- JCAP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Jernigan Capital (JCAP) 8-KRegulation FD Disclosure

Filed: 8 Jun 15, 12:00am

Exhibit 99.1

1 NAREIT Presentation

2 Disclaimer About Jernigan Capital, Inc. Jernigan Capital is a commercial real estate finance company that provides financing to private developers, owners and operat ors of self - storage facilities. Jernigan Capital offers financing solutions for the ground - up construction of self - storage facilities or major self - storage rede velopment opportunities, as well as for the acquisition of, refinancing of existing indebtedness on, or recapitalization of stabilized self - storage facilities. J ernigan Capital intends to elect to be taxed as a real estate investment trust and is externally managed by JCap Advisors, LLC. Forward - Looking Statements Some of the statements contained in this presentation constitute forward - looking statements within the meaning of the federal se curities laws, including statements regarding deals expected to close and deals under consideration. Forward - looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward - looking statements by the use of forward - looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “pla ns,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” or “potential” or the negative of these words or similar words, which are pr edi ctions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward - looking statements by disc ussions of strategy, plans or intentions. The forward - looking statements contained in this presentation reflect our current views about future events and are subject to n umerous known and unknown risks, uncertainties, assumptions and changes in circumstances, many of which are beyond our control, that may cause actual r esu lts to differ significantly from those expressed in any forward - looking statement. While forward - looking statements reflect our good faith beliefs, assumpt ions and expectations, they are not guarantees of future performance. Furthermore, we expressly disclaim any obligation to publicly update or revise any fo rward - looking statement to reflect changes in the underlying assumptions or factors, new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause our future results to differ significantly from any forward - looking statements, see the secti on entitled “Risk Factors” in Registration Statement on Form S - 11 (File No. 333 - 202239), and our other filings with the Securities and Exchange Commission. This presentation contains statistics and other data that has been obtained from or compiled from information made available by third parties. We have not independently verified such statistics or data. Contact: Jernigan Capital Gregory W. Ward, 305 - 381 - 9696

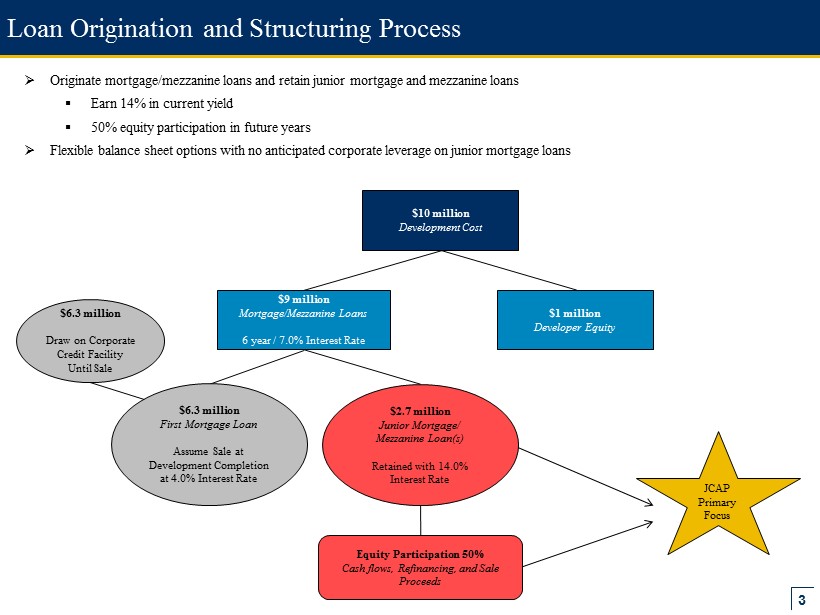

3 Loan Origination and Structuring Process $10 million Development Cost $9 million Mortgage/Mezzanine Loans 6 year / 7.0% Interest Rate $1 million Developer Equity $2.7 million Junior Mortgage/ Mezzanine Loan(s) Retained with 14.0% Interest Rate Equity Participation 50% Cash flows, Refinancing, and Sale Proceeds $6.3 million First Mortgage Loan Assume Sale at Development Completion at 4.0% Interest Rate » Originate mortgage/mezzanine loans and retain junior mortgage and mezzanine loans ▪ Earn 14% in current yield ▪ 50 % equity participation in future years » Flexible balance sheet options with no anticipated corporate leverage on junior mortgage loans $6.3 million Draw on Corporate Credit Facility Until Sale JCAP Primary Focus

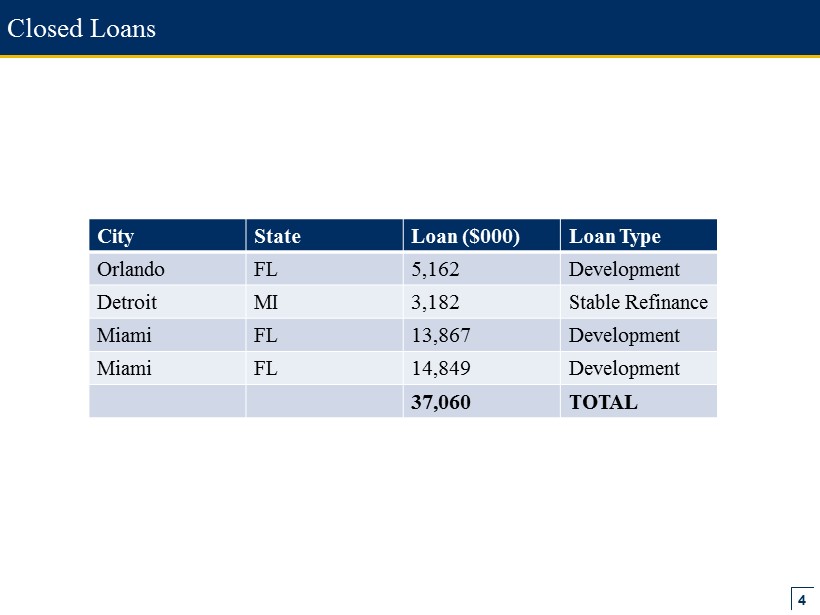

4 Closed Loans City State Loan ($000) Loan Type Orlando FL 5,162 Development Detroit MI 3,182 Stable Refinance Miami FL 13,867 Development Miami FL 14,849 Development 37,060 TOTAL

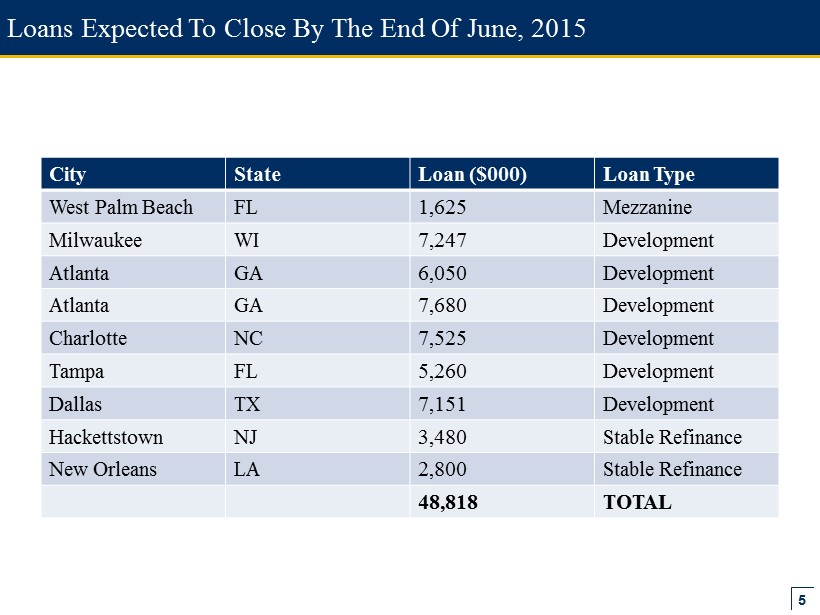

5 Loans Expected To Close By The End Of June, 2015 City State Loan ($000) Loan Type West Palm Beach FL 1,625 Mezzanine Milwaukee WI 7,247 Development Atlanta GA 6,050 Development Atlanta GA 7,680 Development Charlotte NC 7,525 Development Tampa FL 5,260 Development Dallas TX 7,151 Development Hackettstown NJ 3,480 Stable Refinance New Orleans LA 2,800 Stable Refinance 48,818 TOTAL

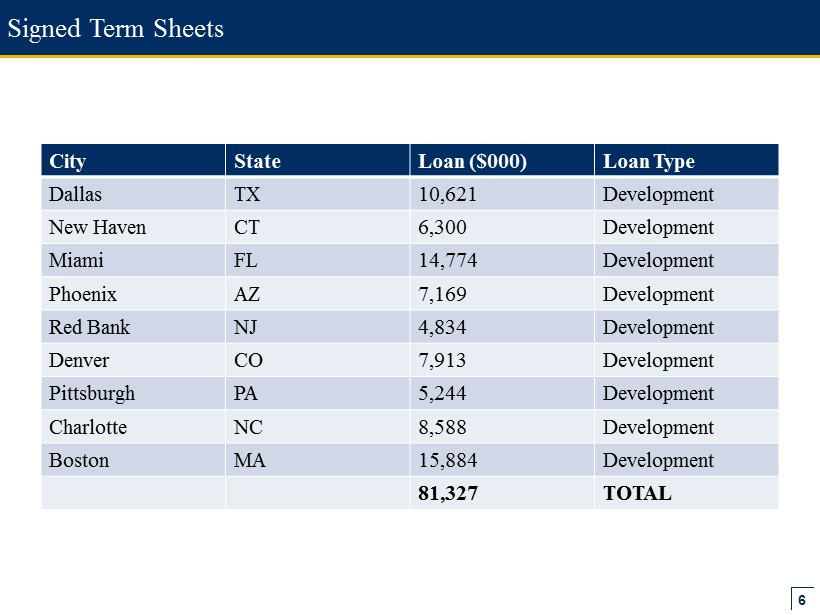

6 Signed Term Sheets City State Loan ($000) Loan Type Dallas TX 10,621 Development New Haven CT 6,300 Development Miami FL 14,774 Development Phoenix AZ 7,169 Development Red Bank NJ 4,834 Development Denver CO 7,913 Development Pittsburgh PA 5,244 Development Charlotte NC 8,588 Development Boston MA 15,884 Development 81,327 TOTAL

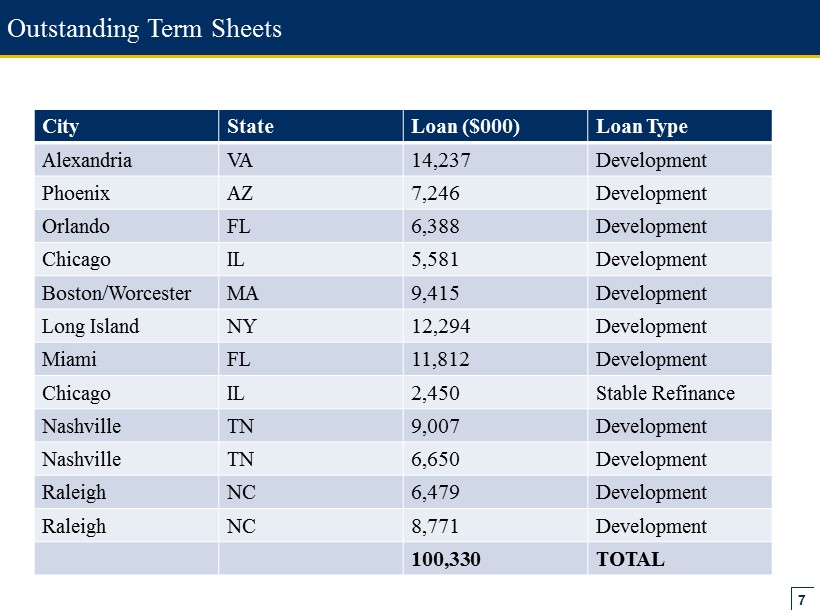

7 Outstanding Term Sheets City State Loan ($000) Loan Type Alexandria VA 14,237 Development Phoenix AZ 7,246 Development Orlando FL 6,388 Development Chicago IL 5,581 Development Boston/Worcester MA 9,415 Development Long Island NY 12,294 Development Miami FL 11,812 Development Chicago IL 2,450 Stable Refinance Nashville TN 9,007 Development Nashville TN 6,650 Development Raleigh NC 6,479 Development Raleigh NC 8,771 Development 100,330 TOTAL

8 Underwriting/Under Consideration • 43 properties • $315.3 million t otal loan volume • 14 states • AZ, CA, CO, DC, FL, MO, NC, NJ, NY, OH, SC, TN, TX, UT • Total pipeline at approximately $583 million

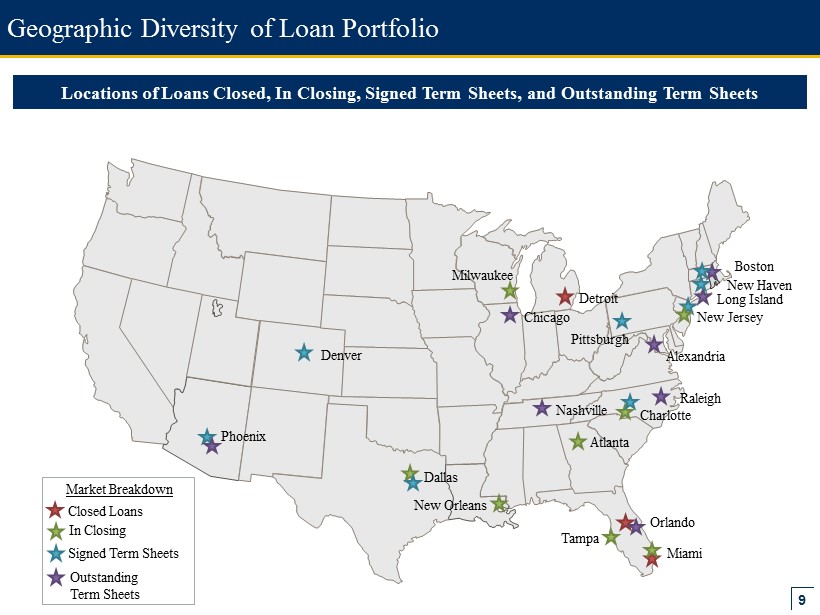

9 Geographic Diversity of Loan Portfolio Phoenix Dallas Tampa Atlanta Boston New Jersey Alexandria Miami Chicago In Closing Closed Loans Locations of Loans Closed, In Closing, Signed Term Sheets, and Outstanding Term Sheets Market Breakdown Denver Charlotte Orlando Nashville Signed Term Sheets Outstanding Term Sheets Detroit Pittsburgh Long Island New Haven Milwaukee New Orleans Raleigh