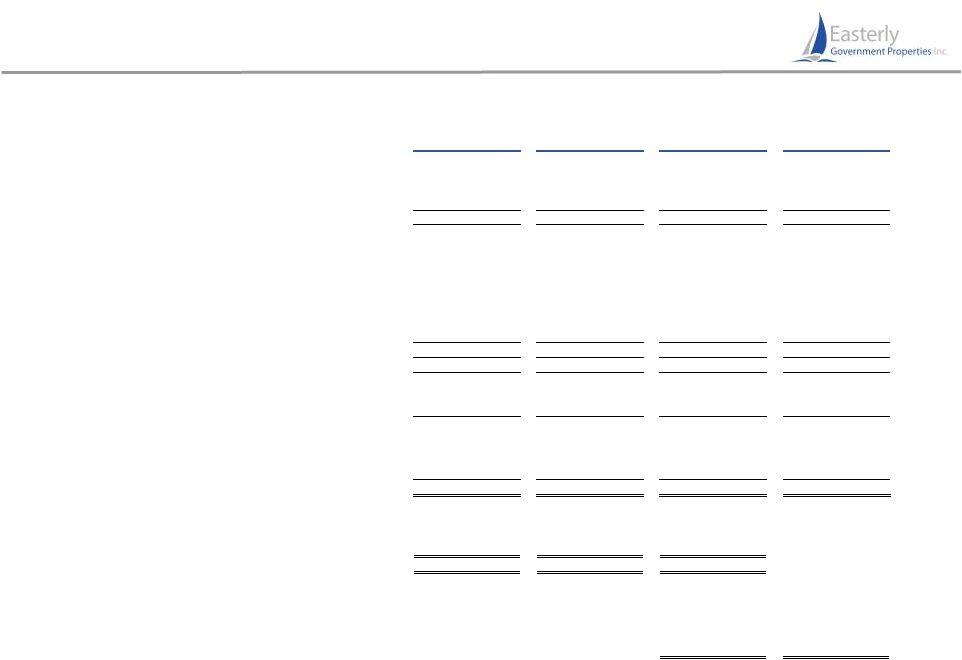

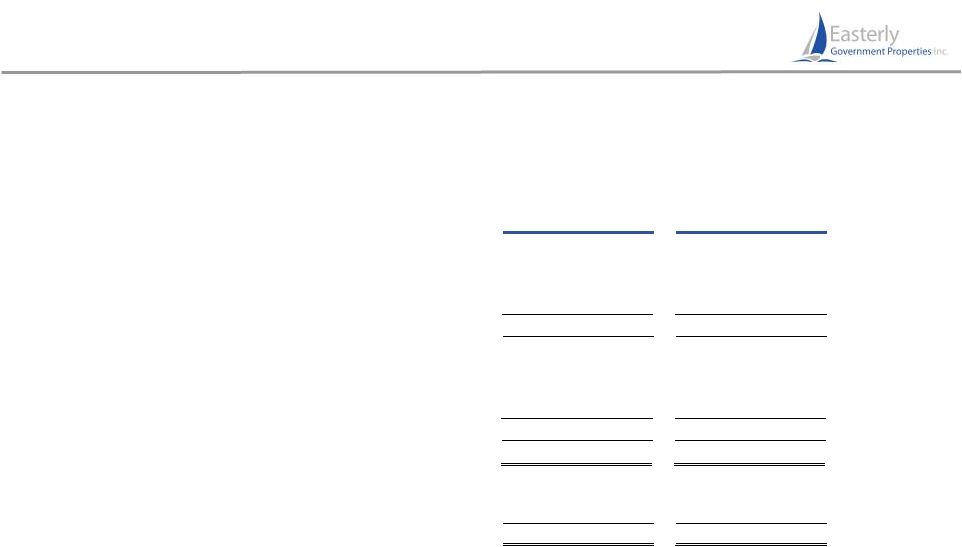

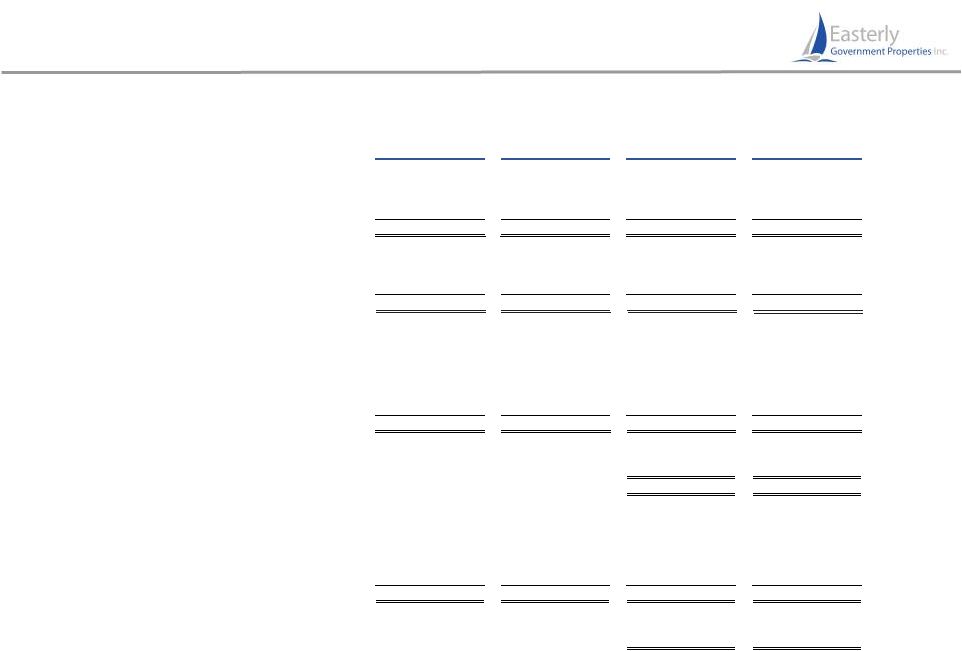

8 related to its initial public offering, including legal and accounting fees and new entity formation costs and (2) reflects a full quarter of operations for the period from January 1, 2015 to March 31, 2015 on a pro forma basis based on the financial results of the 49 days of operations between February 11, 2015 and March 31, 2015. Darrell Crate, Chairman of the Board commented, “We are pleased with both our portfolio performance and our pipeline of acquisition opportunities. Easterly offers a differentiated growth story to investors with our definable edge in sourcing, underwriting, and managing properties leased to one of the highest quality tenants, the U.S. Federal Government.” Portfolio Operations As of June 30, 2015, the Company wholly owned 31 properties in the United States, encompassing approximately 2.2 million square feet in the aggregate, including 28 properties that were leased primarily to U.S. Government tenant agencies and three properties that were entirely leased to private tenants. As of June 30, 2015, the portfolio had a weighted average age of 10.9 years, was 100% occupied, and had a weighted average lease term of 7.6 years. With just seven percent of the leases, by annualized lease income, rolling through the end of 2017, Easterly expects to continue to provide a highly visible and stable cash- flow stream. Acquisitions Since the completion of the Company’s IPO on February 11, 2015 the Company has acquired two properties for an aggregate purchase price of $34.3 million. On April 1, 2015, Easterly acquired the Department of Energy (“DOE”) building in Lakewood, Colorado for $20.3 million, its first acquisition since its IPO. The 115,650-square foot building serves as the headquarters for the DOE’s Western Area Power Administration (“WAPA”) and represents the Company’s second asset in Lakewood, Colorado, a major federal agency center in the Rocky Mountain region. Built in 1999, the Lakewood building is a Class A facility leased to the General Services Administration (“GSA”) on behalf of the DOE until 2029. The building is 100% occupied by WAPA and provides engineering, accounting, human resources, legal and training support to four regional offices that operate and maintain the DOE’s Western Transmission System which covers a 1.3 million square mile service area. On June 17, 2015, Easterly acquired the Thad Cochran U.S. Bankruptcy Courthouse in Aberdeen, Mississippi for $14.1 million, its second acquisition since its IPO. This acquisition is demonstrative of Easterly’s core strategy of investing in mission critical properties occupied by essential functions of the U.S. Government. The 46,979-square foot building is a modern building in terms of court functionality and security, expressed in the stately form of a Greco-Roman classical design. Built in 2005 based on the exacting standards of the U.S. Courts Design Guide, the Company believes it is fully compliant with the Judiciary’s needs in terms of security, space sizes and function, and circulation patterns for the public and judicial officers. The property is leased to the GSA with 10 years remaining on an initial 20-year lease. Balance Sheet Easterly believes that its strong balance sheet and borrowing ability under its unsecured revolving credit facility provides ample capacity to pursue and fund its growth plan. As of June 30, 2015, the Company had total indebtedness of $102.2 million comprised of $33.4 million on its unsecured revolving credit facility and $68.8 million of mortgage debt (excluding unamortized premiums and discounts). At June 30, 2015, Easterly had a net debt to total enterprise value of 13.5% and a net debt to annualized pro forma quarterly EBITDA ratio of 2.1x. Easterly’s outstanding debt has a weighted average maturity of 9.7 years and a weighted average interest rate of 3.3%. The Company has roughly $366.6 million of remaining capacity on its $400 million revolver, before consideration for the facility’s $250 million accordion feature. Dividend On August 4, 2015 the Board of Directors of Easterly approved a cash dividend for the second quarter of 2015 in the amount of $0.21 per common share. The dividend will be payable September 3, 2015 to shareholders of record on August 18, 2015. Second Quarter 2015 Results |