- TLN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Talen Energy (TLN) 424B3Prospectus supplement

Filed: 1 May 15, 12:00am

Filed pursuant to Rule 424(b)(3)

Registration Nos. 333-199888 and 333-199888-01

PROSPECTUS

83,525,000 Shares

TALEN ENERGY CORPORATION

Common Stock

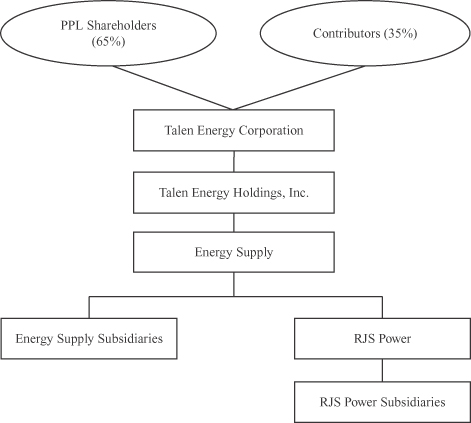

This prospectus is being furnished in connection with the planned distribution by PPL Corporation (“PPL”) on a pro rata basis to its shareholders of all the shares of common stock of its wholly owned subsidiary Talen Energy Holdings, Inc. (“HoldCo”) outstanding prior to the Merger described below. HoldCo will own and operate PPL Energy Supply, LLC (“Energy Supply”) and, immediately prior to the Merger described below, will own 100% of the common stock of Talen Energy Corporation (“Talen Energy”). We refer to such planned distribution as the “Distribution” or “spinoff.” Immediately following the Distribution and at the Effective Time (as defined below), a wholly owned subsidiary of Talen Energy will be merged with and into HoldCo, with HoldCo continuing as the surviving company and as a wholly owned subsidiary of Talen Energy (the “Merger”), and each share of HoldCo common stock distributed to PPL shareholders and outstanding immediately prior to the Effective Time will be automatically converted into one share of Talen Energy common stock. Substantially contemporaneous with the Merger, the competitive power generation business owned by RJS Generation Holdings LLC (“RJS Power”) and its subsidiaries (the “RJS Power business”) will be contributed by its owners to Talen Energy through the contribution, directly or indirectly, of all of the equity interests of RJS Power, in exchange for shares of Talen Energy common stock (such contribution referred to herein as the “Combination”).

Each share of PPL common stock outstanding as of 5:00 p.m. New York City time on May 20, 2015, the record date for the Distribution (the “record date”), will entitle its holder to receive a number of shares of HoldCo common stock determined by a formula described in this prospectus. We expect the distribution ratio of the HoldCo common stock to be approximately 0.125 shares of HoldCo common stock per share of PPL common stock. Upon the immediate conversion of HoldCo common stock into Talen Energy common stock as described above, the PPL shareholders will receive their shares of Talen Energy common stock in book-entry form. As a result of the Combination, Raven Power Holdings LLC (“Raven”), C/R Energy Jade, LLC (“Jade”) and Sapphire Power Holdings LLC (“Sapphire”) or a special purpose entity wholly owned by Raven, Jade and Sapphire and controlled by Raven (the “RJS SPE”) will receive in a private placement transaction a number of shares of Talen Energy common stock that will result in PPL’s shareholders owning 65% of Talen Energy’s outstanding shares of common stock and Raven, Jade and Sapphire, collectively, or the RJS SPE, as applicable (the “Contributors”) owning the remaining 35% immediately following the Combination. We expect that the Distribution, the Merger and the Combination will be tax-free to PPL’s shareholders for U.S. federal income tax purposes, except for gain or loss attributable to cash received in lieu of fractional shares of Talen Energy in the Merger. Immediately after the Distribution and the Combination, Talen Energy will be an independent, publicly traded company that will own and operate the combined businesses of Energy Supply and RJS Power. Except for the provision of certain transition services, PPL will have no continuing involvement in Talen Energy or its businesses.

Talen Energy has been approved to list its common stock on the New York Stock Exchange (the “NYSE”) under the symbol “TLN.”

No action will be required of you to receive common stock of Talen Energy, which means that:

| • | you will not be required to pay for HoldCo’s common stock that you receive in the Distribution or our common stock you receive in the Merger; |

| • | you do not need to surrender or exchange any of your PPL common stock in order to receive Talen Energy common stock or take any other action in connection with the spinoff. |

There is currently no trading market for our common stock. However, we expect that a limited market, commonly known as a “when-issued” trading market, for our common stock will develop on or shortly before the record date for the Distribution, and we expect “regular way” trading of our common stock will begin the first trading day after the completion of the Transactions.

You should carefully consider the matters described under “Risk Factors” beginning on page 34 of this prospectus for a discussion of factors that should be considered by recipients of our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this prospectus is May 1, 2015.

| Page | ||||

| 1 | ||||

| 2 | ||||

| 27 | ||||

| 34 | ||||

| 57 | ||||

| 59 | ||||

| 67 | ||||

| 95 | ||||

| 96 | ||||

Unaudited Pro Forma Condensed Combined Financial Information | 97 | |||

Selected Historical Consolidated Financial Data of Energy Supply | 108 | |||

Selected Historical Consolidated and Combined Financial Data of RJS Power | 109 | |||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 110 | |||

| 162 | ||||

| 188 | ||||

| 195 | ||||

Security Ownership of Certain Beneficial Owners and Management | 205 | |||

| 207 | ||||

| 209 | ||||

| 214 | ||||

| 216 | ||||

| 220 | ||||

| 220 | ||||

| 221 | ||||

| 222 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus is being furnished solely to provide information to PPL shareholders who will receive shares of Talen Energy common stock in the Transactions. It is not to be construed as an inducement or encouragement to buy or sell any of our securities or any securities of PPL, Talen Energy, HoldCo, RJS Power or Energy Supply. This prospectus describes our business, our relationship with PPL, the Contributors and the Transactions, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of our common stock that you will receive in the Transactions. You should be aware of certain risks relating to the Transactions, our business and ownership of our common stock, which are described under the heading “Risk Factors.”

i

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information, except in the normal course of discharging our public disclosure obligations.

Unless otherwise indicated or the context otherwise requires, “we,” “us” or “our” refers to Talen Energy Corporation and its subsidiaries after giving effect to the Transactions. Please see “Glossary” for the definitions of certain terms used in this prospectus.

ii

On June 9, 2014, PPL, HoldCo, Talen Energy, Energy Supply, Raven, Jade and Sapphire entered into a Separation Agreement (the “Separation Agreement”) and, with Merger Sub, a Transaction Agreement (the “Transaction Agreement”), pursuant to which a newly formed entity, HoldCo, owning the Energy Supply business would be spun off to PPL’s shareholders and combined with the RJS Power business to create Talen Energy, an independent publicly traded company, in a transaction intended to be generally tax-free to PPL and PPL’s shareholders. See “The Transactions—Background of the Transactions.”

On June 1, 2015, the expected date of the Distribution (the “Distribution Date”), each holder of PPL common stock as of the record date will be entitled to receive a number of shares of HoldCo common stock determined by a formula based on the number of shares of PPL common stock outstanding as of 5:00 p.m., New York City time on the record date. Each such record holder will be entitled to receive a number of shares of HoldCo common stock equal to the aggregate number of shares of HoldCo common stock multiplied by a fraction, the numerator of which is the number of shares of PPL common stock held by such record holder on the record date and the denominator of which is the total number of shares of PPL common stock outstanding on the record date. Based on the number of shares of PPL common stock outstanding as of March 31, 2015, we expect the distribution ratio to be approximately 0.125 shares of HoldCo common stock for each share of PPL common stock. The actual distribution ratio will be determined on May 20, 2015, the record date. PPL will have no continuing ownership interest in, control of or affiliation with Talen Energy following the Distribution. Immediately following the Distribution and at the Effective Time, a wholly owned subsidiary of Talen Energy will merge with and into HoldCo, with HoldCo continuing as the surviving company and as a wholly owned subsidiary of Talen Energy (the “Merger”), and each share of HoldCo common stock will be automatically converted into one share of common stock of Talen Energy. Substantially contemporaneous with the Merger, the RJS Power business will be contributed by its owners to Talen Energy through the contribution, directly or indirectly, of all of the equity interests of RJS Power in exchange for shares of Talen Energy common stock (such contribution referred to herein as the “Combination”), which will result in PPL shareholders owning 65% of Talen Energy’s outstanding common stock and the Contributors owning the remaining 35% immediately following the Combination. Immediately following the Transactions, 128,500,000 shares of our common stock will be issued and outstanding, inclusive of the number of shares to be issued in a private placement transaction in connection with the Combination.

You will not be required to make any payment, surrender or exchange your PPL common stock or take any other action to receive your shares of Talen Energy common stock. In lieu of fractional shares of Talen Energy, shareholders will receive a cash payment. To that end, the distribution agent will sell whole shares that otherwise would have been distributed as fractional shares of Talen Energy in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and similar costs, pro rata to each PPL shareholder who would otherwise have been entitled to receive a fractional share of Talen Energy, as applicable, as a result of the Transactions.

We expect that the Distribution and the Merger will be tax-free to PPL’s shareholders for U.S. federal income tax purposes, except for any gain or loss attributable to cash received in lieu of a fractional share of Talen Energy in the Transactions. Immediately after the Transactions, we will be an independent, publicly traded company that will own and operate the combined businesses of Energy Supply and RJS Power.

You may contact PPL with any questions.

PPL’s contact information is:

PPL Corporation

Attn: Investor Relations

Two North Ninth Street

Allentown, PA 18101-1179

Tel: (610) 774-5151

1

The following summary highlights information contained elsewhere in this prospectus relating to the Transactions. You should read this entire prospectus including the risk factors, management’s discussion and analysis of financial condition and results of operations of Energy Supply and RJS Power, historical financial statements of Energy Supply and RJS Power, and our unaudited pro forma condensed combined financial information and the respective notes to the financial statements and pro forma financial information. Our pro forma condensed combined financial data adjust the historical financial data of Energy Supply and RJS Power to give effect to the Transactions and our anticipated post-Transactions capital structure.

Except as otherwise indicated or the context otherwise requires, the information included in this prospectus assumes the completion of the Transactions. Capitalized terms not otherwise defined in this prospectus have the meanings assigned to them under “Glossary” included elsewhere in this prospectus.

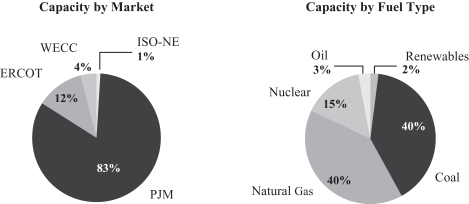

Talen Energy

Upon completion of the Transactions described in this prospectus, Talen Energy Corporation (“Talen Energy,” “Talen,” or the “Company”) will be one of the largest competitive energy and power generation companies in North America. Our primary business will be the production and sale of electricity, capacity and related products from our fleet of power plants totaling approximately 14,000 MW of generating capacity. We will own and operate a portfolio of generation assets principally located in PJM and ERCOT, which we consider to be two of the most attractive power markets in the United States. Within these markets, our portfolio is expected to benefit from technological and fuel diversity, enabling us to respond to changing market conditions and regulatory developments. We believe stockholder value creation is built on a foundation of excellence in operations and skillful commercial management of our generation fleet with a strong focus on cash returns. We intend to pursue a strategy that embraces these core concepts, optimizes Talen Energy’s operations and supports value-enhancing growth.

Our Operations

Our generation fleet is diverse in terms of fuel, technology, dispatch characteristics and location. A majority of our generation revenue is expected to come from our efficient low-cost baseload and intermediate generation facilities. We also expect to capture additional value by selling power during periods of peak demand from our quick-start peaking facilities. We plan to further enhance margins by selling capacity within the PJM markets, both in the three-year forward PJM base residual auction and through bilateral agreements with power purchasers, as well as by providing ancillary services to support transmission system reliability.

We believe our assets are strategically positioned in what we view as the two most attractive power markets in the United States, each of which is characterized by strong and improving fundamentals and a regulatory framework supportive of competitive generators. Our generation facilities will be predominantly located in PJM, an RTO, and ERCOT, an ISO, which are regional organizations formed, in part, to provide reliable wholesale power marketplaces. PJM is the largest wholesale energy market in the United States and ERCOT is the oldest ISO in the country. PJM is characterized by improving fundamentals due to limited import capacity, significant anticipated capacity retirements, an improving demand outlook and a forward capacity market that provides future cash flow visibility for generation asset owners. Specific efforts are being undertaken by PJM to support and potentially increase capacity prices for existing generation to ensure the availability of adequate resources. ERCOT is an attractive wholesale electricity market with historically above-average demand growth, tight reserve margins, increasing price caps and an increasing reliance on flexible and quickly-dispatchable natural gas-fired assets. Additionally, the ERCOT sub region in which we operate, ERCOT-South, has historically experienced premium energy pricing relative to the average price for the broader ISO. We consider PJM and ERCOT to be two of the most well-developed power markets in the United States, providing significant price transparency, market liquidity and support to competitive generators, including recent proposed reforms that we believe will enhance the value of our portfolio.

2

The competitive dispatch costs and operating flexibility of our generation fleet position us favorably to generate attractive cash margins in a wide variety of market conditions. In an effort to support our operations and stabilize future cash flows, we will enter into forward physical and financial transactions to hedge energy, capacity and related products and to hedge fuel and fuel transportation. We will sell the output of our generation facilities to a diverse group of wholesale customers, including RTOs and ISOs, utilities, cooperatives, municipalities, power marketers, and financial counterparties. We will also sell the output of our generation facilities to commercial, industrial and residential retail customers.

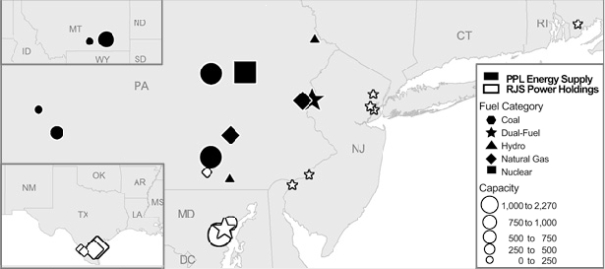

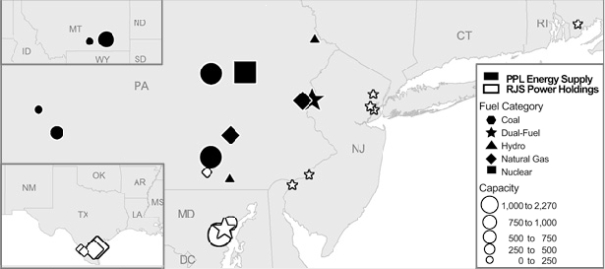

The following map illustrates the locations of our generation facilities as of December 31, 2014:

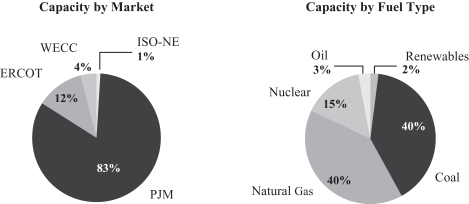

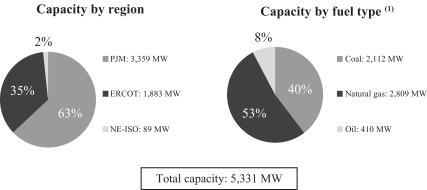

The charts below illustrate the composition and diversity of our portfolio by market and fuel type as of December 31, 2014:

|

The charts above do not reflect the sale or other disposition of approximately 1,300 MW of generation capacity that is required to obtain regulatory approval for the Transactions. As a result, our generation portfolio will not include all of the plants that currently comprise the Energy Supply business and the RJS Power business. See “The Separation Agreement and The Transaction Agreement—The Transaction Agreement—Regulatory Approvals and Efforts to Close—Mitigation Plans.”

3

Our Competitive Strengths

We believe that we will be well-positioned to execute our business strategy and create superior value for our stakeholders based on the following competitive strengths:

Well-positioned in attractive, liquid and transparent energy markets. We believe that the composition and locations of our facilities will give us a strategic advantage and offer attractive upside opportunities. The majority of our facilities will be located in PJM and ERCOT, which are among the most liquid, well-developed power markets in the United States, each with attractive fundamentals.

We believe the PJM market presents attractive value opportunities, driven by a substantial number of announced power plant retirements, limited import capacity and an improving demand outlook. Our PJM assets are highly diverse both in terms of fuel (coal, natural gas/oil dual fuel, nuclear, natural gas, oil and hydro and other renewables) and dispatch (baseload, intermediate/load following and peaking), which provides us with operational flexibility and enables our portfolio to provide reliable generation under a variety of market conditions. A key attribute of PJM is its base residual auction, a long-term capacity market in which power customers pay for capacity three years in advance. These known capacity revenues are expected to be an important component of our gross margins. Additionally, we expect that recently proposed market reforms may provide additional revenue opportunities for us in PJM in future capacity auctions. See “—Our Key Markets—PJM” for information on the recently proposed market reforms in PJM.

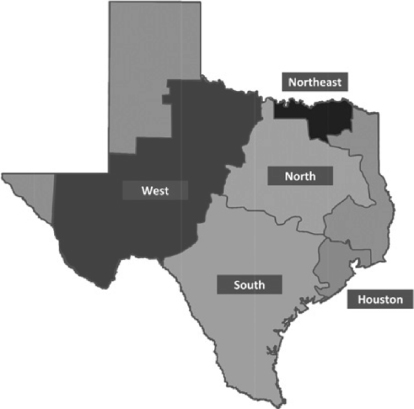

We believe the ERCOT market also presents attractive value opportunities, driven by robust demand growth and limited import capacity, which we expect will result in a lower reserve margin. Our generation assets in ERCOT consist of flexible, natural gas-fired units that have the ability to start up quickly and respond to load variability, which positions them well to produce significant margin from ancillary products offered in this market in addition to physical energy sales. All of our ERCOT capacity is located in the ERCOT South Zone, which has historically experienced premium pricing due to favorable supply and demand fundamentals and strong demand driven by growth related to Eagle Ford shale development, the midstream energy sector and petrochemical industry expansion. The ERCOT regulatory framework has addressed resource adequacy concerns through rule changes that have increased generator compensation and pricing floors for ancillary products and increased the state-wide offer cap. ERCOT reserve margins are forecasted to continue to compress due to growing demand and limited announced new-build projects, further tightening the supply/demand balance across ERCOT and creating conditions that may generate increased price volatility and higher energy prices until additional resources are added.

Robust cash flow generation potential. We expect to be able to generate substantial free cash flow, which we define as cash from operations less maintenance capital expenditures. A number of factors are expected to contribute to our strong cash flow profile: our focus on lean operations, relatively low financial leverage, efficient baseload units with low dispatch costs, significant ancillary revenue potential of the Texas facilities, significant synergies resulting from successful execution of our transition plans with PPL and Riverstone, and a well-maintained fleet requiring modest maintenance and environmental expenditures. The stability of our cash flows is further supported by forward capacity sales in PJM through May 2018. We believe this cash flow potential provides a competitive advantage by making us more resilient during price fluctuations in the commodity cycles, less reliant on external sources of capital to finance operations and a company better situated to pursue both organic and acquisition-driven growth opportunities.

Strong balance sheet, poised for growth. We believe that our expected financial leverage will provide multiple competitive advantages. First, our strong balance sheet and credit profile are expected to enhance our ability to pursue both organic and acquisition-driven growth by offering favorable access to capital markets and maximum financial flexibility. We also believe a strong balance sheet will position us well to manage through periods of commodity price volatility which may require collateral posting and credit support that could challenge a more levered competitive power company. We believe we will be able to use our strong balance

4

sheet to grow through acquisitions, taking an opportunistic approach when others in the sector may face financial stresses during those periods. Finally, our low level of financial leverage will allow us to absorb a greater degree of operating cash flow volatility, which will allow our margin hedging program to have a shorter-term focus. We believe this will reduce hedging transaction volume and expenses, liquidity needs and hedge book complexity, which we believe will result in lower operating costs and greater financial transparency.

Competitive scale. As one of the largest competitive power generating companies in North America, with approximately 14,000 MW of operating capacity, we expect to benefit from the multiple competitive advantages attendant to a large scale portfolio. We will have a scale presence in our key markets, allowing us to operate integrated portfolios within each of PJM and ERCOT and offering us beneficial dispatch and operational synergies. We expect those benefits will include improved leverage of our fixed costs, enhanced procurement opportunities and diversity of cash flows. These advantages combined with a strong balance sheet and significant liquidity, enable us to operate with more financial flexibility and, as such, should enable us to utilize our competitive scale to grow and further expand our already-robust generation platform.

Significant historical environmental control investments. We believe our assets are substantially compliant with current environmental regulations and are well-positioned relative to the current trend of tightening environmental legislation and regulations. Because of significant prior investments and the composition of our fleet, we expect that future environmental compliance-driven capital expenditures will be a relatively modest $155 million dollars through 2019, representing less than 10% of total capital expenditures for the same period.

Proven, experienced management team. Our management team has significant experience and expertise operating power generating facilities, marketing electricity and ancillary services and managing the risks of a competitive power generation business. We have a strong track record of value creation through the execution of strategic initiatives and exceptional asset management, which positions us optimally to enhance and expand the Talen Energy platform. We strongly believe that the proven leadership team at Talen Energy will successfully execute our business strategy and deliver superior operating and financial performance.

Our Business Strategy

Our business strategy is to maximize value to our customers and stockholders with particular emphasis on:

Excellence in operations. We believe that value is built on a foundation of operational excellence. Safety is a core value of ours and is critical to maintaining a platform for strong, reliable plant performance. We inherit robust safety programs from our predecessor companies which have demonstrated dedication to sustaining safe cultures by achieving VPP Star status at a majority of our facilities.

We also believe value is a function of disciplined investment and continuous improvement in operating efficiency. We intend to make prudent investments to enable our plants to run at the most profitable times while ensuring safe, reliable operations. Additionally, we plan to continue our commitment to asset optimization and reducing operating costs. We believe that persistent focus on process improvement and innovative cost management is a key component to success.

Focus on cash returns. We will run our business with a focus on producing strong cash flows in order to sustain our operations and fund growth opportunities. Capital allocation decisions will be made on a cash return basis, as we believe this discipline is necessary to drive consistent long-term value creation for our stockholders. We believe that our proven management team, reliable, low-cost operating structure and strong commercial management of our plants will enable us to invest in and grow the existing platform while enhancing overall cash flows and achieving attractive returns on investment.

5

Active hedging and commercial management. Hedging the fuel and output of our plants will be primarily focused on providing margin and cash flow visibility on a one-year forward basis. We intend to execute hedging and marketing strategies for the output of our facilities in both the wholesale and retail energy markets. We also intend to execute asset-based portfolio strategies to monetize inherent market volatility. We believe our hedging and commercial management strategy, in combination with a strong balance sheet, will provide a long-term advantage through cycles of higher and lower commodity prices. Finally, our lower level of financial leverage will allow us to absorb a greater degree of operating cash flow volatility, which will further allow our margin hedging program to have a shorter-term focus. We believe this will reduce hedging transaction volume and expenses, liquidity needs and hedge book complexity, which we further believe will result in lower operating costs and greater financial flexibility.

Growth posture. We believe scale in the competitive power generation sector is an element of value creation. We expect to be able to leverage our management and operational systems to integrate additional assets and activities with relatively modest incremental cost. We intend to grow value through development and acquisitions that are complementary to our competitive strengths, with a focus on developed competitive markets that offer liquidity and price transparency. Additionally, as Talen Energy grows, our goal is to maintain a multi-fuel and multi-dispatch profile, as we believe this type of diversity is inherently valuable and provides an added measure of risk mitigation. We believe that our strong balance sheet and cash flow generation, combined with our current presence in attractive markets and our experienced, disciplined management team, will position Talen Energy favorably in its pursuit of value-enhancing growth opportunities.

Our Management Team

In selecting our management team, sourced largely from PPL, we have focused on individuals that have strong and proven track records of delivering stockholder value in executive capacities covering operations, strategy and financing. Our President and Chief Executive Officer, Paul Farr, has over 20 years of power and utilities experience having spent more than seven years as Chief Financial Officer of PPL prior to being named President of Energy Supply at the announcement of the Transactions. Mr. Farr also has extensive operations experience, having served as Chief Operating Officer of PPL Global, LLC for over three years, which included responsibility for all of PPL’s international utilities operations in Latin America and the United Kingdom, as well as global corporate strategy. Mr. Farr was also integral to the establishment of PPL’s competitive power generation business in Montana from 1999 to 2001. Jeremy McGuire, our Senior Vice President and Chief Financial Officer, served as Vice President–Strategic Development of PPL Strategic Development, LLC since 2008. Prior to joining PPL, Mr. McGuire was an investment banker for 13 years, ten of which were focused on competitive power companies and utilities. Mr. Farr and Mr. McGuire were instrumental in PPL’s acquisition and financing of $14 billion in utility businesses in Kentucky and the United Kingdom, which nearly doubled PPL’s asset base, increased annual revenues by 70 percent and helped grow market capitalization by 40 percent between 2009 and 2011.

Our executive team includes other key members that bring significant experience and expertise operating, marketing and managing risks of a competitive power generation business. Joe Hopf, our Senior Vice President and Chief Commercial Officer, has more than 30 years of experience in the electricity business serving in various roles in power plant operations, trading and risk management. Most recently, Mr. Hopf led PPL’s fossil and hydro generating operations with nearly 8,000 MWs of generating capacity. Tim Rausch, our Senior Vice President and Chief Nuclear Officer, served as PPL Generation’s Senior Vice President and Chief Nuclear Officer since 2009. Mr. Rausch came to PPL after 25 years of experience in virtually all disciplines of the nuclear power industry. Jim Schinski, our Senior Vice President and Chief Administrative Officer, joined PPL Services in 2009 as Vice President-Chief Information Officer. Prior to joining PPL, Mr. Schinski served as Chief Information Officer and Vice President of Human Resources for the Midwest Independent System Operator since 2004, where he was responsible for design, development, implementation and operation of technology systems for one of the country’s

6

largest electricity markets. We believe our leadership team positions Talen Energy to meet our objectives of delivering superior operating and financial performance through committed execution of Talen Energy’s business strategy.

Our Key Markets

The substantial majority of our generation capacity is located in either PJM or ERCOT. We consider these regions to be among the most well-developed, transparent and liquid energy markets in the United States.

PJM

PJM is an RTO that coordinates the movement of wholesale electricity in all or parts of thirteen states and the District of Columbia. It is the largest competitive wholesale electricity market in the United States, dispatching more than 180,000 MW to more than 60 million people. The current mix of generating capacity within PJM is largely coal-dominated, with a significant number of nuclear and natural gas power plants rounding out the dispatch curve. As is the case in many markets in the United States, generating capacity within PJM is transitioning from a coal-dominated generation base to a mix that incorporates larger amounts of natural gas and renewable units, driven in large part by current and impending EPA regulations. The following map illustrates PJM by regions.

PJM benefits from a combination of stable demand growth, liquid trading hubs, limited energy import capacity and a wide range of available market products. Generation owners in PJM may earn energy, capacity and ancillary revenues. The PJM energy market consists of day-ahead and real-time markets. The day-ahead

7

market is a forward market in which hourly prices are calculated for the next operating day based on offers, bids and bilateral obligations. The real-time market is a spot market in which energy is continuously bought and sold based on actual grid operating conditions.

The PJM capacity market, known as the Reliability Pricing Model (“RPM”), is intended to ensure that resources are available when needed to keep the power grid operating reliably for customers. Under the RPM, PJM conducts a series of auctions. Most capacity is procured in the base residual auctions each May for the sale of generating capacity three years in advance of the delivery year. In these auctions, prices are set based on available capacity and other factors such as transmission constraints. The capacity market construct provides generation owners the opportunity for some revenue visibility on a multi-year basis.

Recent developments have the potential to be supportive of future revenue opportunities for generation owners in PJM, including:

| • | PJM’s proposal to add an enhanced “Capacity Performance” product to the capacity market structure to permit additional compensation for generation owners/operators to make the necessary investments to maintain system reliability in exchange for stronger performance requirements. The intent of the Capacity Performance product is to improve operational availability during periods of peak power system demand, such as extreme weather. Specifically, PJM’s stated objectives of this product include fuel security through dependable fuel sources, high availability of generation resources and operational diversity. If approved by the FERC, Capacity Performance is expected to benefit generation owners like Talen Energy that will own assets supplied by firm fuel commitments and have demonstrated reliability during peak load and extreme weather conditions; |

| • | PJM’s recent changes to the “Variable Resource Requirement” (“VRR”) curve. The VRR curve is a downward-sloping demand curve used by PJM to model sufficient capacity resources for PJM and set capacity prices. The VRR curve supports PJM’s objective of attracting and retaining adequate capacity resources to ensure grid reliability, providing an indication of incremental reliability and economic value of capacity at different planning reserve levels. PJM’s recent changes include a shift in the VRR curve, which signifies an increase in demand and therefore price, offering potential upside to future capacity prices for PJM generators; |

| • | Recent developments that increase uncertainty associated with demand response’s ability to participate in future capacity auctions, offering potential upside to future capacity prices for PJM generators; and |

| • | Potential rule changes affecting price formation including offer cap changes which may lead to higher energy market prices. |

8

ERCOT

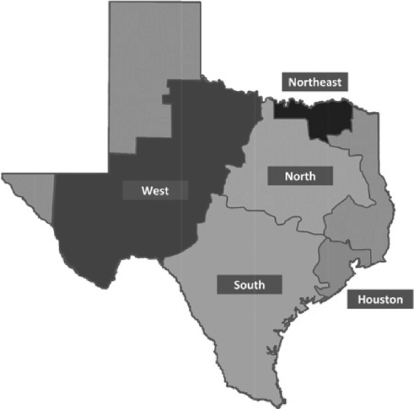

ERCOT is an ISO that manages the flow of electricity from approximately 75,000 MW of installed capacity to 24 million Texas customers, representing 90% of the state’s electric load and covering approximately 75% of its geography. ERCOT is an attractive wholesale electricity market with historically above-average demand growth, tight reserve margins, increasing price caps and an increasing reliance on flexible and quickly-dispatchable natural gas-fired assets. ERCOT was established in September 1996 and, as such, is the oldest ISO in the United States. The following map illustrates ERCOT by regions.

As an energy-only market, ERCOT’s market design is different from other competitive electricity markets in the United States. Other markets, including PJM, maintain a minimum reserve margin through regulated planning, resource adequacy requirements and/or capacity markets. In contrast, ERCOT’s resource adequacy is predominately dependent on free market processes and energy market price signals. All electricity prices are subject to a system-wide offer cap, which was $5,000/MWh in 2013. This offer cap increased to $7,000/MWh in 2014 and is set to increase to $9,000/MWh in June 2015, providing a higher maximum marginal price. The system-wide offer cap has been reached on a number of occasions since 2011.

Transactions in ERCOT take place in two key markets: the day-ahead market and the real-time market. The day-ahead market is a voluntary forward energy market conducted the day before each operating day in which generators and purchasers of power may bid for one or more hours of energy supply or consumption. The day-ahead market also allows ERCOT and generators and purchasers of power to buy and sell ancillary services. The real-time market is a spot market in which energy may be sold in five-minute intervals.

9

Generation facilities in the region include efficient combined cycle natural gas-fired facilities, a large wind fleet and a mixture of environmentally compliant and older, non-compliant coal-fired assets. The combination of these assets has historically led to lower marginal cost of production during most periods, compared to other markets. However, the region has limited excess capacity to meet high demand days and the marginal facilities have high operating costs. Therefore, the marginal price of supply rapidly increases during periods of high demand. As a result, many generators benefit from these sporadic periods of “scarcity pricing” in which power prices increase significantly.

The Texas population and gross state product is currently expanding at well above the national average rate, spurred in part from significant growth in oil and gas development and associated petrochemical industry growth. In December 2014, ERCOT released its latest reserve margin projections, which showed ERCOT’s reserve margin dipping below the current target reserve margin of 13.75% in 2019. The table below illustrates ERCOT’s forecasted reserve margin for 2015 through 2019.

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

Reserve Margin Forecast | 15.7 | % | 17.1 | % | 18.1 | % | 16.5 | % | 13.6 | % | ||||||||||

In addition to energy, ancillary services, such as non-spinning reserves, responsive reserves and regulation up/down, offer another potential revenue stream for market participants in order to maintain system reliability, which is impacted by the high concentration of wind capacity in ERCOT. These ancillary services provide network support from quick-start generation capacity that is able to reach full load operation in exceptionally short periods of time in order to help manage the impact of wind variability on the electricity grid. Such ancillary services have received increased compensation and exhibited higher offer floors in part because ERCOT has one of the highest concentrations of wind capacity in the United States, with over 12,500 MW of installed capacity.

10

Market Opportunity

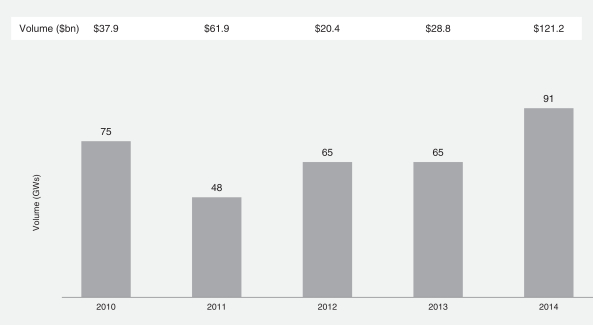

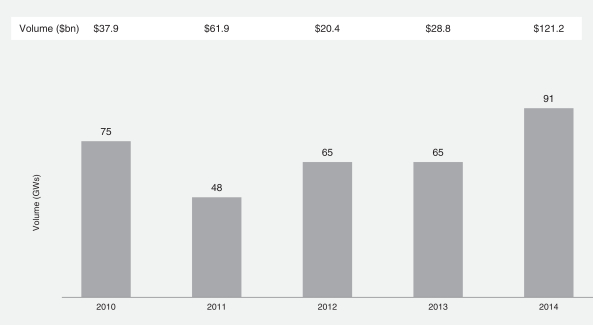

The market for competitive power generation assets has been very robust over the past five years, and we expect a continuation of this trend, providing further opportunities to enhance our competitive scale. From 2010 to 2014, roughly 344 GW of competitive power generation capacity has been sold, with approximately 121 GW and 36 GW in PJM and ERCOT, respectively. The diverse nature of these transactions, encompassing both conventional (predominantly natural gas and coal) and renewable (predominantly wind and solar) generating facilities, aligns with our goal of maintaining a multi-fuel and multi-dispatch profile. The table below illustrates the volume of transactions in dollars and GWs from 2010 through 2014.

We believe that there will continue to be significant acquisition opportunities for competitive power generation assets in the United States, enabling us to grow our fleet and enhance shareholder value. Approximately 81 GW of operating capacity are owned by companies that operate both regulated utilities and competitive power generation assets, while approximately 40 GW are owned by private equity funds. Given the trend of separating competitive power generation assets from regulated utility assets, and the typically defined target holding period of private equity funds, we expected that a significant number of assets will come to market over the next several years.

11

Transaction Rationale

We believe that the creation of Talen Energy through the separation of Energy Supply from PPL’s rate-regulated utility business and concurrent combination with RJS Power will maximize value for both PPL shareholders as well as Talen Energy stockholders. The separation will give rise to a number of significant benefits by allowing each company to pursue its own business strategy without requiring compromise relative to the other. Separating PPL into two independent companies, with one focused on rate-regulated utility operations and the other focused on competitive energy and power generation, recognizes the significant opportunities each of the two businesses have going forward as well as the different risks inherent in each. The two businesses have significantly different capital investment priorities, obligations and opportunities. They also have significantly different risk profiles and costs of capital. Each company will be able to attract investors and source capital based on its own risk profile and return prospects. This will translate into a better alignment of PPL’s and Talen Energy’s management teams with the direct interests of their respective shareholders because the factors that drive shareholder value for a competitive power generation company are often different, and at times at odds with, factors that drive shareholder value for a rate-regulated utility. In addition, the separation will also allow Talen Energy to compensate employees in the competitive power generation business with its own equity, which will result in equity compensation that is more in line with the financial results of such employees’ direct work product. Further, PPL determined that shareholder value could be enhanced by simultaneously combining Energy Supply with another competitive power generation company, thereby increasing the scale and diversity of the generating fleet and enhancing the ability to realize cost synergies and margin benefits through initiatives and programs currently being developed by management, as well as creating a larger, stronger platform from which to pursue additional organic and acquisition-related growth opportunities.

The Companies

Energy Supply

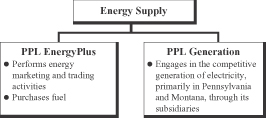

Energy Supply is primarily engaged in the competitive power generation and marketing of electricity, generating capacity, ancillary services and related commodities primarily on a wholesale basis from its fleet of power plants located in Pennsylvania and Montana, totaling approximately 9,896 MW of electricity generation capacity as of December 31, 2014. Energy Supply’s principal subsidiaries are PPL EnergyPlus, LLC (“PPL EnergyPlus”), its marketing and trading subsidiary, and PPL Generation, LLC (“PPL Generation”), the subsidiaries of which own and operate its generating facilities in Pennsylvania and Montana.

PPL Generation owns and operates, through its subsidiaries, a diverse portfolio of competitive domestic power generating facilities. Its power generating facilities are fueled by coal, uranium, natural gas, oil and water. Approximately 93% and 7% of the net generating capacity of PPL Generation is located in PJM and WECC, respectively. PPL EnergyPlus sells electricity produced by PPL Generation’s facilities, participates in wholesale market load-following auctions, and markets various energy products and commodities such as: capacity, transmission, financial transmission rights, coal, natural gas, oil, uranium, emission allowances, renewable energy credits and other commodities in competitive wholesale and competitive retail markets, primarily in the northeastern and northwestern United States. PPL EnergyPlus focuses on entering into energy and energy-related physical and financial contracts to hedge the variability of expected cash flows associated with PPL Generation’s facilities and its marketing activities, as well as for trading purposes.

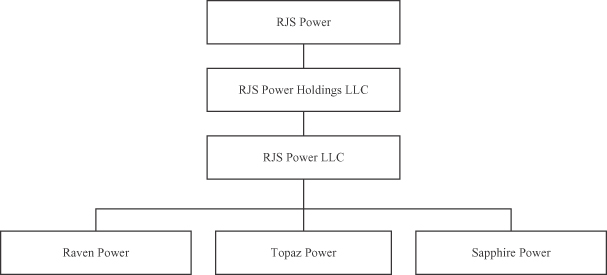

RJS Power

RJS Power is engaged in the competitive power generation and marketing of electricity, generating capacity and ancillary services on a wholesale basis from its fleet of power generating facilities located in five states totaling approximately 5,331 MW of electricity generation capacity as of December 31, 2014. RJS Power owns and operates a diverse portfolio of power generating facilities of various technology types and operating

12

characteristics fueled by coal, natural gas and oil. RJS Power focuses on managing the dispatch of its assets to maximize physical energy margin and engaging in prudent risk mitigation through contracted forward capacity sales and physical and financial hedges. Approximately 63% and 35% of the net generating capacity of RJS Power’s facilities is located in PJM and ERCOT, respectively.

Our Fleet

Asset | Location | Fuel Type | Ownership | Owned Capacity (MW) (1) | Commercial Operation Date | Region/ ISO | ||||||||

Energy Supply (1) | ||||||||||||||

Montour | PA | Coal | 100% | 1,504 | 1972 – 1973 | PJM | ||||||||

Brunner Island | PA | Coal | 100% | 1,411 | 1961 – 1969 | PJM | ||||||||

Keystone | PA | Coal | 12% | 211 | 1967 – 1968 | PJM | ||||||||

Conemaugh | PA | Coal | 16% | 278 | 1970 – 1971 | PJM | ||||||||

Martins Creek 3 & 4 | PA | Natural Gas / Oil | 100% | 1,700 | 1975 – 1977 | PJM | ||||||||

Ironwood | PA | Natural Gas | 100% | 660 | 2001 | PJM | ||||||||

Lower Mt. Bethel | PA | Natural Gas | 100% | 538 | 2004 | PJM | ||||||||

Peakers | PA | Natural Gas / Oil | 100% | 354 | 1967 – 1973 | PJM | ||||||||

Susquehanna | PA | Nuclear | 90% | 2,245 | 1983 – 1985 | PJM | ||||||||

Eastern Hydro (2) | PA | Hydro | 100% | 293 | 1910 – 1926 | PJM | ||||||||

Colstrip 1 & 2 | MT | Coal | 50% | 307 | 1975 – 1976 | WECC | ||||||||

Colstrip 3 | MT | Coal | 30% | 222 | 1984 | WECC | ||||||||

Corette (3) | MT | Coal | 100% | 148 | 1968 | WECC | ||||||||

Renewables (4) | NH, NJ, PA, VT | Renewables | 100% | 25 | Various | Various | ||||||||

|

| |||||||||||||

Total Energy Supply | 9,896 | |||||||||||||

RJS Power (1)(5) | ||||||||||||||

Brandon Shores | MD | Coal | 100% | 1,273 | 1984 – 1991 | PJM | ||||||||

H.A. Wagner | MD | Coal / Natural Gas / Oil | 100% | 976 | 1956 – 1972 | PJM | ||||||||

C.P. Crane | MD | Coal | 100% | 399 | 1961 – 1967 | PJM | ||||||||

Bayonne | NJ | Natural Gas / Oil | 100% | 174 | 1988 | PJM | ||||||||

Camden | NJ | Natural Gas / Oil | 100% | 151 | 1993 | PJM | ||||||||

Dartmouth | MA | Natural Gas / Oil | 100% | 89 | 1996 | ISO-NE | ||||||||

Elmwood Park | NJ | Natural Gas / Oil | 100% | 73 | 1989 | PJM | ||||||||

Newark Bay | NJ | Natural Gas / Oil | 100% | 129 | 1993 | PJM | ||||||||

Pedricktown (6) | NJ | Natural Gas / Oil | 100% | 132 | 1992 | PJM | ||||||||

York | PA | Natural Gas | 100% | 52 | 1989 | PJM | ||||||||

Laredo 4 | TX | Natural Gas | 100% | 98 | 2008 | ERCOT | ||||||||

Laredo 5 | TX | Natural Gas | 100% | 98 | 2008 | ERCOT | ||||||||

Nueces Bay 7 | TX | Natural Gas | 100% | 678 | 2010 | ERCOT | ||||||||

Barney Davis 1 | TX | Natural Gas | 100% | 335 | 1974 | ERCOT | ||||||||

Barney Davis 2 | TX | Natural Gas | 100% | 674 | 2010 | ERCOT | ||||||||

|

| |||||||||||||

| Total RJS Power | 5,331 | |||||||||||||

|

| |||||||||||||

Total Talen Energy | 15,227 | |||||||||||||

|

| |||||||||||||

| (1) | Does not reflect the sale or other disposition of approximately 1,300 MW of generating capacity that is required to obtain regulatory approval for the Transactions. See “The Separation Agreement and the Transaction Agreement—The Transaction Agreement—Regulatory Approvals and Efforts to Close—Mitigation Plans.” |

| (2) | Includes Holtwood and Wallenpaupack. |

13

| (3) | Operations were suspended and the Corette plant was retired in March 2015. |

| (4) | Energy Supply is presently considering divesting its renewables plants. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Energy Supply—Overview—Financial and Operational Developments—Mechanical Contracting Subsidiaries and Renewables Plants.” |

| (5) | Total net generating capacities are based on average summer and winter capacity. |

| (6) | Pedricktown capacity includes capacity dedicated to serving landlord load (which has historically averaged 9 MW). |

Risk Factors

We face numerous risks related to, among other things, our business operations, our strategies, general economic conditions, competitive dynamics of the industry, our level of indebtedness, the legal and regulatory environment in which we operate, and our status as an independent public company following the Transactions. These risks are set forth in detail under the heading “Risk Factors.” If any of these risks should materialize, they could have a material adverse effect on our business, financial condition, results of operations or cash flows. We encourage you to review these risk factors carefully. Furthermore, this prospectus contains forward-looking statements that involve risks, uncertainties and assumptions. Actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those under the headings “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” Risks related to our business include, among others:

| • | our operating and financial performance and prospects; |

| • | our access to financial and capital markets to issue debt or enter into new credit facilities; |

| • | investor perceptions of us and the industry and markets in which we operate; |

| • | future sales of equity or equity-related securities; |

| • | many of our facilities operate, wholly or partially, without power sale agreements; |

| • | our financial performance can be impacted by changing natural gas prices and unpredictable price movements in the wholesale power markets and other markets that are beyond our control; |

| • | changes in earnings estimates or buy/sell recommendations by analysts; |

| • | general financial, domestic, economic and other market conditions; |

| • | costs, results of operations, financial conditions and cash flows could be adversely impacted by disruption of fuel supplies; |

| • | trading operations and the use of hedging agreements could result in financial losses that negatively impact results of operations; |

| • | the accounting for hedging activities may increase volatility in the Company’s quarterly and annual financial results; |

| • | maintenance, expansion and refurbishment of power generation facilities involve significant risks that could result in unplanned power outages or reduced output and could have a material adverse effect on our results of operations, cash flow and financial conditions; |

| • | increased stringency of environmental regulations and requirements and other environmentally related issues could increase our costs significantly; |

| • | insufficient liquidity to hedge markets effectively; and |

| • | competition in wholesale power markets and issues related to the oversupply of power generation capacity in certain regional markets in which we operate may have a material adverse effect on our operations. |

14

Summary of the Transactions

We provide below a summary of the Transactions. See “The Transactions” for a more detailed description.

The Distribution and the Merger

Distributing Company | PPL Corporation, a Pennsylvania corporation. After the Distribution, PPL will not own any shares of Talen Energy common stock. |

Distributed Company | Talen Energy Corporation, a Delaware corporation. After the Distribution and Merger, Talen Energy will be an independent, publicly traded company. |

Record Date | Record ownership will be determined as of 5:00 p.m., New York City time, on May 20, 2015. |

Distribution Date | The Distribution Date is expected to be on or about June 1, 2015. |

Distribution Ratio | Each share of PPL common stock outstanding as of the record date will entitle its holder to receive a number of shares of HoldCo common stock determined by a formula based on the number of PPL shares of common stock outstanding at 5:00 p.m. New York City time, on the record date. Each such record holder will be entitled to receive a number of shares of HoldCo common stock equal to the aggregate number of shares of HoldCo common stock multiplied by a fraction, the numerator of which is the number of shares of PPL common stock held by such record holder on the record date and the denominator of which is the total number of shares of PPL common stock outstanding on the record date. Based on the number of shares of PPL common stock outstanding as of March 31, 2015, we expect the distribution ratio to be approximately 0.125 shares of HoldCo common stock for each share of PPL common stock. Promptly after the record date, we will issue a press release disclosing the actual distribution ratio. As a result of the Merger, each such share of HoldCo common stock will be converted into one share of Talen Energy common stock. The shareholders of PPL as of the record date and their transferees will own 65%, and the Contributors, collectively, will own 35%, of the shares of Talen Energy common stock immediately following the Combination. |

Securities to be distributed and delivered | All of the 83,525,000 shares of common stock of HoldCo outstanding immediately prior to the Merger will be distributed pro rata to PPL shareholders who hold PPL common stock as of the record date and will be automatically converted into shares of Talen Energy common stock at the Effective Time and delivered to PPL shareholders. The number of Talen Energy shares that PPL will ultimately deliver to its shareholders will be reduced to the extent that cash payments are to be made in lieu of fractional shares, as described below. |

15

The Distribution | On the Distribution Date, PPL will cause the distribution agent to distribute the shares of HoldCo common stock to the transfer agent for the accounts of the PPL shareholders as of the record date, which shares (other than shares held by Talen Energy, Merger Sub, HoldCo or any HoldCo subsidiary, which shares will be cancelled and retired) will be, immediately prior to the effective time of the Merger, automatically converted into the right to receive shares of Talen Energy common stock on a one-for-one basis. It is expected that it will take the distribution agent up to three business days to electronically issue Talen Energy shares to PPL shareholders or their respective bank or brokerage firm on behalf of PPL shareholders by way of direct registration in book-entry form. PPL shareholders will not be required to make any payment, surrender or exchange PPL common stock or take any other action to receive their Talen Energy common stock. |

No fractional shares | Holders of PPL common stock will not receive any fractional shares of Talen Energy common stock. In lieu of fractional shares of Talen Energy, PPL shareholders will receive a cash payment. Fractional shares of Talen Energy common stock that would otherwise be allocable to any record holders of PPL common stock will be aggregated and, following the Merger, sold by the distribution agent as whole shares of Talen Energy in the open market at prevailing market prices (or otherwise as reasonably directed by PPL, in consultation with the Contributors). The exchange agent will make available the net proceeds of this sale, after deducting any required withholding taxes and brokerage charges, commissions and transfer taxes, on a pro rata basis, without interest, to each PPL shareholder who would otherwise have been entitled to receive a fractional share of Talen Energy in the Distribution and the Merger. See “The Transactions—Structure of the Distribution, the Merger and the Combination—Treatment of Fractional Shares.” The receipt of cash in lieu of fractional shares generally will be taxable to the recipient shareholders that are subject to U.S. federal income tax as described in “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions.” |

Tax consequences of the Distribution, Merger and Combination to PPL shareholders | PPL expects to receive an opinion from Simpson Thacher to the effect that the contribution by PPL of 100% of the outstanding equity securities of Energy Supply to HoldCo (the “HoldCo Contribution”) together with the Distribution will qualify as a reorganization pursuant to Section 368(a)(1)(D) of the Code and a tax-free distribution pursuant to Section 355 of the Code, that the Merger will qualify as a reorganization pursuant to Section 368(a) of the Code, and that the Merger and Combination together will qualify as a transaction described in Section 351 of the Code. Such opinions will rely on certain facts and assumptions, and certain representations and undertakings, provided by us, PPL and the Contributors regarding the past and future conduct of our respective businesses and other matters. |

16

| Assuming that the HoldCo Contribution and the Distribution together qualify as a reorganization pursuant to Section 368(a)(1)(D) of the Code and a tax-free distribution pursuant to Section 355 of the Code, no gain or loss will be recognized by PPL shareholders for U.S. federal income tax purposes upon the deemed receipt of HoldCo common stock pursuant to the Distribution. Assuming that the Merger qualifies as a reorganization pursuant to Section 368(a) of the Code and that the Merger and Combination together will qualify as a transaction described in Section 351 of the Code, HoldCo stockholders will not recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger and Combination, except for any gain or loss attributable to cash received in lieu of a fractional share of Talen Energy. See “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions” and “Risk Factors—Risks Relating to the Transactions—If the Distribution does not qualify as a tax-free distribution under the Code and/or the Merger does not qualify as a reorganization under the Code, including as a result of subsequent acquisitions of stock of PPL or Talen Energy, then PPL and/or its shareholders may be required to pay substantial U.S. federal income taxes.” |

| Each PPL shareholder is urged to consult his, her or its tax advisor as to the specific tax consequences of the Transactions to that shareholder, including the effect of any state, local or non-U.S. tax laws and of changes in applicable tax laws. |

Relationship with PPL and TPM after the Transactions | PPL will have no continuing ownership interest in, control of or affiliation with Talen Energy following the Distribution. Talen Energy has entered into the Separation Agreement, the Transaction Agreement and the Employee Matters Agreement and, shortly before the Distribution, Talen Energy expects to enter into other agreements with PPL and the Contributors related to the Transactions. These agreements will govern the relationship between Talen Energy and PPL subsequent to the completion of the Distribution and provide for the allocation between Talen Energy and PPL of various assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities). The Separation Agreement, in particular, provides for the settlement or extinguishment of certain obligations between Talen Energy and PPL. Energy Supply will enter into Transition Services Agreements with PPL and TPM, pursuant to which the parties thereto will provide certain services to the other parties thereto and their respective subsidiaries on a transitional basis. We describe these and related arrangements in greater detail under “The Separation Agreement and the Transaction Agreement—Ancillary Agreements” and describe some of the risks of these arrangements under “Risk Factors—Risks Relating to the Transactions.” |

17

Distribution Agent | Wells Fargo Bank, National Association |

The Combination

Structure of the Combination | The Contributors will contribute, directly or indirectly, all of the outstanding equity interests of RJS Power to Talen Energy. |

Consideration for the Combination | In consideration of the Combination, we will issue additional shares of our common stock to the Contributors in an aggregate amount which will result in PPL shareholders owning 65% of Talen Energy’s outstanding common stock and the Contributors owning the remaining 35% immediately following the Combination. Talen Energy’s stockholders immediately prior to the Combination will not receive any consideration in the Combination, and Talen Energy will remain the parent company for the combined company. |

Approval of the Combination | No vote by PPL shareholders is required or is being sought in connection with the Combination. Each of PPL, HoldCo, Talen Energy and Energy Supply and RJS has already approved the Combination. |

Termination of the Transaction Agreement | The Transaction Agreement may be terminated at any time prior to the Closing Date by mutual consent of PPL and the Contributors. The Transaction Agreement may also be terminated on the occurrence of certain events, including if the Closing Transactions have not been consummated on or prior to June 30, 2015, if the consummation of any component of the Transactions would be illegal or otherwise prohibited under applicable law, order or other action by any governmental authority or if either party has breached or failed to perform any of its respective representations, warranties, covenants or other agreements contained in the Transaction Agreement. Each of the foregoing termination events are described in greater detail under “The Separation Agreement and the Transaction Agreement—The Transaction Agreement—Termination of the Transaction Agreement.” |

Transaction Expense Adjustments | Generally, all fees and expenses incurred in connection with the Transactions are to be paid by the party incurring such fees or expenses; however, any costs incurred by PPL, Energy Supply, Talen Energy, HoldCo or Merger Sub or any of their subsidiaries in connection with the Separation Transactions and the Distribution, other than certain shared expenses, are to be paid by PPL. Certain expenses incurred in connection with the Transactions are to be paid by Talen Energy if the Closing Transactions are consummated, or 65% by PPL and 35% by the Contributors if the Closing Transactions are not consummated. All fees and expenses of financial, legal, accounting and other professional advisors retained by each of the parties will be paid by the party incurring such fees and expenses, unless such expenses are considered “Shared Expenses” pursuant to |

18

the Transaction Agreement. See “The Separation Agreement and the Transaction Agreement—The Transaction Agreement—Transaction Expense Adjustments.” |

Tax consequences to PPL shareholders | PPL shareholders are not expected to recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger and Combination, except for any gain or loss attributable to cash received in lieu of a fractional share of Talen Energy. See “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions.” |

| Each PPL shareholder is urged to consult his, her or its tax advisor as to the specific tax consequences of the Combination to that shareholder, including the effect of any state, local or non-U.S. tax laws and of changes in applicable tax laws. |

Accounting Treatment of the Combination | Energy Supply will be the accounting acquirer in the Combination. Accordingly, Energy Supply will apply acquisition accounting to the assets acquired and liabilities assumed of RJS Power upon consummation of the Combination. See “The Transactions—Accounting Treatment and Considerations.” |

The Transactions

Primary purpose of the Transactions | The primary purpose of the Transactions is to separate the Energy Supply business from PPL and combine the Energy Supply business with the RJS Power business in order to realize the full value of the Energy Supply business in both the short- and long-term. See “The Transactions–PPL’s Reasons for the Transactions.” |

Conditions to the Transactions | The Transactions are subject to a number of important conditions. Under the terms of the Separation Agreement and the Transaction Agreement, the consummation of the Transactions are conditioned upon, among other things, (i) the Separation Transactions having occurred in accordance with the Separation Agreement, (ii) the SEC declaring effective the registration statement of which this prospectus forms a part and no actual or threatened stop order of the SEC suspending effectiveness of the registration statement being in effect prior to the Separation; (iii) the Talen Energy common stock being authorized for listing on the NYSE; (iv) certain regulatory approvals being obtained, including approval by the NRC and the FERC,Hart-Scott-Rodino clearance and certain approvals by the PUC (as more fully described in “The Separation Agreement and the Transaction Agreement—Transaction Agreement—Regulatory Approvals and Efforts to Close”), and (v) there being, after giving effect to the financings described in “The Separation Agreement and Transaction Agreement—The Transaction Agreement—Financing and Debt Payoff” and the posting of any credit support and other |

19

financial commitments required to be provided by RJS Power, Talen Energy, Merger Sub, HoldCo, Energy Supply and/or their respective subsidiaries in connection with, or as a condition to, regulatory approvals required in connection with the Transactions, at least $1.0 billion of undrawn capacity under a revolving credit facility or similar facility available to Talen Energy and its subsidiaries (for purposes of which any letters of credit or other credit support measures posted in connection with energy marketing and trading transactions then outstanding shall not be considered as drawn against such facility). For a more detailed description of the Distribution conditions see “The Separation Agreement and the Transaction Agreement—The Separation Agreement—Conditions to the Separation” and “The Separation Agreement and the Transaction Agreement—The Transaction Agreement—Conditions to Consummation of the Closing Transactions.” |

| No approval by the PPL shareholders or the Contributors is required in connection with the Transactions. |

Trading market and symbol | We have been approved to list our common stock on the NYSE under the ticker symbol “TLN.” We anticipate that, on or shortly before the record date for the Distribution, trading of Talen Energy common stock will begin on a “when-issued” basis and will continue up to and including the Distribution Date. See “The Transactions—Listing and Trading of Our Common Stock.” |

Dividend Policy | We do not currently expect to declare or pay dividends on our common stock. See “Dividend Policy.” |

New Energy Supply Revolving Credit Facility | In connection with the Transactions, Energy Supply will enter into a senior secured revolving facility that will provide for revolving loans in an aggregate principal amount of up to $1.85 billion. See “The Transactions— New Energy Supply Revolving Credit Facility” and “Description of Material Indebtedness.” |

20

The following chart illustrates our simplified organizational structure following the Transactions.

Market and Industry Data

Certain market, industry, regulatory, competitive position and other similar data included in this prospectus were obtained from Energy Supply’s and RJS Power’s own research, from surveys, studies or reports conducted by third parties or from government, industry or general publications or websites (including surveys and forecasts). Some data is also based on good faith estimates by management, which are derived from their review of internal surveys or studies, as well as the independent sources described above. Statements regarding industry, regulatory, competitive position or other similar data presented in this prospectus involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

* * * * *

Talen Energy Corporation is a Delaware corporation. Prior to the Transactions, our principal executive offices are located at Two North Ninth Street, Allentown, Pennsylvania, 18101, and our telephone number at that address is (610) 774-5151. Following the Transactions, our principal executive offices will be located in 835 W. Hamilton Street, Allentown, Pennsylvania 18101. Our website will be www.talenenergy.com. Information on, and which can be accessed through, our website is not incorporated in this prospectus.

21

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA OF ENERGY SUPPLY

The following table sets forth summary historical consolidated financial data of Energy Supply as of December 31, 2013 and 2014 and for each of the years ended December 31, 2012, 2013 and 2014. The summary historical consolidated financial data of Energy Supply as of December 31, 2013 and 2014 and for each of the years ended December 31, 2012, 2013 and 2014 have been derived from, and should be read together with, the audited consolidated financial statements of Energy Supply and the accompanying notes contained elsewhere in this prospectus. The summary historical consolidated financial data presented below include certain assets and liabilities of Energy Supply relating to facilities that may be sold as part of Talen Energy’s mitigation plan discussed elsewhere in this prospectus. As a result, the summary historical consolidated financial data of Energy Supply set forth below may not necessarily be indicative of the Energy Supply business that will be operated by Talen Energy in future periods. The summary historical consolidated financial data set forth below are not necessarily indicative of the results of future operations.

The summary historical consolidated financial data should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated Financial Data of Energy Supply,” “Unaudited Pro Forma Condensed Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Energy Supply” and the consolidated financial statements of Energy Supply and accompanying notes, all of which are included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| (dollars in millions) | 2012 | 2013 | 2014 | |||||||||

Statement of Operations Data: | ||||||||||||

Operating revenues | $ | 5,346 | $ | 4,514 | $ | 3,736 | ||||||

Operating income (loss) | 804 | (293 | ) | 397 | ||||||||

Income (loss) from continuing operations after income taxes attributable to member | 428 | (262 | ) | 187 | ||||||||

Net income (loss) attributable to member | 474 | (230 | ) | 410 | ||||||||

|

|

|

|

|

| |||||||

Balance Sheet Data (at period end): | ||||||||||||

Cash and cash equivalents | $ | 239 | $ | 352 | ||||||||

Total assets | 11,074 | 10,760 | ||||||||||

Total liabilities | 6,276 | 6,853 | ||||||||||

Long-term debt, including current portion | 2,525 | | 2,218 | | ||||||||

Member’s equity | 4,798 | 3,907 | ||||||||||

|

|

|

| |||||||||

Statement of Cash Flows Data: | ||||||||||||

Cash provided by (used in): | ||||||||||||

Operating activities | $ | 784 | $ | 410 | $ | 462 | ||||||

Investing activities | (469 | ) | (631 | ) | 497 | |||||||

Financing activities | (281 | ) | 47 | (846 | ) | |||||||

22

SUMMARY HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL DATA OF RJS POWER

The following table sets forth summary historical consolidated and combined financial data of RJS Power as of December 31, 2013 and 2014 and for each of the years ended December 31, 2012, 2013 and 2014. The summary historical consolidated and combined financial data of RJS Power as of December 31, 2013 and 2014 and for each of the years ended December 31, 2012, 2013 and 2014 have been derived from, and should be read together with, the audited consolidated and combined financial statements of RJS Power and the accompanying notes contained elsewhere in this prospectus. The summary historical consolidated and combined financial data presented below include certain assets and liabilities of RJS Power relating to facilities that may be sold as part of Talen Energy’s mitigation plan discussed elsewhere in this prospectus. As a result, the summary historical consolidated and combined financial data of RJS Power set forth below may not necessarily be indicative of the RJS Power business that will be operated by Talen Energy in future periods. The summary historical consolidated and combined financial data set forth below are not necessarily indicative of the results of future operations.

The summary historical consolidated and combined financial data should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated and Combined Financial Data of RJS Power,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—RJS Power,” “Unaudited Pro Forma Condensed Combined Financial Information” and the consolidated and combined financial statements of RJS Power and accompanying notes, all of which are included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| (dollars in millions) | 2012 | 2013 | 2014 | |||||||||

Statement of Operations Data: | ||||||||||||

Operating revenues | $ | 453 | $ | 979 | $ | 1,045 | ||||||

Operating income (loss) | 82 | 67 | 55 | |||||||||

Income (loss) from continuing operations after income taxes | 33 | (27 | ) | (55 | ) | |||||||

Net income (loss) | 33 | (27 | ) | (55 | ) | |||||||

|

|

|

|

|

| |||||||

Balance Sheet Data (at period end): | ||||||||||||

Cash and cash equivalents | $ | 141 | $ | 30 | ||||||||

Total assets | 1,981 | 1,798 | ||||||||||

Total liabilities | 1,376 | 1,549 | ||||||||||

Long-term debt | 1,204 | 1,275 | ||||||||||

Members’ interests | 605 | 249 | ||||||||||

|

|

|

| |||||||||

Statement of Cash Flows Data: | ||||||||||||

Net cash provided by (used in): | ||||||||||||

Operating activities | $ | 14 | $ | 169 | $ | 183 | ||||||

Investing activities | (397 | ) | (33 | ) | 11 | |||||||

Financing activities | 384 | (13 | ) | (305 | ) | |||||||

23

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL DATA

The following sets forth summary unaudited pro forma condensed combined financial data which combines the consolidated financial information of Energy Supply and the combined financial information of RJS Power as of and for the year ended December 31, 2014 after giving effect to the spinoff of HoldCo and the Combination with RJS Power as if they were completed on January 1, 2014. The summary unaudited pro forma condensed combined balance sheet data gives effect to the spinoff and the Combination as if they were completed on December 31, 2014. The summary unaudited pro forma condensed combined financial data are derived from the unaudited pro forma condensed combined financial information that is included elsewhere in this prospectus. The summary unaudited pro forma condensed combined financial data are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or the consolidated financial position of the combined company would have been had the Transactions occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position.

This information is only a summary and should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated Financial Data of Energy Supply,” “Selected Historical Consolidated and Combined Financial Data of RJS Power,” “Unaudited Pro Forma Condensed Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Energy Supply” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—RJS Power,” which are included elsewhere in this prospectus.

| (dollars in millions) | Year Ended December 31, 2014 | |||

Statement of Operations Data: | ||||

Operating revenues | $ | 4,274 | ||

Operating income | 409 | |||

Income from continuing operations after income taxes attributable to stockholders | $ | 139 | ||

|

| |||

Balance Sheet Data (at period end): | ||||

Cash and cash equivalents | $ | 903 | ||

Total assets | 13,906 | |||

Total liabilities | 8,527 | |||

Long-term debt, including current portion | 3,419 | |||

Stockholders’ equity | 5,379 | |||

|

| |||

Other Financial Data: | ||||

Pro forma Adjusted EBITDA (1) | $ | 915 | ||