Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan F I R S T Q U A R T E R E A R N I N G S S U P P L E M E N T A L M A Y 6 , 2 0 2 1 1

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, expected financial results and operating performance for fiscal 2021, including expected 2021 key financial drivers, expected development targets for fiscal 2021 and fiscal 2022, including expected Shack construction and openings, expected same-Shack sales growth and trends in the Company’s operations, the expansion of the Company’s delivery services, the Company’s digital investments and strategies, and statements relating to the effects of COVID-19 and the Company’s mitigation efforts. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "intend," "outlook," "potential," "project," "projection," "plan," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s expectations include the impact of the COVID-19 pandemic, our ability to develop and open new Shacks on a timely basis, the management of our digital capabilities and expansion into delivery, and risks relating to the restaurant industry generally. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2020 as filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS 2

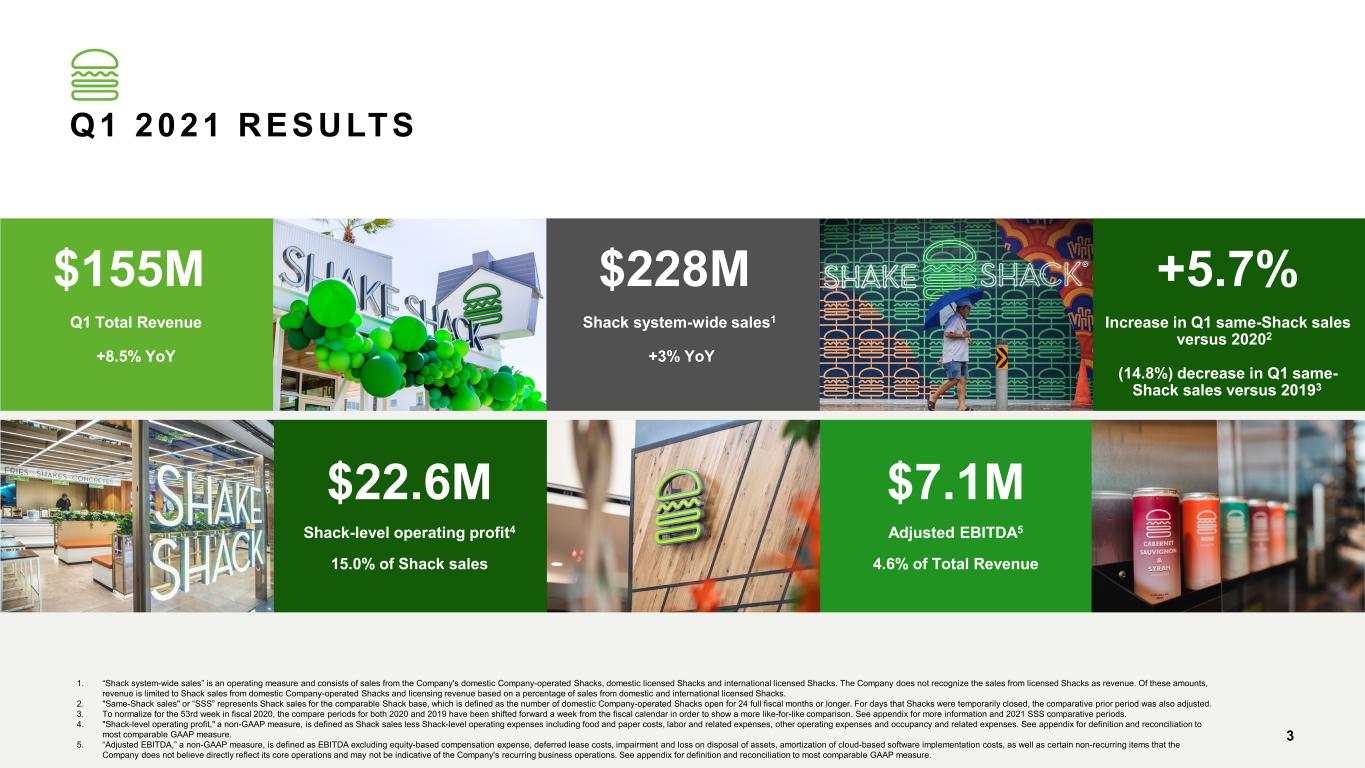

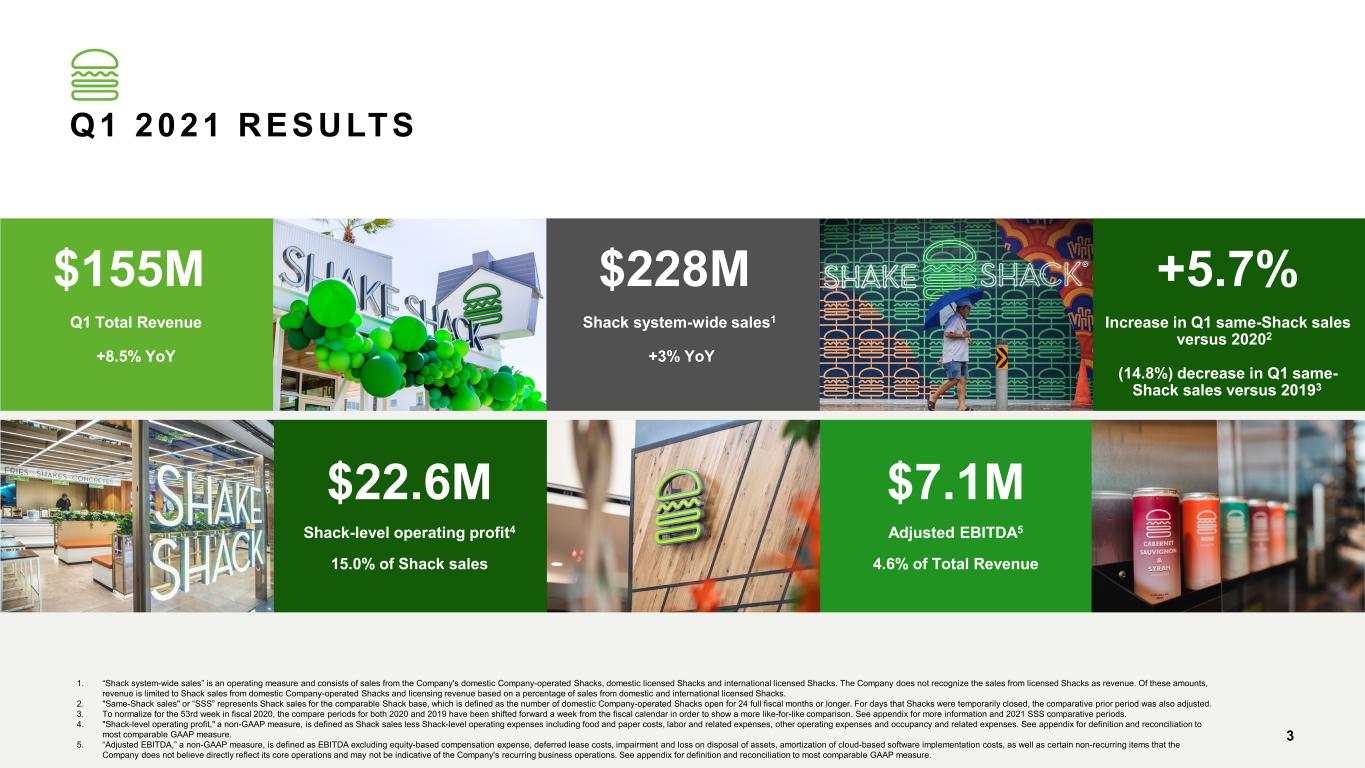

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Q1 2021 RESULTS 1. “Shack system-wide sales” is an operating measure and consists of sales from the Company's domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative prior period was also adjusted. 3. To normalize for the 53rd week in fiscal 2020, the compare periods for both 2020 and 2019 have been shifted forward a week from the fiscal calendar in order to show a more like-for-like comparison. See appendix for more information and 2021 SSS comparative periods. 4. "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. See appendix for definition and reconciliation to most comparable GAAP measure. 5. “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA excluding equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well s certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. See appendix for definition and reconciliation to most comparable GAAP measure. $155M Q1 Total Revenue +8.5% YoY $228M Shack system-wide sales1 +3% YoY $7.1M Adjusted EBITDA5 4.6% of Total Revenue $22.6M Shack-level operating profit4 15.0% of Shack sales +5.7% Increase in Q1 same-Shack sales versus 20202 (14.8%) decrease in Q1 same- Shack sales versus 20193 3

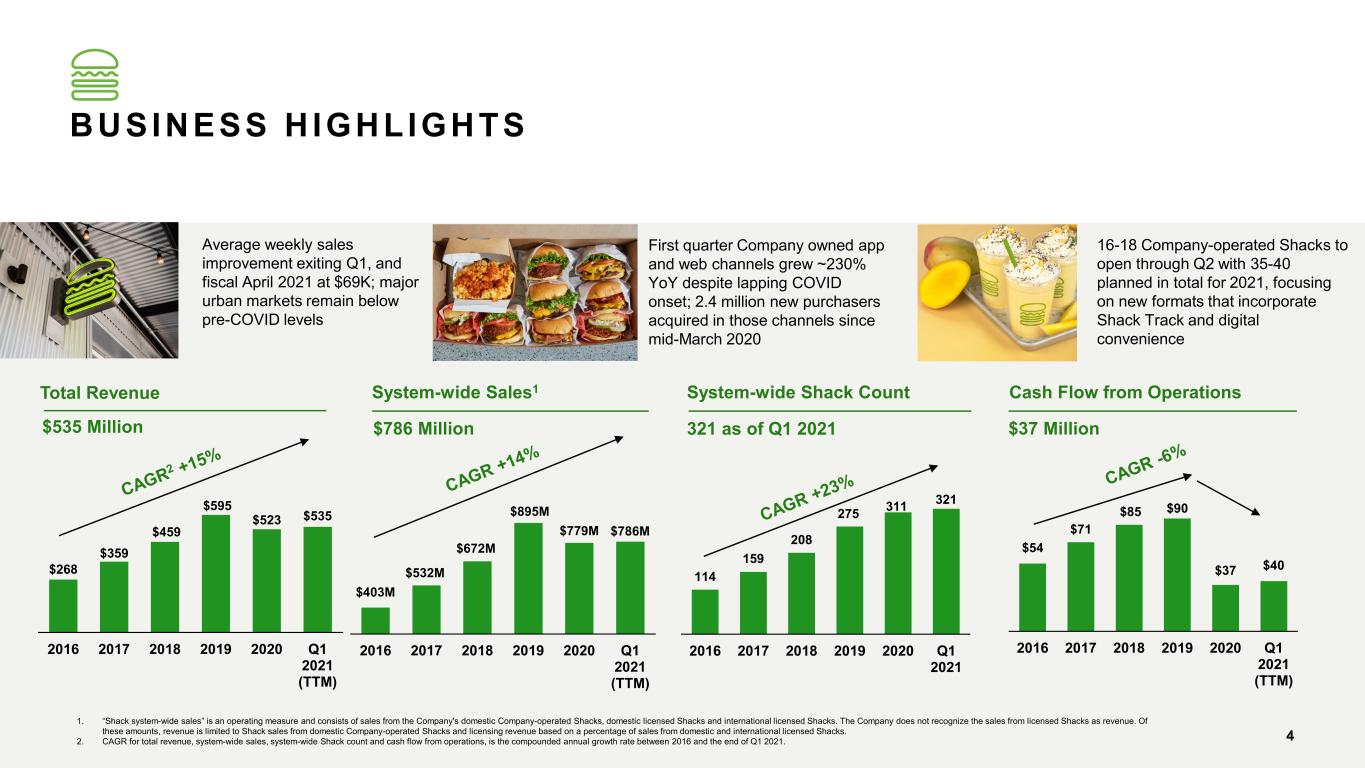

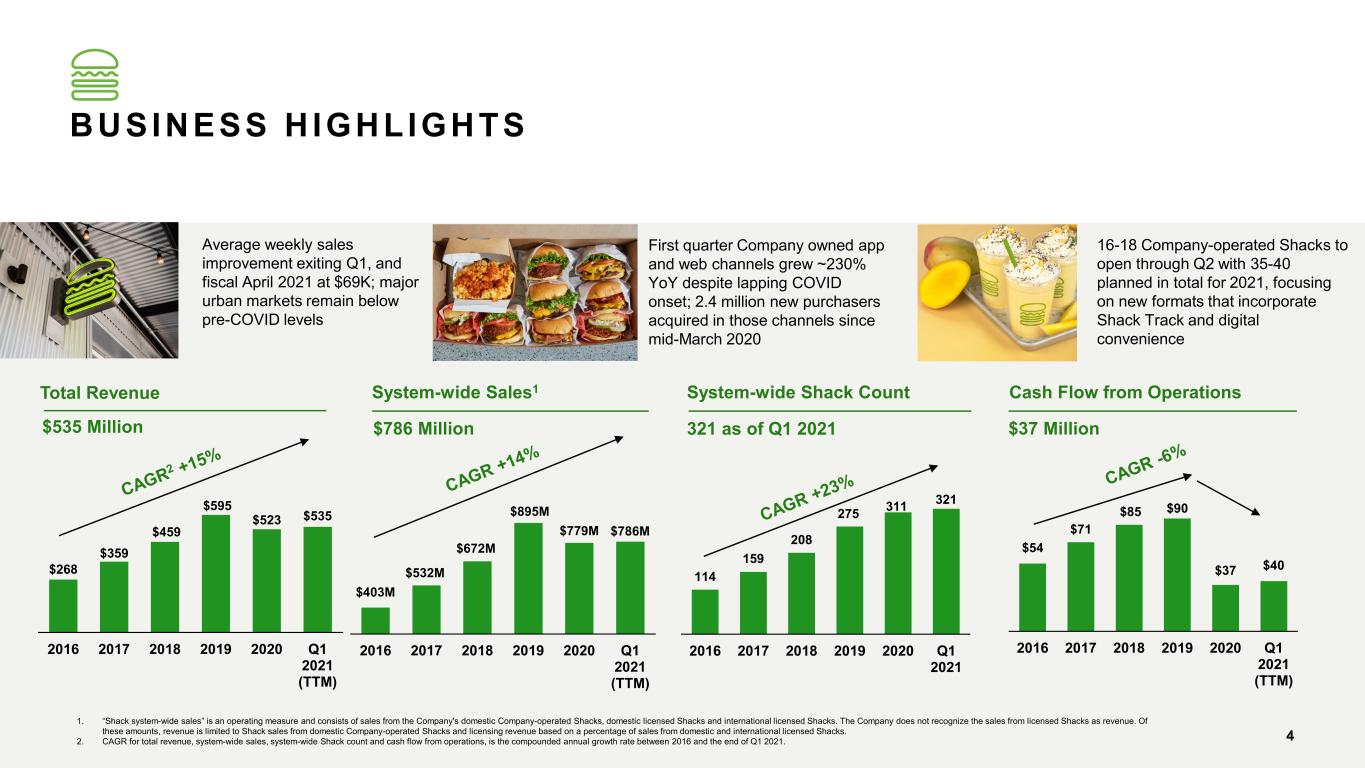

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Total Revenue $535 Million System-wide Sales1 $786 Million System-wide Shack Count 321 as of Q1 2021 Cash Flow from Operations $37 Million 1. “Shack system-wide sales” is an operating measure and consists of sales from the Company's domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. 2. CAGR for total revenue, system-wide sales, system-wide Shack count and cash flow from operations, is the compounded annual growth rate between 2016 and the end of Q1 2021. $268 $359 $459 $595 $523 $535 2016 2017 2018 2019 2020 Q1 2021 (TTM) $403M $532M $672M $895M $779M $786M 2016 2017 2018 2019 2020 Q1 2021 (TTM) 114 159 208 275 311 321 2016 2017 2018 2019 2020 Q1 2021 $54 $71 $85 $90 $37 $40 2016 2017 2018 2019 2020 Q1 2021 (TTM) 4 16-18 Company-operated Shacks to open through Q2 with 35-40 planned in total for 2021, focusing on new formats that incorporate Shack Track and digital convenience First quarter Company owned app and web channels grew ~230% YoY despite lapping COVID onset; 2.4 million new purchasers acquired in those channels since mid-March 2020 Average weekly sales improvement exiting Q1, and fiscal April 2021 at $69K; major urban markets remain below pre-COVID levels BUSINESS H IGHLIGHTS

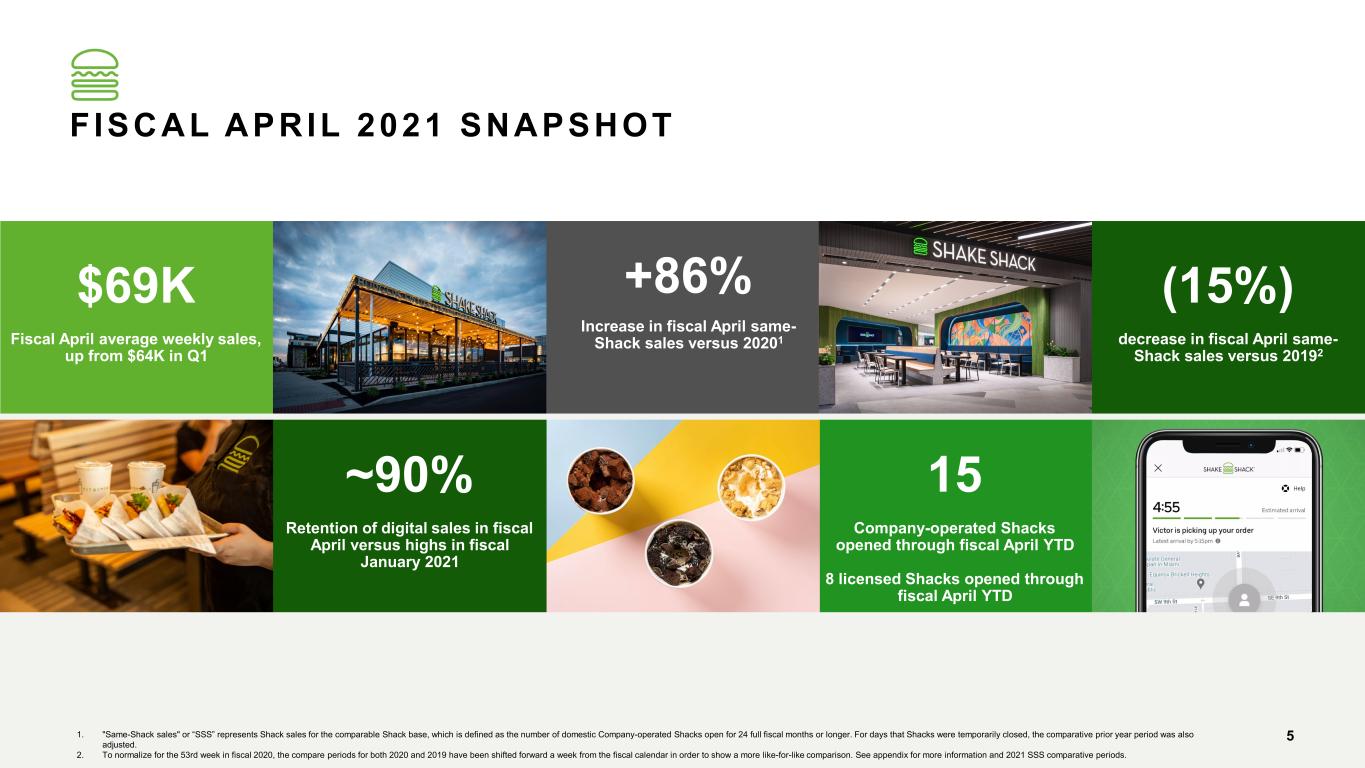

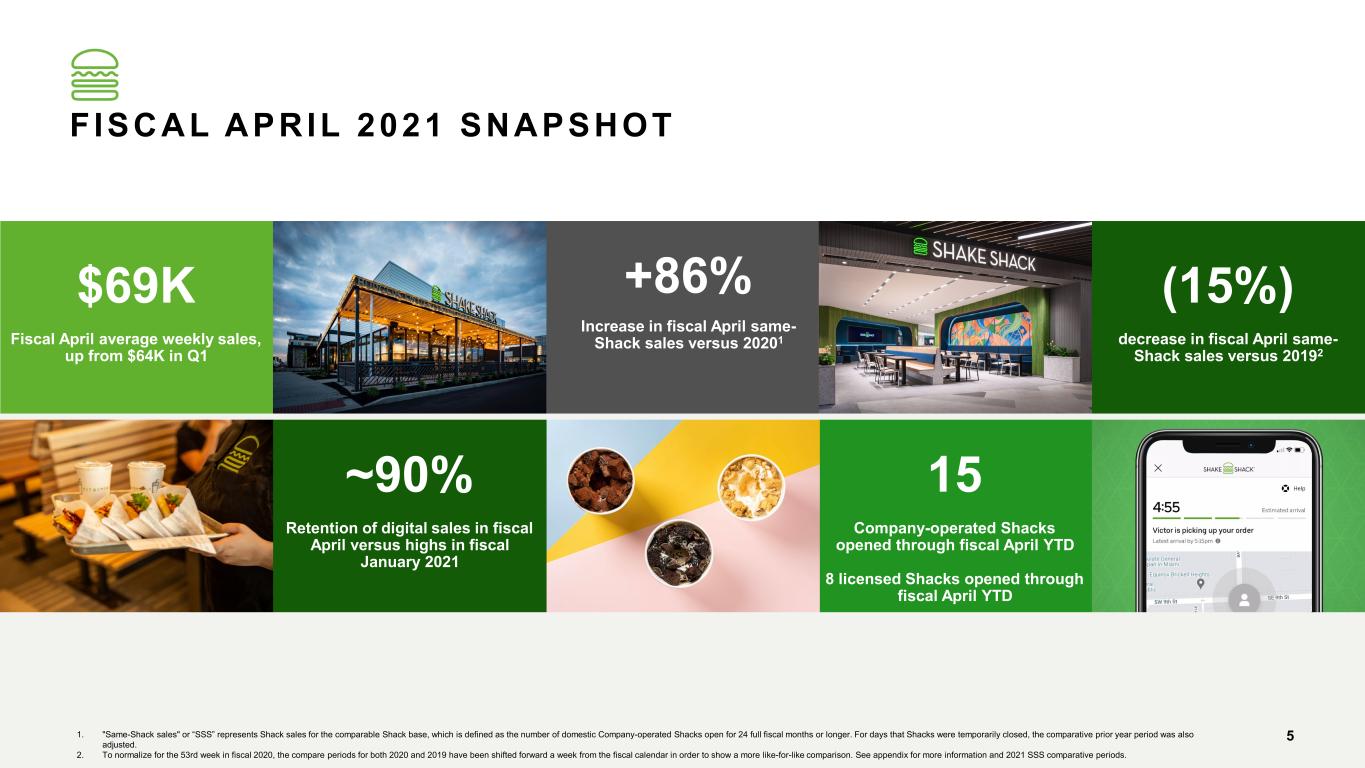

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan FISCAL APRIL 2021 SNAPSHOT 1. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative prior year period was also adjusted. 2. To normalize for the 53rd week in fiscal 2020, the compare periods for both 2020 and 2019 have been shifted forward a week from the fiscal calendar in order to show a more like-for-like comparison. See appendix for more information and 2021 SSS comparative periods. $69K Fiscal April average weekly sales, up from $64K in Q1 15 Company-operated Shacks opened through fiscal April YTD 8 licensed Shacks opened through fiscal April YTD +86% Increase in fiscal April same- Shack sales versus 20201 ~90% Retention of digital sales in fiscal April versus highs in fiscal January 2021 (15%) decrease in fiscal April same- Shack sales versus 20192 5

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan (11%) (56%) (32%) (32%) (23%) (20%) (10%) (5%) (3%) (1%) (6%) (6%) 39% AWS Total YoY Shack Sales Growth (Decline) Fiscal August 2020 Fiscal September 2020 1. Average Weekly Sales (“AWS”) is calculated by dividing total Shack sales by the number of operating weeks for all Shacks in operation during the period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of operating weeks open such that it corresponds to the period of associated sales. 2. Fiscal December 2020 total YoY Shack sales decline excludes impact of the 53rd fiscal accounting week and compares the five weeks from November 19, 2020 through December 23, 2020 to the five weeks from Nov mber 21, 2019 through December 25, 2020.. The favorable impact of the 53rd week in fiscal 2020 was an incremental Shack sales of $10.7 million. Fiscal July 2020 $56K $59K $61K $62KAWS Fiscal October 2020 Fiscal June 2020 $52K$50K Fiscal May 2020 $56K Fiscal March 2020 $32K Fiscal April 2020 AVERAGE WEEKLY SALES 1 (AWS) AW S C O N T I N U E D T O I N C R E A S E I N M A R C H T O $ 6 8 K A N D A P R I L T O $ 6 9 K $62K Fiscal November 2020 $62K Fiscal December 20202 Q3 AWS $58K Q4 AWS $62K Q2 AWS $45K $63K Fiscal January 2021 $60K Fiscal February 2021 6 Q1 AWS $64K $69K Fiscal April 2021 $68K Fiscal March 2021 171%

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan1. Urban refers to a Shack that is located in a very densely populated city area. These locations tend to be very walkable, close to lots of traffic, shopping, tourism and/or office buildings. Suburban is any Shack that is not classified as urban. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative year period was also adjusted. 3. To normalize for the 53rd week in fiscal 2020, the compare periods for both 2020 and 2019 have been shifted forward a week from the fiscal calendar in order to show a more like-for-like comparison. See appendix for more information and 2021 SSS comparative periods. 4. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. SUBURBAN SHACKS CONTINUE TO LEAD RECOVERY S U B U R B A N S A M E - S H A C K S A L E S F L AT T O 2 0 1 9 L E V E L S , W H I L E U R B A N M A R K E T S R E M A I N M AT E R I A L LY I M PA C T E D (57%) (43%) (31%) 74% (38%) (16%) (0%) 98% (49%) (32%) (17%) 86% (25%) (27%) (2%) (1%) (14%) (15%) Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 Fiscal January 2021 Fiscal February 2021 Fiscal March 2021 Fiscal April 2021 Urban SSS%Suburban SSS% URBAN/SUBURBAN1 SAME-SHACK SALES2 VS PRIOR YEAR AND 20193 Total SSS% 4 7 Dotted lines represent 2021 SSS % vs 2019

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan REGIONAL PERFORMANCE DRIVEN BY SUBURBAN DENSITY S O U T H E A S T R E G I O N , H E AV Y S U B U R B A N F O O T P R I N T, A B O V E 2 0 1 9 L E V E L S W I T H N Y C , M A N H AT T A N C O N T I N U I N G T O L A G A S B U S I N E S S T R A F F I C , T O U R I S M S L O W T O R E T U R N 1. The regions of domestic Company-operated Shacks are defined as: NYC, which represents 5 boroughs; Northeast, which represents non-NYC NY, CT, DC, DE, MA, MD, NJ, PA, RI, VA; Southeast, which represents AL, FL, GA, LA, NC, TN, TX; Midwest, which represents IL, KS, KY, MI, MN, MO, OH, WI; and West, which represents AZ, CA, CO, NV, UT, WA. 2. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative year period was also adjusted. 3. To normalize for the 53rd week in fiscal 2020, the compare periods for both 2020 and 2019 have been shifted forward a week from the fiscal calendar in order to show a more like-for-like comparison. See appendix for more information and 2021 SSS comparative periods. 4. For Q4 2020, same-Shack sales excludes the impact of the fourteenth week and compares the thirteen weeks from September 24, 2020 through December 23, 2020 to the thirteen weeks from September 26, 2019 through December 25, 2019. REGIONAL1 SAME-SHACK SALES 2 VS PRIOR YEAR3 (64%) 72% (69%) 72% (41%) 89% (41%) 119% (47%) 84% (45%) 68% Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 Fiscal January 2021 Fiscal February 2021 Fiscal March 2021 Fiscal April 2021 Northeast Southeast West Midwest NYC (incl. Manhattan) Manhattan 4 8 Fiscal April 2021 vs 2019 2% (9%) (11%) (17%) (35%) (44%)

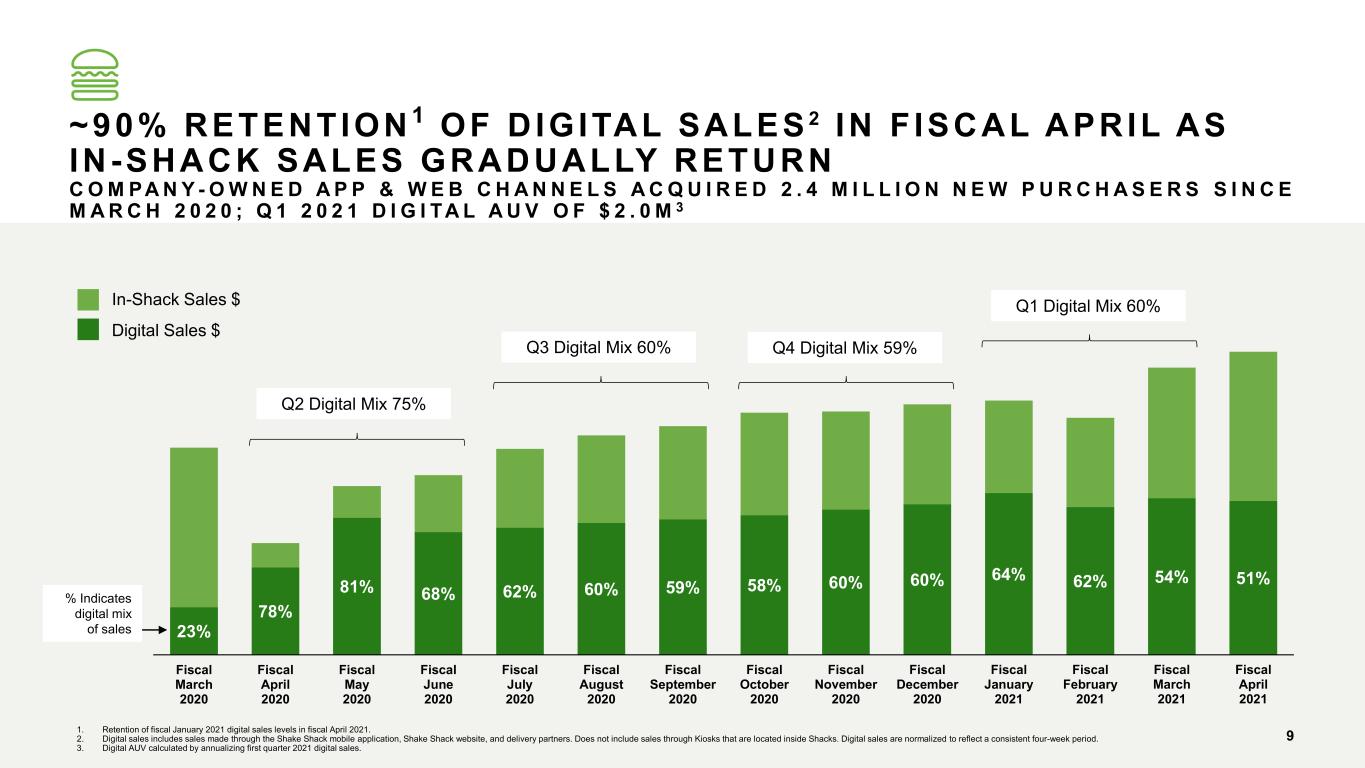

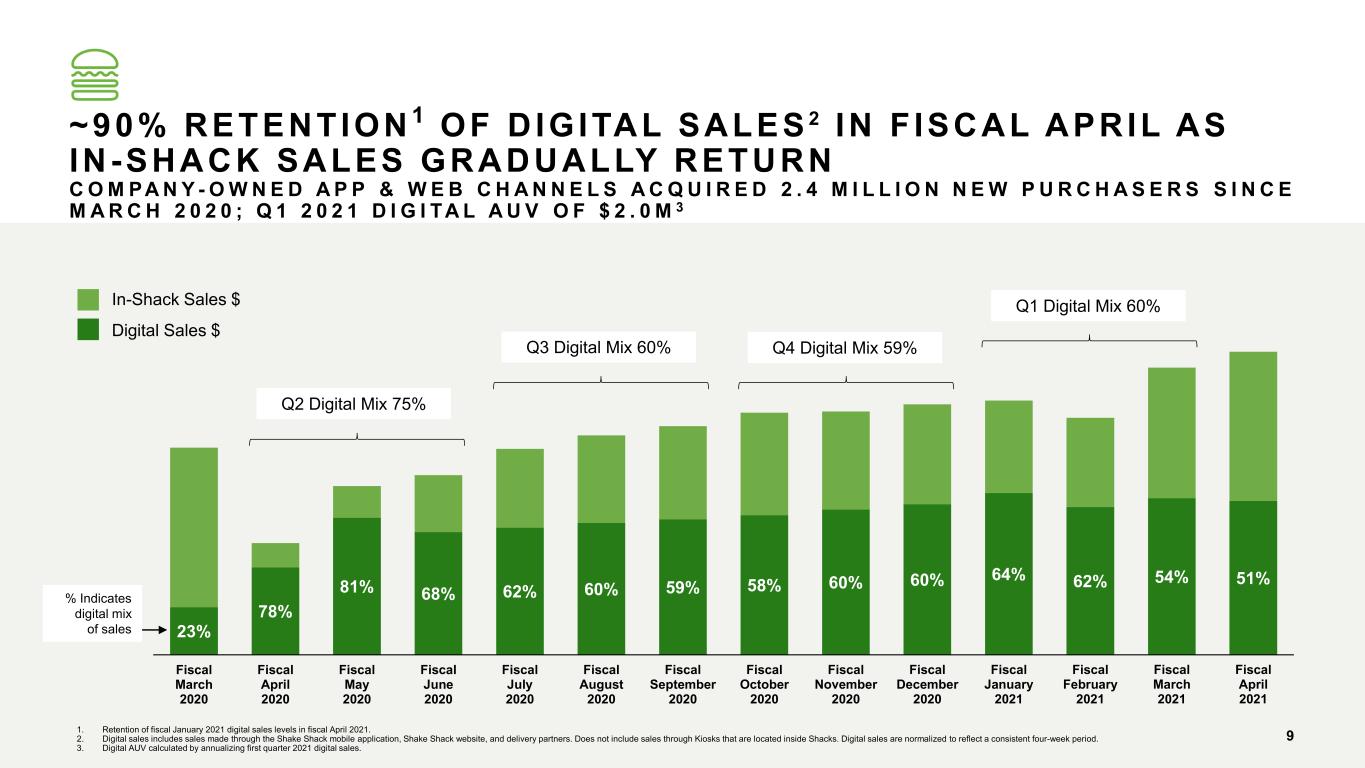

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 1. Retention of fiscal January 2021 digital sales levels in fiscal April 2021. 2. Digital sales includes sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. Does not include sales through Kiosks that are located inside Shacks. Digital sales are normalized to reflect a consistent four-week period. 3. Digital AUV calculated by annualizing first quarter 2021 digital sales. ~90% RETENTION 1 OF D IGITAL SALES 2 IN F ISCAL APRIL AS IN -SHACK SALES GRADUALLY RETURN C O M PA N Y - O W N E D A P P & W E B C H A N N E L S A C Q U I R E D 2 . 4 M I L L I O N N E W P U R C H A S E R S S I N C E M A R C H 2 0 2 0 ; Q 1 2 0 2 1 D I G I TA L A U V O F $ 2 . 0 M 3 23% 78% 81% 68% 62% 60% 59% 58% 60% 60% 64% 62% 54% 51% Fiscal March 2020 Fiscal April 2020 Fiscal May 2020 Fiscal June 2020 Fiscal July 2020 Fiscal August 2020 Fiscal September 2020 Fiscal October 2020 Fiscal November 2020 Fiscal December 2020 Fiscal January 2021 Fiscal February 2021 Fiscal March 2021 Fiscal April 2021 % Indicates digital mix of sales In-Shack Sales $ Digital Sales $ Q3 Digital Mix 60% Q4 Digital Mix 59% Q2 Digital Mix 75% 9 Q1 Digital Mix 60%

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan DIGITAL FOCUS ON NEW PROGRAMS AND ENHANCED USER EXPERIENCE F U L LY L A U N C H E D S H A C K A P P D E L I V E R Y I N F I R S T Q U A R T E R 10 Shack App Delivery rolled out nationwide in March through partnership with Uber Eats Upcoming web redesign will feature enhanced user experience and greater personalization through targeted messaging and improved merchandising Other digital product launches including new payment gateway and new Android app will encourage app delivery & pre-order conversion

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 16-18 SHACKS PLANNED TO OPEN IN F IRST HALF OF 2021 F I R S T I N D I A N A P O L I S S H A C K O P E N E D W I T H D R I V E - U P S H A C K T R A C K W I N D O W ; 2 0 2 1 S H A C K C L A S S O P E N I N G W I T H S T R O N G S A L E S AT $ 7 9 K AW S I N Q 1 11 Take out at the Shack Track walk-up window in Boulder Pull right up to the Shack Track drive-up window in Fishers - Indianapolis area Guests line up for the Santa Monica opening

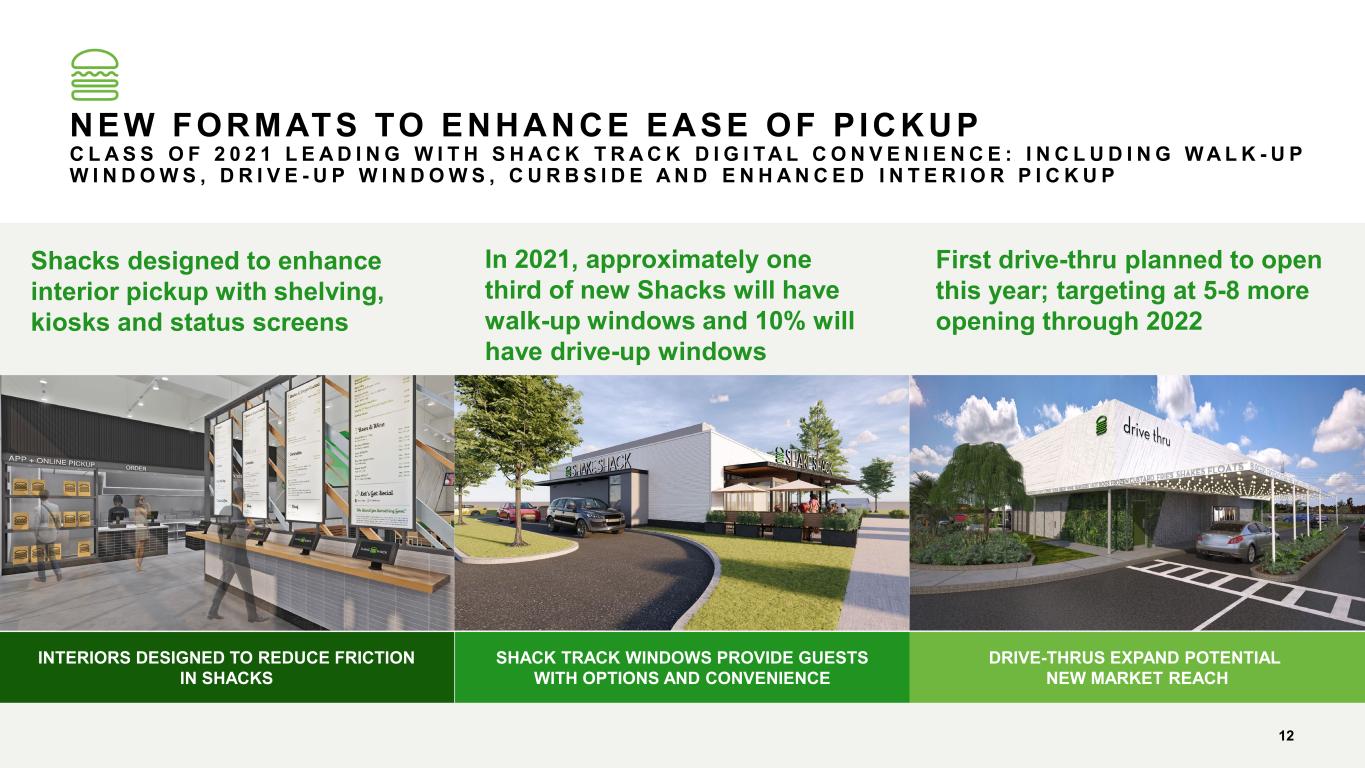

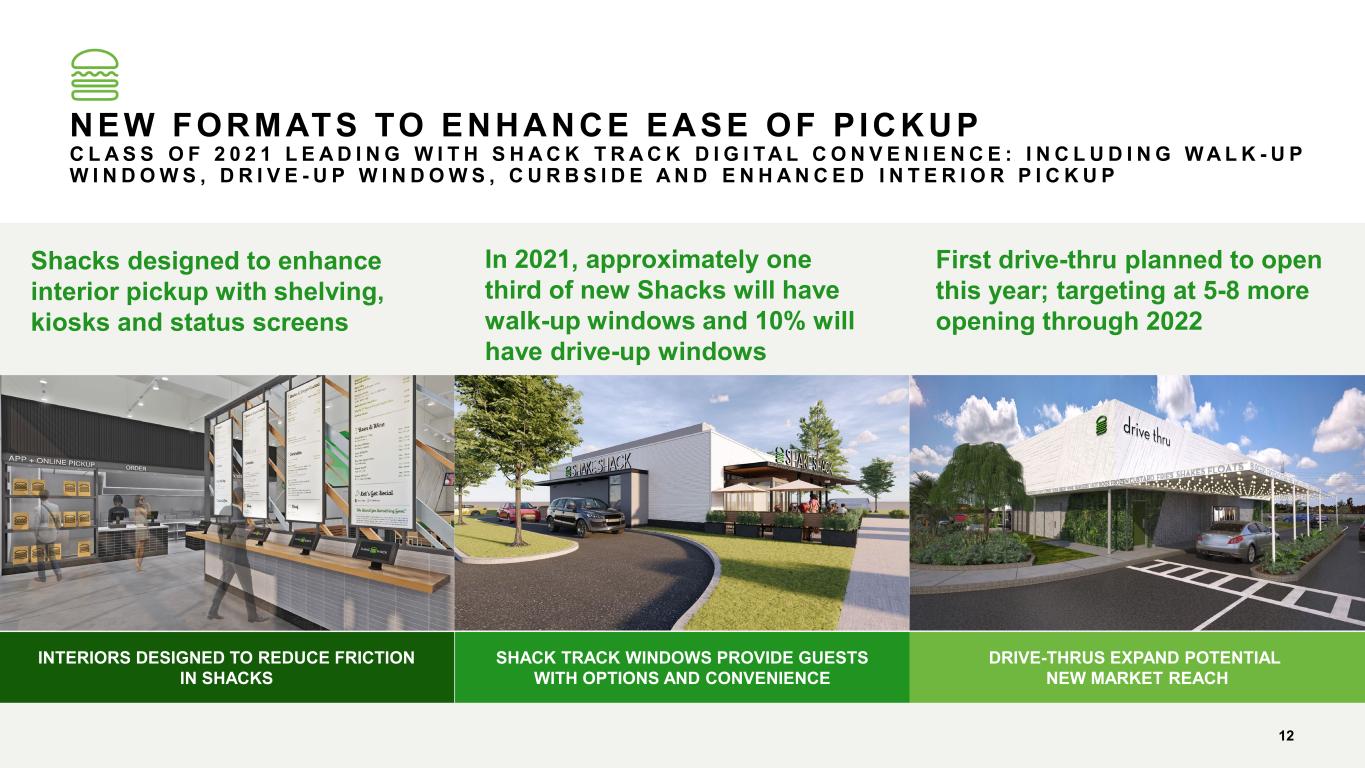

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan NEW FORMATS TO ENHANCE EASE OF P ICKUP C L A S S O F 2 0 2 1 L E A D I N G W I T H S H A C K T R A C K D I G I TA L C O N V E N I E N C E : I N C L U D I N G W A L K - U P W I N D O W S , D R I V E - U P W I N D O W S , C U R B S I D E A N D E N H A N C E D I N T E R I O R P I C K U P INTERIORS DESIGNED TO REDUCE FRICTION IN SHACKS SHACK TRACK WINDOWS PROVIDE GUESTS WITH OPTIONS AND CONVENIENCE DRIVE-THRUS EXPAND POTENTIAL NEW MARKET REACH Shacks designed to enhance interior pickup with shelving, kiosks and status screens In 2021, approximately one third of new Shacks will have walk-up windows and 10% will have drive-up windows First drive-thru planned to open this year; targeting at 5-8 more opening through 2022 12

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 1. Licensed weekly sales is an operating measure and consists of sales from domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. 2. Fiscal December 2020 total YoY licensed sales decline excludes impact of the 53rd fiscal accounting week. The favorable impact of the 53rd week in fiscal 2020 was an incremental licensed sales of $7.0 million. 13 13% (65%) (58%) (47%) (32%) (23%) (9%) (10%) (10%) (15%) (27%) (8%) 20% Licensed Weekly Sales Total year-over-year licensed sales growth (decline) Fiscal August 2020 Fiscal September 2020 Fiscal July 2020 $4.6M $5.4M $5.7M $5.9M Fiscal October 2020 Licensed Weekly Sales1 Fiscal May 2020 $2.4M Fiscal June 2020 $3.5M Fiscal April 2020 $2.0M Fiscal March 2020 $4.6M $5.9M Fiscal November 2020 $6.4M Fiscal December 20202 $5.6M Fiscal January 2021 L ICENSED BUSINESS IMPROVED THROUGHOUT F IRST QUARTER I M P R O V I N G P E R F O R M A N C E A C R O S S I N T E R N AT I O N A L A N D D O M E S T I C S H A C K S D R I V E N B Y N E W O P E N I N G S , R E S T R I C T I O N S B E I N G L I F T E D A N D I N C R E A S E D A I R P O R T T R A F F I C 1 $6.0M Fiscal February 2021 $6.3M Fiscal March 2021 $6.6M Fiscal April 2021 233%

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 8 L ICENSED SHACKS OPENED YTD, 15 -20 TARGETED IN 2021 N E W M A R K E T G R O W T H I N M A C A O A L O N G W I T H A D D I T I O N A L O P E N I N G S I N K O R E A , M A I N L A N D C H I N A , S I N G A P O R E A N D M I D D L E E A S T ; S H E N Z H E N E X P E C T E D T O O P E N L AT E R T H I S Y E A R 1414

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan CULINARY COLLABS FEATURING DIVERSE LOCAL CHEFS T H E N O W S E R V I N G S E R I E S F O C U S E S O N S U P P O R T I N G T H E R E S TA U R A N T I N D U S T R Y W I T H A P O R T I O N O F N E T P R O C E E D S G O I N G T O N O N - P R O F I T S T H AT B E N E F I T L O C A L R E S TA U R A N T C O M M U N I T I E S 1515 Pinky Cole of Slutty Vegan ATL in Atlanta Junghyun Park of Atob y/Atomix in NYC

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan ANNUAL STAND FOR SOMETHING GOOD REPORT: ESG EFFORTS PUBLISHED A H I G H - L E V E L O V E R V I E W O F S H A K E S H A C K ’ S D O M E S T I C , C O M PA N Y - O W N E D O P E R AT I O N S I N 2 0 2 0 A N D N E W O R U P C O M I N G R E S P O N S I B L E B U S I N E S S I N I T I AT I V E S Donated $100K to Equal Justice Initiative in support of their mission to end mass incarceration and challenge racial and economic injustice 2020 Company Mi les tones Cumulatively invested an additional $6M (approx.) in employees, including premium pay and up to a $400 holiday bonus for all hourly team members, plus guaranteed bonus for managers For the second year in a row, earned a 100% score on Human Rights Campaign’s Corporate Equality Index for support of LGBTQ+ employees in the workplace Provided 11,000+ meals to healthcare and frontline workers Launched four Employee Resource Groups (ERGs) Hosted internal “Stand Together Series” Ran Company-wide unconscious bias training Distributed 6,500+ custom-designed Black Lives Matter uniform shirts to team members Empowered team members to vote by providing educational resources and developing a paid time off Voting Policy in support of #ShacktheVote Launched Shift Up, a leadership development program providing Shift Managers with the professional skills needed to advance to Manager roles at Shake Shack Full report now available on the Shake Shack investor relations webpage

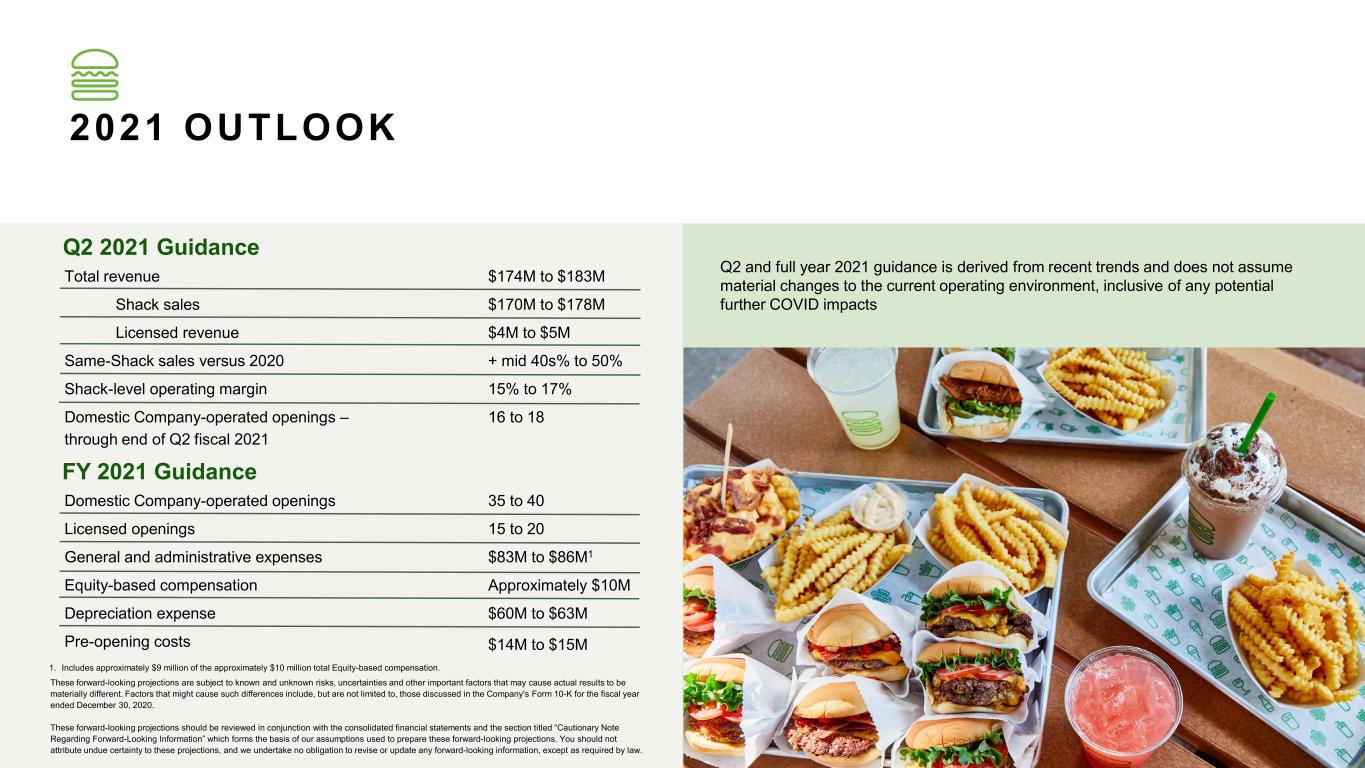

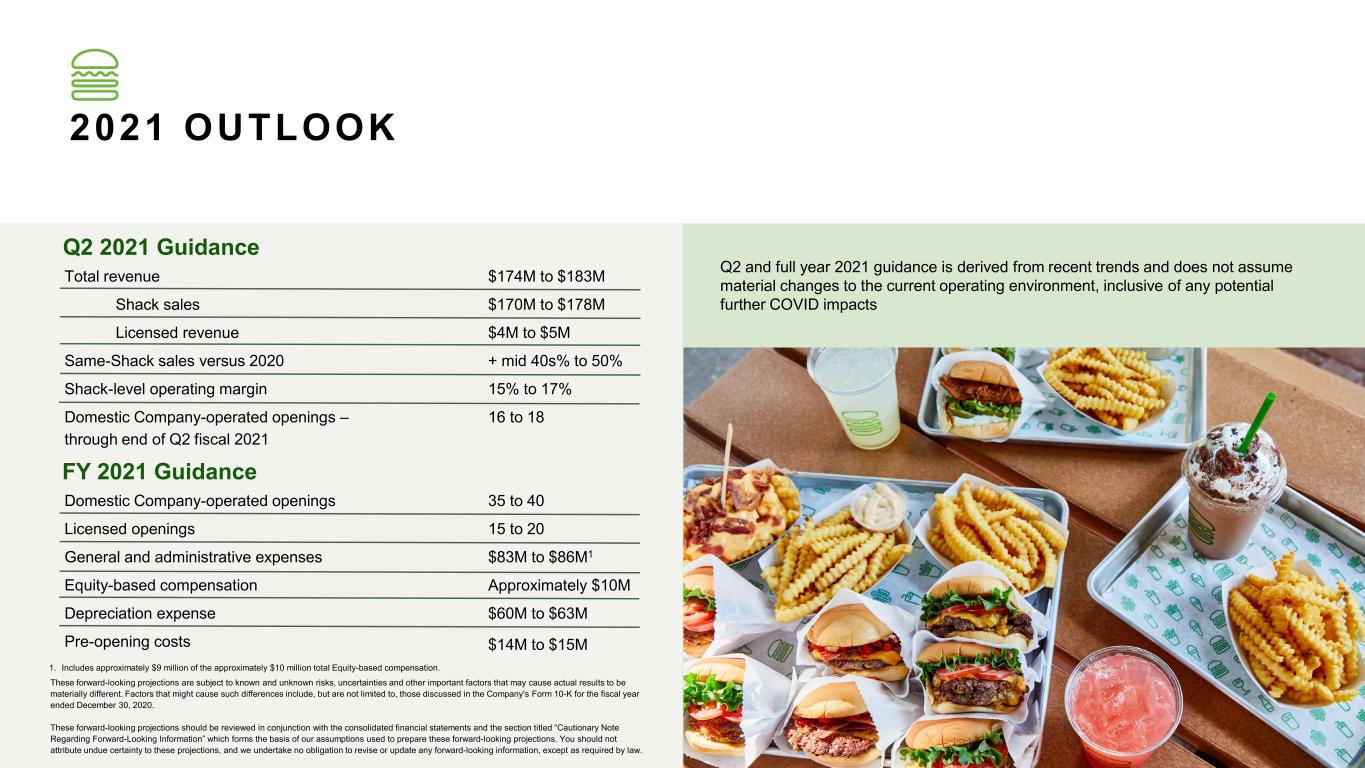

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2021 OUTLOOK 1. Includes approximately $9 million of the approximately $10 million total Equity-based compensation. These forward-looking projections are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. Factors that might cause such differences include, but are not limited to, those discussed in the Company's Form 10-K for the fiscal year ended December 30, 2020. These forward-looking projections should be reviewed in conjunction with the consolidated financial statements and the section titled “Cautionary Note Regarding Forward-Looking Information” which forms the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. Total revenue Shack sales Licensed revenue Same-Shack sales versus 2020 Shack-level operating margin Domestic Company-operated openings – through end of Q2 fiscal 2021 Domestic Company-operated openings Licensed openings General and administrative expenses Equity-based compensation Depreciation expense Pre-opening costs $174M to $183M $170M to $178M $4M to $5M + mid 40s% to 50% 15% to 17% 16 to 18 35 to 40 15 to 20 $83M to $86M1 Approximately $10M $60M to $63M $14M to $15M 17 Q2 and full year 2021 guidance is derived from recent trends and does not assume material changes to the current operating environment, inclusive of any potential further COVID impacts Q2 2021 Guidance FY 2021 Guidance

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Board of Direct rs M eting 1 20 FINANCIAL DETAILS

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan “Adjusted EBITDA,” a non-GAAP measure”, is defined as EBITDA (as defined below), excluding equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation assets, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as net income (loss) before interest expense (net of interest income), taxes, depreciation and amortization, which also excludes equity-based compensation expense, deferred lease costs, impairment and loss on disposal of assets, amortization of cloud-based software implementation assets, as well as certain non-recurring and other items that the Company does not believe directly reflect its core operations, as a percentage of revenue. "Same-Shack Sales" represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For days that Shacks were temporarily closed, the comparative 2019 period was also adjusted. “Licensed weekly sales” is calculated by dividing the total sales for the period for all licensed Shacks by the number of weeks in the period. “EBITDA,” a non-GAAP measure, is defined as net income (loss) before interest expense (net of interest income), income tax expense (benefit), and depreciation and amortization expense. DEFIN IT IONS "Shack-level operating profit," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including food and paper costs, labor and related expenses, other operating expenses and occupancy and related expenses as a percentage of Shack sales. "Shack sales" is defined as the aggregate sales of food, beverages and Shake Shack- branded merchandise at domestic Company-operated Shacks and excludes sales from licensed Shacks. “Shack system-wide sales” is an operating measure and consists of sales from domestic Company-operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to Shack sales from domestic Company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees such as territory fees and opening fees. “Adjusted pro forma effective tax rate,” a non-GAAP measure, represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. 19

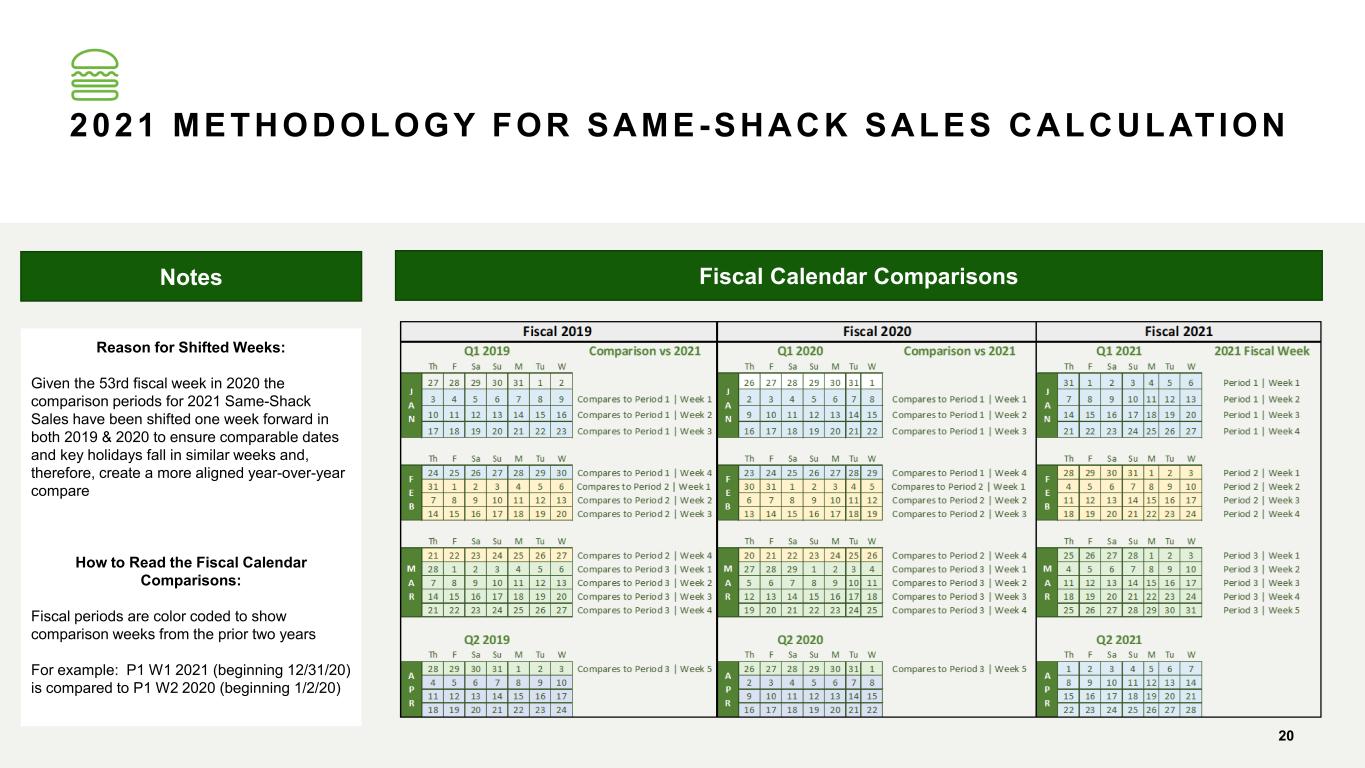

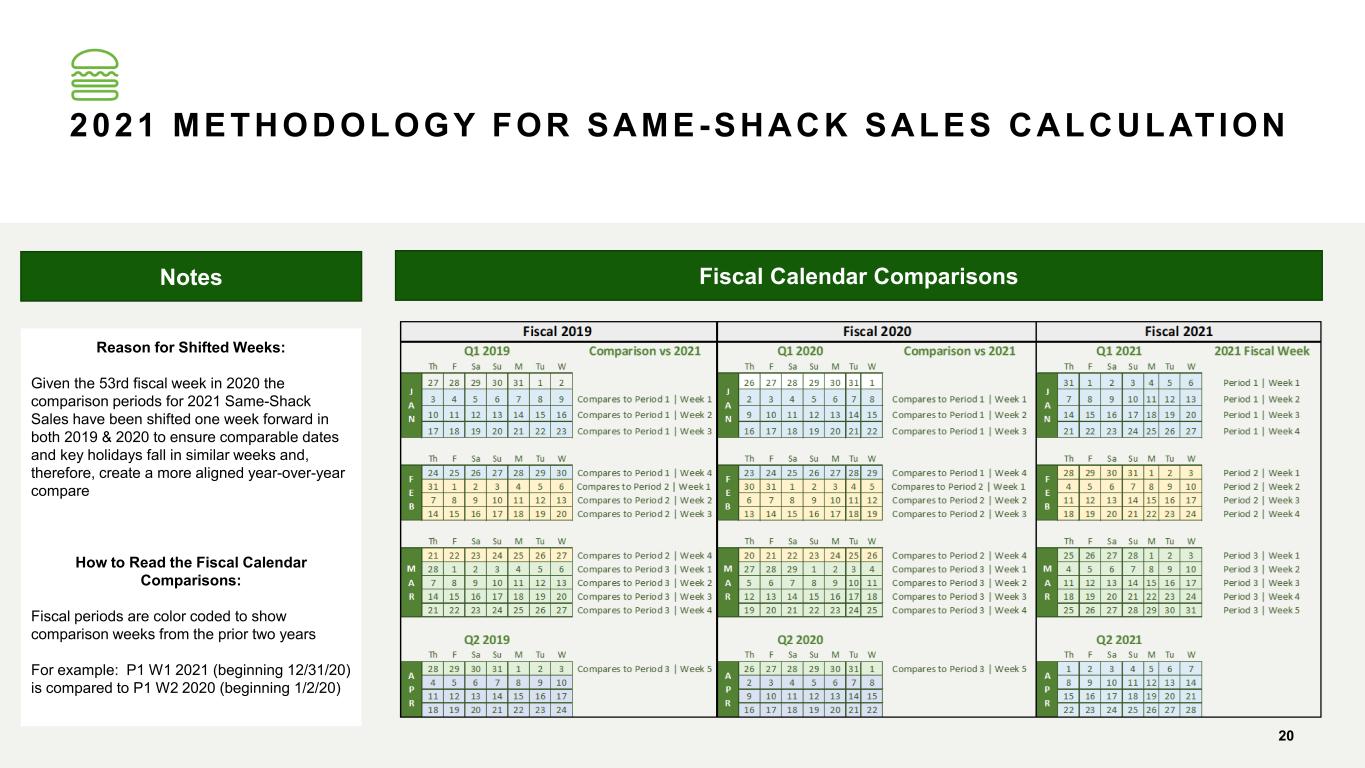

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2021 METHODOLOGY FOR SAME-SHACK SALES CALCULATION 20 Notes Fiscal Calendar Comparisons Reason for Shifted Weeks: Given the 53rd fiscal week in 2020 the comparison periods for 2021 Same-Shack Sales have been shifted one week forward in both 2019 & 2020 to ensure comparable dates and key holidays fall in similar weeks and, therefore, create a more aligned year-over-year compare How to Read the Fiscal Calendar Comparisons: Fiscal periods are color coded to show comparison weeks from the prior two years For example: P1 W1 2021 (beginning 12/31/20) is compared to P1 W2 2020 (beginning 1/2/20)

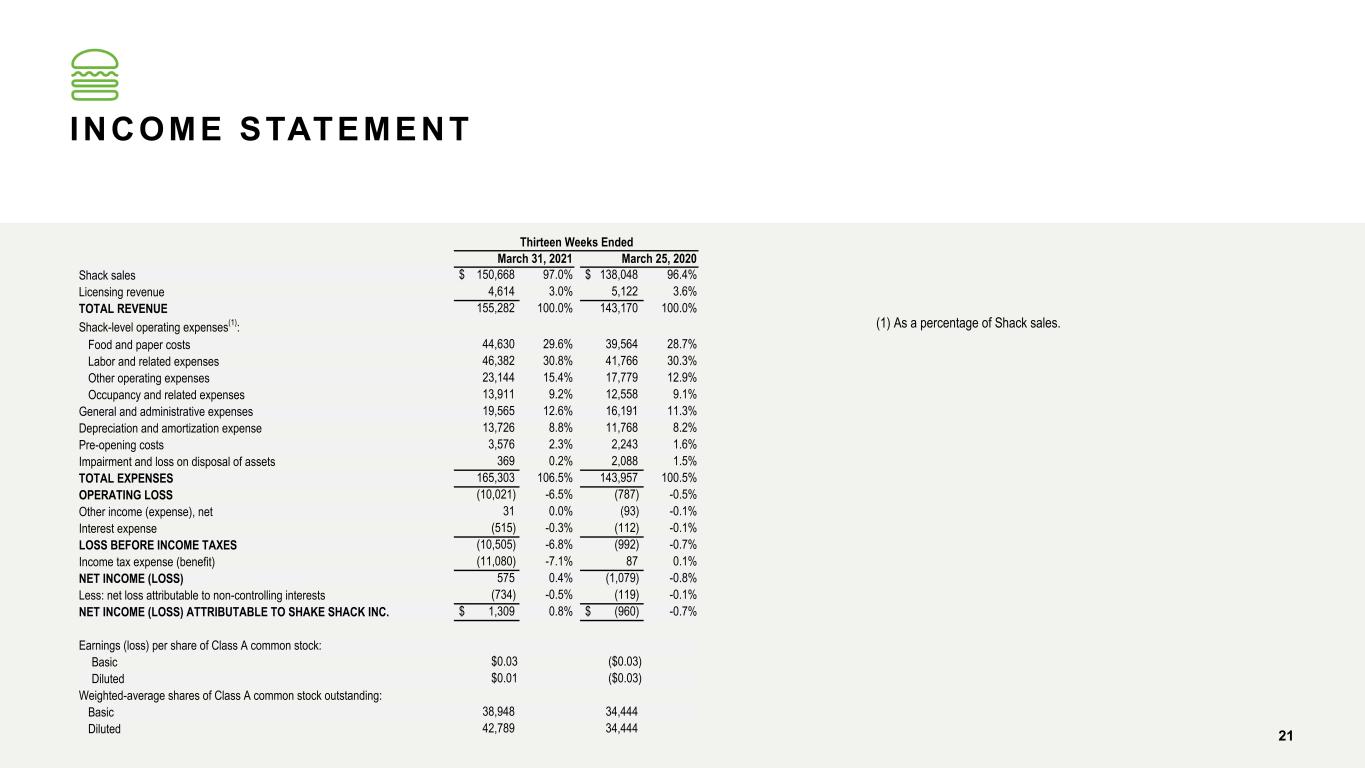

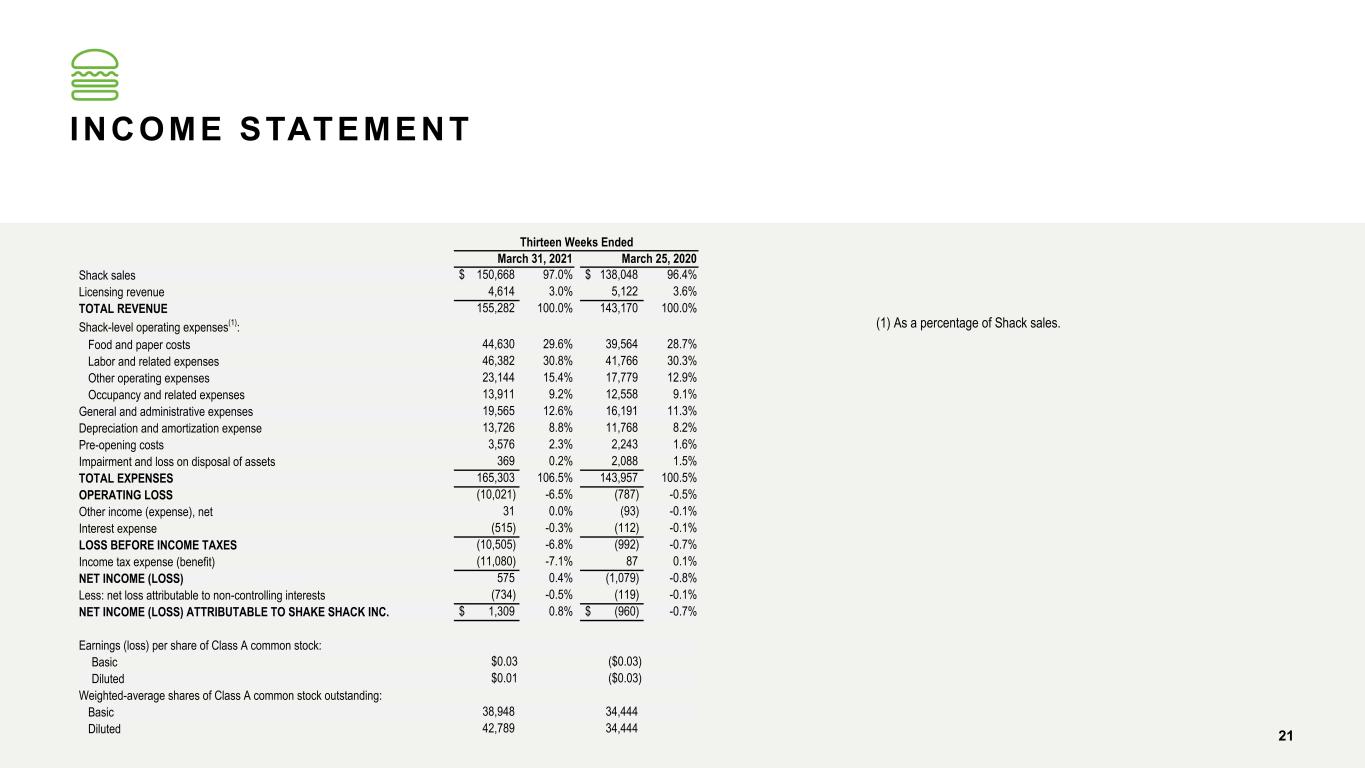

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan INCOME STATEMENT 21 Shack sales $ 150,668 97.0% $ 138,048 96.4% Licensing revenue 4,614 3.0% 5,122 3.6% TOTAL REVENUE 155,282 100.0% 143,170 100.0% Shack-level operating expenses(1): Food and paper costs 44,630 29.6% 39,564 28.7% Labor and related expenses 46,382 30.8% 41,766 30.3% Other operating expenses 23,144 15.4% 17,779 12.9% Occupancy and related expenses 13,911 9.2% 12,558 9.1% General and administrative expenses 19,565 12.6% 16,191 11.3% Depreciation and amortization expense 13,726 8.8% 11,768 8.2% Pre-opening costs 3,576 2.3% 2,243 1.6% Impairment and loss on disposal of assets 369 0.2% 2,088 1.5% TOTAL EXPENSES 165,303 106.5% 143,957 100.5% OPERATING LOSS (10,021) -6.5% (787) -0.5% Other income (expense), net 31 0.0% (93) -0.1% Interest expense (515) -0.3% (112) -0.1% LOSS BEFORE INCOME TAXES (10,505) -6.8% (992) -0.7% Income tax expense (benefit) (11,080) -7.1% 87 0.1% NET INCOME (LOSS) 575 0.4% (1,079) -0.8% Less: net loss attributable to non-controlling interests (734) -0.5% (119) -0.1% NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. $ 1,309 0.8% $ (960) -0.7% Earnings (loss) per share of Class A common stock: Basic $0.03 ($0.03) Diluted $0.01 ($0.03) Weighted-average shares of Class A common stock outstanding: Basic 38,948 34,444 Diluted 42,789 34,444 Thirteen Weeks Ended March 31, 2021 March 25, 2020 (1) As a percentage of Shack sales.

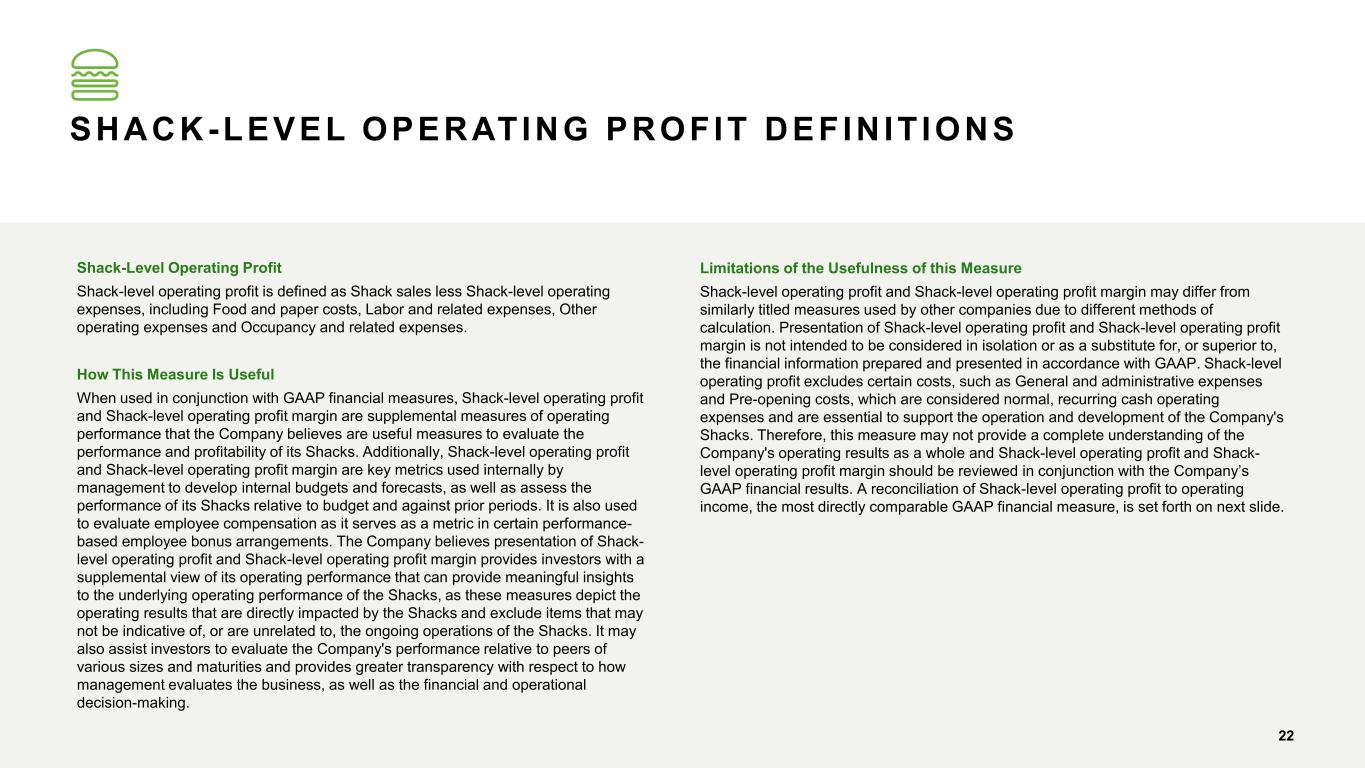

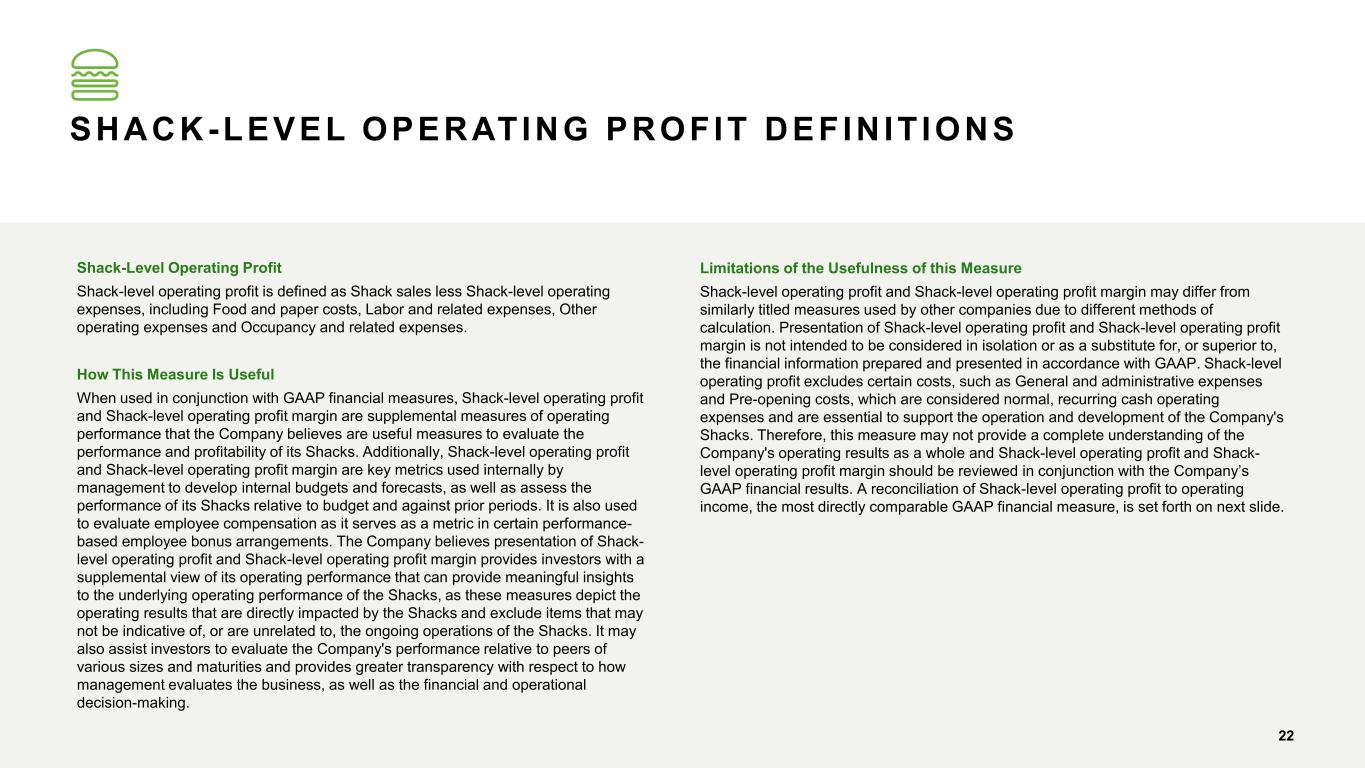

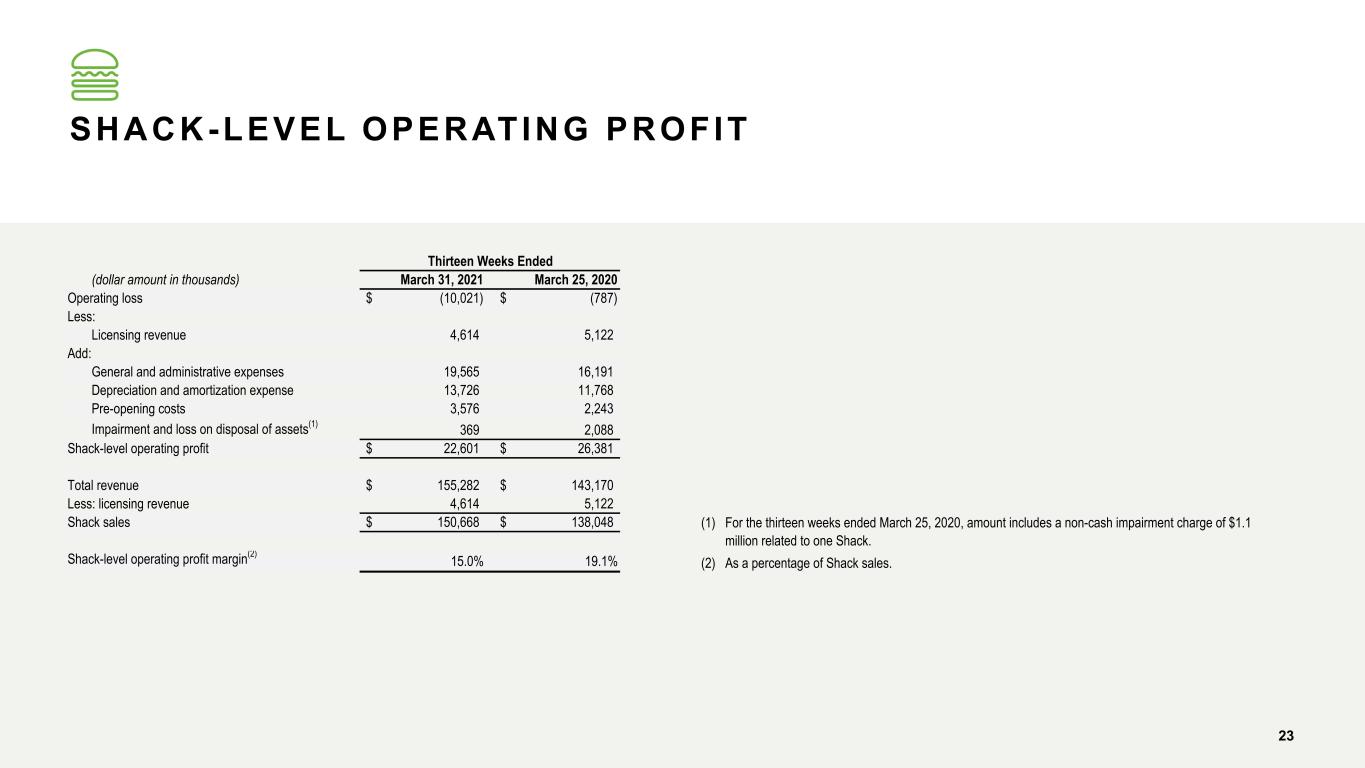

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Shack-Level Operating Profit Shack-level operating profit is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack-level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance- based employee bonus arrangements. The Company believes presentation of Shack- level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision-making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as General and administrative expenses and Pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack- level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack-level operating profit to operating income, the most directly comparable GAAP financial measure, is set forth on next slide. SHACK-LEVEL OPERATING PROFIT DEFIN IT IONS 22

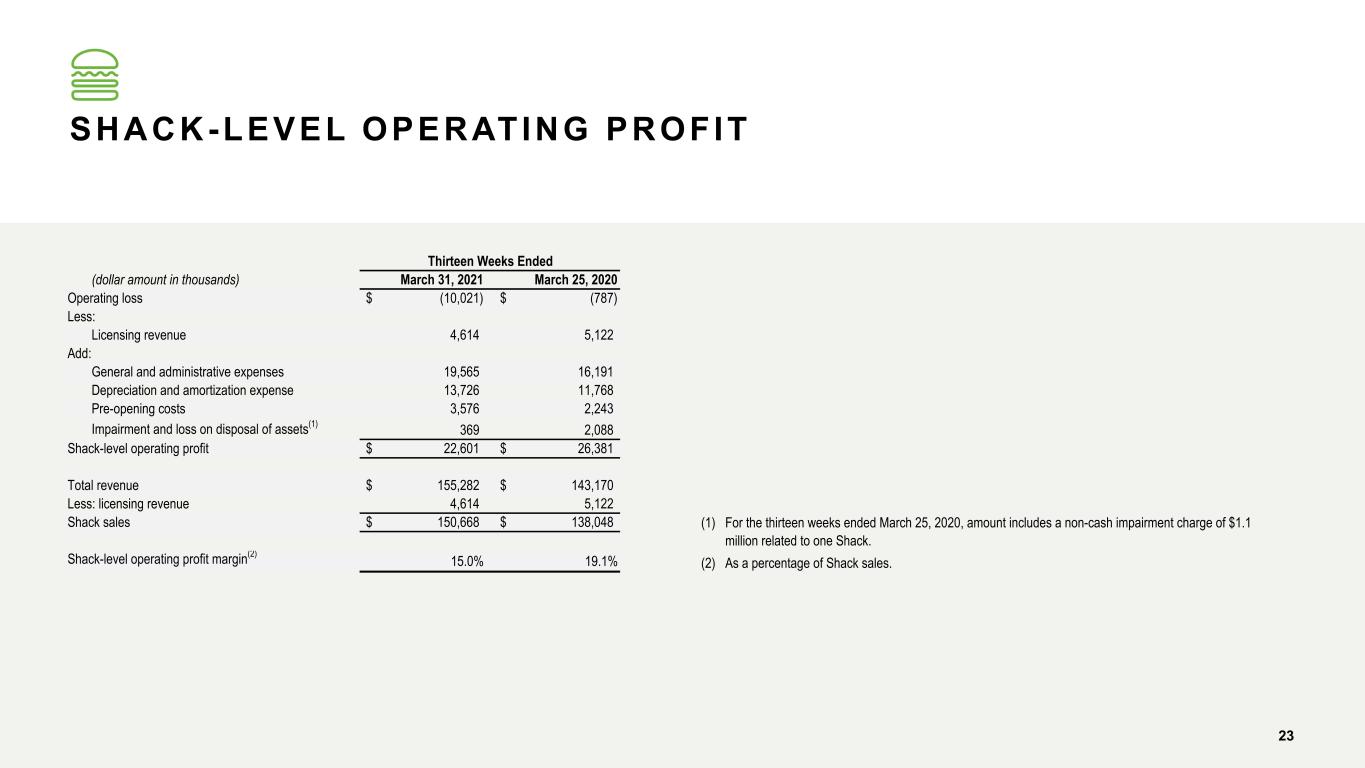

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan SHACK-LEVEL OPERATING PROFIT 23 (dollar amount in thousands) March 31, 2021 March 25, 2020 Operating loss (10,021)$ (787)$ Less: Licensing revenue 4,614 5,122 Add: General and administrative expenses 19,565 16,191 Depreciation and amortization expense 13,726 11,768 Pre-opening costs 3,576 2,243 Impairment and loss on disposal of assets(1) 369 2,088 Shack-level operating profit 22,601$ 26,381$ Total revenue 155,282$ 143,170$ Less: licensing revenue 4,614 5,122 Shack sales 150,668$ 138,048$ Shack-level operating profit margin(2) 15.0% 19.1% Thirteen Weeks Ended (1) (2) For the thirteen weeks ended March 25, 2020, amount includes a non-cash impairment charge of $1.1 million related to one Shack. As a percentage of Shack sales.

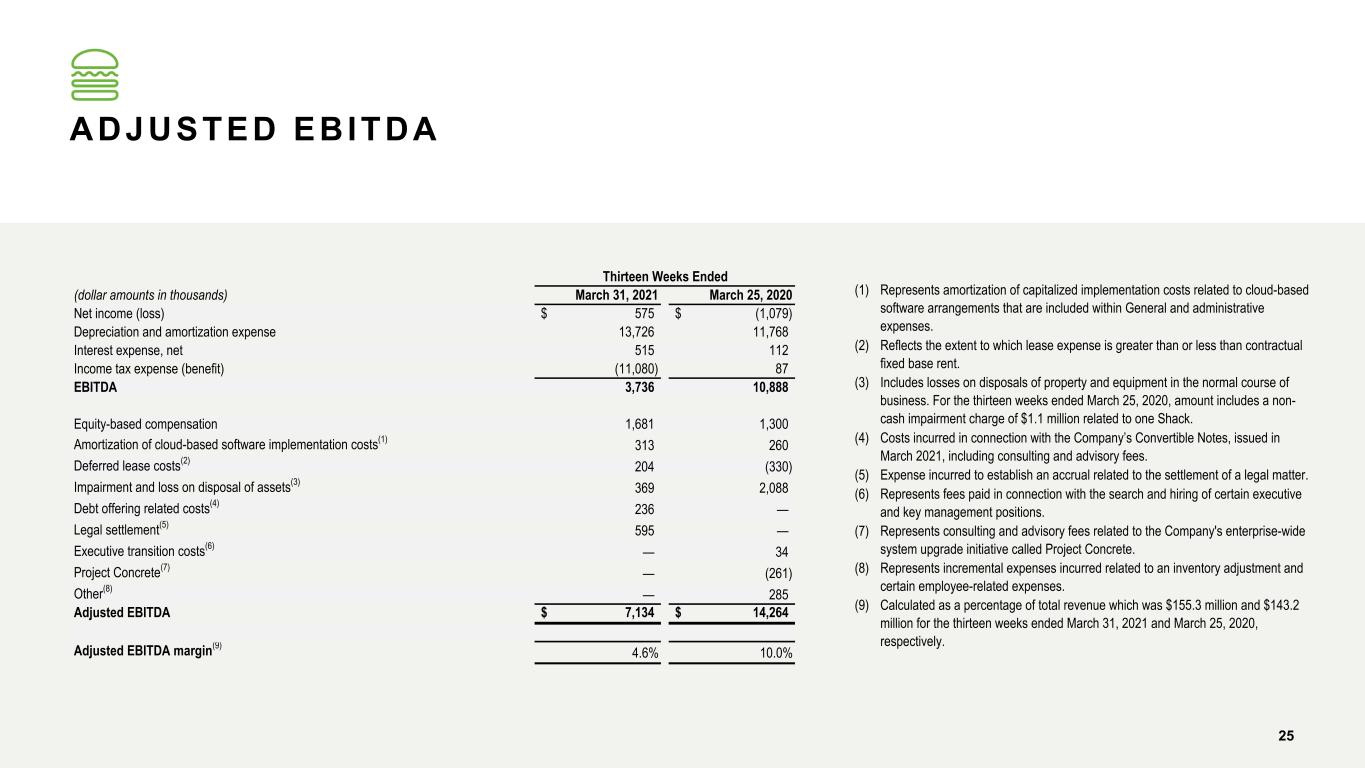

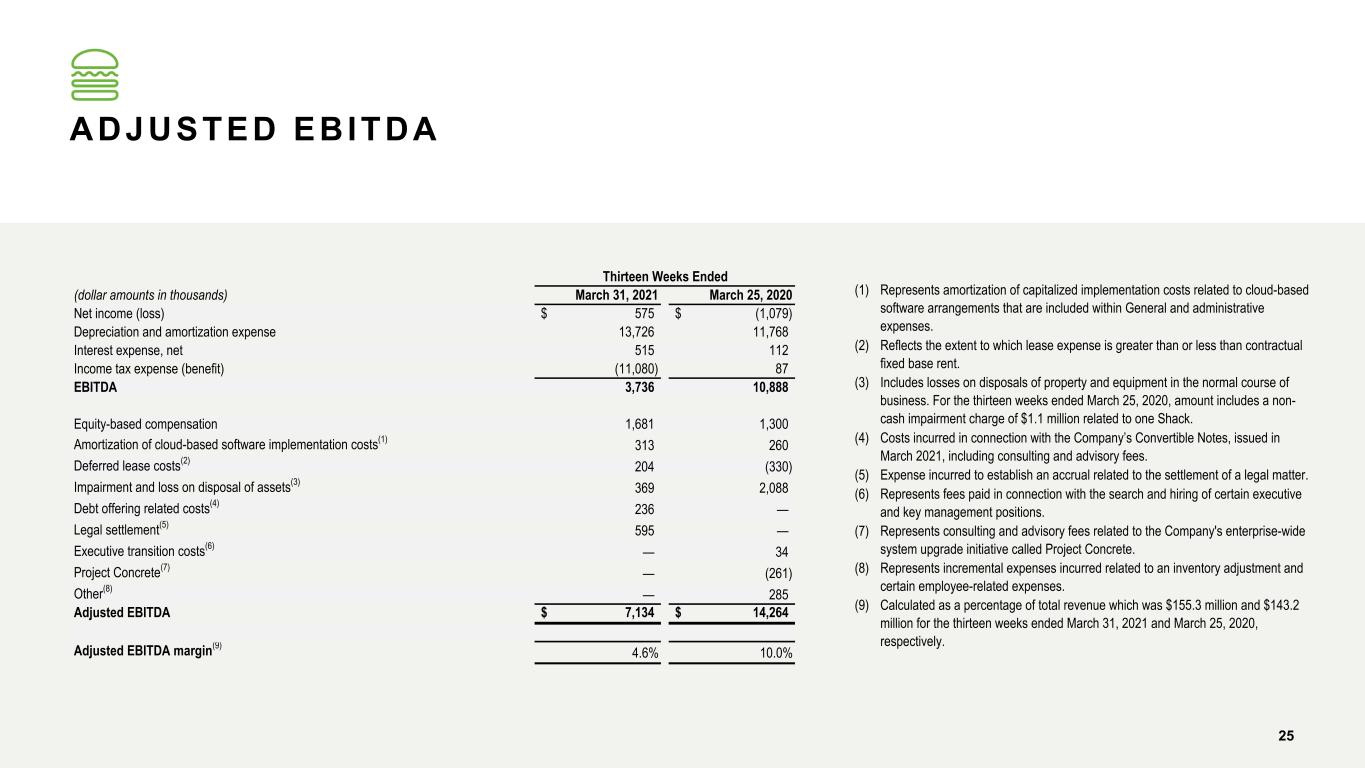

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan EBITDA and Adjusted EBITDA EBITDA is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA (as defined above) excluding equity-based compensation expense, deferred lease cost, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. ADJUSTED EBITDA DEFIN IT IONS Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth on next slide. 24

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 25 ADJUSTED EBITDA (dollar amounts in thousands) March 31, 2021 March 25, 2020 Net income (loss) 575$ (1,079)$ Depreciation and amortization expense 13,726 11,768 Interest expense, net 515 112 Income tax expense (benefit) (11,080) 87 EBITDA 3,736 10,888 Equity-based compensation 1,681 1,300 Amortization of cloud-based software implementation costs(1) 313 260 Deferred lease costs(2) 204 (330) Impairment and loss on disposal of assets(3) 369 2,088 Debt offering related costs(4) 236 — Legal settlement(5) 595 — Executive transition costs(6) — 34 Project Concrete(7) — (261) Other(8) — 285 Adjusted EBITDA 7,134$ 14,264$ Adjusted EBITDA margin(9) 4.6% 10.0% Thirteen Weeks Ended (1) Represents amortization of capitalized implementation costs related to cloud-based software arrangements that are included within General and administrative expenses. (2) Reflects the extent to which lease expense is greater than or less than contractual fixed base rent. (3) Includes losses on disposals of property and equipment in the normal course of business. For the thirteen weeks ended March 25, 2020, amount includes a non- cash impairment charge of $1.1 million related to one Shack. (4) Costs incurred in connection with the Company’s Convertible Notes, issued in March 2021, including consulting and advisory fees. (5) Expense incurred to establish an accrual related to the settlement of a legal matter. (6) Represents fees paid in connection with the search and hiring of certain executive and key management positions. (7) Represents consulting and advisory fees related to the Company's enterprise-wide system upgrade initiative called Project Concrete. (8) Represents incremental expenses incurred related to an inventory adjustment and certain employee-related expenses. (9) Calculated as a percentage of total revenue which was $155.3 million and $143.2 million for the thirteen weeks ended March 31, 2021 and March 25, 2020, respectively.

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan Adjusted Pro Forma Effective Tax Rate Adjusted pro forma effective tax rate represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. How This Measure Is Useful When used in conjunction with GAAP financial measures, adjusted pro forma effective tax rate is a supplemental measure of operating performance that the Company believes is useful to evaluate its performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes this measure facilitates comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in effective tax rate driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. ADJUSTED PRO FORMA EFFECTIVE TAX RATE DEFIN IT IONS Limitations of the Usefulness of this Measure Adjusted pro forma effective tax rate may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma effective tax rate should not be considered an alternative to effective tax rate, as determined under GAAP. While this measure is useful in evaluating the Company's performance, it does not account for the effective tax rate attributable to the non-controlling interest holders and therefore does not provide a complete understanding of effective tax rate. Adjusted pro forma effective tax rate should be evaluated in conjunction with GAAP financial results. A reconciliation of adjusted pro forma effective tax rate, the most directly comparable GAAP measure, is set forth on next slide. 26

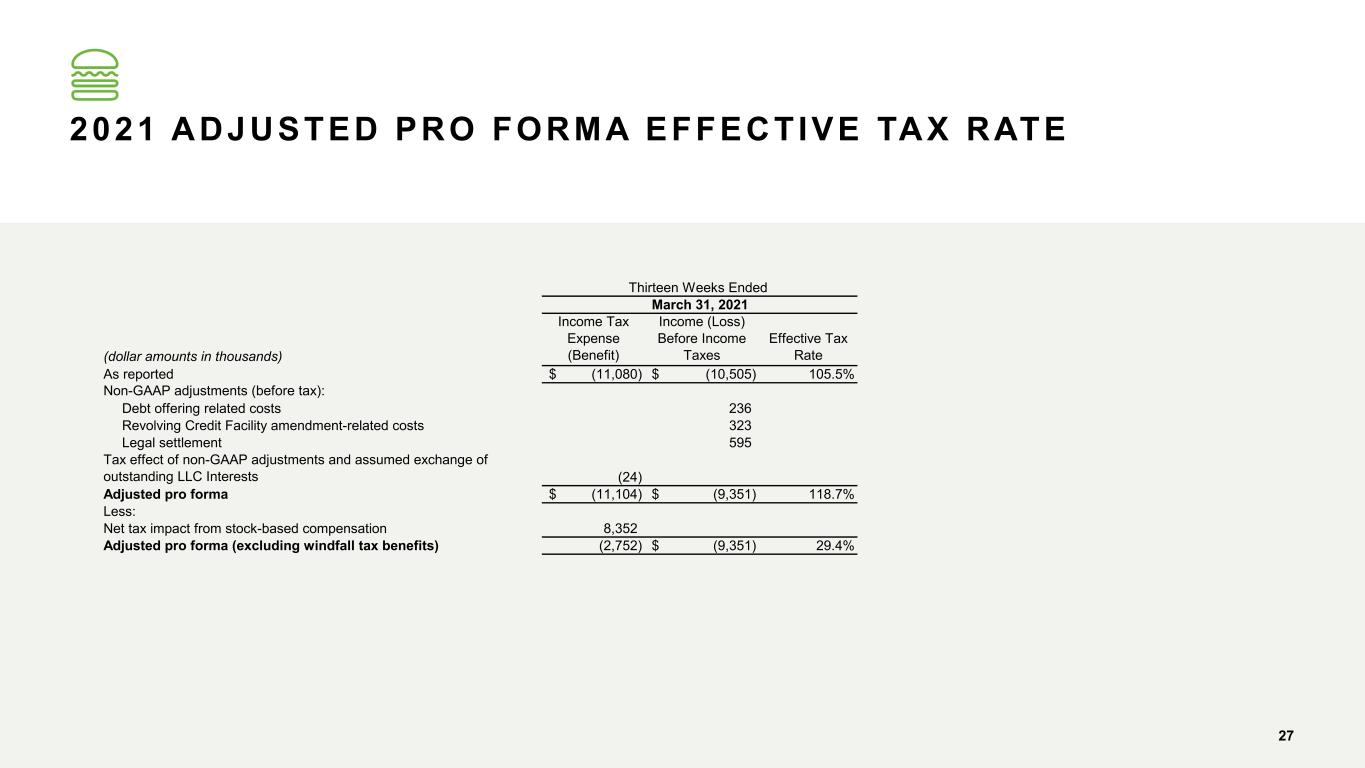

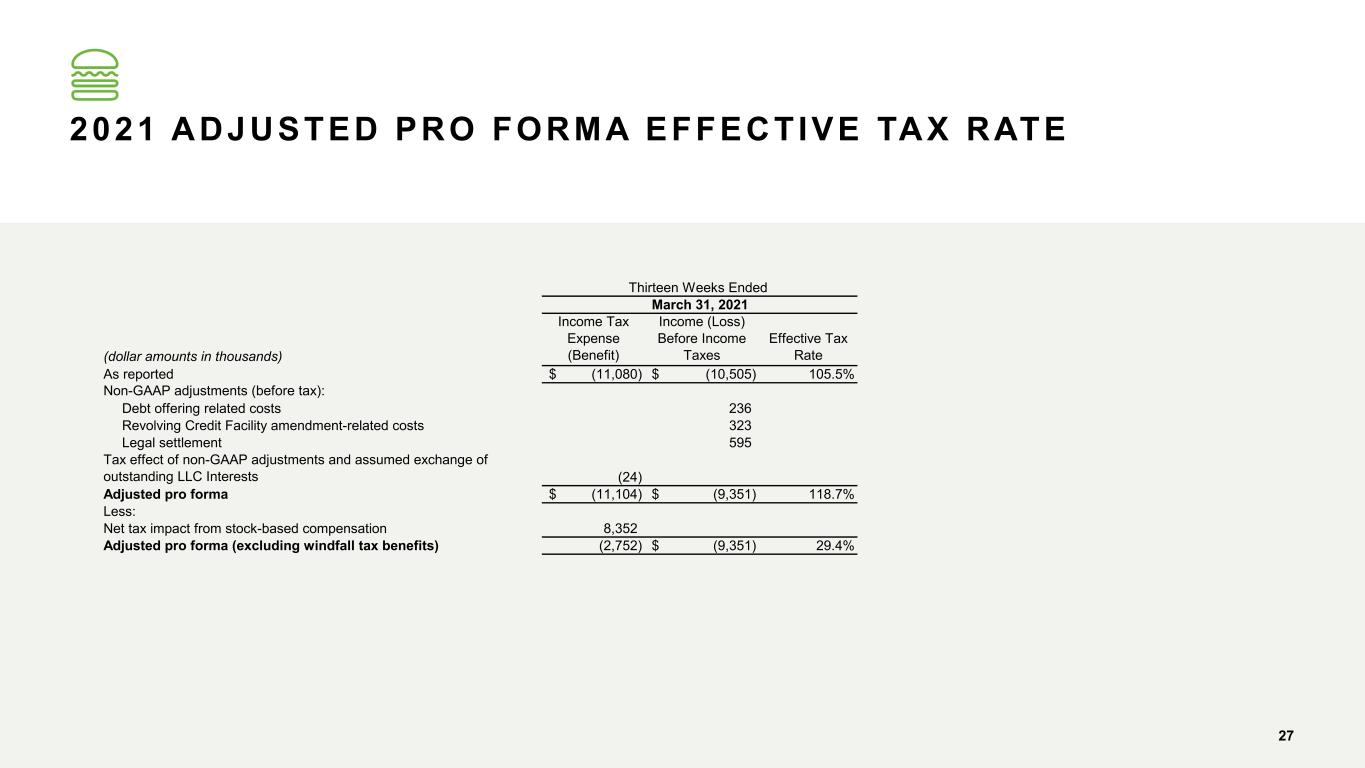

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2021 ADJUSTED PRO FORMA EFFECTIVE TAX RATE 27 (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported (11,080)$ (10,505)$ 105.5% Non-GAAP adjustments (before tax): Debt offering related costs 236 Revolving Credit Facility amendment-related costs 323 Legal settlement 595 Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (24) Adjusted pro forma (11,104)$ (9,351)$ 118.7% Less: Net tax impact from stock-based compensation 8,352 Adjusted pro forma (excluding windfall tax benefits) (2,752) (9,351)$ 29.4% March 31, 2021 Thirteen Weeks Ended

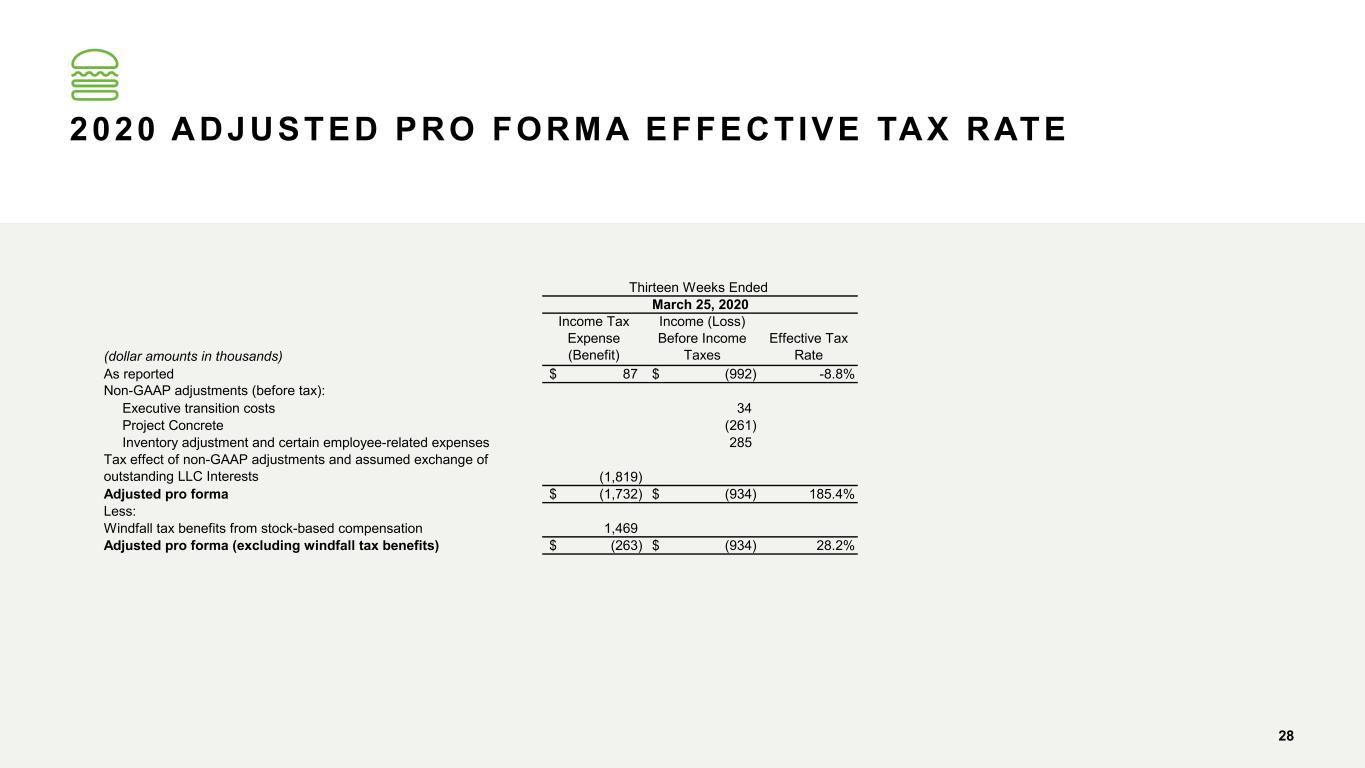

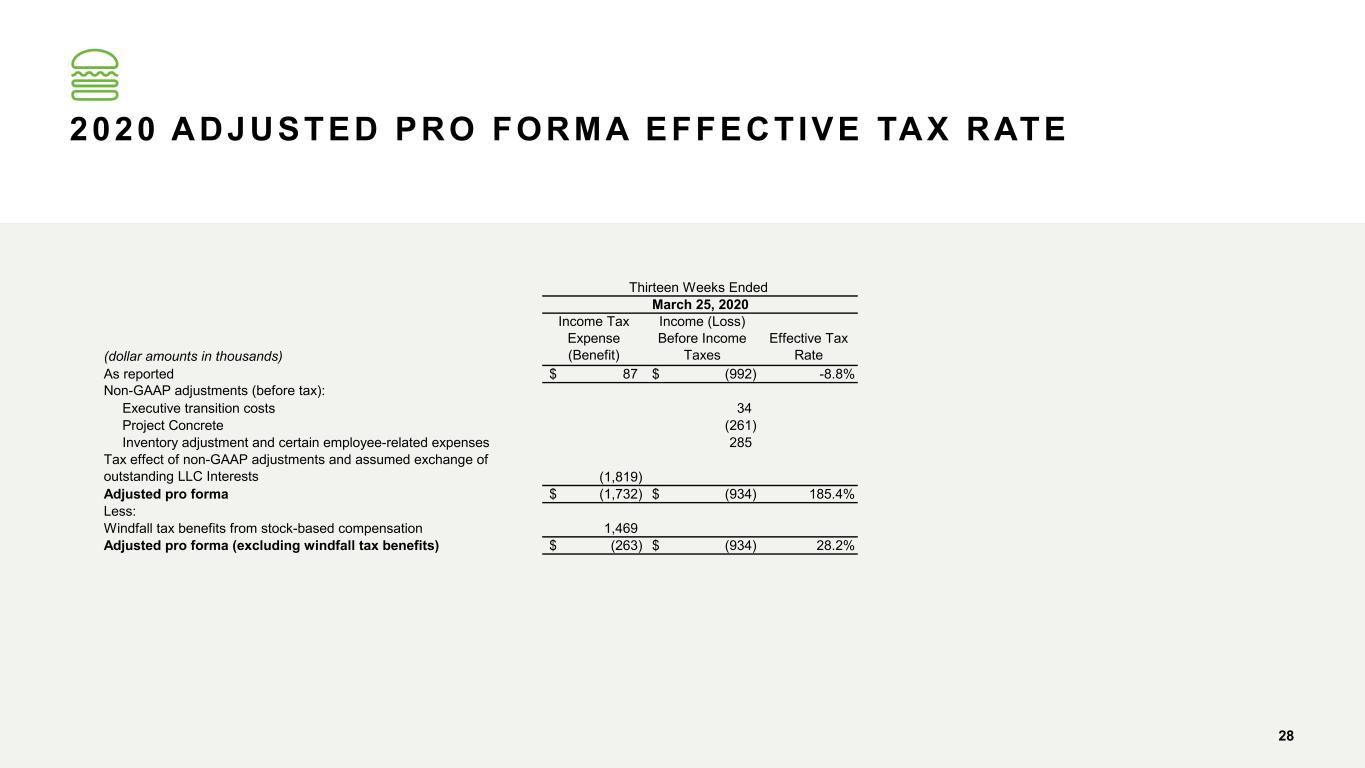

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan 2020 ADJUSTED PRO FORMA EFFECTIVE TAX RATE 28 (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported 87$ (992)$ -8.8% Non-GAAP adjustments (before tax): Executive transition costs 34 Project Concrete (261) Inventory adjustment and certain employee-related expenses 285 Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (1,819) Adjusted pro forma (1,732)$ (934)$ 185.4% Less: Windfall tax benefits from stock-based compensation 1,469 Adjusted pro forma (excluding windfall tax benefits) (263)$ (934)$ 28.2% March 25, 2020 Thirteen Weeks Ended

Meeting of the Board of Directors | Q4 2019 2020 Strategic Plan CONTACT INFORMATION INVESTOR CONTACT Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com MEDIA CONTACT Kristyn Clark, Shake Shack kclark@shakeshack.com