First Quarter 2022 Shareholder Letter

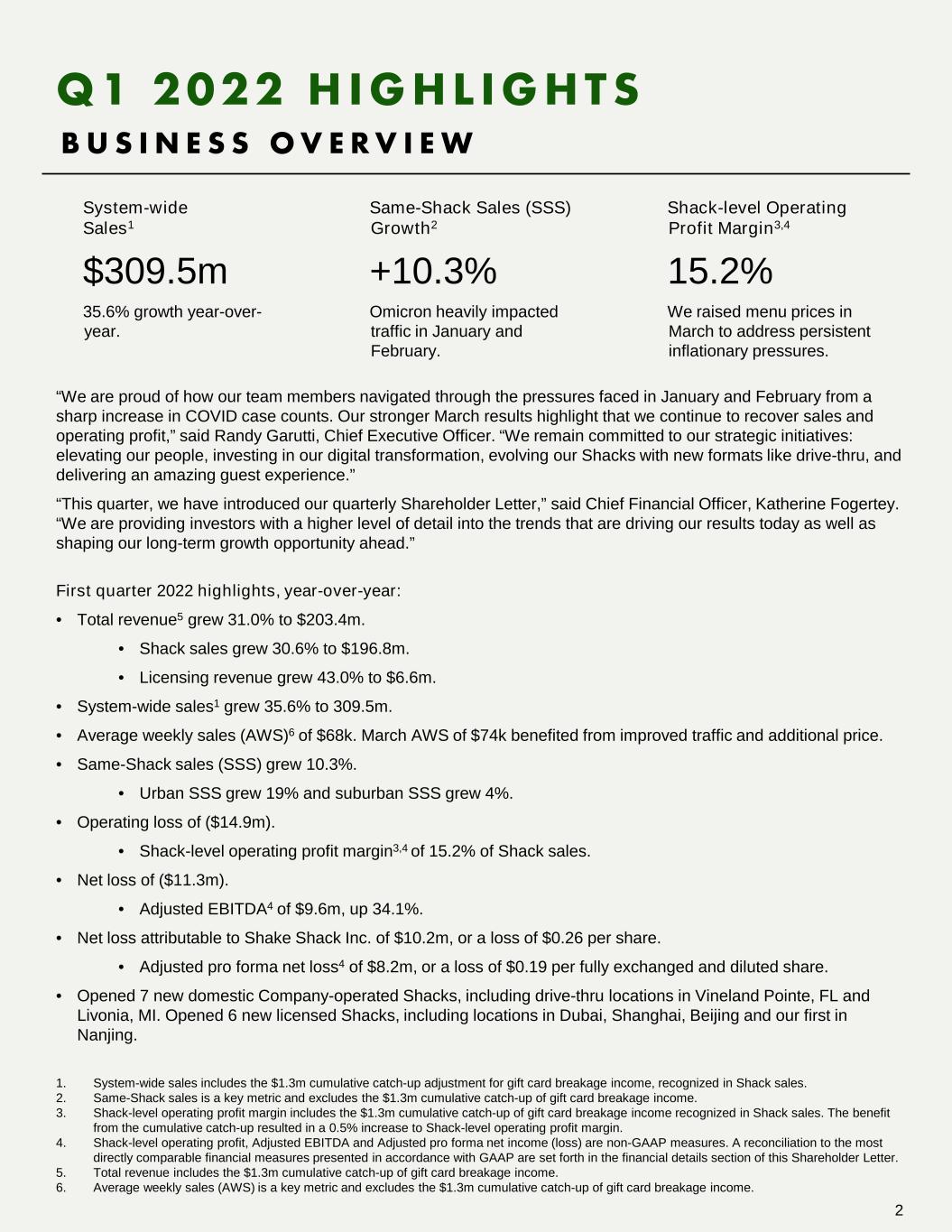

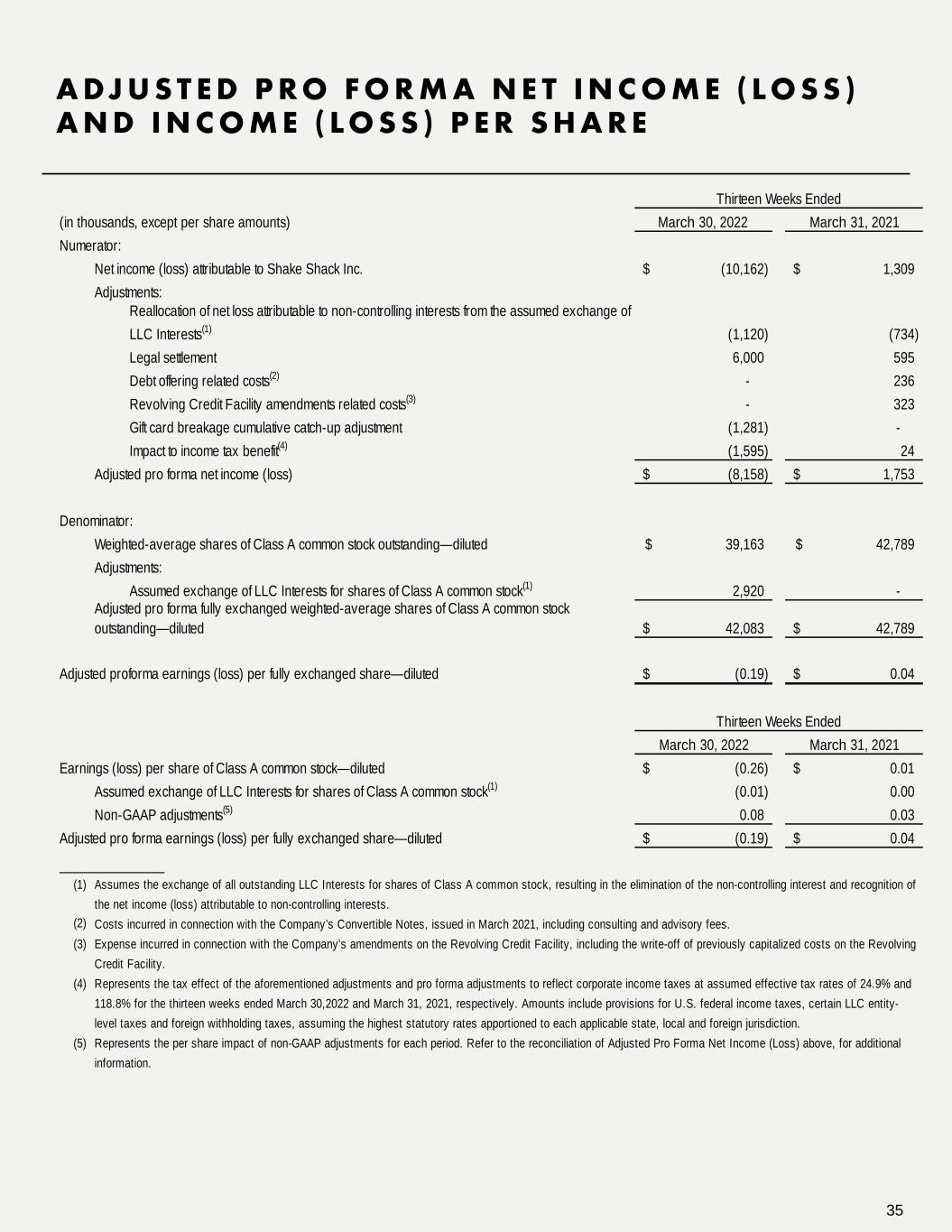

“We are proud of how our team members navigated through the pressures faced in January and February from a sharp increase in COVID case counts. Our stronger March results highlight that we continue to recover sales and operating profit,” said Randy Garutti, Chief Executive Officer. “We remain committed to our strategic initiatives: elevating our people, investing in our digital transformation, evolving our Shacks with new formats like drive-thru, and delivering an amazing guest experience.” “This quarter, we have introduced our quarterly Shareholder Letter,” said Chief Financial Officer, Katherine Fogertey. “We are providing investors with a higher level of detail into the trends that are driving our results today as well as shaping our long-term growth opportunity ahead.” First quarter 2022 highlights, year-over-year: • Total revenue5 grew 31.0% to $203.4m. • Shack sales grew 30.6% to $196.8m. • Licensing revenue grew 43.0% to $6.6m. • System-wide sales1 grew 35.6% to 309.5m. • Average weekly sales (AWS)6 of $68k. March AWS of $74k benefited from improved traffic and additional price. • Same-Shack sales (SSS) grew 10.3%. • Urban SSS grew 19% and suburban SSS grew 4%. • Operating loss of ($14.9m). • Shack-level operating profit margin3,4 of 15.2% of Shack sales. • Net loss of ($11.3m). • Adjusted EBITDA4 of $9.6m, up 34.1%. • Net loss attributable to Shake Shack Inc. of $10.2m, or a loss of $0.26 per share. • Adjusted pro forma net loss4 of $8.2m, or a loss of $0.19 per fully exchanged and diluted share. • Opened 7 new domestic Company-operated Shacks, including drive-thru locations in Vineland Pointe, FL and Livonia, MI. Opened 6 new licensed Shacks, including locations in Dubai, Shanghai, Beijing and our first in Nanjing. Q 1 2 0 2 2 H I G H L I G H T S System-wide Sales1 $309.5m 35.6% growth year-over- year. Same-Shack Sales (SSS) Growth2 +10.3% Omicron heavily impacted traffic in January and February. Shack-level Operating Profit Margin3,4 15.2% We raised menu prices in March to address persistent inflationary pressures. 2 B U S I N E S S O V E R V I E W 1. System-wide sales includes the $1.3m cumulative catch-up adjustment for gift card breakage income, recognized in Shack sales. 2. Same-Shack sales is a key metric and excludes the $1.3m cumulative catch-up of gift card breakage income. 3. Shack-level operating profit margin includes the $1.3m cumulative catch-up of gift card breakage income recognized in Shack sales. The benefit from the cumulative catch-up resulted in a 0.5% increase to Shack-level operating profit margin. 4. Shack-level operating profit, Adjusted EBITDA and Adjusted pro forma net income (loss) are non-GAAP measures. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. 5. Total revenue includes the $1.3m cumulative catch-up of gift card breakage income. 6. Average weekly sales (AWS) is a key metric and excludes the $1.3m cumulative catch-up of gift card breakage income.

60% 47% 42% 42% 43% 0% 10% 20% 30% 40% 50% 60% 70% $40M $50M $60M $70M $80M $90M $100M 1Q21 2Q21 3Q21 4Q21 1Q22 $23M $35M $30M $32M $30M 15.0% 19.2% 15.8% 16.4% 15.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 1Q21 2Q21 3Q21 4Q21 1Q22 $155M $187M $194M $203M $203M 1Q21 2Q21 3Q21 4Q21 1Q22 321 339 350 369 382 1Q21 2Q21 3Q21 4Q21 1Q22 $64K $72K $72K $74K $68K 1Q21 2Q21 3Q21 4Q21 1Q22 $228M $282M $299M $314M $310M 1Q21 2Q21 3Q21 4Q21 1Q22 1. Digital sales include sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. It does not include sales through Kiosks that are located inside Shacks. Digital sales and digital sales mix are key metrics and exclude the $1.3m cumulative catch-up of gift card breakage, recognized in Shack sales. 2. "Shack-level operating profit" and "Shack-level operating profit margin" are non-GAAP measures. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. Total Revenue Digital Sales1 $ Shack-level Operating Profit2 Average Weekly Sales (AWS) System-wide Shack Count System-wide Sales Q 1 2 0 2 2 H I G H L I G H T S B U S I N E S S O V E R V I E W % label indicates digital mix of sales % label indicates Shack-level operating profit margin2 3

TO O U R S H A R E H O L D E R S Thank you for the opportunity to introduce our new quarterly Shareholder Letter where we provide insights and analysis around our business and growth opportunity. Shake Shack evolved from its humble beginnings in 2004 as a hot dog cart in Madison Square Park to over 60 Shake Shacks open globally at our 2015 IPO. Today, there are more than 380 Shacks around the world, and we are encouraged by our growing development pipeline. We operate more formats, including drive-thru, offering more convenience than ever before. We continue to build digital connectivity throughout the omnichannel guest experience. In the first quarter, 43% of Shack sales came through digital channels, and about 60% more guests have made a first-time purchase in our own App and Web channels compared to last year. All the while, we have kept to our core values that we believe separate us from traditional fast food. Stand For Something Good ® is a simple mission that guides everything we do: using the best ingredients, looking out for our communities, and providing unforgettable experiences for our guests, team members, and partners. We are proud of how our team members have navigated through this challenging operating environment. At the beginning of the first quarter, we experienced a sharp drop in sales due to Omicron. We had more than 160 days of closures and reduced hours as we navigated a challenging operating backdrop. In March and April however, our sales trends rebounded as COVID cases declined and more consumers returned to restaurants, travel and offices. We continue to face significant inflation pressures across our business as we proudly invest in our team members and manage the pressures across our supply chain. In March, we raised our menu prices by approximately 3.5% across tiers and are now charging 15% higher prices on third-party delivery. While it is still early, we are encouraged by our guest reception. May 5, 2022 The Company will host a conference call to discuss its first quarter 2022 financial results today at 5:00 p.m. ET. The conference call can be accessed live at (877) 407-0792, or (201) 689-8263 for international callers. A replay of the call will be available until May 12, 2022 by dialing (844) 512-2921 or (412) 317-6671 for international callers; the passcode is 13729452.The live audio webcast of the conference call will be accessible in the Events & Presentations section on the Company's Investor Relations website at investor.shakeshack.com. An archived replay of the webcast will also be available shortly after the live event has concluded. 4

S T R O N G S A L E S R E C O V E RY I N M A R C H First quarter AWS1 of $68k improved in March following Omicron impacts in January and February. Omicron headwinds eased throughout the quarter, and we benefited from increased travel, tourism, and overall mobility in March, especially in our urban centers. Additionally, to address persistent inflationary pressures as well as the elevated cost structure of third-party delivery, we raised our menu price by an additional 3.5% in March and raised the premium we charge in third-party delivery channels to 15%. March 2022 AWS of $74k improved 9% relative to March 2021 and 17% compared to January 2022. April 2022 AWS of $76k was up 10% year-over-year. While we are encouraged by the traffic driven recovery that we are realizing in urban and suburban markets, we still see further opportunity for mobility drivers such as travel, tourism, events, commuting, and return to office to get back to pre-Omicron levels in some key markets, including New York, Los Angeles and Chicago. $58K $64K $72K $72K $74K $71K $63K $67K $74K $76K Q1 2022 AWS $68K AVERAGE WEEKLY SALES (AWS) – STEADY IMPROVEMENT EACH MONTH OF 2022 9% Total YoY Shack Sales Growth / (Decline) First Quarter 2021 103% Second Quarter 2021 48% Third Quarter 2021 21% Fiscal January 2022 39% Fiscal February 2022 31% Fiscal March 2022 38% Fourth Quarter 20213 44% Full Year 20214 (14%) Full Year 20202 27% Fiscal April 2022 1. Average weekly sales (AWS) is a key metric and excludes the $1.3m cumulative catch-up of gift card breakage income. 2. Full Year 2020 total YoY Shack sales decline excludes the impact of the 53rd fiscal accounting week in 2020 and compares the fifty-two weeks from December 26, 2019 through December 23, 2020 to the fifty-two weeks from December 27, 2018 through December 25, 2019. The favorable impact of the 53rd week in fiscal 2020 was an incremental Shack sales of $10.7 million. 3. Fourth Quarter 2021 total YoY Shack sales increase excludes the impact of the 53rd fiscal accounting week in 2020 and compares the thirteen weeks from September 30, 2021 through December 29, 2021 to the thirteen weeks from September 24, 2020 through December 23, 2020. 4. Full Year 2021 total YoY Shack sales increase excludes the impact of the 53rd fiscal accounting week in 2020 and compares the fifty-two weeks from December 31, 2020 through December 29, 2021 to the fifty-two weeks from December 26, 2019 through December 23, 2020. 5

SSS grew 10.3% in the first quarter versus 2021, as we realized sales pressures in the beginning of the quarter from Omicron. Same-Shack sales in the quarter were negatively impacted by reduced operating hours and one day closures, relative to pre-COVID levels, as our Operators managed through a challenging staffing environment, prioritizing providing a great guest experience. As a reminder, SSS excludes closures that are two days or more, but one day closures and the impact of operating with fewer hours are not excluded. Later in the quarter and into April, traffic improved as mobility recovered particularly in urban markets. April SSS rose 13% versus 2021, with traffic growth in urban and suburban markets. URBAN & SUBURBAN2 SSS % VS PRIOR YEAR (7%) 54% 34% 33% 19% 6% 53% 25% 21% 10% 20% 52% 17% 12% 4% First Quarter 2021 Second Quarter 2021 Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 Urban SSS% Total SSS % Suburban SSS % 1. Same-Shack sales, or “SSS”, and same-Shack sales growth are key metrics and exclude the $1.3m cumulative catch-up adjustment for gift card breakage income, recognized in Shack sales. 2. We have updated our urban/suburban classification resulting in immaterial changes to historical SSS% values. • Urban SSS grew 19% year-over-year, with strong recovery trends in March. Urban centers across the country rebounded in the first quarter despite realizing heavy impacts from Omicron in January and February, particularly in NYC, Las Vegas and Washington, DC. All dayparts were positive in the quarter versus 2021, led by weekday lunch. We are encouraged by the improvements we saw in March and April sales, and note that our Urban markets broadly remain affected by lower office occupancy, travel, tourism, commuting, and entertainment traffic compared to pre-COVID levels. • Suburban SSS grew 4% year-over-year, even as urban Shacks posted strong growth. We remain encouraged by our opportunity in suburban markets as we expand development and evolve formats like drive-thru. Suburban same-Shack sales grew 4% year-over-year, following 20% year-over-year growth in Q1 2021. Our suburban Shacks realized a greater impact from reduced hours and closures than our urban Shacks in the quarter. Still, traffic growth was positive in the quarter. Suburban SSS benefited from higher prices in March, however we continue to realize a price/mix impact from lapping a strong digital mix in 2021 as more of our guests dined in the Shack during the quarter. U R B A N & S U B U R B A N S A M E - S H A C K S A L E S 1 6

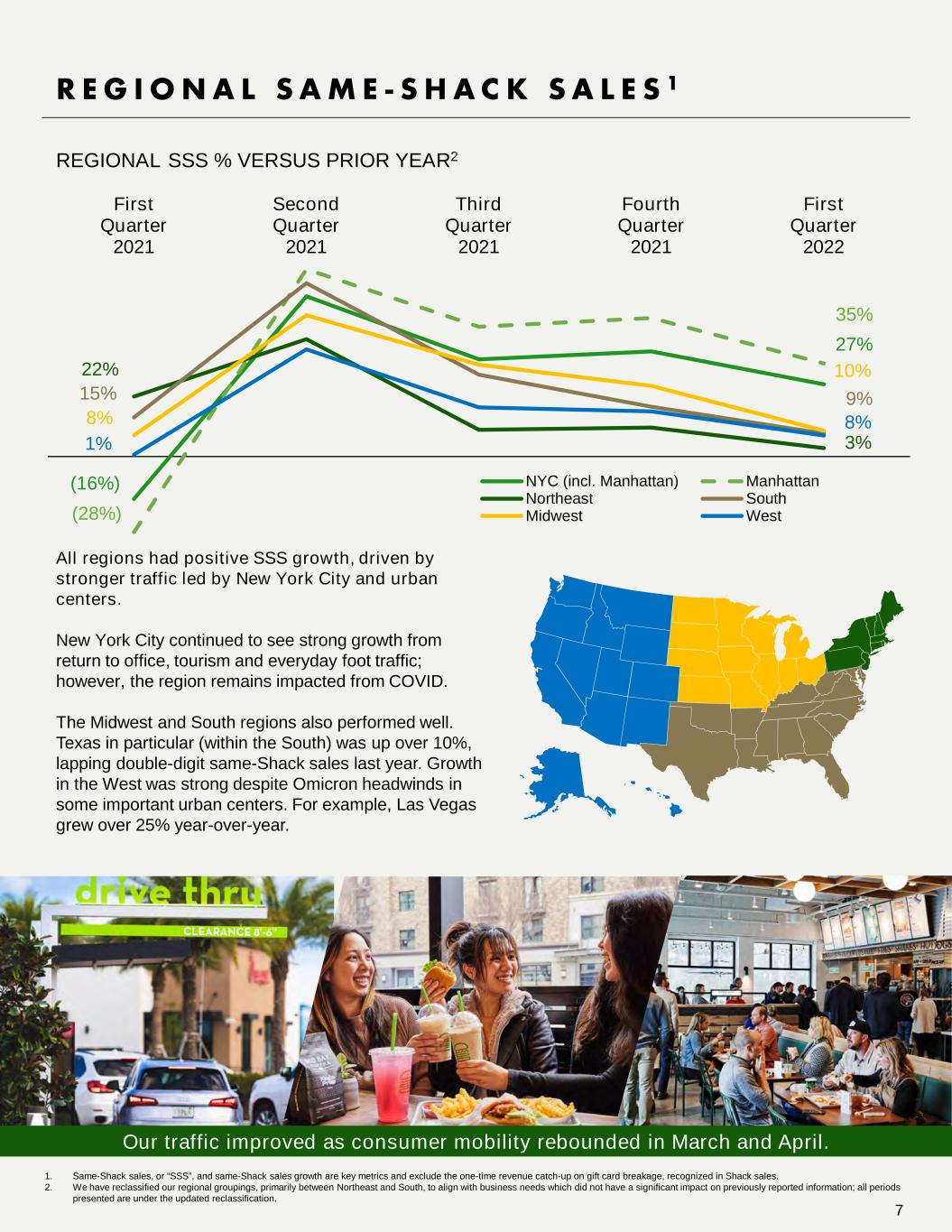

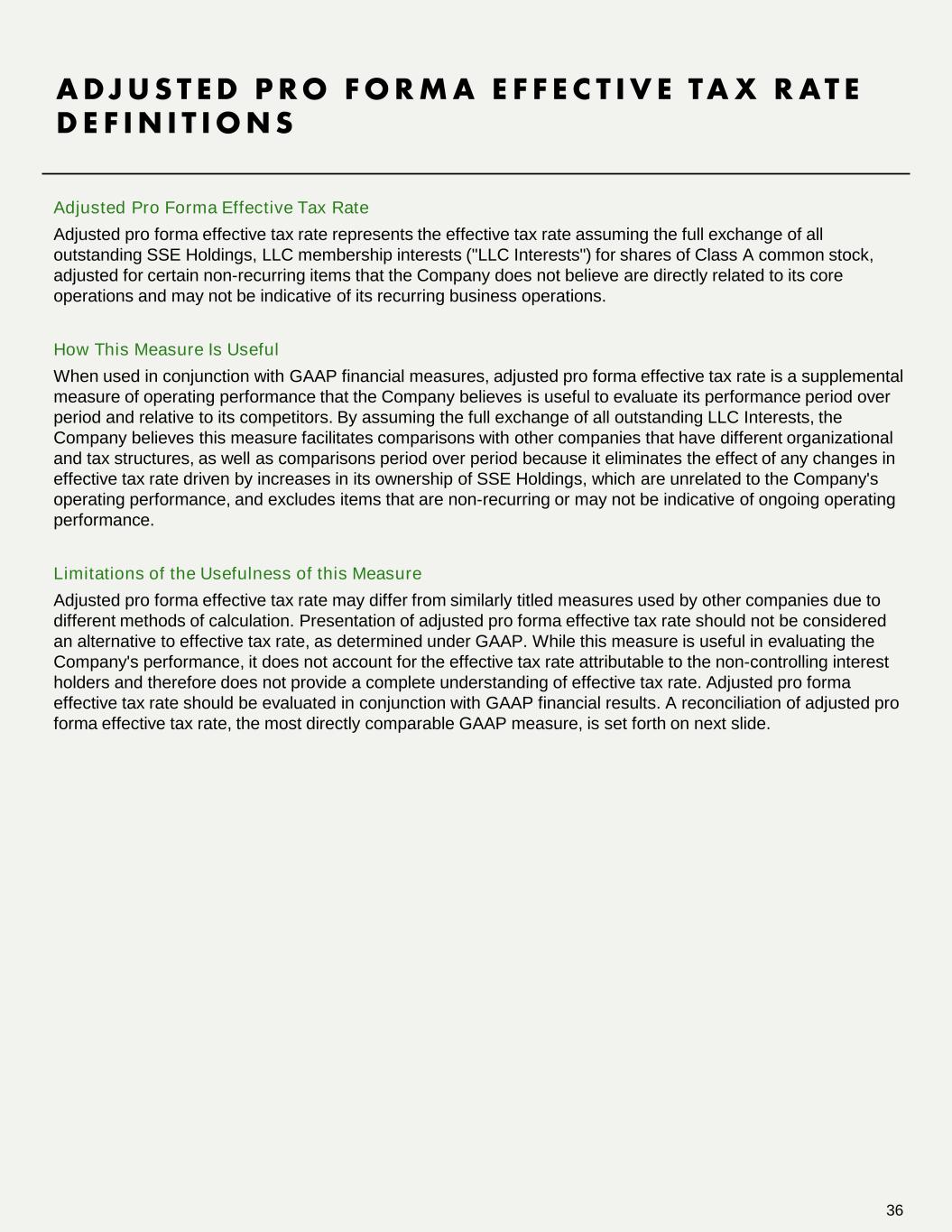

REGIONAL SSS % VERSUS PRIOR YEAR2 All regions had positive SSS growth, driven by stronger traffic led by New York City and urban centers. New York City continued to see strong growth from return to office, tourism and everyday foot traffic; however, the region remains impacted from COVID. The Midwest and South regions also performed well. Texas in particular (within the South) was up over 10%, lapping double-digit same-Shack sales last year. Growth in the West was strong despite Omicron headwinds in some important urban centers. For example, Las Vegas grew over 25% year-over-year. (16%) 27% (28%) 35% 22% 3% 15% 9% 8% 10% 1% 8% First Quarter 2021 Second Quarter 2021 Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 NYC (incl. Manhattan) Manhattan Northeast South Midwest West 1. Same-Shack sales, or “SSS”, and same-Shack sales growth are key metrics and exclude the one-time revenue catch-up on gift card breakage, recognized in Shack sales. 2. We have reclassified our regional groupings, primarily between Northeast and South, to align with business needs which did not have a significant impact on previously reported information; all periods presented are under the updated reclassification. R E G I O N A L S A M E - S H A C K S A L E S 1 Our traffic improved as consumer mobility rebounded in March and April. 7

60% 47% 42% 42% 43% First Quarter 2021 Second Quarter 2021 Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 In-Shack Sales $ Digital Sales $ D I G I TA L S A L E S 1 DIGITAL SALES MIX1 1. Digital sales includes sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. It does not include sales through Kiosks that are located inside Shacks. Digital sales and digital sales mix are key metrics and exclude the one-time revenue catch-up of gift card breakage, recognized in Shack sales. 2. Measured by fiscal March 2022 digital sales versus fiscal January 2021, when digital sales peaked. App exclusive offers drive engagement and excitement. Our Digital Transformation is driving higher guest acquisition, retention, and spend: % Label Indicates digital mix of sales • Our digital guest average check was 25% higher than non-digital check in the first quarter. • First quarter digital sales mix was 43%1. • More than 60% growth in the number of guests that made a first- time purchase in our owned digital channels (Shack app and web) compared to last year. • We retained nearly 80%2 of the digital business we amassed when digital sales peaked during COVID (January 2021), even as in-Shack sales increased significantly. 8

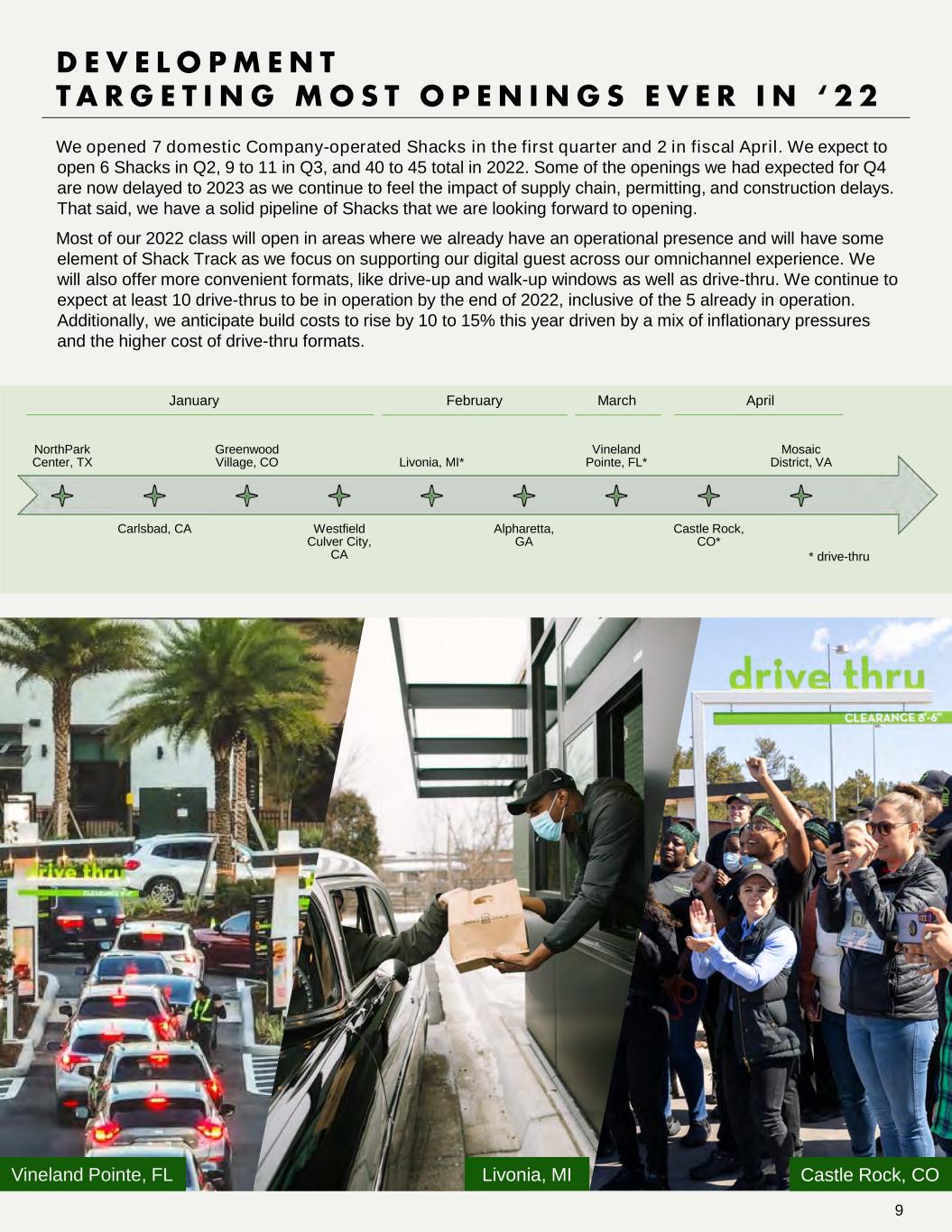

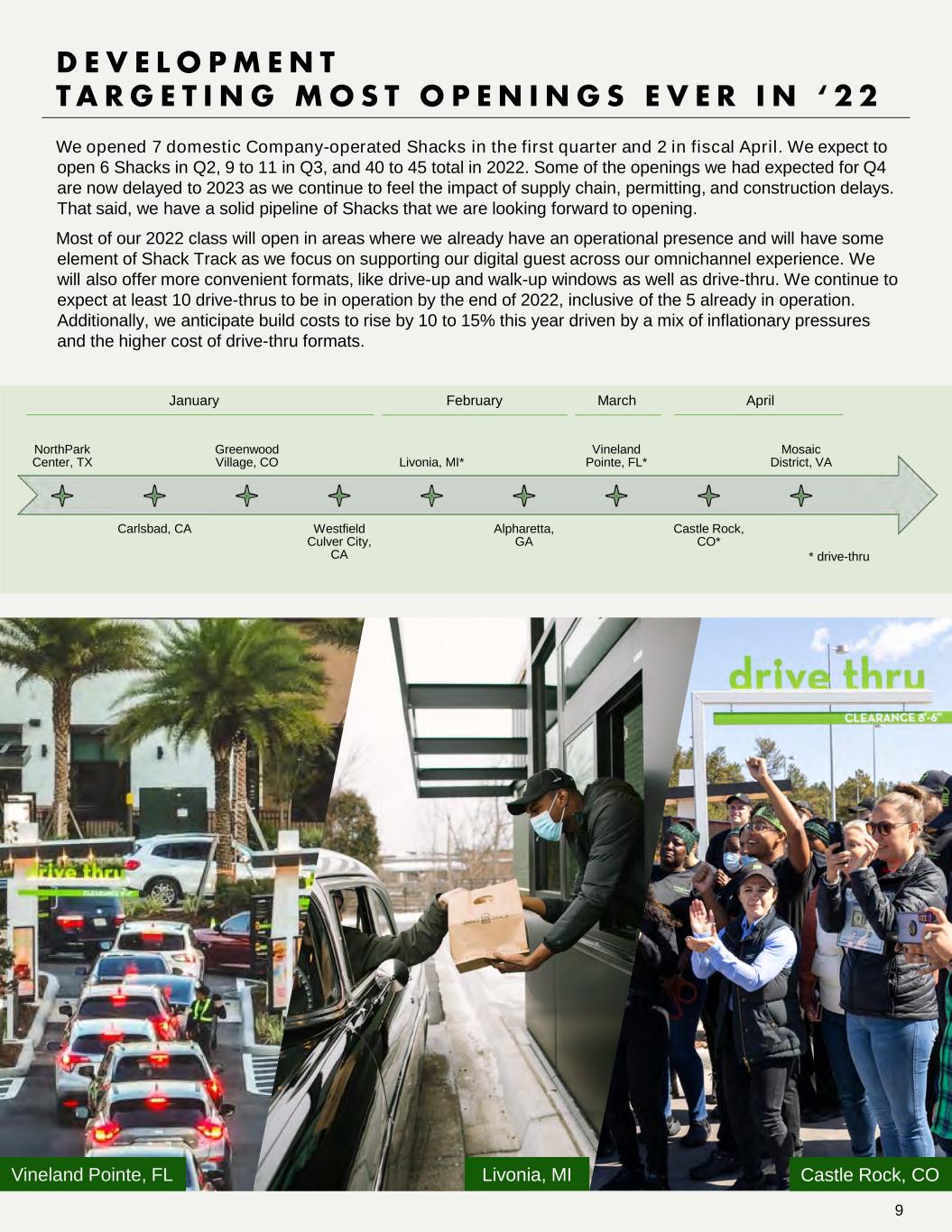

NorthPark Center, TX Carlsbad, CA Greenwood Village, CO Westfield Culver City, CA Livonia, MI* Alpharetta, GA Vineland Pointe, FL* Castle Rock, CO* Mosaic District, VA D E V E L O P M E N T T A R G E T I N G M O S T O P E N I N G S E V E R I N ‘ 2 2 We opened 7 domestic Company-operated Shacks in the first quarter and 2 in fiscal April. We expect to open 6 Shacks in Q2, 9 to 11 in Q3, and 40 to 45 total in 2022. Some of the openings we had expected for Q4 are now delayed to 2023 as we continue to feel the impact of supply chain, permitting, and construction delays. That said, we have a solid pipeline of Shacks that we are looking forward to opening. Most of our 2022 class will open in areas where we already have an operational presence and will have some element of Shack Track as we focus on supporting our digital guest across our omnichannel experience. We will also offer more convenient formats, like drive-up and walk-up windows as well as drive-thru. We continue to expect at least 10 drive-thrus to be in operation by the end of 2022, inclusive of the 5 already in operation. Additionally, we anticipate build costs to rise by 10 to 15% this year driven by a mix of inflationary pressures and the higher cost of drive-thru formats. * drive-thru January February March April Livonia, MI Castle Rock, COVineland Pointe, FL 9

$77.6M $100.4M $111.6M $118.4M $112.8M Total Licensing Sales C O N T I N U E D L I C E N S E D B U S I N E S S G R O W T H Our Licensing revenue grew 43% year-over-year, reaching $6.6m this quarter. Our Licensing revenue benefited from relaxed COVID-related restrictions in many regions, in addition to strong performance of our class of 2021. However, we remain subject to global headwinds and significant COVID uncertainty in some markets. Licensing sales1 grew 45% year-over-year to $112.8m this quarter. Domestic and select international market performance was strong, however sales performance was impacted by COVID-related pressures, primarily in Mainland China and Hong Kong. We opened 6 new licensed Shacks in the first quarter and 2 more in fiscal April, bringing us to 159 licensed Shacks globally. We expect to open a total of 23 to 27 licensed Shacks in 2022. This year we have expanded our footprint further in China, with new market openings in cities like Nanjing and Guangzhou. While we are pleased with our first quarter performance, our licensed partners continue to experience COVID- related market interruptions, primarily in Mainland China and Hong Kong. We believe these pressures will continue to impact our Licensing business for the foreseeable future. TOTAL LICENSING SALES ROSE 45% YOY (6%) 187% 61% 50% 45% Total YoY Licensing Sales Growth / (Decline) First Quarter 2021 Second Quarter 2021 Third Quarter 2021 Fourth Quarter 20212 First Quarter 2022 1. Total licensed sales is an operating measure and consists of sales from domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees 2. Fourth Quarter 2021 total Licensing sales YoY growth excludes the favorable $7.0m impact of the 53rd fiscal accounting week in Fourth Quarter 2020. Galerías, Monterrey, MX Parc Central, Guangzhou, CNDeji Plaza, Nanjing, CN 10

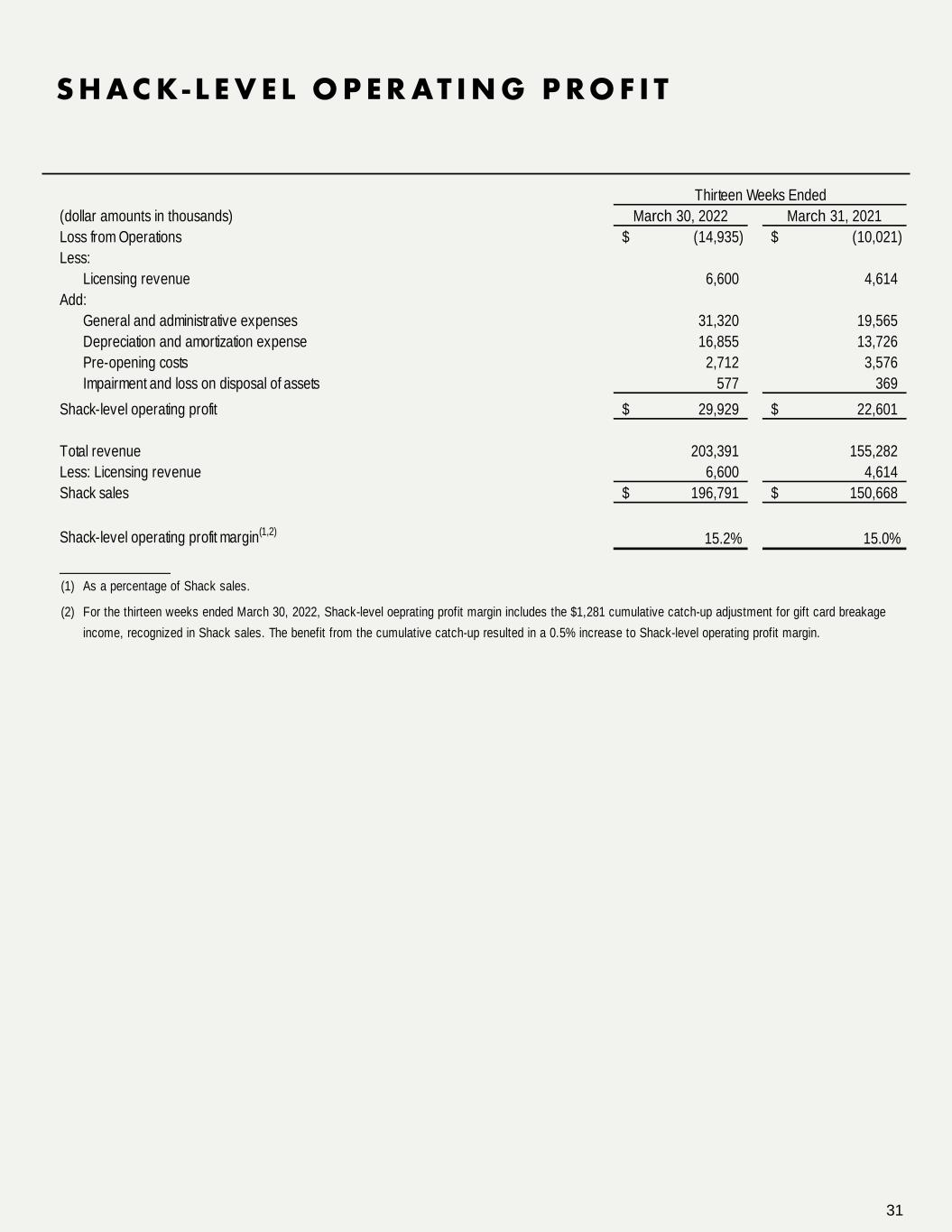

S H A C K - L E V E L O P E R A T I N G P R O F I T 1 E X C E E D E D E X P E C T A T I O N S Shack-level operating profit1 of $29.9m grew 32.4% year-over-year and represents a 15.2% margin, despite the traffic impact of Omicron early in the quarter and ongoing inflationary pressures. Profitability improved throughout the quarter as traffic rebounded and we realized strong flow through on the incremental sales in March relative to January. We are encouraged by the results of our March 2022 price increase and continue to evaluate opportunities to take further price increases as we continue to navigate a challenging inflationary backdrop in our Shacks. The components of our Shack-level costs (covered in more detail in the following pages) are as follows: • Food and paper was 30.4% of Shack sales. • Labor was 30.7% of Shack sales. • Other operating expense was 15.4% of Shack sales. • Occupancy was 8.3% of Shack sales. $23M $35M $30M $32M $30M 1Q21 2Q21 3Q21 4Q21 1Q22 Shack-level Operating Profit1 ($) 15.0% 19.2% 15.8% 16.4% 15.2% 1Q21 2Q21 3Q21 4Q21 1Q22 Shack-level Operating Margin1 (%) 1. Shack-level operating profit includes the $1.3m gift card breakage income cumulative catch-up. The benefit from the cumulative catch-up resulted in a 0.5% increase to Shack-level operating profit margin. Shack-level operating profit is a non-GAAP measure. A reconciliation to the most directly comparable financial measure presented in accordance with GAAP is set forth in the financial details section of this Shareholder Letter. 11

S H A C K - L E V E L O P E R A T I N G P R O F I T F O O D & P A P E R C O S T S While the inflationary backdrop is largely uncertain, we expect blended food and paper inflation of high single to low double digits in FY2022. We anticipate 1H2022 to realize the highest degree of year-over-year inflation across our basket and expect the 2H2022 impact to be less severe as we lap higher beef prices in the prior year. We are focused on improving our profitability considering elevated inflationary pressures and are evaluating the potential for additional price increases across menu, channel and tiers later this year. Food and Paper Inflationary Pressures Commodities Basket Range Q1 2022 YoY Inflation Q2 2022 YoY Inflation Outlook* FY2022 YoY Inflation Outlook * Beef 25% - 30% + ~ 20% + LSD % + LSD - MSD % Total Food1 ~ 90% + Low Teens % + HSD % + HSD - LDD% Paper and Packaging ~ 10% + HSD % + ~20% + Mid Teens % Blended Food & Paper 100% + Low Teens % + Low Teens % + HSD - LDD % Food and paper costs were 30.4% of Shack sales in the first quarter, up 80 bps year-over-year. The March 2022 price increase helped address most of the additional commodity inflation that we experienced in the first quarter versus last quarter. Blended food and paper prices rose by a low teens percentage year-over-year, led by beef, chicken and dairy. We expect inflationary pressures to persist into the second quarter, led by paper and packaging, dairy, and chicken. 29.6% 30.3% 31.0% 31.0% 30.4% 1Q21 2Q21 3Q21 4Q21 1Q22 COGS as a % of Shack Sales We take the time and effort to find and use only the best ingredients – from fresh and antibiotic-free meat to cage-free eggs and real cane sugar. Our basket can change due to product and sales channel mix. Additionally, we do not contract many components of our basket, and those that we do have different contracted periods throughout the year. We are providing our current expectations on commodity outlook for our basket as we see today; however, the blended weight and the individual components are subject to change for a variety of reasons. 1. Total Food includes food and beverage. 12

Occupancy and related expenses (“Occupancy”) % of Shack sales was 8.3% in the first quarter, down 90 bps year-over-year. Occupancy % increased quarter-over-quarter due to sales pressures in January and February. We realized stronger profitability flow-through on March’s higher sales on our Occupancy line relative to January. Other operating expenses (“Other opex”) % of Shack sales was 15.4% in the first quarter, flat year-over-year. Other opex % increased quarter- over-quarter primarily driven by sales deleverage and delivery commissions due to a higher delivery mix. As of March 2022, we are currently charging a 15% premium on DSP menu prices to help address the added costs we incur through third-party delivery channels. 9.2% 8.2% 7.8% 8.1% 8.3% 1Q21 2Q21 3Q21 4Q21 1Q22 15.4% 13.4% 14.2% 14.9% 15.4% 1Q21 2Q21 3Q21 4Q21 1Q22 S H A C K - L E V E L O P E R A T I N G P R O F I T L A B O R , O T H E R O P E X & O C C U P A N C Y 30.8% 29.0% 31.1% 29.6% 30.7% 1Q21 2Q21 3Q21 4Q21 1Q22 Labor as a % of Shack Sales Labor and related expenses (“Labor”) % of Shack sales was 30.7% in the first quarter, down 10 bps year-over-year. We continue to invest in our Shack team members as we staff for growth and sales recovery. We raised our starting wages by high single-digit percentage year-over-year in the first quarter as we proudly invest in our team members. We expect to raise our starting wages by high single-digits to low double-digits in the second quarter year-over-year, and mid to high single-digits for full year 2022. Occupancy as a % of Shack Sales Other Opex as a % of Shack Sales 13

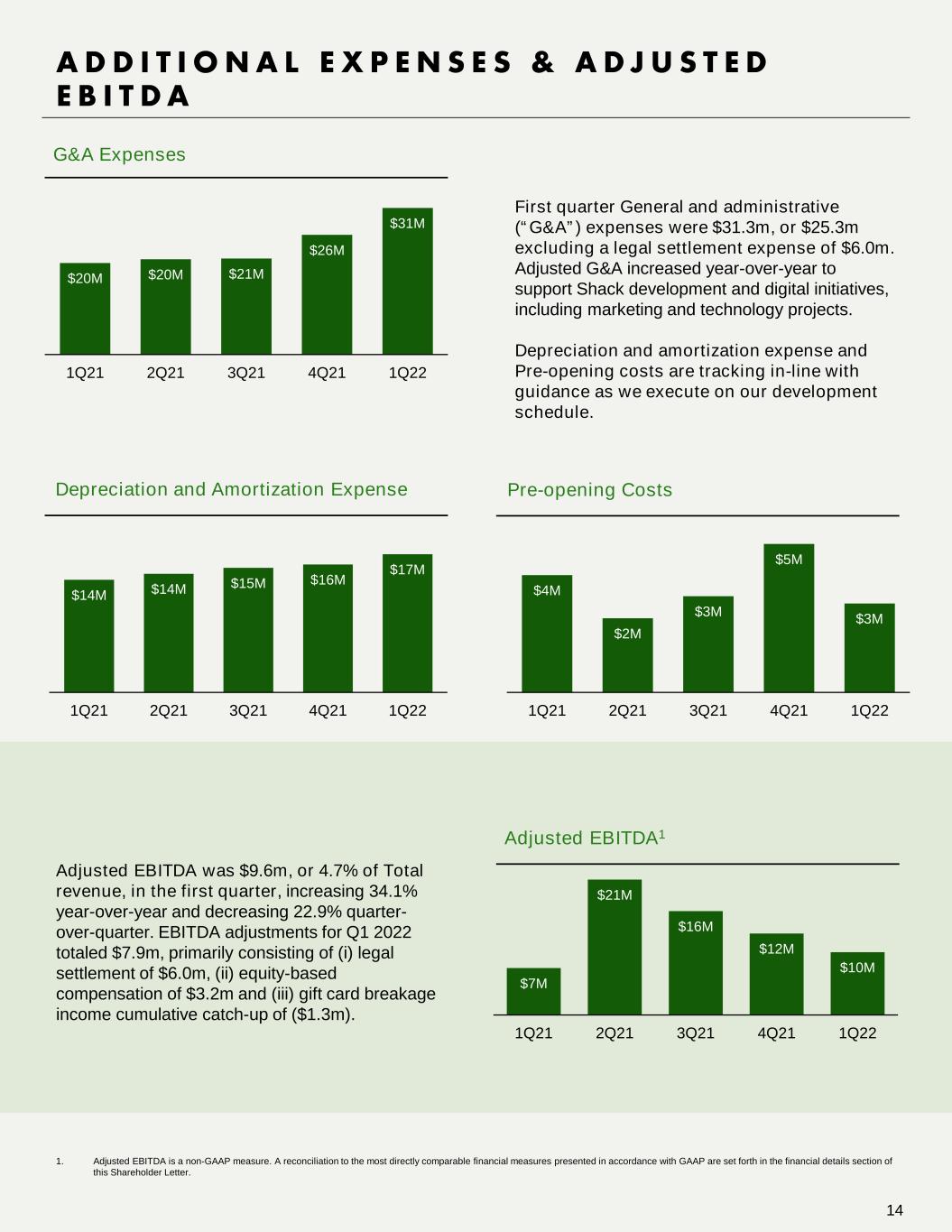

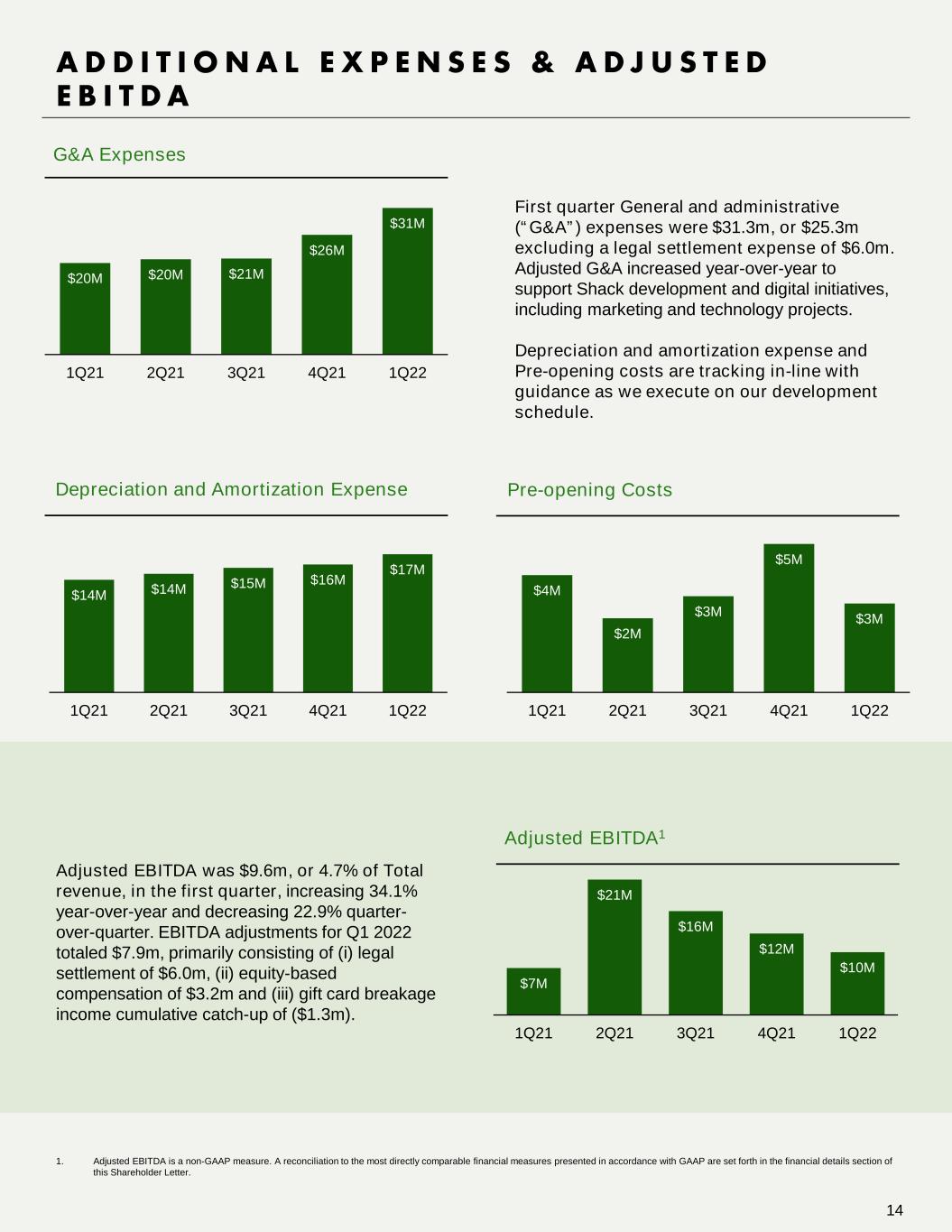

$20M $20M $21M $26M $31M 1Q21 2Q21 3Q21 4Q21 1Q22 G&A Expenses First quarter General and administrative (“G&A”) expenses were $31.3m, or $25.3m excluding a legal settlement expense of $6.0m. Adjusted G&A increased year-over-year to support Shack development and digital initiatives, including marketing and technology projects. Depreciation and amortization expense and Pre-opening costs are tracking in-line with guidance as we execute on our development schedule. $14M $14M $15M $16M $17M 1Q21 2Q21 3Q21 4Q21 1Q22 Depreciation and Amortization Expense $4M $2M $3M $5M $3M 1Q21 2Q21 3Q21 4Q21 1Q22 Pre-opening Costs A D D I T I O N A L E X P E N S E S & A D J U S T E D E B I T D A 1. Adjusted EBITDA is a non-GAAP measure. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. Adjusted EBITDA was $9.6m, or 4.7% of Total revenue, in the first quarter, increasing 34.1% year-over-year and decreasing 22.9% quarter- over-quarter. EBITDA adjustments for Q1 2022 totaled $7.9m, primarily consisting of (i) legal settlement of $6.0m, (ii) equity-based compensation of $3.2m and (iii) gift card breakage income cumulative catch-up of ($1.3m). $7M $21M $16M $12M $10M 1Q21 2Q21 3Q21 4Q21 1Q22 Adjusted EBITDA1 14

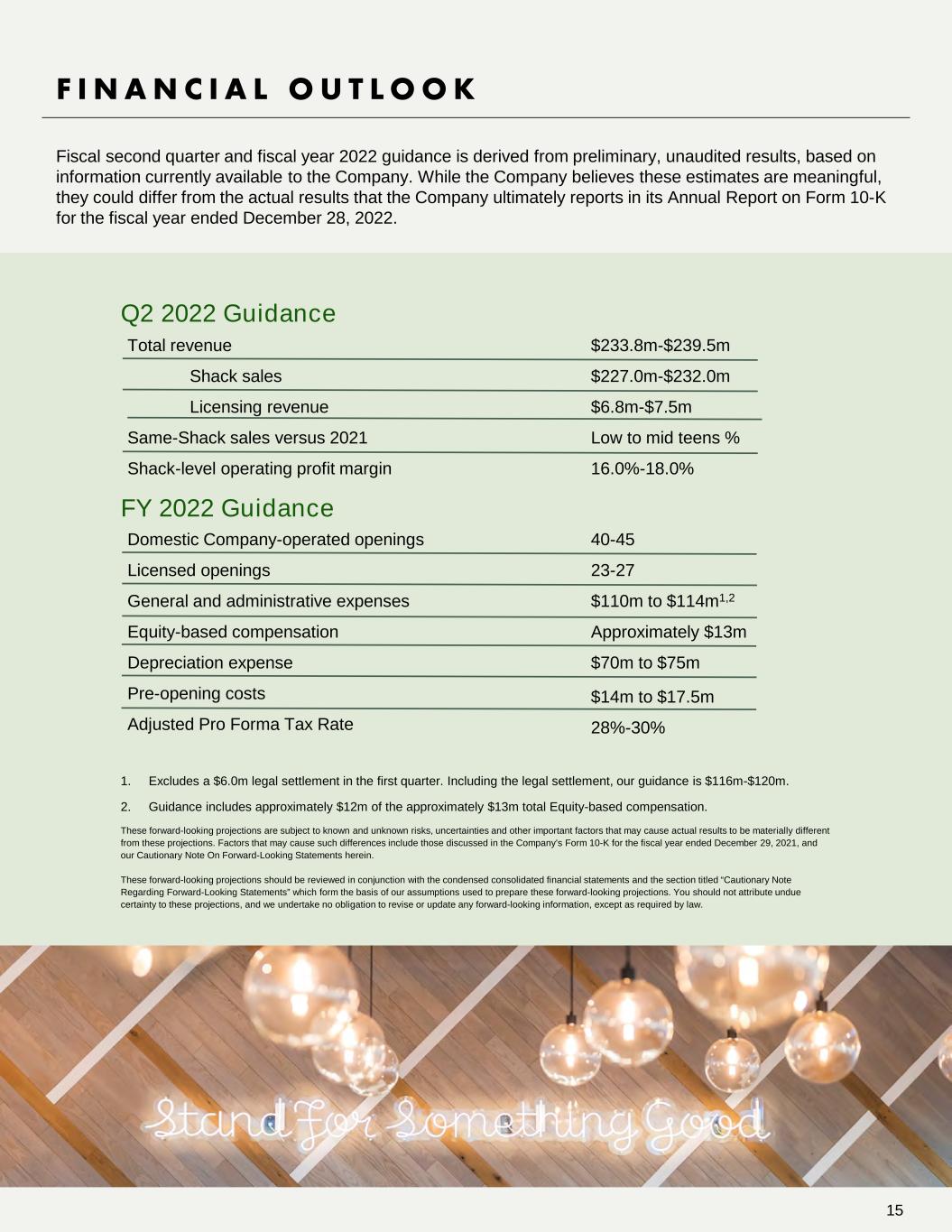

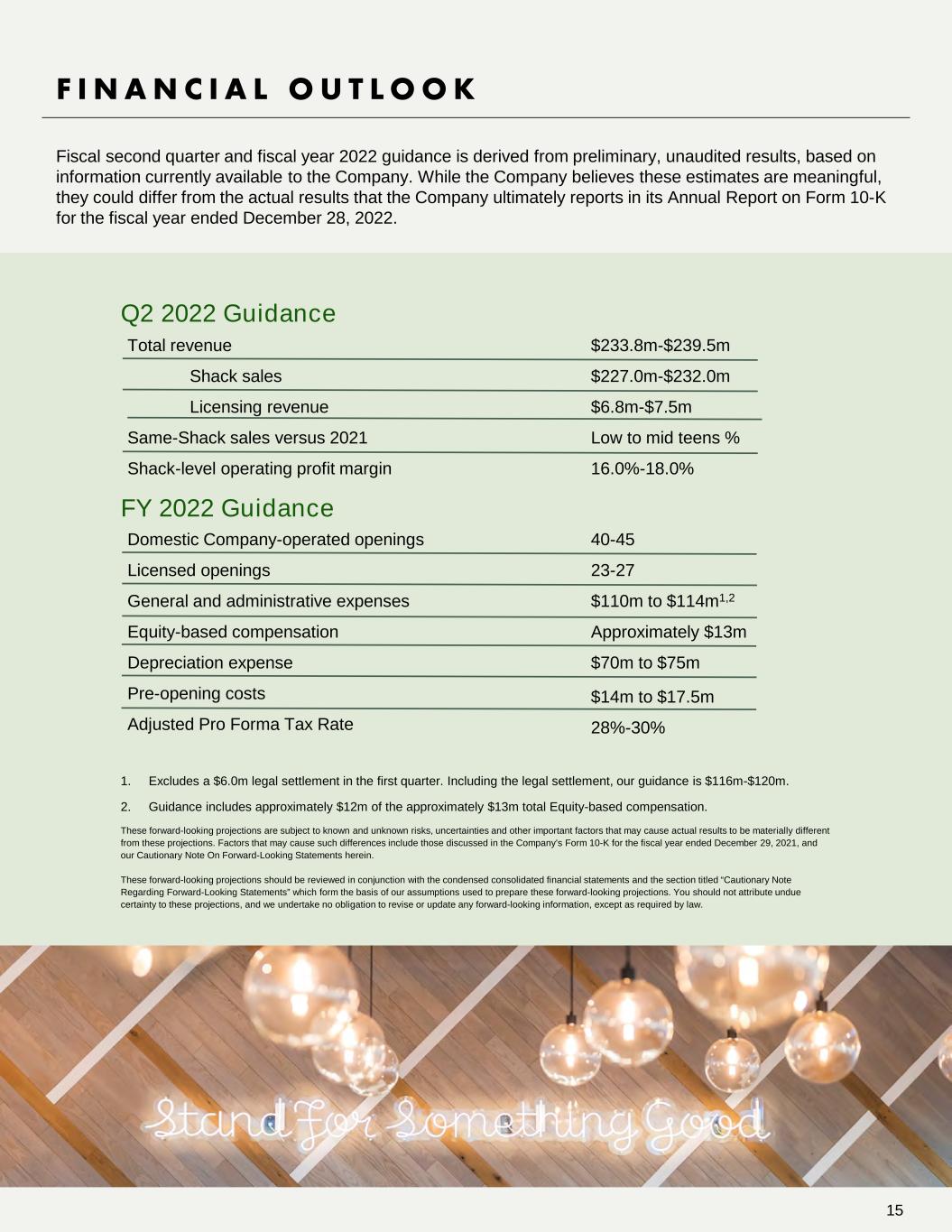

Fiscal second quarter and fiscal year 2022 guidance is derived from preliminary, unaudited results, based on information currently available to the Company. While the Company believes these estimates are meaningful, they could differ from the actual results that the Company ultimately reports in its Annual Report on Form 10-K for the fiscal year ended December 28, 2022. F I N A N C I A L O U T L O O K 1. Excludes a $6.0m legal settlement in the first quarter. Including the legal settlement, our guidance is $116m-$120m. 2. Guidance includes approximately $12m of the approximately $13m total Equity-based compensation. These forward-looking projections are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from these projections. Factors that may cause such differences include those discussed in the Company's Form 10-K for the fiscal year ended December 29, 2021, and our Cautionary Note On Forward-Looking Statements herein. These forward-looking projections should be reviewed in conjunction with the condensed consolidated financial statements and the section titled “Cautionary Note Regarding Forward-Looking Statements” which form the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. Total revenue Shack sales Licensing revenue Same-Shack sales versus 2021 Shack-level operating profit margin Domestic Company-operated openings Licensed openings General and administrative expenses Equity-based compensation Depreciation expense Pre-opening costs Adjusted Pro Forma Tax Rate $233.8m-$239.5m $227.0m-$232.0m $6.8m-$7.5m Low to mid teens % 16.0%-18.0% 40-45 23-27 $110m to $114m1,2 Approximately $13m $70m to $75m $14m to $17.5m 28%-30% Q2 2022 Guidance FY 2022 Guidance 15

F O U R P I L L A R S O F O U R S T R A T E G I C P L A N S T R AT E G I C F O C U S DIGITAL TRANSFORMATIONELEVATING OUR PEOPLE FORMAT EVOLUTION & EXPANSION GUEST EXPERIENCE RULES We are leveraging our digital channels to transform the way that we deliver Enlightened Hospitality to our guests. Our omnichannel experience with personalized digital marketing offers more connections and exceptional guest experience. This, we believe, is a key to our long-term frequency. We Stand For Something Good. We are committed to doing the right thing for our teams, guests, and communities. We strive to be market-leading employers and will continue to invest in our people to drive Company growth, value, and culture to meet both current and future business needs. We continue to expand our domestic and global footprint to provide access to unreached markets, with an eye on convenience and experience. As we continue to focus on measuring and considering our environmental impact, we leverage repurposed boarding, energy efficient equipment, solar panels, and locally sourced craft furniture. Our food is always freshly made to order. We pride ourselves in providing our guests with food that raises the bar, from the ingredients we source to the moment they take their first bite. We prioritize guest experience through unmatched hospitality, elevated culinary innovations, limited time offers (LTOs) and marketing campaigns. 16

Our continuous effort to attract the best talent in the restaurant industry has enabled our success thus far and will prepare us for the growth ahead. We understand the value of investing in our people and will continue to invest in higher wages, growth initiatives, and a strong pipeline of leaders. We have raised our starting wage rates by 13% since 2020 and increased starting wages in about 75% of our Shacks in 2021. In 2021, over 50% of all promotions were women and over 70% were underrepresented minorities. In just a few short weeks, we will host our biennial Leadership Retreat where we will bring together more than 1,200 leaders at every management level across the country to align, inspire and plan for the growth ahead. We will keep building out existing diversity, equity and inclusion initiatives such as mentoring programs, unconscious bias training, and employee resource groups. E L E V A T I N G O U R P E O P L E S T R AT E G I C F O C U S Leadership development programs train team members for internal promotions and build our pipeline for growth. Committed to being a leading employer in the market, with approximately $15 average national starting wages. Over 2,800 internal promotions in 2021, almost double the number of promotions from 2020. 17

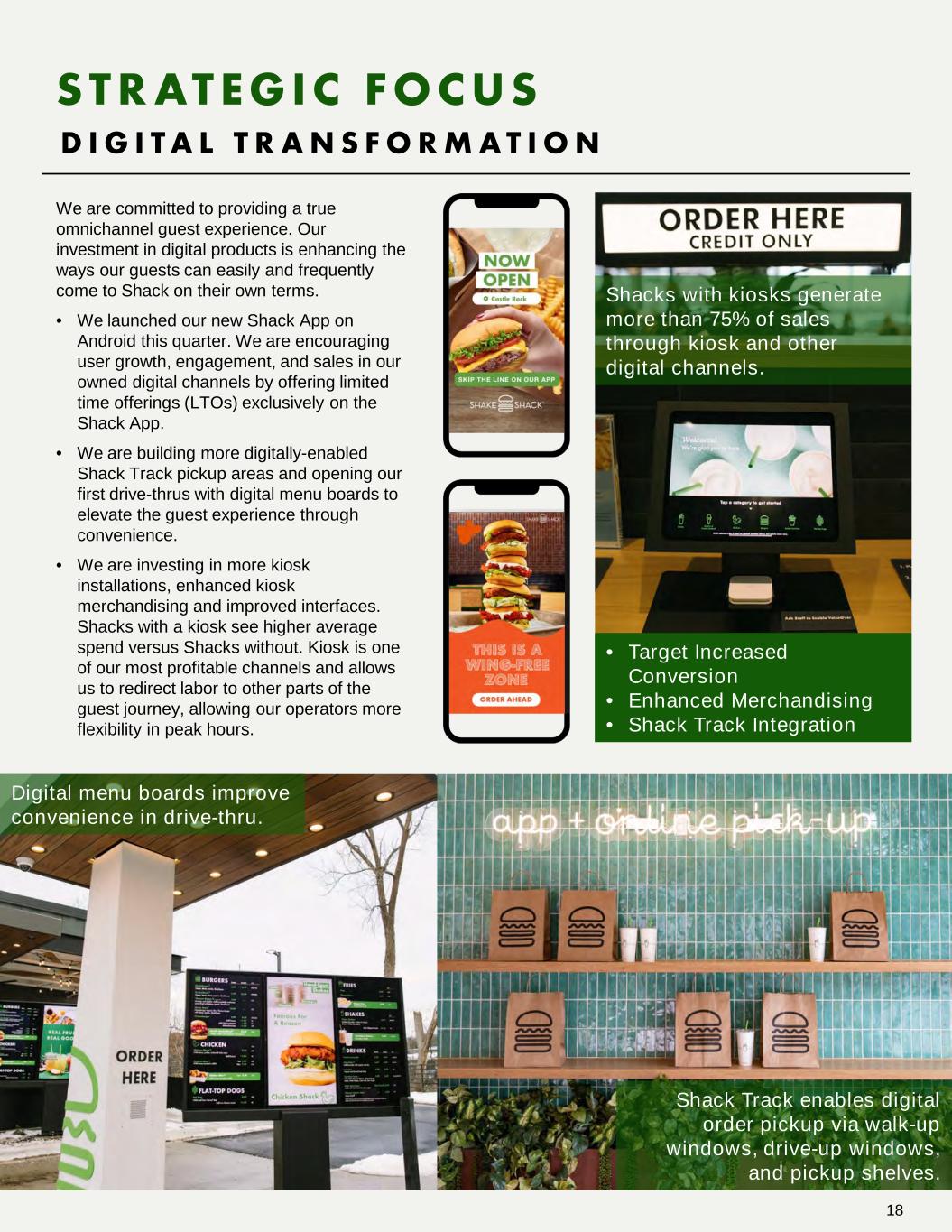

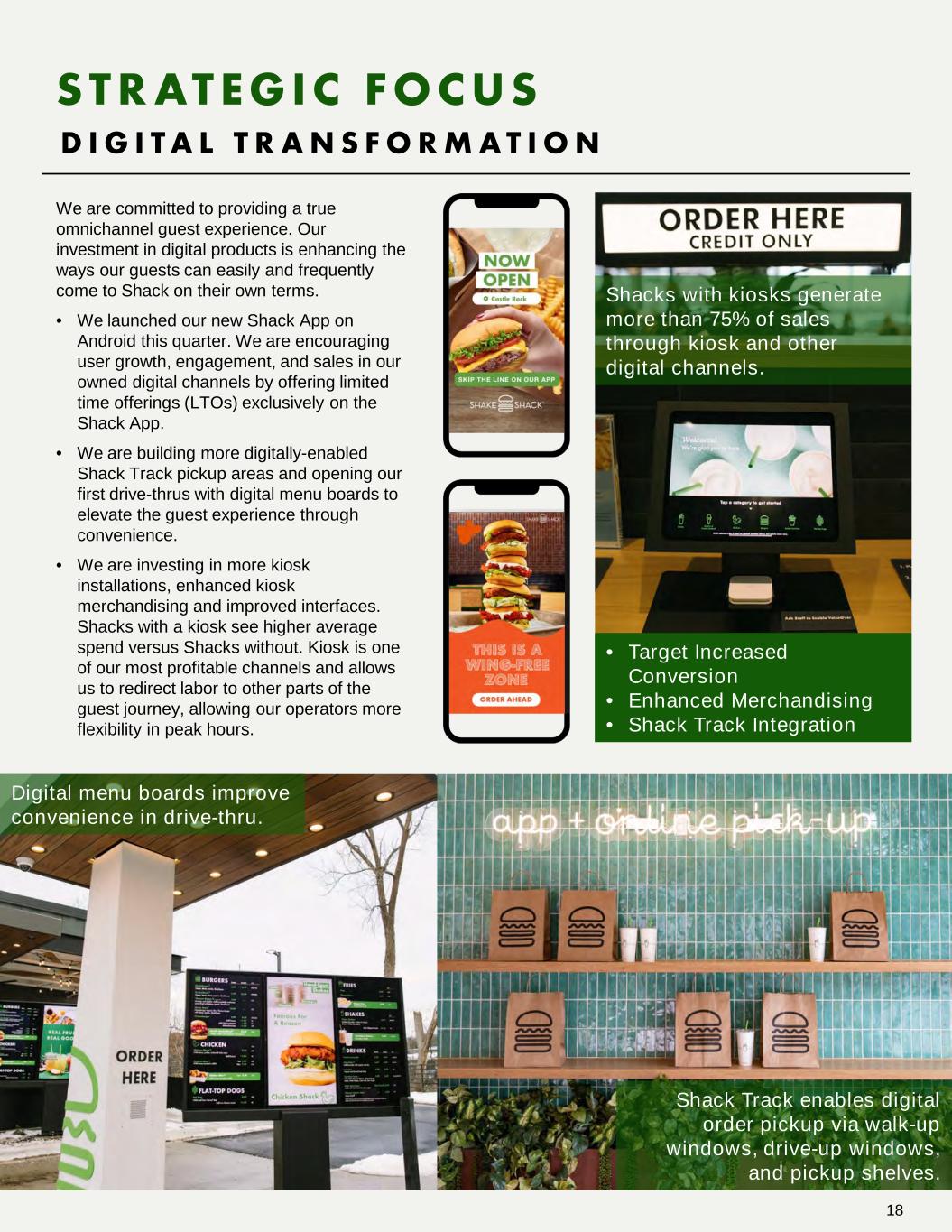

Shacks with kiosks generate more than 75% of sales through kiosk and other digital channels. Shack Track enables digital order pickup via walk-up windows, drive-up windows, and pickup shelves. We are committed to providing a true omnichannel guest experience. Our investment in digital products is enhancing the ways our guests can easily and frequently come to Shack on their own terms. • We launched our new Shack App on Android this quarter. We are encouraging user growth, engagement, and sales in our owned digital channels by offering limited time offerings (LTOs) exclusively on the Shack App. • We are building more digitally-enabled Shack Track pickup areas and opening our first drive-thrus with digital menu boards to elevate the guest experience through convenience. • We are investing in more kiosk installations, enhanced kiosk merchandising and improved interfaces. Shacks with a kiosk see higher average spend versus Shacks without. Kiosk is one of our most profitable channels and allows us to redirect labor to other parts of the guest journey, allowing our operators more flexibility in peak hours. • Target Increased Conversion • Enhanced Merchandising • Shack Track Integration D I G I T A L T R A N S F O R M A T I O N S T R AT E G I C F O C U S Digital menu boards improve convenience in drive-thru. 18

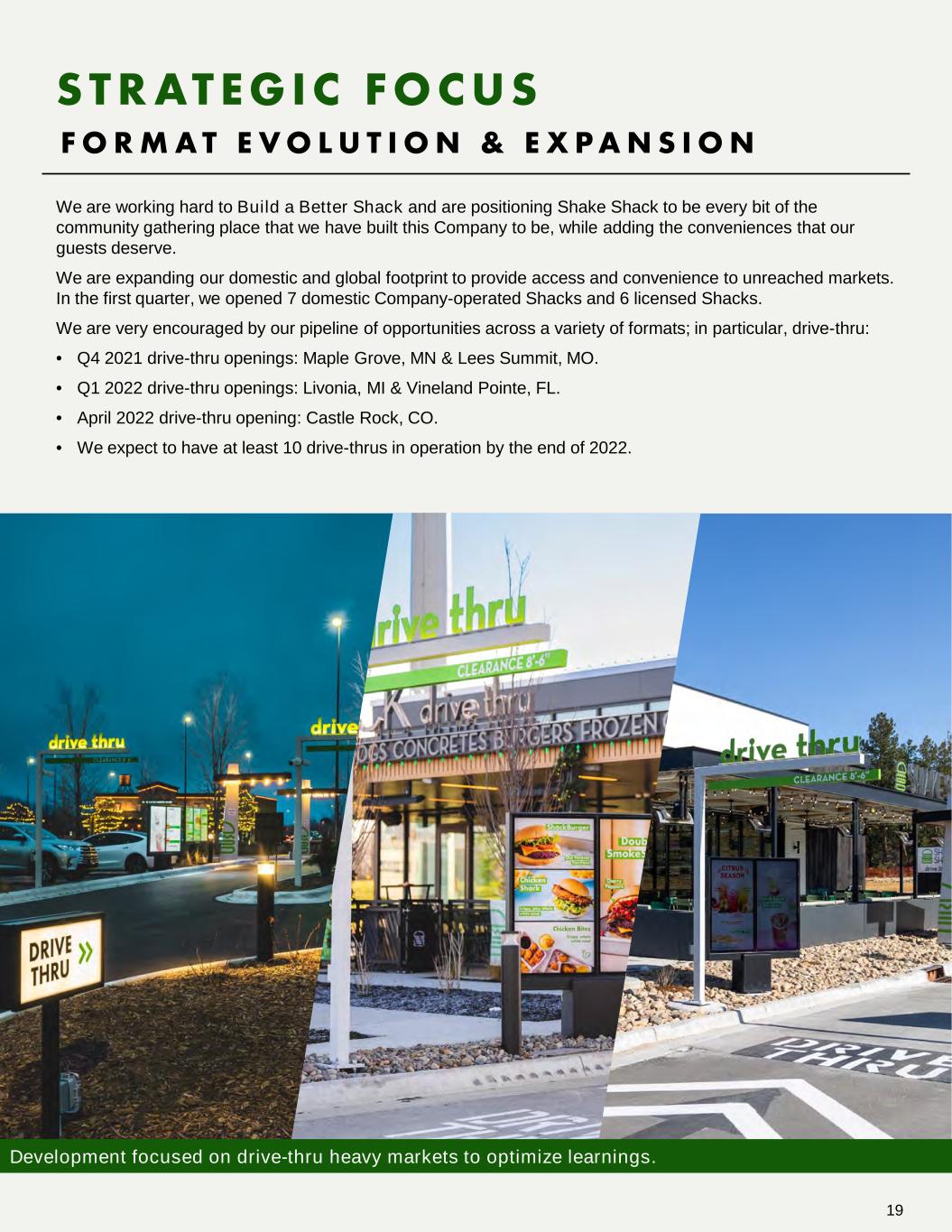

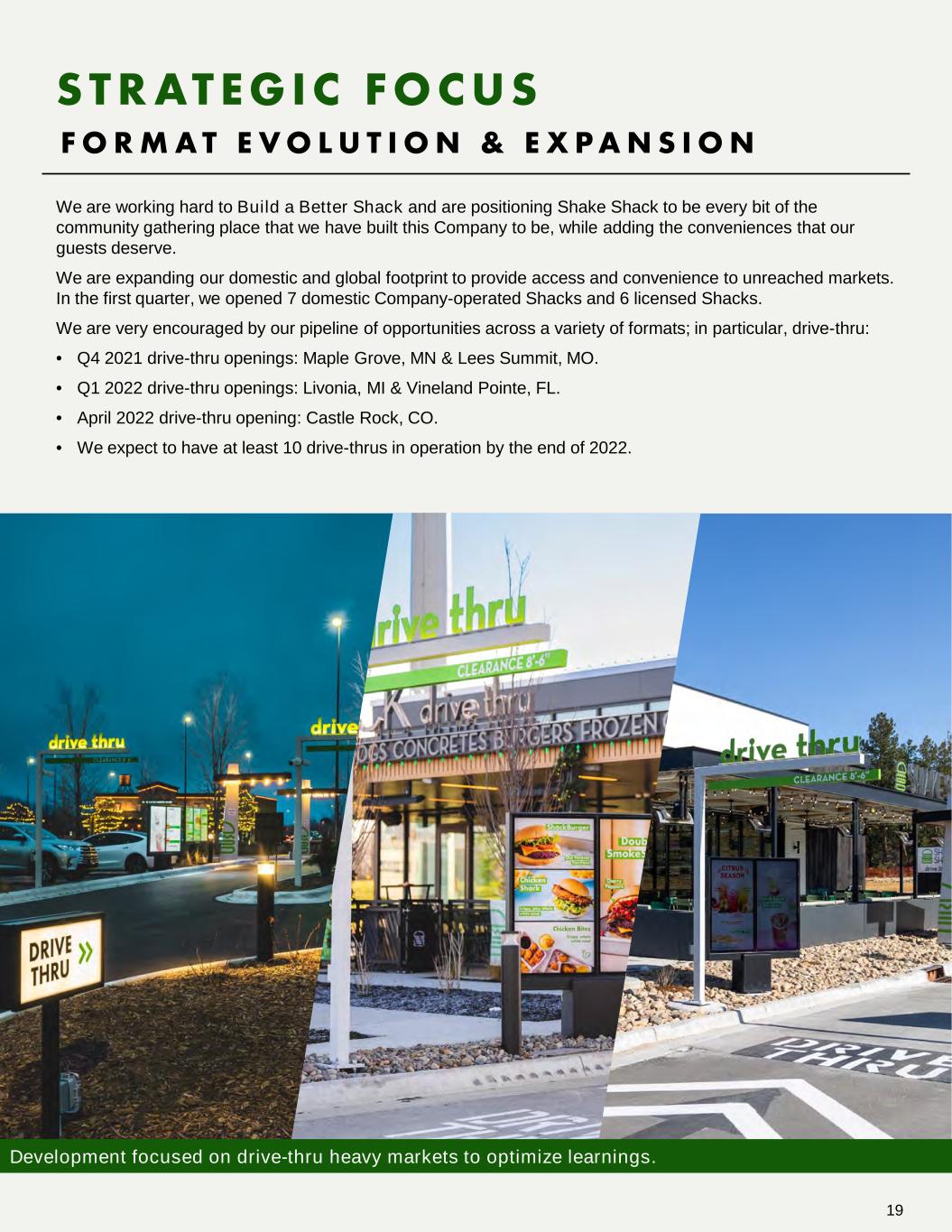

We are working hard to Build a Better Shack and are positioning Shake Shack to be every bit of the community gathering place that we have built this Company to be, while adding the conveniences that our guests deserve. We are expanding our domestic and global footprint to provide access and convenience to unreached markets. In the first quarter, we opened 7 domestic Company-operated Shacks and 6 licensed Shacks. We are very encouraged by our pipeline of opportunities across a variety of formats; in particular, drive-thru: • Q4 2021 drive-thru openings: Maple Grove, MN & Lees Summit, MO. • Q1 2022 drive-thru openings: Livonia, MI & Vineland Pointe, FL. • April 2022 drive-thru opening: Castle Rock, CO. • We expect to have at least 10 drive-thrus in operation by the end of 2022. F O R M A T E V O L U T I O N & E X P A N S I O N S T R AT E G I C F O C U S Development focused on drive-thru heavy markets to optimize learnings. 19

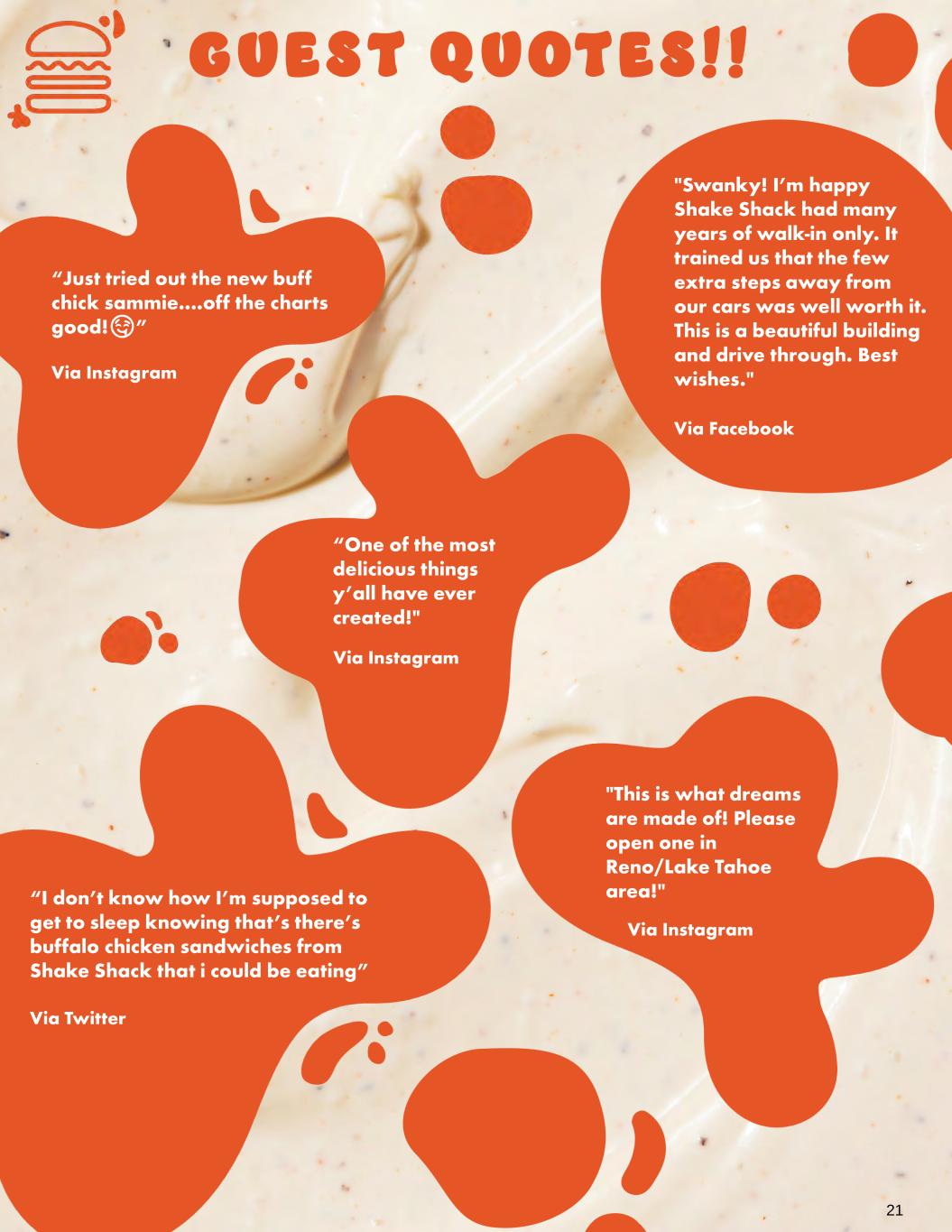

In 2021, we launched a chef series called “Now Serving,” featuring 6 renowned chefs from across the country. The events brought one-of-a-kind culinary creations with proceeds supporting restaurants and chefs impacted by the pandemic. Of note, nearly all selected chefs were people of color or women. We expect to continue our collaborations in the future to generate excitement, drive guest engagement, and contribute to our community. Our Food Raises the Bar. Our team of chefs is dedicated to the culinary experience and bringing exciting new items to our menus all over the world. We are uplifting our culinary program with exciting Limited Time Offerings (LTOs) and buzz-worthy collaborations that drive engagement with new and existing guests. This quarter, our LTOs featured a Buffalo Chicken Sandwich, Buffalo Fries, Wake & Shake, Chocolate Pie Shake, and beverage flavors such as Blood Orange Citrus, Kiwi Apple, and Hibiscus Lychee. Our Buffalo Fries were one of the best performing fry LTOs yet. We've got an exciting LTO lineup planned for the rest of the year to drive further traffic and brand awareness. O U R G U E S T E X P E R I E N C E R U L E S ! S T R AT E G I C F O C U S Chef Dominique Crenn Dominique Crenn’s Grilled Cheese Chef Junghyun Park Atoboy Shrimp Burger Chef JJ Johnson Little J’s BurgerCurry & Crunch Fries 20

"Swanky! I’m happy Shake Shack had many years of walk-in only. It trained us that the few extra steps away from our cars was well worth it. This is a beautiful building and drive through. Best wishes." Via Facebook “I don’t know how I’m supposed to get to sleep knowing that’s there’s buffalo chicken sandwiches from Shake Shack that i could be eating” Via Twitter “One of the most delicious things y’all have ever created!" “Just tried out the new buff chick sammie….off the charts good!🤤🤤” Via Instagram G U E S T Q U OT E S ! ! "This is what dreams are made of! Please open one in Reno/Lake Tahoe area!" Via Instagram Via Instagram 21

Financial Details

C A U T I O N A RY N O T E O N F O R WA R D - L O O K I N G S TAT E M E N T S This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, the Company's strategic initiatives, expected financial results and operating performance for fiscal 2022, expected development targets for fiscal 2022, including expected Shack construction and openings, expected same-Shack sales growth, average weekly sales and trends in the Company’s operations, the expansion of the Company’s delivery services and store format evolution and expansion, the Company’s digital investments and strategies, 2022 guidance, and statements relating to the impact of COVID-19. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial position, results of operations, plans, objectives, future performance and business. You can identify forward- looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "intend," "outlook," "potential," "preliminary," "project," "projection," "plan," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s expectations include the continuing impact of the COVID-19 pandemic, the Company's ability to develop and open new Shacks on a timely basis, increased costs or shortages or interruptions in the supply and delivery of the Company's products, increased labor costs or shortages, inflationary pressures, the Company's management of its digital capabilities and expansion into new channels including drive-thru, the Company's ability to maintain and grow sales at its existing Shacks, and risks relating to the restaurant industry generally. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2021 as filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. 23

D E F I N I T I O N S The following definitions, and definitions on the subsequent pages, apply to terms as used in this shareholder letter: "Shack sales" is defined as the aggregate sales of food, beverages, gift card breakage income, and Shake Shack branded merchandise at domestic Company-operated Shacks and excludes sales from licensed Shacks. “System-wide sales” is an operating measure and consists of sales from the Company's domestic Company- operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For consecutive days that Shacks were temporarily closed, the comparative period was also adjusted. "Average weekly sales" or “AWS” is calculated by dividing total Shack sales by the number of operating weeks for all Shacks in operation during the period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of operating weeks open such that it corresponds to the period of associated sales. “Adjusted pro forma net income," a non-GAAP measure, represents Net income (loss) attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring and other items that the Company does not believe directly reflect its core operations and may not be indicative of the Company’s recurring business operations. “EBITDA,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit), and Depreciation and amortization expense. “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA (as defined above), excluding equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud- based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense, which also excludes equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations, as a percentage of Total revenue. 24

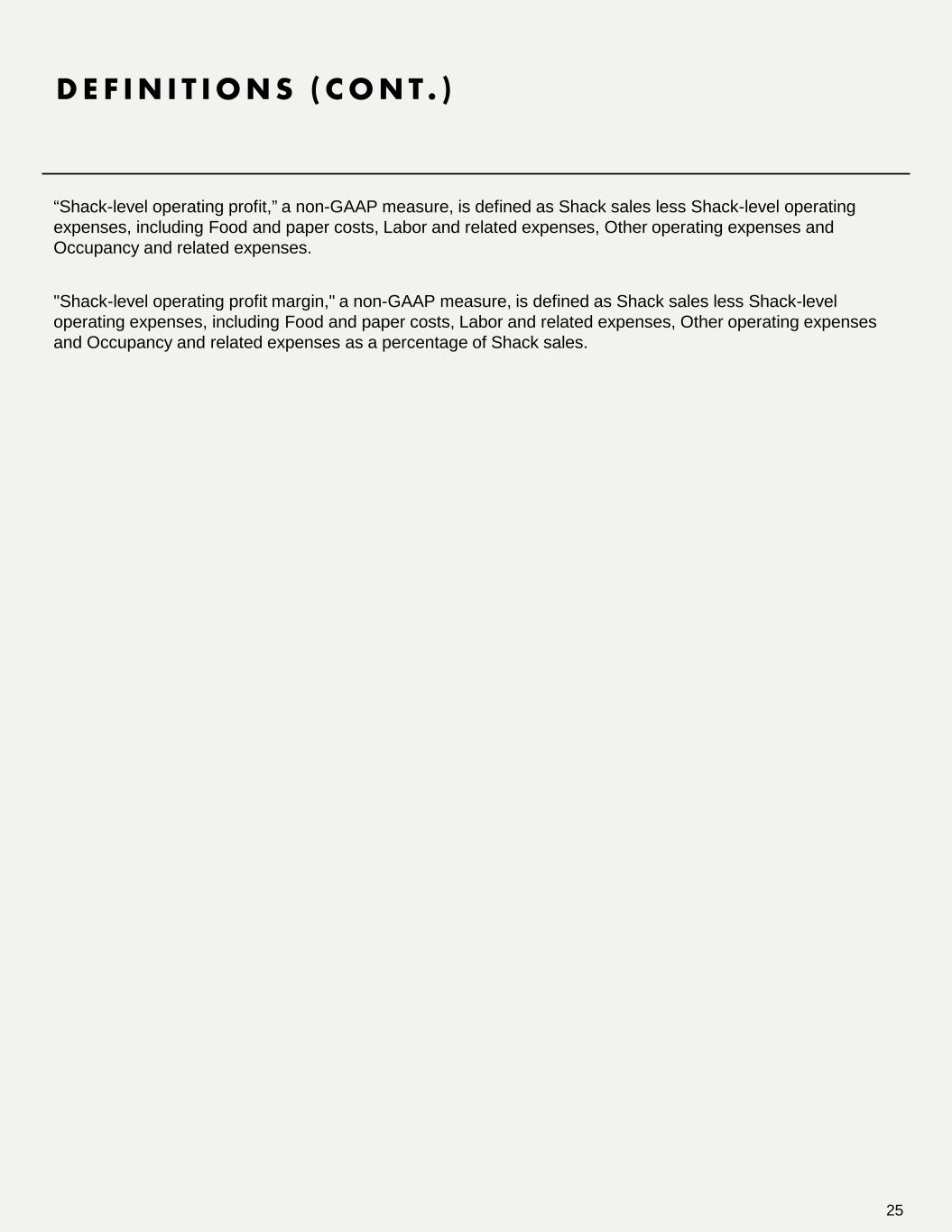

D E F I N I T I O N S ( C O N T . ) “Shack-level operating profit,” a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales. 25

D E V E L O P M E N T H I G H L I G H T S March 30, 2022 March 31, 2021 164 123 System-wide 382 321 Domestic Company-operated 225 192 Licensed 157 129 Domestic licensed 27 22 International licensed 130 107 Thirteen Weeks Ended Shacks in the comparable base Shack counts (at end of period): Development Highlights During the first quarter of 2022, the Company opened seven new domestic Company-operated Shacks, four new international licensed Shacks and two new domestic licensed Shacks. Location Type Opening Date Dallas, TX — NorthPark Center Domestic Company-operated 1/12/2022 Carlsbad, CA — Carlsbad Domestic Company-operated 1/12/2022 Ridgefield, NJ — Vince Lombardi Service Area Domestic Licensed 1/12/2022 Shanghai, China — iAPM International Licensed 1/13/2022 Greenwood Village, CO — Greenwood Village Domestic Company-operated 1/21/2022 Culver City, CA — Westfield Culver City Domestic Company-operated 1/22/2022 Beijing, China — Indigo International Licensed 1/25/2022 Livonia, MI — Livonia Domestic Company-operated 2/10/2022 Alpharetta, GA — Alpharetta Domestic Company-operated 2/16/2022 Dubai, UAE — Dubai Hills International Licensed 2/17/2022 Nanjing, China — Deiji Plaza International Licensed 2/22/2022 Orlando, FL — Vineland Pointe Domestic Company-operated 3/24/2022 St. Louis, MO — Enterprise Center Domestic Licensed 3/30/2022 In fiscal April 2022, the Company opened two additional domestic Company-operated Shacks and two additional international licensed Shacks. 26

B A L A N C E S H E E T S ( U N A U D I T E D ) (in thousands, except share and per share amounts) March 30, 2022 December 29, 2021 ASSETS Current assets: Cash and cash equivalents $ 279,251 $ 302,406 Marketable securities 79,676 80,000 Accounts receivable, net 11,755 13,657 Inventories 3,780 3,850 Prepaid expenses and other current assets 12,155 9,763 Total current assets 386,617 409,676 Property and equipment, net of accumulated depreciation of $236,933 and $222,768, respectively 398,971 389,386 Operating lease assets 346,128 347,277 Deferred income taxes, net 304,166 298,668 Other assets 13,846 12,563 TOTAL ASSETS $ 1,449,728 $ 1,457,570 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $ 13,395 $ 19,947 Accrued expenses 38,997 36,892 Accrued wages and related liabilities 16,032 14,638 Operating lease liabilities, current 36,951 35,519 Other current liabilities 20,586 14,501 Total current liabilities 125,961 121,497 Long-term debt 243,804 243,542 Long-term operating lease liabilities 399,487 400,113 Liabilities under tax receivable agreement, net of current portion 234,273 234,045 Other long-term liabilities 20,944 22,773 Total liabilities 1,024,469 1,021,970 Commitments and contingencies Stockholders' equity: Preferred stock, no par value—10,000,000 shares authorized; none issued and outstanding as of March 30, 2022 and December 29, 2021. — — Class A common stock, $0.001 par value—200,000,000 shares authorized; 39,218,290 and 39,142,397 shares issued and outstanding as of March 30, 2022 and December 29, 2021, respectively. 39 39 Class B common stock, $0.001 par value—35,000,000 shares authorized; 2,911,587 and 2,921,587 shares issued and outstanding as of March 30, 2022 and December 29, 2021, respectively. 3 3 Additional paid-in capital 406,981 405,940 Retained earnings (accumulated deficit) (6,608) 3,554 Accumulated other comprehensive income (loss) — 1 Total stockholders' equity attributable to Shake Shack Inc. 400,415 409,537 Non-controlling interests 24,844 26,063 Total equity 425,259 435,600 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 1,449,728 $ 1,457,570 27

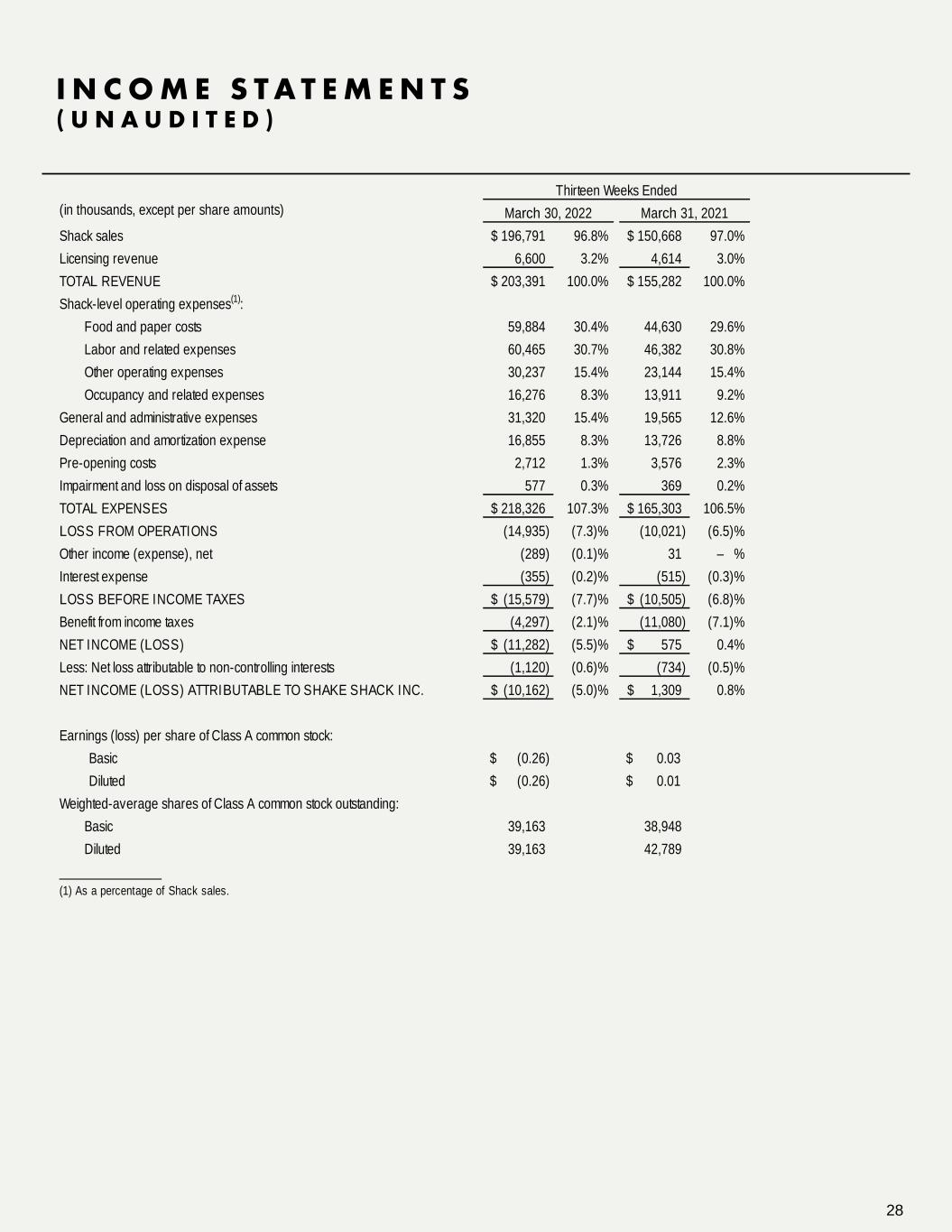

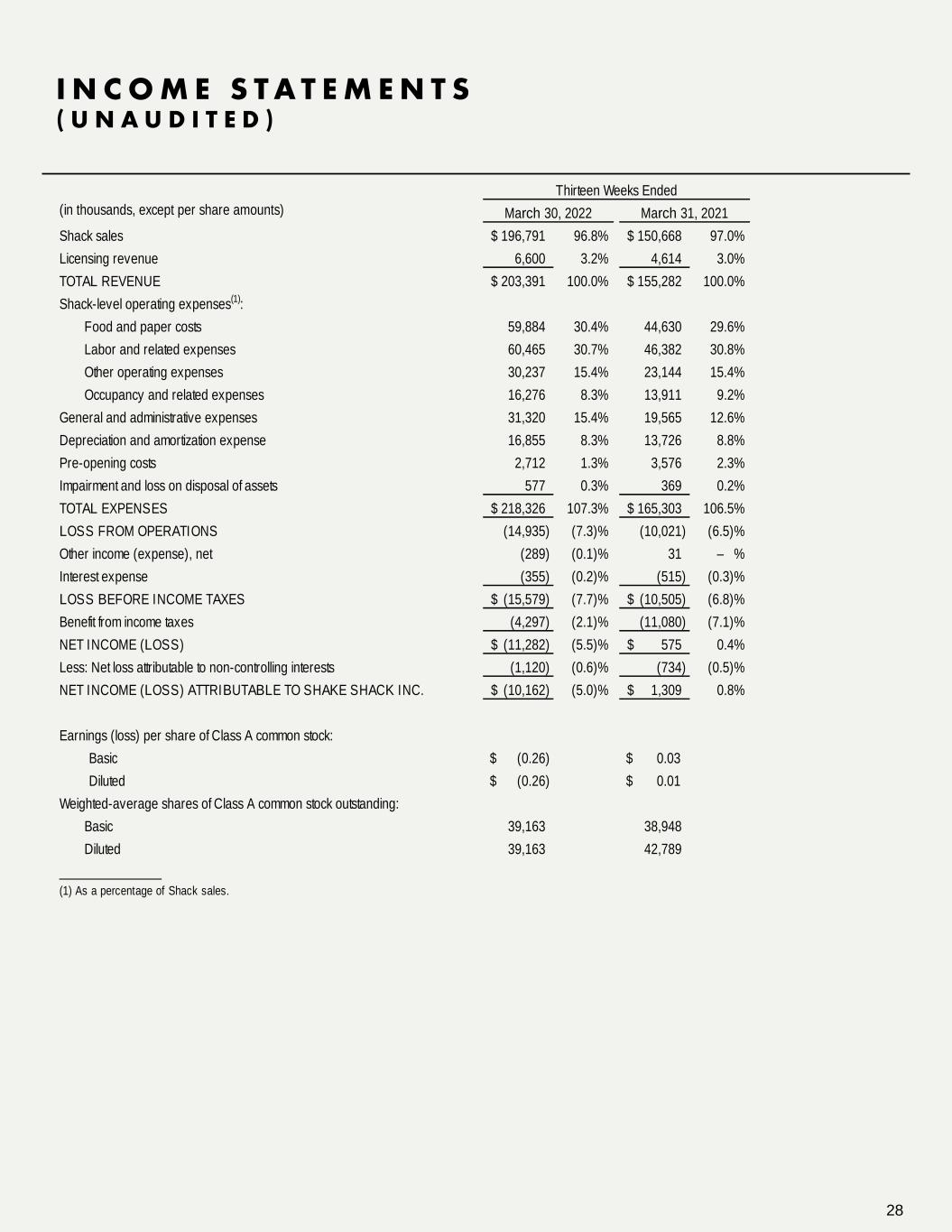

I N C O M E S T A T E M E N T S ( U N A U D I T E D ) Shack sales 196,791$ 96.8% 150,668$ 97.0% Licensing revenue 6,600 3.2% 4,614 3.0% TOTAL REVENUE 203,391$ 100.0% 155,282$ 100.0% Shack-level operating expenses(1): Food and paper costs 59,884 30.4% 44,630 29.6% Labor and related expenses 60,465 30.7% 46,382 30.8% Other operating expenses 30,237 15.4% 23,144 15.4% Occupancy and related expenses 16,276 8.3% 13,911 9.2% General and administrative expenses 31,320 15.4% 19,565 12.6% Depreciation and amortization expense 16,855 8.3% 13,726 8.8% Pre-opening costs 2,712 1.3% 3,576 2.3% Impairment and loss on disposal of assets 577 0.3% 369 0.2% TOTAL EXPENSES 218,326$ 107.3% 165,303$ 106.5% LOSS FROM OPERATIONS (14,935) (7.3)% (10,021) (6.5)% Other income (expense), net (289) (0.1)% 31 – % Interest expense (355) (0.2)% (515) (0.3)% LOSS BEFORE INCOME TAXES (15,579)$ (7.7)% (10,505)$ (6.8)% Benefit from income taxes (4,297) (2.1)% (11,080) (7.1)% NET INCOME (LOSS) (11,282)$ (5.5)% 575$ 0.4% Less: Net loss attributable to non-controlling interests (1,120) (0.6)% (734) (0.5)% NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. (10,162)$ (5.0)% 1,309$ 0.8% Earnings (loss) per share of Class A common stock: Basic $ (0.26) $ 0.03 Diluted $ (0.26) $ 0.01 Weighted-average shares of Class A common stock outstanding: Basic 39,163 38,948 Diluted 39,163 42,789 _______________ (1) As a percentage of Shack sales. Thirteen Weeks Ended (in thousands, except per share amounts) March 30, 2022 March 31, 2021 28

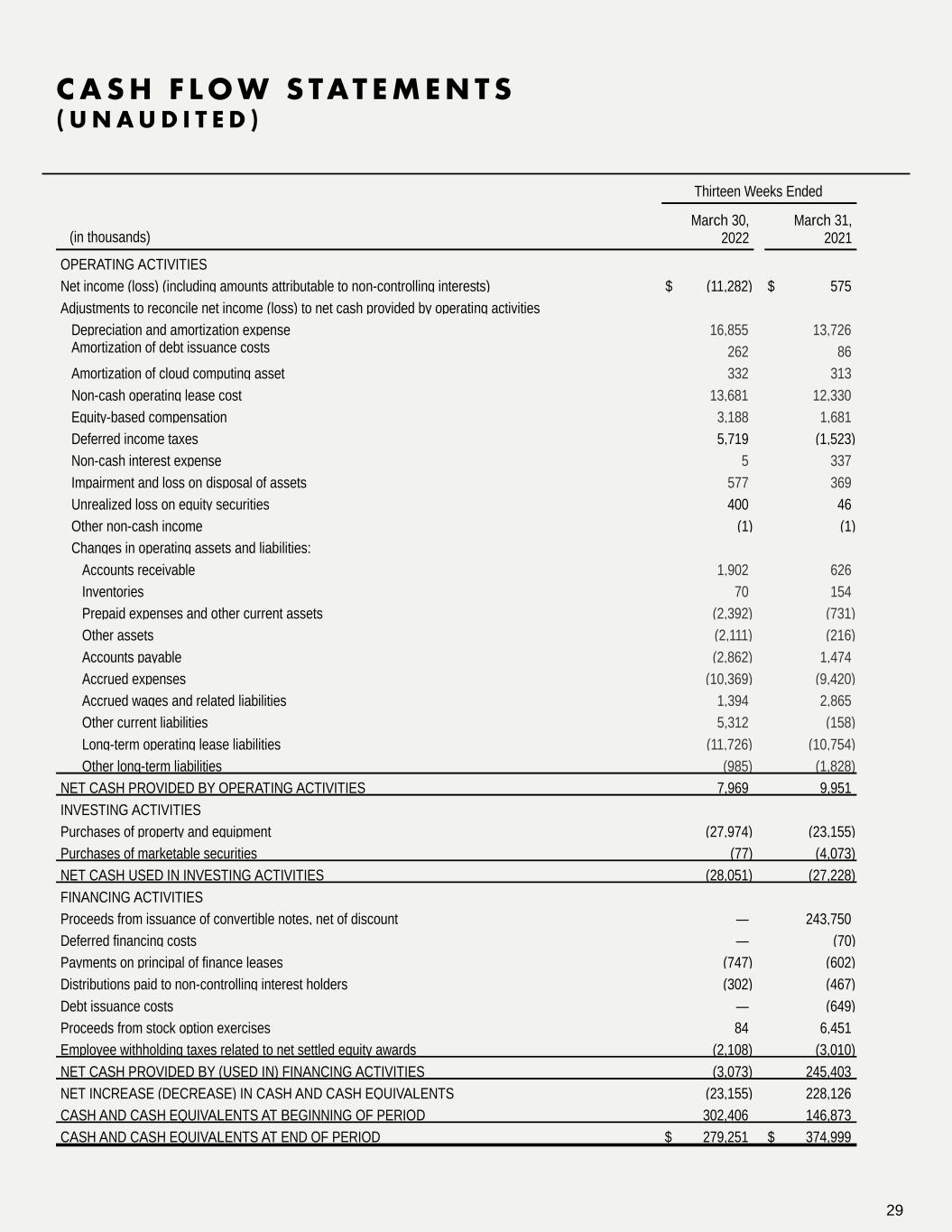

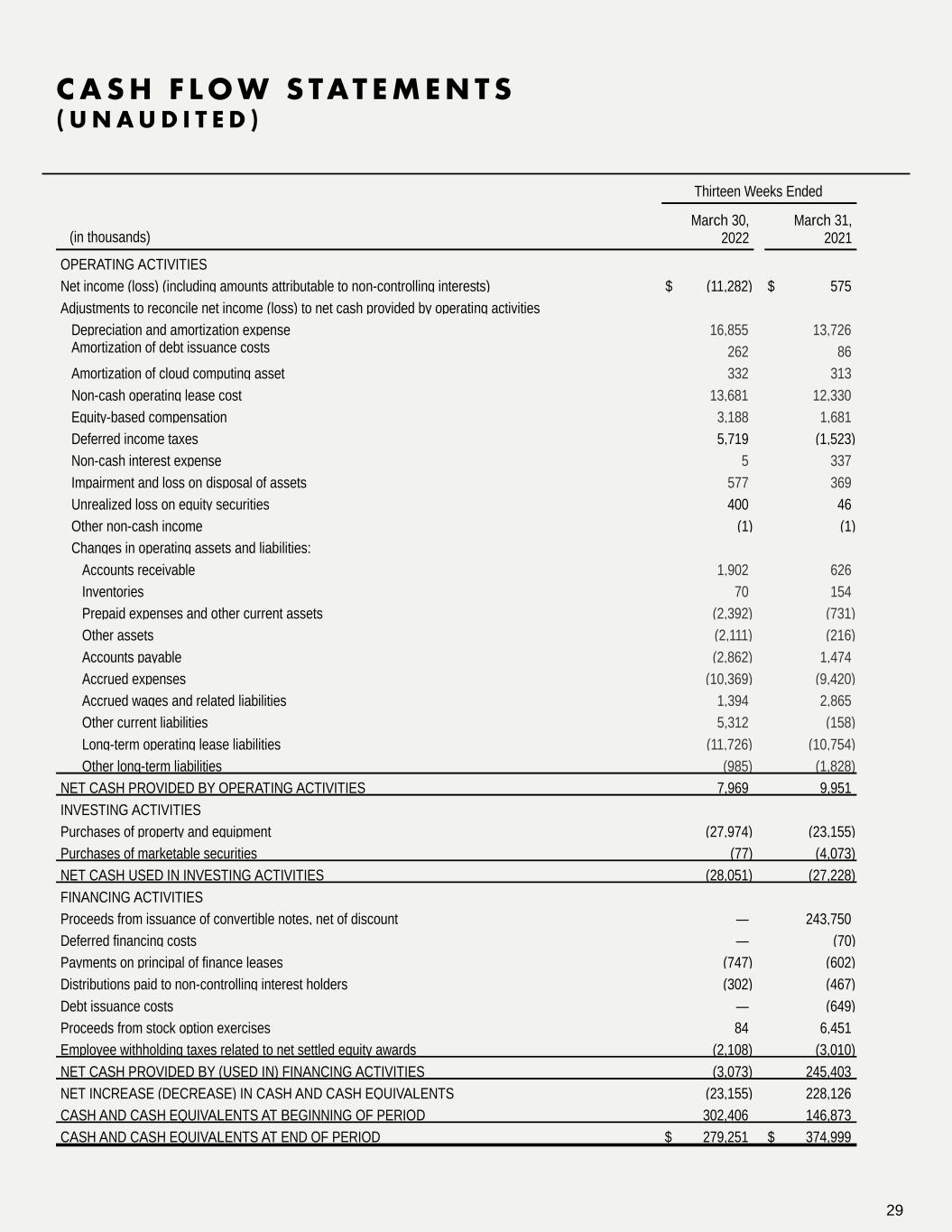

C A S H F L O W S TAT E M E N T S ( U N A U D I T E D ) (in thousands) Thirteen Weeks Ended March 30, 2022 March 31, 2021 OPERATING ACTIVITIES Net income (loss) (including amounts attributable to non-controlling interests) $ (11,282) $ 575 Adjustments to reconcile net income (loss) to net cash provided by operating activities Depreciation and amortization expense 16,855 13,726 Amortization of debt issuance costs 262 86 Amortization of cloud computing asset 332 313 Non-cash operating lease cost 13,681 12,330 Equity-based compensation 3,188 1,681 Deferred income taxes 5,719 (1,523) Non-cash interest expense 5 337 Impairment and loss on disposal of assets 577 369 Unrealized loss on equity securities 400 46 Other non-cash income (1) (1) Changes in operating assets and liabilities: Accounts receivable 1,902 626 Inventories 70 154 Prepaid expenses and other current assets (2,392) (731) Other assets (2,111) (216) Accounts payable (2,862) 1,474 Accrued expenses (10,369) (9,420) Accrued wages and related liabilities 1,394 2,865 Other current liabilities 5,312 (158) Long-term operating lease liabilities (11,726) (10,754) Other long-term liabilities (985) (1,828) NET CASH PROVIDED BY OPERATING ACTIVITIES 7,969 9,951 INVESTING ACTIVITIES Purchases of property and equipment (27,974) (23,155) Purchases of marketable securities (77) (4,073) NET CASH USED IN INVESTING ACTIVITIES (28,051) (27,228) FINANCING ACTIVITIES Proceeds from issuance of convertible notes, net of discount — 243,750 Deferred financing costs — (70) Payments on principal of finance leases (747) (602) Distributions paid to non-controlling interest holders (302) (467) Debt issuance costs — (649) Proceeds from stock option exercises 84 6,451 Employee withholding taxes related to net settled equity awards (2,108) (3,010) NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES (3,073) 245,403 NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (23,155) 228,126 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 302,406 146,873 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 279,251 $ 374,999 29

S H A C K - L E V E L O P E R AT I N G P R O F I T D E F I N I T I O N S Shack-Level Operating Profit Shack-level operating profit, a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses. Shack-level Operating Profit Margin Shack-level operating profit margin, a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack-level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance- based employee bonus arrangements. The Company believes presentation of Shack-level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision- making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as General and administrative expenses and Pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack-level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack- level operating profit to operating income (loss), the most directly comparable GAAP financial measure, is set forth on next slide. 30

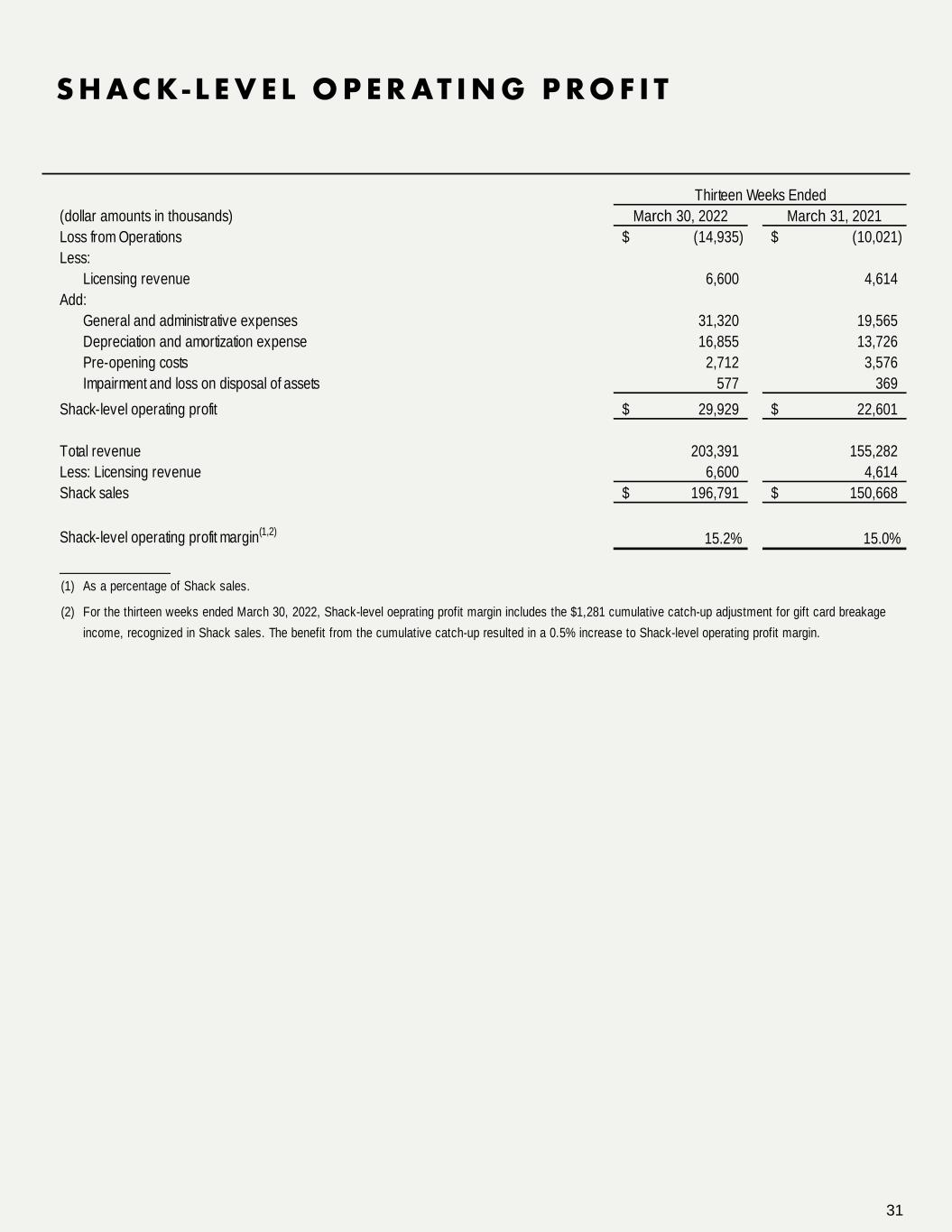

S H A C K - L E V E L O P E R AT I N G P R O F I T (dollar amounts in thousands) March 30, 2022 March 31, 2021 Loss from Operations (14,935)$ (10,021)$ Less: Licensing revenue 6,600 4,614 Add: General and administrative expenses 31,320 19,565 Depreciation and amortization expense 16,855 13,726 Pre-opening costs 2,712 3,576 Impairment and loss on disposal of assets 577 369 29,929$ 22,601$ Total revenue 203,391 155,282 Less: Licensing revenue 6,600 4,614 Shack sales 196,791$ 150,668$ Shack-level operating profit margin(1,2) 15.2% 15.0% _______________ (1) (2) For the thirteen weeks ended March 30, 2022, Shack-level oeprating profit margin includes the $1,281 cumulative catch-up adjustment for gift card breakage income, recognized in Shack sales. The benefit from the cumulative catch-up resulted in a 0.5% increase to Shack-level operating profit margin. Thirteen Weeks Ended As a percentage of Shack sales. Shack-level operating profit 31

EBITDA and Adjusted EBITDA EBITDA, a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense. Adjusted EBITDA, a non-GAAP measure, is defined as EBITDA (as defined above) excluding equity-based compensation expense, deferred lease cost, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. Adjusted EBITDA Margin Adjusted EBITDA margin, a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense, which also excludes equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations, as a percentage of Total revenue. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to Net income (loss), the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D E B I T D A D E F I N I T I O N S 32

A DJ U S T E D E B I T D A (in thousands) March 30, 2022 March 31, 2021 Net income (loss) (11,282)$ 575$ Depreciation and amortization expense 16,855 13,726 Interest expense, net 355 515 Benefit from income taxes (4,297) (11,080) EBITDA 1,631 3,736 Equity-based compensation 3,188 1,681 Amortization of cloud-based software implementation costs 332 313 Deferred lease costs(1) (877) 204 Impairment and loss on disposal of assets 577 369 Debt offering related costs(2) - 236 Legal settlement 6,000 595 Gift card breakage cumulative catch-up adjustment (1,281) - Adjusted EBITDA 9,570$ 7,134$ Adjusted EBITDA margin(3) 4.7% 4.6% _______________ (1) (2) (3) Calculated as a percentage of Total revenue, which was $203.4 million and $155.3 million for the thirteen weeks ended March 30, 2022, and March 31, 2021, respectively. Thirteen Weeks Ended Reflects the extent to which lease expense is greater than or less than contractual fixed base rent. Costs incurred in connection with the Company’s Convertible Notes, issued in March 2021, including consulting and advisory fees. 33

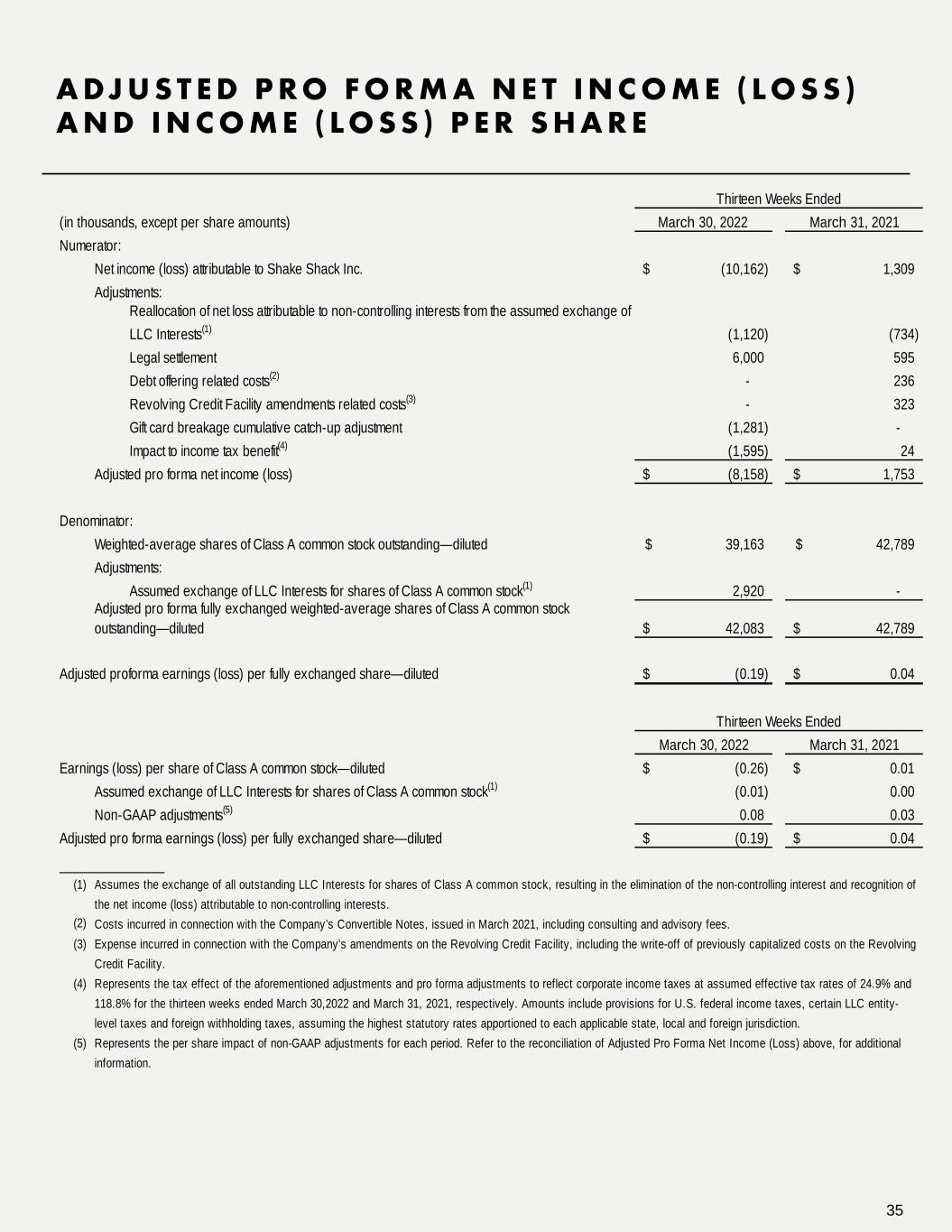

Adjusted Pro Forma Net Income (Loss) and Adjusted Pro Forma Earnings (Loss) Per Fully Exchanged and Diluted Share Adjusted pro forma net income (loss) represents Net income (loss) attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of recurring business operations. Adjusted pro forma earnings (loss) per fully exchanged and diluted share is calculated by dividing adjusted pro forma net income (loss) by the weighted-average shares of Class A common stock outstanding, assuming the full exchange of all outstanding LLC Interests, after giving effect to the dilutive effect of outstanding equity-based awards. How These Measures Are Useful When used in conjunction with GAAP financial measures, adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share are supplemental measures of operating performance that the Company believes are useful measures to evaluate performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes these measures facilitate comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in Net income (loss) attributable to Shake Shack Inc. driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of These Measures Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should not be considered alternatives to Net income (loss) and earnings (loss) per share, as determined under GAAP. While these measures are useful in evaluating the Company's performance, it does not account for the earnings attributable to the non-controlling interest holders and therefore does not provide a complete understanding of the Net income (loss) attributable to Shake Shack Inc. Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should be evaluated in conjunction with GAAP financial results. A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E D E F I N I T I O N S 34

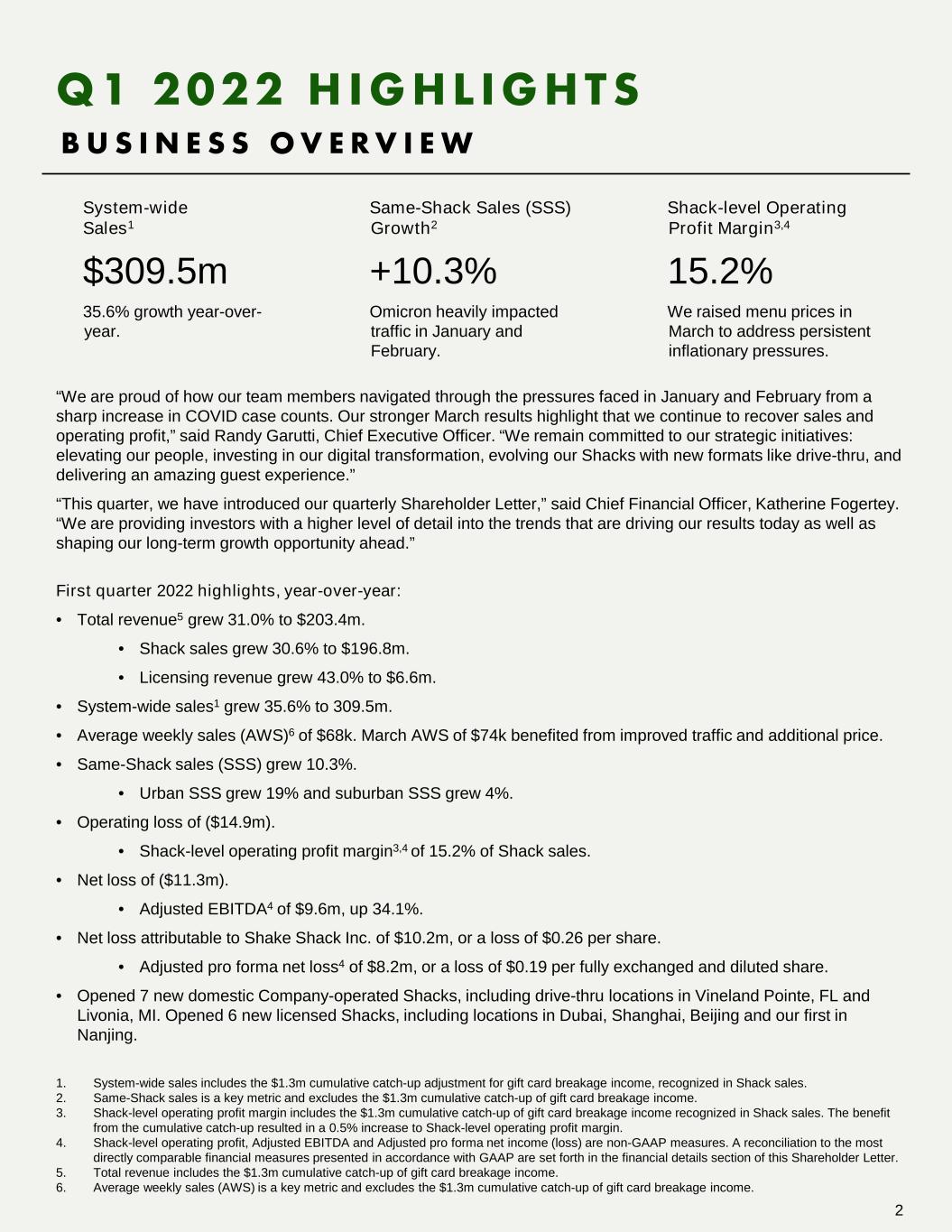

A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E (in thousands, except per share amounts) March 30, 2022 March 31, 2021 Numerator: Net income (loss) attributable to Shake Shack Inc. (10,162)$ 1,309$ Adjustments: Reallocation of net loss attributable to non-controlling interests from the assumed exchange of LLC Interests(1) (1,120) (734) Legal settlement 6,000 595 Debt offering related costs(2) - 236 Revolving Credit Facility amendments related costs(3) - 323 Gift card breakage cumulative catch-up adjustment (1,281) - Impact to income tax benefit(4) (1,595) 24 Adjusted pro forma net income (loss) (8,158)$ 1,753$ Denominator: Weighted-average shares of Class A common stock outstanding—diluted 39,163$ 42,789$ Adjustments: Assumed exchange of LLC Interests for shares of Class A common stock(1) 2,920 - 42,083$ 42,789$ Adjusted proforma earnings (loss) per fully exchanged share—diluted (0.19)$ 0.04$ March 30, 2022 March 31, 2021 Earnings (loss) per share of Class A common stock—diluted (0.26)$ 0.01$ Assumed exchange of LLC Interests for shares of Class A common stock(1) (0.01) 0.00 Non-GAAP adjustments(5) 0.08 0.03 Adjusted pro forma earnings (loss) per fully exchanged share—diluted (0.19)$ 0.04$ _______________ (1) (2) Costs incurred in connection with the Company’s Convertible Notes, issued in March 2021, including consulting and advisory fees. (3) (4) (5) Represents the per share impact of non-GAAP adjustments for each period. Refer to the reconciliation of Adjusted Pro Forma Net Income (Loss) above, for additional information. Thirteen Weeks Ended Represents the tax effect of the aforementioned adjustments and pro forma adjustments to reflect corporate income taxes at assumed effective tax rates of 24.9% and 118.8% for the thirteen weeks ended March 30,2022 and March 31, 2021, respectively. Amounts include provisions for U.S. federal income taxes, certain LLC entity- level taxes and foreign withholding taxes, assuming the highest statutory rates apportioned to each applicable state, local and foreign jurisdiction. Adjusted pro forma fully exchanged weighted-average shares of Class A common stock outstanding—diluted Assumes the exchange of all outstanding LLC Interests for shares of Class A common stock, resulting in the elimination of the non-controlling interest and recognition of the net income (loss) attributable to non-controlling interests. Thirteen Weeks Ended Expense incurred in connection with the Company's amendments on the Revolving Credit Facility, including the write-off of previously capitalized costs on the Revolving Credit Facility. 35

Adjusted Pro Forma Effective Tax Rate Adjusted pro forma effective tax rate represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. How This Measure Is Useful When used in conjunction with GAAP financial measures, adjusted pro forma effective tax rate is a supplemental measure of operating performance that the Company believes is useful to evaluate its performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes this measure facilitates comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in effective tax rate driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of this Measure Adjusted pro forma effective tax rate may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma effective tax rate should not be considered an alternative to effective tax rate, as determined under GAAP. While this measure is useful in evaluating the Company's performance, it does not account for the effective tax rate attributable to the non-controlling interest holders and therefore does not provide a complete understanding of effective tax rate. Adjusted pro forma effective tax rate should be evaluated in conjunction with GAAP financial results. A reconciliation of adjusted pro forma effective tax rate, the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E D E F I N I T I O N S 36

2 0 2 2 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E 2 0 2 1 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported (11,080)$ (10,505)$ 105.5% Non-GAAP adjustments (before tax): Debt offering related costs - 236 Revolving Credit Facility amendment-related costs - 323 Legal settlement - 595 Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (24) - Adjusted pro forma (11,104)$ (9,351)$ 118.7% Less: Windfall tax benefits from stock-based compensation 8,352 - Adjusted pro forma (excluding windfall tax benefits) (2,752)$ (9,351)$ 29.4% March 31, 2021 Thirteen Weeks Ended (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported (4,297)$ (15,579)$ 27.6% Non-GAAP adjustments (before tax): Legal settlement - 6,000 Gift Card Adjustment - (1,281) Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 1,595 - Adjusted pro forma (2,702)$ (10,860)$ 24.9% Less: Net tax impact from stock-based compensation (419) - Adjusted pro forma (excluding windfall tax benefits) (3,121)$ (10,860)$ 28.7% March 30, 2022 Thirteen Weeks Ended 37

INVESTOR CONTACT Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com MEDIA CONTACT Kristyn Clark, Shake Shack kclark@shakeshack.com CONTACT INFORMATION