Exhibit 99.2

First Quarter 2019 |

| 1 |

Forward Looking Statements

This Supplemental Information package contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). These forward-looking statements include, without limitation, statements about our estimates, expectations, predictions and forecasts of our future business plans and financial and operating performance and/or results, including our second quarter and full-year 2019 earnings guidance and the assumptions underlying such guidance, our ability to successfully source, structure, negotiate and close investments in and acquisitions of self-storage facilities, the market dynamics of the MSAs in which our investments are located, our ability to fund our outstanding future investment commitments, our ability to own and manage our real estate assets, the availability, terms and our rate of deployment of equity capital and our ability to increase the borrowing base of our credit facility, as well as statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. When we use the words “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” or similar expressions or their negatives, as well as statements in future tense, we intend to identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, beliefs and expectations, such forward-looking statements are not predictions of future events or guarantees of future performance and our actual financial and operating results could differ materially from those set forth in the forward-looking statements. Some factors that might cause such differences are described in the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K, and those set forth in our other reports and information filed with the Securities and Exchange Commission (“SEC”), which factors include, without limitation, the following:

| · | | our ability to successfully source, structure, negotiate and close investments in and acquisitions of self-storage facilities; |

| · | | changes in our business strategy and the market’s acceptance of our investment terms; |

| · | | our ability to fund our outstanding and future investment commitments; |

| · | | our ability to complete construction and obtain certificates of occupancy for self-storage development projects in which we invest; |

| · | | the future availability for borrowings under our credit facility (including borrowing base capacity and the availability of the accordion feature); |

| · | | availability, terms and our rate of deployment of equity and debt capital; |

| · | | our manager’s ability to hire and retain qualified personnel; |

| · | | changes in the self-storage industry, interest rates or the general economy; |

| · | | the degree and nature of our competition; |

| · | | volatility in the value of our assets carried at fair market value; |

| · | | potential limitations on our ability to pay dividends at historical rates; |

| · | | limitations in our existing and future debt agreements on our ability to pay distributions; |

| · | | the impact of our outstanding preferred stock on our ability to execute our business plan and pay distributions on our common stock; and |

| · | | general volatility of the capital markets and the market price of our common stock. |

Given these uncertainties, undue reliance should not be placed on our forward-looking statements. We assume no duty or responsibility to publicly update or revise any forward-looking statement that may be made to reflect future events or circumstances or to reflect the occurrence of unanticipated events. We urge you to review the disclosures concerning risks in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and in other documents that we file from time-to-time with the SEC.

Non-GAAP Financial Measures

Adjusted Earnings is a non-GAAP measure and is defined as net income attributable to common stockholders plus stock dividends to preferred stockholders, stock-based compensation expense, depreciation and amortization on real estate assets, depreciation and amortization on SL1 Venture real estate assets, and other expenses. Management uses Adjusted Earnings and Adjusted Earnings per diluted share as key performance indicators in evaluating the operations of the Company's business. The Company is a capital provider to self-storage developers and believes that these measures are useful to management and investors as a starting point in measuring its operational performance because they exclude various equity-based payments (including stock dividends) and other items included in net income that do not relate to or are not indicative of its present and future operating performance, which can make periodic and peer analyses of operating performance more difficult. The Company’s computation of Adjusted Earnings and Adjusted Earnings per share may not be comparable to other key performance indicators reported by other REITs or real estate companies. Reconciliations of Adjusted Earnings and Adjusted Earnings per share to Net income attributable to common stockholders and Earnings per share, respectively, are provided in the attached table entitled “Calculation of Adjusted Earnings.”

First Quarter 2019 |

| 2 |

Press Release – May 2019

Jernigan Capital Reports First Quarter Earnings per Share and Adjusted Earnings per Share Above

High End of Guidance Range

MEMPHIS, Tennessee, May 1, 2019 / Business Wire / Jernigan Capital, Inc. (NYSE: JCAP), a leading capital partner for self-storage entrepreneurs nationwide, today announced results for the quarter ended March 31, 2019.

First Quarter Highlights include:

| § | | Earnings per share and adjusted earnings per share of $0.35 and $0.52, respectively, both above the high end of guidance ranges provided with the Company’s fourth quarter 2018 earnings release; |

| § | | Continued transition to property ownership with on-balance sheet purchase of the developer’s interest in the Company’s New Haven development property investment and purchase by the Company’s joint venture with Heitman of the developers’ interests in the Atlanta 1, Jacksonville, Atlanta 2, and Denver development property investments – Company now has direct or indirect fee ownership in 63% of the facilities for which it has financed development and that have been open for business more than 12 months; |

| § | | Closed on two development investments, in Stamford, Connecticut and Staten Island, New York, with an aggregate commitment amount of $21.7 million; |

| § | | Leasing commenced on the Generation V self-storage facilities underlying four development property investments in which the Company has an aggregate committed investment of $29.1 million, 49.9% profits interests and ROFRs; and |

| § | | Increased book value per common share to $19.02 at March 31, 2019 from $18.35 at March 31, 2018. |

“The Company is off to a great start in 2019,” stated Dean Jernigan, Executive Chairman of Jernigan Capital, Inc. “As the development cycle approaches its fifth year, we remain selective in committing to new development opportunities, focusing exclusively on select submarkets with strong demographics that have been largely overlooked this development cycle. Year-to-date we have closed three new development investments in Staten Island, NY, Stamford, CT, and Long Island, NY, three submarkets that exhibit the compelling demographics that we expect will drive strong demand and excellent returns over time.”

John Good, Chief Executive Officer of the Company, added, “Our first quarter results reflect another quarter of strong execution, with revenue, earnings per share and adjusted earnings per share exceeding the high end of our quarterly guidance ranges. We posted 89% growth in total revenues and 103% growth in adjusted earnings compared to the first quarter of 2018. Our portfolio of state-of-the-art Generation V self-storage properties continues to progress through construction and lease-up, with 46 facilities, representing 65% of self-storage projects that we have financed, open and operating as of the end of the first quarter.”

“We continue to see opportunities to acquire developer interests in our core development investments,” Mr. Good continued. “In January, our joint venture with Heitman acquired developers’ interests in two facilities in the Atlanta MSA, one facility in the Jacksonville MSA and one facility in the Denver MSA, and in March we acquired the developer’s interest in our New Haven, Connecticut development property. We have now purchased our developers’ interests in eight facilities on balance sheet and in four facilities within our joint venture. With those acquisitions and the three development investment commitments year-to-date, we have committed almost 50% of the midpoint of our full year 2019 investment guidance range of $85 million to $115 million.”

“From a capital perspective, we continue to be extremely focused on maximizing stockholder value by properly matching investments with the optimal capital sources, including our recently upsized credit facility and our common stock ATM program,” Mr. Good added. “Our investment commitments including 2019 closing guidance are fully covered through mid-2020, and we have positioned ourselves to maintain conservative leverage levels in the range of 25% to 30% of total assets for the foreseeable future.”

Financial Highlights

Earnings per share and adjusted earnings per share for the three months ended March 31, 2019 were $0.35 and $0.52, respectively, which are each $0.13 above the high end of the Company’s guidance range provided in the Company’s fourth quarter 2018 earnings release.

Net income attributable to common stockholders for the three months ended March 31, 2019 was $7.1 million, or $0.35 per share, and adjusted earnings were $10.6 million, or $0.52 per share, representing increases of $5.3 million, or 303%, and $5.4 million, or 103%, over the $1.8 million and $5.2 million of earnings and adjusted earnings, respectively, reported for the first quarter of 2018.

Total revenues for the three months ended March 31, 2019 were $9.9 million, representing an increase of $4.7 million, or 89% over revenues for the comparable period in 2018. The increase in revenues is primarily attributed to the increase in the outstanding principal balances on the Company’s investment portfolio.

First Quarter 2019 |

| 3 |

General and administrative expenses, excluding fees to the manager, for the three months ended March 31, 2019 and 2018 were $1.8 million. Included in these amounts were stock-based compensation expense of $0.3 million for the three months ended March 31, 2019 and 2018.

Net income attributable to common stockholders and adjusted earnings for the quarter ended March 31, 2019 also includes increases in the fair value of investments of $8.8 million compared to increases of $4.3 million for the comparable period in 2018. This represents a $4.5 million, or 104%, year-over-year increase from the quarter ended March 31, 2018.

Subsequent Events

In April, the Company closed a new development investment in Long Island, New York with a $23.5 million commitment.

Capital Markets Activities

As of March 31, 2019, the Company had borrowed $27 million of $118 million of total availability under its secured revolving credit facility. The Company expects availability under its credit facility to continue to increase over the remainder of 2019 as the Company adds existing on-balance sheet operating properties to the borrowing base.

During the first quarter, the Company issued an aggregate $2.9 million of common stock under the Company’s at-the-market (“ATM”) program at an average share price of $21.43, a 12.7% premium to the Company’s reported book value per share as of December 31, 2018. The Company had $72.2 million available on its current common stock ATM Program at March 31, 2019.

Dividends

On February 22, 2019, the Company declared cash and stock dividends on its Series A Preferred Stock. The cash dividend of $2.2 million was paid on April 15, 2019 to holders of record on April 1, 2019. A stock dividend of 2,125 shares of additional Series A Preferred Stock was issued on April 15, 2019 to holders of record on April 1, 2019 for an aggregate value of $2.1 million pursuant to the terms of the Stock Purchase Agreement.

On February 22, 2019, the Company declared a cash dividend on its Series B Preferred Stock. The cash dividend of $0.7 million was paid on April 15, 2019 to holders of record on April 1, 2019.

Additionally, on February 22, 2019, the Company declared a dividend of $0.35 per common share. The dividend was paid on April 15, 2019 to common stockholders of record on April 1, 2019.

First Quarter 2019 |

| 4 |

Second Quarter Guidance

The following table reflects earnings per share and adjusted earnings per share guidance ranges for the three months ending June 30, 2019. Such guidance is based on management's current expectations of Company investment and acquisition activity (including fair value appreciation, the expected timing of construction progress and receipts of certificates of occupancy, and the assumptions regarding the timing of acquisitions of developer interests), the operational and new supply dynamics of the self-storage markets in which the Company has invested, and overall economic conditions, including interest rate levels. Adjusted earnings is a performance measure that is not specifically defined by accounting principles generally accepted in the United States (“GAAP”) and is defined as net income attributable to common stockholders (computed in accordance with GAAP) plus stock dividends to preferred stockholders, stock-based compensation expense, and depreciation and amortization on real estate assets. For more information about our calculation of adjusted earnings, see “Non-GAAP Financial Measures” below.

| | | | | | |

| | | | | | |

| | Dollars in thousands, |

| | except share and per share data |

| | Three months ending |

| | June 30, 2019 |

| | Low | | High |

Interest income from investments | | $ | 8,750 | | $ | 8,850 |

Rental revenue from real estate owned | | | 1,625 | | | 1,675 |

Other income | | | 35 | | | 40 |

Total revenues | | $ | 10,410 | | $ | 10,565 |

G&A expenses (1) | | | (4,575) | | | (4,425) |

Property operating expenses (excl. depreciation and amortization) | | | (870) | | | (820) |

Depreciation and amortization on real estate assets | | | (1,100) | | | (1,050) |

Interest expense | | | (2,100) | | | (2,000) |

JV income | | | 70 | | | 90 |

Other interest income | | | 10 | | | 15 |

Net unrealized gain on investments (2) | | | 6,000 | | | 8,000 |

Net income | | | 7,845 | | | 10,375 |

Net income attributable to preferred stockholders (3) | | | (5,100) | | | (5,090) |

Net income attributable to common stockholders | | | 2,745 | | | 5,285 |

Add: stock dividends | | | 2,125 | | | 2,125 |

Add: stock-based compensation | | | 720 | | | 700 |

Add: depreciation and amortization on real estate assets (4) | | | 1,190 | | | 1,130 |

Adjusted earnings | | $ | 6,780 | | $ | 9,240 |

Earnings per share – diluted | | $ | 0.13 | | $ | 0.25 |

Adjusted earnings per share – diluted | | $ | 0.32 | | $ | 0.44 |

Average shares outstanding – diluted | | | 20,950,000 | | | 20,950,000 |

| 1) | | Includes $2.1 million (low) / $2.0 million (high) of fees to Manager for the three months ending June 30, 2019. |

| 2) | | Excludes $0.05 million (low and high) of unrealized appreciation in fair value of investments from the real estate venture, which is included in JV income for the three months ending June 30, 2019. |

| 3) | | Represents both cash dividends and stock dividends (which stock dividends will be paid out in either shares of the Company’s common stock or additional shares of Series A Preferred Stock, at the option of the Series A stockholders) estimated with respect to outstanding shares of Series A Preferred Stock, as well as cash dividends estimated with respect to outstanding shares of Series B Preferred Stock. |

| 4) | | Includes $0.1 million (low and high) of depreciation and amortization on the real estate assets wholly-owned by the real estate venture, which is included in JV income for the three months ending June 30, 2019. |

The Company is also reaffirming its previously issued guidance for full year 2019. Net income attributable to common stockholders is expected to be between $0.82 and $1.46 per share, and adjusted earnings is expected to be between $1.52 and $2.13 per share.

Additionally, the Company continues to monitor its 2019 fair value guidance with updated estimates of construction progress, timing of the receipt of certificates of occupancy from its development partners and the movement of interest rates and spreads. Of the estimated $30.0 million to $40.0 million of fair value appreciation in 2019, the Company recognized $8.8 million during the first quarter, and expects $6.0 million to $8.0 million to be recognized in the second quarter, $5.5 million to $9.0 million to be recognized in the third quarter, and $9.7 million to $14.2 million to be recognized in the fourth quarter. The Company’s 2019 fair value guidance reflects updated estimates of the timing of construction completion of the self-storage facilities underlying certain of our development investments, as well as the timing of stabilization of facilities in which we have invested. Timing of fair value appreciation is heavily dependent upon construction progress and the timing of construction completion, both of which are subject to factors outside the control of the Company and the Company’s development partners. Moreover, when the Company acquires the developer’s interest in a self-storage project that the Company has financed, the Company no longer accounts for such investment under the fair value method, so acquisitions of developer interests have a potentially material effect on future fair value recognized in the Company’s financial statements. As such, the amount and exact timing of fair value recognition is subject to change.

First Quarter 2019 |

| 5 |

Jernigan Capital, Inc.

Financial Highlights- Trailing Five Quarters

(unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| | Three months ended |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| | 2019 | | 2018 | | 2018 | | 2018 | | 2018 |

Operating Data: | | | | | | | | | | | | | | | |

Interest income, rental-related income and other revenues | | $ | 9,884 | | $ | 9,666 | | $ | 9,091 | | $ | 7,241 | | $ | 5,216 |

JV income | | | 156 | | | 58 | | | 440 | | | 435 | | | 550 |

Total revenues and JV income | | | 10,040 | | | 9,724 | | | 9,531 | | | 7,676 | | | 5,766 |

General & administrative expenses | | | (3,765) | | | (4,375) | | | (3,599) | | | (3,616) | | | (3,122) |

Property operating expenses of real estate owned | | | (762) | | | (508) | | | (473) | | | (420) | | | (311) |

Depreciation and amortization of real estate owned | | | (1,029) | | | (982) | | | (854) | | | (887) | | | (702) |

Interest expense | | | (1,213) | | | (634) | | | (467) | | | (638) | | | (416) |

Other expenses | | | - | | | - | | | - | | | - | | | (290) |

Subtotal | | | 3,271 | | | 3,225 | | | 4,138 | | | 2,115 | | | 925 |

Realized gain on investments | | | - | | | - | | | 619 | | | - | | | - |

Net unrealized gain on investments | | | 8,830 | | | 18,942 | | | 11,060 | | | 8,623 | | | 4,320 |

Other interest income | | | 13 | | | 84 | | | 147 | | | 59 | | | 109 |

Net income | | | 12,114 | | | 22,251 | | | 15,964 | | | 10,797 | | | 5,354 |

Net income attributable to preferred stockholders | | | (5,032) | | | (5,049) | | | (4,790) | | | (4,580) | | | (3,595) |

Net income attributable to common stockholders | | $ | 7,082 | | $ | 17,202 | | $ | 11,174 | | $ | 6,217 | | $ | 1,759 |

Plus: stock dividends to preferred stockholders | | | 2,125 | | | 2,125 | | | 2,125 | | | 2,125 | | | 2,125 |

Plus: stock-based compensation | | | 328 | | | 321 | | | 385 | | | 777 | | | 345 |

Plus: depreciation and amortization on real estate assets | | | 1,029 | | | 982 | | | 854 | | | 887 | | | 702 |

Plus: depreciation and amortization on SL1 Venture real estate assets | | | 56 | | | - | | | - | | | - | | | - |

Plus: other expenses | | | - | | | - | | | - | | | - | | | 290 |

Adjusted Earnings | | $ | 10,620 | | $ | 20,630 | | $ | 14,538 | | $ | 10,006 | | $ | 5,221 |

| | | | | | | | | | | | | | | |

Basic earnings per share attributable to common stockholders | | $ | 0.35 | | $ | 0.87 | | $ | 0.58 | | $ | 0.40 | | $ | 0.12 |

Diluted earnings per share attributable to common stockholders | | $ | 0.35 | | $ | 0.87 | | $ | 0.57 | | $ | 0.40 | | $ | 0.12 |

| | | | | | | | | | | | | | | |

Adjusted Earnings per share attributable to common stockholders – diluted | | $ | 0.52 | | $ | 1.04 | | $ | 0.75 | | $ | 0.64 | | $ | 0.36 |

| | | | | | | | | | | | | | | |

Dividends declared per share of common stock | | $ | 0.35 | | $ | 0.35 | | $ | 0.35 | | $ | 0.35 | | $ | 0.35 |

| | | | | | | | | | | | | | | |

Weighted-average shares of common stock outstanding: | | | | | | | | | | | | | | | |

Basic | | | 20,297,551 | | | 19,655,942 | | | 19,184,172 | | | 15,274,459 | | | 14,247,174 |

Diluted | | | 20,455,116 | | | 19,816,194 | | | 19,459,751 | | | 15,564,317 | | | 14,555,337 |

Shares of common stock outstanding: | | | 20,567,694 | | | 20,430,218 | | | 19,364,339 | | | 19,254,141 | | | 14,447,043 |

| | | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 3,860 | | $ | 8,715 | | $ | 42,624 | | $ | 43,331 | | $ | 15,238 |

Self-Storage Investment Portfolio: | | | | | | | | | | | | | | | |

Development property investments at fair value | | | 405,999 | | | 373,564 | | | 335,509 | | | 302,245 | | | 239,754 |

Bridge investments at fair value | | | 87,046 | | | 84,383 | | | 81,862 | | | 79,581 | | | 77,435 |

Operating property loans at fair value | | | - | | | - | | | 2,440 | | | 5,862 | | | 5,885 |

Self-storage real estate owned | | | 111,297 | | | 100,099 | | | 74,444 | | | 61,896 | | | 61,633 |

Accumulated depreciation on self-storage real estate owned | | | (4,926) | | | (3,897) | | | (2,915) | | | (2,061) | | | (1,174) |

Self-storage real estate owned, net | | | 106,371 | | | 96,202 | | | 71,529 | | | 59,835 | | | 60,459 |

Investment in and advances to self-storage real estate venture | | | 12,360 | | | 14,155 | | | 14,401 | | | 14,846 | | | 14,759 |

Total assets | | | 630,632 | | | 590,408 | | | 556,228 | | | 509,860 | | | 417,252 |

Gross assets | | | 635,558 | | | 594,305 | | | 559,143 | | | 511,921 | | | 418,426 |

| | | | | | | | | | | | | | | |

Senior loan participation | | | - | | | - | | | - | | | - | | | 732 |

Secured revolving credit facility | | | 27,000 | | | - | | | - | | | - | | | 30,000 |

Term loans, net of unamortized costs | | | 33,716 | | | 24,609 | | | 24,578 | | | - | | | - |

Total liabilities | | | 77,831 | | | 42,544 | | | 40,689 | | | 16,122 | | | 43,944 |

| | | | | | | | | | | | | | | |

Total equity | | | 552,801 | | | 547,864 | | | 515,539 | | | 493,738 | | | 373,308 |

Common book value / common shares outstanding | | $ | 19.02 | | $ | 19.01 | | $ | 18.38 | | $ | 18.13 | | $ | 18.35 |

First Quarter 2019 |

| 6 |

Jernigan Capital, Inc.

Consolidated Balance Sheets-Trailing Five Quarters

(unaudited, in thousands)

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | As of |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| | 2019 | | 2018 | | 2018 | | 2018 | | 2018 |

Assets: | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 3,860 | | $ | 8,715 | | $ | 42,624 | | $ | 43,331 | | $ | 15,238 |

Self-Storage Investment Portfolio: | | | | | | | | | | | | | | | |

Development property investments at fair value | | | 405,999 | | | 373,564 | | | 335,509 | | | 302,245 | | | 239,754 |

Bridge investments at fair value | | | 87,046 | | | 84,383 | | | 81,862 | | | 79,581 | | | 77,435 |

Operating property loans at fair value | | | - | | | - | | | 2,440 | | | 5,862 | | | 5,885 |

Self-storage real estate owned, net | | | 106,371 | | | 96,202 | | | 71,529 | | | 59,835 | | | 60,459 |

Investment in and advances to self-storage real estate venture | | | 12,360 | | | 14,155 | | | 14,401 | | | 14,846 | | | 14,759 |

Other loans, at cost | | | 5,025 | | | 4,835 | | | 4,818 | | | 1,361 | | | 1,103 |

Deferred financing costs | | | 4,404 | | | 4,619 | | | 1,503 | | | 1,644 | | | 1,565 |

Prepaid expenses and other assets | | | 5,348 | | | 3,702 | | | 1,327 | | | 975 | | | 884 |

Fixed assets, net | | | 219 | | | 233 | | | 215 | | | 180 | | | 170 |

Total assets | | $ | 630,632 | | $ | 590,408 | | $ | 556,228 | | $ | 509,860 | | $ | 417,252 |

| | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | |

Senior loan participation | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 732 |

Secured revolving credit facility | | | 27,000 | | | - | | | - | | | - | | | 30,000 |

Term loans, net of unamortized costs | | | 33,716 | | | 24,609 | | | 24,578 | | | - | | | - |

Due to Manager | | | 2,267 | | | 3,334 | | | 2,309 | | | 1,887 | | | 1,405 |

Accounts payable, accrued expenses and other liabilities | | | 2,612 | | | 2,402 | | | 2,235 | | | 2,916 | | | 3,155 |

Dividends payable | | | 12,236 | | | 12,199 | | | 11,567 | | | 11,319 | | | 8,652 |

Total liabilities | | $ | 77,831 | | $ | 42,544 | | $ | 40,689 | | $ | 16,122 | | $ | 43,944 |

| | | | | | | | | | | | | | | |

Equity: | | | | | | | | | | | | | | | |

Series A Cumulative preferred stock | | $ | 124,262 | | $ | 122,137 | | $ | 122,137 | | $ | 107,168 | | $ | 72,181 |

Series B Cumulative preferred stock | | | 37,298 | | | 37,401 | | | 37,425 | | | 37,463 | | | 35,988 |

Common stock | | | 205 | | | 204 | | | 193 | | | 192 | | | 144 |

Additional paid-in capital | | | 389,431 | | | 386,394 | | | 364,108 | | | 361,636 | | | 277,194 |

Retained earnings (Accumulated deficit) | | | 1,605 | | | 1,728 | | | (8,324) | | | (12,721) | | | (12,199) |

Total equity | | | 552,801 | | | 547,864 | | | 515,539 | | | 493,738 | | | 373,308 |

Total liabilities and equity | | $ | 630,632 | | $ | 590,408 | | $ | 556,228 | | $ | 509,860 | | $ | 417,252 |

First Quarter 2019 |

| 7 |

Jernigan Capital, Inc.

Consolidated Statements of Operations

(unaudited, in thousands, except per share data)

| | | | | | | |

| | | | | | | |

| | Three months ended | |

| | March 31, | |

| | 2019 | | 2018 | |

Revenues: | | | | | |

Interest income from investments | | $ | 8,212 | | $ | 4,562 | |

Rental and other property-related income from real estate owned | | | 1,450 | | | 623 | |

Other revenues | | | 222 | | | 31 | |

Total revenues | | | 9,884 | | | 5,216 | |

| | | | | | | |

Costs and expenses: | | | | | | | |

General and administrative expenses | | | 1,762 | | | 1,818 | |

Fees to Manager | | | 2,003 | | | 1,304 | |

Property operating expenses of real estate owned | | | 762 | | | 311 | |

Depreciation and amortization of real estate owned | | | 1,029 | | | 702 | |

Other expenses | | | - | | | 290 | |

Total costs and expenses | | | 5,556 | | | 4,425 | |

| | | | | | | |

Operating income | | | 4,328 | | | 791 | |

| | | | | | | |

Other income (expense): | | | | | | | |

Equity in earnings from unconsolidated real estate venture | | | 156 | | | 550 | |

Net unrealized gain on investments | | | 8,830 | | | 4,320 | |

Interest expense | | | (1,213) | | | (416) | |

Other interest income | | | 13 | | | 109 | |

Total other income | | | 7,786 | | | 4,563 | |

Net income | | | 12,114 | | | 5,354 | |

Net income attributable to preferred stockholders | | | (5,032) | | | (3,595) | |

Net income attributable to common stockholders | | $ | 7,082 | | $ | 1,759 | |

| | | | | | | |

Basic earnings per share attributable to common stockholders | | $ | 0.35 | | $ | 0.12 | |

Diluted earnings per share attributable to common stockholders | | $ | 0.35 | | $ | 0.12 | |

| | | | | | | |

Dividends declared per share of common stock | | $ | 0.35 | | $ | 0.35 | |

First Quarter 2019 |

| 8 |

Jernigan Capital, Inc.

Calculation of Adjusted Earnings and Reconciliation to Net Income Attributable to Common Stockholders

(unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three months ended |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| | 2019 | | 2018 | | 2018 | | 2018 | | 2018 |

Net income attributable to common stockholders | | $ | 7,082 | | $ | 17,202 | | $ | 11,174 | | $ | 6,217 | | $ | 1,759 |

Plus: stock dividends to preferred stockholders | | | 2,125 | | | 2,125 | | | 2,125 | | | 2,125 | | | 2,125 |

Plus: stock-based compensation | | | 328 | | | 321 | | | 385 | | | 777 | | | 345 |

Plus: depreciation and amortization on real estate assets | | | 1,029 | | | 982 | | | 854 | | | 887 | | | 702 |

Plus: depreciation and amortization on SL1 Venture real estate assets | | | 56 | | | - | | | - | | | - | | | - |

Plus: other expenses | | | - | | | - | | | - | | | - | | | 290 |

Adjusted Earnings | | $ | 10,620 | | $ | 20,630 | | $ | 14,538 | | $ | 10,006 | | $ | 5,221 |

| | | | | | | | | | | | | | | |

Adjusted Earnings per share attributable to common stockholders – diluted | | $ | 0.52 | | $ | 1.04 | | $ | 0.75 | | $ | 0.64 | | $ | 0.36 |

| | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding – diluted | | | 20,455,116 | | | 19,816,194 | | | 19,459,751 | | | 15,564,317 | | | 14,555,337 |

First Quarter 2019 |

| 9 |

Jernigan Capital, Inc.

Second Quarter and Full Year 2019 Guidance

(in thousands, except share and per share data)

| | | | | | | | | | | | |

| | Dollars in thousands, |

| | except share and per share data |

| | Three months ending | | Year ending |

| | June 30, 2019 | | December 31, 2019 |

| | Low | | High | | Low | | High |

Interest income from investments | | $ | 8,750 | | $ | 8,850 | | $ | 36,000 | | $ | 37,000 |

Rental revenue from real estate owned | | | 1,625 | | | 1,675 | | | 7,000 | | | 7,300 |

Other income | | | 35 | | | 40 | | | 140 | | | 160 |

Total revenues | | $ | 10,410 | | $ | 10,565 | | $ | 43,140 | | $ | 44,460 |

G&A expenses (1) | | | (4,575) | | | (4,425) | | | (17,550) | | | (16,250) |

Property operating expenses (excl. depreciation and amortization) | | | (870) | | | (820) | | | (3,500) | | | (3,300) |

Depreciation and amortization on real estate assets | | | (1,100) | | | (1,050) | | | (4,850) | | | (4,350) |

Interest expense | | | (2,100) | | | (2,000) | | | (9,500) | | | (9,000) |

JV income | | | 70 | | | 90 | | | 450 | | | 500 |

Other interest income | | | 10 | | | 15 | | | 80 | | | 120 |

Net unrealized gain on investments (2) | | | 6,000 | | | 8,000 | | | 30,000 | | | 40,000 |

Net income | | | 7,845 | | | 10,375 | | | 38,270 | | | 52,180 |

Net income attributable to preferred stockholders (3) | | | (5,100) | | | (5,090) | | | (20,300) | | | (20,150) |

Net income attributable to common stockholders | | | 2,745 | | | 5,285 | | | 17,970 | | | 32,030 |

Add: stock dividends | | | 2,125 | | | 2,125 | | | 8,500 | | | 8,500 |

Add: stock-based compensation | | | 720 | | | 700 | | | 1,800 | | | 1,750 |

Add: depreciation and amortization on real estate assets (4) | | | 1,190 | | | 1,130 | | | 5,150 | | | 4,630 |

Adjusted earnings | | $ | 6,780 | | $ | 9,240 | | $ | 33,420 | | $ | 46,910 |

Earnings per share – diluted | | $ | 0.13 | | $ | 0.25 | | $ | 0.82 | | $ | 1.46 |

Adjusted earnings per share – diluted | | $ | 0.32 | | $ | 0.44 | | $ | 1.52 | | $ | 2.13 |

Average shares outstanding – diluted | | | 20,950,000 | | | 20,950,000 | | | 22,000,000 | | | 22,000,000 |

| 5) | | Includes $2.1 million (low) / $2.0 million (high) and $9.4 million (low) / $8.4 million (high) of fees to Manager for the three months ending June 30, 2019 and for the year ending December 31, 2019, respectively. |

| 6) | | Excludes $0.05 million (low and high) and $0.2 million (low and high) of unrealized appreciation in fair value of investments from the real estate venture, which is included in JV income for the three months ending June 30, 2019 and for the year ending December 31, 2019, respectively. |

| 7) | | Represents both cash dividends and stock dividends (which stock dividends will be paid out in either shares of the Company’s common stock or additional shares of Series A Preferred Stock, at the option of the Series A stockholders) estimated with respect to outstanding shares of Series A Preferred Stock, as well as cash dividends estimated with respect to outstanding shares of Series B Preferred Stock. |

| 8) | | Includes $0.1 million (low and high) and $0.3 million (low and high) of depreciation and amortization on the real estate assets wholly-owned by the real estate venture, which is included in JV income for the three months ending June 30, 2019 and for the year ending December 31, 2019, respectively. |

Full-Year Key Assumptions:

| · | | Projected closings on $85 million to $115 million of new self-storage investments for the full-year 2019, including acquisitions of developer interests (on-balance sheet and JCAP’s proportionate share in the SL1 Venture), new development property investments, new bridge investments and joint venture investments; |

| · | | Fundings of approximately $200 million to $230 million on the Company’s closed and projected investment commitments during the year ending December 31, 2019, including cash payable for the acquisitions of developer interests; and |

| · | | Utilization of the Company’s credit facility over the course of the year with expected borrowings at year-end of between $120.0 million and $160.0 million. |

Of the estimated $30.0 million to $40.0 million of fair value appreciation in 2019, the Company recognized $8.8 million during the first quarter, and expects $6.0 million to $8.0 million to be recognized in the second quarter, $5.5 million to $9.0 million to be recognized in the third quarter, and $9.7 million to $14.2 million to be recognized in the fourth quarter. The Company’s 2019 fair value guidance reflects updated estimates of the timing of construction completion of the self-storage facilities underlying certain of our development investments, as well as the timing of stabilization of facilities in which we have invested. Timing of fair value appreciation is heavily dependent upon construction progress and the timing of construction completion, both of which are subject to factors outside the control of the Company and the Company’s development partners. Moreover, when the Company acquires the developer’s interest in a self-storage project that the Company has financed, the Company no longer accounts for such investment under the fair value method, so acquisitions of developer interests have a potential material effect on future fair value recognized in the Company’s financial statements. As such, the amount and exact timing of fair value recognition is subject to change.

First Quarter 2019 |

| 10 |

Jernigan Capital, Inc.

Schedule of Owned Properties

As of March 31, 2019

(unaudited, dollars in thousands)

| | | | | | | | | | | | | | |

Location | | | | | | | | | | | | | | |

(MSA) | | Date | | Date | | JCAP Capital | | Size | | Months | | % Physical |

Address | | Opened | | Acquired | | Investment (1) | | (NRSF) (2) | | Open (3) | | Occupancy (3) |

Orlando 1/2

11920 W Colonial Dr. | | 5/1/2016 | | 8/9/2017 | | $ | 12,047 | | 93,965 | | 36 | | 85.8 | % |

Jacksonville 1

1939 East West Pkwy | | 8/12/2016 | | 1/10/2018 | | | 8,686 | | 59,848 | | 33 | | 86.5 | % |

Atlanta 2

340 Franklin Gateway SE | | 5/24/2016 | | 2/2/2018 | | | 8,766 | | 66,187 | | 35 | | 78.1 | % |

Atlanta 1

5110 McGinnis Ferry Rd | | 5/25/2016 | | 2/2/2018 | | | 10,467 | | 71,718 | | 35 | | 86.8 | % |

Pittsburgh

6400 Hamilton Ave | | 5/11/2017 | | 2/20/2018 | | | 7,732 | | 47,594 | | 24 | | 41.4 | % |

Charlotte 1

9323 Wright Hill Rd | | 8/18/2016 | | 8/31/2018 | | | 10,525 | | 85,350 | | 32 | | 61.1 | % |

New York City 1

1775 5th Ave | | 9/29/2017 | | 12/21/2018 | | | 19,938 | | 105,272 | | 19 | | 62.8 | % |

New Haven

453 Washington Ave | | 12/16/2016 | | 3/8/2019 | | | 9,511 | | 64,225 | | 28 | | 65.7 | % |

Total Owned Properties | | | | $ | 87,672 | | | | | | | |

| (1) | | JCAP Capital Investment represents the sum of the funded principal balance of the loan (net of unamortized origination fees), cash consideration (inclusive of transaction costs), assumed liabilities, net property working capital acquired, all as of the date of acquisition, and any capital costs spent after the date of acquisition. The stabilized yield on our capital investment ranges from 7.5% to 8.5%. |

| (2) | | The net rentable square feet (“NRSF”) includes only climate controlled and non-climate controlled storage space. It does not include retail space, office space, non-covered RV space or parking spaces. |

First Quarter 2019 |

| 11 |

Jernigan Capital, Inc.

Schedule of Completed Projects

As of March 31, 2019

(unaudited, dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Location | | | | | | | | Remaining | | | | | | | | | | | | |

| | (MSA) | | | | | Funded | | Unfunded | | Fair | | Size | | Date | | Months | | % Physical |

Closing Date | | Address | | Commitment | | Investment | | Commitment (1) | | Value | | (NRSF) (2) | | Opened | | Open (3) | | Occupancy (3) |

7/2/2015 | | Milwaukee

420 W St Paul Ave | | $ | 7,650 | | $ | 7,648 | | $ | 2 | | $ | 9,128 | | 81,489 | | 10/9/2016 | | 31 | | 66.8 | % |

10/27/2015 | | Austin

251 North A W Grimes Blvd | | | 8,658 | | | 7,951 | | | 707 | | | 7,940 | | 77,234 | | 3/16/2017 | | 25 | | 78.8 | % |

8/14/2015 | | Raleigh

1515 Sunrise Ave | | | 8,792 | | | 8,689 | | | 103 | | | 8,236 | | 60,171 | | 3/8/2018 | | 14 | | 40.7 | % |

11/17/2016 | | Jacksonville 2

45 Jefferson Rd | | | 7,530 | | | 7,279 | | | 251 | | | 9,397 | | 70,255 | | 3/27/2018 | | 13 | | 43.8 | % |

1/31/2017 | | Atlanta 4

4676 S Atlanta Rd | | | 13,678 | | | 13,185 | | | 493 | | | 15,632 | | 103,240 | | 7/12/2018 | | 10 | | 23.8 | % |

2/24/2017 | | Orlando 3

12709 E Colonial Dr | | | 8,056 | | | 7,363 | | | 693 | | | 8,911 | | 69,645 | | 7/26/2018 | | 9 | | 26.5 | % |

4/20/2017 | | Denver 2

3110 S Wadsworth Blvd | | | 11,164 | | | 10,481 | | | 683 | | | 12,952 | | 74,521 | | 7/31/2018 | | 9 | | 20.0 | % |

6/29/2017 | | Boston 1 (4)

329 Boston Post Rd E | | | - | | | - | | | - | | | 2,661 | | 90,453 | | 8/8/2018 | | 9 | | 22.1 | % |

4/14/2017 | | Louisville 1

2801 N Hurstbourne Pkwy | | | 8,523 | | | 7,141 | | | 1,382 | | | 8,831 | | 65,776 | | 8/15/2018 | | 8 | | 25.9 | % |

9/20/2016 | | Charlotte 2

1010 E 10th St | | | 12,888 | | | 11,697 | | | 1,191 | | | 12,838 | | 76,985 | | 8/30/2018 | | 8 | | 23.9 | % |

9/28/2017 | | Louisville 2

3415 Bardstown Rd | | | 9,940 | | | 8,914 | | | 1,026 | | | 11,131 | | 76,553 | | 8/31/2018 | | 8 | | 18.5 | % |

6/12/2017 | | Tampa 4

3201 32nd Ave S | | | 10,266 | | | 9,000 | | | 1,266 | | | 11,767 | | 72,765 | | 10/9/2018 | | 7 | | 19.2 | % |

5/2/2017 | | Atlanta 6

2033 Monroe Dr | | | 12,543 | | | 11,218 | | | 1,325 | | | 13,717 | | 80,585 | | 10/15/2018 | | 6 | | 23.1 | % |

7/27/2017 | | Jacksonville 3

2004 Edison Ave | | | 8,096 | | | 6,978 | | | 1,118 | | | 8,598 | | 68,300 | | 11/6/2018 | | 6 | | 18.3 | % |

6/19/2017 | | Baltimore 1 (5)

1835 Washington Blvd | | | 10,775 | | | 9,461 | | | 1,593 | | | 11,105 | | 83,635 | | 11/20/2018 | | 5 | | 13.0 | % |

5/19/2017 | | Tampa 3

2460 S Falkenburg Rd | | | 9,224 | | | 7,355 | | | 1,869 | | | 8,650 | | 70,474 | | 11/29/2018 | | 5 | | 20.5 | % |

6/28/2017 | | Knoxville

130 Jack Dance St | | | 9,115 | | | 8,156 | | | 959 | | | 9,228 | | 72,540 | | 11/30/2018 | | 5 | | 23.1 | % |

2/24/2017 | | New Orleans

2705 Severn Ave | | | 12,549 | | | 10,918 | | | 1,631 | | | 12,709 | | 86,765 | | 12/21/2018 | | 4 | | 16.0 | % |

6/30/2017 | | New York City 2 (5)

465 W 150th St | | | 26,482 | | | 25,716 | | | 1,807 | | | 29,534 | | 40,593 | | 12/28/2018 | | 4 | | 4.1 | % |

8/30/2017 | | Orlando 4

9001 Eastmar Commons | | | 9,037 | | | 7,114 | | | 1,923 | | | 8,732 | | 76,340 | | 1/16/2019 | | 3 | | 16.1 | % |

2/8/2018 | | Minneapolis 2

3216 Winnetka Ave N | | | 10,543 | | | 8,456 | | | 2,087 | | | 9,615 | | 83,026 | | 3/14/2019 | | 1 | | 5.9 | % |

12/1/2017 | | Boston 2

10 Hampshire Rd | | | 8,771 | | | 5,436 | | | 3,335 | | | 6,520 | | 76,710 | | 3/19/2019 | | 1 | | 2.7 | % |

Total Completed Development Loans | | $ | 224,280 | | $ | 200,156 | | $ | 25,444 | | $ | 237,832 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

3/2/2018 | | Miami 6

590 NW 137th Ave | | $ | 13,370 | | $ | 13,370 | | $ | - | | $ | 17,681 | | 76,765 | | 8/12/2016 | | 33 | | 81.5 | % |

3/2/2018 | | Miami 4

1103 SW 3rd Ave | | | 20,201 | | | 20,201 | | | - | | | 23,217 | | 74,685 | | 10/9/2016 | | 31 | | 85.7 | % |

3/2/2018 | | Miami 8

2434 SW 28th Lane | | | 13,553 | | | 13,553 | | | - | | | 14,119 | | 51,923 | | 12/12/2016 | | 29 | | 85.5 | % |

3/2/2018 | | Miami 7 (5)

18460 Pines Blvd | | | 18,462 | | | 17,986 | | | 1,022 | | | 16,812 | | 86,640 | | 3/26/2018 | | 13 | | 46.6 | % |

3/2/2018 | | Miami 5 (5)

4001 NW 77th Ave | | | 17,738 | | | 17,272 | | | 991 | | | 15,217 | | 77,075 | | 8/13/2018 | | 9 | | 24.1 | % |

Total Completed Bridge Investments | | $ | 83,324 | | $ | 82,382 | | $ | 2,013 | | $ | 87,046 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Completed Projects | | $ | 307,604 | | | | | | | | | | | | | | | | | | |

| (1) | | Commitment is fixed during underwriting at an amount deemed sufficient to cover interest carry and excess operating expenses over rental revenue during lease-up and deferred developer’s fees (if any) payable upon stabilization. Remaining unfunded commitment on completed projects is expected to be utilized primarily for such purposes. To the extent not needed for such purposes, such commitment will not be advanced. |

| (2) | | The NRSF includes only climate controlled and non-climate controlled storage space. It does not include retail space, office space, non-covered RV space or parking spaces. |

| (4) | | This loan was repaid in full through a refinancing negotiated by our partner. The investment represents our 49.9% Profits Interest which was retained during the transaction. |

| (5) | | The funded amount of these investments include PIK interest accrued on our loan or interest accrued on our preferred equity investment, as applicable. These interest amounts are not included in the commitment amount for each investment. |

First Quarter 2019 |

| 12 |

Schedule of Projects in Progress

As of March 31, 2019

(unaudited, dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | Location | | | | | | | | Remaining | | | | | | | | | Estimated |

| | (MSA) | | | | | Funded | | Unfunded | | Fair | | Size | | Construction | | C/O |

Closing Date | | Address | | Commitment | | Investment | | Commitment | | Value | | (NRSF) (1) | | Start Date | | Quarter (2) |

1/18/2017 | | Atlanta 3

1484 Northside Dr NW | | $ | 14,115 | | $ | 9,498 | | $ | 4,617 | | $ | 10,549 | | 92,935 | | Q4 2017 | | Q2 2019 |

2/27/2017 | | Atlanta 5

56 Peachtree Valley Rd NE | | | 17,492 | | | 15,640 | | | 1,852 | | | 18,345 | | 86,819 | | Q3 2017 | | Q2 2019 (3) |

3/1/2017 | | Fort Lauderdale

5601 NE 14th Ave | | | 9,952 | | | 7,740 | | | 2,212 | | | 10,547 | | 79,279 | | Q1 2018 | | Q2 2019 |

3/1/2017 | | Houston

1050 Brittmoore Rd | | | 14,825 | | | 13,400 | | | 1,425 | | | 16,176 | | 133,035 | | Q4 2017 | | Q2 2019 |

4/20/2017 | | Denver 1

6206 W Alameda Ave | | | 9,806 | | | 7,666 | | | 2,140 | | | 8,669 | | 60,171 | | Q1 2018 | | Q2 2019 |

5/2/2017 | | Tampa 2

9125 Ulmerton Rd | | | 8,091 | | | 6,684 | | | 1,407 | | | 7,540 | | 71,400 | | Q1 2018 | | Q2 2019 |

9/14/2017 | | Los Angeles 1

959 W Hyde Park Blvd | | | 28,750 | | | 8,979 | | | 19,771 | | | 8,938 | | 120,038 | | Q4 2019 | | Q3 2020 |

9/14/2017 | | Miami 1

4250 SW 8th St | | | 14,657 | | | 7,425 | | | 7,232 | | | 7,224 | | 69,175 | | Q2 2018 | | Q1 2020 |

10/12/2017 | | Miami 2 (4)

880 W Prospect Rd | | | 9,459 | | | 1,367 | | | 8,141 | | | 1,144 | | 58,000 | | Q4 2019 | | Q3 2020 |

10/30/2017 | | New York City 3 (4)

5203 Kennedy Blvd | | | 14,701 | | | 5,276 | | | 9,587 | | | 4,911 | | 68,660 | | Q4 2017 | | Q3 2020 |

11/16/2017 | | Miami 3 (4)

120-132 NW 27th Ave | | | 20,168 | | | 4,725 | | | 15,604 | | | 4,267 | | 96,295 | | Q4 2018 | | Q1 2020 |

11/21/2017 | | Minneapolis 1

2109 University Ave W | | | 12,674 | | | 5,462 | | | 7,212 | | | 5,829 | | 88,343 | | Q2 2018 | | Q4 2019 |

12/15/2017 | | New York City 4

6 Commerce Center Dr | | | 10,591 | | | 2,663 | | | 7,928 | | | 2,569 | | 78,425 | | Q2 2018 | | Q1 2020 |

12/27/2017 | | Boston 3

19 Coolidge Hill Rd | | | 10,174 | | | 2,608 | | | 7,566 | | | 2,500 | | 62,700 | | Q4 2019 | | Q2 2020 |

12/28/2017 | | New York City 5

375 River St | | | 16,073 | | | 7,538 | | | 8,535 | | | 7,477 | | 90,200 | | Q4 2018 | | Q4 2019 |

3/30/2018 | | Philadelphia (4)

550 Allendale Rd | | | 14,338 | | | 10,598 | | | 3,908 | | | 10,829 | | 69,383 | | Q2 2018 | | Q3 2019 (3) |

4/6/2018 | | Minneapolis 3

101 American Blvd West | | | 12,883 | | | 4,208 | | | 8,675 | | | 4,209 | | 86,075 | | Q3 2018 | | Q4 2019 |

5/1/2018 | | Miami 9 (4)

10651 W Okeechobee Rd | | | 12,421 | | | 2,869 | | | 9,623 | | | 2,696 | | 70,538 | | Q3 2019 | | Q2 2020 |

5/15/2018 | | Atlanta 7

2915 Webb Rd | | | 9,418 | | | 1,378 | | | 8,040 | | | 1,329 | | 76,519 | | Q3 2018 | | Q1 2020 |

5/23/2018 | | Kansas City

510 Southwest Blvd | | | 9,968 | | | 2,349 | | | 7,619 | | | 2,320 | | 77,188 | | Q3 2018 | | Q4 2019 |

6/7/2018 | | Orlando 5

7212 W Sand Lake Rd | | | 12,969 | | | 2,533 | | | 10,436 | | | 2,478 | | 76,147 | | Q4 2018 | | Q4 2019 |

6/12/2018 | | Los Angeles 2 (4)

7855 Haskell Ave | | | 9,298 | | | 4,675 | | | 4,874 | | | 4,721 | | 116,022 | | Q3 2019 | | Q4 2020 |

11/16/2018 | | Baltimore 2

8179 Ritchie Hwy | | | 9,247 | | | 397 | | | 8,850 | | | 319 | | 61,750 | | Q2 2019 | | Q2 2020 |

3/1/2019 | | New York City 6

435 Tompkins Ave | | | 18,796 | | | 2,112 | | | 16,684 | | | 1,963 | | 76,250 | | Q3 2019 | | Q4 2020 |

3/15/2019 | | Stamford (4)

370 West Main St | | | 2,904 | | | 2,913 | | | - | | | 2,885 | | 38,650 | | Q2 2019 | | Q1 2020 |

Total Projects in Progress | | $ | 323,770 | | $ | 140,703 | | $ | 183,938 | | $ | 150,434 | | | | | | |

| (1) | | The NRSF includes only climate controlled and non-climate controlled storage space. It does not include retail space, office space, non-covered RV space or parking spaces. |

| (2) | | Estimated C/O dates represent the Company’s best estimate as of March 31, 2019 based on project specific information learned through underwriting and communications with respective developers. These dates are subject to change due to unexpected project delays/efficiencies. |

| (3) | | This facility received a temporary C/O or C/O subsequent to March 31, 2019. |

| (4) | | The funded amount of these investments include PIK interest accrued on our loan or interest accrued on our preferred equity investment, as applicable. These interest amounts are not included in the commitment amount for each investment. |

First Quarter 2019 |

| 13 |

Schedule of Heitman JV Owned Properties and Development Projects Completed

As of March 31, 2019

(unaudited, dollars in thousands)

JV Owned Properties:

| | | | | | | | | | | | | | |

Location | | | | | | | | | | | | | | |

(MSA) | | Date | | Date | | JV Capital | | Size | | Months | | % Physical |

Address | | Opened | | Acquired | | Investment (1) | | (NRSF) (2) | | Open (3) | | Occupancy (3) |

Jacksonville

3211 San Pablo Rd S | | 7/26/2017 | | 1/28/2019 | | | 12,564 | | 80,621 | | 21 | | 79.9 | % |

Atlanta 2

11220 Medlock Bridge Rd | | 9/14/2017 | | 1/28/2019 | | | 10,079 | | 70,139 | | 19 | | 58.7 | % |

Denver

2255 E 104th Ave | | 12/14/2017 | | 1/28/2019 | | | 13,899 | | 85,575 | | 16 | | 56.2 | % |

Atlanta 1

1801 Savoy Dr | | 4/12/2018 | | 1/28/2019 | | | 11,770 | | 71,147 | | 13 | | 41.1 | % |

Total Owned Properties | | | | $ | 48,312 | | | | | | | |

| (1) | | JV Capital Investment represents the sum of the funded principal balance of the loan (net of unamortized origination fees), cash consideration (inclusive of transaction costs), assumed liabilities, and net property working capital acquired, all as of the date of acquisition. The stabilized yield on our capital investment ranges from 7.5% to 8.5%. |

| (2) | | The net rentable square feet (“NRSF”) includes only climate controlled and non-climate controlled storage space. It does not include retail space, office space, non-covered RV space or parking spaces. |

Development Projects Completed:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Location | | | | | | | | Remaining | | | | | | | | | | | | |

| | (MSA) | | | | | Funded | | Unfunded | | Fair | | Size | | Date | | Months | | % Physical | |

Closing Date | | Address | | Commitment | | Investment | | Commitment (1) | | Value | | (NRSF) (2) | | Opened | | Open (3) | | Occupancy (3) | |

9/28/2016 | | Columbia

401 Hampton St | | $ | 9,199 | | $ | 9,020 | | $ | 179 | | $ | 9,695 | | 70,935 | | 8/23/2017 | | 20 | | 66.0 | % |

4/15/2016 | | Washington DC

1325 Kenilworth Ave NE | | | 17,269 | | | 17,269 | | | - | | | 19,864 | | 90,325 | | 9/25/2017 | | 19 | | 60.7 | % |

5/14/2015 | | Miami 1

490 NW 36th St | | | 13,867 | | | 12,722 | | | 1,145 | | | 15,252 | | 75,770 | | 2/23/2018 | | 14 | | 52.1 | % |

12/22/2016 | | Raleigh

7710 Alexander Town Blvd | | | 8,877 | | | 8,576 | | | 301 | | | 9,303 | | 64,108 | | 6/8/2018 | | 11 | | 31.5 | % |

9/25/2015 | | Fort Lauderdale

812 NW 1st St | | | 13,230 | | | 12,826 | | | 404 | | | 17,292 | | 87,384 | | 7/26/2018 | | 9 | | 25.0 | % |

5/14/2015 | | Miami 2

1100 NE 79th St | | | 14,849 | | | 14,492 | | | 357 | | | 15,301 | | 74,080 | | 10/30/2018 | | 6 | | 36.7 | % |

7/21/2016 | | New Jersey

6 Central Ave | | | 7,828 | | | 6,465 | | | 1,363 | | | 7,587 | | 59,010 | | 1/24/2019 | | 3 | | 6.4 | % |

Total Completed Development Loans | | $ | 85,119 | | $ | 81,370 | | $ | 3,749 | | $ | 94,294 | | | | | | | | | |

| (1) | | Commitment is fixed during underwriting at an amount deemed sufficient to cover interest carry and excess operating expenses over rental revenue during lease-up and deferred developer’s fees (if any) payable upon stabilization. Remaining unfunded commitment on completed projects is expected to be utilized primarily for such purposes. To the extent not needed for such purposes, such commitment will not be advanced. |

| (2) | | The NRSF includes only climate controlled and non-climate controlled storage space. It does not include retail space, office space, non-covered RV space or parking spaces. |

First Quarter 2019 |

| 14 |

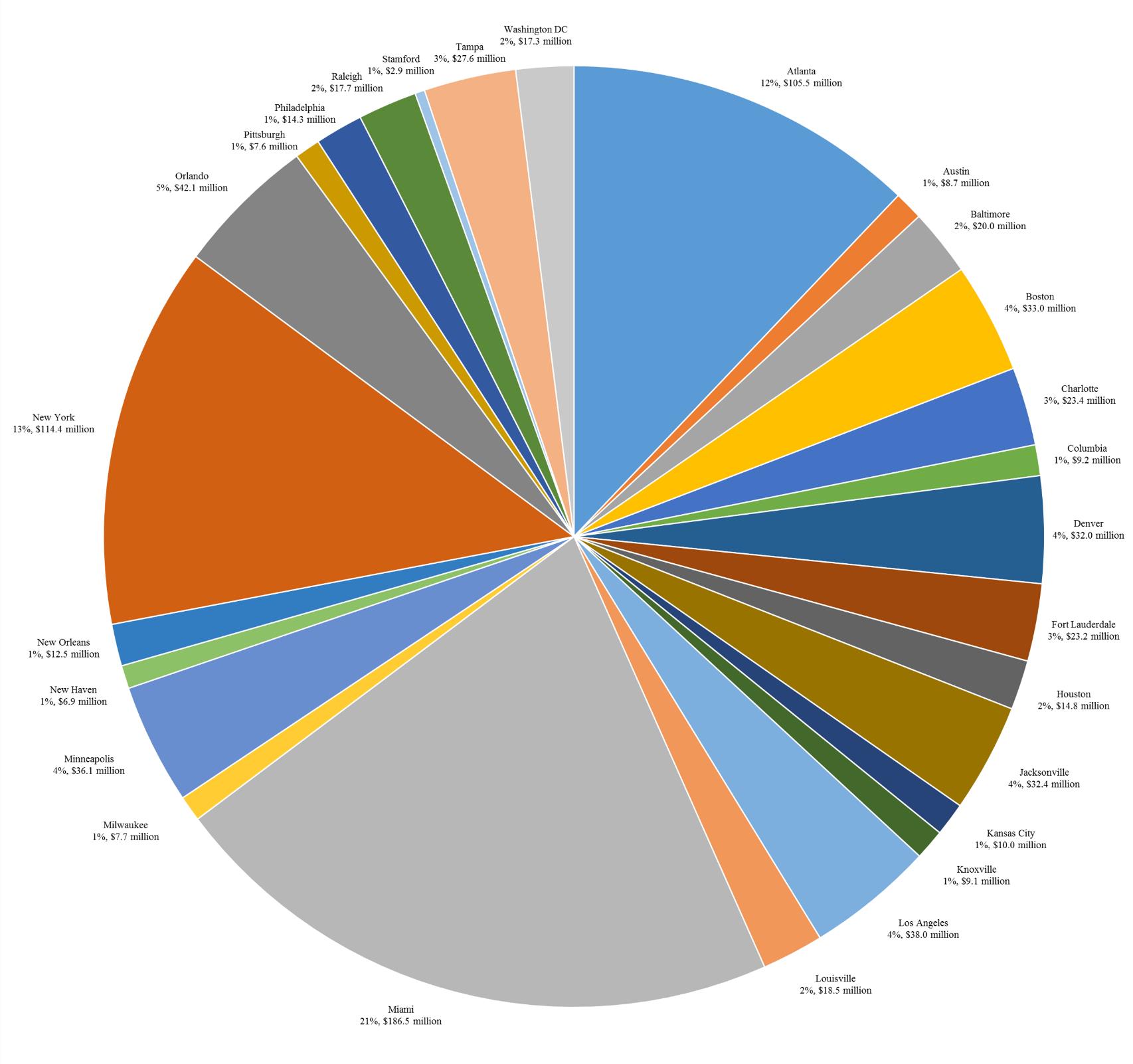

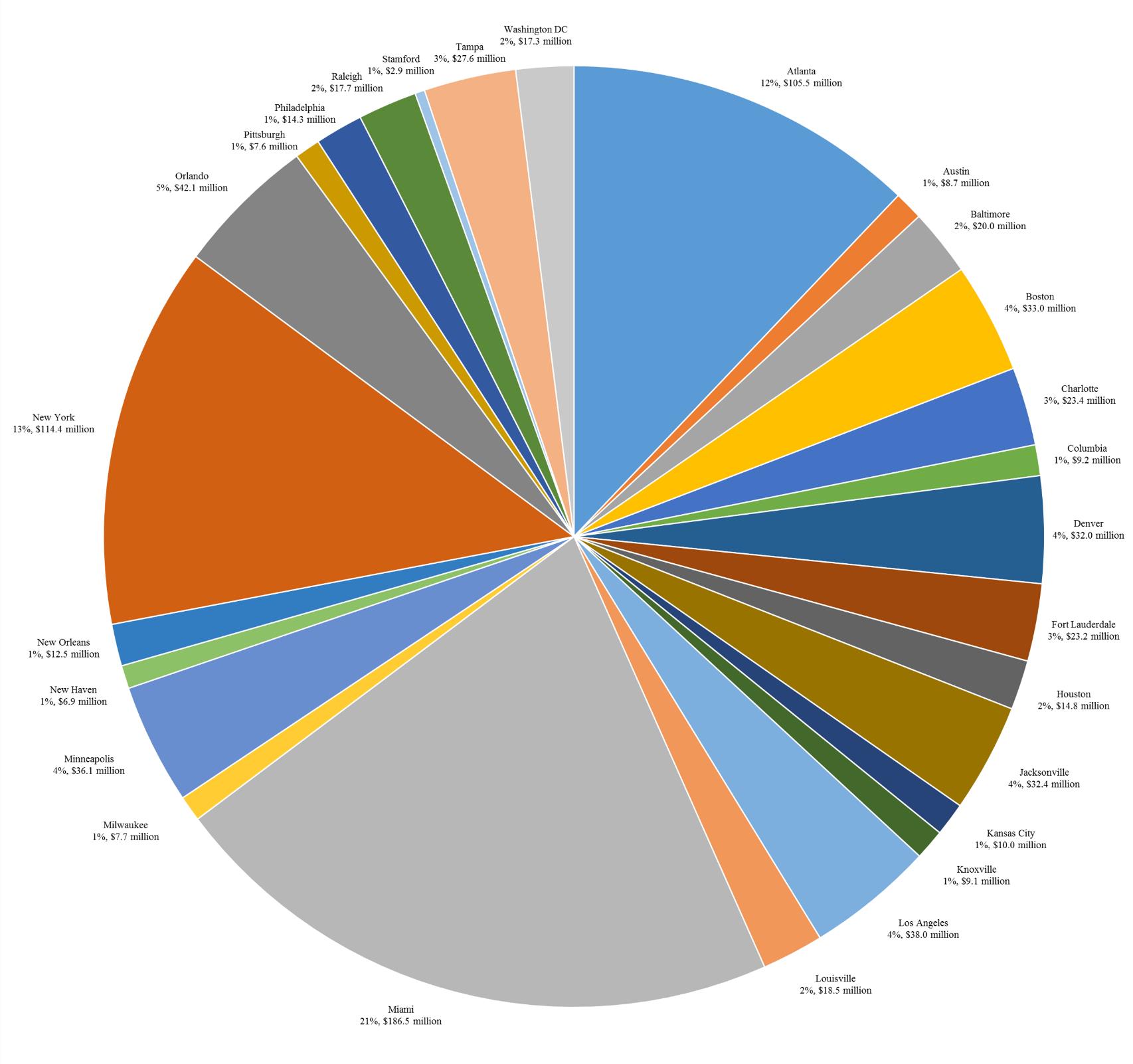

Closed Investments by Geography

As of March 31, 2019

First Quarter 2019 |

| 15 |

Capital Sources and Investment Uses

As of March 31, 2019

(dollars in millions)

| | | |

| | | |

Estimated Capital to be Used in Investing Activities (1) | | | |

Contractual investment obligations: | | | |

Development property investments | | $ | 209 |

Bridge investments | | | 2 |

Total Committed Investments | | $ | 211 |

Remaining Prospective Investments per FY 2019 guidance: | | | 75 |

Total to Fund Investments | | $ | 286 |

| | | |

| | | |

Estimated Sources of Capital | | | |

Cash and cash equivalents as of March 31, 2019 | | $ | 4 |

Identified secured debt on one wholly-owned property | | | 8 |

Remaining credit facility capacity (2) | | | 208 |

Remaining capital needs | | | 66 |

Total Sources | | $ | 286 |

| (1) | | Does not include financing spend or operating cash flow. |

| (2) | | Assumes increase in the availability under the Credit Facility. As of March 31, 2019, the Company had $118.0 million of total availability for borrowing under the Credit Facility ($91.0 million available after considering amounts outstanding). |

The Company may use any combination of the following capital sources to fund additional capital needs:

| · | | Refinancing of JCAP mortgage indebtedness (49.9% profits interest and ROFR retained) – $50 million to $70 million |

| · | | Potential sales of facilities underlying current development investments to a third party – $10 million to $20 million |

| · | | Common Stock ATM issuances – $72 million |

| · | | Potential exercise of accordion feature of Credit Facility – $165 million |

Timing of Funding $286 million of Remaining and Prospective 2019 Investments

First Quarter 2019 |

| 16 |

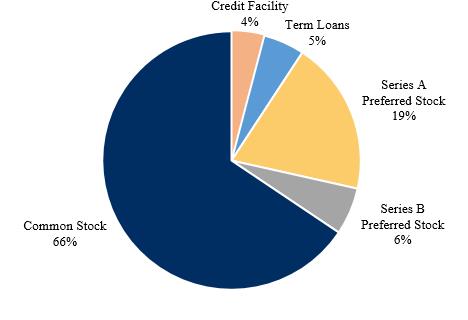

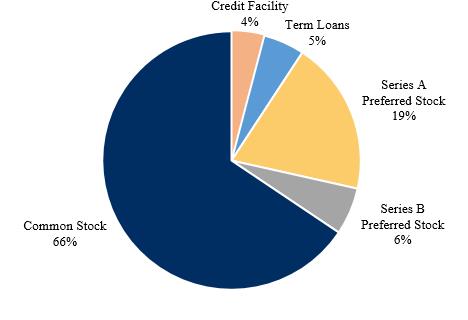

Capital Structure

As of March 31, 2019

(dollars in millions)

| | | |

| | | |

Credit Facility Outstanding | | $ | 27 |

Term Loans | | | 34 |

Series A Preferred Stock | | | 127 |

Series B Preferred Stock | | | 39 |

Common Stock | | | 433 |

Total Capital | | $ | 660 |

First Quarter 2019 |

| 17 |

Jernigan Capital, Inc.

Company Information |

| | | | | | |

Corporate Headquarters | | Trading Symbol | | Investor Relations | | Information Requests |

6410 Poplar Avenue | | Common shares: JCAP | | 6410 Poplar Avenue | | To request an Investor Relations |

Suite 650 | | 7.00% Series B Preferred Stock: JCAP- | | Suite 650 | | package or annual report, please |

Memphis, TN 38119 | | PR B | | Memphis, TN 38119 | | visit our website at |

901.567.9510 | | Stock Exchange Listing | | 901.567.9510 | | www.jernigancapital.com |

| | New York Stock Exchange | | | | |

| | |

Executive Management |

| | |

Dean Jernigan | | John A. Good |

Executive Chairman | | Chief Executive Officer |

| | |

Jonathan Perry | | David Corak |

President and Chief Investment Officer | | Senior Vice President of Corporate Finance |

| | |

Kelly P. Luttrell | | |

Senior Vice President, Chief Financial Officer, Treasurer and Corporate Secretary | | |

| | |

Independent Directors |

| | |

Randall L. Churchey | | Mark O. Decker |

Director | | Director |

| | |

James D. Dondero | | Rebecca Owen |

Director | | Director |

| | |

Howard A. Silver | | Harry J. Thie |

Director | | Director |

| | |

Equity Research Coverage |

| | |

Baird Equity Research | | B. Riley FBR |

RJ Milligan | | Tim Hayes |

rjmilligan@rwbaird.com | | timothyhayes@brileyfbr.com |

| | |

Jefferies LLC | | KeyBanc Capital Markets |

Omotayo Okusanya | | Todd M. Thomas |

tokusanya@jefferies.com | | tthomas@key.com |

| | |

Raymond James & Associates | | |

Jonathan Hughes | | |

jonathan.hughes@raymondjames.com | | |

Any opinions, estimates, forecasts or predictions regarding Jernigan Capital’s performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Jernigan Capital or its management. Jernigan Capital does not by its reference above or distribution imply its endorsement of or concurrence with such opinions, estimates, forecasts or predictions.

First Quarter 2019 |

| 18 |