Exhibit 99.2

May 9, 2017 NASDAQ: AQMS 2017 Q1 Earnings Call

Safe Harbor NASDAQ: AQMS This document contains forward - looking statements concerning Aqua Metals, Inc., the lead - acid battery recycling industry, the intended benefits of its agreements with Johnson Controls and Interstate Batteries, the future of lead - acid battery recycling via traditional smelters, the Company’s development of its commercial lead - acid battery recycling facilities and the quality, efficiency and profitability of Aqua Metals’ proposed lead - acid battery recycling operations. Those forward - looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially. Among those factors are: (1) the fact that Company has not yet ramped up its initial commercial recycling facility, to full scale operation thus subjecting the Company to all of the risks inherent in a start - up; (2) the uncertainties involved in any new commercial relationship and the risk that Aqua Metals will not receive the intended benefits of its agreements with Johnson Controls or Interstate Batteries; (3) risks related to Aqua Metals’ ability to raise sufficient capital, as and when needed; to expand its recycling facilities; (4) changes in the federal, state and foreign laws regulating the recycling of lead - acid batteries; (5) the Company’s ability to protect its proprietary technology, trade secrets and know - how and (6) those other risks disclosed in the section “Risk Factors” included in the Annual Report on Form 10 - K filed with the SEC on March 2, 2017. Aqua Metals cautions readers not to place undue reliance on any forward - looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur. 2

Strategic relationships helped de - risk our start - up……. • AquaRefinery 1 (McCarran, NV) operating and in revenue – Began production in Q1 – truckloads of feedstock crushed – Sales to strategic partner in Q2 – truckloads of product shipped – Ramping production to >120mT/day of lead by the end of 2017 – Validating our economic projections and incorporating lessons learned • Now planning AquaRefineries 2 - 5 and learning from chemical industry and datacenter operators – Moving away from opportunistic build - out of small stand - alone facilities and evaluating “clusters” centered on logistics nodes • Equipment licensing has started – Working with JCI to plan the retrofit of an existing facility, as the blueprint for others • Acquisition of Ebonex should accelerate development of higher value products 3 NASDAQ: AQMS ….and provide the stability to optimize our business expansion

Agenda • AquaRefinery 1 update • Planning for AquaRefineries 2 - 5 and Licensing roll - out • Ebonex acquisition • Financials • Summary NASDAQ: AQMS 4

Strategic partners brought scale and urgency NASDAQ: AQMS Opportunity delivered through strategic relationships Lead Capacity ( mT /day) AquaRefining Modules needed Potential annual revenue Start Date AquaRefinery 1 120 - 160 16 - 32 $100 - 120 M /year Operational AquaRefinery 1 - 5 ~800 ~160 $500 - 600M/year 2017 Licensing (JCI and beyond ) >8,000 >1,600 TBD 2018 5 • The scale and demand for additional facilities and licensing means that we cannot wait until Facility 2 to start implementing advances and lessons learned • Facility 1 is being used both for revenue generation, continuous improvement and to validate process upgrades • Built a talent acquisition function, recruiting from role models and complementary industries

AquaRefinery 1 is running and we are scaling output • Started production in Q1 and sales in Q2 • Status – Breaking and separation: commissioned and operating – Aqua Preparation: process operating – adding capacity and streamlining operations – Aqua Refining: Module 1 operational, Modules 2 - 4 in - start - up, Modules 5 - 16 being updated to latest specification – Ingot production: being commissioned • Metallic lead being shipped pre - ingot – Plant staffing • A & B shifts: fully staffed, C & D shifts: recruiting to full complement in next month • The focus of process development has moved from Alameda to Reno • Implementing next year’s improvements now NASDAQ: AQMS 6

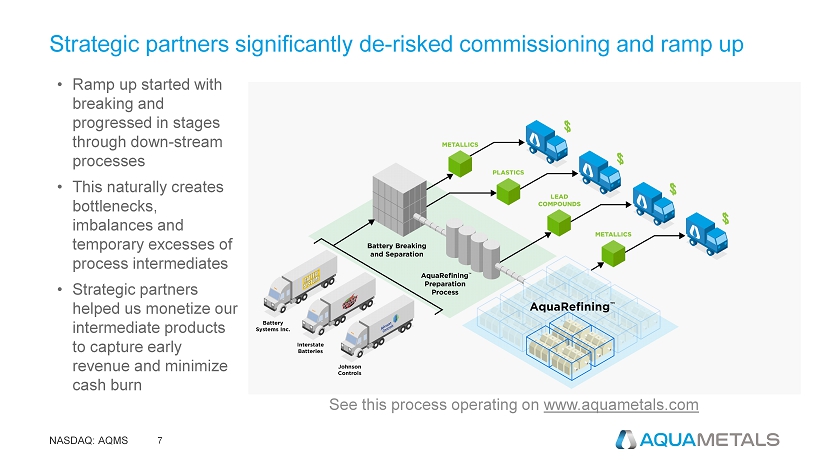

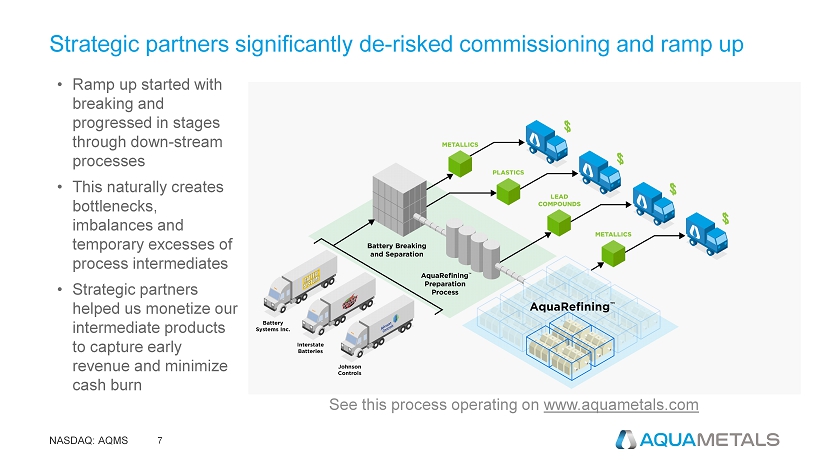

Strategic partners significantly de - risked commissioning and ramp up NASDAQ: AQMS 7 • Ramp up started with breaking and progressed in stages through down - stream processes • This naturally creates bottlenecks, imbalances and temporary excesses of process intermediates • Strategic partners helped us monetize our intermediate products to capture early revenue and minimize cash burn See this process operating on www.aquametals.com

AquaRefinery 1: Implementing improvements as we develop them • Breaking and Separation – took longer than we planned but considerably shorter than industry norms – We needed to achieve a higher degree of separation than for smelting – and achieved it • Numerous upgrades to support industry leading separation – in collaboration with Wirtz – Holding tanks being upgraded with higher capacity and better mixing – Input conveyor being upgraded to support higher feed rate • Aqua Preparation – initially delayed by intermittent supply from the breaker – Switched to improved and lower cost chemistry – Tank mixing and filtration upgraded to improve reliability • Aqua Refining – initially delayed by intermittent supply from Aqua Preparation – Commissioning delayed by reduced electrolyte availability – Used delay to develop, test and implement numerous upgrades • Ingot Casting – commissioning delayed by intermittent supply of processed lead – Underway NASDAQ: AQMS 8

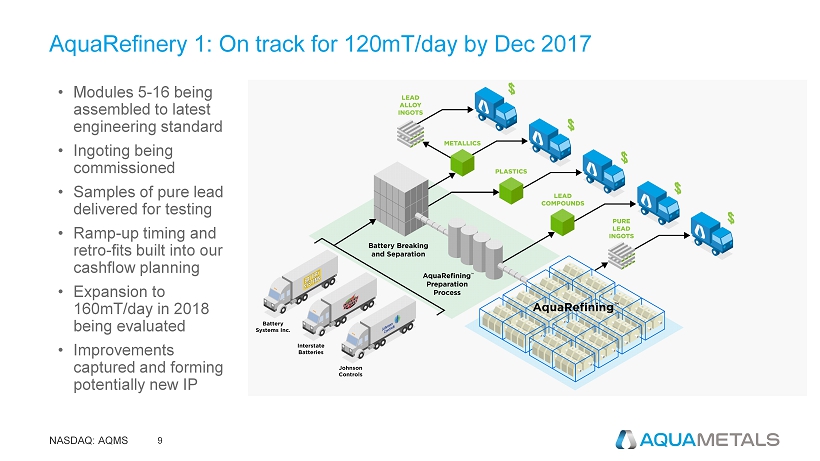

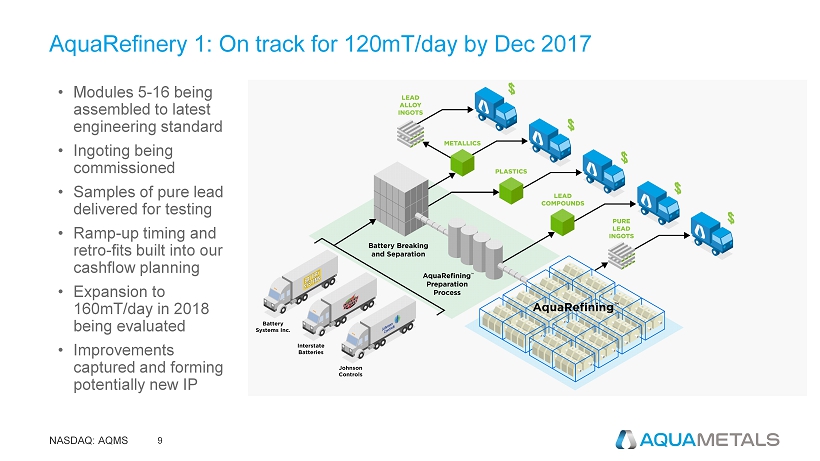

AquaRefinery 1: On track for 120mT/day by Dec 2017 NASDAQ: AQMS 9 • Modules 5 - 16 being assembled to latest engineering standard • Ingoting being commissioned • Samples of pure lead delivered for testing • Ramp - up timing and retro - fits built into our cashflow planning • Expansion to 160mT/day in 2018 being evaluated • Improvements captured and forming potentially new IP

We are preparing for rapid build - out and licensing • We are validating our business model – Projected financials for a new 160mT/day facility remain at $54mm CapEx, $100 - 120mm Revenue and $20 - 30mm EBITDA – We will report progress in our quarterly earnings • We are not providing forward guidance on ramp - up of revenue, products or capacity – We have more than adequate cash on - hand and our focus is to be ready for explosive growth in 2018 – We want the flexibility to test and validate multiple potential improvements by Dec ’17 and may choose to temporarily suspend production to support this NASDAQ: AQMS 10

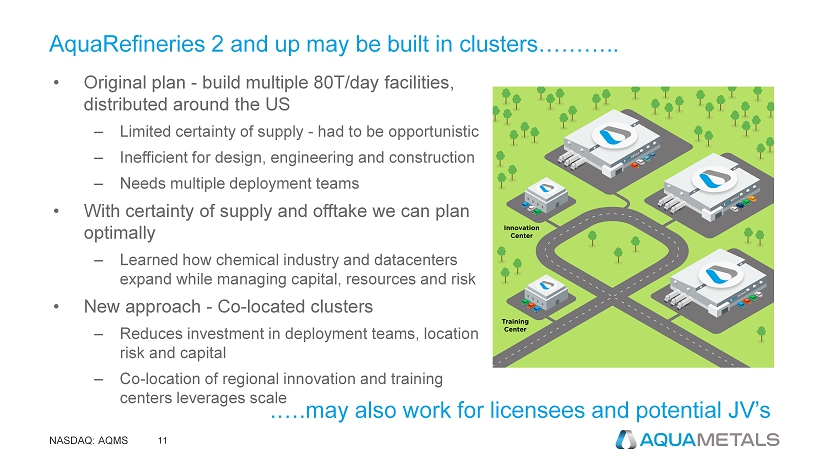

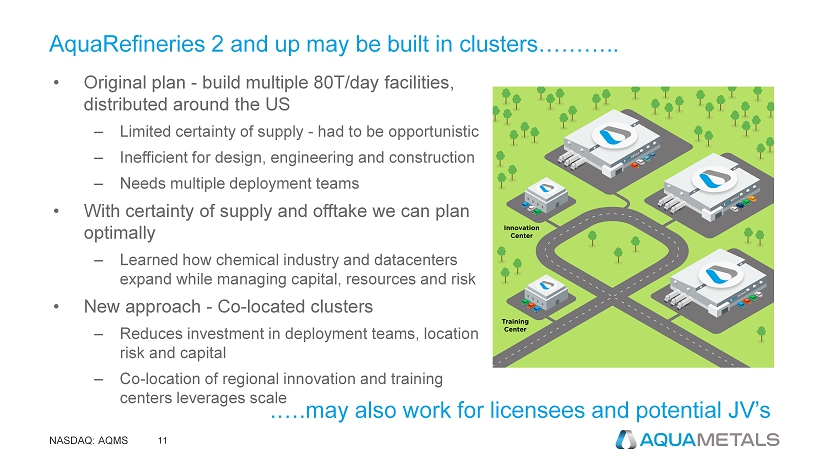

AquaRefineries 2 and up may be built in clusters……….. • Original plan - build multiple 80T/day facilities, distributed around the US – Limited certainty of supply - had to be opportunistic – Inefficient for design, engineering and construction – Needs multiple deployment teams • With certainty of supply and offtake we can plan optimally – Learned how chemical industry and datacenters expand while managing capital, resources and risk • New approach - Co - located clusters – Reduces investment in deployment teams, location risk and capital – Co - location of regional innovation and training centers leverages scale NASDAQ: AQMS 11 .….may also work for licensees and potential JV’s

“Ebonex” – what we acquired • Ownership of Ebonex tm a unique electrically conductive ceramic material • Potential performance additive for lead acid batteries – Potentially synergistic with our own lead nano - fibers • Ownership of patents, know - how, tooling and equipment to produce high performance battery electrodes • Ownership of patents, know - how, tooling and equipment to produce an advanced “bipolar” lead acid battery • Battery development and test equipment NASDAQ: AQMS 12 Ideally, we would have made this acquisition 2 years from now – but the opportunity would not be there in 2 years

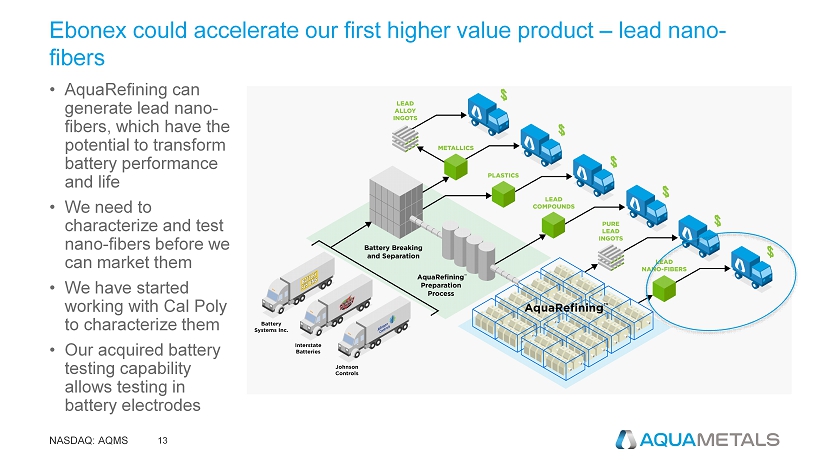

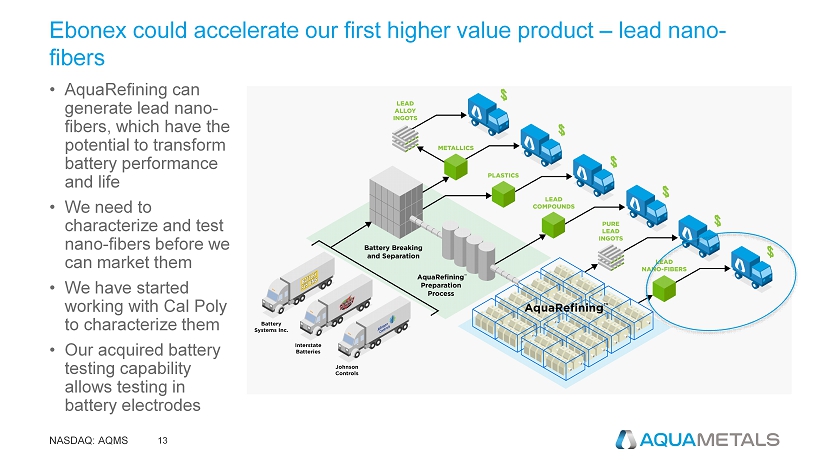

Ebonex could accelerate our first higher value product – lead nano - fibers NASDAQ: AQMS 13 • AquaRefining can generate lead nano - fibers, which have the potential to transform battery performance and life • We need to characterize and test nano - fibers before we can market them • We have started working with Cal Poly to characterize them • Our acquired battery testing capability allows testing in battery electrodes

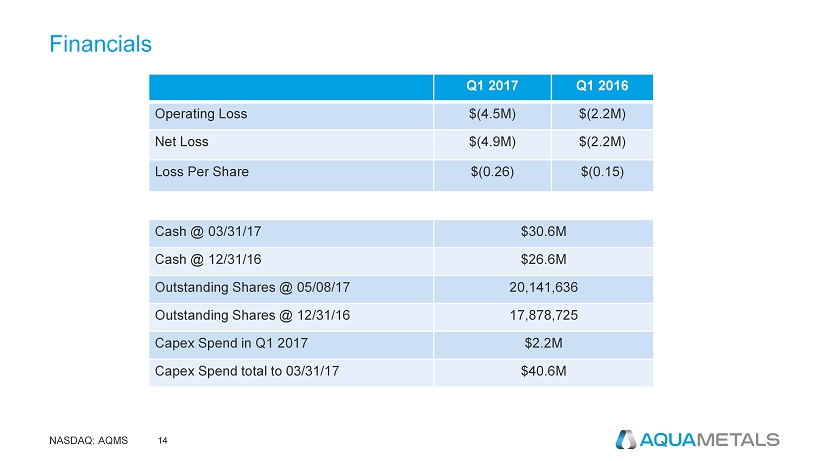

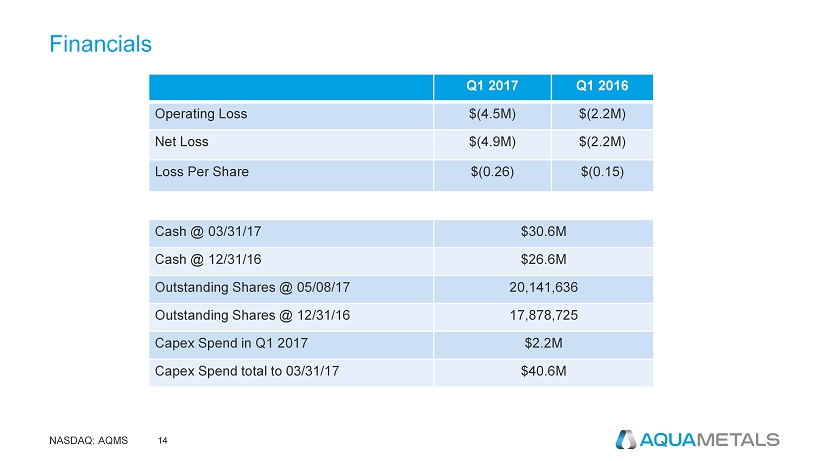

Financials Q1 2017 Q1 2016 Operating Loss $(4.5M) $(2.2M) Net Loss $(4.9M) $(2.2M) Loss Per Share $(0.26) $(0.15) Cash @ 03/31/17 $30.6M Cash @ 12/31/16 $26.6M Outstanding Shares @ 05/08/17 20,141,636 Outstanding Shares @ 12/31/16 17,878,725 Capex Spend in Q1 2017 $2.2M Capex Spend total to 03/31/17 $40.6M NASDAQ: AQMS 14

Key Takeaways • Preparation for large scale roll - out is our priority • AquaRefinery 1, commissioned, in revenue and on track for 120mT/day – Continues to be our primary focus – Using it to prepare for accelerated growth • Strategic partners brought scale and urgency – De - risked our ramp - up – Provided stability for efficient scale - up – Allows for more aggressive build - out • Beginning early stage work on higher value products and services – Positioned to leverage existing and future strategic partners • Invitational site visits announced – Sell - side analyst invitational arranged for May – Buy - side analyst and investor invitationals being arranged for June and beyond NASDAQ: AQMS 15