative impact of acquisition-related transaction cash outflows of $6.6M and integration cash outflows of $6.8M. Normalizing for these one-time items, the non-GAAP cash flow from operations would have been $104 million as represented by the green dotted line. 2. 2019 cash flow from operations was impacted by timing of certain account receivable collections, which occurred after December 31, 2019. Accordingly, the Company increased its 2020 cash flow from operations guidance by $25 million to reflect the collection of these receivable balances. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 24

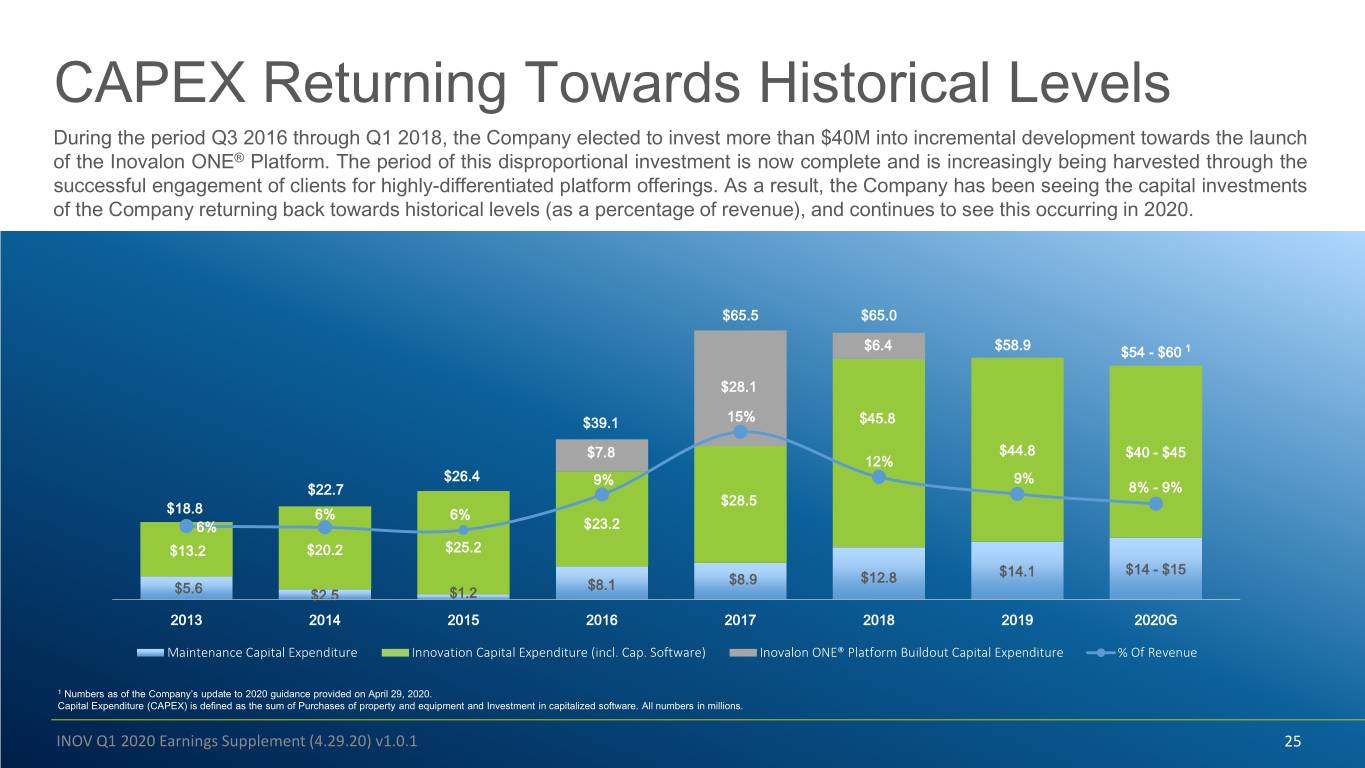

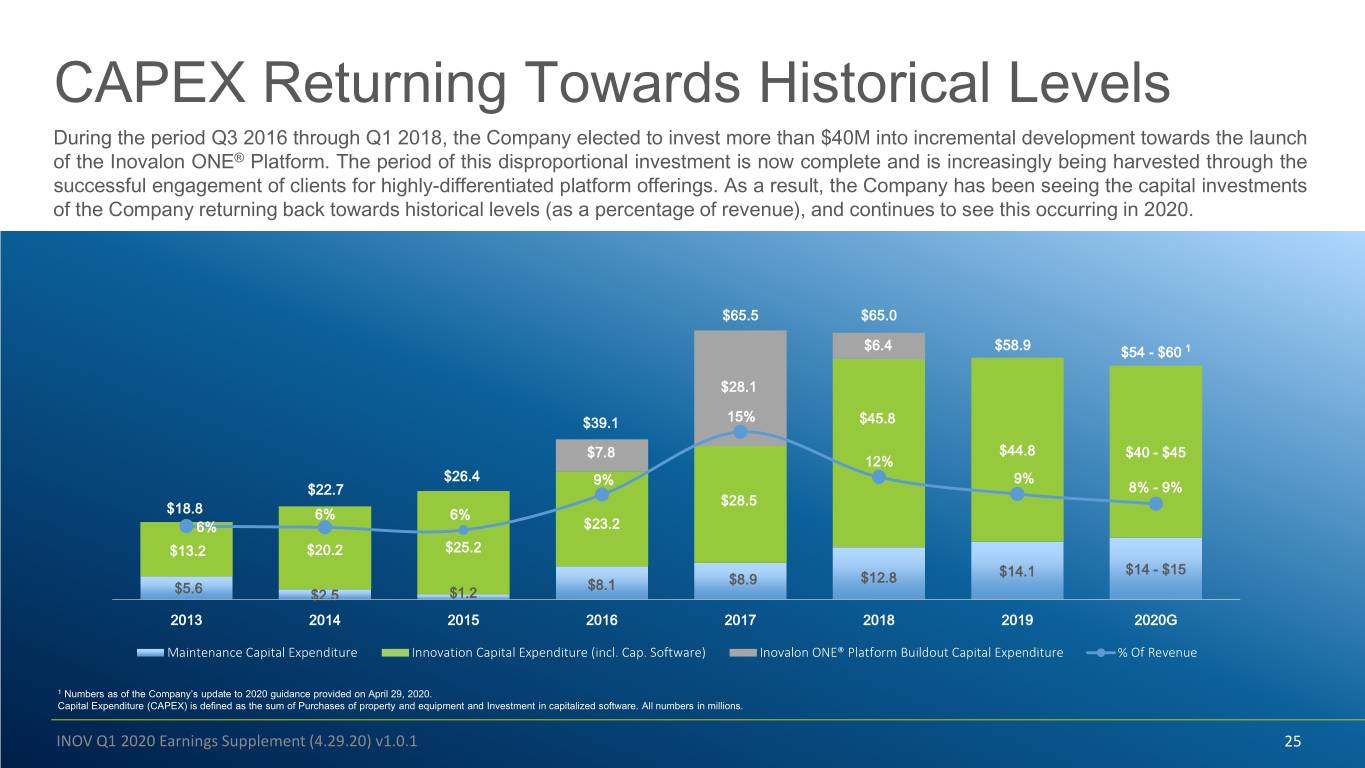

CAPEX Returning Towards Historical Levels During the period Q3 2016 through Q1 2018, the Company elected to invest more than $40M into incremental development towards the launch of the Inovalon ONE® Platform. The period of this disproportional investment is now complete and is increasingly being harvested through the successful engagement of clients for highly-differentiated platform offerings. As a result, the Company has been seeing the capital investments of the Company returning back towards historical levels (as a percentage of revenue), and continues to see this occurring in 2020. $65.5 $65.0 $58.9 $6.4 $54 - $60 1 $28.1 $39.1 15% $45.8 $7.8 $44.8 $40 - $45 12% $26.4 9% 9% $22.7 8% - 9% $28.5 $18.8 6% 6% 6% $23.2 $13.2 $20.2 $25.2 $14 - $15 $12.8 $14.1 $8.1 $8.9 $5.6 $2.5 $1.2 2013 2014 2015 2016 2017 2018 2019 2020G Maintenance Capital Expenditure Innovation Capital Expenditure (incl. Cap. Software) Inovalon ONE® Platform Buildout Capital Expenditure % Of Revenue 1 Numbers as of the Company’s update to 2020 guidance provided on April 29, 2020. Capital Expenditure (CAPEX) is defined as the sum of Purchases of property and equipment and Investment in capitalized software. All numbers in millions. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 25

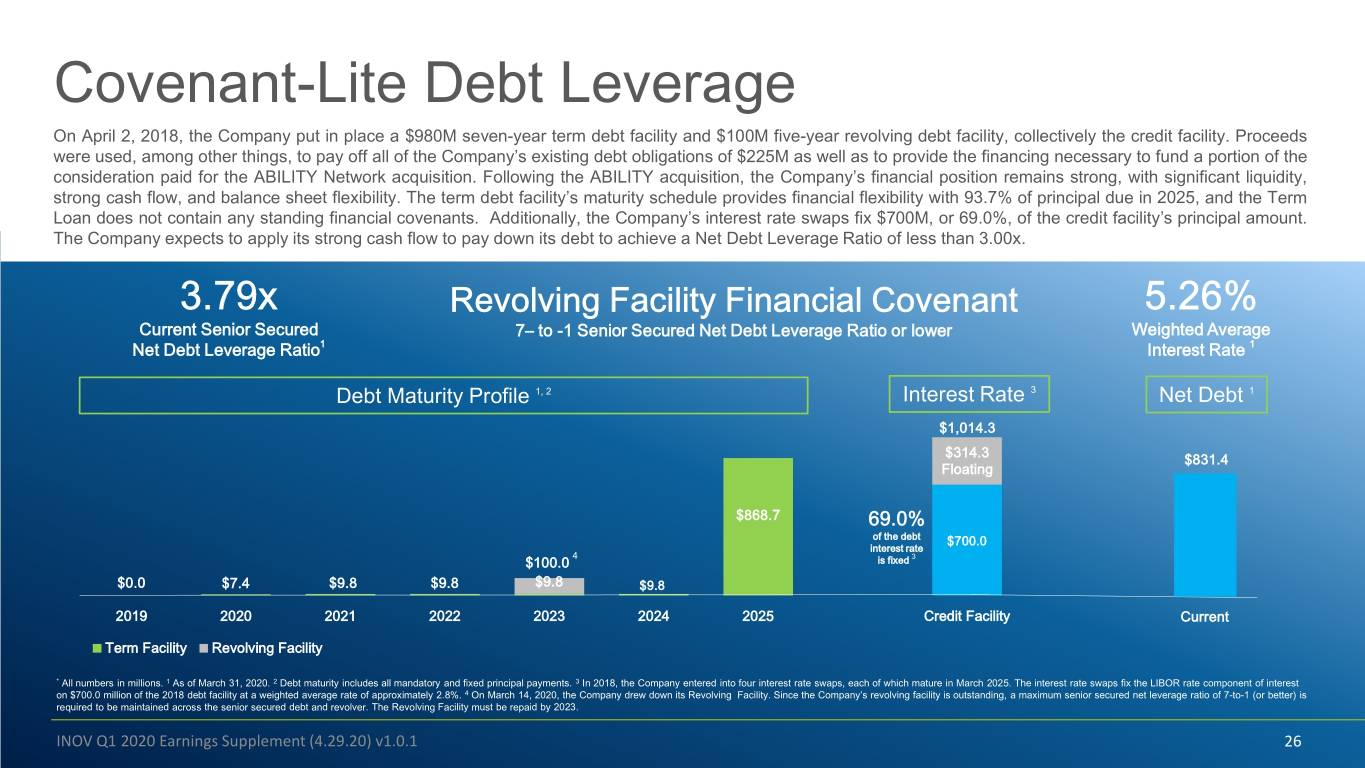

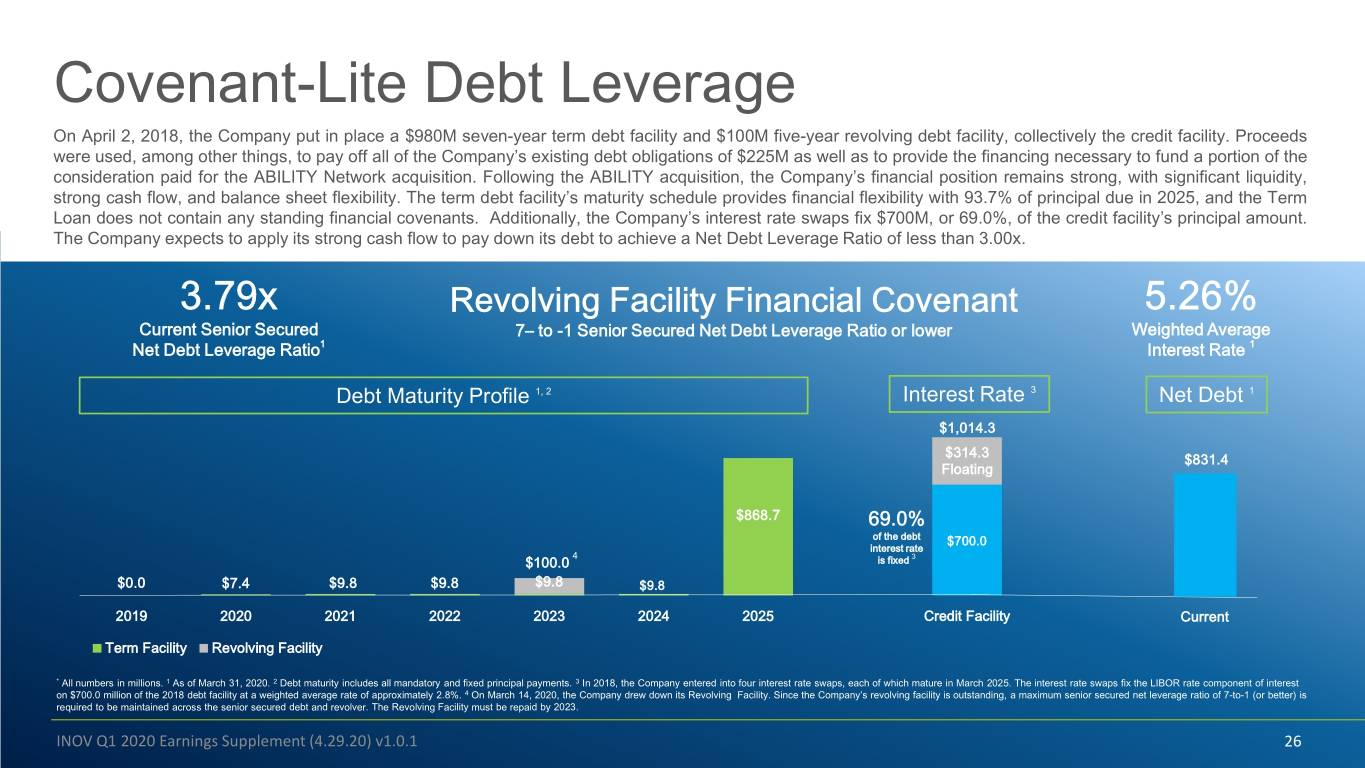

Covenant-Lite Debt Leverage On April 2, 2018, the Company put in place a $980M seven-year term debt facility and $100M five-year revolving debt facility, collectively the credit facility. Proceeds were used, among other things, to pay off all of the Company’s existing debt obligations of $225M as well as to provide the financing necessary to fund a portion of the consideration paid for the ABILITY Network acquisition. Following the ABILITY acquisition, the Company’s financial position remains strong, with significant liquidity, strong cash flow, and balance sheet flexibility. The term debt facility’s maturity schedule provides financial flexibility with 93.7% of principal due in 2025, and the Term Loan does not contain any standing financial covenants. Additionally, the Company’s interest rate swaps fix $700M, or 69.0%, of the credit facility’s principal amount. The Company expects to apply its strong cash flow to pay down its debt to achieve a Net Debt Leverage Ratio of less than 3.00x. 3.79x Revolving Facility Financial Covenant 5.26% Current Senior Secured 7– to -1 Senior Secured Net Debt Leverage Ratio or lower Weighted Average Net Debt Leverage Ratio1 Interest Rate 1 Debt Maturity Profile 1, 2 Interest Rate 3 Net Debt 1 $1,014.3 $314.3 $831.4 Floating $868.7 69.0% of the debt $700.0 interest rate 4 3 $100.0 is fixed $0.0 $7.4 $9.8 $9.8 $9.8 $9.8 2019 2020 2021 2022 2023 2024 2025 Credit Facility Current Term Facility Revolving Facility * All numbers in millions. 1 As of March 31, 2020. 2 Debt maturity includes all mandatory and fixed principal payments. 3 In 2018, the Company entered into four interest rate swaps, each of which mature in March 2025. The interest rate swaps fix the LIBOR rate component of interest on $700.0 million of the 2018 debt facility at a weighted average rate of approximately 2.8%. 4 On March 14, 2020, the Company drew down its Revolving Facility. Since the Company’s revolving facility is outstanding, a maximum senior secured net leverage ratio of 7-to-1 (or better) is required to be maintained across the senior secured debt and revolver. The Revolving Facility must be repaid by 2023. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 26

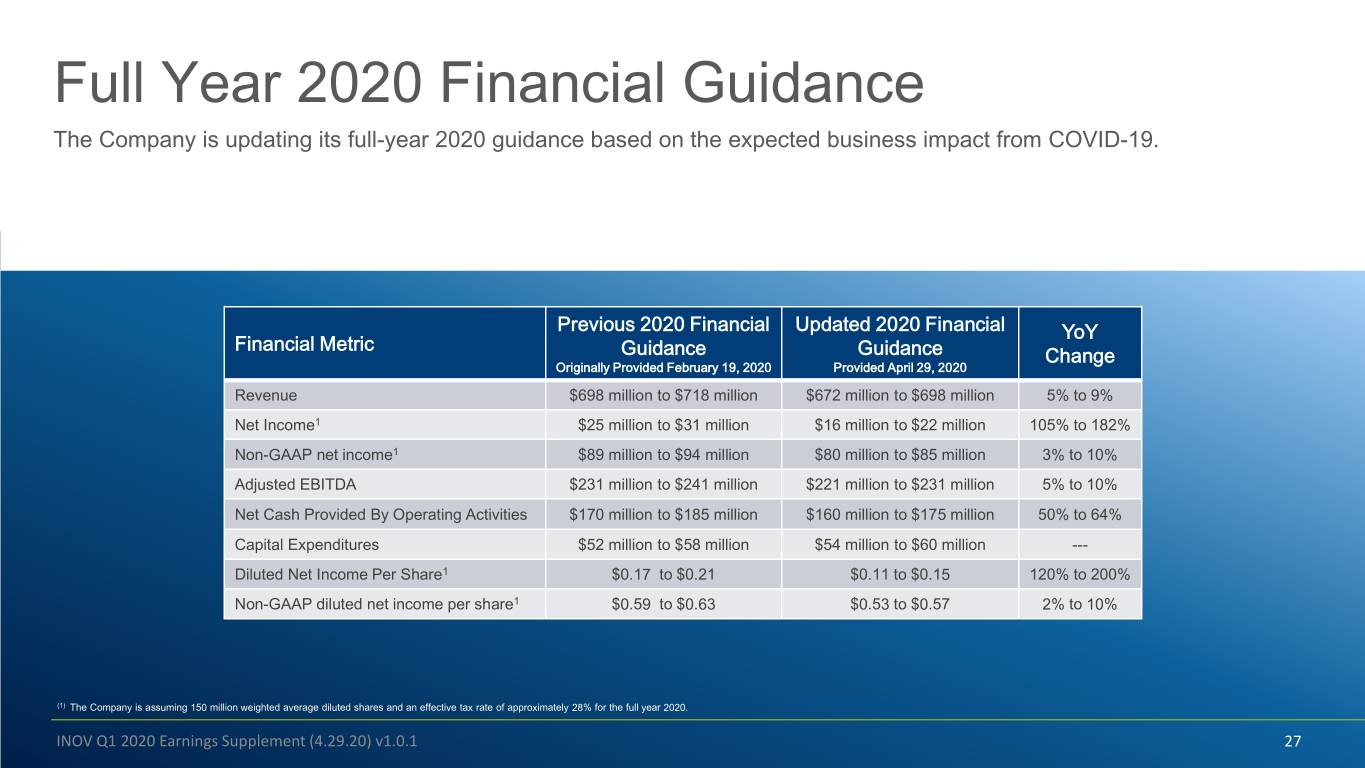

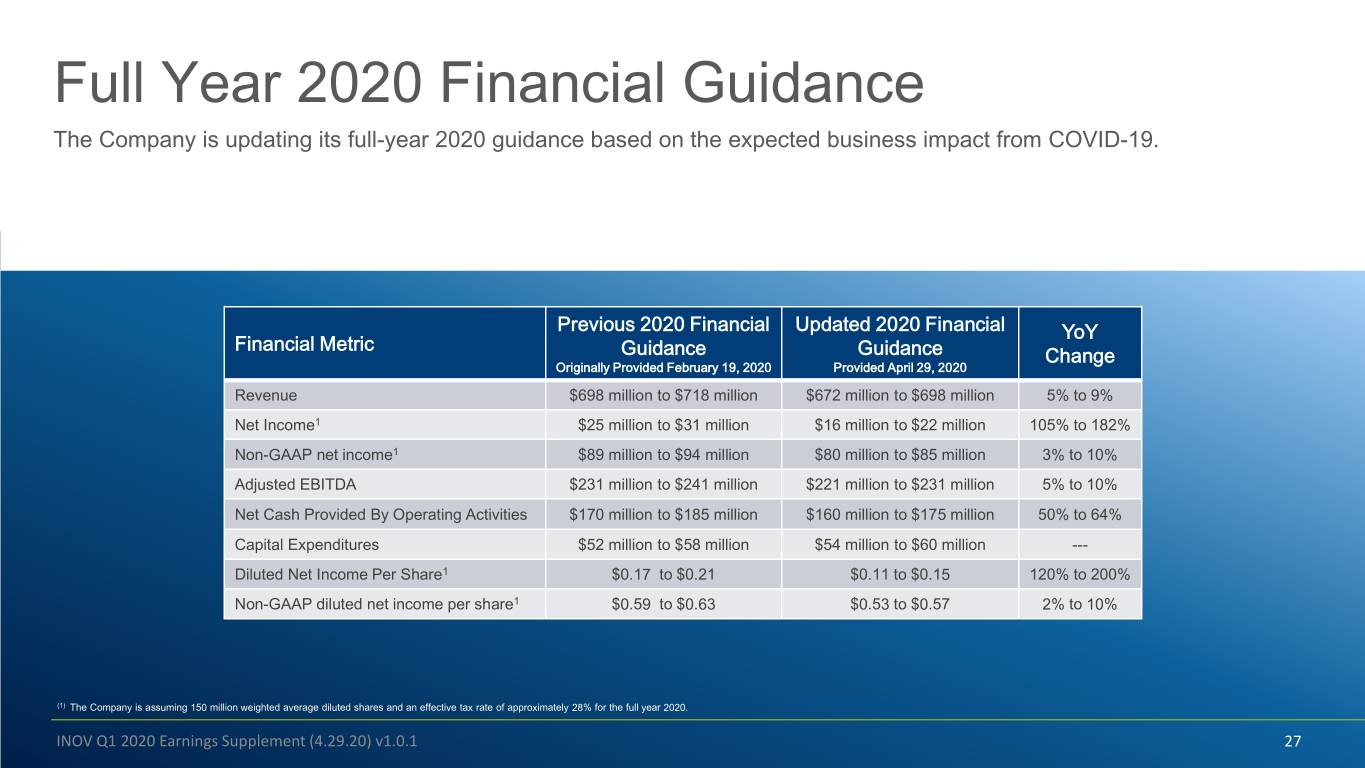

Full Year 2020 Financial Guidance The Company is updating its full-year 2020 guidance based on the expected business impact from COVID-19. Previous 2020 Financial Updated 2020 Financial YoY Financial Metric Guidance Guidance Change Originally Provided February 19, 2020 Provided April 29, 2020 Revenue $698 million to $718 million $672 million to $698 million 5% to 9% Net Income1 $25 million to $31 million $16 million to $22 million 105% to 182% Non-GAAP net income1 $89 million to $94 million $80 million to $85 million 3% to 10% Adjusted EBITDA $231 million to $241 million $221 million to $231 million 5% to 10% Net Cash Provided By Operating Activities $170 million to $185 million $160 million to $175 million 50% to 64% Capital Expenditures $52 million to $58 million $54 million to $60 million --- Diluted Net Income Per Share1 $0.17 to $0.21 $0.11 to $0.15 120% to 200% Non-GAAP diluted net income per share1 $0.59 to $0.63 $0.53 to $0.57 2% to 10% (1) The Company is assuming 150 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2020. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 27

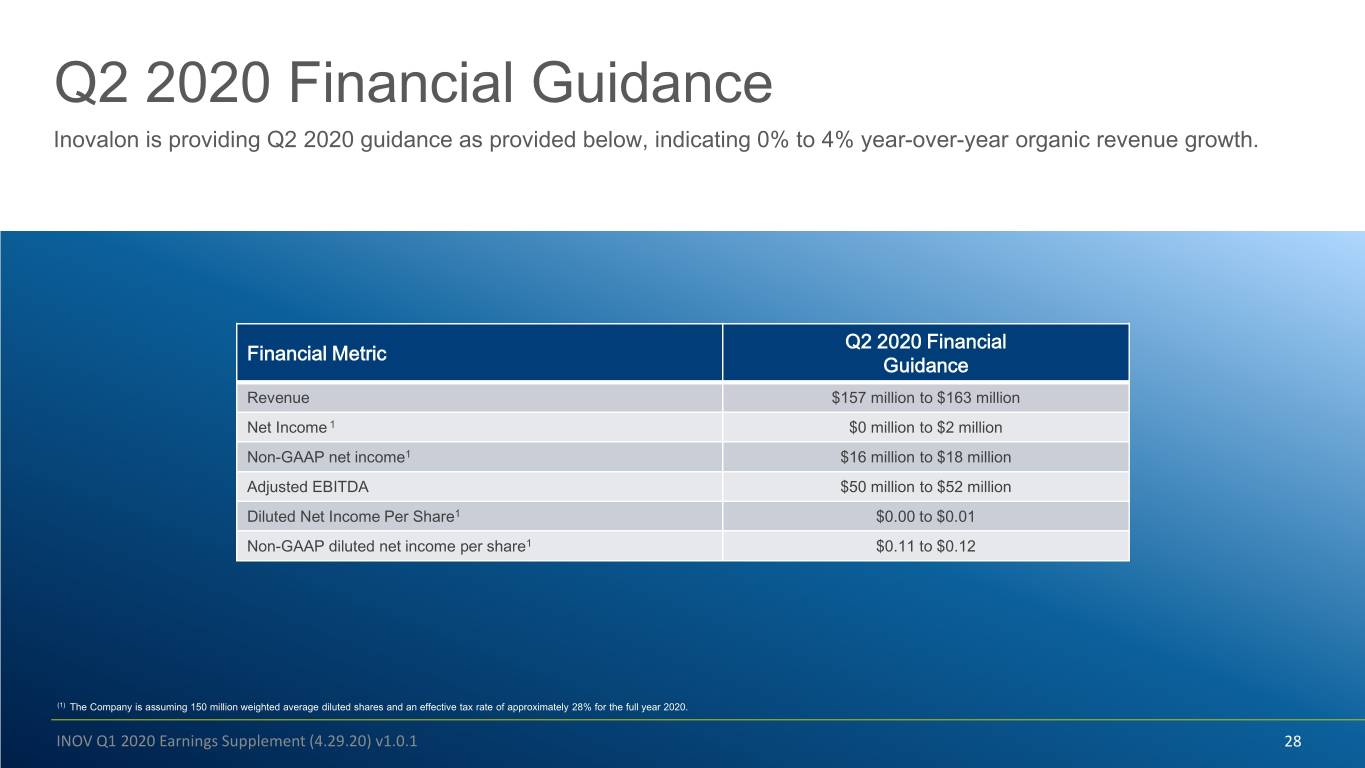

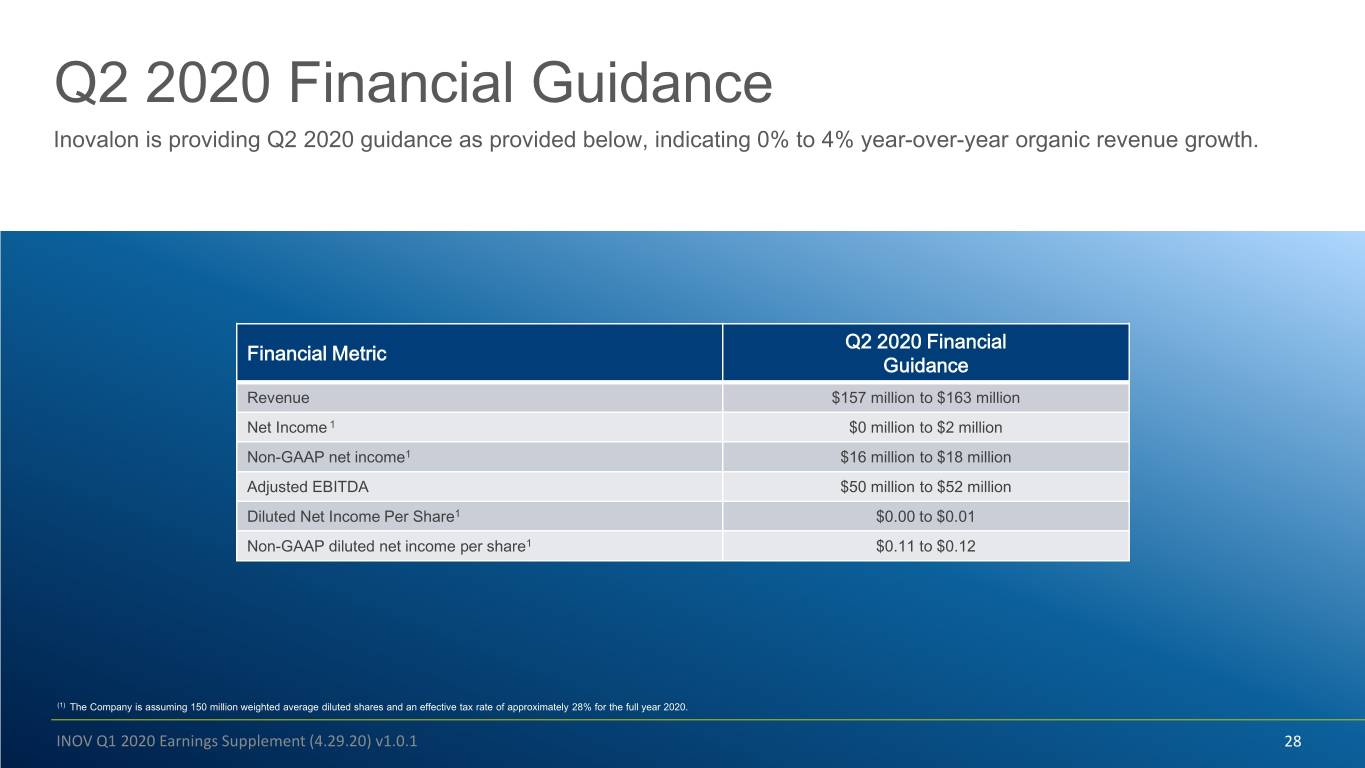

Q2 2020 Financial Guidance Inovalon is providing Q2 2020 guidance as provided below, indicating 0% to 4% year-over-year organic revenue growth. Q2 2020 Financial Financial Metric Guidance Revenue $157 million to $163 million Net Income 1 $0 million to $2 million Non-GAAP net income1 $16 million to $18 million Adjusted EBITDA $50 million to $52 million Diluted Net Income Per Share1 $0.00 to $0.01 Non-GAAP diluted net income per share1 $0.11 to $0.12 (1) The Company is assuming 150 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2020. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 28

Contents 1 Overview 2 2020 Q1 & TTM Financial Results This presentation serves as a supplement to the Inovalon announcement on April 29, 2020 pertaining to first quarter (Q1) of 2020 3 2020 Financial Guidance results and guidance. 4 Appendix 1: Reconciliations INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 29

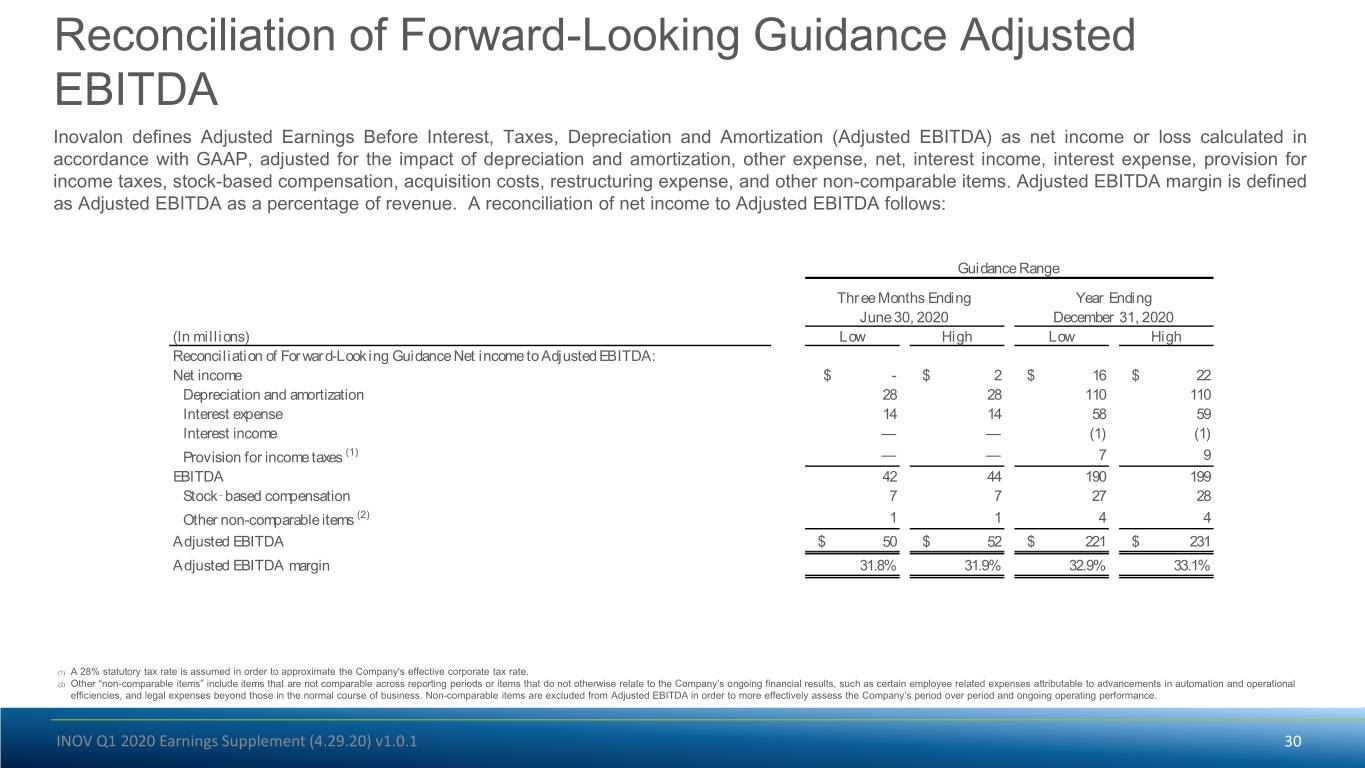

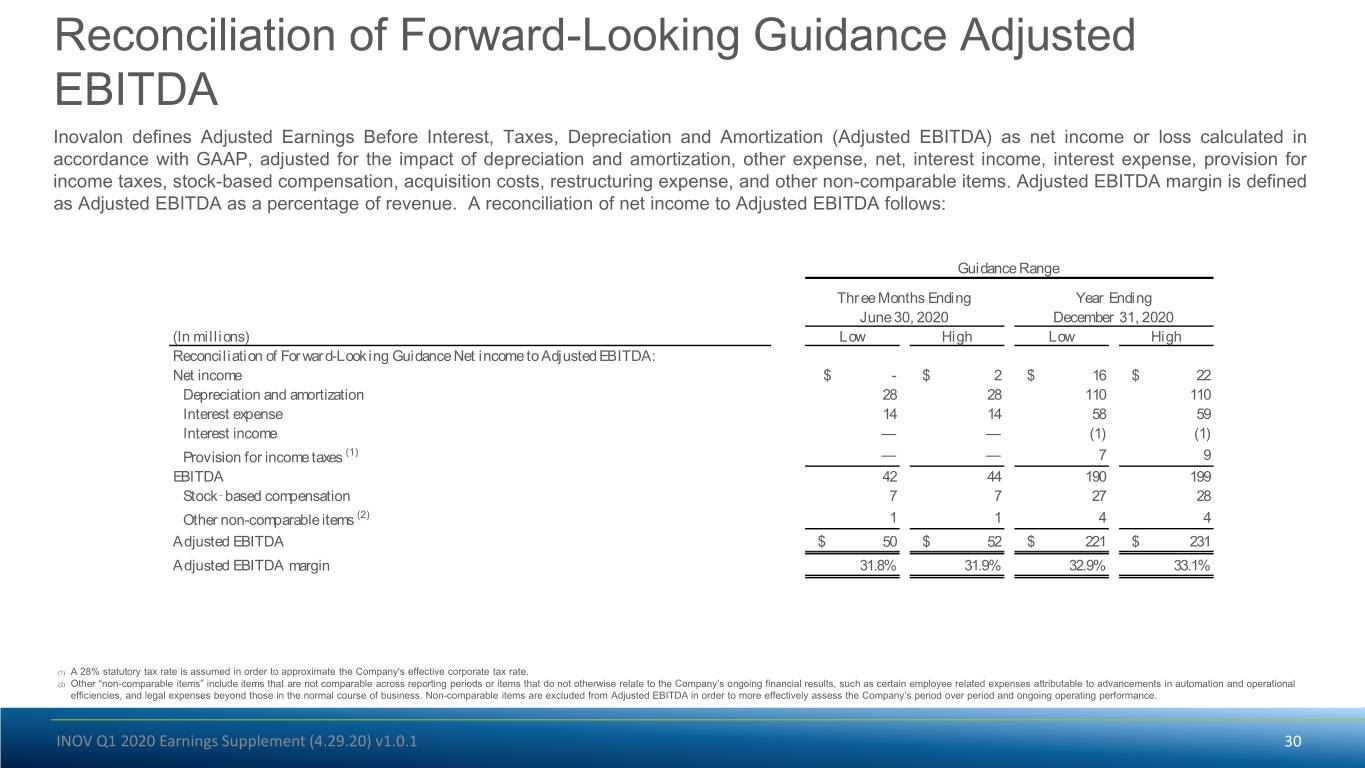

Reconciliation of Forward-Looking Guidance Adjusted EBITDA Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income or loss calculated in accordance with GAAP, adjusted for the impact of depreciation and amortization, other expense, net, interest income, interest expense, provision for income taxes, stock-based compensation, acquisition costs, restructuring expense, and other non-comparable items. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of revenue. A reconciliation of net income to Adjusted EBITDA follows: Guidance Range Three Months Ending Year Ending June 30, 2020 December 31, 2020 (In millions) Low High Low High Reconciliation of Forward-Looking Guidance Net income to Adjusted EBITDA: Net income $ - $ 2 $ 16 $ 22 Depreciation and amortization 28 28 110 110 Interest expense 14 14 58 59 Interest income — — (1) (1) Provision for income taxes (1) — — 7 9 EBITDA 42 44 190 199 Stock‑based compensation 7 7 27 28 Other non-comparable items (2) 1 1 4 4 Adjusted EBITDA $ 50 $ 52 $ 221 $ 231 Adjusted EBITDA margin 31.8% 31.9% 32.9% 33.1% (1) A 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate. (2) Other “non-comparable items” include items that are not comparable across reporting periods or items that do not otherwise relate to the Company’s ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Adjusted EBITDA in order to more effectively assess the Company’s period over period and ongoing operating performance. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 30

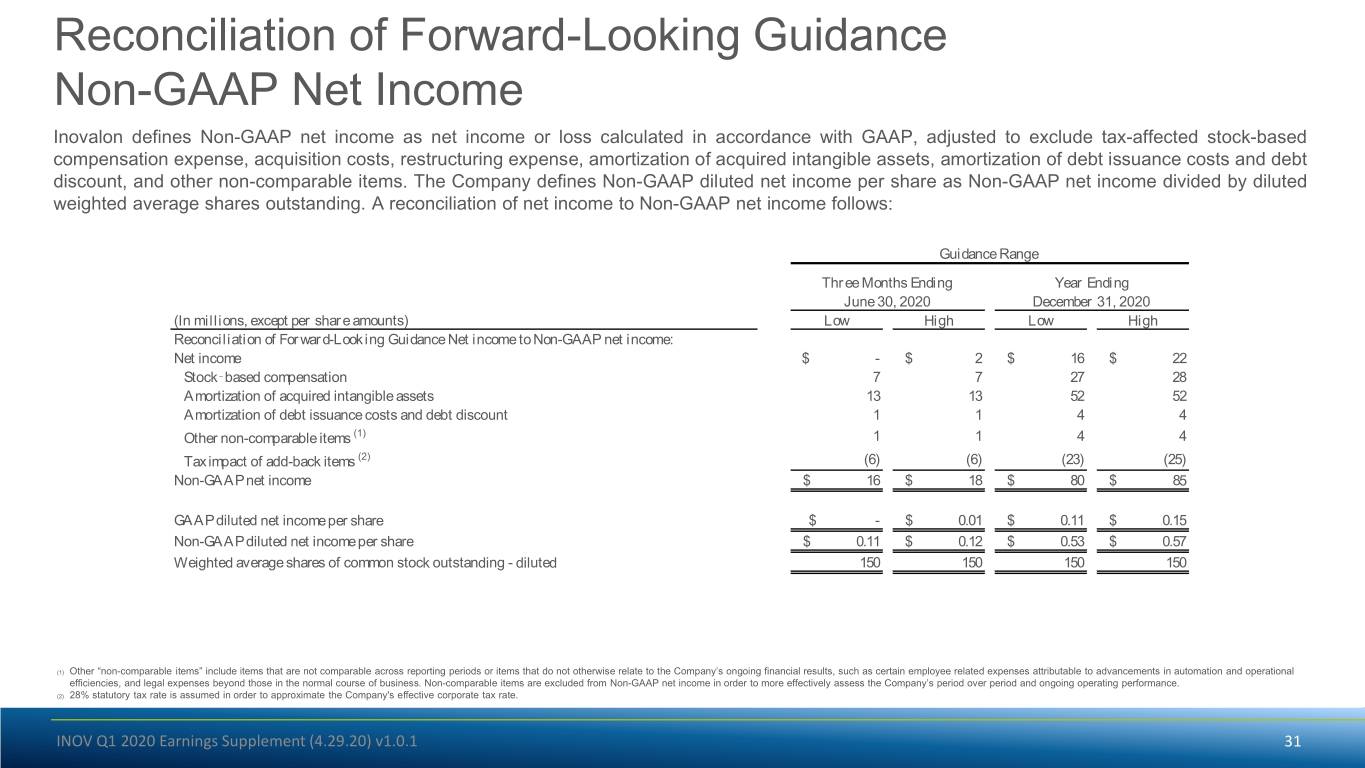

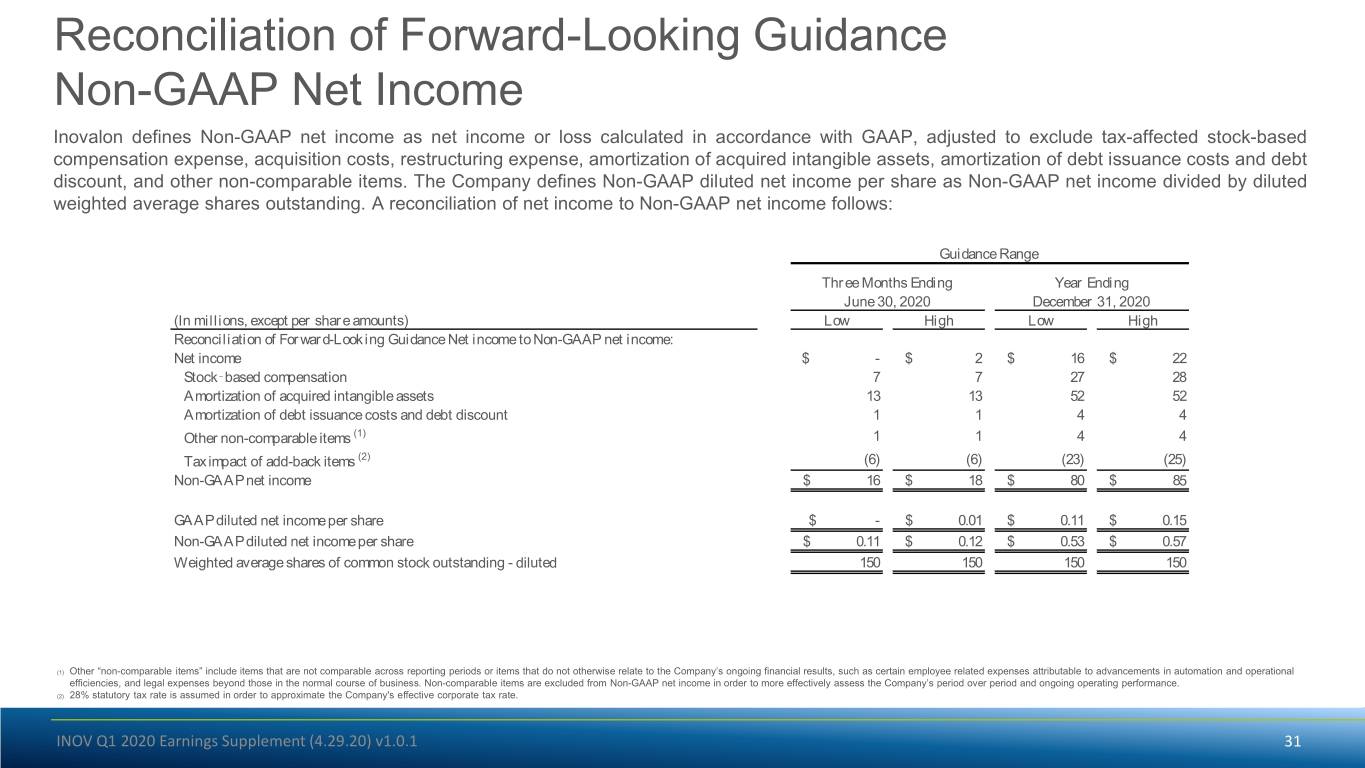

Reconciliation of Forward-Looking Guidance Non-GAAP Net Income Inovalon defines Non-GAAP net income as net income or loss calculated in accordance with GAAP, adjusted to exclude tax-affected stock-based compensation expense, acquisition costs, restructuring expense, amortization of acquired intangible assets, amortization of debt issuance costs and debt discount, and other non-comparable items. The Company defines Non-GAAP diluted net income per share as Non-GAAP net income divided by diluted weighted average shares outstanding. A reconciliation of net income to Non-GAAP net income follows: Guidance Range Three Months Ending Year Ending June 30, 2020 December 31, 2020 (In millions, except per share amounts) Low High Low High Reconciliation of Forward-Looking Guidance Net income to Non-GAAP net income: Net income $ - $ 2 $ 16 $ 22 Stock‑based compensation 7 7 27 28 Amortization of acquired intangible assets 13 13 52 52 Amortization of debt issuance costs and debt discount 1 1 4 4 Other non-comparable items (1) 1 1 4 4 Tax impact of add-back items (2) (6) (6) (23) (25) Non-GAAP net income $ 16 $ 18 $ 80 $ 85 GAAP diluted net income per share $ - $ 0.01 $ 0.11 $ 0.15 Non-GAAP diluted net income per share $ 0.11 $ 0.12 $ 0.53 $ 0.57 Weighted average shares of common stock outstanding - diluted 150 150 150 150 (1) Other “non-comparable items” include items that are not comparable across reporting periods or items that do not otherwise relate to the Company’s ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Non-GAAP net income in order to more effectively assess the Company’s period over period and ongoing operating performance. (2) 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 31

Definitions 1. Annual Recurring Revenue is defined as subscription-based revenue from existing clients plus outstanding intra-year renewals valued at an amount agreed upon in principal. 2. Annual Revenue Retention is defined as the percentage of revenue from engagements with existing clients in the prior year present in the current year. For example, Annual Revenue Retention would be less than 100% if there was a net loss of revenue from existing clients who either downsized or exited existing engagements, and would be more than 100% if on a net basis existing clients expanded existing engagements. 3. Annualized Contract Value (ACV) is defined as a metric reflecting the sum of the first 12 months of revenue expected from contracts signed during a specific period (such as a quarter or year). New sales ACV refers to the sum of the first 12 months of revenue expected from new sales contracts signed during a specific period (such as a quarter or year). 4. Coverage is defined as the sum of Annual Recurring Revenue, Legacy revenue under contract, and expected Services revenue, divided by the specified year's revenue guidance. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 32

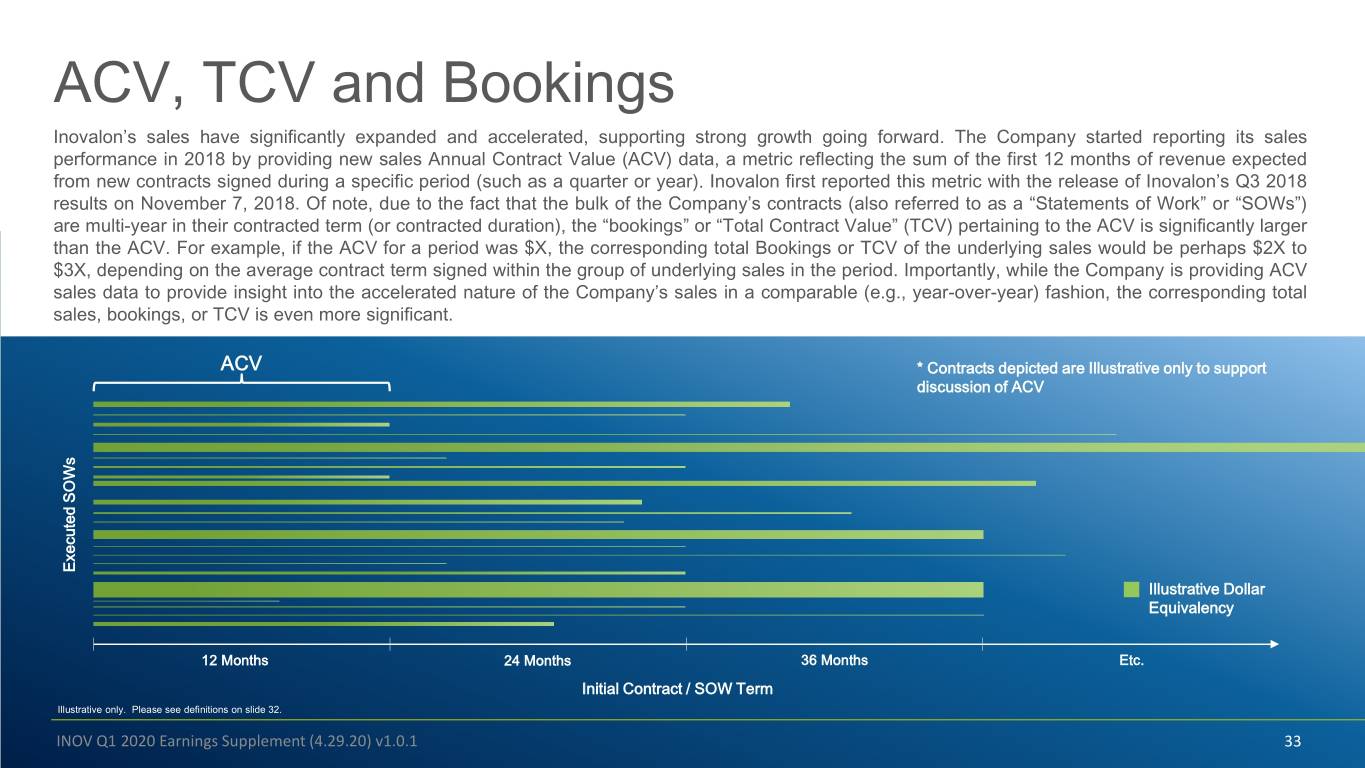

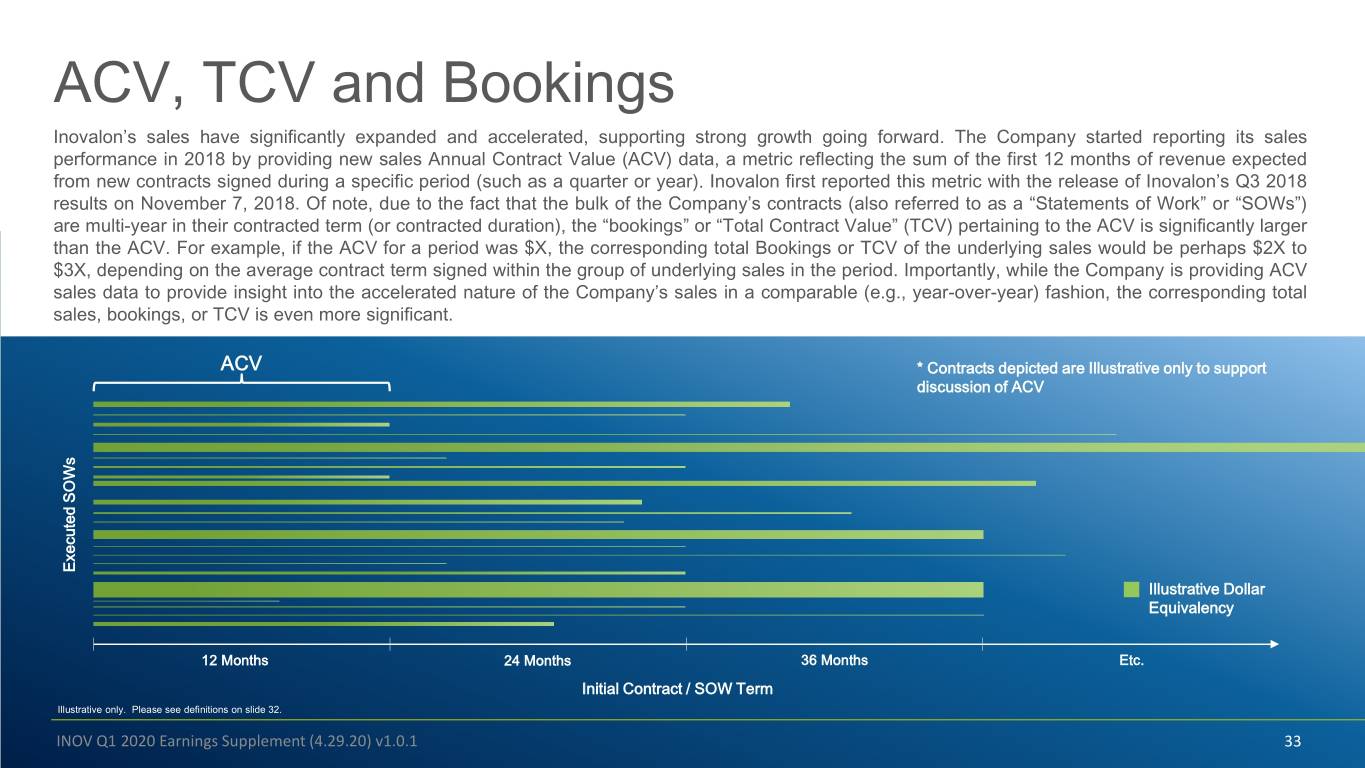

ACV, TCV and Bookings Inovalon’s sales have significantly expanded and accelerated, supporting strong growth going forward. The Company started reporting its sales performance in 2018 by providing new sales Annual Contract Value (ACV) data, a metric reflecting the sum of the first 12 months of revenue expected from new contracts signed during a specific period (such as a quarter or year). Inovalon first reported this metric with the release of Inovalon’s Q3 2018 results on November 7, 2018. Of note, due to the fact that the bulk of the Company’s contracts (also referred to as a “Statements of Work” or “SOWs”) are multi-year in their contracted term (or contracted duration), the “bookings” or “Total Contract Value” (TCV) pertaining to the ACV is significantly larger than the ACV. For example, if the ACV for a period was $X, the corresponding total Bookings or TCV of the underlying sales would be perhaps $2X to $3X, depending on the average contract term signed within the group of underlying sales in the period. Importantly, while the Company is providing ACV sales data to provide insight into the accelerated nature of the Company’s sales in a comparable (e.g., year-over-year) fashion, the corresponding total sales, bookings, or TCV is even more significant. ACV * Contracts depicted are Illustrative only to support discussion of ACV Executed SOWs Illustrative Dollar Equivalency 12 Months 24 Months 36 Months Etc. Initial Contract / SOW Term Illustrative only. Please see definitions on slide 32. INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1 33

Healthcare Empowered® © 2020 by Inovalon. All rights reserved.