Reforma, Mexico City

Cautionary note on forward-looking statements This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, expected financial outlook for fiscal 2019, expected Shack openings, expected same-Shack sales growth and trends in Shake Shack Inc.’s (the “Company’s”) operations. Forward-looking statements discuss the Company's current expectations and projections relating to their financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 26, 2018, filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. 2

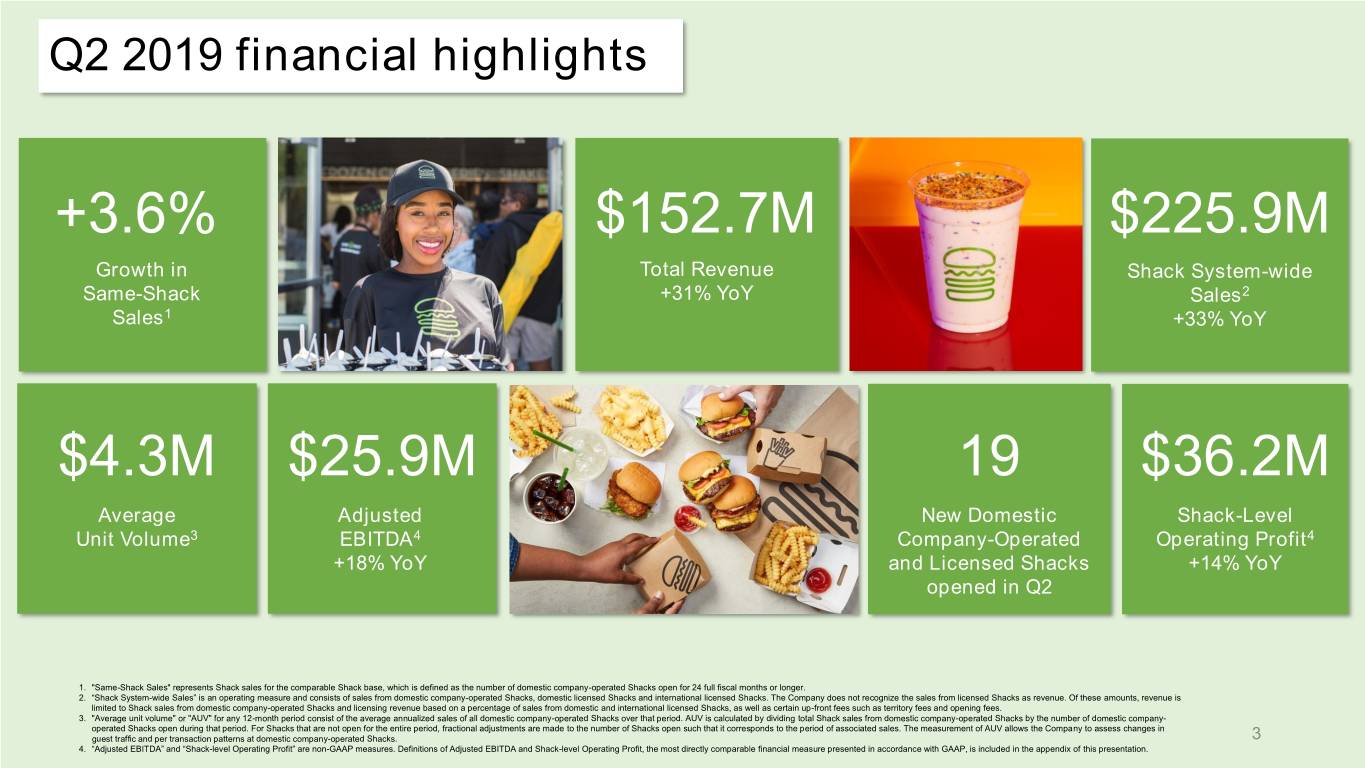

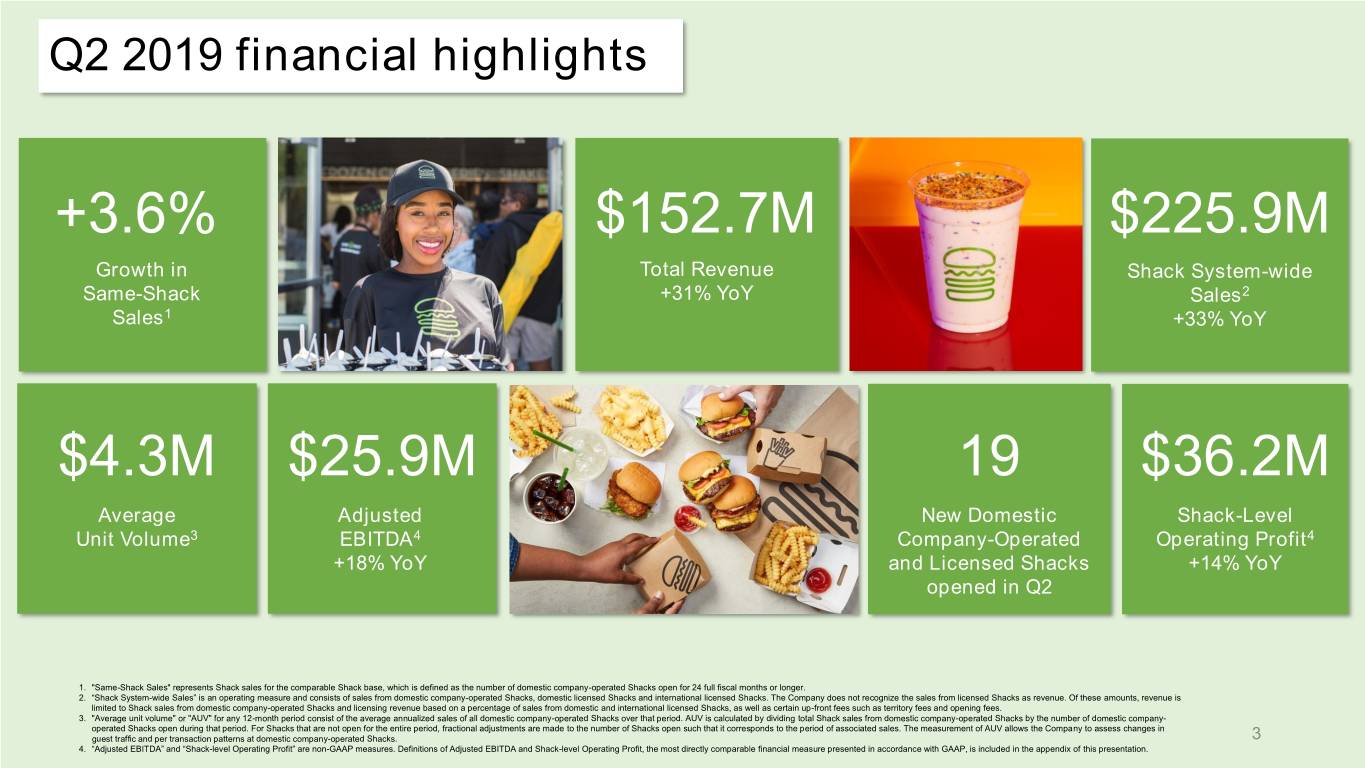

Q2 2019 financial highlights +3.6% $152.7M $225.9M Growth in Total Revenue Shack System-wide Same-Shack +31% YoY Sales2 Sales1 +33% YoY $4.3M $25.9M 19 $36.2M Average Adjusted New Domestic Shack-Level Unit Volume3 EBITDA4 Company-Operated Operating Profit4 +18% YoY and Licensed Shacks +14% YoY opened in Q2 1. "Same-Shack Sales" represents Shack sales for the comparable Shack base, which is defined as the number of domestic company-operated Shacks open for 24 full fiscal months or longer. 2. “Shack System-wide Sales” is an operating measure and consists of sales from domestic company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. 3. "Average unit volume" or "AUV" for any 12-month period consist of the average annualized sales of all domestic company-operated Shacks over that period. AUV is calculated by dividing total Shack sales from domestic company-operated Shacks by the number of domestic company- operated Shacks open during that period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of Shacks open such that it corresponds to the period of associated sales. The measurement of AUV allows the Company to assess changes in guest traffic and per transaction patterns at domestic company-operated Shacks. 3 4. “Adjusted EBITDA” and “Shack-level Operating Profit” are non-GAAP measures. Definitions of Adjusted EBITDA and Shack-level Operating Profit, the most directly comparable financial measure presented in accordance with GAAP, is included in the appendix of this presentation.

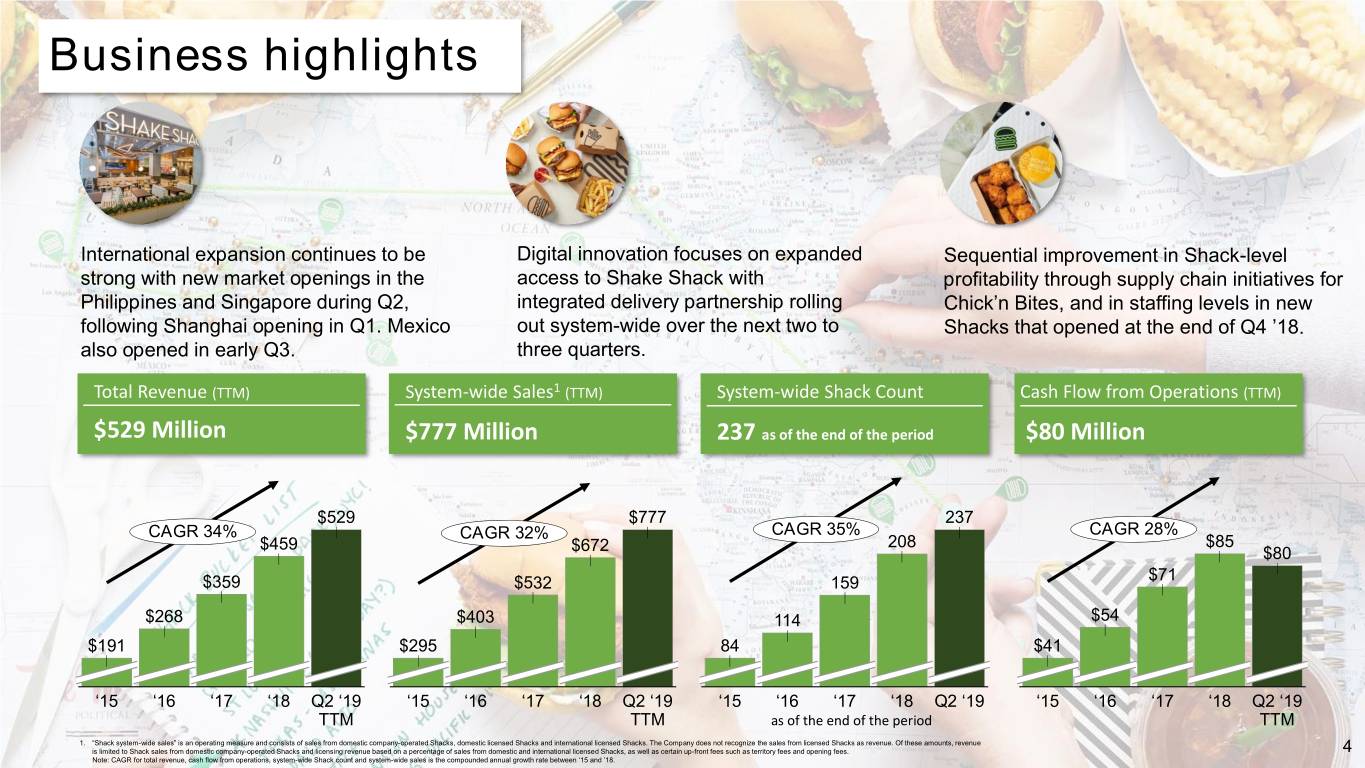

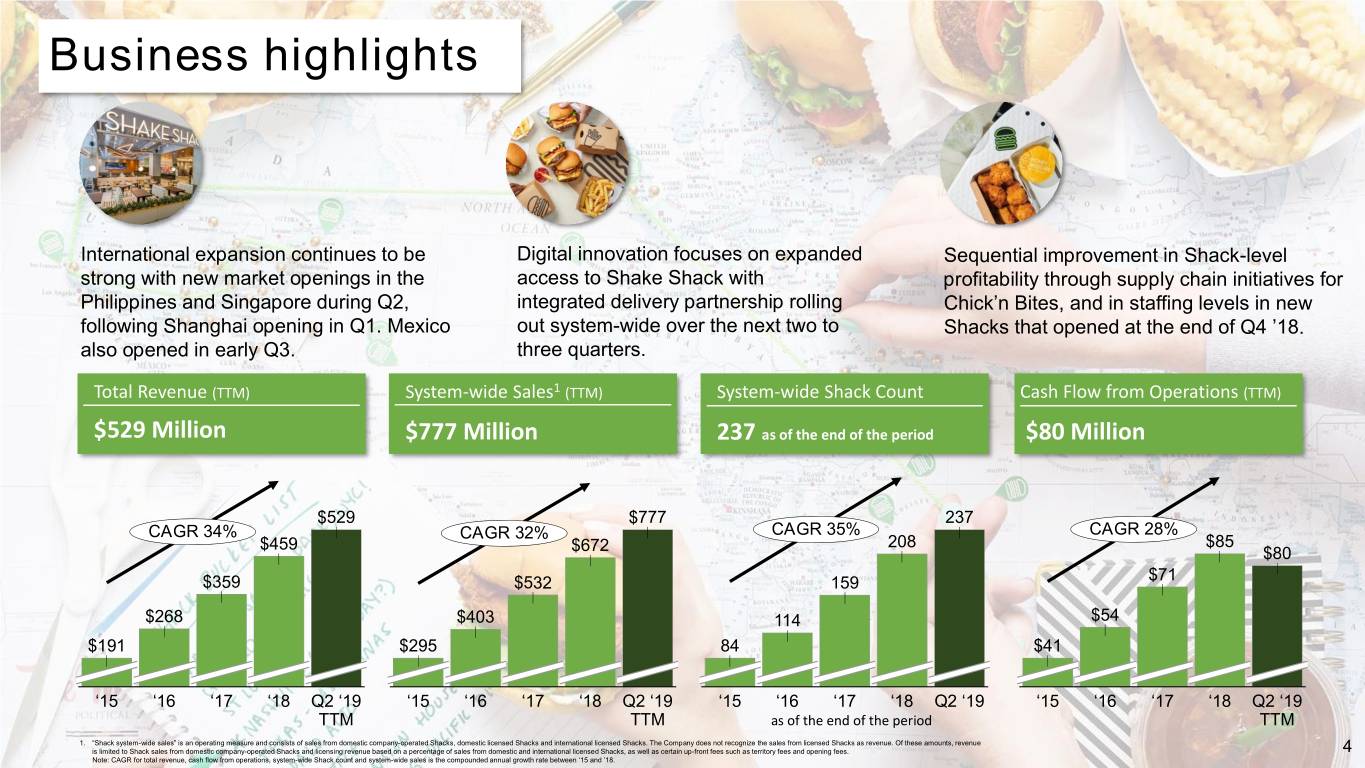

Business highlights International expansion continues to be Digital innovation focuses on expanded Sequential improvement in Shack-level strong with new market openings in the access to Shake Shack with profitability through supply chain initiatives for Philippines and Singapore during Q2, integrated delivery partnership rolling Chick’n Bites, and in staffing levels in new following Shanghai opening in Q1. Mexico out system-wide over the next two to Shacks that opened at the end of Q4 ’18. also opened in early Q3. three quarters. Total Revenue (TTM) System-wide Sales1 (TTM) System-wide Shack Count Cash Flow from Operations (TTM) $529 Million $777 Million 237 as of the end of the period $80 Million $529 $777 237 CAGR 34% CAGR 32% CAGR 35% CAGR 28% $459 208 $85 $672 $80 $359 $532 159 $71 $268 $403 114 $54 $191 $295 84 $41 ‘15 ‘16 ‘17 ‘18 Q2 ‘19 ‘15 ‘16 ‘17 ‘18 Q2 ‘19 ‘15 ‘16 ‘17 ‘18 Q2 ‘19 ‘15 ‘16 ‘17 ‘18 Q2 ‘19 TTM TTM as of the end of the period TTM 1. “Shack system-wide sales” is an operating measure and consists of sales from domestic company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. 4 Note: CAGR for total revenue, cash flow from operations, system-wide Shack count and system-wide sales is the compounded annual growth rate between ‘15 and ’18.

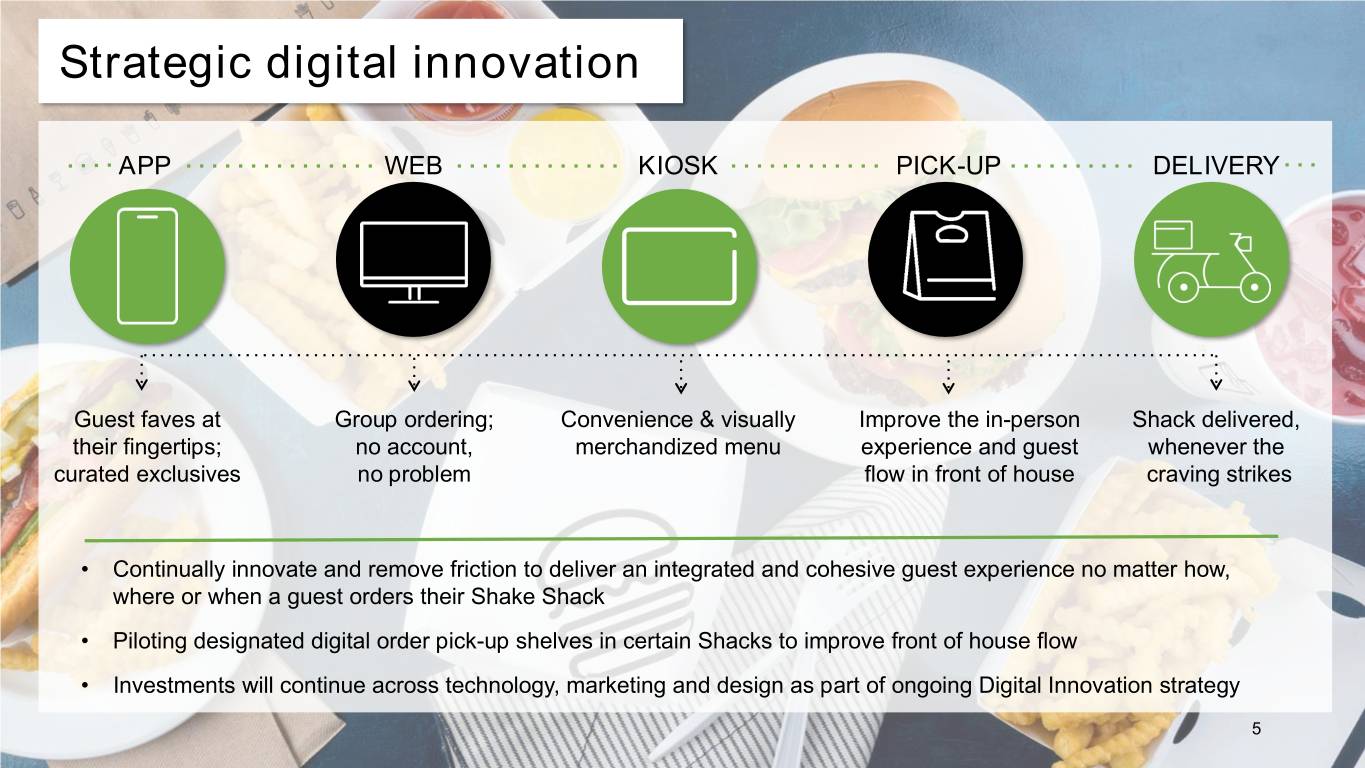

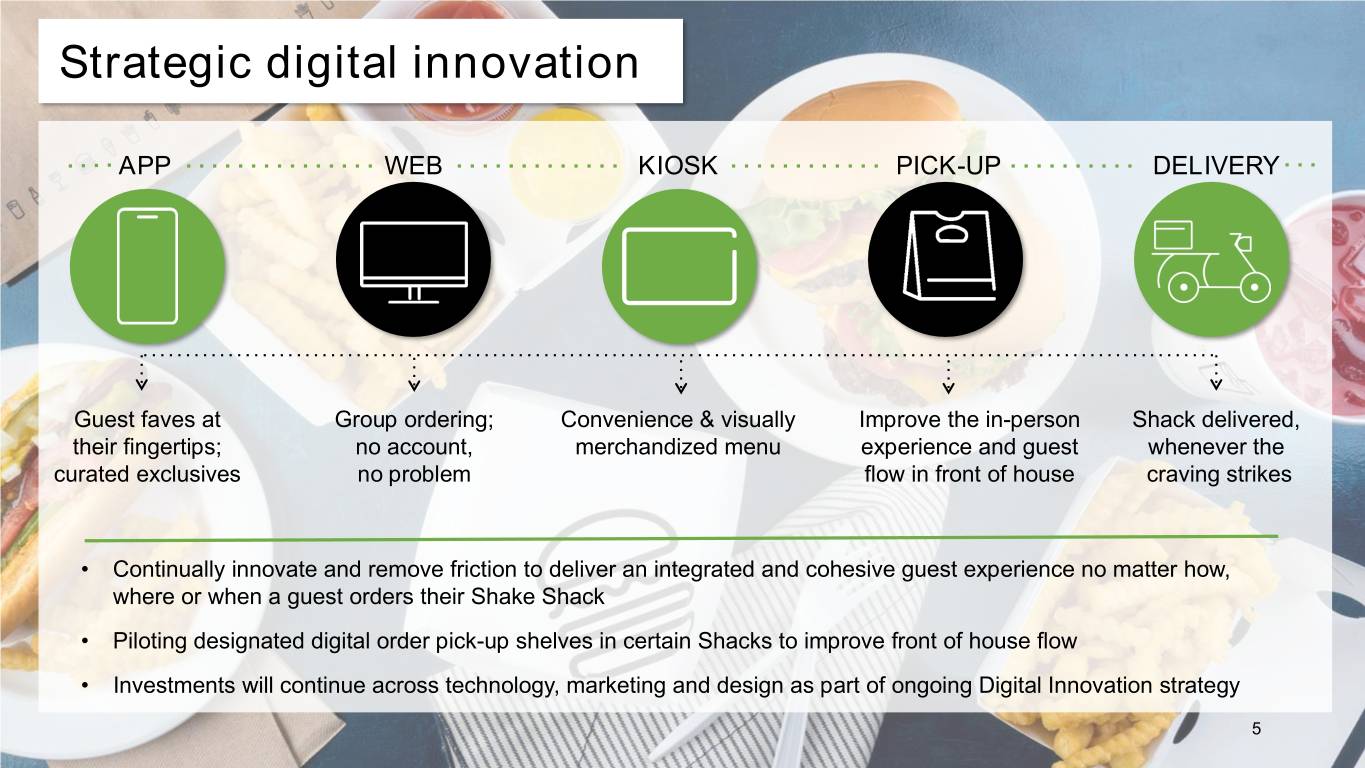

Strategic digital innovation APP WEB KIOSK PICK-UP DELIVERY Guest faves at Group ordering; Convenience & visually Improve the in-person Shack delivered, their fingertips; no account, merchandized menu experience and guest whenever the curated exclusives no problem flow in front of house craving strikes • Continually innovate and remove friction to deliver an integrated and cohesive guest experience no matter how, where or when a guest orders their Shake Shack • Piloting designated digital order pick-up shelves in certain Shacks to improve front of house flow • Investments will continue across technology, marketing and design as part of ongoing Digital Innovation strategy 5

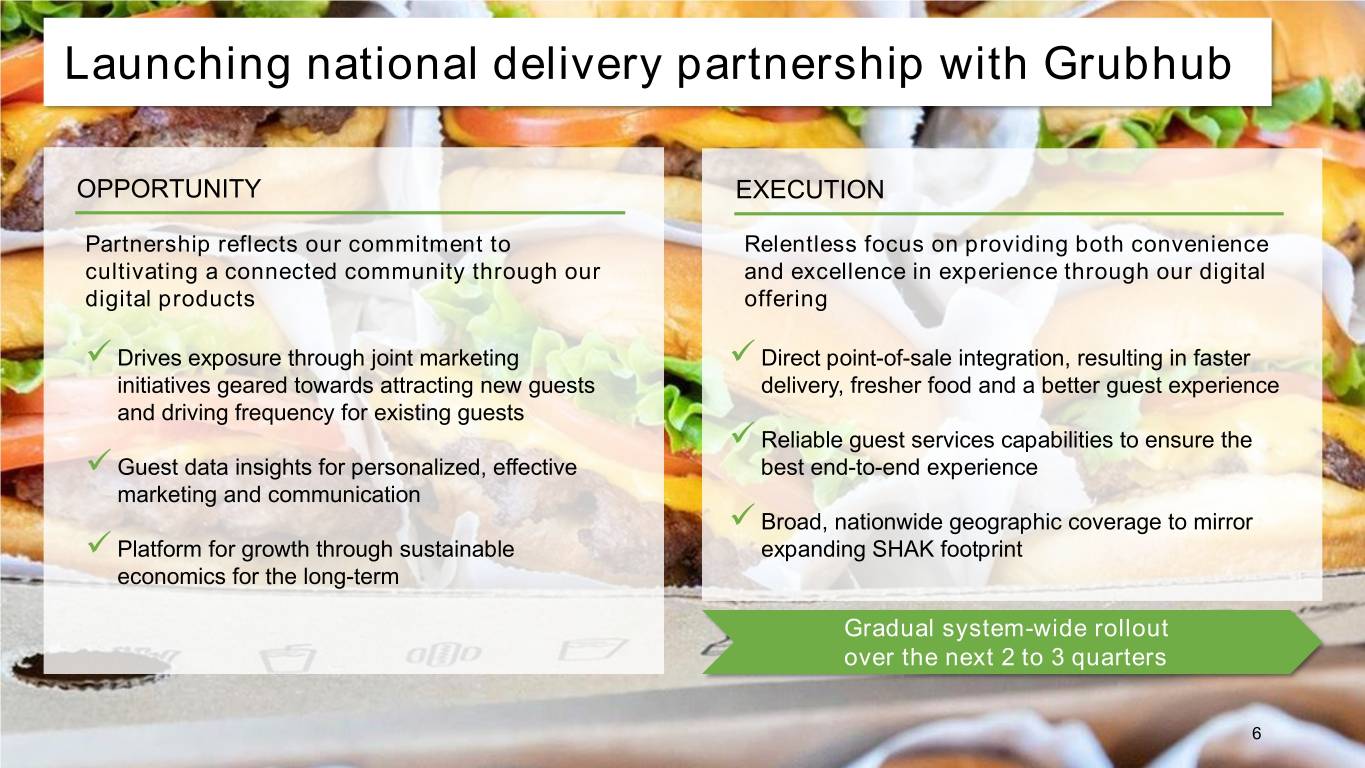

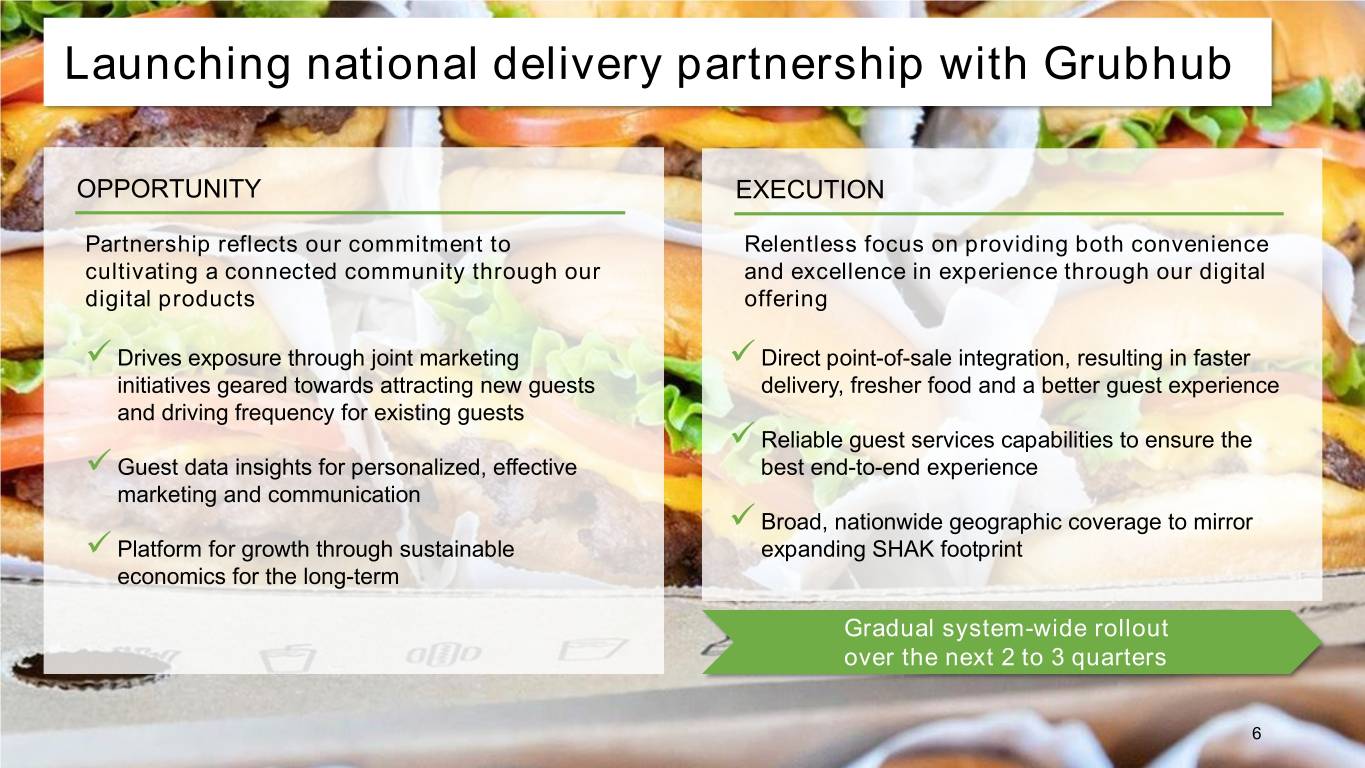

Launching national delivery partnership with Grubhub OPPORTUNITY EXECUTION Partnership reflects our commitment to Relentless focus on providing both convenience cultivating a connected community through our and excellence in experience through our digital digital products offering ✓ Drives exposure through joint marketing ✓ Direct point-of-sale integration, resulting in faster initiatives geared towards attracting new guests delivery, fresher food and a better guest experience and driving frequency for existing guests ✓ Reliable guest services capabilities to ensure the ✓ Guest data insights for personalized, effective best end-to-end experience marketing and communication ✓ Broad, nationwide geographic coverage to mirror ✓ Platform for growth through sustainable expanding SHAK footprint economics for the long-term Gradual system-wide rollout over the next 2 to 3 quarters 6

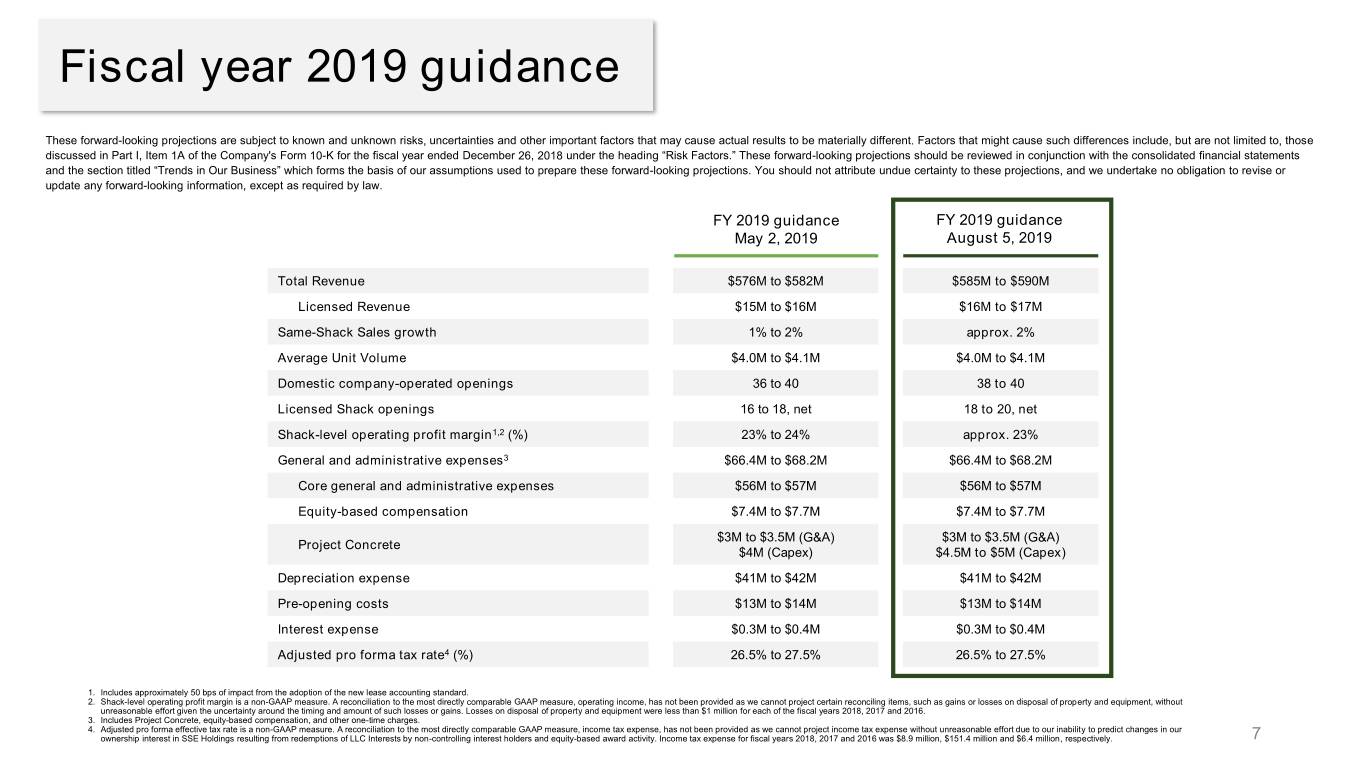

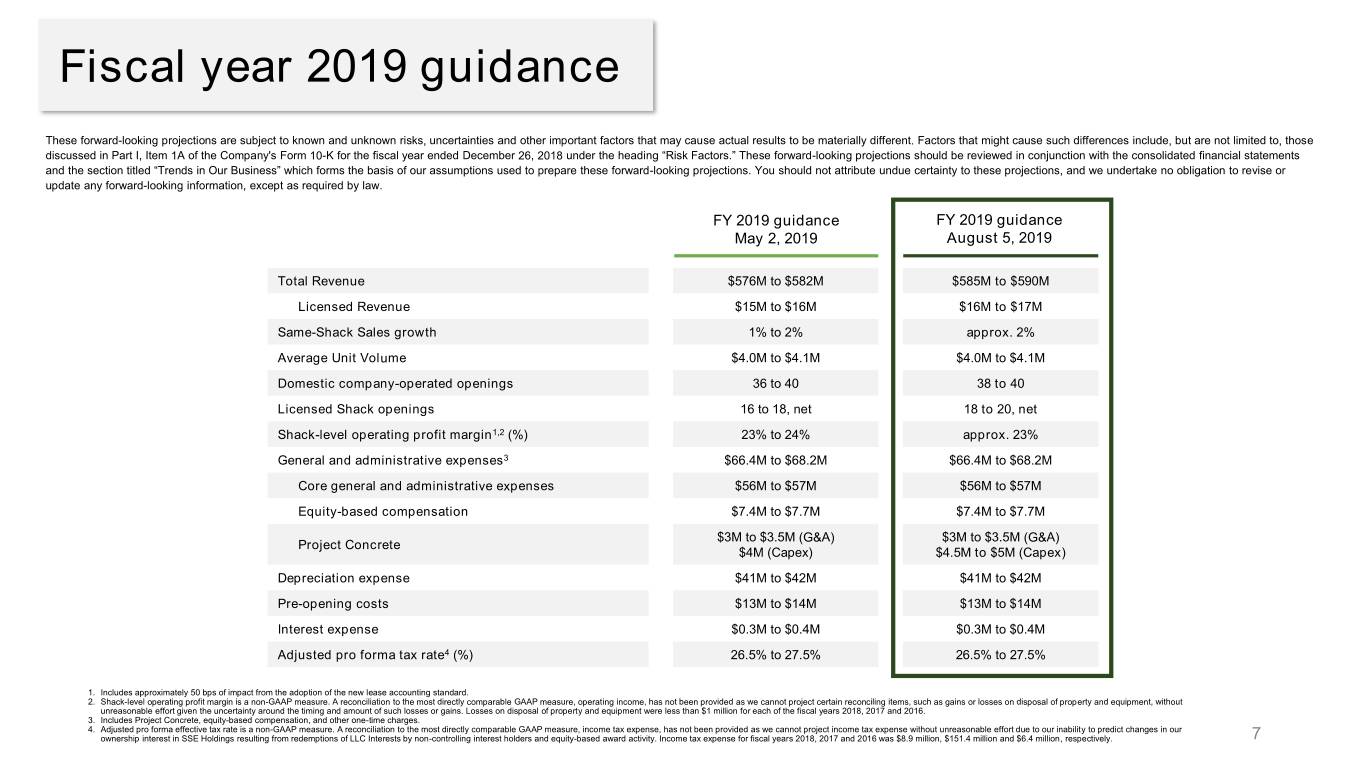

Fiscal year 2019 guidance These forward-looking projections are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A of the Company's Form 10-K for the fiscal year ended December 26, 2018 under the heading “Risk Factors.” These forward-looking projections should be reviewed in conjunction with the consolidated financial statements and the section titled “Trends in Our Business” which forms the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. FY 2019 guidance FY 2019 guidance May 2, 2019 August 5, 2019 Total Revenue $576M to $582M $585M to $590M Licensed Revenue $15M to $16M $16M to $17M Same-Shack Sales growth 1% to 2% approx. 2% Average Unit Volume $4.0M to $4.1M $4.0M to $4.1M Domestic company-operated openings 36 to 40 38 to 40 Licensed Shack openings 16 to 18, net 18 to 20, net Shack-level operating profit margin1,2 (%) 23% to 24% approx. 23% General and administrative expenses3 $66.4M to $68.2M $66.4M to $68.2M Core general and administrative expenses $56M to $57M $56M to $57M Equity-based compensation $7.4M to $7.7M $7.4M to $7.7M $3M to $3.5M (G&A) $3M to $3.5M (G&A) Project Concrete $4M (Capex) $4.5M to $5M (Capex) Depreciation expense $41M to $42M $41M to $42M Pre-opening costs $13M to $14M $13M to $14M Interest expense $0.3M to $0.4M $0.3M to $0.4M Adjusted pro forma tax rate4 (%) 26.5% to 27.5% 26.5% to 27.5% 1. Includes approximately 50 bps of impact from the adoption of the new lease accounting standard. 2. Shack-level operating profit margin is a non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, operating income, has not been provided as we cannot project certain reconciling items, such as gains or losses on disposal of property and equipment, without unreasonable effort given the uncertainty around the timing and amount of such losses or gains. Losses on disposal of property and equipment were less than $1 million for each of the fiscal years 2018, 2017 and 2016. 3. Includes Project Concrete, equity-based compensation, and other one-time charges. 4. Adjusted pro forma effective tax rate is a non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, income tax expense, has not been provided as we cannot project income tax expense without unreasonable effort due to our inability to predict changes in our ownership interest in SSE Holdings resulting from redemptions of LLC Interests by non-controlling interest holders and equity-based award activity. Income tax expense for fiscal years 2018, 2017 and 2016 was $8.9 million, $151.4 million and $6.4 million, respectively. 7

Team member spotlight When did you realize that Shack was the place for you? “When I was a guest waiting in line at the Madison Square Park Shack in 2009. I joined the Shake Shack family shortly after my experience and started as a line cook. I’ve had the opportunity to grow and progress over the years. Today, I'm an Area Director overseeing five Shacks; Madison Square Park, Upper East Side, Midtown East, Herald Square, Hudson Yards, and the West Village.” What are you most proud of in your life? “ What’s your real-life super power? “Seeing greatness in people just by looking in their eyes.” Meredith Doll, Area Director Years part of our Shake Shack Family: 9 8

Appendix Including GAAP & Non-GAAP Measures 9

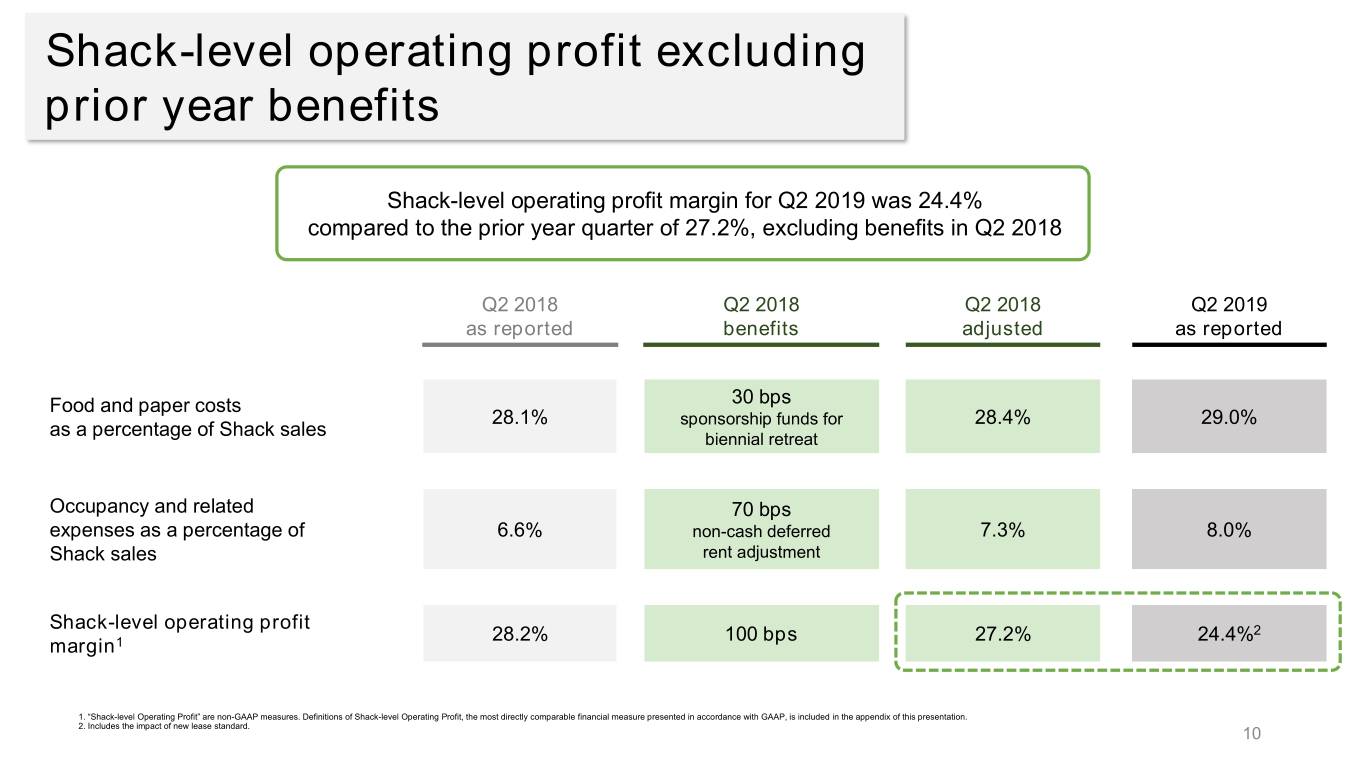

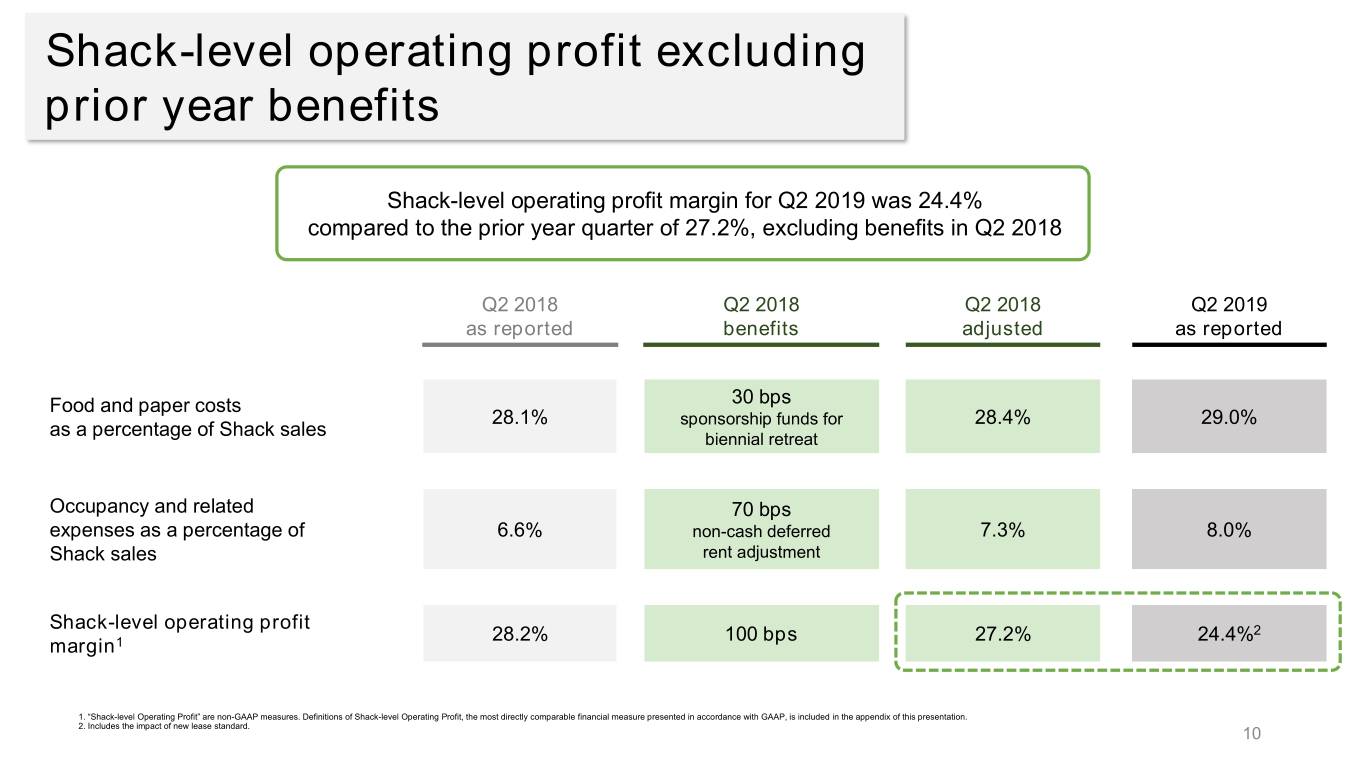

Shack-level operating profit excluding prior year benefits Shack-level operating profit margin for Q2 2019 was 24.4% compared to the prior year quarter of 27.2%, excluding benefits in Q2 2018 Q2 2018 Q2 2018 Q2 2018 Q2 2019 as reported benefits adjusted as reported Food and paper costs 30 bps 28.1% sponsorship funds for 28.4% 29.0% as a percentage of Shack sales biennial retreat Occupancy and related 70 bps expenses as a percentage of 6.6% non-cash deferred 7.3% 8.0% Shack sales rent adjustment Shack-level operating profit 28.2% 100 bps 27.2% 24.4%2 margin1 1. “Shack-level Operating Profit” are non-GAAP measures. Definitions of Shack-level Operating Profit, the most directly comparable financial measure presented in accordance with GAAP, is included in the appendix of this presentation. 2. Includes the impact of new lease standard. 10

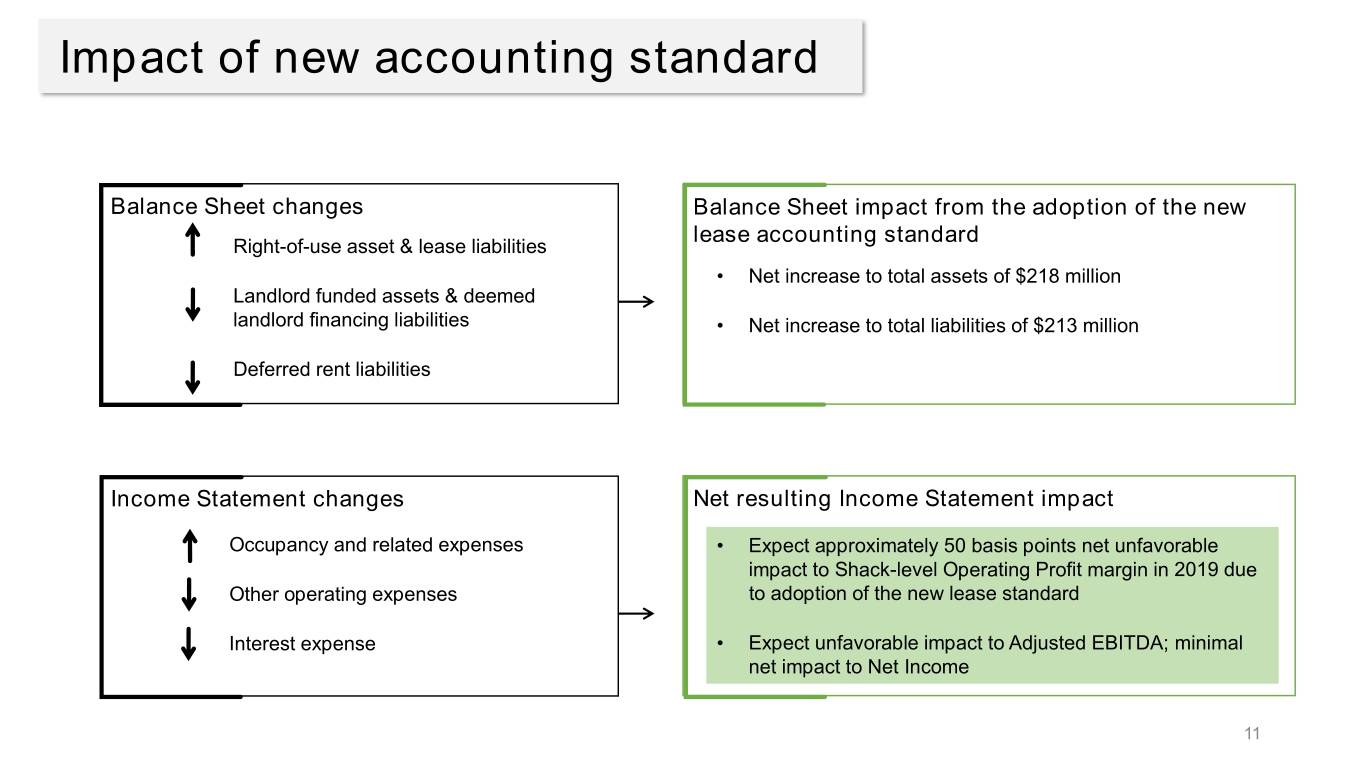

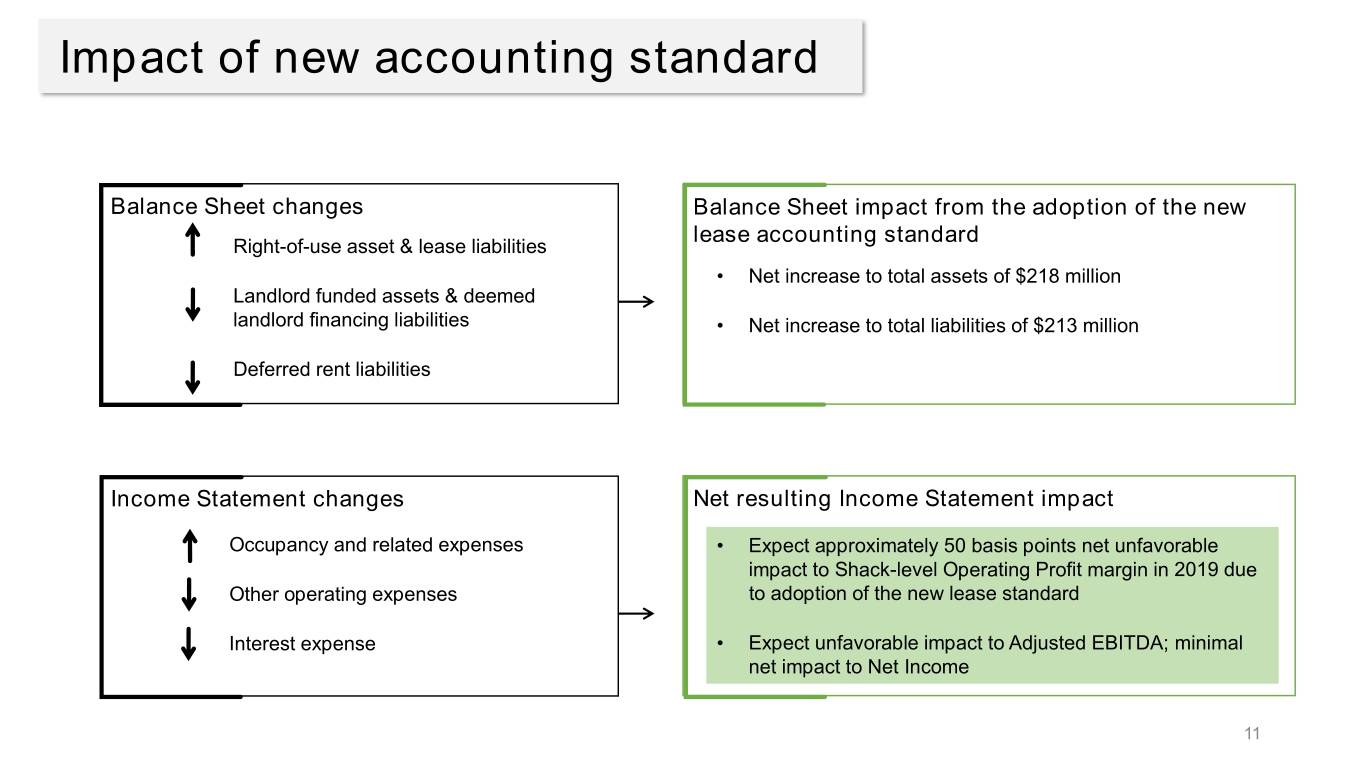

Impact of new accounting standard Balance Sheet changes Balance Sheet impact from the adoption of the new lease accounting standard Right-of-use asset & lease liabilities • Net increase to total assets of $218 million Landlord funded assets & deemed landlord financing liabilities • Net increase to total liabilities of $213 million Deferred rent liabilities Income Statement changes Net resulting Income Statement impact Occupancy and related expenses • Expect approximately 50 basis points net unfavorable impact to Shack-level Operating Profit margin in 2019 due Other operating expenses to adoption of the new lease standard Interest expense • Expect unfavorable impact to Adjusted EBITDA; minimal net impact to Net Income 11

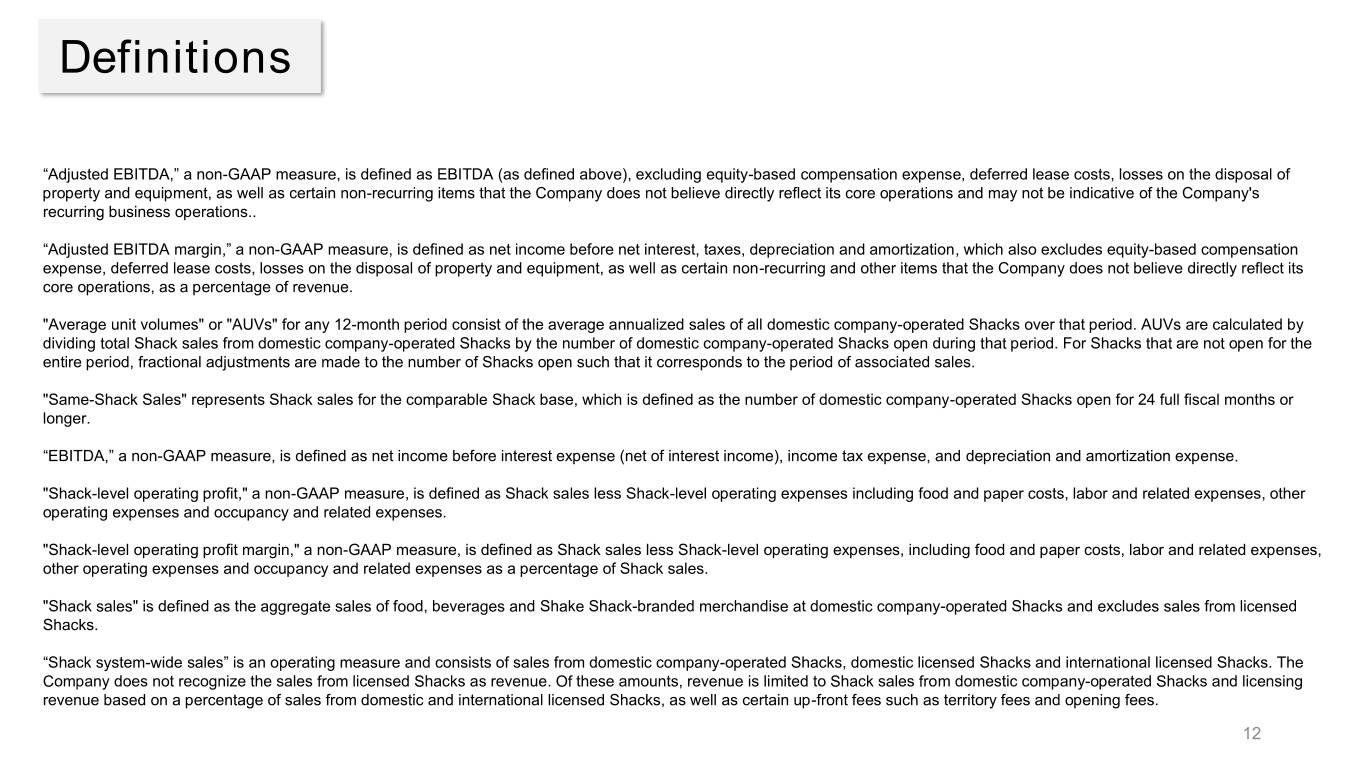

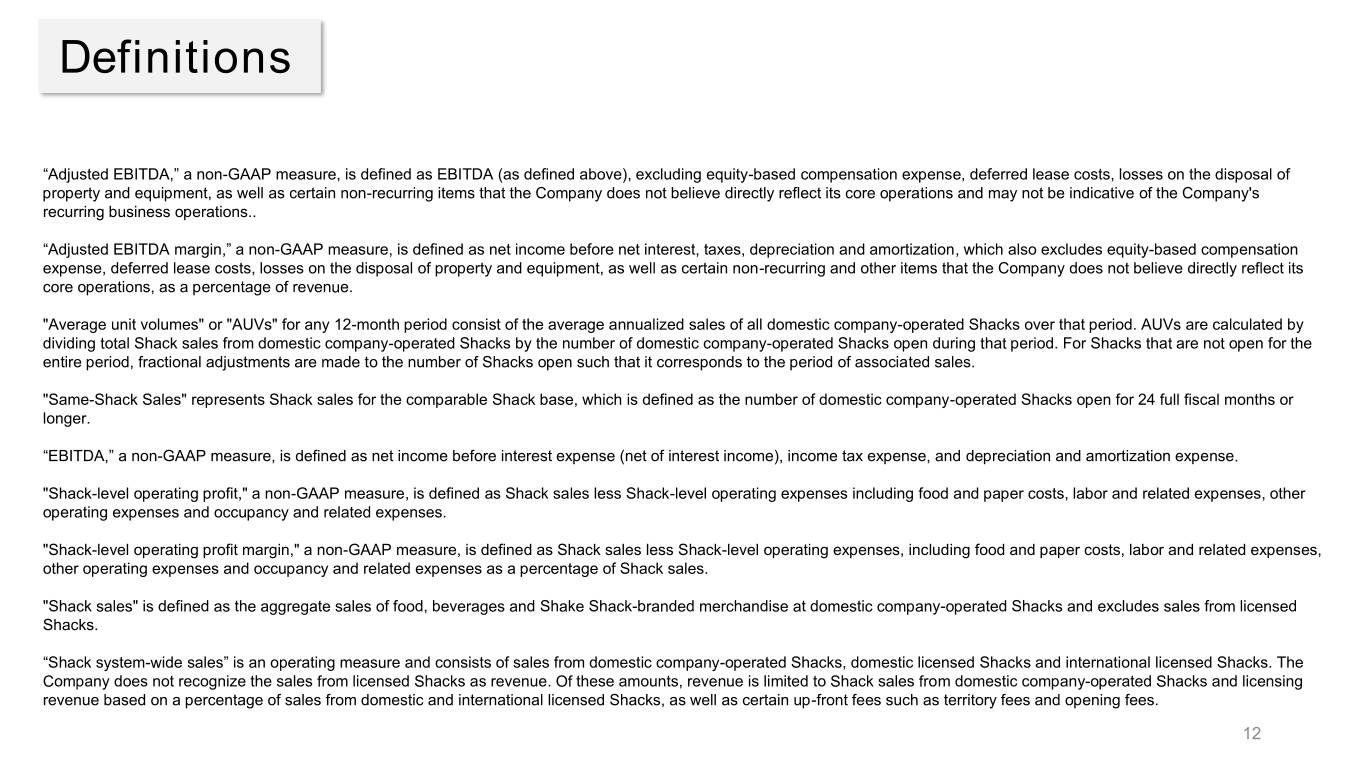

Definitions “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA (as defined above), excluding equity-based compensation expense, deferred lease costs, losses on the disposal of property and equipment, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations.. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as net income before net interest, taxes, depreciation and amortization, which also excludes equity-based compensation expense, deferred lease costs, losses on the disposal of property and equipment, as well as certain non-recurring and other items that the Company does not believe directly reflect its core operations, as a percentage of revenue. "Average unit volumes" or "AUVs" for any 12-month period consist of the average annualized sales of all domestic company-operated Shacks over that period. AUVs are calculated by dividing total Shack sales from domestic company-operated Shacks by the number of domestic company-operated Shacks open during that period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of Shacks open such that it corresponds to the period of associated sales. "Same-Shack Sales" represents Shack sales for the comparable Shack base, which is defined as the number of domestic company-operated Shacks open for 24 full fiscal months or longer. “EBITDA,” a non-GAAP measure, is defined as net income before interest expense (net of interest income), income tax expense, and depreciation and amortization expense. "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses as a percentage of Shack sales. "Shack sales" is defined as the aggregate sales of food, beverages and Shake Shack-branded merchandise at domestic company-operated Shacks and excludes sales from licensed Shacks. “Shack system-wide sales” is an operating measure and consists of sales from domestic company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. 12

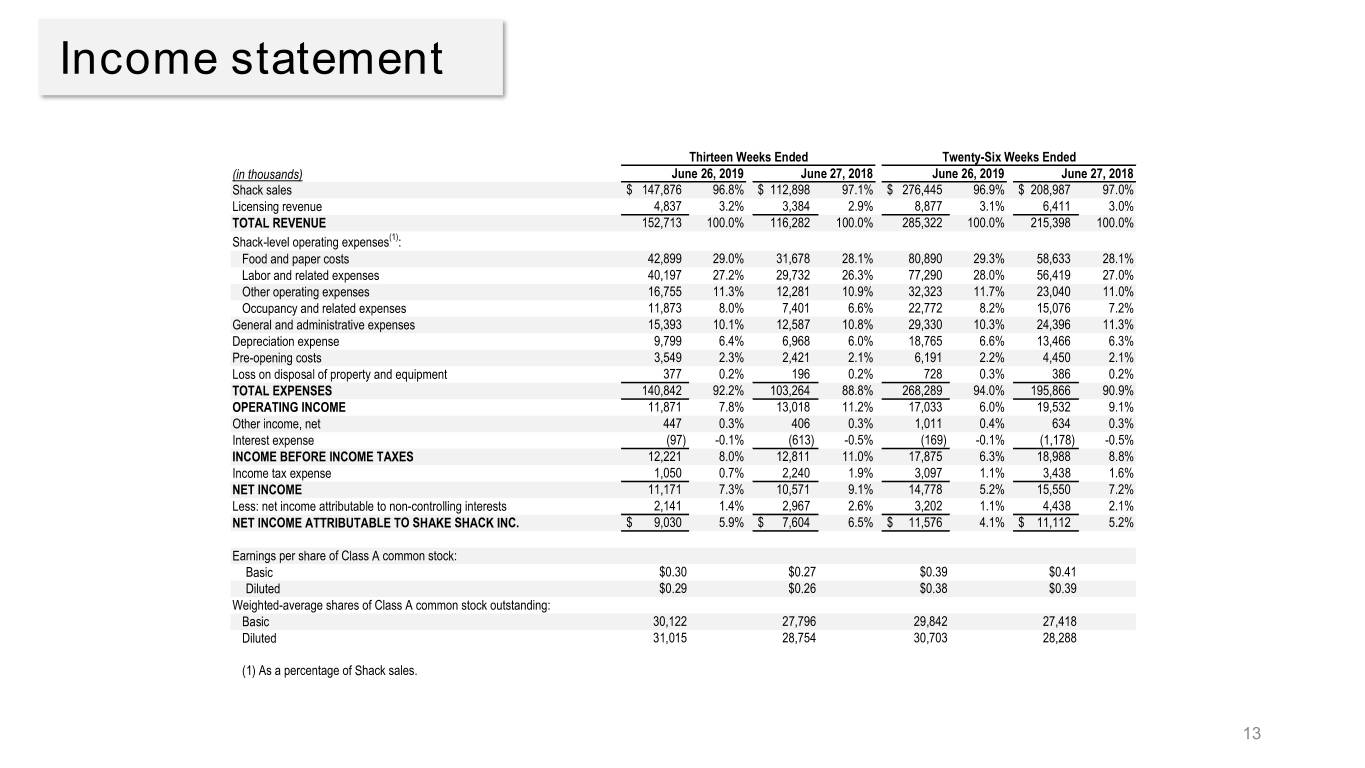

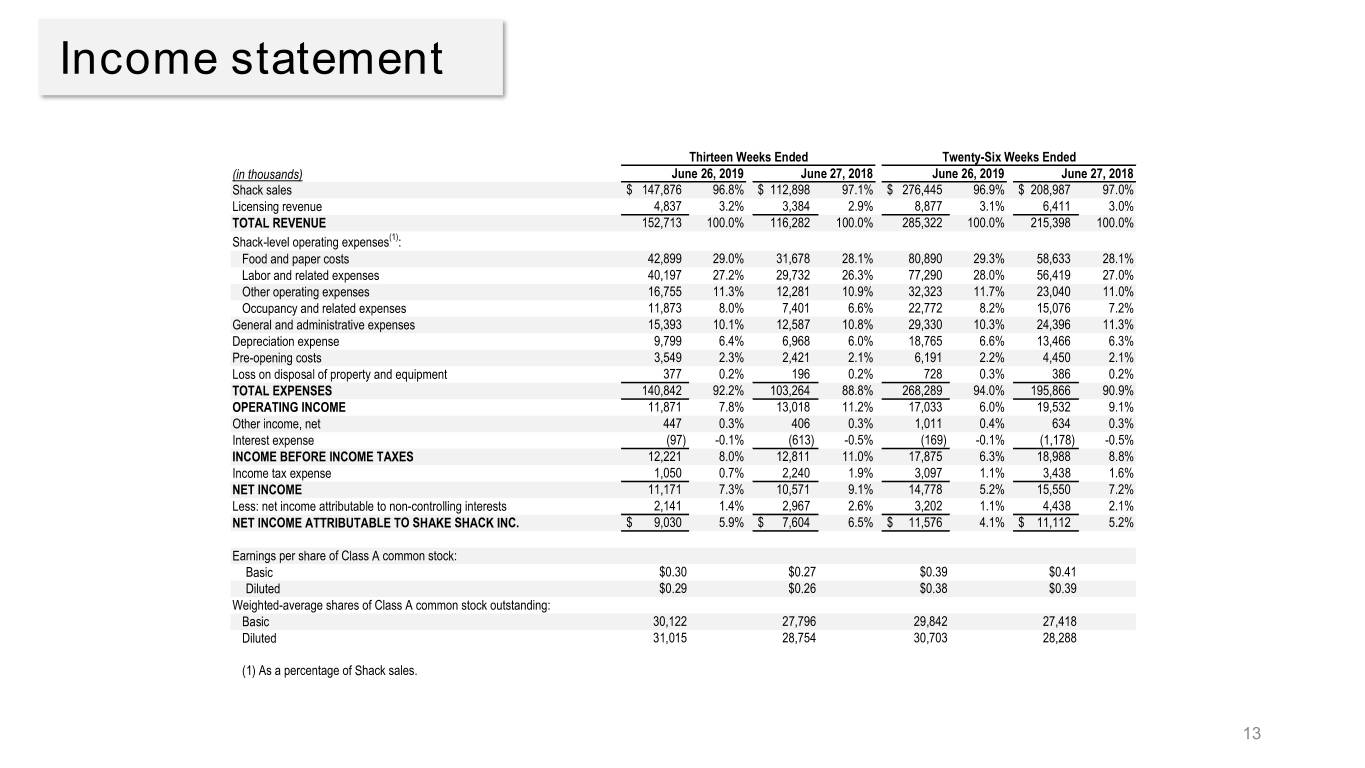

Income statement Thirteen Weeks Ended Twenty-Six Weeks Ended (in thousands) June 26, 2019 June 27, 2018 June 26, 2019 June 27, 2018 Shack sales $ 147,876 96.8% $ 112,898 97.1% $ 276,445 96.9% $ 208,987 97.0% Licensing revenue 4,837 3.2% 3,384 2.9% 8,877 3.1% 6,411 3.0% TOTAL REVENUE 152,713 100.0% 116,282 100.0% 285,322 100.0% 215,398 100.0% Shack-level operating expenses(1): Food and paper costs 42,899 29.0% 31,678 28.1% 80,890 29.3% 58,633 28.1% Labor and related expenses 40,197 27.2% 29,732 26.3% 77,290 28.0% 56,419 27.0% Other operating expenses 16,755 11.3% 12,281 10.9% 32,323 11.7% 23,040 11.0% Occupancy and related expenses 11,873 8.0% 7,401 6.6% 22,772 8.2% 15,076 7.2% General and administrative expenses 15,393 10.1% 12,587 10.8% 29,330 10.3% 24,396 11.3% Depreciation expense 9,799 6.4% 6,968 6.0% 18,765 6.6% 13,466 6.3% Pre-opening costs 3,549 2.3% 2,421 2.1% 6,191 2.2% 4,450 2.1% Loss on disposal of property and equipment 377 0.2% 196 0.2% 728 0.3% 386 0.2% TOTAL EXPENSES 140,842 92.2% 103,264 88.8% 268,289 94.0% 195,866 90.9% OPERATING INCOME 11,871 7.8% 13,018 11.2% 17,033 6.0% 19,532 9.1% Other income, net 447 0.3% 406 0.3% 1,011 0.4% 634 0.3% Interest expense (97) -0.1% (613) -0.5% (169) -0.1% (1,178) -0.5% INCOME BEFORE INCOME TAXES 12,221 8.0% 12,811 11.0% 17,875 6.3% 18,988 8.8% Income tax expense 1,050 0.7% 2,240 1.9% 3,097 1.1% 3,438 1.6% NET INCOME 11,171 7.3% 10,571 9.1% 14,778 5.2% 15,550 7.2% Less: net income attributable to non-controlling interests 2,141 1.4% 2,967 2.6% 3,202 1.1% 4,438 2.1% NET INCOME ATTRIBUTABLE TO SHAKE SHACK INC. $ 9,030 5.9% $ 7,604 6.5% $ 11,576 4.1% $ 11,112 5.2% Earnings per share of Class A common stock: Basic $0.30 $0.27 $0.39 $0.41 Diluted $0.29 $0.26 $0.38 $0.39 Weighted-average shares of Class A common stock outstanding: Basic 30,122 27,796 29,842 27,418 Diluted 31,015 28,754 30,703 28,288 (1) As a percentage of Shack sales. 13

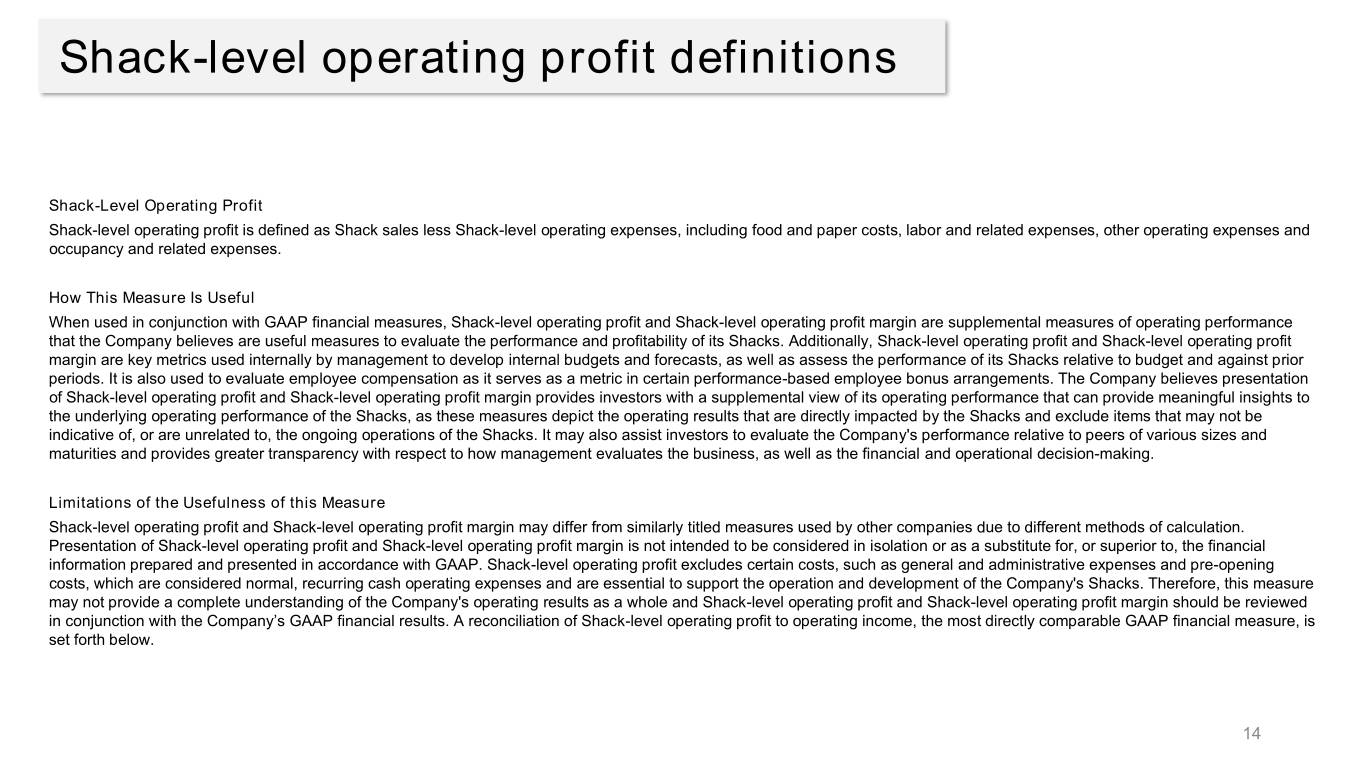

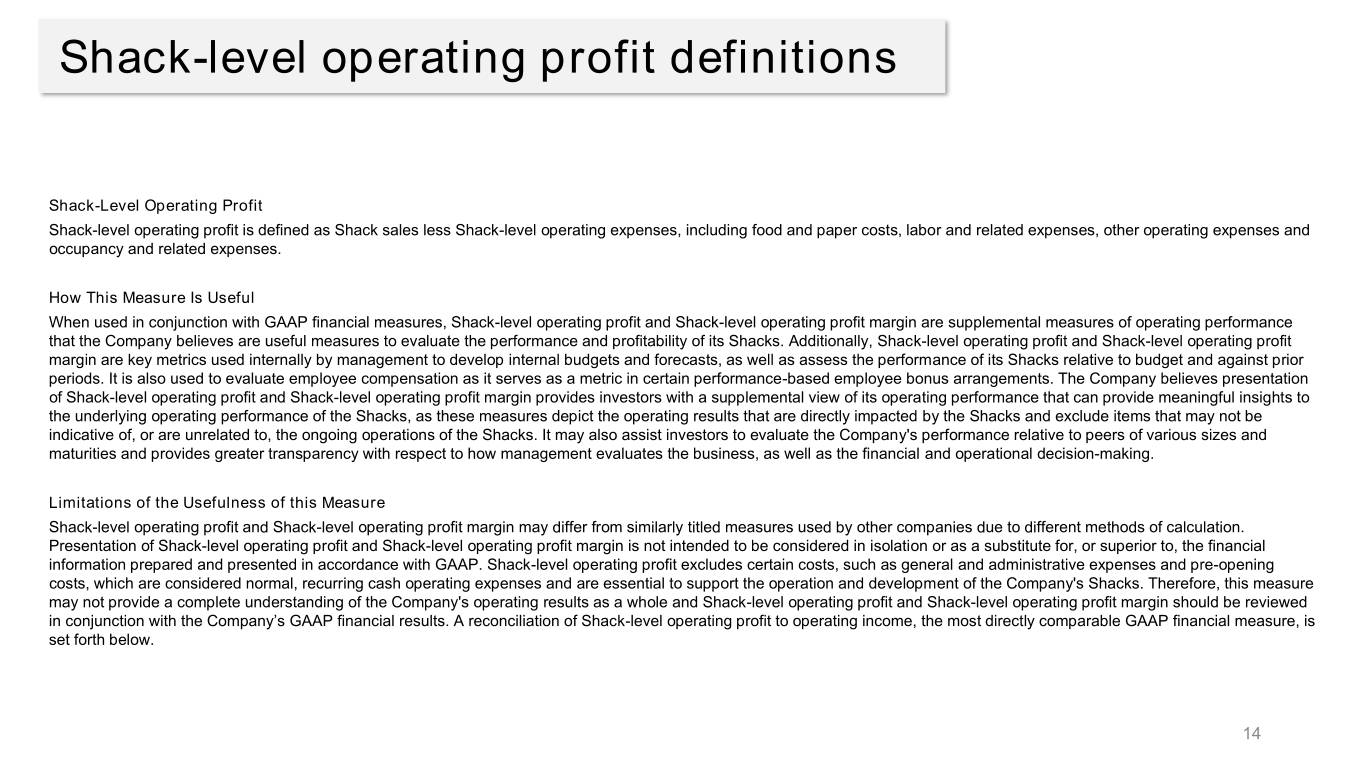

Shack-level operating profit definitions Shack-Level Operating Profit Shack-level operating profit is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack-level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance-based employee bonus arrangements. The Company believes presentation of Shack-level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision-making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as general and administrative expenses and pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack-level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack-level operating profit to operating income, the most directly comparable GAAP financial measure, is set forth below. 14

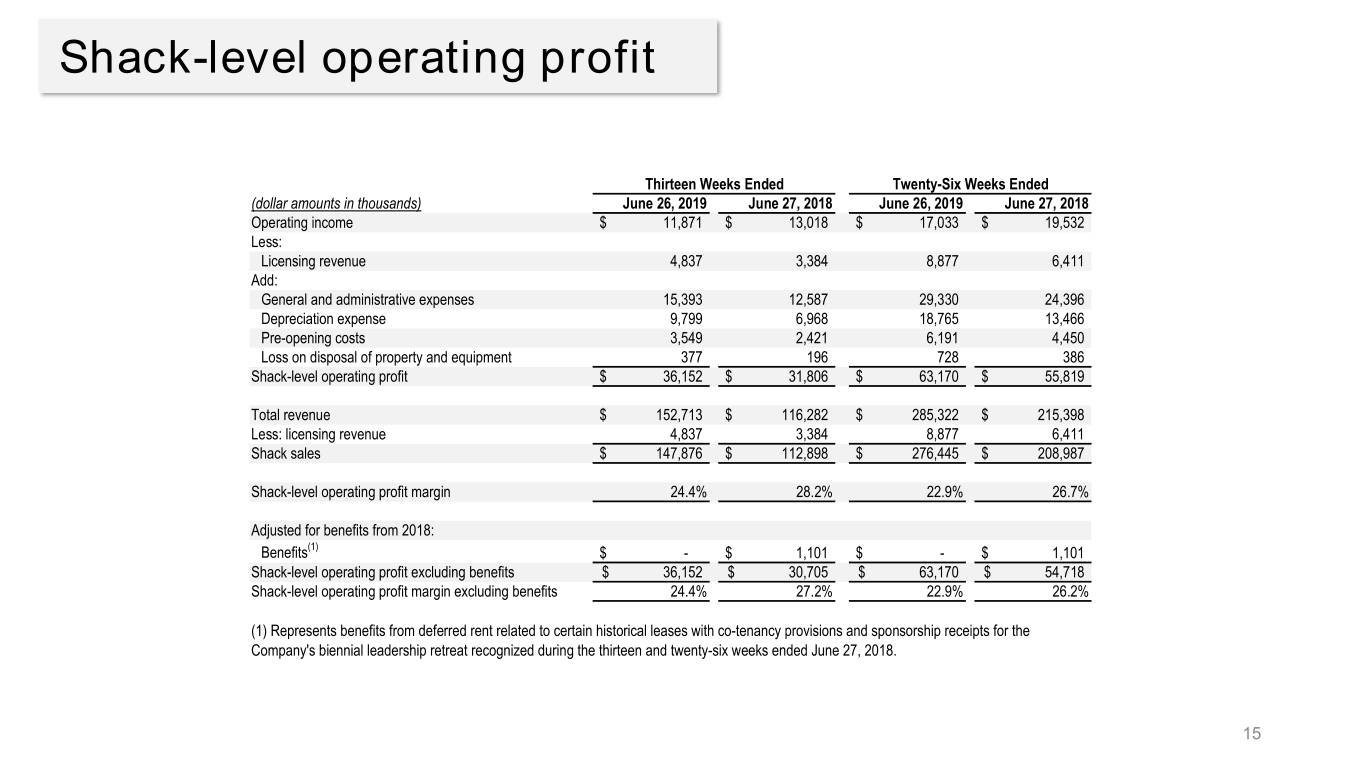

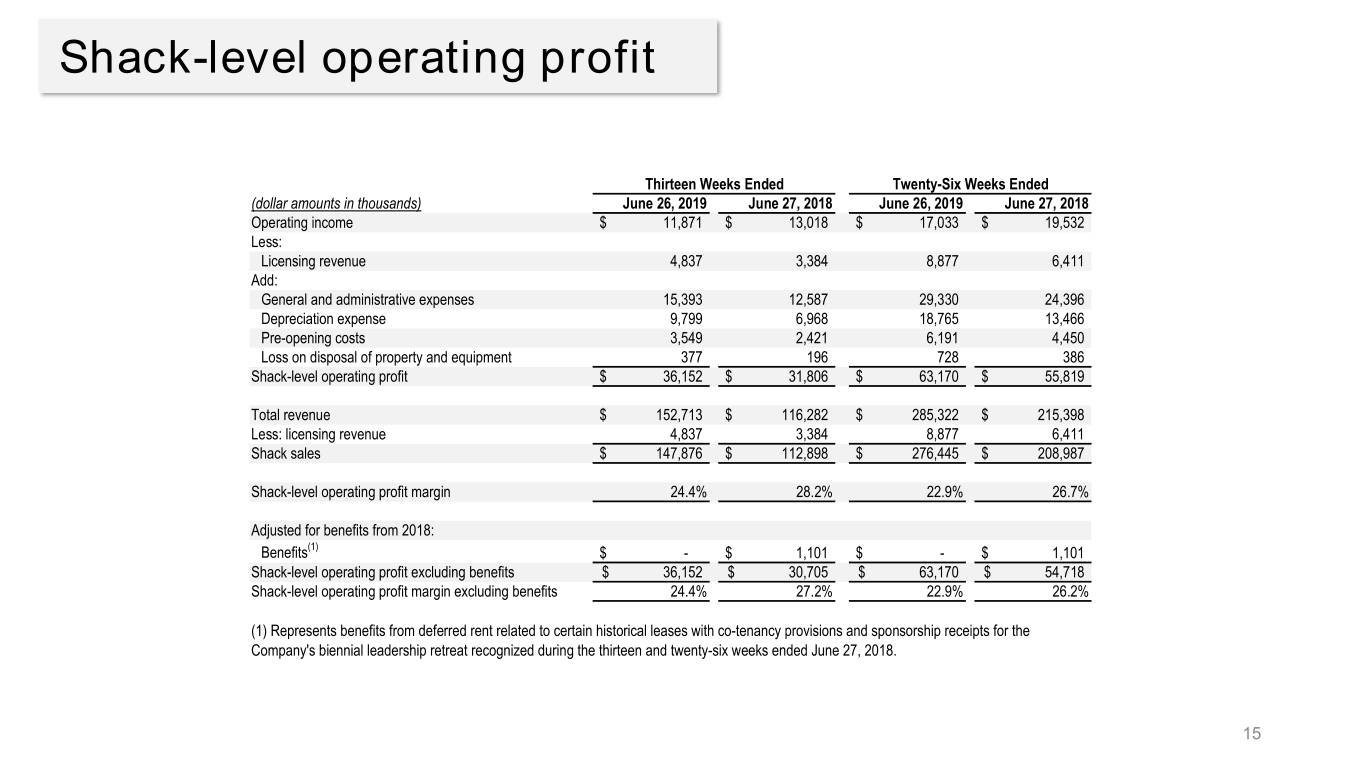

Shack-level operating profit Thirteen Weeks Ended Twenty-Six Weeks Ended (dollar amounts in thousands) June 26, 2019 June 27, 2018 June 26, 2019 June 27, 2018 Operating income $ 11,871 $ 13,018 $ 17,033 $ 19,532 Less: Licensing revenue 4,837 3,384 8,877 6,411 Add: General and administrative expenses 15,393 12,587 29,330 24,396 Depreciation expense 9,799 6,968 18,765 13,466 Pre-opening costs 3,549 2,421 6,191 4,450 Loss on disposal of property and equipment 377 196 728 386 Shack-level operating profit $ 36,152 $ 31,806 $ 63,170 $ 55,819 Total revenue $ 152,713 $ 116,282 $ 285,322 $ 215,398 Less: licensing revenue 4,837 3,384 8,877 6,411 Shack sales $ 147,876 $ 112,898 $ 276,445 $ 208,987 Shack-level operating profit margin 24.4% 28.2% 22.9% 26.7% Adjusted for benefits from 2018: Benefits(1) $ - $ 1,101 $ - $ 1,101 Shack-level operating profit excluding benefits $ 36,152 $ 30,705 $ 63,170 $ 54,718 Shack-level operating profit margin excluding benefits 24.4% 27.2% 22.9% 26.2% (1) Represents benefits from deferred rent related to certain historical leases with co-tenancy provisions and sponsorship receipts for the Company's biennial leadership retreat recognized during the thirteen and twenty-six weeks ended June 27, 2018. 15

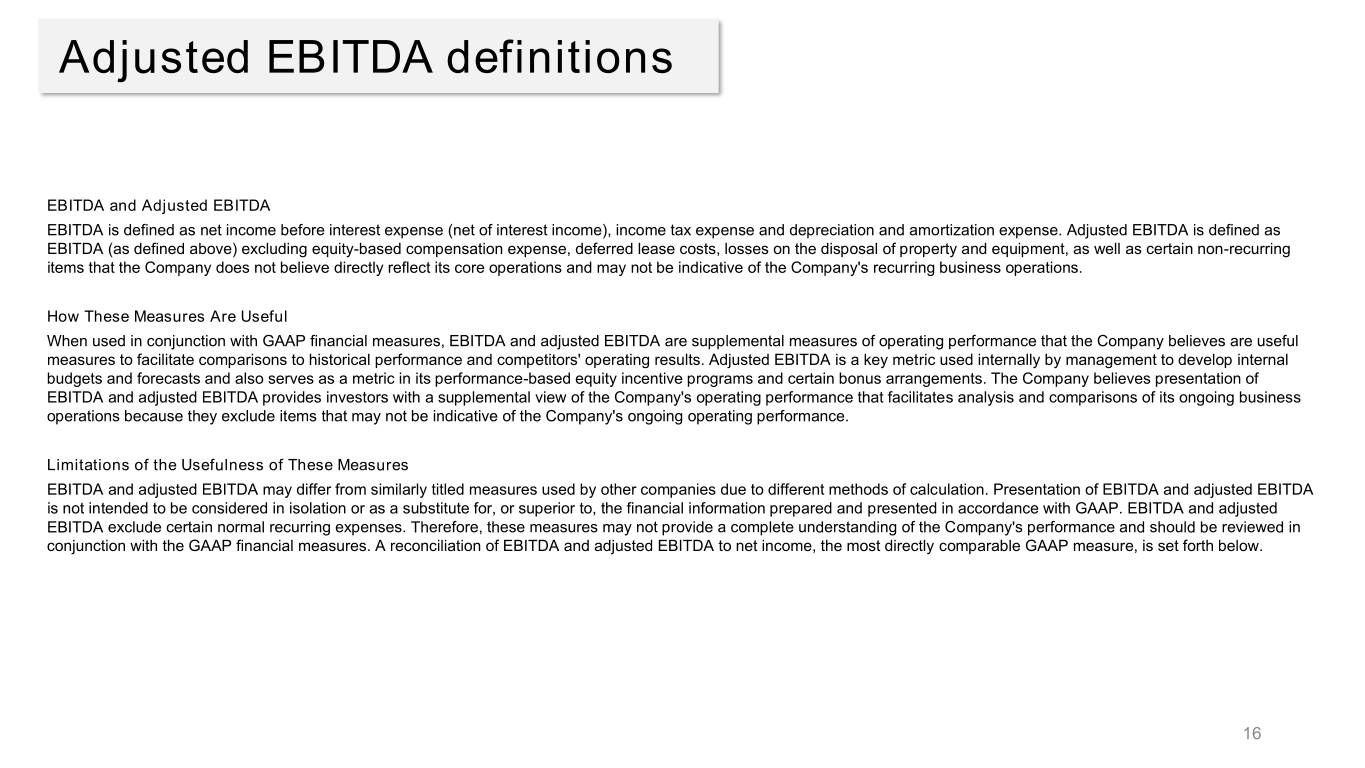

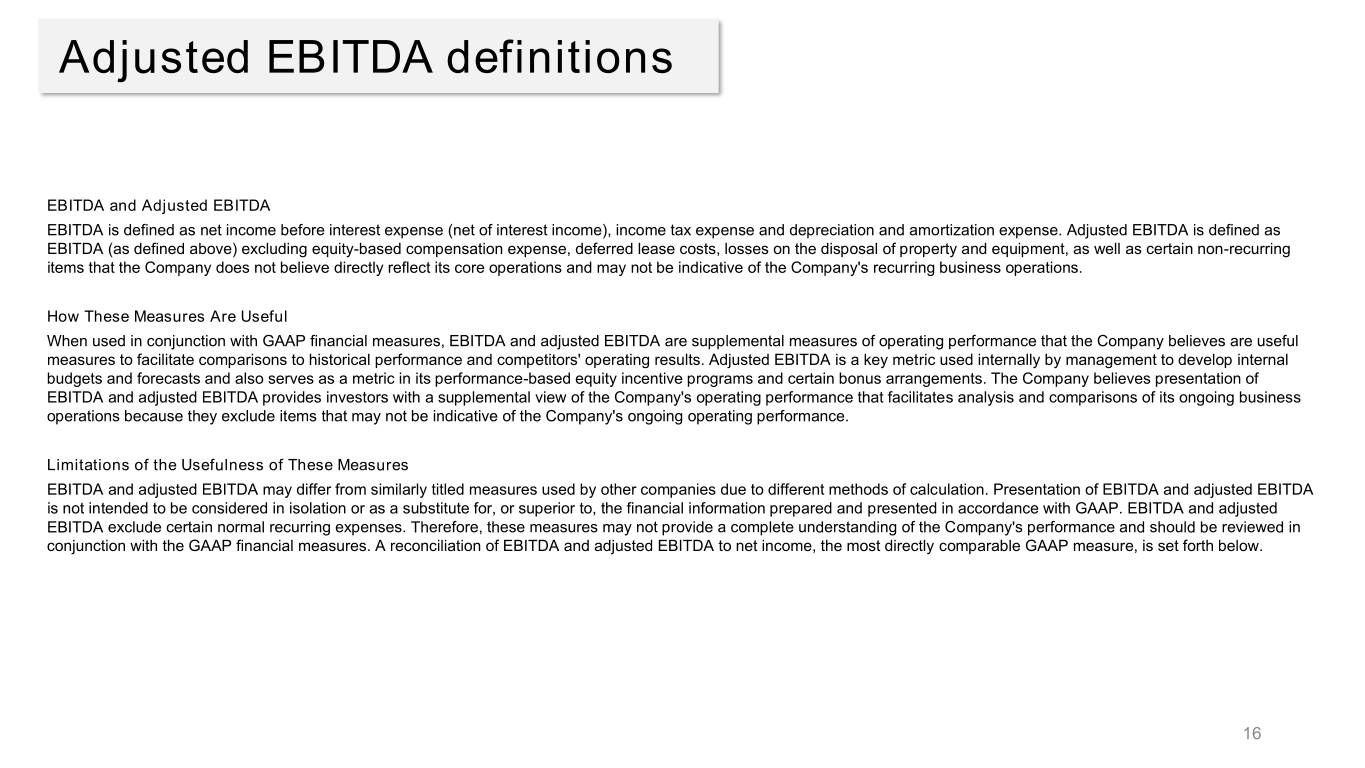

Adjusted EBITDA definitions EBITDA and Adjusted EBITDA EBITDA is defined as net income before interest expense (net of interest income), income tax expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA (as defined above) excluding equity-based compensation expense, deferred lease costs, losses on the disposal of property and equipment, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below. 16

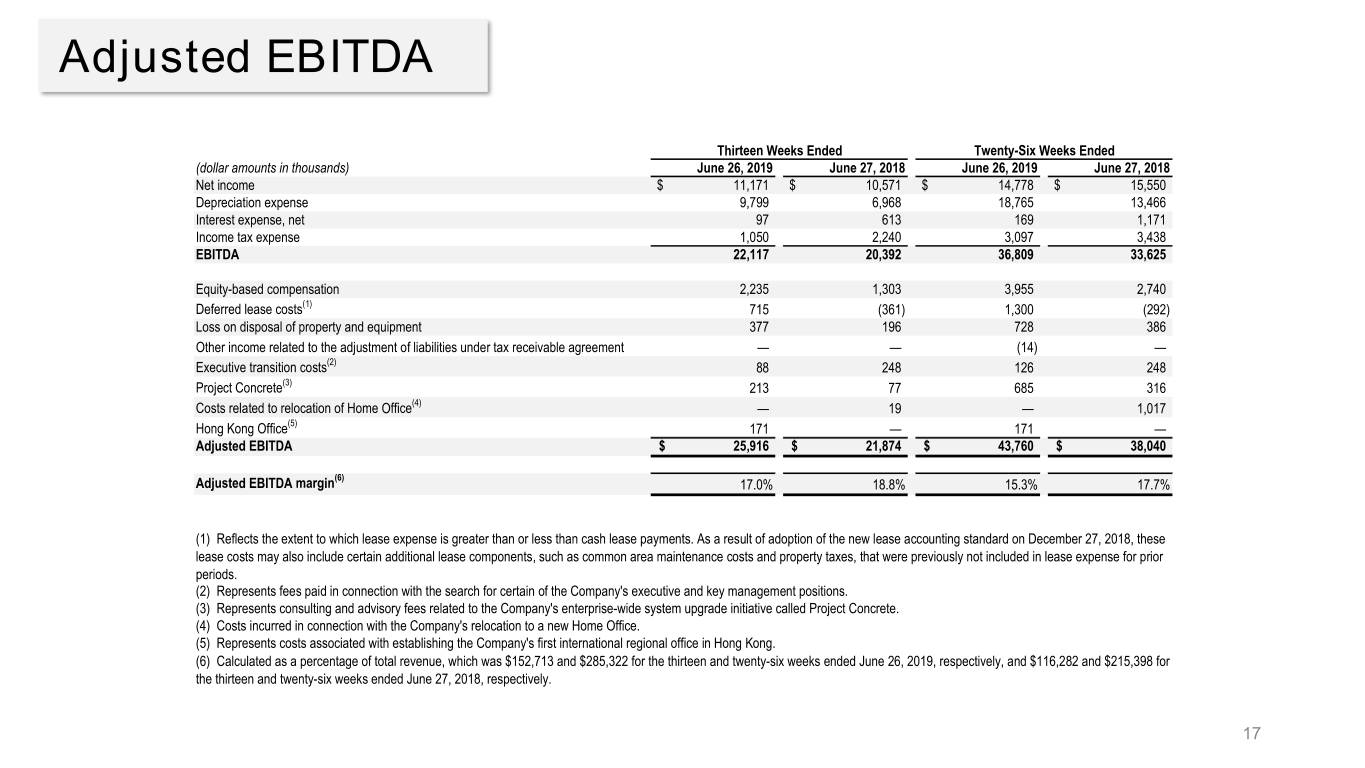

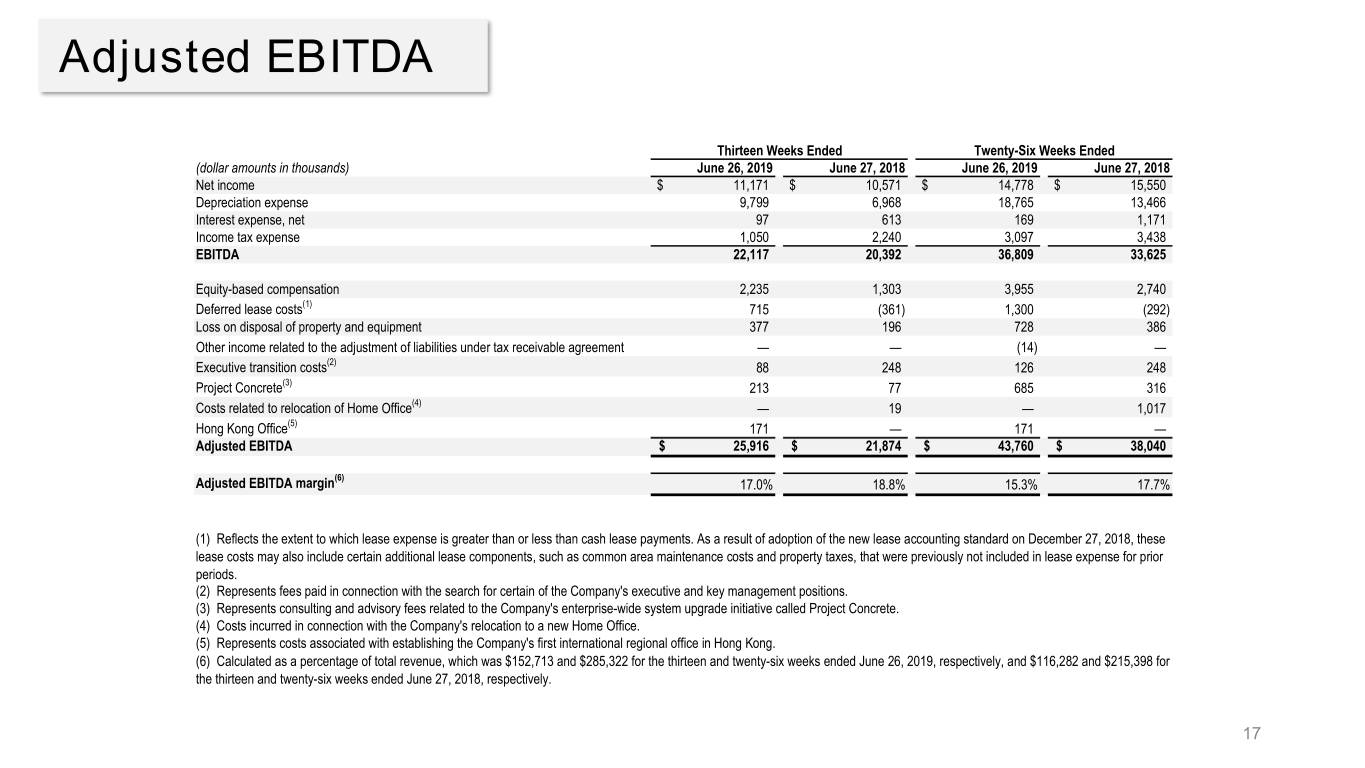

Adjusted EBITDA Thirteen Weeks Ended Twenty-Six Weeks Ended (dollar amounts in thousands) June 26, 2019 June 27, 2018 June 26, 2019 June 27, 2018 Net income $ 11,171 $ 10,571 $ 14,778 $ 15,550 Depreciation expense 9,799 6,968 18,765 13,466 Interest expense, net 97 613 169 1,171 Income tax expense 1,050 2,240 3,097 3,438 EBITDA 22,117 20,392 36,809 33,625 Equity-based compensation 2,235 1,303 3,955 2,740 Deferred lease costs(1) 715 (361) 1,300 (292) Loss on disposal of property and equipment 377 196 728 386 Other income related to the adjustment of liabilities under tax receivable agreement — — (14) — Executive transition costs(2) 88 248 126 248 Project Concrete(3) 213 77 685 316 Costs related to relocation of Home Office(4) — 19 — 1,017 Hong Kong Office(5) 171 — 171 — Adjusted EBITDA $ 25,916 $ 21,874 $ 43,760 $ 38,040 (6) Adjusted EBITDA margin 17.0% 18.8% 15.3% 17.7% (1) Reflects the extent to which lease expense is greater than or less than cash lease payments. As a result of adoption of the new lease accounting standard on December 27, 2018, these lease costs may also include certain additional lease components, such as common area maintenance costs and property taxes, that were previously not included in lease expense for prior periods. (2) Represents fees paid in connection with the search for certain of the Company's executive and key management positions. (3) Represents consulting and advisory fees related to the Company's enterprise-wide system upgrade initiative called Project Concrete. (4) Costs incurred in connection with the Company's relocation to a new Home Office. (5) Represents costs associated with establishing the Company's first international regional office in Hong Kong. (6) Calculated as a percentage of total revenue, which was $152,713 and $285,322 for the thirteen and twenty-six weeks ended June 26, 2019, respectively, and $116,282 and $215,398 for the thirteen and twenty-six weeks ended June 27, 2018, respectively. 17

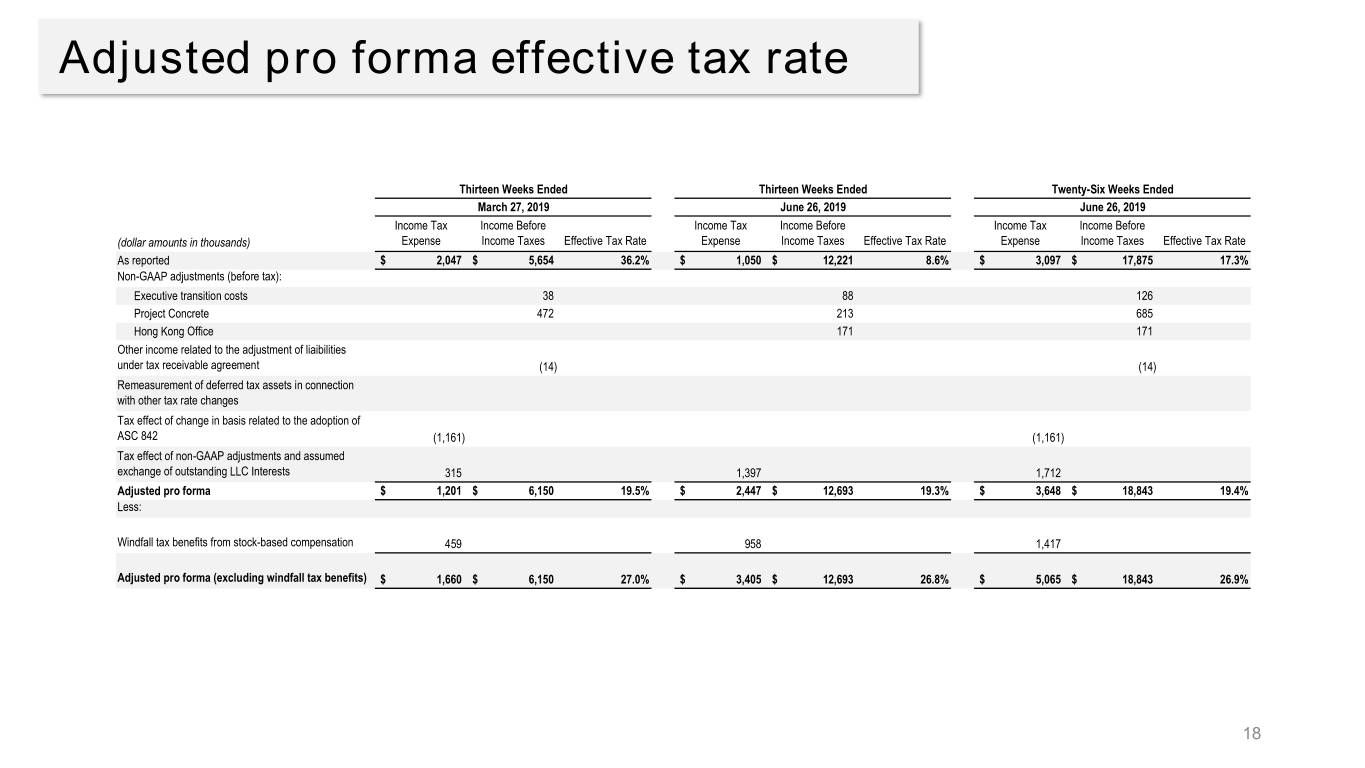

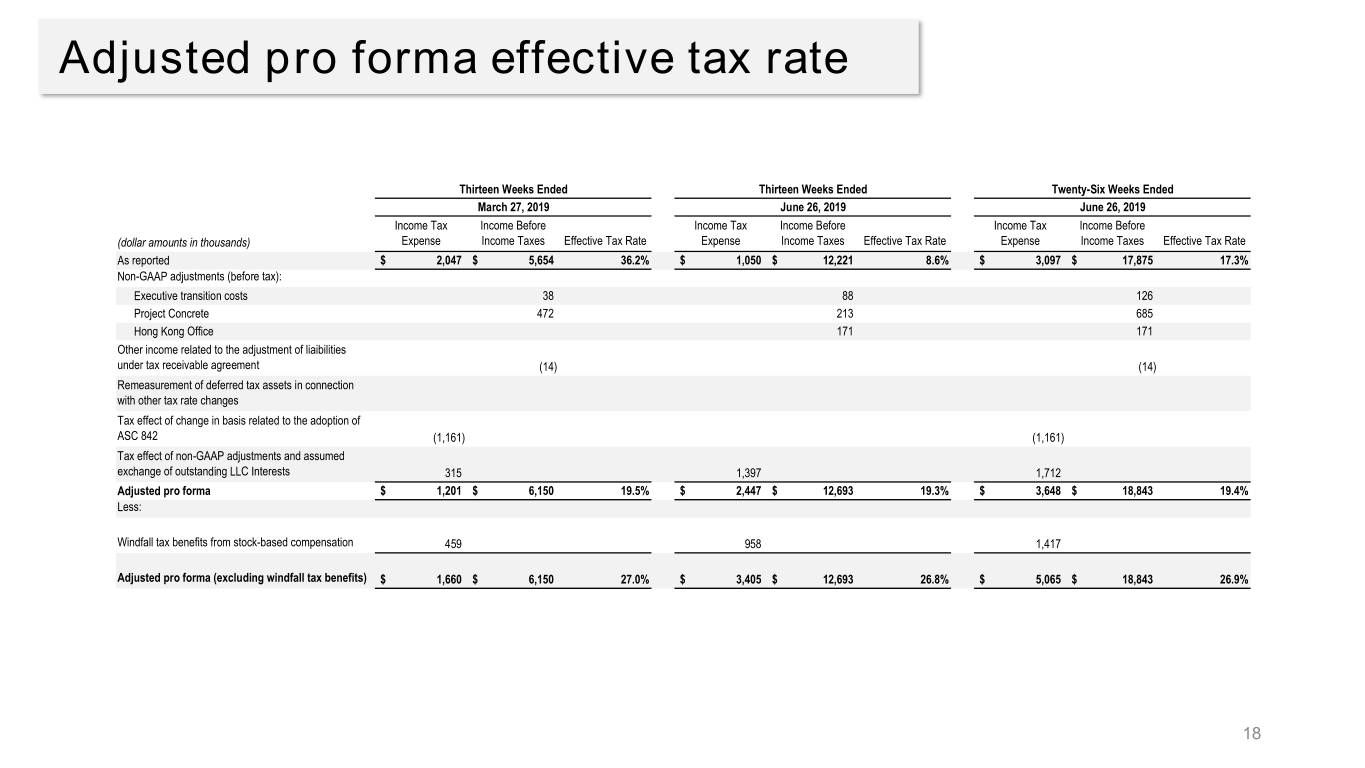

Adjusted pro forma effective tax rate Thirteen Weeks Ended Thirteen Weeks Ended Twenty-Six Weeks Ended March 27, 2019 June 26, 2019 June 26, 2019 Income Tax Income Before Income Tax Income Before Income Tax Income Before (dollar amounts in thousands) Expense Income Taxes Effective Tax Rate Expense Income Taxes Effective Tax Rate Expense Income Taxes Effective Tax Rate As reported $ 2,047 $ 5,654 36.2% $ 1,050 $ 12,221 8.6% $ 3,097 $ 17,875 17.3% Non-GAAP adjustments (before tax): Executive transition costs 38 88 126 Project Concrete 472 213 685 Hong Kong Office 171 171 Other income related to the adjustment of liaibilities under tax receivable agreement (14) (14) Remeasurement of deferred tax assets in connection with other tax rate changes Tax effect of change in basis related to the adoption of ASC 842 (1,161) (1,161) Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 315 1,397 1,712 Adjusted pro forma $ 1,201 $ 6,150 19.5% $ 2,447 $ 12,693 19.3% $ 3,648 $ 18,843 19.4% Less: Windfall tax benefits from stock-based compensation 459 958 1,417 Adjusted pro forma (excluding windfall tax benefits) $ 1,660 $ 6,150 27.0% $ 3,405 $ 12,693 26.8% $ 5,065 $ 18,843 26.9% 18

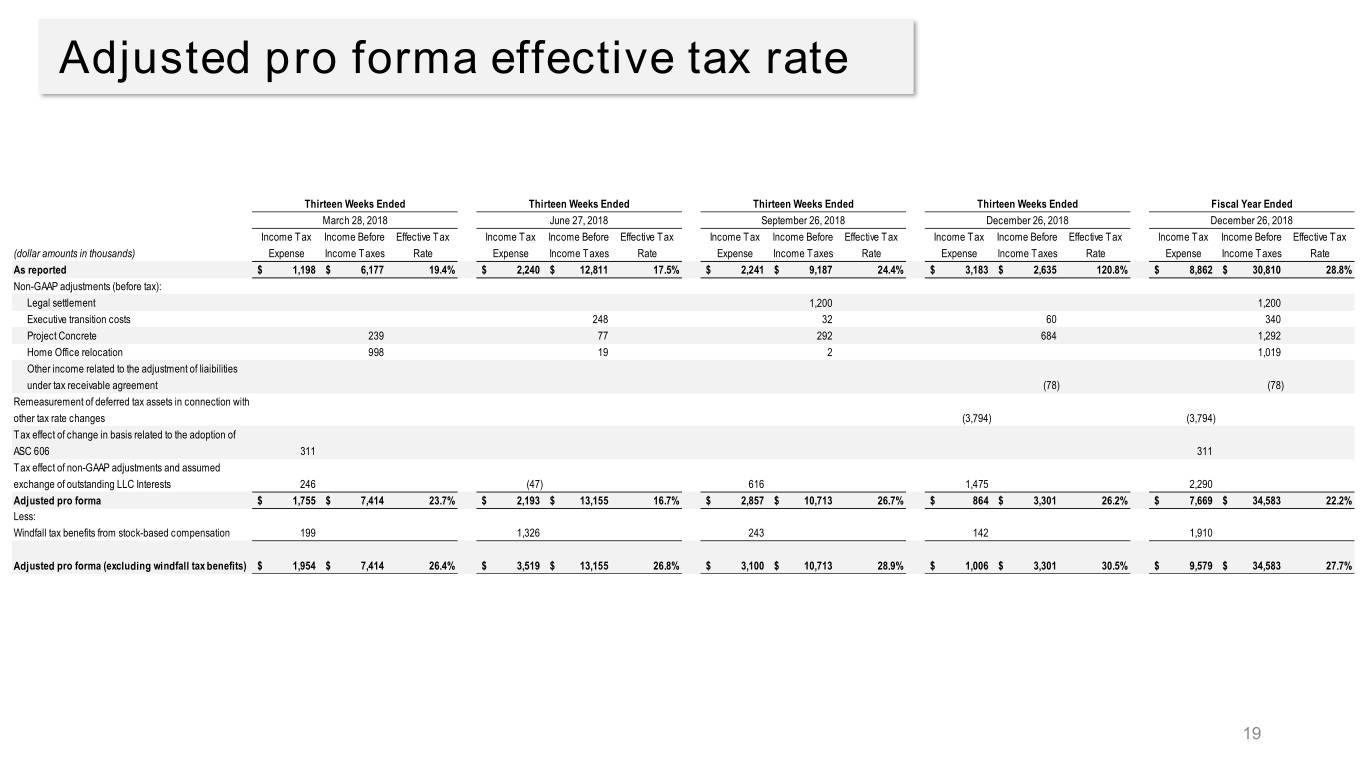

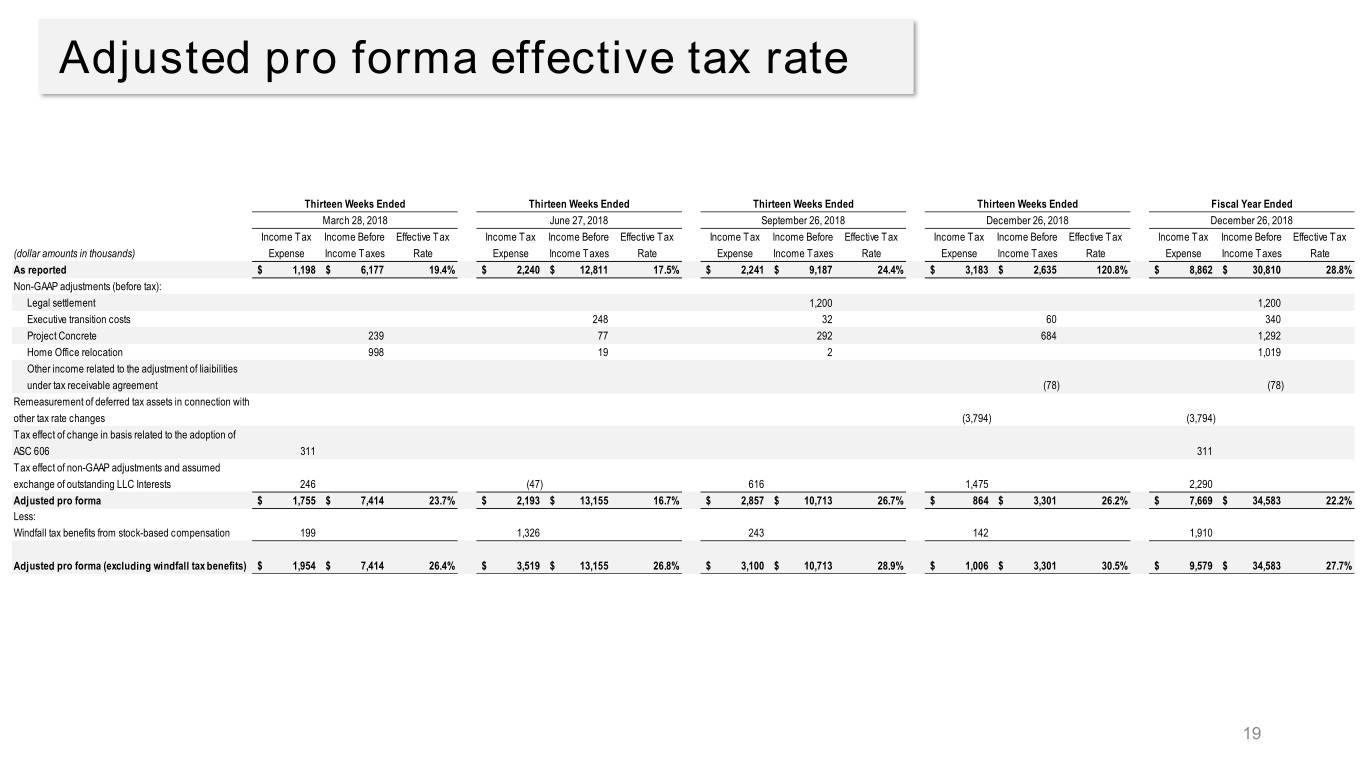

Adjusted pro forma effective tax rate Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended Fiscal Year Ended March 28, 2018 June 27, 2018 September 26, 2018 December 26, 2018 December 26, 2018 Income Tax Income Before Effective Tax Income Tax Income Before Effective Tax Income Tax Income Before Effective Tax Income Tax Income Before Effective Tax Income Tax Income Before Effective Tax (dollar amounts in thousands) Expense Income Taxes Rate Expense Income Taxes Rate Expense Income Taxes Rate Expense Income Taxes Rate Expense Income Taxes Rate As reported $ 1,198 $ 6,177 19.4% $ 2,240 $ 12,811 17.5% $ 2,241 $ 9,187 24.4% $ 3,183 $ 2,635 120.8% $ 8,862 $ 30,810 28.8% Non-GAAP adjustments (before tax): Legal settlement 1,200 1,200 Executive transition costs 248 32 60 340 Project Concrete 239 77 292 684 1,292 Home Office relocation 998 19 2 1,019 Other income related to the adjustment of liaibilities under tax receivable agreement (78) (78) Remeasurement of deferred tax assets in connection with other tax rate changes (3,794) (3,794) Tax effect of change in basis related to the adoption of ASC 606 311 311 Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 246 (47) 616 1,475 2,290 Adjusted pro forma $ 1,755 $ 7,414 23.7% $ 2,193 $ 13,155 16.7% $ 2,857 $ 10,713 26.7% $ 864 $ 3,301 26.2% $ 7,669 $ 34,583 22.2% Less: Windfall tax benefits from stock-based compensation 199 1,326 243 142 1,910 Adjusted pro forma (excluding windfall tax benefits) $ 1,954 $ 7,414 26.4% $ 3,519 $ 13,155 26.8% $ 3,100 $ 10,713 28.9% $ 1,006 $ 3,301 30.5% $ 9,579 $ 34,583 27.7% 19

Investor Contact: Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com Media Contact: Kristyn Clark, Shake Shack 646-747-8776 kclark@shakeshack.com 20