NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

First Quarter 2024 Financial Results

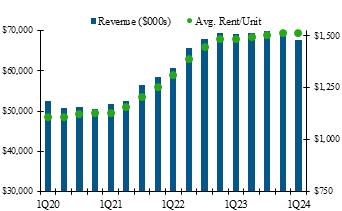

| ● | | Total revenues were $67.6 million for the first quarter of 2024, compared to $69.2 million for the first quarter of 2023. |

| ● | | Net income for the first quarter of 2024 totaled $26.3 million, or income of $1.00 per diluted share, which included $24.3 million of depreciation and amortization expense. This compared to net loss of $(3.9) million, or loss of $(0.15) per diluted share, for the first quarter of 2023, which included $23.3 million of depreciation and amortization expense. |

| ● | | The change in our net income of $26.4 million for the three months ended March 31, 2024 as compared to our net loss of $(3.9) million for the three months ended March 31, 2023 primarily relates to an increase in gain on sale of real estate and a decrease in interest expense, partially offset by an increase in depreciation expense. |

| ● | | For the first quarter of 2024, NOI was $41.1 million on 37 properties, compared to $41.1 million for the first quarter of 2023 on 40 properties. |

| ● | | For the first quarter of 2024, Q1 Same Store NOI increased 4.0% to $39.2 million, compared to $37.7 million for the first quarter of 2023. |

| ● | | For the first quarter of 2024, FFO totaled $18.9 million, or $0.72 per diluted share, compared to $19.3 million, or $0.74 per diluted share, for the first quarter of 2023. |

| ● | | For the first quarter of 2024, Core FFO totaled $19.6 million, or $0.75 per diluted share, compared to $18.6 million, or $0.71 per diluted share, for the first quarter of 2023. |

| ● | | For the first quarter of 2024, AFFO totaled $22.6 million, or $0.86 per diluted share, compared to $21.0 million, or $0.81 per diluted share, for the first quarter of 2023. |

First Quarter Earnings Conference Call

NexPoint Residential Trust, Inc., (“NXRT” or the “Company”), (NYSE:NXRT) will host a call on Tuesday, April 30, 2024, at 11:00 a.m. ET (10:00 a.m. CT), to discuss its first quarter 2024 financial results. The conference call can be accessed live over the phone by dialing 888-660-4430 or, for international callers, +1 646-960-0537 and using passcode Conference ID: 5001576. A live audio webcast of the call will be available online at the Company’s website, nxrt.nexpoint.com (under “Resources”). An online replay will be available shortly after the call on the Company’s website and continue to be available for 60 days.

A replay of the conference call will also be available through Tuesday, May 14, 2024, by dialing 800-770-2030 or, for international callers, +1 647-362-9199 and entering passcode 5001576.

About NXRT

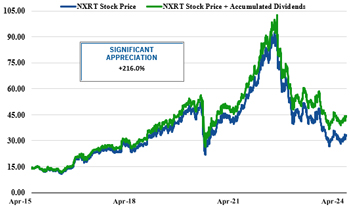

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol “NXRT,” primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with “value-add” potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States. NXRT is externally advised by NexPoint Real Estate Advisors, L.P., an affiliate of NexPoint Advisors, L.P., an SEC-registered investment advisor, which has extensive real estate experience. Our filings with the Securities and Exchange Commission (the “SEC”) are available on our website, nxrt.nexpoint.com, under the “Financials” tab.

Cautionary Statement Regarding Forward-Looking Statements

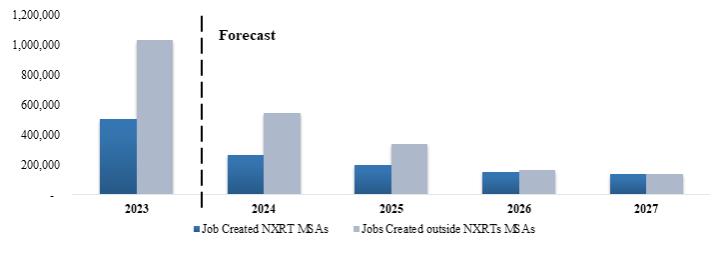

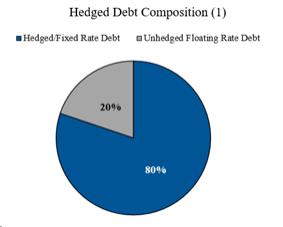

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as “expect,” “anticipate,” “estimate,” “may,” “should,” “plan” and similar expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding NXRT’s business and industry in general, dispositions in process, including the timing of sale and investment returns, forecasted job creation, forecasted NXRT MSA quarterly deliveries and absorptions, forecasted submarket deliveries, NXRT’s guidance for financial results for the full year 2024, including earnings per diluted share, Core FFO per diluted share, same store rental income, same store total revenue and same store NOI, and the related components and assumptions, including expected acquisitions and dispositions, expected same store pool, shares outstanding and same store growth projections, NXRT’s net asset value and the related components and assumptions, estimated value-add expenditures, debt payments, outstanding debt and shares outstanding, net income and NOI guidance for the second quarter and full year 2024 and the related assumptions, planned value-add programs, including rehab costs, rent change and return on investment, expected settlement of interest rate swaps and the effect on the debt maturity schedule, rehab budgets and expected acquisitions and dispositions and related timing. They are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement, including those described in greater detail in our filings with the Securities and Exchange Commission, particularly those described in our Annual Report on Form 10-K. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s most recent Annual Report on Form 10-K and other filings with the SEC for a more complete discussion of the risks and other factors that could affect any forward-looking statements. The statements made herein speak only as of the date of this release and except as required by law, NXRT does not undertake any obligation to publicly update or revise any forward-looking statements.