Exhibit 99.1

25 April 2023 | NYSE:NXRT

EARNINGS SUPPLEMENT: FIRST QUARTER 2023

NEXPOINT RESIDENTIAL TRUST, INC.

300 CRESCENT COURT, SUITE 700

DALLAS, TX 75201

INVESTOR RELATIONS:

KRISTEN THOMAS

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

TABLE OF CONTENTS

Earnings Release | | 1 |

Cautionary Statement Regarding Forward-Looking Statements | | 2 |

Overview | | 3 |

Highlights of Recent Activity | | 4 |

Financial Summary | | 6 |

2023 Full Year Guidance | | 7 |

Components of Net Asset Value | | 8 |

Consolidated Balance Sheets | | 9 |

Consolidated Statements of Operations | | 10 |

NOI and Same Store NOI | | 11 |

Q1 Same Store Results | | 12 |

Q1 Same Store Properties Operating Metrics | | 14 |

QoQ Same Store Properties Operating Metrics | | 15 |

FFO, Core FFO and AFFO | | 16 |

Historical Capital Expenditures | | 17 |

Value-Add Program Details | | 18 |

Outstanding Debt Details | | 21 |

Debt Maturity Schedule | | 24 |

Historical Acquisition Details | | 25 |

Historical Disposition Details | | 26 |

Definitions and Reconciliations of Non-GAAP Measures | | 27 |

|

ROCKLEDGE APARTMENTS: MARIETTA, GA |

|

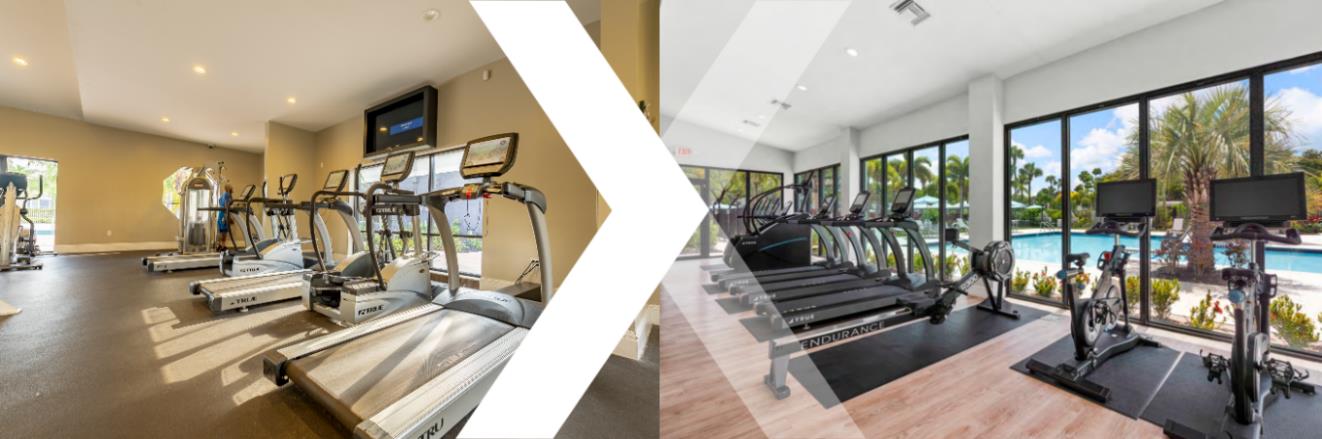

OUTSIDE CLUBHOUSE UPON ACQUISITION |

|

GARDEN AREA CONVERSION & CLUBHOUSE PAINT – COMPLETED IN 2023

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

FOR IMMEDIATE RELEASE

Contact:

Investor Relations

Kristen Thomas

IR@nexpoint.com

(214) 276-6300

Media inquiries: Pro-NexPoint@prosek.com

NEXPOINT RESIDENTIAL TRUST, INC. REPORTS FIRST QUARTER 2023 RESULTS

NXRT Refinances Venue on Camelback, Pays Down $17.5 million on Credit Facility and Executes Value-Add Strategy

Dallas, TX, April 25, 2023 – NexPoint Residential Trust, Inc. (NYSE:NXRT) reported financial results for the first quarter ended March 31, 2023.

Highlights

• | NXRT1 reported Net Loss, FFO2, Core FFO2 and AFFO2 of $(3.9)M, $19.3M, $18.6M and $21.0M, respectively, attributable to common stockholders for the quarter ended March 31, 2023, compared to Net Loss, FFO, Core FFO and AFFO of $(4.7)M, $19.0M, $20.1M and $22.3M, respectively, attributable to common stockholders for the quarter ended March 31, 2022. |

• | For the three months ended March 31, 2023, Q1 Same Store properties3 average effective rent, total revenue and NOI2 increased 13.3%, 11.1% and 9.4%, respectively and occupancy decreased 30 bps from the prior year period. |

• | The weighted average effective monthly rent per unit across all 40 properties held as of March 31, 2023 (the “Portfolio”), consisting of 15,020 units4, was $1,487, while physical occupancy was 94.0%. |

• | NXRT paid a first quarter dividend of $0.42 per share of common stock on March 31, 2023. |

• | During the first quarter, NXRT refinanced Venue on Camelback and paid down $17.5 million of the corporate credit facility through refinancing proceeds and available cash. As of March 31, 2023, there was $57.0 million in aggregate principal outstanding under our corporate credit facility. |

• | During the first quarter, for the properties in our Portfolio, we completed 494 full and partial upgrades and leased 565 upgraded units, achieving an average monthly rent premium of $153 and a 21.2% ROI5. |

• | Since inception, for the properties currently in our Portfolio, we have completed 8,127 full and partial, 4,914 kitchen and laundry appliances and 10,423 technology packages, resulting in a $153, $47 and $45 average monthly rental increase per unit and a 21.8%, 65.6% and 37.4% ROI, respectively. |

| (1) | In this release, “we,” “us,” “our,” the “Company,” “NexPoint Residential Trust,” and “NXRT” each refer to NexPoint Residential Trust, Inc., a Maryland corporation. |

| (2) | FFO, Core FFO, AFFO and NOI are non-GAAP measures. For a discussion of why we consider these non-GAAP measures useful and reconciliations of FFO, Core FFO, AFFO and NOI to net loss, see the “Definitions and Reconciliations of Non-GAAP Measures” and “FFO, Core FFO and AFFO” sections of this release. |

| (3) | We define “Same Store” properties as properties that were in our Portfolio for the entirety of the periods being compared. There are 36 properties encompassing 13,534 units of apartment space in our Same Store pool for the three months ended March 31, 2023 (our “Q1 Same Store” properties). The same store unit count excludes 107 units that are currently down due to casualty events (Rockledge: 22 units, Versailles: 17 units, Silverbrook: 16 units, Arbors of Brentwood: 16 units, Six Forks Station: 14 units, Bella Solara: 8 units, Versailles II: 7 units, Summers Landing: 4 units, Parc500: 2 unit and Avant at Pembroke Pines: 1 unit). |

| (4) | Total number of units owned in our Portfolio as of March 31, 2023 is 15,127, however 107 units are currently down due to casualty events (Rockledge: 22 units, Versailles: 17 units, Silverbrook: 16 units, Arbors of Brentwood: 16 units, Six Forks Station: 14 units, Bella Solara: 8 units, Versailles II: 7 units, Summers Landing: 4 units, Parc500: 2 unit and Avant at Pembroke Pines: 1 unit). |

| (5) | We define Return on Investment (“ROI”) as the sum of the actual rent premium divided by the sum of the total cost. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

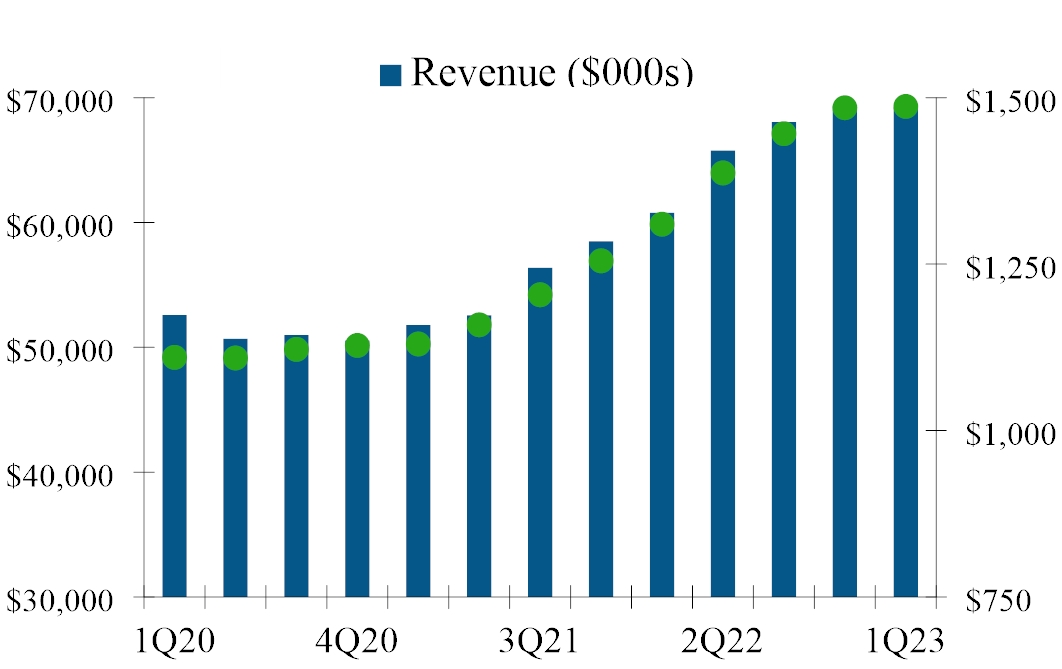

First Quarter 2023 Financial Results

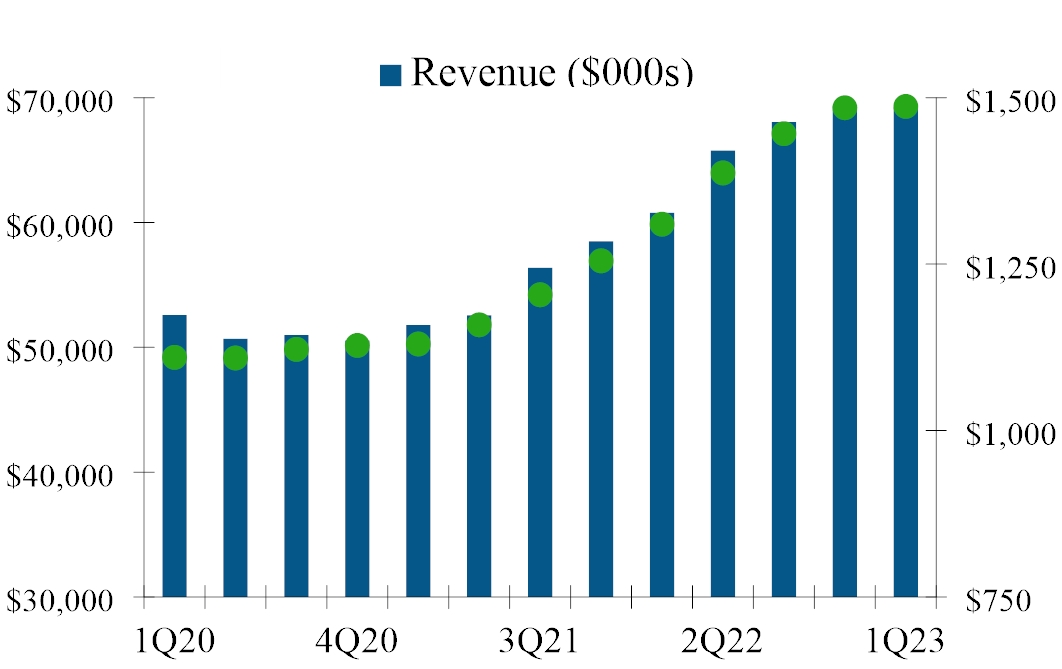

• | Total revenues were $69.2 million for the first quarter of 2023, compared to $60.8 million for the first quarter of 2022. |

• | Net loss for the first quarter of 2023 totaled $(3.9) million, or loss of $(0.15) per diluted share, which included $23.3 million of depreciation and amortization expense. This compared to net loss of $(4.7) million, or loss of $(0.18) per diluted share, for the first quarter of 2022, which included $23.7 million of depreciation and amortization expense. |

• | The change in our net loss of $(3.9) million for the three months ended March 31, 2023 as compared to our net loss of $(4.7) million for the three months ended March 31, 2022 primarily relates to increases in rental income, partially offset by increases in depreciation and interest expense. |

• | For the first quarter of 2023, NOI was $41.1 million on 40 properties, compared to $36.7 million for the first quarter of 2022 on 39 properties. |

• | For the first quarter of 2023, Q1 Same Store NOI increased 9.4% to $37.8 million, compared to $34.5 million for the first quarter of 2022. |

• | For the first quarter of 2023, FFO totaled $19.3 million, or $0.74 per diluted share, compared to $19.0 million, or $0.73 per diluted share, for the first quarter of 2022. |

• | For the first quarter of 2023, Core FFO totaled $18.6 million, or $0.71 per diluted share, compared to $20.1 million, or $0.77 per diluted share, for the first quarter of 2022. |

• | For the first quarter of 2023, AFFO totaled $21.0 million, or $0.81 per diluted share, compared to $22.3 million, or $0.85 per diluted share, for the first quarter of 2022. |

First Quarter Earnings Conference Call

NexPoint Residential Trust, Inc., ("NXRT" or the "Company"), (NYSE:NXRT) will host a call on Tuesday, April 25, 2023, at 11:00 a.m. ET (10:00 a.m. CT), to discuss its first quarter 2023 financial results. The conference call can be accessed live over the phone by dialing 888-660-4430 or, for international callers, +1 646-960-0537 and using passcode Conference ID: 5001576. A live audio webcast of the call will be available online at the Company's website, nxrt.nexpoint.com (under "Resources"). An online replay will be available shortly after the call on the Company's website and continue to be available for 60 days.

A replay of the conference call will also be available through Tuesday, May 9, 2023, by dialing 800-770-2030 or, for international callers, +1 647-362-9199 and entering passcode 5001576.

About NXRT

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol “NXRT,” primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with “value-add” potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States. NXRT is externally advised by NexPoint Real Estate Advisors, L.P., an affiliate of NexPoint Advisors, L.P., an SEC-registered investment advisor, which has extensive real estate experience. Our filings with the Securities and Exchange Commission (the “SEC”) are available on our website, nxrt.nexpoint.com, under the “Financials” tab.

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as “expect,” “anticipate,” “estimate,” “may,” “should,” “plan” and similar expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding NXRT’s business and industry in general, NXRT’s room for future rent growth, forecasted submarket deliveries, NXRT’s guidance for financial results for the full year 2023, including earnings per diluted share, Core FFO per diluted share, same store rental income, same store total revenue and same store NOI, interest expense, and the related components and assumptions, including expected acquisitions and dispositions, expected same store pool, shares outstanding and same store growth projections, NXRT’s net asset value and the related components and assumptions, estimated value-add expenditures, debt payments, outstanding debt and shares outstanding, net income and NOI guidance for the second quarter and full year 2023 and the related assumptions, planned value-add programs, including projected average rent, rent change and return on investment, expected settlement of interest rate swaps and the effect on the debt maturity schedule, rehab budgets and expected acquisitions and dispositions and related timing. They are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement, including those described in greater detail in our filings with the Securities and Exchange Commission, particularly those described in our Annual Report on Form 10-K. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s most recent Annual Report on Form 10-K and other filings with the SEC for a more complete discussion of the risks and other factors that could affect any forward-looking statements. The statements made herein speak only as of the date of this release and except as required by law, NXRT does not undertake any obligation to publicly update or revise any forward-looking statements.

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

NEXPOINT RESIDENTIAL TRUST, INC: FIRST QUARTER 2023 OVERVIEW

Company Profile

(share counts in thousands) | |

Exchange/Ticker | NYSE:NXRT |

Share Price (1) | $43.82 |

Insider Ownership (2) | 13.07% |

2023 Q2 Dividend Per Share | $0.42 |

Dividend Yield (1) | 3.83% |

Shares outstanding - basic (3) | 25,599 |

Shares outstanding - diluted (3) | 25,599 |

(1) | As of the close of market trading on April 24, 2023. |

(2) | As of the close of market trading on March 31, 2023. |

(3) | Weighted average for the three months ended March 31, 2023. |

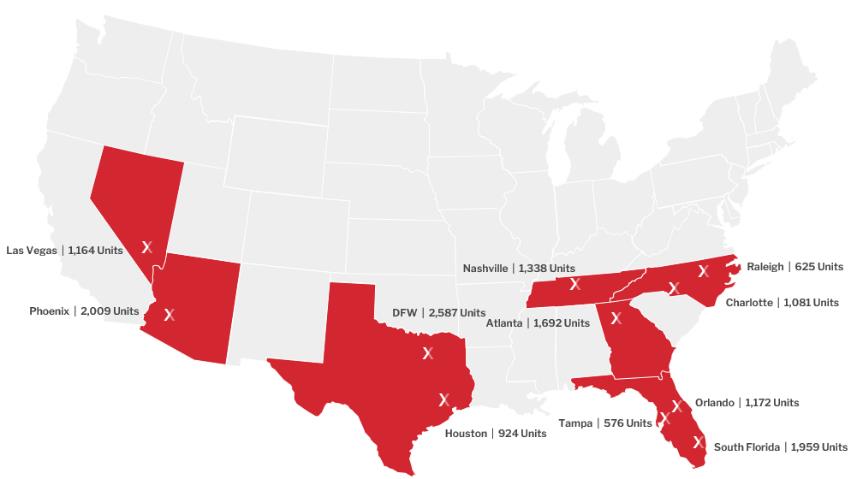

Portfolio Composition by Market

Market | | % of Units |

Dallas/Fort Worth | | 17.1% |

Phoenix | | 13.3% |

South Florida | | 13.0% |

Atlanta | | 11.2% |

Nashville | | 8.8% |

Orlando | | 7.8% |

Las Vegas | | 7.7% |

Charlotte | | 7.1% |

Houston | | 6.1% |

Raleigh | | 4.1% |

Tampa | | 3.8% |

Total | | 100.0% |

| | |

Revenue & Average Rent Per Unit | | Stock Price Performance (Since Inception; 4/1/2015) |

| | |

| |

|

| | |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Highlights of Recent Activity

NXRT Q1 2023 NEW LEASES & RENEWALS

Market | | New Leases | | | % Increase | | | Rent Increase | | | | Renewals | | | % Increase | | | Rent Increase | |

South Florida | | | 286 | | | 9.8% | | | $ | 188.04 | | | | | 297 | | | 6.6% | | | $ | 127.33 | |

Atlanta | | | 169 | | | 9.7% | | | $ | 136.40 | | | | | 203 | | | 3.5% | | | $ | 51.08 | |

Orlando | | | 184 | | | 5.2% | | | $ | 76.88 | | | | | 129 | | | 5.7% | | | $ | 85.50 | |

Tampa | | | 90 | | | 3.3% | | | $ | 45.80 | | | | | 52 | | | 5.8% | | | $ | 79.69 | |

Charlotte | | | 151 | | | 2.9% | | | $ | 34.97 | | | | | 129 | | | 3.3% | | | $ | 42.34 | |

Raleigh/Durham | | | 61 | | | 2.9% | | | $ | 38.66 | | | | | 76 | | | 7.6% | | | $ | 104.91 | |

Nashville | | | 167 | | | 2.3% | | | $ | 27.67 | | | | | 158 | | | 3.2% | | | $ | 40.99 | |

Dallas/Fort Worth | | | 329 | | | 2.0% | | | $ | 78.94 | | | | | 295 | | | 7.0% | | | $ | 84.36 | |

Phoenix | | | 334 | | | -0.7% | | | $ | (12.34 | ) | | | | 241 | | | 3.1% | | | $ | 44.77 | |

Houston | | | 138 | | | -2.9% | | | $ | (39.52 | ) | | | | 79 | | | 3.0% | | | $ | 38.19 | |

Las Vegas | | | 191 | | | -4.5% | | | $ | (62.82 | ) | | | | 136 | | | 2.0% | | | $ | 27.43 | |

TOTAL | | | 2,100 | | | 2.8% | | | $ | 53.22 | | | | | 1,795 | | | 4.8% | | | $ | 70.03 | |

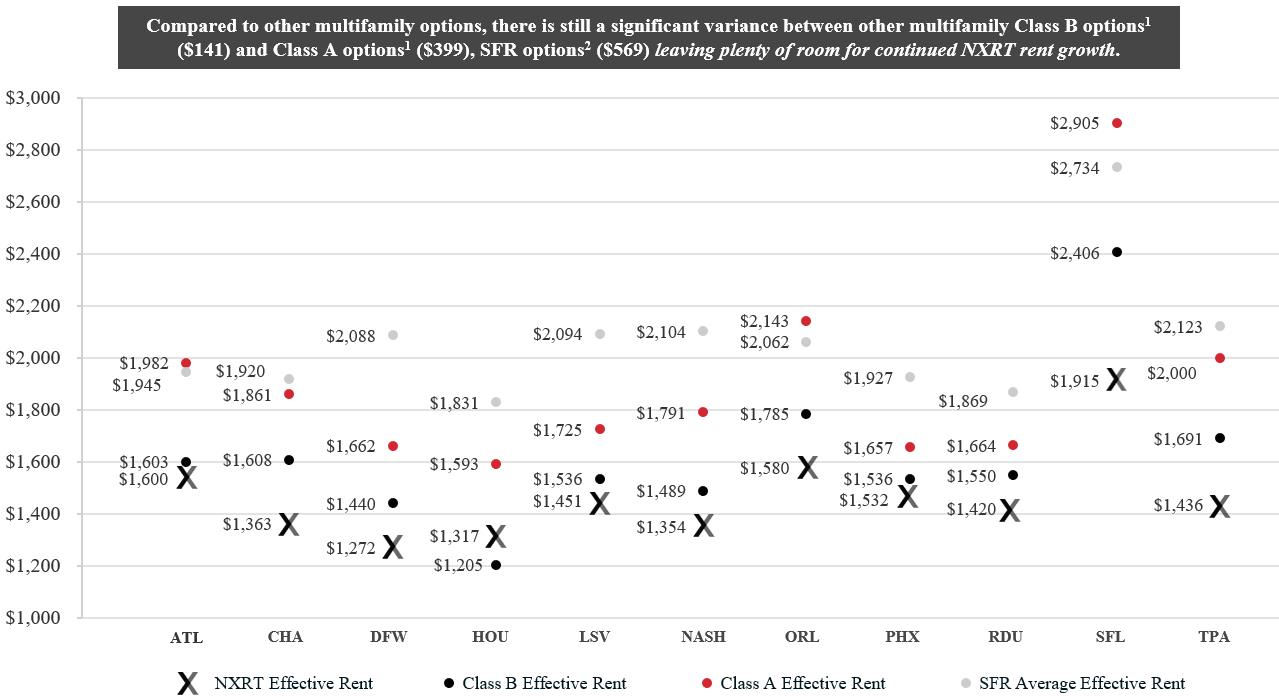

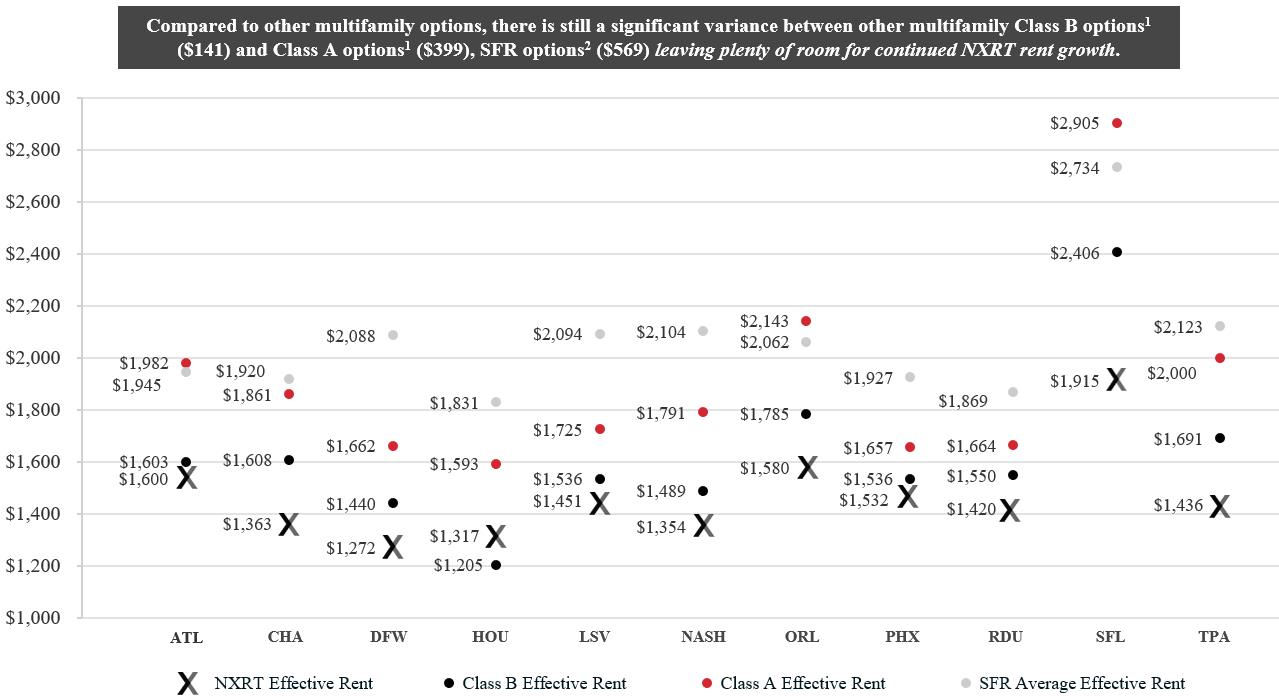

ROOM FOR FUTURE RENT GROWTH

| (1) | Source: RealPage as of March 31, 2023. |

| (2) | Source: Average of Invitation Homes and American Homes 4 Rent. Average effective rent per market based on recent public filings as of December 31, 2022. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

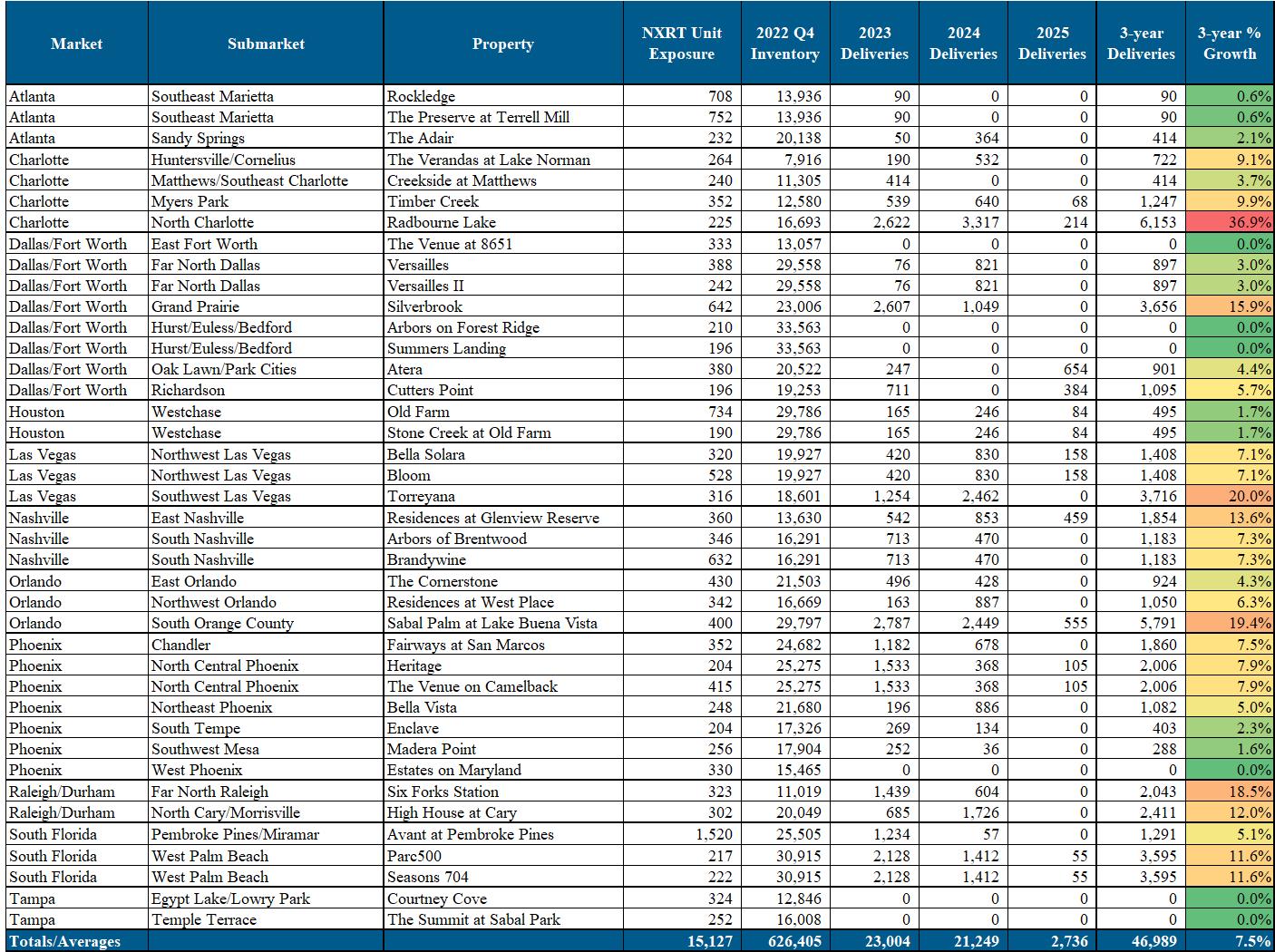

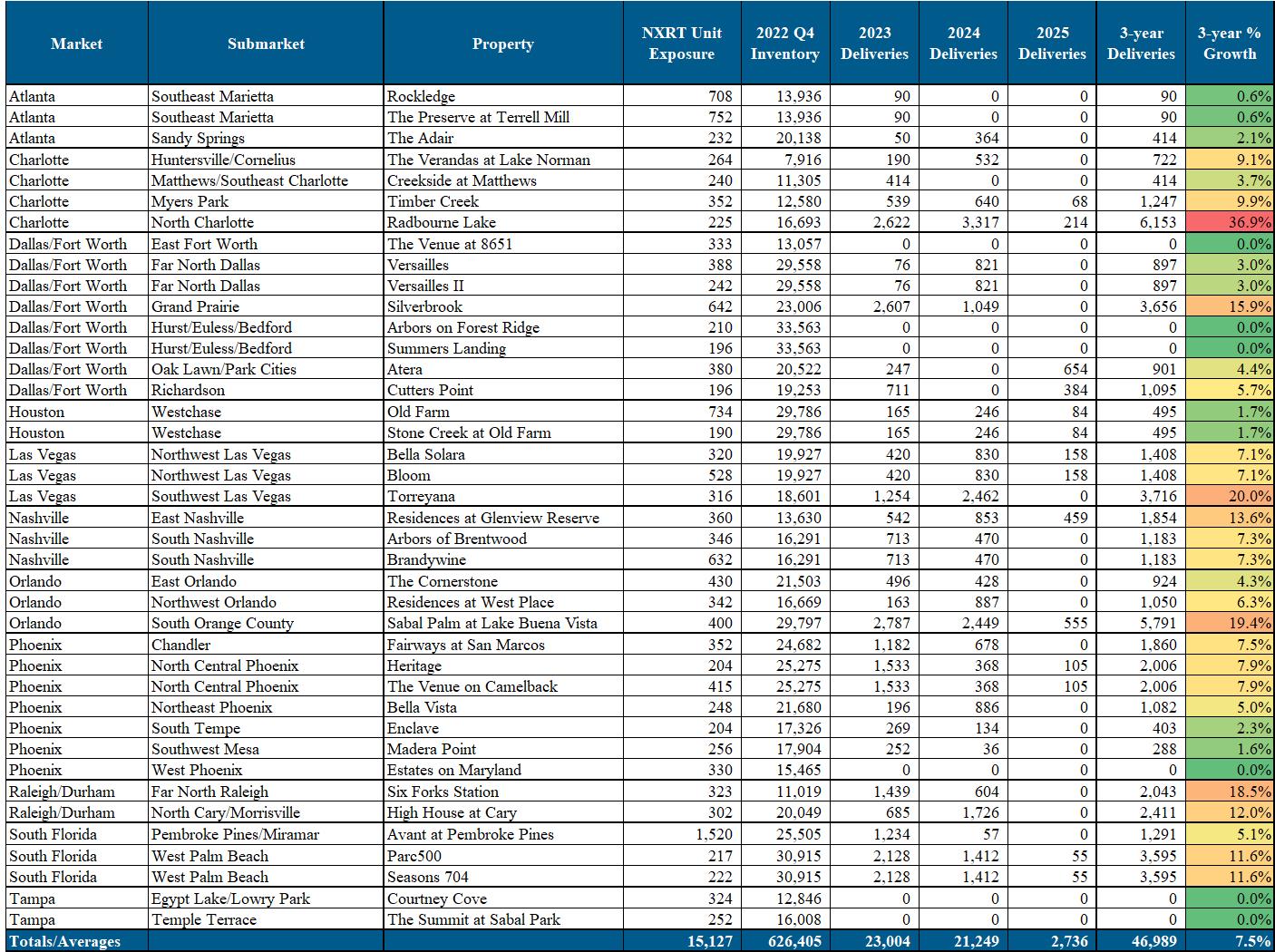

FORECASTED SUBMARKET DELIVERIES (1)

(1) | Source: 2023 RealPage, Inc.; Data as of March 2023. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Financial Summary

| | Q1 2023 | | | Q1 2022 | | | FY 2022 | | | FY 2021 | |

(in thousands, except for per share and unit data) | | | | | | | | | | | | | | | | |

Company Profile | | | | | | | | | | | | | | | | |

Market Capitalization | | $ | 1,120,000 | | | $ | 2,321,000 | | | $ | 1,112,000 | | | $ | 2,138,000 | |

Share Price (as of the last day of the period) | | $ | 43.67 | | | $ | 90.31 | | | $ | 43.52 | | | $ | 83.83 | |

Weighted average common shares outstanding - basic | | | 25,599 | | | | 25,620 | | | | 25,610 | | | | 25,170 | |

Weighted average common shares outstanding - diluted | | | 25,599 | | | | 25,620 | | | | 25,610 | | | | 25,760 | |

| | | | | | | | | | | | | | | | |

Earnings Profile | | | | | | | | | | | | | | | | |

Total revenues | | $ | 69,227 | | | $ | 60,786 | | | $ | 263,952 | | | $ | 219,240 | |

Net income (loss) attributable to common stockholders | | | (3,883 | ) | | | (4,653 | ) | | | (9,260 | ) | | | 23,037 | |

NOI (1) | | | 41,130 | | | | 36,673 | | | | 157,424 | | | | 128,763 | |

Same Store NOI (2) | | | 37,750 | | | | 34,520 | | | | 129,279 | | | | 111,265 | |

Same Store NOI Growth (%) (2) | | | 9.4 | % | | | | | | | 16.2 | % | | | | |

| | | | | | | | | | | | | | | | |

Earnings Metrics Per Common Share (diluted basis) | | | | | | | | | | | | | | | | |

Earnings (loss) | | $ | (0.15 | ) | | $ | (0.18 | ) | | $ | (0.36 | ) | | $ | 0.89 | |

FFO (1) | | $ | 0.74 | | | $ | 0.73 | | | $ | 2.81 | | | $ | 2.47 | |

Core FFO (1) | | $ | 0.71 | | | $ | 0.77 | | | $ | 3.13 | | | $ | 2.43 | |

AFFO (1) | | $ | 0.81 | | | $ | 0.85 | | | $ | 3.49 | | | $ | 2.75 | |

Dividends declared per common share | | $ | 0.42 | | | $ | 0.38 | | | $ | 1.56 | | | $ | 1.40 | |

Net Income (Loss) Coverage (3) | | -0.36x | | | -0.47x | | | -0.23x | | | 0.63x | |

FFO Coverage (3) | | 1.76x | | | 1.91x | | | 1.80x | | | 1.76x | |

Core FFO Coverage (3) | | 1.70x | | | 2.02x | | | 2.01x | | | 1.73x | |

AFFO Coverage (3) | | 1.92x | | | 2.25x | | | 2.24x | | | 1.96x | |

| | | | | | | | | | | | | | | | |

Portfolio | | | | | | | | | | | | | | | | |

Total Properties | | | 40 | | | | 39 | | | | 40 | | | | 39 | |

Total Units (4) | | | 15,020 | | | | 14,776 | | | | 15,096 | | | | 14,825 | |

Occupancy | | | 94.0 | % | | | 94.2 | % | | | 94.1 | % | | | 94.3 | % |

Average Effective Monthly Rent per Unit | | $ | 1,487 | | | $ | 1,310 | | | $ | 1,480 | | | $ | 1,261 | |

| | | | | | | | | | | | | | | | |

Same Store Portfolio Metrics (2) | | | | | | | | | | | | | | | | |

Total Same Store Properties | | | 36 | | | | 36 | | | | 31 | | | | 31 | |

Total Same Store Units | | | 13,534 | | | | 13,593 | | | | 12,210 | | | | 12,286 | |

Occupancy | | | 94.0 | % | | | 94.3 | % | | | 94.1 | % | | | 94.3 | % |

Average Effective Monthly Rent per Unit | | $ | 1,494 | | | $ | 1,319 | | | $ | 1,493 | | | $ | 1,267 | |

| | | | | | | | | | | | | | | | |

Value-Add Program | | | | | | | | | | | | | | | | |

Completed Full/Partial Interior Rehab Units | | | 494 | | | | 531 | | | | 2,409 | | | | 1,264 | |

Cumulative Completed Rehab Units (5) | | | 8,127 | | | | | | | | | | | | | |

Average Increase to Effective Monthly Rent per Unit (Post-Rehab) | | $ | 153 | | | | | | | | | | | | | |

ROI on Post-Rehab Units | | | 21.8 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Outstanding Debt Summary | | | | | | | | | | | | | | | | |

Total Mortgage Debt | | $ | 1,621,634 | | | $ | 1,280,765 | | | | | | | | | |

Credit Facilities | | | 57,000 | | | | 335,000 | | | | | | | | | |

Total Debt Outstanding | | $ | 1,678,634 | | | $ | 1,615,765 | | | | | | | | | |

Leverage Ratio (Net Debt to Enterprise Value) (6) | | | 60 | % | | | 39 | % | | | | | | | | |

(1) | For more information and reconciliations of NOI, FFO, Core FFO and AFFO, see the “FFO, Core FFO and AFFO,” “NOI and Same Store NOI” and “Definitions and Reconciliations of Non-GAAP Measures” sections of this release. |

(2) | We define “Same Store” properties as properties that were in our Portfolio for the entirety of the periods being compared. For additional information regarding our Q1 Same Store properties, see the “Q1 Same Store Results” section of this release. |

(3) | Indicates coverage ratio of Net Income (Loss)/FFO/Core FFO/AFFO per common share (diluted) over dividends declared per common share during the period. The Company uses actual diluted weighted average common shares outstanding when in a dilutive position for FFO, Core FFO and AFFO. |

(4) | Total units owned as of March 31, 2023 is 15,127, however 107 units are currently excluded due to fires and water damage. |

(5) | Inclusive of all full and partial interior upgrades completed through March 31, 2023. Cumulative results exclude rehabs completed for properties sold through March 31, 2023. |

(6) | For more information and a reconciliation of debt to net debt, see the “Definitions and Reconciliations of Non-GAAP Measures” section of this release. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

2023 Full Year Guidance Summary

NXRT is updating 2023 guidance ranges for earnings per diluted share, Core FFO per diluted share, Same Store rental income, Same Store total revenue, Same Store total expenses, Same Store NOI, interest expense and its related components, and reaffirming Acquisitions and Dispositions as follows (dollars in millions, except per share amounts):

| | Guidance Range (1) | | | | | |

| | Low-End | | | Mid-Point | | | High-End | | | Prior Mid-Point | |

Earnings (loss) per diluted share (2) | | $ | 0.86 | | | $ | 1.00 | | | $ | 1.14 | | | $ | 1.08 | |

Core FFO per diluted share (2) (3) | | $ | 2.92 | | | $ | 3.06 | | | $ | 3.20 | | | $ | 3.09 | |

| | | | | | | | | | | | | | | | |

Same Store Growth: (4) | | | | | | | | | | | | | | | | |

Rental Income | | | 10.5 | % | | | 11.3 | % | | | 12.1 | % | | | 11.5 | % |

Total Revenue | | | 10.1 | % | | | 10.8 | % | | | 11.6 | % | | | 10.9 | % |

Total Expenses (5) | | | 11.4 | % | | | 10.6 | % | | | 9.9 | % | | | 10.7 | % |

Same Store NOI (3) | | | 9.2 | % | | | 11.0 | % | | | 12.8 | % | | | 11.0 | % |

| | | | | | | | | | | | | | | | |

Components to Interest Expense: | | | | | | | | | | | | | | | | |

Interest Expense on Mortgage Debt | | $ | (100.0 | ) | | $ | (102.6 | ) | | $ | (105.1 | ) | | $ | (103.8 | ) |

Interest Expense on Revolver | | $ | (2.5 | ) | | $ | (2.5 | ) | | $ | (2.5 | ) | | $ | (2.1 | ) |

Deferred Financing Cost & Discount Amortization | | $ | (3.0 | ) | | $ | (3.0 | ) | | $ | (3.0 | ) | | $ | (3.0 | ) |

Interest Rate Swap Settlement | | $ | 43.9 | | | $ | 45.8 | | | $ | 47.7 | | | $ | 46.6 | |

Mark to Market – Fair Value of Rate Caps | | $ | (3.5 | ) | | $ | (1.9 | ) | | $ | (0.3 | ) | | $ | 1.4 | |

Total Interest Expense | | $ | (65.1 | ) | | $ | (64.2 | ) | | $ | (63.2 | ) | | $ | (60.9 | ) |

| | | | | | | | | | | | | | | | |

Other Considerations: (5) | | | | | | | | | | | | | | | | |

Acquisitions | | $ | — | | | $ | 125.0 | | | $ | 250.0 | | | $ | 125.0 | |

Dispositions | | $ | — | | | $ | 125.0 | | | $ | 250.0 | | | $ | 125.0 | |

(1) | Full Year 2023 guidance forecast includes Same Store growth projections presented above, which takes into effect the held for sale properties of Old Farm and Stone Creek at Old Farm, thereby removing those assets from the Full Year 2023 expected Same Store pool. |

(2) | Weighted average diluted share count estimate for full year 2023 is approximately 26.3 million. |

(3) | Same Store NOI and Core FFO are non-GAAP measures. For reconciliations of Full Year 2023 Same Store NOI and Core FFO guidance to net loss guidance, and a discussion of why we consider these non-GAAP measures useful, see the “Definitions and Reconciliations of Non-GAAP Measures” section of this release. |

(4) | Year-over-year growth for the Full Year 2023 expected Same Store pool (36 properties). |

(5) | We continue to evaluate our Portfolio for capital recycling opportunities. Transaction volumes presented are incorporated into the earnings per share and Core FFO guidance above. Actual acquisitions and dispositions could vary significantly from our projections. We undertake no duty to update these assumptions, except as required by law. |

Additional information on 2023 financial and earnings guidance is included in the following sections of this release.

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Components of Net Asset Value

(dollar and share amounts in thousands, except per share and per unit data)

REAL ESTATE VALUE BY MARKET

Property | | NOI | | | Cap Rate Range (1) | | | Value Range (2) | |

Market | | Contribution | | | Min | | | Max | | | Min | | | Max | |

Texas | | | | | | | | | | | | | | | | | | | | |

Dallas/Fort Worth | | 12.7% | | | 5.0% | | | 5.3% | | | $ | 405,437 | | | $ | 439,476 | |

| | | | | | | | | | | | | | | | | | | | |

North Carolina | | | | | | | | | | | | | | | | | | | | |

Raleigh | | 3.8% | | | 5.0% | | | 5.3% | | | | 121,073 | | | | 131,238 | |

Charlotte | | 6.8% | | | 5.0% | | | 5.3% | | | $ | 216,551 | | | $ | 234,731 | |

| | | | | | | | | | | | | | | | | | | | |

Georgia | | | | | | | | | | | | | | | | | | | | |

Atlanta | | 8.5% | | | 5.0% | | | 5.3% | | | $ | 270,104 | | | $ | 292,780 | |

| | | | | | | | | | | | | | | | | | | | |

Tennessee | | | | | | | | | | | | | | | | | | | | |

Nashville | | 11.7% | | | 5.0% | | | 5.3% | | | $ | 373,011 | | | $ | 404,327 | |

| | | | | | | | | | | | | | | | | | | | |

Florida | | | | | | | | | | | | | | | | | | | | |

Orlando | | 8.1% | | | 5.0% | | | 5.3% | | | $ | 256,980 | | | $ | 278,554 | |

Tampa | | 4.4% | | | 5.0% | | | 5.3% | | | $ | 138,415 | | | $ | 150,036 | |

South Florida | | 18.5% | | | 5.0% | | | 5.3% | | | $ | 586,904 | | | $ | 636,177 | |

| | | | | | | | | | | | | | | | | | | | |

Nevada | | | | | | | | | | | | | | | | | | | | |

Las Vegas | | 8.8% | | | 5.0% | | | 5.3% | | | $ | 282,505 | | | $ | 306,223 | |

| | | | | | | | | | | | | | | | | | | | |

Arizona | | | | | | | | | | | | | | | | | | | | |

Phoenix | | 16.7% | | | 5.0% | | | 5.3% | | | $ | 529,711 | | | $ | 574,182 | |

Total / Ave | | 100.0% | | | 5.0% | | | 5.3% | | | $ | 3,180,691 | | | $ | 3,447,724 | |

NAV SUMMARY

Component | | Min | | | Max | |

Tangible Assets | | | | | | | | |

Real Estate (2) | | $ | 3,180,691 | | | $ | 3,447,724 | |

Cash | | 14,142 | |

Restricted Cash - Renovation Reserves (4) | | 6,988 | |

Renovation Expenditures (4) | | (6,988) | |

Cash Adjustments (5) | | (314) | |

Fair Market Value of Interest Rate Swaps | | 86,234 | |

Other Assets | | 52,580 | |

Houston Gross Sale Proceeds (6) | | 135,000 | |

Value of Assets | | $ | 3,468,333 | | | $ | 3,735,366 | |

| | | | | | | | |

Tangible Liabilities | | | | | | | | |

Credit Facility (7) | | $57,000 | |

Mortgage Debt | | 1,621,634 | |

Total Outstanding Debt | | 1,678,634 | |

Forward 12-month Principal Payments | | (314) | |

Total Outstanding Debt (FY 2023 Est.) | | 1,678,320 | |

Other Tangible Liabilities (at Book) | | 36,768 | |

Value of Liabilities | | $1,715,088 | |

Net Leverage (mid-point) | | 48% | |

Net Asset Value | | $ | 1,753,245 | | | $ | 2,020,278 | |

Shares outstanding - diluted (FY 2023 Est.) | | 26,300 | |

Est. NAV / Share | | $ | 66.66 | | | $ | 76.82 | |

NAV / Share (mid-point) | | $71.74 | |

NOI ESTIMATE

| | | | | | | | |

Q4 2022 NOI Actual | | 41,777 | |

Q1 2023 NOI Actual | | 41,130 | |

| | Low | | | High | |

Estimated Q2 2023 NOI Guidance (3) | | | 40,732 | | | | 42,562 | |

2023 NOI Guidance (3) | | $ | 166,986 | | | $ | 172,386 | |

IMPLIED VALUATION METRICS

| | Min | | Max |

Implied Real Estate Value | | $3,180,691 | | $3,447,724 |

No. of Units (March 31, 2023) (2) | | 15,127 |

Implied Value/Apartment Unit | | $210.3 | | $227.9 |

Implied Value/Apartment Unit (mid-point) | | $219.1 |

(1) | Management estimates based on independent third-party review of our properties. |

(2) | Estimated value ranges are presented for the existing portfolio (40 properties as of as of March 31, 2023). |

(3) | The Company anticipates net income will be in the range between approximately $22.4 million and $29.8 million for the full year 2023 and between $33.8 million and 37.8 million for the second quarter of 2023. FY 2023 NOI Guidance considers the forecast dispositions of Old Farm and Stone Creek at Old Farm and considers a commensurate volume of capital recycling. |

(4) | Includes approximately $7.0 million that is held for value-add upgrades; reduced by $7.0 million for estimated 2023 rehab expenditures. |

(5) | Includes approximately $0.3 million in forward 12-month principal payments. |

(6) | Old Farm and Stone Creek at Old Farm are under a binding sales contract and expected to close in the first half of the year. |

(7) | Includes outstanding balance of March 31, 2023. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

NEXPOINT RESIDENTIAL TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

| | March 31, 2023 | | | December 31, 2022 | |

| | (Unaudited) | | | | | |

ASSETS | | | | | | | | |

Operating Real Estate Investments | | | | | | | | |

Land | | $ | 378,417 | | | $ | 378,438 | |

Buildings and improvements | | | 1,764,796 | | | | 1,760,782 | |

Construction in progress | | | 13,174 | | | | 10,622 | |

Furniture, fixtures and equipment | | | 162,048 | | | | 152,529 | |

Total Gross Operating Real Estate Investments | | | 2,318,435 | | | | 2,302,371 | |

Accumulated depreciation and amortization | | | (372,378 | ) | | | (349,276 | ) |

Total Net Operating Real Estate Investments | | | 1,946,057 | | | | 1,953,095 | |

Real estate held for sale, net of accumulated depreciation of $22,017 and $22,017, respectively | | | 89,848 | | | | 89,457 | |

Total Net Real Estate Investments | | | 2,035,905 | | | | 2,042,552 | |

Cash and cash equivalents | | | 14,142 | | | | 16,762 | |

Restricted cash | | | 32,933 | | | | 35,037 | |

Accounts receivable, net | | | 18,522 | | | | 17,121 | |

Prepaid and other assets | | | 8,113 | | | | 10,425 | |

Fair value of interest rate swaps | | | 86,234 | | | | 103,440 | |

TOTAL ASSETS | | $ | 2,195,849 | | | $ | 2,225,337 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

Liabilities: | | | | | | | | |

Mortgages payable, net | | $ | 1,541,531 | | | $ | 1,526,828 | |

Mortgages payable held for sale, net | | | 68,040 | | | | 68,016 | |

Credit facility, net | | | 55,419 | | | | 72,644 | |

Accounts payable and other accrued liabilities | | | 13,722 | | | | 12,325 | |

Accrued real estate taxes payable | | | 8,655 | | | | 7,232 | |

Accrued interest payable | | | 9,049 | | | | 7,946 | |

Security deposit liability | | | 3,202 | | | | 3,200 | |

Prepaid rents | | | 2,140 | | | | 1,849 | |

Total Liabilities | | | 1,701,758 | | | | 1,700,040 | |

| | | | | | | | |

Redeemable noncontrolling interests in the Operating Partnership | | | 6,058 | | | | 5,631 | |

| | | | | | | | |

Stockholders' Equity: | | | | | | | | |

Preferred stock, $0.01 par value: 100,000,000 shares authorized; 0 shares issued | | | — | | | | — | |

Common stock, $0.01 par value: 500,000,000 shares authorized; 25,657,723 and 25,549,319 shares issued and outstanding, respectively | | | 256 | | | | 255 | |

Additional paid-in capital | | | 405,847 | | | | 405,376 | |

Accumulated earnings less dividends | | | (3,084 | ) | | | 11,880 | |

Accumulated other comprehensive income | | | 85,014 | | | | 102,155 | |

Total Stockholders' Equity | | | 488,033 | | | | 519,666 | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 2,195,849 | | | $ | 2,225,337 | |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

NEXPOINT RESIDENTIAL TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except per share amounts)

(Unaudited)

| | For the Three Months Ended March 31, | |

| | 2023 | | | 2022 | |

Revenues | | | | | | | | |

Rental income | | $ | 67,537 | | | $ | 59,297 | |

Other income | | | 1,690 | | | | 1,489 | |

Total revenues | | | 69,227 | | | | 60,786 | |

Expenses | | | | | | | | |

Property operating expenses | | | 13,266 | | | | 13,596 | |

Real estate taxes and insurance | | | 10,020 | | | | 8,720 | |

Property management fees (1) | | | 2,027 | | | | 1,757 | |

Advisory and administrative fees (2) | | | 1,889 | | | | 1,843 | |

Corporate general and administrative expenses | | | 3,367 | | | | 3,486 | |

Property general and administrative expenses | | | 2,270 | | | | 2,006 | |

Depreciation and amortization | | | 23,266 | | | | 23,718 | |

Total expenses | | | 56,105 | | | | 55,126 | |

Operating income | | | 13,122 | | | | 5,660 | |

Interest expense | | | (16,739 | ) | | | (10,636 | ) |

Gain on extinguishment of debt and modification costs | | | 122 | | | | — | |

Casualty gain (loss) | | | (814 | ) | | | 128 | |

Miscellaneous income | | | 411 | | | | 181 | |

Net loss | | | (3,898 | ) | | | (4,667 | ) |

Net loss attributable to redeemable noncontrolling interests in the Operating Partnership | | | (15 | ) | | | (14 | ) |

Net loss attributable to common stockholders | | $ | (3,883 | ) | | $ | (4,653 | ) |

Other comprehensive income (loss) | | | | | | | | |

Unrealized gains (losses) on interest rate derivatives | | | (17,206 | ) | | | 54,579 | |

Total comprehensive income (loss) | | | (21,104 | ) | | | 49,912 | |

Comprehensive income (loss) attributable to redeemable noncontrolling interests in the Operating Partnership | | | (80 | ) | | | 150 | |

Comprehensive income (loss) attributable to common stockholders | | $ | (21,024 | ) | | $ | 49,762 | |

| | | | | | | | |

Weighted average common shares outstanding - basic | | | 25,599 | | | | 25,620 | |

Weighted average common shares outstanding - diluted | | | 25,599 | | | | 25,620 | |

| | | | | | | | |

Loss per share - basic | | $ | (0.15 | ) | | $ | (0.18 | ) |

Loss per share - diluted | | $ | (0.15 | ) | | $ | (0.18 | ) |

(1) | Fees incurred to an unaffiliated third party that is an affiliate of the noncontrolling limited partner of the Operating Partnership (the “OP”). |

(2) | Fees incurred to the Company’s adviser. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

NOI and Same Store NOI for the Three Months Ended March 31, 2023 and 2022

The following table, which has not been adjusted for the effects of noncontrolling interests, reconciles NOI and our Q1 Same Store NOI for the three months ended March 31, 2023 and 2022 to net loss, the most directly comparable GAAP financial measure (in thousands):

| | For the Three Months Ended March 31, | | |

| | 2023 | | | 2022 | | |

Net loss | | $ | (3,898 | ) | | $ | (4,667 | ) | |

Adjustments to reconcile net loss to NOI: | | | | | | | | | |

Advisory and administrative fees | | | 1,889 | | | | 1,843 | | |

Corporate general and administrative expenses | | | 3,367 | | | | 3,486 | | |

Casualty-related expenses/(recoveries) | (1) | | (1,706 | ) | | | 1,047 | | |

Casualty gains | | | 814 | | | | (128 | ) | |

Property general and administrative expenses | (2) | | 781 | | | | 738 | | |

Depreciation and amortization | | | 23,266 | | | | 23,718 | | |

Interest expense | | | 16,739 | | | | 10,636 | | |

Gain on extinguishment of debt and modification costs | | | (122 | ) | | | — | | |

NOI | | $ | 41,130 | | | $ | 36,673 | | |

Less Non-Same Store | | | | | | | | | |

Revenues | | | (6,579 | ) | | | (4,403 | ) | |

Operating expenses | | | 3,199 | | | | 2,302 | | |

Operating income | | | — | | | | (52 | ) | |

Same Store NOI | | $ | 37,750 | | | $ | 34,520 | | |

(1) | Adjustment to net loss to exclude certain property operating expenses that are casualty-related expenses/(recoveries). |

(2) | Adjustment to net loss to exclude certain property general and administrative expenses that are not reflective of the continuing operations of the properties or are incurred on our behalf at the property for expenses such as legal, professional, centralized leasing service and franchise tax fees. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Q1 Same Store Results of Operations for the Three Months Ended March 31, 2023 and 2022

There are 36 properties encompassing 13,534 units of apartment space, or approximately 89.5% of our Portfolio, in our same store pool for the three months ended March 31, 2023 and 2022 (our “Q1 Same Store” properties). Our Q1 Same Store properties exclude the following 4 properties in our Portfolio as of March 31, 2023: Old Farm, Stone Creek at Old Farm, The Adair and Estates on Maryland as well as the 107 units mentioned on page 1 that are currently down.

As of March 31, 2023, our Q1 Same Store properties were approximately 94.0% leased with a weighted average monthly effective rent per occupied apartment unit of $1,494, a year-over-year decrease of 30 bps and increase of $175, respectively.

The following table reflects the revenues, property operating expenses and NOI for the three months ended March 31, 2023 and 2022 for our Q1 Same Store and Non-Same Store properties (dollars in thousands):

| | For the Three Months Ended March 31, | | | | | | | | | |

| | 2023 | | | 2022 | | | $ Change | | | % Change | |

Revenues | | | | | | | | | | | | | | | | |

Same Store | | | | | | | | | | | | | | | | |

Rental income | | $ | 61,149 | | | $ | 54,963 | | | $ | 6,186 | | | | 11.3 | % |

Other income | | | 1,499 | | | | 1,420 | | | | 79 | | | | 5.6 | % |

Same Store revenues | | | 62,648 | | | | 56,383 | | | | 6,265 | | | | 11.1 | % |

Non-Same Store | | | | | | | | | | | | | | | | |

Rental income | | | 6,388 | | | | 4,334 | | | | 2,054 | | | | 47.4 | % |

Other income | | | 191 | | | | 69 | | | | 122 | | | N/M | |

Non-Same Store revenues | | | 6,579 | | | | 4,403 | | | | 2,176 | | | | 49.4 | % |

Total revenues | | | 69,227 | | | | 60,786 | | | | 8,441 | | | | 13.9 | % |

| | | | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | | | | |

Same Store | | | | | | | | | | | | | | | | |

Property operating expenses (1) | | | 13,376 | | | | 11,587 | | | | 1,789 | | | | 15.4 | % |

Real estate taxes and insurance | | | 8,781 | | | | 7,632 | | | | 1,149 | | | | 15.1 | % |

Property management fees (2) | | | 1,827 | | | | 1,627 | | | | 200 | | | | 12.3 | % |

Property general and administrative expenses (3) | | | 1,325 | | | | 1,146 | | | | 179 | | | | 15.6 | % |

Same Store operating expenses | | | 25,309 | | | | 21,992 | | | | 3,317 | | | | 15.1 | % |

Non-Same Store | | | | | | | | | | | | | | | | |

Property operating expenses (4) | | | 1,596 | | | | 962 | | | | 634 | | | N/M | |

Real estate taxes and insurance | | | 1,239 | | | | 1,088 | | | | 151 | | | | 13.9 | % |

Property management fees (2) | | | 200 | | | | 130 | | | | 70 | | | N/M | |

Property general and administrative expenses (5) | | | 164 | | | | 122 | | | | 42 | | | | 34.4 | % |

Non-Same Store operating expenses | | | 3,199 | | | | 2,302 | | | | 897 | | | | 39.0 | % |

Total operating expenses | | | 28,508 | | | | 24,294 | | | | 4,214 | | | | 17.3 | % |

| | | | | | | | | | | | | | | | |

Operating income | | | | | | | | | | | | | | | | |

Same Store | | | | | | | | | | | | | | | | |

Miscellaneous income | | | 411 | | | | 129 | | | | 282 | | | N/M | |

Non-Same Store | | | | | | | | | | | | | | | | |

Miscellaneous income | | | — | | | | 52 | | | | (52 | ) | | N/M | |

Total operating income | | | 411 | | | | 181 | | | | 230 | | | N/M | |

| | | | | | | | | | | | | | | | |

NOI | | | | | | | | | | | | | | | | |

Same Store | | | 37,750 | | | | 34,520 | | | | 3,230 | | | | 9.4 | % |

Non-Same Store | | | 3,380 | | | | 2,153 | | | | 1,227 | | | N/M | |

Total NOI (6) | | $ | 41,130 | | | $ | 36,673 | | | $ | 4,457 | | | | 12.2 | % |

(1) | For the three months ended March 31, 2023 and 2022, excludes approximately $1,712,000 and $1,562,000, respectively, of casualty-related recoveries. |

(2) | Fees incurred to an unaffiliated third party that is an affiliate of the noncontrolling limited partner of the OP. |

(3) | For the three months ended March 31, 2023 and 2022, excludes approximately $695,000 and $694,000, respectively, of expenses that are not reflective of the continuing operations of the properties or are incurred on our behalf at the property for expenses such as legal, professional, centralized leasing service and franchise tax fees. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

(4) | For the three months ended March 31, 2023 and 2022, excludes approximately $6,000 and $2,609,000, respectively, of casualty-related expenses. |

(5) | For the three months ended March 31, 2023 and 2022, excludes approximately $86,000 and $44,000, respectively, of expenses that are not reflective of the continuing operations of the properties or are incurred on our behalf at the property for expenses such as legal, professional, centralized leasing service and franchise tax fees. |

(6) | For additional information regarding NOI, see the “Definitions and Reconciliations of Non-GAAP Measures” and “NOI and Same Store NOI” sections of this release. |

The following table contains additional information about our Q1 Same Store properties rent and occupancy metrics, revenues, operating expenses and NOI for the three months ended March 31, 2023 and 2022 (dollars in thousands, except for per unit data):

| | Q1 2023 | | | Q1 2022 | | | % Change | |

Same Store Total Units | | | 13,534 | | | | 13,593 | | | | | |

Same Store Occupied Units | | | 12,718 | | | | 12,815 | | | | | |

Same Store Ending Occupancy | | | 94.0 | % | | | 94.3 | % | | | -0.3 | % |

Same Store Average Rent per Unit | | $ | 1,494 | | | $ | 1,319 | | | | 13.3 | % |

| | | | | | | | | | | | |

Same Store Revenues | | | | | | | | | | | | |

Same Store Rental Income | | $ | 61,149 | | | $ | 54,963 | | | | 11.3 | % |

Same Store Other Income | | | 1,499 | | | | 1,420 | | | | 5.6 | % |

Total Same Store Revenues | | | 62,648 | | | | 56,383 | | | | 11.1 | % |

| | | | | | | | | | | | |

Same Store Operating Expenses | | | | | | | | | | | | |

Payroll | | | 5,358 | | | | 4,647 | | | | 15.3 | % |

Repairs & Maintenance | | | 5,291 | | | | 4,322 | | | | 22.4 | % |

Utilities | | | 2,727 | | | | 2,618 | | | | 4.2 | % |

Real Estate Taxes | | | 7,364 | | | | 6,366 | | | | 15.7 | % |

Insurance | | | 1,417 | | | | 1,266 | | | | 11.9 | % |

Property Management Fees | | | 1,827 | | | | 1,627 | | | | 12.3 | % |

Office Operations | | | 961 | | | | 798 | | | | 20.4 | % |

Marketing | | | 364 | | | | 348 | | | | 4.6 | % |

Total Same Store Operating Expenses | | | 25,309 | | | | 21,992 | | | | 15.1 | % |

| | | | | | | | | | | | |

Same Store Operating Income | | | | | | | | | | | | |

Miscellaneous income | | | 411 | | | | 129 | | | N/M | |

Total Same Store Operating Income | | | 411 | | | | 129 | | | N/M | |

| | | | | | | | | | | | |

Q1 Same Store NOI | | $ | 37,750 | | | $ | 34,520 | | | | 9.4 | % |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Q1 Same Store Properties Operating Metrics

(dollars in thousands, except for per unit data)

| | | | | | | | | | | | |

Properties by Market (1) | | Unit Count | | Average Effective Rent | Occupancy | Total Rental Income |

| | | | | | | | | | | | |

| | Total | | Q1 2023 | Q1 2022 | % Change | Q1 2023 | Q1 2022 | bps ∆ | Q1 2023 | Q1 2022 | % Change |

Texas | | | | | | | | | | | | |

Dallas | | 2,543 | | $1,271 | $1,133 | 12.2% | 93.1% | 93.8% | -70 | $9,966 | $9,301 | 7.1% |

Average/Total | | 2,543 | | 1,271 | 1,133 | 12.2% | 93.1% | 93.8% | -70 | 9,966 | 9,301 | 7.1% |

| | | | | | | | | | | | |

North Carolina | | | | | | | | | | | | |

Charlotte | | 1,081 | | 1,352 | 1,230 | 9.9% | 92.0% | 93.9% | -190 | 4,257 | 3,909 | 8.9% |

Raleigh/Durham | | 611 | | 1,420 | 1,308 | 8.6% | 94.9% | 92.3% | 260 | 2,576 | 2,398 | 7.4% |

Average/Total | | 1,692 | | 1,377 | 1,259 | 9.4% | 93.1% | 93.3% | -20 | 6,833 | 6,307 | 8.3% |

| | | | | | | | | | | | |

Georgia | | | | | | | | | | | | |

Atlanta | | 1,438 | | 1,453 | 1,311 | 10.8% | 92.1% | 94.6% | -250 | 6,074 | 5,520 | 10.0% |

Average/Total | | 1,438 | | 1,453 | 1,311 | 10.8% | 92.1% | 94.6% | -250 | 6,074 | 5,520 | 10.0% |

| | | | | | | | | | | | |

Tennessee | | | | | | | | | | | | |

Nashville | | 1,322 | | 1,329 | 1,160 | 14.6% | 94.2% | 94.9% | -70 | 5,587 | 4,931 | 13.3% |

Average/Total | | 1,322 | | 1,329 | 1,160 | 14.6% | 94.2% | 94.9% | -70 | 5,587 | 4,931 | 13.3% |

| | | | | | | | | | | | |

Florida | | | | | | | | | | | | |

Orlando | | 1,172 | | 1,578 | 1,344 | 17.4% | 94.9% | 95.2% | -30 | 5,422 | 4,828 | 12.3% |

Tampa | | 576 | | 1,430 | 1,216 | 17.6% | 95.5% | 93.9% | 160 | 2,530 | 2,096 | 20.7% |

South Florida | | 1,956 | | 2,013 | 1,723 | 16.8% | 95.4% | 94.9% | 50 | 12,010 | 10,433 | 15.1% |

Average/Total | | 3,704 | | 1,785 | 1,524 | 17.1% | 95.2% | 94.9% | 30 | 19,962 | 17,357 | 15.0% |

| | | | | | | | | | | | |

Arizona | | | | | | | | | | | | |

Phoenix | | 1,679 | | 1,499 | 1,335 | 12.3% | 95.1% | 95.3% | -20 | 8,034 | 7,089 | 13.3% |

Average/Total | | 1,679 | | 1,499 | 1,335 | 12.3% | 95.1% | 95.3% | -20 | 8,034 | 7,089 | 13.3% |

| | | | | | | | | | | | |

Nevada | | | | | | | | | | | | |

Las Vegas | | 1,156 | | 1,430 | 1,328 | 7.7% | 93.5% | 92.3% | 120 | 4,693 | 4,458 | 5.3% |

Average/Total | | 1,156 | | 1,430 | 1,328 | 7.7% | 93.5% | 92.3% | 120 | 4,693 | 4,458 | 5.3% |

| | | | | | | | | | | | |

Average/Total | | 13,534 | | $1,494 | $1,319 | 13.3% | 94.0% | 94.3% | -30 | $61,149 | $54,963 | 11.3% |

(1) | This table only includes the 36 properties in our Q1 Same Store pool. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

QoQ Same Store Properties Operating Metrics

(dollars in thousands, except for per unit data)

| | | | | | | | | | | | |

Properties by Market (1) | | Unit Count | | Average Effective Rent | Occupancy | Total Rental Income |

| | | | | | | | | | | | |

| | Total | | Q1 2023 | Q4 2022 | % Change | Q1 2023 | Q4 2022 | bps ∆ | Q1 2023 | Q4 2022 | % Change |

Texas | | | | | | | | | | | | |

Dallas | | 2,543 | | $1,271 | $1,264 | 0.6% | 93.1% | 94.3% | -120 | $9,966 | $10,058 | -0.9% |

Average/Total | | 2,543 | | 1,271 | 1,264 | 0.6% | 93.1% | 94.3% | -120 | 9,966 | 10,058 | -0.9% |

| | | | | | | | | | | | |

North Carolina | | | | | | | | | | | | |

Charlotte | | 1,081 | | 1,352 | 1,328 | 1.8% | 92.0% | 94.6% | -260 | 4,257 | 4,260 | -0.1% |

Raleigh/Durham | | 611 | | 1,420 | 1,427 | -0.5% | 94.9% | 95.0% | -10 | 2,576 | 2,604 | -1.1% |

Average/Total | | 1,692 | | 1,377 | 1,364 | 1.0% | 93.1% | 94.7% | -160 | 6,833 | 6,864 | -0.5% |

| | | | | | | | | | | | |

Georgia | | | | | | | | | | | | |

Atlanta | | 1,438 | | 1,453 | 1,449 | 0.3% | 92.1% | 93.8% | -170 | 6,074 | 6,194 | -1.9% |

Average/Total | | 1,438 | | 1,453 | 1,449 | 0.3% | 92.1% | 93.8% | -170 | 6,074 | 6,194 | -1.9% |

| | | | | | | | | | | | |

Tennessee | | | | | | | | | | | | |

Nashville | | 1,322 | | 1,329 | 1,312 | 1.3% | 94.2% | 94.9% | -70 | 5,587 | 5,481 | 1.9% |

Average/Total | | 1,322 | | 1,329 | 1,312 | 1.3% | 94.2% | 94.9% | -70 | 5,587 | 5,481 | 1.9% |

| | | | | | | | | | | | |

Florida | | | | | | | | | | | | |

Orlando | | 1,172 | | 1,578 | 1,568 | 0.6% | 94.9% | 92.7% | 220 | 5,422 | 5,059 | 7.2% |

Tampa | | 576 | | 1,430 | 1,431 | -0.1% | 95.5% | 94.3% | 120 | 2,530 | 2,425 | 4.3% |

South Florida | | 1,956 | | 2,013 | 1,997 | 0.8% | 95.4% | 95.0% | 40 | 12,009 | 11,684 | 2.8% |

Average/Total | | 3,704 | | 1,785 | 1,773 | 0.7% | 95.2% | 94.2% | 100 | 19,961 | 19,168 | 4.1% |

| | | | | | | | | | | | |

Arizona | | | | | | | | | | | | |

Phoenix | | 1,679 | | 1,499 | 1,491 | 0.5% | 95.1% | 94.7% | 40 | 8,034 | 7,930 | 1.3% |

Average/Total | | 1,679 | | 1,499 | 1,491 | 0.5% | 95.1% | 94.7% | 40 | 8,034 | 7,930 | 1.3% |

| | | | | | | | | | | | |

Nevada | | | | | | | | | | | | |

Las Vegas | | 1,156 | | 1,430 | 1,455 | -1.7% | 93.5% | 91.1% | 240 | 4,694 | 4,816 | -2.5% |

Average/Total | | 1,156 | | 1,430 | 1,455 | -1.7% | 93.5% | 91.1% | 240 | 4,694 | 4,816 | -2.5% |

| | | | | | | | | | | | |

Average/Total | | 13,534 | | $1,494 | $1,485 | 0.6% | 94.0% | 94.1% | -10 | $61,149 | $60,511 | 1.1% |

(1) | This table only includes the 36 properties in our Q1 Same Store pool. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

FFO, Core FFO and AFFO

The following table reconciles our calculations of FFO, Core FFO and AFFO to net loss, the most directly comparable GAAP financial measure, for the three months ended March 31, 2023 and 2022 (in thousands, except per share amounts):

| | For the Three Months Ended March 31, | | | | | |

| | 2023 | | | 2022 | | | % Change | |

Net loss | | $ | (3,898 | ) | | $ | (4,667 | ) | | | 16.5 | % |

Depreciation and amortization | | | 23,266 | | | | 23,718 | | | | -1.9 | % |

Adjustment for noncontrolling interests | | | (73 | ) | | | (57 | ) | | | 28.1 | % |

FFO attributable to common stockholders | | | 19,295 | | | | 18,994 | | | | 1.6 | % |

| | | | | | | | | | | | |

FFO per share - basic | | $ | 0.75 | | | $ | 0.74 | | | | 1.7 | % |

FFO per share - diluted | | $ | 0.74 | | | $ | 0.73 | | | | 2.0 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Gain on extinguishment of debt and modification costs | | | (122 | ) | | | — | | | | 0.0 | % |

Casualty-related expenses/(recoveries) | | | (1,706 | ) | | | 1,047 | | | N/M | |

Casualty loss (gain) | | | 814 | | | | (128 | ) | | N/M | |

Amortization of deferred financing costs - acquisition term notes | | | 330 | | | | 182 | | | N/M | |

Adjustment for noncontrolling interests | | | 2 | | | | (4 | ) | | N/M | |

Core FFO attributable to common stockholders | | | 18,613 | | | | 20,091 | | | | -7.4 | % |

| | | | | | | | | | | | |

Core FFO per share - basic | | $ | 0.73 | | | $ | 0.78 | | | | -7.3 | % |

Core FFO per share - diluted | | $ | 0.71 | | | $ | 0.77 | | | | -6.9 | % |

| | | | | | | | | | | | |

Amortization of deferred financing costs - long term debt | | | 438 | | | | 386 | | | | 13.4 | % |

Equity-based compensation expense | | | 1,966 | | | | 1,876 | | | | 4.8 | % |

Adjustment for noncontrolling interests | | | (9 | ) | | | (7 | ) | | | 28.6 | % |

AFFO attributable to common stockholders | | | 21,008 | | | | 22,346 | | | | -6.0 | % |

| | | | | | | | | | | | |

AFFO per share - basic | | $ | 0.82 | | | $ | 0.87 | | | | -5.9 | % |

AFFO per share - diluted | | $ | 0.81 | | | $ | 0.85 | | | | -5.6 | % |

| | | | | | | | | | | | |

Weighted average common shares outstanding - basic | | | 25,599 | | | | 25,620 | | | | -0.1 | % |

Weighted average common shares outstanding - diluted | (1) | | 26,075 | | | | 26,193 | | | | -0.5 | % |

| | | | | | | | | | | | |

Dividends declared per common share | | $ | 0.420 | | | $ | 0.380 | | | | 10.5 | % |

| | | | | | | | | | | | |

Net loss Coverage - diluted | (2) | -0.36x | | | -0.47x | | | | -24.6 | % |

FFO Coverage - diluted | (2) | 1.76x | | | 1.91x | | | | -7.7 | % |

Core FFO Coverage - diluted | (2) | 1.70x | | | 2.02x | | | | -15.8 | % |

AFFO Coverage - diluted | (2) | 1.92x | | | 2.25x | | | | -14.6 | % |

(1) | The Company uses actual diluted weighted average common shares outstanding when in a dilutive position for FFO, Core FFO and AFFO. |

(2) | Indicates coverage ratio of Net Loss/FFO/Core FFO/AFFO per common share (diluted) over dividends declared per common share during the period. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Historical Capital Expenditures

| | Q1 2023 | | | Q1 2022 | | | % Change | |

($ in thousands) | | | | | | | | | | | | |

Capital Expenditures | | | | | | | | | | | | |

Acquisition Capital Expenditures | | $ | — | | | $ | — | | | N/A | |

| | | | | | | | | | | | |

Capitalized Rehab Expenditures | | | | | | | | | | | | |

Interior | | | 7,309 | | | | 4,714 | | | | 55.0 | % |

Exterior and common area | | | 4,007 | | | | 917 | | | | 337.0 | % |

| | | | | | | | | | | | |

Capitalized Maintenance Expenditures | | | | | | | | | | | | |

Recurring | | | 2,680 | | | | 2,043 | | | | 31.2 | % |

Non-Recurring | | | 2,294 | | | | 1,200 | | | | 91.2 | % |

| | | | | | | | | | | | |

Total Capital Expenditures | | $ | 16,290 | | | $ | 8,874 | | | | 83.6 | % |

Value-Add Program Details: Interiors (Full & Partials)

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Property Name (1) | | Units | | | Rehab Units Completed (2) | | | Average Rent Pre-Rehab | | | Average Rent Post-Rehab | | | Avg. Rehab Cost Per Unit (3) | | | Post-Rehab Rent Change % | | | ROI (3) | |

Value-Add Programs In Progress | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Arbors of Brentwood | | | 346 | | | | 130 | | | $ | 1,245 | | | $ | 1,438 | | | $ | 9,880 | | | | 15.5 | % | | | 23.4 | % |

Arbors on Forest Ridge | | | 210 | | | | 175 | | | | 803 | | | | 904 | | | | 4,379 | | | | 12.7 | % | | | 27.9 | % |

Atera Apartments | | | 380 | | | | 223 | | | | 1,176 | | | | 1,325 | | | | 3,265 | | | | 12.6 | % | | | 54.6 | % |

Avant at Pembroke Pines | | | 1,520 | | | | 520 | | | | 1,765 | | | | 2,030 | | | | 15,815 | | | | 15.0 | % | | | 20.1 | % |

Bella Solara | | | 320 | | | | 110 | | | | 1,283 | | | | 1,445 | | | | 10,814 | | | | 12.6 | % | | | 18.0 | % |

Bella Vista | | | 248 | | | | 186 | | | | 1,451 | | | | 1,599 | | | | 10,302 | | | | 10.1 | % | | | 17.1 | % |

Bloom | | | 528 | | | | 131 | | | | 1,265 | | | | 1,422 | | | | 14,227 | | | | 12.4 | % | | | 13.2 | % |

Brandywine I & II | | | 632 | | | | 448 | | | | 1,041 | | | | 1,207 | | | | 9,414 | | | | 16.0 | % | | | 21.2 | % |

Courtney Cove | | | 324 | | | | 247 | | | | 926 | | | | 1,030 | | | | 4,933 | | | | 11.3 | % | | | 25.4 | % |

Creekside at Matthews | | | 240 | | | | 64 | | | | 1,333 | | | | 1,514 | | | | 10,696 | | | | 13.6 | % | | | 20.4 | % |

Cutter's Point | | | 196 | | | | 152 | | | | 981 | | | | 1,109 | | | | 6,021 | | | | 12.9 | % | | | 25.3 | % |

Estates on Maryland | | | 330 | | | | 75 | | | | 1,260 | | | | 1,448 | | | | 10,491 | | | | 14.9 | % | | | 21.5 | % |

Fairways of San Marcos | | | 352 | | | | 123 | | | | 1,511 | | | | 1,698 | | | | 10,833 | | | | 12.4 | % | | | 20.8 | % |

High House at Cary | | | 302 | | | | 59 | | | | 1,337 | | | | 1,579 | | | | 10,160 | | | | 18.1 | % | | | 28.6 | % |

Madera Point | | | 256 | | | | 254 | | | | 865 | | | | 975 | | | | 4,282 | | | | 12.7 | % | | | 30.9 | % |

Parc500 | | | 217 | | | | 203 | | | | 1,270 | | | | 1,459 | | | | 13,793 | | | | 14.8 | % | | | 16.4 | % |

Radbourne Lake | | | 225 | | | | 351 | | | | 1,057 | | | | 1,113 | | | | 1,920 | | | | 5.3 | % | | | 35.2 | % |

Residences at Glenview Reserve | | | 360 | | | | 198 | | | | 1,132 | | | | 1,330 | | | | 12,284 | | | | 17.5 | % | | | 19.4 | % |

Residences at West Place | | | 342 | | | | 124 | | | | 1,478 | | | | 1,675 | | | | 10,925 | | | | 13.3 | % | | | 21.6 | % |

Rockledge Apartments | | | 708 | | | | 406 | | | | 1,205 | | | | 1,408 | | | | 10,435 | | | | 16.8 | % | | | 23.3 | % |

Sabal Palm at Lake Buena Vista | | | 400 | | | | 80 | | | | 1,592 | | | | 1,822 | | | | 13,105 | | | | 14.4 | % | | | 21.1 | % |

Seasons 704 Apartments | | | 222 | | | | 225 | | | | 1,187 | | | | 1,317 | | | | 6,695 | | | | 11.0 | % | | | 23.3 | % |

Silverbrook | | | 642 | | | | 482 | | | | 803 | | | | 889 | | | | 4,086 | | | | 10.8 | % | | | 25.5 | % |

Six Forks Station | | | 323 | | | | 81 | | | | 1,181 | | | | 1,418 | | | | 12,288 | | | | 20.1 | % | | | 23.2 | % |

Summers Landing | | | 196 | | | | 36 | | | | 1,017 | | | | 1,209 | | | | 7,821 | | | | 18.8 | % | | | 29.3 | % |

Summit at Sabal Park | | | 252 | | | | 231 | | | | 980 | | | | 1,082 | | | | 5,782 | | | | 10.4 | % | | | 21.1 | % |

The Adair | | | 232 | | | | 85 | | | | 1,715 | | | | 2,000 | | | | 12,042 | | | | 16.6 | % | | | 28.3 | % |

The Cornerstone | | | 430 | | | | 478 | | | | 1,043 | | | | 1,134 | | | | 4,758 | | | | 8.7 | % | | | 23.0 | % |

The Enclave | | | 204 | | | | 155 | | | | 1,443 | | | | 1,627 | | | | 9,604 | | | | 12.8 | % | | | 23.0 | % |

The Heritage | | | 204 | | | | 166 | | | | 1,396 | | | | 1,538 | | | | 9,901 | | | | 10.1 | % | | | 17.2 | % |

The Preserve at Terrell Mill | | | 752 | | | | 677 | | | | 857 | | | | 1,021 | | | | 10,518 | | | | 19.2 | % | | | 18.7 | % |

The Verandas at Lake Norman | | | 264 | | | | 52 | | | | 1,404 | | | | 1,597 | | | | 10,640 | | | | 13.8 | % | | | 21.8 | % |

The Venue on Camelback | | | 415 | | | | 247 | | | | 764 | | | | 1,017 | | | | 9,775 | | | | 33.1 | % | | | 31.0 | % |

Timber Creek | | | 352 | | | | 246 | | | | 893 | | | | 1,037 | | | | 7,415 | | | | 16.1 | % | | | 23.2 | % |

Torreyana Apartments | | | 316 | | | | 43 | | | | 1,494 | | | | 1,614 | | | | 12,608 | | | | 8.0 | % | | | 11.4 | % |

Venue at 8651 | | | 333 | | | | 290 | | | | 818 | | | | 928 | | | | 6,842 | | | | 13.5 | % | | | 19.3 | % |

Versailles | | | 388 | | | | 302 | | | | 804 | | | | 902 | | | | 6,101 | | | | 12.2 | % | | | 19.3 | % |

Versailles II | | | 242 | | | | 72 | | | | 961 | | | | 1,087 | | | | 4,726 | | | | 13.1 | % | | | 32.0 | % |

Total/Weighted Average | | | 14,203 | | | | 8,127 | | | $ | 1,101 | | | $ | 1,254 | | | $ | 8,407 | | | | 13.9 | % | | | 21.8 | % |

(1) | We do not plan to upgrade 100% of the units at each of our properties. |

(2) | Inclusive of all full and partial interior upgrades completed through March 31, 2023. |

(3) | Inclusive of all full and partial interior upgrades completed and leased through March 31, 2023. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Value-Add Program Details: Kitchen & Laundry Appliances

Property Name (1) | | Units | | | Rehab Units Completed (2) | | | Avg. Rehab Cost Per Unit (3) | | | Post-Rehab Rent Change $ | | | ROI (3) | |

Value-Add Programs In Progress | | | | | | | | | | | | | | | | | | | | |

Arbors of Brentwood | | | 346 | | | | 308 | | | $ | 859 | | | $ | 50 | | | | 69.6 | % |

Arbors on Forest Ridge | | | 210 | | | | 127 | | | | 768 | | | | 41 | | | | 64.8 | % |

Atera Apartments | | | 380 | | | | 366 | | | | 816 | | | | 41 | | | | 59.6 | % |

Avant at Pembroke Pines | | | 1,520 | | | | 131 | | | | 1,183 | | | | 47 | | | | 47.6 | % |

Brandywine I & II | | | 632 | | | | 168 | | | | 1,040 | | | | 43 | | | | 50.1 | % |

Creekside at Matthews | | | 240 | | | | 125 | | | | 1,087 | | | | 55 | | | | 60.7 | % |

Cutter's Point | | | 196 | | | | 137 | | | | 754 | | | | 46 | | | | 73.1 | % |

Estates on Maryland | | | 330 | | | | 29 | | | | 1,097 | | | | 35 | | | | 38.3 | % |

Madera Point | | | 256 | | | | 157 | | | | 899 | | | | 28 | | | | 36.7 | % |

Radbourne Lake | | | 225 | | | | 224 | | | | 717 | | | | 40 | | | | 66.9 | % |

Rockledge Apartments | | | 708 | | | | 612 | | | | 821 | | | | 40 | | | | 58.5 | % |

Sabal Palm at Lake Buena Vista | | | 400 | | | | 634 | | | | 599 | | | | 86 | | | | 171.8 | % |

Silverbrook | | | 642 | | | | 377 | | | | 736 | | | | 49 | | | | 79.4 | % |

Six Forks Station | | | 323 | | | | 205 | | | | 1,096 | | | | 55 | | | | 60.2 | % |

Summers Landing | | | 196 | | | | 83 | | | | 839 | | | | 50 | | | | 71.5 | % |

Summit at Sabal Park | | | 252 | | | | 248 | | | | 998 | | | | 40 | | | | 48.1 | % |

The Adair | | | 232 | | | | 11 | | | | 1,100 | | | | 45 | | | | 49.1 | % |

The Cornerstone | | | 430 | | | | 17 | | | | 809 | | | | 50 | | | | 74.2 | % |

The Verandas at Lake Norman | | | 264 | | | | 133 | | | | 1,089 | | | | 45 | | | | 49.6 | % |

Timber Creek | | | 352 | | | | 137 | | | | 765 | | | | 45 | | | | 70.6 | % |

Venue at 8651 | | | 333 | | | | 248 | | | | 769 | | | | 47 | | | | 72.7 | % |

Versailles | | | 388 | | | | 302 | | | | 872 | | | | 50 | | | | 68.5 | % |

Versailles II | | | 242 | | | | 135 | | | | 906 | | | | 31 | | | | 40.7 | % |

Total/Weighted Average | | | 9,097 | | | | 4,914 | | | $ | 864 | | | $ | 47 | | | | 65.6 | % |

(1) | We do not plan to upgrade 100% of the units at each of our properties. |

(2) | Inclusive of all kitchen and laundry appliance upgrades completed through March 31, 2023. |

(3) | Inclusive of all kitchen and laundry appliance upgrades completed and leased through March 31, 2023. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Value-Add Program Details: Smart Home Technology Packages

Property Name (1) | | Units | | | Rehab Units Completed (2) | | | Avg. Rehab Cost Per Unit (3) | | | Post-Rehab Rent Change $ | | | ROI (3) | |

Value-Add Programs In Progress | | | | | | | | | | | | | | | | | | | | |

Arbors of Brentwood | | | 346 | | | | 346 | | | $ | 1,419 | | | $ | 45 | | | | 30.9 | % |

Arbors on Forest Ridge | | | 210 | | | | 210 | | | | 1,416 | | | | 45 | | | | 30.9 | % |

Atera Apartments | | | 380 | | | | 380 | | | | 1,339 | | | | 50 | | | | 37.0 | % |

Avant at Pembroke Pines | | | 1,520 | | | | 1,520 | | | | 1,350 | | | | 45 | | | | 32.4 | % |

Bella Vista | | | 248 | | | | 248 | | | | 970 | | | | 40 | | | | 39.3 | % |

Brandywine I & II | | | 632 | | | | 632 | | | | 1,234 | | | | 45 | | | | 35.5 | % |

Courtney Cove | | | 324 | | | | 324 | | | | 1,238 | | | | 35 | | | | 26.2 | % |

Creekside at Matthews | | | 240 | | | | 240 | | | | 913 | | | | 65 | | | | 72.9 | % |

Cutter's Point | | | 196 | | | | 196 | | | | 1,400 | | | | 45 | | | | 31.3 | % |

Fairways of San Marcos | | | 352 | | | | 352 | | | | 901 | | | | 40 | | | | 42.3 | % |

Madera Point | | | 256 | | | | 256 | | | | 1,283 | | | | 45 | | | | 34.1 | % |

Old Farm | | | 734 | | | | 734 | | | | 928 | | | | 45 | | | | 47.2 | % |

Radbourne Lake | | | 225 | | | | 225 | | | | 630 | | | | 35 | | | | 51.4 | % |

Residences at Glenview Reserve | | | 360 | | | | 360 | | | | 1,017 | | | | 45 | | | | 43.1 | % |

Sabal Palm at Lake Buena Vista | | | 400 | | | | 400 | | | | 1,237 | | | | 45 | | | | 35.4 | % |

Silverbrook | | | 642 | | | | 642 | | | | 1,308 | | | | 45 | | | | 33.5 | % |

Six Forks Station | | | 323 | | | | 323 | | | | 844 | | | | 35 | | | | 38.4 | % |

Stone Creek at Old Farm | | | 190 | | | | 190 | | | | 909 | | | | 45 | | | | 48.2 | % |

Summers Landing | | | 196 | | | | 196 | | | | 1,449 | | | | 45 | | | | 30.2 | % |

The Adair | | | 232 | | | | 232 | | | | 913 | | | | 45 | | | | 48.0 | % |

The Cornerstone | | | 430 | | | | 430 | | | | 1,236 | | | | 45 | | | | 35.4 | % |

The Enclave | | | 204 | | | | 204 | | | | 966 | | | | 40 | | | | 39.4 | % |

The Heritage | | | 204 | | | | 204 | | | | 997 | | | | 40 | | | | 38.2 | % |

The Verandas at Lake Norman | | | 264 | | | | 264 | | | | 954 | | | | 65 | | | | 69.8 | % |

Timber Creek | | | 352 | | | | 352 | | | | 1,299 | | | | 45 | | | | 33.7 | % |

Venue at 8651 | | | 333 | | | | 333 | | | | 1,229 | | | | 45 | | | | 35.6 | % |

Versailles | | | 388 | | | | 388 | | | | 1,080 | | | | 45 | | | | 40.6 | % |

Versailles II | | | 242 | | | | 242 | | | | 1,241 | | | | 45 | | | | 35.3 | % |

Total/Weighted Average | | | 10,423 | | | | 10,423 | | | $ | 1,165 | | | $ | 45 | | | | 37.4 | % |

| | | | | | | | | | | | | | | | | | | | |

Planned Value-Add Programs | | | | | | | | | | | | | | Rent Change & ROI (Projections) | |

Bella Solara | | | 320 | | | | — | | | TBD | | | TBD | | | TBD | |

Bloom | | | 528 | | | | — | | | TBD | | | TBD | | | TBD | |

Estates on Maryland | | | 330 | | | | — | | | TBD | | | TBD | | | TBD | |

Hight House at Cary | | | 302 | | | | — | | | TBD | | | TBD | | | TBD | |

Residences at West Place | | | 342 | | | | — | | | TBD | | | TBD | | | TBD | |

Rockledge Apartments | | | 708 | | | | — | | | TBD | | | TBD | | | TBD | |

Seasons 704 Apartments | | | 222 | | | | — | | | TBD | | | TBD | | | TBD | |

Summit at Sabal Park | | | 252 | | | | — | | | TBD | | | TBD | | | TBD | |

The Preserve at Terrell Mill | | | 752 | | | | — | | | TBD | | | TBD | | | TBD | |

The Venue on Camelback | | | 415 | | | | — | | | TBD | | | TBD | | | TBD | |

Torreyana Apartments | | | 316 | | | | — | | | TBD | | | TBD | | | TBD | |

Total/Weighted Average Planned | | | 4,487 | | | | — | | | TBD | | | TBD | | | TBD | |

(1) | We do not plan to upgrade 100% of the units at each of our properties. |

(2) | Inclusive of all smart home technology package upgrades completed through March 31, 2023. |

(3) | Inclusive of all smart home technology package upgrades completed and leased through March 31, 2023. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Outstanding Debt Details

Mortgage Debt

The following table contains summary information concerning the mortgage debt of the Company as of March 31, 2023 (dollars in thousands):

Operating Properties | | Type | | Term (months) | | | Outstanding Principal (1) | | | Interest Rate (2) | | | Maturity Date |

Arbors on Forest Ridge | | Floating | | | 120 | | | $ | 19,184 | | | 6.18% | | | 12/1/2032 |

Cutter's Point | | Floating | | | 120 | | | | 21,524 | | | 6.18% | | | 12/1/2032 |

Silverbrook | | Floating | | | 120 | | | | 46,088 | | | 6.18% | | | 12/1/2032 |

The Summit at Sabal Park | | Floating | | | 120 | | | | 30,826 | | | 6.18% | | | 12/1/2032 |

Courtney Cove | | Floating | | | 120 | | | | 36,146 | | | 6.18% | | | 12/1/2032 |

The Preserve at Terrell Mill | | Floating | | | 120 | | | | 71,098 | | | 6.18% | | | 12/1/2032 |

Versailles | | Floating | | | 120 | | | | 40,247 | | | 6.18% | | | 12/1/2032 |

Seasons 704 Apartments | | Floating | | | 120 | | | | 33,132 | | | 6.18% | | | 12/1/2032 |

Madera Point | | Floating | | | 120 | | | | 34,457 | | | 6.18% | | | 12/1/2032 |

Venue at 8651 | | Floating | | | 120 | | | | 18,690 | | | 6.18% | | | 12/1/2032 |

The Venue on Camelback | | Floating | | | 84 | | | | 42,788 | | | 6.81% | | | 2/1/2033 |

Timber Creek | | Floating | | | 84 | | | | 24,100 | | | 6.12% | | | 10/1/2025 |

Radbourne Lake | | Floating | | | 84 | | | | 20,000 | | | 6.15% | | | 10/1/2025 |

Sabal Palm at Lake Buena Vista | | Floating | | | 84 | | | | 42,100 | | | 6.16% | | | 9/1/2025 |

Cornerstone | | Floating | | | 120 | | | | 46,804 | | | 6.72% | | | 12/1/2032 |

Parc500 | | Floating | | | 120 | | | | 29,416 | | | 6.18% | | | 12/1/2032 |

Rockledge Apartments | | Floating | | | 120 | | | | 93,129 | | | 6.18% | | | 12/1/2032 |

Atera Apartments | | Floating | | | 120 | | | | 46,198 | | | 6.18% | | | 12/1/2032 |

Crestmont Reserve | | Floating | | | 84 | | | | 12,061 | | | 6.04% | | | 10/1/2025 |

Brandywine I & II | | Floating | | | 84 | | | | 43,835 | | | 6.04% | | | 10/1/2025 |

Bella Vista | | Floating | | | 84 | | | | 29,040 | | | 6.18% | | | 2/1/2026 |

The Enclave | | Floating | | | 84 | | | | 25,322 | | | 6.18% | | | 2/1/2026 |

The Heritage | | Floating | | | 84 | | | | 24,625 | | | 6.18% | | | 2/1/2026 |

Summers Landing | | Floating | | | 84 | | | | 10,109 | | | 6.04% | | | 10/1/2025 |

Residences at Glenview Reserve | | Floating | | | 84 | | | | 25,785 | | | 6.30% | | | 10/1/2025 |

Residences at West Place | | Fixed | | | 120 | | | | 33,817 | | | 4.24% | | | 10/1/2028 |

Avant at Pembroke Pines | | Floating | | | 84 | | | | 177,100 | | | 6.29% | | | 9/1/2026 |

Arbors of Brentwood | | Floating | | | 84 | | | | 34,237 | | | 6.29% | | | 10/1/2026 |

Torreyana Apartments | | Floating | | | 120 | | | | 50,580 | | | 6.18% | | | 12/1/2032 |

Bloom | | Floating | | | 120 | | | | 59,830 | | | 6.18% | | | 12/1/2032 |

Bella Solara | | Floating | | | 120 | | | | 40,328 | | | 6.18% | | | 12/1/2032 |

Fairways at San Marcos | | Floating | | | 120 | | | | 60,228 | | | 6.18% | | | 12/1/2032 |

The Verandas at Lake Norman | | Floating | | | 84 | | | | 34,925 | | | 6.48% | | | 7/1/2028 |

Creekside at Matthews | | Floating | | | 120 | | | | 29,648 | | | 6.18% | | | 12/1/2032 |

Six Forks Station | | Floating | | | 120 | | | | 41,180 | | | 6.35% | | | 10/1/2031 |

High House at Cary | | Floating | | | 84 | | | | 46,625 | | | 6.64% | | | 1/1/2029 |

The Adair | | Floating | | | 84 | | | | 35,115 | | | 6.60% | | | 4/1/2029 |

Estates on Maryland | | Floating | | | 84 | | | | 43,157 | | | 6.60% | | | 4/1/2029 |

| | | | | | | | $ | 1,553,474 | | | | | | | |

Fair market value adjustment | | | | | | | | | 583 | | | | | | | |

Deferred financing costs, net of accumulated amortization of $2,936 | | | | | | | | | (12,526 | ) | | | | | | |

| | | | | | | | $ | 1,541,531 | | | | | | | |

| | | | | | | | | | | | | | | | |

Held For Sale Properties | | | | | | | | | | | | | | | | |

Old Farm | | Floating | | | 84 | | | $ | 52,886 | | | 6.54% | | | 7/1/2024 |

Stone Creek at Old Farm | | Floating | | | 84 | | | | 15,274 | | | 6.54% | | | 7/1/2024 |

| | | | | | | | $ | 68,160 | | | | | | | |

Deferred financing costs, net of accumulated amortization of $553 | | | | | | | | | (120 | ) | | | | | | |

| | | | | | | | $ | 68,040 | | | | | | | |

(1) | Mortgage debt that is non-recourse to the Company and encumbers the multifamily properties. |

(2) | Interest rate is based on a reference rate plus an applicable margin, except for fixed rate mortgage debt. One-month LIBOR was 4.858% and 30-Day Average SOFR was 4.630% as of March 31, 2023.

|

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Credit Facility

The following table contains summary information concerning the Company’s credit facility as of March 31, 2023 (dollars in thousands):

| | Type | | Term (months) | | | Outstanding Principal | | | Interest Rate (1) | | | Maturity Date |

Corporate Credit Facility | | Floating | | | 36 | | | $ | 57,000 | | | 6.88% | | | 6/30/2025 |

Deferred financing costs, net of accumulated amortization of $1,426 | | | | | | | | | (1,581 | ) | | | | | | |

| | | | | | | | $ | 55,419 | | | | | | | |

(1) | Interest rate is based on Term SOFR plus an applicable margin. Term SOFR as of March 31, 2023 was 4.802%. |

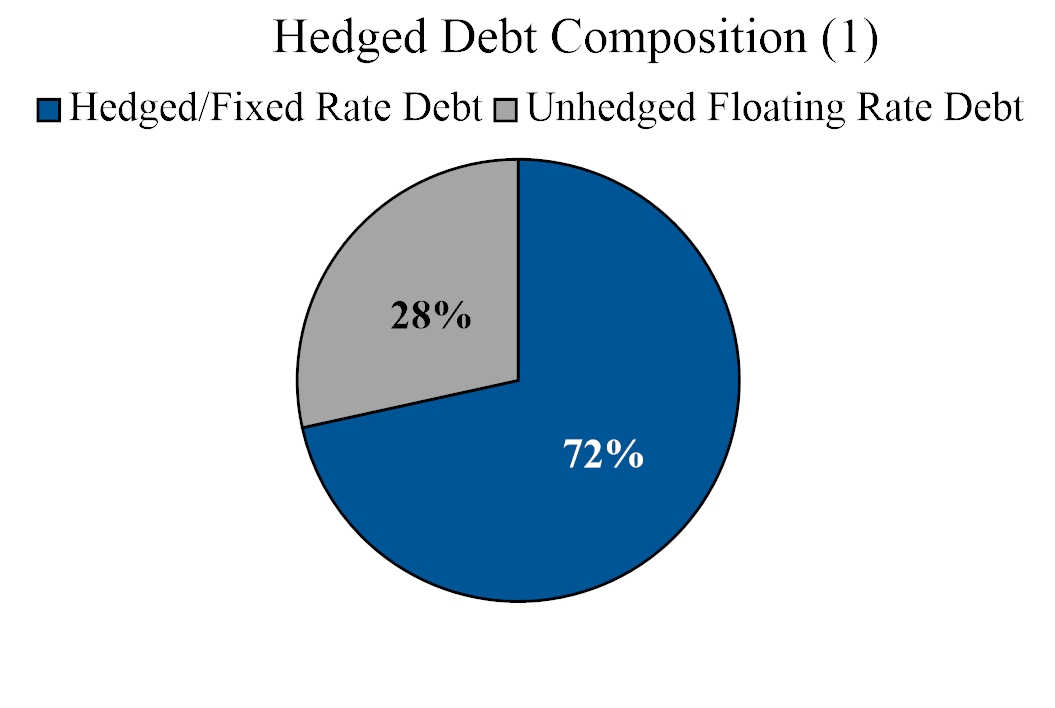

Interest Rate Swap Agreements

As of March 31, 2023, the Company had the following outstanding interest rate swaps that were designated as cash flow hedges of interest rate risk (dollars in thousands):

Effective Date | | Termination Date | | Counterparty | | Notional Amount | | | Fixed Rate (1) | | |

June 1, 2019 | | June 1, 2024 | | KeyBank | | $ | 50,000 | | | | 2.0020 | % | |

June 1, 2019 | | June 1, 2024 | | Truist | | | 50,000 | | | | 2.0020 | % | |

September 1, 2019 | | September 1, 2026 | | KeyBank | | | 100,000 | | | | 1.4620 | % | |

September 1, 2019 | | September 1, 2026 | | KeyBank | | | 125,000 | | | | 1.3020 | % | |

January 3, 2020 | | September 1, 2026 | | KeyBank | | | 92,500 | | | | 1.6090 | % | |

March 4, 2020 | | June 1, 2026 | | Truist | | | 100,000 | | | | 0.8200 | % | |

June 1, 2021 | | September 1, 2026 | | KeyBank | | | 200,000 | | | | 0.8450 | % | |

June 1, 2021 | | September 1, 2026 | | KeyBank | | | 200,000 | | | | 0.9530 | % | |

March 1, 2022 | | March 1, 2025 | | Truist | | | 145,000 | | | | 0.5730 | % | |

March 1, 2022 | | March 1, 2025 | | Truist | | | 105,000 | | | | 0.6140 | % | |

| | | | | | $ | 1,167,500 | | | | 1.0682 | % | (2) |

(1) | The floating rate option for the interest rate swaps is one-month LIBOR. As of March 31, 2023, one-month LIBOR was 4.858%. |

(2) | Represents the weighted average fixed rate of the interest rate swaps. |

The following table contains summary information regarding our forward interest rate swap (dollars in thousands):

Effective Date | | Termination Date | | Counterparty | | Notional Amount | | | Fixed Rate (1) | | |

September 1, 2026 | | January 1, 2027 | | KeyBank | | $ | 92,500 | | | | 1.7980 | % | |

(1) | The floating rate option for the interest rate swap is one-month LIBOR. As of March 31, 2023, one-month LIBOR was 4.858%. |

(2) | Represents the weighted average fixed rate of the forward interest rate swap. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

Interest Rate Cap Agreements

As of March 31, 2023, the Company had the following outstanding interest rate caps outstanding that are not designated as cash flow hedges of interest rate risk (dollars in thousands):

Properties | | Type | | Notional | | | Strike Rate | | |

Sabal Palm at Lake Buena Vista | | Floating | | $ | 42,100 | | | | 6.20 | % | |

Residences at Glenview Reserve | | Floating | | | 25,977 | | | | 4.81 | % | |

Timber Creek | | Floating | | | 24,100 | | | | 4.99 | % | |

Brandywine I & II | | Floating | | | 43,835 | | | | 6.82 | % | |

Radbourne Lake | | Floating | | | 20,000 | | | | 6.46 | % | |

Summers Landing | | Floating | | | 10,109 | | | | 6.07 | % | |

Crestmont Reserve | | Floating | | | 12,061 | | | | 6.82 | % | |

Fairways at San Marcos | | Floating | | | 46,464 | | | | 3.37 | % | |

The Verandas at Lake Norman | | Floating | | | 34,925 | | | | 3.40 | % | |

Creekside at Matthews | | Floating | | | 31,900 | | | | 4.40 | % | |

Six Forks Station | | Floating | | | 41,180 | | | | 4.00 | % | |

High House at Cary | | Floating | | | 46,625 | | | | 2.74 | % | |

Estates on Maryland | | Floating | | | 43,157 | | | | 3.91 | % | |

The Adair | | Floating | | | 35,115 | | | | 3.91 | % | |

Rockledge Apartments | | Floating | | | 93,129 | | | | 6.45 | % | |

The Preserve at Terrell Mill | | Floating | | | 71,098 | | | | 6.45 | % | |

Fairways at San Marcos | | Floating | | | 60,228 | | | | 6.70 | % | |

Bloom | | Floating | | | 59,830 | | | | 6.70 | % | |

Atera Apartments | | Floating | | | 46,198 | | | | 6.45 | % | |

Silverbrook | | Floating | | | 46,088 | | | | 6.45 | % | |

Torreyana Apartments | | Floating | | | 50,580 | | | | 6.70 | % | |

Cornerstone | | Floating | | | 46,804 | | | | 6.66 | % | |

Versailles | | Floating | | | 40,247 | | | | 6.45 | % | |

Bella Solara | | Floating | | | 40,328 | | | | 6.70 | % | |

Courtney Cove | | Floating | | | 36,146 | | | | 6.70 | % | |

Madera Point | | Floating | | | 34,457 | | | | 6.70 | % | |

Creekside at Matthews | | Floating | | | 29,648 | | | | 6.45 | % | |

Parc500 | | Floating | | | 29,416 | | | | 6.45 | % | |

Seasons 704 Apartments | | Floating | | | 33,132 | | | | 6.70 | % | |

The Summit at Sabal Park | | Floating | | | 30,826 | | | | 6.70 | % | |

Cutter's Point | | Floating | | | 21,524 | | | | 6.45 | % | |

Venue at 8651 | | Floating | | | 18,690 | | | | 6.45 | % | |

The Heritage | | Floating | | | 24,625 | | | | 5.18 | % | |

The Enclave | | Floating | | | 25,322 | | | | 5.18 | % | |

Bella Vista | | Floating | | | 29,040 | | | | 5.18 | % | |

Arbors on Forest Ridge | | Floating | | | 19,184 | | | | 6.70 | % | |

Venue on Camelback | | Floating | | | 42,788 | | | | 6.07 | % | |

| | | | $ | 1,386,876 | | | | 5.82 | % | (1) |

(1) | Represents the weighted average cap rate of the interest rate caps. |

NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

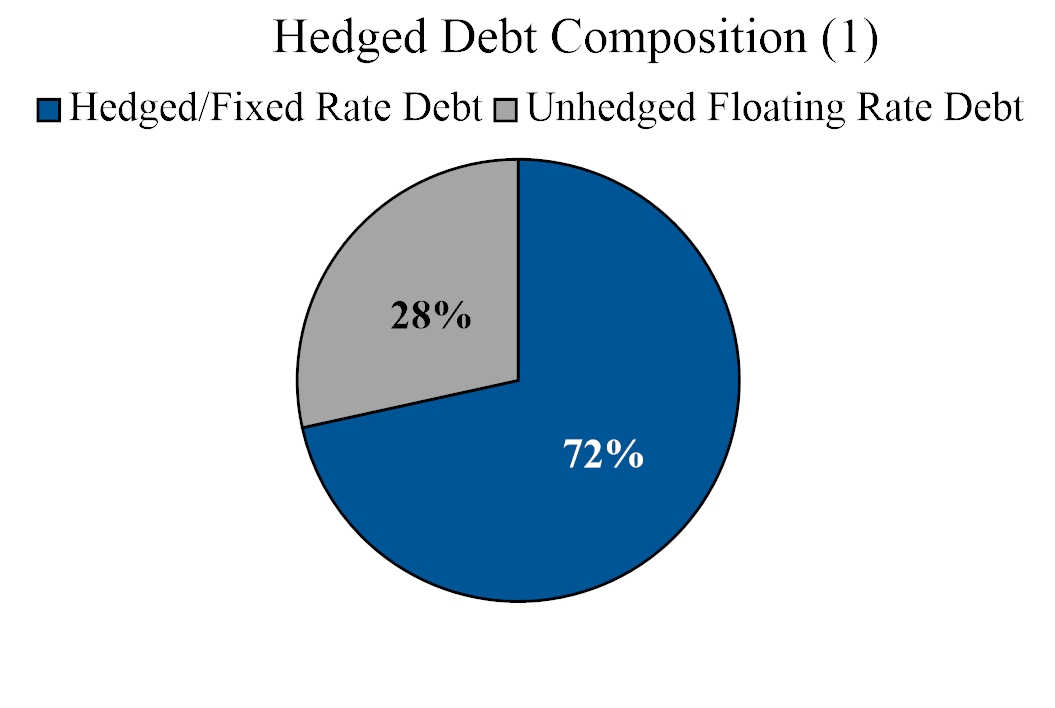

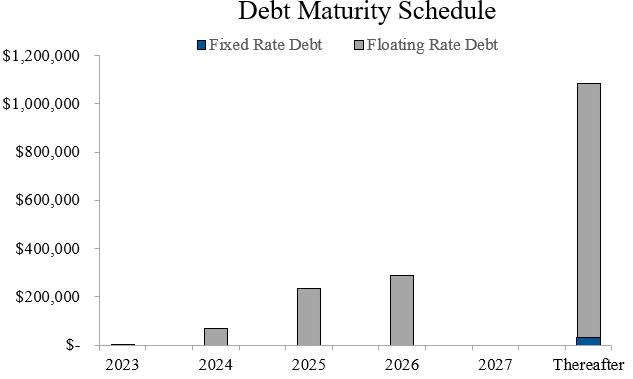

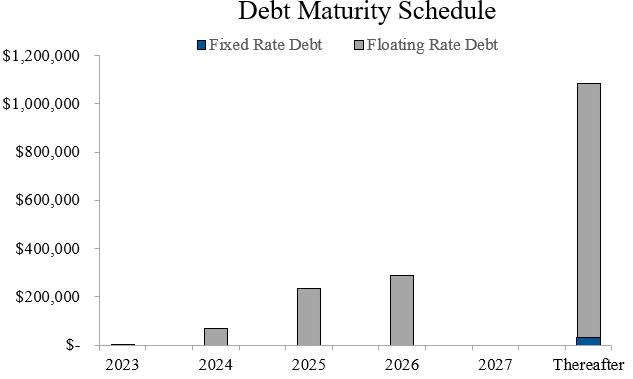

Debt Maturity Schedule

The following table summarizes our contractual obligations and commitments as of March 31, 2023 for the next five calendar years subsequent to March 31, 2023 and thereafter. We used the applicable reference rates as of March 31, 2023 to calculate interest expense due by period on our floating rate debt and net interest expense due by period on our interest rate swaps.

| | | Payments Due by Period (in thousands) | |

| | | Total | | | 2023 | | | 2024 | | | 2025 | | | 2026 | | | 2027 | | | Thereafter | |

Operating Properties Mortgage Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal payments | | | $ | 1,553,474 | | | $ | 226 | | | $ | 391 | | | $ | 177,373 | | | $ | 290,324 | | | $ | - | | | $ | 1,085,160 | |

Interest expense | (1) | | | 555,156 | | | | 40,814 | | | | 55,125 | | | | 62,132 | | | | 58,451 | | | | 68,593 | | | | 270,041 | |

Total | | | $ | 2,108,630 | | | $ | 41,040 | | | $ | 55,516 | | | $ | 239,505 | | | $ | 348,775 | | | $ | 68,593 | | | $ | 1,355,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Held For Sale Property Mortgage Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal payments | | | $ | 68,160 | | | $ | — | | | $ | 68,160 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Interest expense | | | | 5,657 | | | | 3,404 | | | | 2,253 | | | | — | | | | — | | | | — | | | | — | |

Total | | | $ | 73,817 | | | $ | 3,404 | | | $ | 70,413 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Credit Facility | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal payments | | | $ | 57,000 | | | $ | — | | | $ | — | | | $ | 57,000 | | | $ | — | | | $ | — | | | $ | — | |

Interest expense | | | | 9,255 | | | | 3,100 | | | | 4,126 | | | | 2,029 | | | | — | | | | — | | | | — | |

Total | | | $ | 66,255 | | | $ | 3,100 | | | $ | 4,126 | | | $ | 59,029 | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total contractual obligations and commitments | | | $ | 2,248,702 | | | $ | 47,544 | | | $ | 130,055 | | | $ | 298,534 | | | $ | 348,775 | | | $ | 68,593 | | | $ | 1,355,201 | |

(1) | Interest expense obligations includes the impact of expected settlements on interest rate swaps which have been entered into in order to fix the interest rate on the hedged portion of our floating rate debt obligations. As of March 31, 2023, we had entered into 10 interest rate swap transactions with a combined notional amount of $1.2 billion. We have allocated the total impact of expected settlements on the $1.2 billion notional amount of interest rate swaps to ‘Operating Properties Mortgage Debt.’ We used the applicable reference rates as of March 31, 2023 to determine our expected settlements through the terms of the interest rate swaps. |