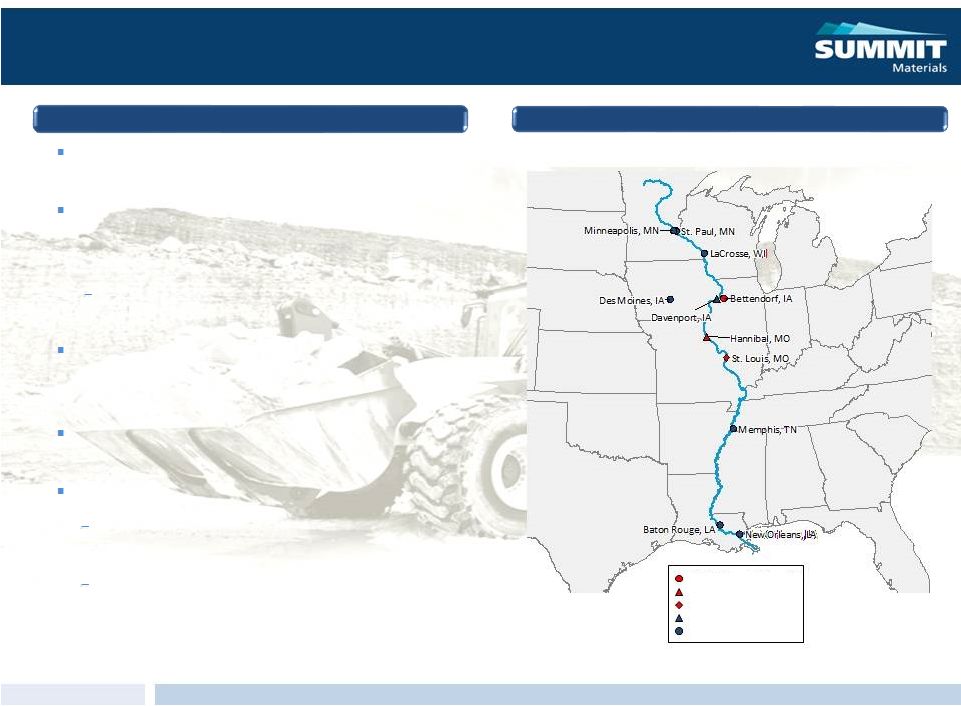

Transaction Overview Summit Materials, LLC ("Summit", the "Company“ or the "Borrower") is a leading, vertically-integrated, geographically diverse construction materials company supplying aggregates, cement, ready-mixed concrete, asphalt and related paving and construction services for a variety of end-uses in the U.S. construction industry and western Canada Summit plans to complete, through its subsidiary Continental Cement Company, L.L.C. ("Continental Cement" or "CCC"), the acquisition of Lafarge North America Inc.’s Davenport, Iowa cement plant and seven cement distribution terminals ("Davenport Assets") for $450 million plus CCC’s Bettendorf, Iowa cement distribution terminal (the "Transaction") LTM March 2015, the Davenport Assets’ Pro Forma Revenue and Pro Forma Adjusted EBITDA was $146 and $56 1 million, respectively Transaction is expected to close in July 2015 and is contingent on final regulatory approval and the Lafarge-Holcim merger closing $370 million paid at closing; $80 million to be paid no later than 12/31/15 Summit intends to finance the initial $370 million, refinance its existing Term Loan B due 2019 and refinance a portion of its existing Senior Unsecured Notes due 2020 with a new $650 million Term Loan B ("TLB") due 2022 and new $275 million Senior Unsecured Notes (“New Notes”) Summit intends to satisfy $80 million via an equity raise In LTM Q1 2015, Summit’s Pro Forma Net Revenue and Pro Forma Adjusted EBITDA was $1,315 and $268 million, respectively 2 Pro Forma for the completion of the Davenport Assets transaction, Secured Net Leverage of 2.5x and Net Leverage of 4.6x (1) Includes approximately $2 million of run-rate synergies (low end of $2-$4 million of estimated synergies range). See “Davenport Assets EBITDA Bridge” on slide 39 for more information. (2) Pro forma for all Summit completed acquisitions as of 3/28/15 and for the purchase of the Davenport Assets. See “Davenport Assets EBITDA Bridge” and “Summit EBITDA Bridge” on slides 39 and 38, respectively, for more information. Summit LTM Q1 2015 Pro Forma Net Revenue calculated by subtracting Summit’s net revenue for Q1 2014 from Summit’s net revenue for fiscal 2014 and adding Summit’s net revenue for the Q1 2015 and estimated net revenue for the Davenport Assets for LTM Q1 2015. Exhibit 99.1 |