As filed with the Securities and Exchange Commission on December 3, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AVOGENX, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | | 2834 | | 47-1806563 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

Avogenx, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, North Carolina 27615

Telephone: (919) 480-1518

(Address, including zip code, and telephone number including area code, of registrant’s principal executive offices)

James Green

President and Chief Executive Officer

Avogenx, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, North Carolina 27615

Telephone: (919) 480-1518

(name, address, including zip code, and telephone number, including area code, of agent for service)

copies to:

Darren L. Ofsink, Esq. Ofsink, LLC 230 Park Avenue, Suite 851 New York, New York 10169 Telephone: (646) 627-7326 Facsimile: (646) 224-9844 | | Heyward D. Armstrong, Esq. Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P. 150 Fayetteville Street, Suite 2300 Raleigh, North Carolina 27601 Telephone: (919) 821-1220 Facsimile: (919) 821-6800 |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement and all other conditions to the proposed transactions have been satisfied or waived as set forth in the merger agreement dated as of September 30, 2014 described herein.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| | | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company þ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | |

| | | | | | | | | | |

Title of each class of securities to be registered | Amount to be registered(1) | | Proposed maximum offering price per share | | | Proposed maximum aggregate offering price(2) | | | Amount of registration fee(3) | |

| Common Stock, par value $0.001 per share | 27,553,174 shares | | $ | 0.3902 | | | $ | 10,751,248.49 | | | $ | 1,249.30 | |

| | |

| (1) | Represents the maximum number of shares of common stock of the registrant (i) estimated to be issuable to existing holders of shares of common stock of Islet Sciences, Inc. upon conversion of their shares of common stock of Islet Sciences, Inc. into shares of common stock of the registrant and (ii) reserved for issuance upon exercise of outstanding warrants, stock options and other equity awards of Islet Sciences, Inc. which will be converted into warrants, stock options and other equity awards of the registrant, in each such case in connection with the holding company merger described herein, assuming a conversion rate of three shares of Islet Sciences, Inc. common stock for one share of Avogenx, Inc. common stock. In the event that the conversion rate in the holding company merger is greater than 3:1 (i.e., more than three of shares of Islet Sciences, Inc. common stock are exchanged for each share of Avogenx, Inc. common stock), the amount of common stock deemed to be covered by this registration statement shall be proportionately reduced. |

| (2) | The proposed maximum aggregate offering price of common stock of the registrant is based upon the market value of shares of common stock of Islet Sciences, Inc. in accordance with Rule 457(f)(1) and 457(c) under the Securities Act and is equal to the product of: (i) $0.3902, the average of the high and low prices per share of common stock of Islet Sciences, Inc. as reported by the Over-the-Counter Markets (“OTCQB”) on December 1, 2014 (as adjusted assuming a conversion rate in the holding company merger of 3:1 as described above) and (ii) 27,553,174, which represents the maximum number of shares to be registered by Avogenx, Inc. in connection with the holding company merger described herein (assuming a conversion rate in the holding company merger of 3:1 as described above). |

| (3) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $116.20 per $1,000,000 of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS CONSENT SOLICITATION STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT OFFER THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS CONSENT SOLICITATION STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION—DATED _________, 2014

| CONSENT SOLICITATION STATEMENT OF ISLET SCIENCES, INC | | PROSPECTUS OF AVOGENX, INC. |

To Stockholders of Islet Sciences, Inc.:

As you may be aware, Islet Sciences, Inc., a Nevada corporation (“Islet Sciences”), entered into an Agreement and Plan of Merger, dated as of September 30, 2014 (the “Merger Agreement”), by and among Islet Sciences, Brighthaven Ventures, L.L.C., a North Carolina limited liability company (“BHV”), Avogenx, Inc., a Delaware corporation and a direct wholly owned subsidiary of Islet Sciences (“Holdco” or “Avogenx”), Islet Merger Sub, Inc., a Nevada corporation and a direct wholly owned subsidiary of Holdco (“Islet Merger Sub”), and each of the members of BHV (the “BHV Members”). Pursuant to the Merger Agreement, Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity (the “Merger”), and Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members, to be adjusted for the Exchange Ratio (as defined below), and additional milestone payments described below, which are based on the development of Remogliflozin (the “BHV Securities Exchange” and together with the Merger, the “Transactions”).

In connection with the Transactions, shares of Islet Sciences common stock outstanding immediately prior to the effective time of the Merger will be converted into the right to receive shares of Avogenx common stock at the conversion rate of not less than three and not more than 40 shares of Islet Sciences common stock for one share of Avogenx common stock, with the effective number of shares of Islet Sciences common stock convertible into one share of Avogenx common stock to be determined by the Islet Sciences board of directors prior to the effective time of the Merger (the “Exchange Ratio”). At November 24, 2014, 66,928,724 shares of common stock of Islet Sciences were outstanding. Upon completion of the Transactions, shares of common stock of Islet Sciences held by such holders will be cancelled. Avogenx intends to apply to quote its common stock, as successor to Islet Sciences, on the OTCQB and upon the completion of the Transactions, Avogenx common stock will trade under a new symbol.

The Islet Sciences board of directors has carefully considered the Merger and the terms of the Merger Agreement and has determined that the Merger and the Merger Agreement are fair, advisable and in the best interest of Islet Sciences and its stockholders. Accordingly, the Islet Sciences board of directors has approved the Merger and the Merger Agreement. However, the approval of Islet Sciences stockholders holding a majority of the outstanding Islet Sciences common stock is required for the Merger to close, and you are being sent this document to ask you to approve the Merger Agreement and the Merger by executing and returning the written consent furnished with this consent solicitation statement/prospectus.

Certain stockholders of Islet Sciences, representing approximately 36.8% of the outstanding shares of Islet Sciences common stock, have entered into a voting agreement with Islet Sciences under which they have agreed to execute and return consents with respect to their shares of Islet Sciences common stock approving the Merger Agreement and the Merger.

The Islet Sciences board of directors has set , 2014 as the record date for determining holders of Islet Sciences common stock entitled to execute and deliver written consents with respect to this solicitation. If you are a record holder of outstanding Islet Sciences common stock on that date, you are urged to complete, date and sign the enclosed written consent and promptly return it to Islet Sciences. See “Solicitation of Written Consents.”

We encourage you to read carefully this consent solicitation statement/prospectus in its entirety, including the section entitled “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this consent solicitation statement/prospectus, or determined if this consent solicitation statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This consent solicitation statement/prospectus is dated , 2014, and is first being mailed to Islet Sciences stockholders on or about , 2014.

| | | |

| | | | |

| | By: | /s/ James Green | |

| | | James Green | |

| | | President and Chief Executive Officer | |

| | | | |

Islet Sciences, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, North Carolina 27615

Notice of Solicitation of Written Consent

To Stockholders of Islet Sciences, Inc.:

Pursuant to an Agreement and Plan of Merger, dated as of September 30, 2014 (the “Merger Agreement”), by and among Islet Sciences, Inc., a Nevada corporation (“Islet Sciences”), Brighthaven Ventures, L.L.C., a North Carolina limited liability company (“BHV”), Avogenx, Inc., a Delaware corporation and a direct wholly owned Subsidiary of Islet Sciences (“Holdco” or “Avogenx”), Islet Merger Sub, Inc., a Nevada corporation and a direct wholly owned subsidiary of Holdco (“Islet Merger Sub”), and each of the members of BHV (the “BHV Members”), Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity (the “Merger”), and Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members, to be adjusted for the Exchange Ratio (as defined below), and additional milestone payments described below, which are based on the development of BHV’s drug compound, Remogliflozin (the “BHV Securities Exchange” and together with the Merger, the “Transactions”). In connection with the Transactions, shares of Islet Sciences common stock outstanding immediately prior to the effective time of the Merger will be converted into the right to receive shares of Avogenx common stock at the conversion rate of not less than three and not more than 40 shares of Islet Sciences common stock for one share of Avogenx common stock, with the effective number of shares of Islet Sciences common stock convertible into one share of Avogenx common stock to be determined by the Islet Sciences board of directors prior to the effective time of the Merger (the “Exchange Ratio”). Following the completion of the Transactions, Islet Sciences and BHV will each be wholly owned subsidiaries of Avogenx.

This consent solicitation statement/prospectus is being delivered to you on behalf of the Islet Sciences board of directors to request that holders of Islet Sciences common stock as of the record date of , 2014 execute and return written consents to approve the Merger Agreement and the Merger.

This consent solicitation statement/prospectus describes the proposed Merger and the actions to be taken in connection with the Merger and provides additional information about the parties involved. Please give this information your careful attention. A copy of the Merger Agreement is attached as Annex A to this consent solicitation statement/prospectus.

A summary of the dissenter’s rights that may be available to you is described below under “Dissenter’s Rights.” Please note that if you wish to exercise dissenter’s rights you must not sign and return a written consent approving the Merger Agreement and the Merger. However, so long as you do not return a consent form at all, it is not necessary to affirmatively vote against or disapprove the Merger Agreement and the Merger. In addition, you must take all other steps necessary to perfect your dissenter’s rights.

The Islet Sciences board of directors has carefully considered the Merger and the terms of the Merger Agreement and has determined that the Merger and the Merger Agreement are fair, advisable and in the best interests of Islet Sciences and its stockholders.

Please complete, date and sign the written consent furnished with this consent solicitation statement/prospectus and return it promptly to Islet Sciences by one of the means described in “Solicitation of Written Consents.”

| | By Order of the Board of Directors, | |

| | | | |

| | | James Green | |

| | | President and Chief Executive Officer | |

| | | | |

TABLE OF CONTENTS

| | | Page |

| ADDITIONAL INFORMATION | | | | 1 |

| | |

| QUESTIONS AND ANSWERS | | 2 |

| | |

| SUMMARY | | 5 |

| | |

| SELECTED HISTORICAL FINANCIAL DATA OF ISLET SCIENCES | | 9 |

| | |

| SELECTED HISTORICAL FINANCIAL DATA OF BHV | | 9 |

| | |

| SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | | 10 |

| | |

| RISK FACTORS | | 11 |

| | |

| FORWARD-LOOKING STATEMENTS | | 17 |

| | |

| SOLICITATION OF WRITTEN CONSENTS | | 18 |

| | | |

| BACKGROUND OF THE TRANSACTIONS | | 19 |

| | |

| TERMS OF THE TRANSACTIONS | | 22 |

| | |

ISLET SCIENCES’ REASONS FOR THE TRANSACTIONS; RECOMMENDATION OF THE ISLET SCIENCES BOARD | | 32 |

| | |

| INTERESTS OF DIRECTORS AND EXECUTIVE OFFICERS OF ISLET SCIENCES IN THE TRANSACTIONS | | 34 |

| | |

| ACCOUNTING TREATMENT OF THE TRANSACTIONS | | 35 |

| | |

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | | 35 |

| | |

| FINANCIAL STATEMENTS | | 37 |

| | |

| ISLET SCIENCES AND BHV UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | | 37 |

| | |

| NOTES TO THE ISLET SCIENCES AND BHV UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | | 41 |

| | |

| CERTAIN MARKET INFORMATION WITH RESPECT TO ISLET SCIENCES COMMON STOCK | | 43 |

| | |

| DIVIDEND POLICIES AND RESTRICTIONS | | 43 |

| | |

| BUSINESS OF ISLET SCIENCES | | 43 |

| | |

| BUSINESS OF BHV | | 52 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF ISLET SCIENCES | | 56 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF BHV | | 61 |

| | |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS OF ISLET SCIENCES | | 63 |

| | |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS OF BHV | | 65 |

| | |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS OF AVOGENX AFTER THE TRANSACTIONS | | 65 |

| | |

| EXECUTIVE OFFICERS AND DIRECTORS OF AVOGENX FOLLOWING THE TRANSACTIONS | | 67 |

| | |

| COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | | 69 |

| | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, AND DIRECTOR INDEPENDENCE | | 72 |

| | |

| DESCRIPTION OF AVOGENX CAPITAL STOCK | | 72 |

| | | |

| COMPARISON OF RIGHTS OF STOCKHOLDERS | | 76 |

| | | |

| DISSENTER’S RIGHTS | | 82 |

| | |

| EXPERTS | | 83 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | | 83 |

| | |

| LEGAL MATTERS | | 83 |

| | |

| INDEX TO FINANCIAL STATEMENTS | | F-1 |

| | |

| ANNEX A – Agreement and Plan of Merger | | A-1 |

| | |

| ANNEX B – Voting Agreement | | B-1 |

| | |

| ANNEX C – Sections 92A.300 to 92A.500 of the Nevada Revised Statutes | | C-1 |

| | | |

| ANNEX D - Form of Written Consent | | D-1 |

ADDITIONAL INFORMATION

This document, which forms part of a registration statement on Form S-4 filed by Avogenx, Inc. (“Avogenx”) with the Securities and Exchange Commission (the “SEC”), constitutes a prospectus of Avogenx under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of Avogenx common stock to be issued to Islet Sciences, Inc. (“Islet Sciences”) stockholders pursuant to the Agreement and Plan of Merger, dated as of September 30, 2014 (the “Merger Agreement”), by and among Islet Sciences, Brighthaven Ventures, L.L.C. (“BHV”), Avogenx, Islet Merger Sub, Inc. (“Islet Merger Sub”), and each of the members of BHV (the “BHV Members”). This document also constitutes a consent solicitation statement of Islet Sciences with respect to the proposal to approve the Merger Agreement. Pursuant to the Merger Agreement, Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity (the “Merger”), and Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members, to be adjusted for the Exchange Ratio (as defined below), and additional milestone payments described below, which are based on the development of BHV’s drug compound, Remogliflozin (the “BHV Securities Exchange” and together with the Merger, the “Transactions”). In connection with the Transactions, shares of Islet Sciences common stock outstanding immediately prior to the effective time of the Merger will be converted into the right to receive shares of Avogenx common stock at the conversion rate of not less than three and not more than 40 shares of Islet Sciences common stock for one share of Avogenx common stock, with the effective number of shares of Islet Sciences common stock convertible into one share of Avogenx common stock to be determined by the Islet Sciences board of directors prior to the effective time of the Merger (the “Exchange Ratio”). Following the completion of the Transactions, Islet Sciences and BHV will each be wholly owned subsidiaries of Avogenx.

This consent solicitation statement/prospectus incorporates important business and financial information about Islet Sciences that is contained in documents filed with the SEC and that is not included in or delivered with this document. You may obtain this information without charge through the SEC’s website (www.sec.gov) or upon your written or oral request from Islet Sciences at 6601 Six Forks Rd, Suite 140, Raleigh, North Carolina 27615, Attn: Investor Relations, www.isletsciences.com, by emailing info@isletsciences.com or telephoning (919) 480-1518. To ensure timely delivery, any request should be made no later than , 2014. For additional details about where you can find information about Islet Sciences, see “Where You Can Find More Information.”

Information on the internet websites of Islet Sciences or BHV, or any subsidiary of Islet Sciences, is not part of this document. You should not rely on that information in deciding whether to approve the Merger Agreement and the Merger unless that information is in this document.

You should rely only on the information contained in this document. We have not authorized anyone to provide you with different information. This document is dated , 2014. You should not assume that information contained in this document is accurate as of any date other than that date. Neither the mailing of this document to Islet Sciences stockholders nor the issuance by Avogenx of common stock in the Merger will create any implication to the contrary.

This consent solicitation statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a consent, in any jurisdiction in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction. Islet Sciences has supplied all information relating to Islet Sciences contained in this document, and BHV has supplied all information relating to BHV contained in this document.

QUESTIONS AND ANSWERS

The following are some questions that you, as a stockholder of Islet Sciences, may have regarding the Merger and the Merger Agreement, and brief answers to those questions. Islet Sciences urges you to read carefully the remainder of this consent solicitation statement/prospectus because the information in this section may not provide all the information that might be important to you with respect to the Merger. Additional important information is also contained in the annexes and exhibits to this consent solicitation statement/prospectus. See “Where You Can Find More Information.”

Q: What is the proposed transaction?

A: Islet Sciences has entered into an agreement with BHV, Avogenx, Islet Merger Sub, and the BHV Members, pursuant to which Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity, and Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members, to be adjusted for the Exchange Ratio, and additional milestone payments described below, which are based on the development of Remogliflozin. Following the completion of the Transactions, Islet Sciences and BHV will each be wholly owned subsidiaries of Avogenx.

The Merger Agreement is included as Annex A to this consent solicitation statement/prospectus. It is the legal document that governs the Transactions.

Q: Who is soliciting my written consent?

A: The Islet Sciences board of directors is providing these consent solicitation materials to you. These materials also constitute a prospectus with respect to the Avogenx common stock issuable to Islet Sciences stockholders and the BHV Members in connection with the Transactions.

Q: What am I being asked to approve?

A: You are being asked to approve the Merger Agreement and the Merger.

Q: Have the terms of the Transactions been evaluated by independent directors of Islet Sciences?

A: Yes. The independent members of the Islet Sciences board of directors, comprised of Dr. Eric Barnett and Dr. Michael Luther, considered and negotiated the terms and conditions of the Merger Agreement.

Q: Who is entitled to give a written consent?

A: The Islet Sciences board of directors has set , 2014 as the record date for determining holders of shares of Islet Sciences common stock entitled to execute and deliver written consents with respect to this solicitation. Holders of Islet Sciences common stock on the record date may (i) execute a written consent to approve the Merger Agreement (which is equivalent to a vote in favor of approval of the Merger Agreement), or (ii) choose not to execute the written consent (which is equivalent to a vote against approval of the Merger Agreement).

Q: What happens if I sell my shares of Islet Sciences common stock after the record date but before the Merger?

A: If you sell or otherwise transfer your shares of Islet Sciences common stock after the record date but before the consummation of the Merger, you will retain your right to execute a written consent to approve the Transactions (which is equivalent to a vote in favor of the proposal), or choose not to execute the written consent (which is equivalent to a vote against the proposal).

Q: What will I receive in the Merger?

A: Under the Merger Agreement, shares of Islet Sciences common stock outstanding immediately prior to the effective time of the Merger will be converted into the right to receive shares of Avogenx common stock at the conversion rate of not less than three and not more than 40 shares of Islet Sciences common stock for one share of Avogenx common stock, with the effective number of shares of Islet Sciences common stock convertible into one share of Avogenx common stock to be determined by the Islet Sciences board of directors prior to the effective time of the Merger. As of November 24, 2014, 66,928,724 shares of common stock of Islet Sciences were outstanding. Upon completion of the Merger, shares of common stock of Islet Sciences held by such holders will be cancelled.

Q: What is the recommendation of the Islet Sciences board of directors?

A: The Islet Sciences board of directors, with the directors who are the members of BHV abstaining from voting, has determined that the Merger Agreement and the Merger are advisable and fair to and in the best interests of Islet Sciences and its stockholders, and recommends that Islet Sciences’ stockholders approve the Merger Agreement and the Merger.

Q: What stockholder consent is required to approve the Merger?

A: We cannot complete the Merger unless Islet Sciences stockholders approve the Merger Agreement and the Merger. Approval of the Merger Agreement and the Merger require the approval of the holders of a majority of the outstanding shares of Islet Sciences common stock.

On September 30, 2014, Islet Sciences entered into a series of voting agreements, substantially in the form attached to this consent solicitation statement/prospectus as Annex B, with certain directors of Islet Sciences that own shares of Islet Sciences common stock and holders of more than 5% of Islet Sciences outstanding common stock, which collectively own approximately 36.8% of Islet Sciences’ outstanding common stock. Pursuant to these voting agreements, these stockholders agreed to deliver a written consent in favor of the approval of the Merger Agreement and the Merger following the delivery of this consent solicitation statement/prospectus upon effectiveness of the registration statement of which it is a part.

Q: How can I return my written consent?

A: If you hold shares of Islet Sciences common stock as of the record date for granting written consent and you wish to submit your consent, you must fill out the enclosed written consent, date and sign it, and promptly return it to Islet Sciences. Once you have completed, dated and signed your written consent, you may deliver it to Islet Sciences by emailing a .pdf copy of your written consent to info@isletsciences.com (Attention: Corporate Secretary) or by mailing your written consent to Islet Sciences, Inc. at 6601 Six Forks Rd, Suite 140, Raleigh, North Carolina 27615, Attention: Corporate Secretary. If you mail your written consent, please allow sufficient time for it to be delivered in advance of the delivery deadline discussed below. Islet Sciences will not be holding a stockholders’ meeting to consider this proposal, and therefore you will be unable to vote in person by attending a stockholders’ meeting.

Q: What happens if I do not return my written consent?

A: If you are a record holder of shares of Islet Sciences common stock and you do not return your written consent, that will have the same effect as a vote against the proposal to approve the Merger Agreement and the Merger.

Q: What is the deadline for returning my written consent?

A: The Islet Sciences board of directors has set , 2014 as the targeted final date for receipt of written consents, which is the date on which Islet Sciences expects to receive consents under the Voting Agreement. Islet Sciences reserves the right to extend the final date for receipt of written consents beyond , 2014. Any such extension may be made without notice to Islet Sciences stockholders. Once a sufficient number of consents to approve the Merger Agreement and the Merger have been received, the consent solicitation will conclude.

Q: If my shares of Islet Sciences common stock are held in “street name” by my broker or other nominee, will my broker or other nominee execute a written consent without instructions from me?

A: No. Your broker will not be able to execute a written consent without instructions from you. Please follow the procedure your broker provides to participate in the consent solicitation.

Q: What should I do if I receive more than one set of materials?

A: You may receive more than one set of materials for the written consent, including multiple copies of this consent solicitation statement/prospectus. For example, if you hold your shares of Islet Sciences common stock in more than one brokerage account, you will receive a separate instruction card for each brokerage account in which you hold shares. Please submit each separate instruction card or consent that you receive by following the instructions set forth in each separate instruction card or consent.

Q: Can I change or revoke my written consent?

A: Yes. If you are a record holder of shares of Islet Sciences common stock on the record date, you may change or revoke your consent at any time before the consents of a sufficient number of shares to approve the Merger Agreement and the Merger have been filed with the corporate secretary of Islet Sciences. If you wish to change or revoke your consent or prior revocation before that time, you may do so by sending in a new written consent with a later date by one of the means described in the section entitled “Solicitation of Written Consents—Submission of Consents,” or delivering a notice of revocation to the corporate secretary of Islet Sciences.

Q: Can I exercise dissenter’s rights?

A: If you are an Islet Sciences stockholder who does not approve the Merger Agreement via written consent, you may, by strictly complying with Sections 92A.300 to 92A.500 of the Nevada Revised Statutes, be entitled to the dissenter’s rights described therein. Sections 92A.300 to 92A.500 of the Nevada Revised Statutes are attached to this consent solicitation statement/prospectus as Annex C. Failure to follow precisely any of the statutory procedures set forth in Annex C may result in the loss or waiver of dissenter’s rights under Nevada law. Nevada law requires that, among other things, you send a demand for payment of fair value of your Islet shares to the surviving company in the Merger after receiving a notice from Islet Sciences that dissenter’s rights are available to you, which notice will be sent to non-consenting stockholders in the future. This consent solicitation/prospectus is not intended to constitute such a notice. Do not send in your demand prior to mailing of such notice because any demand for appraisal made prior to your receipt of such notice may not be effective to perfect your rights. See “Dissenter’s Rights.”

Q: What are the material United States federal income tax consequences of the Merger to the Islet Sciences stockholders?

A: The Merger is intended to qualify for U.S. federal income tax purposes as an exchange under Section 351 of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, no gain or loss will be recognized by the stockholders of Islet Sciences as a result of the exchange of Islet Sciences shares for Avogenx shares pursuant to the Merger. In connection with the filing of the registration statement of which this document is a part, Anderson Bradshaw, PLLC has delivered an opinion to Islet Sciences that the exchange of Islet Sciences shares by the stockholders of Islet Sciences for Avogenx shares will qualify as an exchange under Section 351 of the Code and that no gain or loss recognition is incurred to the public stockholders of Islet Sciences. See “Material U.S. Federal Income Tax Consequences.”

Q: When does Islet Sciences expect to complete the Merger?

A: We anticipate that we will complete the Merger during the fourth quarter of our fiscal year ending April 30, 2014. However, we cannot assure you when or if the Merger will occur. We must first obtain the requisite approval of Islet Sciences stockholders and satisfy other conditions before we can complete the Merger.

Q: Should I send in my Islet Sciences stock certificate now?

A: No. Islet Sciences stockholders SHOULD NOT send in any stock certificates now. After the Transactions are completed, Avogenx will send you written instructions explaining how to exchange your Islet Science stock certificates.

Q: Whom should I contact if I have questions?

A: If you have questions about the Merger or the process for returning your written consent, or if you need additional copies of this document or a replacement written consent, please contact: Islet Sciences, Inc. at 6601 Six Forks Rd, Suite 140, Raleigh, North Carolina 27615, Attention: Corporate Secretary, Telephone: (919) 480-1518.

SUMMARY

This summary highlights selected information contained elsewhere in this consent solicitation statement/prospectus and does not contain all of the information that may be important to you. You should carefully read the entire consent solicitation statement/prospectus, including “Risk Factors” and the financial statements, before making an investment decision.

Unless the context requires otherwise, “we,” “us” and “our” refers to Avogenx, Inc., the issuer of the shares offered hereby, and its future wholly-owned subsidiary, Islet Sciences, as well as Islet Sciences’ direct and indirect subsidiaries. “Avogenx” refers solely to Avogenx, Inc., the issuer of the shares offered hereby. “Islet Sciences” refers to Islet Sciences, Inc., a Nevada corporation, our current public parent company individually or collectively with its subsidiaries not formed for purposes of the transactions described herein, as the context may require. “BHV” refers to Brighthaven Ventures, LLC, a North Carolina limited liability company, d/b/a BHV Pharma. When we express “beliefs” with respect to BHV, or its business, we have based those statements or beliefs on our general knowledge of the industries involved, the results of our due diligence investigations of BHV and other information provided to us by the management of BHV.

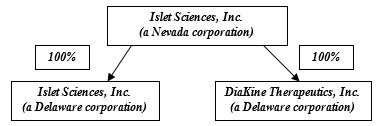

This consent solicitation statement/prospectus is being filed in contemplation of the Transactions, pursuant to which Islet Sciences will acquire BHV. This will be done pursuant to the Merger Agreement. Pursuant to the Merger Agreement, Islet Sciences has formed a wholly owned subsidiary, Avogenx, which has formed another wholly owned subsidiary, Islet Merger Sub.

Upon satisfaction or waiver of the conditions to the transactions specified in the Merger Agreement, (i) Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity, thus completing the Merger and (ii)Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members (to be adjusted for the Exchange Ratio) and additional milestone payments described below, which are based on the development of Remogliflozin (“Remo”), thus completing the BHV Securities Exchange. Following the completion of the Transactions, Islet Sciences and BHV will each be wholly owned subsidiaries of Avogenx.

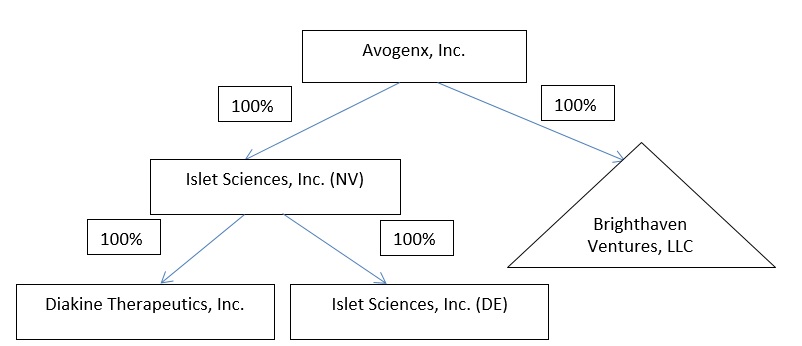

Therefore, the resulting structure will be as follows:

The Companies

Islet Sciences, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, NC 27615

(919) 480-1518

Islet Sciences is a biotechnology company engaged in the research, development, and commercialization of new medicines and technologies for the treatment of metabolic diseases and related indications where there is a significant medical need. The rising incidence of obesity is associated with many obesity-related health complications, including cardiovascular disease, diabetes, hyperlipidemia, hypertension, nonalcoholic fatty liver disease/steatohepatitis (NAFLD/NASH). This constellation is also recognized as the metabolic syndrome and is characterized by underlying insulin resistance. See “Comparative Review of Diets for the Metabolic Syndrome: Implications for Nonalcoholic Fatty Liver Disease,” The American Journal of Clinical Nutrition, Angela M. Zivkovic, J. Bruce German and Arun J. Sanyal (December 3, 2007). These various diseases have interrelated risk factors and markers, such that often treatment of one disease may allow new therapies and opportunities for treatment in one of these related indications.

Islet Sciences is developing the following therapeutic product candidates to address the needs of patients suffering from metabolic disease:

● | ISLT-P, an implantable suspension of encapsulated insulin-producing porcine islet cells, for the treatment of insulin-dependent diabetes; |

| ● | ISLT-2669, a novel lead IL-12 small molecule inhibitor selected for preclinical development for treatment of type 2 diabetes. This IL12 inhibitor blocks the auto-immune and inflammatory cascade initiated by IL-12 receptor activation; and |

| ● | ISLT-LSF Analogs, a library of small molecule lisofylline analogs that block inflammatory actions of cytokines that destroy insulin-producing beta cells, for diabetes and diabetes-related complications. |

Islet Sciences is also developing the following diagnostic product candidate to better enable patients and their physicians to understand disease diagnosis and progression.

| ● | ISLT-Bdx, a PCR based molecular diagnostic measuring hypomethylated beta cell-derived DNA as a biomarker of beta cell loss for the early detection of type 1 diabetes or onset of insulin dependent type 2 diabetes. |

Avogenx, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, NC 27615

(919) 480-1518

Avogenx is a direct, wholly owned subsidiary of Islet Sciences formed solely to effect the Transactions and has not conducted any business. Pursuant to the Merger Agreement described in this consent solicitation statement/prospectus, Avogenx will, by operation of law, become the parent company of Islet Sciences and BHV, which will both survive as wholly owned subsidiaries of Avogenx.

Islet Merger Sub, Inc.

6601 Six Forks Rd, Suite 140

Raleigh, NC 27615

(919) 480-1518

Islet Merger Sub is a direct wholly owned subsidiary of Avogenx formed solely to effect the Transactions and has not conducted and will not conduct any business during any period of its existence. Pursuant to the Merger Agreement, Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences continuing as the surviving corporation and a wholly owned subsidiary of Avogenx.

Brighthaven Ventures, LLC

6601 Six Forks Rd, Suite 140

Raleigh, NC 27615

(919) 480-1518

BHV is a privately held pharmaceutical company developing the SGLT2 inhibitor remogliflozin etabonate (“remogliflozin”) for type 2 diabetes and non-alcoholic steatohepatitis (“NASH”). Remogliflozin is currently in phase II clinical development.

The Transactions

In connection with reorganization of its holding company structure and to complete the acquisition of BHV, Islet Sciences has formed Avogenx, and Avogenx has formed Islet Merger Sub.

Upon satisfaction or waiver of the conditions to the Transactions, Islet Merger Sub will merge with and into Islet Sciences with Islet Sciences as the surviving entity. As a result of the Merger, Islet Sciences will, by operation of law, become a wholly owned subsidiary of Avogenx. The officers and directors of Avogenx at the effective time of the Merger will continue to be the officers and directors of Avogenx immediately after consummation of the Merger. Shares of Islet Sciences common stock outstanding immediately prior to consummation of the Merger will be converted into the right to receive shares of Avogenx common stock at the conversion rate of not less than three and not more than 40 shares of Islet Sciences common stock for one share of Avogenx common stock, with the effective number of shares of Islet Sciences common stock convertible into one share of Avogenx common stock to be determined by the Islet Sciences board of directors prior to the effective time of the Merger. We anticipate that Avogenx common stock will be quoted on the OTCQB and will trade under a new ticker symbol.

Upon satisfaction or waiver of the conditions to the Transactions specified in the Merger Agreement, Avogenx will acquire all of the outstanding membership interests of BHV in consideration for the issuance of an aggregate of 30 million shares of common stock of Avogenx to the BHV Members to be adjusted for the Exchange Ratio and additional milestone payments described below, which are based on the development of Remogliflozin. As a result of the BHV Securities Exchange, BHV will become a wholly-owned subsidiary of Avogenx.

Treatment of Islet Warrants and Options

Each outstanding Islet warrant, option or other right to acquire Islet Sciences common stock will upon closing of the Merger cease to represent a right to purchase shares of Islet Sciences common stock and will instead represent the right to purchase shares of Avogenx common stock equal to the number of shares of Islet Sciences common stock subject to such Islet warrant, option or other right to acquire Islet Sciences common stock immediately prior to the closing of the Merger, as adjusted for the Exchange Ratio. See “Terms of the Transactions— Islet Sciences Warrants and Stock Options.”

Ownership of Avogenx after the Transactions

Subject to the adjustment for the Exchange Ratio, thirty million shares of Avogenx common stock will be issuable to the BHV Members upon consummation of the BHV Securities Exchange. Based upon the 66,928,724 shares of Islet Sciences common stock outstanding on November 24, 2014, a total of 96,928,724 shares of Avogenx common stock would be outstanding after the Transactions, subject to the adjustment for the Exchange Ratio. Based on such shares outstanding on November 24, 2014, the shares issuable to the BHV Members in the BHV Securities Exchange would represent approximately 31.0% of the outstanding shares of Avogenx common stock immediately after the closing of the BHV Securities Exchange. The BHV Members can also receive additional milestone payments in Avogenx shares, as described below, which milestones are based on the development of Remogliflozin.

Recommendation of the Board of Directors of Islet

The Islet Sciences board of directors recommends that the Islet Sciences stockholders approve the Merger Agreement and the Merger by executing and delivering the written consent furnished with this consent solicitation/prospectus. The Islet board of directors believes the consideration to be received by the Islet Sciences stockholders is fair, advisable and in the best interests of Islet Sciences and its stockholders. See “Islet Sciences’ Reasons for the Acquisition of BHV; Recommendation of the Islet Sciences Board.”

Solicitation of Written Consents

Approval of the Merger Agreement and the Merger requires the approval of the holders of a majority of the outstanding shares of Islet Sciences common stock. See “Solicitation of Written Consents.”

Voting Agreement

On September 30, 2014, certain stockholders of Islet Sciences, who collectively hold approximately 36.8% of the outstanding shares of Islet Sciences common stock, entered into voting agreements with Islet Sciences pursuant to which they have agreed to execute and return consents with respect to their shares of Islet Sciences common stock approving the Merger Agreement and the Merger. See “Security Ownership of Management and Certain Beneficial Owners of Islet Sciences.”

Comparison of the Rights of Stockholders of Avogenx and Islet Sciences

If Islet Sciences stockholders approve the Merger Agreement and exchange their stock for Avogenx common stock, they will become Avogenx stockholders and will have rights different from those they currently have as Islet stockholders because Avogenx is a Delaware corporation and is subject to the requirements of Delaware law and its Certificate of Incorporation, which are different from the requirements that govern Islet Sciences as a Nevada corporation. See “Comparison of Rights of Stockholders.”

Conditions to Completion of the Transactions

The completion of the Transactions depends upon the satisfaction or waiver of a number of conditions which are described in more detail later in this consent solicitation statement/prospectus, including, among other things:

| | ● | | the absence of any legal prohibition on completion of the Transactions; |

| | ● | | the material accuracy, as of the date of the Merger Agreement and as of closing, of the representations and warranties made by the parties in the Merger Agreement and material compliance by the parties with their respective obligations under the Merger Agreement; |

| | ● | | the effectiveness of the registration statement of which this consent solicitation statement/prospectus is a part; |

| | ● | | the absence of any change since the date of the Merger Agreement that would reasonably be expected to have a Material Adverse Effect, subject to certain exceptions, upon either BHV or Islet Sciences. |

Dissenter’s Rights

Under the Nevada Revised Statutes (the “NRS”), if you do not wish to accept the consideration provided for in the Merger Agreement and the proposed Merger is consummated, you have the right (assuming all statutory conditions are met) to receive payment in cash for the fair value of your Islet Sciences common stock. To exercise your dissenter’s rights, you must (among other things) submit a written demand for payment to Islet Sciences, within 30 days after the date of delivery of a separate notice that will be mailed to non-consenting stockholders no later than 10 days after the effective date of the Merger. The demand for appraisal must not be sent prior to the date of such separate notice. Only the stockholder of record may submit a demand for payment; therefore, if your shares are not registered in your name, you will not be able to take these steps yourself, but must have them done by the record holder. To preserve your right to demand payment for the fair value of your shares, you must not submit a written consent in favor of approving the Merger Agreement, or otherwise consent to or vote FOR the approval of the Merger Agreement. However, so long as you do not return a consent form at all, it is not necessary to affirmatively vote against or disapprove the Merger Agreement. In addition, you must hold your shares continuously through the effective date of the Merger, meet other statutory conditions and take all other steps to perfect your dissenter’s right, which are not all listed here. A copy of the relevant statute, Sections 92A.300 to 92A.500 of the NRS, is appended to this consent solicitation statement/prospectus as Annex C for information purposes only. This consent solicitation statement/prospectus is not intended to constitute the notice of dissenter’s rights under Section 92A.430. See “Dissenter’s Rights.”

Material U.S. Federal Income Tax Consequences

Subject to the limitations and qualifications described in “Material U.S. Federal Income Tax Consequences” below, the exchange by U.S. holders of shares of Islet Sciences common stock for shares of Avogenx common stock pursuant to the Merger will constitute an exchange to which Section 351 of the Internal Revenue Code of 1986 (the “Code”) applies. As a result, no gain or loss will be recognized by the stockholders of Islet Sciences as a result of the exchange of Islet Sciences shares for Avogenx shares pursuant to the Merger. Your tax consequences will depend on your own situation. You should consult your tax advisor to fully understand the tax consequences of the Transactions to you.

In connection with the filing of the registration statement of which this document is a part, Anderson Bradshaw, PLLC has delivered an opinion to Islet Sciences that the exchange of Islet Sciences shares by the stockholders of Islet Sciences for Avogenx shares will qualify as an exchange under Section 351 of the Code and that no gain or loss recognition is incurred to the public stockholders of Islet Sciences.

Risk Factors

In evaluating the Merger and Merger Agreement, you should carefully read this consent solicitation statement/prospectus and the documents attached to this consent solicitation statement/prospectus, and especially consider the factors discussed in the section entitled “Risk Factors.”

SELECTED HISTORICAL FINANCIAL DATA OF ISLET SCIENCES

Annual Data

Set forth below is Islet Sciences’ selected historical consolidated financial and other operating data. Islet Sciences’ selected historical consolidated financial data and other data set forth below have been derived from its audited consolidated financial statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Islet Sciences” and the Consolidated Financial Statements of Islet Sciences and Notes thereto set forth elsewhere in this consent solicitation statement/prospectus.

| | Years Ended April 30, | | Three Months Ended July 31, |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

| | | | | | | | | (Unaudited) | |

| | | | | | | | | | | | | |

| Statement of Operations Data: | | | | | | | | | | | | |

| Net sales | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Loss from operations | | $ | (2,935,034 | ) | | $ | (12,122,474 | ) | | $ | (463,730 | ) | | $ | (1,292,623 | ) |

| Net loss per common share basic and diluted: | | $ | (0.05 | ) | | $ | (0.21 | ) | | $ | (0.01 | ) | | $ | (0.02 | ) |

| Net loss | | $ | (2,946,430 | ) | | $ | (11,702,599 | ) | | $ | (464,530 | ) | | $ | (1,294,854 | ) |

Weighted average common shares outstanding basic and diluted (in thousands) | | | 58,215 | | | | 54,512 | | | | 67,070 | | | | 56,715 | |

| | | | | | | | |

| Balance sheet data (at period end): | | | | | | | | | | | | | | | | |

| Total assets | | $ | 4,620,187 | | | $ | 3,642,889 | | | $ | 3,936,243 | | | $ | 3,631,814 | |

| Total liabilities | | $ | 4,343,161 | | | $ | 3,011,084 | | | $ | 3,783,763 | | | $ | 4,294,863 | |

| Other financial data: | | | | | | | | | | | | | | | | |

| Net cash used in operating activities | | $ | (972,928 | ) | | $ | (3,903,163 | ) | | $ | (614,121 | ) | | $ | (35,836 | ) |

| Net cash provided by (used in) investing activities | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Net cash provided by (used in) financing activities | | $ | 2,110,719 | | | $ | 1,998,220 | | | $ | (69,823 | ) | | $ | 32,365 | |

SELECTED HISTORICAL FINANCIAL DATA OF BHV

Annual and Interim Data

Set forth below is BHV’s selected historical consolidated financial and other operating data. BHV’s selected historical consolidated financial data and other data set forth below have been derived from its audited consolidated financial statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of BHV” and the Consolidated Financial Statements of BHV and Notes thereto set forth elsewhere in this consent solicitation statement/prospectus.

| | | | | | | | | | | | | |

| | | Years Ended April 30, | | | Three Months Ended July 31, | |

| | | 2014 | | 2013 | | | 2014 | | | 2013 | |

| | | | | | | | (Unaudited) | |

| | | | | | | | | | | | |

| Statement of Operations Data: | | | | | | | | | | | | |

| Net sales | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Loss from operations | | $ | (109,557 | ) | | $ | (96,977 | ) | | $ | (99,148 | ) | | $ | (16,468 | ) |

| Net loss | | $ | (125,520 | ) | | $ | (116,775 | ) | | $ | (102,448 | ) | | $ | (21,232 | ) |

| Balance sheet data (at period end): | | | | | | | | | | | | | | | | |

| Total assets | | $ | 15,906 | | | $ | 16,408 | | | $ | 12,587 | | | $ | 28,754 | |

| Total liabilities | | $ | 485,808 | | | $ | 360,790 | | | $ | 584,937 | | | $ | 391,458 | |

| Other financial data: | | | | | | | | | | | | | | | | |

| Net cash used in operating activities | | $ | (502 | ) | | $ | (36,562 | ) | | $ | (3,319 | ) | | $ | (21,232 | ) |

SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following selected unaudited pro forma condensed combined financial information has been prepared to illustrate the effect of the acquisition of BHV and has been prepared for informational purposes only and should be read in conjunction with the unaudited pro forma condensed combined financial information and the accompanying notes thereto, contained elsewhere in this consent solicitation statement/prospectus. The selected unaudited pro forma condensed combined financial information is based upon the historical condensed consolidated financial statements of Islet Sciences and BHV and notes thereto and should be read in conjunction with the historical financial statements and the accompanying notes of Islet Sciences and BHV, each of which are contained in this consent solicitation statement/prospectus. The selected unaudited pro forma condensed combined financial information does not give effect to the proposed exchange ratio of between 3 and 40 shares of common stock of Islet Sciences for one shares of common stock of Avogenx.

The historical consolidated financial information has been adjusted in the selected unaudited pro forma combined financial statements to give effect to pro forma events that are (1) directly attributable to the acquisition of BHV, (2) factually supportable, and (3) with respect to the statement of operations, expected to have a continuing impact on the combined results of Islet Sciences and BHV. The following selected unaudited pro forma combined financial information depicts the combined balance sheet as of July 31, 2014 and the combined statement of operations for the three months ended July 31, 2014 and for the year ended April 30, 2014 as if the acquisition had occurred. The selected unaudited pro forma combined statement of operations has been prepared assuming the acquisition of BHV had been completed on May 1, 2013, the beginning of the earliest period presented. The selected unaudited pro forma combined balance sheet has been computed assuming the acquisition of BHV had been completed on July 31, 2014. The selected unaudited pro forma financial information has been adjusted with respect to certain aspects of the acquisition of BHV to reflect:

| | ● | | changes in assets and liabilities (as disclosed in more detail elsewhere in this consent solicitation statement/prospectus) to record their preliminary estimated fair values at the closing date of the acquisition and changes in certain expenses resulting therefrom; |

| | ● | | additional indebtedness, including, but not limited to, interest expense; and |

The selected unaudited pro forma combined financial information was prepared in accordance with the acquisition method of accounting under accounting principles generally accepted in the United States, or GAAP, and the regulations of the SEC, and is not necessarily indicative of the financial position or results of operations that would have occurred if the acquisition of BHV had been completed on the dates indicated, nor is it indicative of the future operating results or financial position of Islet Sciences and BHV. Assumptions and estimates underlying the pro forma adjustments are described in the notes accompanying the unaudited pro forma condensed combined financial information, which should be read in connection with the selected unaudited pro forma combined financial information. The accounting for the acquisition is dependent upon certain valuations and other studies that have yet to commence or progress to a stage where there is sufficient information for a definitive measurement. Due to the fact that the selected unaudited pro forma condensed combined financial information has been prepared based upon preliminary estimates, the final amounts recorded for the acquisition may differ materially from the information presented. These estimates are subject to change pending further review of the assets acquired and liabilities assumed.

The selected unaudited pro forma condensed combined statement of operations does not give effect to the legal and regulatory costs expected to be incurred by Islet Sciences and BHV in connection with the Transactions.

| | | Pro Forma Islet Sciences and BHV | |

| | | Year Ended April 30, 2014 | | | Three Months Ended July 31, 2014 | |

| | | | |

Summary of Net Revenue and Income (Loss): | | | | | | |

| Net revenue | | $ | — | | | $ | — | |

| Operating expenses: | | | | | | | | |

| Research and development | | | 656,319 | | | | 70,289 | |

| General and administrative | | | 2,294,686 | | | | 492,589 | |

| Impairment loss | | | 93,586 | | | | — | |

| | | | | | | | | |

| Total operating expenses | | | 3,044,591 | | | | 562,878 | |

| | | | | | | | | |

| Loss from operations | | | (3,044,591 | ) | | | (562,878 | ) |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest expense | | | (27,360 | ) | | | (4,100 | ) |

| | | | | | | | | |

| Total other income (expense) | | | (27,360 | ) | | | (4,100 | ) |

| | | | | | | | | |

| Loss before income taxes | | | (3,071,951 | ) | | | (566,978 | ) |

| | | | | | | | | |

| Net loss | | $ | (3,071,951 | ) | | $ | (566,978 | ) |

| | | | | | | | | |

| Basic and diluted net loss per share attributable to common stockholders | | $ | (0.03 | ) | | $ | (0.01 | ) |

| | | | | | | | | |

Outstanding Shares: | | | | | | | | |

| Weighted average shares used in the computation of basic and diluted net loss per share | | | 88,214,535 | | | | 97,069,789 | |

| | | | | | | | | |

Period-End Financial Position: | | | | | | | | |

| Total assets | | | | | | | $29,394,888 | |

| Total liabilities | | | | | | | $24,742,408 | |

| Stockholders’ equity | | | | | | | $4,652,480 | |

RISK FACTORS

You should carefully consider the following risks associated with the common stock covered hereby. Additional risks and uncertainties not presently known to us or which are not currently believed to be important also may adversely affect the Transactions and Avogenx following the Transactions.

We have a limited operating history and are a development stage company.

We started our operations in 2010. To date, we have had no sales and profits. We cannot assure investors that we will ever become or remain profitable. An investment in our securities is subject to all of the risks involved in a newly established business venture. Potential investors should be aware of the problems, delays, expenses, and difficulties experienced by companies in the early developmental stage, which generally include unanticipated problems and additional costs relating to the commencement of operations and implementation of a business plan.

Future funding requirements

To date, we have not generated any revenue from product sales. We do not know when, or if, we will generate any revenue from product sales. We do not expect to generate any revenue from product sales unless and until we obtain regulatory approval of our product candidates and our companion diagnostic products or any of our other product candidates. At the same time, we expect our expenses to increase in connection with our ongoing development activities, particularly as we continue the research, development and clinical trials of, and seek regulatory approval for, our product candidates and companion diagnostic. In addition, subject to obtaining regulatory approval of any of our product candidates and companion diagnostic, we expect to incur significant commercialization expenses for product sales, marketing, manufacturing and distribution. We anticipate that we will need significant additional funding, which may not be available to us on acceptable terms, or at all, and if not so available, may require us to delay, limit, reduce, or cease our operations.

Until such time that we can generate meaningful revenue from product sales, if ever, we expect to finance our operating activities through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements, and other collaborations, strategic alliances and licensing arrangements or a combination of these approaches. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our common stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our common stockholders. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through government or other third-party funding, marketing and distribution arrangements or other collaborations, or strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us.

There are risks associated with our proposed acquisition of BHV.

On September 30 2014, Islet Sciences entered into the Merger Agreement with BHV. If all conditions to closing in the Merger Agreement are met, Islet Sciences will complete the acquisition of BHV, upon the effectiveness of the registration of which this consent solicitation statement/prospectus is a part, and the receipt of the requisite approval of Islet Sciences stockholders. The addition of BHV’s Remogliflozin to our pipeline is a key element of our strategy to transition into a clinical stage company and attract additional funding. If the Transactions are not completed or their completion is delayed, Islet Sciences’ strategy, results of operations and consolidated financial condition may be severely and adversely impacted.

Completion of the Transactions is subject to many conditions and if these conditions are not satisfied or, where permissible, waived, the merger will not be completed.

The obligations of Islet Sciences and BHV to complete the Transactions are subject to satisfaction or, where permissible, waiver of a number of conditions, including, among others: (i) Islet Sciences must have obtained stockholder approval of the Merger Agreement and the Merger, (ii) all authorizations, consents, orders or approvals of, or declarations or filings with, and all expirations of waiting periods required from, any governmental authority under applicable laws shall have been filed, have occurred or been obtained, and all such requisite regulatory approvals shall be in full force and effect, (iii) shares of Avogenx issuable pursuant to the Merger Agreement shall have been authorized for quotation on the OTCQB, (iv) the registration statement of which this consent solicitation statement/prospectus is a part shall have been declared effective, is not subject to any stop order and no proceeding for that purpose, and no similar proceeding with respect to this consent solicitation statement/prospectus, shall have been initiated or threatened in writing by the SEC or its staff, (v) no temporary restraining order, preliminary or permanent injunction or other order issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the Transactions shall be in effect. For a more complete summary of the conditions that must be satisfied (or, where permissible, waived) prior to completion of the Transactions, see “Terms of the Transactions – Terms of the Merger Agreement – Conditions to Completion of the Transactions.” There can be no assurance that the conditions to closing of the Transactions will be satisfied or, where permissible, waived, or that the Transactions will be completed. Further, it is possible that one or more of the conditions to closing the Transactions will not be met and that the party for whom the condition exists will waive the condition and the Transactions will be completed anyway.

Shares of Avogenx common stock to be received by Islet Sciences stockholders as a result of the Merger will have rights different from shares of the Islet Sciences common stock.

Upon completion of the Merger, the rights of former stockholders of Islet Sciences will be governed by Avogenx’s Certificate of Incorporation and By-Laws. The rights associated with Islet Sciences common stock are different from the rights associated with Avogenx common stock, especially because Islet Sciences is a Nevada corporation and Avogenx is a Delaware corporation. Please see the section entitled “Comparison of Rights of Stockholders” beginning on page 76 of this consent solicitation statement/prospectus for a discussion of the different rights associated with Avogenx common stock.

Islet Sciences will incur significant transaction and merger-related costs in connection with the Transactions.

Islet Sciences expects to incur a number of costs associated with the Transactions. The significant costs associated with the Transactions include, among others, professional fees and expenses, filing fees due in connection with filings required under applicable law and filing fees and printing and mailing costs for this consent solicitation statement/prospectus. Some of these costs have already been incurred or may be incurred regardless of whether the Transactions are consummated, including a portion of the professional fees and expenses and filing fees for this consent solicitation statement/prospectus.

The unaudited pro forma condensed combined financial statements included in this consent solicitation statement/prospectus are preliminary and the actual financial condition and results of operations of Avogenx after the Transactions may differ materially.

The unaudited pro forma combined financial statements in this consent solicitation statement/prospectus are presented for illustrative purposes only and are not necessarily indicative of what Avogenx’s actual financial condition or results or operations would have been had the Transactions been completed on the dates indicated. The unaudited pro forma condensed combined financial statements reflect adjustments, which are based upon preliminary estimates, to record the BHV identifiable assets acquired and liabilities assumed at fair value. The purchase price allocation reflected in this document is preliminary, and final allocation of the purchase price will be based upon the actual purchase price and the fair value of the assets and liabilities of BHV as of the date of the completion of the Transactions. Accordingly, the final acquisition accounting adjustments may differ materially from the pro forma adjustments reflected in this document. For more information, see “Islet Sciences and BHV Unaudited Pro Forma Condensed Combined Financial Information.”

If we cease to continue as an operational entity, due to lack of funding or otherwise, you may lose your entire investment.

Our current plans indicate that we will need substantial additional capital for research and development, including costs associated with developing our technology and conducting clinical trials of our product candidates, before we have any anticipated revenue generating products.

When we require additional funds, general market conditions or the then-current market price of our common stock may not support capital raising transactions such as additional public or private offerings of our common stock. If we require additional funds and we are unable to obtain them on a timely basis or on terms favorable to us, we may be required to scale back our development of new products, sell or license some or all of our technology or assets, or curtail or cease operations.

You may experience dilution of your ownership interests due to the future issuance of additional shares of our common stock.

Avogenx may in the future issue additional shares of common stock or other securities, resulting in the dilution of the ownership interests of its common stockholders. Avogenx is currently authorized to issue two hundred million shares of common stock and ten million shares of preferred stock with such designations, preferences and rights as determined by its board of directors. Issuance of additional shares of common stock may substantially dilute the ownership interests of Avogenx’s stockholders. Avogenx may also issue additional shares of its common stock or other securities that are convertible into or exercisable for common stock in connection with the hiring of personnel, future acquisitions, future public or private placements of our securities for capital raising purposes, or for other business purposes. Any such issuance would further dilute the interests of Avogenx’s stockholders.

There has been no active public market for our securities.

There has been no active public market for Islet Sciences common stock and may not be for Avogenx common stock. An active public market for our common stock may not develop or be sustained. The market price of our common stock may fluctuate significantly in response to factors, some of which are beyond our control. These factors include product liability claims or other litigation, the announcement of new pharmaceuticals or pharmaceutical enhancements by our competitors, developments concerning intellectual property rights and regulatory approvals, quarterly variations in competitors’ results of operations, changes in earnings estimates or recommendations by securities analysts, developments in our industry, and general market conditions and other factors, including factors unrelated to our operating performance.

Avogenx’s common stock is likely to be considered a "penny stock" and may be difficult to sell.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market or exercise price of less than $5.00 per share, subject to specific exemptions. The market price of Avogenx’s common stock is likely to be below $5.00 per share, as the Islet Sciences common stock is currently below this level, and therefore will be designated as a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell such shares and may affect the ability of investors to sell their shares and the ability of investors to buy shares. In addition, since Islet Sciences’ common stock is currently quoted on the OTC Bulletin Board, investors may find it difficult to obtain accurate quotations of the stock and may find few buyers to purchase the stock or a lack of market makers to support the stock price.

No assurance of future successful development.

Prospects for companies in the business of development of new drug products generally are uncertain given the nature of the industry and, accordingly, investments in such companies are highly speculative.

Our products may not be successfully developed or commercialized, which would harm us and force us to curtail our operations.

We may not be able to obtain regulatory approvals for product candidates we develop, to enter clinical trials for any of our product candidates, or to commercialize any products, on a timely basis or at all. If we are unable, for technological or other reasons, to complete the development, introduction or scale-up of manufacturing of potential products, or if our products do not achieve a significant level of market acceptance, we would be forced to curtail or cease operations.

Any product candidate we advance into clinical trials may cause undesirable side effects that could delay or prevent its regulatory approval or commercialization.

Undesirable side effects caused by any product candidate we advance into clinical trials could interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications. This, in turn, could prevent us from commercializing these or any other product candidate we advance into clinical trials.

Any one or a combination of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase the costs and expenses of commercializing the product, which in turn could delay or prevent us from generating significant revenues from the sale of the product.

If we receive regulatory approval we will also be subject to ongoing FDA obligations and continued regulatory review such as continued safety reporting requirements, and we may also be subject to additional FDA post-marketing obligations. FDA and corresponding foreign regulatory requirements could adversely affect our ability to generate revenue and require additional expenditures to bring our products to market.

Any regulatory approvals that we receive for our products may also be subject to limitations on the indicated uses for which the product may be marketed or contain requirements for potentially costly post-marketing follow-up studies. In addition we or our third party manufacturers may be required to undergo a pre-approval inspection of manufacturing facilities by the FDA and foreign authorities before obtaining marketing approval and will be subject to periodic inspection by the FDA and corresponding foreign regulatory authorities under reciprocal agreements with the FDA. Such inspections may result in compliance issues that could prevent or delay marketing approval or require the expenditure of money or other resources to correct noncompliance.

If a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, our collaborators, or us, including requiring withdrawal of the product from the market. Our product candidates will also be subject to ongoing FDA requirements for the labeling, packaging, storage, advertising, promotion, record-keeping, and submission of safety and other post-market information on the drug. If our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

| – | impose civil or criminal penalties; |

| – | withdraw regulatory approval; |

| – | suspend any ongoing clinical trials; |

| – | refuse to approve pending applications or supplements to approved applications filed by us or our collaborators; |

| – | impose restrictions on operations, including costly new manufacturing requirements; or |

| – | seize or detain products or require a product recall. |

Moreover, in order to market any products outside of the United States, we and our collaborators must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks described above regarding FDA approval in the United States. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval could have the same adverse effects described above regarding FDA approval in the United States. As described above, such effects include the risk that our product candidates may not be approved for all indications requested, which could limit the uses of our product candidates and adversely impact potential royalties and product sales, and that such approval may be subject to limitations on the indicated uses for which the product may be marketed or require costly, post-marketing follow-up studies.