1 Third Quarter 2022 Shareholder Letter

“We are pleased with our third quarter results, especially noting stronger than expected sales exiting September, a trend that’s continued into October. We grew Total revenue 17.5% year-over-year to $227.8 million; Average weekly sales outperformed historical seasonality at $73,000; same-Shack sales grew 6.3% year-over-year with 2.9% traffic growth. Shack-level operating profit margin was 16.3%. Despite macro challenges and construction delays, we opened 8 new Company-operated and licensed Shacks in the third quarter and 11 in the fourth quarter-to-date, and we have 35 Company-operated Shacks under construction today,” said Chief Executive Officer, Randy Garutti. “Our recent sales performance outpaced our expectations, and our guests are trading up into our premium offerings. To address continued inflationary pressures, we raised our menu prices by 2% to 10% across price tiers (blended 5% to 7% price) in mid-October. While it is still early, initial results are encouraging. The macro- economic backdrop remains uncertain, and we are contemplating a wide range of scenarios when planning our G&A and capex investments. We remain focused on improving our profitability and investing for our long-term sustainable sales growth,” said Chief Financial Officer, Katherine Fogertey. Third quarter 2022 highlights, year-over-year: • Total revenue grew 17.5% to $227.8m. • Shack sales grew 17.4% to $219.5m. • Licensing revenue grew 20.1% to $8.3m. • System-wide sales grew 18.3% to $353.2m. • Average weekly sales (AWS) of $73k, down 4% quarter-over-quarter. • Same-Shack sales (SSS) grew 6.3%. • Urban SSS grew 10.9% and suburban SSS grew 2.2%. • Operating loss of $4.8m. • Shack-level operating profit margin1 of 16.3% of Shack sales. • Net loss of $2.3m. • Adjusted EBITDA1 of $19.5m, up 23.5%. • Net loss attributable to Shake Shack Inc. of $2.0m, or a loss of $0.05 per share. • Adjusted pro forma net loss1 of $2.3m, or a loss of $0.06 per fully exchanged and diluted share. • Opened 2 new domestic Company-operated Shacks. Opened 6 new licensed Shacks, including locations in China and Korea. Q 3 2 0 2 2 H I G H L I G H T S System-wide Sales $353.2m 18.3% growth year-over- year. Same-Shack Sales (SSS) Growth +6.3% Accelerated throughout the quarter and into October. Shack-level Operating Profit Margin1 16.3% Impacted by continued inflationary pressures. 2 B U S I N E S S O V E R V I E W 1. Shack-level operating profit, Adjusted EBITDA and Adjusted pro forma net income (loss) are non-GAAP measures. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP is set forth in the financial details section of this Shareholder Letter.

$72K $74K $68K $76K $73K 3Q21 4Q21 1Q22 2Q22 3Q22 42% 42% 43% 38% 36% 0% 10% 20% 30% 40% 50% 60% 70% $40M $50M $60M $70M $80M $90M $100M 3Q21 4Q21 1Q22 2Q22 3Q22 $30M $32M $30M $42M $36M 15.8% 16.4% 15.2% 18.8% 16.3% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 3Q21 4Q21 1Q22 2Q22 3Q22 $194M $203M $203M $231M $228M 3Q21 4Q21 1Q22 2Q22 3Q22 350 369 382 395 402 3Q21 4Q21 1Q22 2Q22 3Q22 $299M $314M $310M $352M $353M 3Q21 4Q21 1Q22 2Q22 3Q22 1. Digital sales include sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. It does not include sales through kiosks that are located inside Shacks. Digital sales and digital sales mix are key metrics and fiscal 2022 excludes the $1.3m cumulative catch-up of gift card breakage, recognized in Shack sales in 1Q22. 2. Shack-level operating profit and Shack-level operating profit margin are non-GAAP measures. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP is set forth in the financial details section of this Shareholder Letter. Total Revenue Digital Sales1 $ Shack-level Operating Profit2 Average Weekly Sales (AWS) System-wide Shack Count System-wide Sales Q 3 2 0 2 2 H I G H L I G H T S A W S O U T P E R F O R M E D S E A S O N A L I T Y , L E D B Y S T R O N G S E P T E M B E R T R A F F I C G R O W T H I N U R B A N M A R K E T S % label indicates digital mix of sales % label indicates Shack-level operating profit margin2 3

4 TO O U R S H A R E H O L D E R S Our third quarter sales performance was strong. Average weekly sales outperformed historical seasonality and our same-Shack sales were led by urban centers including New York City, Boston, and Washington, D.C. We retained our sales in suburban markets and a large portion of our digital business. Shake Shack has above average exposure to high income consumers relative to traditional fast food, and we continue to see stronger trends from these guests. Our success in menu innovation is seen with higher attach rates for cold beverage and the success of our recent Hot Ones™ LTO. Shack-level operating profit margin was 16.3% in the third quarter, with impacts from inflationary pressures on food and paper, wages, utilities, and more. In mid-October, we raised menu prices from 2% to 10% across price tiers, for a blended 5% to 7% increase. Even with this increase, the average ShackBurger – made with our non-hormone premium beef – fries and drink is below $14, and an attractive value compared to other lunch and dinner options. While our sales have continued to grow, we are not staffed to optimal levels, which is impacting our ability to be open full hours consistently in all channels. It is also weighing on our throughput. Investments in our Team Members and added training and retention initiatives are a key priority, as is streamlining work in the Shacks. As one example, we are bringing digital kiosks, our highest margin channel, to all Shacks by the end of 2023. Delays from permitting and equipment availability have pressured our development schedule and our sales growth in 2022. We expect to open 35 to 40 Company-operated Shacks this year and are planning for about 40 new openings in 2023. We have 35 new Company-operated Shacks under construction today across a variety of formats, including 9 drive-thrus. While recent sales trends have been encouraging, we remain mindful of potential macroeconomic risks and are considering a wide range of potential scenarios when planning our G&A and capex investments over the coming months. We are strategically investing for our long-term growth potential, and are focused on growing sales, Shack-level operating profit margin and Adjusted EBITDA. November 3, 2022 Shake Shack will host a conference call at 8:00 a.m. ET, accessible live over the phone by dialing (877) 407-0792, or for international callers by dialing (201) 689-8263. A replay of the call will be available until November 10, 2022 by dialing (844) 512-2921 or for international callers by dialing (412) 317-6671; the passcode is 13732788. The live audio webcast of the conference call will also be accessible in the Events & Presentations section on the Company's Investor Relations website at investor.shakeshack.com. Nat Diego Fry Bar in San Diego

5 AW S D R I V E N BY T R A F F I C G R O W T H Third quarter AWS1 was $73k with year-over-year growth led by in-Shack traffic. For most of the quarter, results were in-line with historical seasonality, and we faced similar impacts as last quarter around consumer mobility and macro-driven pressures to low-income consumer spending. Later in the quarter, consumer mobility improved – driven by our urban centers – leading September AWS to outperform historical seasonality. October AWS was $73k, outperforming historical seasonality, supported by our mid-month price increase. Many of the factors that drove our performance in September continued into October. $72K $72K $74K $71K $68K $76K $75K $75K $71K $73K Q3 2022 AWS $73K AWS OUTPERFORMED SEASONALITY IN Q3, LED BY URBAN STRENGTH IN SEPTEMBER 103% Total YoY Shack Sales Growth Fiscal October 2022 48% Second Quarter 2021 38% Third Quarter 2021 23% First Quarter 2022 15% Second Quarter 2022 18% Fiscal July 2022 44% Fourth Quarter 20212 31% Full Year 20213 18% Fiscal September 2022 18% Fiscal August 2022 1. Average weekly sales (AWS) is a key metric. First quarter 2022 AWS excludes the $1.3m cumulative catch-up of gift card breakage income. 2. Fourth Quarter 2021 total YoY Shack sales increase excludes the impact of the 53rd fiscal accounting week in 2020 and compares the thirteen weeks from September 30, 2021 through December 29, 2021 to the thirteen weeks from September 24, 2020 through December 23, 2020. 3. Full Year 2021 total YoY Shack sales increase excludes the impact of the 53rd fiscal accounting week in 2020 and compares the fifty-two weeks from December 31, 2020 through December 29, 2021 to the fifty-two weeks from December 26, 2019 through December 23, 2020. Cow Hollow, CA

Same-Shack sales grew 6.3% in the third quarter versus 2021, supported by 2.9% traffic growth and 3.4% price/mix. We maintained mid-single digit price in the quarter. Our performance was led by our in-Shack channel, which skews to more single orders. Additionally, across all channels, more guests are ordering in smaller groups and single orders compared to 2020 and 2021. Adjusting for this dynamic, items per check trends in cold beverage, fries and shakes remained strong. • Our urban SSS grew 11% in the third quarter. Trends for most of the quarter were in-line with expectations. After Labor Day, urban centers posted strong traffic trends compared to recent years. Shacks in urban transit centers performed especially well, generating more than 60% SSS growth in the quarter, an acceleration from the second quarter. • Suburban SSS grew 2% in the third quarter with momentum building throughout the quarter. Sales in our suburban Shacks were more impacted from staffing pressures compared to our urban Shacks. October SSS grew 8.3% versus 2021, with performance led by price and urban market traffic. We raised menu prices between 2% and 10% across price tiers, for a blended 5%-7% in mid-October. URBAN & SUBURBAN SSS1,2 % VERSUS PRIOR YEAR 34% 33% 19% 19% 11% 25% 21% 10% 10% 6% 17% 12% 4% 3% 2% Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 Second Quarter 2022 Third Quarter 2022 Urban SSS% Total SSS % Suburban SSS % S A M E - S H A C K S A L E S ( S S S ) 6 1. Same-Shack sales, or “SSS”, and same-Shack sales growth are key metrics. First quarter 2022 excludes the $1.3m cumulative catch-up adjustment for gift card breakage income, recognized in Shack sales in 1Q22. 2. As a reminder, SSS excludes the impact of closures that are two days or more, but one day closures and the impact of operating with fewer hours are not excluded. REGIONAL SSS1,2 % VERSUS PRIOR YEAR 36% 18% 49% 23% 10% 7% 31% 4% 34% 0% 18% 3% Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 Second Quarter 2022 Third Quarter 2022 NYC (incl. Manhattan) Manhattan Northeast South Midwest West

D E V E L O P M E N T U P D A T E S We opened two Company-operated Shacks in the third quarter and four more already in the fourth quarter-to-date. Permitting, inspection, construction postponements, equipment availability and other items continue to impact new Shacks openings. We still plan to open 35 to 40 Shacks this year, tracking near the low end of the range, and are now targeting to open around 40 Shacks next year. Our pipeline is strong, and we have 35 Shacks under construction today. We anticipate build costs to rise by 10% to 15% this year and are planning for higher build costs in 2023. A portion of this is related to higher inflation in construction expenses, and we are spending more on our initial drive-thrus as we test and learn more about this format. We are focused on improving on our design and construction to optimize sales, throughput, and build costs while streamlining Shack models that look and feel better than ever. Our new drive-thru formats present exciting opportunities to open our addressable market and drive guest frequency. We currently expect about 9 -10 to be in operation by the end of this year, and at least 10 to 15 more in 2023. 7 Rosedale Center, MN Drive-Thru – Coming Soon Baton Rouge, LA Drive-Thru – Coming Soon Walnut Creek, CA – Coming Soon

42% 42% 43% 38% 36% Third Quarter 2021 Fourth Quarter 2021 First Quarter 2022 Second Quarter 2022 Third Quarter 2022 In-Shack Sales $ Digital Sales $ 8 B U L I D I N G G R E AT G U E S T E X P E R I E N C E S W I T H D I G I TA L I N A N D O U T O F T H E S H A C K DIGITAL SALES1 MIX 1. Digital sales includes sales made through the Shake Shack mobile application, Shake Shack website, and delivery partners. It does not include sales through kiosks that are located inside Shacks. Digital sales and digital sales mix are key metrics and in 1Q22 exclude the $1.3m cumulative catch-up of gift card breakage, recognized in Shack sales in 1Q22. % Label indicates digital mix of sales Our Digital Evolution drives higher retention and spend: • Our digital guests spent on average 25% more per visit than non- digital guests in the third quarter, and digital sales mix was 36%.1 • We are focused on leveraging our 4.5m app purchasers with targeted messages, driving strong engagement and enabling us to re-target users based on purchase behavior. • Our digital exclusive offers have driven a boost in app installs and strong participation from our existing digital guests. Key promotions in the quarter included daypart opportunities and the launch of Limited Time Offerings. Bringing Kiosks to nearly all Shacks by end of 2023: • Currently, about half of our Shacks have kiosks and we have committed to retrofitting all Shacks with kiosks by the end of 2023. We expect to make significant progress on our goal in early 2023. • Our kiosk channel is our highest profit margin channel and highest in- Shack check. We find Shacks with kiosks have better labor utilization rates than Shacks without kiosks. Our digital investments today are building integration across our channels so we can better communicate with our guests, however they wish to visit us. Beverly Hills, CA

$111.6M $118.4M $112.8M $128.6M $133.7M Total Licensing Sales L I C E N S E D B U S I N E S S G R O W T H Our third quarter Licensing revenue was $8.3m, growing 20.1% year-over-year. Licensing sales grew 19.8% year-over-year to $133.7m. Our licensing business benefited from strong performance across domestic and select international markets, as well as strong performance from the class of 2022 and 2021. Today we have 177 licensed Shacks globally, including 7 licensed openings in the fourth quarter-to-date. We expect to open 27 to 30 licensed Shacks in 2022, and 25 to 30 more in 2023. In the third quarter, over 80% of our licensing sales were in foreign currencies, which were disadvantaged as the USD appreciated. We have factored in moderate USD appreciation into our fourth quarter licensing guidance. TOTAL LICENSING SALES1 ROSE NEARLY 20% YOY 61% 50% 45%YoY Licensing Sales Growth Third Quarter 2021 Fourth Quarter 20212 First Quarter 2022 1. Total licensed sales is an operating measure and consists of sales from domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. 2. Fourth quarter 2021 total licensing sales YoY growth excludes the favorable $7.0m impact of the 53rd fiscal accounting week in the fourth quarter 2020. 9 28% Second Quarter 2022 20% Third Quarter 2022 Chengdu, China July August September October 8 6 6 8 6New Shack Openings Manila, Philippines November Smithsonian Hazy Center, Chantilly, VA* Molly Pitcher Travel Plaza, Cranbury, NJ* Taikoo Li, Chengdu, China Qibao Vanke, Shanghai, China BNA Intl Airport, Nashville, TN* Jamsil, Seoul, Korea Mitikah, Mexico City, Mexico Junius Ponds Travel Plaza, Phelps, NY* Junction 8, Singapore Mall of Asia, Manila, Philippines Universal Studios, Osaka, Japan MCO Intl Airport, Orlando, FL* IND Intl Airport, Indianapolis, IN*

10 S H A C K - L E V E L O P E R A T I N G P R O F I T Shack-level operating profit1 of $35.8m grew 21.0% year-over-year and represents a 16.3% margin. Third quarter margin included an incremental 100 bps impact from higher utilities, elevated costs to maintain our Shacks and equipment, and the impact of supporting recent openings. Beef prices were a benefit in the quarter, but the remainder of the food items in our basket was up mid-teens percent year-over-year. As a reminder, our second quarter Shack-level operating profit margin of 18.8% included a ~40 bps benefit from leadership retreat sponsorship credits. We plan for continued investments in our teams and expect high single-digit blended food and paper inflation to persist in the fourth quarter and expect inflation to remain into 2023. In mid-October, we raised our menu prices by 2% to 10% across price tiers and channels (blended 5%-7%) to maintain high-single digit pricing. Our new Shacks tend to take several months to reach full operating efficiency. As such, we expect modest ongoing pressure to our Shack-level operating profit margins for the next several quarters as we work through a heavy schedule of new Shack openings. The components of our Shack-level costs (covered in more detail in the following pages) are as follows: • Food and paper costs were 30.9% of Shack sales. • Labor and related expenses were 29.4% of Shack sales. • Other operating expenses were 15.5% of Shack sales. • Occupancy and related expenses were 7.9% of Shack sales. 1. Shack-level operating profit is a non-GAAP measure. A reconciliation to the most directly comparable financial measure presented in accordance with GAAP is set forth in the financial details section of this Shareholder Letter. First quarter 2022 Shack-level operating profit includes the $1.3m gift card breakage income cumulative catch-up. The benefit from the cumulative catch-up resulted in a 0.5% increase to first quarter 2022 Shack-level operating profit margin. Beverly Hills, CA $30M $32M $30M $42M $36M 3Q21 4Q21 1Q22 2Q22 3Q22 Shack-level Operating Profit1 ($) 15.8% 16.4% 15.2% 18.8% 16.3% 3Q21 4Q21 1Q22 2Q22 3Q22 Shack-level Operating Margin1 (%) Shack-level Operating Profit grew 21.0% year-over-year

11 S H A C K - L E V E L O P E R A T I N G P R O F I T F O O D & P A P E R C O S T S We expect blended food and paper costs to rise by high single-digits % year-over-year in the fourth quarter and FY2022. While we expect to continue to see deflation in beef in 4Q, we anticipate mid teens inflation in the rest of our basket. This includes our expectation that dairy,1 fries, and fryer oil costs will increase ~25% in the fourth quarter. To combat the persisting elevated cost environment, we implemented a blended 5% - 7% menu price increase in mid-October. This tactical price increase was necessary to maintain profitability. Food and Paper Inflationary Pressures Commodities Basket Range Q3 2022 YoY Inflation Q4 2022 YoY Inflation Outlook* FY2022 YoY Inflation Outlook* Beef ~ 25% to 30% - HSD % - HSD to - MSD % Flat to - LSD % Total Food2 ~ 90% + HSD % + HSD % + HSD % Paper and Packaging ~ 10% + ~20% + LDD % + Mid Teens % Blended Food & Paper 100% + HSD % + HSD % + HSD % Food and paper costs were 30.9% of Shack sales in the third quarter, down 10 bps year-over-year. As a reminder, the second quarter food and paper costs as a % of Shack sales had a ~40 bps benefit from credits related to our leadership retreat. While beef prices were deflationary in the quarter, blended food and paper inflation still rose high single- digits year-over-year, led by dairy, fries & fryer oil, and paper & packaging. We are pleased with higher cold beverage attach rates given more favorable margin versus our average food costs, offsetting some other COGS inflation year-over-year and quarter-over-quarter. 31.0% 31.0% 30.4% 29.6% 30.9% 3Q21 4Q21 1Q22 2Q22 3Q22 COGS as a % of Shack Sales Our basket can change due to product and sales channel mix. Additionally, we do not contract many components of our basket, and those that we do have different contracted periods throughout the year. We are providing our current expectations for our basket; however, the blended weight and the individual components are subject to change for a variety of reasons. 1. Dairy includes butter, cheese, custard, and milk. 2. Total Food includes food and beverage.

Occupancy and related expenses (“Occupancy”) was 7.9% of Shack sales in the third quarter. Occupancy % increased quarter- over-quarter primarily driven by sales deleverage, as third quarter sales were seasonally softer relative to the second quarter. Other operating expenses (“Other opex”) was 15.5% of Shack sales in the third quarter, up 130 bps year-over-year, driven primarily by higher utilities, R&M, and cleaning costs. In addition to these elevated inflationary pressures in other operating expenses, a heavy NSO schedule (expecting to open more than 20 Shacks in the fourth quarter) has the potential to weigh on this expense line in coming quarters. In the fourth quarter, we expect Other opex to be at a similar percentage of Shack sales. Where staffing is challenging, we are incurring additional T&E expense as we are leveraging managers from other locations to support recent Shack openings. 7.8% 8.1% 8.3% 7.5% 7.9% 3Q21 4Q21 1Q22 2Q22 3Q22 14.2% 14.9% 15.4% 14.6% 15.5% 3Q21 4Q21 1Q22 2Q22 3Q22 S H A C K - L E V E L O P E R A T I N G P R O F I T L A B O R , O T H E R O P E X & O C C U P A N C Y 31.1% 29.6% 30.7% 29.5% 29.4% 3Q21 4Q21 1Q22 2Q22 3Q22 Labor as a % of Shack SalesLabor and related expenses (“Labor”) was 29.4% of Shack sales in the third quarter, down 170 bps year-over-year. We proudly invest in our team members and have raised average starting wages by more than 20% since 2019, and expect to make continued investments in our team members in 2023. We now offer tips to our team members across all channels at nearly all Company-operated Shacks. However, the staffing environment remains challenging with high hourly turnover. This dynamic has negatively impacted overall staffing levels, efficiency, and in some cases, channels and hours of operation. Occupancy as a % of Shack Sales Other Opex as a % of Shack Sales 12 Birmingham, AL

$21M $26M $25M $28M $27M 3Q21 4Q21 1Q22* 2Q22* 3Q22 G&A Expenses Third quarter General and Administrative (“G&A”) expenses were $26.6m. G&A increased year-over-year primarily to support our teams and the 35-40 expected Shack openings this year. We have taken a more moderate approach to our G&A investments in the second half of 2022. Depreciation and amortization expense and Pre- opening costs are reflective of inflationary pressures and our development schedule. We are experiencing longer lead times to open restaurants, which is impacting pre-opening expense. $15M $16M $17M $18M $19M 3Q21 4Q21 1Q22 2Q22 3Q22 Depreciation and Amortization Expense $3M $5M $3M $3M $3M 3Q21 4Q21 1Q22 2Q22 3Q22 Pre-opening Costs A D D I T I O N A L E X P E N S E S & A D J U S T E D E B I T D A 1 1. Adjusted EBITDA is a non-GAAP measure. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. Adjusted EBITDA grew 23.5% year-over-year to $19.5m, or 8.6% of Total revenue. EBITDA adjustments for Q3 2022 totaled $4.2m, consisting of (i) equity-based compensation of $3.5m, (ii) impairments & disposals of $0.6m, (iii) amortization of software implementation costs of $0.4m, and (iv) deferred lease costs of ($0.3m). $16M $12M $10M $22M $20M 3Q21 4Q21 1Q22 2Q22 3Q22 Adjusted EBITDA 13 * We incurred $6.75m legal expense in 1H22, which we exclude from our FY22 guidance range of $111m-$113m. $29M$31M excl. legal expense excl. legal expense

Fiscal fourth quarter and fiscal year 2022 and fiscal year 2023 guidance is derived from preliminary, unaudited results, based on information currently available to the Company. While the Company believes these estimates are meaningful, they could differ from the actual results that the Company ultimately reports in its Annual Report on Form 10-K for the fiscal year ended December 28, 2022. F I N A N C I A L O U T L O O K 1. Excludes a $6.0m legal expense in the first quarter and a $750k legal expense in the second quarter. Including the legal expense, our guidance is $117.8m-$119.8m. 2. Guidance includes approximately $12m of the approximately $13m total Equity-based compensation. These forward-looking projections are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from these projections. Factors that may cause such differences include those discussed in the Company's Form 10-K for the fiscal year ended December 29, 2021, and our Cautionary Note On Forward-Looking Statements herein. These forward-looking projections should be reviewed in conjunction with the condensed consolidated financial statements and the section titled “Cautionary Note Regarding Forward-Looking Statements” which form the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. 14 Total revenue Shack sales Licensing revenue Same-Shack sales versus 2021 Shack-level operating profit margin Domestic Company-operated openings Licensed openings General and administrative expenses Equity-based compensation Depreciation and amortization expense Pre-opening costs Adjusted Pro Forma Tax Rate Domestic Company-operated openings Licensed openings $233.2m-$238.7m $225.0m-$230.0m $8.2m-$8.7m Mid single-digits % 16.0%-18.0% 35-40 27-30 $111m to $113m1,2 Approximately $13m $70m to $75m $15m to $17.5m 30%-32% Approximately 40 25-30 Q4 2022 Guidance FY 2022 Guidance FY 2023 Guidance

We have been busy in our Innovation Kitchen cooking up exciting culinary treats for our guests. We are always innovating our menu offerings to improve the guest experience. We continue to test a new non-dairy chocolate shake and will be testing a new version of our Veggie Shack burger at about 30 Shacks towards the end of this year. We are uplifting our culinary program with Limited Time Offerings (LTOs) and buzz-worthy collaborations that drive engagement with new and existing guests. Recent LTOs featured: • Hot Ones™ Collaboration: Spicy Bacon Burger, Spicy Bacon Chicken, and Spicy Bacon Cheese Fries. • Fall Shakes: Apple Cider Donut, Pumpkin Patch, and Choco Salted Toffee. • Fall/Winter Lemonade Trio: Yuzu Orange Cider, Harvest Berry Lemonade, and Concord Grape Punch. • Current Holiday Shakes: Christmas Cookie, Chocolate Milk & Cookies, and Chocolate Peppermint Shake. We collaborated with partners at local events and select Shacks to develop exclusive experiences: • Shack Jams: Partnered with Sofar Sounds, turning five Shacks into a concert venue hosting 400+ guests. • Burgers + Brews: Partnered with Wynwood Brewing to offer a pairing menu featuring Wynwood brews. • Ping Pong 4 Purpose: Partnered with our Dodger’s Stadium Shack for a celebrity charity event. • Yappy Hour: Celebrated International Dog Day with a “Pooch-inis” picnic at Madison Square Park. C L O S I N G S U M M E R W I T H A H O T F I N I S H O U R G U E S T E X P E R I E N C E R U L E S ! 15

16 GUEST QU TES “These were quite possibility the most delicious sandwiches I’ve ever eaten. I go to bed thinking about this experience…” via Instagram “oh wow @shakeshack just destroyed the competition with their Hot Ones menu! 🔥🔥” via Twitter “The @shakeshack Hot Ones chicken sandwich is the Fast Food Item Of The Year, and I don't think it's even close. Rich. Hot. Decadent. Perfectly spicy.” via Twitter “The hot ones collaboration was amazing! First time to Shake Shack and I’ll 100% be coming back.” via Twitter “The hot ones chicken sandwich needs to be a permanent menu option” via Twitter “omg yesss huge fan of Shake Shack and hot ones, this is the best collab ever, you guys are awesome🔥🔥 ” via Instagram TM

Financial Details

C A U T I O N A RY N O T E O N F O R WA R D - L O O K I N G S TAT E M E N T S 18 This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, the Company's strategic initiatives, expected financial results and operating performance for fiscal 2022, expected development targets, including expected Shack construction and openings, expected same-Shack sales growth, average weekly sales and trends in the Company’s operations, the expansion of the Company’s delivery services and store format evolution and expansion, the Company’s digital investments and strategies, 2022 guidance, and statements relating to the impact of COVID- 19. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial position, results of operations, plans, objectives, future performance and business. You can identify forward- looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "intend," "outlook," "potential," "preliminary," "project," "projection," "plan," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s expectations include the continuing impact of the COVID-19 pandemic, including the potential impact of any COVID-19 variants, the Company's ability to develop and open new Shacks on a timely basis, increased costs or shortages or interruptions in the supply and delivery of the Company's products, increased labor costs or shortages, inflationary pressures, the Company's management of its digital capabilities and expansion into new channels including drive-thru, the Company's ability to maintain and grow sales at its existing Shacks, and risks relating to the restaurant industry generally. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2021 as filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward- looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

D E F I N I T I O N S 19 The following definitions, and definitions on the subsequent pages, apply to terms as used in this shareholder letter: "Shack sales" is defined as the aggregate sales of food, beverages, gift card breakage income, and Shake Shack branded merchandise at domestic Company-operated Shacks and excludes sales from licensed Shacks. “System-wide sales” is an operating measure and consists of sales from the Company's domestic Company- operated Shacks, domestic licensed Shacks and international licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from domestic and international licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of domestic Company-operated Shacks open for 24 full fiscal months or longer. For consecutive days that Shacks were temporarily closed, the comparative period was also adjusted. "Average weekly sales" or “AWS” is calculated by dividing total Shack sales by the number of operating weeks for all Shacks in operation during the period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of operating weeks open such that it corresponds to the period of associated sales. “Adjusted pro forma net income," a non-GAAP measure, represents Net income (loss) attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring and other items that the Company does not believe directly reflect its core operations and may not be indicative of the Company’s recurring business operations. “EBITDA,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit), and Depreciation and amortization expense. “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA (as defined above), excluding equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud- based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense, which also excludes equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations, as a percentage of Total revenue.

D E F I N I T I O N S ( C O N T . ) 20 “Shack-level operating profit,” a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses. "Shack-level operating profit margin," a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales.

D E V E L O P M E N T H I G H L I G H T S 21 Development Highlights During the third quarter of 2022, we opened two new domestic Company-operated Shacks, three new domestic licensed Shack and three new international licensed Shacks. There was one permanent international licensed Shack closure in the third quarter of 2022. Location Type Opening Date Chantilly, VA — Smithsonian - National Air & Space Museum Domestic Licensed 7/3/2022 New York, NY — Meatpacking District Domestic Company-operated 7/14/2022 Cranbury, NJ — Molly Pitcher Travel Plaza Domestic Licensed 7/25/2022 Chengdu, China — Sino-Ocean Taikoo Li International Licensed 7/31/2022 Atlanta, GA — Lenox Square Domestic Company-operated 8/3/2022 Shanghai, China — Qibao Vanke International Licensed 8/20/2022 Nashville, TN — Nashville International Airport Domestic Licensed 8/28/2022 Seoul, South Korea — Jamsil International Licensed 9/23/2022 September 28, 2022 September 29, 2021 Shacks in the comparable base 171 143 Shack counts (at end of period): System-wide total 402 350 Domestic Company-operated 232 205 Licensed total 170 145 Domestic Licensed 30 24 International Licensed 140 121 Thirteen Weeks Ended

B A L A N C E S H E E T S ( U N A U D I T E D ) 22 September 28, December 29, 2022 2021 ASSETS Current assets: Cash and cash equivalents 256,998$ 302,406$ Marketable securities 80,015 80,000 Accounts receivable, net 11,800 13,657 Inventories 3,996 3,850 Prepaid expenses and other current assets 14,246 9,763 Total current assets 367,055 409,676 Property and equipment, net of accumulated depreciation of $271,938 and $222,768 respectively 441,870 389,386 Operating lease assets 370,536 347,277 Deferred income taxes, net 306,976 298,668 Other assets 15,330 12,563 TOTAL ASSETS 1,501,767$ 1,457,570$ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable 17,210$ 19,947$ Accrued expenses 49,387 36,892 Accrued wages and related liabilities 17,758 14,638 Operating lease liabilities, current 40,690 35,519 Other current liabilities 19,497 14,501 Total current liabilities 144,542 121,497 Long-term debt 244,328 243,542 Long-term operating lease liabilities 429,165 400,113 Liabilities under tax receivable agreement, net of current portion 234,892 234,045 Other long-term liabilities 20,588 22,773 Total liabilities 1,073,515 1,021,970 Commitments and contingencies Stockholders' equity: Preferred stock, no par value—10,000,000 shares authorized; none issued and outstanding as of September 28, 2022 and December 29, 2021. - - Class A common stock, $0.001 par value—200,000,000 shares authorized; 39,279,699 and 39,142,397 shares issued and outstanding as of September 28, 2022 and December 29, 2021, respectively. 39 39 Class B common stock, $0.001 par value—35,000,000 shares authorized; 2,869,513 and 2,921,587 shares issued and outstanding as of September 28, 2022 and December 29, 2021, respectively. 3 3 Additional paid-in capital 413,274 405,940 Retained earnings (accumulated deficit) (9,820) 3,554 Accumulated other comprehensive income (loss) (1) 1 Total stockholders' equity attributable to Shake Shack, Inc. 403,495 409,537 Non-controlling interests 24,757 26,063 Total equity 428,252 435,600 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1,501,767$ 1,457,570$ (in thousands, except per share amounts)

I N C O M E S T A T E M E N T S ( U N A U D I T E D ) 23 Shack sales 219,501$ 96.4% 186,972$ 96.4% 639,346$ 96.6% 519,110$ 96.7% Licensing revenue 8,313 3.6% 6,923 3.6% 22,611 3.4% 17,527 3.3% TOTAL REVENUE 227,814$ 100.0% 193,895$ 100.0% 661,957$ 100.0% 536,637$ 100.0% Shack-level operating expenses(1): Food and paper costs 67,774 30.9% 57,925 31.0% 193,645 30.3% 157,472 30.3% Labor and related expenses 64,638 29.4% 58,208 31.1% 190,954 29.9% 157,221 30.3% Other operating expenses 33,966 15.5% 26,613 14.2% 96,766 15.1% 74,032 14.3% Occupancy and related expenses 17,337 7.9% 14,640 7.8% 50,270 7.9% 43,427 8.4% General and administrative expenses 26,645 11.7% 20,504 10.6% 87,040 13.1% 60,435 11.3% Depreciation and amortization expense 18,647 8.2% 15,183 7.8% 53,589 8.1% 43,381 8.1% Pre-opening costs 3,041 1.3% 2,933 1.5% 8,576 1.3% 8,767 1.6% Impairment and loss on disposal of assets 592 0.3% 535 0.3% 1,697 0.3% 1,262 0.2% TOTAL EXPENSES 232,640$ 102.1% 196,541$ 101.4% 682,537$ 103.1% 545,997$ 101.7% LOSS FROM OPERATIONS (4,826) (2.1)% (2,646) (1.4)% (20,580) (3.1)% (9,360) (1.7)% Other income, net 1,482 0.7% 18 – % 1,731 0.3% 157 – % Interest expense (475) (0.2)% (350) (0.2)% (1,145) (0.2)% (1,224) (0.2)% LOSS BEFORE INCOME TAXES (3,819)$ (1.7)% (2,978)$ (1.5)% (19,994)$ (3.0)% (10,427)$ (1.9)% Benefit from income taxes (1,508) (0.7)% (576) (0.3)% (5,098) (0.8)% (10,665) (2.0)% NET INCOME (LOSS) (2,311)$ (1.0)% (2,402)$ (1.2)% (14,896)$ (2.3)% 238$ – % Less: Net loss attributable to non-controlling interests (287) (0.1)% (224) (0.1)% (1,522) (0.2)% (837) (0.2)% NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. (2,024)$ (0.9)% (2,178)$ (1.1)% (13,374)$ (2.0)% 1,075$ 0.2% Earnings (loss) per share of Class A common stock: Basic $ (0.05) $ (0.06) $ (0.34) $ 0.03 Diluted $ (0.05) $ (0.06) $ (0.34) $ 0.01 Weighted-average shares of Class A common stock outstanding: Basic 39,274 39,137 39,221 39,066 Diluted 39,274 39,137 39,221 43,448 _______________ (1) As a percentage of Shack sales. Thirteen Weeks Ended Thirty-Nine Weeks Ended (in thousands, except per share amounts) September 28, 2022 September 29, 2021 September 28, 2022 September 29, 2021

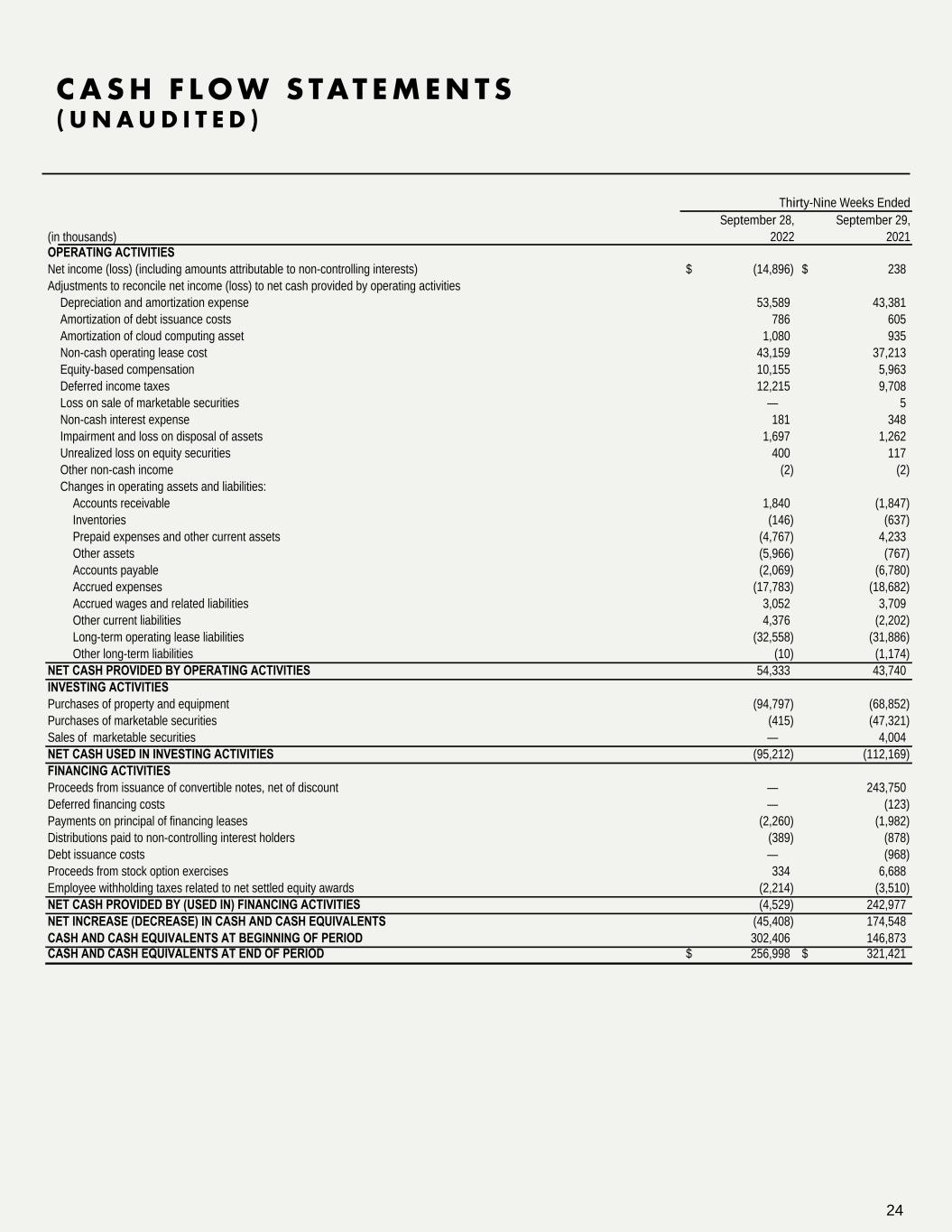

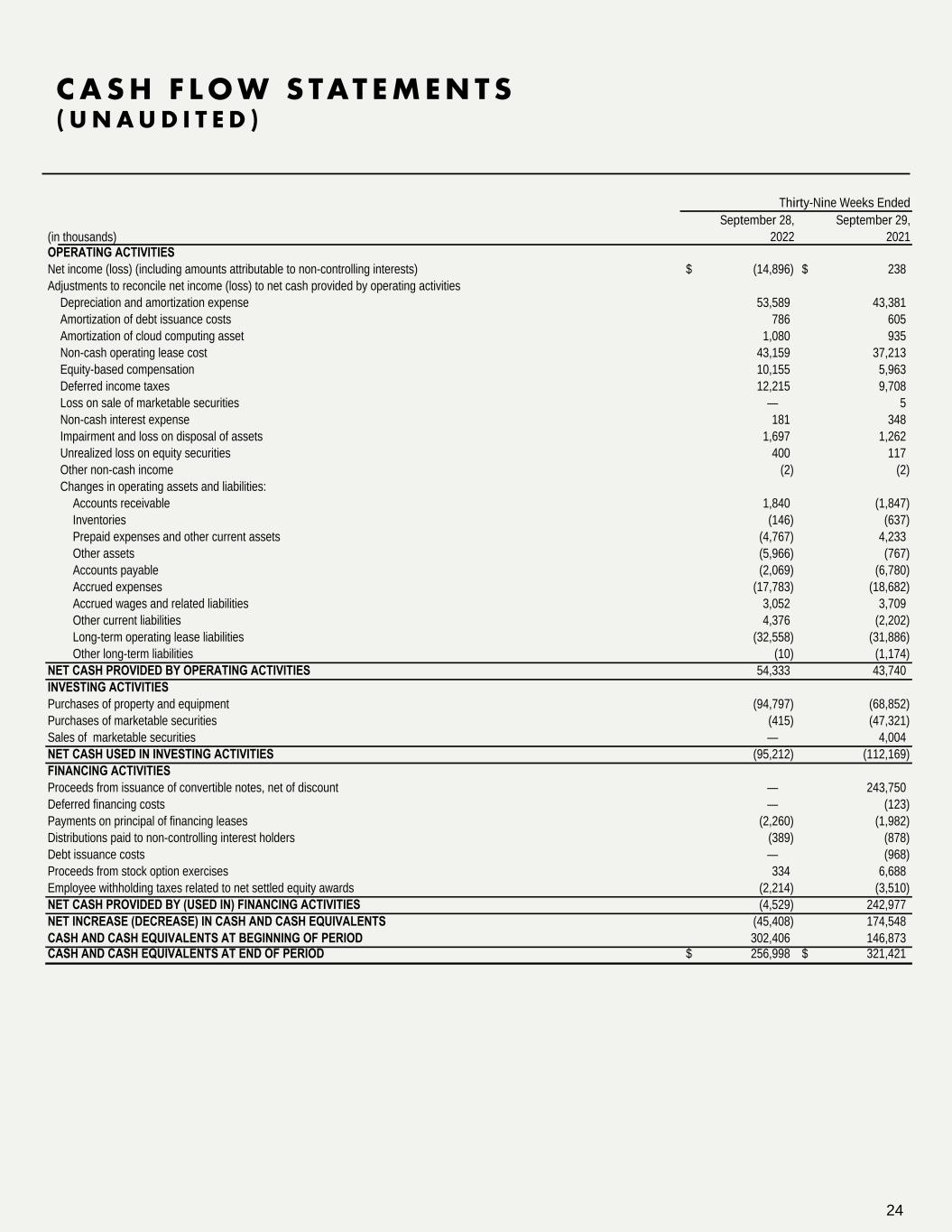

C A S H F L O W S TAT E M E N T S ( U N A U D I T E D ) 24 September 28, September 29, (in thousands) 2022 2021 OPERATING ACTIVITIES Net income (loss) (including amounts attributable to non-controlling interests) (14,896)$ 238$ Adjustments to reconcile net income (loss) to net cash provided by operating activities Depreciation and amortization expense 53,589 43,381 Amortization of debt issuance costs 786 605 Amortization of cloud computing asset 1,080 935 Non-cash operating lease cost 43,159 37,213 Equity-based compensation 10,155 5,963 Deferred income taxes 12,215 9,708 Loss on sale of marketable securities — 5 Non-cash interest expense 181 348 Impairment and loss on disposal of assets 1,697 1,262 Unrealized loss on equity securities 400 117 Other non-cash income (2) (2) Changes in operating assets and liabilities: Accounts receivable 1,840 (1,847) Inventories (146) (637) Prepaid expenses and other current assets (4,767) 4,233 Other assets (5,966) (767) Accounts payable (2,069) (6,780) Accrued expenses (17,783) (18,682) Accrued wages and related liabilities 3,052 3,709 Other current liabilities 4,376 (2,202) Long-term operating lease liabilities (32,558) (31,886) Other long-term liabilities (10) (1,174) NET CASH PROVIDED BY OPERATING ACTIVITIES 54,333 43,740 INVESTING ACTIVITIES Purchases of property and equipment (94,797) (68,852) Purchases of marketable securities (415) (47,321) Sales of marketable securities — 4,004 NET CASH USED IN INVESTING ACTIVITIES (95,212) (112,169) FINANCING ACTIVITIES Proceeds from issuance of convertible notes, net of discount — 243,750 Deferred financing costs — (123) Payments on principal of financing leases (2,260) (1,982) Distributions paid to non-controlling interest holders (389) (878) Debt issuance costs — (968) Proceeds from stock option exercises 334 6,688 Employee withholding taxes related to net settled equity awards (2,214) (3,510) NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES (4,529) 242,977 NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (45,408) 174,548 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 302,406 146,873 CASH AND CASH EQUIVALENTS AT END OF PERIOD 256,998$ 321,421$ Thirty-Nine Weeks Ended

S H A C K - L E V E L O P E R AT I N G P R O F I T D E F I N I T I O N S 25 Shack-Level Operating Profit Shack-level operating profit, a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses. Shack-level Operating Profit Margin Shack-level operating profit margin, a non-GAAP measure, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales. How This Measure Is Useful When used in conjunction with GAAP financial measures, Shack-level operating profit and Shack-level operating profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Shack-level operating profit and Shack-level operating profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance- based employee bonus arrangements. The Company believes presentation of Shack-level operating profit and Shack-level operating profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision- making. Limitations of the Usefulness of this Measure Shack-level operating profit and Shack-level operating profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Shack-level operating profit and Shack-level operating profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Shack-level operating profit excludes certain costs, such as General and administrative expenses and Pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Shack-level operating profit and Shack-level operating profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Shack- level operating profit to operating income (loss), the most directly comparable GAAP financial measure, is set forth on next slide.

S H A C K - L E V E L O P E R AT I N G P R O F I T 26 (dollar amounts in thousands) September 28, 2022 September 29, 2021 September 28, 2022 September 29, 2021 Loss from operations (4,826)$ (2,646)$ (20,580)$ (9,360)$ Less: Licensing revenue 8,313 6,923 22,611 17,527 Add: General and administrative expenses 26,645 20,504 87,040 60,435 Depreciation and amortization expense 18,647 15,183 53,589 43,381 Pre-opening costs 3,041 2,933 8,576 8,767 Impairment and loss on disposal of assets 592 535 1,697 1,262 Shack-level operating profit 35,786$ 29,586$ 107,711$ 86,958$ Total revenue 227,814 193,895 661,957 536,637 Less: Licensing revenue 8,313 6,923 22,611 17,527 Shack sales 219,501$ 186,972$ 639,346$ 519,110$ Shack-level operating profit margin(1,2) 16.3% 15.8% 16.8% 16.8% _______________ (1) (2) For the thirty-nine weeks ended September 28, 2022, Shack-level operating profit margin includes the $1,281 cumulative catch-up adjustment for gift card breakage income, recognized in Shack sales. Thirteen Weeks Ended Thirty-Nine Weeks Ended As a percentage of Shack sales.

EBITDA and Adjusted EBITDA EBITDA, a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense. Adjusted EBITDA, a non-GAAP measure, is defined as EBITDA (as defined above) excluding equity-based compensation expense, deferred lease cost, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. Adjusted EBITDA Margin Adjusted EBITDA margin, a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense, which also excludes equity-based compensation expense, deferred lease costs, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations, as a percentage of Total revenue. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to Net income (loss), the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D E B I T D A D E F I N I T I O N S 27

A DJ U S T E D E B I T D A 28 (dollar amounts in thousands) September 28, 2022 September 29, 2021 September 28, 2022 September 29, 2021 Net income (loss) (2,311)$ (2,402)$ (14,896)$ 238$ Depreciation and amortization expense 18,647 15,183 53,589 43,381 Interest expense, net 475 350 1,145 1,224 Benefit from income taxes (1,508) (576) (5,098) (10,665) EBITDA 15,303 12,555 34,740 34,178 Equity-based compensation 3,515 2,324 10,155 5,963 Amortization of cloud-based software implementation costs 397 308 1,080 935 Deferred lease costs(1) (258) 108 (1,908) 237 Impairment and loss on disposal of assets 592 535 1,697 1,262 Legal matters - - 6,750 619 Gift card breakage cumulative catch-up adjustment - - (1,281) - Debt offering related costs(2) - - - 236 Executive transition costs - - - 179 Adjusted EBITDA 19,549$ 15,830$ 51,233$ 43,609$ Adjusted EBITDA margin(3) 8.6% 8.2% 7.7% 8.1% _______________ (1) (2) (3) Calculated as a percentage of Total revenue, which was $227.8 million and $662.0 million for the thirteen and thirty-nine weeks ended September 28, 2022, respectively, and $193.9 million and $536.6 million for the thirteen and thirty- nine weeks ended September 29, 2021, respectively. Thirteen Weeks Ended Thirty-Nine Weeks Ended Reflects the extent to which lease expense is greater than or less than contractual fixed base rent. Costs incurred in connection with the Company’s Convertible Notes, issued in March 2021, including consulting and advisory fees.

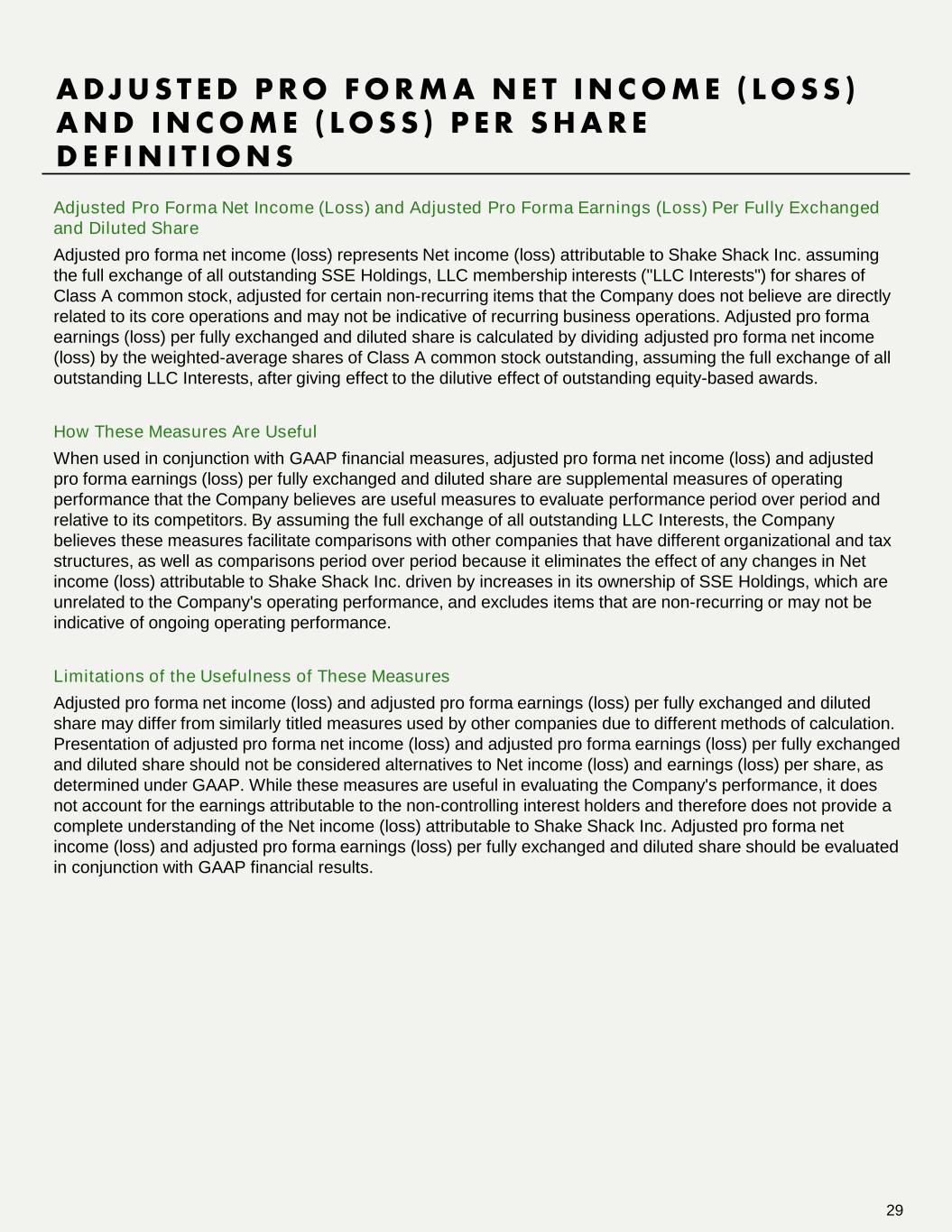

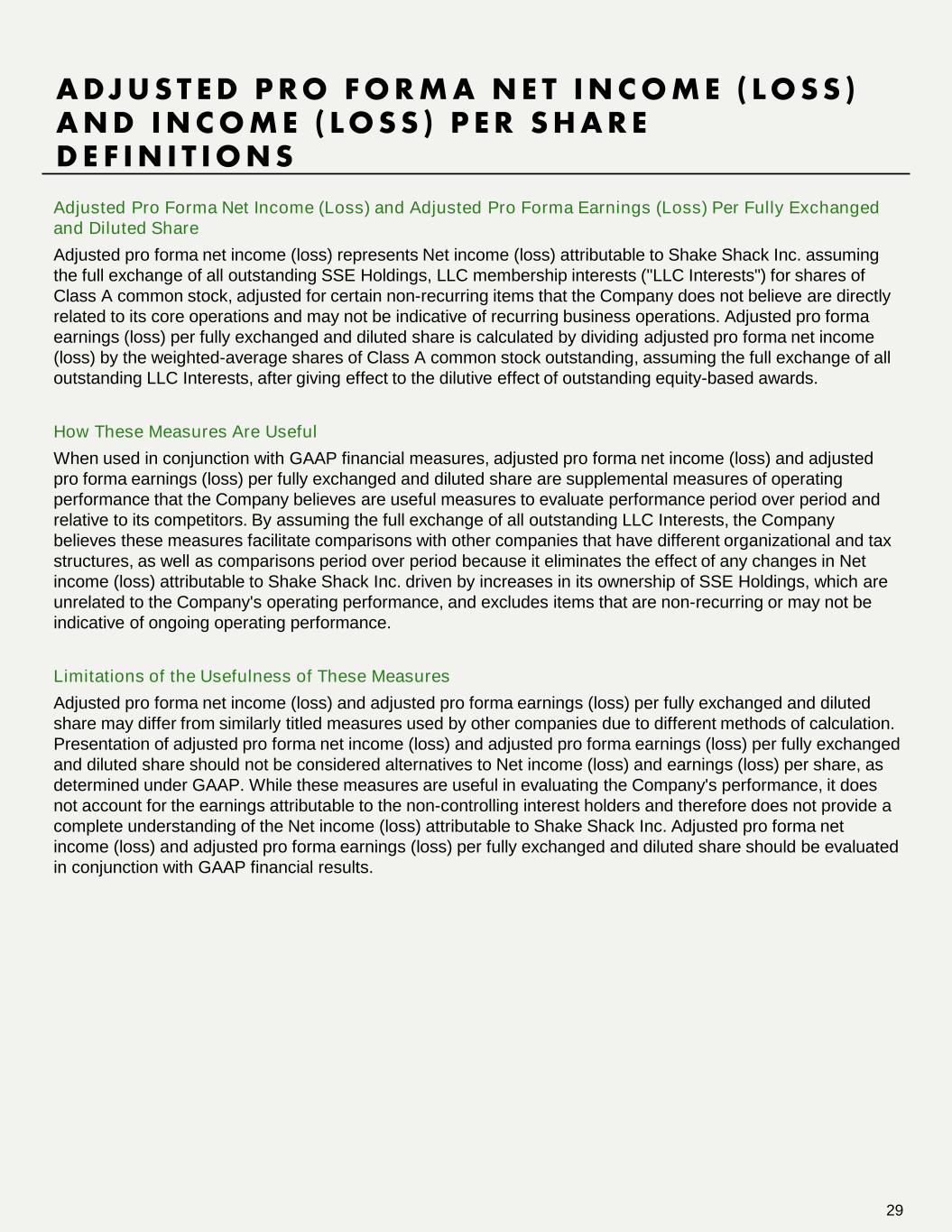

Adjusted Pro Forma Net Income (Loss) and Adjusted Pro Forma Earnings (Loss) Per Fully Exchanged and Diluted Share Adjusted pro forma net income (loss) represents Net income (loss) attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of recurring business operations. Adjusted pro forma earnings (loss) per fully exchanged and diluted share is calculated by dividing adjusted pro forma net income (loss) by the weighted-average shares of Class A common stock outstanding, assuming the full exchange of all outstanding LLC Interests, after giving effect to the dilutive effect of outstanding equity-based awards. How These Measures Are Useful When used in conjunction with GAAP financial measures, adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share are supplemental measures of operating performance that the Company believes are useful measures to evaluate performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes these measures facilitate comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in Net income (loss) attributable to Shake Shack Inc. driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of These Measures Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should not be considered alternatives to Net income (loss) and earnings (loss) per share, as determined under GAAP. While these measures are useful in evaluating the Company's performance, it does not account for the earnings attributable to the non-controlling interest holders and therefore does not provide a complete understanding of the Net income (loss) attributable to Shake Shack Inc. Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should be evaluated in conjunction with GAAP financial results. A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E D E F I N I T I O N S 29

A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E 30 (in thousands, except per share amounts) September 28, 2022 September 29, 2021 September 28, 2022 September 29, 2021 Numerator: Net income (loss) attributable to Shake Shack Inc. (2,024)$ (2,178)$ (13,374)$ 1,075$ Adjustments: Reallocation of Net loss attributable to non-controlling interests from the assumed exchange of LLC Interests(1) (287) (224) (1,522) (837) Legal matters - - 6,750 619 Gift card breakage cumulative catch-up adjustment - - (1,281) - Debt offering related costs(2) - - - 236 Executive transition costs - - - 179 Revolving Credit Facility amendments related costs(3) - - - 323 Impact to income tax expense (benefit)(4) (11) 392 (922) 528 Adjusted pro forma net income (loss) (2,322)$ (2,010)$ (10,349)$ 2,123$ Denominator: Weighted-average shares of Class A common stock outstanding—diluted 39,274 39,137 39,221 43,448 Adjustments: Assumed exchange of LLC Interests for shares of Class A common stock(1) 2,871 2,922 2,899 - 42,145 42,059 42,120 43,448 Adjusted proforma earnings (loss) per fully exchanged share—diluted (0.06)$ (0.05)$ (0.25)$ 0.05$ September 28, 2022 September 29, 2021 September 28, 2022 September 29, 2021 Earnings (loss) per share of Class A common stock—diluted (0.05)$ (0.06)$ (0.34)$ 0.01$ Assumed exchange of LLC Interests for shares of Class A common stock(1) - - (0.01) - Non-GAAP adjustments(5) (0.01) 0.01 0.10 0.04 Adjusted pro forma earnings (loss) per fully exchanged share—diluted (0.06)$ (0.05)$ (0.25)$ 0.05$ _______________ (1) (2) Costs incurred in connection with the Company’s Convertible Notes, issued in March 2021, including consulting and advisory fees. (3) (4) (5) Represents the per share impact of non-GAAP adjustments for each period. Refer to the reconciliation of Adjusted Pro Forma Net Income (Loss) above, for additional information. Thirteen Weeks Ended Thirty-Nine Weeks Ended Represents the tax effect of the aforementioned adjustments and pro forma adjustments to reflect corporate income taxes at assumed effective tax rates of 39.2% and 28.8% for the thirteen and thirty-nine weeks ended September 28, 2022, respectively, and 32.5% and 123.4% for the thirteen and thirty-nine weeks ended September 29, 2021, respectively. Amounts include provisions for U.S. federal income taxes, certain LLC entity-level taxes and foreign withholding taxes, assuming the highest statutory rates apportioned to each applicable state, local and foreign jurisdiction. Adjusted pro forma fully exchanged weighted-average shares of Class A common stock outstanding—diluted Assumes the exchange of all outstanding LLC Interests for shares of Class A common stock, resulting in the elimination of the non-controlling interest and recognition of the net income (loss) attributable to non-controlling interests. Thirteen Weeks Ended Thirty-Nine Weeks Ended Expense incurred in connection with the Company's amendments on the Revolving Credit Facility, including the write-off of previously capitalized costs on the Revolving Credit Facility.

Adjusted Pro Forma Effective Tax Rate Adjusted pro forma effective tax rate represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. How This Measure Is Useful When used in conjunction with GAAP financial measures, adjusted pro forma effective tax rate is a supplemental measure of operating performance that the Company believes is useful to evaluate its performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes this measure facilitates comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in effective tax rate driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of this Measure Adjusted pro forma effective tax rate may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma effective tax rate should not be considered an alternative to effective tax rate, as determined under GAAP. While this measure is useful in evaluating the Company's performance, it does not account for the effective tax rate attributable to the non-controlling interest holders and therefore does not provide a complete understanding of effective tax rate. Adjusted pro forma effective tax rate should be evaluated in conjunction with GAAP financial results. A reconciliation of adjusted pro forma effective tax rate, the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E D E F I N I T I O N S 31

2 0 2 2 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E 32 2 0 2 1 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate Income Tax Expense Income Before Income Taxes Effective Tax Rate As reported (576)$ (2,978)$ 19.3% (10,665)$ (10,427)$ 102.3% Non-GAAP adjustments (before tax): Debt offering related costs - - - 236 Revolving Credit Facility amendment-related costs - - - 323 Legal settlement - - - 619 Executive transition costs - - - 179 Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests (392) - (528) - Adjusted pro forma (968)$ (2,978)$ 32.5% (11,193)$ (9,070)$ 123.4% Less: Windfall tax benefits from stock-based compensation 54 8,526 Adjusted pro forma (excluding windfall tax benefits) (914)$ (2,978)$ 30.7% (2,667)$ (9,070)$ 29.4% September 29, 2021 Thirty-Nine Weeks EndedThirteen Weeks Ended September 29, 2021 (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate Income Tax Expense (Benefit) Income Before Income Taxes Effective Tax Rate As reported (1,508)$ (3,819)$ 39.5% (5,098)$ (19,994)$ 25.5% Non-GAAP adjustments (before tax): Debt offering related costs - - - - Revolving Credit Facility amendment-related costs - - - - Legal settlement - - - 6,750 Gift Card Adjustment - - - (1,281) Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 11 922 - Adjusted pro forma (1,497)$ (3,819)$ 39.2% (4,176)$ (14,525)$ 28.8% Less: Net tax impact from stock-based compensation (30) (453) - Adjusted pro forma (excluding windfall tax benefits) (1,527)$ (3,819)$ 40.0% (4,629)$ (14,525)$ 31.9% September 28, 2022 September 28, 2022 Thirteen Weeks Ended Thirty-Nine Weeks Ended

INVESTOR CONTACT Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com MEDIA CONTACT Kristyn Clark, Shake Shack kclark@shakeshack.com CONTACT INFORMATION